2330 trade ideas

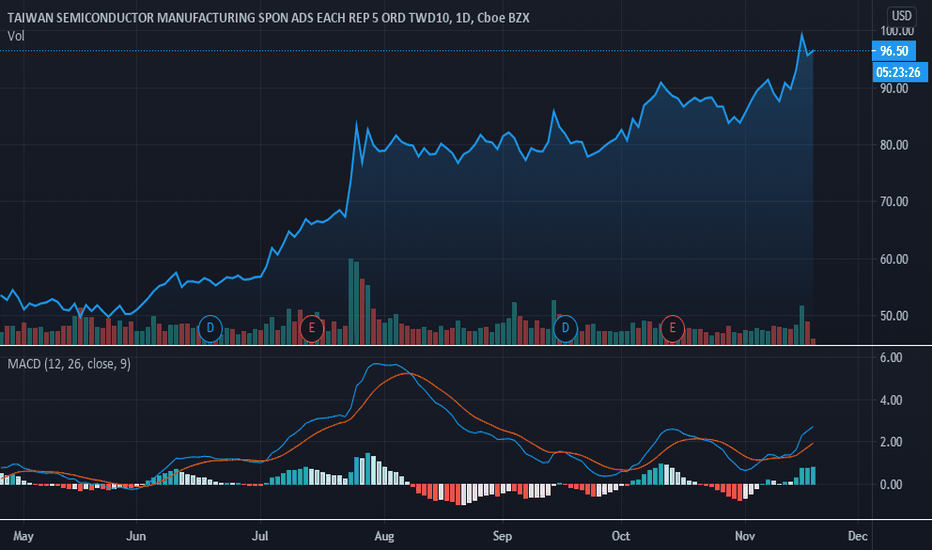

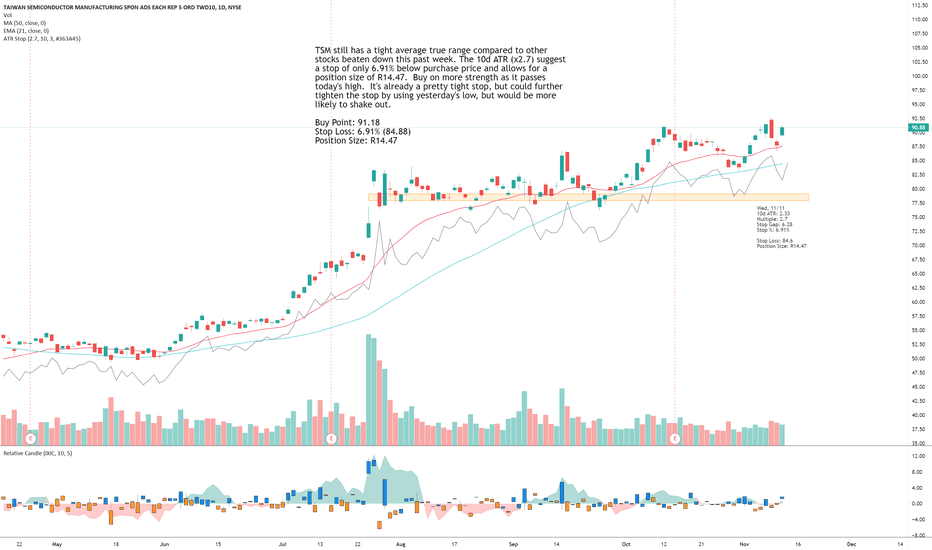

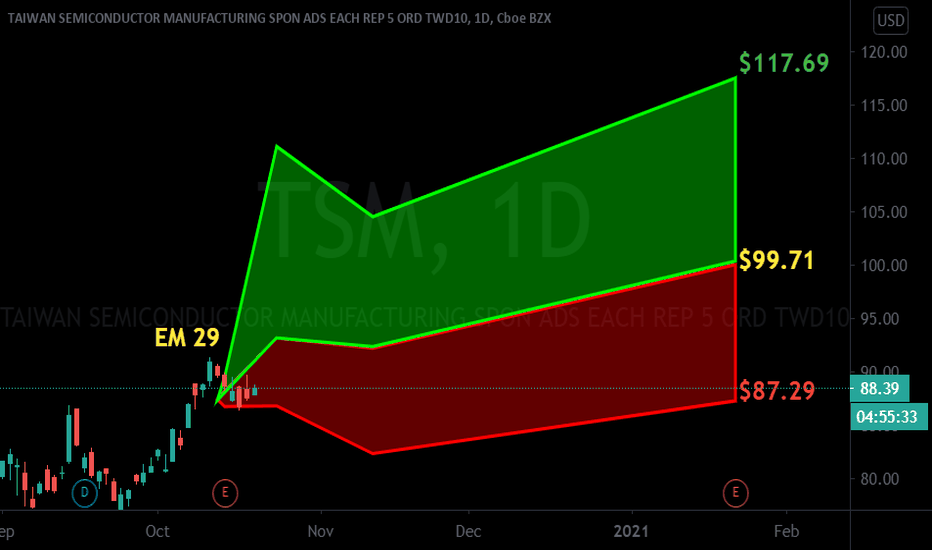

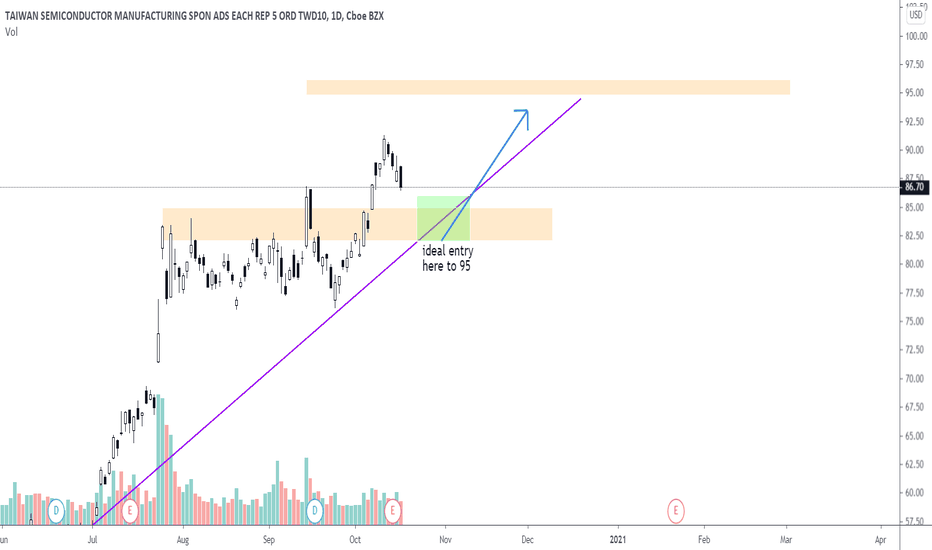

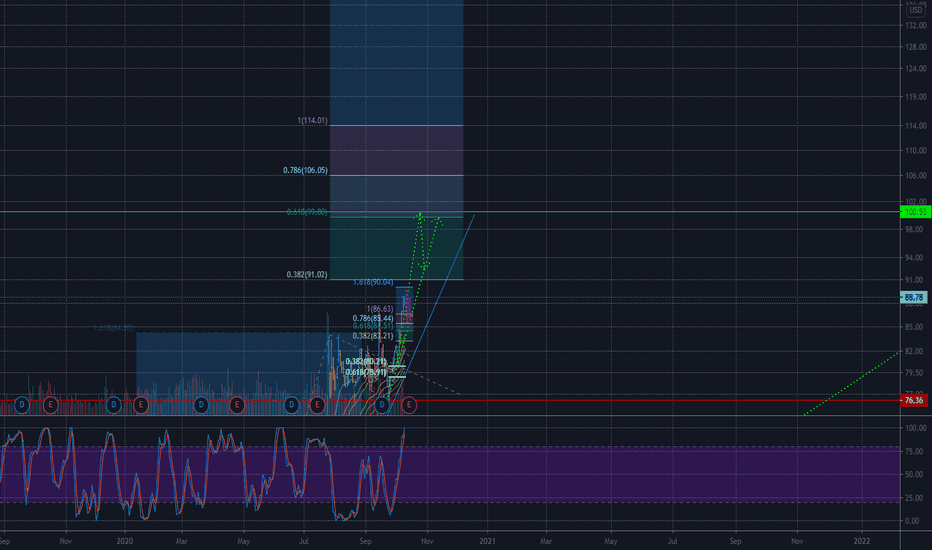

TSM offers another change to enterTSM still has a tight average true range compared to other stocks beaten down this past week. The 10d ATR (x2.7) suggest a stop of only 6.91% below purchase price and allows for a position size of R14.47. Buy on more strength as it passes today's high. It's already a pretty tight stop, but could further tighten the stop by using yesterday's low, but would be more likely to shake out.

Buy Point: 91.18

Stop Loss: 6.91% (84.88)

Position Size: R14.47

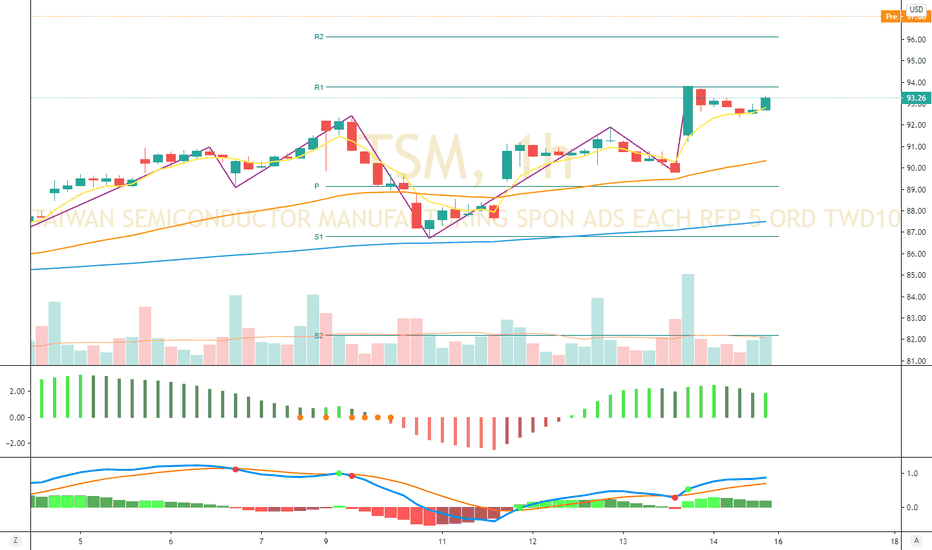

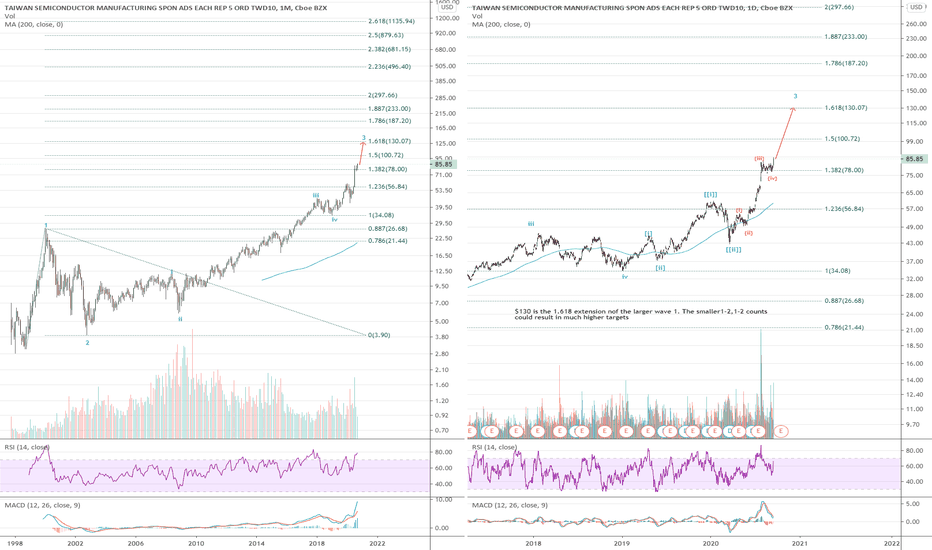

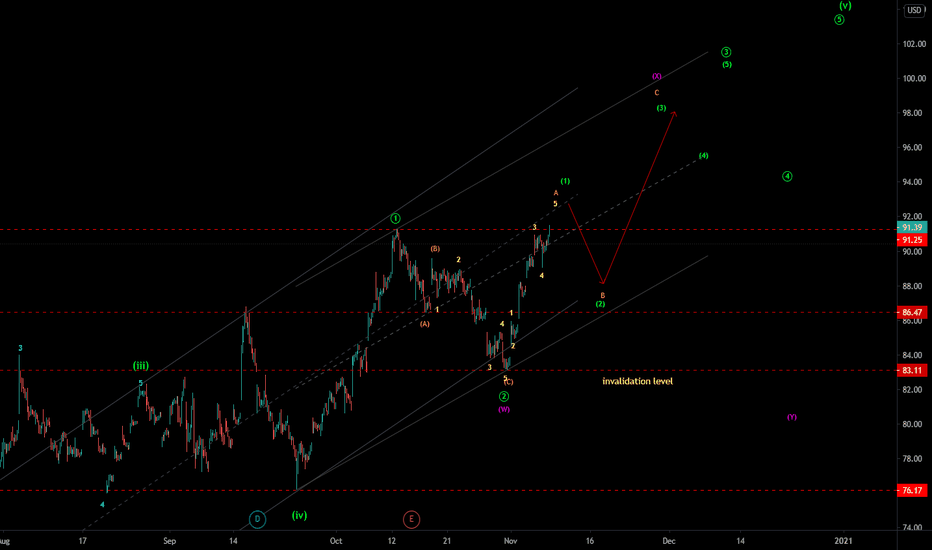

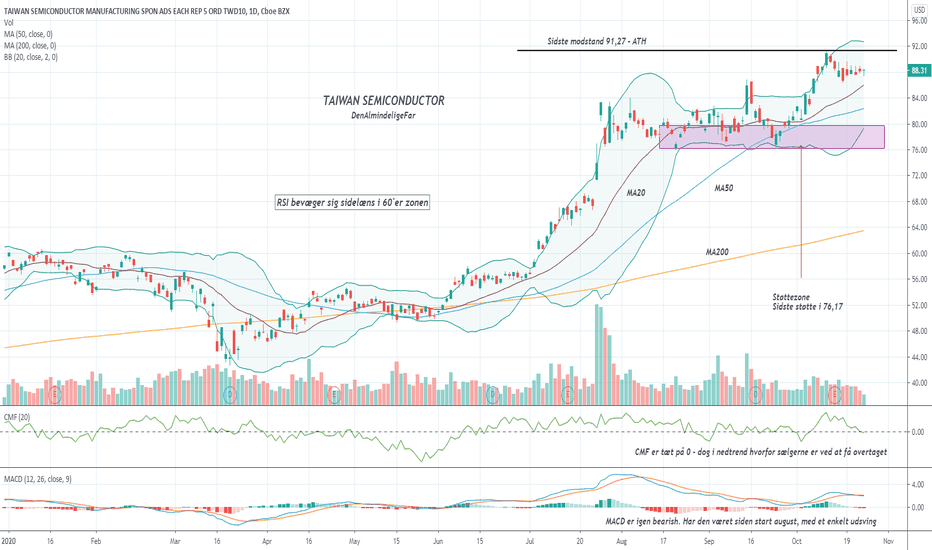

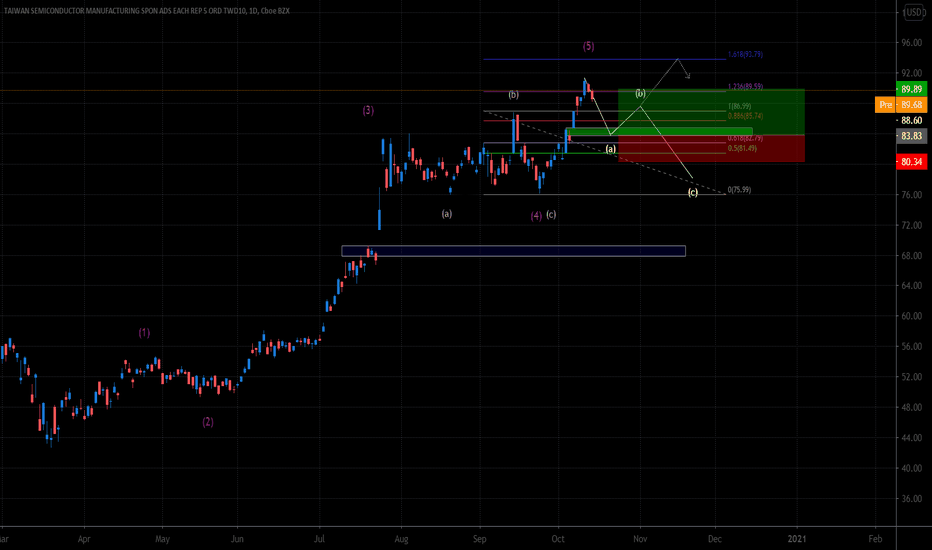

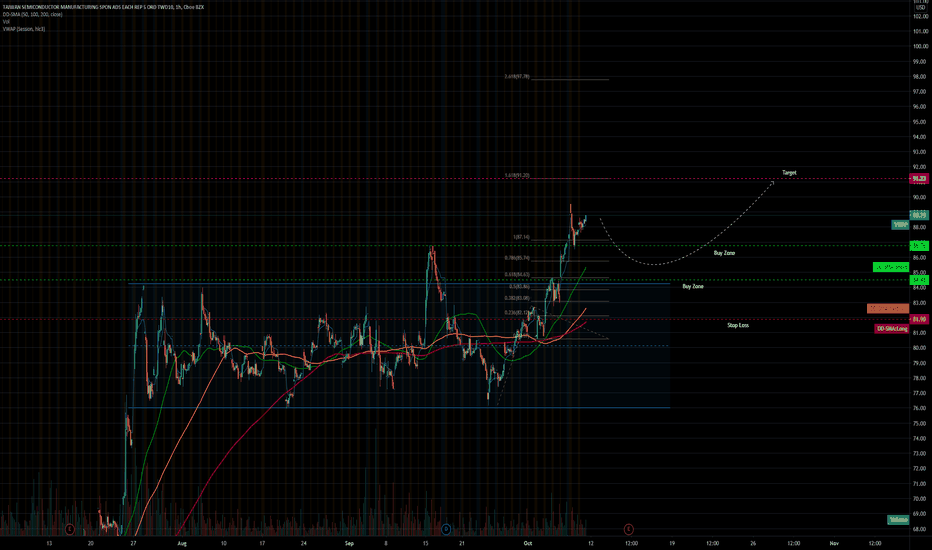

TSM - Elliottwave analysis - 5th wave extensionTSM - It seems extending 5th wave of impulse cycle. So stay bullish in three wave pull back each time whenever the correction will be choppy sideway. The up move seems like in 3rd wave, where subwave 1 is about to finish. Thereafter 2nd subwave correction will be proceed, which may go deeper down. so buy near 87-85 zone with stop level below 83.10 for target of new high above 96 to 100 level. This is one of the most outperformer stock to NDX or SPX.

Give thumbs up if you really like the trade idea.

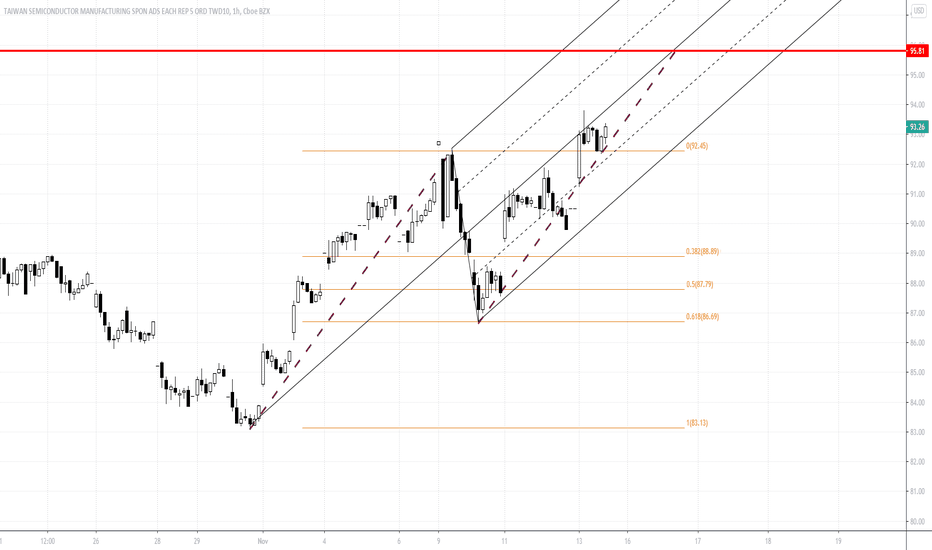

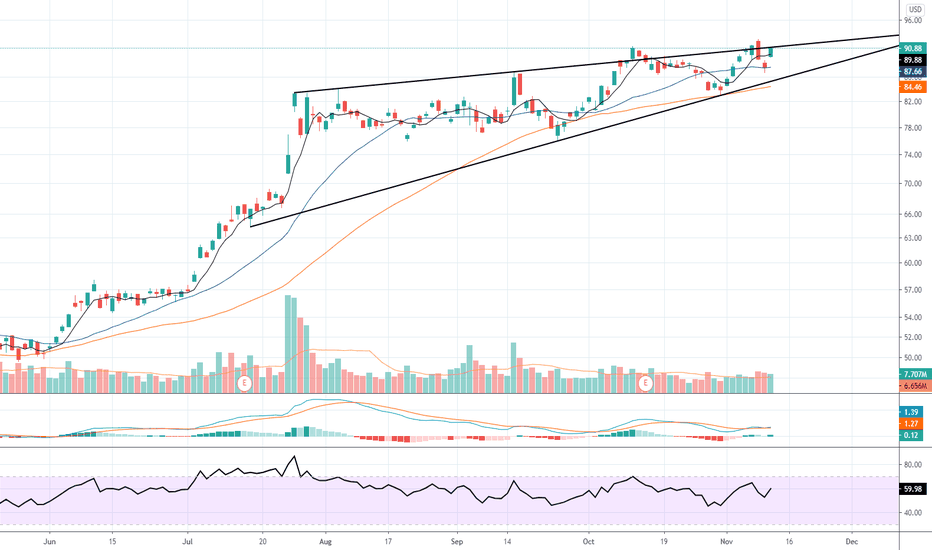

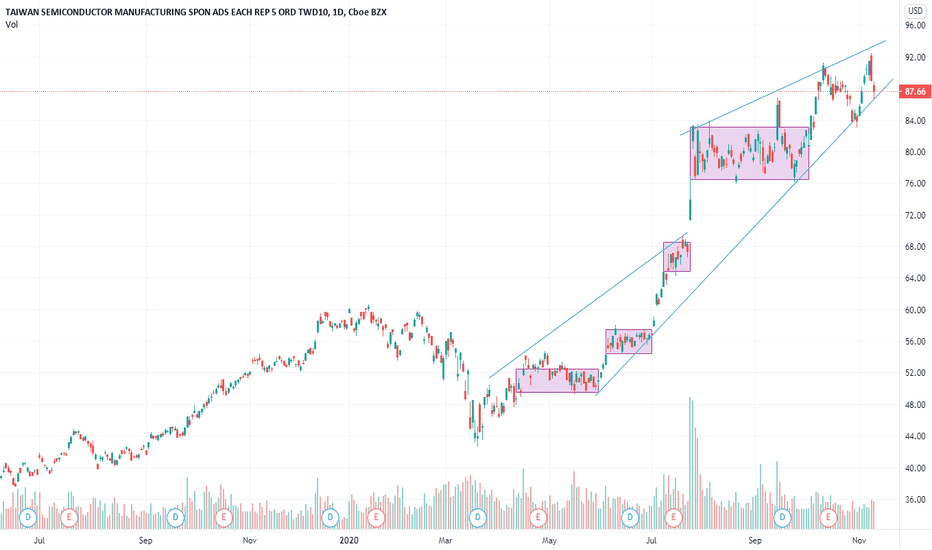

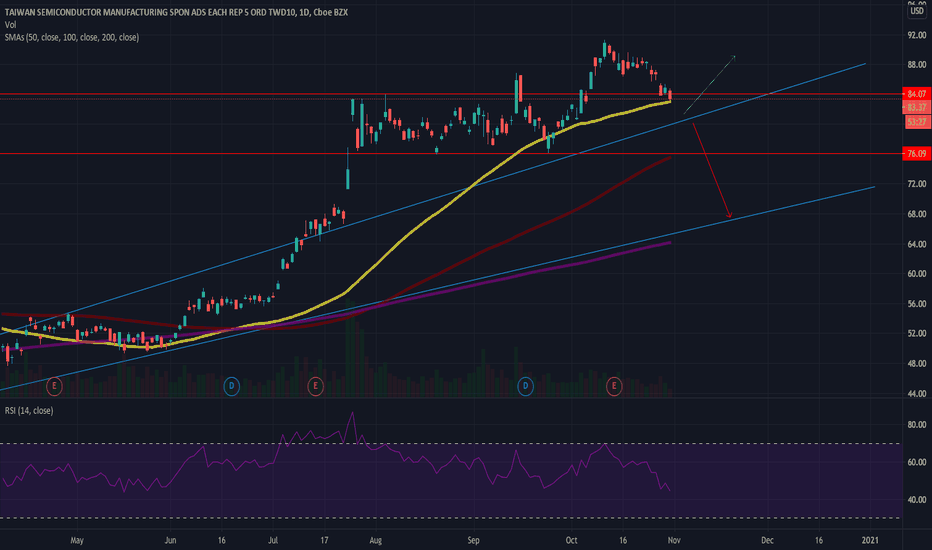

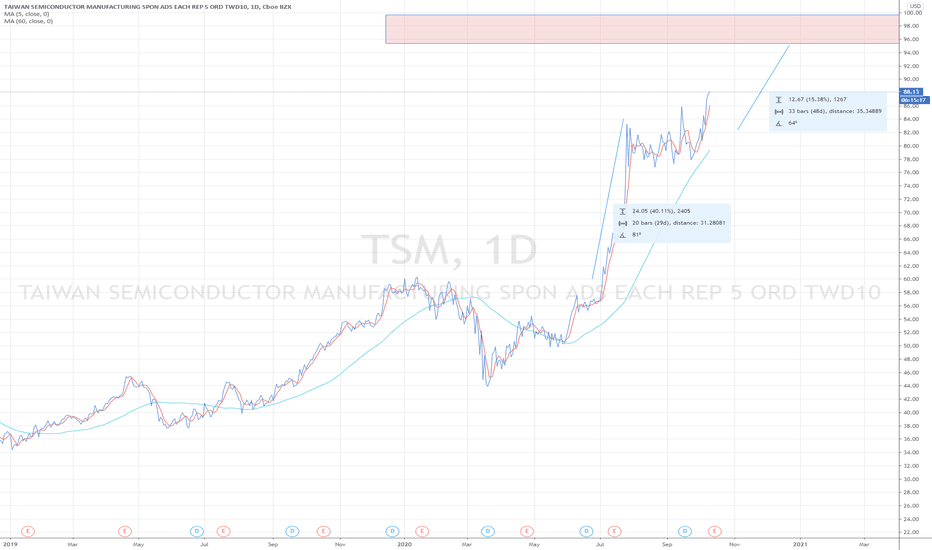

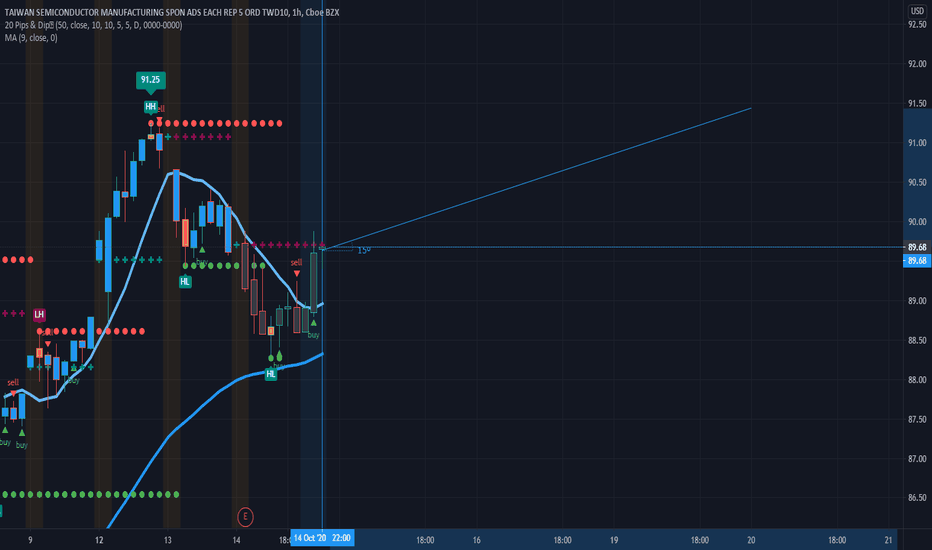

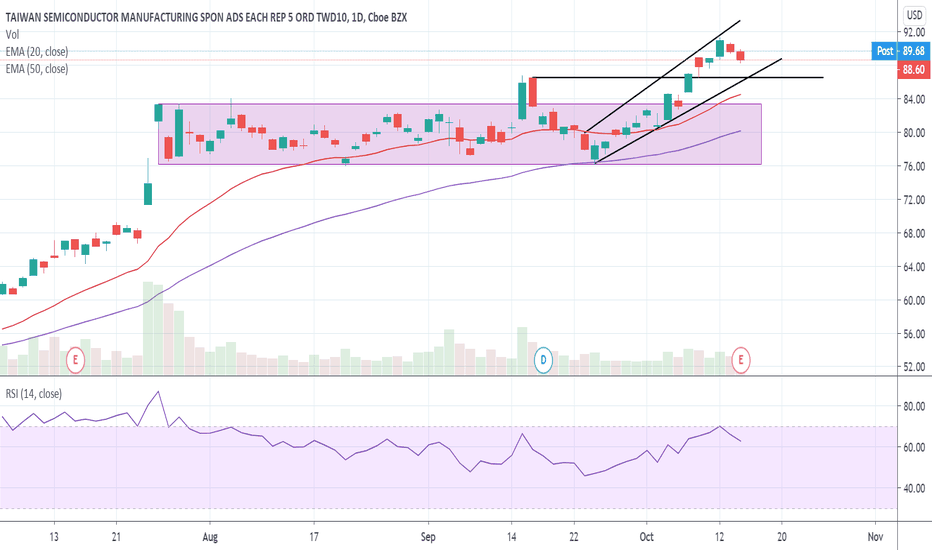

TSM Uptrend rising wedge - potential bearish reversalUptrend rising wedge pattern forming on the daily, with rough performance lately on this stock... against all odds. A bit of a stretch on this formation, but if the levels hold, we could see a bigger retracement lower, before going up again. I'm bullish on this company - but in the short term we may have to endure some retracing.

Investment strategy would be consider shorting in the near future, but definitely a bullish outlook in the long term