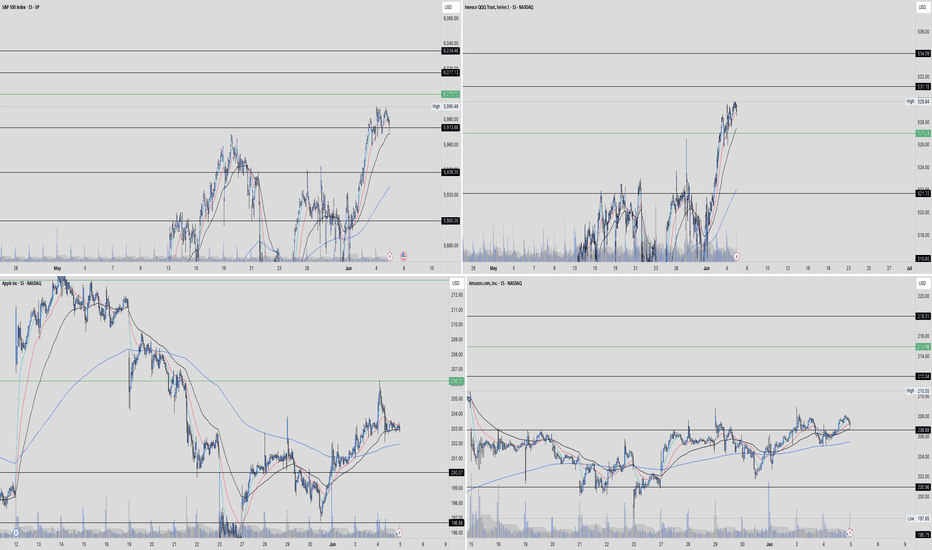

Morning market ideasSPX could be finished overnight but the cash session may try to equal the overnight high. Gold is coming up to heavy resistance. Oil Looks to be heading towards 66 and maybe more. BTC looks like it may drop again but right now it's at support. Natural Gas is likely going to drop.

US500.F trade ideas

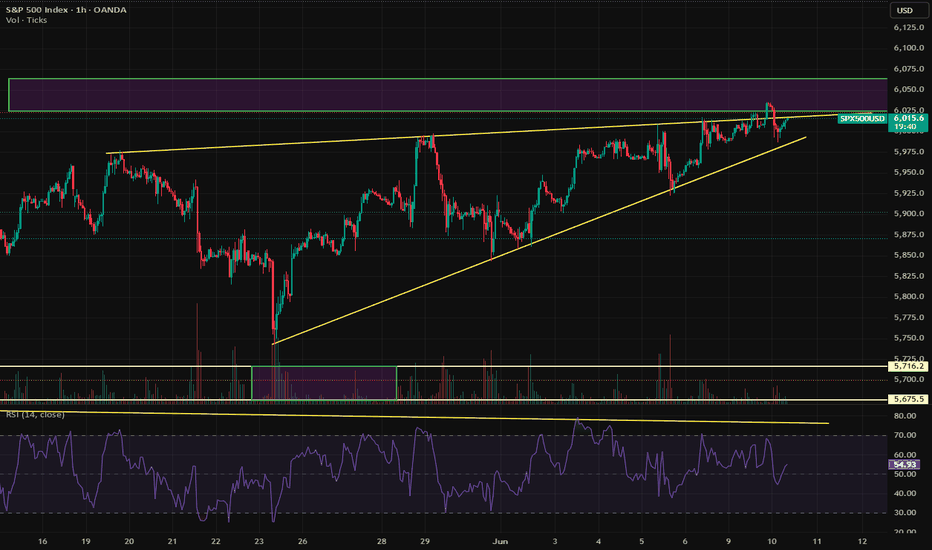

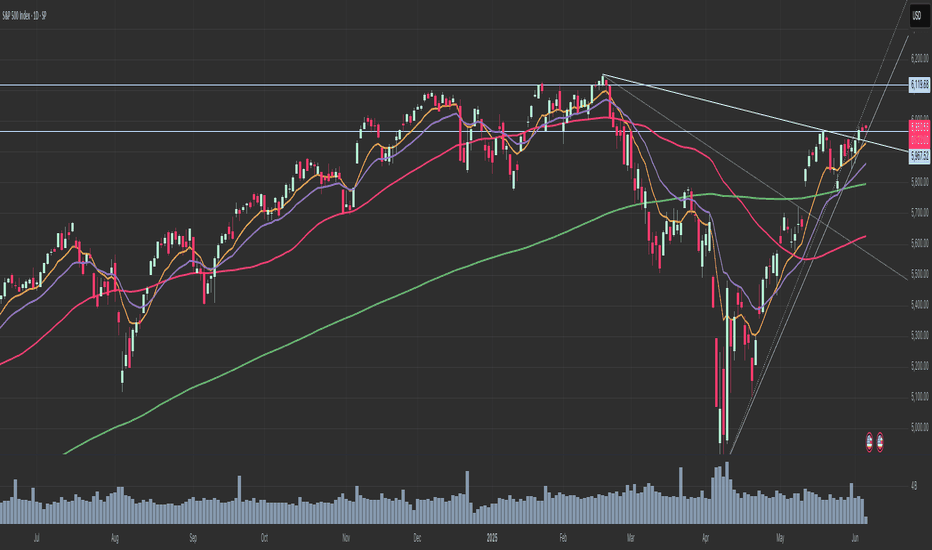

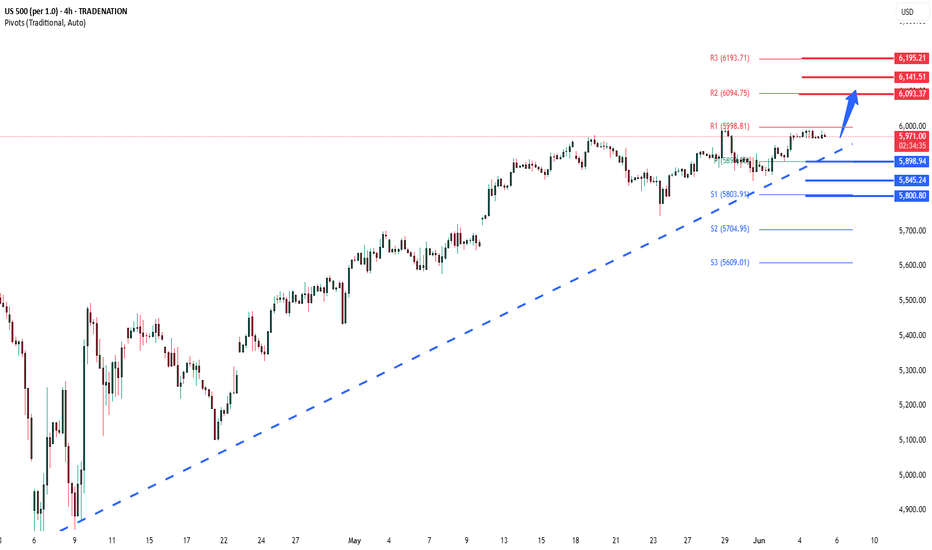

S&P500 INTRADAY uptrend continuation supported at 5960Key Support and Resistance Levels

Resistance Level 1: 6120

Resistance Level 2: 6170

Resistance Level 3: 6220

Support Level 1: 5960

Support Level 2: 5900

Support Level 3: 5800

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

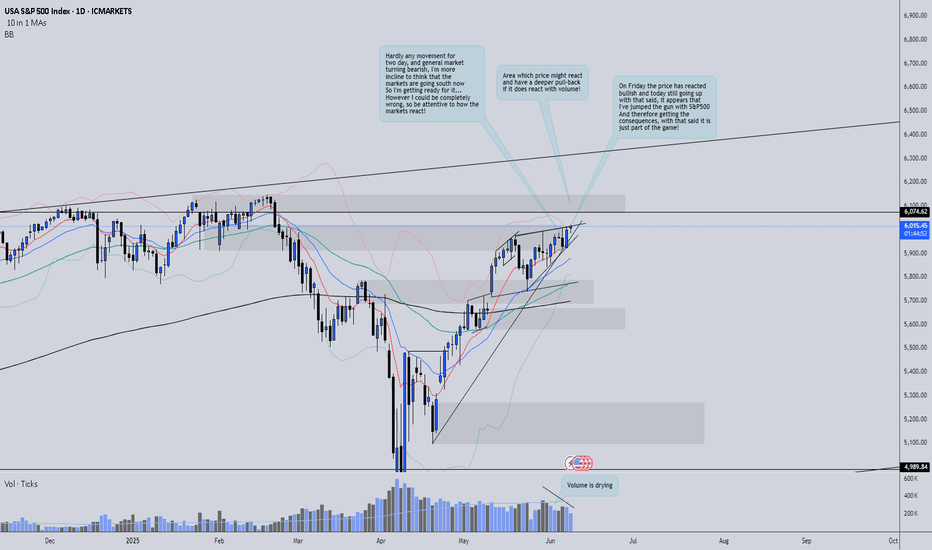

S&P 500 update from last week📉 Lesson Learned – The Way of a Trader 📈

Well… this time I jumped the gun. Thought the market would break lower from a compression point, but I was wrong. Price pushed higher, broke the ascending channel upwards — and I paid the price 💸

Not much volume behind the move, but still... up is up.

I acted on a gut feeling, and that didn’t work out.

The mistake?

⛔ Tried to predict the top

⛔ Didn't wait for a confirmed break with volume

Now it’s time to:

✅ Review

✅ Re-evaluate

✅ Learn

✅ Come back stronger

We’re not always going to be right — and that’s part of the game.

Discipline beats ego.

Welcome to the life of a trader.

Let’s keep improving 🔁

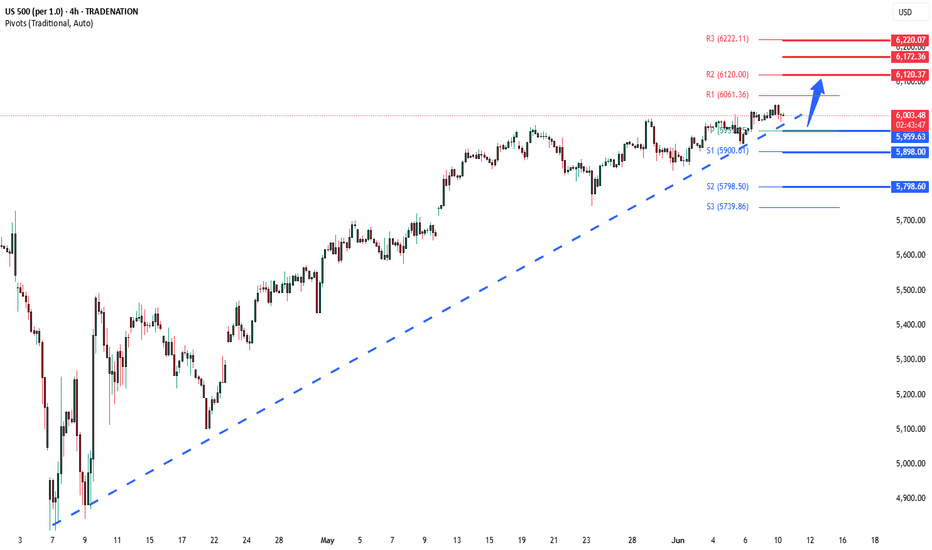

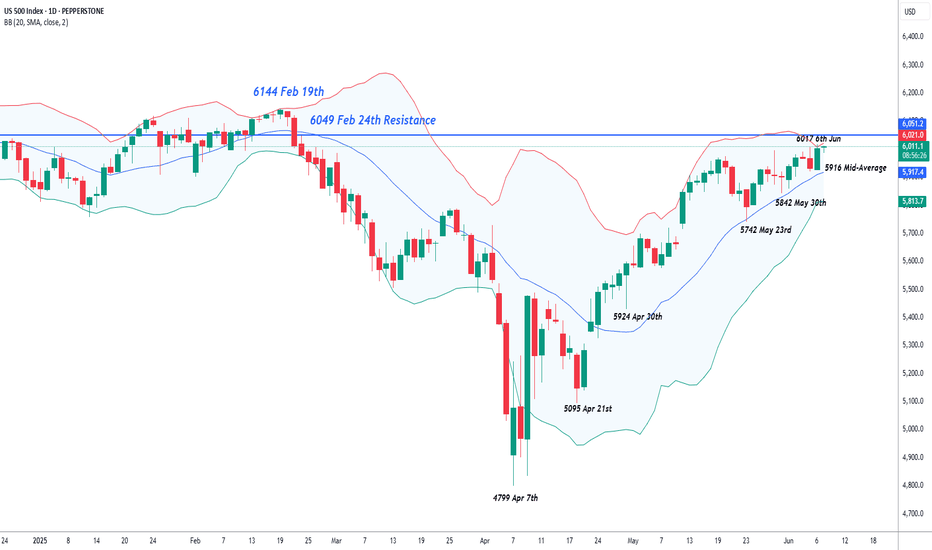

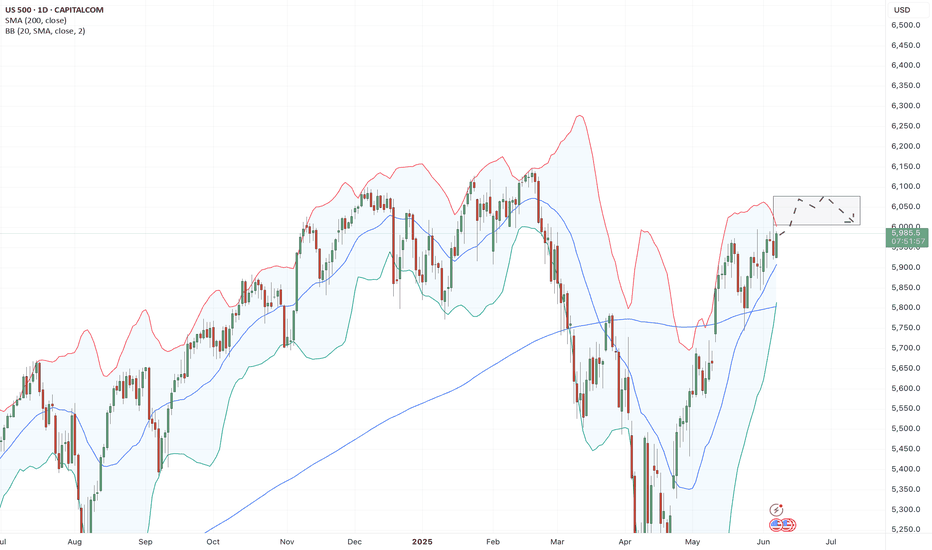

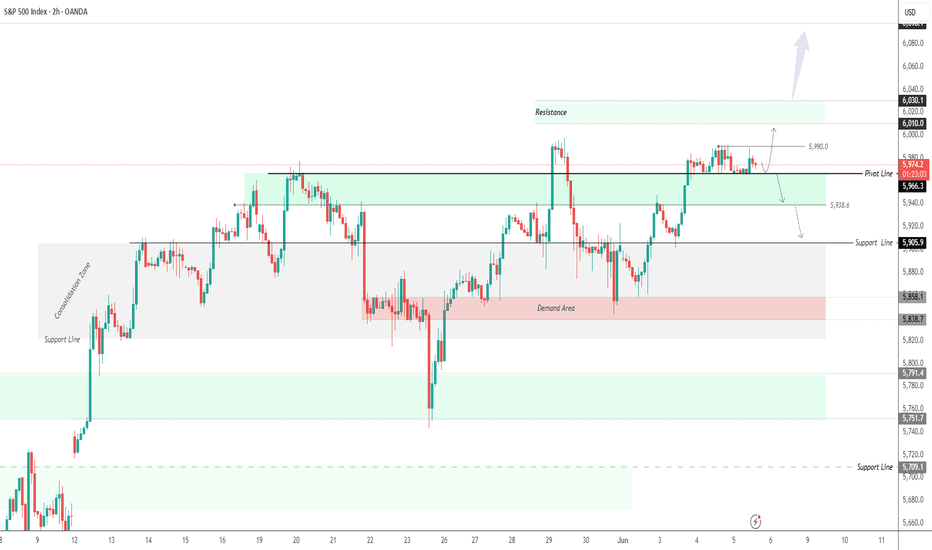

US 500 Index – All Time Highs Back in SightFresh optimism regarding trade negotiations between the US and China, coupled with confirmation on Friday that the US labour market is cooling down slowly and not indicating an imminent US recession, has seen the US 500 index open this morning at 4 month highs, bumping up against the psychological 6000 again, with its all time peak of 6144 (February 19th) back in sight.

Looking forward, this could be a pivotal week for the US 500, with a variety of risk events for traders to consider, all of which may have the potential to impact the direction of risk sentiment into the Friday close.

First up, later today, traders will be eagerly awaiting updates from the second round of trade talks between US and Chinese trade teams, who are tasked with defusing tensions regarding the supply of rare earth minerals and advanced technology.

Then, on Wednesday (CPI 1330 BST) and Thursday (PPI 1330 BST) the next round of US inflation updates for May are released. These could be relevant to traders who have become more sensitive to potential price rises due to the impact of President Trump's trade tariffs. Any surprise deviations from expectations in either of these releases could see an increase in US 500 index volatility.

Putting this all together with any fresh reports outlining progress on trade deals between the US and Japan or the EU, and it could be a volatile week in store. With this in mind, it can be helpful to consider the technical indicators and trends.

Technical Update: Focus on the Bollinger Mid Average

While some may have argued for a slowing in upside momentum of the recent US 500 index advance, price weakness has continued to be limited in both time and extent.

Importantly, as the chart above shows, when short term setbacks in price have recently materialised, it has been the rising Bollinger mid-average that has marked a support focus.

This maintains the potential of a more constructive picture and positive price trend, where buyers have been happy to pay a higher price each time that weakness is seen, and have been able to push the index above previous peaks in price, to new recovery highs.

Of course, there is no guarantee this pattern of higher highs and higher lows in price will extend further, but traders may well be focusing on this type of pattern as having the potential to lead to a more sustained phase of price strength.

What are the potential support and resistance levels that traders may be watching this week for clues to the direction of the next possible price move?

Potential Resistance Levels:

Further evidence that a positive trend in price could still be in place came on Friday, as a new recovery price high at 6017 was posted.

Traders may now be watching how a previous price high at 6049, which was posted on February 24th is defended, as closing breaks may see further attempts to push to higher levels. Such moves could then lead to further price strength towards 6144, the February 19th all-time high.

Potential Support Levels:

Having held and turned price activity higher over previous tests, it may well still be the rising Bollinger mid-average, which currently stands at 5916 that represents a possible support focus this week.

Closes below this level while not confirmation of a more extended phase of price weakness, may see a deeper decline to test 5842, the May 30th session low, even on to the 5742 level, which is equal to the low posted on May 23rd.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

RKLB Weekly Options Trade Plan – 2025-06-07🚀 RKLB Weekly Options Trade Plan – 2025-06-07

Bias: Moderately Bullish

Holding Period: 3–5 trading days

Catalyst: Trump–Musk headline cycle + strong short-term momentum

Timeframe: Expiry June 13, 2025

🔍 Multi-Model Consensus Summary

Model Direction Strike Entry Stop Target(s) Confidence

Grok No Trade – – – – 0%

Claude Long Call $30 $0.76 $0.38 $1.50 75%

Llama Long Call $30 $0.76 $0.57 $1.14 70%

Gemini Long Call $31 $0.49 $0.24 $0.74–$0.98 65%

DeepSeek Long Call $30 $0.76 $0.38 $1.52 70%

✅ Consensus: Buy $30 call expiring 2025-06-13

💬 4 of 5 models bullish; 3 aligned on same strike and premium

⚠️ Max pain at $26 and overbought daily RSI are top risks

📈 Technical Snapshot

Price Trend: Bullish short-term (price > EMAs on 5-min & daily)

RSI: Nearing overbought (RSI ~69)

MACD: Bullish short-term, weakening daily

Resistance: $29.00–$29.50

Support: $28.70–$28.75

✅ Trade Setup

Parameter Value

Instrument RKLB

Direction CALL (LONG)

Strike $30

Entry Price $0.76

Profit Target $1.14 (≈50% gain)

Stop Loss $0.38 (≈50% loss)

Size 1 contract

Expiry 2025-06-13 (Weekly)

Confidence 70%

Entry Timing At market open

⚠️ Key Risks

Max Pain Gravity: $26 could act as price magnet by end of week

Overbought Setup: Daily RSI + Bollinger breach may cap further upside

Exhaustion Signs: Bearish MACD divergence could lead to snap pullback

Momentum Trade: Must act quickly; trail stops if resistance nears

S&P500 tests the upper border of the rangeThe S&P 500 index is concentrating in the massive triangle below the psychological level of $6000, and given the overall neutral to good market sentiment, it’s not expected to plummet from this area before testing the area of $6000-6200. Should the breakout of this zone happen, it’s not expected to be sustainable and may quickly revert back to the range, as traders are quite cautious right now and the market is prone to liquidations and quick profit taking.

Don't forget - this is just the idea, always do your own research and never forget to manage your risk!

SPX500 H1 | Heading into an overlap resistanceSPX500 is rising towards an overlap resistance and could potentially reverse off this level to drop lower.

Sell entry is at 5,967.36 which is an overlap resistance that aligns close to the 61.8% Fibonacci retracement.

Stop loss is at 6,012.00 which is a level that sits above a multi-swing-high resistance.

Take profit is at 5,909.96 which is a swing-low support that aligns close to the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

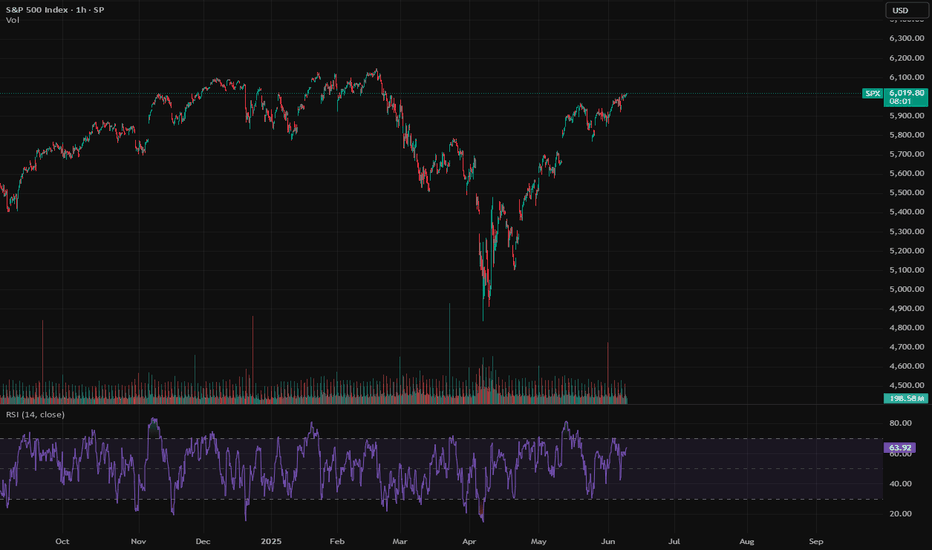

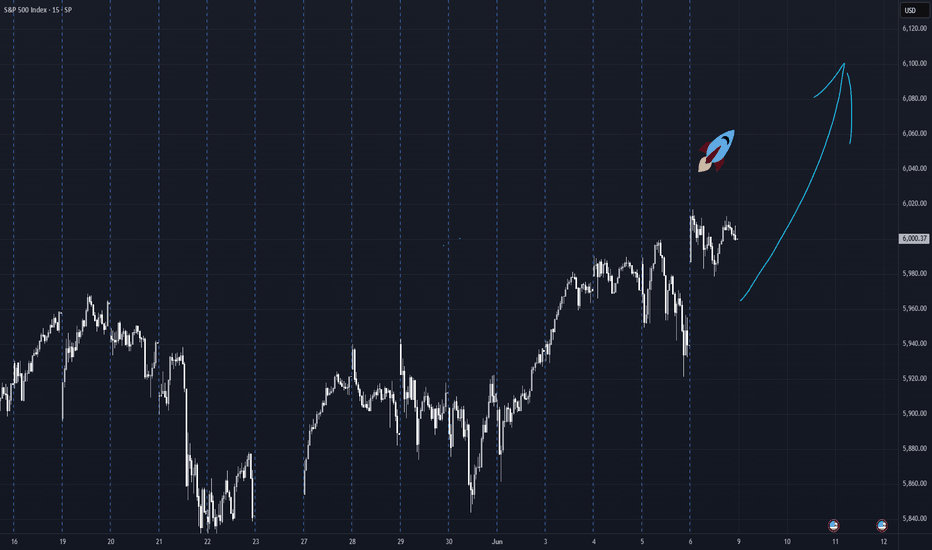

Come on SPX! Let's cross back over 6,000Stop playing with me SPX. So far this week, we've seen a slowwww drift up. Ok, Monday and Tuesday did put in some solid bars, but now here we are, babying this 6,000 psychological area.

Below is my write up from Sunday. While I always state different scenarios, I've been leaning bullish...though some of my individual stock plays have retested my stop levels this week. (They have been a bit more sideways)

SPX (written Sunday 06/01/25)

Still above key weekly MAs, trend remains intact

The weekly chart still shows an uptrend. We're above the 10EMA, 20EMA, and 50SMA, and those moving averages are turning up. So while the pace of the uptrend has slowed, the broader structure hasn't broken down. This past week was a digestion of the recent April and early May run, and so far, not an unraveling of it.

Friday's dip was likely just a shakeout.

Friday gave us a candle that flushed below the daily 20EMA then quickly reversed. That kind of action often traps early shorts and clears out weaker long hands…a classic shakeout. If this theory holds, we should see strength early next week. But if we break below the 5750-5725 area, that thesis gets invalidated. At that point, I'd treat the move as something more structurally weak, not just a pullback.

Confluence zone still holding for now

We're sitting right on a layered area of support above all moving averages, and a horizontal support and resistance level from earlier this year. So far, it has held. If it continues to hold, it gives the index a platform to try the upside again.

Trendlines matter, but not more than the overall structure

I was asked about trendlines this week, and it was a good reminder to step back and recognize how I was sharing my use of them. Trendlines are helpful, but they’re just one part of the picture. Same goes for moving averages, volume, and other tools. They only hold weight relative to the context. In a choppy, indecisive market, over-focusing on any single signal can do more harm than good. I'm aiming to keep my analysis well-rounded, zoomed out, and centered on structure.

What would confirm the upside?

A clean move back above 6,000 and a push through the February all-time high would help strengthen the case for continued upside. Not just because it’s a technical level, but because it’s psychological too. If we’re breaking out into new highs, especially after the chop and hesitation of the last few weeks, that’s when retail traders tend to feel like we’re “in the clear.” That can bring in more participation, more confidence, and more momentum. Ideally, we’d see a higher low hold on any dips, and then a strong push through 6,000 with follow-through, not just a quick tag and pullback. That kind of behavior would tell me buyers are stepping in with conviction again.

What would shift the bias more bearish?

A breakdown and hold below 5725 (not just a quick flush) would suggest deeper downside potential. From there, 5600 (around the daily 50SMA) becomes the next level I’d watch for support. But so far, I’m not leaning toward this as the main scenario.

What do you all see? Will we break 6,000 and get an increase in momentum?

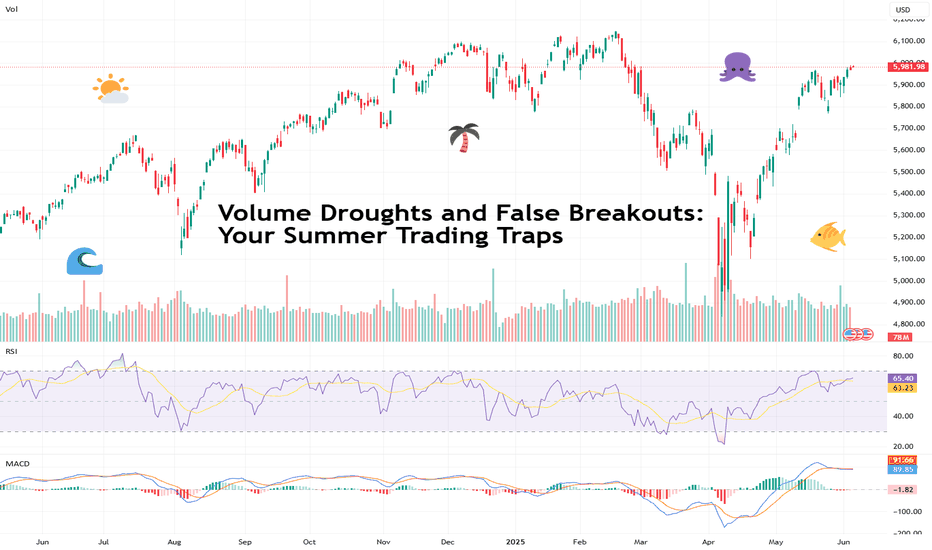

Volume Droughts and False Breakouts: Your Summer Trading TrapsThe market’s heating up — but is your breakout about to dry up? Here’s a word about the importance of summer trading success (helped by volume — the main character).

☀️ Welcome to the Liquidity Desert

Summer’s getting ready to slap the market with a whole flurry of different setups. Picture this — the beaches are full, your trading desk is half-abandoned, and the only thing more elusive than a decent breakout is your intention to actually read that big fat technical analysis book you bought last year.

And yet, here you are — eyes glued to the chart — watching a clean breakout above resistance that’s just begging for you to hit “buy.” Everything looks perfect. Price rips through the level like it’s made of butter. But there’s just one tiny problem: no volume. None. Nada. Niente.

Congratulations. You’ve just bought the world’s most attractive false breakout.

🏝️ Summer Markets: Where Good Setups Go to Die

Let’s set the scene.

It’s June. The big dogs on Wall Street are golfing in the Hamptons and sipping mezcal espresso martinis, interns are running the order flow, and every chart you love is doing just enough to get your hopes up before crushing them like a half-melted snow cone.

This isn’t your usual high-volatility playground. Summer markets — especially between June and August — are notorious for thin liquidity . That means fewer participants, smaller volume, and a much higher likelihood of being tricked by price action that looks strong… until it’s not.

And it’s not just stocks. Forex, crypto, commodities — even the bond boys — all face the same issue: when fewer people are trading, price becomes more fragile. And fragile price = bad decisions.

🚨 Why False Breakouts Love Quiet Markets

False breakouts happen when price appears to break above resistance (or below support), only to reverse sharply — often trapping late traders and triggering stop hunts.

But in summer? It’s a whole different beast. Here’s why:

No liquidity cushion : In normal markets, you need strong volume to fuel a breakout. Without that, the breakout doesn’t necessarily have the gas to keep going.

Market makers get bored : Thin markets mean it’s easier for a few big orders to push prices where they want. Welcome to manipulation season (there, we said what we said!).

Algos go wild : With fewer humans around, algorithms dominate. And they love playing games around key levels.

🧊 The Mirage Setup: A Cautionary Tale

Let’s say you’re watching GameStop NYSE:GME stock. Resistance at $30. Price hovers there for days, teasing a breakout. Then — boom — a sudden 6% pop above.

You buy. Everyone buys. The trading community goes nuts. “This is it bois!”

But there’s a problem. Look at the volume: a trickle. Not even half the average daily volume. Ten minutes later, NYSE:GME is back below $30, your stop loss is hit, and you’re left explaining to your cat why you’re emotionally invested in a ticker.

Moral of the story? Don’t trust breakouts when no one’s trading.

📉 Volume: Your Summer Lie Detector

Volume is more than just a histogram under your chart. It’s your truth serum. Your smoke alarm. Your buddy who tells you to think twice before jumping in that trade.

Here’s how to read it right when everyone else is checking out:

Confirm the move : If price breaks out, but volume doesn’t spike at least 20–30% above the average — be suspicious.

Look for acceleration : Healthy moves gather steam. You want to see volume growing into the breakout, not fizzling.

Watch for volume cliffs : A sudden volume drop right after a breakout often signals that the move is running on fumes.

Add Volume Profile Indicators : Just to be safe, you can always add Volume Profile Indicators to your chart — they analyze both price and volume and can highlight what your keen eye might miss.

Remember what happened last summer? And how we all learned the downside of something called "carry trade"? Those who were short the Japanese yen remember .

🧠 Context Over Candles: Be a Liquidity Detective

Let’s say you see a double top pattern — your favorite. Clean lines. Tight price action. Perfect setup.

But now zoom out.

It’s July 3. Pre-holiday half-day. No volume. And the S&P 500 SP:SPX has moved 0.04% all day. Still want in?

Technical analysis doesn’t work in a vacuum. Chart patterns lose their predictive power when the environment they live in is compromised. And thin liquidity is a compromised environment.

🐍 Snakes in the Sand: How Market Makers Bait Traps

Market makers (and large players) are like desert snakes — quiet, patient, and very good at making you move when you shouldn’t.

Here’s how they bait traders in illiquid markets:

Run stops above resistance to trigger breakout buyers.

Dump shares immediately after breakout to trap retail.

Ride the reversal as trapped longs scramble to exit.

They’re so powerful some say they run the game — and can stop it anytime it’s not going their way (remember the GameStop freeze? ) It’s a psychological game — and in the summer, it’s easier to do shenanigans because most players aren’t watching.

Don’t be the one jumping at shadows. Be the trader who expects the trap.

🛠️ How to Survive (and Thrive) in the Summer Slump

Not all is lost. You can still trade — smartly.

Here’s your Summer Survival Toolkit :

Wait for volume confirmation on every breakout.

Lower your position size . Less liquidity = more slippage risk.

Set wider stops , or better yet, sit out the chop.

Focus on trending names with relative strength and solid weight (think: tech titans, oil plays, or financials).

Use alerts instead of staring at charts . Don’t mistake boredom for opportunity.

And most importantly: Know when not to trade . Discipline is a position too.

🔚 Final Word: This Isn’t the Off-Season. It’s the Setup Season.

Summer might feel slow, but it’s not dead.

Smart traders know that the best trades of Q3 and Q4 often begin in July — as early trendlines form, consolidation patterns develop, and institutional footprints quietly appear in the tape.

So use this time wisely. Don’t force trades. Watch volume like a hawk. And never forget: the best breakouts don’t need hype — they bring their own thunder.

Stay cool, stay patient, and trade smart. The mirage may be tempting, but the oasis always belongs to the ones who go far enough and don’t give up.

Off to you : How are you navigating trading during the summer months? Staying poolside with one eye on the charts or actively seeking out opportunities while folks catch a break? Share your insights in the comments!

US500 potential buyUS500 is setting up for a classic Wyckoff spring. This is a high probability set up with high risk to reward (5R+)

Here is what needs to happen

For situations 1 and 2,

a. price should break blue support (traps sellers and shakes out weak hands)

b. price should then close above any of the 2 blue supports with high volume

c. enter at the close of that bar or retest of the blue line

d. T.P @ recent high.

What do you think? how would you approach this better?

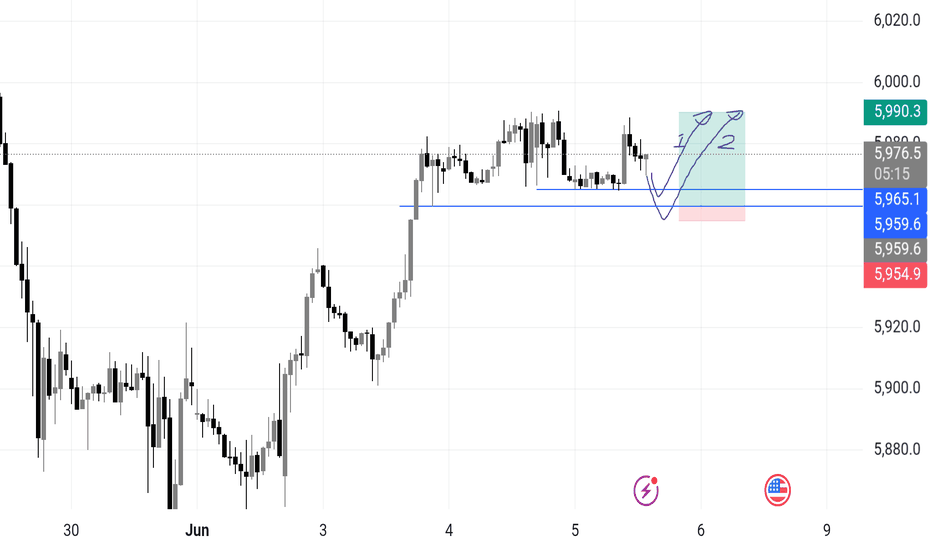

SPX500 – Consolidation Between 5966–5990, Breakout to Set DirectSPX500 | Technical View

The price is currently consolidating between 5966 and 5990.

A 1H or 4H candle close below 5966 would confirm bearish momentum, with downside targets at 5938 and 5905.

However, as long as price trades above 5966, the outlook remains bullish, targeting 5990.

A 1H close above 5990 may extend the move toward 6010 and 6030.

Resistance: 5990, 6010, 6030

Support: 5938, 5905, 5858

S&P500 awaits Trade Balance and Jobless Claims figuresTrump Tightens Immigration: Bans people from 12 countries, limits entry from 7 more, and blocks foreign students from attending Harvard.

Russia-Ukraine Tensions: Putin plans to strike back after a Ukrainian drone attack. Trump says Russia’s allies won’t profit from rebuilding Ukraine.

UK Housing Boom: Home sales rose 6% in May, the strongest in 3+ years, despite the end of a buyer tax break.

Germany & U.S.: German politician Friedrich Merz meets Trump today. At home, Germany faces rising public concern about tough economic times.

ECB Rate Cut Likely: The European Central Bank is expected to cut rates by 0.25% to 2%, but may slow further cuts soon.

Key Support and Resistance Levels

Key trading leel is at: 6000

Resistance Level 1: 6090

Resistance Level 2: 6140

Resistance Level 3: 6200

Support Level 1: 5900

Support Level 2: 5845

Support Level 3: 5800

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

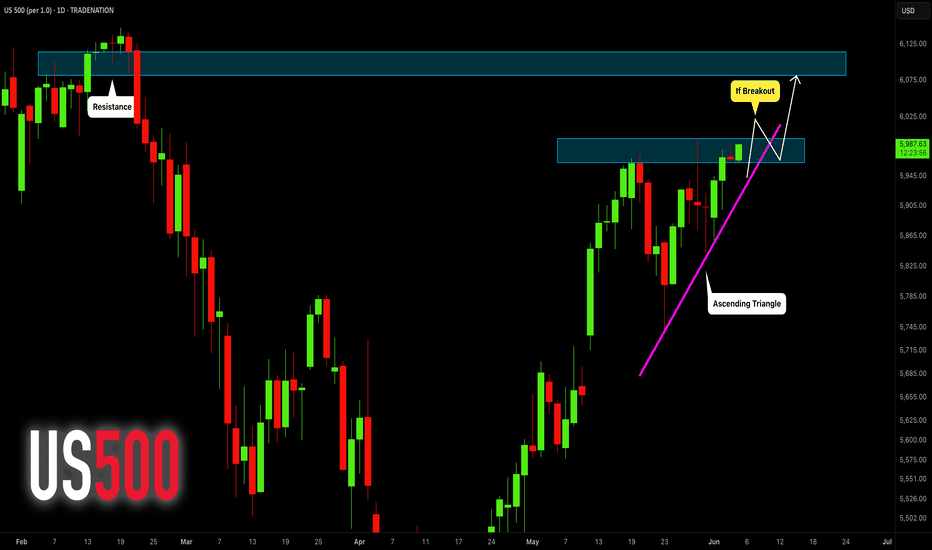

S&P500 Index (US500): Bullish Accumulation Pattern

I spotted a nice example of an ascending triangle pattern on a daily time frame.

To confirm a bullish continuation, we will need a bullish breakout

of its neckline.

A daily candle close above 5996 will provide a reliable confirmation.

A rise will be anticipated at least to 6080 resistance then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

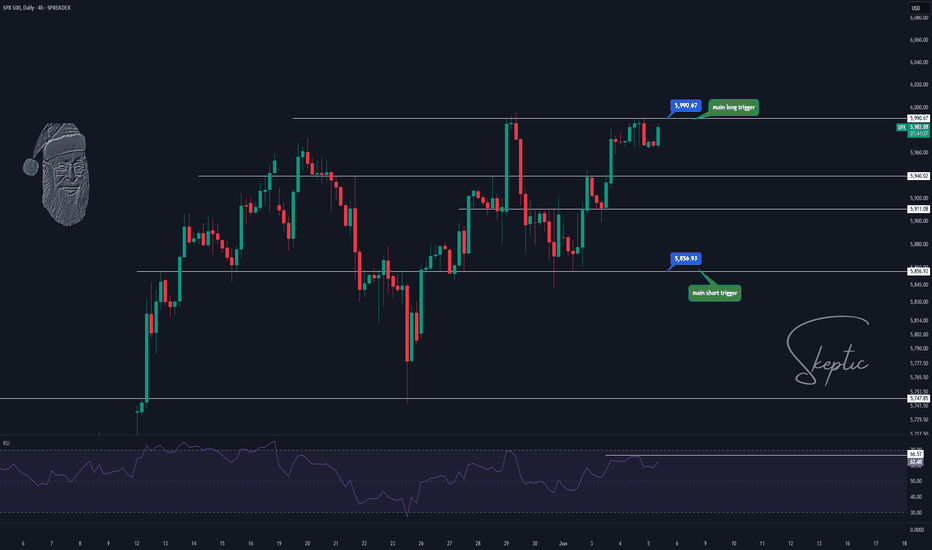

Skeptic | SPX 500 Analysis: Long Triggers Ready to Rip!Hey, what’s good? It’s Skeptic! 😎 Last week, we scored a nice R/R on SPX 500, and now it’s looking ready for another big move, super close to our long trigger. Let’s check it out with a multi-timeframe breakdown to grab those long and short triggers!

Daily Timeframe: The Big View

The SPX was riding a strong bullish wave, then hit a deep correction. Here’s what’s up:

It’s bounced back most of that drop and is nearing its ceiling at 6128.55. 🏔️

A break and hold above 6128.55 could kick the bullish trend into high gear, per Dow Theory.

Watch the daily RSI—if it goes overbought, we might see a fast, big rally. 🚀

This is our long-term play, so let’s zoom in for the short-term action!

4-Hour Timeframe: Long & Short Triggers

On the 4-hour chart, here’s the plan for our trades:

Long Trigger: Break above 5990.67, with RSI above 66.57 to show the move’s got juice.

Stop Loss: Your choice—put it below 5955.77, or check 1H or 15-minute charts for a tighter stop under the last low. 🎯

Short Trigger: A drop below 5856.93 lets you short, but it’s against the trend, so keep it low-risk. Take profits quick, use a small stop loss, and close when you hit a good R/R. ⚠️

Shorts are tricky here, so play it safe and don’t go all-in!

RSI Trick & Your Input

Love RSI? I’ve been using it forever, and I think most guides get it wrong. They say overbought RSI means sell, but for me, it’s a go sign for longs! Want a full RSI tutorial? Tell me in the comments, and I’ll hook you up! 📢

💬 Let’s Talk!

If this got you hyped, hit that boost—it helps a ton! 😊 Got another pair or setup you want me to hit? Drop it in the comments. Thanks for chilling with me—keep trading smart! ✌️

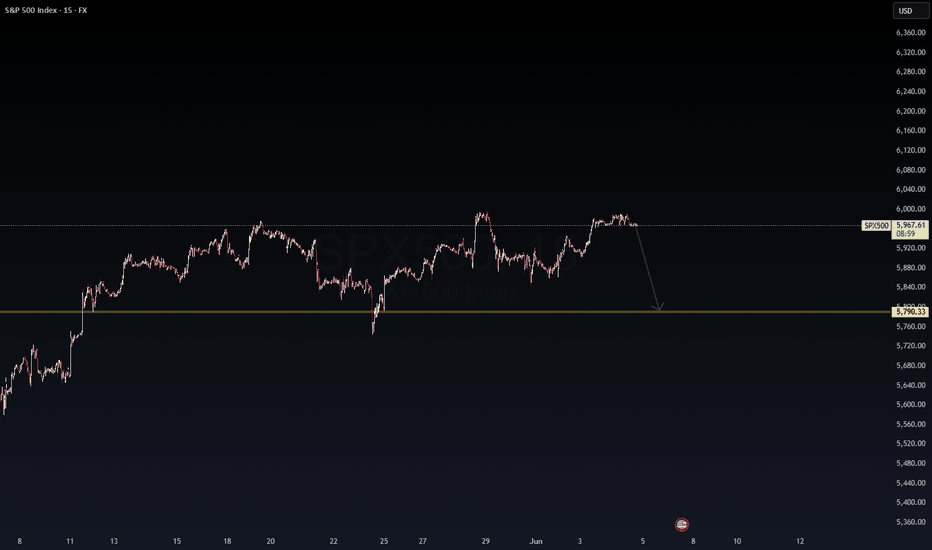

SPX500 — Structural Weakness Emerging on the 15-Min ChartWe may be approaching a critical inflection point.

Price action is showing signs of exhaustion after multiple failed attempts to break higher. The market structure is compressing beneath resistance, setting the stage for a potential breakdown.

🧭 Key Level to Watch:

Support at 5,790.33 aligns with previous liquidity sweeps and demand zones. A move toward this level could reflect rotation from short-term bullish euphoria into a broader correction cycle.

⚠️ Institutional traders, are you watching the same tape?

This isn’t just about price—it’s about positioning.

Market signals:

Distribution pattern forming

Liquidity void below current level

Compression likely to result in expansion (downside bias)

In markets like these, timing is everything.

Capital flows speak louder than sentiment.

#SP500 #MarketStructure #InstitutionalTrading #TechnicalAnalysis #SmartMoney #LiquidityZones #MacroStrategy #WaverVanir #RiskManagement

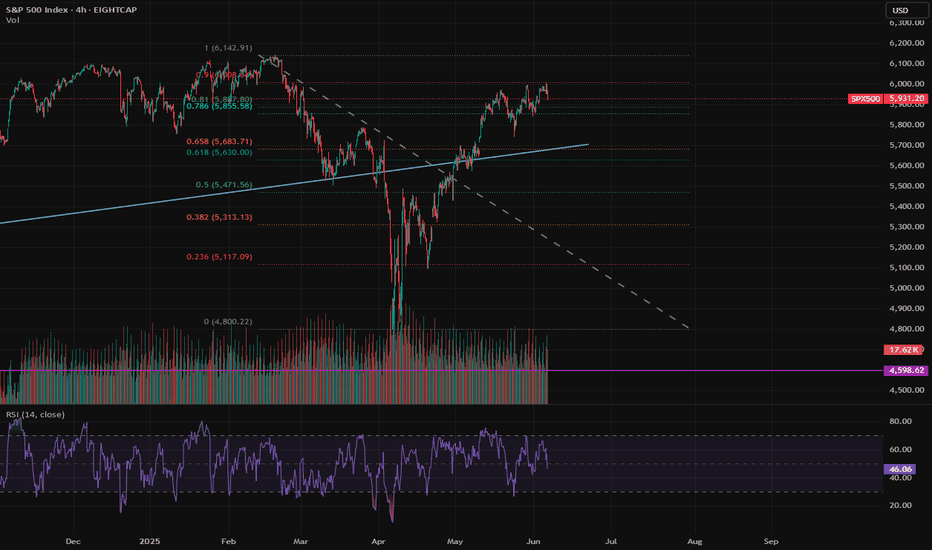

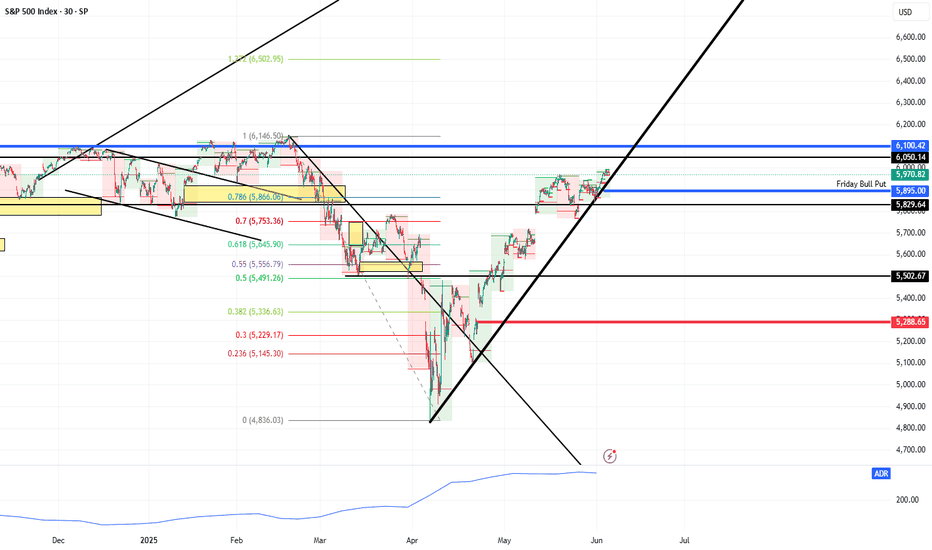

All-Time Highs (3% Up) or US/China Trade Gap (4-5% Down)?It's summer time (1st week of June)

Brutally slow price action thus far, Non-Farm Payroll hits this Friday

Next week will be more US Inflation Date (CPI, PPI)

S&P and Nasdaq are only 3% (or slightly less) away from all-time highs

Melt-up momentum says it's the path of least resistance

US/China Trade Agreement Gap (that silly little Monday announcement) is 4-5% lower

Whatever we hit, there will be disappointed traders and investors - the ultimate pain trade :)

I'm not bearish, I'm ridiculously cautious as a bull and wanting to see a pullback. I can tell

because it's actually annoying watching the market grind so slow to the upside shrugging

off every bad news bite and sense of reality

The big beautiful tax bill is losing support (see Elon Musk's latest comments)

The Trump Administration has pivoted so hard the other way the market is virtually

ignoring tariff news now

Let price be your guide. I'm connecting the April 7 lows forward and if the bears cross it and price sweeps some lows, there might be some pullback potential in the cards

Plenty to watch - be patient - opportunities await. Not forcing anything for now and I'm

doing the "boring" stuff for income trading.

Thanks for watching!!!

The close - no bells ring at a topMy feeling right now is one of deja vu. Like the bottom before the president delayed tariffs, there was no volume and my assumption was we would go a bit lower. Here we have no volume and my assumption has been we will go a bit higher. Could we top here? It's possible. The bear divergences are pointing to a move down at least temporarily.

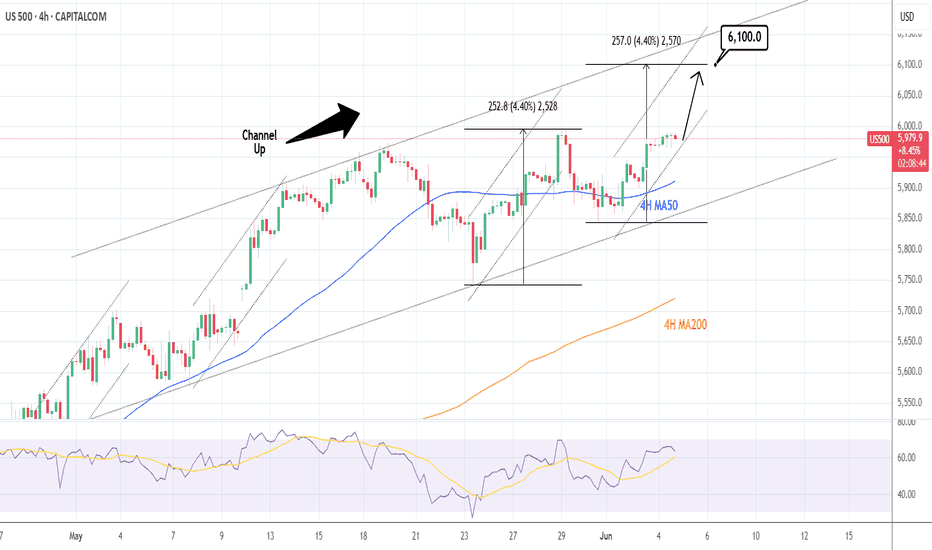

S&P500: Gearing up for a push to 6,100S&P500 is bullish on its 1D technical outlook (RSI = 64.611, MACD = 85.830, ADX = 19.630) as it has been trading inside a Channel Up for over a month. Right now it is halfway through the new bullish wave. We expect it to rise by at least +4.40%, same as the previous one. Stay bullish as long as the 4H MA50 holds, TP = 6,100.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##