US SPX 500 Index forum

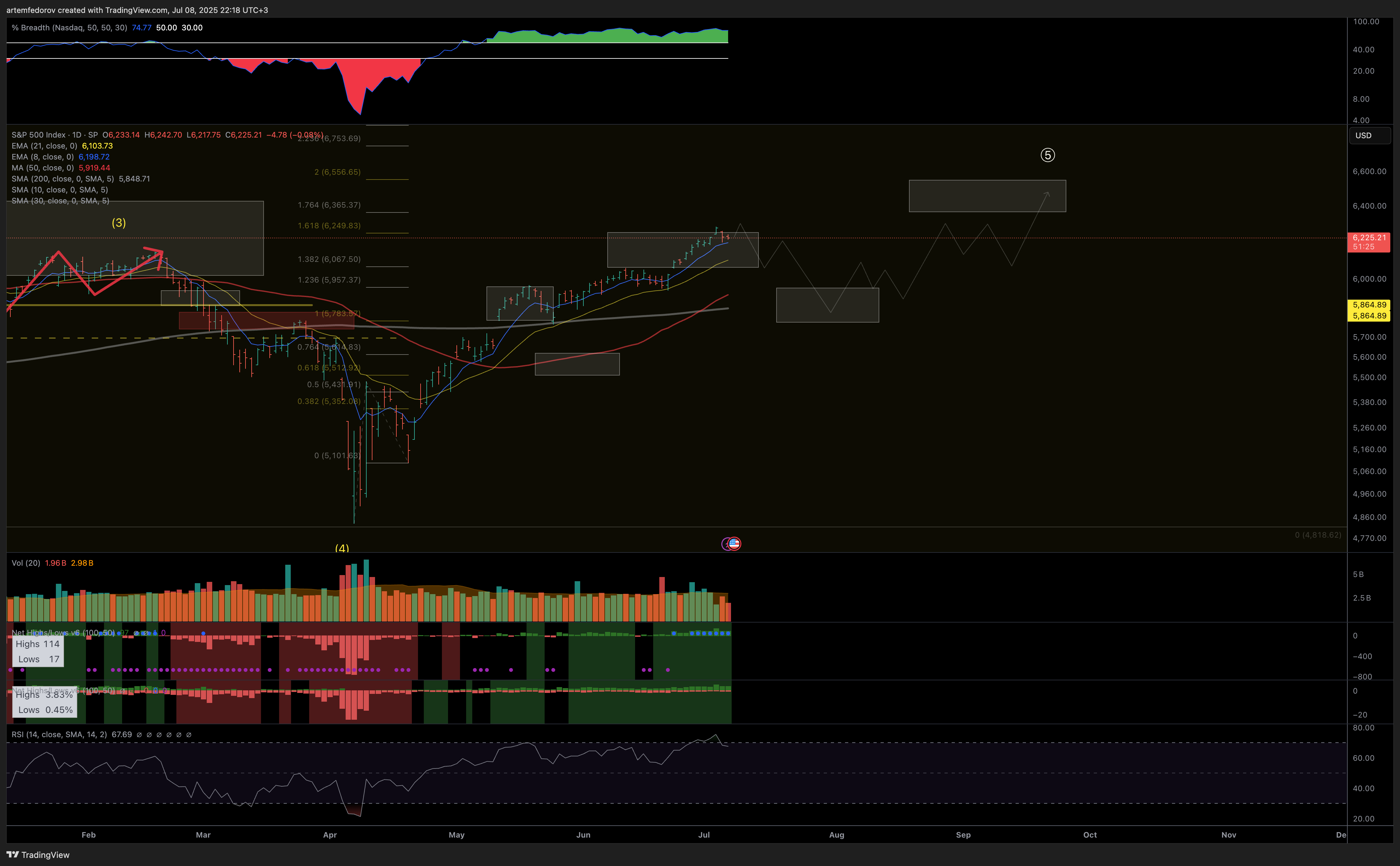

Big picture: Ideally one more leg up to the 6500 macro resistance zone in late 2025 - H1 2026.

Chart: tradingview.com/x/KV753HSj/

The Markets really do respect structure. Our role is to be aware of it and what may happen.

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

🌊 Flow with Intelligence, Not Noise.

⚙️ Views are Personal & Educational

🎯 Summary posts only. Full context via DM

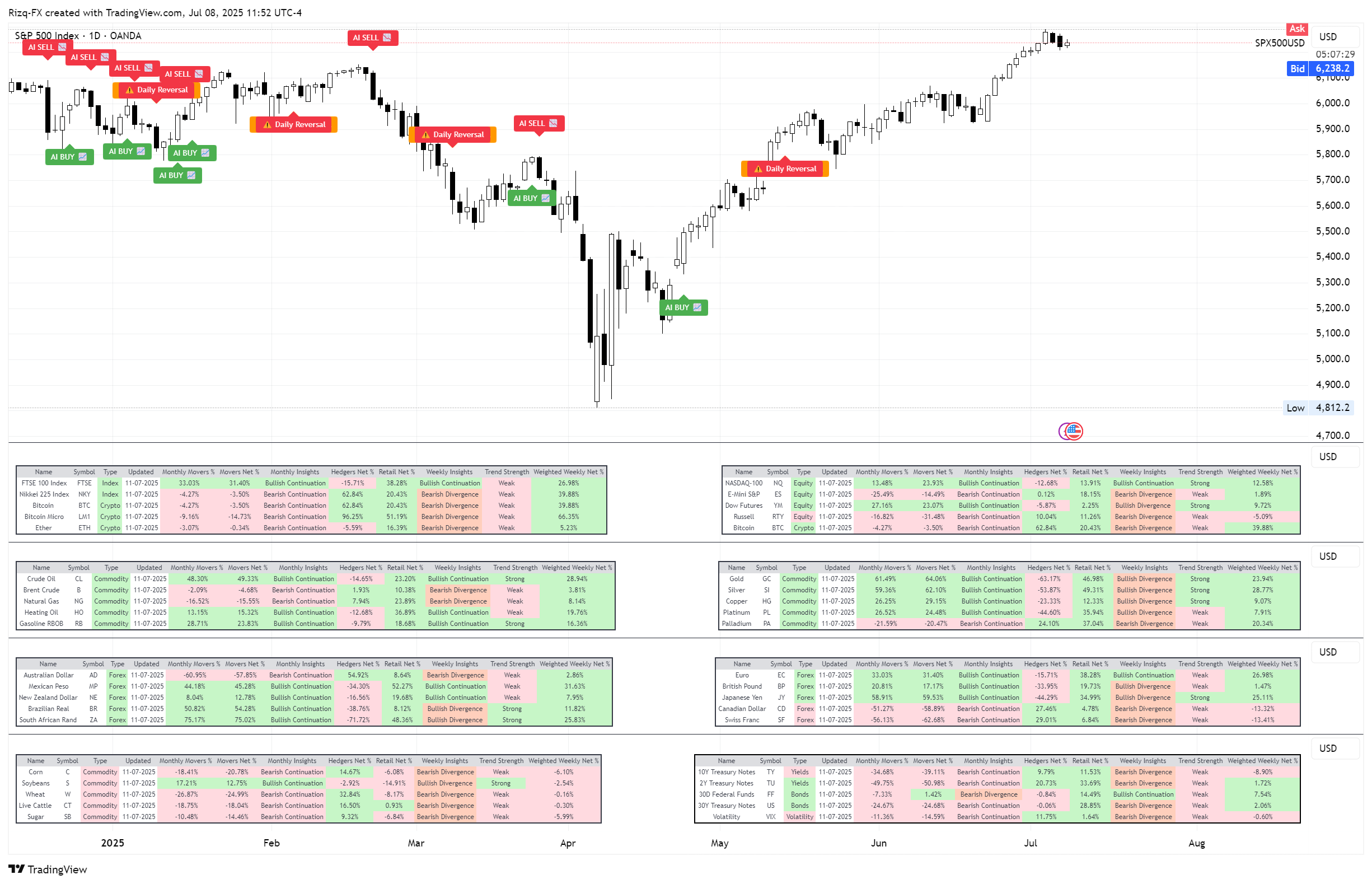

🧠 Retail Crowd Presses Long on SPX + NDX — Hedgers Step Back as CPI + FOMC Loom

📆 Tuesday, July 08, 2025 | ⏰ 10:30 BST / 05:30 EDT

📦 Positioning divergence unresolved — CPI and Fed minutes are the catalysts

📉 CoT Suggestion Snapshot

• SSPX: Retail net long bias rises ⚠️

• SNDX: Tech long crowd builds under 23K 🔻

• Crude: Overextended long exposure 🔻

• Gold: Hedge unwind risk grows 🔻

• AUD/USD: Retail overstep in FX 🔻

• BTC: Neutral flows persist ⚖️

🔁 Suggestion Outcome Review

Asset Bias Suggestion Outcome

SPX Long bias >6,200 ✅ Coil intact

NDX Long crowd risk ⚠️ No momentum yet

Crude Fade >68.5 zone ✅ Rejected 68.5

Gold Hold long ❌ Invalid — lost 3,330

Silver Reversal risk ✅ Turning lower

AUD Crowded long unwind 🔄 Building pressure

📌 This Week’s Watchlist

• ✅ Crude short bias working

• ✅ Silver reversal in play

• ⚠️ SPX + NDX: crowd long into CPI/FOMC

• ❌ Gold: hedge unwind accelerating

• 🔄 AUD: Flow flip watch

🎯 Tactical Bias Insights

• 🔻 Short: Crude into resistance

• 🔻 Short: Gold <3,330

• 🔻 Short: AUD/NZD crowded longs

• ⚠️ SPX/NDX: Wait for CPI + Fed minutes

• ⚖️ BTC: Structureless — avoid for now

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

🌊 Flow with Intelligence, Not Noise.

⚙️ Views are Personal & Educational, reflective of our Analysis and Research.

🎯 Summary posts only. Full context via DM

⚠️ Educational content only. Not investment advice.

📉 COT data reflects futures positioning as of July 02 (reported July 05)

📅 Released Monday, July 08 due to U.S. holiday delay

📆 Tuesday, July 08, 2025 | ⏰ 10:30 BST / 05:30 EDT

📦 Positioning divergence unresolved — CPI and Fed minutes are the catalysts

📉 CoT Suggestion Snapshot

• SSPX: Retail net long bias rises ⚠️

• SNDX: Tech long crowd builds under 23K 🔻

• Crude: Overextended long exposure 🔻

• Gold: Hedge unwind risk grows 🔻

• AUD/USD: Retail overstep in FX 🔻

• BTC: Neutral flows persist ⚖️

🔁 Suggestion Outcome Review

Asset Bias Suggestion Outcome

SPX Long bias >6,200 ✅ Coil intact

NDX Long crowd risk ⚠️ No momentum yet

Crude Fade >68.5 zone ✅ Rejected 68.5

Gold Hold long ❌ Invalid — lost 3,330

Silver Reversal risk ✅ Turning lower

AUD Crowded long unwind 🔄 Building pressure

📌 This Week’s Watchlist

• ✅ Crude short bias working

• ✅ Silver reversal in play

• ⚠️ SPX + NDX: crowd long into CPI/FOMC

• ❌ Gold: hedge unwind accelerating

• 🔄 AUD: Flow flip watch

🎯 Tactical Bias Insights

• 🔻 Short: Crude into resistance

• 🔻 Short: Gold <3,330

• 🔻 Short: AUD/NZD crowded longs

• ⚠️ SPX/NDX: Wait for CPI + Fed minutes

• ⚖️ BTC: Structureless — avoid for now

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

🌊 Flow with Intelligence, Not Noise.

⚙️ Views are Personal & Educational, reflective of our Analysis and Research.

🎯 Summary posts only. Full context via DM

⚠️ Educational content only. Not investment advice.

📉 COT data reflects futures positioning as of July 02 (reported July 05)

📅 Released Monday, July 08 due to U.S. holiday delay