USDAUD trade ideas

Market Analysis: AUD/USD Attempts Fresh ClimbMarket Analysis: AUD/USD Attempts Fresh Climb

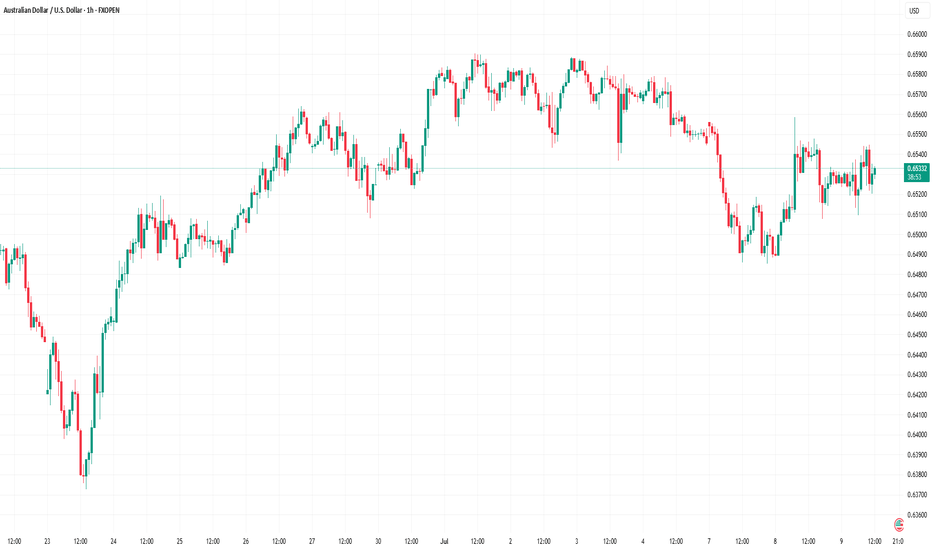

AUD/USD is attempting a fresh increase from the 0.6485 support.

Important Takeaways for AUD/USD Analysis Today

- The Aussie Dollar found support at 0.6485 and recovered against the US Dollar.

- There is a key bearish trend line forming with resistance at 0.6535 on the hourly chart of AUD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase above 0.6550. The Aussie Dollar tested the 0.6585 zone before the bears appeared and pushed it lower against the US Dollar.

The pair declined below the 0.6560 and 0.6550 support levels. The recent low was formed at 0.6485 and the pair is rising again. The bulls pushed it above the 50% Fib retracement level of the downward move from the 0.6588 swing high to the 0.6485 low.

The pair is now consolidating above the 50-hour simple moving average. On the upside, the AUD/USD chart indicates that the resistance is near the 0.6535 zone. There is also a key bearish trend line forming at 0.6535.

The first major resistance might be 0.6550 and the 61.8% Fib retracement level. An upside break above it might send the pair further higher. The next major resistance is near the 0.6560 level. Any more gains could clear the path for a move toward the 0.6585 resistance zone.

If not, the pair might correct lower. Immediate support sits near the 0.6510 level. The next support could be 0.6485. If there is a downside break below 0.6485, the pair could extend its decline toward the 0.6440 zone. Any more losses might signal a move toward 0.6420.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

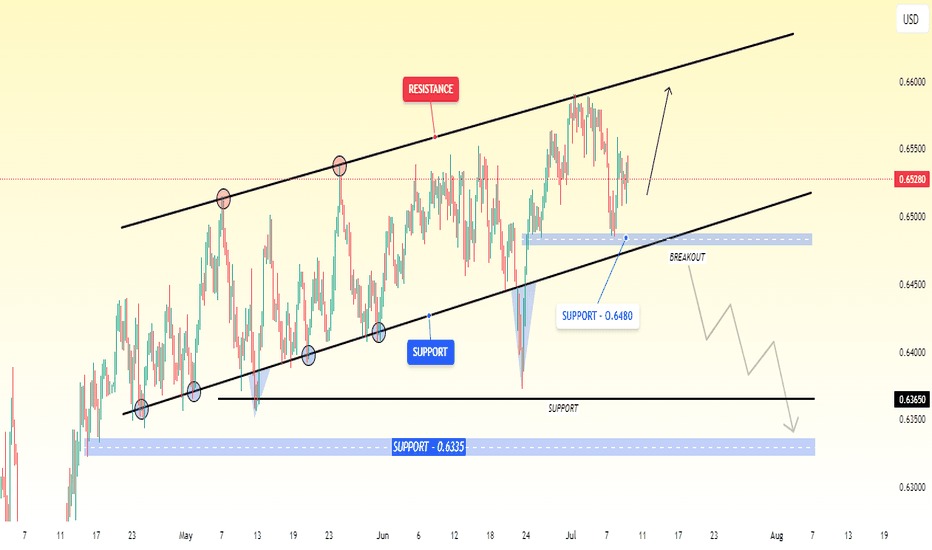

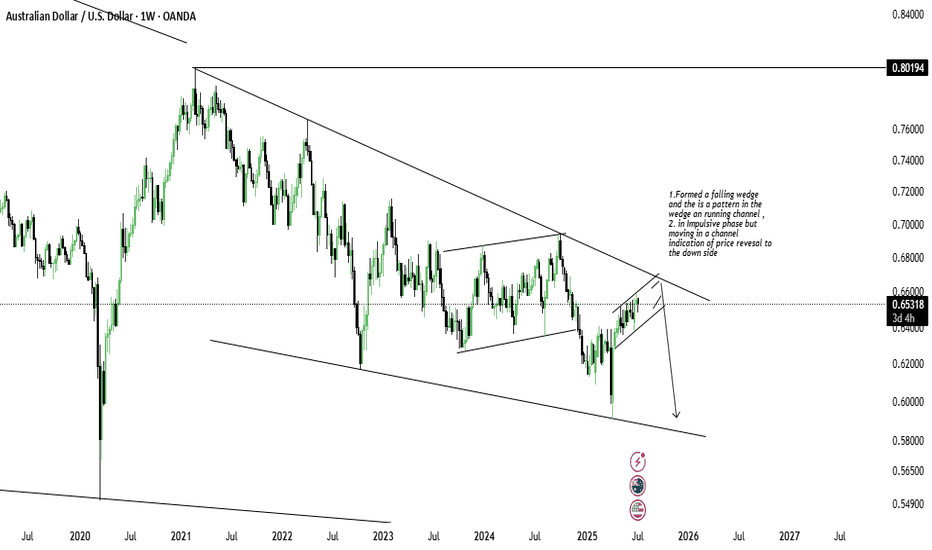

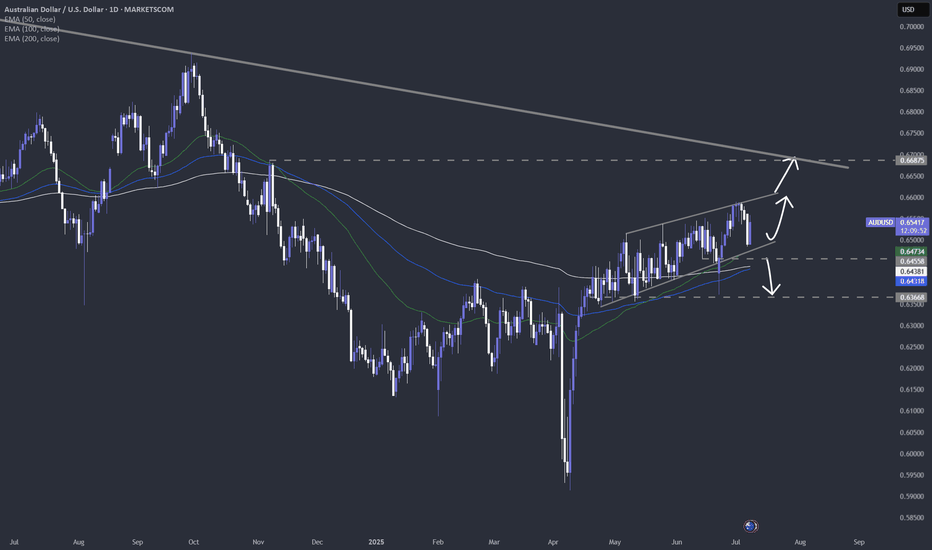

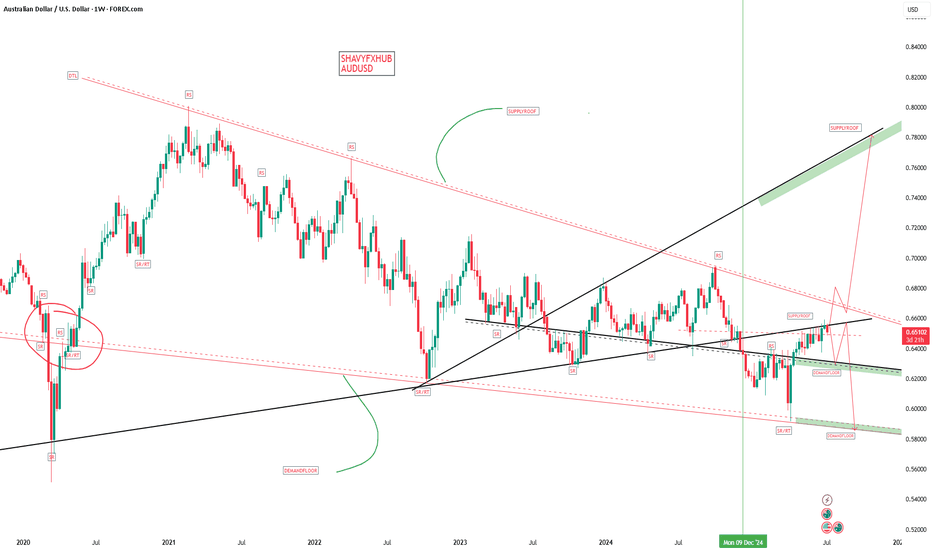

AUD/USD Maintains Upward Momentum Within Rising ChannelThe AUD/USD currency pair is currently moving within an rising channel and appears to be heading toward the upper resistance line of the trend.

However, if the price breaks below the first support level at 0.6480, it may signal a reversal, and the pair could start to decline. In that case, the next key support levels where the price might find buying interest or stabilize are around 0.6365 and 0.6335.

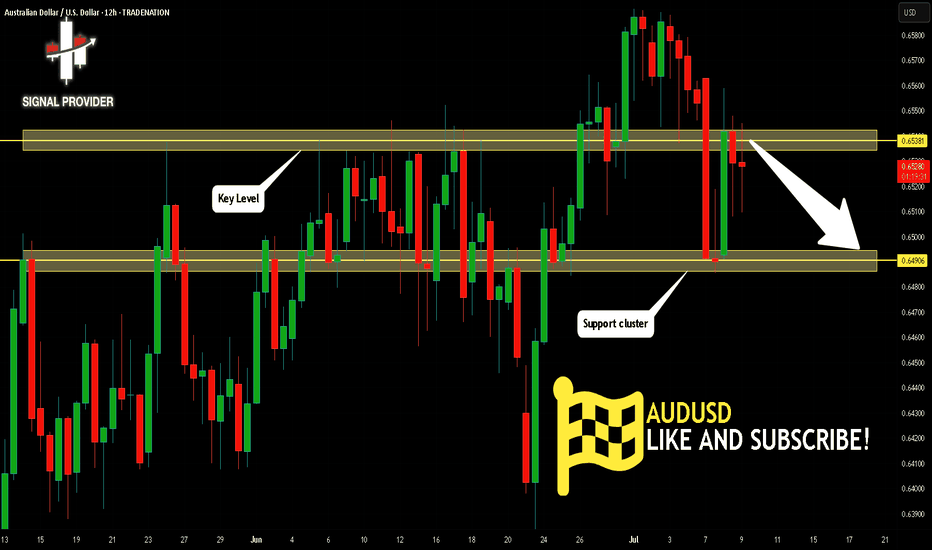

AUDUSD Will Move Lower! Short!

Take a look at our analysis for AUDUSD.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 0.653.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 0.649 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

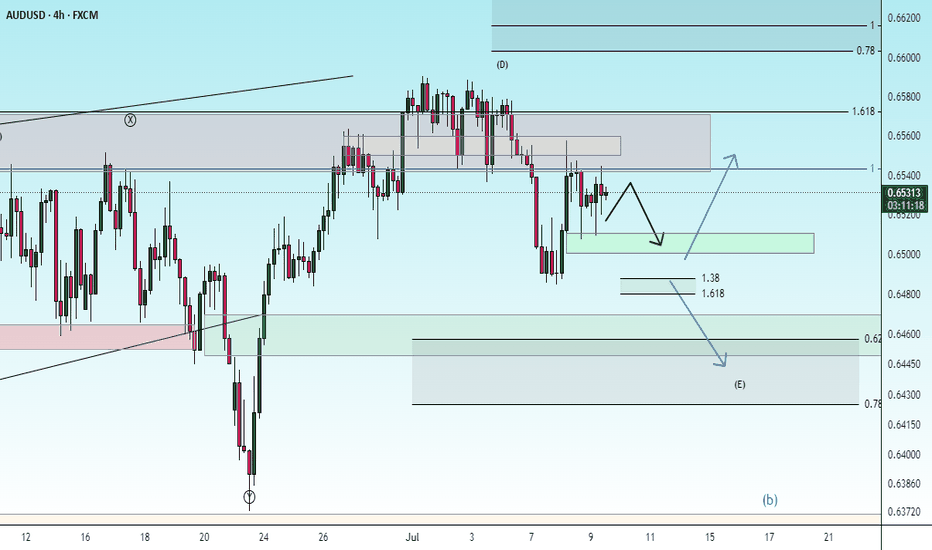

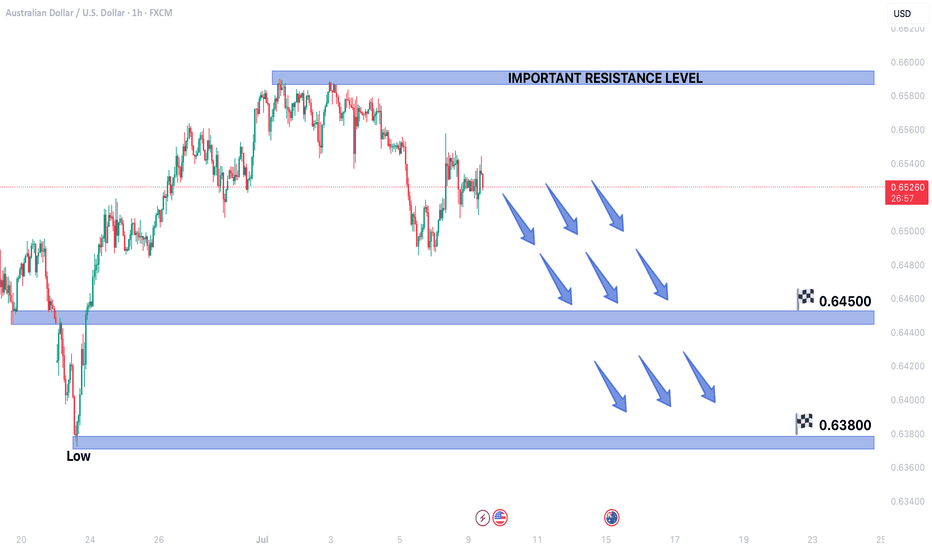

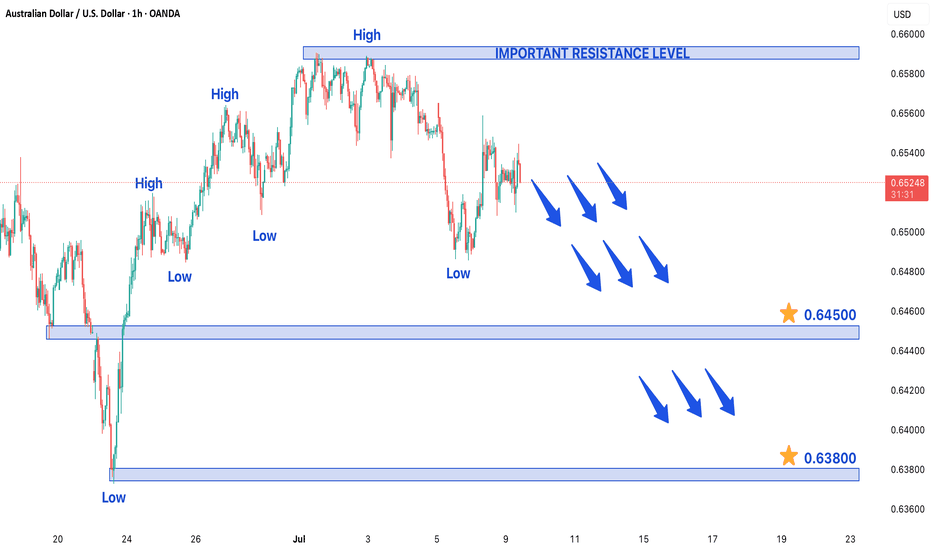

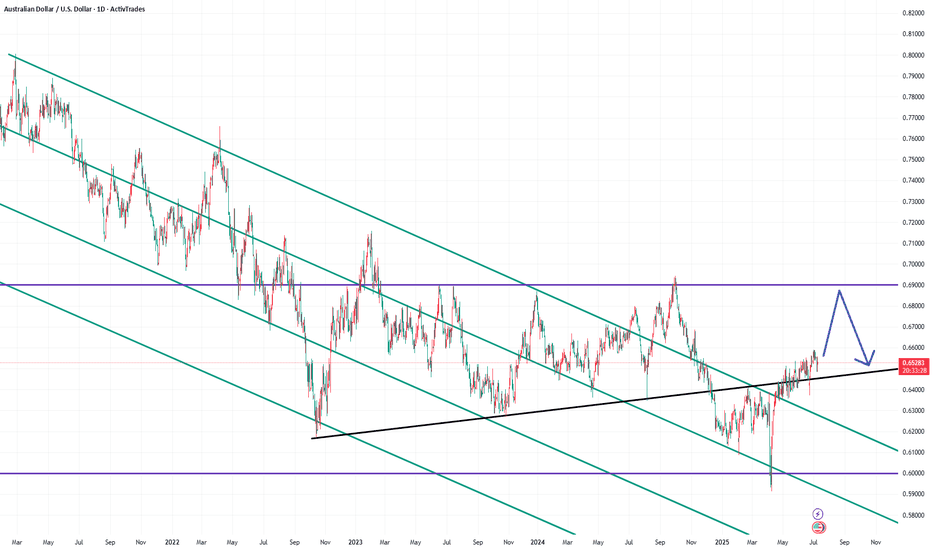

AUDUSD STARTED FORMING BEARISH TREND STRUCTUREAUDUSD STARTED FORMING BEARISH TREND STRUCTURE

Price started forming lower low, which indicates bearish trend.

price is expected to remain bearish in upcoming trading sessions.

on lower side market may hit the targets of 0.64500 & 0.63800.

On higher side 0.65900 level can act as a important resistance level.

AUDUSD STARTED FORMING BEARISH TREND STRUCTUREThe AUD/USD pair has recently begun forming a bearish trend structure, signaling a potential continuation of downward momentum in the coming trading sessions. This shift in market sentiment is evident as the price has started printing lower lows, a key characteristic of a bearish trend. Lower lows indicate that sellers are gaining control, pushing the exchange rate downward with each successive decline. Traders and investors should remain cautious, as this pattern suggests further downside potential unless a significant reversal occurs.

On the lower side, the market is expected to test key support levels at 0.64500 and 0.63800. These levels may act as critical zones where buyers could attempt to step in, but if selling pressure persists, a breakdown could lead to an extended decline. A breach below these supports may open the door for deeper losses, reinforcing the bearish outlook. Conversely, if the pair finds stability near these levels, a short-term bounce or consolidation could occur before the next directional move.

On the upside, 0.65900 stands as a crucial resistance level. Any bullish retracement towards this zone could attract fresh selling interest, capping upward movements. A sustained break above this resistance would be necessary to invalidate the current bearish structure, potentially shifting the trend towards neutrality or even bullish reversal. Until then, rallies towards this resistance may present selling opportunities for traders aligning with the prevailing downtrend.

In summary, the AUD/USD pair is exhibiting bearish tendencies, with lower lows confirming seller dominance. The immediate targets lie at 0.64500 and 0.63800, while 0.65900 serves as a key resistance to watch. Traders should monitor price action around these levels for potential bearish continuation or signs of a trend reversal. Risk management remains essential, as unexpected macroeconomic developments or shifts in market sentiment could alter the current trajectory.

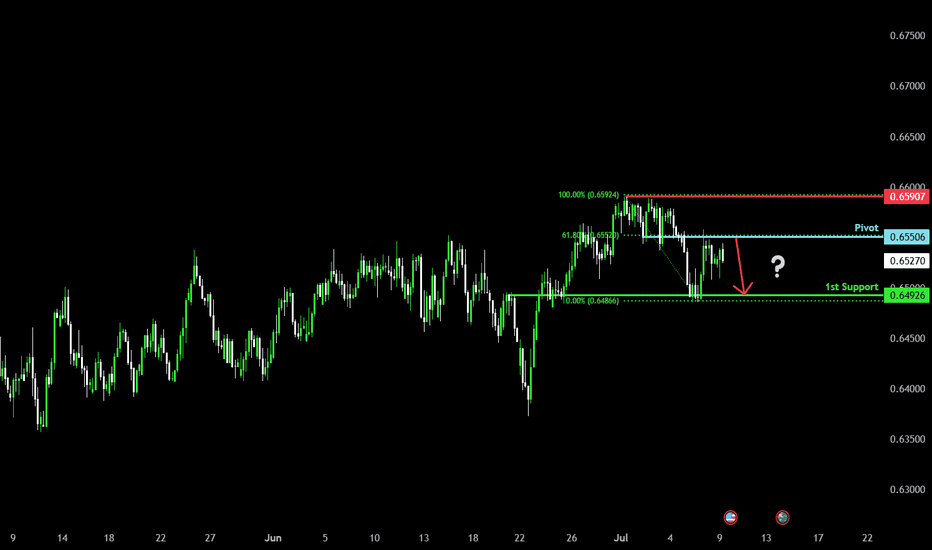

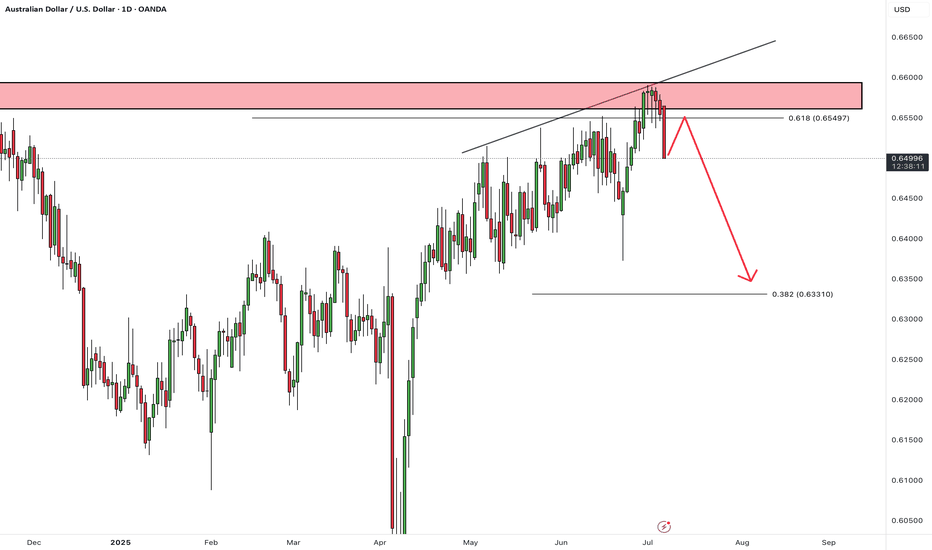

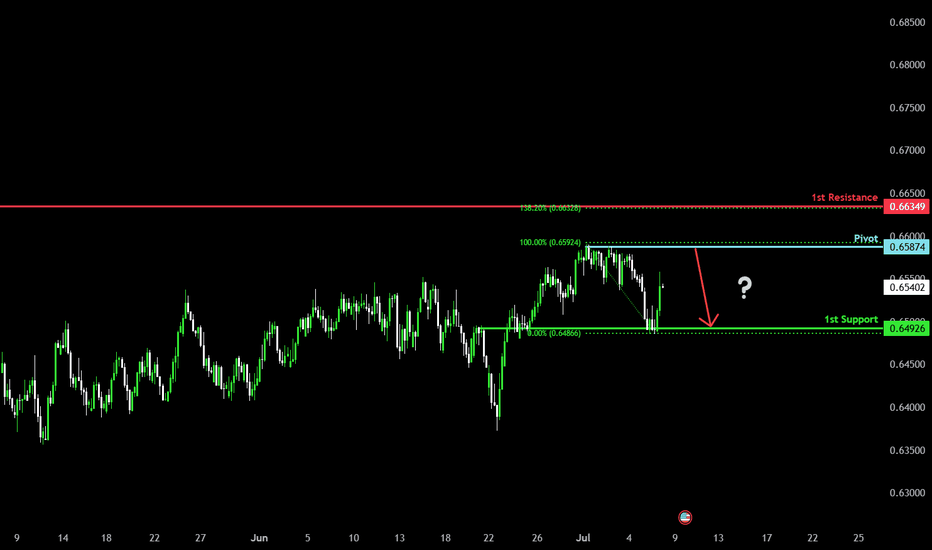

Bearish drop off 61.8% Fibonacci resistance?The Aussie (AUD/USD) has rejected off the pivot, which acts as a pullback resistance, and could drop to the 1st support, which has been identified as an overlap support.

Pivot: 0.6550

1st Support: 0.6492

1st Resistance: 0.6590

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

aud/usdThe Australian Dollar and the US Dollar pair belong the Majors, a group of the most popular traded pairs in the world. This pair's popularity soared because traders were attracted to the interest rate differential of the pair. This has waned in recent years due to economic volatility worldwide.

AUDUSD InsightHello to all our subscribers, and welcome!

Please share your personal thoughts in the comments. Don’t forget to like and subscribe.

Key Points

- U.S. President Donald Trump stated ahead of a cabinet meeting at the White House that he will announce tariffs on semiconductors, pharmaceuticals, and several other items, adding that pharmaceuticals could face tariffs of up to 200%.

- The European Union has not yet received a formal tariff notice from Trump. However, it is reportedly considering a possible agreement to maintain a base tariff rate of 10%.

- Michele Bullock, Governor of the Reserve Bank of Australia, remarked, “I don’t think inflation is sustainably low—I actually believe it is still higher.”

Key Economic Events This Week

+ July 9: FOMC Meeting Minutes Release

+ July 10: Germany June CPI

+ July 11: U.K. May GDP

AUDUSD Chart Analysis

The recent uptrend has temporarily paused around the 0.66000 level. However, the pair is expected to resume its upward momentum in the 0.64700–0.65000 zone. Once the bullish trend resumes, it is likely to rise smoothly toward the 0.67000 level, although minor resistance is expected at 0.67000, which could trigger a short-term pullback. In the longer term, the pair is still projected to rise toward the 0.69000 level.

Australian dollar stabilizes after RBA's surpriseThe Australian dollar is in positive territory after a three-day skid, declining 1.5%. In the North American session, AUD/USD is trading at 0.6532, up 0.50% on the day. The Australian dollar rose as much as 0.95% earlier before retreating.

The Reserve Bank of Australia blindslided the markets on Tuesday as the central bank held the cash rate at 3.85%. The markets had priced in a quarter-point cut at 96%, but the RBA had the last laugh. For the first time, the RBA published the vote tally, which was 6-3 in favor of maintaining the rate.

The rate statement was cautious, as members said "there are uncertainties about the outlook for domestic economic activity and inflation".

Governor Bullock tried to calm the markets, saying that the decision was about "timing rather than direction" and that the Bank would "wait a few weeks" to confirm that inflation was on track to ease and remain sustainably around 2.5%. Bullock said that "we don't want to end up having to fight inflation again".

Inflation is moving in the right direction but the RBA wants to see the second-quarter inflation report on July 30, ahead of the rate decision on Aug. 12. Headline CPI in May eased to 2.1% y/y from 2.4% in April. The core rate dropped to 2.8% from 2.4% in April, the lowest rate since early 2022.

The RBA will be hoping that waiting till August will provide some clarity with regard to US tariff policy. President Trump has pledged new tariffs against various countries but this move is not expected to have much impact on Australia's economy.

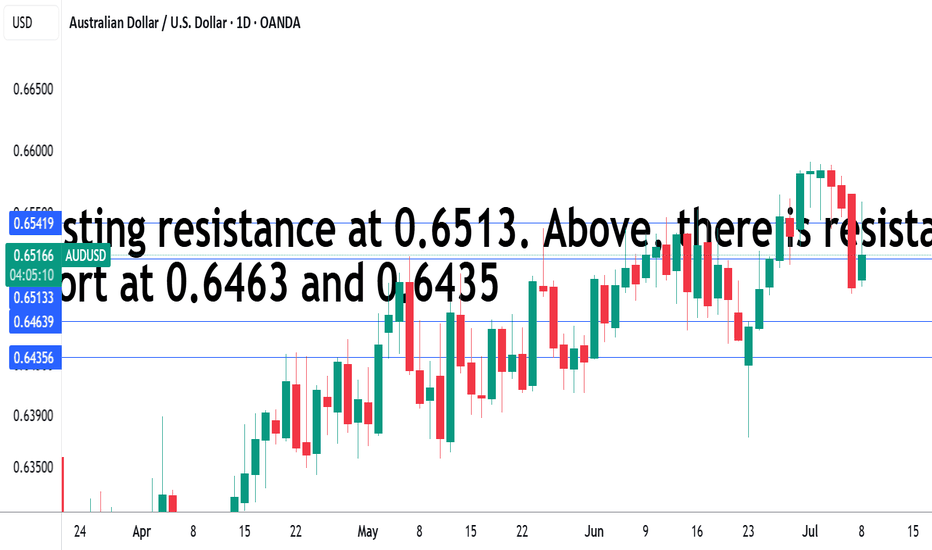

AUD/USD is testing resistance at 0.6513. Above, there is resistance at 0.6541

There is support at 0.6463 and 0.6435

Australian dollar stabilizes after RBA's surprise The Australian dollar is in positive territory after a three-day skid, declining 1.5%. In the North American session, AUD/USD is trading at 0.6532, up 0.50% on the day. The Australian dollar rose as much as 0.95% earlier before retreating.

The Reserve Bank of Australia blindslided the markets on Tuesday as the central bank held the cash rate at 3.85%. The markets had priced in a quarter-point cut at 96%, but the RBA had the last laugh. For the first time, the RBA published the vote tally, which was 6-3 in favor of maintaining the rate.

The rate statement was cautious, as members said "there are uncertainties about the outlook for domestic economic activity and inflation".

Governor Bullock tried to calm the markets, saying that the decision was about "timing rather than direction" and that the Bank would "wait a few weeks" to confirm that inflation was on track to ease and remain sustainably around 2.5%. Bullock said that "we don't want to end up having to fight inflation again".

Inflation is moving in the right direction but the RBA wants to see the second-quarter inflation report on July 30, ahead of the rate decision on Aug. 12. Headline CPI in May eased to 2.1% y/y from 2.4% in April. The core rate dropped to 2.8% from 2.4% in April, the lowest rate since early 2022.

The RBA will be hoping that waiting till August will provide some clarity with regard to US tariff policy. President Trump has pledged new tariffs against various countries but this move is not expected to have much impact on Australia's economy.

AUD/USD is testing resistance at 0.6513.

Above, there is resistance at 0.6541

There is support at 0.6463 and 0.6435

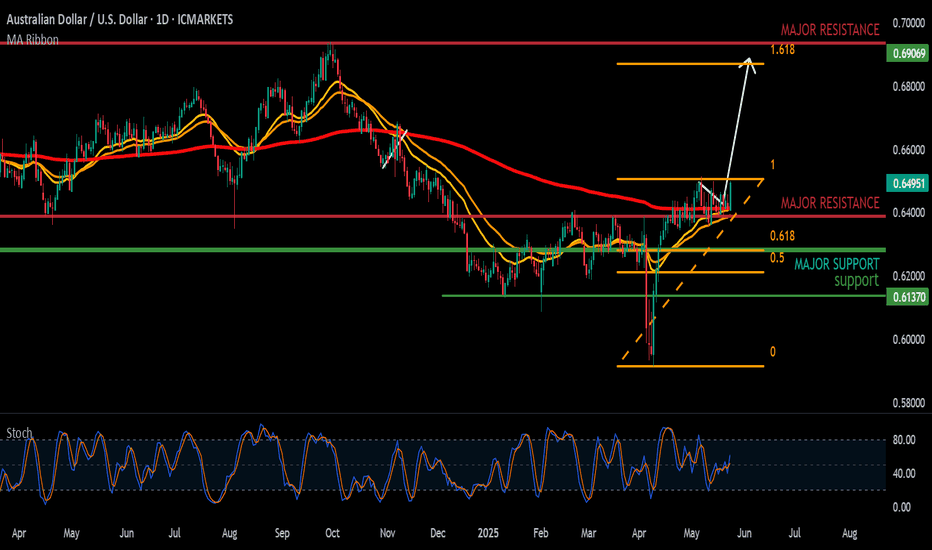

AUDUSD trend reversal to the upside!!!# AUD/USD Long Trading Plan

## Setup

- **Pair**: AUD/USD

- **Direction**: LONG

- **Reason**: Breakout above major resistance indicating bullish trend.

## Entry

- Enter on confirmed break above resistance

- OR enter on retest on smaller time frame like 4h, 1h

## Stop Loss

- Below the broken resistance level

- Risk: 1-2% of account

## Take Profit

- **TP1**: Next resistance level (partial close) at 0.66825

- **TP2**: Extended target based on fib 1.618 at 0.68944

- **Risk:Reward**: Minimum 1:2

## Trade Management

- Move stop to breakeven after TP1 hit

- Trail stop as price moves in favor

- proper risk and reward

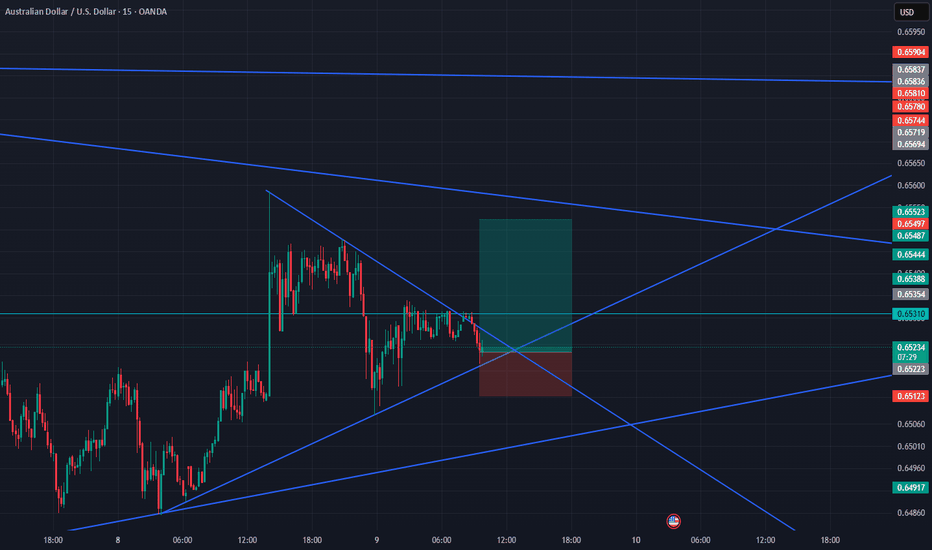

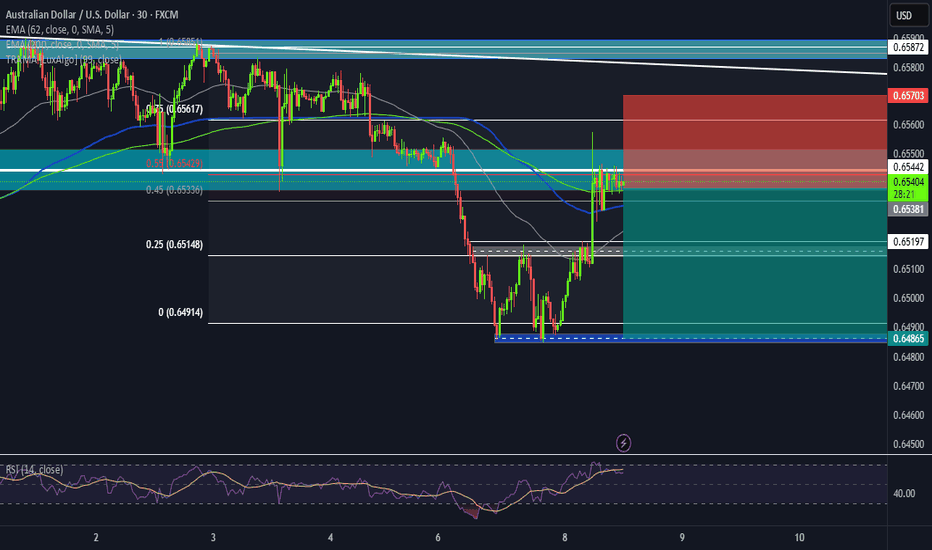

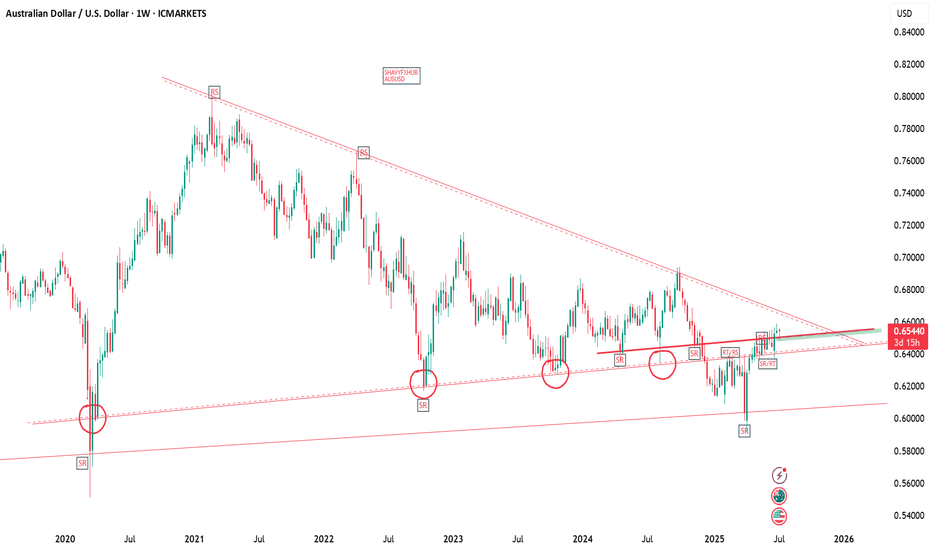

AUDUSDOverall bearish market structure in the higher time frames

- High wicks exhausting the buyers ( sellers stepping in? )

- RSI crossing over ( potential for a market direction change )

- Testing Supply zone but failing to break through

- Tested Major Fib levels and currently consolidation and unable to break through

- Currently in the 30 minute time frame is this the retracement to then fall towards the downsides

- Stop Loss is placed from the ATR number which was 32.

- Take Profit at next demand zone

Any questions or wanting to follow more of my trades, don't hesitate to drop me a message

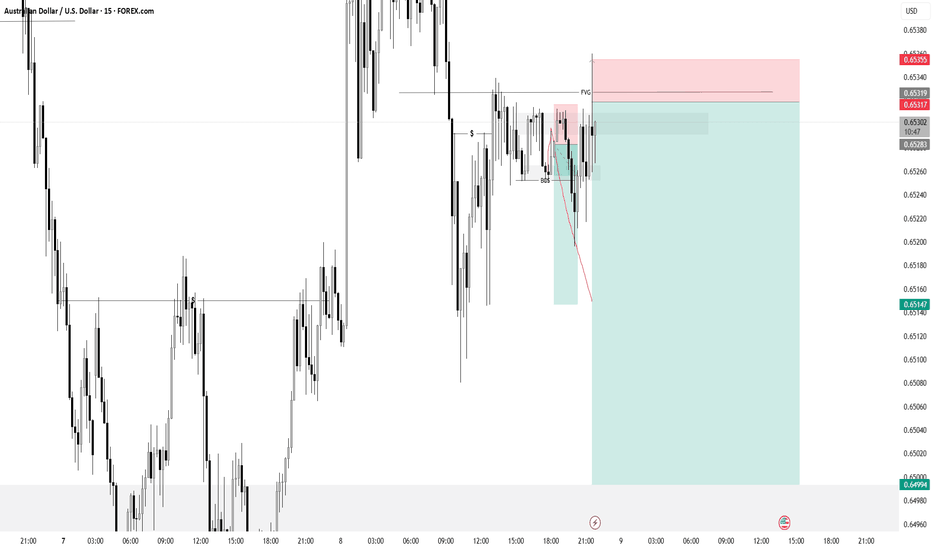

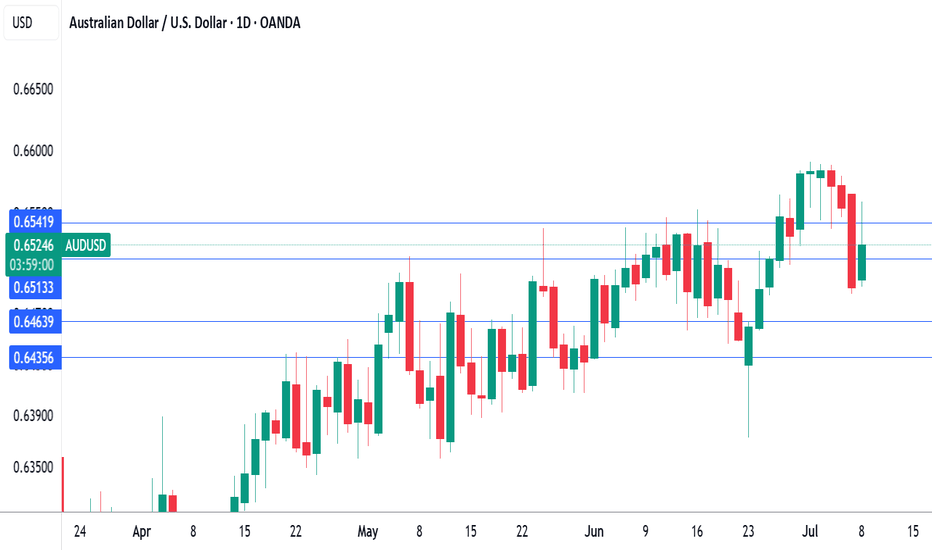

Australian Dollar Strengthens Following RBA DecisionAustralian Dollar Strengthens Following RBA Decision

Today, the AUD/USD pair experienced a spike in volatility. According to ForexFactory, analysts had forecast that the Reserve Bank of Australia (RBA) would cut interest rates from 3.85% to 3.60%. However, the market was caught off guard as the central bank opted to keep rates unchanged.

The RBA stated the following:

→ It remains cautious in its inflation outlook and awaits further evidence confirming that inflation is on track to return to the 2.5% target.

→ The decision to hold the rate was made by a vote of six to three — a rare instance of a split opinion among committee members.

The initial market reaction to the RBA’s unexpected move was a sharp appreciation of the Australian dollar. However, this was followed by a quick pullback in the minutes that followed (as indicated by the arrows).

Technical Analysis of the AUD/USD Chart

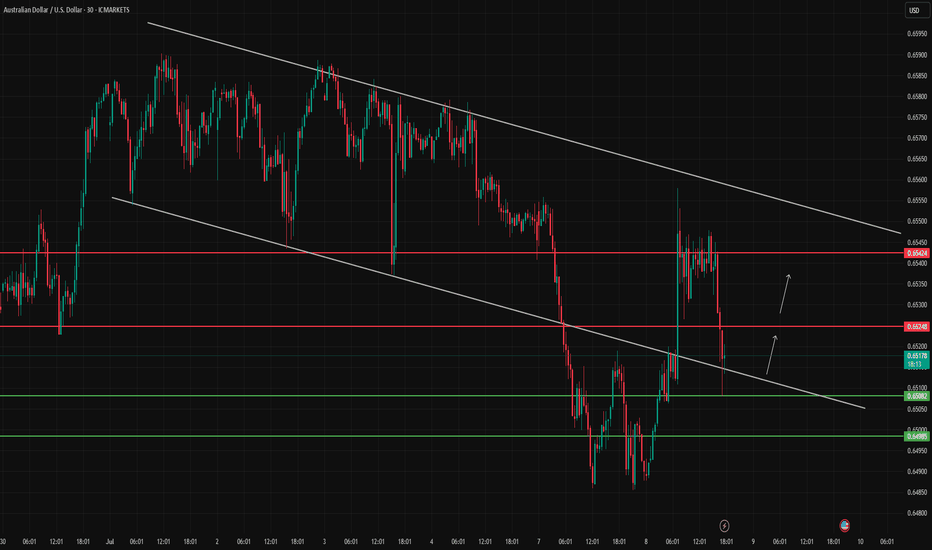

Since early July, price action in AUD/USD has been forming a descending channel (marked in red). In this context:

→ Today’s sharp rally and subsequent retracement underscored the significance of the upper boundary of the channel;

→ The pair tested a previously broken ascending trendline (the lower line of the blue channel);

→ Although the price briefly rose above the 0.65450 level, this area may now act as resistance going forward.

There is a possibility that, as forex trading unfolds throughout the day, AUD/USD could retreat towards the median line of the descending channel. Such a move could be interpreted as follows:

→ The initial reaction to the RBA decision may have been premature;

→ Selling pressure persists, which might trigger a move towards the support zone near 0.64850.

Looking ahead, the trajectory of AUD/USD in July 2025 will be largely influenced by developments surrounding a potential trade agreement between the United States and other countries, including Australia.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Surprise halt by the RBA. A positive for the AUD.After a surprise halt by the RBA, where the Bank kept the cash rate unchanged, MARKETSCOM:AUDUSD reversed sharply higher. Where it may go next? Let's dig in.

FX_IDC:AUDUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

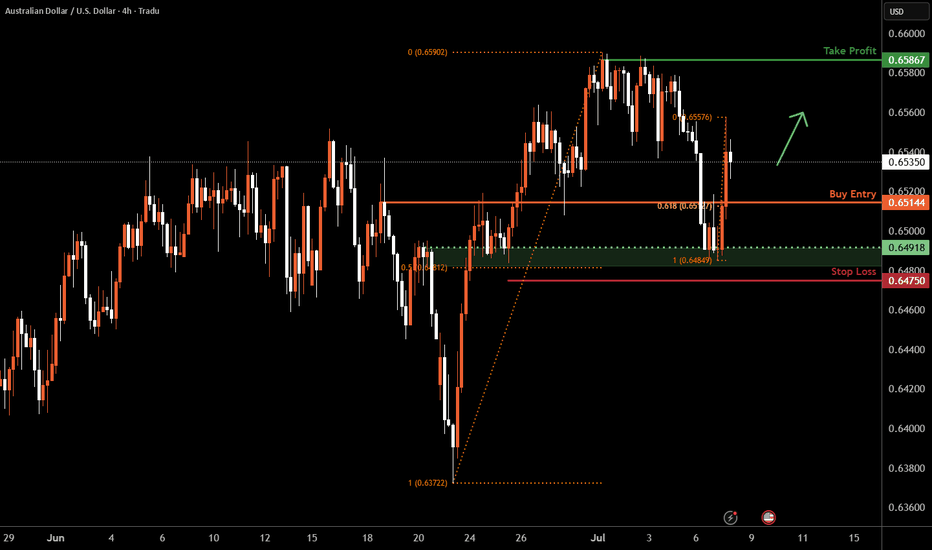

Aussie H4 | Pullback support at 61.8% Fibonacci retracementThe Aussie (AUD/USD) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 0.6514 which is a pullback support that aligns with the 61.8% Fibonacci retracement.

Stop loss is at 0.6475 which is a level that lies underneath an overlap support and the 50% Fibonacci retracement.

Take profit is at 0.6586 which is a multi-swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

AUDUSDTHE month July 8, 2025, the key Australian economic events

2:30 AM WAT – NAB Business Confidence

Actual: 5

Forecast: 2

The NAB Business Confidence Index rose sharply to 5 in June 2025 from 2 in May, marking its highest level since January and indicating improving business sentiment. This improvement was driven by gains in sales, profitability, and employment, signaling optimism about the economic outlook despite some lingering cost pressures.

5:30 AM WAT – RBA Cash Rate and Related Announcements

Cash Rate Actual: 3.85% (no cut at this meeting)

Forecast: 3.60% (markets had expected a 25 bps cut)

Previous: 3.85%

The Reserve Bank of Australia (RBA) held the cash rate steady at 3.85%, surprising markets that had expected a cut to 3.60%. The RBA Rate Statement accompanied the decision, providing insights into the bank’s view on inflation, growth, and monetary policy. The decision reflects the RBA’s cautious stance amid mixed economic signals and ongoing inflation concerns.

The stronger business confidence contrasted with the RBA’s decision to pause rate cuts, highlighting uncertainty about the economic outlook and inflation trajectory in Australia.

AU10Y=ROSE TO 4.3% FROM DAILY OPEN OF 4.206%

AUD OCR=3.85% THE SAME

US10Y=4.391%

US IRT=4.25-4.5%

This shift in AU1OY and RATE hold of 3.85% will give AUD a buy opportunity going forward.

while we are seeing tariff related shocks evident ,AUSTRALIA a commodities dependent economy will take a offensive .

The announcement and implementation of tariffs have created uncertainty, causing the AUD to decline from recent highs. The AUD/USD pair dropped in anticipation of tariff changes and broader risk aversion in global markets.

Market Sentiment:

The threat of higher tariffs and trade tensions typically weighs on the AUD, as Australia’s economy is highly exposed to global trade flows. Increased tariffs can reduce export competitiveness and hurt terms of trade, especially if global growth slows as a result.

Limited Direct Impact:

since the US is not Australia’s largest export market. However, indirect effects—such as slower global growth or disruptions in China (Australia’s biggest trading partner)—could further pressure the AUD.

Broader Economic and Policy Context

RBA Response:

The Reserve Bank of Australia (RBA) has cited tariff uncertainty as a reason for holding interest rates steady, adopting a “wait-and-see” approach until the full effects of global trade tensions are clearer.

Exchange Rate as Shock Absorber:

The AUD often acts as a buffer during global shocks. If tariffs or trade tensions worsen, a weaker AUD can help offset some of the negative effects by making Australian exports more competitive, but it also increases the cost of imports.

Key Takeaways

Tariff uncertainty has already contributed to recent AUD weakness.

If trade tensions escalate or global growth slows, the AUD could face further downside.

The RBA is likely to remain cautious, and the AUD will remain sensitive to both tariff developments and broader economic data.

#AUDUSD

AUDUSDHello Traders! 👋

What are your thoughts on AUDUSD?

The AUDUSD pair reached a resistance zone, which was accompanied by a negative divergence, signaling weakening bullish momentum. This led to a bearish reaction from that area.

We expect that, after some consolidation around this resistance, the pair will likely continue its decline at least toward the specified support level.

Don’t forget to like and share your thoughts in the comments! ❤️

AUDUSD Today July 8th 2025, the Reserve Bank of Australia (RBA) is widely expected to announce a 25 basis point cut in the official cash rate, lowering it from 3.85% to 3.60%. This would be the third rate cut in 2025, reflecting easing inflation and a slowing economy.

Key Details for July 8, 2025:

2:30 AM WAT:

Release of NAB Business Confidence data for Australia.

5:30 AM WAT:

Announcement of the RBA Cash Rate decision, expected to be cut to 3.60% from 3.85%.

Release of the RBA Rate Statement, outlining the rationale behind the decision.

RBA Press Conference follows, providing further insights and answering questions.

Market Expectations and Impact:

Major banks including Westpac, Commonwealth Bank, NAB, and ANZ unanimously forecast this 25 bps cut due to softer inflation and subdued economic growth.

The rate cut is expected to ease borrowing costs, potentially saving mortgage holders .

The RBA aims to balance supporting growth while maintaining inflation within its 2–3% target band.

Summary Timeline (WAT)

Time Event Expected Outcome

2:30 AM NAB Business Confidence Indicator of business sentiment

5:30 AM RBA Cash Rate Announcement Cut from 3.85% to 3.60%

5:30 AM RBA Rate Statement Explanation of decision

5:30 AM RBA Press Conference Q&A and further guidance

This rate cut is part of a broader easing cycle, with markets pricing in multiple cuts through the rest of 2025 as inflation remains manageable but economic growth slows.

2. 10-Year Government Bond Yields

Australia 10-Year Bond Yield: Has been falling in 2025 alongside expectations of RBA rate cuts,

AU10Y=4.232%

OCR=3.85% TO TRIM IT TO 3.60% TODAY.

US10Y=4.383%

USD IRT=4.25%-4.5%

3. Interest Rates

Reserve Bank of Australia (RBA) Cash Rate: Recently cut from 3.85% to 3.60% in July 2025, with expectations of further easing (potentially down to ~3.6% by year-end).

US Federal Reserve Rate: Held steady at 4.25%–4.50% as of mid-2025, with a slower pace of cuts compared to Australia.

4. Interest Rate Differential and Impact on AUD/USD

The interest rate differential (US rate minus Australian rate) currently favors the US by approximately 0.65–0.9 percentage points (Fed rate ~4.25–4.50% vs. RBA ~3.60%).

This narrowing differential from earlier wider gaps has weighed on the AUD, as higher US rates attract capital flows, supporting the USD.

However, the recent RBA rate cuts and easing inflation in Australia have softened the differential, giving some support to the AUD.

Other factors influencing AUD/USD include US tariffs, China’s economic outlook (as Australia’s key trading partner), and global risk sentiment.

The AUD/USD is expected to remain sensitive to the interest rate differential and central bank policies.

Further RBA cuts could weaken the AUD if the US Fed maintains higher rates.

Conversely, any signs of US rate cuts or easing trade tensions could boost the AUD.

Inflation trends, China’s economic health, and geopolitical factors will also play key roles.

In essence:

The interest rate differential between the US and Australia currently favors the US, supporting the USD over the AUD, but recent RBA easing and falling Australian bond yields have narrowed this gap, providing some support to the AUD/USD pair . Traders closely watch upcoming economic data and central bank decisions for direction.

#AUDUSD #RBA #FEDS #BONDS #AU10Y #US10Y

Heading into pullback resistance?The Aussie (AUD/USD) is rising towards the pivot and could reverse to the 1st support which is an overlap support.

Pivot: 0.6587

1st Support: 0.6492

1st Resistance: 0.6634

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.