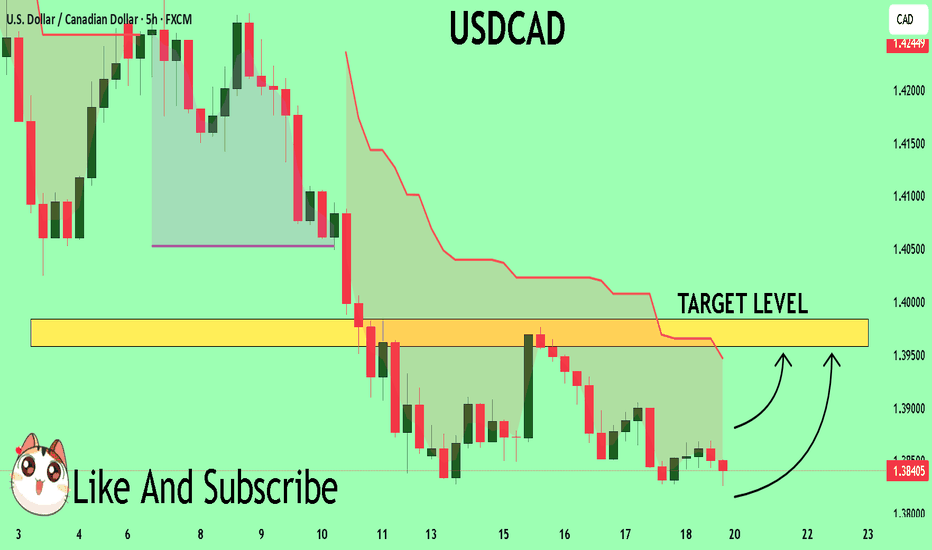

USDCAD Will Go Up From Support! Long!

Take a look at our analysis for USDCAD.

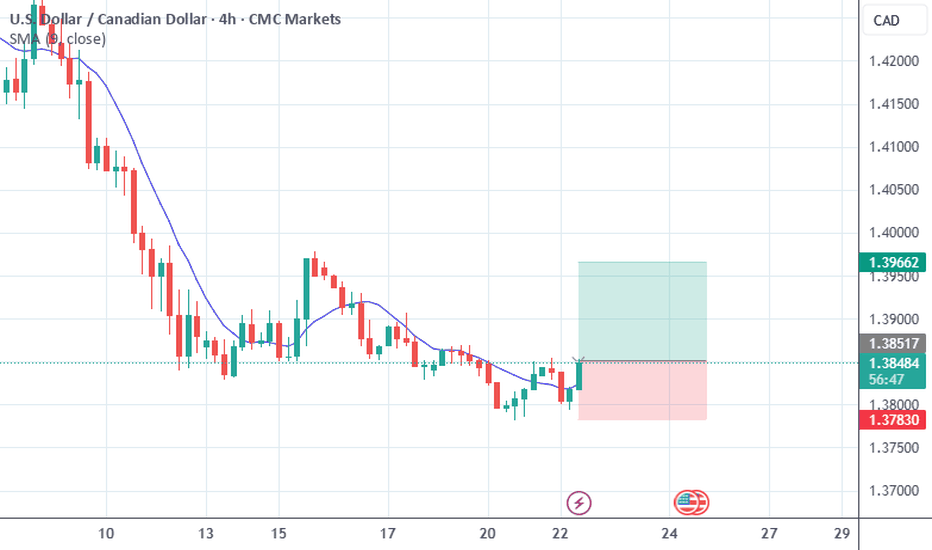

Time Frame: 3h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 1.385.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 1.396 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

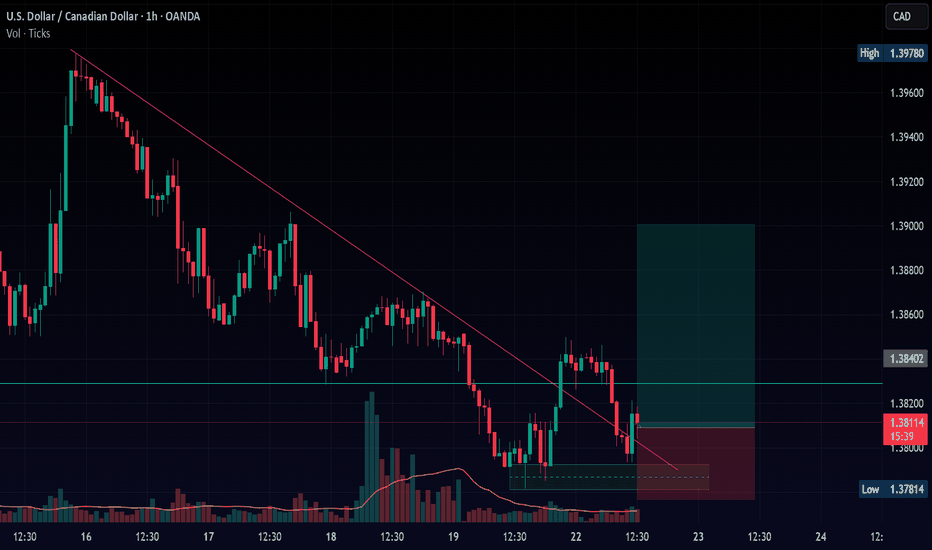

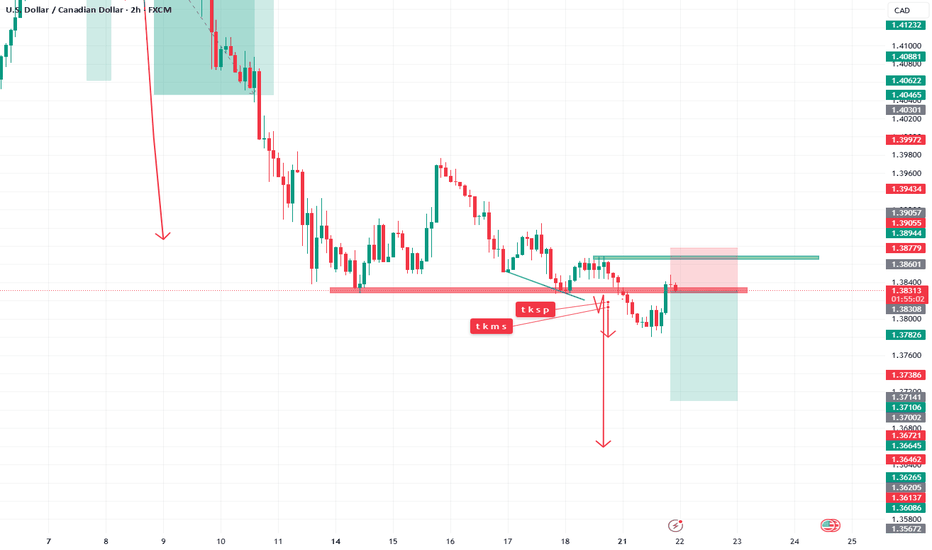

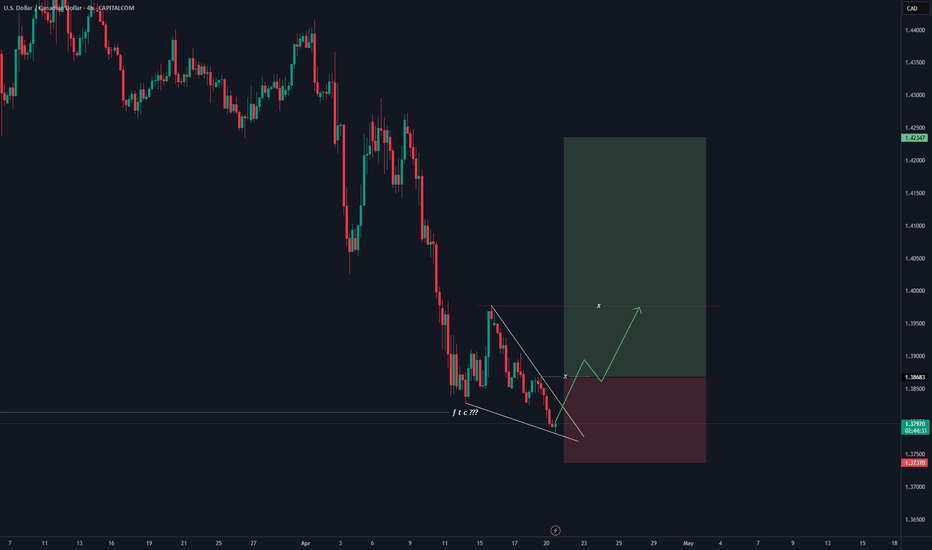

USDCAD trade ideas

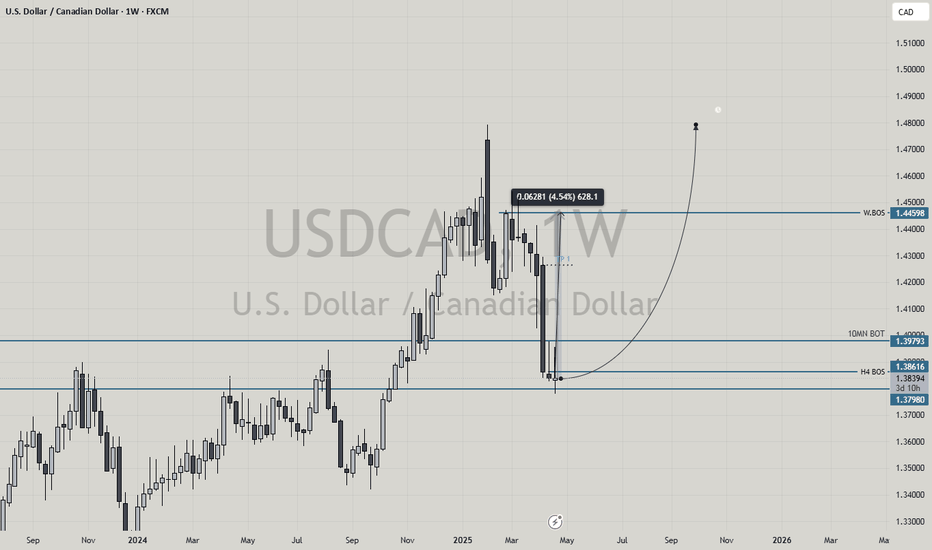

USDCAD A break of the 4hr structure would call for the following, A break of the daily that would lead us breaking the 4hr BOT. Unless Trump does the unthinkable, this will be a good swing trade to hold.

Based on the weekly, it would indicate the end of the W. counter trend and a continuation of the bullish move

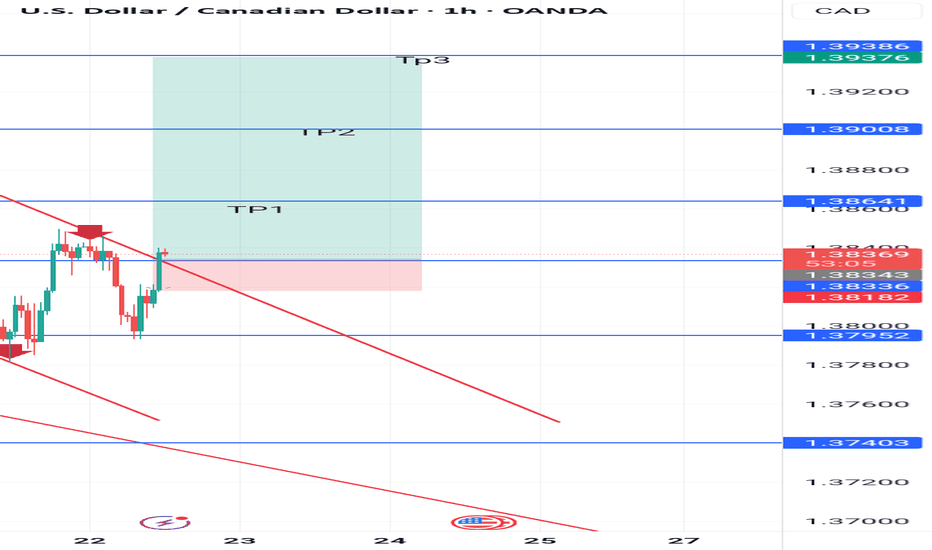

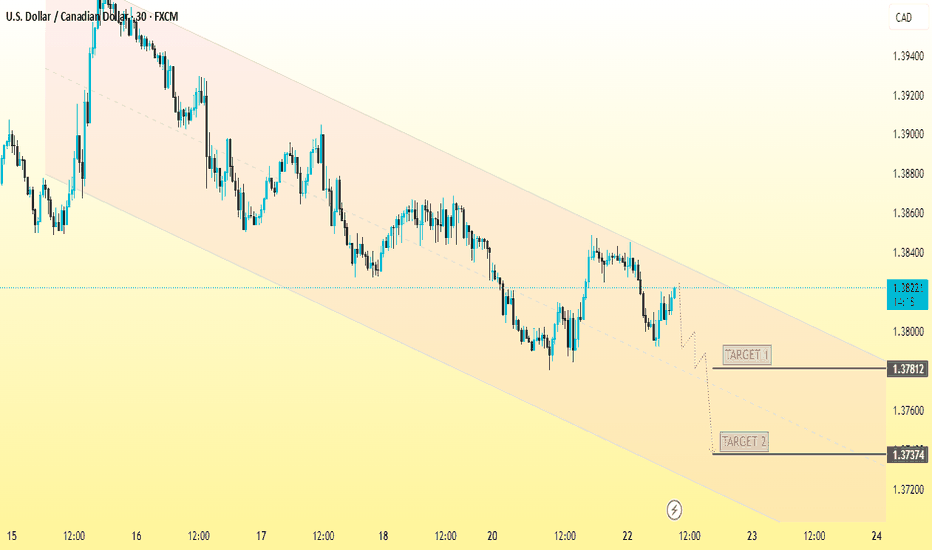

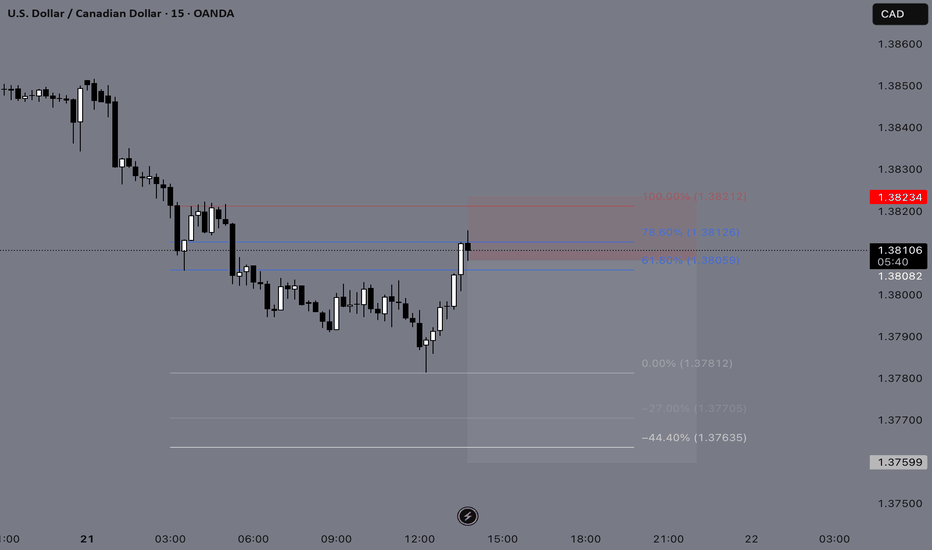

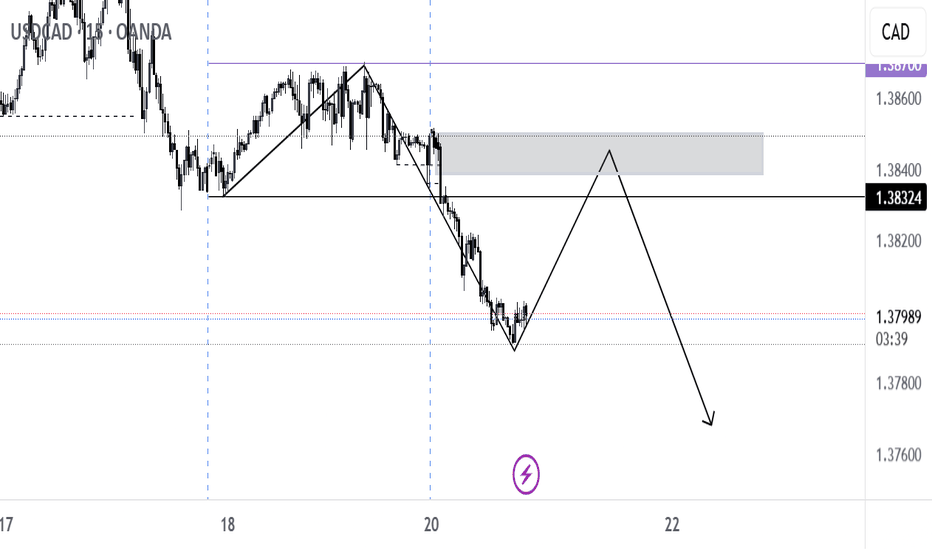

USD/CAD Analysis (30min TimeframeUSD/CAD

Timeframe: 30-Minute Chart

Trend: Bearish (within a descending channel)

---

Entry Point:

Entry Price: 1.38192 (current market price marked on chart)

---

Take Profit Targets:

TP1: 1.37812 (labeled "TARGET 1")

Final TP (TP2): 1.37374 (labeled "TARGET 2")

---

Support Levels:

1.37812 – First major support level (TP1)

1.37374 – Second strong support level (TP2, previous structure low)

---

Resistance Levels:

1.38192 – Current entry zone and minor resistance (short-term reaction level)

1.38400 - 1.38500 – Mid-channel resistance area

1.38700+ – Upper trendline resistance (from channel)

---

Chart Structure:

Descending Channel: Price is respecting a downward sloping parallel channel.

Bearish Momentum: Lower highs and lower lows.

Entry at Pullback: Entry aligns with a pullback to channel mid-zone.

---

Suggested Caption to Share with Your Client:

> USD/CAD Trade Setup (30-Min Chart):

Price is trending inside a descending channel.

Entry: 1.38192

TP1: 1.37812

Final TP: 1.37374

Trend: Bearish

Expecting continuation to downside after pullback.

Key Resistance: 1.38400–1.38700

Key Support: 1.37812, 1.37374

Watch for bearish confirmation at entry level before executing.

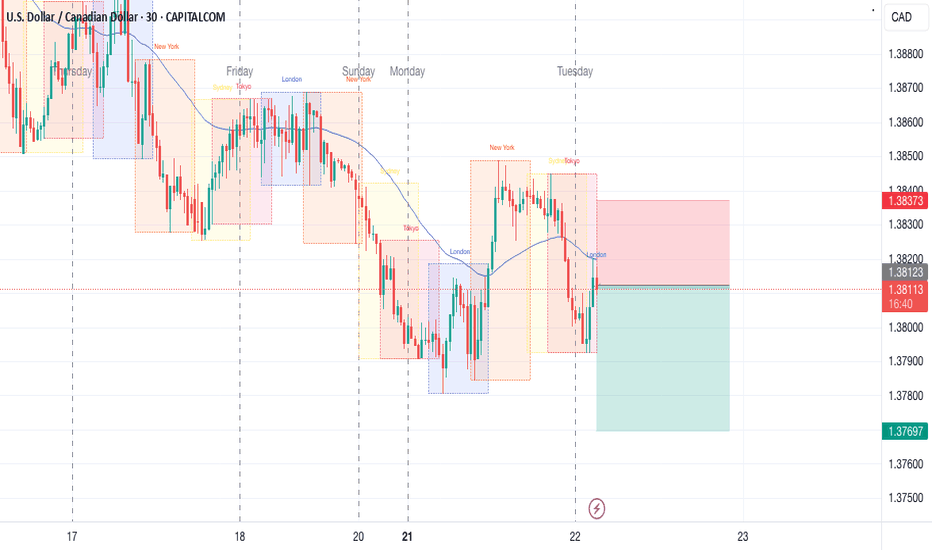

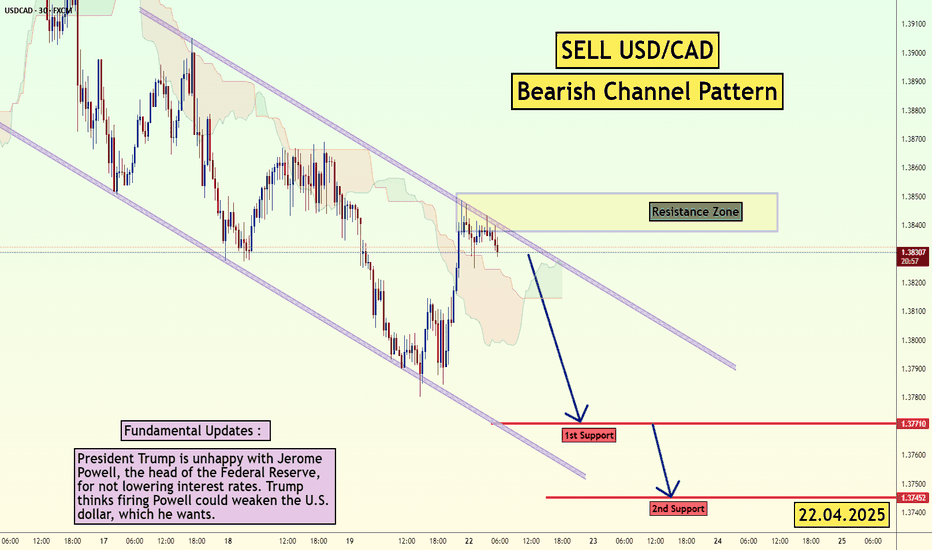

USD/CAD - Channel Pattern (22.04.2025)The USD/CAD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.3771

2nd Support – 1.3745

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

USDCAD Will Explode! BUY!

My dear friends,

My technical analysis for USDCAD is below:

The market is trading on 1.3840 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.3958

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK

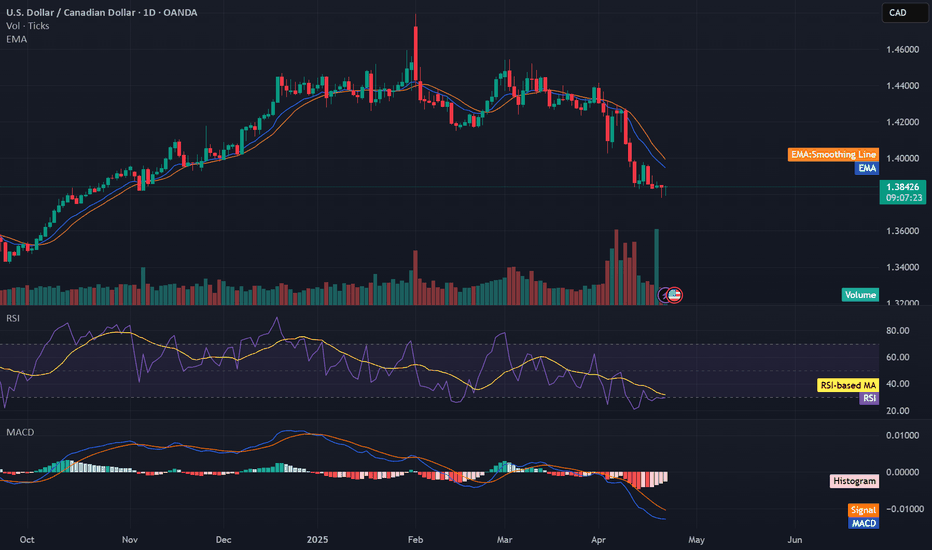

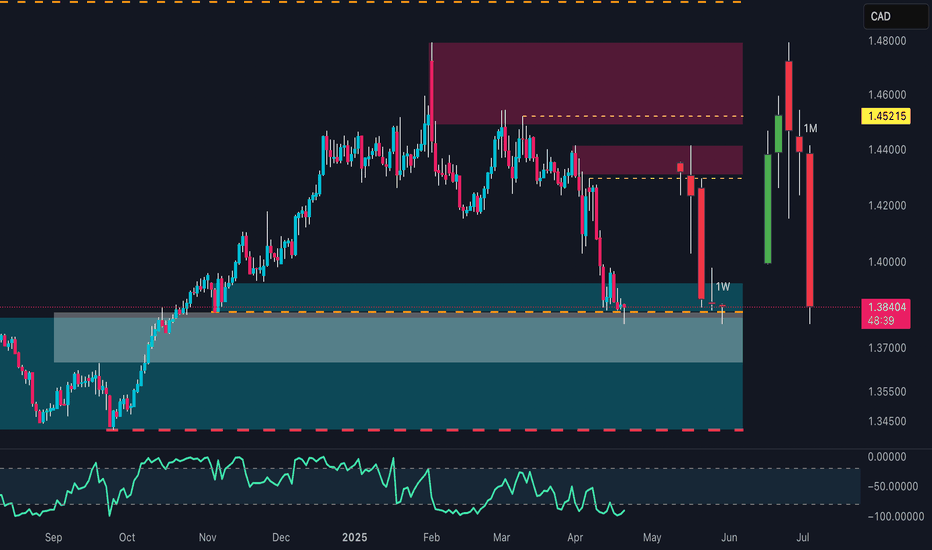

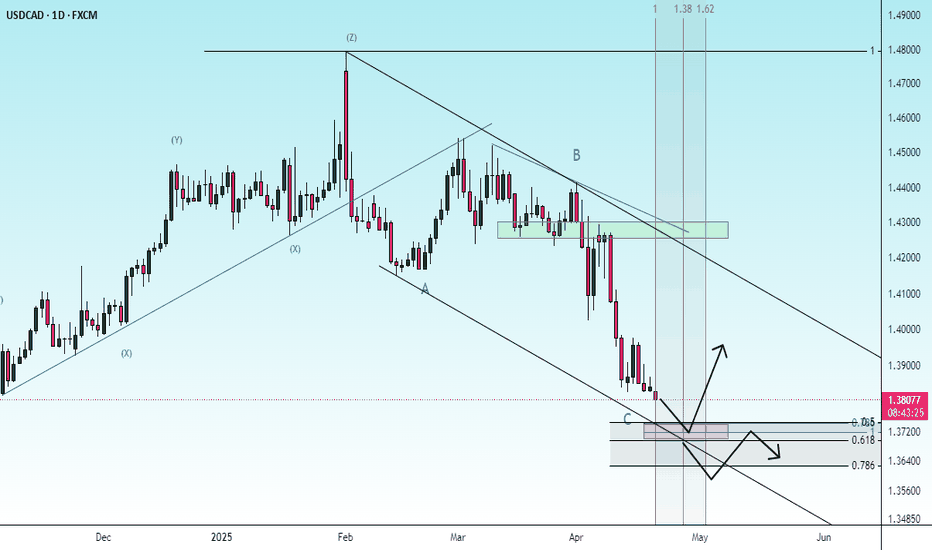

USDCAD Ready to Collapse? COT Signals a Bearish Storm!🔎 1. COT Context – Canadian Dollar (CAD)

Asset Managers: Consistently net short for most of the period, but since January 2025, there's been a strong recovery—net positions have become progressively less negative. By mid-April, they’re still short, but significantly less so.

Leveraged Money: Also heavily short in December 2024, but showing a clear bullish reversal starting in early 2025, with net positions turning increasingly positive on CAD.

✅ Interpretation: There's been a clear sentiment shift from bearish to bullish on CAD starting late 2024. This adds downward pressure on USDCAD.

💵 2. COT Context – US Dollar Index (USD)

Asset Managers: Consistently long, but reducing their net exposure since late March 2025.

Leveraged Money: Opposite of CAD – heavily short in December 2024, now recovering, though without strong momentum. Positions are hovering around neutral.

⚠️ Interpretation: While CAD grows stronger, USD shows signs of indecision or profit-taking. This amplifies the bearish bias on USDCAD.

📉 3. Technical Analysis – USDCAD

Current Price: 1.38369, right near a strong demand zone between 1.3700 – 1.3830, which has already been tested multiple times.

The current weekly candle is forming a doji or pin bar, hinting at a potential technical bounce.

Key Resistance: 1.45215 (monthly high).

Key Support: 1.3700. A breakdown below this could trigger a move toward 1.3480.

RSI: Neutral to slightly bearish, no major divergences observed.

🧠 Technical Outlook:

If the 1.3700–1.3830 zone holds, we might see a corrective bounce toward 1.4000–1.4100.

If that zone breaks, expect a bearish continuation toward 1.3580–1.3480.

📊 Trade Summary

Fundamental Bias (COT): Bearish USDCAD → Strong CAD, weakening USD.

Technical Bias: Neutral to bearish, potential for short-term bounce before continuation.

🧭 Trade Plan

🎯 Short on pullback toward 1.4000–1.4100 with stop above 1.4150, targeting 1.3600–1.3500.

🎯 Breakout trade below 1.3700 → Enter on daily close confirmation, target 1.3480.