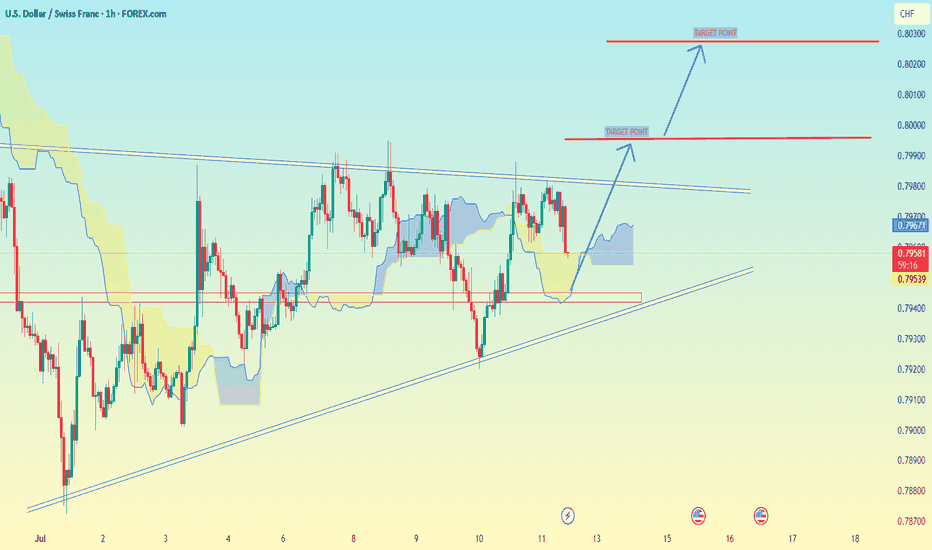

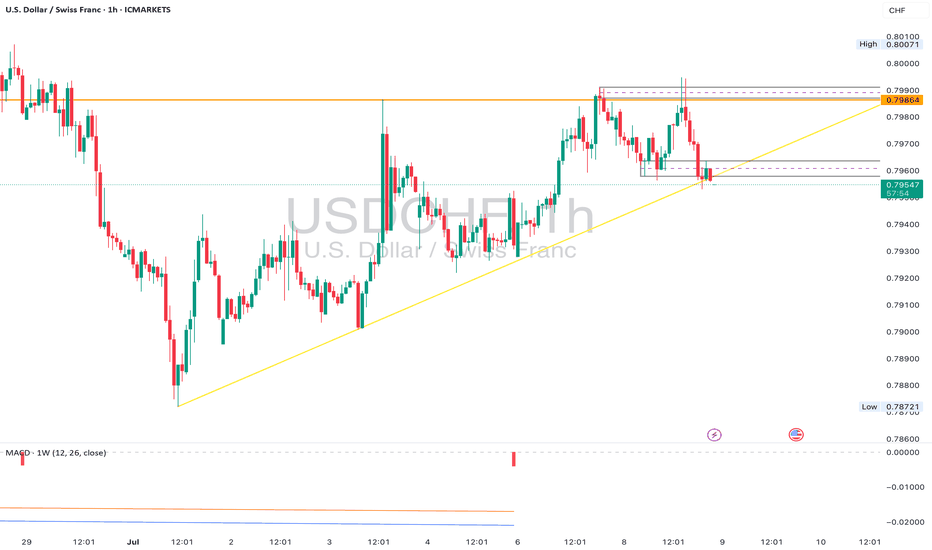

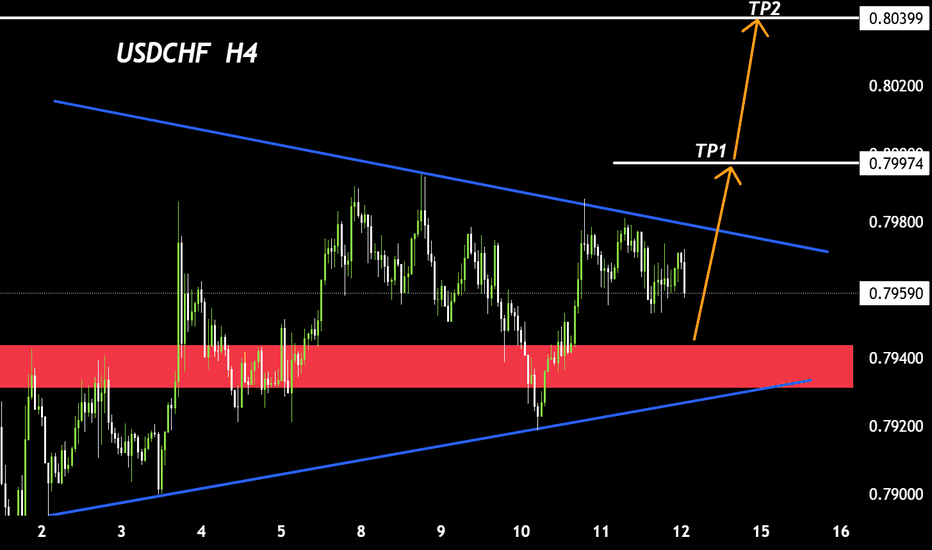

USD/CHF (1-hour timeframe)USD/CHF (1-hour timeframe), the analysis appears to include:

Ascending triangle pattern (with higher lows and a horizontal resistance).

Ichimoku Cloud for trend analysis.

Two marked target levels with projected breakout potential.

Identified Targets:

1. First Target:

🔹 Around 0.80000

This is just above the current resistance zone and seems to be the initial breakout target if price breaks the horizontal resistance.

2. Second Target (Final Target):

🔹 Around 0.80300 – 0.80350

This is the next higher resistance or profit-taking zone based on projected move from the triangle breakout.

---

Summary:

If the price breaks and closes above the horizontal resistance (approx. 0.79850), your potential targets are:

🎯 Target 1: 0.80000

🎯 Target 2: 0.80300–0.80350

Keep an eye on price action and volume confirmation before entry. Let me know if you want stop-loss suggestions or a risk/reward breakdown.

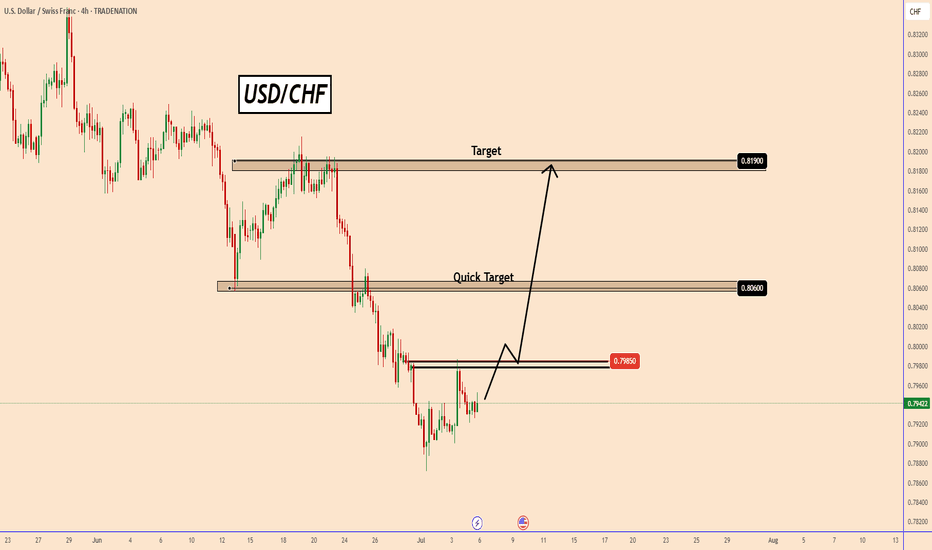

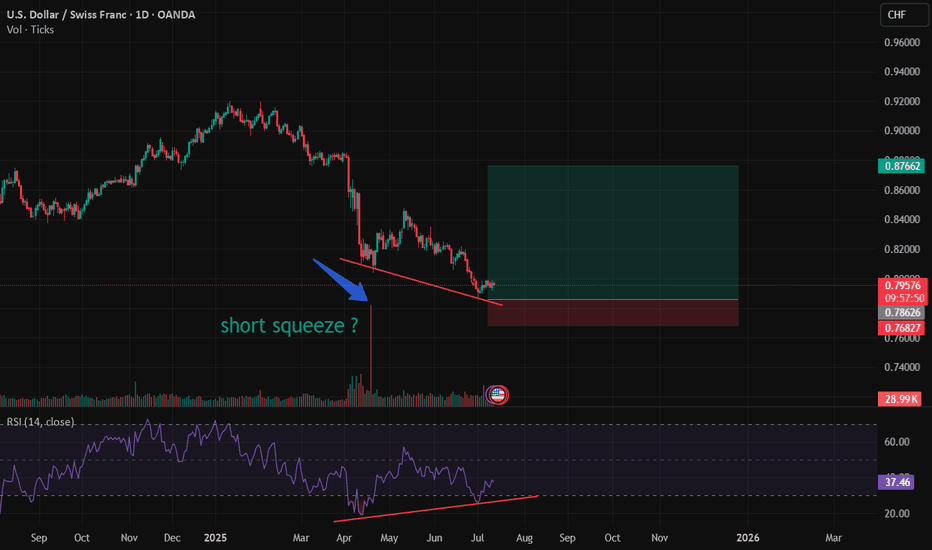

USDCHF trade ideas

USDCHF: A Bullish Reversal Hinges on 0.7985USDCHF: A Bullish Reversal Hinges on 0.7985

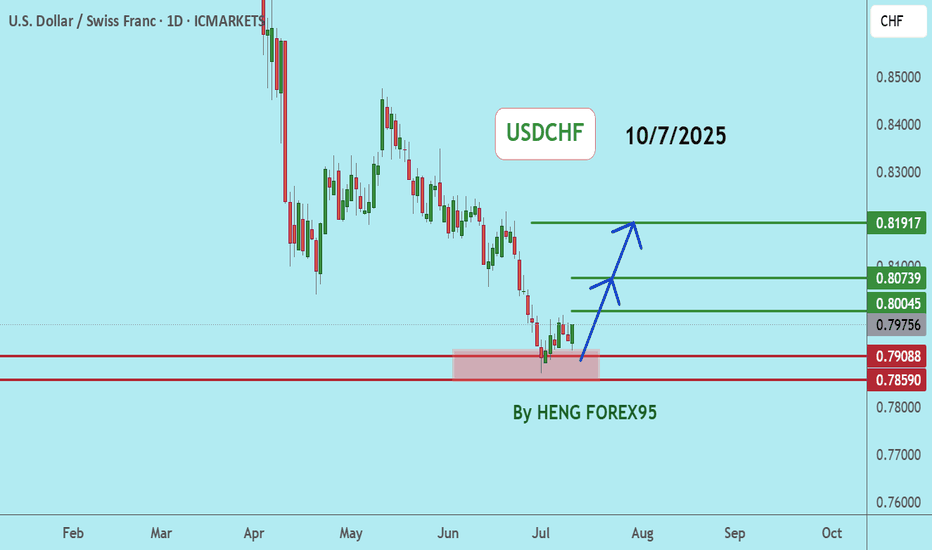

USDCHF is currently testing a critical support zone near 0.7880—a level not seen since 2011.

The fact that price has returned to this area after more than a decade underscores the significance of this moment.

The pair remains under pressure for two key reasons:

Ongoing US tariff tensions have created big uncertainty and weighed on the dollar.

The Swiss National Bank continues to intervene in the FX market under the pretext of supporting the domestic economy and controlling inflation. While their reasoning may seem increasingly dubious, the impact on USDCHF is undeniable.

A decisive move above 0.7985 could signal the start of a bullish trend, with potential upside targets at 0.8060 and 0.8190.

A break of this resistance would not only shift short-term momentum but could also signal a broader trend reversal.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

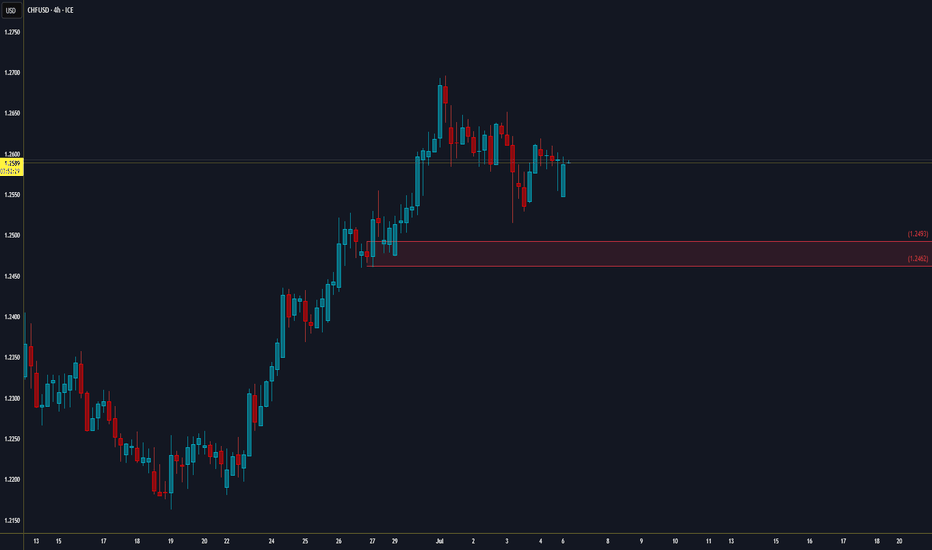

How to mark your charts Lightning fast!One of the things I didn't like was marking my charts. I would take so much time marking my charts and adding the prices on the side. My mentor showed me the fastest way. Just use the FIB tool and use "0" and "1". Now you can focus on other important things. I want to thank my mentor for showing me this. Good luck to everyone

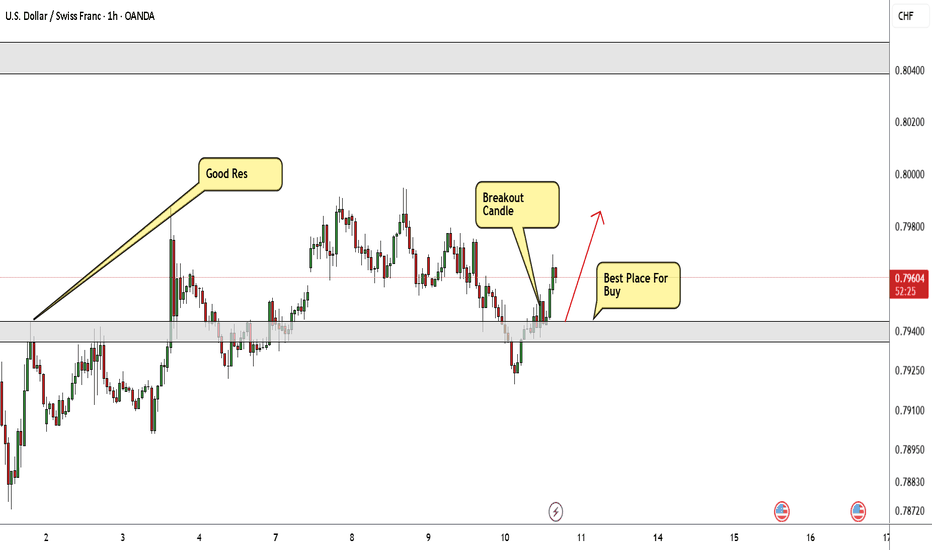

USD/CHF Breakout Done , Long Setup Valid To Get 100 Pips !Here is my opinion on USD/CHF , We have a clear breakout and the price now above my support area , i`m waiting the price to go back to retest it and then give me any bullish price action and i will enter a buy trade , the reason for cancel this idea , if we have a daily closure again below my area.

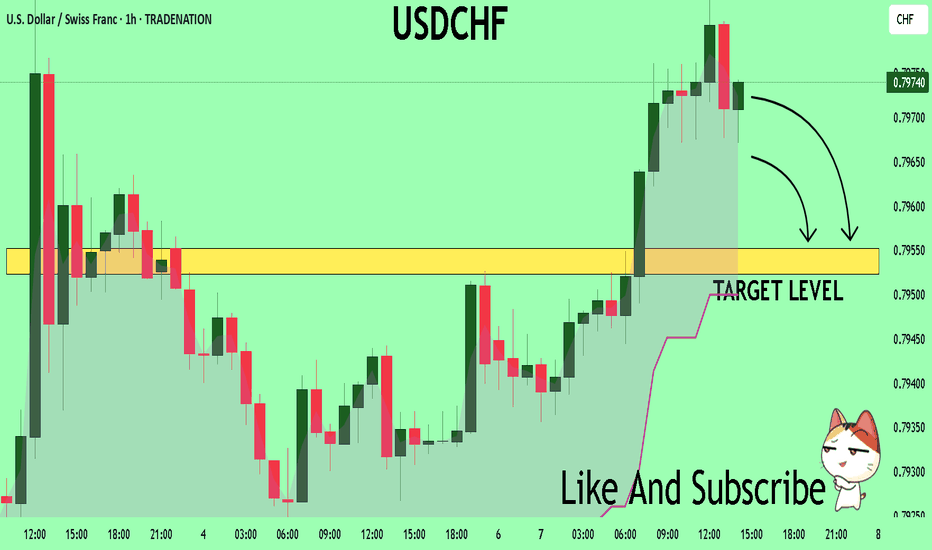

USDCHF Will Collapse! SELL!

My dear followers,

This is my opinion on the USDCHF next move:

The asset is approaching an important pivot point 0.7969

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 0.7955

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

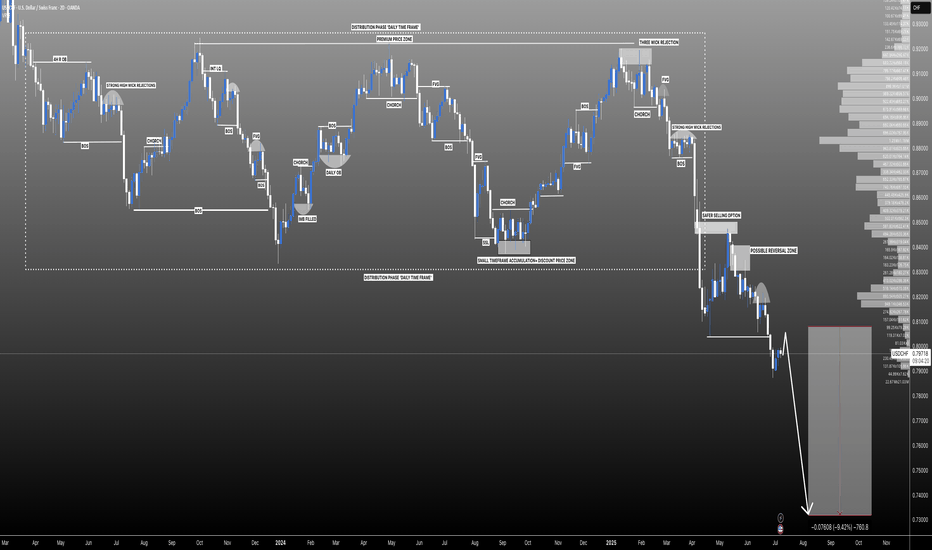

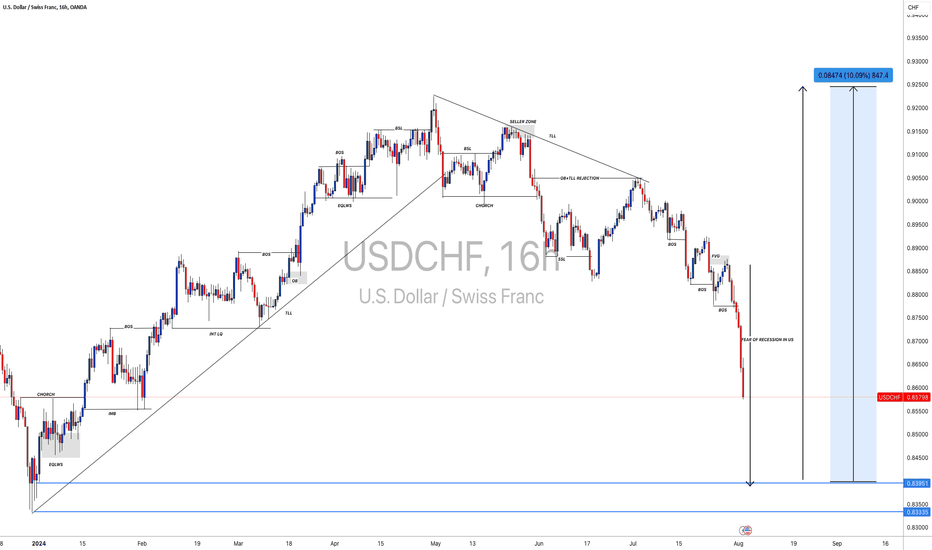

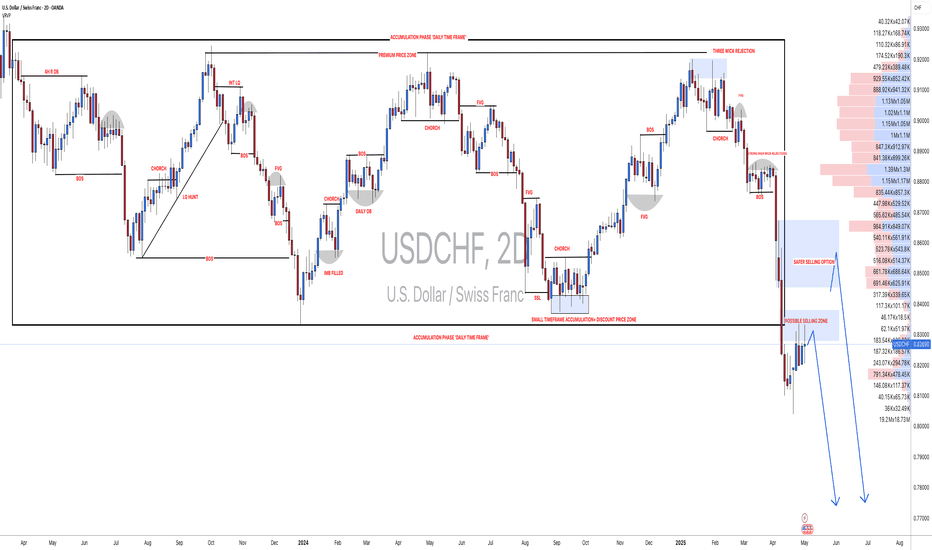

Setupsfx_ | USDCHF: A Big Major Swing Sell In Making 760+ Pips The USDCHF pair has dropped significantly since our last update. We anticipate another drop before price may reverse. DXY is also dropping and may continue to decline. There’s a major swing target that will take time to complete successfully. Use risk management according to your own risk tolerance.

Thank you for your continued support!

Team Setupsfx_

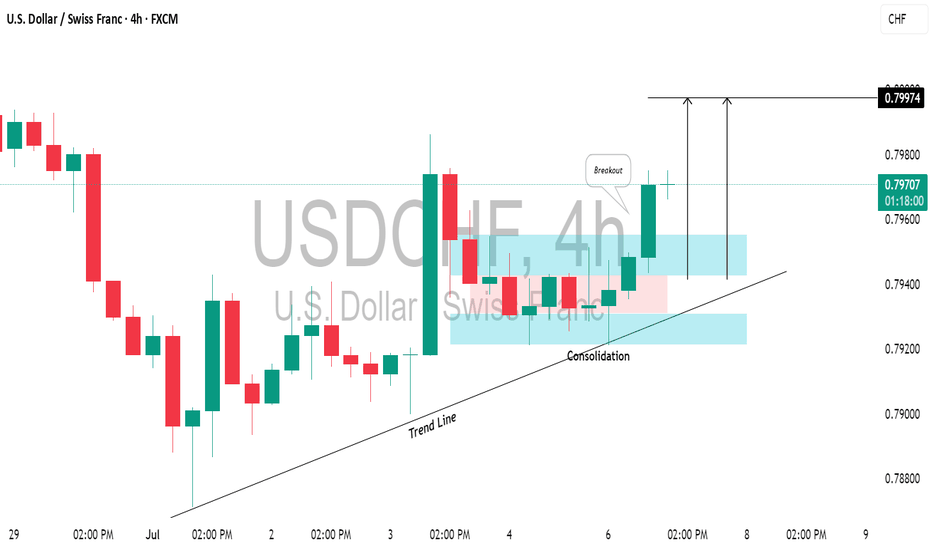

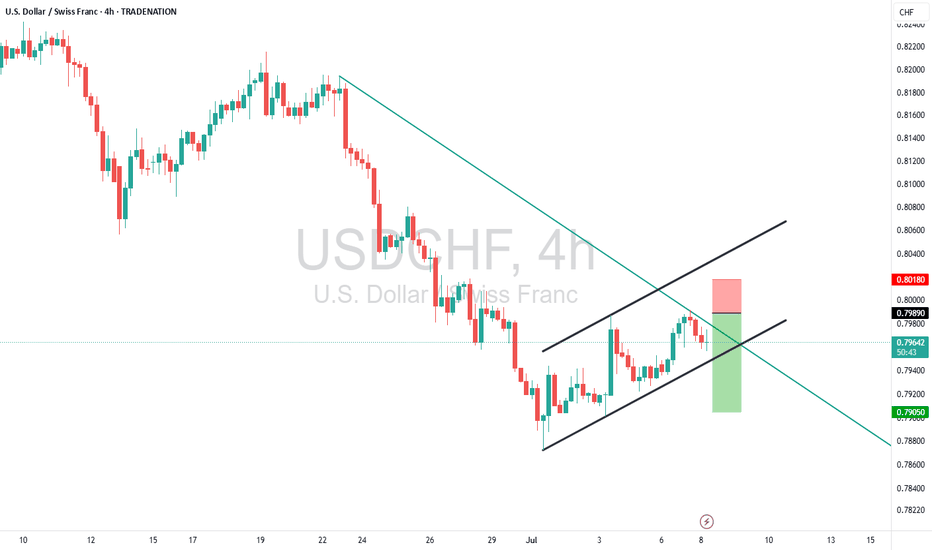

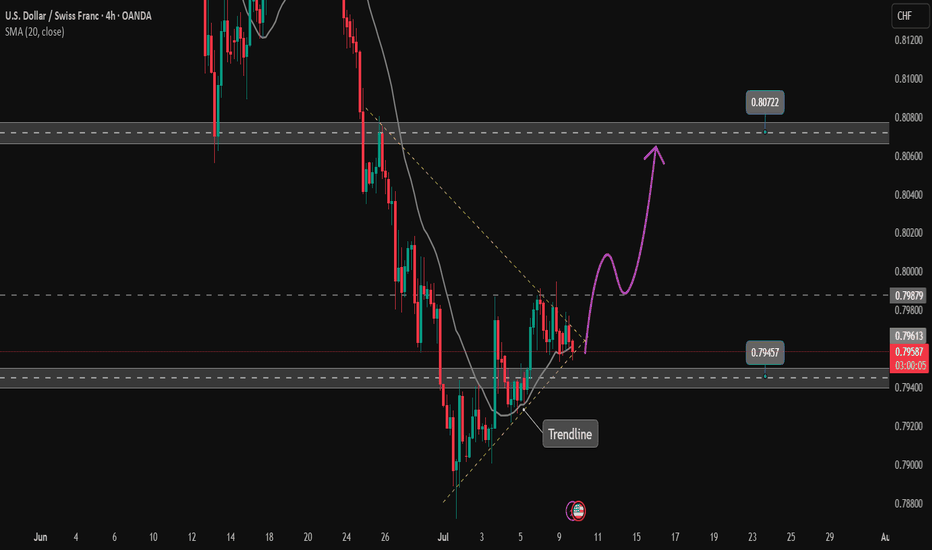

USDCHF: Bullish Outlook ExplainedLast week, the 📈USDCHF price reached a significant ascending trend line on the 4-hour chart.

Despite the market consolidating within a horizontal range for a while, the contact with the trend line propelled the pair upward.

The market subsequently broke and closed above the range's resistance.

I anticipate that the pair will continue to rise, reaching at least 0.7997.

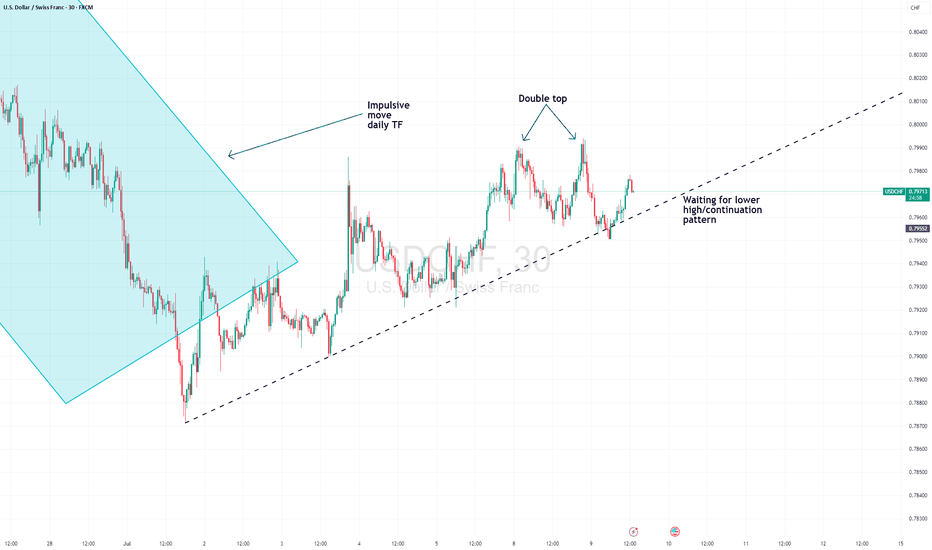

USDCHF shortPlanning to short USD/CHF if a continuation pattern forms following the double top. The trade becomes invalid if the price makes a higher high, breaking above the double top, or if there are any shifts in macroeconomic outlook.

Jul. 9th, 2025 at 12:00 PM GMT+8

The Swiss Franc's appeal as a safe-haven currency has increased due to geopolitical tensions.

U.S. trade tariffs have contributed to uncertainty in global markets, impacting the dollar negatively.

Weak economic indicators from the U.S. have led investors to reassess monetary policy outlooks for both countries.

USDCHF – Trendline Break Signals Bearish Shift (1H Analysis)USDCHF has broken beneath a key ascending trendline that’s been supporting price since July 3rd. This drop comes after multiple failed attempts to break the 0.7986–0.8000 resistance zone — a level that continues to reject bullish pressure.

Now, price is retesting the broken trendline and the 50 EMA from below, creating a potential bearish continuation setup if this retest holds.

⸻

Bias: 🔻 Short

This is now a bearish structure unless price reclaims and closes above 0.7985 with strength.

⸻

Trade Idea:

• Entry Zone: 0.7960–0.7970 (trendline/EMA retest)

• TP1: 0.7930 (previous low / structure support)

• TP2: 0.7900 (psychological + demand zone)

• Invalidation: Clean break and hold above 0.7986

⸻

📌 Structure shift + EMA + trendline confluence

📌 Clean rejection from resistance

📌 Lower highs forming

⸻

#USDCHF #Forex #TrendlineBreak #BearishSetup #BuiltNotBegged #AutoMarkets #PriceAction #ForexAnalysis #TradingViewCommunity

#USDCHF: 878+ PIPS Swing Buy In Making! Good Luck! Dear Traders,

OANDA:USDCHF

Price has been dropping since we had a change of character, there are many factors that are helping in USDCHF to drop. The mainly the first reason is CHF dominance in the market, CHF has been bullish ever since Gold continued the bullish trend, CHF, AUD and GOLD all of these three are positively correlated. Other fundamental reason is the blooming fear of recession in the US Market, on Friday we saw indices and stocks drop record high similarly to the first announcement of covid lockdown. USD index saw sharp drop due to this and it is likely that price will continue to do that on dxy index.

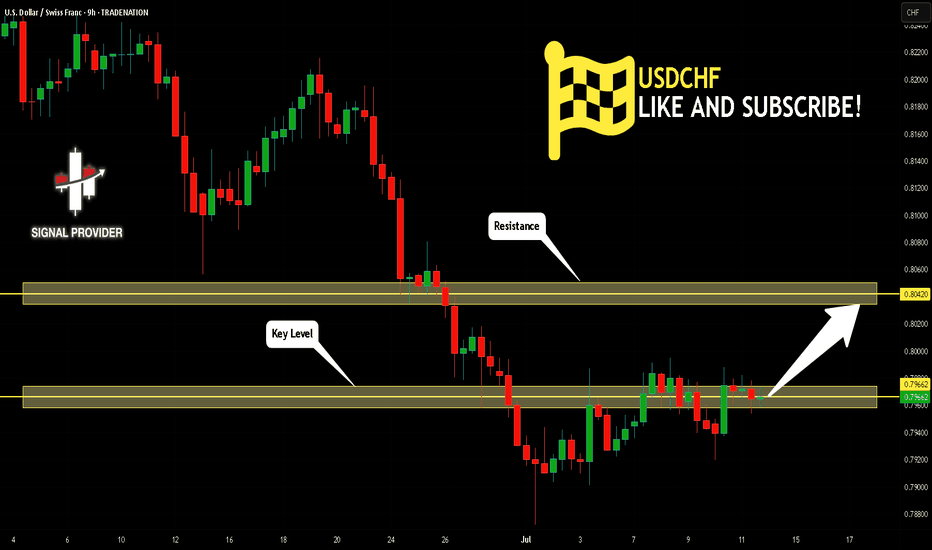

USDCHF Will Grow! Long!

Here is our detailed technical review for USDCHF.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 0.796.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 0.804 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

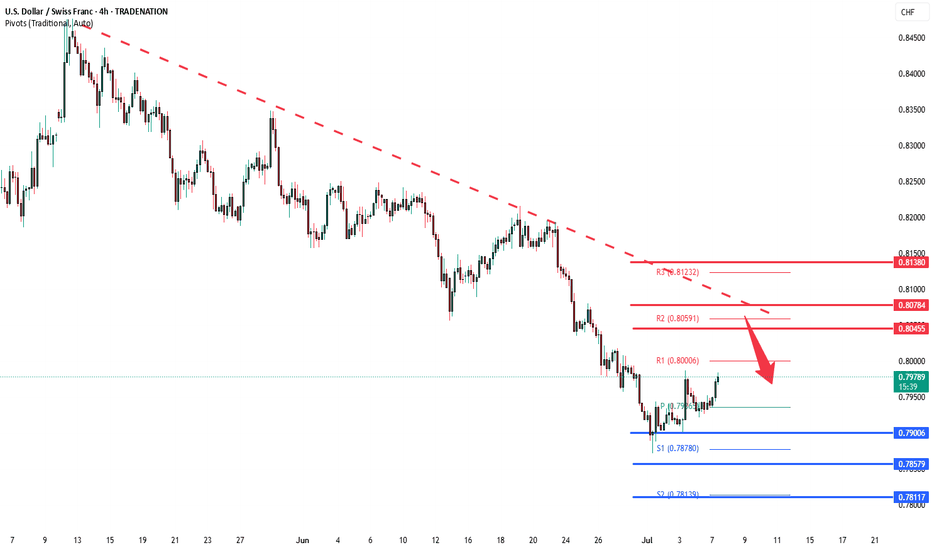

USDCHF downtrend continuation below 0.8050 The USDCHF pair remains under bearish pressure, consistent with the prevailing downtrend. Recent price action has transitioned into a sideways consolidation, suggesting a pause in bearish momentum but not a reversal.

The key technical level to monitor is 0.8050, which marks a prior intraday consolidation zone and acts as immediate resistance. Should the pair stage an oversold bounce toward this level, a bearish rejection could reinforce the existing downtrend, with potential downside targets at 0.7900, followed by 0.7860 and 0.7810 over the longer term.

On the other hand, a confirmed breakout above 0.8050, supported by a daily close above this level, would invalidate the bearish outlook. Such a move would signal a possible shift in sentiment and open the door for a retest of the 0.8080 resistance zone, with further upside potential toward 0.8140.

Conclusion:

The broader trend remains bearish below 0.8050, and rallies into resistance may present renewed selling opportunities. However, a sustained break above 0.8050 would warrant a reassessment of the bearish bias and could signal the start of a short-term recovery phase. Traders should watch for price action confirmation at this key pivot area.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Is it time for the buyers to step in?Double bottom forming at this key area on the pair. There's a huge abnormal sell volume candle printed in April, If really there are players positioned there a hard push up could mean a short squeeze propelling the price to go up further and quicker as sellers will have to run for cover.

USDCHF – Sell Into Resistance in Bearish ChannelTrade Idea

Type: Sell Limit

Entry: 0.7989

Target: 0.7905

Stop Loss: 0.8018

Duration: Intraday

Expires: 09/07/2025 06:00

Technical Overview

The primary trend remains bearish, and price is currently trading within a corrective channel formation, suggesting further downside potential.

Trendline resistance at 0.7995 aligns closely with the entry point of 0.7989, providing a strong technical barrier to cap gains.

The recent weakness in the US dollar supports a continued bearish outlook for USDCHF.

A break below support zones could accelerate a move toward the target at 0.7905.

No significant events are scheduled in the next 24 hours, allowing technical patterns to dominate intraday trading.

Key Technical Levels

Resistance: 0.7991 / 0.8020 / 0.8050

Support: 0.7958 / 0.7922 / 0.7900

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

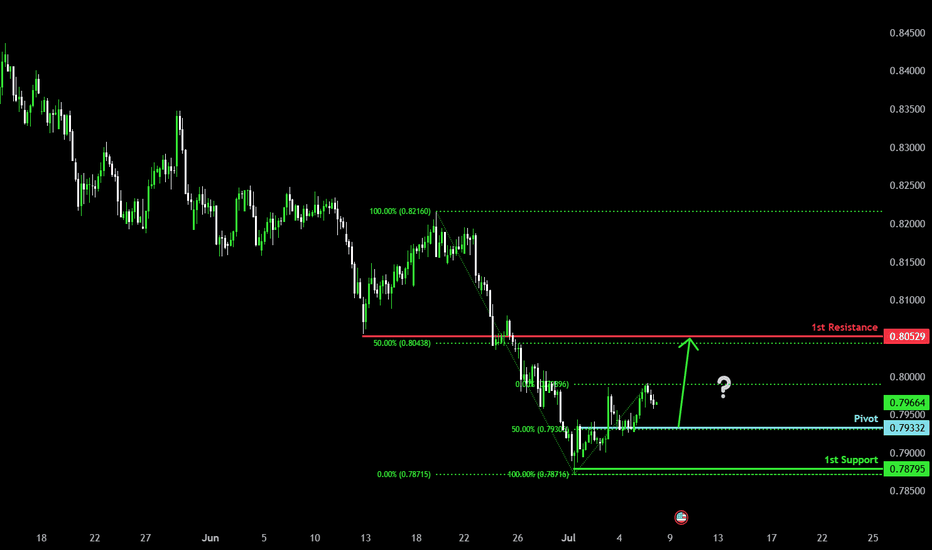

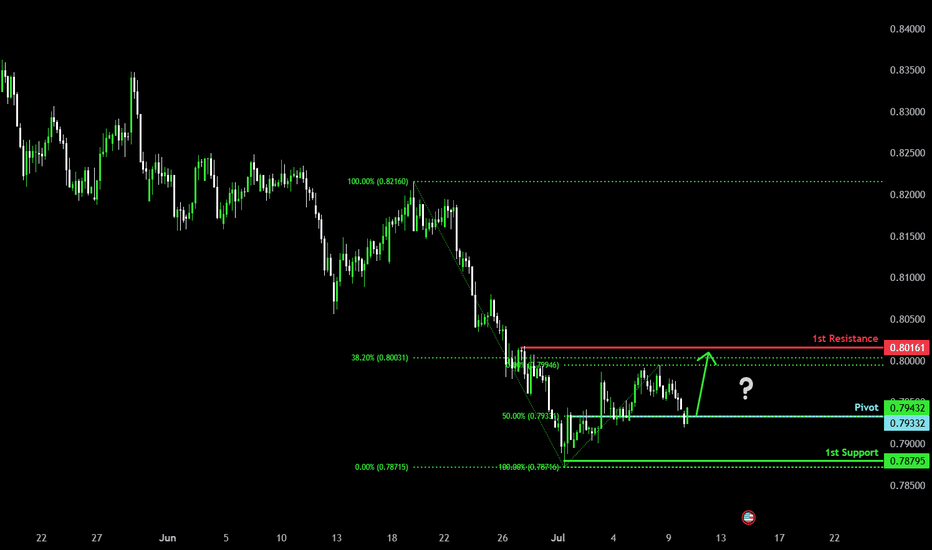

Could the price bounce from here?The Swissie (USD/CHF) is falling towards the pivot, which is an overlap support and could bounce to the 50% Fibonacci resistance.

Pivot: 0.7933

1st Support: 0.7879

1st Resistance: 0.8052

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

#USDCHF: Will USD Breakthrough The Strong Bearish Downtrend? The USDCHF currency pair has experienced significant volatility due to the ongoing trade dispute between the United States and China, which has led to a substantial decline in the DXY index. Consequently, CHF and JPY have emerged as the most stable currencies in the market.

Despite the USDCHF currency pair reversing its bullish trend, we anticipate a potential reversal back to a bearish position. We believe this reversal may be a temporary trap, and the currency pair is likely to regain its bullish position in the future.

There are two potential areas where the USDCHF currency pair could reverse from its current trend. The first area is relatively early, and if the USDCHF currency pair crosses a specific region, we may have a second safe option that could provide greater stability.

We extend our best wishes and best of luck in your trading endeavours. Your unwavering support is greatly appreciated.

If you wish to contribute, here are several ways you can assist us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_🚀❤️

USDCHF: DXY Likely to remain bearish in long term! The USDCHF pair is likely to remain bearish in the coming days as DXY doesn’t show any bullish momentum. However, we expect DXY to be bullish in the short term, which will help the price reach our designated selling zone. Once the price reaches this zone and shows a reversal sign in a smaller timeframe, you can consider entering or taking any decision.

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_🚀❤️

Could the Swissie bounce from here?The price is reacting off the pivot which acts as an overlap support and could bouncer to the 1st resistance which is slightly above the 37.2% Fibonacci retracement.

Pivot: 0.7933

1st Support: 0.7879

1st Resistance: 0.8016

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

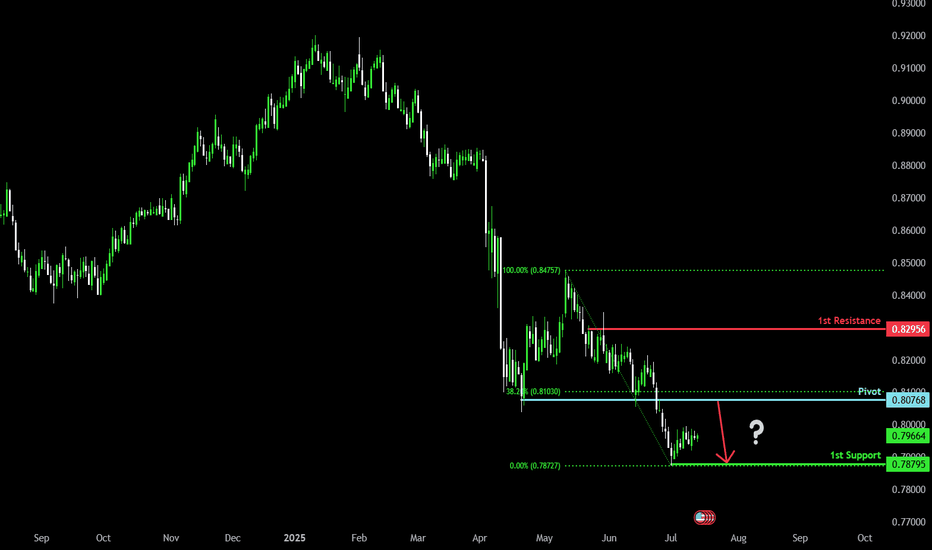

Bearish reversal off pullback resistance?The Swissie (USD/CHF) is rising towards the pivot, which is a pullback resistance that lines up with the 38.2% Fibonacci retracement and could reverse to the 1st support.

Pivot: 0.8076

1st Support: 0.7879

1st Resistance: 0.8295

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

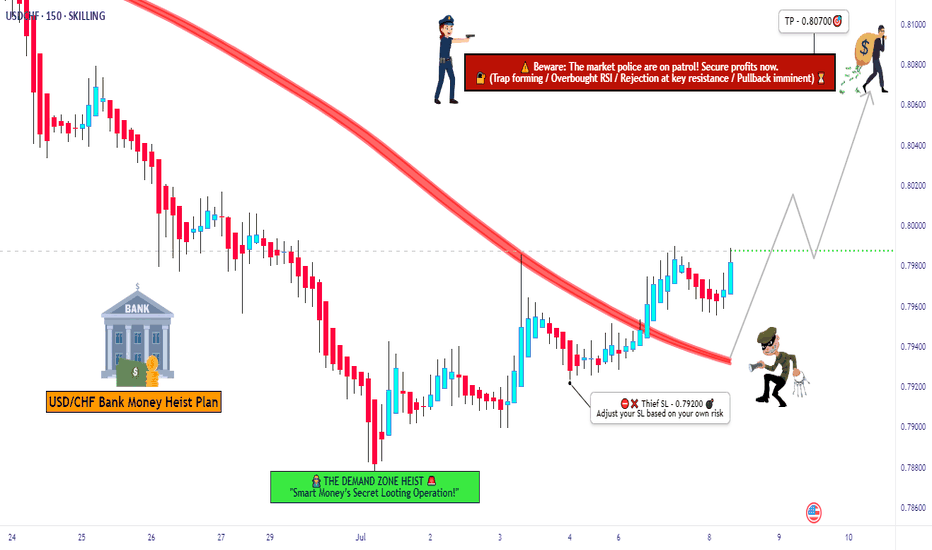

USD/CHF SWISSY Forex Heist Plan | Thief-Style Buy Setup🔥💰 "Forex Bank Heist: Thief Trading Blueprint for USD/CHF SWISSY 💵💸" 💣🚨

"Steal Pips, Not Dreams. Trade Like a Robber, Think Like a Mastermind." 🕶️💼

🌟 Hello World! Bonjour! Ola! Hallo! Marhaba! 🌟

Welcome, all Money Makers, Market Hustlers & Chart Robbers 🕵️♂️🤑🚁

Let’s gear up for our latest USD/CHF "Swissy" Forex Bank Heist, crafted using our high-level Thief Trading Style—a bold fusion of technical know-how, street-smart price action, and strategic risk maneuvers.

💎 HEIST PLAN SUMMARY

This trade is locked, loaded, and ready to target the vault using a Bullish Breakout / Pullback strategy.

We are eyeing the SWISSY with laser focus, watching closely for price action to retest key support zones, then blast through resistance to secure our escape route.

Let’s not get caught in the police trap zone (aka overbought resistance with fakeouts and bearish ambushes). Keep those trailing stops tight and your loot tighter. 🏃♂️💨

🎯 ENTRY STRATEGY — “The Vault is Open!” 📈

💰 Buy Limit Orders near recent swing low or pullback zone (15M–30M timeframe).

💣 Use DCA (Dollar-Cost Averaging) or Layered Entry strategy to spread risk and improve entry points.

🏹 Entry range: Monitor consolidation for the perfect dip-snatch setup.

🛑 STOP LOSS — “Fallback Safe House” 🚨

📍 Place SL just below recent swing low using 2H timeframe (e.g., 0.79200).

💡 Adjust based on position size, number of entries, and personal risk.

🏴☠️ TARGET ZONE — “The Getaway” 🎯

🎯 TP Level: 0.80700

🚁 Or escape early if momentum weakens—profit is profit.

💹 Scalpers: Ride only the bullish getaway car. Use Trailing SLs to ride and protect gains.

📊 MARKET STATUS — "SWISSY Watchtower" 🕵️

The market is currently neutral, but pressure is building. Expect a bullish breakout if macro & technicals align.

💡 Smart Robbers read the full blueprint:

→ Macro Outlook

→ COT Reports

→ Sentiment Analysis

→ Intermarket Trends

→ Seasonality & Institutional Flow

📰 TRADING ALERT — “Dodge the Sirens” 🚓

🚨 Avoid opening new trades during high-impact news events

💼 Use Trailing Stop-Loss to lock in profits

🧠 Plan your risk and exit BEFORE the bullets (candles) start flying

❤️ BOOST THE CREW! 💥

If this plan helps you pull clean profits, show love and Boost the chart 🔥📈

Your support fuels more strategies and keeps the crew funded 💼💵

Stay sharp, stay ruthless, and always trade like a Thief in the Charts 🎩🕶️

📌 Disclaimer

This strategy is educational and should not be considered investment advice.

Always trade based on your own analysis, risk profile, and market research.

🗓️ Stay tuned for the next Forex Heist Blueprint — we rob charts, not wallets.

📡 Tap follow. Boost the crew. Profit like a pro.

USDCHF continues bullish recovery. Opportunity for BUY signal✏️#USDCHF is showing bullish recovery. The price is trading in a triangle pattern in the recovery phase. The 1.79500 area is an important support zone that is driving the pair's upside. 0.80700 is the immediate Target for a BUY signal.

📈Key Level

SUPPORT 0.79500

RESISTANCE 0.80700

BUY now at support 0.79500

Target: 0.80700

SELL Trigger: Break support 0.79500

Leave your comments on the idea. I am happy to read your views.

USDCHF LONG TERM UPUSDCHF Live Trading Session/ USDCHF analysis #forex #forextraining #forexHello Traders

In This Video USDCHF HOURLY Forecast By World of Forex

today USDCHF Analysis

This Video includes_ (USDCHF market update)

USDCHF Analysis today | Technical and Order Flow

#usdjpy #usdchftechnicalanalysis #usdjpytoday #gold

What is The Next Opportunity on USDCHF Market

how to Enter to the Valid Entry With Assurance Profit?

This Video is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

Disclaimer: Financial Trading Has Large Potential Rewards, But Also Large Potential Risk. You must be aware of the Risk and Be Welling to Accept Them in order to Trade the Financial Market . Please be Carefully With Your Money.

We are talking about future market, anything can Happen,Markets are Always like that.dnt Risky more Than 2% of your account

Now you can join with our "vip premium" service

Join us and let's make trading together

USDCHFUSDCHF If the price can stay above 0.78590, it is expected that the price will rebound. Consider buying in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!