USDCHF trade ideas

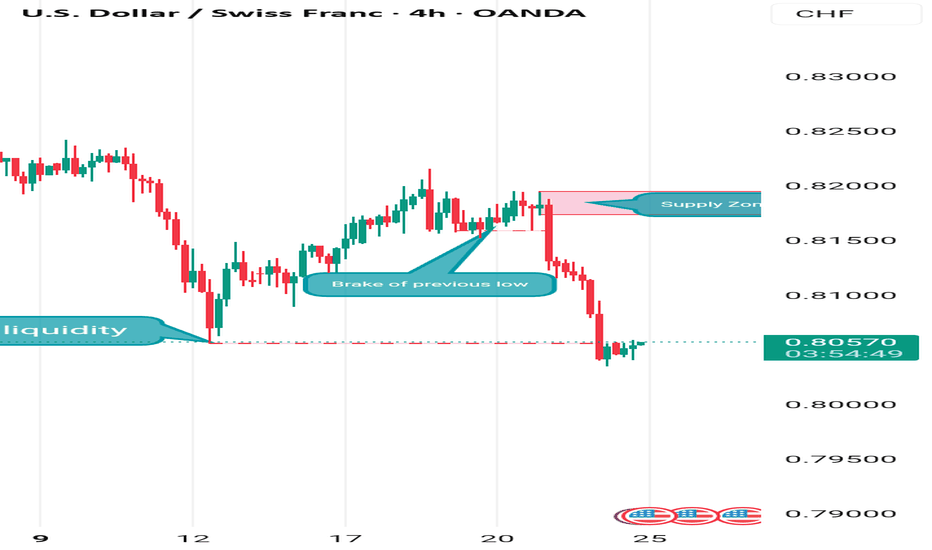

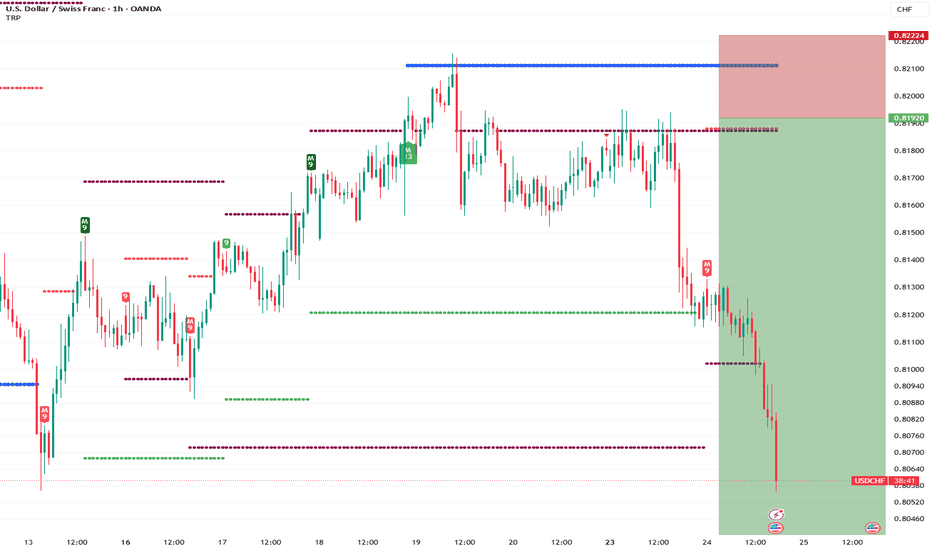

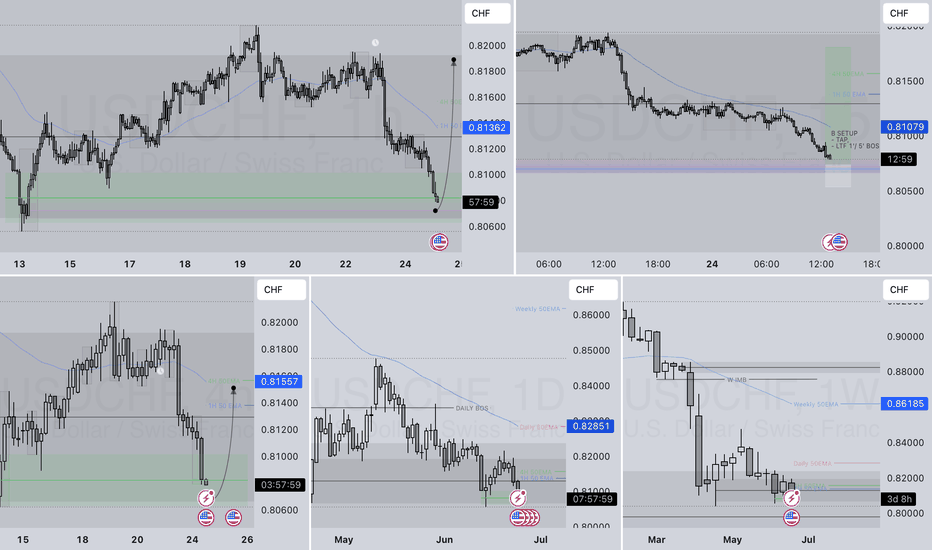

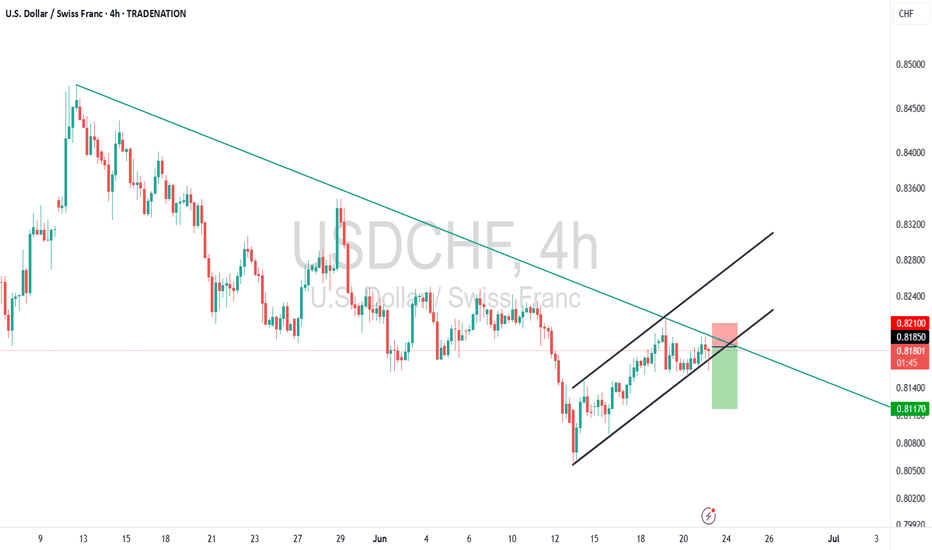

USD/CHF – Rejection at Key Fib Confluence, Bearish Continuation We’re seeing a beautiful textbook rejection off the 0.79Fib zone (0.8200), precisely where price tapped into a previous structure break and minor supply block. Price surged into the red zone, wicked just above the 200 EMA, and was instantly met with heavy sell-side pressure — a strong signal of institutional distribution.

📌 Technical Confluences at Play:

Price failed to break the 200 EMA cleanly — acting as dynamic resistance.

0.79 Fib levels aligning with prior supply.

Rising wedge structure broken to the downside.

Entry candle printing a solid engulfing rejection — institutional footprint.

📉 Target Zone:

Primary TP sits at the 0.236 Fib level (0.8101), but the full measured move of this wedge gives us a final downside target near 0.8038, with intermediate stops at key Fibs. Invalidation above 0.82294

🧠 Trader’s Insight:

“Patience is power. You don’t chase moves, you position for moments.”

Let the market come to your zone of interest, validate your thesis, and then strike with precision. The best trades come from areas where multiple confirmations stack in your favor.

📉 Trade Plan:

Entry: 0.81933 rejection zone

TP1: 0.8130

TP2: 0.8101

Final TP: 0.8038

SL: Above 0.82294 (tight invalidation)

@WrightWayInvestments

@WrightWayInvestments

@WrightWayInvestments

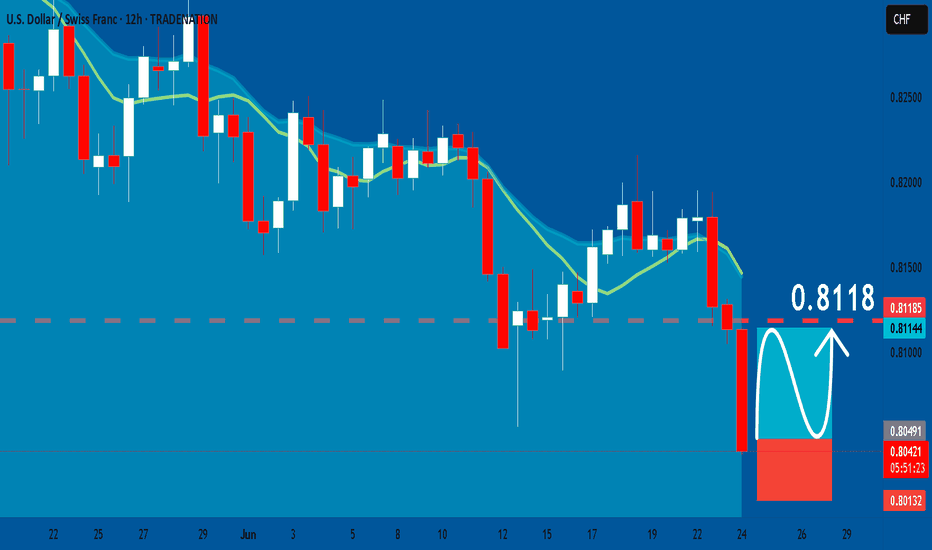

USDCHF: Bullish Continuation & Long Trade

USDCHF

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy USDCHF

Entry Level - 0.8046

Sl - 0.8013

Tp - 0.8118

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDCHF UPDATE🔥 Quick update on the move...

USDCHF rolled over just like mapped — clean lower highs, sharp drop, volume kicked in late. But I froze and didn’t pull the trigger.

It played out without me. No revenge, no chasing. Just a missed shot 🎯

Now back to neutral. Watching, not forcing.

⚡

Sell idea worked — I didn’t. On to the next setup.

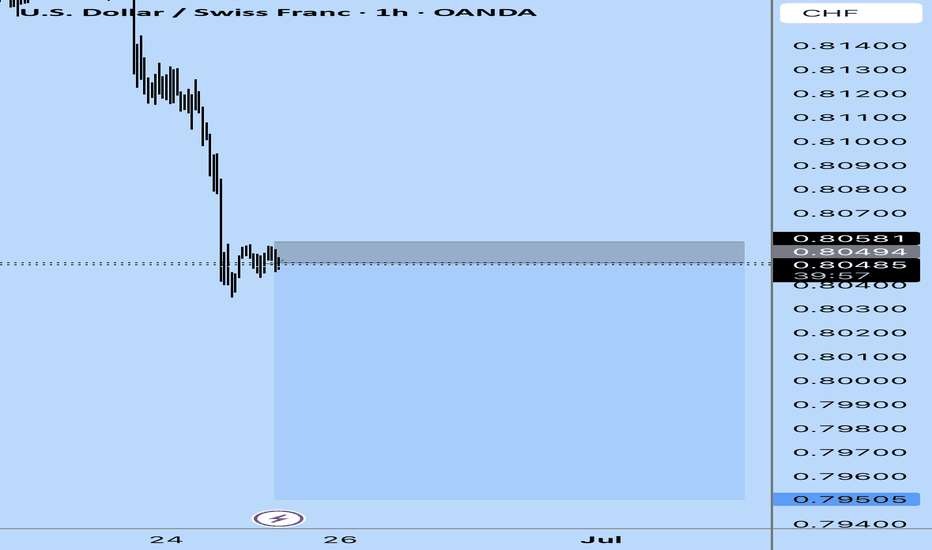

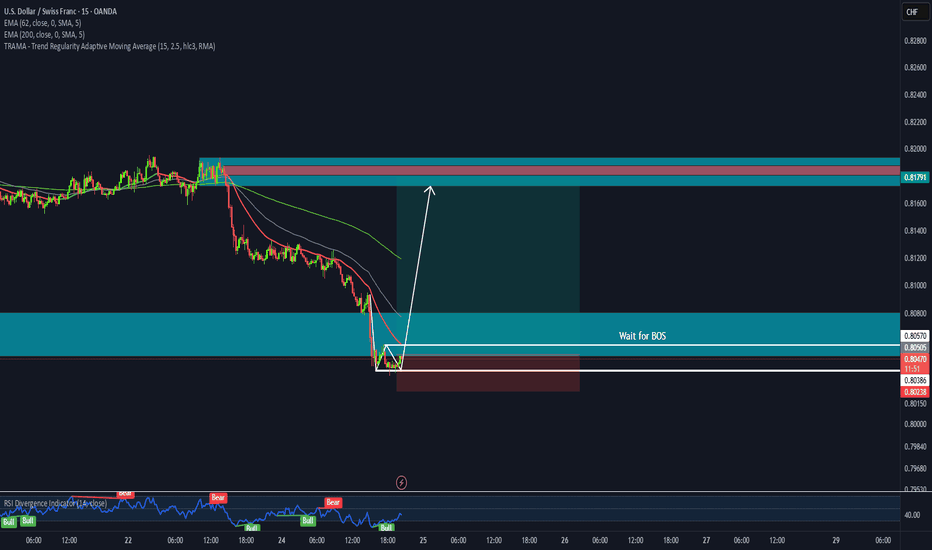

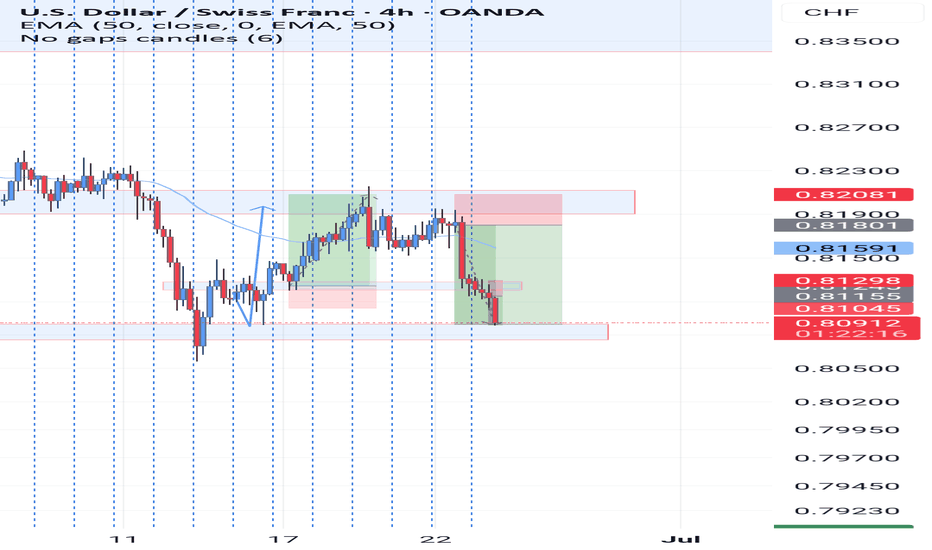

USDCHF LONG FORECAST Q2 W26 D24 Y25 14:00GMTUSDCHF LONG FORECAST Q2 W26 D24 Y25 1400GMT

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily order block

✅15' order block

✅Intraday breaks of structure

✅4H Order block

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

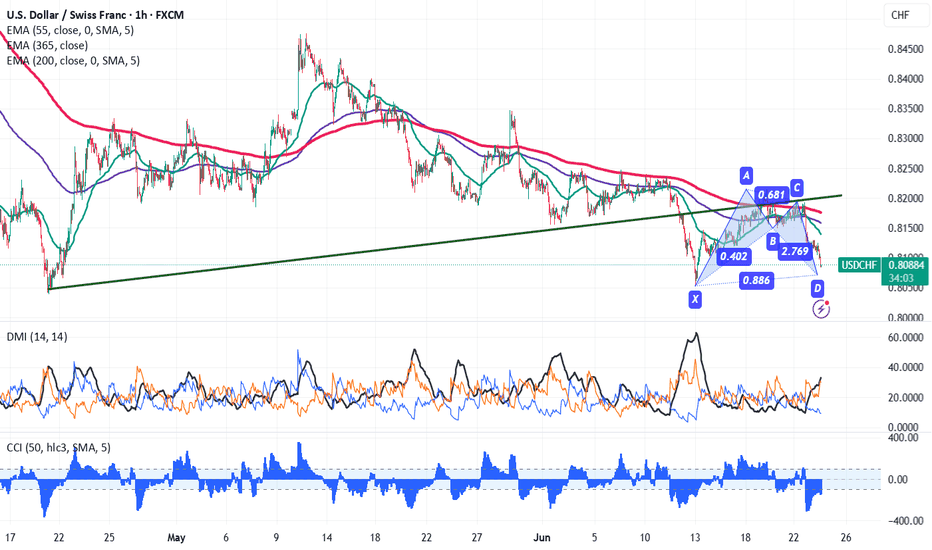

USDCHF Forms Bullish Gartley, Targets Upside Despite Bearish BiaChart pattern- Bullish Gartley pattern

Potential Reversal Zone (PRZ)- 0.8070

USDCHF pare most of its gains improving risk mood. It hits an intraday low of 0.80877 and is currently trading around 0.80866. Intraday bias appears to be bearish as long as the resistance 0.8140 holds.

Technical Analysis Points to Further Upside

The pair is trading below the 55-EMA, 200 EMA and 365 EMA on the 4-hour chart indicates a bearish trend. The immediate resistance is at 0.8140 any break above targets 0.8180/0.8250/0.8300.

Support Levels and Potential Declines

On the downside, near-term support is around 0.8080, any violation below will drag the pair to 0.8000/0.7920.

Indicators (1-Hour)

CCI (50) - Bearish

Directional movement Index - Bearish

Trading Strategy Recommendation

It is good to buy on dips around 0.8070 with a stop-loss at 0.8040 for a TP of 0.8185..

USDCHF - TIME FOR RECOVERYTeam, USDCHF has been selling off last few days

Time to make AMERICAN greater again, lolz

This price is good for entry

Please ensure once it hit your 1st target, bring STOP LOSS TO BE

Always take 50-70% from your current volume

TODAY, we short AUS200 target hit

also DAX short also hit.

Now, lets focus on USDCHF!

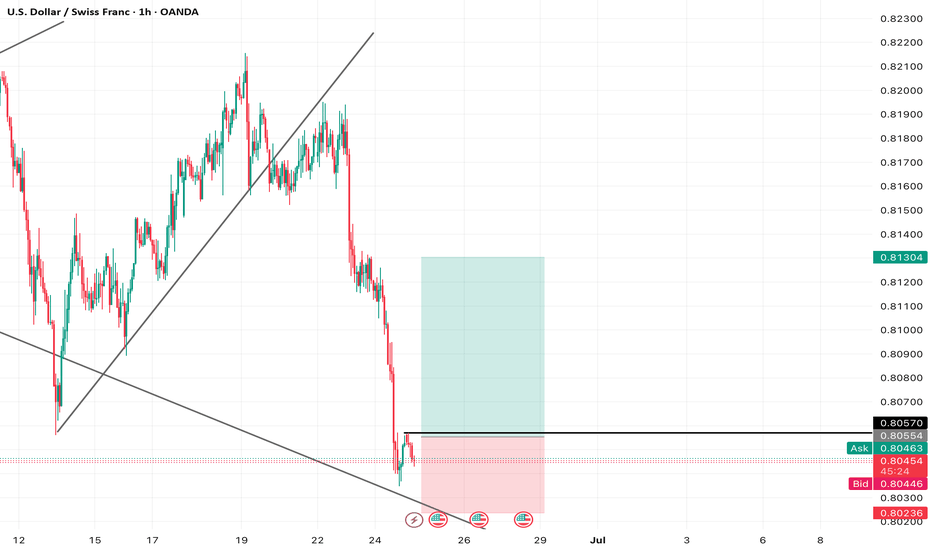

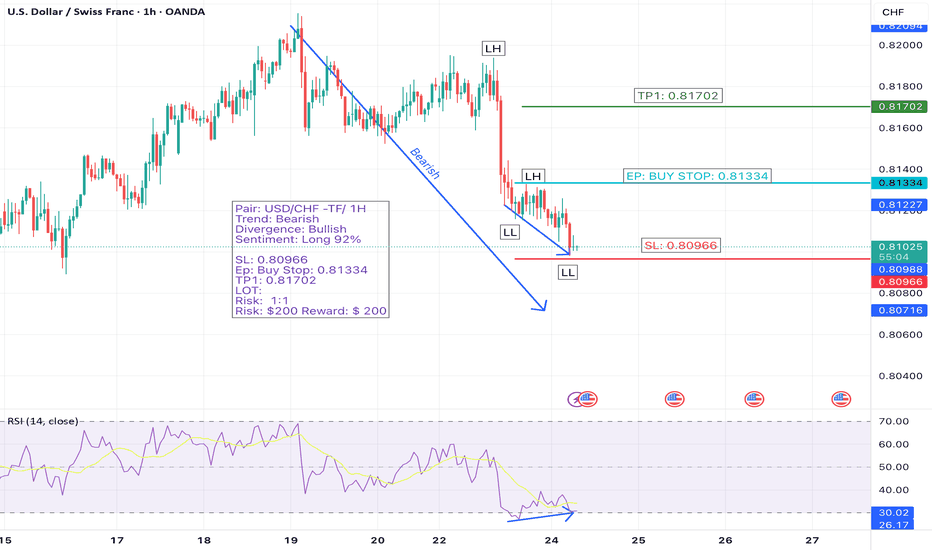

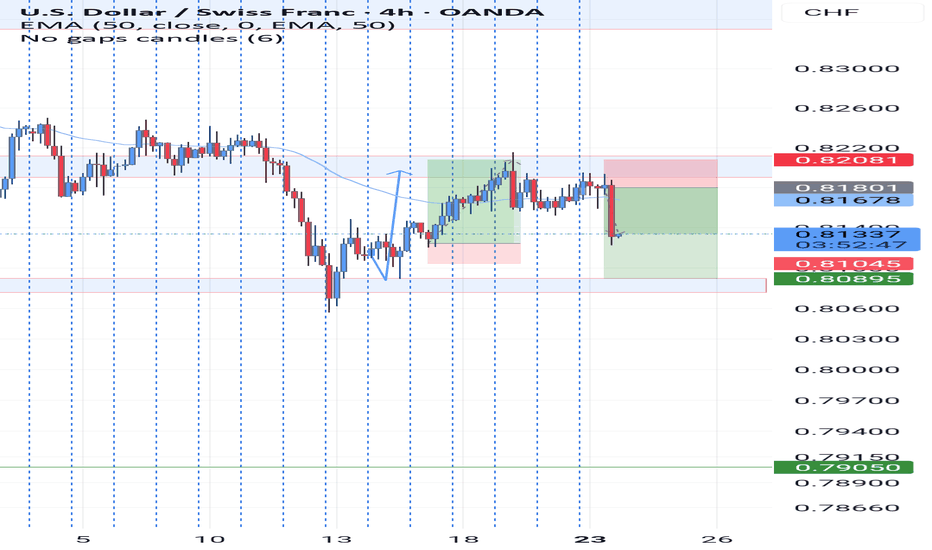

USD/CHF – T/F:1H - Potential Bullish Reversal SetupWe're watching USD/CHF closely for a bullish trend reversal. The pair is currently in a bearish trend, but a clear bullish divergence has formed—signaling early momentum shift.

According to Myfxbook sentiment data, 92% of retail traders are holding long positions, indicating strong bullish interest in this pair. However, we are waiting for confirmation via breakout of the last lower high (LH) before entering the trade.

Trade Details:

🔹 Pair: USD/CHF

🔹 Trend: Bearish (reversal expected)

🔹 Divergence: Bullish

🔹 Sentiment: 92% Long (Myfxbook)

🔹 Entry: Buy Stop at 0.81334 (after LH breakout)

🔹 Stop Loss: 0.80966

🔹 Take Profit: 0.81702

🔹 Risk/Reward: 1:1

🔹 Risk: $200

🔹 Potential Reward: $200

🎯 Strategy: Trade will only be activated after confirmation of breakout above the last LH, signaling the start of a bullish structure.

#USDCHF #ForexSignals #BullishDivergence #TrendReversal #MyfxbookSentiment #RetailPositioning #TechnicalAnalysis #ForexSetup #BreakoutTrade #RiskManagement #PriceAction #1HChart #SmartMoney #FXTrading #ReversalSetup

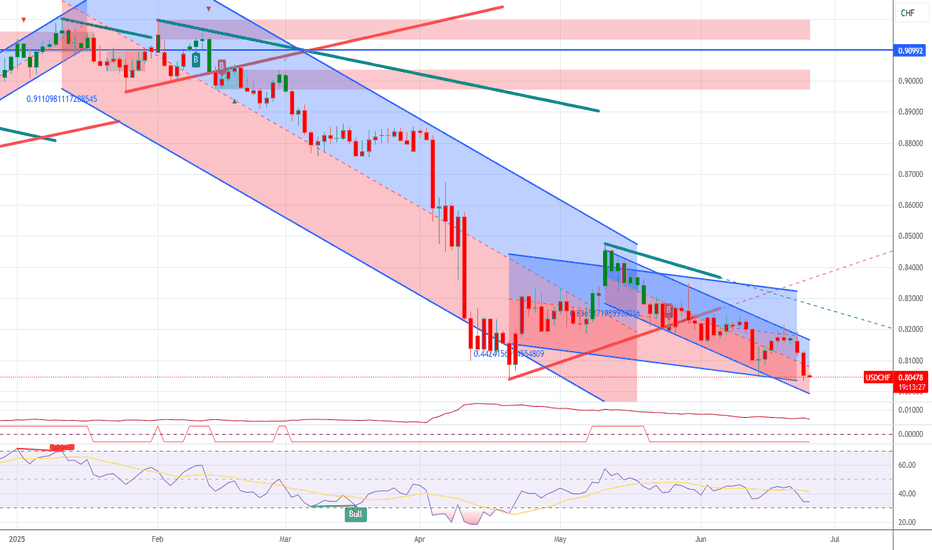

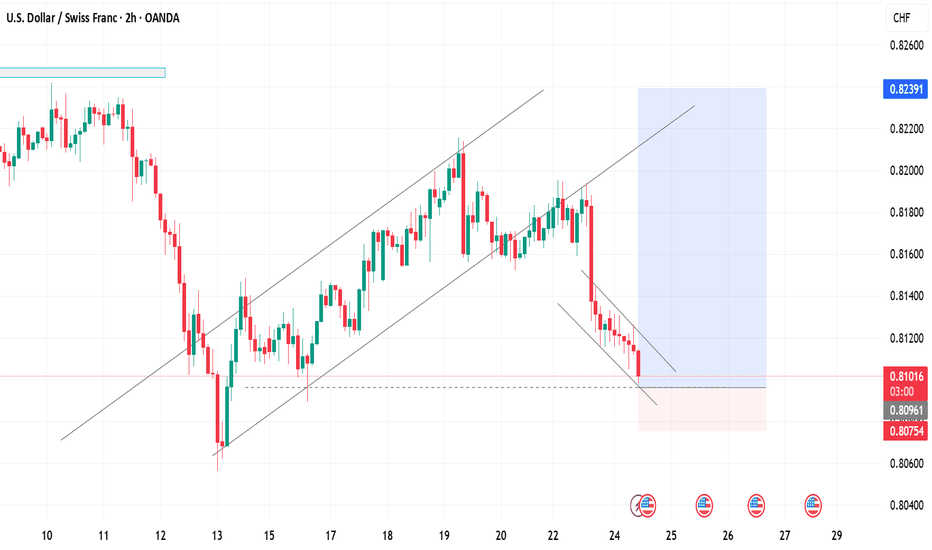

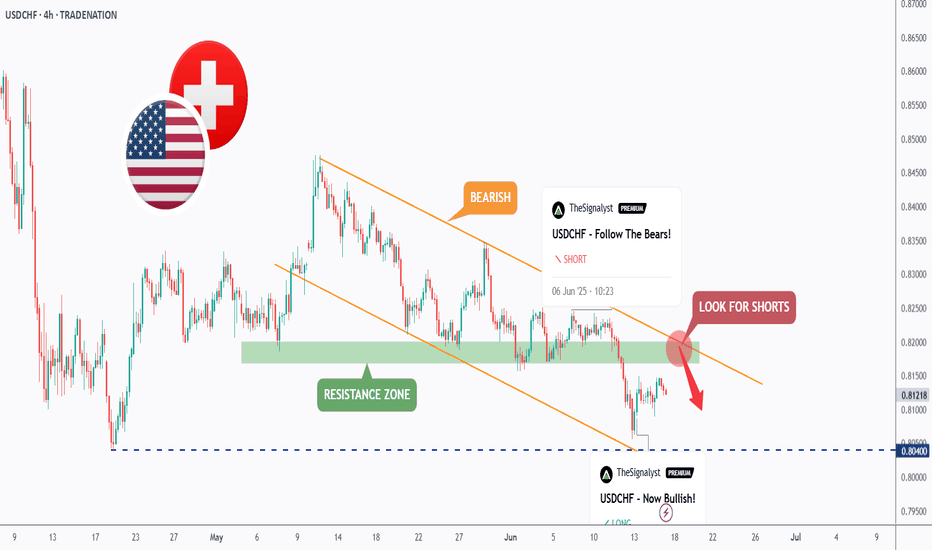

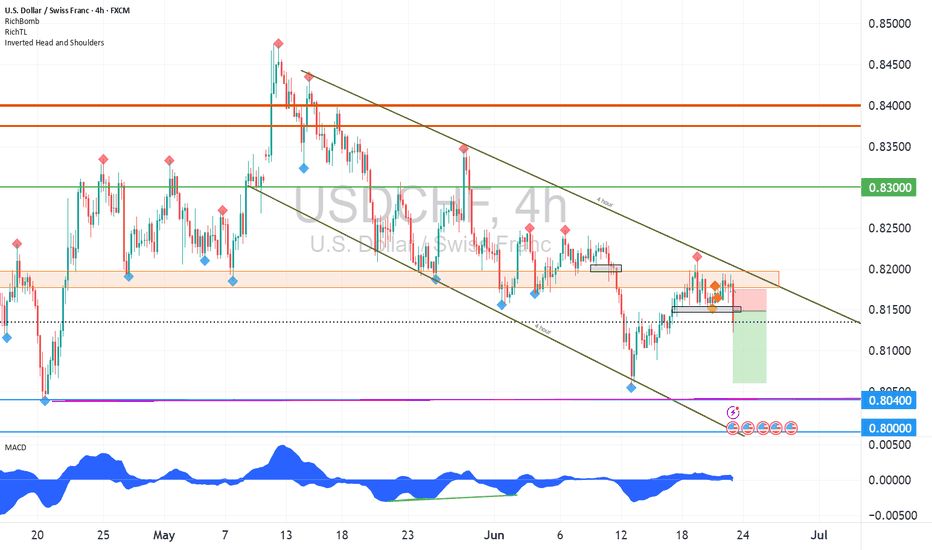

USDCHF - Bearish => Bullish => Now Bearish?Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈USDCHF has been overall bearish trading within the falling channel marked in orange. And it is currently retesting the upper bound of the channel.

Moreover, the green zone is a strong resistance.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper orange trendline and resistance.

📚 As per my trading style:

As #USDCHF approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

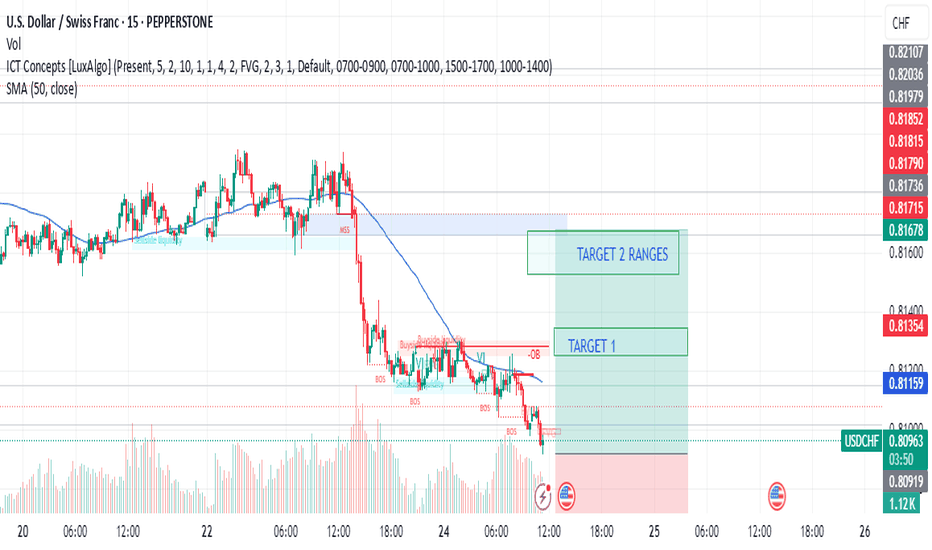

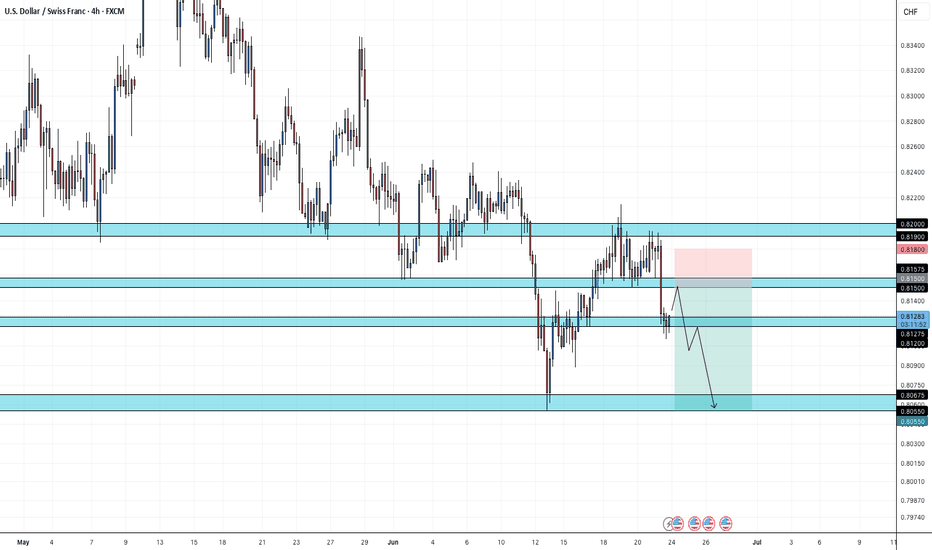

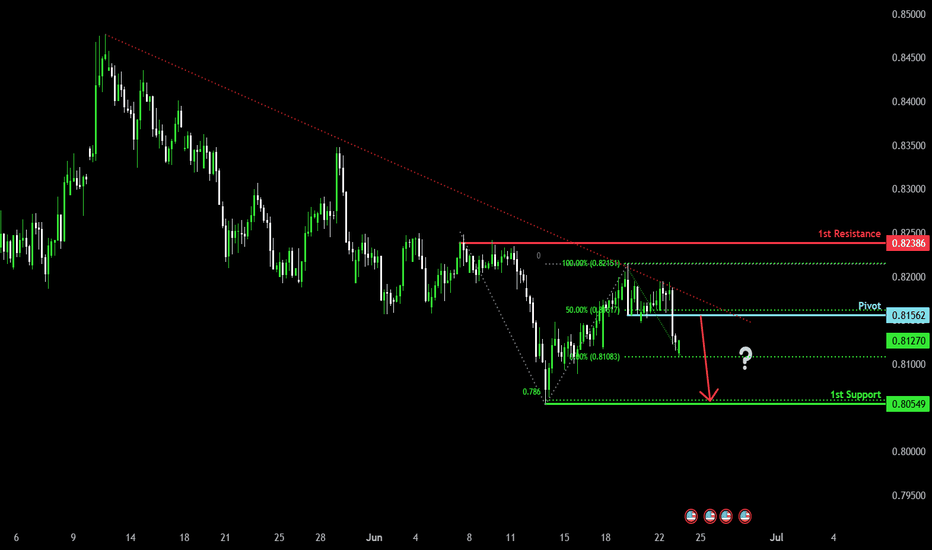

Bearish continuation for the Swissie?The price is rising towards the pivot which is a pullback resistance and could reverse to the pullback support.

Pivot: 0.8156

1st Support: 0.8054

1st Resistance: 0.8238

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

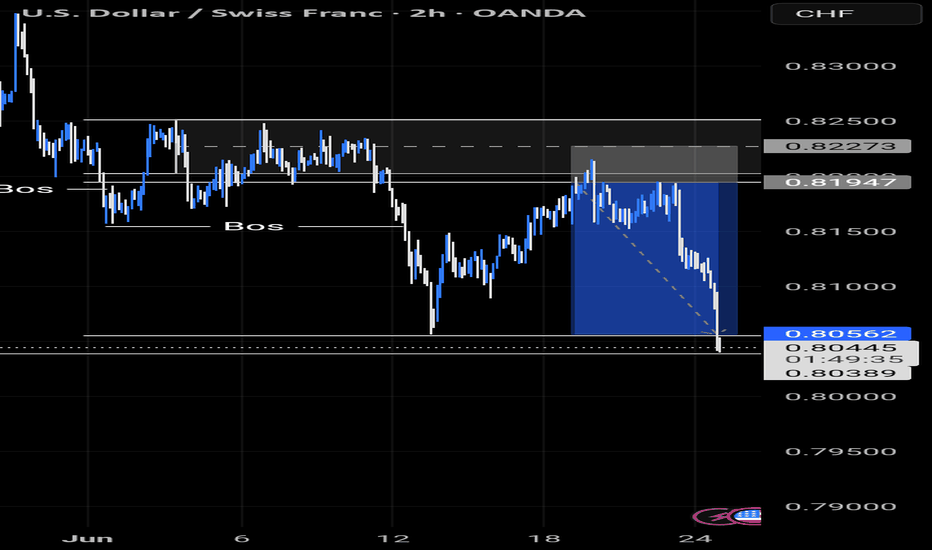

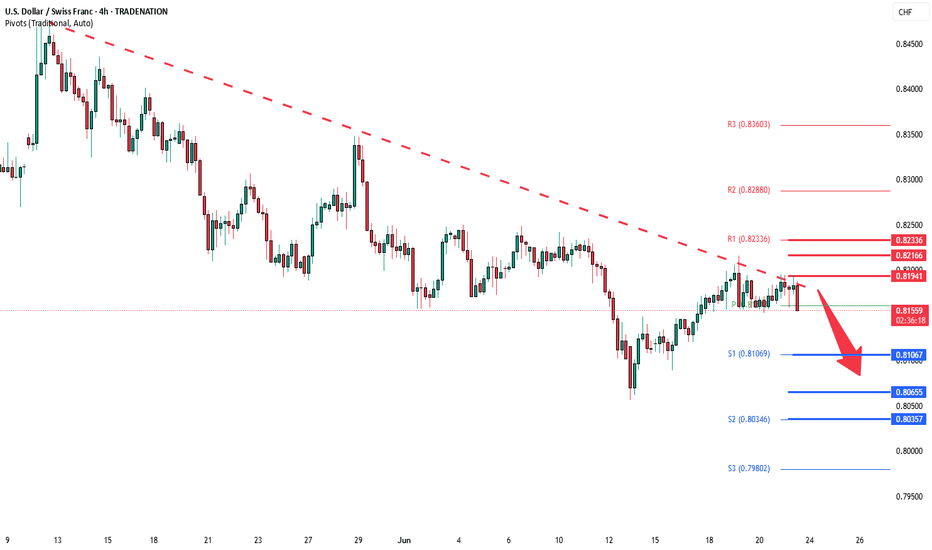

USDCHF resistance retest at 0.8195 The USD/CHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 0.8195, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 0.8195 could confirm the resumption of the downtrend, targeting the next support levels at 0.8100, followed by 0.8065 and 0.8035 over a longer timeframe.

Conversely, a decisive breakout and daily close above 0.8195 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 0.8215, then 0.8240.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 0.8195. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USDCHF – Short Setup Following 5-Wave CompletionUSDCHF Sell Limit

Entry: 0.8185

Target: 0.8117

Stop Loss: 0.8210

Duration: Intraday

Expires : 24/06/2025 08:00

Technical Overview

A 5-wave bullish Elliott Wave sequence appears to have completed at 0.8216, suggesting a corrective phase may follow.

Price is testing bespoke resistance at 0.8185, where we anticipate fresh selling interest.

Although mild early-session buying is possible, upside is expected to be limited, and the broader view favors further downside.

We prefer to initiate short positions early, targeting a move back toward 0.8117.

Two key U.S. PMI reports (Manufacturing & Services) are scheduled for 16:45 UTC, potentially adding short-term volatility.

Key Technical Levels

Resistance: 0.8185 / 0.8210 / 0.8216

Support: 0.8140 / 0.8117 / 0.8085

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

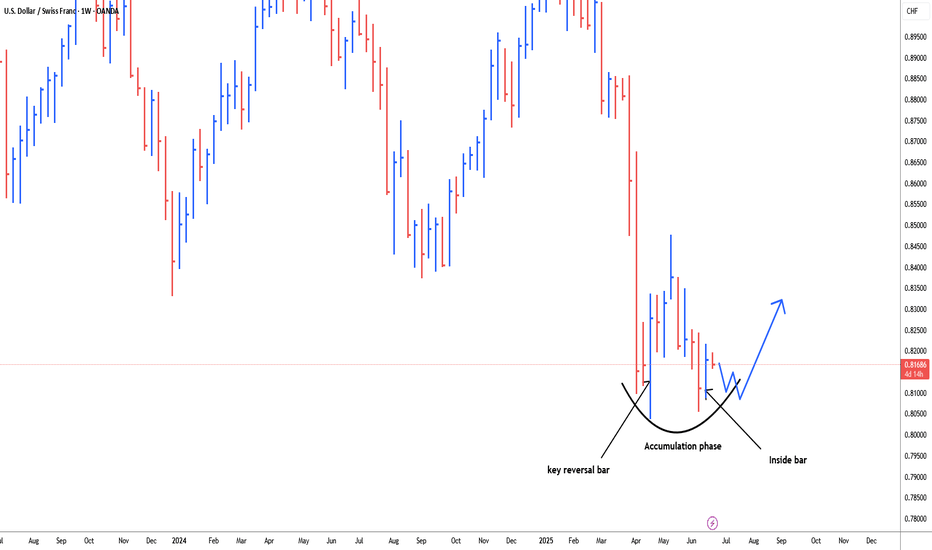

USDCHF weekly accumulation phase for bullish reversal#usdchf 21st weekly bar is a key reversal bar, made a new low closed towards high. 16th June weekly inside bar range confined within the range of the previous previous bar i.e. did not make high or low by the previous bar. need a lot of patience for good profit in usdchf long position reason trend is quite bearish. market takes time to neutralize the trend and to reverse it. 0.8137-0.8120 is 4h demand zone within the weekly chart. 0.8220-0.8250 need to break to the upside for further confirmation of trend change.