USDCHF trade ideas

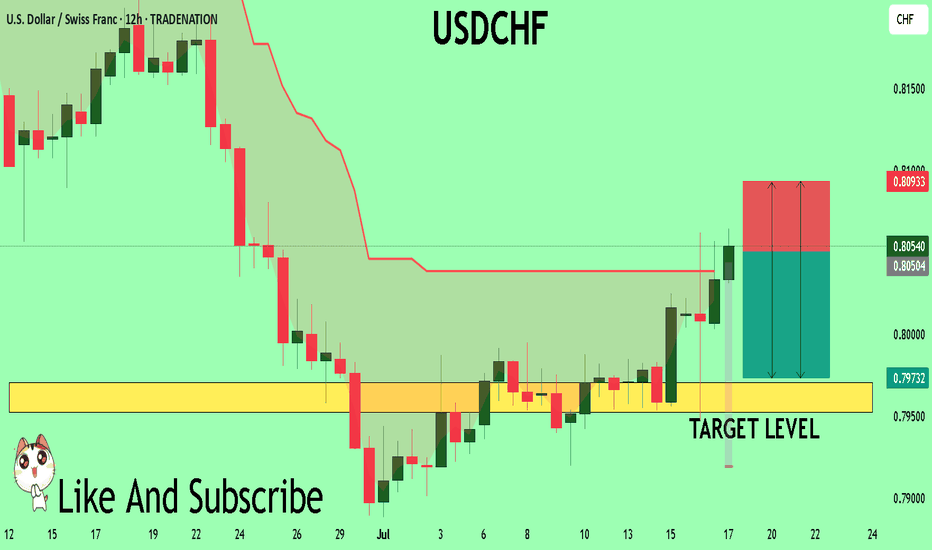

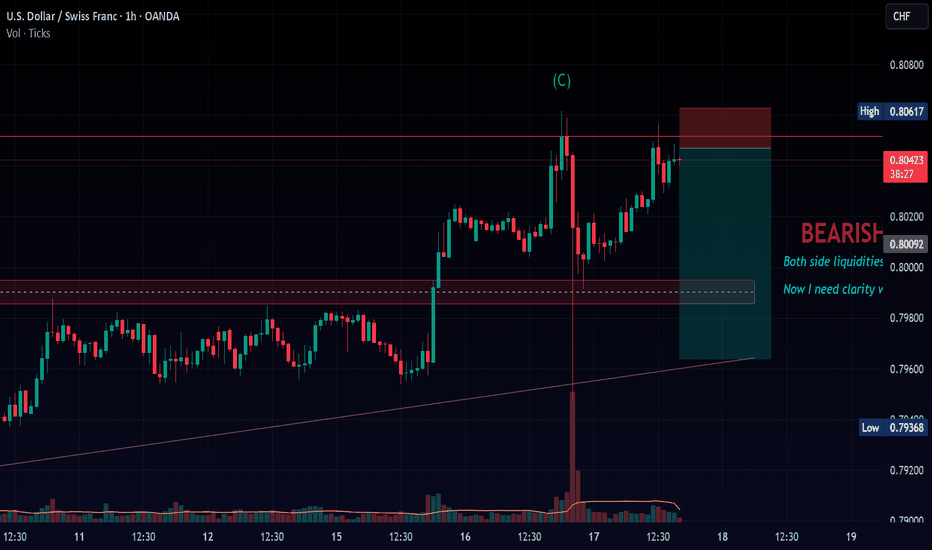

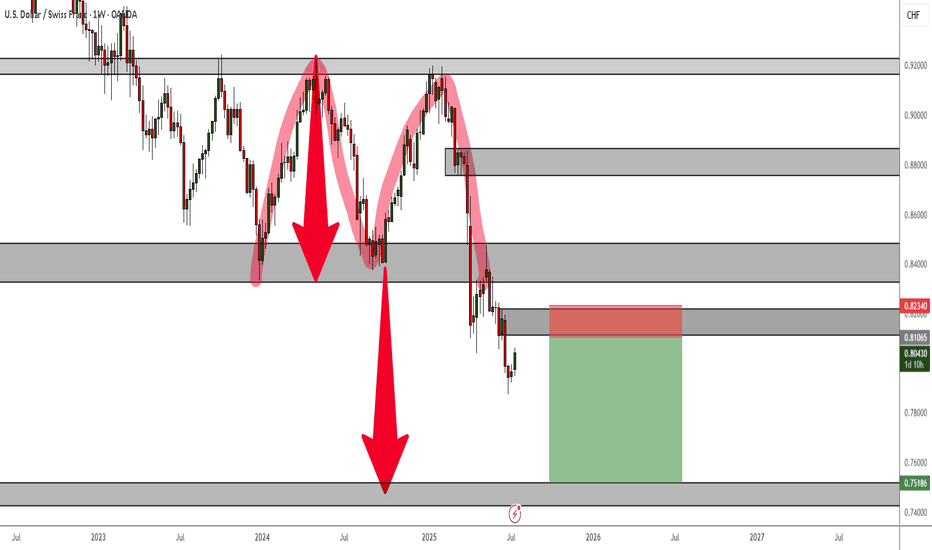

USDCHF The Target Is DOWN! SELL!

My dear followers,

I analysed this chart on USDCHF and concluded the following:

The market is trading on 0.8050 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.7970

Safe Stop Loss - 0.8093

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

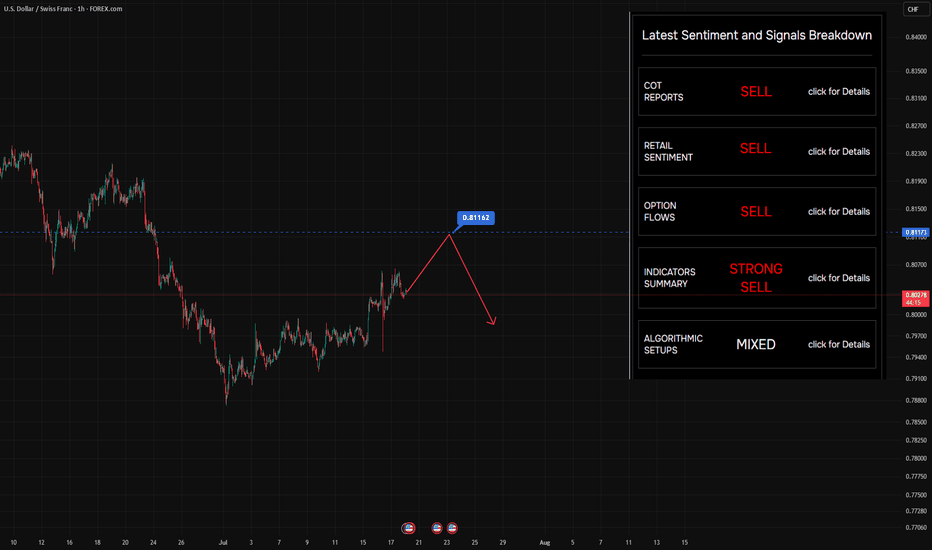

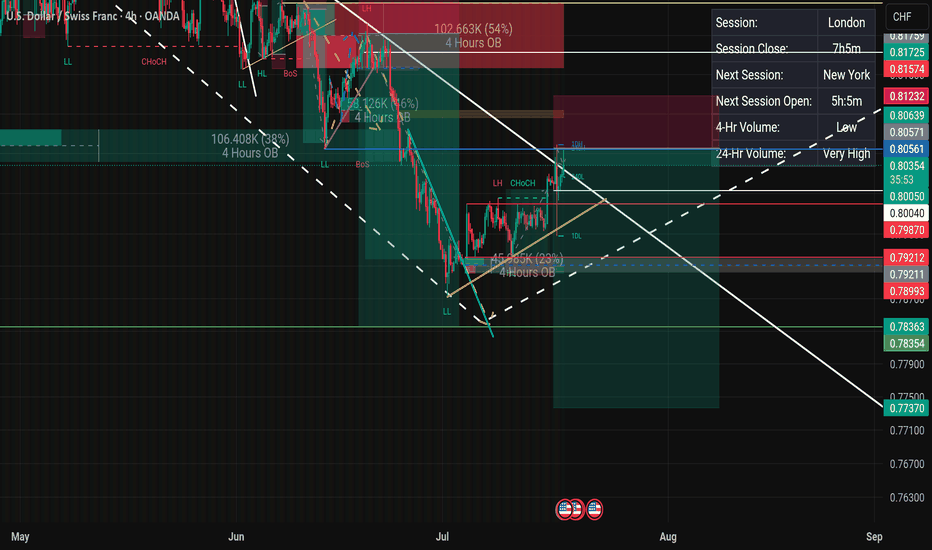

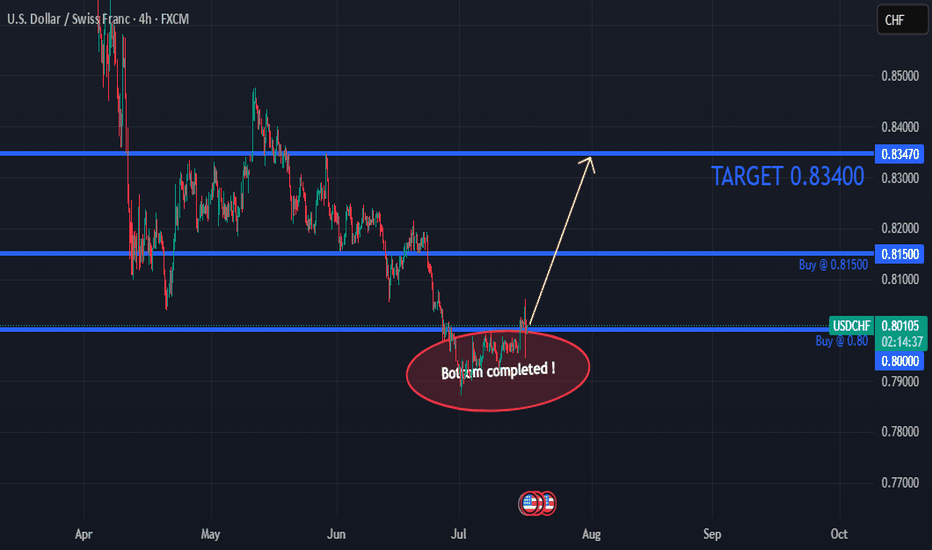

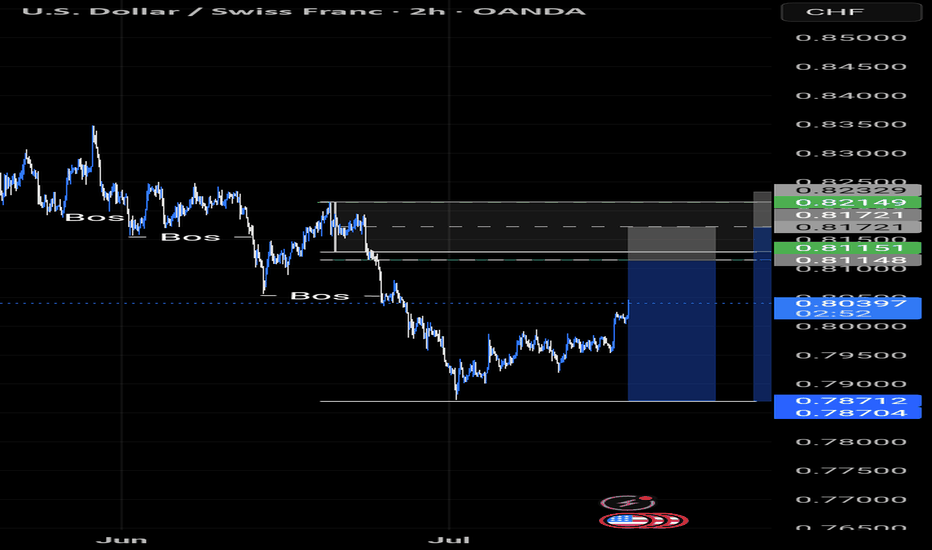

Still looking to sell on rallies — nothing’s changedStill looking to sell on rallies — nothing’s changed. The level on the chart? That’s where buyers jumped in before. Makes sense to target it again.

So… why do we say there are "suffering buyers" at this level?

Let’s rewind a bit (see Chart #2) and imagine price at the point marked on the chart.

At that moment, price had clearly returned to a visible local level — 0.8123 — a zone that naturally attracted traders to jump in on the fly , or triggered limit orders .

But here’s what happened next:

Selling pressure overpowered buying interest — and price moved swiftly lower .

That’s when those buyers got caught.

That’s when the pain started.

🔍 What Makes This Level Special?

Broker data from open sources confirms that open positions are still sitting at this level — meaning a lot of traders are underwater, hoping for a recovery that may never come.

It’s not just technical structure.

It’s crowded sentiment , failed expectations , and trapped capital — all wrapped into one.

🧠 This is what we call a "suffering trader" zone — and it often becomes a magnet for future selling .

📌 Follow along for more breakdowns on flow, positioning, and market sentiment .

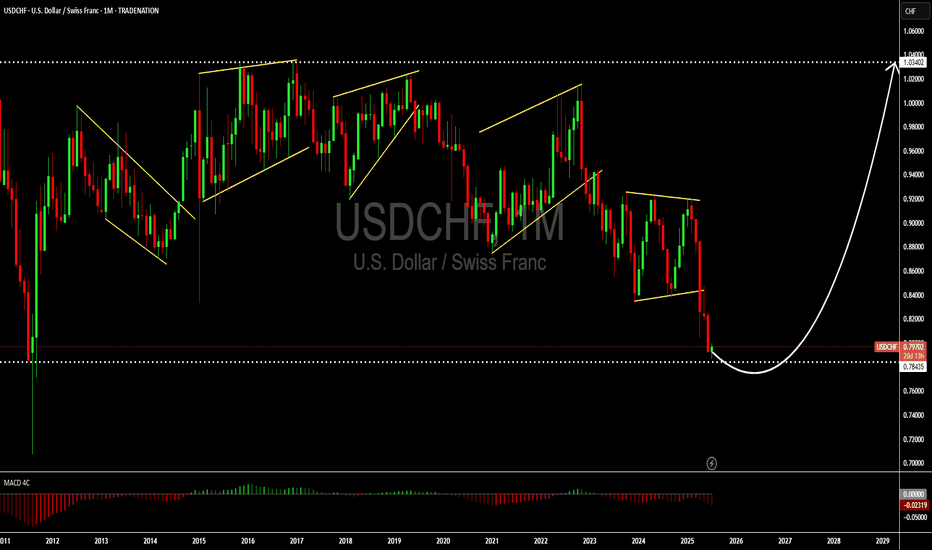

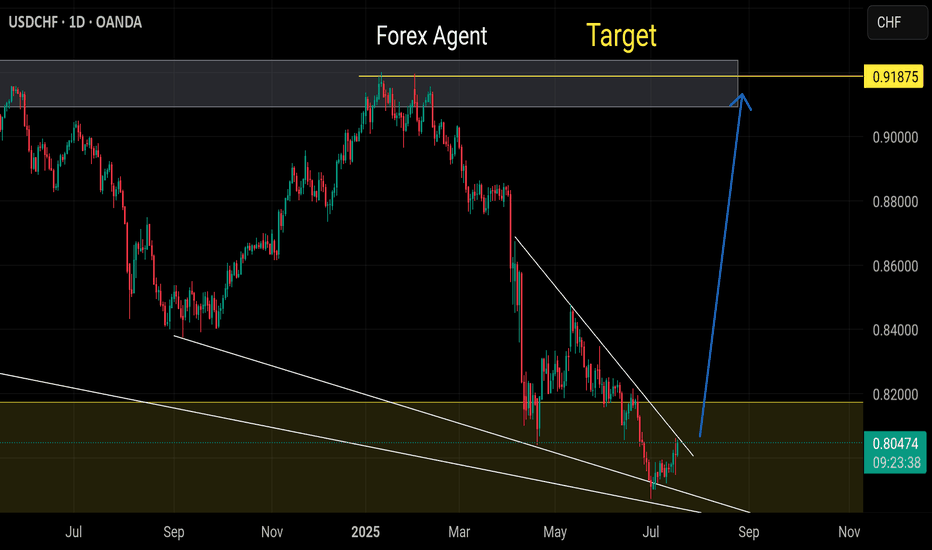

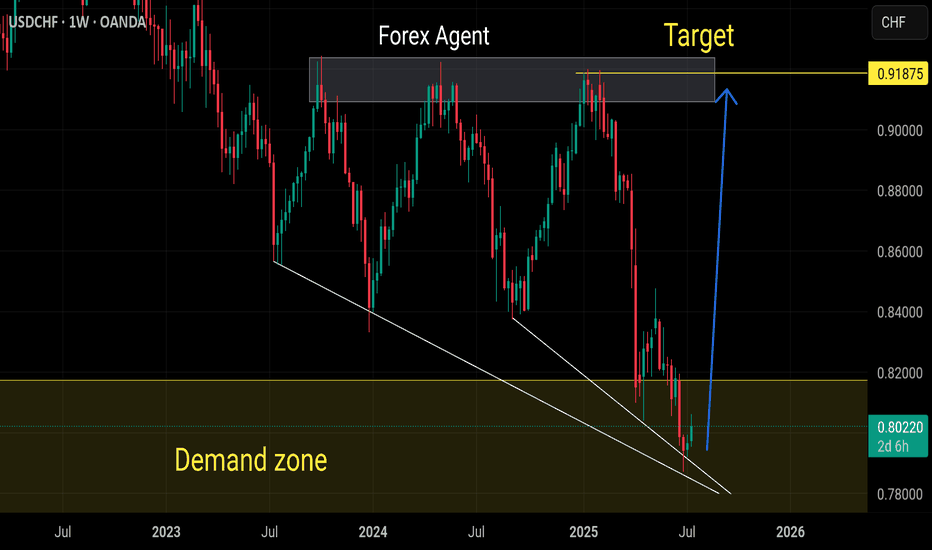

USDCHF long term bullish playHello,

The USDCHF is back to where it last traded in mid 2011. This reflects a significant weakening of the U.S. dollar against the Swiss franc, erasing over a decade of gains. It suggests growing investor demand for safe-haven assets like the franc — possibly driven by concerns around U.S. interest rate policy, inflation trends, or broader global uncertainty. The last time the dollar was this weak against the franc was more than 13 years ago.

While a weaker dollar is seen as good for the United States, we see a long term buy opportunity for this pair from the current level based on technical analysis. The pair is now trading at the bottom of the range.

Next week will be an important time for this pair as we wait for the inflation data. This will be key in guiding what the FED might do during the next meeting towards the end of the month.

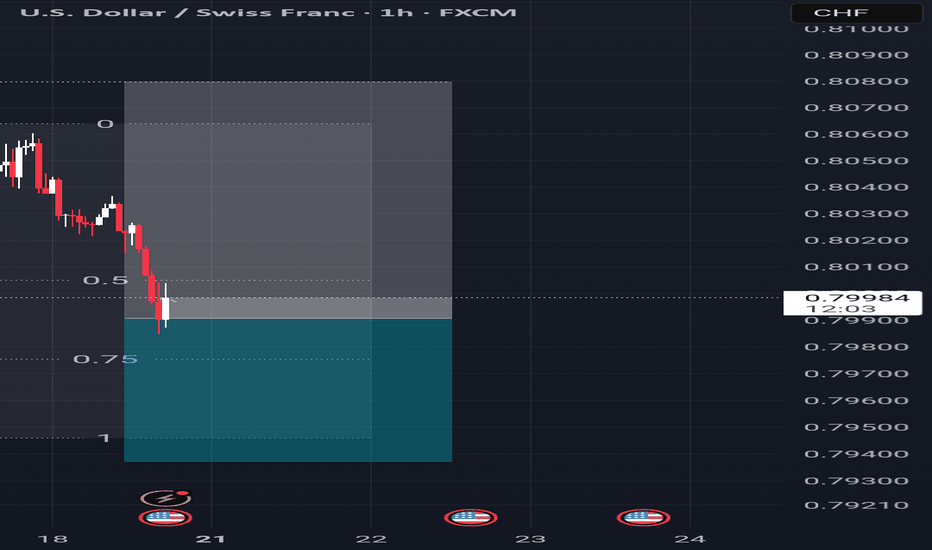

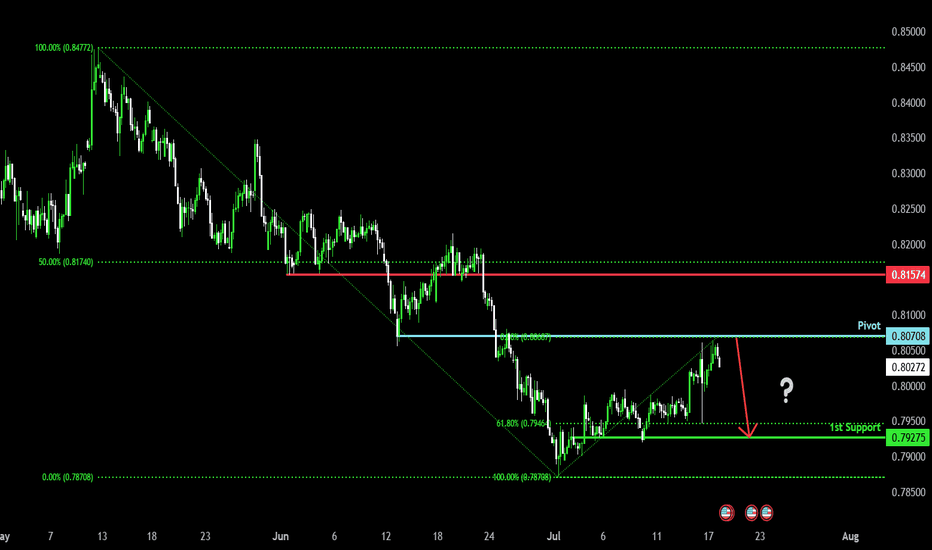

Bearish reversal off pullback resistance?The Swissie (USD/CHF) has rejected off the pivot and could drop to the 1st support which is a pullback support that is slightly below the 61.8% Fibonacci retracement.

Pivot: 0.8070

1st Support: 0.7927

1st Resistance: 0.8157

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

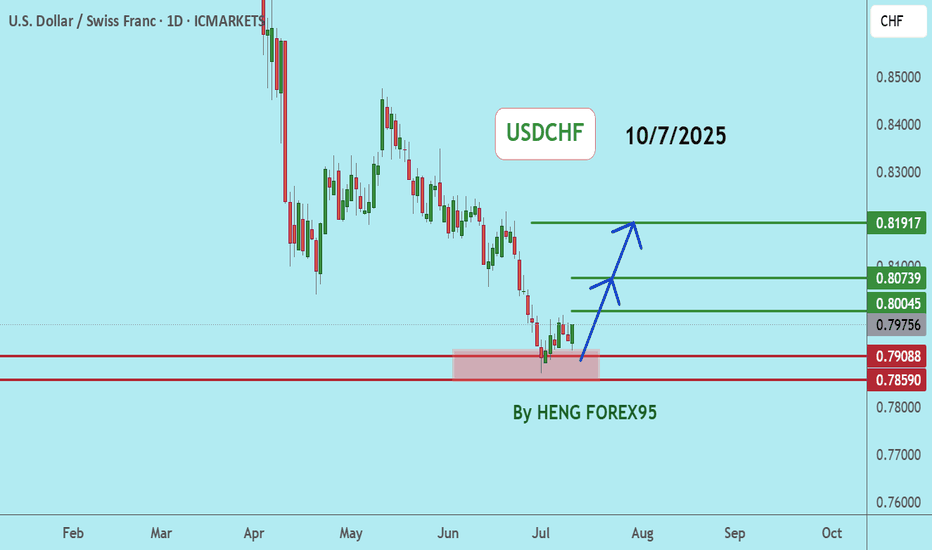

USDCHFUSDCHF If the price can stay above 0.78590, it is expected that the price will rebound. Consider buying in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

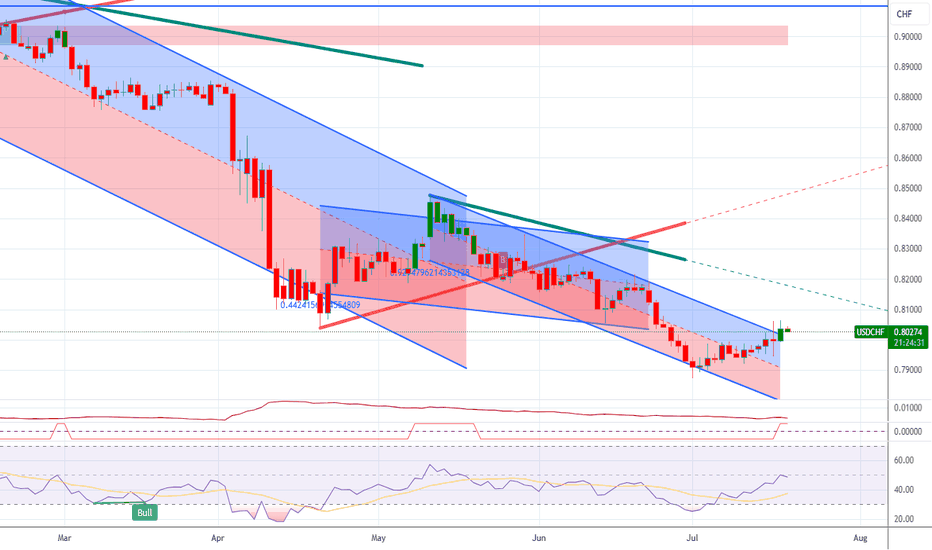

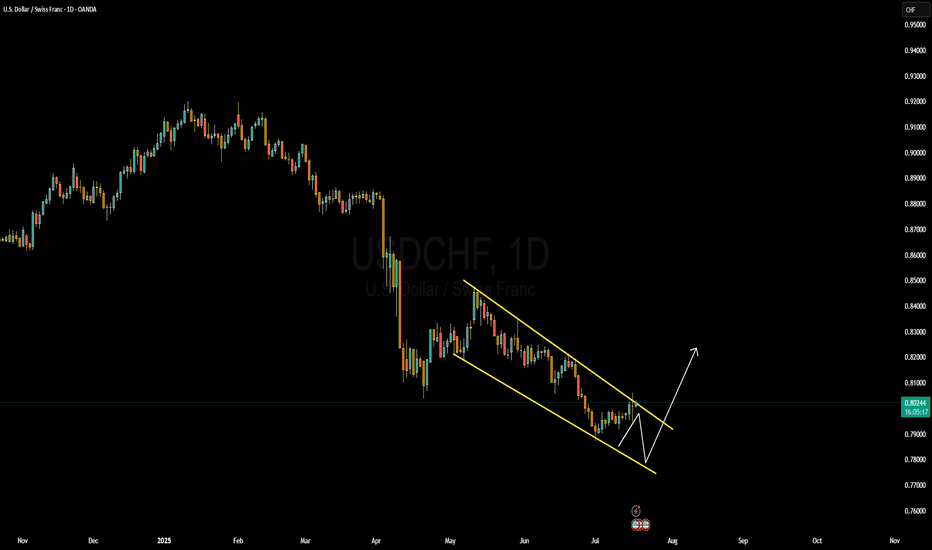

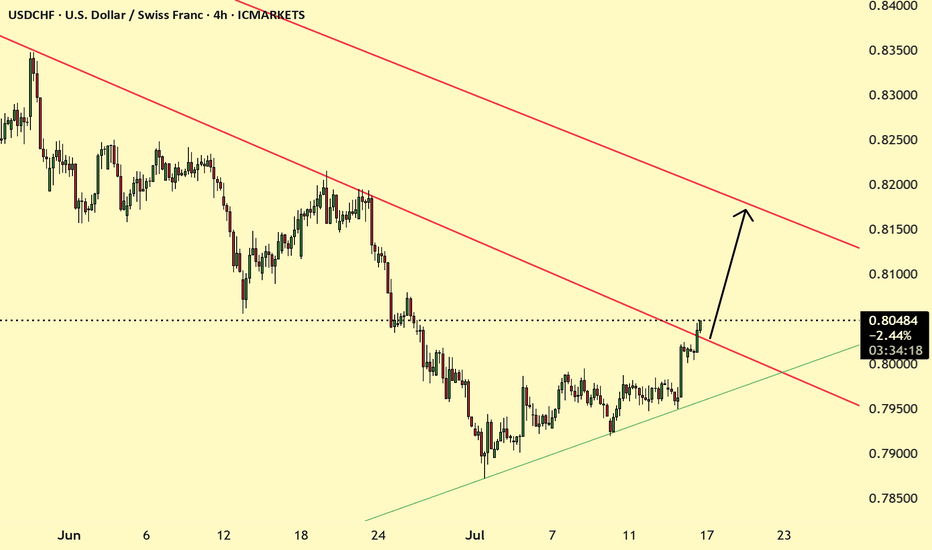

USDCHF Forming Descending ChannelUSDCHF is currently moving within a well-defined descending channel on the daily timeframe. The structure has been respecting this pattern for several months, and we are now approaching a potential breakout zone. Price recently tapped the midline of the channel and showed early signs of bullish rejection. I'm closely monitoring this pair as it builds momentum for a possible bullish reversal, either from a deeper retest at the lower channel boundary or directly breaking above the upper trendline.

On the fundamental side, today's shift in sentiment around the US dollar is quite clear. After a series of weaker US inflation reports and growing market anticipation of a Fed rate cut, USD has come under pressure. However, the Swiss franc is also showing signs of weakness, especially after the Swiss National Bank became the first major central bank to cut interest rates earlier this year and is likely to remain dovish through the remainder of 2025. This monetary policy divergence creates space for USDCHF to rally as investors price in a potential stabilization or rebound in the dollar.

Risk sentiment also plays a role here. With global equities slightly pulling back and geopolitical tensions simmering, safe haven demand is mixed. While CHF typically benefits in risk-off environments, the lack of recent SNB hawkishness gives USDCHF bulls a clearer edge, especially if US data stabilizes or improves.

Technically, I’m anticipating a potential false break to the downside before a sharp bullish wave toward 0.8300 and beyond. Momentum indicators are flattening, and with volume starting to pick up on bullish candles, this setup has potential. I’ll be looking to add further confirmation as price approaches the lower trendline or breaks out with clean structure. Keep a close eye — this setup could turn into a strong profit opportunity in the coming days.

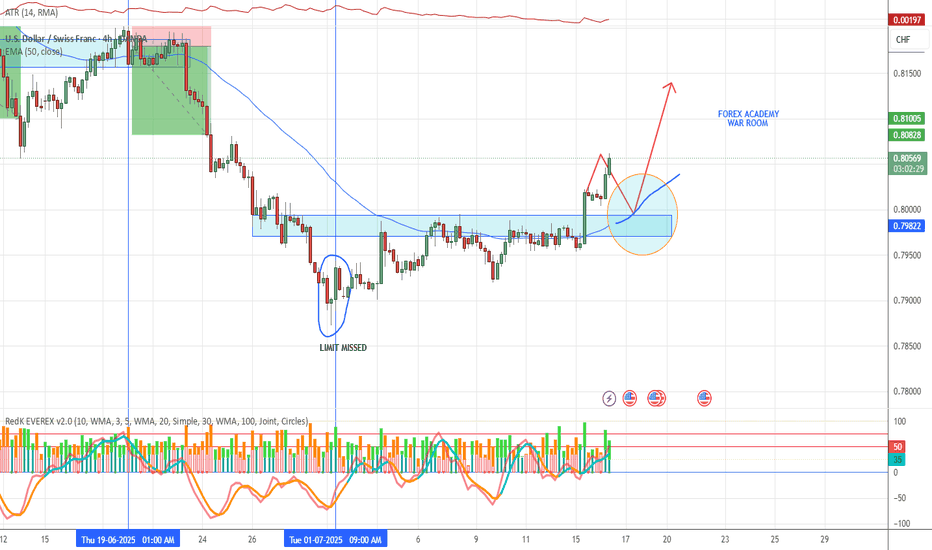

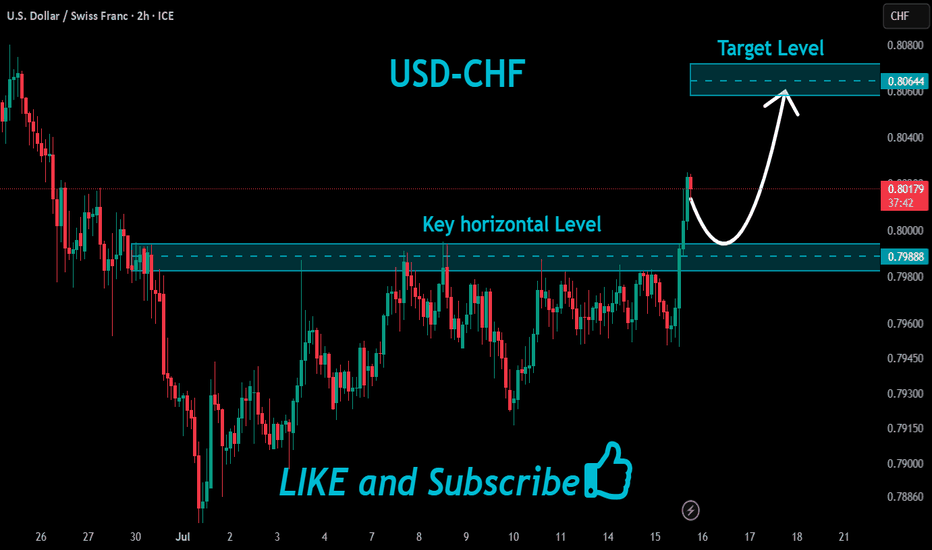

USD/CHF Breakout Done , Long Setup Valid To Get 100 Pips !Here is my opinion on USD/CHF , We have a clear breakout and the price now above my support area , i`m waiting the price to go back to retest it and then give me any bullish price action and i will enter a buy trade , the reason for cancel this idea , if we have a daily closure again below my area.

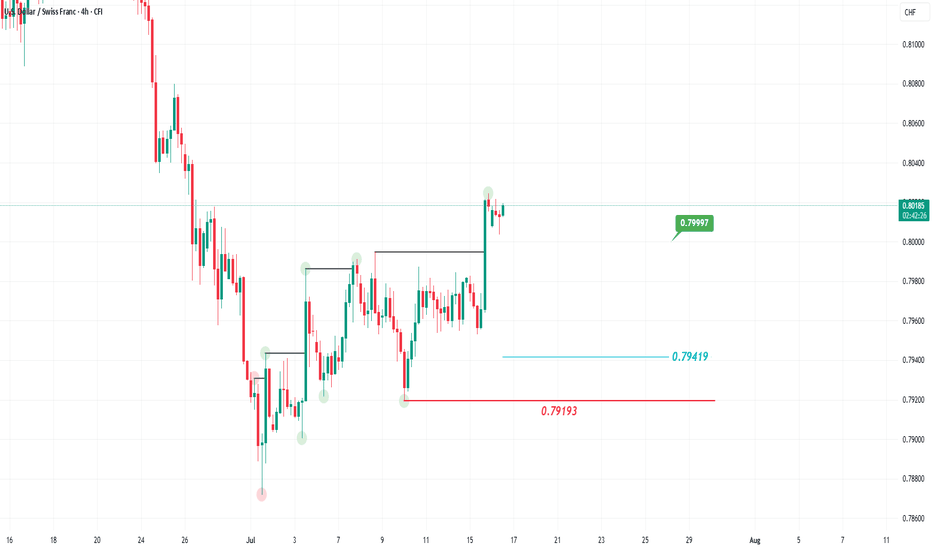

USD/CHF on the rise!The recent rebound of the US dollar has led to a decline in the Swiss franc against it, similar to other major currencies. The US dollar is also expected to show further strength in the coming period, supported by recent positive economic data, most notably, and the annual Consumer Price Index (CPI) - which came in at 2.7%, the highest reading in the last four releases.

This last CPI reading holds particular significance, as the Federal Reserve (Fed) is closely watching it, especially with expectations that the impact of tariffs may start to appear from this and the next reading.

Positive inflation data and a stable labor market give the Fed the flexibility to maintain steady interest rates in the near term, which could support further USD strength. The impact of all this economic data is expected to diminish as we approach August 1, the date when tariffs are set to resume, according to US President Donald Trump.

The world is closely watching how the tariff issue will unfold and whether trade agreements will be reached before that date. All of this directly affects global markets and the US dollar. For these reasons, traders should closely monitor the news, as developments are rapidly changing and appear daily, especially statements from the US President regarding tariffs.

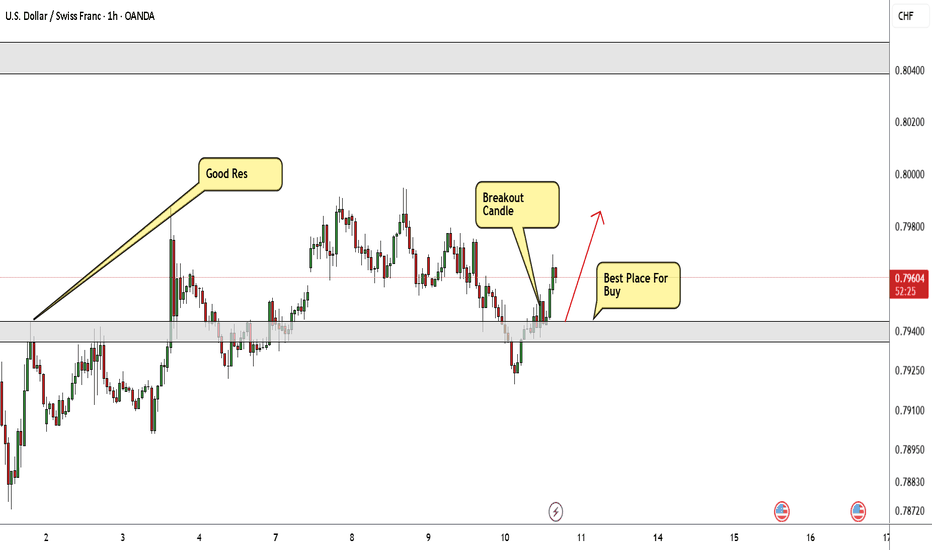

Technical outlook

From a technical perspective, the USD/CHF pair is trading in an uptrend on the 4-hour chart. Its recent pullback to the 0.79419 level is considered corrective, with the uptrend likely to resume and target the 0.79997 level.

However, if the price drops below the 0.79193 level and forms a lower low on the 4-hour chart, this would signal a trend reversal from bullish to bearish, invalidating the bullish scenario mentioned above.

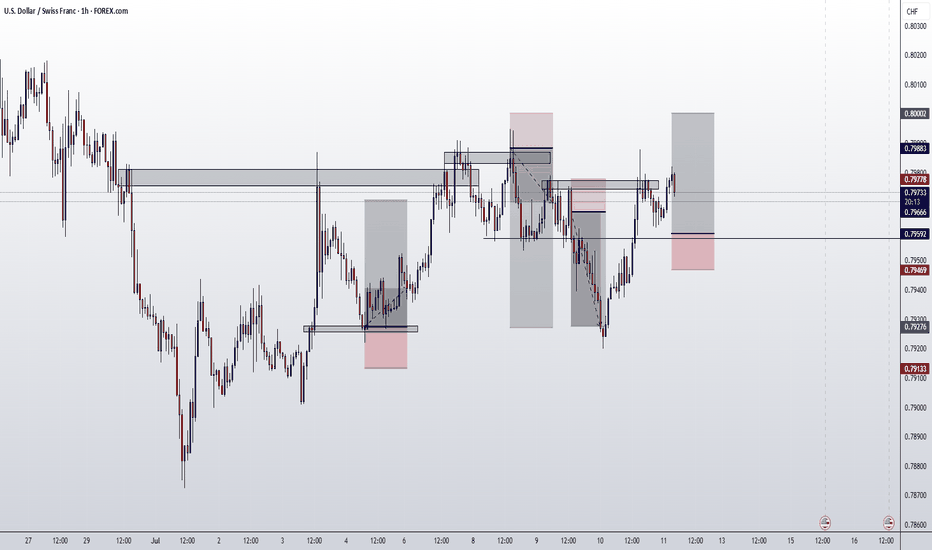

USDCHF ENTRY CHARTWe are BULLISH on this Pair, as we have a shift in trend at yesterday's daily close, the INTRA-DAY TF trend as also shifted to the upside, on our h1, we got a breaker block+ inducement with other confluences, if this matches with your idea, you can add to your watch-list. THANK YOU

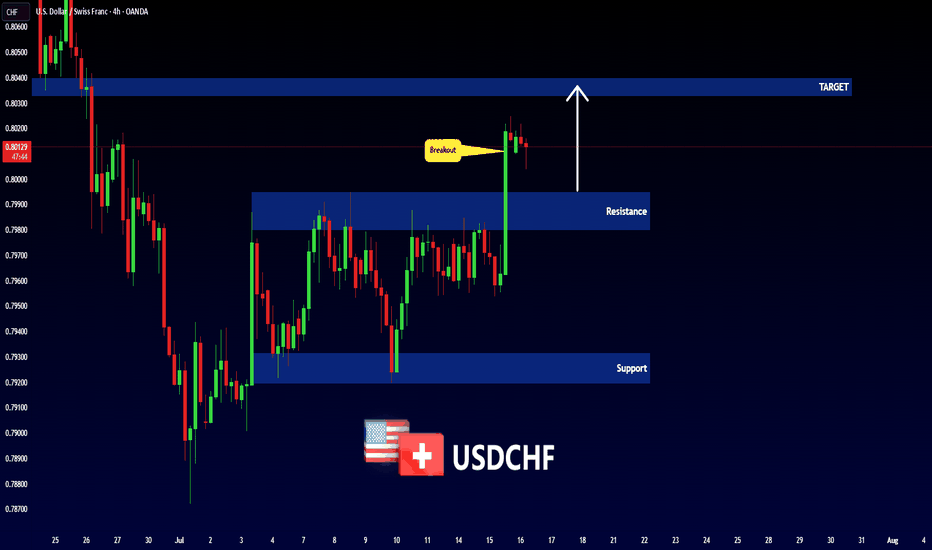

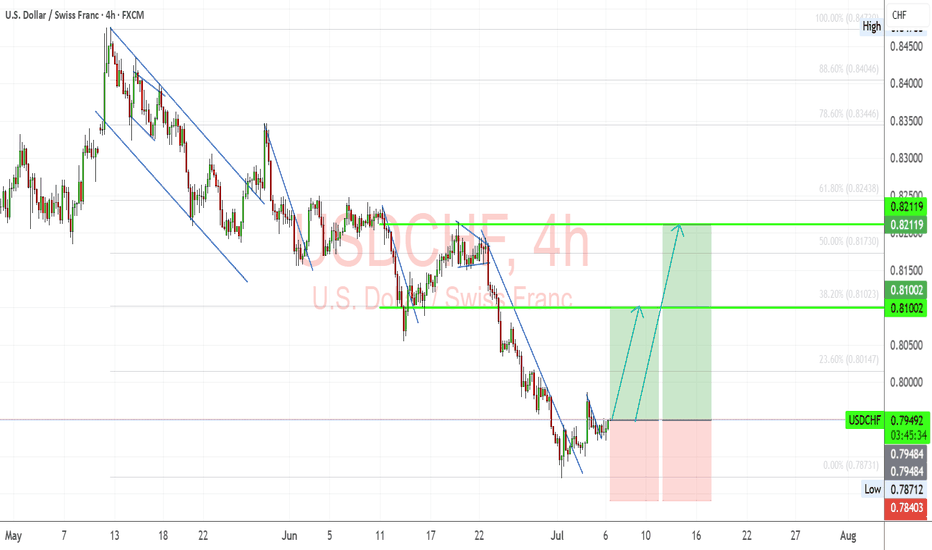

USDCHF – Reversal Setup Building Above 0.79 SupportUSDCHF has broken out of its steep downward channel and is now forming a potential bullish reversal base above the key support zone at 0.7940–0.7870. Price action suggests momentum could be shifting in favor of the bulls, with upside targets sitting at 0.8100 (Fibonacci 38.2%) and 0.8210 (previous resistance and 61.8% retracement).

🔍 Technical Structure:

Clean descending channel now broken.

Price holding above May–June lows, forming a potential higher low.

First target: 0.8100 zone.

Final target: 0.8210 resistance.

Stop: Below 0.7870 structure low.

🧠 Fundamentals:

USD Outlook: Bullish tilt as Fed members push back against early cuts. Markets eye July 11 CPI, which could confirm inflation stickiness and reinforce USD strength.

CHF Outlook: Weak bias, as the SNB has turned more dovish. With safe-haven demand easing and growth outlook softening, CHF is losing favor across the board.

Global sentiment: Risk appetite improving as geopolitical concerns (e.g., Strait of Hormuz, Iran) temporarily ease—removing upward pressure on CHF.

⚠️ Risk Factors:

A surprise drop in U.S. CPI this week could shift USDCHF sharply lower.

Renewed geopolitical tensions may revive CHF demand suddenly.

Fed speak and yields must remain supportive for this structure to play out.

🔁 Asset Dynamics:

USDCHF tends to lag behind DXY and USDJPY. Watch those pairs for confirmation. It can also follow moves in US10Y yields and react inversely to Gold volatility (safe-haven flow shifts).

✅ Trade Bias: Bullish

TP1: 0.8100

TP2: 0.8210

SL: Below 0.7870

Event to Watch: 🇺🇸 U.S. CPI – July 11

📌 If CPI confirms sticky inflation, USDCHF could rally toward the upper retracement zones quickly. Watch for confirmation candles near breakout.