USDEUX trade ideas

EURUSD(20250616) Today's AnalysisMarket news:

Trump: The United States may still intervene in the Iran-Israel conflict. If Iran launches an attack on the United States, the United States will "fight back with all its strength on an unprecedented scale." Iran and Israel should reach an agreement.

Technical analysis:

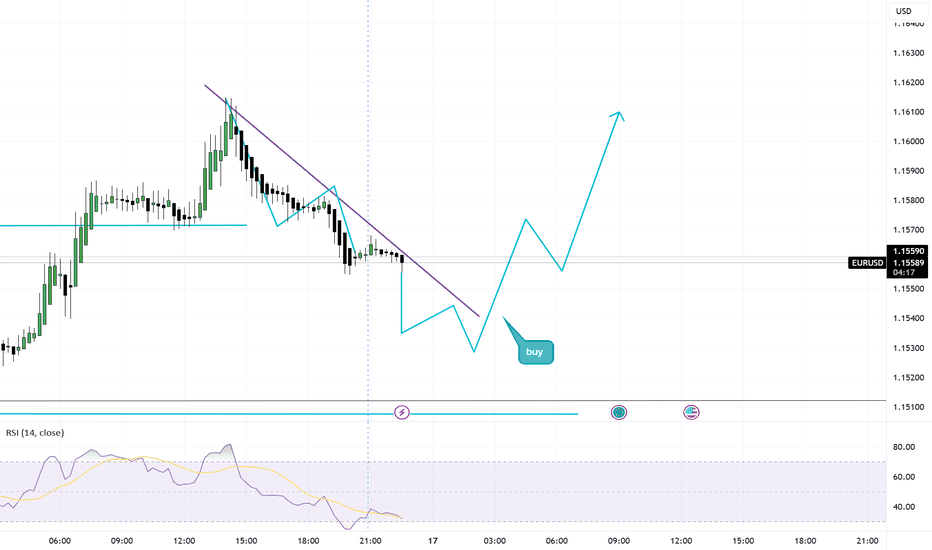

Today's buying and selling boundaries:

1.1550

Support and resistance levels:

1.1674

1.1628

1.1598

1.1502

1.1472

1.1426

Trading strategy:

If the price breaks through 1.1550, consider buying, and the first target price is 1.1598

If the price breaks through 1.1502, consider selling, and the first target price is 1.1472

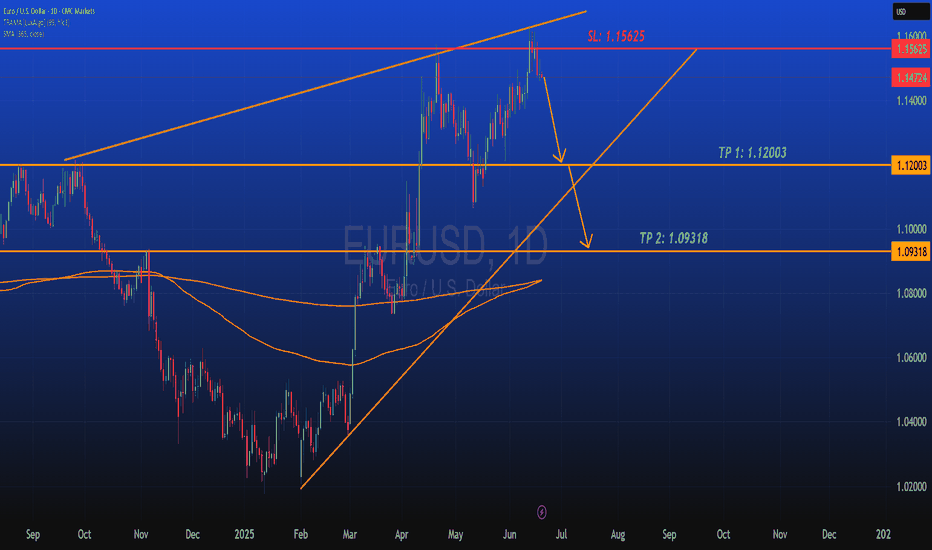

EURUSD Sell/ShortFundamental Analysis

EURUSD rates is being influenced by the current Eurozone's economic performance, driven by key economies like Germany and France, continues to be shaped by industrial output, consumer confidence, and inflation trends. The European Central Bank (ECB) has likely maintained a cautious monetary policy, with interest rates possibly held steady or adjusted slightly to combat inflation while supporting growth. On the U.S. side, the Federal Reserve's stance on interest rates, potentially in a tightening phase to address persistent inflation plays a critical role. Recent U.S. economic data, including GDP growth, employment figures, and consumer spending, may indicate a robust dollar, putting downward pressure on EURUSD. Additionally, geopolitical tensions, energy prices (affecting Eurozone energy imports), and trade balances between the U.S. and EU are likely contributing to volatility. Given the current date, recent ECB and Fed statements or data releases for June 2025 inflation reports.

Technical Analysis:

Based on the provided EURUSD 1D chart (covering mid-2024 to mid-2025), the following technical observations can be made:

Trend and Moving Averages:

For EURUSD it shows a descending trend from a peak around 1.48 in mid-2024, with a potential reversal or consolidation forming in mid-2025. The 50-day and 200-day moving averages (depicted as orange lines) are sloping downward, with the price recently testing these levels around 1.12-1.13. A break above the shorter-term moving average could signal bullish momentum, while a failure to hold might confirm a continuation of the downtrend. Looking for key support levels here are identified at 1.09318 (TP 2) and 1.08000, with the current price hovering near 1.12003 (TP 1). Resistance is notable at 1.15625 (SL) and the previous high near 1.4800. The price action suggests a potential bounce from the recent low, with the next target being the resistance zone around 1.15625 if bullish momentum persists. Candlesticks and volume patterns are showing a recent green candlesticks indicate buying pressure, potentially forming a reversal pattern near the 1.12 level. Volume analysis would confirm the strength of this move, with higher volume on upticks supporting a breakout.

Overall Bias:

The technical setup suggests a short-term bullish correction within a broader bearish trend, contingent on breaking and holding above 1.15625. A drop below 1.09318 would invalidate the bullish case and resume the downtrend toward 1.08000 or lower.

Sentiment Analysis

Market sentiment as of June 2025 likely reflects heightened interest in EUR/USD due to recent economic data and central bank policies. Traders and analysts are closely watching for signs of ECB rate cuts or Fed rate hikes, which could sway the pair. On social platforms and financial forums, there may be a mix of caution and optimism looking out for caution due to the Eurozone's economic challenges (energy costs, political uncertainty), and optimism if U.S. data softens, weakening the dollar. The chart's visibility on trading platforms suggests retail and institutional traders are actively monitoring this pair, with a focus on the 1.12-1.16 range as a critical decision point. Sentiment could shift rapidly based on upcoming economic releases or geopolitical developments.

Conclusion

The EUR/USD pair is at a pivotal juncture, with fundamentals pointing to a stronger USD due to Fed policy, while from a technical standpoint suggest a short-term bounce toward 1.15625 if support at 1.12003 holds. Sentiment indicates active trader interest, with eyes on central bank moves. A break above resistance could target 1.4800 (long-term), while a failure might see a decline to 1.08000. Monitor upcoming data for confirmation.

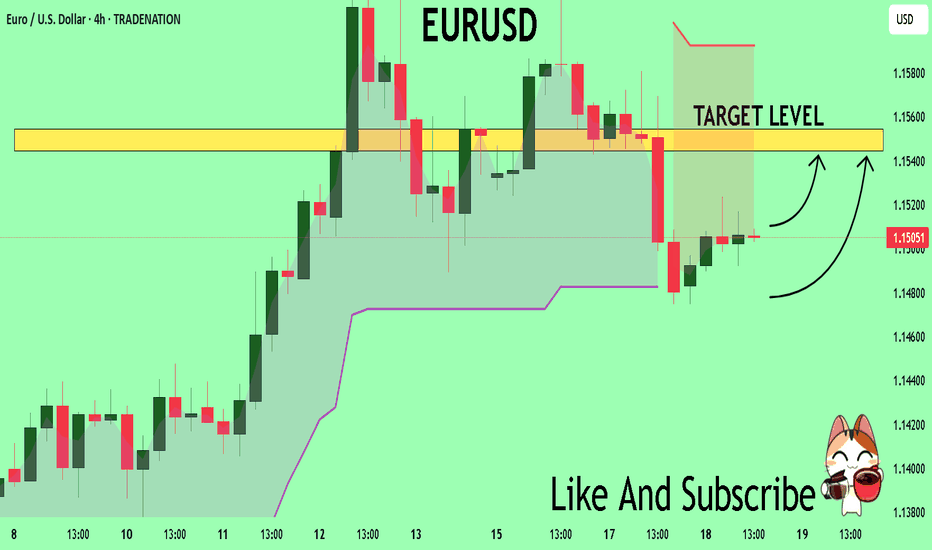

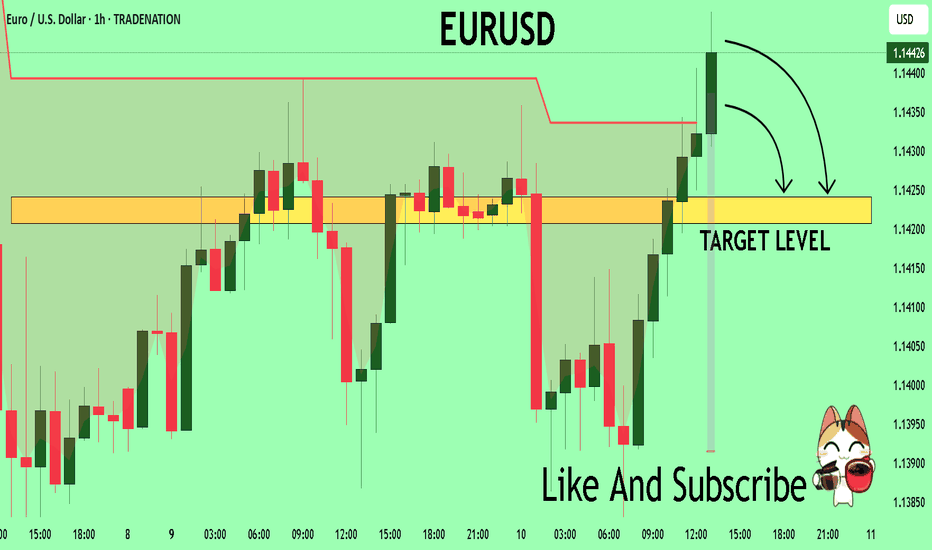

EURUSD The Target Is UP! BUY!

My dear friends,

Please, find my technical outlook for EURUSD below:

The instrument tests an important psychological level 1.1504

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.1544

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

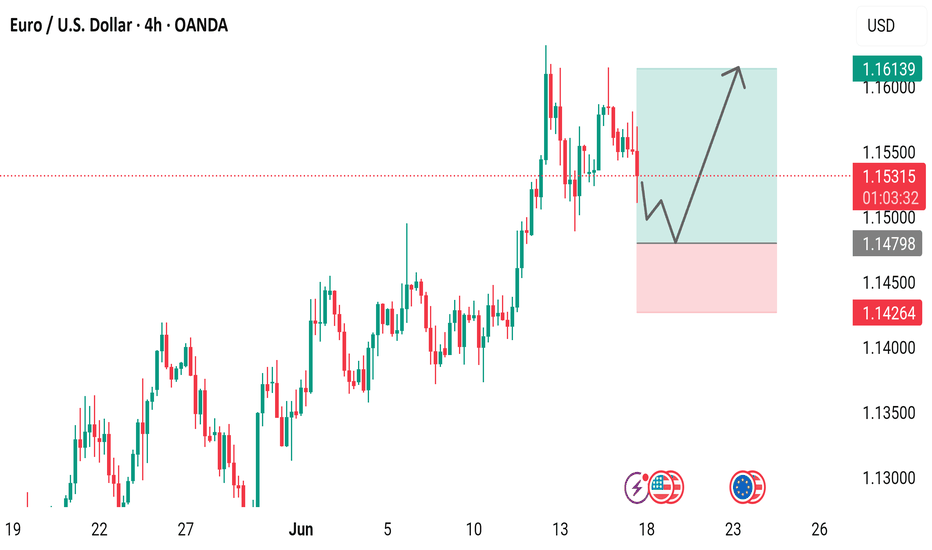

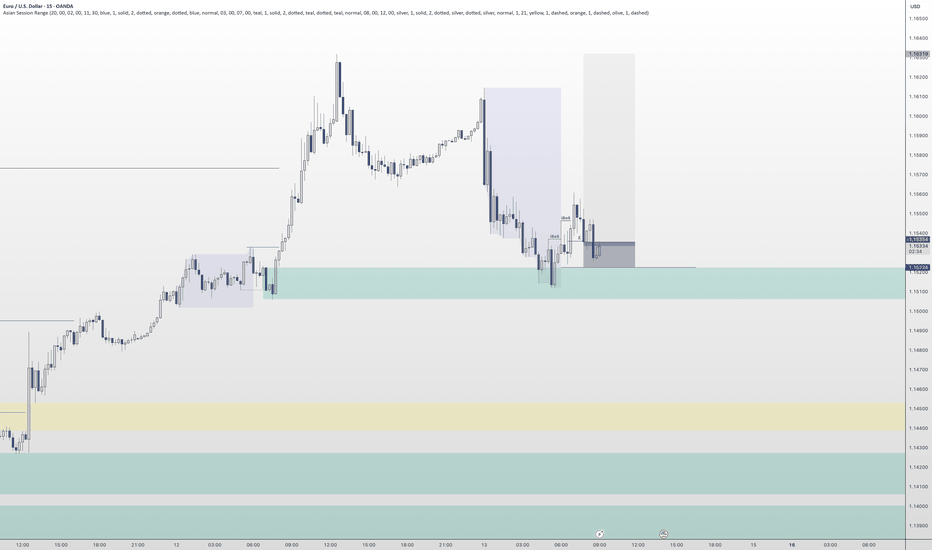

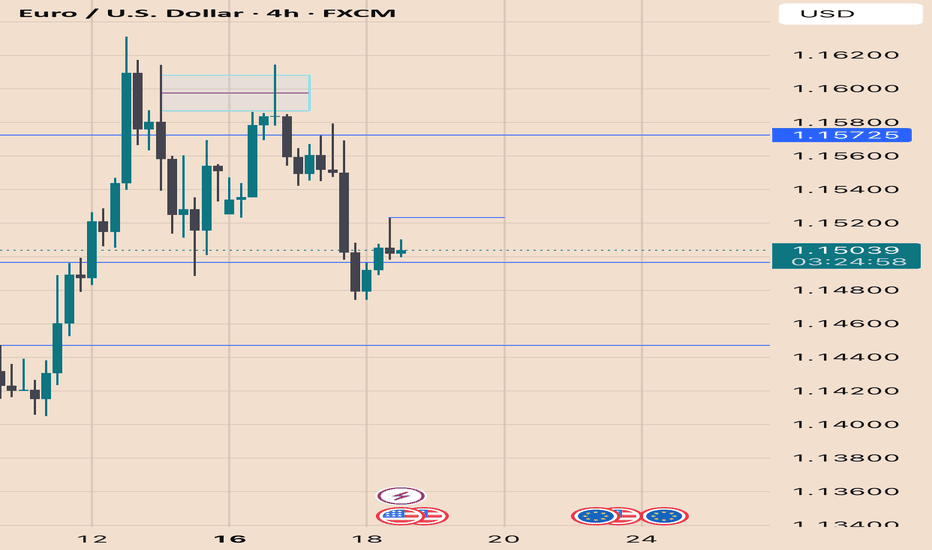

EURUSD before the FEDThe escalating conflict in the Middle East between Israel and Iran, which appears to be intensifying, is driving investors toward safer assets, leading to a stronger USD.

Today, all eyes are on the FED’s interest rate decision.

Watch for potential reactions at key support levels and a possible continuation of the current trend.

However, ahead of the announcement, it's advisable to reduce risk exposure and hold off on opening new positions.

Euro / U.S. Dollar (EUR/USD) 4-Hour Chart - OANDA4-hour candlestick chart from OANDA displays the EUR/USD exchange rate trend from May 19 to June 26, 2025. The current rate is 1.15324, reflecting a 0.25% decrease (-0.00285) as of the latest update. The chart includes a technical analysis section with a green upward trend and a red downward trend, indicating potential price movements between 1.14264 and 1.15500. Key dates and price levels are marked along the x-axis and y-axis, respectively.

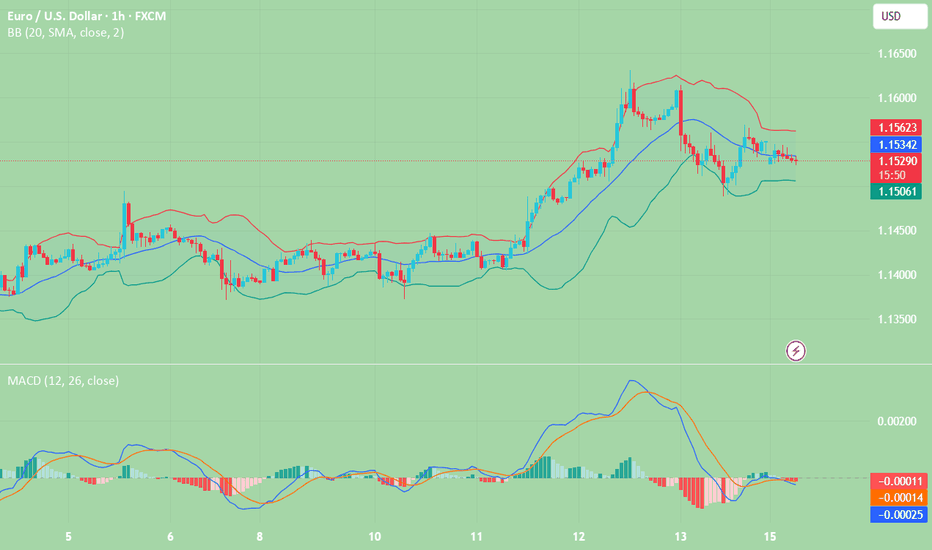

EURUSD: Weak Market & Bearish Forecast

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to sell EURUSD.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

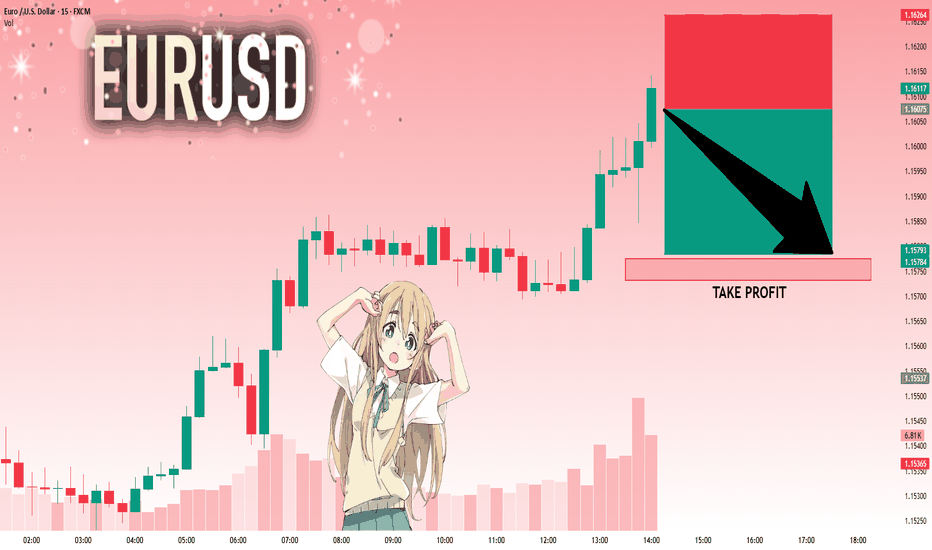

EURUSD: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.16075 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 1.15775..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

EURUSD Buyers In Panic! SELL!

My dear subscribers,

EURUSD looks like it will make a good move, and here are the details:

The market is trading on 1.1441 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.1424

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

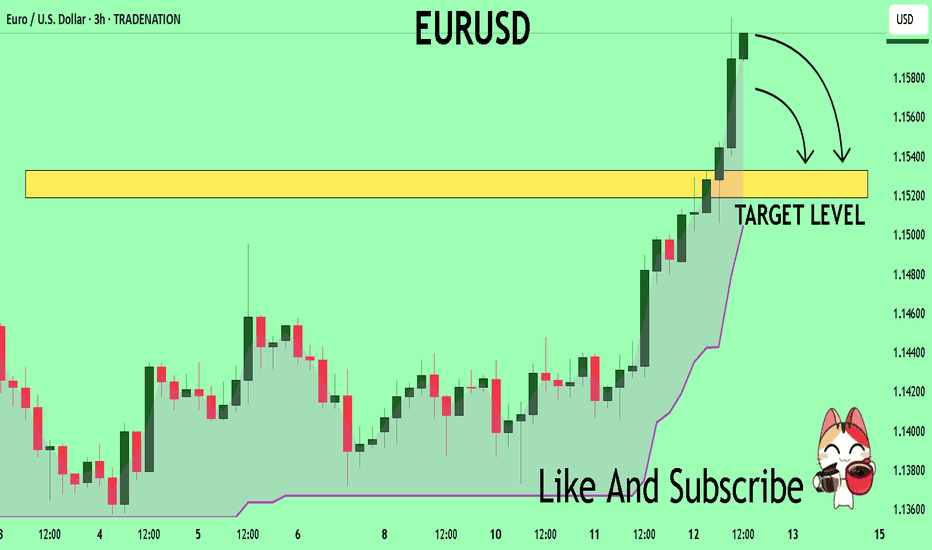

EURUSD Set To Fall! SELL!

My dear friends,

EURUSD looks like it will make a good move, and here are the details:

The market is trading on 1.1596 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 1.1533

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

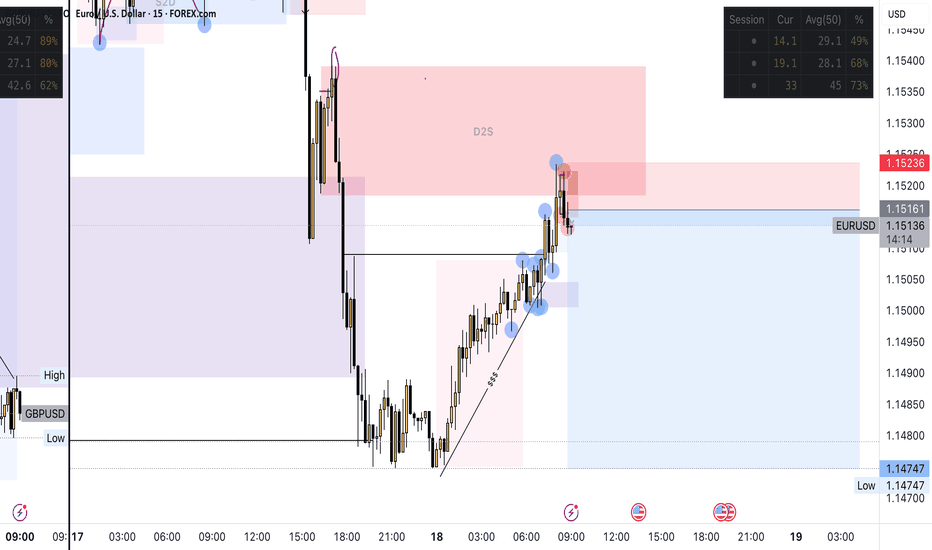

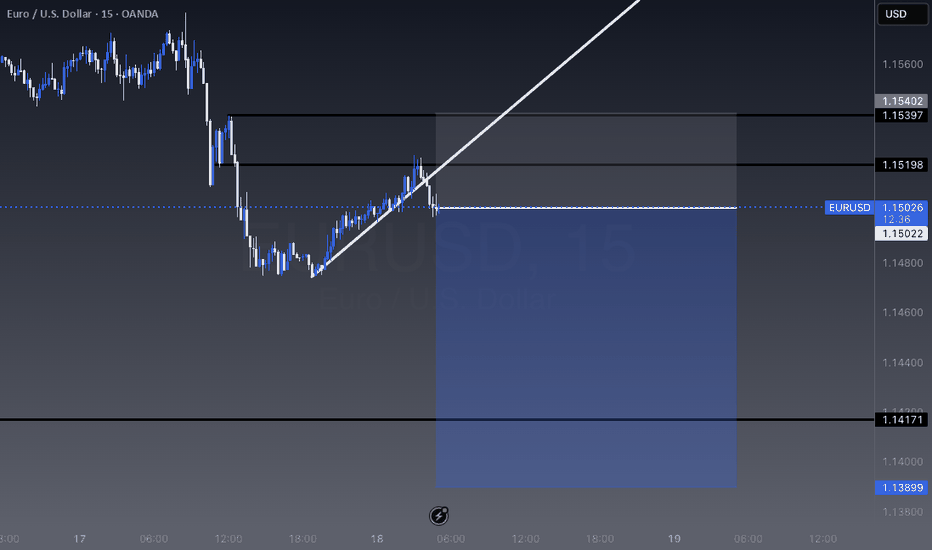

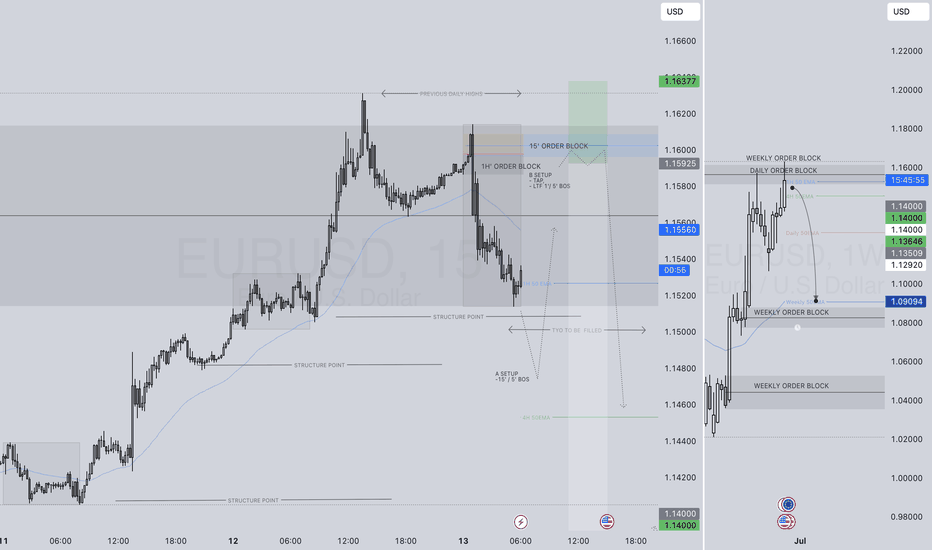

EURUSD SHORT FORECAST Q2 W24 D13 Y25EURUSD SHORT FORECAST Q2 W24 D13 Y25

PERHAPS THE LAST CHANCE FOR SHORTS- GRAB A THE BEST DISCOUNT !

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block

✅15' order block

✅1 hour order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

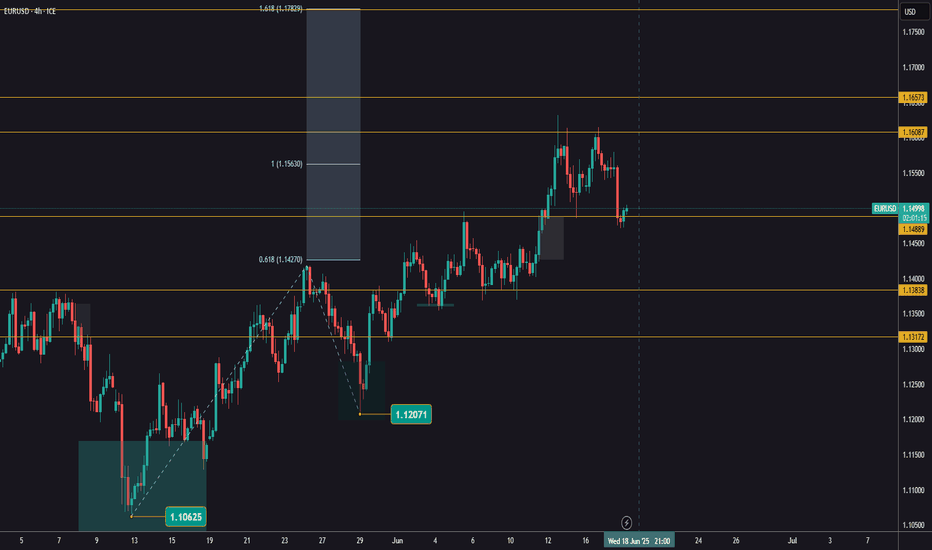

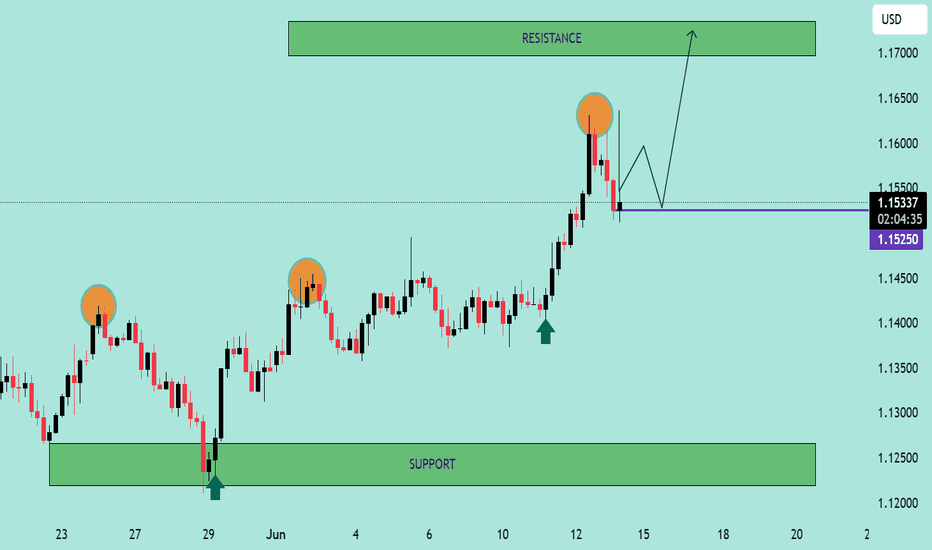

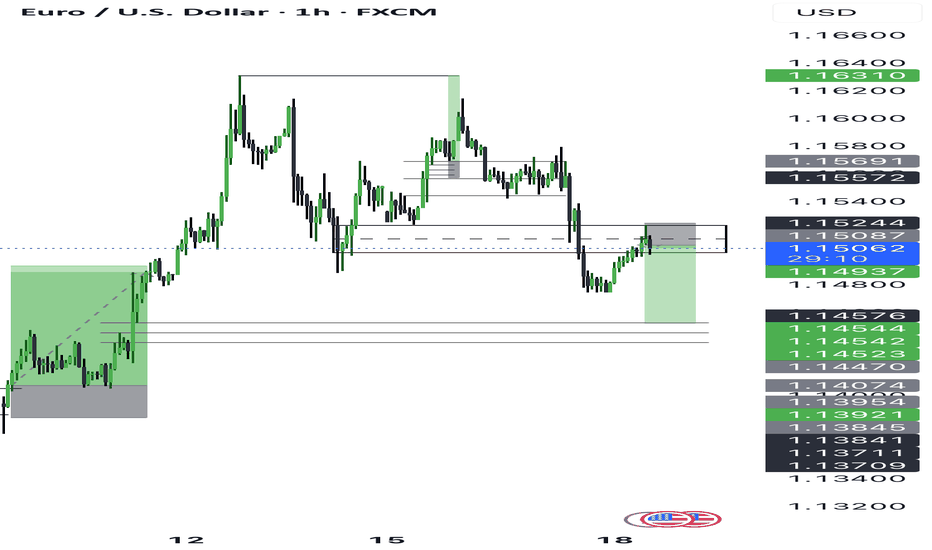

EUR/USD Breakout Retest StrategyEUR/USD Breakout Retest Strategy 🟢📈

📊 Technical Analysis Summary:

The chart illustrates a bullish breakout from a consolidation range with a well-defined support near 1.12500 and resistance between 1.16500–1.17000.

🔍 Key Observations:

🔸 Triple Rejection Zone:

Price faced rejection 3 times (highlighted with orange circles) near the same level before the breakout — classic liquidity sweep above resistance.

🔸 Strong Support Bounce:

Each time price reached the green support zone, it showed strong bullish reaction (green arrows) signaling solid buying interest.

🔸 Break and Retest Formation:

Price broke the previous highs and now seems to be retesting the breakout zone (around 1.15250–1.15300). A successful retest could confirm bullish continuation.

🔸 Projected Bullish Move:

If the retest holds, we may see price pushing up toward the 1.17000 resistance zone as marked.

📌 Trading Plan:

✅ Bullish Bias above 1.15250

✅ Look for bullish candlestick confirmation or breakout structure

🚫 Avoid trades if price drops below 1.15000 with momentum

📈 Target Zone: 1.16500 – 1.17000

🛑 Stop Loss suggestion: Below 1.14750

🧠 Keep patience during the retest — smart money often tests emotions before real moves! 💰📉📈

EURUSD - Long from hereDue to having internal Breaks of Structure to the upside here I have entered a long position as it is a reasonable area to potentially get long as it is a strong area of demand.

I'm aware that there isn't much liquidity built up in and around this area before hitting the demand but its a risk im willing to take as price may just be filling the FVG from all the buying pressure that was in the market yesterday

Any questions please message

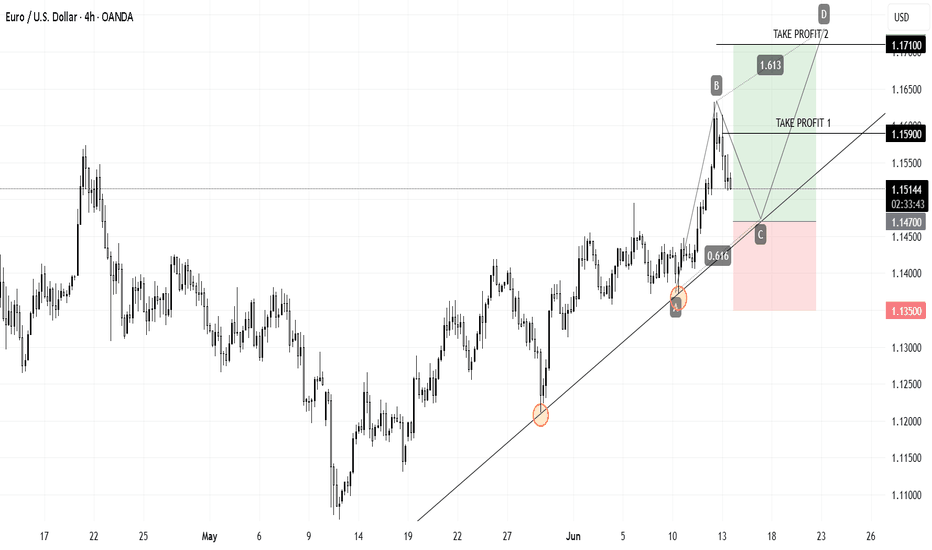

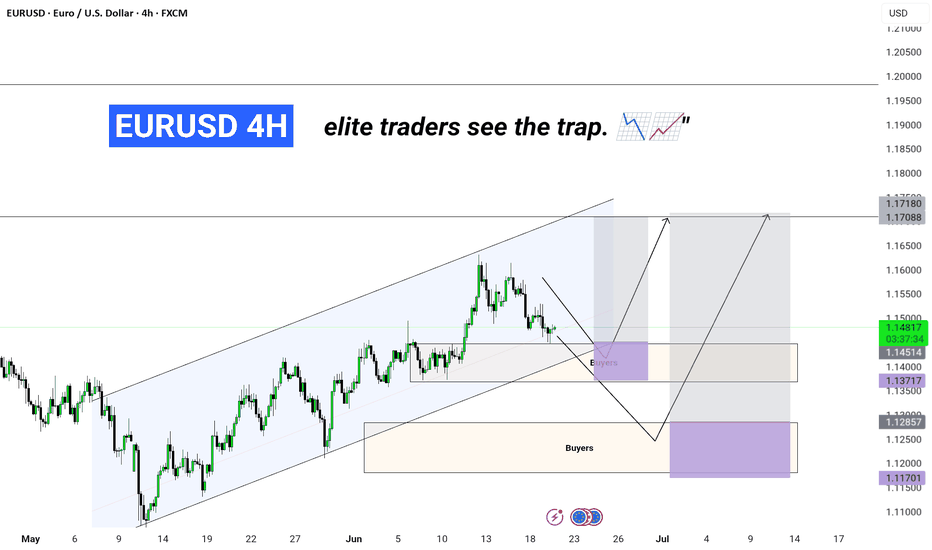

EURUSD ||| Elite traders see the trap

EUR/USD 4H 🔍 – Greenfire Forex Outlook

🟦 Rising channel structure spotted

🔸 Liquidity zones mapped

🟪 Buyer blocks identified (1.137 & 1.117)

📉 Let price dive deeper into the trap...

📈 Then catch the reversal with precision.

This is not a prediction, it's a reaction plan based on price behavior.

🔥 Structure + Zones + Patience = Greenfire Setup

.

#EURUSD #SmartMoneyConcepts #ForexAnalysis #ElliottWave #SMC #PriceAction #ForexIndia #4HChart

EURUSD Sell at current market priceBased on Daily/ H4 & H1 price action, current market price is the best price to enter sell in my opinion. I'm predicted that price will close below 1.15 level at the daily close.

This is my analysis, please calculate your own risk & reward.

Good Luck & happy trading.

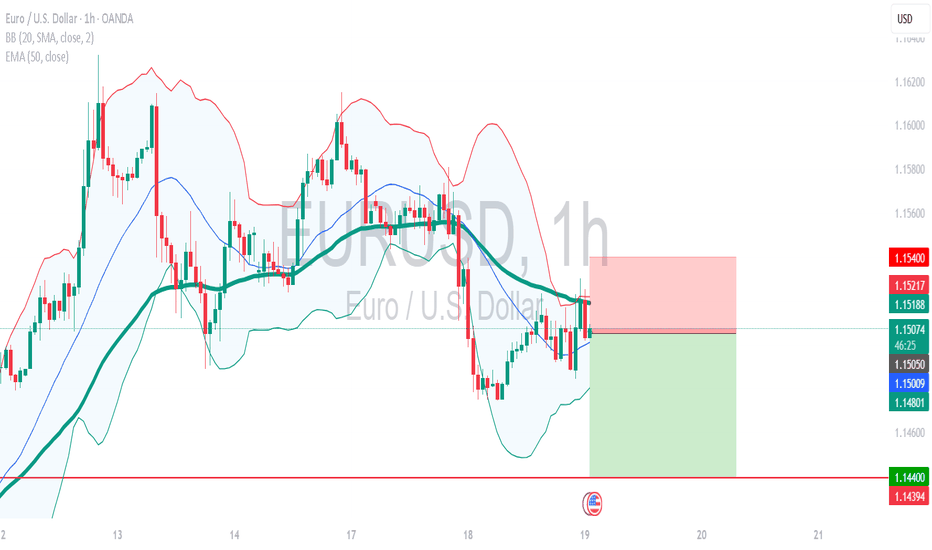

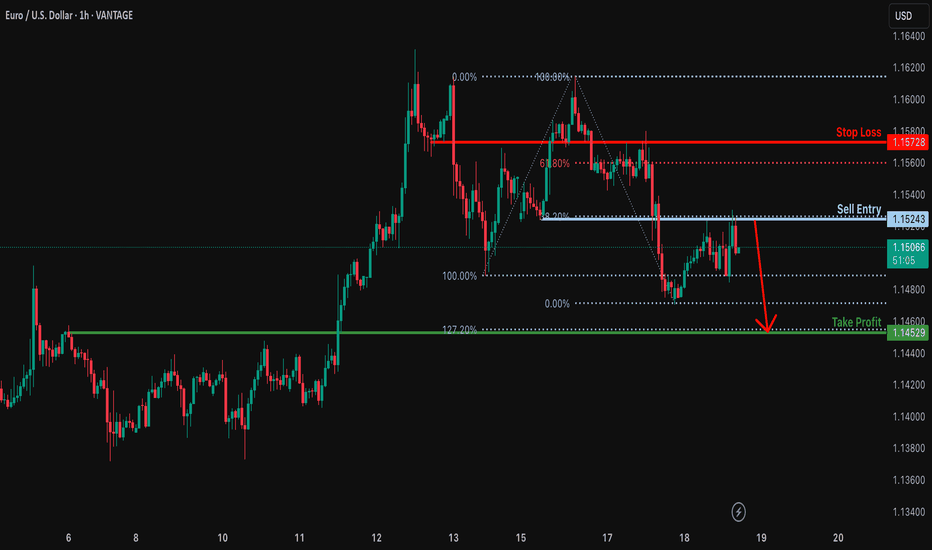

Potential bearish drop?EUR/USD has rejected off the resistance level which is a pullback resistance that aligns with the 38.2% Fibonacci retracement and could drop from this level to our take profit.

Entry: 1.1524

Why we like it:

There is a pullback resistance level that align with the 38.2% Fibonacci retracement.

Stop loss: 1.1572

Why we like it:

There is a pullback resistance level that is slightly above the 61.8% Fibonacci retracement.

Take profit: 1.1452

Why we like it:

There is a pullback support level that lines up with the 127.2% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Markets on EdgeGlobal markets tread cautiously today amid rising Middle East tensions and investor jitters ahead of the Fed’s policy decision. Israel’s continued airstrikes on Iran, now in their 6th day, are weighing heavily on sentiment, with European stocks and oil prices lacking direction.

📊 US Dollar Watch:

Traders are closely eyeing the U.S. Dollar Index (DXY) weekly chart:

• 🔻 Price hit a new low, but RSI divergence signals waning downside momentum.

• ⚠️ Approaching long-term uptrend support from 2011 near 96.30 — could trigger profit-taking.

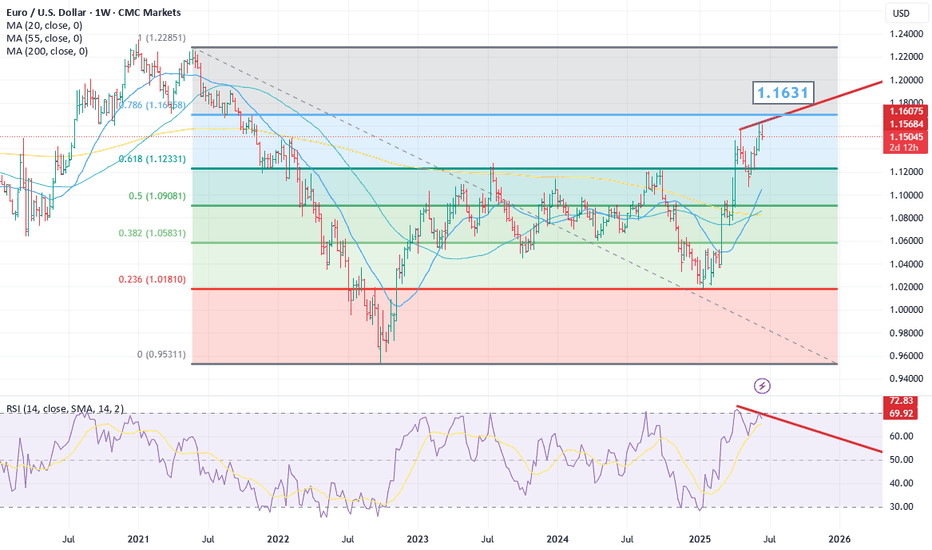

🪙 EUR/USD Weekly:

• ⚠️ Momentum fading as it nears the 78.6% retracement at 1.1696.

• RSI shows bearish divergence despite recent price highs.

📌 Key Takeaway: Charts suggest potential for a pause or reversal in recent USD weakness.

This is not investment advice.

#Forex #USD #EURUSD #DXY #FederalReserve #Markets #TechnicalAnalysis #Geopolitics #Trading