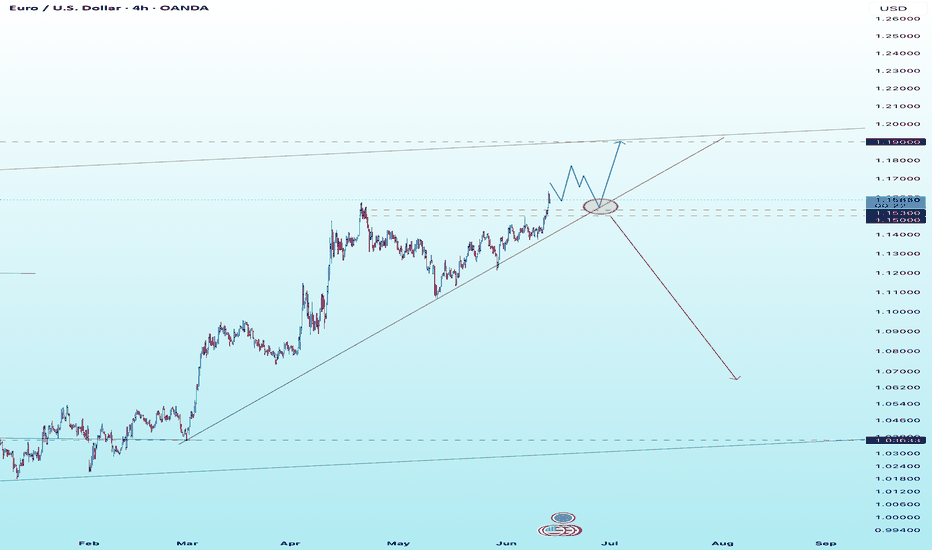

EUR/USD Rally Extends – Eyes on 1.20000 as Momentum BuildsHi Everyone,

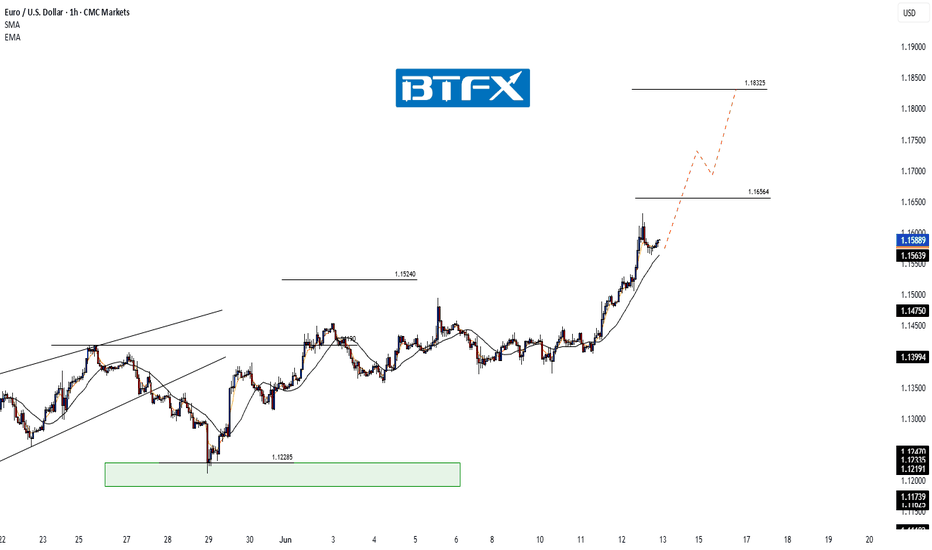

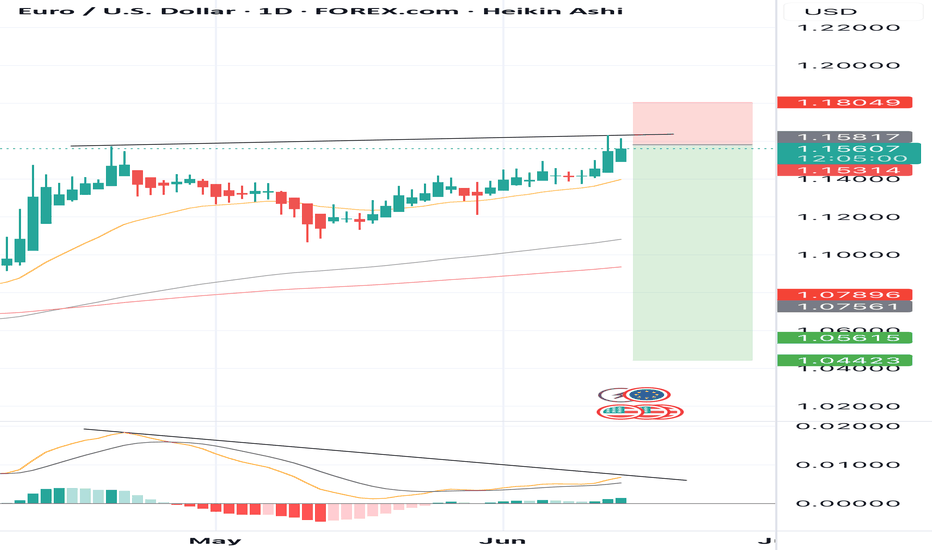

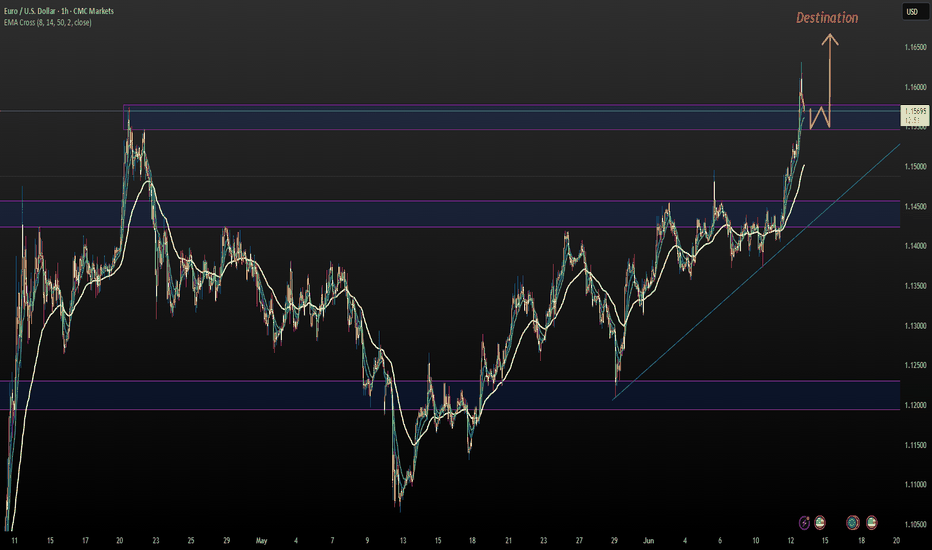

As outlined in our analysis last week (idea linked below), EUR/USD continued to the upside and reached the 1.15240 level.

We expect price action to extend further toward the 1.16564 level, which would reinforce our long-term bullish outlook.

A confirmed break above this resistance would likely open the door for a move toward 1.18325, where we anticipate encountering dynamic resistance.

We will provide further updates on the projected path for EUR/USD should price reach this level.

The longer-term outlook remains bullish, with expectations for the rally to extend toward the 1.2000 level, provided the price holds above the key support at 1.10649.

We will continue to update you throughout the week with how we’re managing our active ideas and positions. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for a good end to the week. Trade safe.

BluetonaFX

USDEUX trade ideas

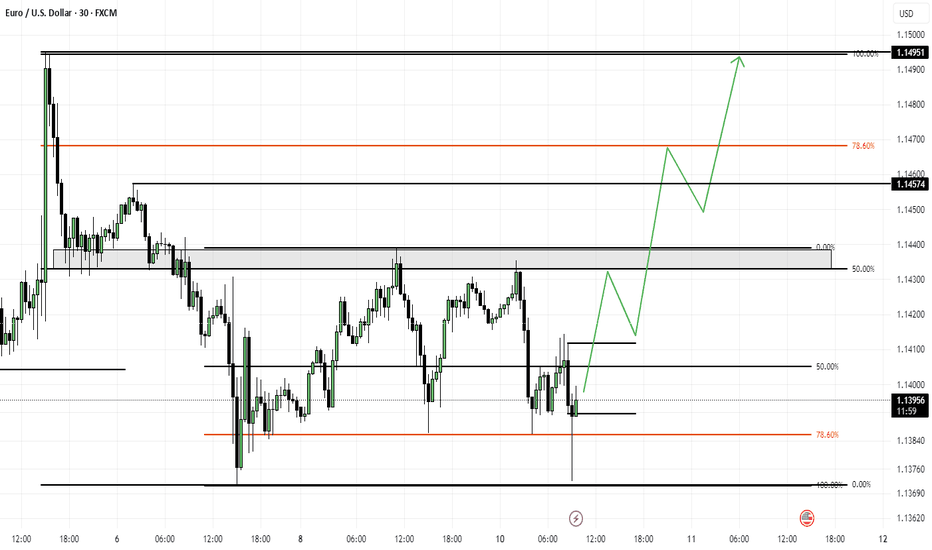

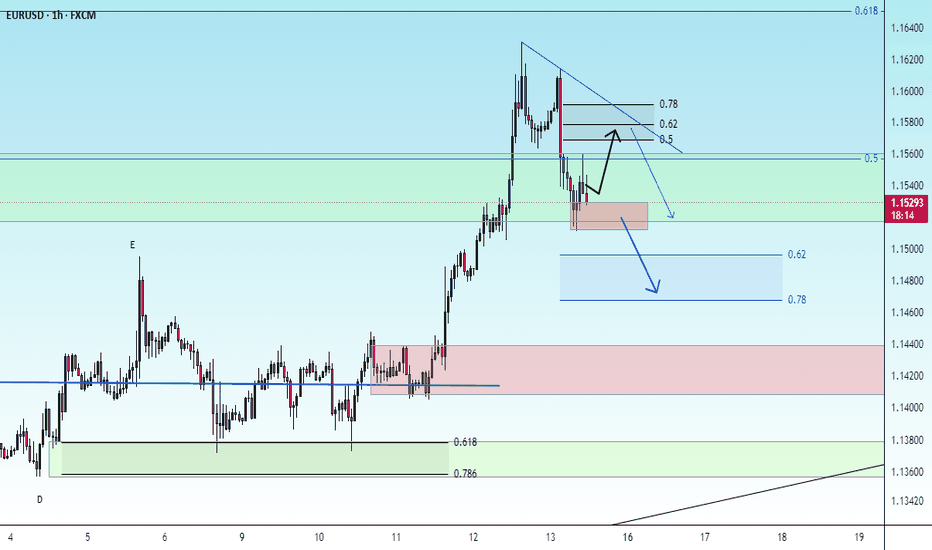

EURUSDPrice has recently retraced to a key support zone and is showing bullish structure on the lower timeframes. A long position is anticipated based on the confluence of the Fibonacci retracement and recent bullish momentum.

Entry: Buy EUR/USD at current market price or upon confirmation of bullish candlestick pattern near the 50%-61.8% Fibonacci retracement zone.

Partial Take Profit: Secure partial profits at the 50% Fibonacci retracement level of the previous swing move.

Final Take Profit: Trail remaining position toward the 100% extension or next significant resistance.

Stop Loss: Below the 61.8% retracement or just under recent swing low for risk management.

Rationale: Bullish order flow combined with Fibonacci confluence suggests a potential continuation move to the upside. Taking partial profits at the 50% level ensures capital protection while allowing room for extended gains.

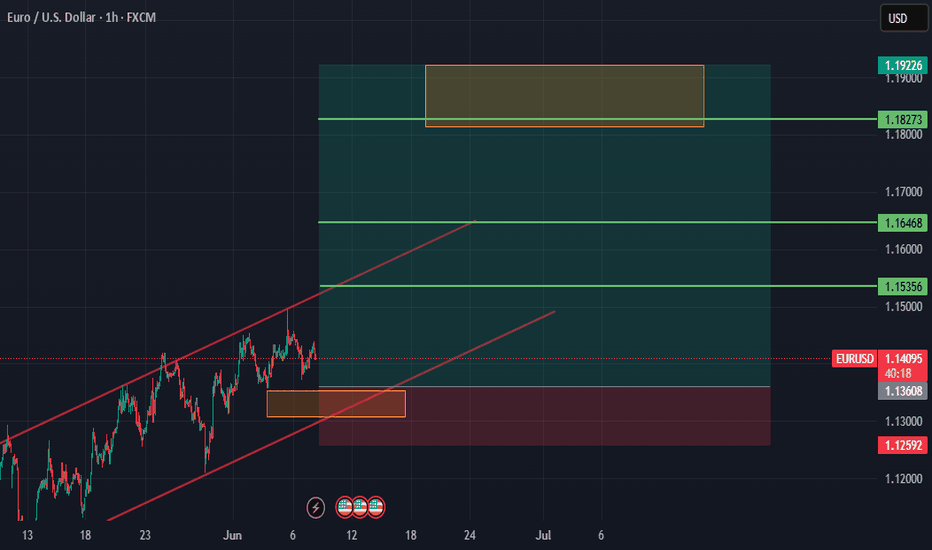

USD Weakness Persists: Can EUR/USD Target 1.18?

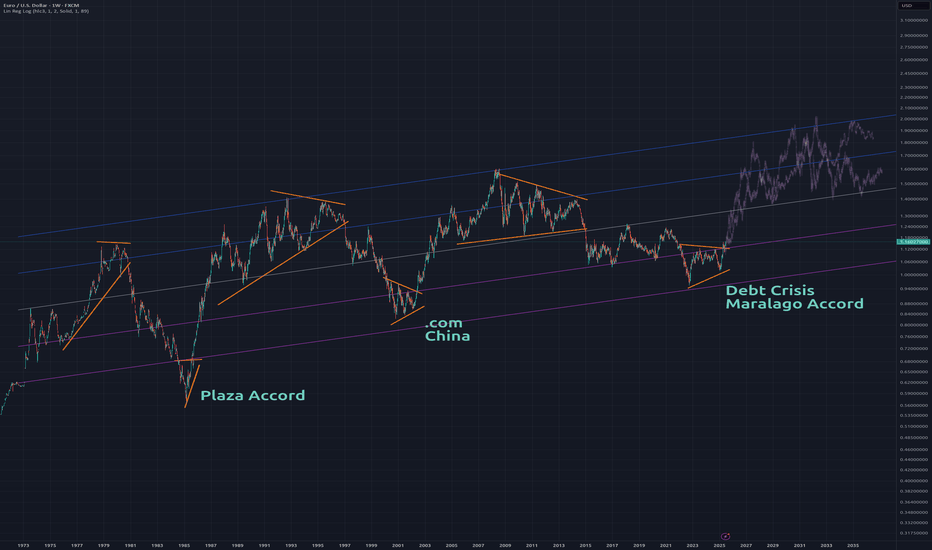

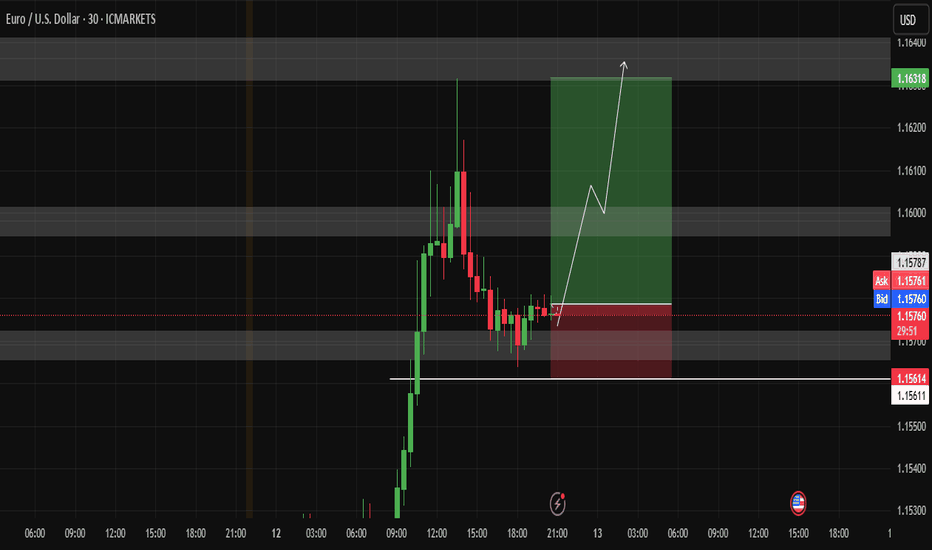

The EUR/USD exchange rate has continued to strengthen, breaking through the psychological barrier of 1.1600 during the intraday session, marking the first time it has reached this level since November 2021. The pair surged to an intraday high of 1.1630, driven by the confluence of a persistently weakening US dollar and enhanced economic resilience in the Eurozone.

Technically, the EUR/USD currently exhibits a robust bullish pattern. If it can sustain above the 1.1600 threshold, it is poised to test the 1.1800 resistance zone. Conversely, a false breakout followed by a retracement below 1.1500 would warrant caution, as it may signal a attenuation of bullish momentum and potential reversal risks.

Humans need to breathe, and perfect trading is like breathing—maintaining flexibility without needing to trade every market swing. The secret to profitable trading lies in implementing simple rules: repeating simple tasks consistently and enforcing them strictly over the long term.

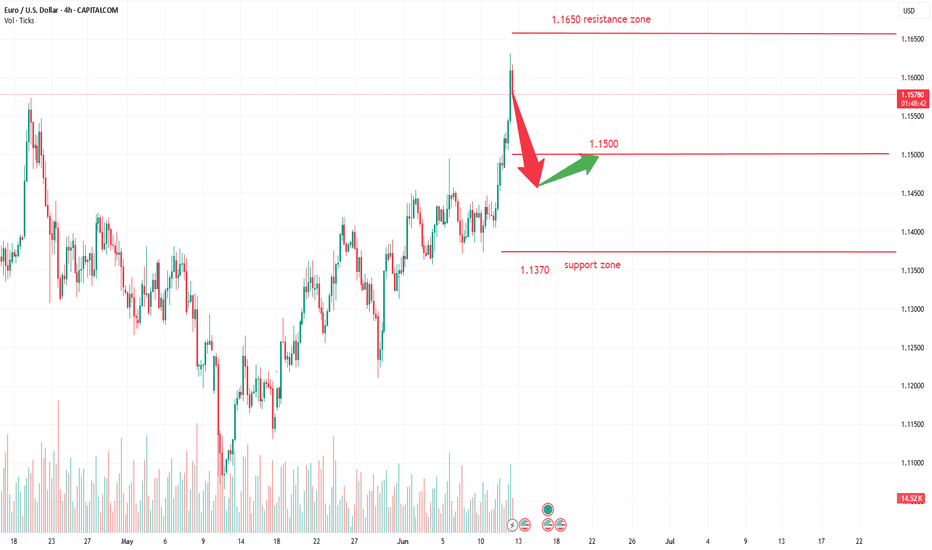

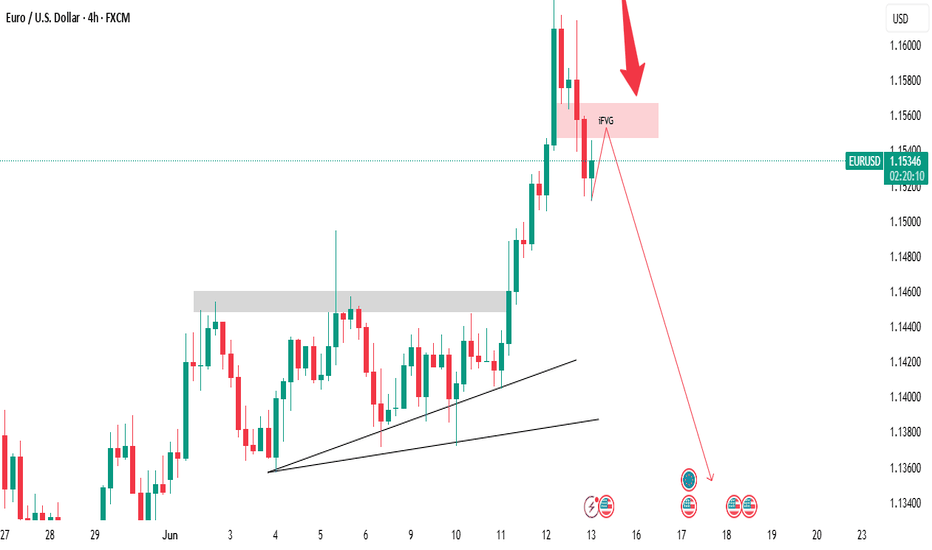

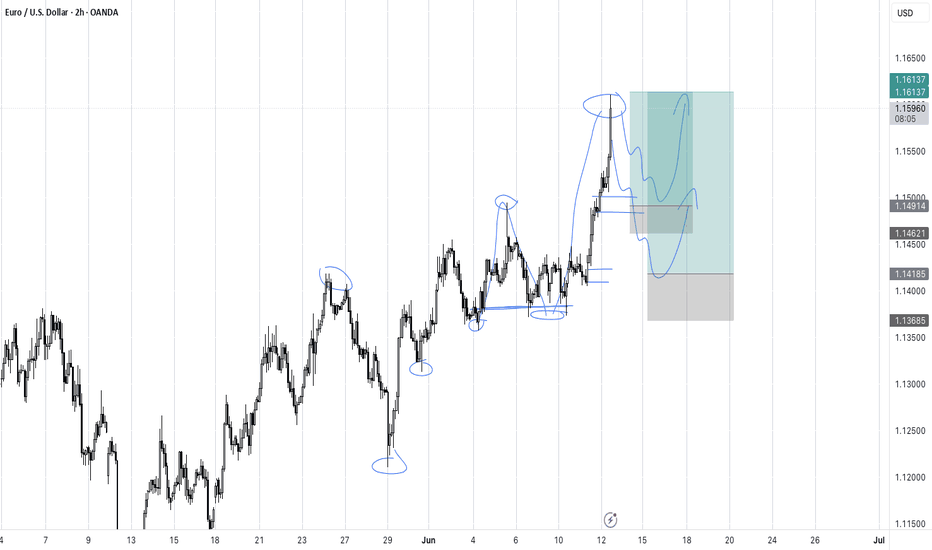

Get Ready – A Pullback May Be ImminentEUR/USD has rallied impressively, gaining nearly 1,400 pips from its February 2025 low. The pair recently surged to revisit a price level last seen in November 2021. However, after such a strong bullish move, a correction appears likely.

I’m anticipating a potential drop of at least 500 pips from the current level after hitting a strong resistance on multiple time frame.

Check the chart for more details.

Stay safe and trade smart.

SELL EURUSD for bullish trend reversal STOP LOSS: 1.1804SELL EURUSD for bullish trend reversal

STOP LOSS: 1.1804

Regular Bearish Divergence

In case of Regular Bearish Divergence:

* The Indicator shows Lower Highs

* Actual Market Price shows Higher Highs

We can see a strong divergence on the MACD already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this level resistance so we

are looking for the trend reversal and correction push from here .....

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything

Remember to risk only what you are comfortable with….....trading with the trend, patient and good risk management is the key to success here

Risk-off sentiment in EUR/USDYesterday, EURUSD hit a new high, reaching 1,1632.

This morning, we're seeing a pullback due to increased demand for safe-haven assets following Israel’s preemptive strike on Iran.

Avoid rushing into new positions today and keep an eye on how the pair reacts around key support levels.

Next week, all eyes will be on the upcoming interest rate decision from the Fed.

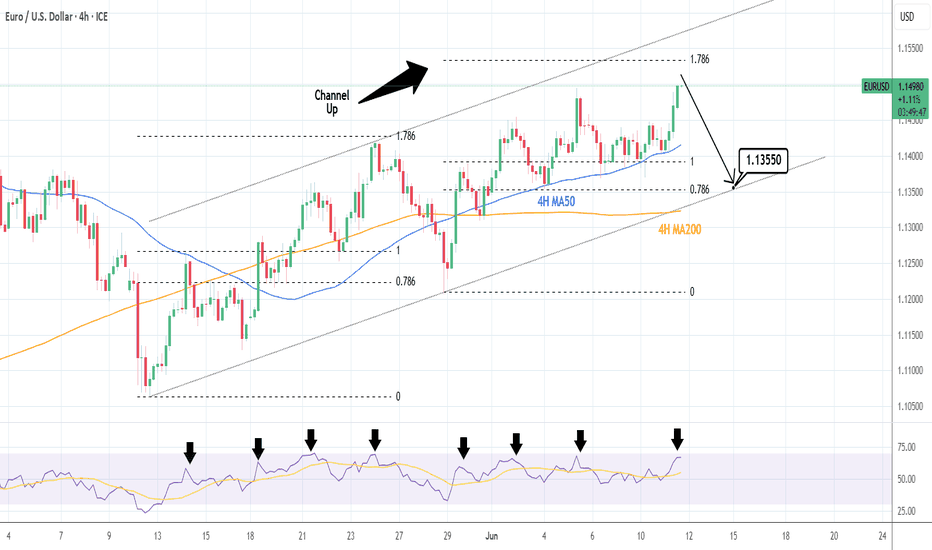

EURUSD: Perfect spot to short.EURUSD is bullish on its 1D technical outlook (RSI = 62.082, MACD = 0.004, ADX = 31.112) as it is trading inside a Channel Up since the May 12th low. The 4H RSI sequence suggests that based on the Channel's first bullish wave, the market is now on the 4th count, which was previously the top (as close to the 1.786 Fibonacci extension as possible). We turn bearish here, targeting the 0.786 Fib level at the bottom of the Channel Up (TP = 1.13550).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

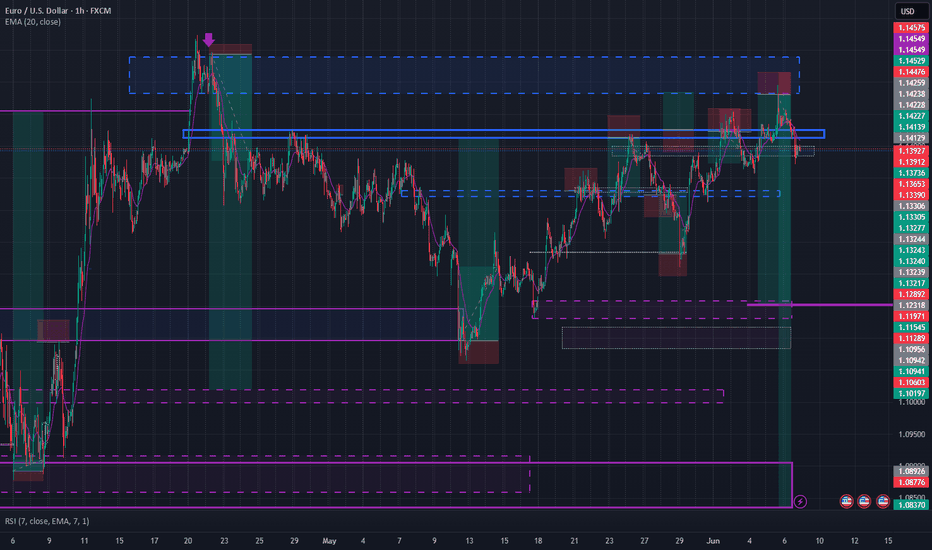

EURUSD BEAR - H1I have given out everything you see here for free.... Plus everything can be verified easily (TradingView Profile / Bio is all I am allowed to say).

I do have a higher bear if you saw the rules... keep an eye on the solid swing (levels)

Plus I do have a breakout BULL waiting if the bear structure fails.

I have made this very simple. I trade the wicks every time. That's why I can roll stops to entry after TP 1 (Fixed at 1:1 +35P)

All my levels have a tolerance of 15 PIPS... just like the banks. BUT I will not be adding more day trade levels (white bordered)

(Intraday levels are dashed)

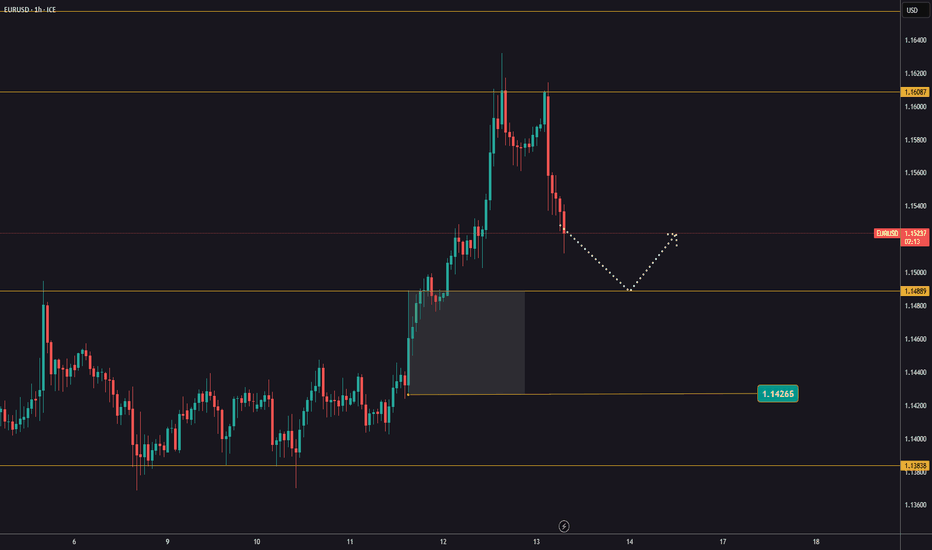

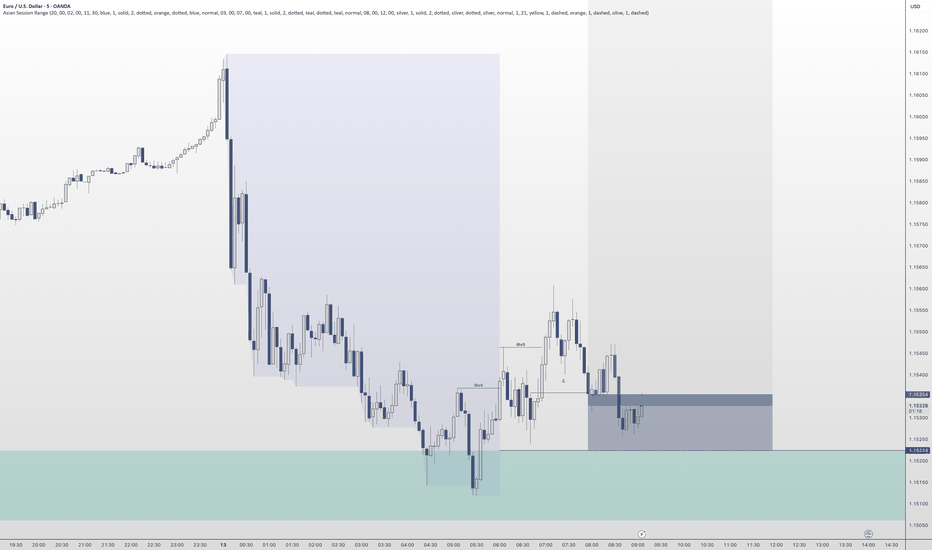

(iFVG) before continuing its fall.EUR/USD is now ready to move downward. The market has already cleared out all the liquidity above, which suggests that it's now in the mood to drop. Earlier, on the 4-hour timeframe, the market had formed a bullish Fair Value Gap (FVG), but that has now been broken to the downside.

Currently, there are chances that the market might touch the imbalance (iFVG) before continuing its fall. Keep an eye on that level and observe how the market reacts there. It could be an important zone.

Do Your Own Research (DYOR)! This is not financial advice.

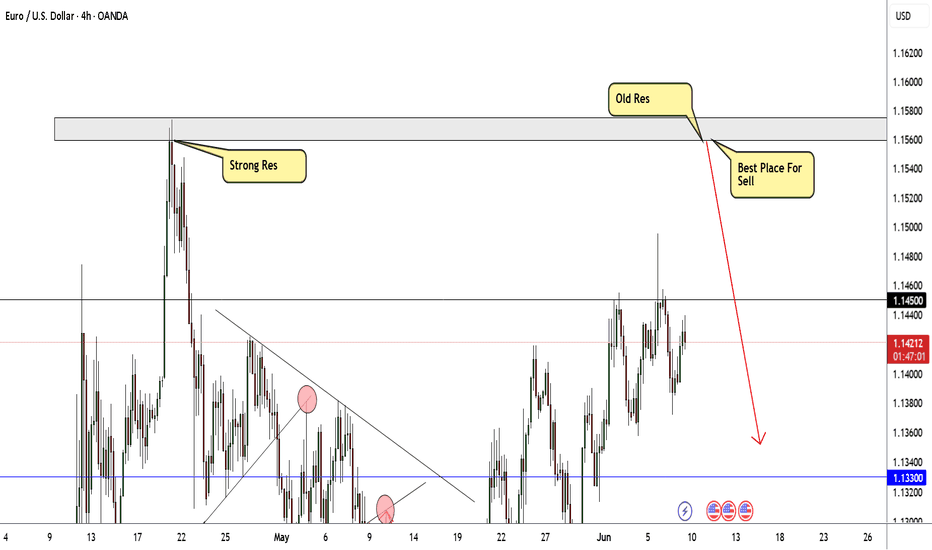

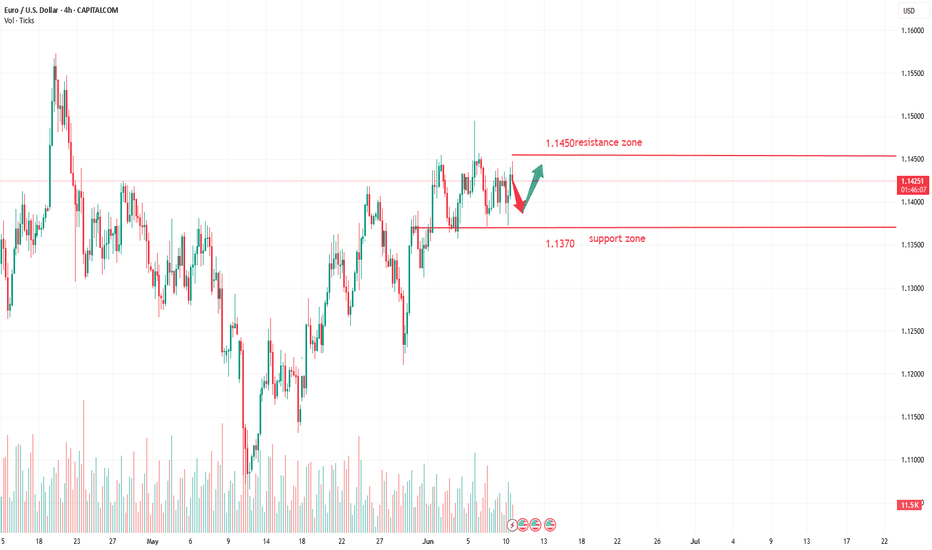

EURUSD | Bearish Bias Below 1.1450, Eyes on 1.1372EURUSD | OVERVIEW

The pair maintains a bearish momentum as long as it trades below the pivot level at 1.1450, targeting the support at 1.1372. A clear break below this level would reinforce the downtrend, potentially extending the decline toward 1.1270.

Alternative Scenario:

A confirmed 1-hour candle close above 1.1450 would indicate a potential shift to a bullish trend, with upside targets at 1.1535, and possibly 1.1625.

Support Levels: 1.1372, 1.1270

Resistance Levels: 1.1535, 1.1625

euro/usdTRADE 5 i belive that e/u is deffently bullish

but i do see a reversal happening allthough i belive this pair to retrace you could catch the pull back to pull the trigger on a new higher higher but i wouldnt personally jump in on the trade on this one i would wait to see where the retracment goes before i jump in remmeber this best part of trading is LEARNING WHEN NOT TO TRADE protect your wealth people i cant stress enought how manyt account i have blown by not knowing when to shut my computer and waiting for a better entry saying that i do belive e/u will go down to come back up lets see where it goes who know I COULD BE WRONG

Latest Published Ideas by UsersThis is not a trading idea, but some form of representing my desire, about to see again on TradingView, the great function that can help and improve the vision and knowledge about the current situation on the market, so effectively.

If you an individual user, member, and friend of TradingView, like this idea,

Click Boost Symbol!

Thank you! Have a great day.

EUR/USD Best Place To Sell To Get 250 Pips , Don`t Miss It !Here is my EUR/USD Analysis and if you check the chart you will see that we have avery strong res area forced the price to go down hard last time , so i will sell this pair from the same res area , it will force the price to go down hard at least 250 pips , waiting the price to touch it and then we can sell it .

Can EUR/USD Break Through the Range Constraint?The EUR/USD exchange rate continues to maintain a range-bound consolidation trend, currently trading around 1.1400. The dovish statements from European Central Bank (ECB) policymakers are offset by the positive economic signals in the Eurozone, leading to a wait-and-see sentiment in the market. In the short term, the EUR/USD exchange rate is expected to remain in a narrow range consolidation pattern. Technically, the exchange rate needs to break through the recent high to sustain the upward momentum; otherwise, it may return to the broader range of 1.12-1.15.

Humans need to breathe, and perfect trading is like breathing—maintaining flexibility without needing to trade every market swing. The secret to profitable trading lies in implementing simple rules: repeating simple tasks consistently and enforcing them strictly over the long term.