EURUSD: Move Up Ahead?! 🇪🇺🇺🇸

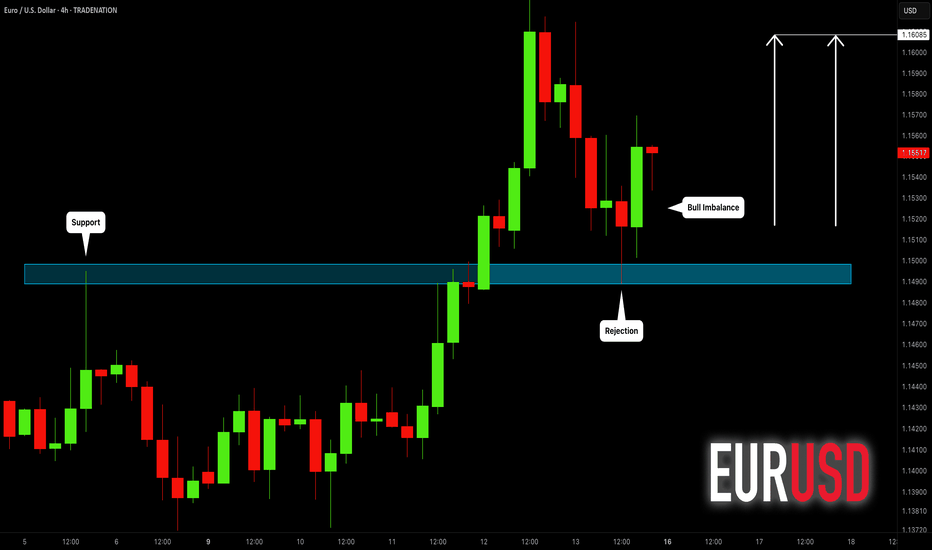

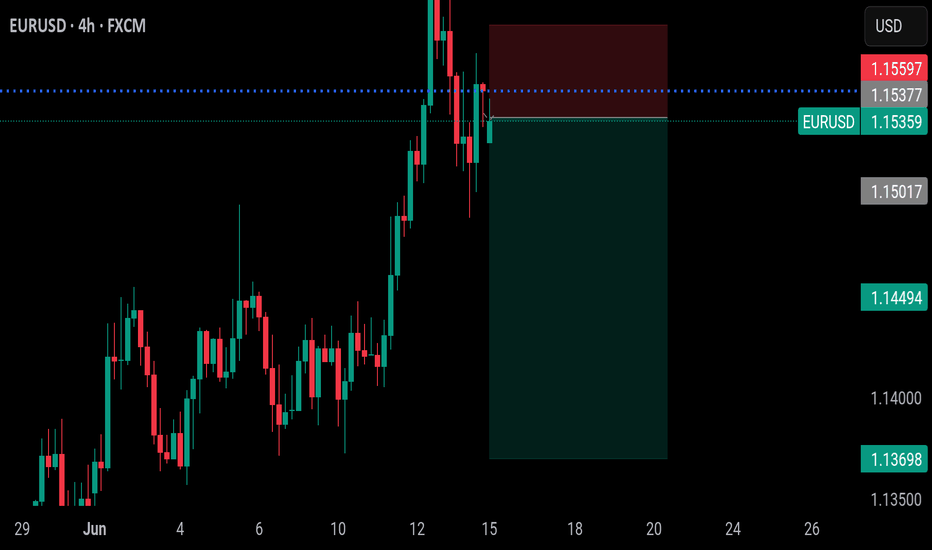

EURUSD nicely respected the underlined key horizontal support.

A strong rejection from that and a formation of a bullish imbalance candle

indicate a highly probably bullish continuation next week.

Goal - 1.1608

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDEUX trade ideas

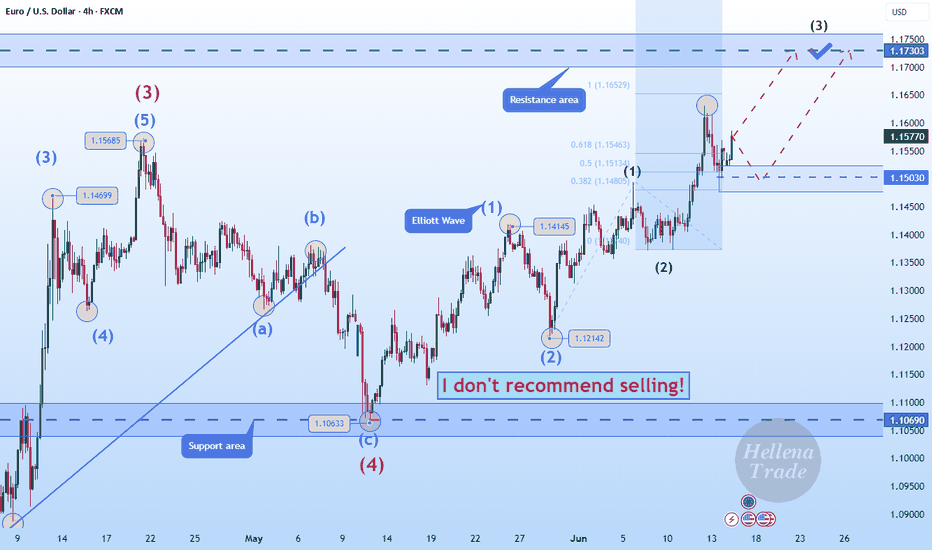

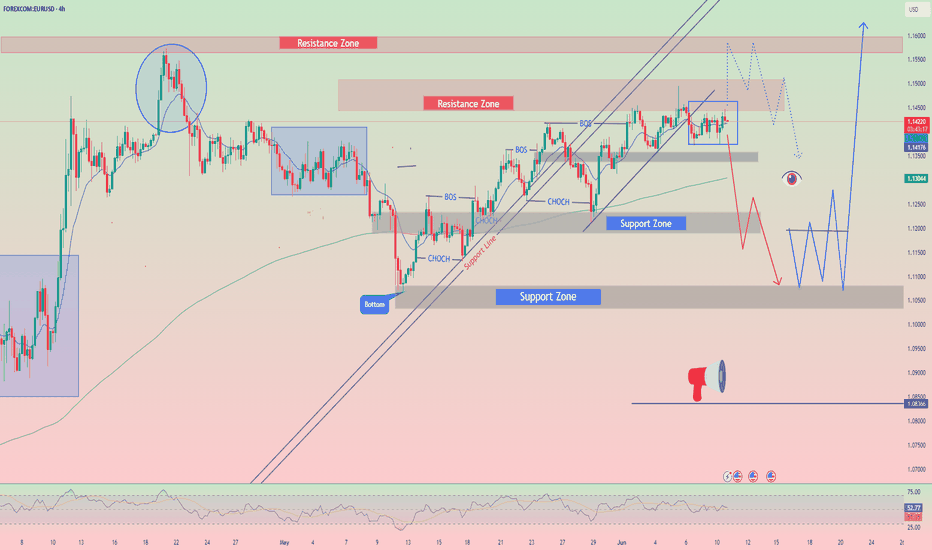

Hellena | EUR/USD (4H): LONG to the resistance area 1.17300.Colleagues, I believe that the upward five-wave impulse is not over yet. At the moment, I see the formation of wave “3” of the lower order and wave “3” of the middle order, which means that the upward movement will continue at least to the resistance area of 1.17300. This area is located between two levels (1.16529-1.18252) of Fibonacci extension.

A correction is possible — be careful.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

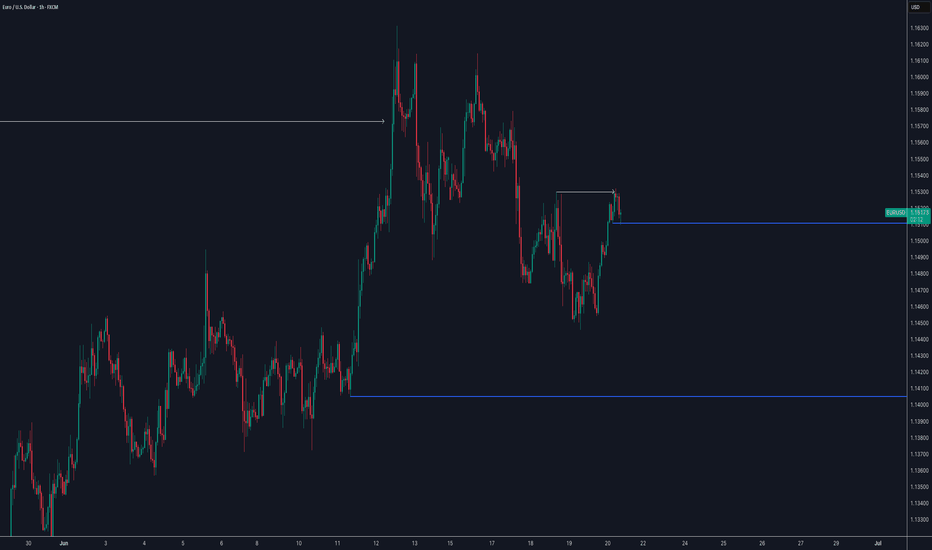

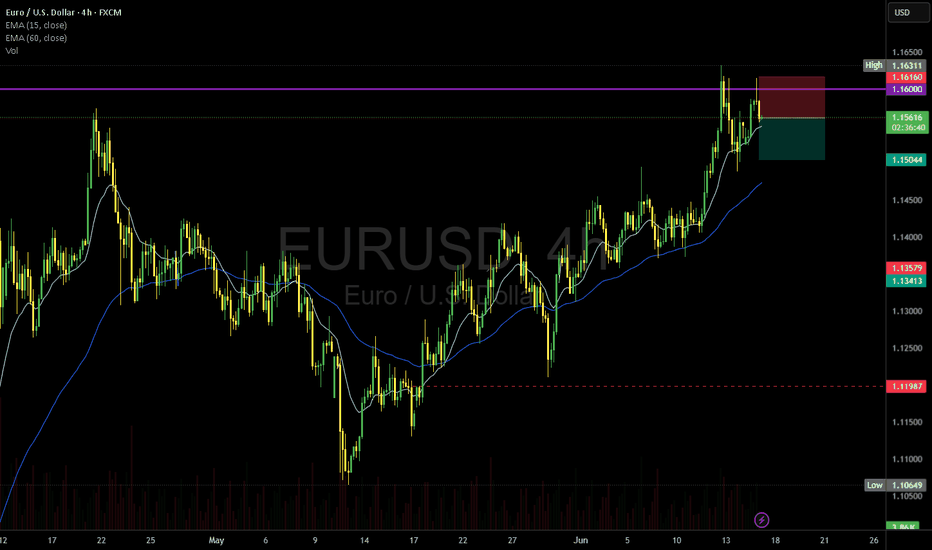

Lingrid | EURUSD continuation Following Key Level BreakoutOANDA:EURUSD has completed a bullish breakout above the triangle pattern and is now consolidating above the key 1.14990 support level. The price structure shows a series of higher lows, with recent action forming a tight range just above trendline support. If bulls defend this area, a move toward the 1.17000 resistance becomes increasingly likely.

📈 Key Levels

Buy zone: 1.14990–1.15200

Sell trigger: break below 1.14800

Target: 1.17000

Buy trigger: break above 1.16000 with bullish volume

💡 Risks

Failure to hold 1.14990 could trigger a move toward 1.12100

DXY strength could suppress EUR upside

ECB or Fed policy shocks could increase volatility

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

EURUSD Analysis Today: Technical and Order Flow Analysis !In this video I will be sharing my EURUSD analysis today, by providing my complete technical and order flow analysis, so you can watch it to possibly improve your forex trading skillset. The video is structured in 3 parts, first I will be performing my complete technical analysis, then I will be moving to the COT data analysis, so how the big payers in market are moving their orders, and to do this I will be using my customized proprietary software and then I will be putting together these two different types of analysis.

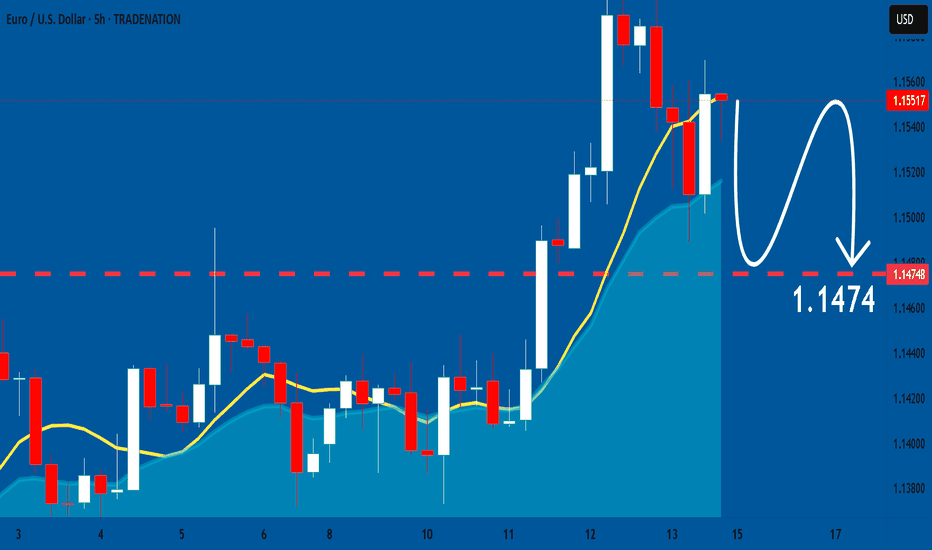

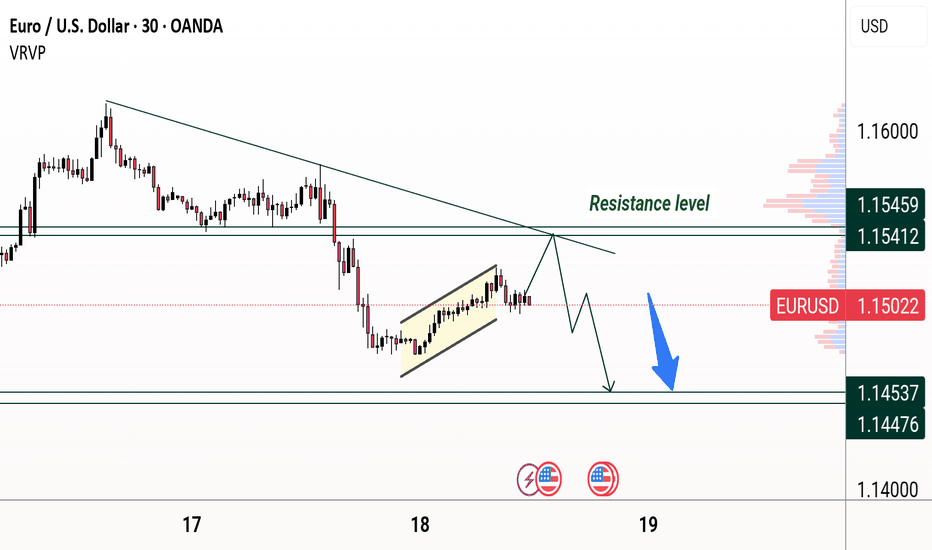

EURUSD: Bearish Continuation is Highly Probable! Here is Why:

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the EURUSD pair which is likely to be pushed down by the bears so we will sell!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Eurusd Will Drop Its PricesEUR/USD continues to recover ground lost and now extends the rebound to the 1.1550 zone on Friday. Meanwhile, the US Dollar maintain its bullish bias intact in response to a significant flight to safety amid increasing geopolitical concerns, while positive consumer sentiment data also contribute to the daily uptick.

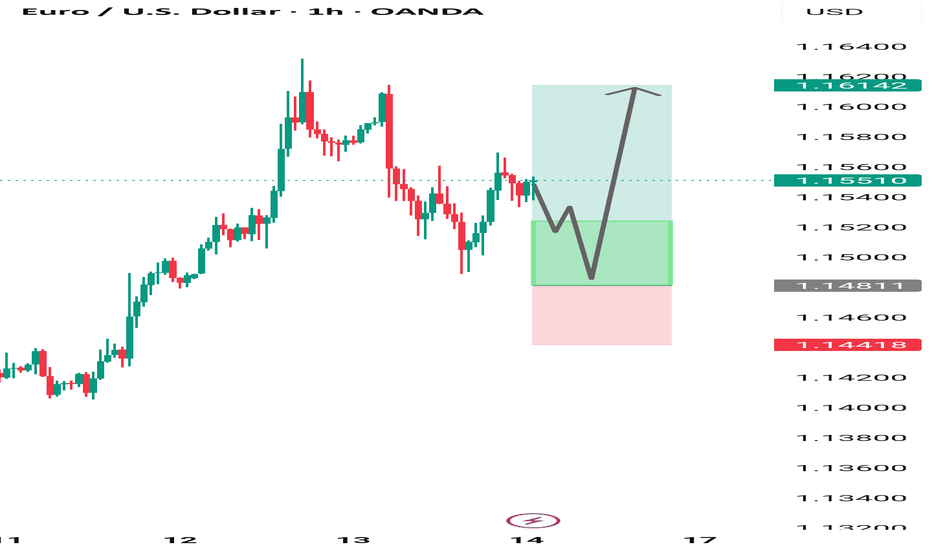

EUR/USD 1-Hour Chart Analysis1-hour candlestick chart for the Euro/US Dollar (EUR/USD) currency pair, sourced from OANDA. The chart highlights a recent price movement with a current value of 1.15510, reflecting a 0.29% decrease (-0.00340). Key price levels are marked, including resistance at 1.16142 and support at 1.14418, with shaded areas indicating potential trading zones. The chart includes a bullish logo and branding from "ALEEGOLDTRADER," suggesting a trading analysis perspective.

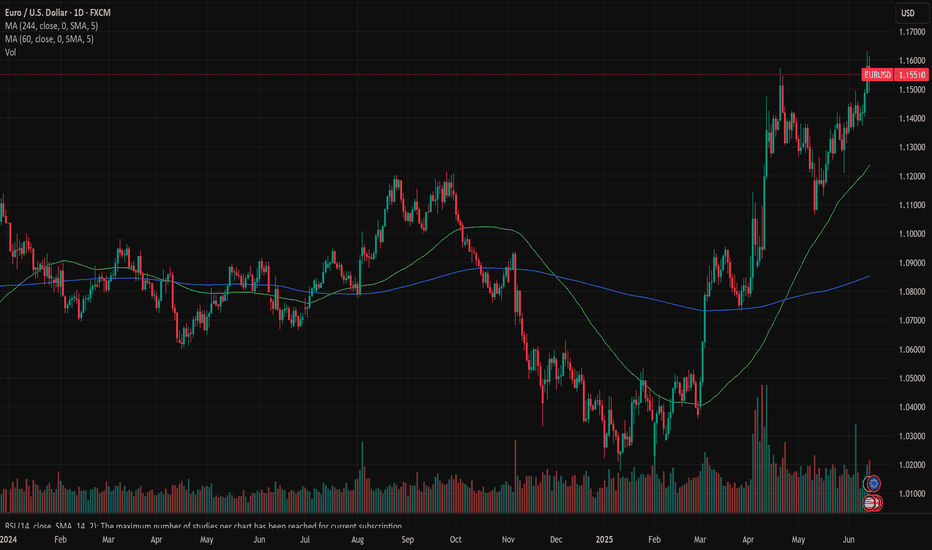

EURUSD: FOMC meeting ahead Previous week on the US market was focused on inflation data. The inflation rate in May was standing at 0,1% for the month, below market expectations of 0,2%. At the same time the US core inflation was also below market estimate at the level of 0,1%, while the market forecasted 0,3% for the month. Inflation rate on a yearly basis in May was standing at 2,3% and core inflation was 2,8%. The Producers Price Index in May was at the level of 0,1% for the month, same as core PPI. Both figures were modestly below market estimates. University of Michigan Consumer Sentiment preliminary for June showed some modest relaxation in the inflation expectations. The indicator reached the level of 60,5 which was better from the market estimate of 53,5. The inflation expectations for this year at the beginning of June were standing at 5,1%, and were decreased from 6,6% posted previously. The five year inflation expectations modestly decreased from 4,2% to 4,1%.

During the previous week there has not been too much currently significant data posted for the Euro Zone and Germany, its largest economy. The wholesale prices in Germany in May dropped by -0,3% for the month, bringing the indicator to the level of 0,4% on a yearly basis. Both figures were in line with market forecasts. The balance of trade in the Euro Zone in April ended the month with a surplus of euro 9,9B, which was significantly below market estimate of euro 18,2B. The Industrial Production in the Euro Zone surprisingly dropped in April by -2,4% for the month, which was higher from estimated -1,7%. The IP on a yearly basis stands at 0,8% in April, again below market consensus of 1,4%.

Although the inflation in the US is evidently slowing down, as well as long term inflation expectations, still, newly emerged tensions in the Middle East made investors prefer long positions in gold rather than USD. In this sense, USD weakened as of the end of the previous week to the lowest weekly level against euro at 1,1624. Still, the currency pair closed the week at 1,1553. The RSI has not reached the clear overbought market side, reaching the highest level at 66. This leaves some space for eurusd to move further to the higher grounds until the clear overbought market side is reached. The MA50 continues to strongly diverge from MA200, without an indication that the potential cross is near in the future.

Usually after a strong push of financial assets toward one side, follows the time when the market is searching the equilibrium level. Depending on further developments on the Middle East crisis, there is a potential that eurusd will start the week ahead with a modest consolidation. The 1,15 resistance line was clearly breached during the previous week, indicating probability that the currency pair will revert a bit back to test for one more time this level. On the opposite side, the 1,16 was shortly tested, but the potential for further upside will depend on weekly fundamentals. The most important event for the week ahead is scheduled for Wednesday, June 16th, when the FOMC meeting is scheduled, as well as US economic projections. This day will most certainly bring some higher volatility on markets. Currently, it is widely expected that the Fed will hold interest rates unchanged at this meeting, and leave the planned rate cut for September. However, what the market is expecting to hear are projections for the future period, especially how the Fed perceives the impact of implemented trade tariffs on the US economy.

Important news to watch during the week ahead are:

EUR: ZEW Economic Sentiment Index for Germany in June, Inflation rate final in May for the Euro Zone, PPI in Germany in May, HCOB Manufacturing PMI flash in June, in both Germany and the Euro Zone,

USD: Retail Sales in May, Industrial Production in May, Building Permits preliminary in May, Housing starts in May, the FOMC meeting and interest rate decision will be held on Wednesday, June 18th, the FOMC economic projections will be posted the same day, Fed press conference after the FOMC meeting on Wednesday. The week ends with data regarding Existing Home Sales in May on Friday.

Analysis and Forecast for EUE/USDToday, the EUR/USD pair is under pressure, having failed to consolidate above the 1.1447 level and showing intraday declines toward the psychological level of 1.1415 and below, amid U.S. dollar strength.

The main drive of the dollar's rise was Friday's strong U.S. Non-Farm Payrolls (NFP) report, which reduced expectations for an imminent rate cut by the Federal Reserve this year. In addition, optimism surrounding the potential resumption of U.S. -China trade talks is dampening bearish sentiment toward the dollar, thereby adding further pressure on EU/USD.

Nevertheless. ongoing negotiation in London and the upcoming key U.S. inflation data later this week are prompting traders to remain cautious and refrain from opening aggressive positions. The market still considers a September Fed rate cut likely, and concerns about the U.S. government's fiscal position are limiting the dollar's upside potential, which in turn lends some support to the euro.

On the other hand, the European Central Bank signaled at its latest meeting that the current rate-cutting cycle may be nearing an end. This also supports the euro and helps limit EUR/USD losses. In the absence of significant economic releases from the eurozone or the U.S. today, the pair's movement is mainly driven by dollar dynamics.

Technically, in order to resume upward movement, EUR/USD needs to break through resistance in the 1.1450-1.1460 level, which could open the path toward the psychological level of 1.1500. A break above that could lead to a retest of late-April highs. Otherwise, the risk of further decline toward the 1.1370 support level remains. However, oscillators on the daily chart are still in positive territory, indicating a generally constructive outlook for the pair.

In the short term, caution advised, with focus on signals from the trade negotiations and upcoming economic data.

EUR/USD) back to bearish Trand Read The captionSMC trading point update

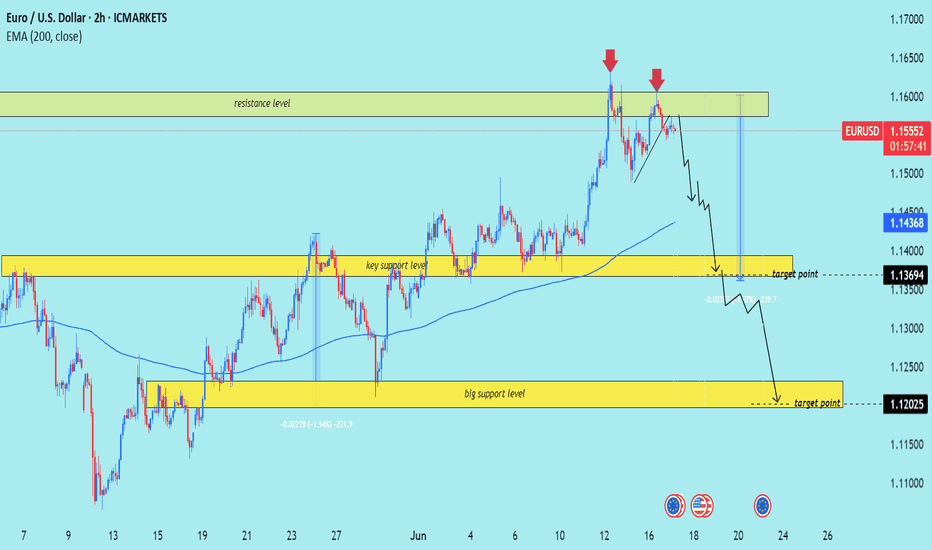

Technical analysis of EUR/USD pair on the 2-hour timeframe. Here's a breakdown of the idea behind the analysis:

---

Trading Idea Summary: EUR/USD Bearish Reversal Setup

1. Rejection at Resistance Zone

Resistance Level (~1.1600): Price has tested this level twice (red arrows) and faced strong rejection, suggesting it’s a firm supply zone.

This double top near resistance signals potential downside pressure.

2. Bearish Market Structure

Price action shows a break in short-term bullish momentum.

Bearish trend arrows and structure indicate expected continuation to the downside.

3. EMA Resistance

The 200 EMA (blue line) at 1.14356 is above the key support zone, acting as dynamic resistance, reinforcing the bearish outlook.

4. Target Levels

First Target: 1.13694 (Key Support Level)

Previous structure zone with strong historical price reaction.

Final Target: 1.12025 (Major Support Zone)

Larger demand area where buyers previously stepped in.

Mr SMC Trading point

---

Conclusion

This analysis suggests a potential short setup with confirmations from:

Repeated resistance rejection

Bearish price structure and trend arrows

EMA as added confluence

Clear downside targets: 1.13694, then 1.12025

> Bearish bias remains valid unless price reclaims and closes above the resistance zone (~1.1600).

pelas support boost 🚀 this analysis)

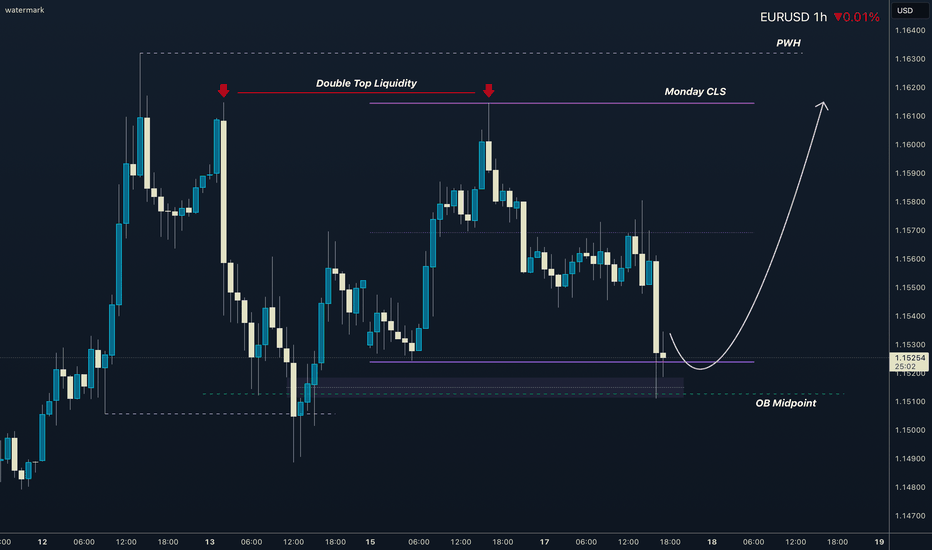

EURUSD I Monday CLS I Model 1 I High risk I FOMC TomorowHey, Market Warriors, here is another outlook on this instrument

If you’ve been following me, you already know every setup you see is built around a CLS Footprint, a Key Level, Liquidity and a specific execution model.

If you haven't followed me yet, start now.

My trading system is completely mechanical — designed to remove emotions, opinions, and impulsive decisions. No messy diagonal lines. No random drawings. Just clarity, structure, and execution.

🧩 What is CLS?

CLS is real smart money — the combined power of major investment banks and central banks moving over 6.5 trillion dollars a day. Understanding their operations is key to markets.

✅ Understanding the behavior of CLS allows you to position yourself with the giants during the market manipulations — leading to buying lows and selling highs - cleaner entries, clearer exits, and consistent profits.

📍 Model 1

is right after the manipulation of the CLS candle when CIOD occurs, and we are targeting 50% of the CLS range. H4 CLS ranges supported by HTF go straight to the opposing range.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

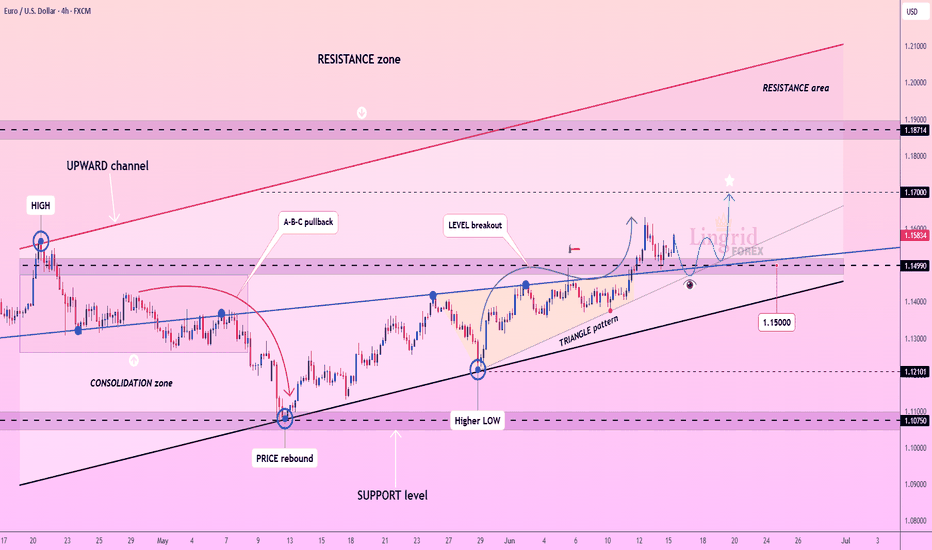

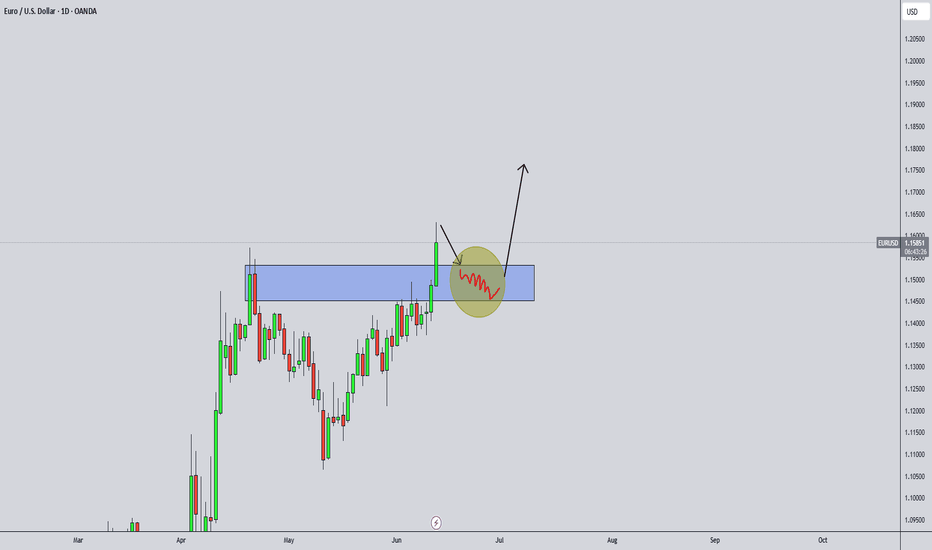

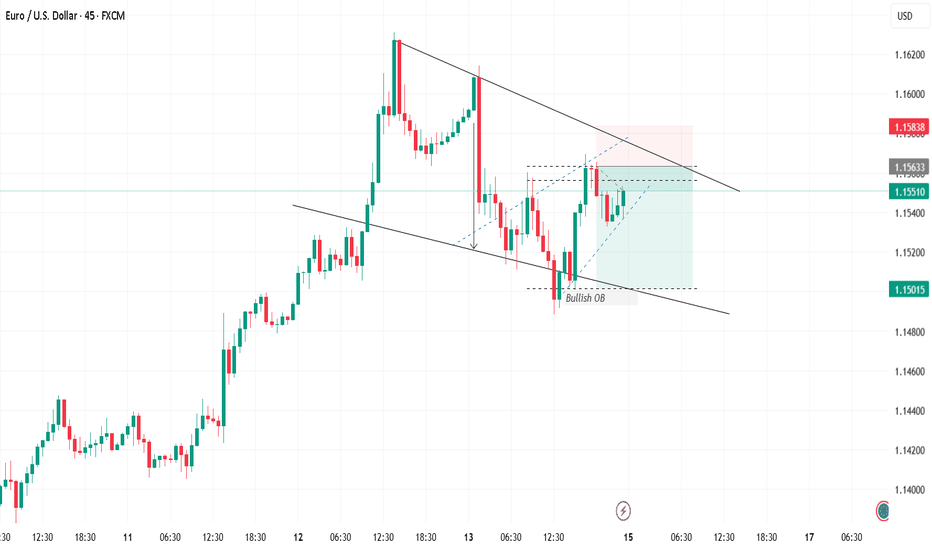

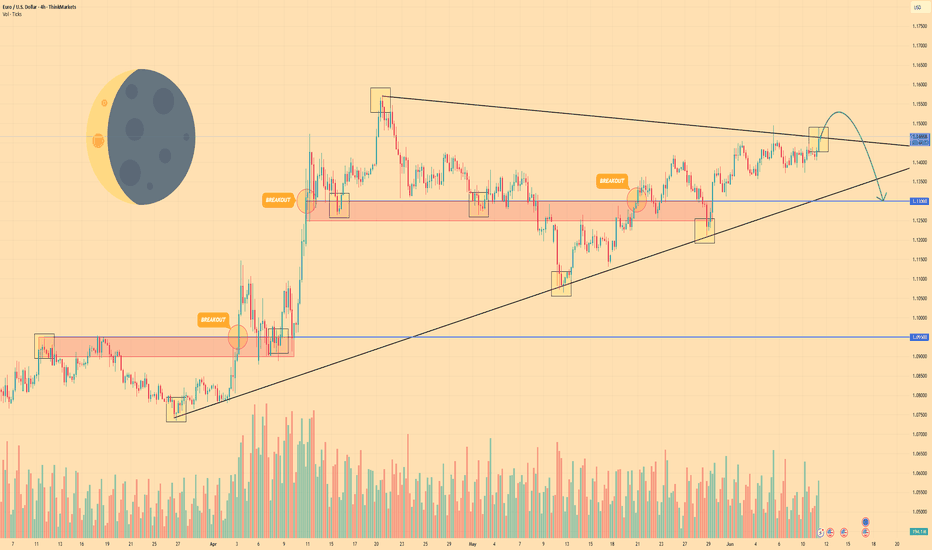

EURO - Price will exit from pennant and then make correctionHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some days ago price reached $1.0950 level and then made a correction movement, after which started to grow in a pennant.

Price made an upward impulse from support line of pennant and broke $1.0950 level, after which made a retest.

Then price continued to move up and reached $1.1300 level, and soon broke it too, and then made a correction movement.

After this, price rose to resistance line of pennant and then started to decline and soon broke $1.1300 level again.

But later it boucned from support line and backed up, and even now it trades very close to resistance line.

In my mind, Euro can rise a little, thereby exiting from pennant and then make a correction to $1.1300 level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

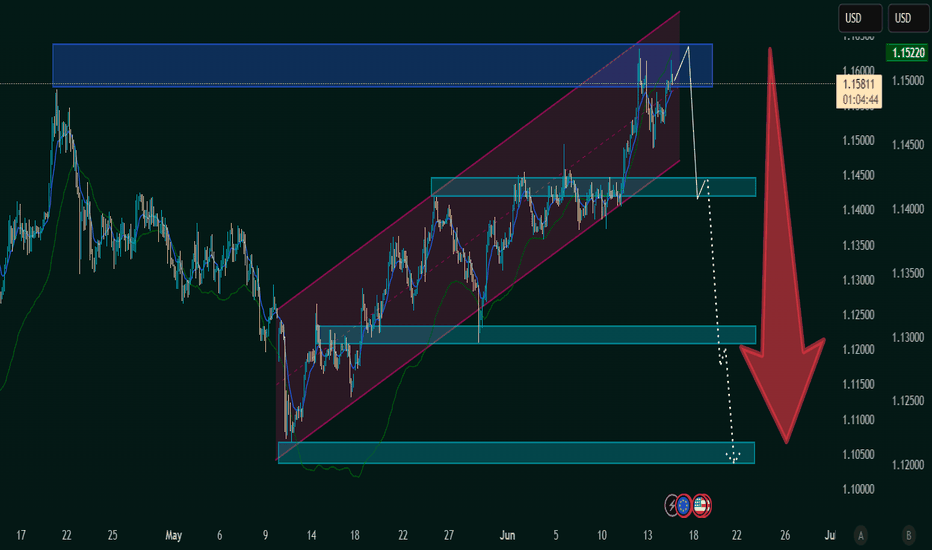

EUR/USD Potential Reversal from Resistance Zone –Bearish OutlookThe EUR/USD pair has been trading within a well-defined ascending channel for several weeks. Price recently tested a strong resistance zone near 1.15850 – 1.16000, which aligns with the upper boundary of the channel and a previously marked supply area.

Key observations:

The price action shows signs of rejection from the resistance zone with a potential double-top or fakeout pattern forming.

A projected bearish trajectory is marked, suggesting a possible break below the channel support.

Immediate bearish targets are set at key demand zones around 1.14500, 1.12500, and further down to 1.10500.

A large red arrow indicates the strong downside bias if the price confirms the breakdown.

Conclusion:

If EUR/USD fails to sustain above the 1.15850 resistance zone and breaks below the ascending channel, a strong bearish correction is anticipated. Traders should watch for confirmation of the breakdown before entering short positions.

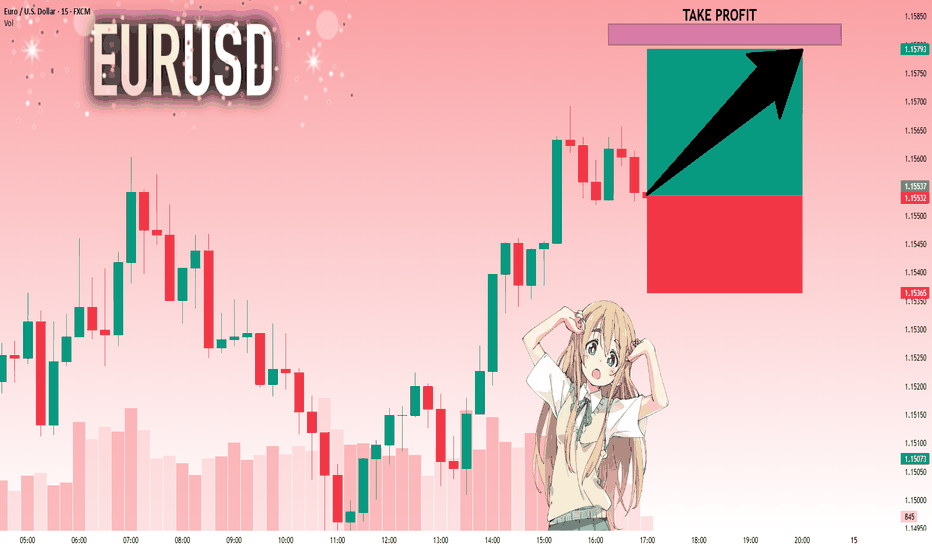

EURUSD: Will Go Up! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 1.15537 will confirm the new direction upwards with the target being the next key level of 1.15800 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

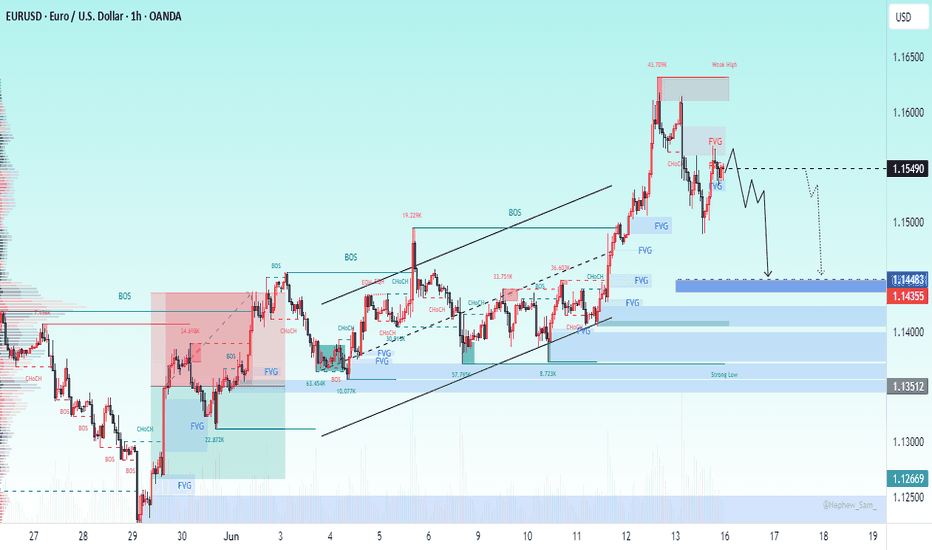

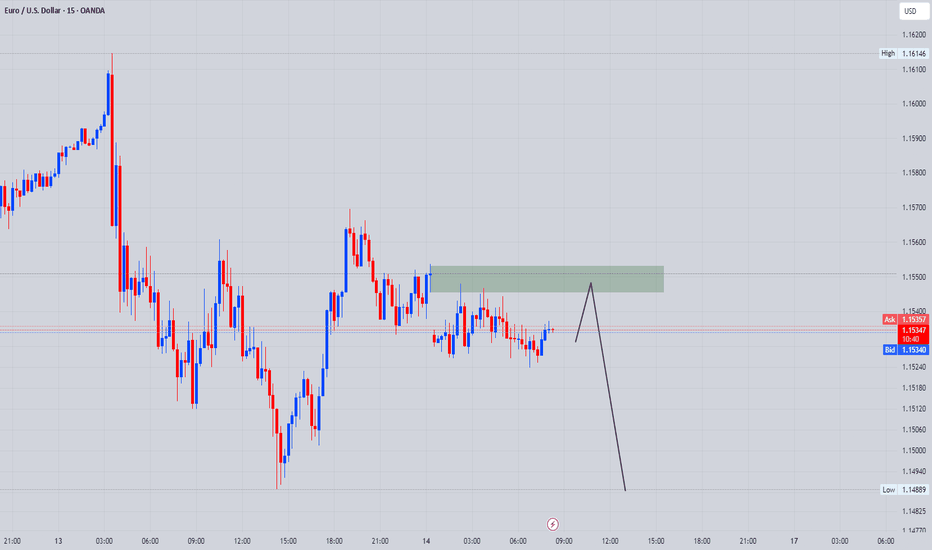

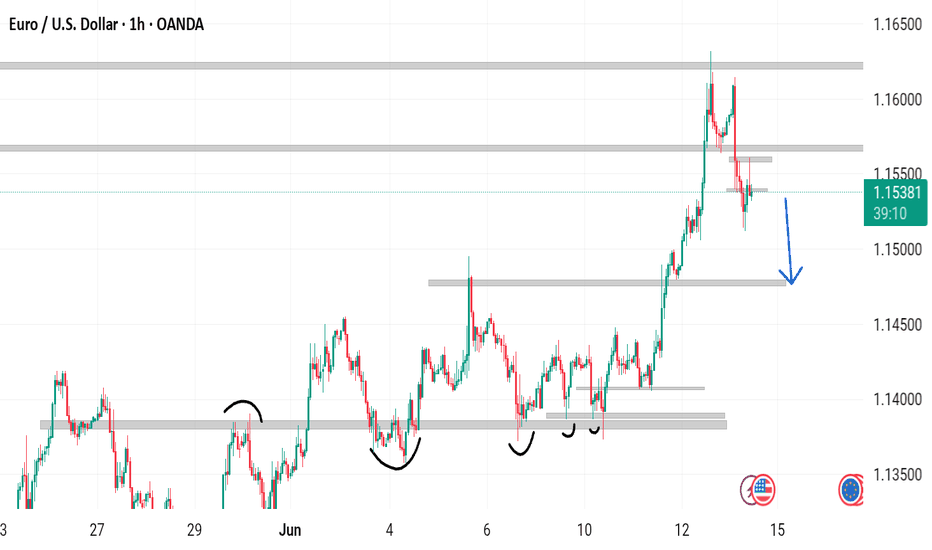

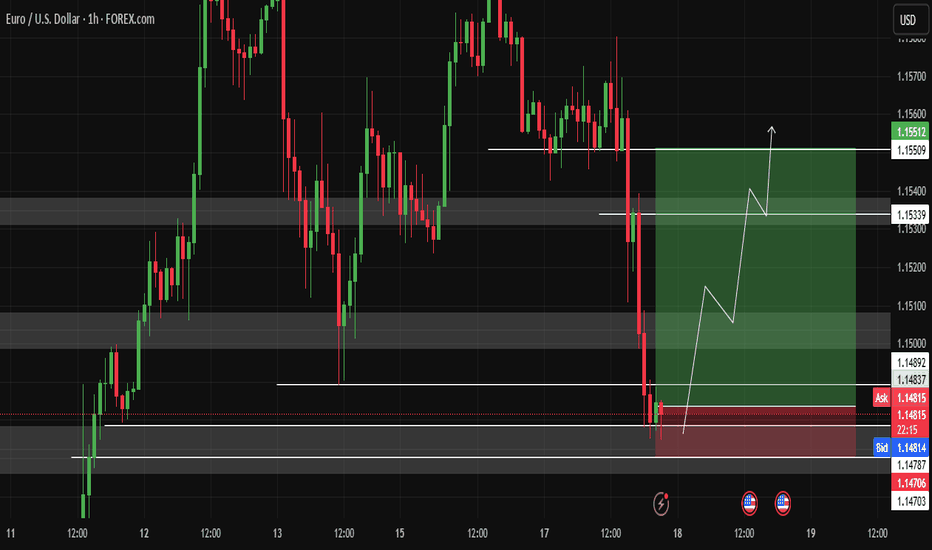

Projected Price Path (White Lines)showing technical analysis and a projected price path. Here’s a breakdown of what’s visible:

🔍 Chart Overview

Pair: EUR/USD

Timeframe: 4H (4-hour)

Current Price: ~1.15881

Date/Time: Around June 13, 2025, 3:47 AM (UTC+3)

🟩 Highlighted Zones

Upper Supply Zone (resistance area):

Around 1.15150 – 1.15300

Price previously reacted and broke above this zone.

Lower Demand Zone (support area):

Between 1.13600 – 1.13900

Price bounced from this level in the past.

Intermediate Zone (recent consolidation):

Around 1.14300 – 1.14500

Possibly an area of minor structure or reaccumulation.

📈 Price Action

Price made a strong bullish move, breaking through previous resistance zones.

Bearish pin bar (rejection wick) at the top suggests potential reversal or pullback.

🔮 Projected Price Path (White Lines)

The drawn projection suggests:

Short-term pullback, possibly to retest the 1.15300–1.15150 area.

A minor lower high forms.

Deeper drop expected toward the demand zone at 1.13800 or lower.

🧠 Analysis Implication

This is likely a swing trader’s roadmap, anticipating a reversal after an overextended move.

The analysis could be based on liquidity sweep above highs and return to structure.

I'm selling EURUSD, you should too!!!War is always bullish Dxy and bearish Eur. Technically too, a high has been taken and expecting retracement.

TP1 @ 1.147

TP2 @ 1 137

Follow me as most of my trades are market orders, so you'll see them on time and enter the trades on time. I want you to recover the money you lost to the market and make so much more

Ya gazie