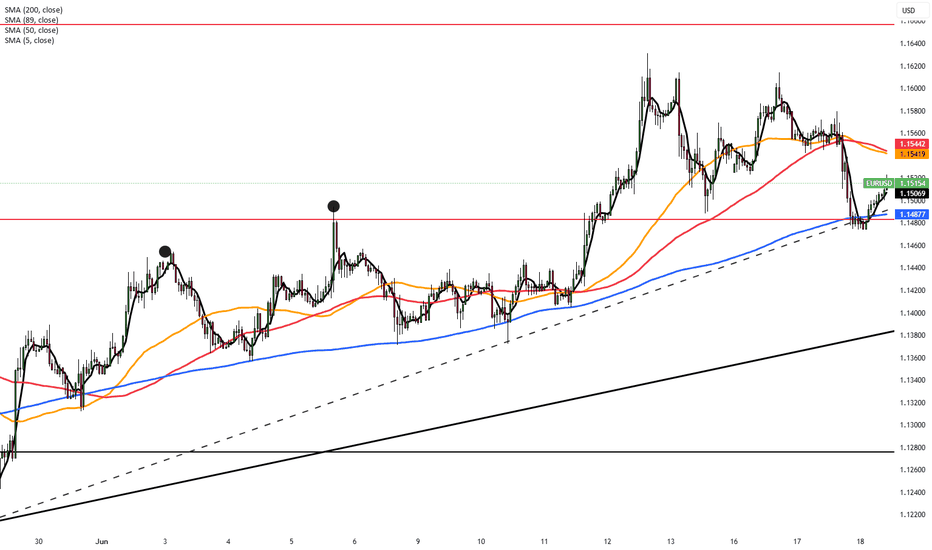

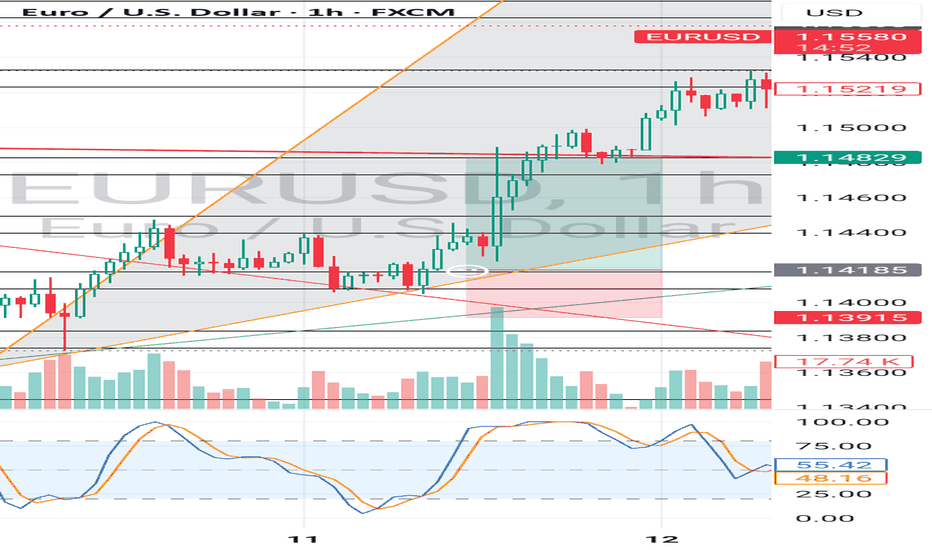

EUR/USD Pressured by Safe-Haven Dollar DemandEUR/USD traded near 1.15 on Wednesday, under pressure from safe-haven demand for the U.S. dollar as Middle East tensions escalated. Fears of broader conflict involving the U.S. kept the dollar firm. Markets await the Federal Reserve’s policy decision, with rates expected to stay unchanged, though guidance may shape future expectations. The euro remained weak, burdened by Europe’s energy import exposure amid rising oil prices.

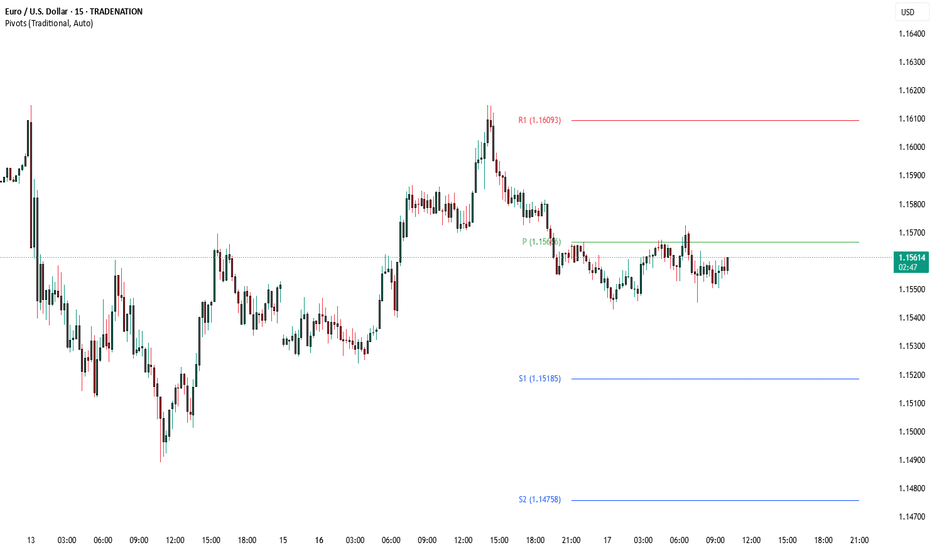

Resistance is located at 1.1580, while support is seen at 1.1460.

USDEUX trade ideas

Fundamental Market Analysis for June 18, 2025 EURUSDEvent to pay attention to today:

12:00 EET. EUR - Consumer Price Index

15:30 EET. USD - Unemployment Claims

21:00 EET. USD - FOMC Rate Decision

Declining confidence in the US economy amid trade policy is undermining the US Dollar (USD) against the Euro (EUR). Data released by the US Census Bureau on Tuesday showed that US retail sales fell 0.9% m/m in May, compared to a 0.1% decline (revised from +0.1%) recorded in April. The figure was weaker than estimates of -0.7%. Meanwhile, US industrial production in May declined 0.2% m/m vs. 0.1% previously (revised from 0%), worse than expectations of 0.1%.

Traders expect the US Federal Reserve to leave borrowing costs unchanged at its June meeting on Wednesday. Markets now estimate a nearly 80% chance that the Fed will cut rates in September and then another in October, according to Reuters.

The mood of European Central Bank (ECB) policymakers is supportive of the common currency. ECB President Christine Lagarde said that rate cuts are coming to an end as the central bank is now in a “good position” to deal with the current uncertainty.

Meanwhile, investors will keep an eye on geopolitical risks. Israel is set to step up strikes on Tehran, while the US is considering expanding its role amid rising tensions between Israel and Iran.

Trade recommendation: SELL 1.1460, SL 1.1560, TP 1.1260

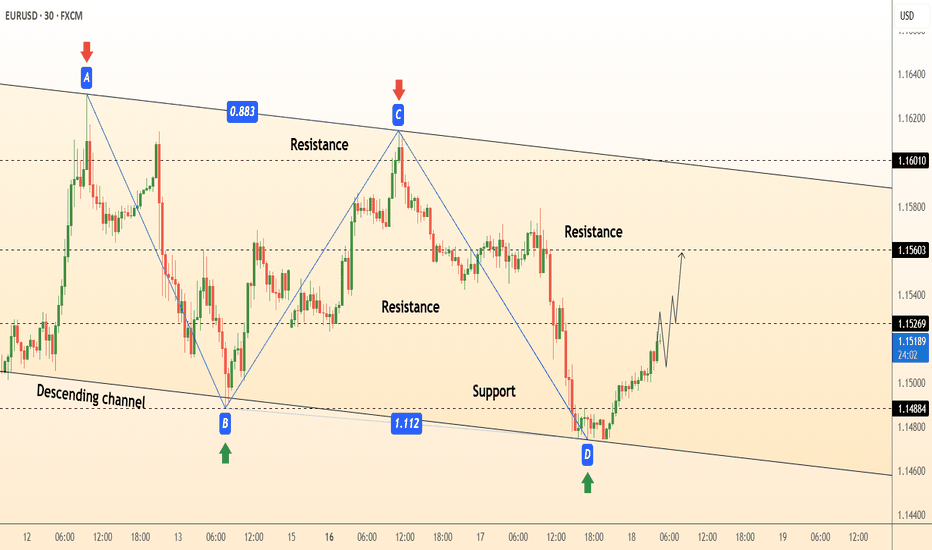

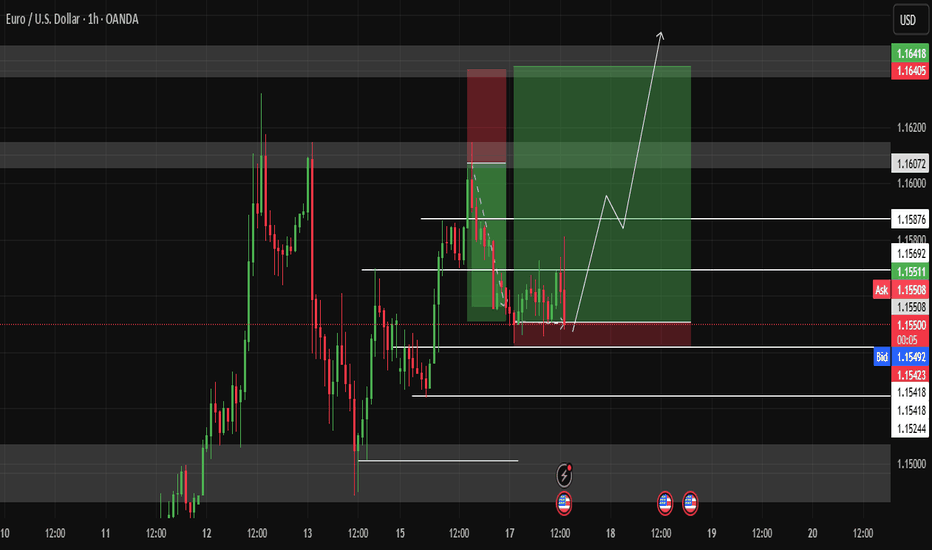

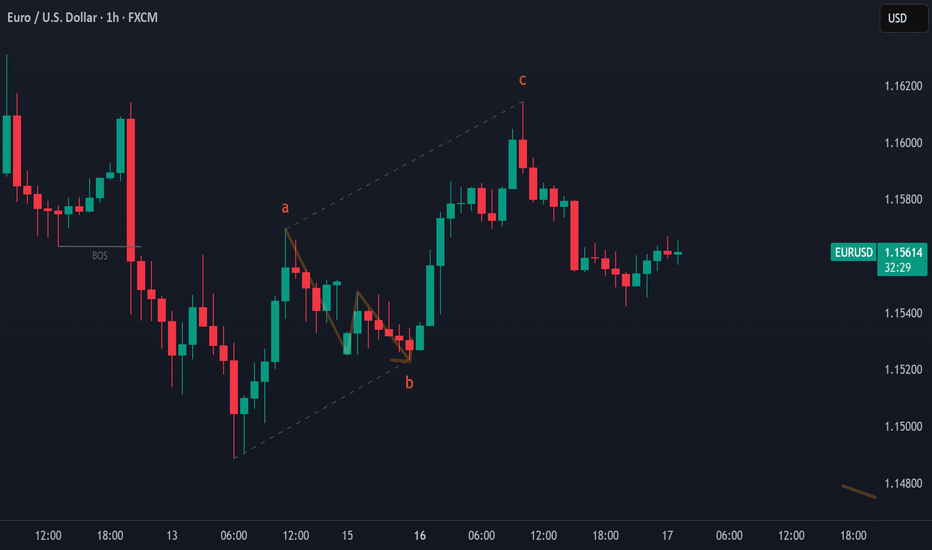

DeGRAM | EURUSD rebound from the lower boundary of the channel📊 Technical Analysis

● A completed AB=CD (0.883 / 1.112) pattern at the channel floor (1.1488) produced a hammer, signalling exhaustion of bears at the measured PRZ.

● Price is now reclaiming the micro structure high 1.1526; that flips the inner range to support and opens the next intra-channel pivot 1.1560, with room to the upper wall near 1.1600.

💡 Fundamental Analysis

● EZ May trade balance swung back to a €4 bn surplus while weak US housing starts shaved another 4 bp off 2-yr yields, compressing the short-rate gap and underpinning EUR bids.

✨ Summary

Buy 1.1500-1.1530; break >1.1560 targets 1.1600, stretch 1.1650. Bull bias void on 30 min close below 1.1480.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

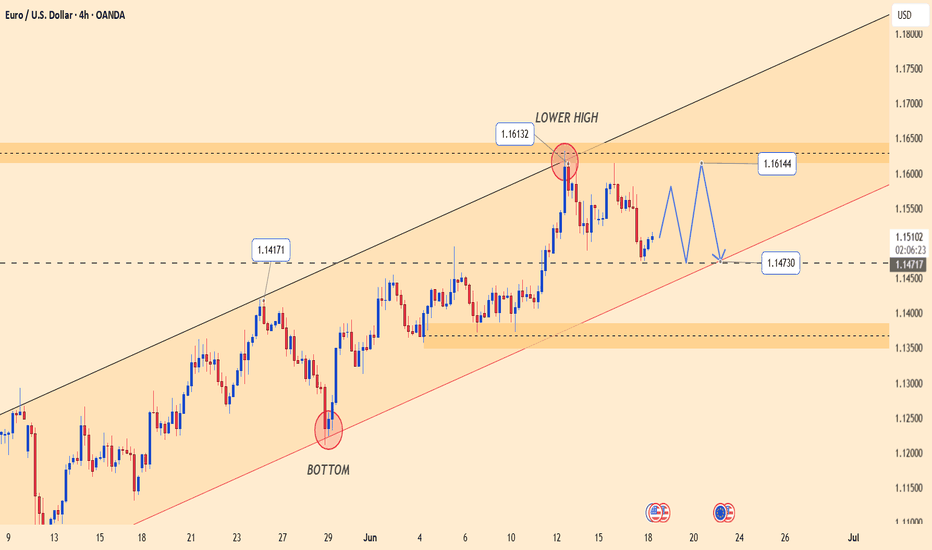

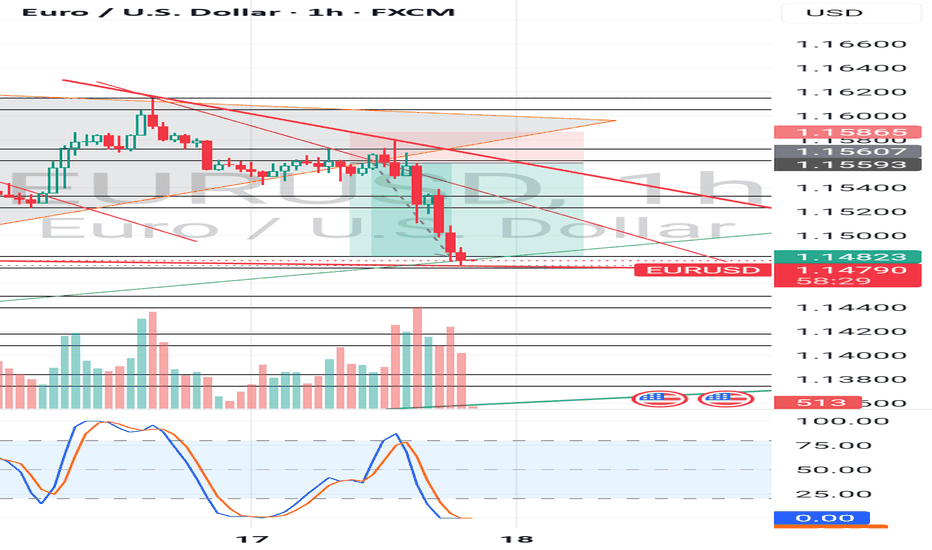

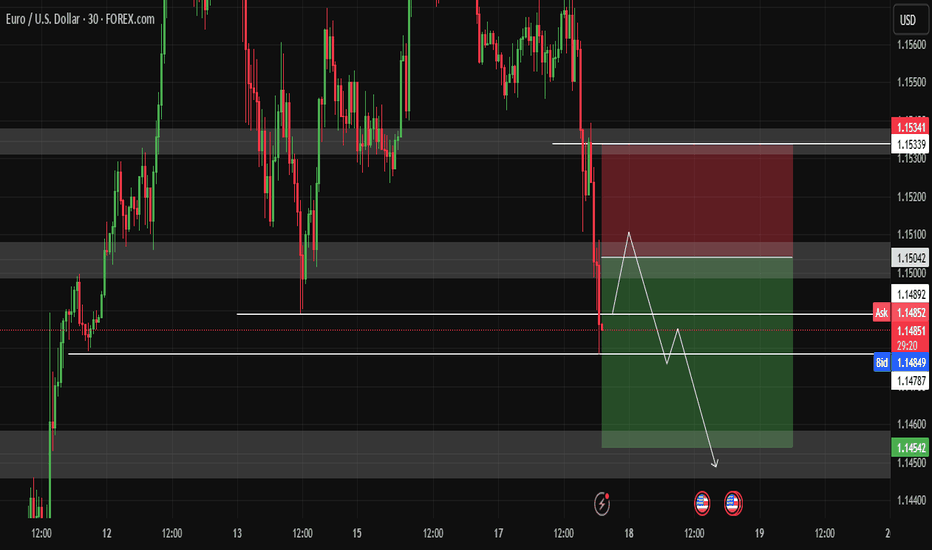

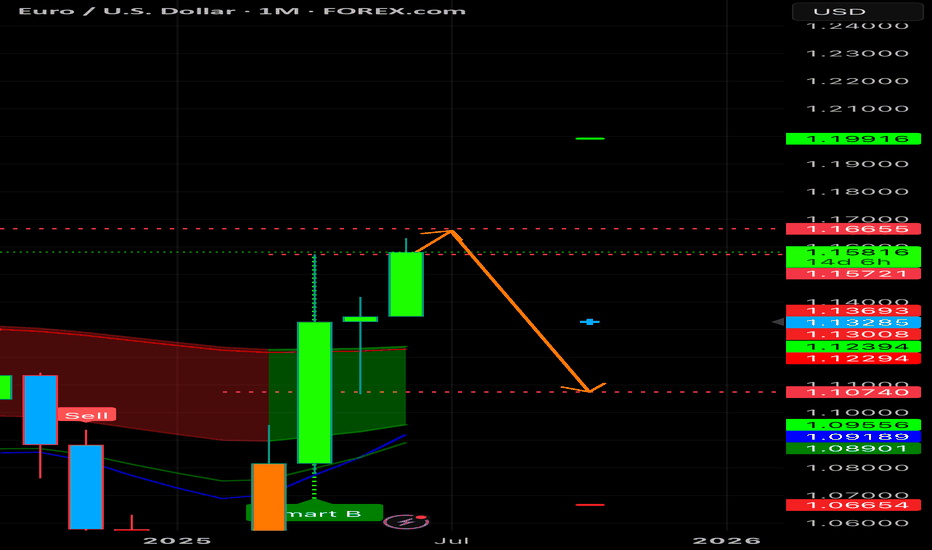

EURUSD – Bullish momentum fades, downside pressure intensifiesEURUSD formed a lower high near 1.1613, signaling weakening bullish momentum. Price is now testing a key trendline, and a break below 1.1473 could confirm a bearish move toward 1.1350.

Market sentiment is currently dominated by the Fed’s hawkish stance following the latest FOMC meeting, where the central bank kept rates unchanged but expressed readiness to hike further if necessary. Meanwhile, although tensions in the Middle East are escalating, they have yet to deliver a significant blow to the USD.

Given the current backdrop, EURUSD is under considerable pressure and may soon break its bullish structure unless strong buying interest re-emerges.

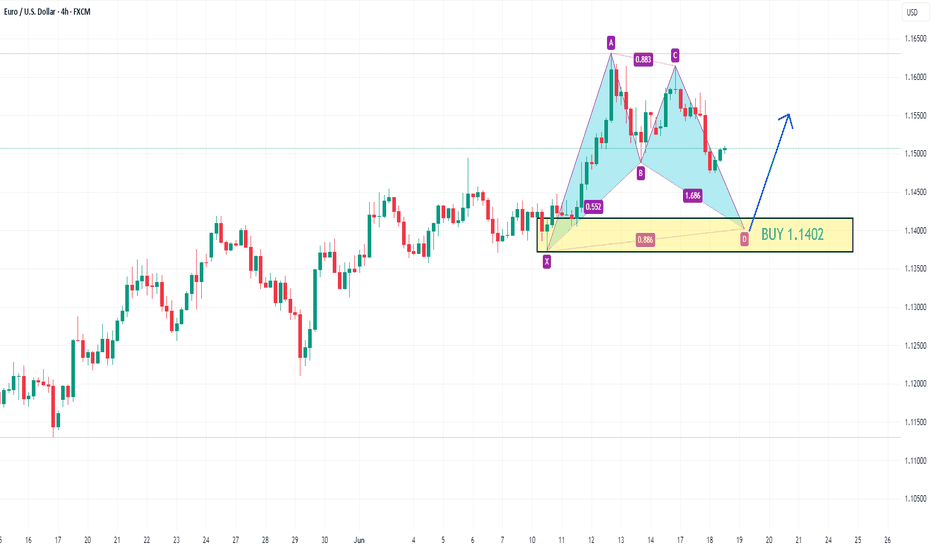

EURUSD Eyes Potential Bullish BatOn the daily chart, EURUSD is currently oscillating at a high level. In the short term, we can pay attention to the area around 1.1402 below. This position is a potential buying position for a bullish bat pattern, and this position is also within the previous demand area.

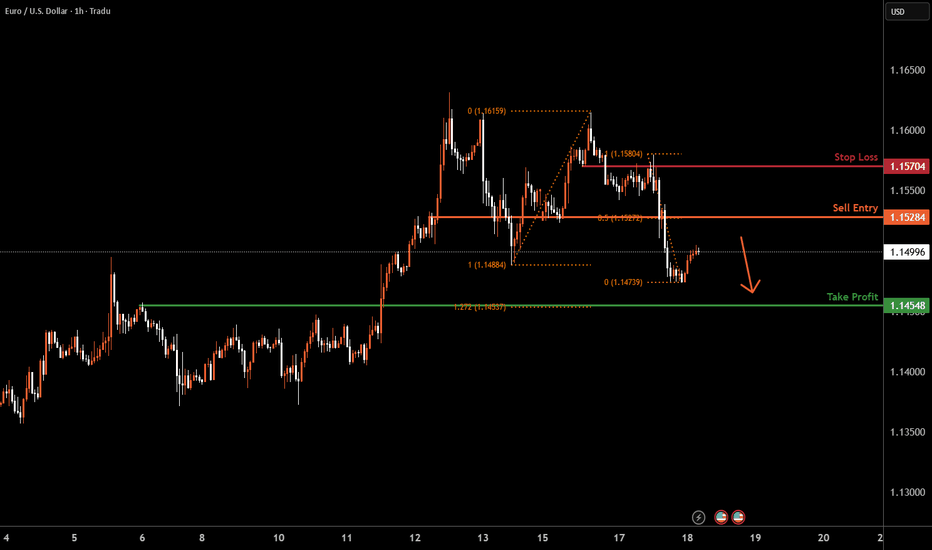

EURUSD H1 I Bearish Reversal Based on the H1 chart, the price is rising toward our sell entry level at 1.1538, a pullback resistance that aligns with the 50% Fib retracement.

Our take profit is set at 1.1454, a pullback support that aligns with the 127.2 Fib extension.

The stop loss is set at 1.1570, an overlap resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

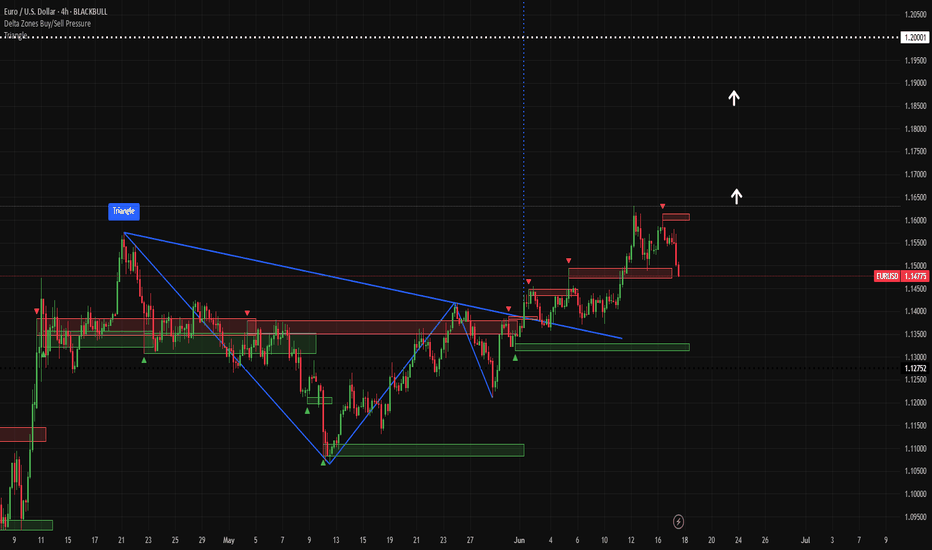

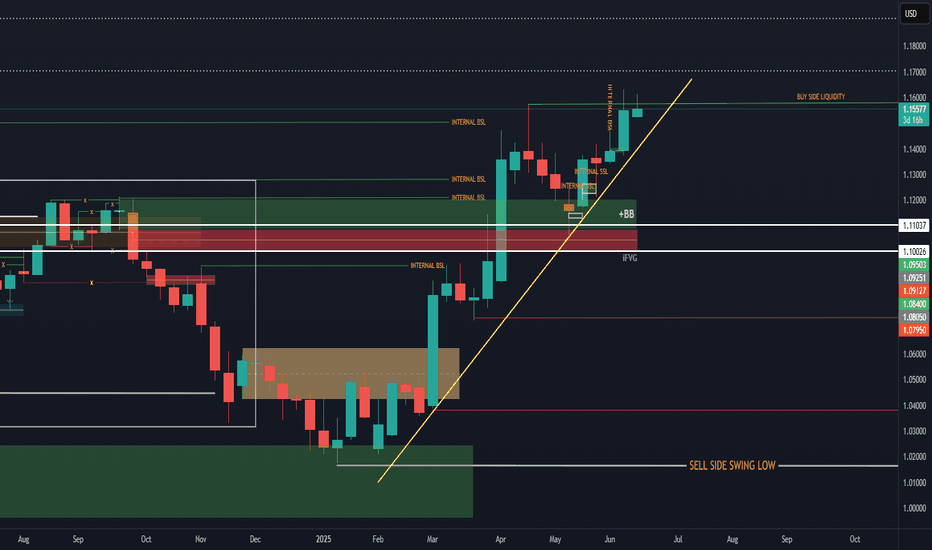

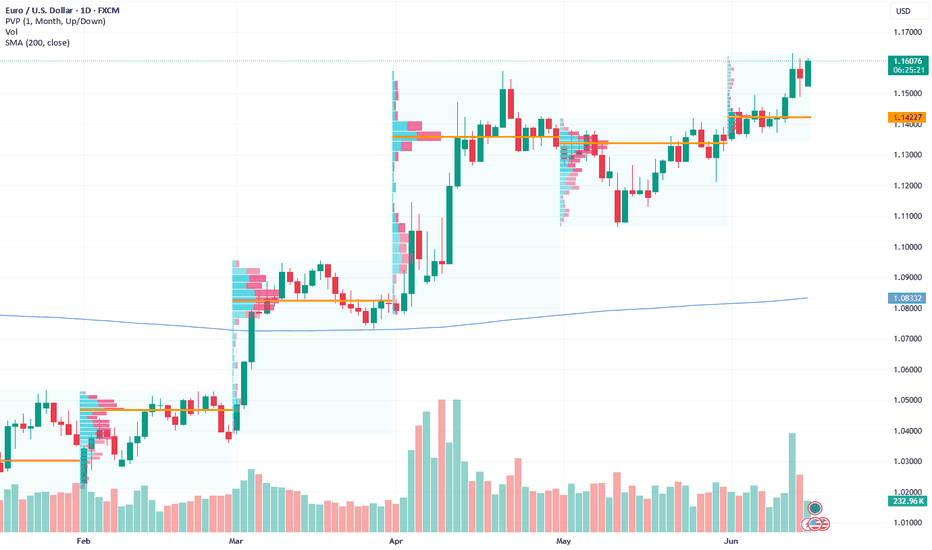

Goldman and BofA agree: The dollar is losing its edgeGoldman Sachs now expects the EUR/USD to hit 1.20 by the end of the year. While this prediction draws comparisons to the 2017 rally in the pair, Goldman notes a key difference. This time, the pricing reflects pessimism in the US dollar, rather than optimism in the euro.

Bank of America seemingly agrees and warns that even a “hawkish” dot plot at this week’s FOMC meeting, where Fed officials signal fewer rate cuts, may only cause a brief bout of euro weakness against the dollar.

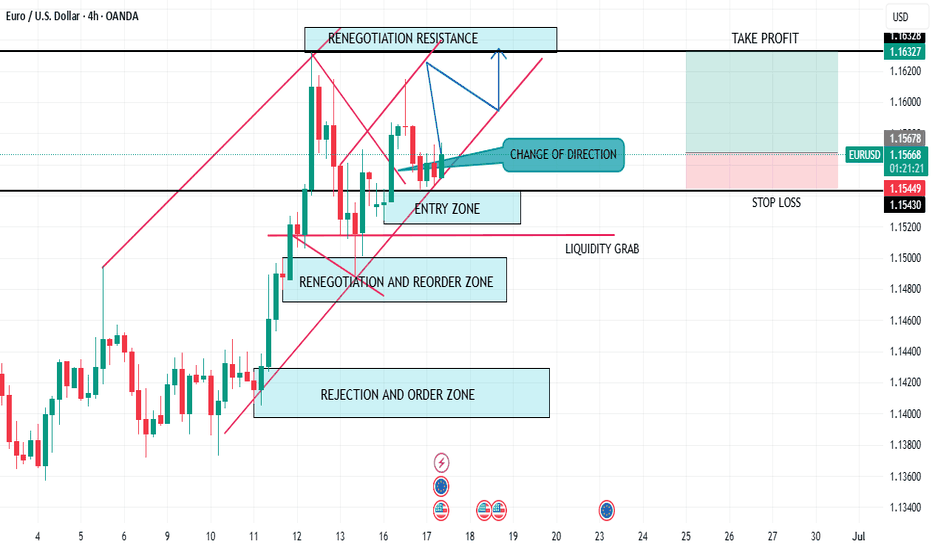

EUR/USD has recently broken out of a long-term descending triangle pattern, which capped price action from mid-April through early June, aligning with Goldman Sachs’ and BofA’s view of a broad EUR strength/ USD weakness.

This recent pullback to the 1.1480 area is a retest of former resistance turned support, suggesting a potential continuation pattern if buyers defend this level.

EUR USD Price has previously rejected from the resistance zone in DTF, and Also traded in an ascending triangle and also formed a double top pattern and held d bearish Trendline, which are all indications of a Bearish trend and movement as seen.

And priced moved perfectly in our Direction 🔥

_THE_KLASSIC_TRADER_.

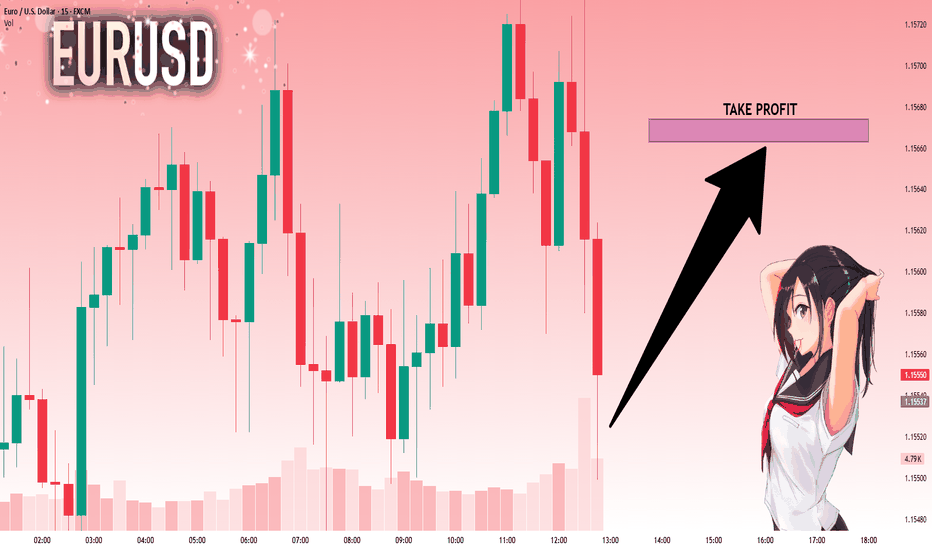

EURUSD: Will Go Up! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.15524 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 1.15663.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

The Day Ahead Tuesday, June 17 – Market Summary (Key Data & Events)

U.S. Focus:

Retail Sales (May) – Key consumer demand gauge; strong data may lift USD and yields.

Industrial Production, Capacity Utilization (May) – Insight into manufacturing health; impacts USD, rates.

Import/Export Price Index (May) – Inflation clues; affects Fed expectations.

NAHB Housing Index (June) – Early read on housing sentiment.

NY Fed Services Index, Business Inventories (April) – Lower-tier data.

5-Year TIPS Auction – Watch for inflation expectations via demand.

Global Data:

Germany & Eurozone ZEW Surveys (June) – Investor sentiment; EUR-sensitive.

Canada International Securities Transactions (April) – Tracks foreign capital flows; affects CAD.

Central Banks:

BoJ Decision – High impact for JPY, JGBs, and Nikkei; watch policy tone.

ECB Speakers (Villeroy, Centeno) – May guide rate expectations and EUR.

Trading Relevance:

FX: USD, JPY, EUR in focus.

Equities: Retail data, BoJ stance may drive risk appetite.

Rates: Data-heavy day for yields; TIPS auction key for inflation outlook.

Commodities: Industrial activity and prices affect demand/inflation views.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Market Review ( DXY & GOLD & EQUITIES & CURRENCIES ) 2025-06-17DXY:

Prediction: Continued bearish pressure, targeting your swing target of 95.00. The fundamental backdrop of potential Fed rate cuts and ongoing geopolitical uncertainty weighing on safe-haven demand for the dollar supports this outlook.

Recommendation: SELL on rallies. Traders should look for opportunities to short the DXY, utilizing resistance levels around 98.50-99.00 for entry. Long-term investors should consider reducing USD exposure in their portfolios.

GOLD:

Prediction: Strong bullish momentum to continue, with a high probability of reaching and exceeding your swing target of 3600. The confluence of safe-haven demand and a weakening dollar provides a powerful tailwind.

Recommendation: BUY on dips. Swing traders can look for pullbacks to key support levels for entry, while long-term investors should consider accumulating gold as a hedge against market volatility and currency depreciation.

EURUSD RISE I believe EURUSD could possibly even rise to 1.18000 . Rejecting sell side pressure no 4hr closure to the downside and break out of liquidity trends . If I continue to see big rejection candles and lack of closure with posturing to the upside I will enter for this long position and scale in positions .

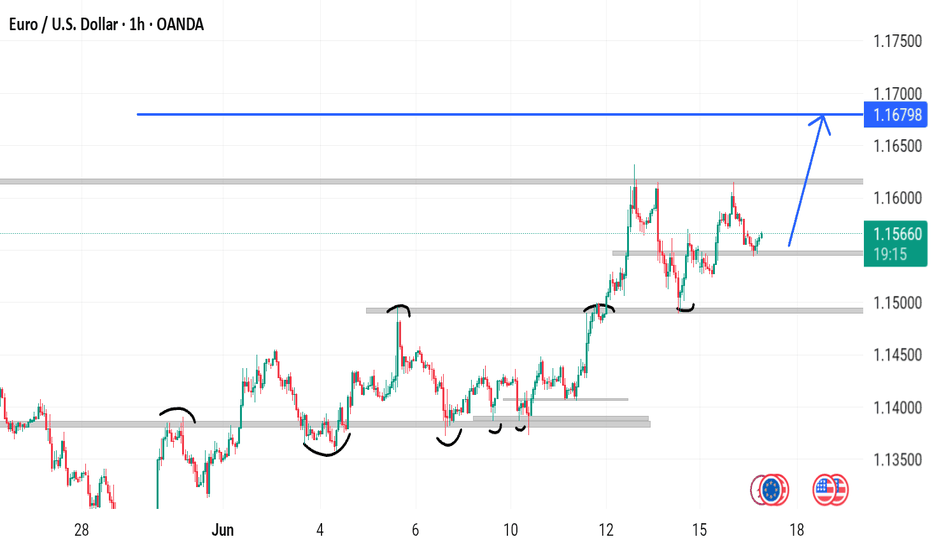

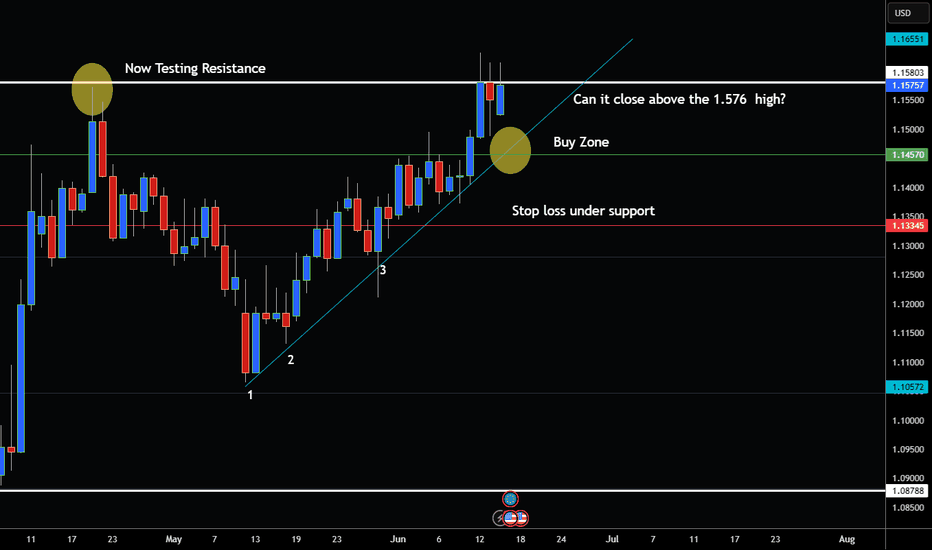

Euro Testing Significant Resistance Level! Hey Traders so today was watching Euro it is in strong uptrend confirmed with my favorite 3 bar trendline. So normally best way to trade the trend is buy when it pulls back to the trendline. I like to use a candle that might hold support around 1.1457 but we also have strong high at 1.576

So aggressive entry would be to buy at that pullback 1.1457-1.1475 wide stop loss below support.

Conservative would be wait for break above that 1.576 high proving market wants to move higher then wait for it to come back and test that level again on pullback and buy at 1.576

If your bearish I don't think it's good to short right now with uptrend showing signs of strength. I would wait until market trades below trendline before considering taking bearish position.

Always use Risk Management!

(Just in case your wrong in your analysis most experts recommend never to risk more than 2% of your account equity on any given trade.)

Hope This Helps Your Trading 😃

Clifford

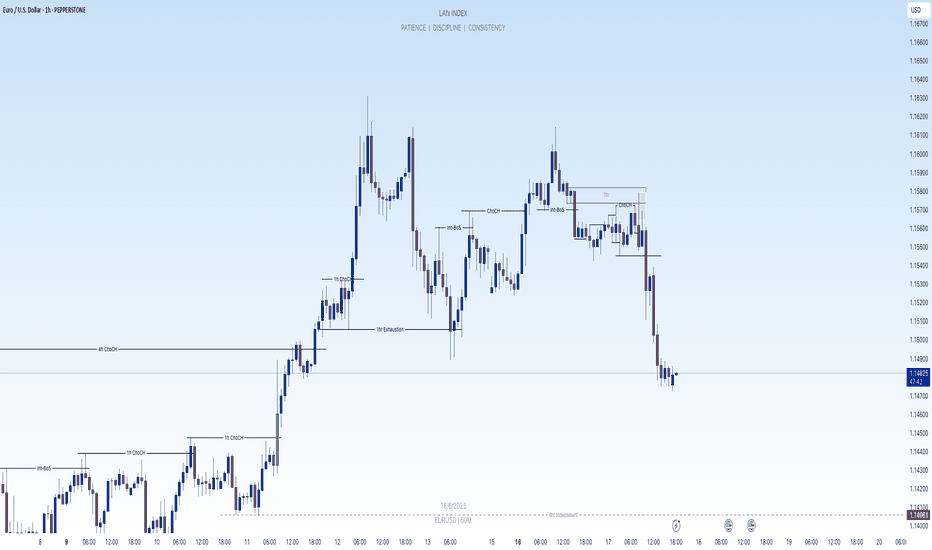

Long trade

🟢 EURUSD – Buyside Trade

Date: Monday, 16th June 2025

Session: London Session AM

Time: 5:00 AM

Entry Timeframe: 1Hr TF

Trade Parameters

Entry: 1.15748

Take Profit: 1.16144 (+0.34%)

Stop Loss: 1.15581 (−0.15%)

Risk-Reward Ratio (RR): 2.29

🧠 Trade Reasoning

This buyside trade was executed after price swept the sell-side high from Monday, 21st April 2025, triggering liquidity above the previous swing, and then sharply rejecting back into structure. The reaction occurred above a 1Hr Fair Value Gap (FVG), indicative of a directional bias.

Breaking: Euro's Momentum Could Trigger $1.19 Surge

Current Price: $1.1546

Direction: LONG

Targets:

- T1 = $1.1700

- T2 = $1.1900

Stop Levels:

- S1 = $1.1400

- S2 = $1.1300

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Euro trading.

**Key Insights:**

The Euro has shown strong resilience despite a challenging macroeconomic environment. The European Central Bank (ECB)'s signaling of a more neutral stance regarding rate hikes has bolstered confidence in the currency. Furthermore, economic challenges within the Eurozone—such as weaker industrial output and shrinking trade surpluses—present medium-term hurdles but align with structural optimism for strategic positions in EUR/USD. Traders are closely watching key support levels as bullish momentum begins to gain traction.

The weakening U.S. dollar, alongside dovish Federal Reserve messaging, plays into Euro strength on the back of favorable interest rate differentials. Additionally, geopolitical factors such as stability concerns surrounding emerging market economies have directed investor interest toward safer currencies like the Euro.

**Recent Performance:**

Over the past week, EUR/USD has hovered around $1.1546 with limited volatility, reflecting strong support levels amidst subdued trading activity. Despite facing negative economic data on industrial production (-2.6% m/m) and trade surplus contraction (€30B to €10B), the pair continues to indicate upside potential fueled by positive speculative sentiment and ECB policy interpretation. Seasonal trends suggest historical Euro strength in mid-year trading windows.

**Expert Analysis:**

Forex analysts widely express bullish sentiment on EUR/USD, supported by ECB communication and diminishing macroeconomic risks. Several technical setups are aligning with long-term resistance breaks near $1.17, with momentum indicators signaling high buying interest. Many see pullback opportunities to nearby support levels ($1.1400 - $1.1300) as high-value entry points for future gains.

On the technical front, the MACD shows a bullish crossover while the RSI remains in moderate territory, suggesting room for potential upside moves without overbuy signals. The Euro's price action momentum also suggests increased trading volume near critical levels, indicating strengthening trend formation.

**News Impact:**

Upcoming ECB speeches, coupled with Eurozone CPI releases, could solidify expectations on inflation and monetary positioning—factors likely to increase Euro demand. Additionally, tariff announcements targeting electric vehicle imports and other related trade dynamics are projected to strengthen Euro-backed industry sentiment. Recent repatriation of global investment capital into Euro-dominated equities adds to structural Forex tailwinds.

**Trading Recommendation:**

Traders should consider taking a bullish stance on the Euro, supported by strong technical indicators and positive macro factors. Entry near current price levels offers favorable risk-reward metrics, with stop-loss placements below $1.1400 providing downside protection. Elevated resistance levels at $1.1700 and $1.1900 manifest as achievable targets in the short- to medium-term horizon, with sustained caution on event-driven volatility.