USDEUX trade ideas

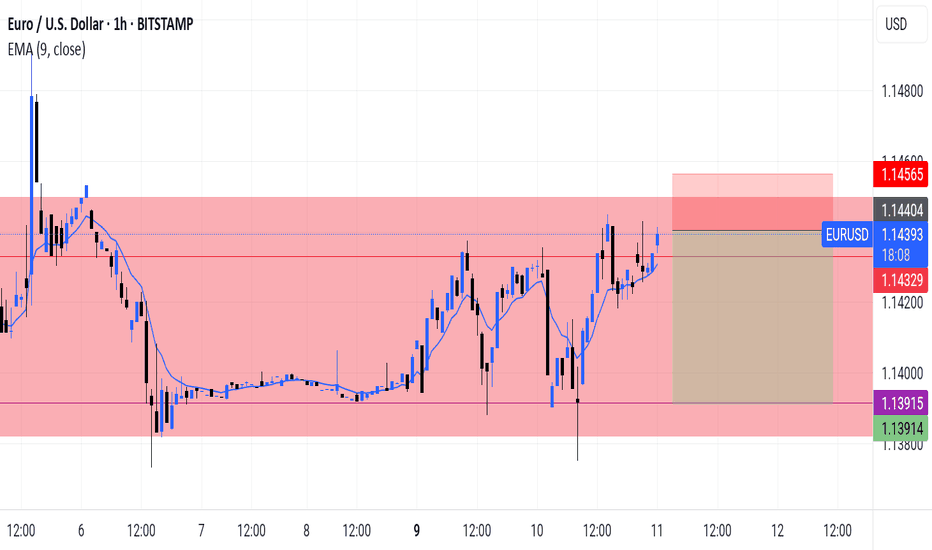

EURUSD - Longs Today

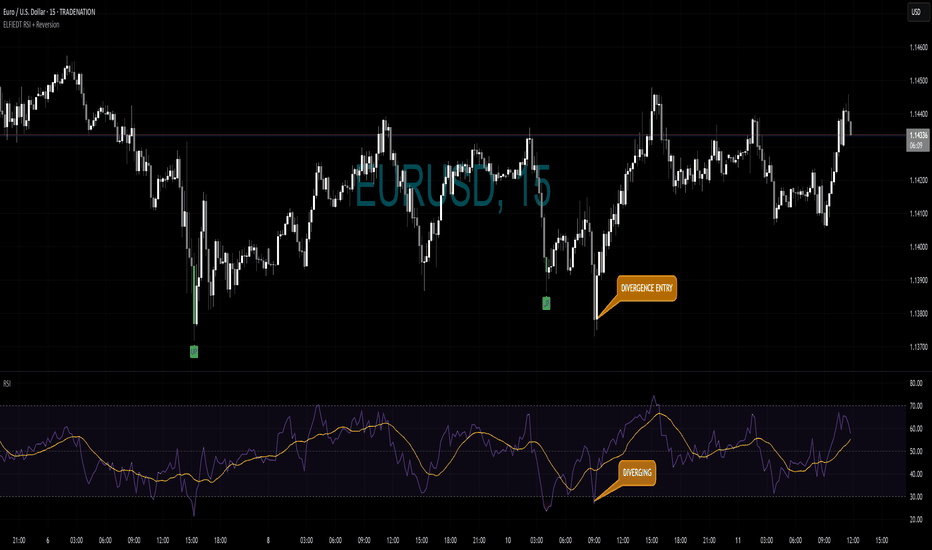

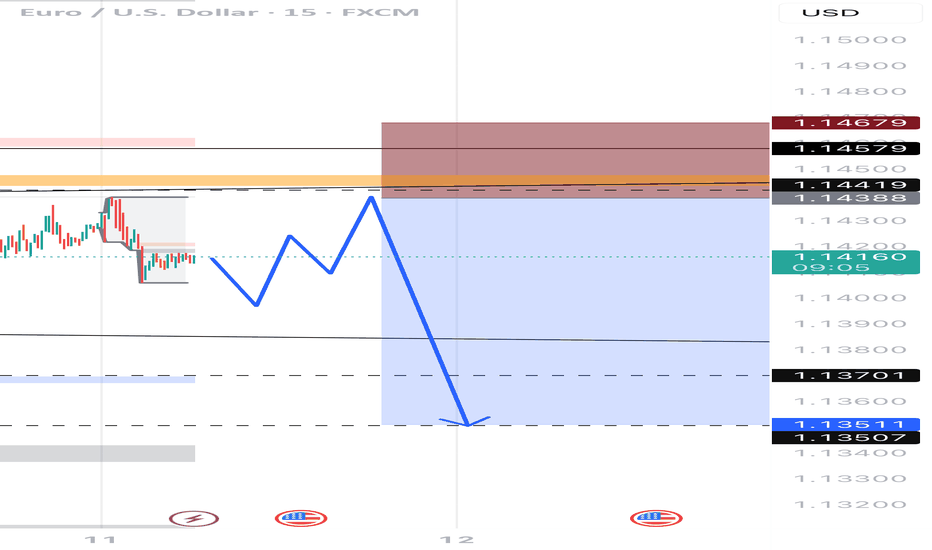

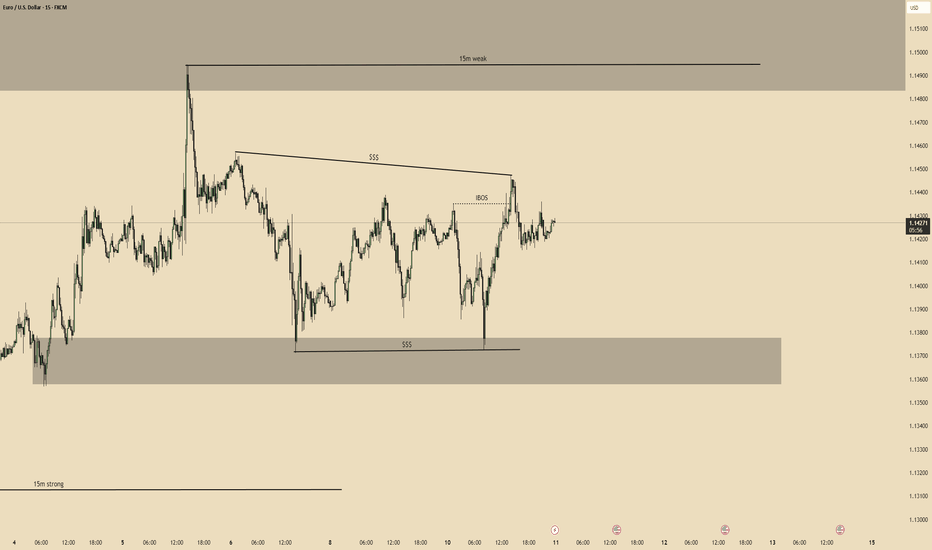

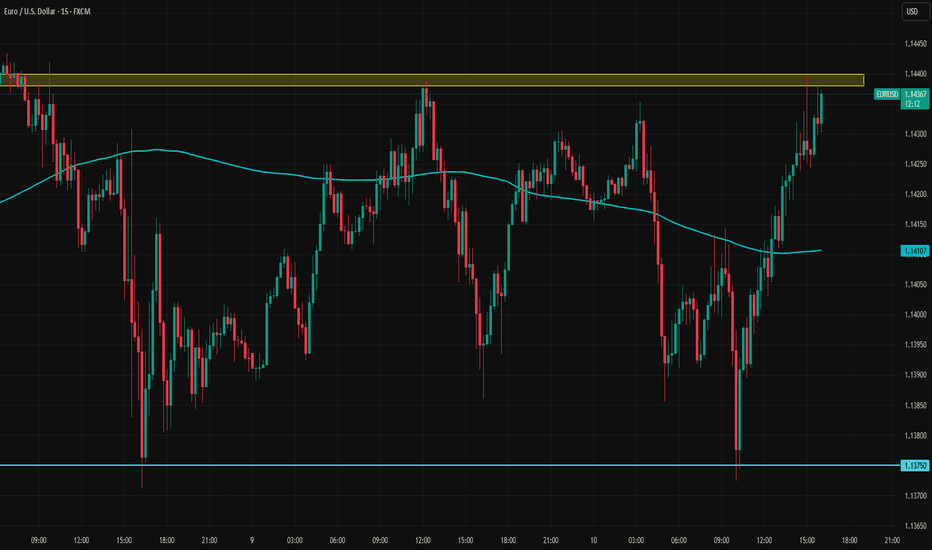

📉 How This Trade Could Have Played Out – EURUSD, 15min Chart

This chart demonstrates a textbook example of how to use the ELFIEDT RSI + 3SD Reversion Strategy with additional RSI divergence to identify a high-probability reversal setup.

🟢 What Happened Here:

✅ Buy Signal Triggered

The script printed a green "UP" signal as price dipped sharply — closing beyond the lower volatility band with momentum in oversold territory and a spike in volume. This marked the initial mean reversion opportunity.

📉 RSI Divergence Formed

Just after the price made a lower low, the RSI formed a higher low — classic bullish divergence, showing underlying strength even as price dropped. This added confluence to the signal.

💡 Divergence-Based Entry Zone

With price recovering above the signal bar and RSI breaking upward, traders could use this divergence as a secondary confirmation entry — improving timing and confidence.

📈 Momentum Followed Through

After the signal and confirmation, price reversed strongly upward with a clear multi-candle move, offering multiple reward opportunities depending on your exit style.

✅ How to Trade It (Step-by-Step)

Wait for a signal label (green/red) from the script — this marks a statistically stretched price condition with volume support.

Add the RSI indicator to your chart.

Watch for divergence (price making a new low, but RSI not confirming) near the signal — this gives you a stronger reason to enter.

Look for a reversal candle (like a bullish engulfing, pin bar, or inside bar) for clean entry timing.

Use the previous low as a stop and target a 1:2 or better reward-risk ratio based on price structure.

🔁 Pro Tip: Top-Down Boost

This exact signal is even more powerful if a similar setup appears on the 1-hour and 5-minute charts around the same area.

✅ When multiple timeframes agree, it’s a higher-probability zone to enter.

🧠 This approach blends statistics, momentum, and price action — giving you structure and flexibility as a trader.

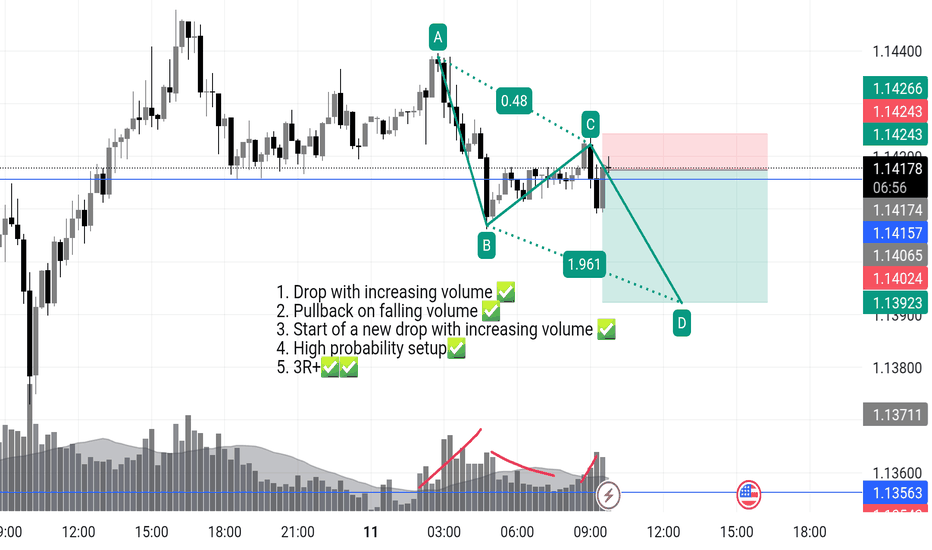

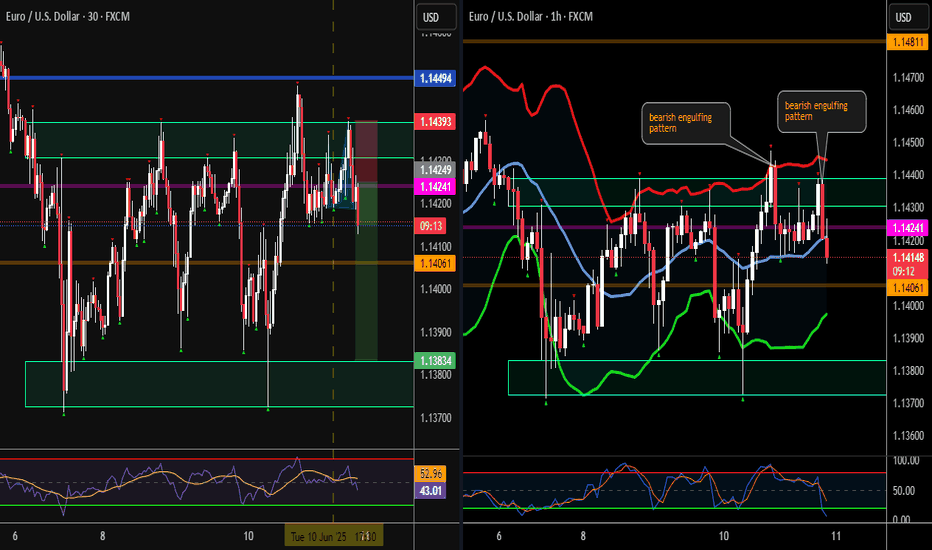

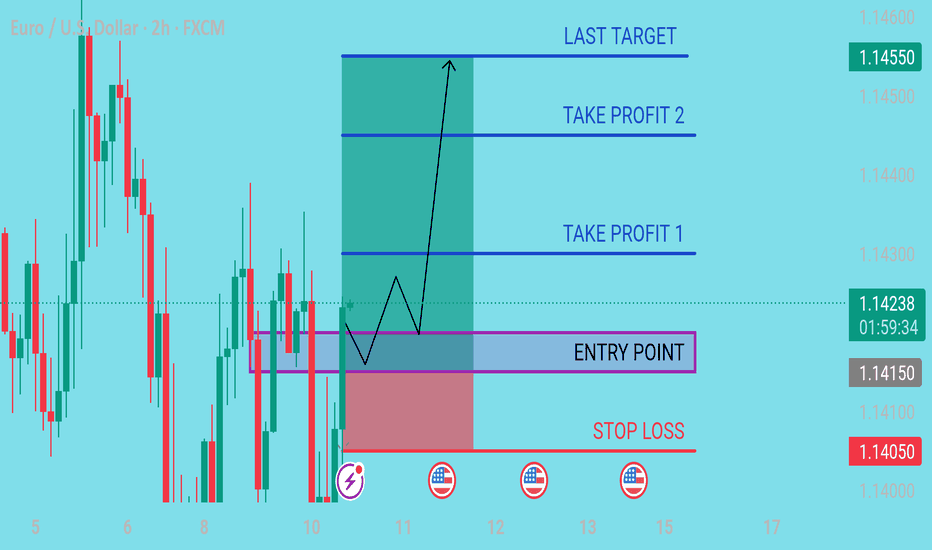

EURUSD shortThe Setup:

1. A-B: Strong impulsive drop on increasing volume → clear evidence of real selling pressure.

2. B-C: Pullback forms on decreasing volume → classic corrective behavior, not buyer aggression.

3. C-D: Entry just below point C as new volume confirms sellers stepping back in.

4. Targeting >3R with stop tucked above C — logical structure, clean invalidation.

✅ Volume confirms the trend

✅ Structure is tight, no randomness

✅ Timing aligns with volatility spike (news at the bottom?)

✅ Clear bearish continuation pattern

what do you think of this a head of cpi?

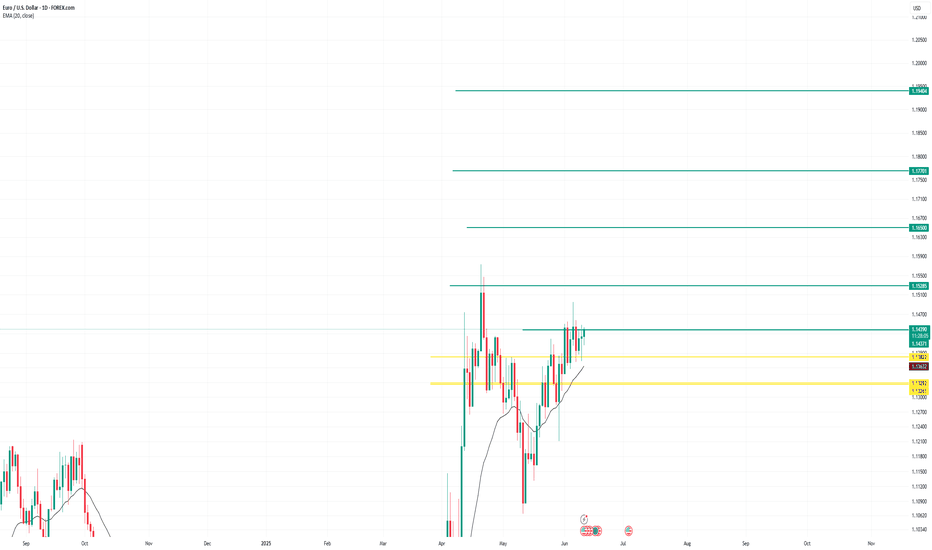

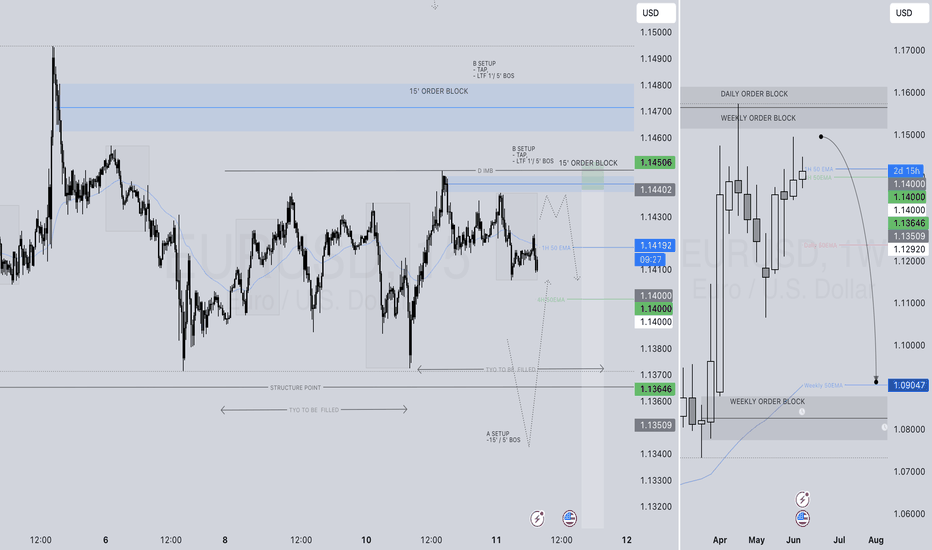

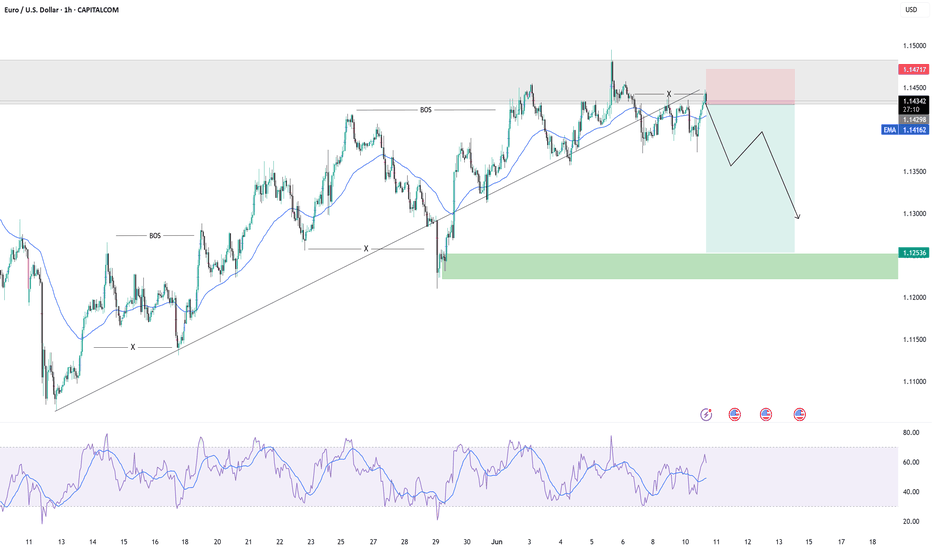

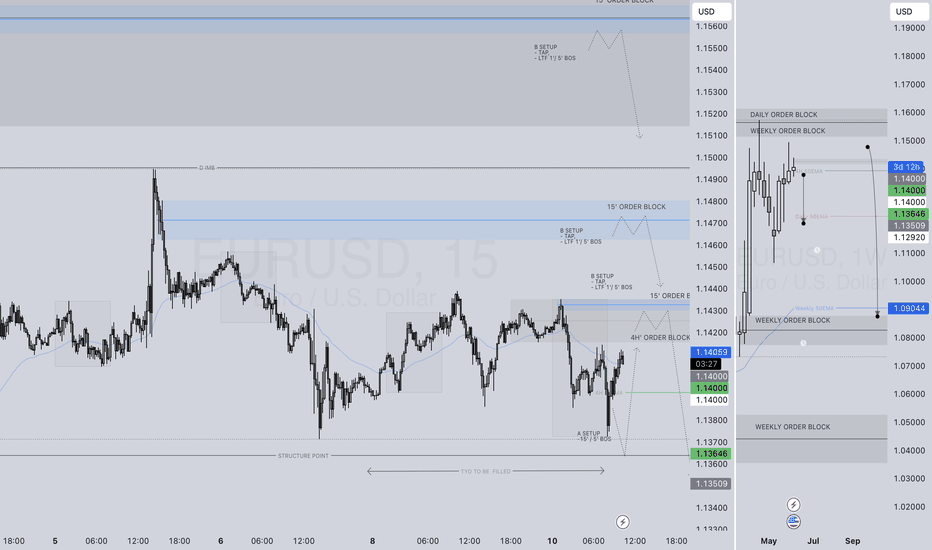

EURUSD SHORT FORECAST Q2 W24 D11 Y25EURUSD SHORT FORECAST Q2 W24 D11 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block

✅15' order block

✅4 hour order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

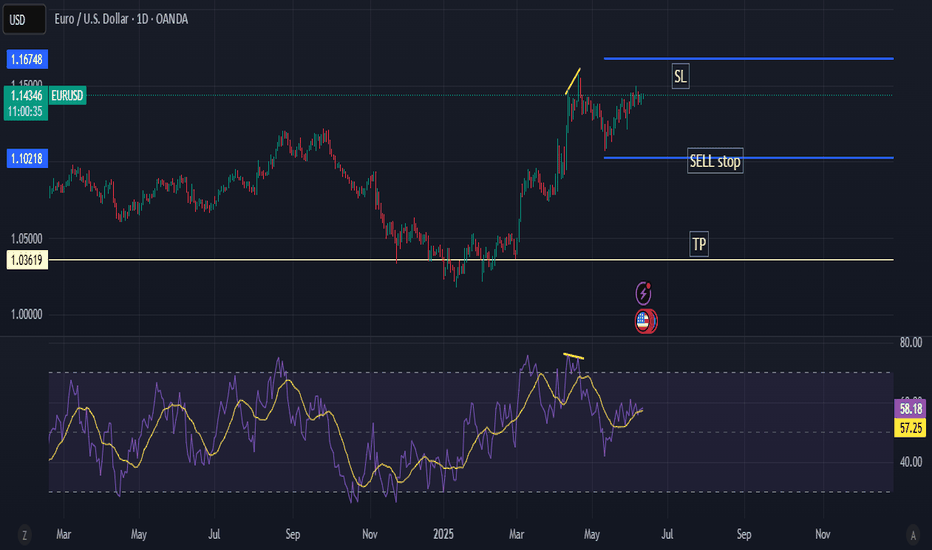

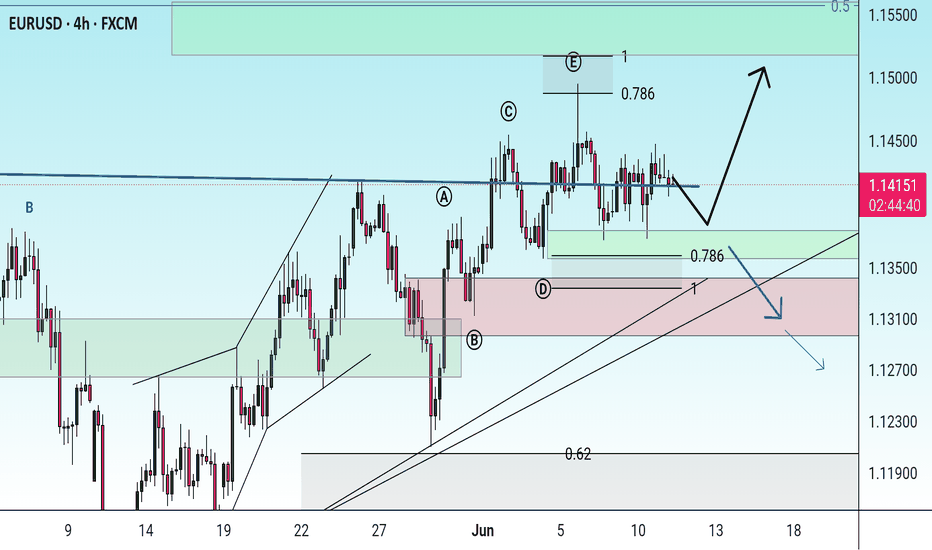

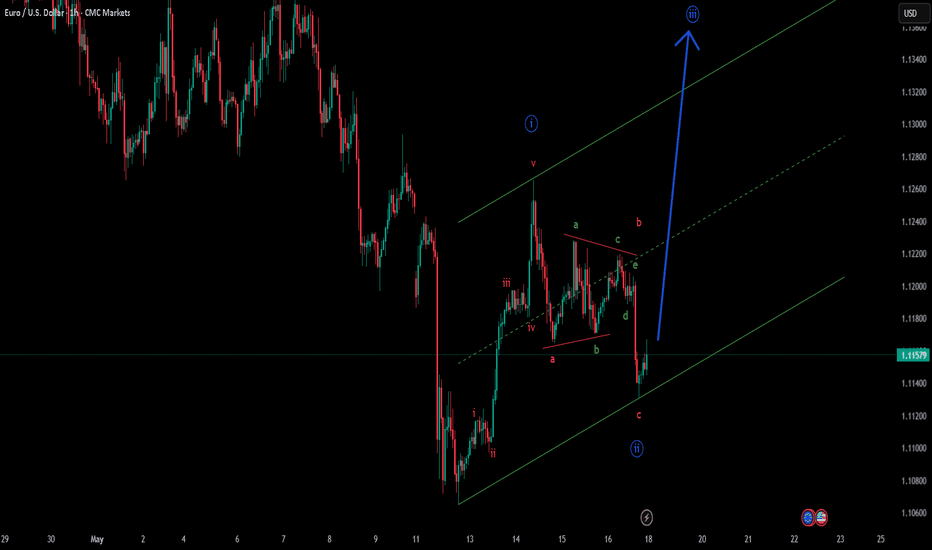

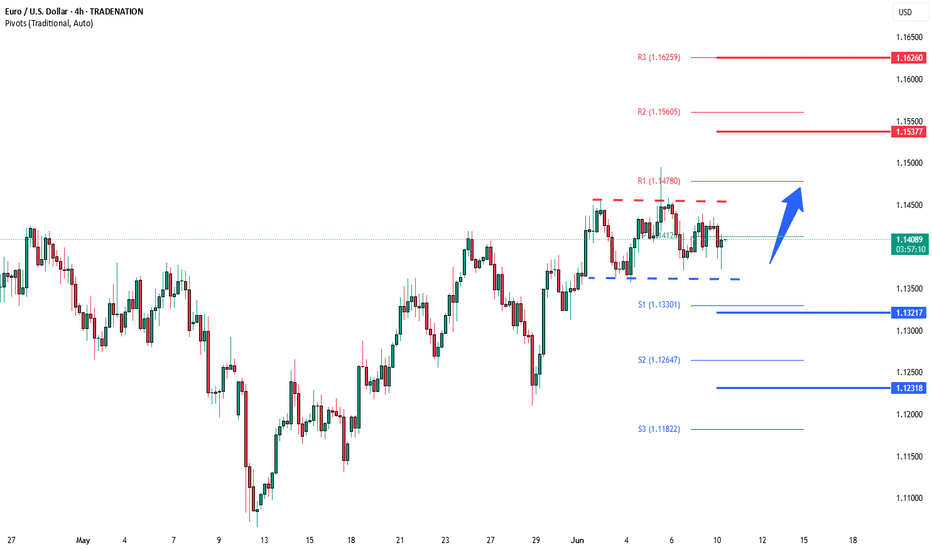

Possibility of uptrend It is expected that after some fluctuations and corrections within the current range, the continuation of the upward trend will take place. Confirmation of the upward trend will be the consolidation of the price above the resistance range. Otherwise, the continuation of the downward trend to the specified support ranges will be possible.

EURUSD SHORTDollar strength this week and month looks promising we have had some good meetings with China this week and there’s a lot of optimism around the dollar . However there’s a many stop losses above as we have many sell positions so i belive we will see a rally up and a big rejection and this trade could happen quickly .

We already had a successful setup with this thought process yesterday and i caught a long and a short however the real moves should kick in today .

EURUSD SHORTFrom April 7th to June 2nd 2025, the market have been rejected at the monthly S/R/PP aera many times and now sells have step into the mkt and they are pushing the mkt to the down side. On the daily time frame at the monthly support resistance piovt point aera the mkt form an INSIDE BAR CANDLESTICK PATTERN that shows that there is a consolidation going on on the 1h TF, so at this point the mkt is telling me that is time to go down 👇. My own thought

EUR/USDTRADE 5 again eu has hit a level and i believe it to go short, this doesnt mean jump into the trade im just looking at where price could go. i belive it to be a good move and we can start to catch these small moves and make profit from them but for now we will just keep are eye on the supply and demand box and see what happends with it

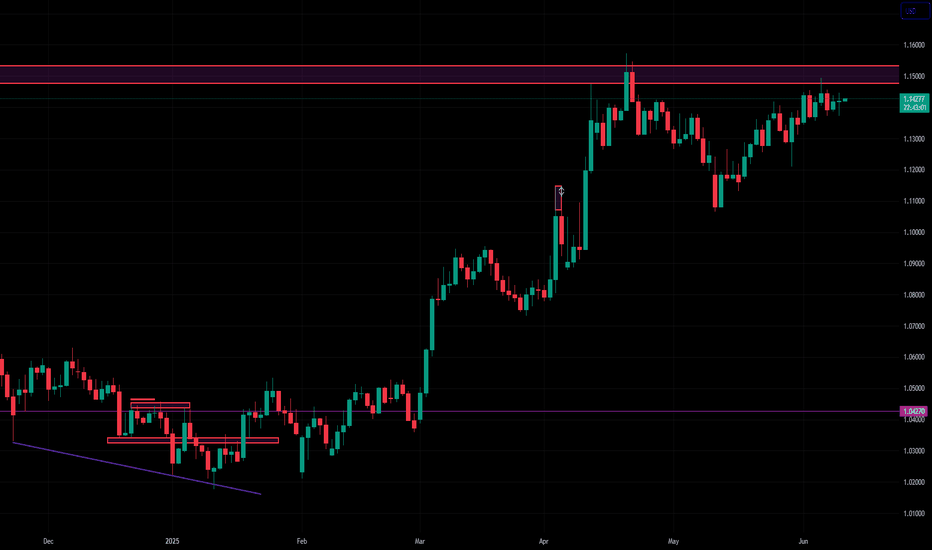

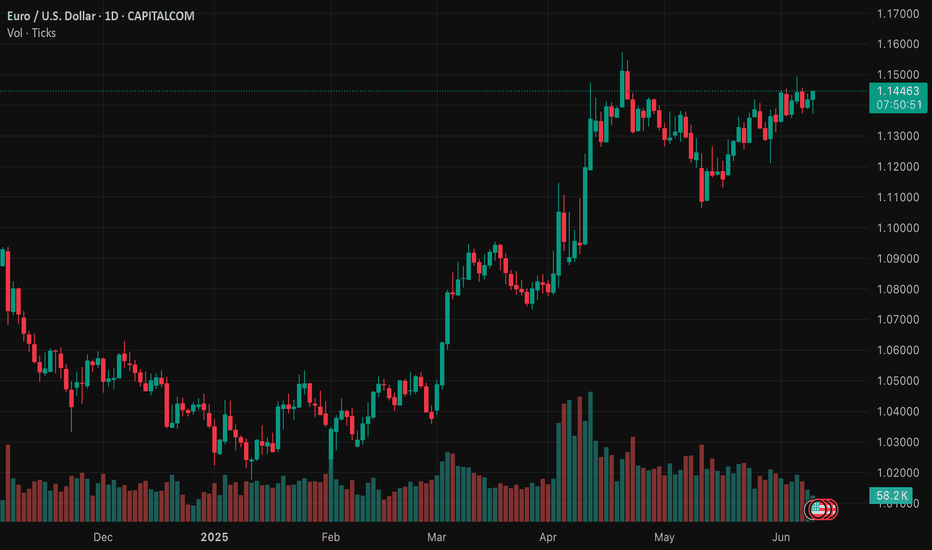

EURUSD Volatility EURUSD: April saw notably elevated volatility. MUFG Research reports the euro surged from 1.0811 to 1.1325 in April, a sharp 2.9% monthly gain, the most significant since early-COVID volatility.

NewbridgeFX describes April as “a month marked by heightened global market uncertainty”, with EUR/USD experiencing considerable swings amid trade tensions, inflation data, and central-bank decisions.

DailyForex highlighted volatility spikes in early April, with sharp moves around tariff announcements and inflation reports

Was April the Most Volatile Month of 2025?

April ranks among the most volatile, if not the top, due to:

Trump's April 2 “Liberation Day” tariffs, triggering global market turbulence.

ECB rate cut and euro strength, adding fuel to price swings

May also remained volatile, but analysis like MUFG and DailyForex suggests volatility slightly subsided compared to April.

📊 Conclusion

April 2025 likely stands as the most volatile month for EUR/USD this year, primarily driven by trade-policy shocks and central bank actions. It appears to edge out volatility in May, making it the standout month.

Market research conducted by Ilyas Khan with assistance from #ChatGPT by #OpenAI.

#eurusd #forex #eur #usd #economics #science #math #mathematics #economy #usa #unitedstatesofamerica #europe #bloomberg #ctv #cnbc #marketnews #market #marketresearch

#AN005 What Changes After USA-China, ECB and Oil

Hello, I'm Andrea Russo, forex trader and creator of the SwipeUP Elite FX Method, which analyzes the market as a Hedge Found. Today I want to talk to you about the latest crucial economic news of the week that will influence the currency markets.

Let's start with the important trade meeting between the United States and China that took place in London. The negotiations, mainly focused on exports and rare earth metals, showed positive signs with optimistic statements from both sides. This event immediately brought an improvement in global sentiment, strengthening trade-sensitive currencies such as the Australian dollar (AUD) and the New Zealand dollar (NZD), while the US dollar recorded a slight decline.

The World Bank, on the other hand, tagged its 2025 global growth forecast from 2.8% to 2.3%. This downgrade reflects significant concerns for the United States, China and Europe, due to trade uncertainties and reduced investments. This scenario, however, could favor some emerging currencies, such as the Brazilian real (BRL) and the Mexican peso (MXN), which benefit from less restrictive monetary policies and a reduction in pressure on the US dollar.

Looking at Europe, the European Central Bank (ECB) has decided to further reduce rates, bringing them to 2%, with the possibility of further decreases of up to -0.25% by the autumn. This expansionary policy is dictated by the need to support a stagnant economy and contain inflation. Inevitably, this will put pressure on the euro (EUR), which is expected to weaken against major currencies, especially the dollar.

In the United States, on the other hand, all eyes are on the May CPI due on June 11. Inflation is expected to be 2.5%, and the publication of data that is above or below expectations could generate strong volatility on the dollar. A higher CPI would strengthen the dollar, reducing the likelihood of a rate cut by the Federal Reserve, while a lower reading could further weaken the greenback.

Finally, oil has also rallied, with WTI up 6% and Brent up 4%. This increase has been driven by a more favorable geopolitical context and the reduction of trade tensions. The effect on currency markets is direct, favoring commodity-related currencies, such as the Canadian dollar (CAD) and the Norwegian krone (NOK), while currencies such as the euro (EUR) and the Japanese yen (JPY), of oil-importing countries, could find themselves in difficulty.

In summary, the current week is proving to be crucial for Forex: declining trade tensions are supporting trade-related currencies, the ECB's accommodative monetary policy is weakening the euro, while US economic data will drive sentiment on the dollar.

To stay updated on future developments, continue to follow my analyses and articles here on TradingView.

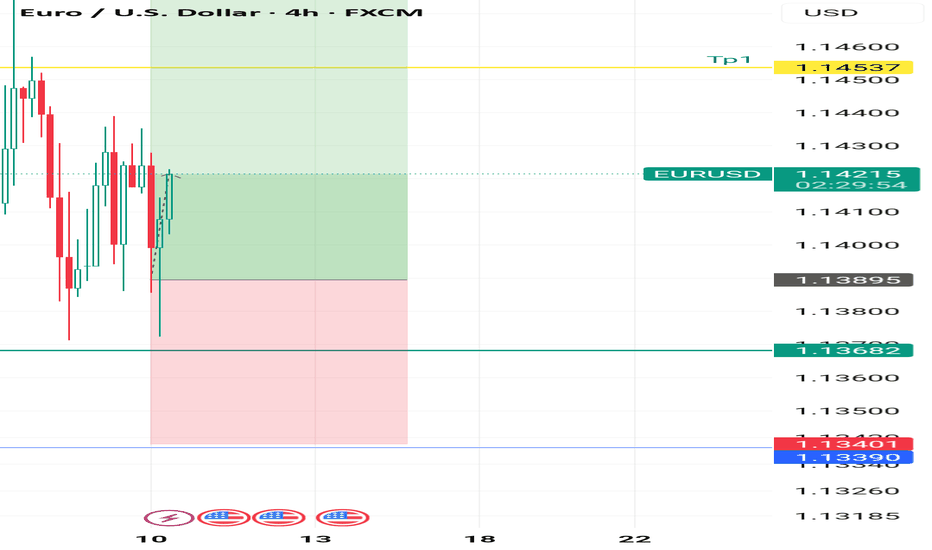

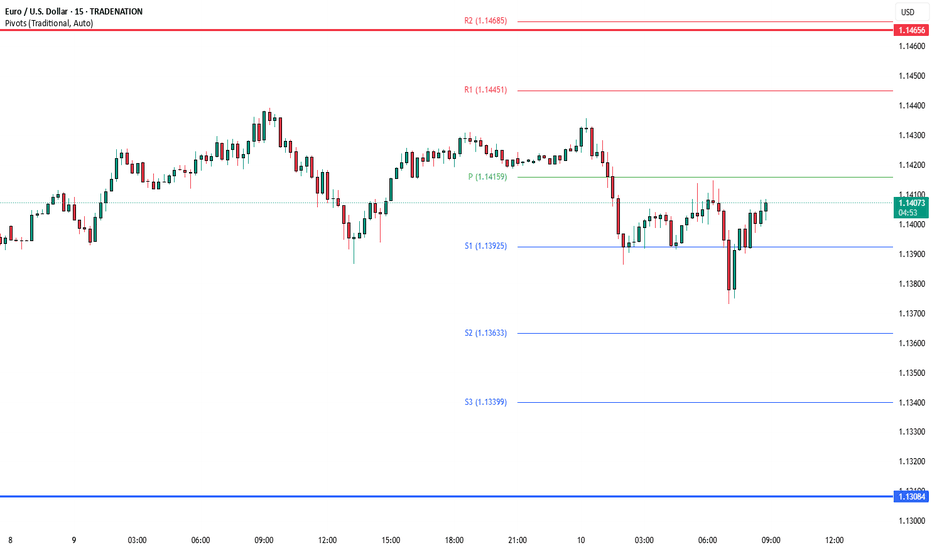

EURUSD is moving within the 1.13640 - 1.14550 range👀Possible scenario:

The euro (EUR) rose 0.22% against the U.S. dollar on June 9, supported by optimism over diplomatic progress between Washington and Beijing on rare-earth minerals and advanced tech. U.S. officials called the talks fruitful, easing global economic concerns.

The ECB’s recent 25-basis-point rate cut lowered borrowing costs to their lowest since November 2022, but hints that easing may end soon kept the euro steady. With a quiet macro calendar on June 10, traders will watch ECB speeches for clues on future policy.

✅Support and Resistance Levels

Now, the support level is located at 1.13640

Resistance level is located at 1.14550

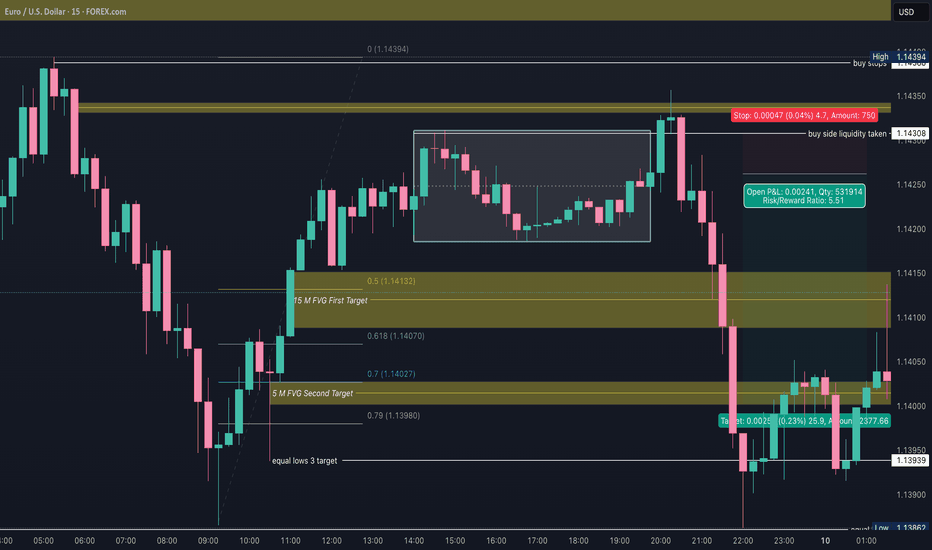

EURUSD Asia Trade Executed June 10EURUSD Trade Executed

June 10

Parent range Premium

Previous session Premium

Suspected Sell off Asia/London

Asia Framework

*Price took equal lows liquidity in NY AM session

*Retraced in NY PM to a session premium

*Consolidated to close NY in a premium

Idea for June 10

*Asia opens to take minor buy side into a FVG- recognizing Asia hunts for minor liquidity before its expansion and with bias identified I am gaining confidence to be patient like today to wait for Price to align to my ideas

*Price bodies tap the CE of the FVG-tippings its hand it will roll over

*Because I was impatient yesterday I waited for 20:00 delivery to play out before reacting

*20:45 small consolidation/minor retracement

*21:05 swing high to CE of 20:35 candle and first presented FVG

*21:06 entry

*Targets speculated that Price was in a session premium with the anticipation to come down to the 50 level-1.14125 level and the FVG targets noted

*21:50 Exit trade second target hit-I actually set the target and got stopped out!

*Employed the Standard Deviation tool that aligned with the 1.14000 price I exited on-pretty cool!

Greed kept me closing the trade and being very happy even though my sentiment was price could reach for equal lows which it did.

For reference I use DXY to frame this trade speculating DXY would run to its buy stops and it did!

Great delivery. Great analysis. So happy with this Asia trade.

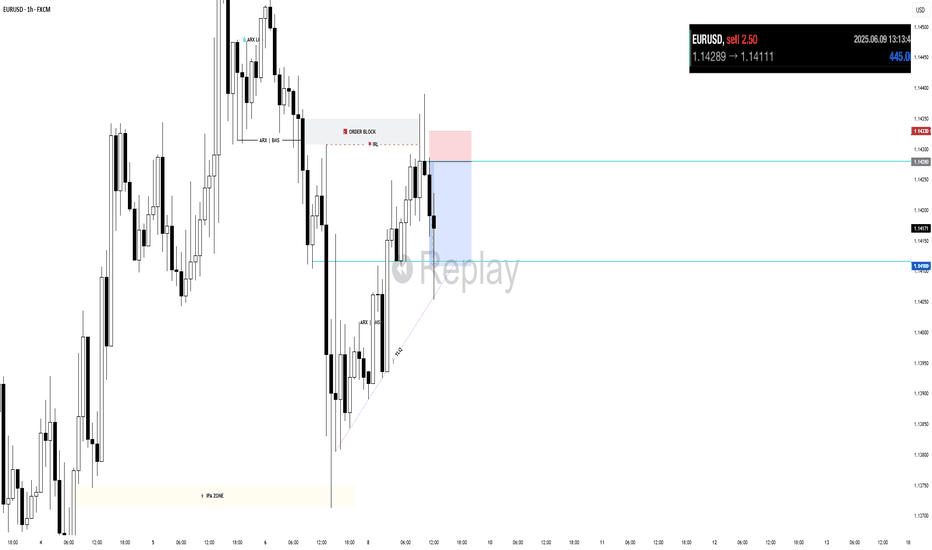

EURUSD | Clean Price Flow Recap Target Hit with ARX StructureQuick breakdown of the recent EURUSD move we analyzed structure held, and price followed through to target.

This video reviews how the setup formed, the confluences behind the entry, and why patience paid off.

🎯 For educational purposes only.

EURUSD SHORT FORECAST Q2 W24 D10 Y25EURUSD SHORT FORECAST Q2 W24 D10 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block

✅15' order block

✅4 hour order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURUSD INTRADAY Bullish continuation pattern developing Trend Overview:

EUR/USD continues to exhibit a bullish price structure, supported by a rising trendline and higher lows. Recent intraday action reflects a corrective pullback, suggesting a temporary pause within the broader uptrend.

Key Technical Levels:

Support: 1.1300 (primary), followed by 1.1235 and 1.1180

Resistance: 1.1430 (initial), then 1.1470 and 1.1500

Technical Outlook:

A pullback toward 1.1300, which coincides with the previous consolidation zone, may present a bullish continuation setup. A confirmed bounce from this level could open the path toward 1.1430, with 1.1470 and 1.1500 as potential longer-term targets.

However, a daily close below 1.1300 would indicate a breakdown of near-term bullish momentum. This scenario would increase the likelihood of a deeper correction toward 1.1235, and possibly 1.1180.

Conclusion:

The outlook for EUR/USD remains constructively bullish, contingent on the 1.1300 support holding. A bounce from this level would reinforce the uptrend. Conversely, a decisive break below 1.1300 would shift the short-term bias to bearish, suggesting further downside toward the 1.1200 area.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

The Day Ahead Market Watch – Tuesday, June 10 (Technical Focus)

Key Data Releases (Potential Volatility Triggers):

US

NFIB Small Business Optimism (May) – Watch for shifts in sentiment that could influence the USD and S&P 500 direction.

3-Year Note Auction – Yields could impact Treasury curve dynamics; monitor for demand strength or weakness.

UK

Average Weekly Earnings (Apr)

Unemployment Rate (Apr)

Jobless Claims Change (May)

These labor data points are pivotal for GBP crosses. Stronger wage data may support GBP/USD, especially near key resistance around 1.2800.

Japan

M2 & M3 Money Supply (May)

Machine Tool Orders (May)

Typically low volatility, but may offer insights for JPY if surprise deviation occurs.

Italy

Industrial Production (Apr) – Weakness could pressure FTSE MIB if it breaks below short-term support near 34,000.

Sweden

GDP Indicator (Apr) – May impact SEK, especially against EUR if growth deviates significantly.

Norway & Denmark

CPI (May) – Inflation data could move NOK and DKK, especially if it challenges central bank guidance.

Central Bank Speakers (Volatility Risk):

ECB: Villeroy, Holzmann, Rehn

Hawkish or dovish signals may drive short-term EUR/USD moves; key resistance to watch: 1.0900. Watch German bund yields for confirmation.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.