Market next move 🔍 Disruptive Counter-Analysis

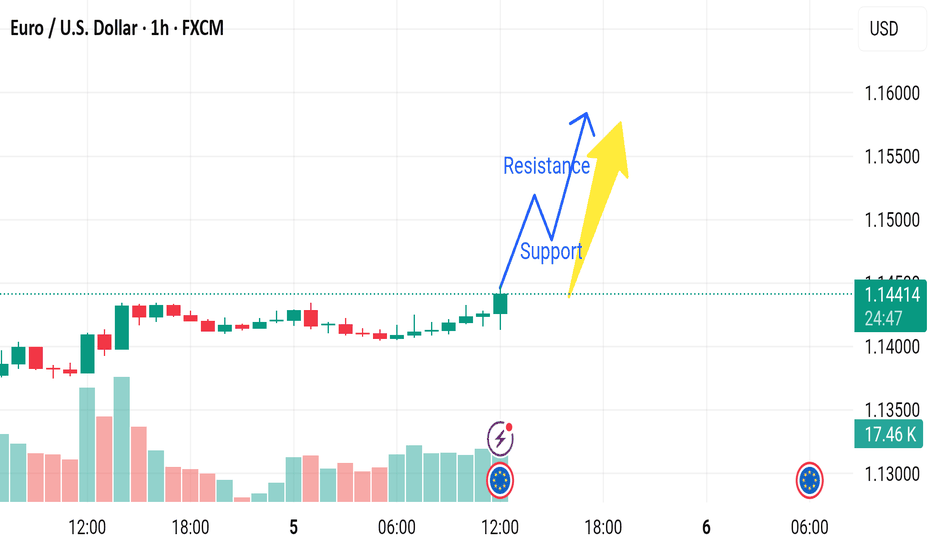

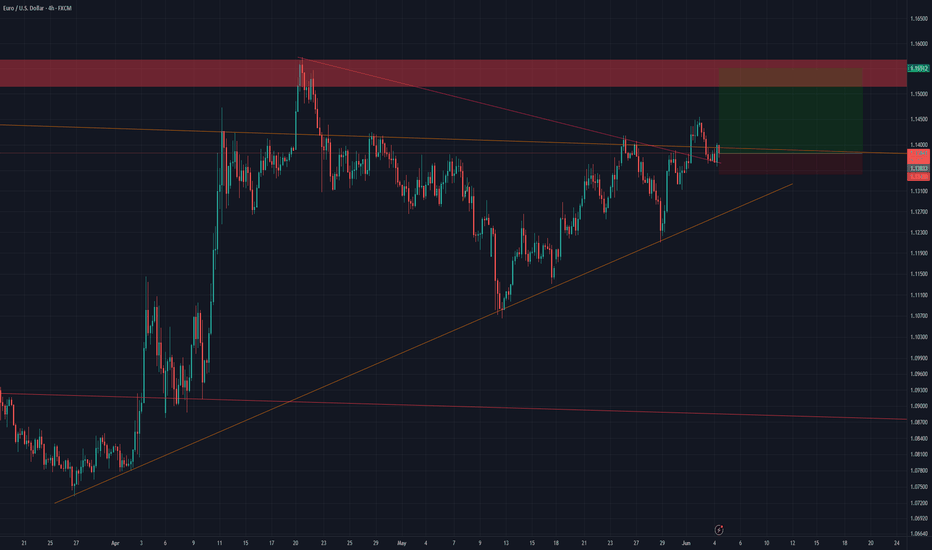

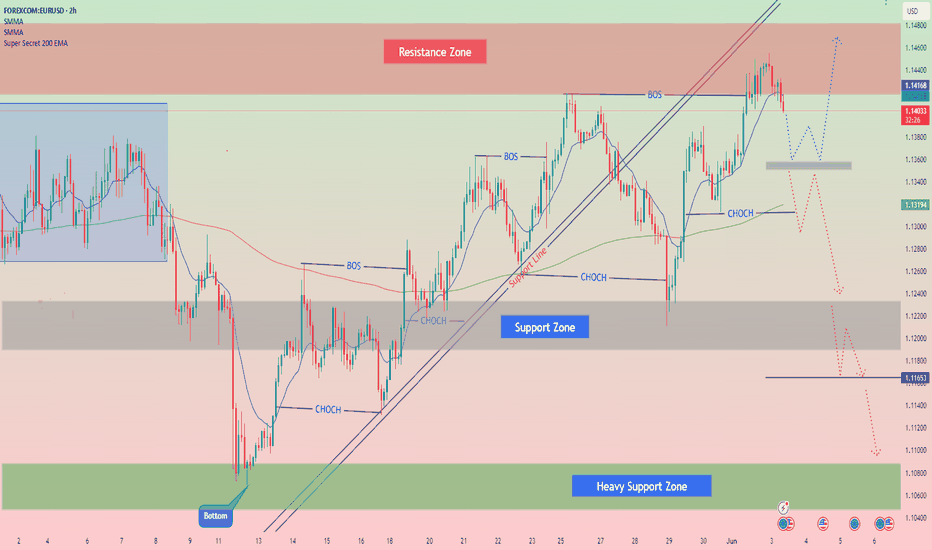

1. False Breakout Risk

The current breakout could be a bull trap. Price may break above the resistance level temporarily before reversing sharply.

Volume Analysis: The volume isn't significantly higher at the breakout candle, which may suggest a lack of strong momentum or institutional participation.

2. Resistance Zone Ahead

The 1.14500 to 1.15000 range is historically a supply zone, where sellers may aggressively enter the market.

This makes any upside move vulnerable to a reversal near that zone.

3. Macroeconomic Risk

A red-circled economic event icon appears on the chart (likely an ECB or Fed-related release). This adds uncertainty—news can invalidate technical patterns.

If the event is bearish for the euro (e.g., weak data or dovish ECB comments), the pair could reverse sharply.

4. Overbought Short-Term

A series of green candles without significant pullback suggests short-term overbought conditions.

RSI or other momentum indicators (not shown here) may confirm this. A correction to the previous base is possible.

USDEUX trade ideas

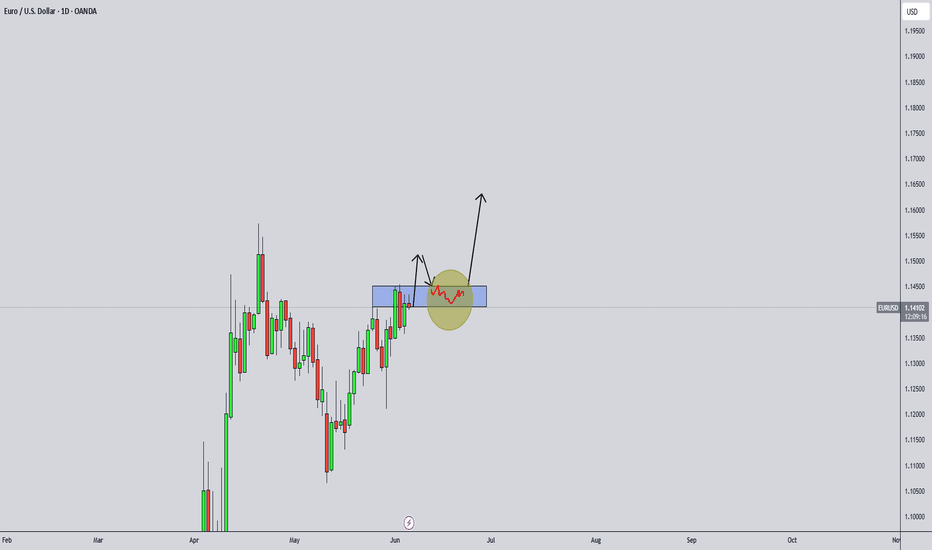

EURUSD BUY IN NOTICE. I just went live with you all, entering a buy position in EURUSD during an important news release. Actually, it was two buy entries, and I managed them really well.

In the first entry, we reached a 1.3% gain, although I couldn’t close it completely. In the second entry, the price hit exactly the point I mentioned it would likely reach during the news event. I’m managing both entries carefully, and at this moment, I already have a significant percentage in profit.

This is how live trading works — with discipline, management, and solid analysis!

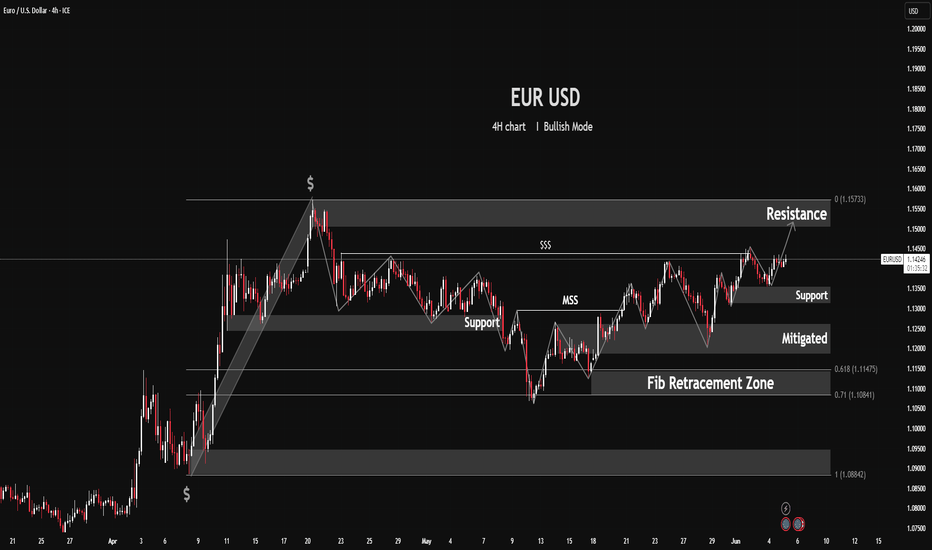

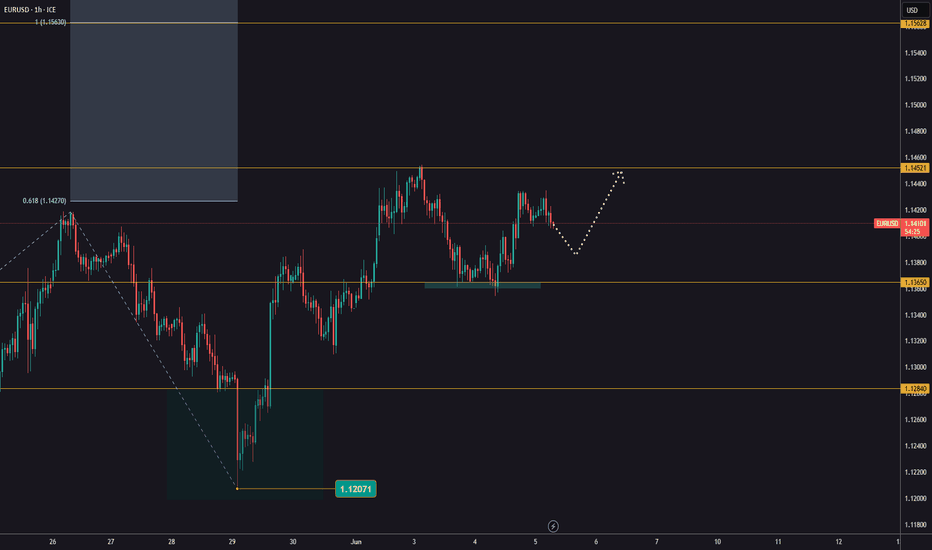

EUR/USD 4H: Bullish Mode - Structure & Key LevelsMarket Context & Structure:

Price initiated a strong bullish impulse from the low at 1.08856 and peaking at 1.15733.

Following this, a corrective phase occurred. The 'MSS' (Market Structure Shift) indicates a return to bullish momentum, breaking the internal bearish structure of the pullback.

Key Levels:

• Resistance (1.15733): The previous swing high and a significant supply zone. The $' above it suggests liquidity targets.

• Support (around 1.1350): The immediate demand zone where buyers are currently active.

• Mitigated Zone (around 1.1250): A previously tested and "filled" demand level, offering potential strong support if retested.

• Fib Retracement Zone (0.618 at 1.11475 to 0.71 at 1.10841): This "sweet spot" for healthy retracements was successfully respected, initiating the current rally. It represents deep, yet still healthy, demand.

Current Outlook:

EUR/USD is clearly in a bullish posture. Price has established higher lows post-MSS and is currently finding support.

Potential Scenario:

We anticipate price to continue its ascent, targeting the primary 'Resistance' zone at 1.15733. A decisive break here would confirm strong bullish continuation.

Invalidation:

The bullish bias would be questioned on a sustained break below the immediate 'Support' zone and fully invalidated with a clear break below the 'Fib Retracement Zone' (below 1.10841).

________________________________________

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

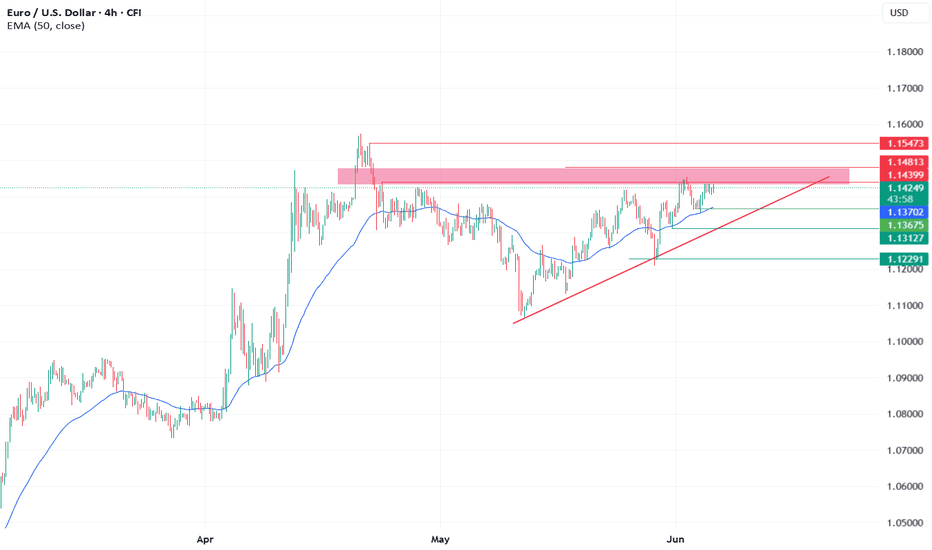

EUR/USD TECHNICALS INTACT AS ECB AND U.S. DATA SET STAGE FOR VOLWith just minutes to go before the European Central Bank (ECB) announces its highly anticipated rate decision, market participants are maintaining a cautious stance. The EUR/USD pair remains relatively calm, reflecting a wait-and-see approach ahead of the official release.

According to broad market consensus, the ECB is expected to implement a 25-basis point rate cut. This move would bring the key deposit rate down to 2.00% and 2.15% main refinancing rate, in response to the eurozone's recent disinflation trend.

Following the rate announcement, ECB President Christine Lagarde is scheduled to hold a press conference, during which she is expected to provide detailed insights into the reasons behind the committee’s decision. Investors and analysts alike will closely scrutinize her statement for forward guidance particularly any indication of whether today’s cut is a one-off adjustment or part of a broader easing strategy going into the second half of 2025.

On the other hand, U.S job report would be on the wire tomorrow by 4:30PM GMT +4, this data point also has the tendency to cause market volatility and as such, traders are advised to pay close attention.

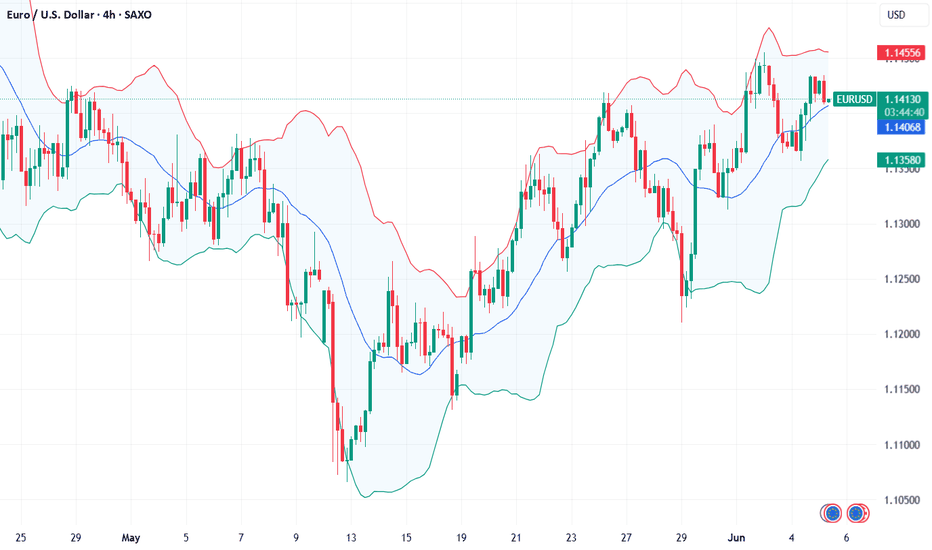

The pair has been trending upward on the 4-hour timeframe, forming a series of higher highs and higher lows while consistently respecting its ascending trendline and above EMA 50. Price is currently facing resistance around 1.1439, as traders await the next major catalyst, the ECB rate decision.

LEVELS TO WATCH OUT:

If the bullish momentum continues, a brake above 1.1439 would potentially target 1.1481 and 1.1547 according to analyst. On the flipside, if sellers’ step in and pushes prices down, a break below 1.1411, would potentially target towards 1.1367 which would have served as break of the trendline and then potentially tank to 1.1229 according to analyst. Breakout of these levels are not ruled out.

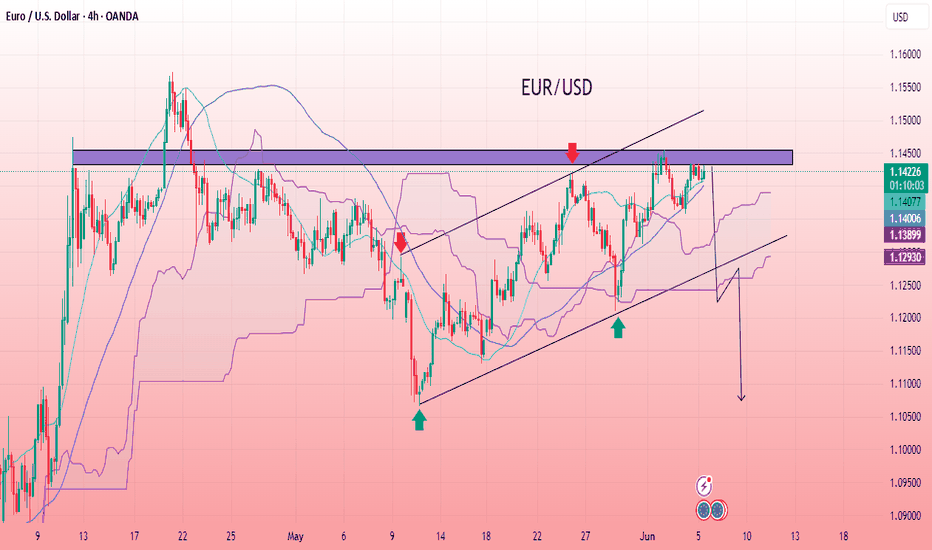

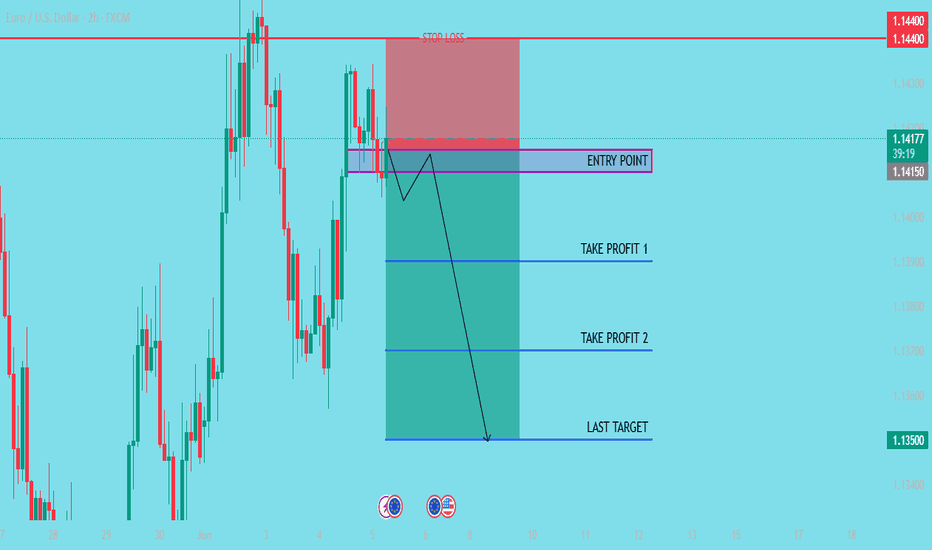

EUR/USD BEARISH SETUPEUR/USD is approaching a major resistance zone within a rising channel, showing signs of exhaustion after multiple failed attempts to break higher. The price action indicates a potential bearish reversal, especially with the presence of long upper wicks and weakening bullish momentum near the upper boundary. The Ichimoku cloud is thinning, and a break below the channel support could trigger a sharp drop. If sellers step in with volume confirmation, a downside move could unfold swiftly. This setup presents a high-probability short opportunity with strong risk-to-reward potential, ideal for trend reversal traders watching for structure breaks.

Entry: 1.14250

Target 1: 1.12230

Target 2: 1.10730

If you found this analysis helpful, don’t forget to drop a like and comment . Your support keeps quality ideas flowing—let’s grow and win together! 💪📈

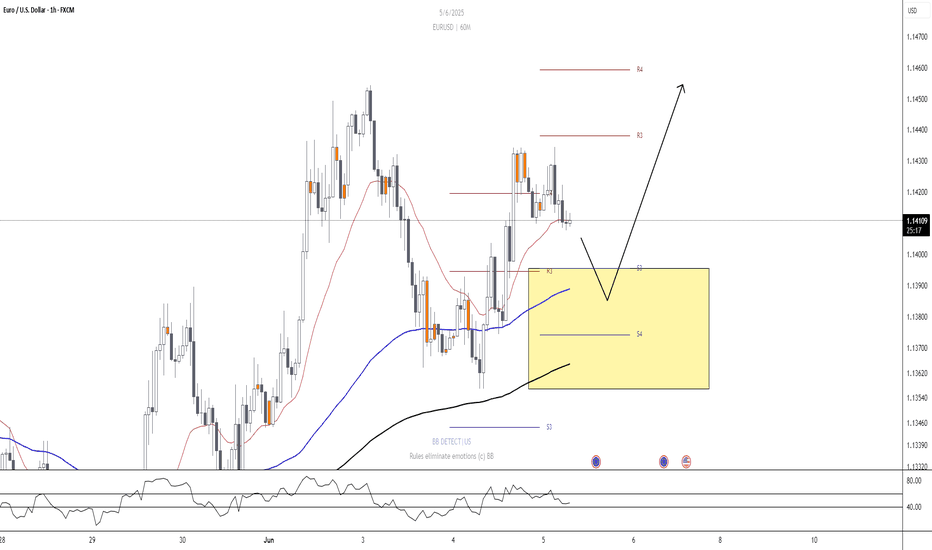

Mr. Wave Says... It’s Time for the Last Push!”[ b] EUR/USD is forming a clean Elliott Wave structure — and guess what?

We’re at Wave 4 consolidation, and Wave 5 is about to explode upward!

🔍 Here's what we're seeing:

✅ Wave 1 to 3 already confirmed with solid impulse

✅ Wave 4 found support near previous breakout zone

🎯 Target: Upper supply zone where Wave 5 is likely to terminate

🔔 This isn’t the time to sleep on the charts. Mr. Wave is literally pointing to the target zone — and we’re not ignoring it. 😉

---

🧠 Pro tip:

Use tight risk management, ride the final push of the motive wave, and watch for reversal signals in the supply zone.

---

📌 #GreenFireForex #ElliottWave #Wave5 #ForexTrading #TechnicalAnalysis #EURUSDSetup #ForexReel #WaveTheory #SupplyZone #ForexSignal #SmartTrading

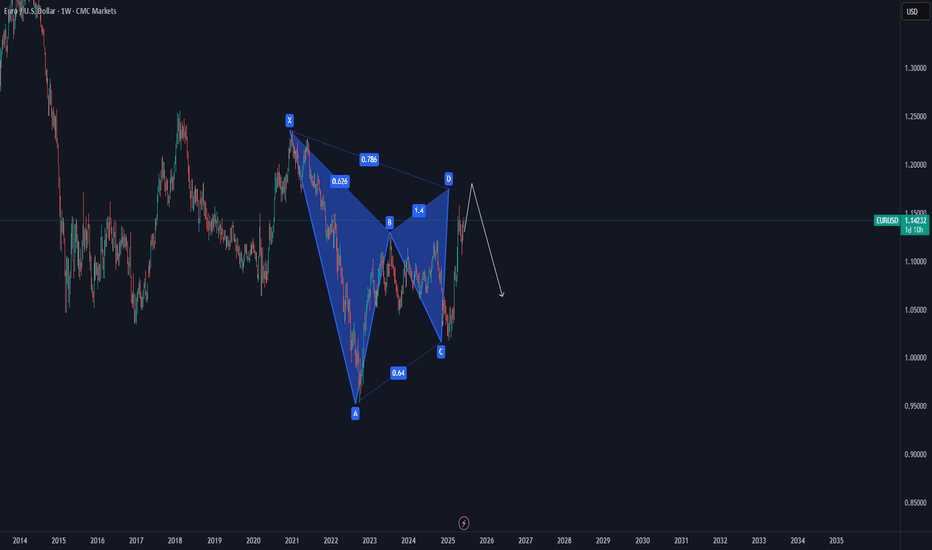

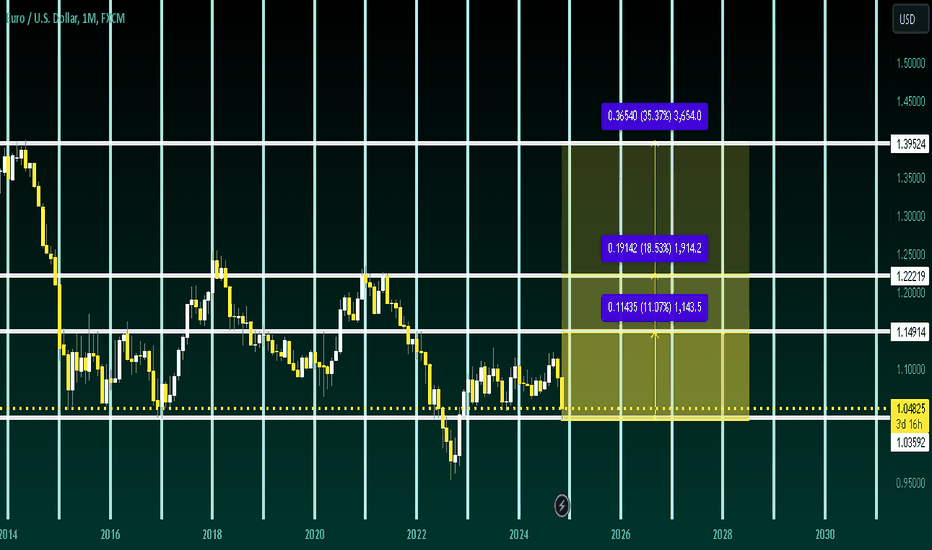

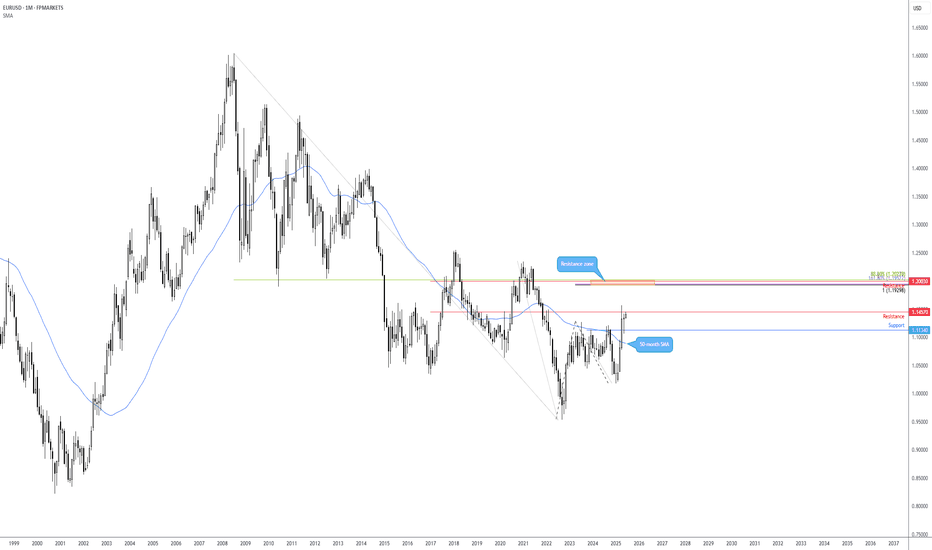

EURUSD FORECAST FY25 TIDES TURNINGi dont usually do forex unless its big yields like this the concerning kind

im bearish on dxy so im going to take the time to call out what i see

i believe the us is in over its head and might jus transition to crypto as their legal tender

to save themselves

global de dollarisation sentiment (geopolitical tensions and sanctions have proven how dollar can be a liability)

national debt cant keep playing jenga with that

inflation might just respike with how they want to print more while cutting interest rates

while still not having dropped it to the 2% target

nations like japan suffered from the covid stimulus nobody will repeat that mistake they will divert their dollar assets into something else like gold not enough tho maybe euros id need to research into their holdings but i wont be suprised if nations dropping dollar instruments its all just strategic for economic resilience looking out for number 1

japan is a loco one they shot rates up 17% from nowhere bro spontaneous

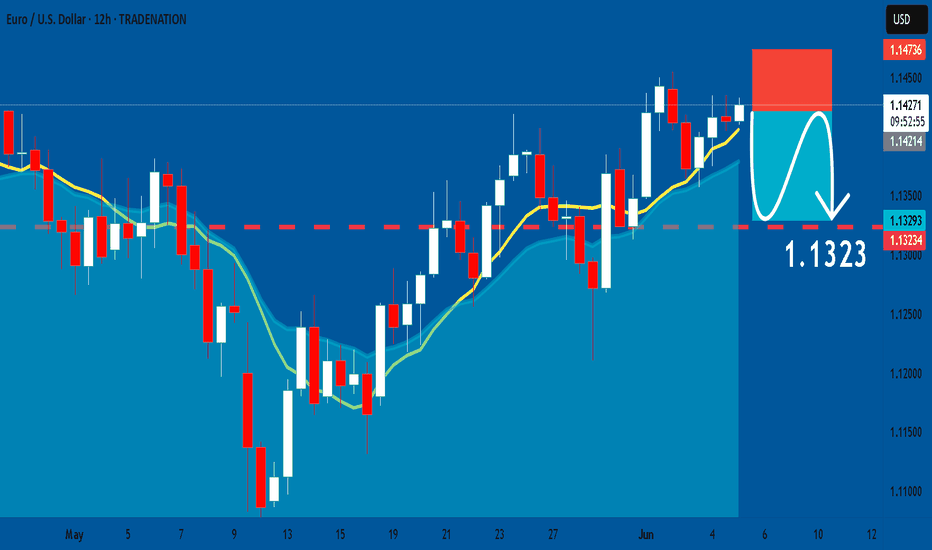

EURUSD: Bearish Continuation & Short Signal

EURUSD

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short EURUSD

Entry - 1.1423

Sl - 1.1473

Tp - 1.1323

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Trading Signals for EUR/USD sell below 1.1432 (21 SMA-6/8 MurrayEUR/USD is trading around 1.1410, below the Murray 6/8 level and within the uptrend channel formed on May 9.

The instrument has an area where buyers have found it easier to take profits around 1.1476. This level could be a barrier for the euro, and from there we could expect a technical correction.

If the bullish force prevails, the euro could reach the top of the uptrend channel around 1.1474 and even the psychological level of 1.1500.

Technically, we observe that the euro is overbought and there could be a technical correction in the coming days, as crucial data from the United States will be released later this week, which could generate strong volatility in the market.

The indicator is showing a negative signal, so if an additional upward movement occurs above the current price, we could consider selling as long as the instrument consolidates below 1.1500.

EURUSD Analysis Today: Technical and Order Flow Analysis !In this video I will be sharing my EURUSD analysis today, by providing my complete technical and order flow analysis, so you can watch it to possibly improve your forex trading skillset. The video is structured in 3 parts, first I will be performing my complete technical analysis, then I will be moving to the COT data analysis, so how the big payers in market are moving their orders, and to do this I will be using my customized proprietary software and then I will be putting together these two different types of analysis.

ECB rate announcement in focusthe European Central Bank (ECB) will be in focus today at 12:15 pm GMT and is anticipated to reduce rates amid recent CPI inflation (Consumer Price Index) softening by more-than-expected in May to 1.9% at the headline year-on-year (YY) level from 2.2% in April. YY core inflation – a measure that excludes volatile energy, food, alcohol, and tobacco prices – also softened to 2.3% in May from 2.7% in April.

I believe the last thing the ECB wants to do is shock the markets today, so I would be very surprised if they maintained rates at current levels. The decision, however, will be far from unanimous, with divisions among the 26 members who make up the ECB’s decision-making body. Markets expect the central bank to reduce all three benchmark rates by 25 bps, which would lower the deposit facility rate to 2.00% and the refinancing rate to 2.15%. If the ECB proceeds with another rate cut, this would mark the eighth reduction since the central bank commenced its easing cycle in mid-2024.

With a rate cut already baked in, I think the question top of mind among investors is what comes next. The ECB will likely want to signal a pause following today's cut, albeit a ‘dovish pause’. In the ECB’s macroeconomic projections, analysts are also expecting notable downward revisions to inflation and growth. Therefore, it will be interesting to see how they convey this via language in their rate statement and in ECB President Christine Lagarde’s press conference.

However, I find it very unlikely that forward guidance will provide a clear path, and the central bank is likely to remain in a data-dependent mode.

While a dovish cut from the ECB could send the EUR/USD southbound today, I expect it to be short-lived if US employment data comes in lower than expected on Friday.

Despite a temporary push lower potentially unfolding in the pair today, I remain bullish EUR/USD. As shown on the chart, the pair is shaking hands with monthly resistance from US$1.1457. Those who regularly follow my research will know that I am not enthusiastic about this level, given the inability of price to push through monthly support at US$1.1134 in May. Should follow-through buying emerge and US$1.1457 bids are consumed, I will be watching monthly resistance as far north as US$1.2028-US$1.1930.

Written by FP Markets Chief Market Analyst Aaron Hill

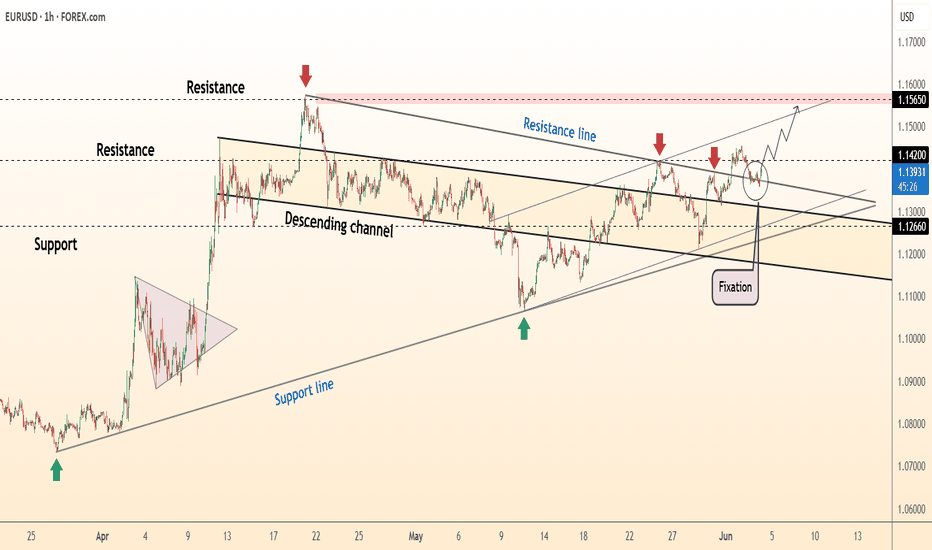

DeGRAM | EURUSD fixed above the resistance line📊 Technical Analysis

● Price has broken the H1 descending-channel roof and twice “fixed” above it at ≈1.137, turning the former ceiling into short-term support.

● The rebound forms an ascending triangle under 1.142; its measured swing targets 1.156 – 1.160, where the violet long-term resistance line and mid-channel parallel converge.

💡 Fundamental Analysis

● Markets expect the ECB to cut only 25 bp on 6 Jun and signal patience, while soft US JOLTS openings and slipping ISM-prices lifted September Fed-cut odds past 60 %, narrowing the 2-yr yield gap and underpinning EUR.

✨ Summary

Buy 1.135-1.137; triangle break >1.142 seeks 1.156 → 1.160. Long view void on an H1 close below 1.126.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURUSD Volatility Alert - ECB Rate Decision/US Non-farm PayrollsEURUSD has experienced a choppy start to the week so far. Initially trading from opening levels around 1.1345 up to a 6-week high of 1.1455 early Tuesday morning, before running into profit taking and then bouncing between these two levels in response to various drivers, including updates on US/China trade discussions, Eurozone inflation, US economy ,and constantly changing interest rate differentials.

Looking forward, there may be potential for this type of price action to continue over the next two trading days, as traders first digest the ECB interest rate decision, which is released at 1315 BST later today, then the comments of ECB President Lagarde in the press conference that commences at 1345 BST.

A 25bps (0.25%) interest rate cut from the ECB is fully anticipated, so is unlikely to cause much of a stir. However, comments from Madame Lagarde in the press conference could lead to volatile EURUSD price action, depending on if she outlines whether policymakers remain open to further cuts, as Eurozone inflation (May CPI 1.9% YoY) moves below the central bank’s 2% target, or if now is the time for a pause to assess the potential impact of US tariffs and future European defence/infrastructure spending.

On Friday, the dollar side of the EURUSD currency pair, could be impacted significantly by the outcome of the latest update on the US labour market in the form of the US Non-farm Payrolls release at 1330 BST.

Data out earlier in the week has so far offered a mixed assessment of the US labour market during the on-going trade tariff uncertainty. However this payrolls update is the one that usually grabs the attention of traders and investors and probably holds more significance.

Their focus is likely to be on the direction of the unemployment rate (currently 4.2%) and average hourly earnings, where any large deviation from market expectations may see EURUSD volatility increase into the weekend, especially if it indicates a weakness in the US economy.

Technical Update:

Today’s ECB announcement, followed by payrolls on Friday, has the potential to be the next important EURUSD sentiment driver, with the reaction to these events possibly offering clues to the next path for price activity.

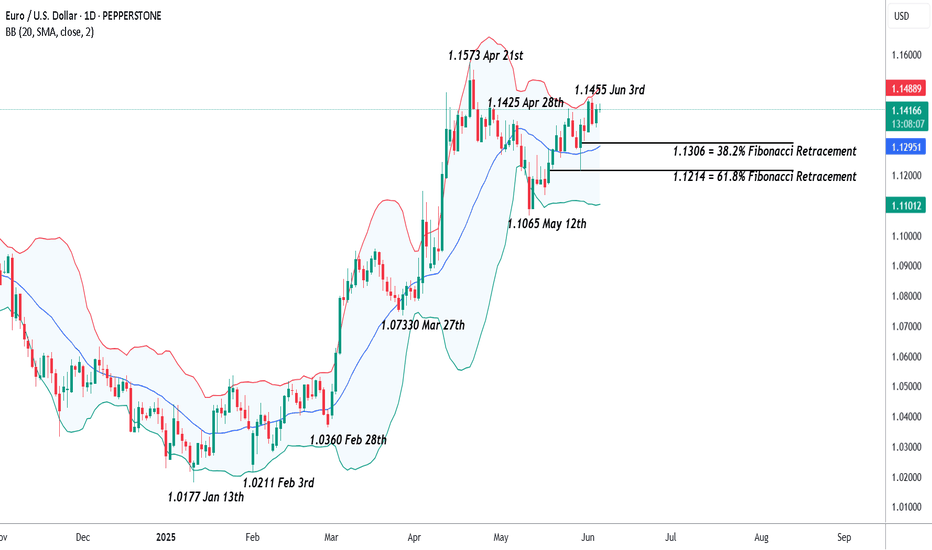

It has already been an impressive recovery in EURUSD since the May 12th session low at 1.1065, a move that has now seen closing breaks above resistance at 1.1425, which is equal to the April 28th last recovery failure high.

However, as we approach the ECB decision and payrolls release, what are the potential support and resistance levels traders may be watching?

Potential Resistance Levels:

Price strength so far this week has been capped by sellers at 1.1455 on June 3rd. As such, this level represents a first possible resistance focus, as having found sellers at this point previously, they may be found again.

While breaks above the 1.1455 high will not guarantee continued price strength, it could open potential for an upside push in price towards the April 21st high 1.1573, possibly further, if this were to give way on a closing basis.

Potential Support Levels:

After a period of price strength, such as that seen since the May 12th low, it is potentially the 38% Fibonacci retracement of the upside move, which in EURUSD stands at 1.1306, that may be viewed as a first support.

As such, if breaks below 1.1306 are seen over coming sessions, it may lead to a deeper decline in price towards 1.1214, which is the 61.8% Fibonacci retracement, possibly further.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

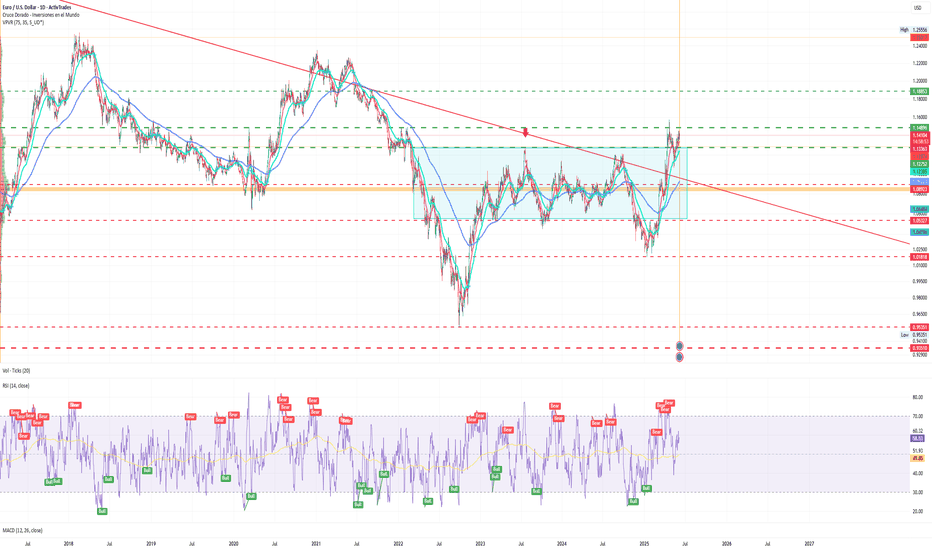

EUR/USD: Options signal more downside for the dollarIon Jauregui - ActivTrades Analyst

After a difficult start of the year for the greenback, the US dollar seems to have slowed its decline... but not for long, if we look at options market activity. Traders are still aggressively bearish, especially against the euro and the yen. According to LSEG data, more than 59% of FX options volume on CME Group (NASDAQ: CME) is in dollar put contracts, reflecting a clear expectation of further depreciation. This pressure is particularly concentrated in EUR/USD, where flows are pointing to a euro rally driven by the expectation of more aggressive rate cuts in the US than in Europe.

Since the beginning of the year, EUR/USD has swung wildly, influenced by rate differentials, macroeconomic data and the Fed's dovish turn. Although the ECB is also poised to cut rates, the market seems to be discounting a deeper and faster cycle in the US, which is weakening the dollar in the medium term.

Technical Analysis

Technically, if the pair manages to consolidate above 1.13366 we could see an advance to the nearby 1.14896 resistance. If this resistance is pierced we could contemplate a free upside move towards 1.18853. If these upside predictions are not fulfilled the pair should look for the mid-range checkpoint at 1.09223, if this area fails to hold we would see a drop to the lower end of the range at 1.053227. The mid-range crosses signal a clear uptrend and the RSI supports the idea of an overbought advance at the current 58.42%.

In short, the options market leaves no room for doubt: investors have not yet closed the bearish chapter for the dollar, and the euro could be one of the major beneficiaries if the selling pressure continues.

"*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

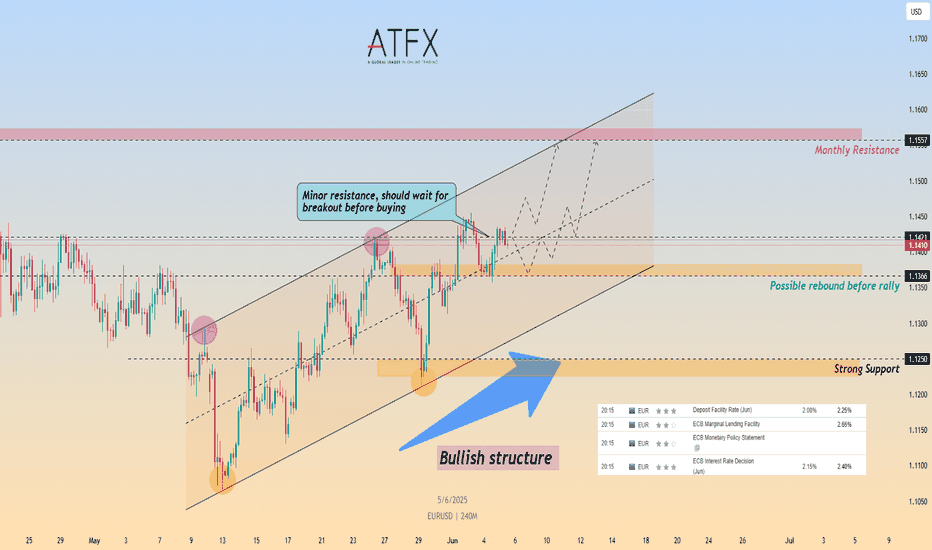

EUR/USD Awaits ECB Decision Near 1.1400 Amid Rate Cut BetsCMCMARKETS:EURUSD FX:EURUSD EUR/USD is consolidating above the 1.1400 psychological level as markets brace for the European Central Bank’s monetary policy announcement. The ECB is widely expected to cut its Deposit Facility Rate by 25bps to 2.00%, marking its seventh consecutive rate cut since June 2024.

Technically, the pair continues to trade within a well-defined ascending channel, reflecting a broader bullish structure. Current price action is facing a minor resistance near 1.1421, which is the top of the short-term range and also a key trendline rejection zone. A clean breakout above this area could expose the monthly resistance near 1.1557.

However, if OANDA:EURUSD EUR/USD fails to breach this level initially, a pullback toward 1.1366 (channel base support) is possible before bulls regain control. The bullish setup remains valid as long as price holds above this support zone.

Traders should monitor the ECB press conference for signals on whether the central bank may pause further easing later this year.

Resistance : 1.1421 , 1.1557

Support : 1.1366 , 1.1250

EURUSD Analysis | Potential Breakdown AheadHello Traders

The pair has been respecting a rising parallel channel after breaking out from a consolidation zone earlier this month.

🔹 Current Price: 1.1409

🔹 Trend: Uptrend within a rising channel

🔹 Key Observation: Price is testing the upper range but showing signs of weakness.

🔍 Technical Breakdown:

Price recently failed to make a new high, showing signs of exhaustion.

A break below the channel support could trigger a sharp move downward.

Two strong support levels are in focus:

1.12308 (short-term target)

1.10812 (major target)

📉 Bearish Scenario:

If we get a confirmed break below the channel, I’ll be looking for short opportunities with the first target at 1.1230, and if momentum continues, down to 1.1080.

⚠ Watch for rejection candles or a strong bearish close below the channel support to confirm the move.

💬 What’s your bias on EUR/USD? Are you trading this potential setup?

#EURUSD #Forex #TechnicalAnalysis #PriceAction #TradingView #ChartAnalysis

EURUSD swing long idea on 1HOn EURUSD we are currently in up trend market on Daily and all time frames bellow. On 1H we can see 3 moving averages that points to upside and give us more probability to price move higher. We need to buy at lowest price. We want first supportive area touch and then on lower time frame wait to price change direction from bear to bull. Have a nice day!

Fundamental Market Analysis for June 5, 2025 EURUSDThe EUR/USD pair is trading cautiously, slightly above the key level of 1.14000 during Thursday's Asian trading session. The major currency pair is expected to remain in a sideways trend as investors await the European Central Bank's (ECB) interest rate decision.

The ECB is almost certain to cut its key lending rates by 25 basis points (bps), bringing the deposit rate and the main refinancing rate to 2% and 2.15%, respectively. This will be the ECB's seventh consecutive interest rate cut and the eighth since June last year, when it began its cycle of monetary expansion.

Traders are increasingly confident of a seventh consecutive ECB interest rate cut as deflationary trends persist in the eurozone. Preliminary data from the eurozone's harmonized index of consumer prices (HICP) released on Tuesday showed that inflationary pressure fell below the central bank's 2% target.

With the Fed widely expected to cut interest rates, investors will be watching ECB President Christine Lagarde's press conference closely for clues on likely monetary policy in the second half of the year. Market participants would also like to hear about the progress of trade negotiations with the US.

Meanwhile, the US dollar (USD) is struggling to stay near a six-week low as weak US data has reignited stagflation risks. The ISM Services PMI unexpectedly declined in May, while its components showed that production costs continue to rise rapidly. ADP employment change data, which reflects labor demand in the private sector, showed that 37,000 new jobs were created in May, the lowest figure since February 2021.

Trading recommendation: SELL 1.14100, SL 1.14400, TP 1.13600

EURUSD ahead of the ECBYesterday, EURUSD bounced off the support zone and moved toward the previous high.

Today, the ECB will announce its interest rate decision.

The news is scheduled for 1:15 pm (London), followed by a press conference 30 minutes later.

Expect potentially sharp and misleading price movements — reduce your risk and avoid rushing into new positions!

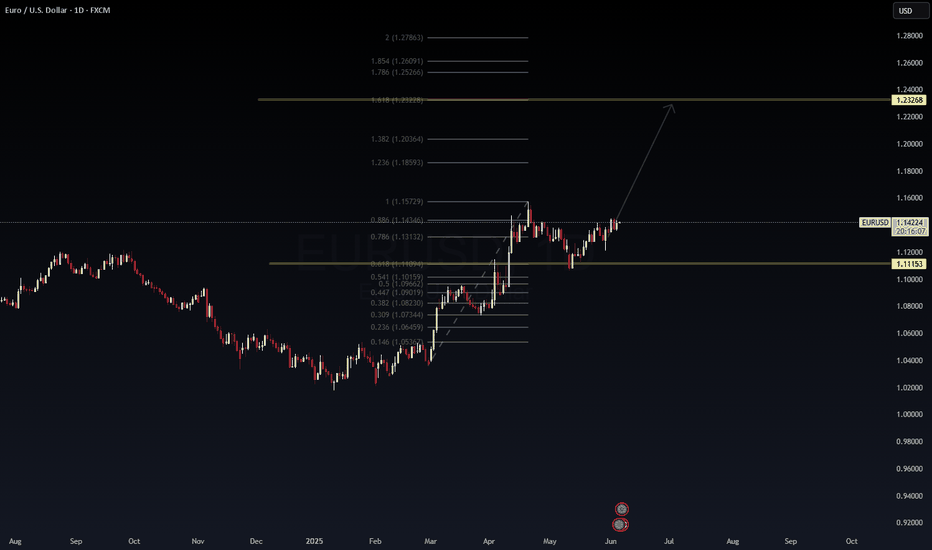

EUR/USD – The Setup Has Spoken.Price is pressing against the 0.886 retracement with strength, and all eyes are now on the 1.23268 – 1.24000 Fibonacci extension zone.

We’re not just charting – we’re challenging.

This is a technical battlefield and we dare any trader to play the same game.

If you're still short, you better know something the rest of us don't.

If you're long – load it right and manage risk. 🫡

📍 Key Levels:

Support: 1.11153

Next Major Target: 1.23268

Bullish Confirmation: Daily close above 1.15729

Let’s see who survives the Fibonacci wave.

Call your strategy – but don't say you weren’t warned.

#EURUSD #ForexTrading #Fibonacci #SmartMoney #WaverVanir #DareToTrade #PriceAction #LiquidityGrab