USDHUF trade ideas

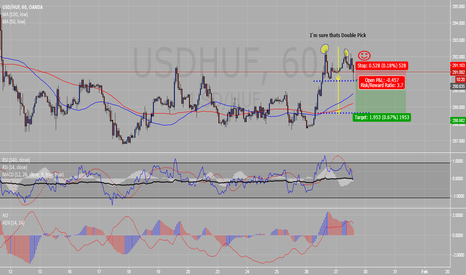

How to catch a local top?Daily:

- Bullish Ichimoku with supportat 281,75. Price move is too sharp, price is far above Kijun Sen and Senkou B! (bit overbought)

- Price reached strong resistance zone at 290+

- Heikin-Ashi candle is bullish, but haDelta and DMO has warning signals: cross down after an extreme high print. This is initial signal of momentum loss. Market should start consolidation / pull back within few days.

- EWO and MACD are bullish

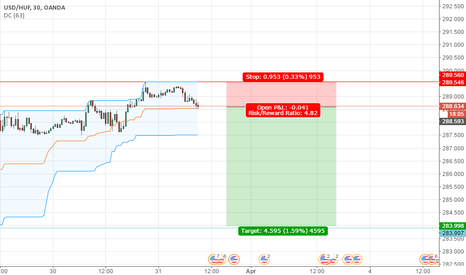

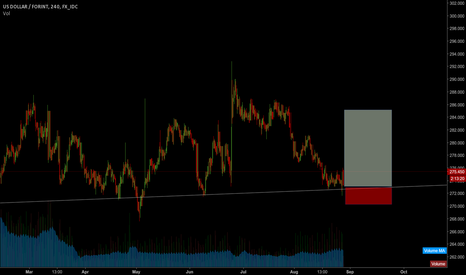

4H:

- Bullish Ichimoku

- Heikin-Ashi signals is more bullish, but DMO is building negative divergence

- EWO is bullish, but decreasing: negative divergence

- A possible bearish wedge: if price can't make a higher high today, then divergences will put pressure on market, and a break below Tenkan and the wedge (289-289,50) can accelerate profit taking down to 283-285 area.

For now profit taking on longs is highly recommended!

Also watch for a swing short -> key level is 289,50

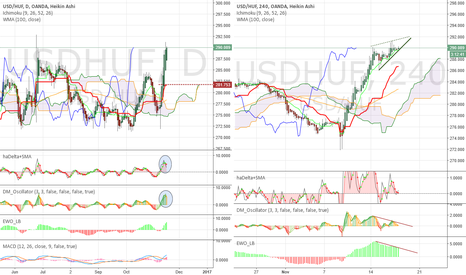

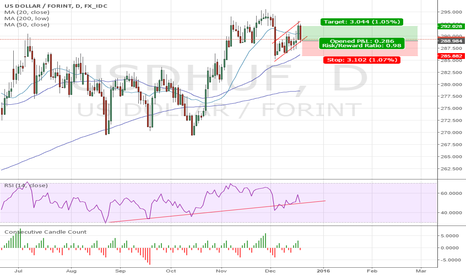

Room to fall - Sell signalWhile Hungarian Central Bank tries to deploy all tools to prevent serious drop in EURHUF (HUF appreciation), the USDHUF is something they can not control. As both FED FOMC meeting, NBH meeting and Hungary's upgrade to investment grade by Standard and Poors is all behind us, it is time to examine the USDHUF chart.

Weekly:

- Ichimoku setup has strbthenning bearish bias: Price is below Kijun and Kumo, Tenkan/Kijun is meadium bearish, however Chikou Span is still at past candles. Chikou/past Kumo relation will be very important to follow in this case, as that reflects possible resistances ahead (first serious resistance will come around 268-270)

- Heikin-Ashi has been indecisive for last four weeks, but if you look at haOscillator, you can see it is possibly rolling over to bearish again below its zero line.

- EWO and MACD are bearish

- Price pattern looks like a bear flag. It's longer term measured target points to as low as 250 (!). Maybe it is hard to immagine now, but long term trends take long time to develop... that's why we call it long term :-D

Note: the purpe measure arrow doesn't mean I expect to reach 250 straight down by december 2016. It just shows the the possible distance to the measured target

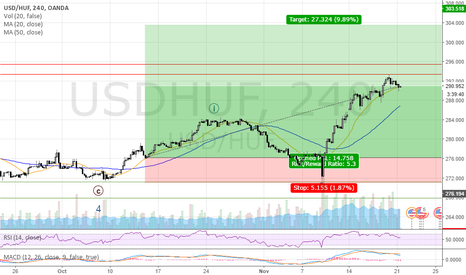

Daily:

- Bearish Ichimoku setup. Kijun Sen has been holding nicely. There were spikes above occasionally, but price always dropped back and closed below Kijun quickly.

- Heikin-Ashi gives a very clear sell signal now! haOscillator to confirm later.

- EWO is bearish

Real bearish acceleration can happen below 272. A quick move to 269-270 first target is possible, there we'll see.