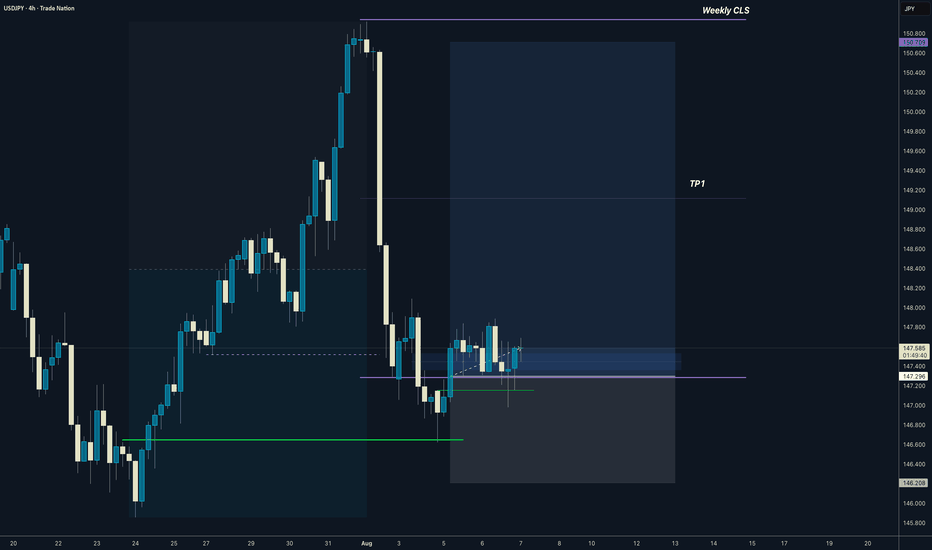

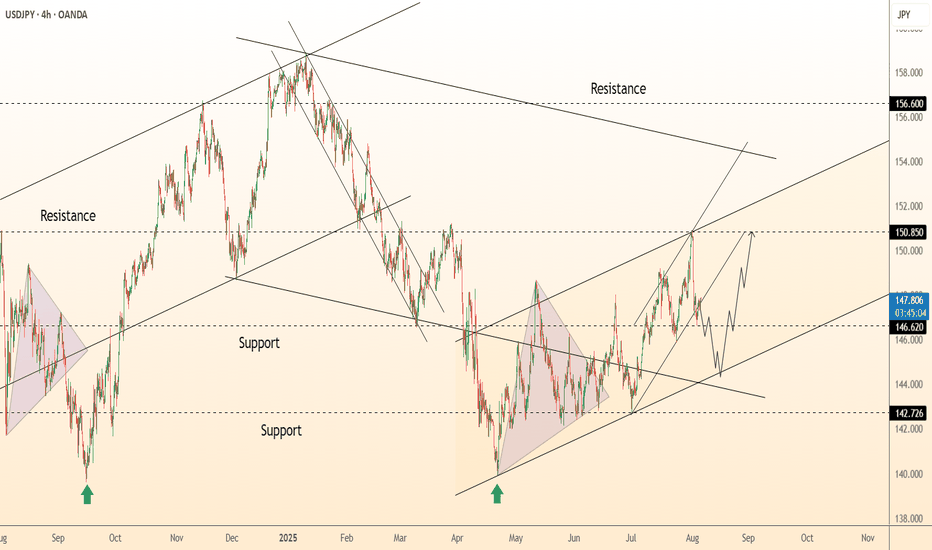

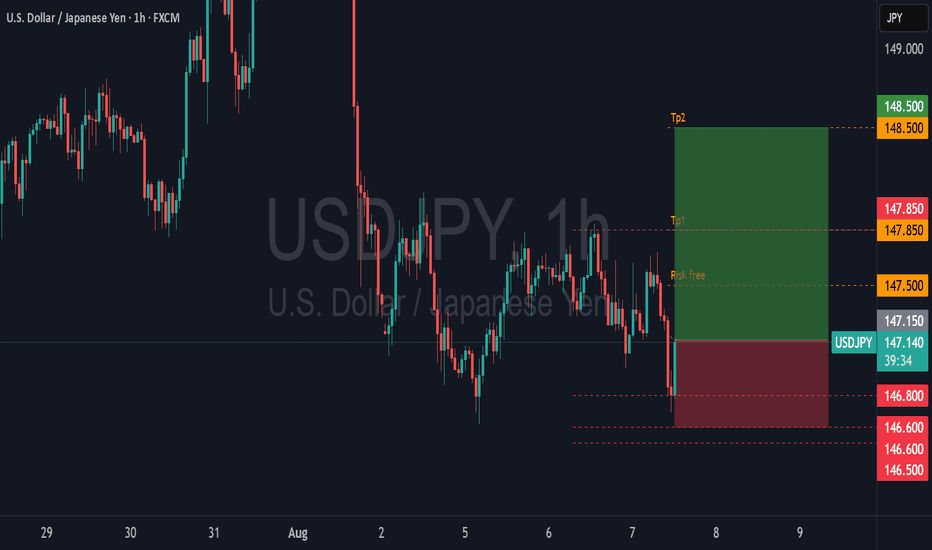

USDJPY I Weekly CLS I Model 1 I TP1 50% then full CLSYo Market Warriors ⚔️

Fresh outlook drop — if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Don't hesitate to ask any questions or share your opinions

USDJPY trade ideas

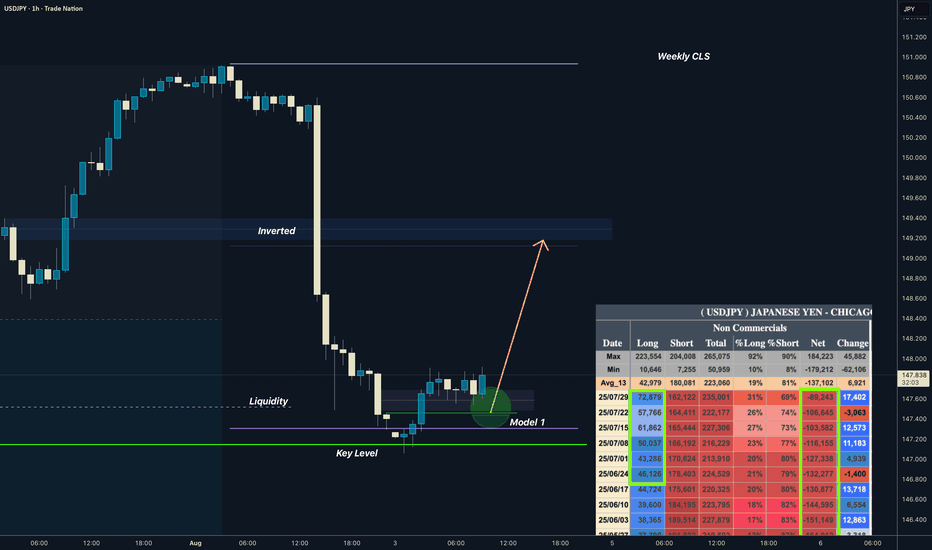

USDJPY I Weekly CLS Range I Model 1 I COT is BullishYo Market Warriors ⚔️

Fresh outlook drop — if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Don't hesitate to ask any questions or share your opinions

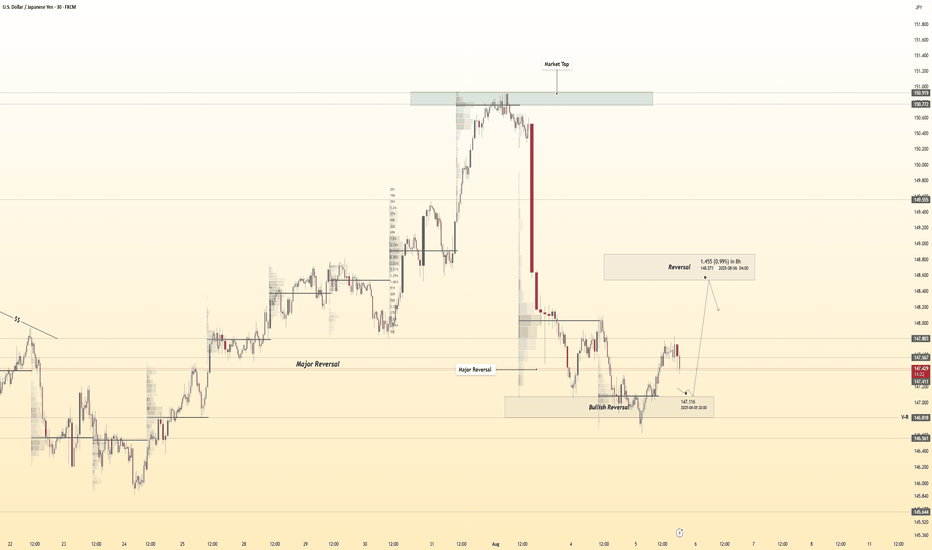

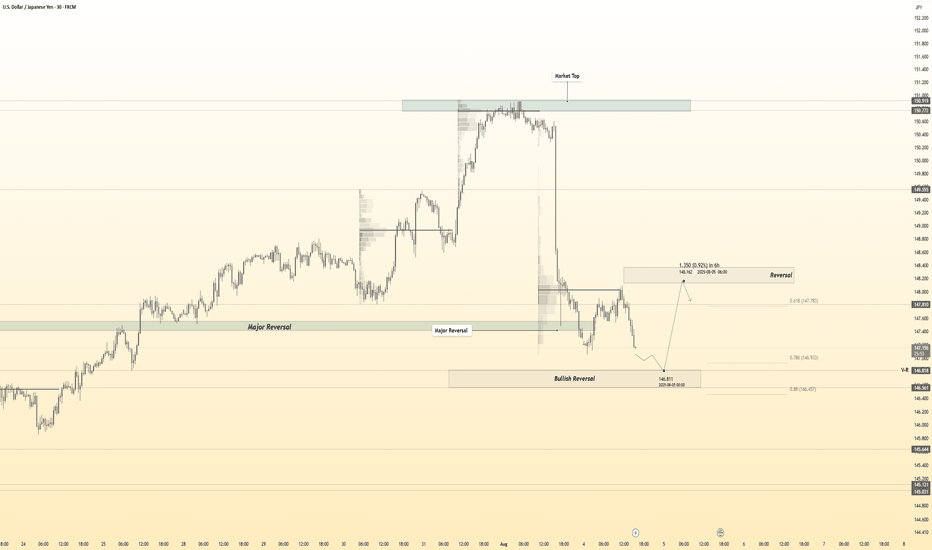

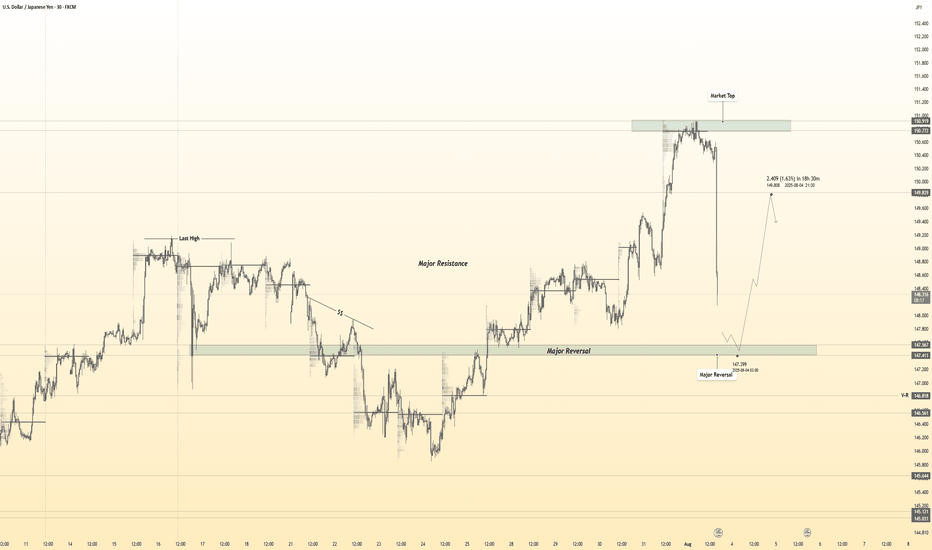

USD/JPY 30Min Engaged ( Bullish Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal : 147.120

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

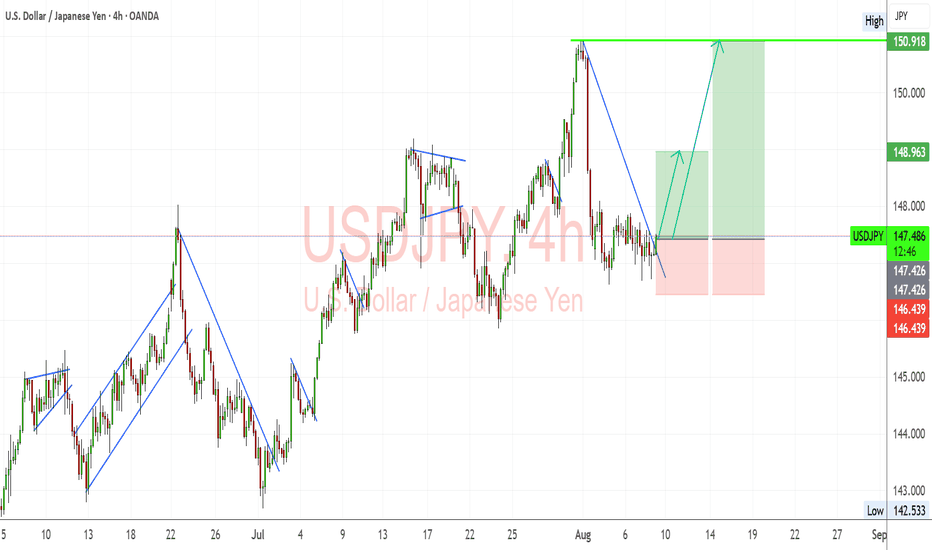

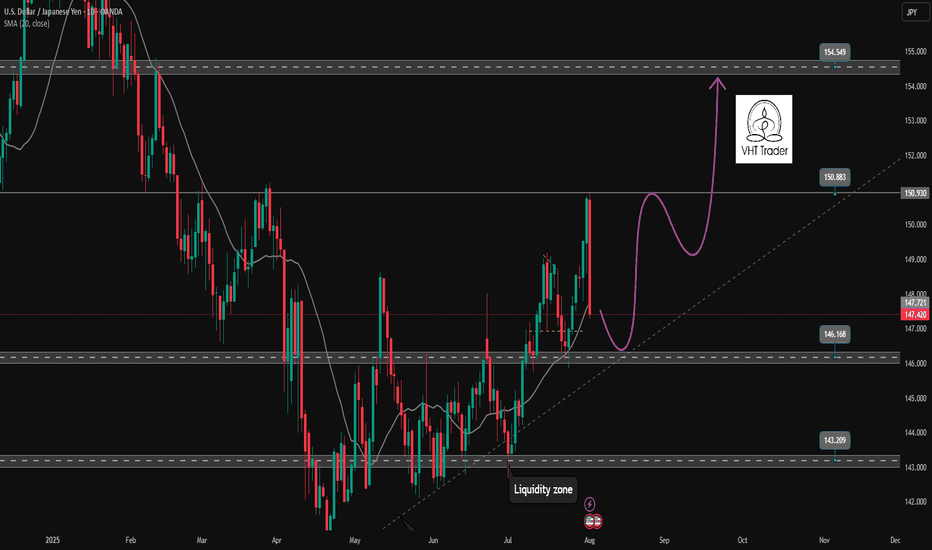

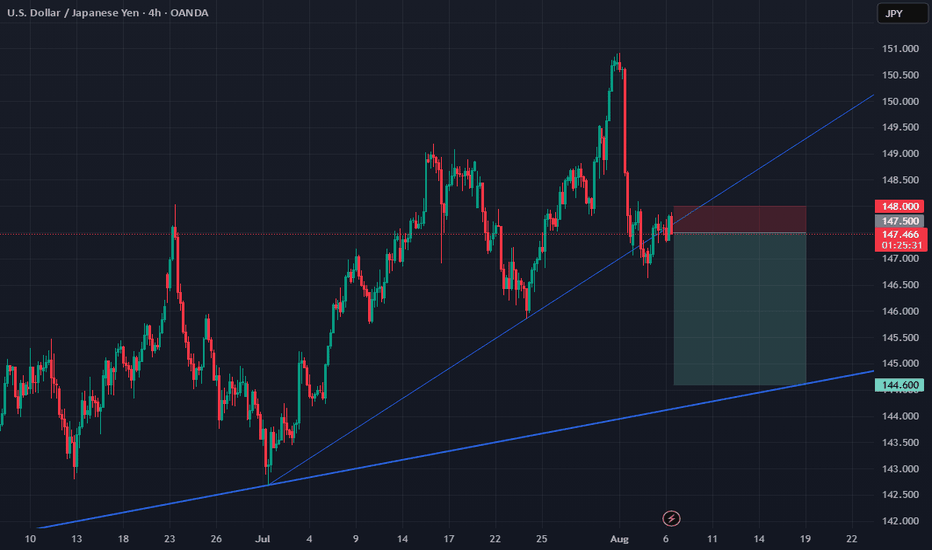

USD/JPY Poised for Breakout as Fundamentals & Technicals AlignUSDJPY is entering a critical juncture where both macroeconomic conditions and price structure are pointing toward a potential bullish continuation. The pair has been consolidating just under a descending trendline after a sharp drop from July’s highs, but strong US fundamentals, a persistently dovish Bank of Japan, and upcoming political catalysts are creating the perfect environment for an upside breakout. If buyers can reclaim momentum above near-term resistance, the path toward retesting multi-month highs appears open, with yen crosses likely to follow the lead.

Technical Analysis (4H Chart)

Price is consolidating around 147.46 after falling from the 150.91 high.

A descending trendline from the late-July peak is being tested. A confirmed breakout would likely accelerate bullish momentum.

Key upside targets:

148.96 – immediate resistance & short-term target (previous swing high).

150.91 – major resistance at July’s high.

Stop-loss at 146.43 safeguards against deeper retracements.

The structure reflects a series of bullish continuation patterns (flags, breakouts, retracements).

Fundamental Analysis

Current Bias: Bullish

USD Strength: Strong US data and anticipation of Trump’s “major” economic announcement are lifting the dollar.

JPY Weakness: Despite better-than-expected Japan Eco Watchers Survey, the BoJ’s ultra-loose stance continues to suppress yen demand.

Rate Differentials: Still heavily in USD’s favor, sustaining upward pressure on USD/JPY.

Risk Sentiment: Even with mild geopolitical tensions, USD’s safe-haven appeal is preventing JPY from benefiting.

Risks:

Disappointing US political announcements.

Hawkish surprises from the BoJ.

Sharp swings in risk sentiment favoring the yen.

Key News/Events Ahead:

Trump’s economic policy reveal.

US CPI & PPI releases.

BoJ policy signals or commentary.

Leader/Lagger Dynamics:

USDJPY is the leader for yen crosses, often setting the tone for GBPJPY, AUDJPY, and CHFJPY.

Summary:

USDJPY’s bullish outlook is reinforced by the combination of favorable fundamentals and a technical setup pointing toward a breakout. A move above 147.80–148.00 could open the door to 148.96 in the short term and 150.91 in the medium term. With yen crosses closely tied to USDJPY’s movements, this pair’s breakout could spark broader JPY weakness across the board, making it a pivotal chart to watch in the days ahead.

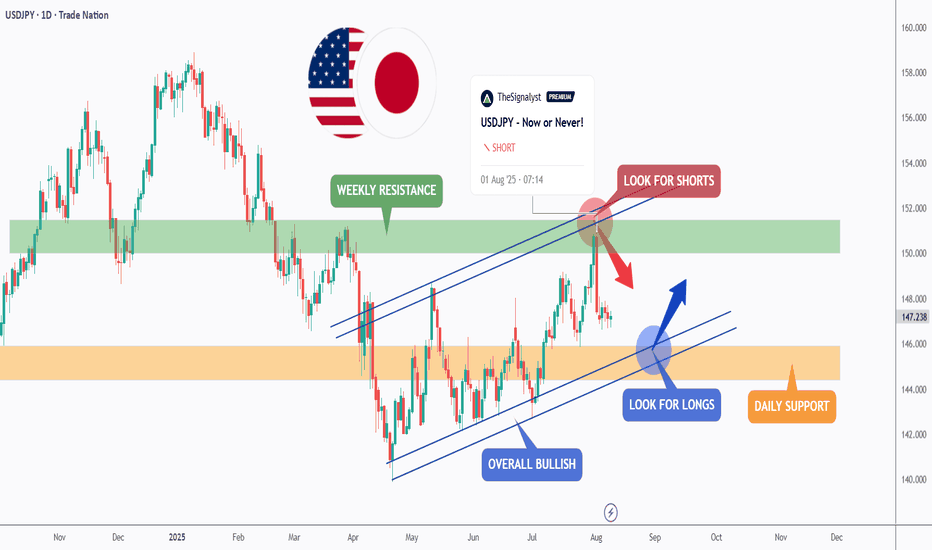

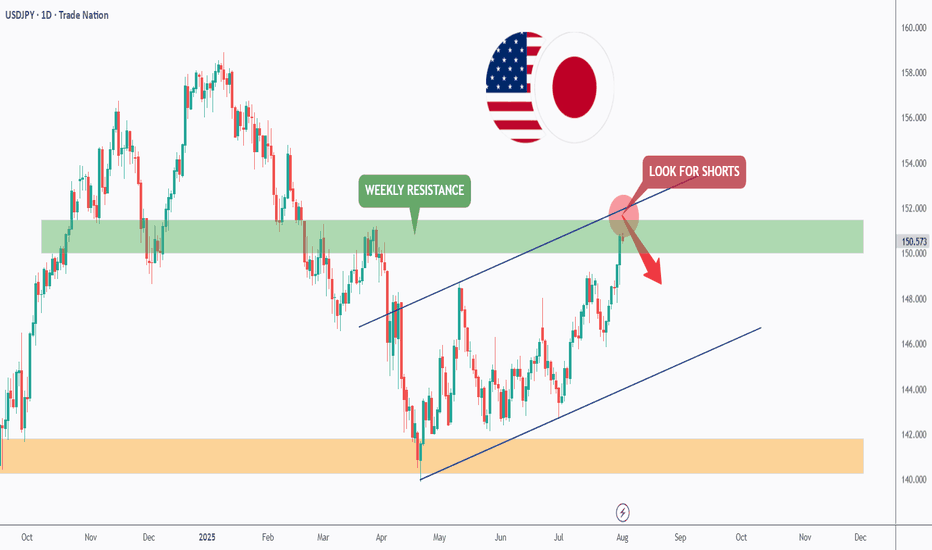

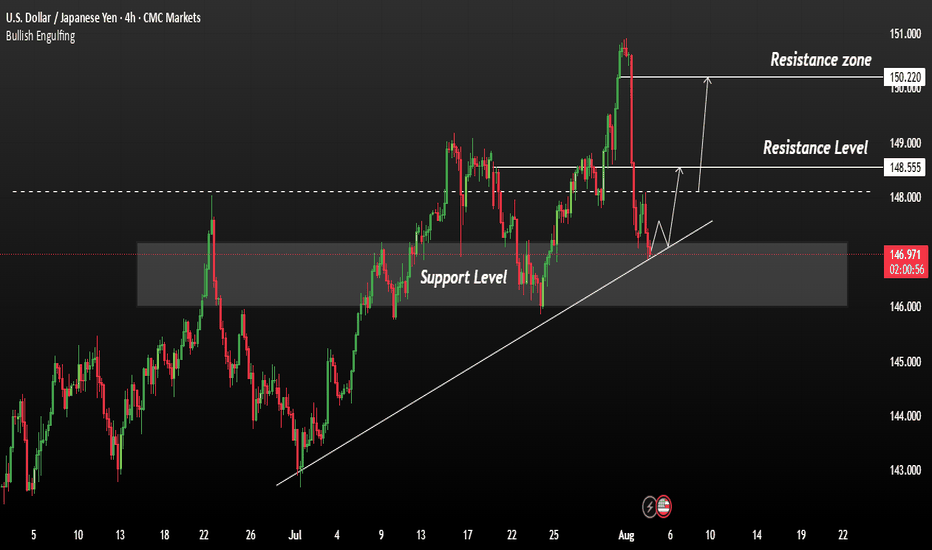

USDJPY – From Shorts to Longs!USDJPY has been trading within a rising channel, maintaining an overall bullish structure in the medium term.

🔍 Current Setup:

We previously looked for shorts from the weekly resistance near the upper bound of the channel — and price reacted as anticipated.

Now, we are waiting for a retest of the lower bound, which is the intersection of the lower trendline and the daily support area, to look for trend-following longs in line with the prevailing bullish trend.

📌 Plan:

Shorts have already played out from the upper bound.

Next, watch for bullish reversal signals around the lower trendline + support confluence for potential long entries.

🎯 Patience is key — let price come to you before taking action.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

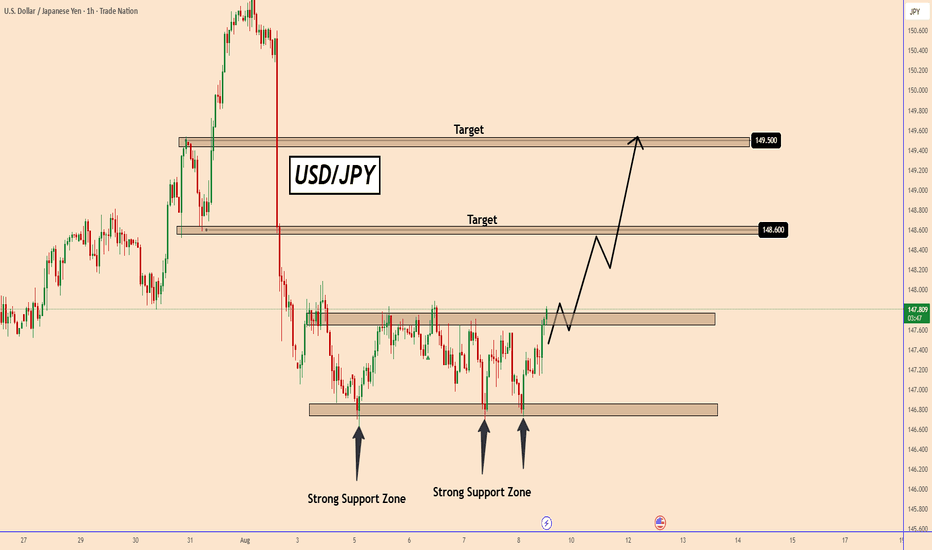

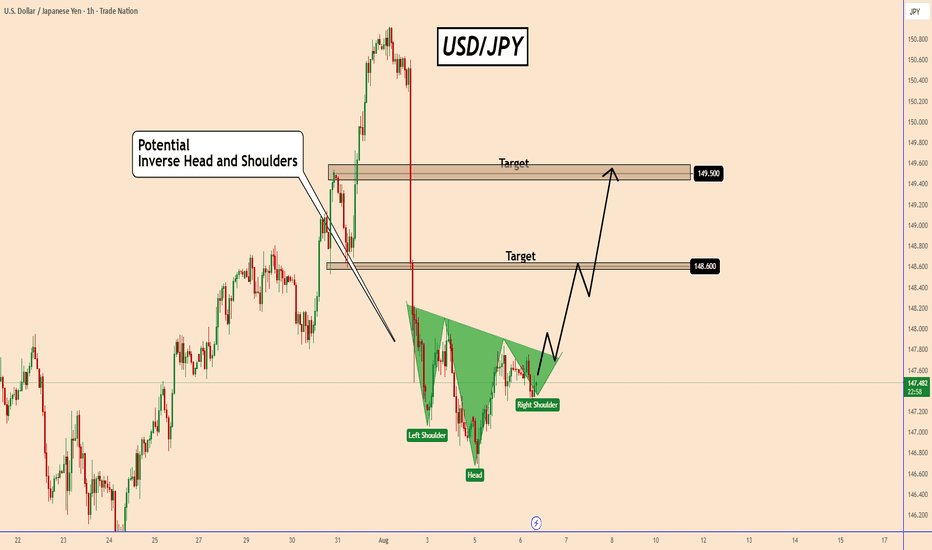

USDJPY Ready for Another Bullish MoveUSDJPY Ready for Another Bullish Move

USDJPY is once again showing signs of a potential upward move.

After last week’s NFP report, the USD saw a strong sell-off, but the price found support around 146.70, as shown on the chart.

Since the NFP numbers came in lower than expected, the market is now pricing in a possible rate cut from the Fed in September.

The support zone near 146.70 has held three times, which increases the chances of a bullish bounce from this level.

If the price breaks clearly out of the current consolidation, USDJPY could rise toward 148.60, and possibly even 149.50.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY Is Showing a Potential Head & Shoulders PatternUSDJPY Is Showing a Potential Head & Shoulders Pattern

After the decline and speculation created by the US NFP, we can see that the USD wants to recover again. It seems that the buyers have returned and did not change the direction of the USDJPY just for the employment data.

However, it was all old in my opinion, despite the aggressive selling of the USD.

During the early European morning, the Japanese Yen lost momentum as disappointing wage data increased economic concerns in Japan.

Labor income in Japan grew by 2.5% year-on-year in June, although it came in below the expected growth of 3.2%.

On the other hand, the BOJ is not serious about raising interest rates again in order to fight inflation and this is still creating some pressure on the JPY.

In the short term, USDJPY looks set to rise as shown in the chart with targets at 148.60 and 149.50.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD/JPY 30Min Engaged ( Bullish Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal : 146.850

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

USDJPY Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 148.300 zone, USDJPY was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 148.300 support and resistance area.

Trade safe, Joe.

USDJPY Potential UpsidesHey Traders, in tomorrow's trading session we are monitoring USDJPY for a buying opportunity around 147.000 zone, USDJPY is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 147.000 support and resistance area.

Trade safe, Joe.

USDJPY - Now or Never!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈USDJPY has been overall bullish trading within the rising channel marked in blue and it is currently retesting the upper bound of the channel acting as an over-bought zone.

Moreover, the green zone is a strong weekly resistance.

📚 As per my trading style:

As #USDJPY is around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD/JPY) support boost Bullish Trend Read The captionSMC Trading point update

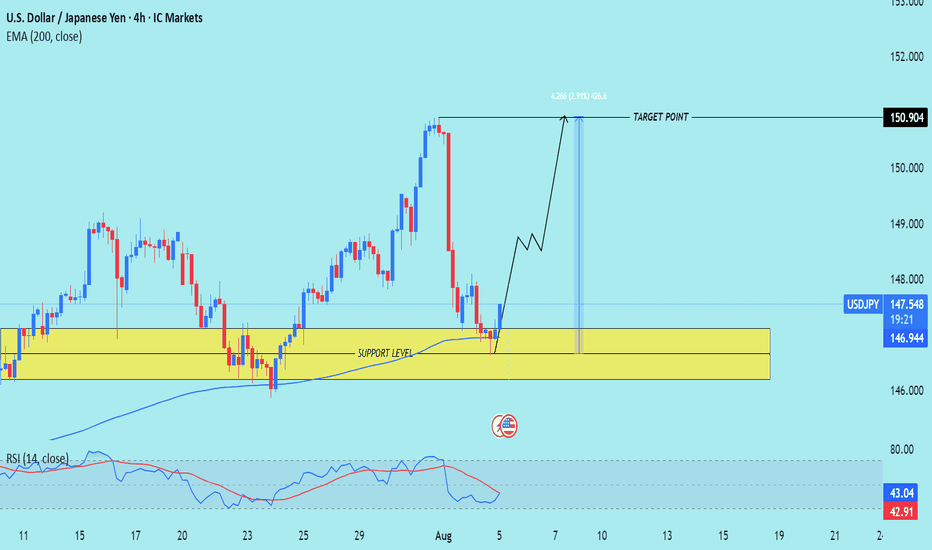

Technical analysis of USD/JPY on the 4-hour timeframe, based on a rejection from a key support zone and signs of trend continuation toward a higher target.

---

Technical Breakdown:

1. Support Level:

Price has bounced from a clearly defined support zone around 146.00 – 146.50, which has held multiple times in the past.

This zone is acting as a strong demand area where buyers are stepping in.

2. Bullish Rejection + Structure:

A bullish candle has formed from the support area, signaling potential reversal.

The drawn projection suggests higher highs and higher lows forming — indicating bullish continuation.

3. EMA (200):

Price has respected the 200 EMA (blue line), bouncing off it — a strong confluence for bullish trend continuation.

EMA is slightly upward sloping, indicating a longer-term bullish bias remains intact.

4. RSI (14):

RSI is rising from oversold territory (42.09), indicating a bullish momentum shift.

A potential bullish divergence might be forming (price made lower low, RSI made higher low).

5. Target Point:

Price is projected to reach 150.904, giving a potential move of ~2.91% (426 pips) from current levels.

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: 146.90 – 147.30 (current levels or slight pullback)

Stop Loss: Below the support zone (~145.90)

Take Profit (TP): 150.900 (key resistance / previous high)

Risk-to-Reward Ratio: Attractive, based on the size of the support zone vs. projected move

Mr SMC Trading point

---

Key Insights:

Strong confluence between price structure, support zone, and 200 EMA bounce.

Favorable risk-reward ratio for swing or intraday traders.

Best confirmation would come from a bullish engulfing candle or break above minor resistance near 147.80.

Please support boost 🚀 this analysis)

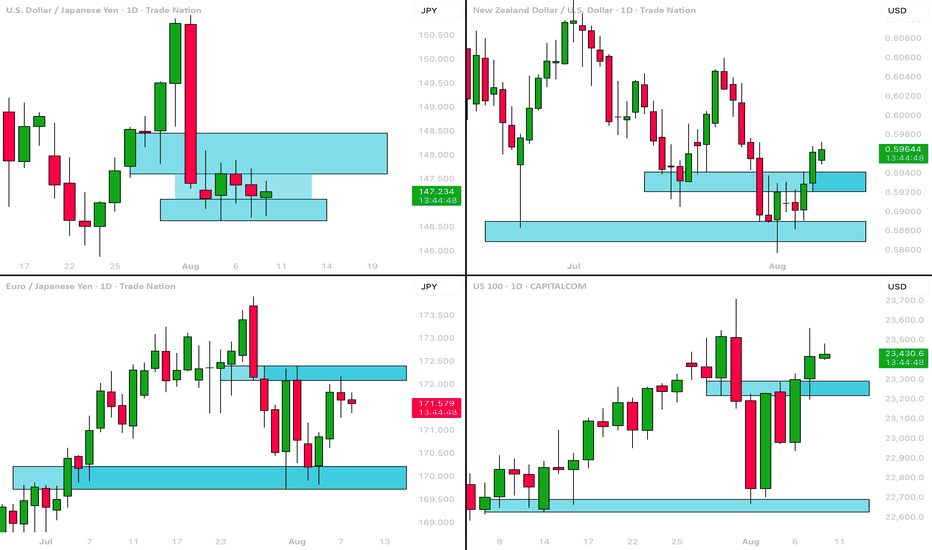

MarketBreakdown | USDJPY, NZDUSD, EURJPY, US100

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #USDJPY daily time frame 🇺🇸🇯🇵

The market is trading in uptrend.

After the price updated a high, it retraced.

I see a consolidation now and a formation of a narrow

horizontal trading range.

A bullish breakout of a resistance of the range and a daily

candle close above that will provide a strong trend-following bullish signal.

An uptrend will most likely resume then.

2️⃣ #NZDUSD daily time frame 🇳🇿🇺🇸

A test of a historically significant major demand cluster triggered a strong

bullish reaction. The price violated a strong resistance and closed above that.

I think that the market will most likely continue growing.

3️⃣ #EURJPY daily time frame 🇪🇺🇯🇵

The pair is trading within a horizontal parallel channel.

With the absence of high impact fundamental news today,

I think that the market will most likely continue consolidating

and the price may retrace from the resistance.

4️⃣ #NASDAQ Index #US100 daily time frame 🇺🇸🇨🇭

Looks like the market is preparing to update the ATH.

A confirmed violation of a minor daily resistance and a valid

Change of Character on intraday time frames indicate clear

strength of the buyers.

I guess that 23700 level will be tested soon with its highly probable breakout.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

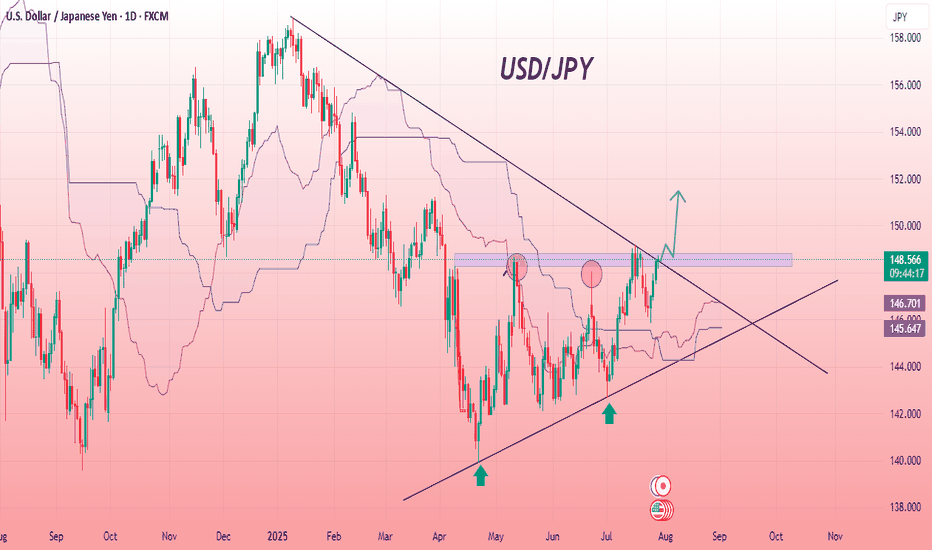

USD/JPY 1D CHART PATTERNThe USDJPY chart shows a clear bullish breakout from a long-term descending trendline, signaling a potential shift in momentum. The pair has formed higher lows, marked by multiple rejections near the ascending support trendline, confirming strong buying interest. Price has successfully broken through a key resistance zone, turning it into support, with Ichimoku cloud indicators supporting the upward movement. A bullish continuation is expected as the price maintains strength above the breakout zone. The recent breakout candle and upward arrow suggest bullish sentiment and room for further upside, aligning with the overall trend reversal pattern visible on the chart.

Entry Buy: 148.570

Target point: 151.500

If you found this analysis helpful, don’t forget to drop a like and comment . Your support keeps quality ideas flowing—let’s grow and win together! 💪📈

DeGRAM | USDJPY will retest the support level📊 Technical Analysis

● USDJPY is riding an ascending channel after a bullish breakout above the long-term descending trendline and successful retests of the 144.9–146.6 zone as support.

● Price is carving higher highs and higher lows, with the current bullish pennant pointing to a measured move toward the 150.8 resistance if 147.2 is breached on strong momentum.

💡 Fundamental Analysis

● The yen remains under pressure as US labor data stays firm and Fed officials hint at fewer cuts, reinforcing US-Japan rate divergence.

● BOJ’s dovish tone in recent speeches and widening trade deficit further weigh on JPY.

✨ Summary

Buy 145.2–146.2; confirmation >147.2 targets 150.8. Invalidation below 142.8 support zone.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

USDJPY Weakening or a Correction to the Uptrend✏️ OANDA:USDJPY is approaching the old Break out support zone. The convergence zone of the 2 EMA lines. If there is a sweep to the support zone at the beginning of the week, it will be an opportunity to buy to continue the bullish wave structure. When this 146.200 zone is broken, the uptrend will be broken and we have to wait for new momentum to determine the next trend.

📉 Key Levels

Support: 146.200-143.200

Resistance: 150.800-154.500

Buy zone 146.300 (Support & Trendline)

Buy zone 143.200 Strong support zone

Target 154.500

Leave your comments on the idea. I am happy to read your views.

USDJPY Showing Bullish Correction USDJPY is currently testing a key support level, with the US dollar showing recovery since the beginning of the session. This bullish momentum is giving the pair a chance to climb higher.

Technical Overview:

The price is approaching the local support zone near 147.50. Bullish momentum is building from this level. If the price holds above 147.50, it could trigger further upside movement Upside Targets will be 148.50 and also 150.20

You May find more details in the chart,

Trade wisely Best of Luck Buddies.

Ps; Support with like and comments for better analysis Thanks Traders.

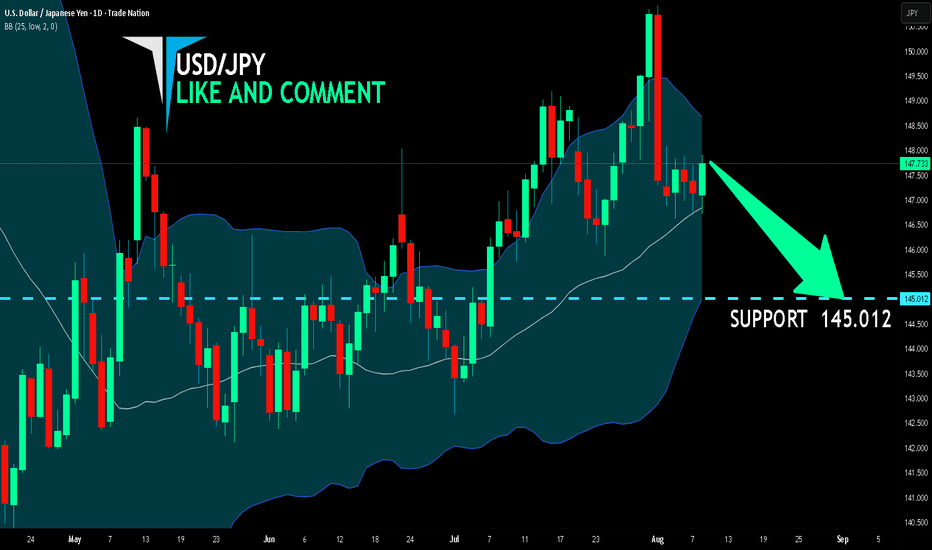

USD/JPY BEARS ARE STRONG HERE|SHORT

Hello, Friends!

We are targeting the 145.012 level area with our short trade on USD/JPY which is based on the fact that the pair is overbought on the BB band scale and is also approaching a resistance line above thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

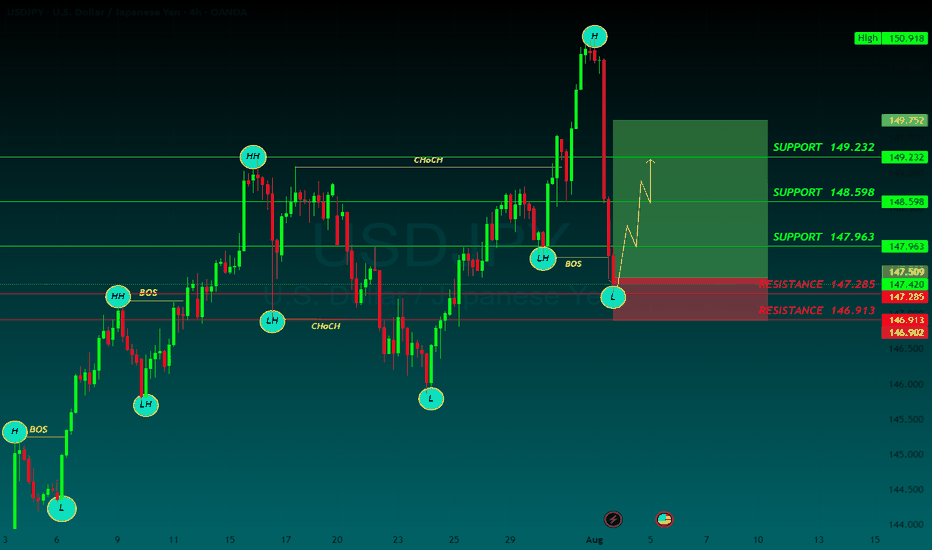

USDJPY BUYThe year will be politically marked by Trump’s return to the White House. A Republican government is seen as positive for financial markets, but Trump’s pledge to cut taxes and impose tariffs on foreign goods and services may introduce uncertainty to both the political and economic landscape.

In Japan, political uncertainty looms, as the ruling Liberal Democratic Party (LDP) lacks a parliamentary majority and may call fresh elections. An LDP victory could strengthen the Yen by ensuring stability, while opposition gains might lead to fiscal expansion and weaken the currency. If no elections occur, a modest budget would likely keep the Yen supported.

In terms of monetary policy, the Fed and BoJ are set to diverge in monetary policy. The Fed expects to deliver only two additional rate cuts in 2025, the BoJ is expected to maintain its dovish stance, avoiding rate hikes amid weak inflation and a shrinking economy, leaving the Yen vulnerable to market disappointment over policy inaction

SUPPORT 149.232

SUPPORT 148.598

SUPPORT 147.963

RESISTANCE 147.285

RESISTANCE 146.913

USDJPY 30Min Engaged (Bullish Reversal Entry Detected )➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish Reversal : 147.450

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.