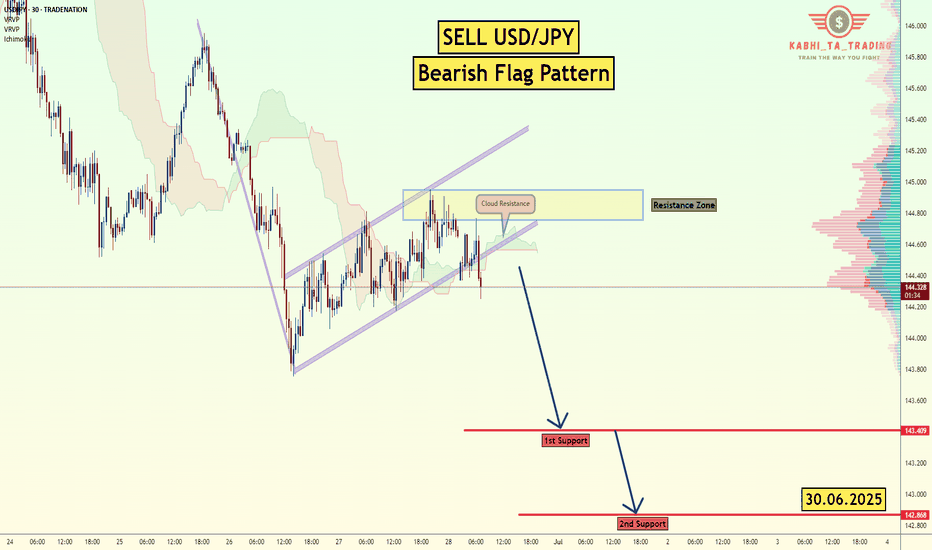

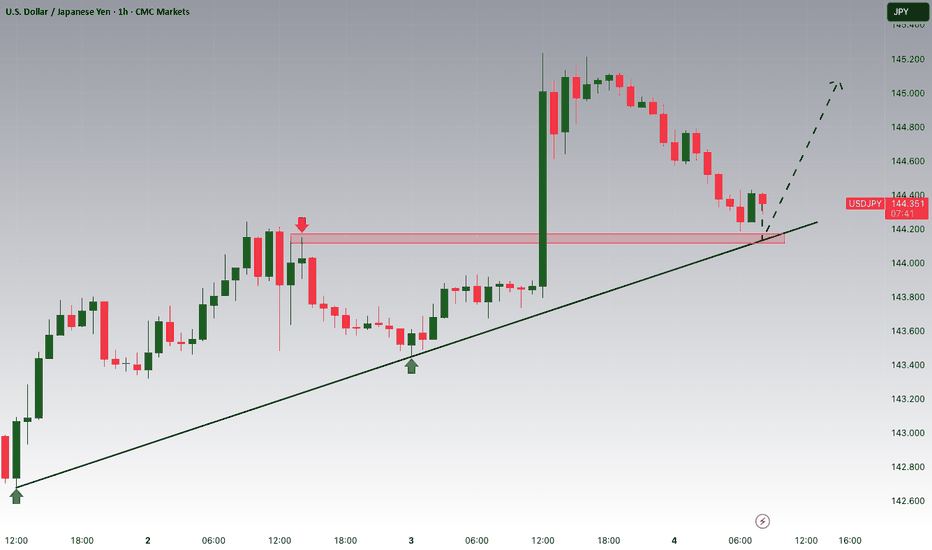

USD/JPY Bearish Flag (30.06.2025)The USD/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Bearish Flag Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

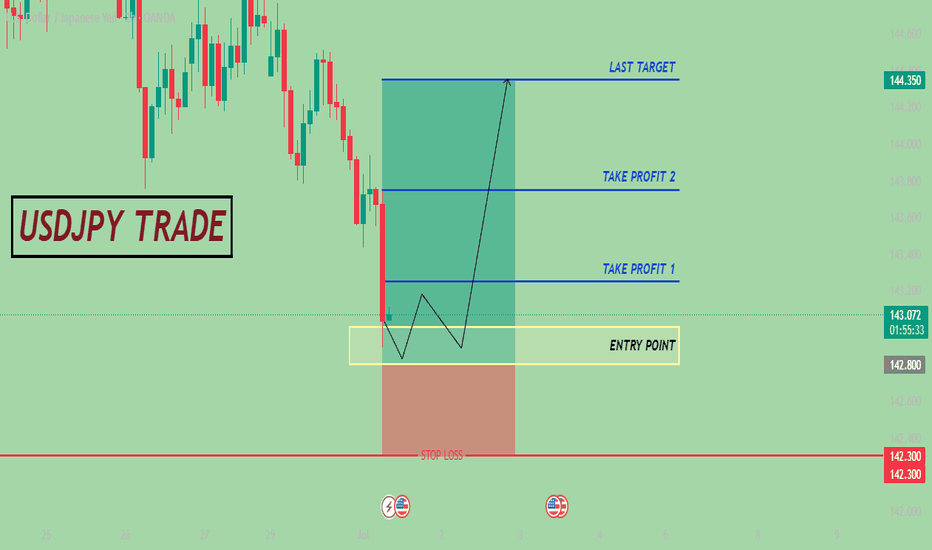

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 143.40

2nd Support – 142.86

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY trade ideas

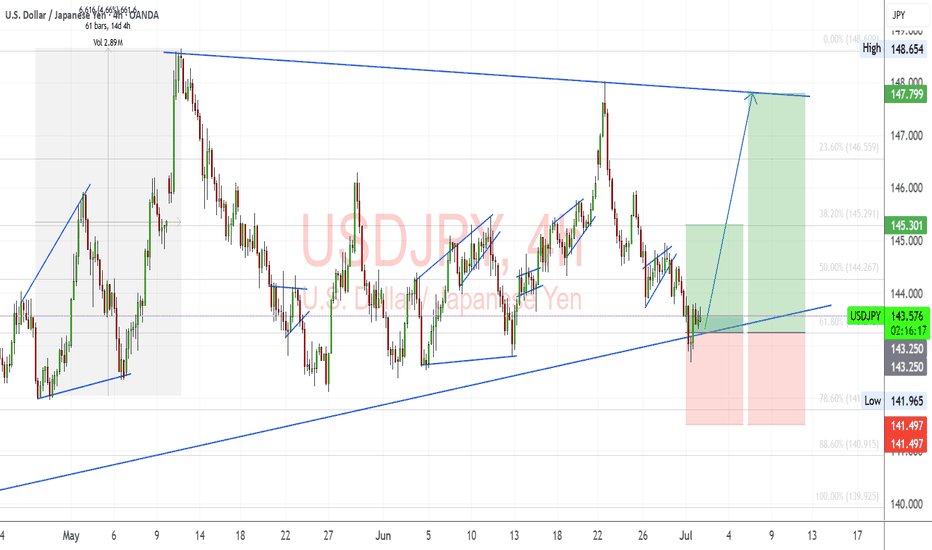

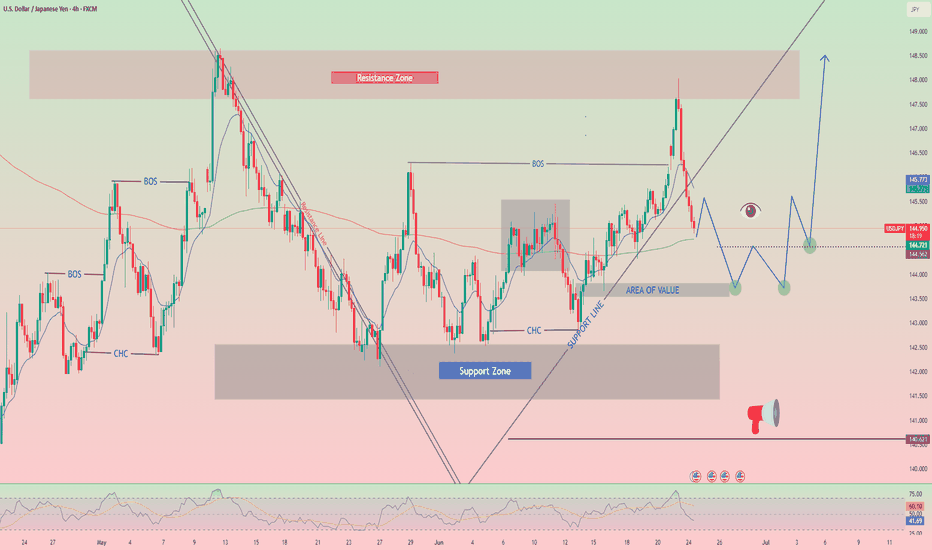

USDJPY – Key Support Bounce with Macro TailwindsUSDJPY is bouncing off a key trendline and 61.8% Fib zone (143.25–143.60) with confluence across multiple JPY crosses (EURJPY, AUDJPY, CADJPY). This area has historically triggered strong upside momentum, and the current setup aligns with both technical structure and macro drivers.

📊 Fundamentals Supporting the Move:

✅ US Yields Stable: US10Y is holding above 4.20%, keeping USDJPY supported. If yields push back toward 4.30%, expect USDJPY to retest 145.30 and potentially 147.80.

✅ BoJ Dovish: Japan shows no shift in policy. Despite weak Tankan data, BoJ remains patient, and no meaningful rate hike or YCC change is expected soon.

✅ USD Macro Resilience: Core PCE held firm at 2.6%. Focus now shifts to ISM Services PMI (Wed) and NFP (Fri). Markets are still pricing a soft landing – supporting risk-on and a stronger USD.

✅ JPY as a Fading Safe Haven: Even with geopolitical headlines (Trump tariff tensions, Taiwan, Middle East), JPY demand remains weak. Traders are favoring USD and Gold over JPY as risk hedges.

⚠️ Risks to Watch:

Dovish US Data Surprise: Weak NFP or ISM could drag yields down and trigger USDJPY reversal.

Verbal or Actual BoJ Intervention: If we approach 148.50–150, Japan may step in again.

Geopolitical Escalation: Any sharp risk-off could trigger safe haven demand for JPY, though this has underperformed recently.

🔎 Correlation Dynamics:

📈 USDJPY is leading JPY crosses like EURJPY and AUDJPY. The recent bounce started simultaneously across the JPY complex, with USDJPY slightly ahead.

📉 If US yields drop or risk sentiment shifts, USDJPY may lag gold or bonds but eventually catch up.

🧠 Trading Plan:

📍 Entry Zone: 143.30–143.60 (trendline + Fib confluence)

🎯 Target 1: 145.30 (38.2% Fib)

🎯 Target 2: 147.80 (channel resistance)

🛑 Invalidation: Daily close below 141.50 with US yields breaking down

📅 Upcoming Events to Watch:

Wed July 3: ISM Services PMI (key for USD reaction)

Fri July 5: US Non-Farm Payrolls + Average Hourly Earnings

JPY Risk: Verbal intervention possible near 148+

🧭 Summary:

USDJPY is positioned for a bullish continuation, backed by:

Rising yields

Resilient US macro

Weak JPY fundamentals

Technical structure respecting trendline support

Short-term traders can target the 145–147.80 range ahead of NFP, with a tight eye on yield and risk sentiment.

📌 If this analysis helps, drop a like and follow for more real-time macro-technical breakdowns. Stay nimble ahead of NFP! 🧠📈

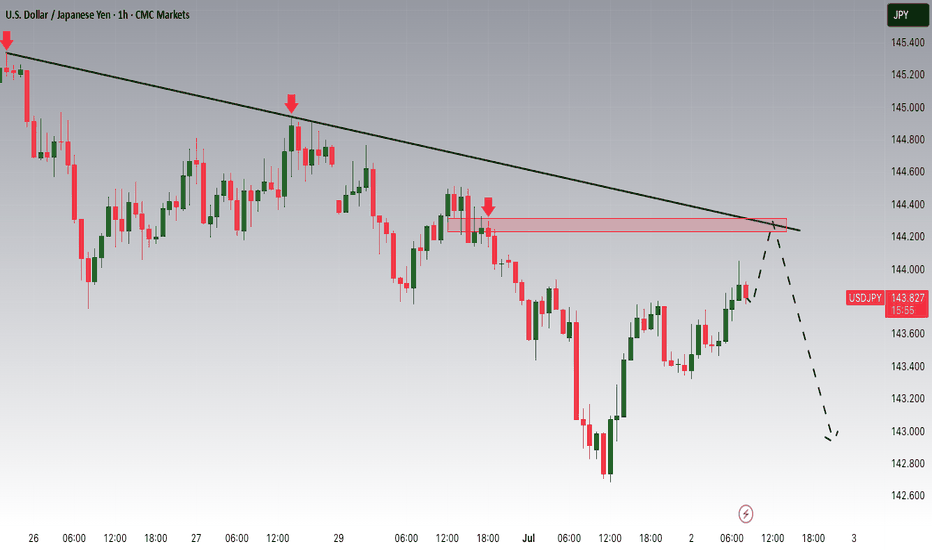

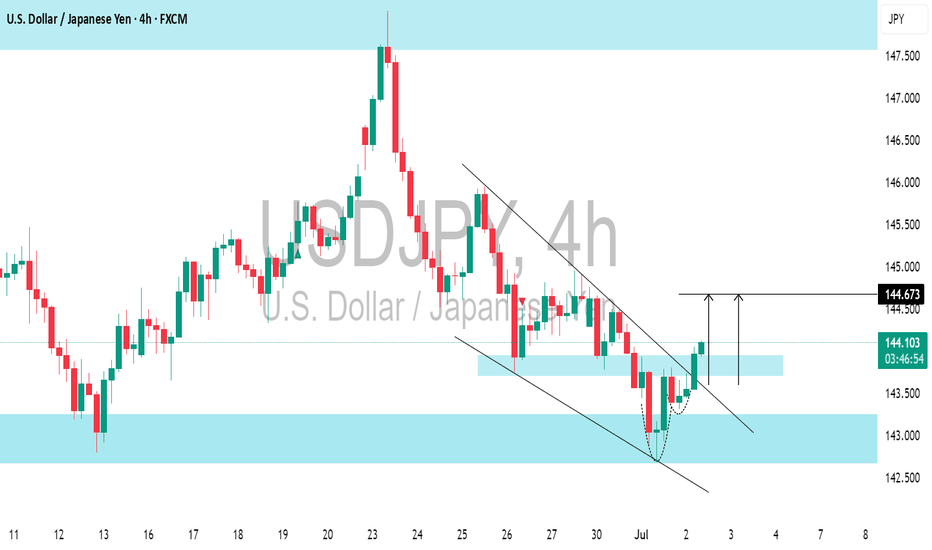

USDJPY: Intraday Bearish ConfirmationLast week, I shared an update on a confirmed structure breakout for 📉USDJPY on a 4-hour chart.

On retesting the broken structure, the price showed a strong bearish signal.

I observed a rising wedge pattern with a broken support line

This breakout suggests a high likelihood that the price will decline to the 143.81 / 143.31 levels.

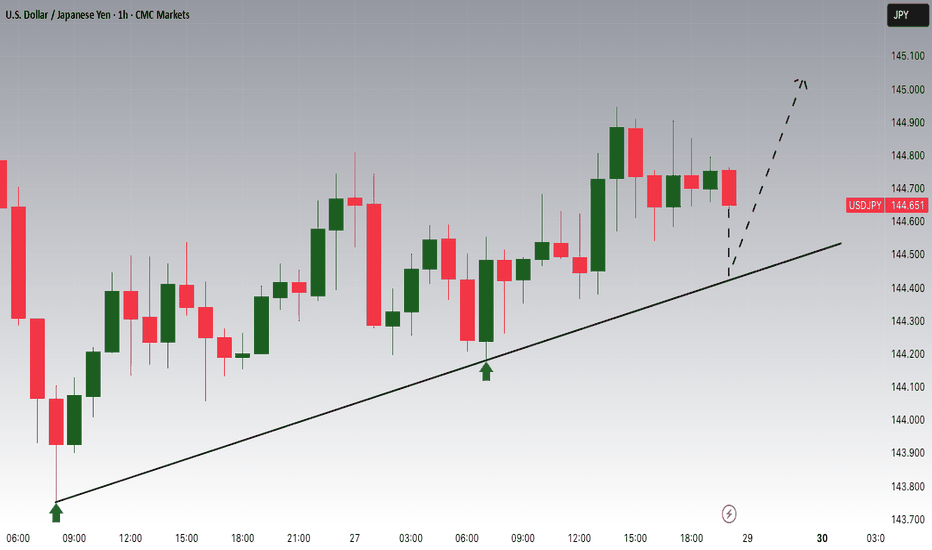

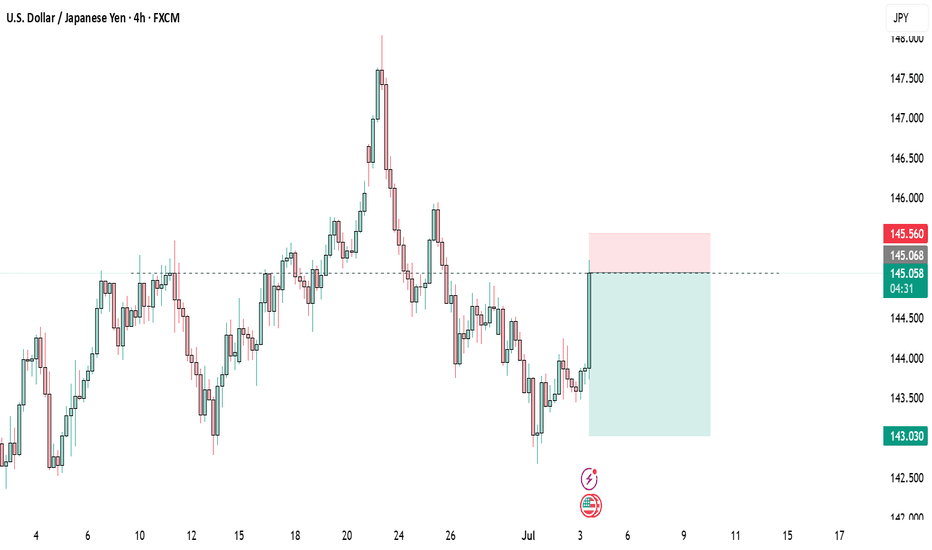

USDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 144.200 zone, USDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 144.200 support and resistance area.

Trade safe, Joe.

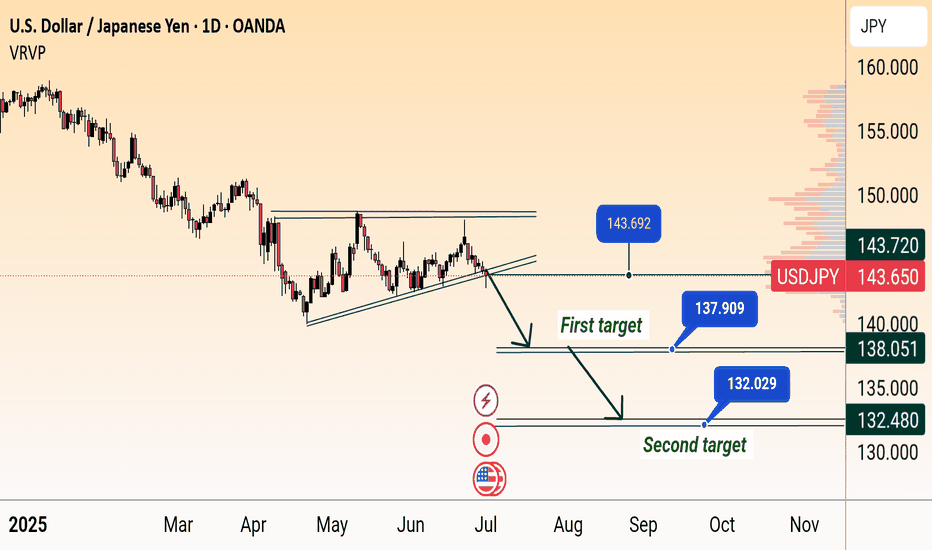

USD/JPY Bearish Breakdown Targets 138 & 132USD/JPY Bearish Breakdown Setup (Daily Chart)

USD/JPY breaks below rising wedge support near 144, signaling potential downside. Price targets are marked at 138.051 (first target) and 132.480 (second target), indicating possible continued weakness if the bearish momentum holds.

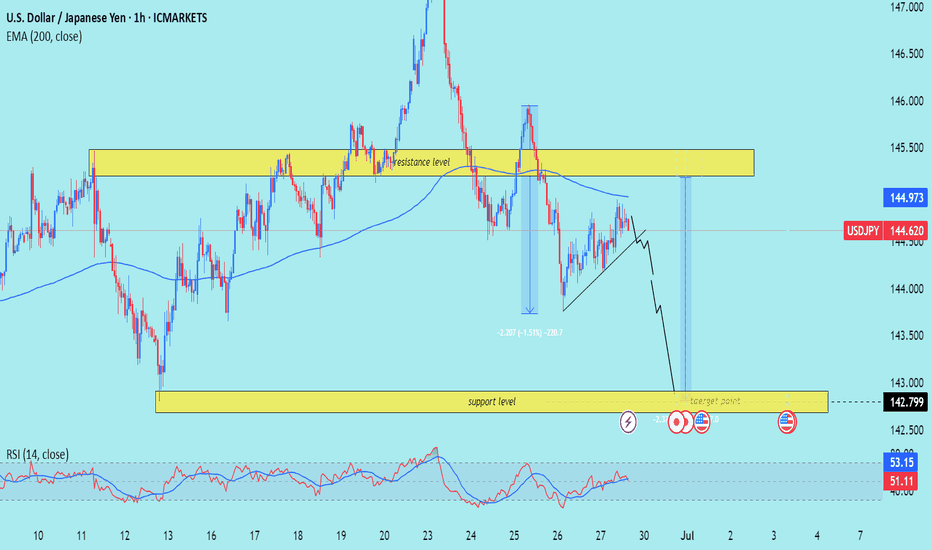

USD/JPY) bearish Trand analysis Read The captionSMC trading point update

Technical analysis of USD/JPY (U.S. Dollar vs Japanese Yen) on the 1-hour timeframe. Here's a clear breakdown of the idea presented:

---

Overview of the Setup

Current Price: 144.620

EMA 200 (Blue Line): 144.973 – price is trading below the EMA, indicating bearish momentum.

Resistance Zone: Around 145.000 – 145.500

Support/Target Zone: Around 142.799

RSI Indicator: ~51.11 – neutral zone (not overbought or oversold)

---

Interpretation of Chart Structure

1. Resistance Level:

Price tested the resistance zone and sharply rejected it.

This zone has held multiple times historically, making it strong.

2. EMA 200 as Resistance:

Price rejected just under the EMA, further confirming downside pressure.

3. Bearish Flag / Rising Wedge Breakdown:

There is a visible bearish continuation pattern (likely a rising wedge or bear flag).

Price is projected to break down from this pattern, continuing the downtrend.

4. Measured Move Projection:

Previous drop of ~230 pips (-1.5%) is mirrored for the next expected move.

The same size move projects the price to reach the target zone around 142.799.

5. Support/Target Zone:

Marked as the final take-profit zone.

Corresponds with historical demand and likely buyer interest.

---

Trade Idea Summary

Bias: Bearish

Entry Idea: After breakdown confirmation below wedge structure or rejection from resistance zone.

Target: 142.799

Stop-Loss Consideration: Above the resistance zone (~145.500) or just above the recent swing high.

Confirmation: Breakdown of rising wedge + below EMA + repeated resistance rejections.

Mr SMC Trading point

---

Key Considerations

Upcoming News Events (Three Icons):

These symbols signal potential USD or JPY volatility, so watch out for data releases that could disrupt the pattern.

RSI Neutral:

RSI is not yet oversold, allowing room for more downside before hitting exhaustion levels.

False Breakouts Possible:

Price may fake a break upward before continuing lower – wait for strong candle confirmation if entering a trade.

plesse support boost 🚀 this analysis)

#USDJPY: Price is currently accumulating ! Wait For DistributionAt present, the USDJPY currency pair appears to be in an accumulation phase, as evidenced by the absence of significant price movement throughout the current week. Several factors contribute to this trend.

Firstly, several significant economic events are scheduled for this week, particularly tomorrow and Friday. These developments hold substantial implications for the future trajectory of the USDJPY pair. Consequently, there exists a possibility that the price may experience a decline prior to initiating a bullish trend.

Secondly, there are two primary areas where the price could reverse its course. The extent to which the USD reacts to the economic data will serve as an indicator of the potential reversal zones.

It is imperative that you conduct your own analysis before making any financial decisions. This chart should be utilised solely for educational purposes and does not guarantee any specific outcome.

Regarding the stop loss, as this is a swing trade, it is advisable to employ a larger stop loss if the price reaches entry zones. The take profit level can be determined based on your entry type and analysis.

We wish you the best of luck in your trading endeavours and emphasise the importance of trading safely.

Kindly share this analysis with others through likes, comments, and social media platforms. If you have any questions or require further assistance, please do not hesitate to comment below. We are here to provide support.

Team Setupsfx_

❤️🚀

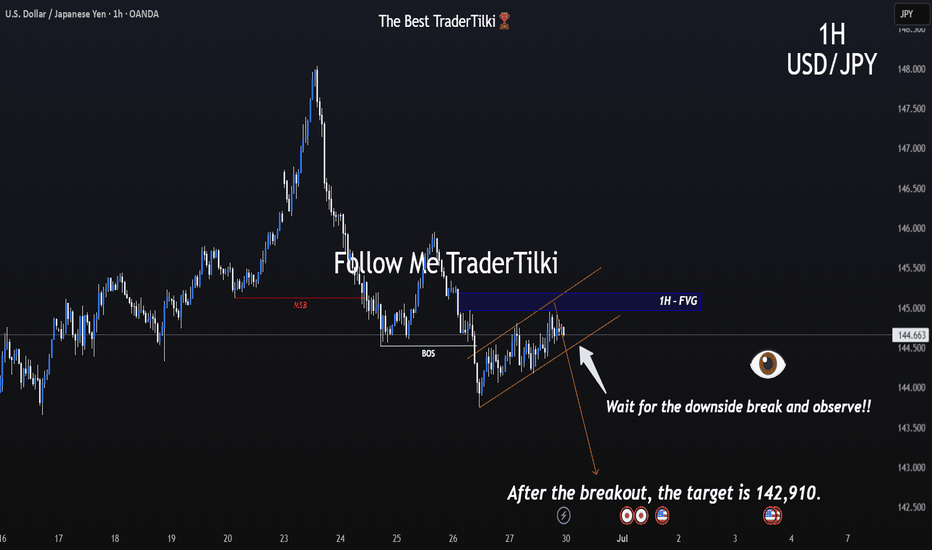

Critical Channel Watch Begins on the 1-Hour Chart of USDJPY.Hey everyone,

📉 My Latest USDJPY Analysis:

USDJPY is currently moving within a downtrend. If the price breaks below the lower boundary of the parallel channel, our first target level will be 142.910. The most crucial factor here is the downward breakout of that channel—don’t overlook it.

Also, keep a close eye on key economic data releases on the fundamental side, as they could significantly influence your strategy.

I meticulously prepare these analyses for you, and I sincerely appreciate your support through likes. Every like from you is my biggest motivation to continue sharing my analyses.

I’m truly grateful for each of you—love to all my followers💙💙💙

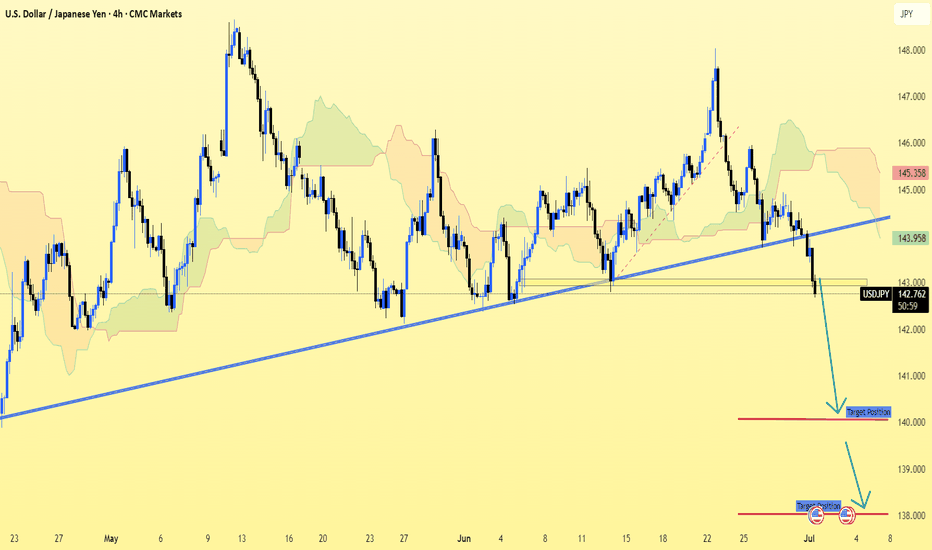

USD/JPY (4H timeframe) shows a clear break 0ut.USD/JPY (4H timeframe) shows a clear break below the ascending trendline and Ichimoku cloud support, suggesting a bearish continuation.

Key Bearish Targets (Based on the chart):

1. First Target Zone:

📉 140.88

This level aligns with previous structure support and is marked as the initial target on the chart.

2. Second Target Zone:

📉 138.85 – 139.00

This is a deeper support zone and is indicated as the next bearish leg if price momentum continues downward.

Summary:

Current Price: ~142.74

Trend: Bearish (Breakdown from trendline + Ichimoku bearish signals)

Target 1: 140.88

Target 2: 138.85

Let me know if you want SL (stop-loss) or entry suggestions.

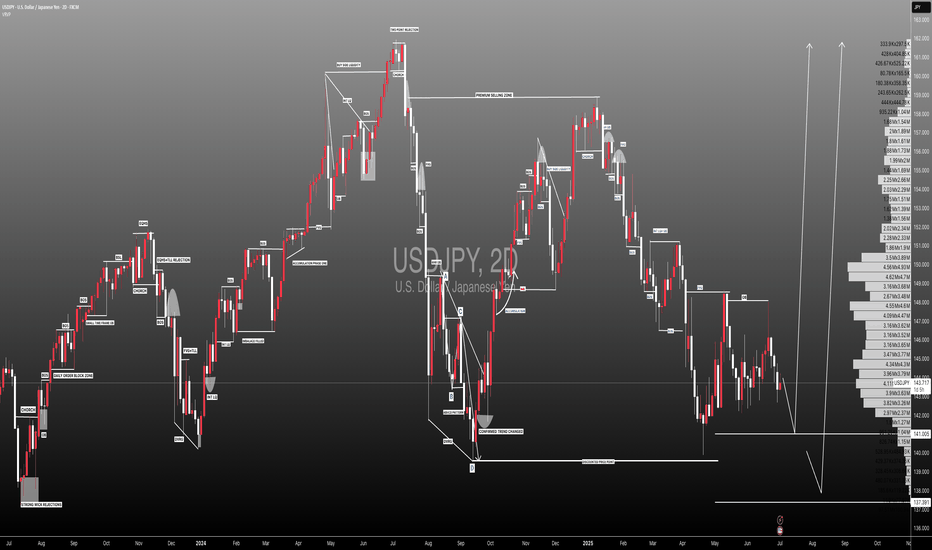

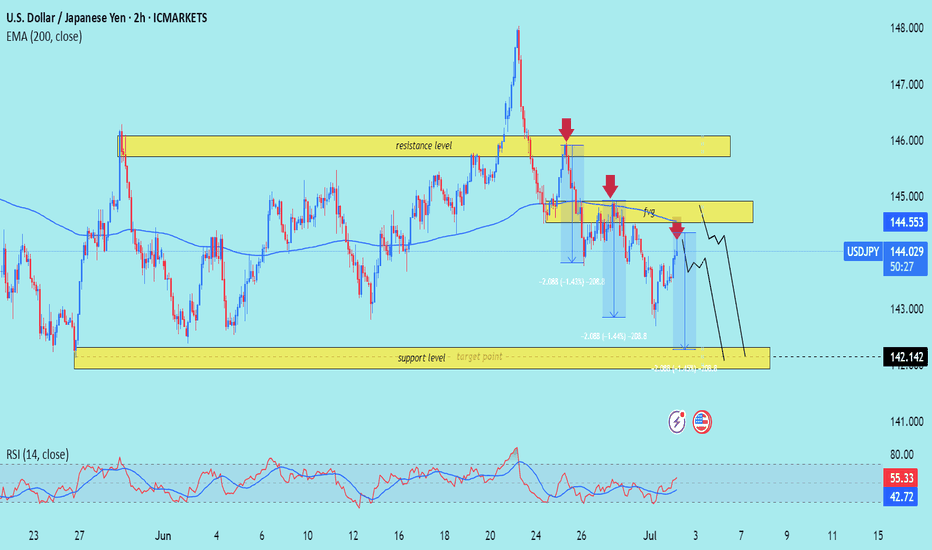

USD/JPY) Back support level Read The captionSMC trading point update

Technical analysis of USD/JPY pair using a combination of price action, resistance/support levels, and indicators. Here's a breakdown of the idea behind the analysis:

---

Chart Breakdown (2H - USD/JPY)

1. Key Zones:

Resistance Level (Yellow Box at Top):

Price has previously been rejected from this zone multiple times.

Recent bearish wicks and aggressive sell-offs are marked by red arrows—showing strong seller interest.

Support Level / Target Point (Bottom Yellow Box):

Price has found strong buying interest around 142.142.

This zone is the anticipated downside target if the bearish scenario plays out.

2. Bearish Bias Justification:

Liquidity Grab / Fakeout (labeled “fug”):

The price briefly broke above the smaller resistance block but quickly reversed.

This "fake breakout" often traps buyers, strengthening the bearish case.

EMA 200 (Blue Line):

Price is currently near or slightly under the 200 EMA (144.553), suggesting a potential rejection area aligning with resistance.

RSI Indicator:

RSI shows divergence and has not confirmed a bullish breakout.

The values (56.77 and 42.82) indicate loss of bullish momentum.

3. Projection (Black Lines):

The black zig-zag lines represent a forecasted drop to the support level.

Suggests a short setup near 144.50–145.00 with targets near 142.14.

Mr SMC Trading point

---

Summary:

Bias: Bearish

Entry Zone: Near resistance area (144.50–145.00)

Target: 142.142 (support zone)

Invalidation: Strong break above 145.00 and hold

Confirmation: Rejection from resistance with bearish candle pattern

---

Please support boost 🚀 this analysis)

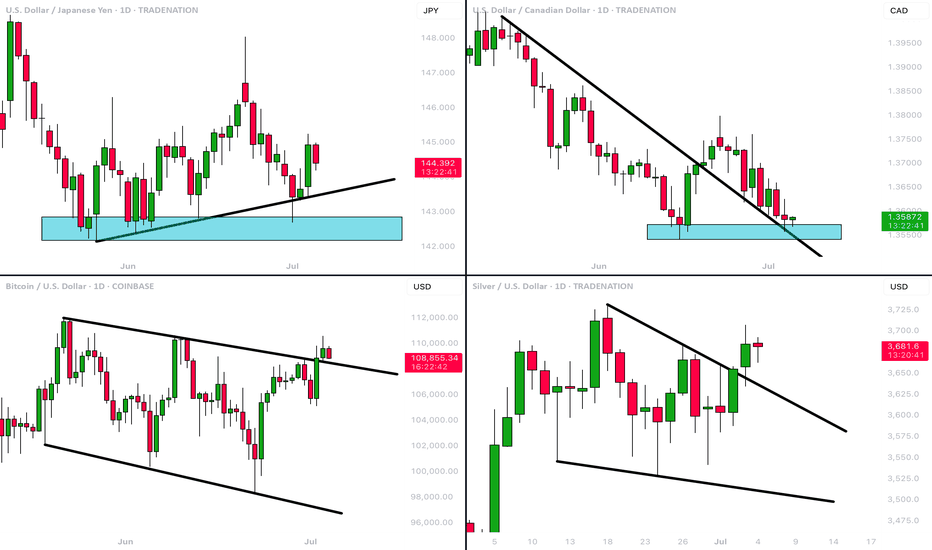

MarketBreakdown | USDJPY, USDCAD, BITCOIN, SILVER

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #USDJPY daily time frame 🇺🇸🇯🇵

The market nicely respected a rising trend line

and bounced from that, forming a high momentum bullish candle.

I think that the pair will continue rising and reach 145.8 level soon.

2️⃣ #USDCAD daily time frame 🇺🇸🇨🇦

The price is currently approaching an important confluence

zone based on a falling trend line and a horizontal support.

I will expect a pullback from that.

3️⃣ #BITCOIN #BTCUSD daily time frame

The price successfully violated a resistance line of a bullish

flag pattern and closed above that.

It is a critical bullish signal. I believe that the price will test

a current high then and will violate that with a high probability.

4️⃣ #SILVER #XAGUSD daily time frame 🪙

The market broke a resistance line of a bullish flag.

Uptrend is going to continue, and the price is going to reach 37,14 level soon.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

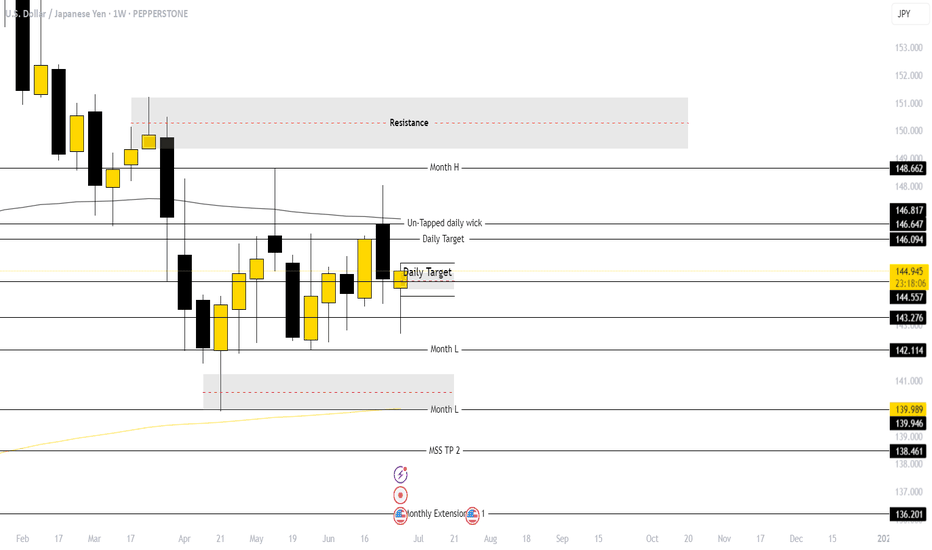

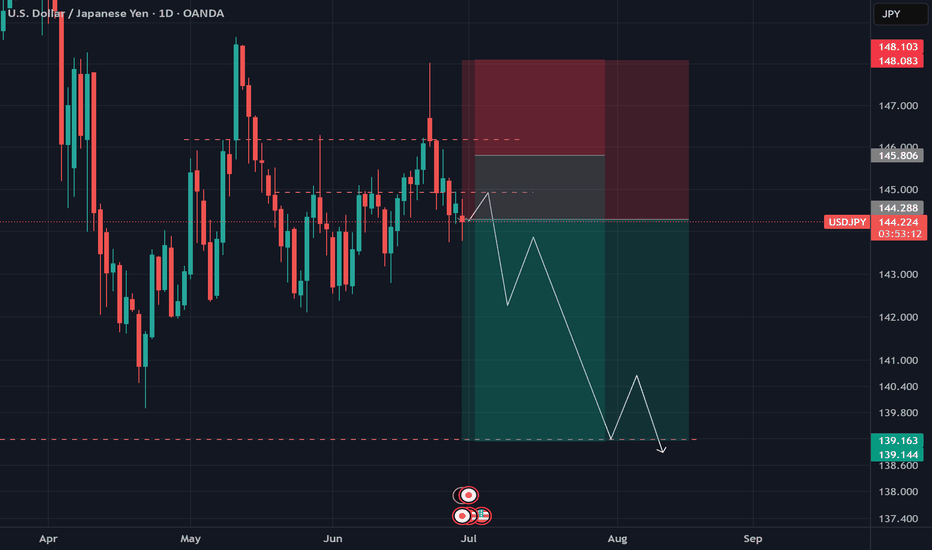

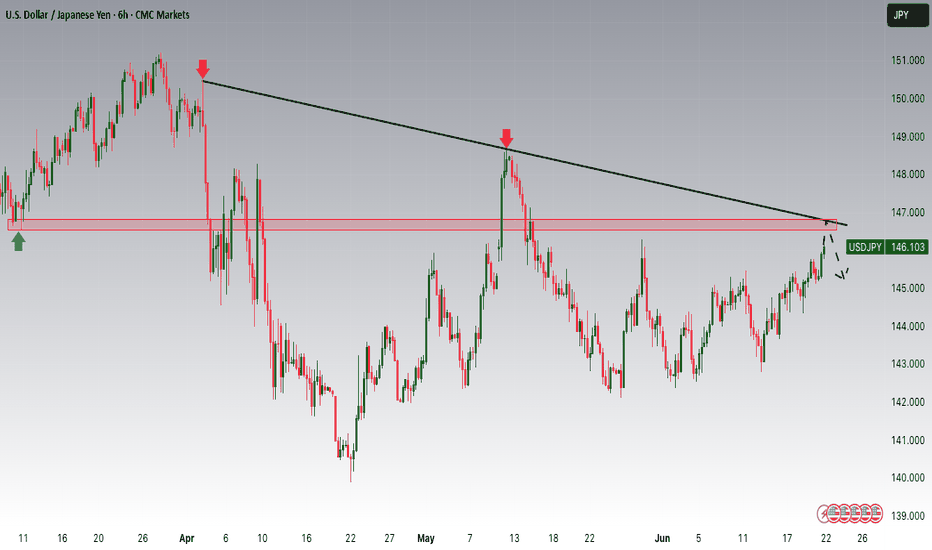

USD/JPY Analysis – June 29, 2025

🚨 Don’t miss the opportunity on yen right now.

From a technical perspective, price action has followed our previous projections almost perfectly —

and now, strong fundamental signals are also emerging following the latest BOJ meeting.

📉 This could be a good time for a Sell position:

either from the current level (for aggressive traders),

or slightly higher around the 145 resistance zone.

🎯 The expected target lies around 139,

in line with the broader corrective structure.

This setup offers a high-potential move — especially for those tracking both TA and FA closely.

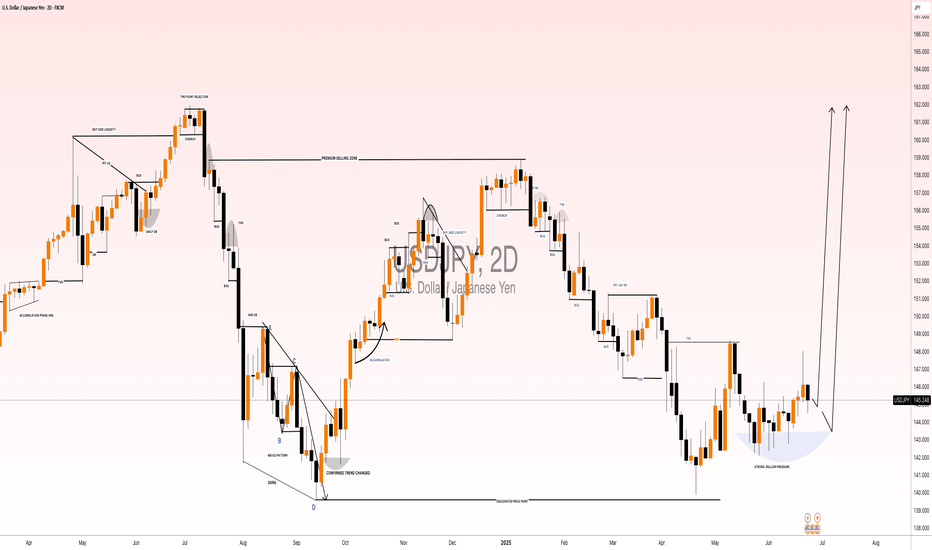

USDJPY: Up to +2000 Pips Move! Stay Tuned USDJPY has been accumulating for a long time, and we are confident that the price will enter the distribution phase. This phase will be extremely bullish, leading the price to new record highs and potentially surpassing 160. We wish you the best in trading and have a great week ahead.

Like and comment for more!

Team Setupsfx_

❤️🚀

Trading Recommendations and Analysis for USDJPYThe technical picture on Monday may shape future developments in the medium term. The week began a gap up, followed by the formation of a long upper shadow. The daily close occurred exactly at the support level of 146.11 thereby closing the gap.

Today's trading also opened exactly at the same level, and the candle is already black in the early hours of trading. This defines Monday's movement as false, thus creating a strong bearish signal, with a potential breakdown of the 143.45 support and a subsequent decline toward the MACD line, which coincides with the target level of 141.70. The Marlin oscillator has turned downward. its return to negative territory will add additional pressure on the price.

In the H4 timeframe, the price has consolidated below the 146.11 level, making it easier to settle below the MACD line eventually.

A break below 145.48 -the June 11 high-will serve as confirmation. The Marlin oscillator appears to be fixed in bearish territory and has joined the new downward movement.

USDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 146.700 zone, USDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 146.700 support and resistance area.

Trade safe, Joe.

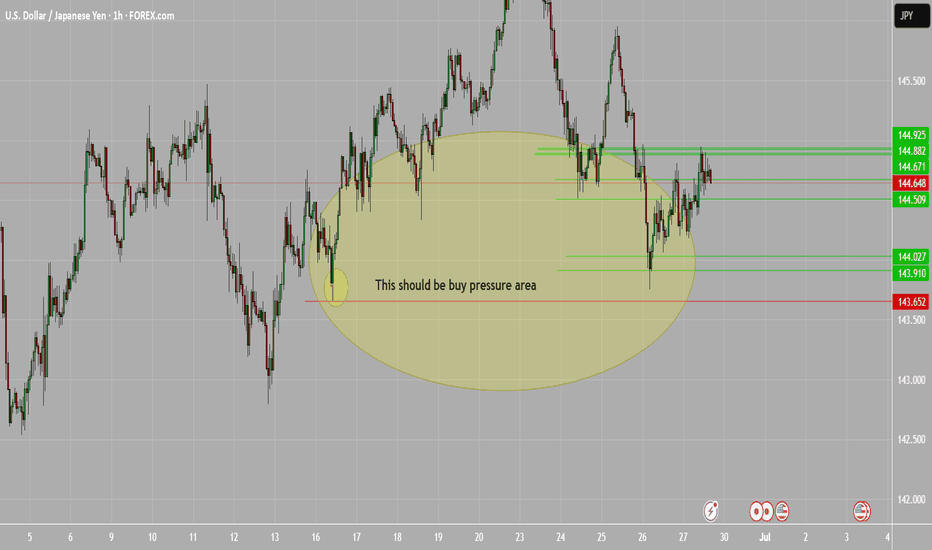

Buy pressure USD/JPYBuyers seeking to continue overall movement to 160 area. From the outside looking in all aspects of final test are being made and have been made at 144 area. This is a good number! Looking even closer, the sellers are selling too fast and are not going to be able to keep up that momentum in comparison to the overall pressure from the bottom. The top has been tested 3 strikes you out. Followed by the long steady ride up with bumps and traps along the way of course. Get your ticket now to get a good seat and watch.

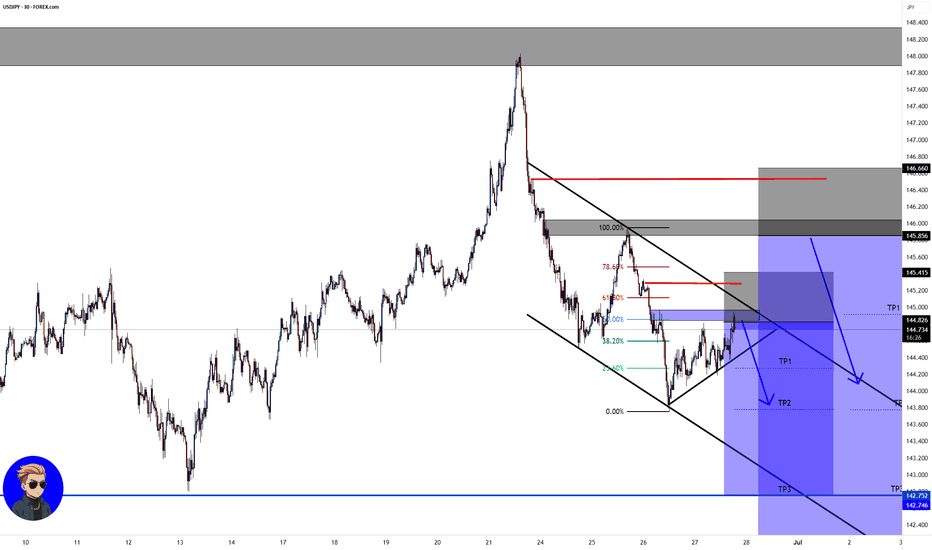

USD/JPY💰Symbol: { USD/JPY }

🟩Price: { 144.790 & 145.856 }

🟥Stop: { 145.415 & 146.660 }

1️⃣profit: { 144.279 & 144.916 }

2️⃣profit: { 143.780 & 143.780 }

3️⃣profit: { 142.746 & 142.746 }

4️⃣profit: { 142.139 }

📊Check your chart before entering.

🚨Check before use to make sure there is no important news.🚨