USDJPY trade ideas

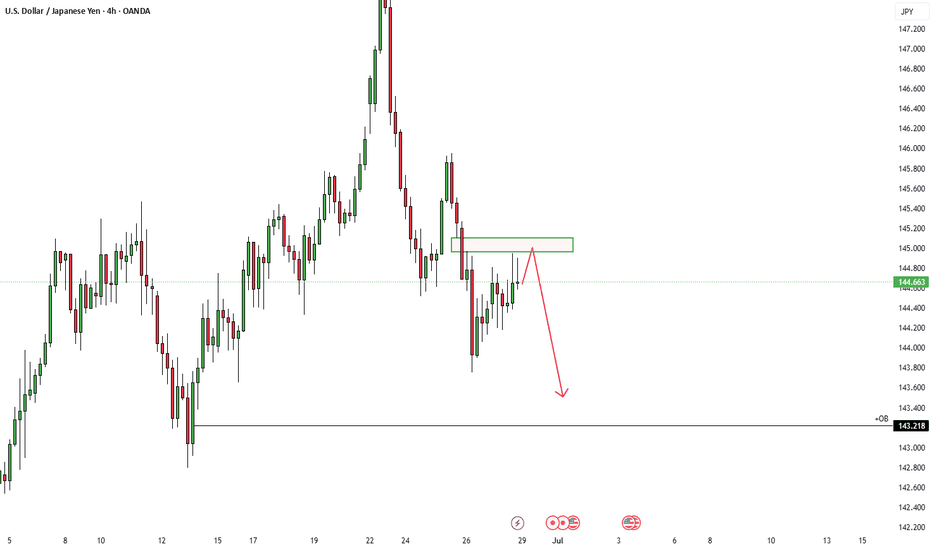

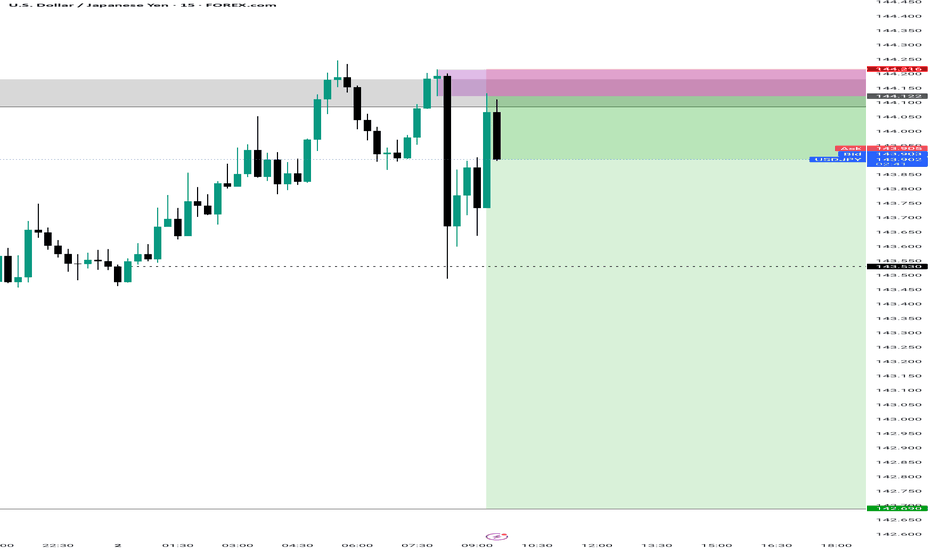

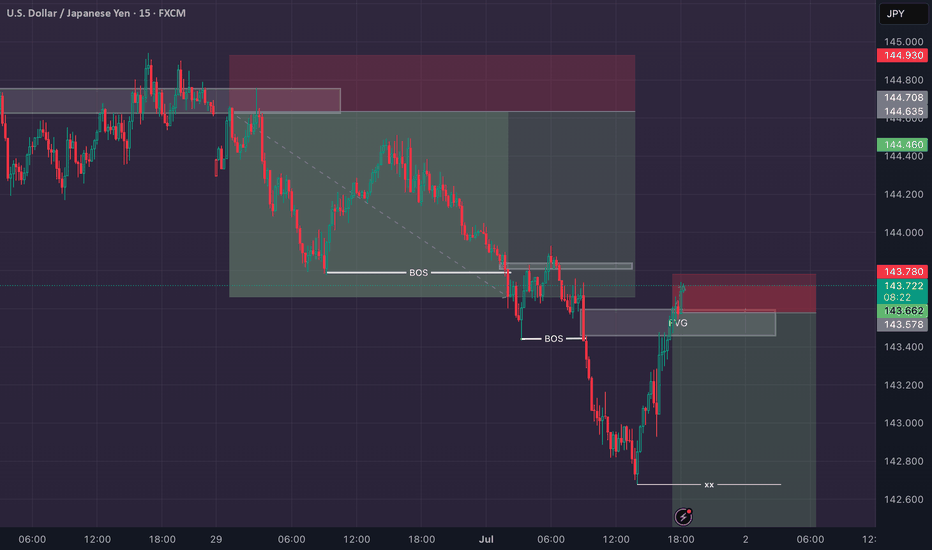

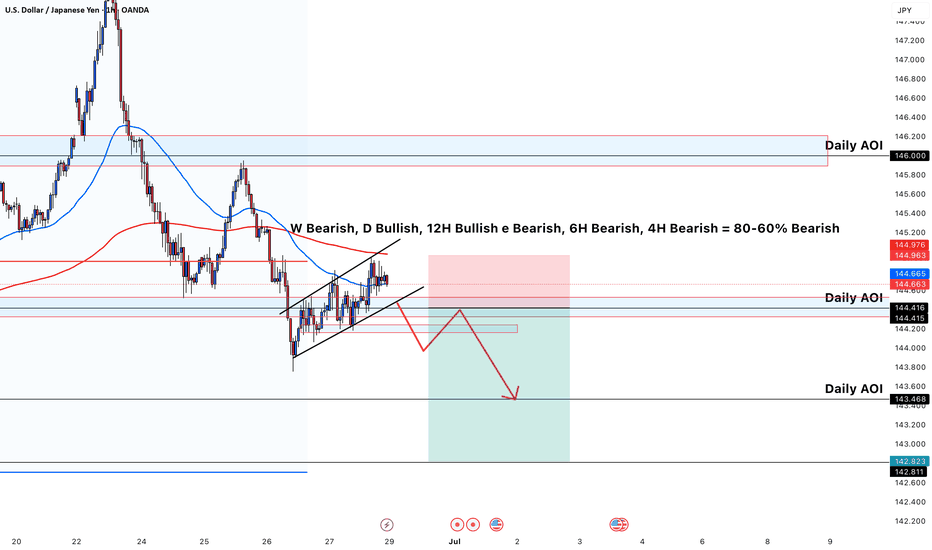

Market next move 🔀 Disruption Analysis – Bearish Alternative Scenario

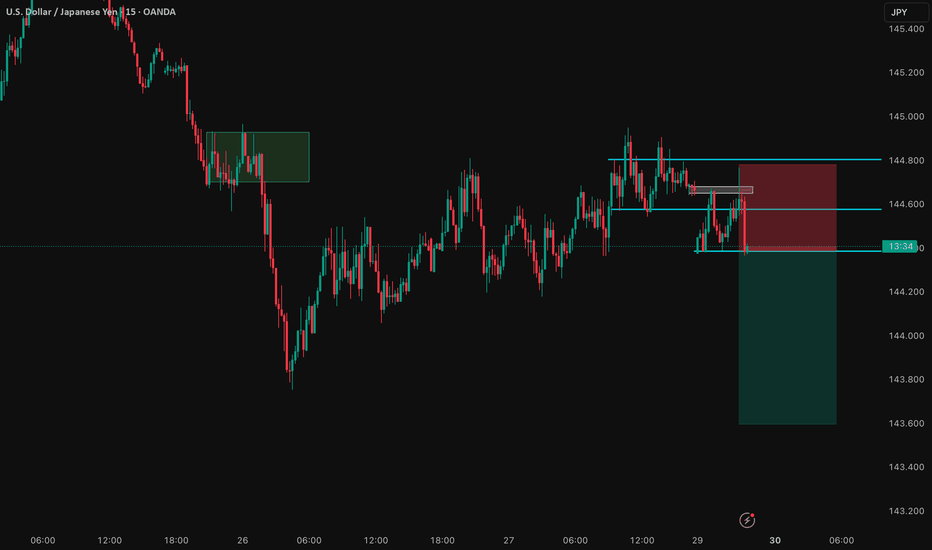

While the current setup points to a bullish continuation above the support zone (around 144.10–144.20) with a projected target near 144.60, here’s how a bearish disruption could unfold instead:

---

🔻 Bearish Disruption Possibility:

1. Failed Breakout / Bull Trap:

Price may fake a move upward to trap breakout buyers near 144.40–144.50, then sharply reverse.

This would indicate a false breakout and potential reversal setup.

2. Rejection at Resistance:

Repeated failure to close above 144.40 may signal exhaustion.

Bearish divergence could form on momentum indicators (like RSI) as price rises.

3. Break Below Support Area:

A decisive break below the red support zone (around 144.10) may shift momentum bearish.

That would confirm a lower high and suggest downside continuation.

4. Next Bearish Target:

Initial support lies at 143.85, with further potential drop toward 143.60.

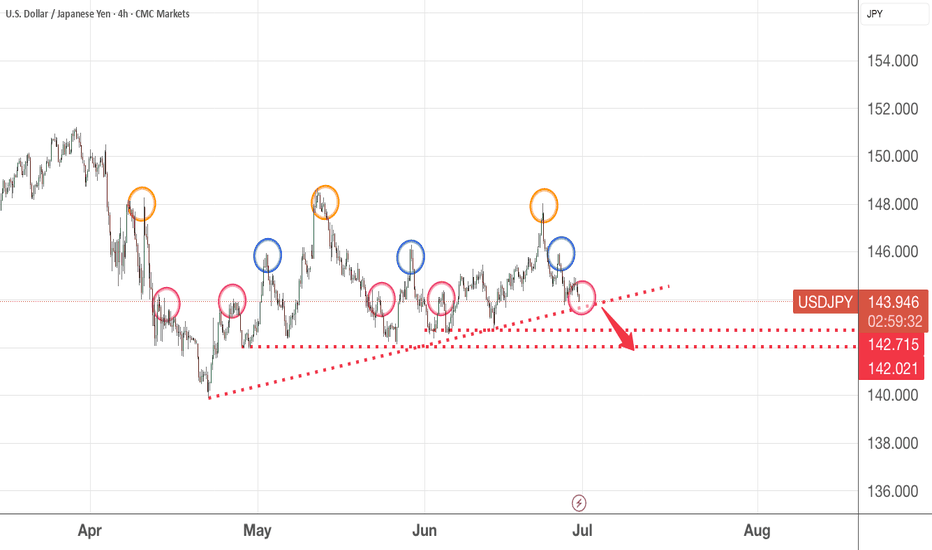

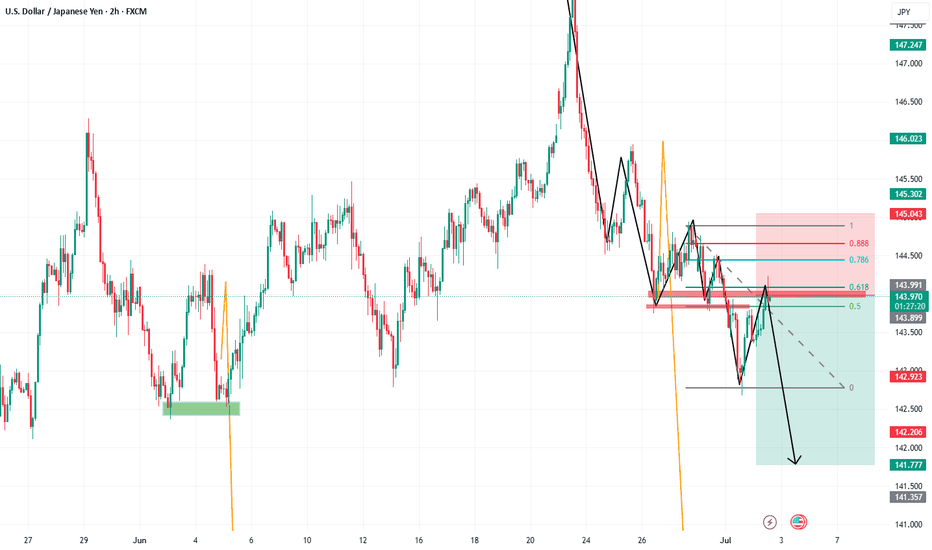

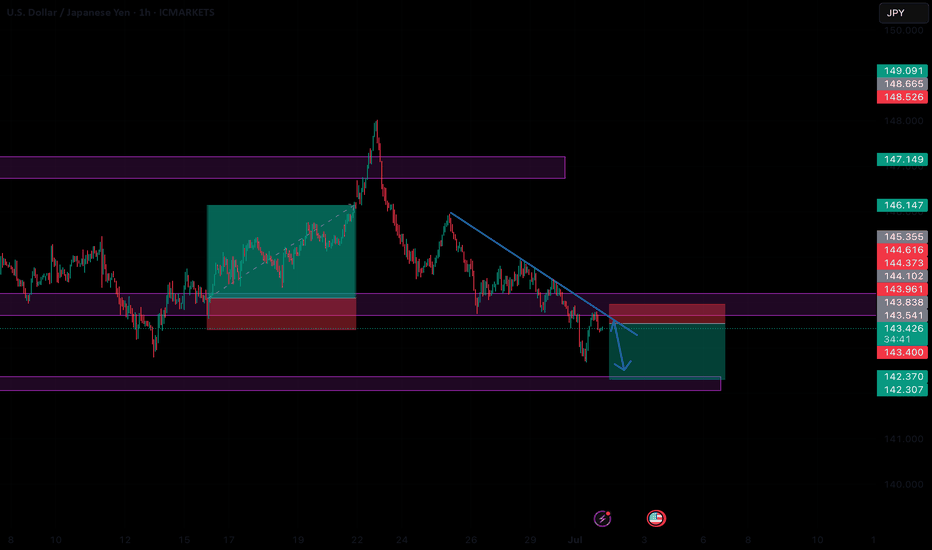

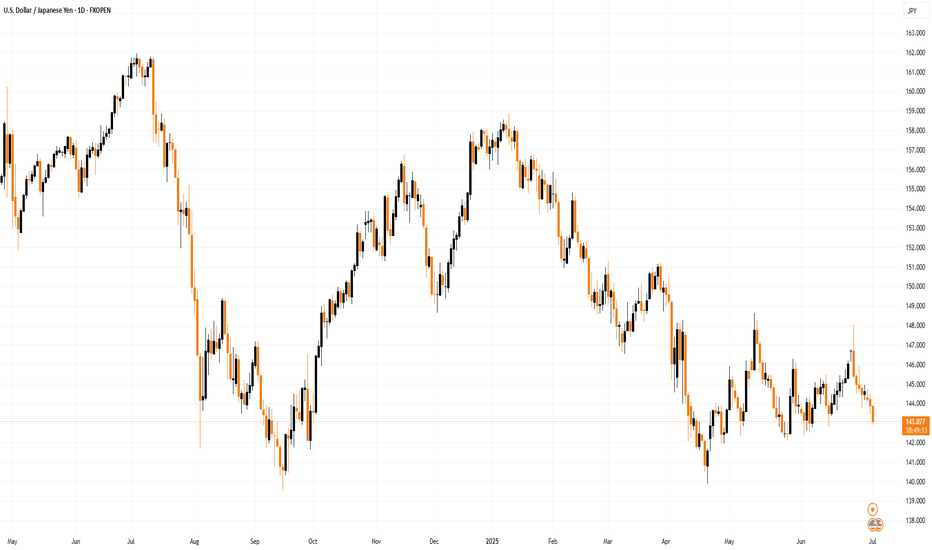

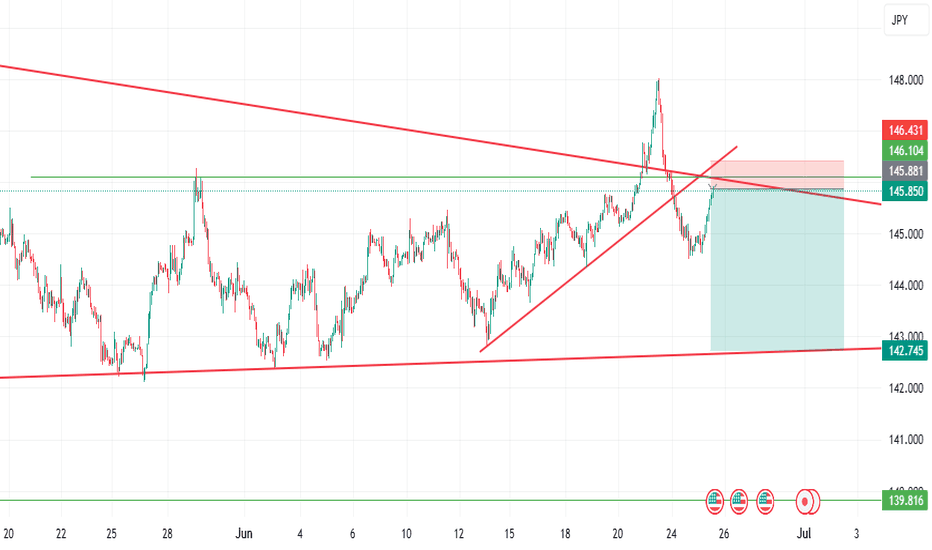

Interesting pattern found in USDJPY 4H chartIn this 4H chart, if you observe closely - the orange circle shows the peak at 148 price level

then, it falls to the blue circle at 146 price level before settling lower at the 143 price level. This is also where we are now.

I believe it is likely to break down further for which I have indicated a potential profit target.

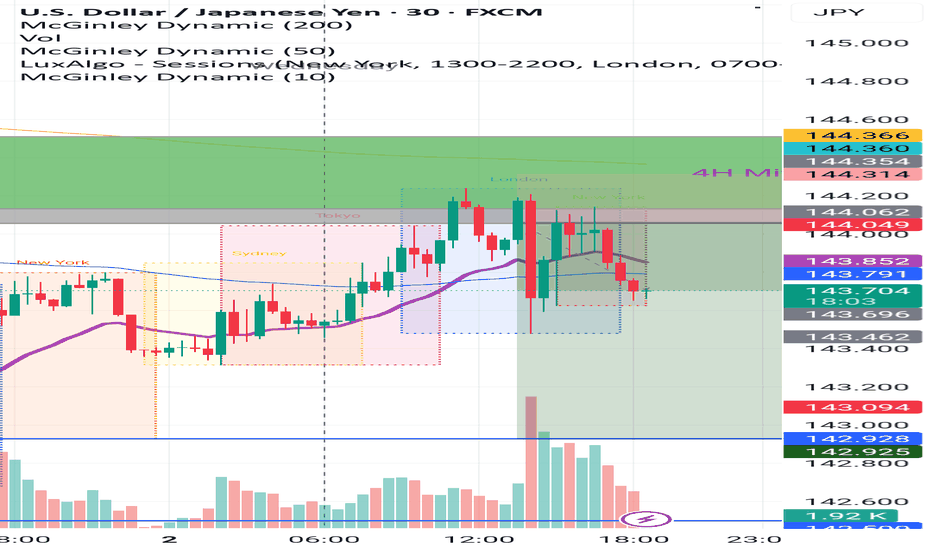

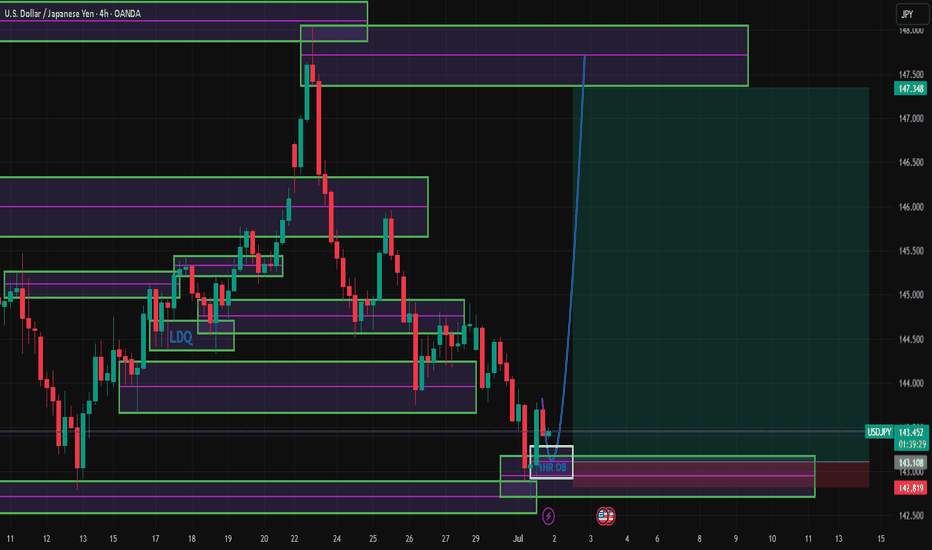

4H ORDER BLOCK UNMITIGATED STRATEGY📉 USDJPY – Short Bias Below Supply Zone (4H Mitigated OB Bearish)

Timeframe: 30m

Bias: Bearish

Type: Intraday / Swing Setup

📌 Key Observations:

Price recently tapped into a 4H Mitigated Order Block (OB) around 144.360 – 144.049 and showed rejection with strong bearish wicks.

This zone aligns with a previous supply area and is marked by confluence from the McGinley Dynamic 50 & 200 EMA.

A short was executed at 144.162, with a stop above the OB at 144.476.

Target is set at 142.500, near previous demand structure and liquidity sweep.

🧠 Trade Rationale:

The 4H bearish OB was mitigated during the Tokyo session with low momentum, followed by a London and NY session rejection.

The pair formed a lower high and is now trading below key moving averages, indicating a possible continuation to the downside.

Multiple sessions show rejection from the same OB area – reinforcing its strength.

Increased volume on the down candle confirms institutional presence.

🎯 Trade Details:

Entry: 144.162

Stop Loss: 144.476

Take Profit: 142.500

RRR: 5.9:1

Position Size: 228,000

Current PnL: +606.12 USD (Floating)

🔍 Next Steps:

Monitor for any signs of bullish order blocks forming around 143.200 or 142.900 as partial TP zones.

Move SL to breakeven once price breaks 143.400.

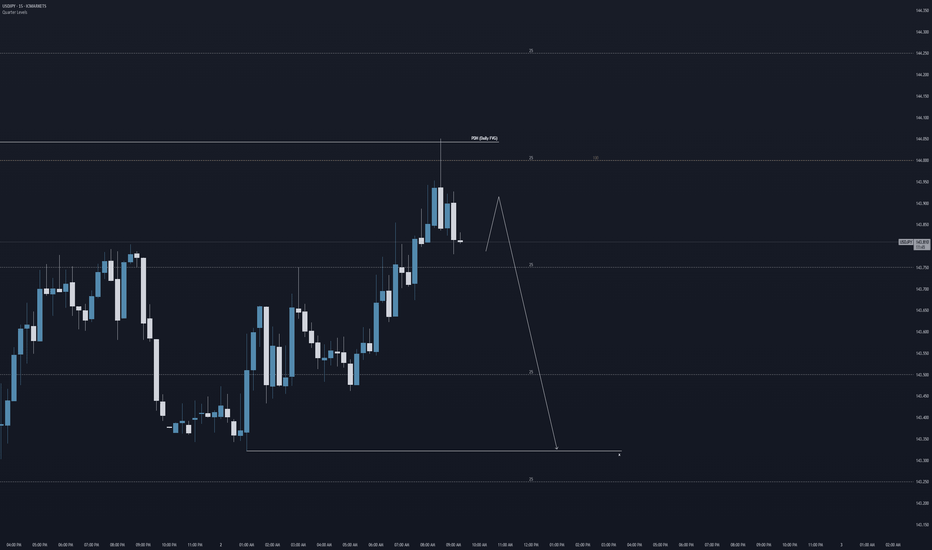

UJ, will we see a bearish leg today?USDJPY looks quite interesting after the wick rejection from key level 144.000. Will this area be respected and give us a bearish leg. Hmm, let's see how price unfolds for this pair today.

Regards,

Aman | SMC Wolf FX

1-1 student onboarding is currently open (website in my signature & profile)

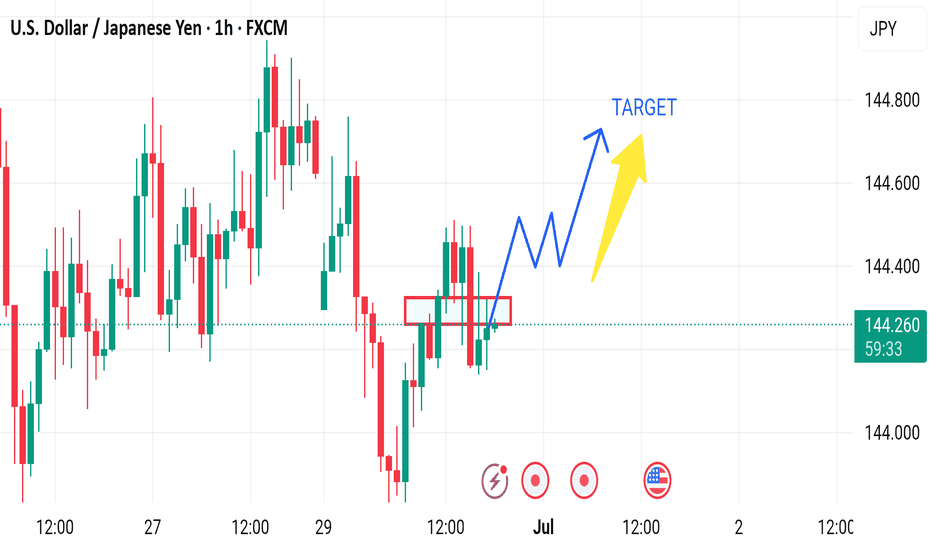

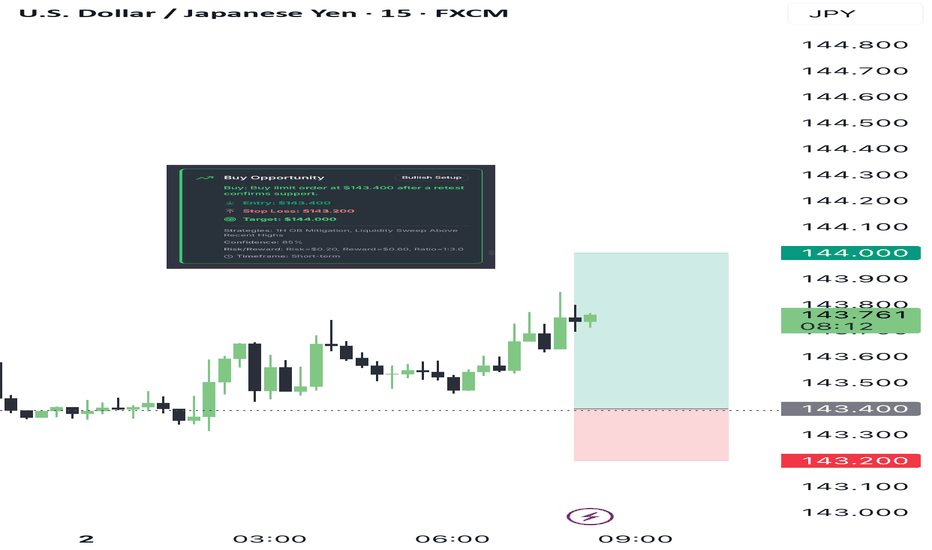

Buy limit order at $143.400 after a retest confirms supportAnalyzing the USD/JPY across multiple timeframes, we observe a consistent pattern of price recovery after a significant drop, indicating a potential phase of accumulation by institutional players. The daily chart shows a recent decline followed by a stabilization and slight upward movement, suggesting a possible change of character (CHoCH) from bearish to bullish momentum. The 4-hour and 1-hour charts confirm this with a series of higher lows and higher highs, indicative of a shift towards bullish sentiment.

The 15-minute, 5-minute, and 1-minute charts display more granular price action, with recent bullish candles suggesting an ongoing push for higher prices. This could be a response to retail selling pressure being absorbed by institutional buying, a common scenario during early stages of a bullish reversal.

INSTITUTIONAL THESIS:

Institutions appear to be in the early stages of an accumulation phase, targeting liquidity above recent highs to trigger stop losses and fuel further upward movement. The presence of unmitigated order blocks (OB) on the 1-hour chart around 143.400 provides a potential area for re-entry, suggesting that price may revisit this zone to balance before continuing upwards.

LEARNING POINT:

"1H Order Block mitigation after liquidity sweep" - This scenario highlights how institutions often retest key levels where significant orders were previously placed, confirming their commitment to driving the price in the intended direction.

SIGNAL: BUY

SYMBOL: USDJPY

ENTRY PRICE: $143.400

STOP LOSS: $143.200

TARGET PRICE: $144.000

CONDITION: Buy limit order at $143.400 after a retest confirms support.

RATIONALE: The setup aligns with a bullish CHoCH on multiple timeframes, presence of a 1H OB, and the anticipation of a liquidity sweep above recent highs.

STRATEGIES USED: 1H OB Mitigation, Liquidity Sweep Above Recent Highs

URGENCY: MEDIUM

TIMEFRAME: Short-term

CONFIDENCE SCORE: 85%

RISK/REWARD RATIO: Risk=$0.20, Reward=$0.60, Ratio=1:3.0

CRITICAL RULES:

The analysis strictly adheres to Smart Money Concepts, avoiding traditional retail indicators.

The decision is based on visible price action and institutional logic, ensuring a high probability of success.

The risk/reward ratio exceeds the minimum requirement of 2:1, enhancing the trade's viability.

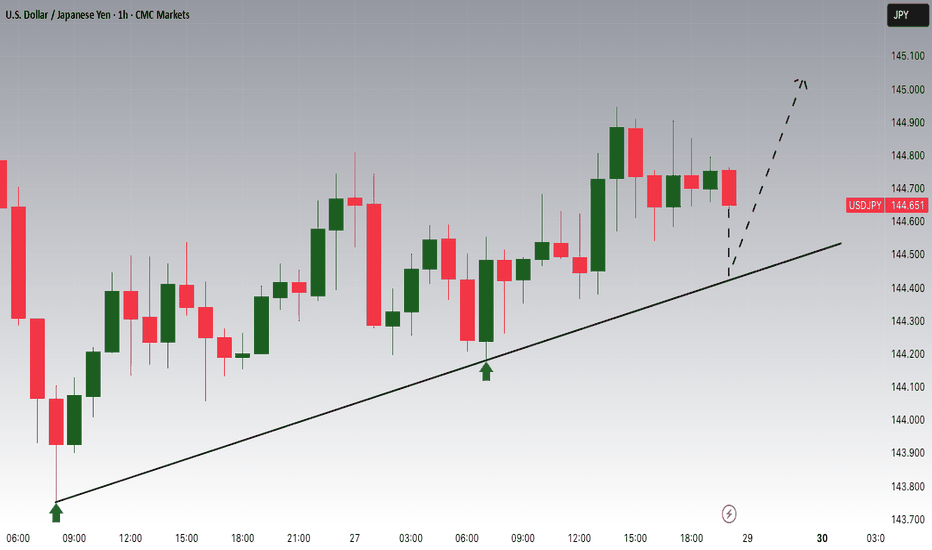

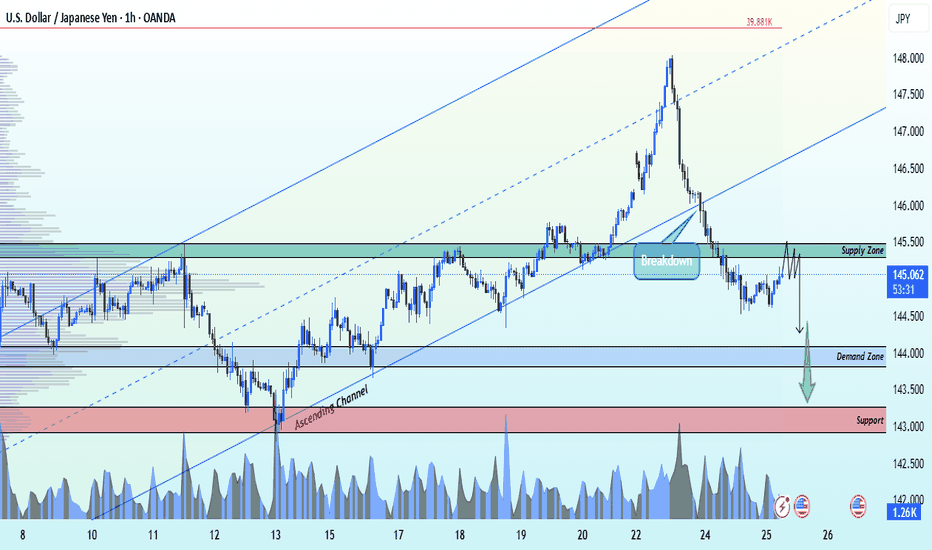

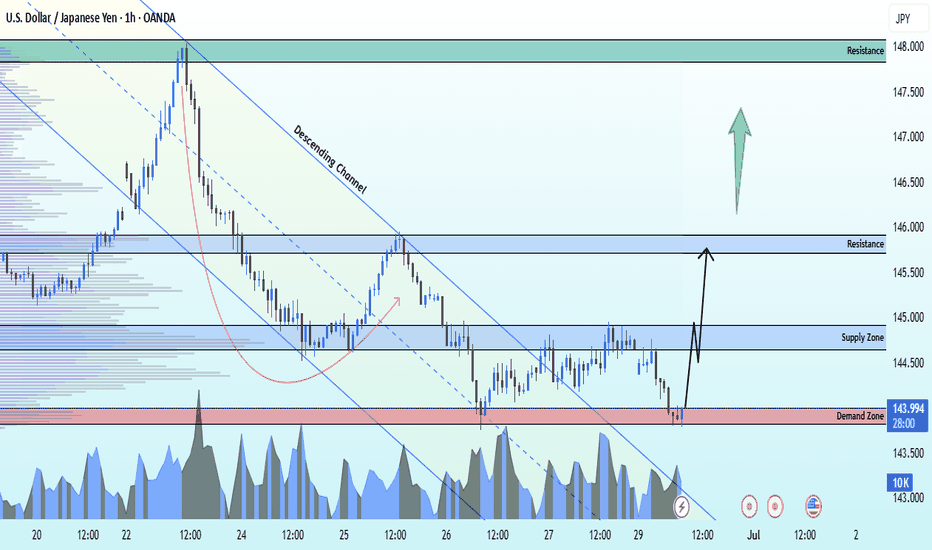

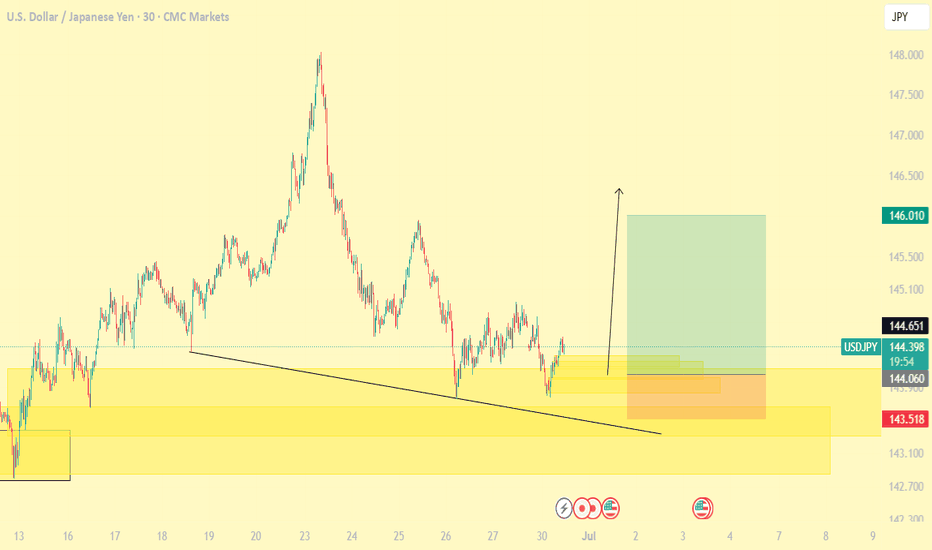

USDJPY Ascending channel breakdown ahead selling strong📉 USDJPY Breaks Down!

Strong sell-off from the key supply zone at 145.500 – the ascending channel has been broken on the 1H timeframe, signaling momentum shift.

🎯 Technical Targets:

🔹 1st Target: 144.000 – key demand zone

🔹 2nd Target: 143.000 – strong support level

Bearish pressure is building — price action confirms the shift. Eyes on lower zones as sellers take control. 📊

🔔 Like, Follow, and Comment your thoughts!

💬 Join us for more timely market updates and clean setups!

#USDJPY #ForexAnalysis #TechnicalTrading #PriceAction #FXSetup #LiviaTrades 😜

USDJPY Analysis – Bullish Continuation After Minor PullbackUSDJPY is currently trading around 143.340, and I anticipate a minor pullback into the 143.296 zone, which aligns with a possible bullish order block and discount zone on the H1/H4 timeframe.

This short-term dip could serve as a liquidity sweep or mitigation before price resumes its bullish trend, targeting the 147.381 level — a key area of interest tied to previous highs and potential liquidity above.

I’ll be watching for bullish confirmation (e.g., clean W-pattern, bullish engulfing candle, or break of internal structure) from the 143.296 zone before taking long entries.

🔻 Short-term expectation: Pullback to 143.296

🔼 Primary bias: Bullish continuation

🎯 Upside target: 147.381

📍 Current price: 143.340

📌 Risk Management Reminder: This is not financial advice. Always apply proper risk management:

✔️ Use a minimum of 1:2 RR setups

✔️ Risk no more than 1–2% of your capital per trade

✔️ Wait for clear confirmation before entering

✔️ Protect your account — preservation over prediction

USDJPY Ascending channel breakout buy strong from demand zone📈 USDJPY Bullish Breakout Alert! 🚀

USDJPY has officially broken out of the descending channel from the 143.800 demand zone — showing strong bullish momentum on the 1H time frame! 🔥

🎯 Technical Targets:

1st Target: 145.000 – Supply Zone 💥

2nd Target: 146.000 – Key Resistance

3rd Target: 148.000 – Major Resistance Level

Momentum is building — bulls are in control! 🐂

👇 Like, Follow & Comment your thoughts below!

💬 Join our trading community for more real-time updates and analysis!

#USDJPY #ForexSignals #PriceAction #BreakoutTrade

#LiviaTrades 😜

Quantitative Trading Models in Forex: A Deep DiveQuantitative Trading Models in Forex: A Deep Dive

Quantitative trading in forex harnesses advanced algorithms and statistical models to decode market dynamics, offering traders a sophisticated approach to currency trading. This article delves into the various quantitative trading models, their implementation, and their challenges, providing insights for traders looking to navigate the forex market with a data-driven approach.

Understanding Quantitative Trading in Forex

Quantitative trading, also known as quant trading, in the forex market involves using sophisticated quantitative trading systems that leverage complex mathematical and statistical methods to analyse market data and execute trades. These systems are designed to identify patterns, trends, and potential opportunities in currency movements that might be invisible to the naked eye.

At the heart of these systems are quantitative trading strategies and models, which are algorithmic procedures developed to determine market behaviour and make informed decisions. These strategies incorporate a variety of approaches, from historical data analysis to predictive modelling, which should ensure a comprehensive assessment of market dynamics. Notably, in quantitative trading, Python and similar data-oriented programming languages are often used to build models.

In essence, quantitative systems help decipher the intricate relationships between different currency pairs, economic indicators, and global events, potentially enabling traders to execute trades with higher precision and efficiency.

Key Types of Quantitative Models

Quantitative trading, spanning diverse markets such as forex, stocks, and cryptocurrencies*, utilises complex quantitative trading algorithms to make informed decisions. While it's prominently applied in quantitative stock trading, its principles and models are particularly significant in the forex market. These models are underpinned by quantitative analysis, derivative modelling, and trading strategies, which involve mathematical analysis of market movements and risk assessment to potentially optimise trading outcomes.

Trend Following Models

Trend-following systems are designed to identify and capitalise on market trends. Using historical price data, they may determine the direction and strength of market movements, helping traders to align themselves with the prevailing upward or downward trend. Indicators like the Average Directional Index or Parabolic SAR can assist in developing trend-following models.

Mean Reversion Models

Operating on the principle that prices eventually move back towards their mean or average, mean reversion systems look for overextended price movements in the forex market. Traders use mean reversion strategies to determine when a currency pair is likely to revert to its historical average.

High-Frequency Trading (HFT) Models

Involving the execution of a large number of orders at breakneck speeds, HFT models are used to capitalise on tiny price movements. They’re less about determining market direction and more about exploiting market inefficiencies at micro-level time frames.

Sentiment Analysis Models

These models analyse market sentiment data, such as news headlines, social media buzz, and economic reports, to gauge the market's mood. This information can be pivotal in defining short-term movements in the forex market, though this model is becoming increasingly popular for quantitative trading in crypto*.

Machine Learning Models

These systems continuously learn and adapt to new market data by incorporating AI and machine learning, identifying complex patterns and relationships that might elude traditional models. They are particularly adept at processing large volumes of data and making predictive analyses.

Hypothesis-Based Models

These models test specific hypotheses about market behaviour. For example, a theory might posit that certain economic indicators lead to predictable responses in currency markets. They’re then backtested and refined based on historical data to validate or refute the hypotheses.

Each model offers a unique lens through which forex traders can analyse the market, offering diverse approaches to tackle the complexities of currency trading.

Quantitative vs Algorithmic Trading

While quant and algorithmic trading are often used interchangeably and do overlap, there are notable differences between the two approaches.

Algorithmic Trading

Focus: Emphasises automating processes, often using technical indicators for decision-making.

Methodology: Relies on predefined rules based on historical data, often without the depth of quantitative analysis.

Execution: Prioritises automated execution of trades, often at high speed.

Application: Used widely for efficiency in executing repetitive, rule-based tasks.

Quantitative Trading

Focus: Utilises advanced mathematical and statistical models to determine market movements.

Methodology: Involves complex computations and data analysis and often incorporates economic theories.

Execution: May or may not automate trade execution; focuses on strategy formulation.

Application: Common in risk management and strategic trade planning.

Implementation and Challenges

Implementing quantitative models in forex begins with the development of a robust strategy involving the selection of appropriate models and algorithms. This phase includes rigorous backtesting against historical data to validate their effectiveness. Following this, traders often engage in forward testing in live market conditions to evaluate real-world performance.

Challenges in this realm are multifaceted. Key among them is the quality and relevance of the data used. Models can be rendered ineffective if based on inaccurate or outdated data. Overfitting remains a significant concern, where systems too closely tailored to historical data may fail to adapt to evolving market dynamics. Another challenge is the constant need to monitor and update models to keep pace with market changes, requiring a blend of technical expertise and market acumen.

The Bottom Line

In this deep dive into quantitative trading in forex, we've uncovered the potency of diverse models, each tailored to navigate the complex currency markets with precision. These strategies, rooted in data-driven analysis, may offer traders an edge in decision-making.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

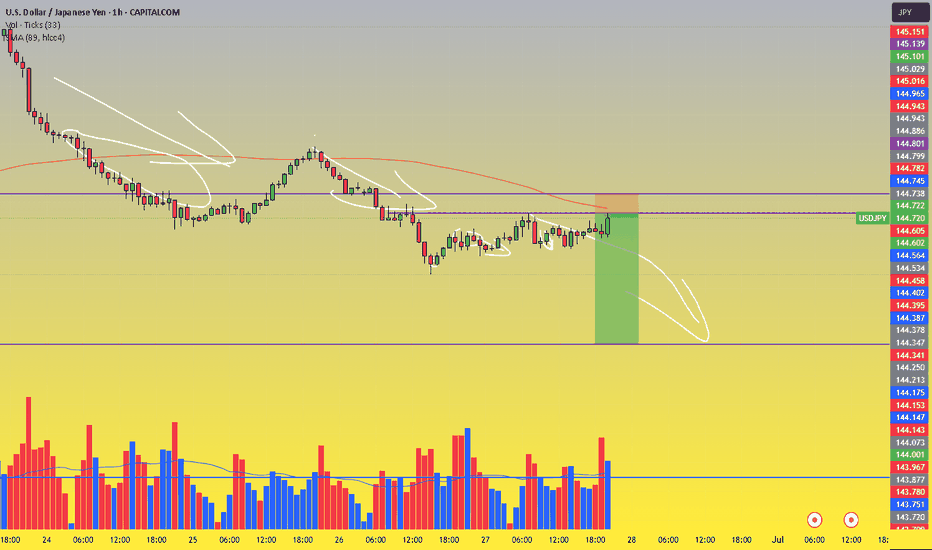

SELL: USDJPY 144.75 Trade Recommendation – 1H Chart🎯 Trade Setup:

Sell Entry Zone: 144.75 – 144.78

Stop Loss (SL): 145.15

Take Profit (TP): 142.60

Risk:Reward Ratio (R:R): Approx. 1:4 → Excellent for swing or intraday setups

📊 Technical Analysis Breakdown:

1. Strong Resistance Zone – High Reversal Probability:

The 144.75–144.78 zone:

A clear historical resistance area with multiple rejections in the past

Converges with the SMA 89 (red line) → acts as a strong dynamic resistance

Price has consistently formed lower highs around this region → showing selling pressure is building

2. Volume Analysis – Distribution Signals:

Volume slightly increased as price approached the resistance but did not accompany a breakout

No “breakout volume” → Indicates possible distribution phase, not accumulation → Favoring SELL positions

3. Price Action & Pattern:

The structure is forming lower highs – a key sign of bearish momentum

After the sharp rejection from the 145.22 zone (June 26), the market has shifted toward a bearish correction cycle

4. Target Area – Key Support:

142.60 is a well-defined support level:

Matches a previous major low

Corresponds with a high-liquidity zone from prior trading sessions

Ideal area to take profit before any potential bounce

⚠️ Risk Management Notes:

Trade confirmation increases if you see bearish candlestick signals (e.g., bearish engulfing, pin bar) in the entry zone

Exit immediately if price breaks and closes above 145.15 with strong volume – that invalidates the bearish setup

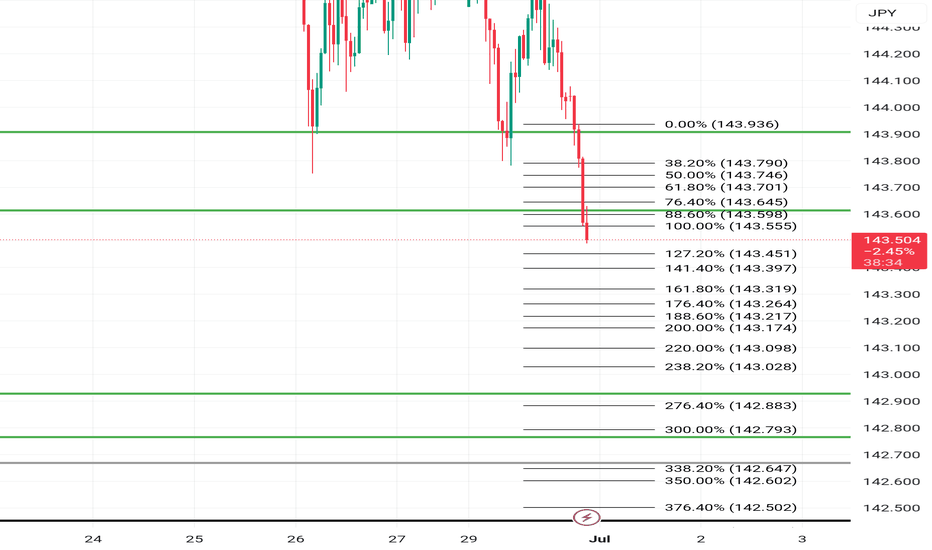

Short sell nowSell this pair now support has been broken which is the green lines on top... which price has pullback too sell now and take profits at the orange lines on. The bottom 300 fib level which is the next level of support where a major reversal is where it initially sold from in the past... look left and you will see

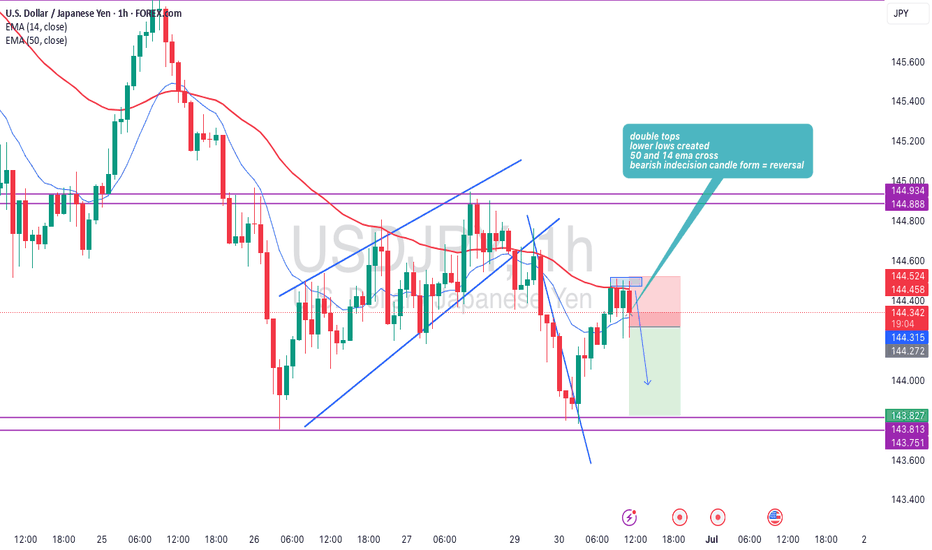

USDJPY Continue Bearish TrendThis USD/JPY chart presents a short bias based on multi-timeframe analysis and structure:

* **Trend Summary (Text on Chart)**:

* **Weekly (W)**: Bearish

* **Daily (D)**: Bullish

* **12H**: Mixed (Bullish & Bearish)

* **6H, 4H**: Bearish

→ Overall sentiment: **60–80% Bearish Bias**

* **Technical Highlights**:

* Price is forming a **rising wedge**, typically a bearish reversal pattern.

* The pair is currently testing a **Daily Area of Interest (AOI)** near 144.665–144.963, suggesting potential resistance.

* Price broke out of the wedge with a projected retest and continuation down.

* Target zone is below **143.468 (Daily AOI)** and extends toward **142.823**, suggesting a potential short setup with a favorable risk/reward ratio.

* Red and blue EMAs indicate price is below the 200 EMA and flirting with the 50 EMA, adding confluence to the short bias.

This analysis implies an anticipated breakdown from the wedge with follow-through to the downside if bearish momentum continues.

Multi-timeframe confluence is mostly bearish:

Weekly, 6H, and 4H are clearly bearish. 12H is mixed, and only the Daily is bullish. This gives an overall 60–80% bearish bias.

Rising wedge pattern:

Price is forming a bearish wedge, typically signaling a reversal or breakdown. It's losing momentum near resistance.

Price is near a Daily Area of Interest (AOI):

The pair is testing a known resistance zone. It has failed to break and hold above it convincingly.

Expecting a break and retest of structure:

You're anticipating the wedge to break down, retest the structure or AOI, and then continue bearish.

Target is aligned with a lower Daily AOI:

You have a clear target near 142.800, where price previously reacted — offering good risk-to-reward for the short.