U.S. Dollar / Japanese Yen forum

Japan Seeks US Deal as Tariff Deadline Nears

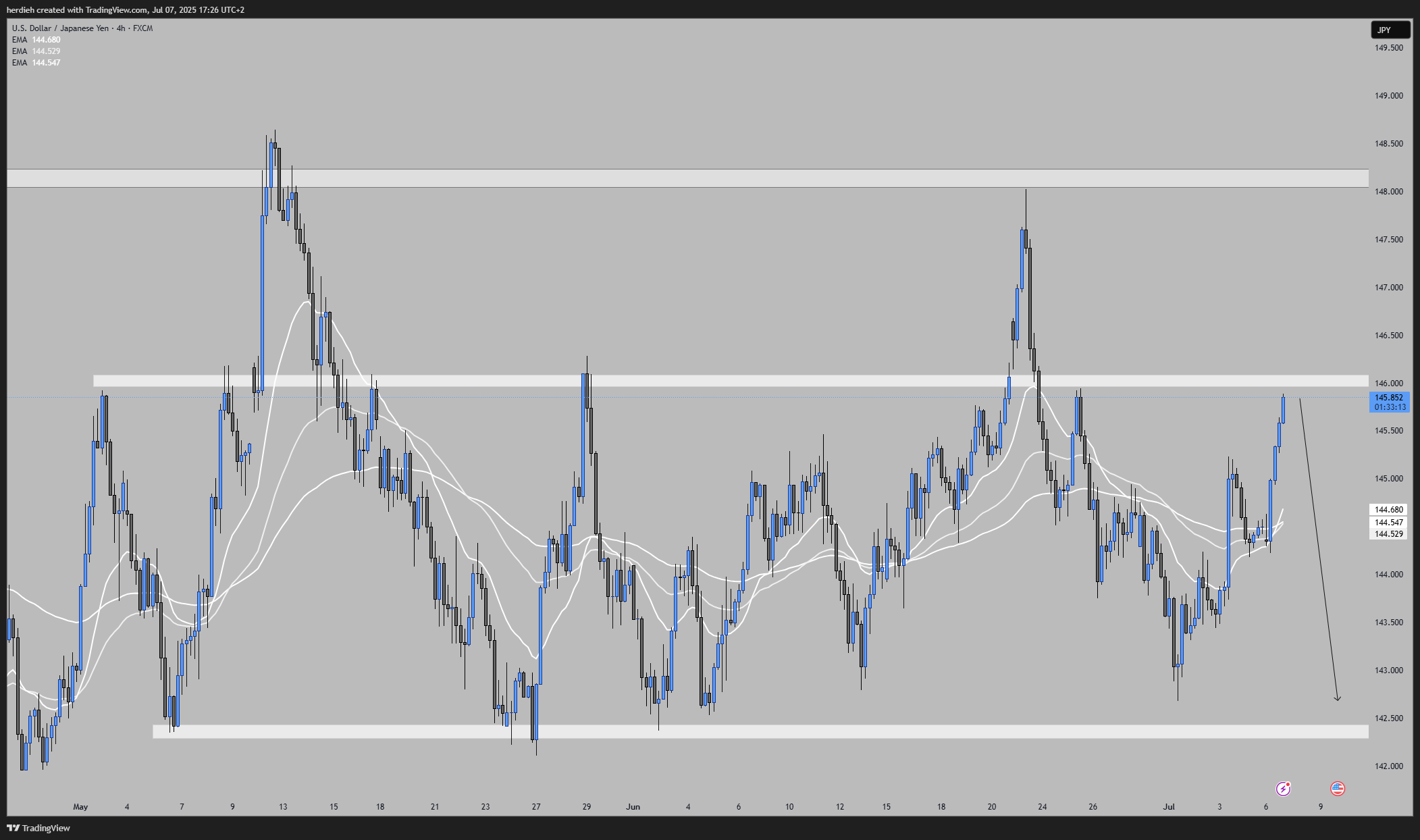

The yen hovered around 145 per dollar Friday after a nearly 1% drop in the previous session, pressured by trade uncertainties as Tokyo seeks a deal with Washington before next week’s deadline. Trump may announce new tariffs or extend deadlines today, having previously threatened tariffs up to 35% on Japanese goods over low US rice and car imports.

The yen also weakened as a stronger US dollar followed a better June jobs report, easing recession fears and reducing near-term Fed cut chances. In Japan, May household spending grew more than forecast, supported by government efforts to increase demand.

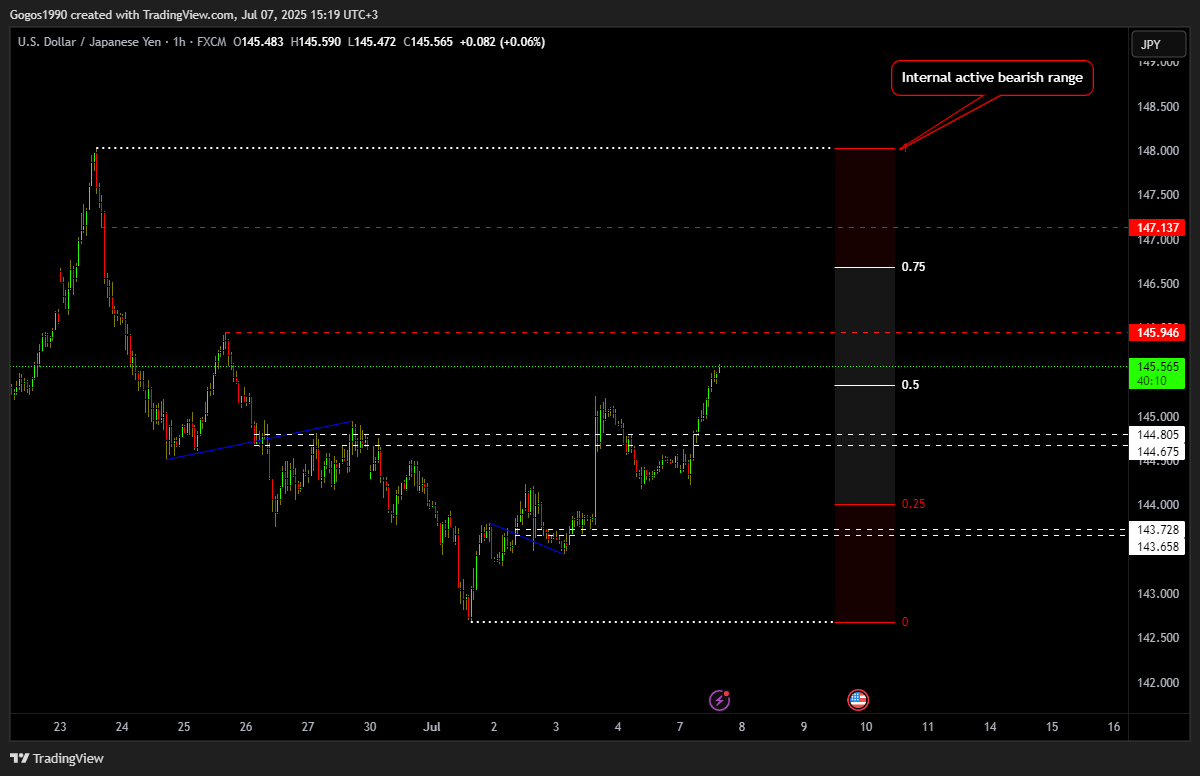

The key resistance is at $145.35, meanwhile the major support is located at $143.55.

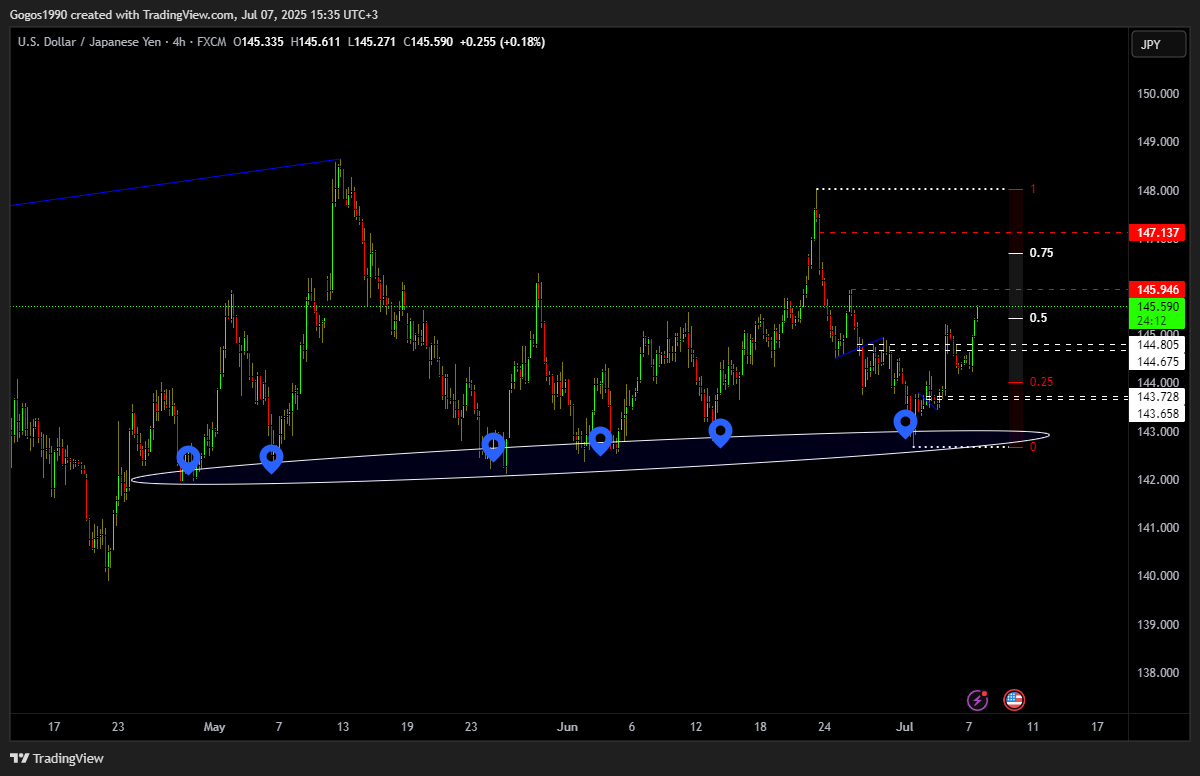

The main reason I’m confident in shorts is shown here. The 142–143 zone has become an extreme area of inducement. And I say extreme because over a 70-day range, we’ve seen a ton of buying activity there — six touches in total.

If I had institutional-sized capital, that’s exactly where I’d want to push price — to that zone — so I could fill my large orders. Why? Because that’s how the game works. For every buyer, there needs to be a seller. And when you’re trying to move billions, you either have to find those counterparties or create them — which is exactly what inducement is all about.

For me, the key area to consider shorts is near the 0.75 retracement level of the current internal bearish range. I do expect a break above the 145.946 high. So, while I’m looking to chase shorts here due to the overall bearish external structure, I’m trying to exercise some patience.