USDNZD trade ideas

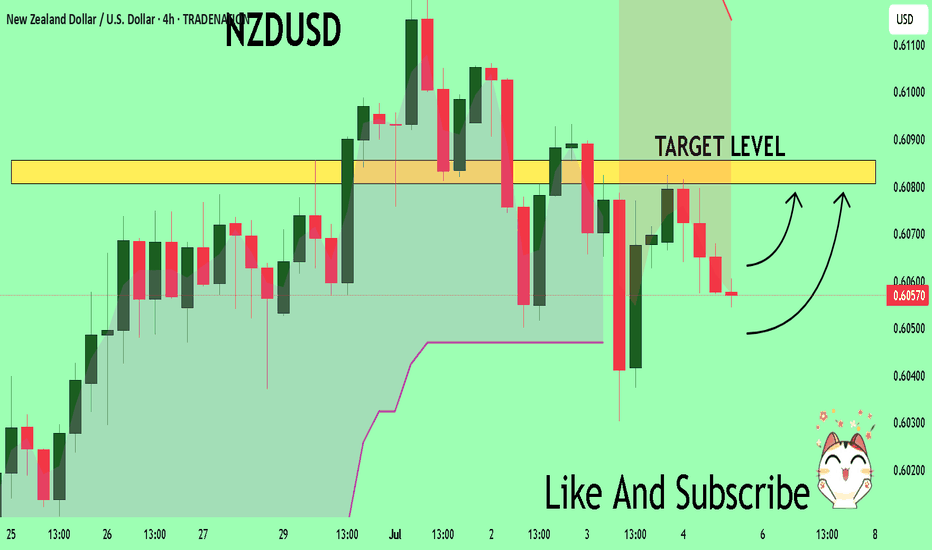

NZDUSD The Target Is UP! BUY!

My dear subscribers,

This is my opinion on the NZDUSD next move:

The instrument tests an important psychological level 0.6056

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.6080

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

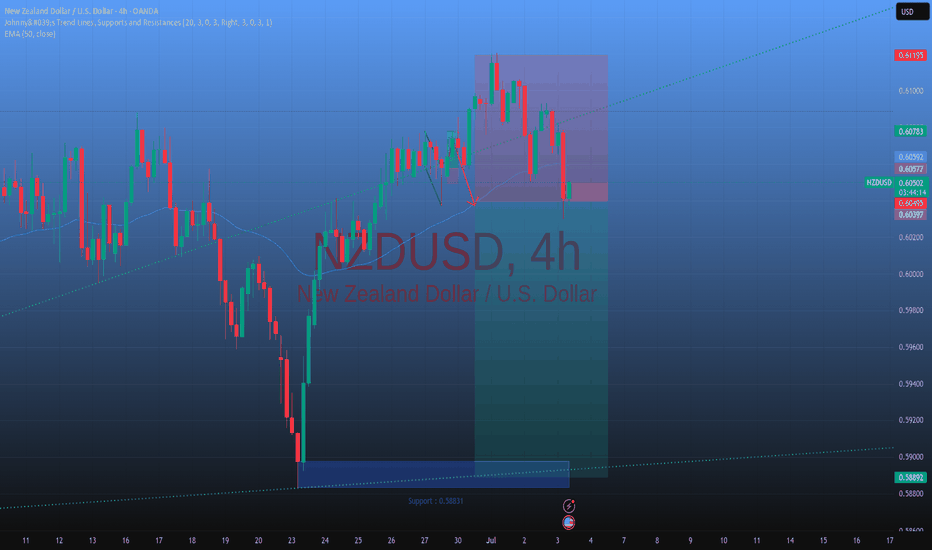

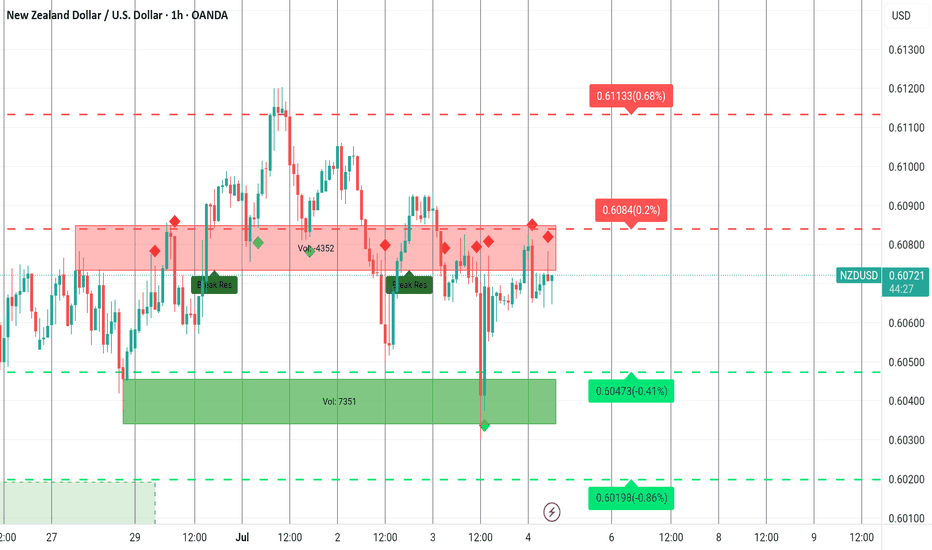

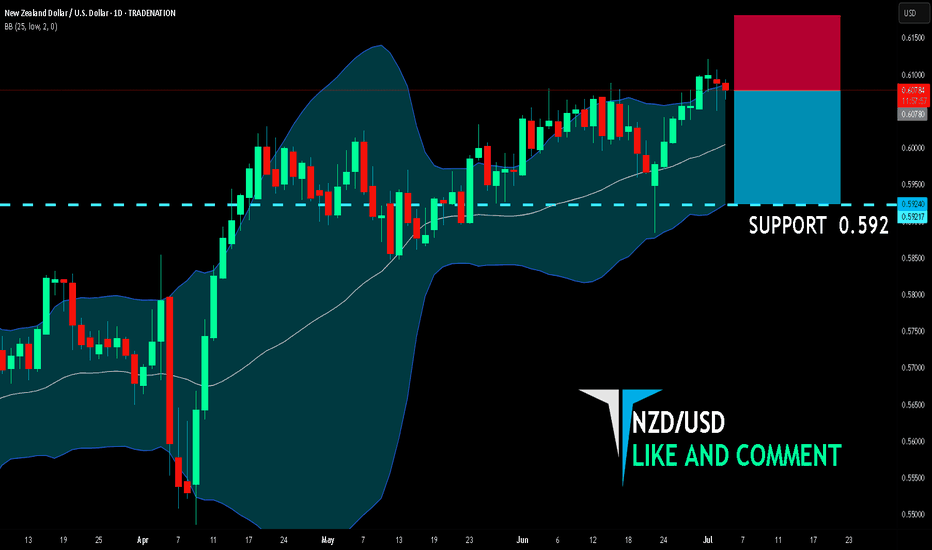

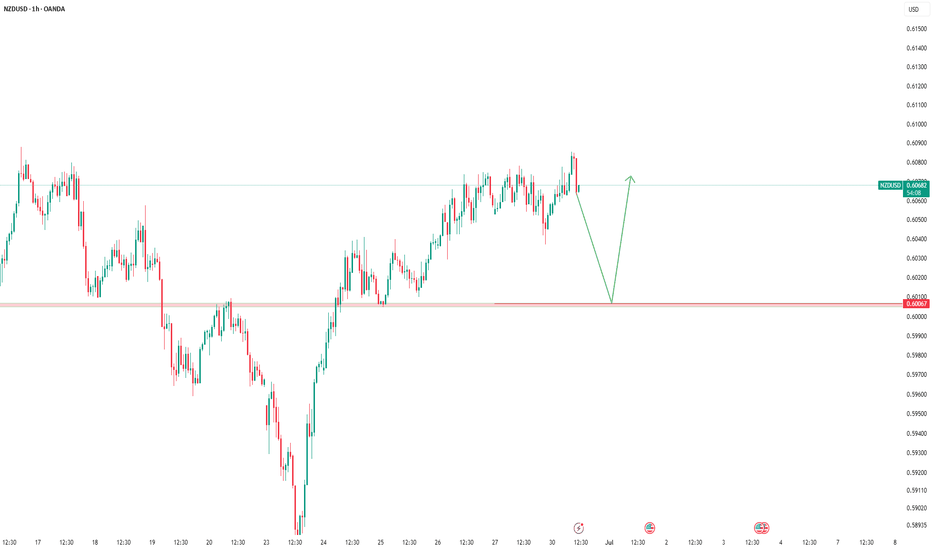

NZDUSD support at 0.5980The NZDUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.5980 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.5980 would confirm ongoing upside momentum, with potential targets at:

0.6070 – initial resistance

0.6110 – psychological and structural level

0.6160 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.5980 would weaken the bullish outlook and suggest deeper downside risk toward:

0.5950 – minor support

0.5920 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Gold holds above 0.5980. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

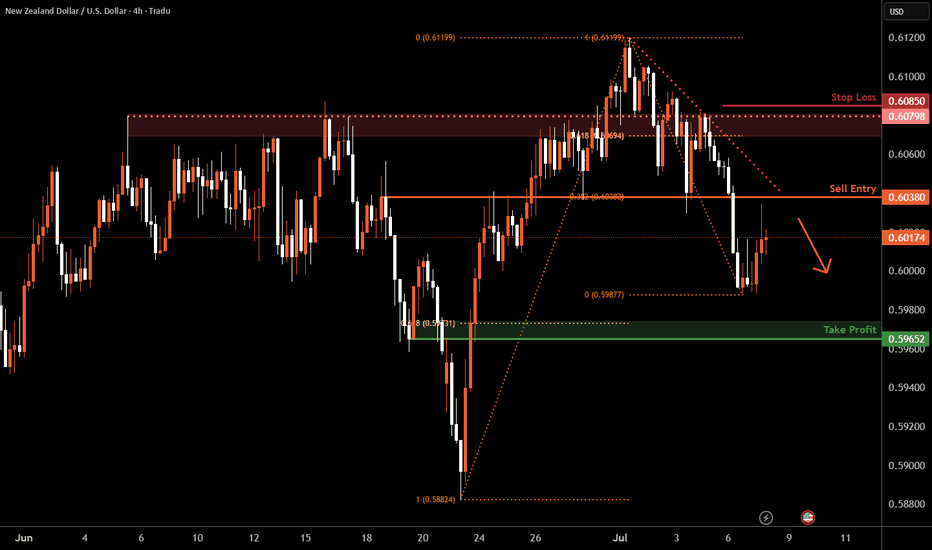

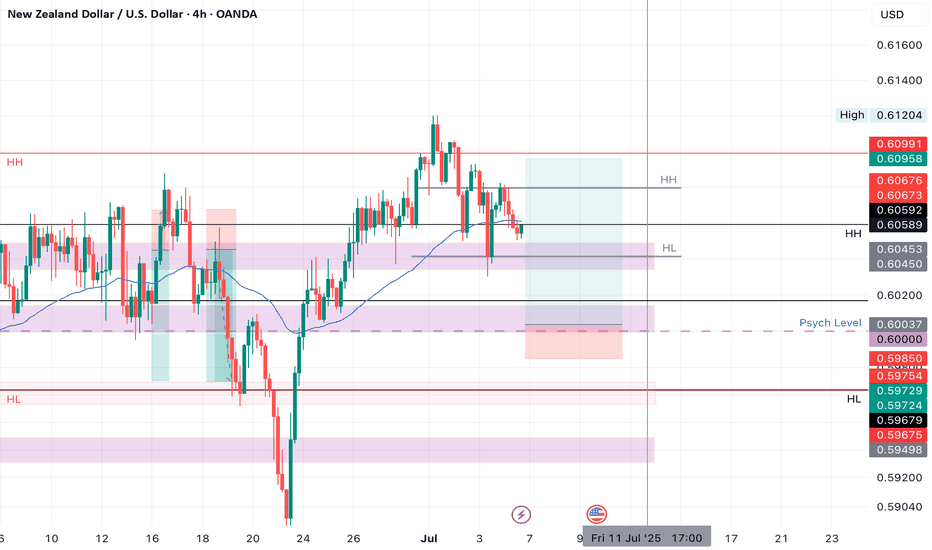

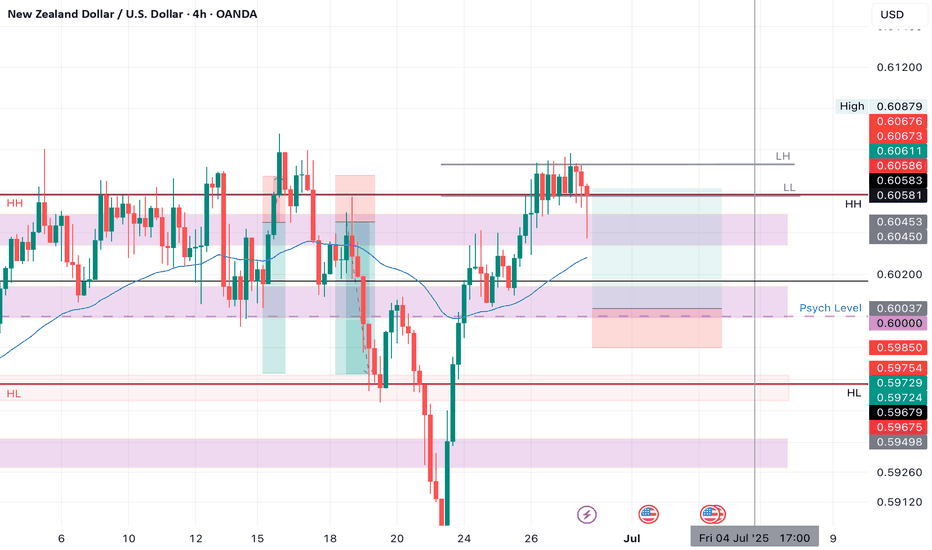

Kiwi H4 | Rising into an overlap resistanceThe Kiwi (NZD/USD) is rising towards an overlap resistance and could potentially reverse off this level to drop lower.

Sell entry is at 0.6038 which is an overlap resistance that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 0.6085 which is a level that sits above the 61.8% Fibonacci retracement and an overlap resistance.

Take profit is at 0.5965 which is a pullback support that aligns closely with the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

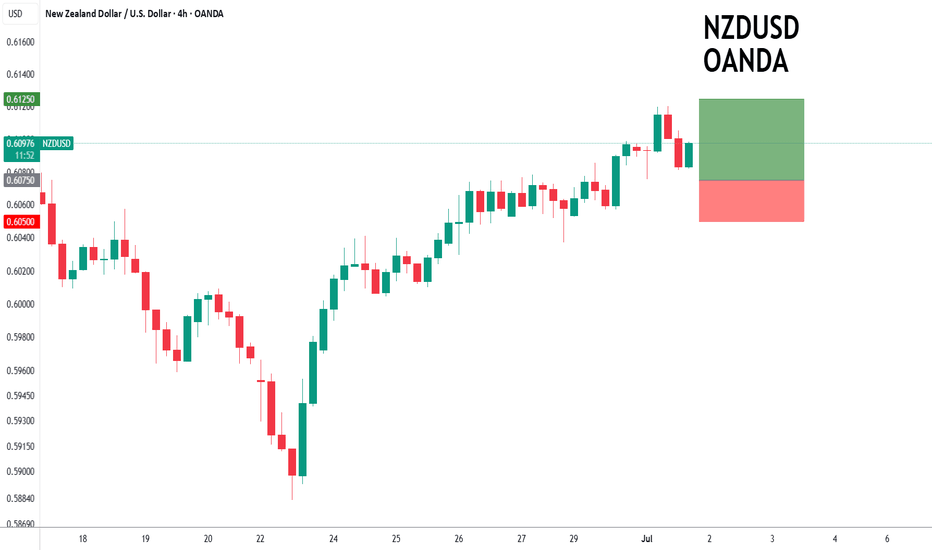

NZDUSD LONGMarket structure bullish on HTFs DW

Entry at both Daily and Weekly AOi

Weekly rejection at AOi

Weekly Previous Structure Point

Daily Rejection at AOi

Previous Daily Structure Point

Daily EMA retest

Around Psychological Level 0.60000

H4 Candlestick rejection

Levels 4.93

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

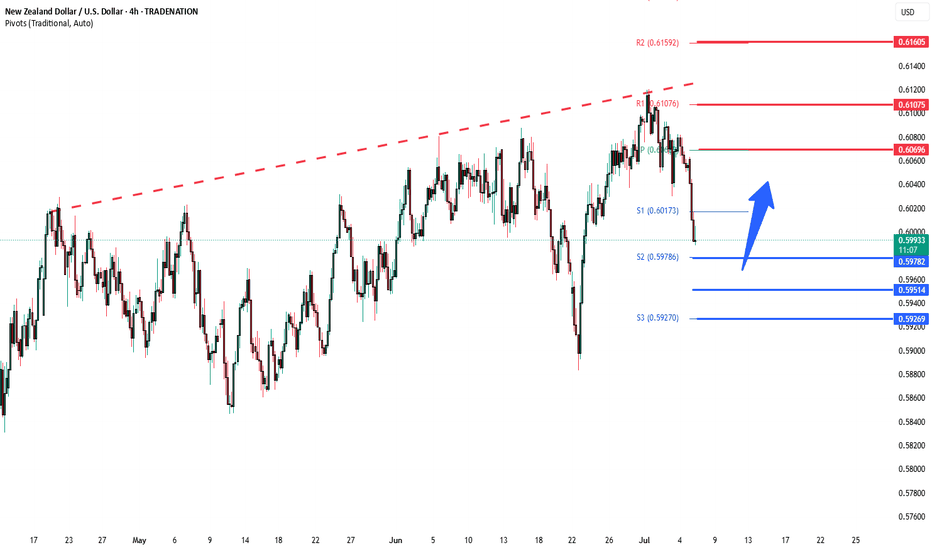

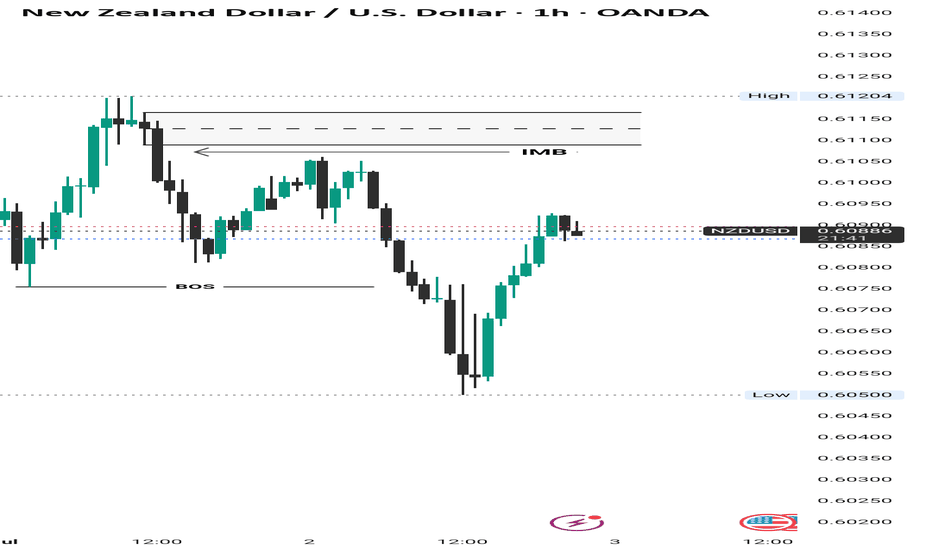

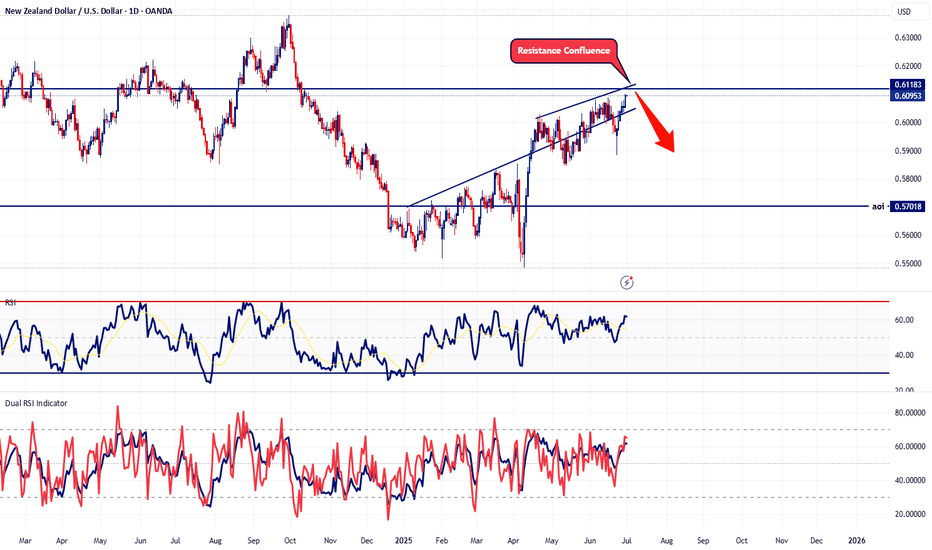

NZD/USD 2 moves away from wiping out June’s rallyThe RBNZ is widely expected to hold the Official Cash Rate at 3.25% this Wednesday.

NZIER’s Shadow Board advises against a cut, noting the economy remains weak but inflation pressures are mixed. Markets see just a 10–15% chance of a cut this week but still price for further easing by October.

NZD/USD has pulled back sharply from 0.6100, with price now possibly consolidating around 0.6000. This area coincides with a key support-turned-resistance level that capped price action in mid-June.

If the pair breaks below 0.5980, the next support sits near 0.5935 – a level that triggered a strong bounce on June 21. A break below that could open the way toward 0.5900 and 0.5860.

On the upside, if the 0.6000 handle holds, short-term resistance lies at 0.6030, with stronger pressure at 0.6065.

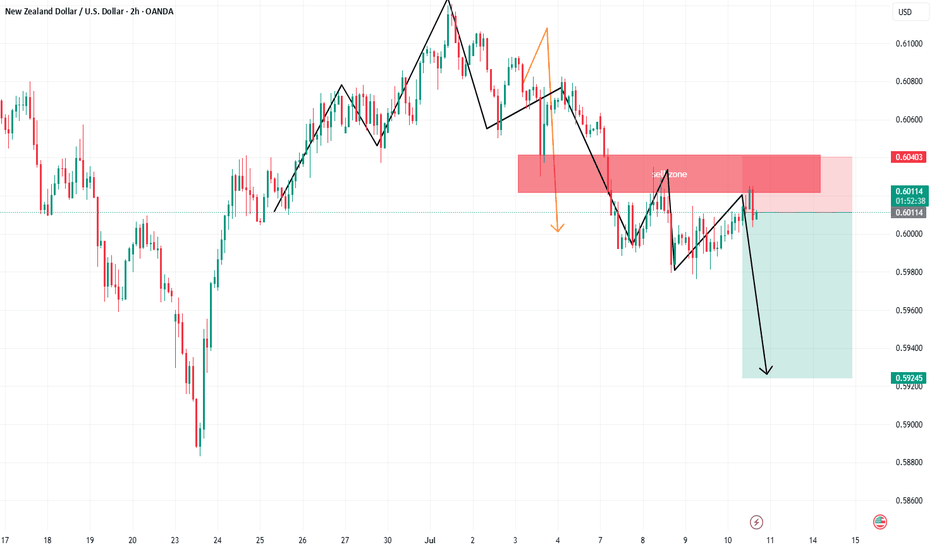

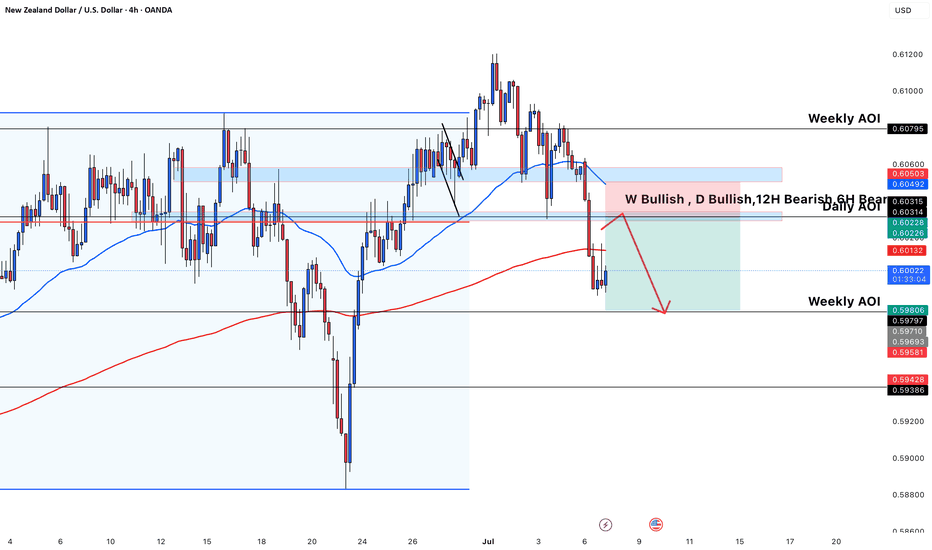

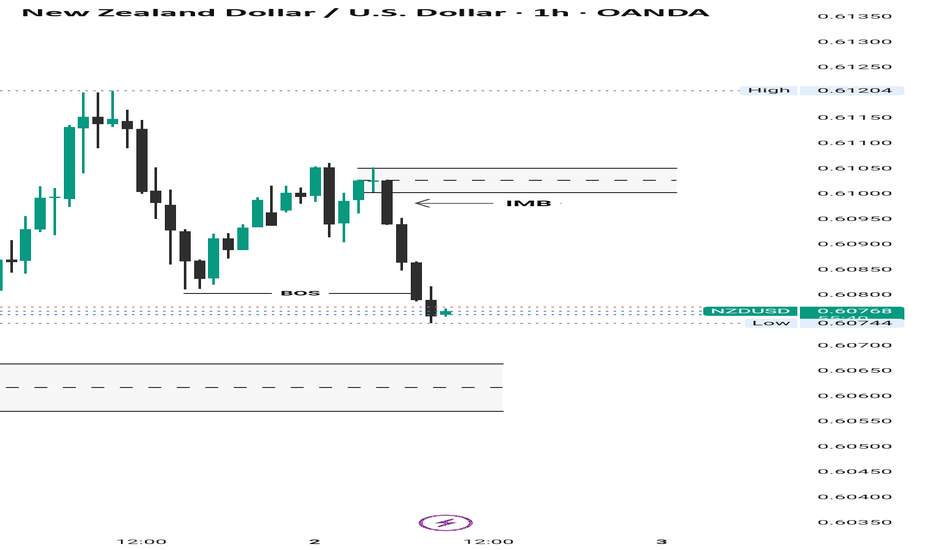

NZDUSD Clear Bearish Continuation🧠 Timeframe Sentiment Overview

Weekly (W): Bullish

Daily (D): Bullish

12H, 6H, 4H: Bearish

Bias: Weak bearish retracement inside HTF bullish trend. Caution advised—likely a counter-trend play or short-term pullback trade.

📉 Market Structure Analysis

Bearish BOS recently occurred on 4H with a sharp drop.

Red arrow forecasts a continuation lower if price respects the short-term supply zone.

📊 EMA Confluence

Price is currently below both the 50 EMA (blue) and 200 EMA (red) → indicates a bearish short-term trend.

EMAs act as dynamic resistance in the supply zone.

Risk-Reward Ratio: Approximately 2:1 or better.

🔁 Strategy Notes

Since HTF is bullish (W + D), this is a counter-trend move, so confirmation (e.g. on 1H or 15m) is important.

Text on chart suggests waiting for 1H structure shift before executing the trade for better timing and lower risk.

✅ Confluences Supporting the Short

Clear 4H BOS and bearish momentum.

Bearish EMAs alignment (50 < 200).

Price entering previous support turned resistance.

Weekly AOI (target) is a high-probability demand zone.

Bearish momentum from 12H/6H/4H despite higher TF bullishness.

⚠️ Caution

Since W and D are bullish, price could bounce aggressively from the Weekly AOI.

Monitor LTF reaction closely for exit/reversal.

NZD/USD SELLERS WILL DOMINATE THE MARKET|SHORT

NZD/USD SIGNAL

Trade Direction: short

Entry Level: 0.607

Target Level: 0.592

Stop Loss: 0.617

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZDUSD LONG Market structure bullish on HTFs DW

Entry at both Daily and Weekly AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Previous Daily Structure Point

Around Psychological Level 0.60000

H4 Candlestick rejection

Levels 3.07

Entry 95%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

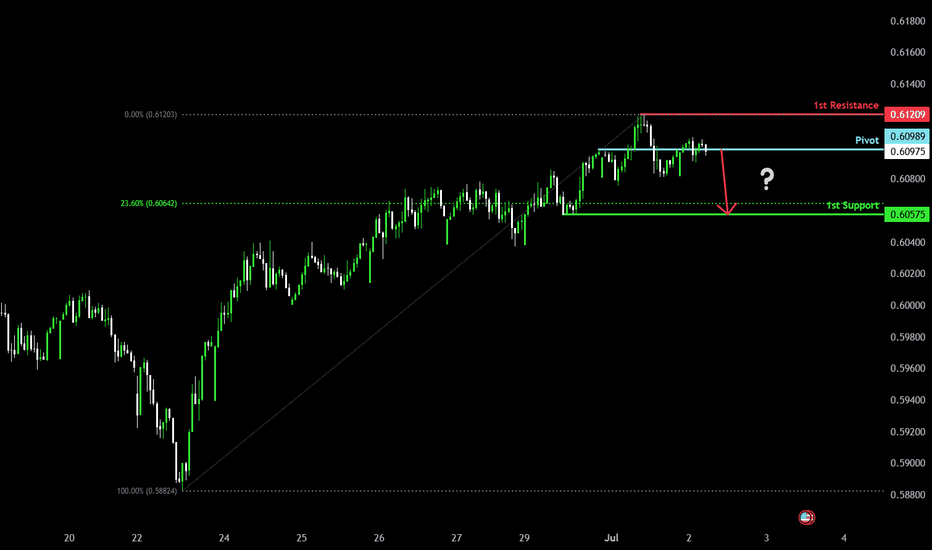

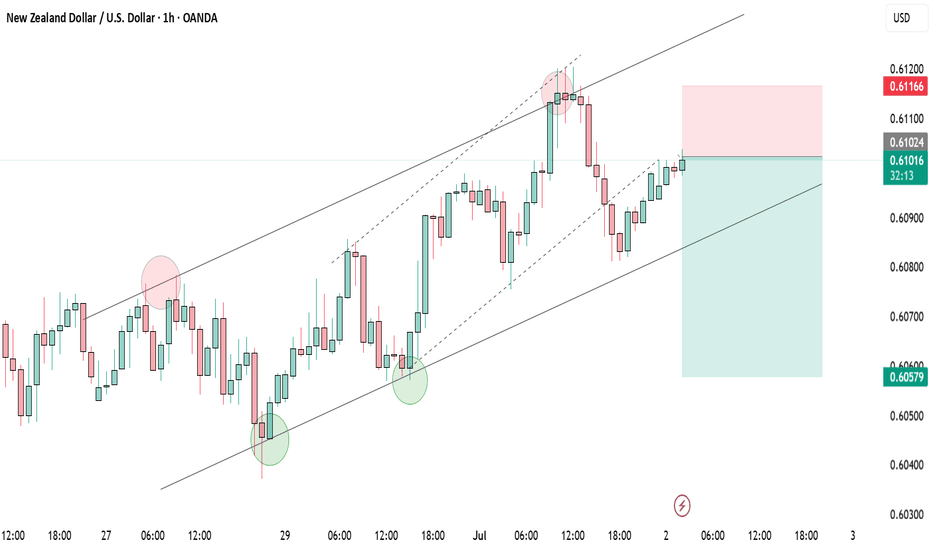

Potential bearish drop?The Kiwi (NZD/USD) is reacting off the pivot which is a pullback resistance and could drop to the 1st support.

Pivot: 0.6098

1st Support: 0.6057

1st Resistance: 0.6120

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

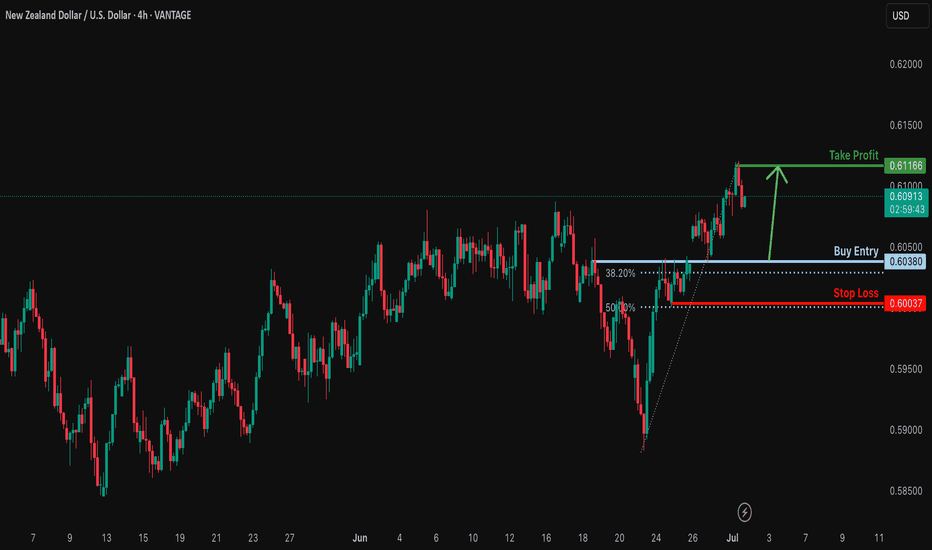

Bullish bounce?NZD/USD is falling towards the support level which is an overlap support that is slightly above the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.6038

Why we like it:

There is an overlap support that is slightly above the 38.2% Fibonacci retracement.

Stop loss: 0.6038

Why we like it:

There is a pullback support that aligns with the 50% Fibonacci retracement.

Take profit: 0.6116

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

"NZD/USD Bullish Heist! Steal Pips Before the Reversal Trap! 🏴☠️ NZD/USD Kiwi Heist Masterplan – Steal the Bull Run! 💰

🌟 Hola, Money Makers & Market Marauders! 🌟

Welcome to the Thief Trading Style raid on the NZD/USD "The Kiwi" Forex vault. Follow the blueprint sketched in the chart for a bold long takeover — escape the high‑risk Yellow MA Zone before guards tighten!

🎯 Heist Blueprint

1. Entry 🚀

"The vault swings wide—yank that Bull loot at any price!"

Drop your buy-limit orders within the next 15–30 min (or at the latest swing low/high). Don’t sleep—set chart alerts for the perfect breach.

2. Stop‑Loss 🛑

Thief-style SL lurks at the nearest 5h swing‑low wick (≈ 0.60400) for intra‑day.

Adjust your SL based on your risk appetite, position size, and combo of orders.

3. Target 🎯

Aim to escape by 0.62000, or bail early for safety.

4. Scalpers’ Edge 🔍

Only rob on the long side. Big bankroll? Go all‑in. Prefer safety? Slide into the swing crew with a trailing SL to lock in your spoils.

🔍 Market Intel

Why the Kiwi Loot is Ripe:

Bullish momentum marches on, fueled by macroeconomic clues, COT data, sentiment shifts, inter-market moves — all pointing upward.

📚 For Full Recon:

Dive into the fundamental, macro, COT, quant, sentiment & intermarket intel — plus trend targets and scorecards. Check the data here 👉🔗🔗

⚠️ Caution Zone

News Watch & Position Safety:

Major news = guarded vault. Don't open new trades during release windows.

If you're in already, use trailing stops to shield your haul and lock in gains.

💪 Support the Crew

Smash that “Boost” to fuel our team and keep the raid running smooth. With Thief Trading Style, every day’s a payday.

🗓️ Stay tuned for the next Kiwi Heist – we’re just getting started. Happy robbing, legends! 🐱👤💥

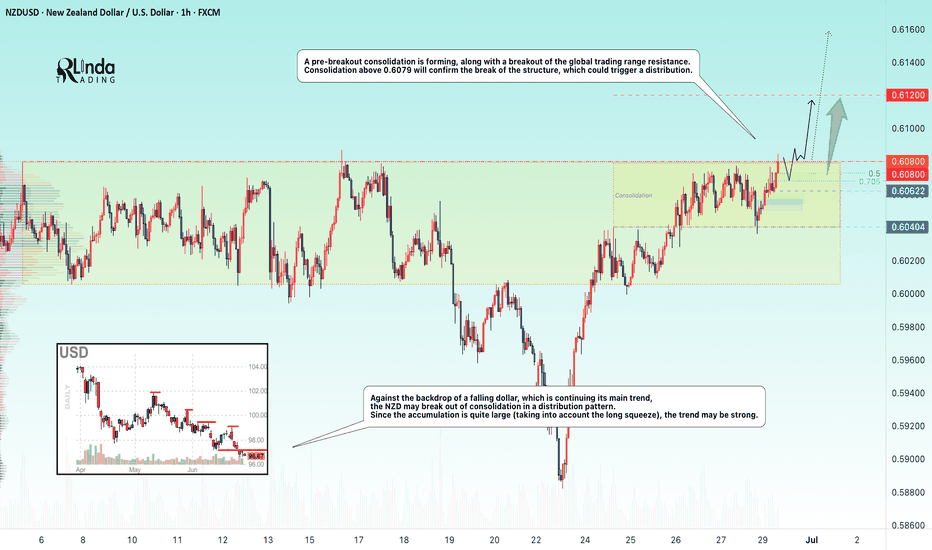

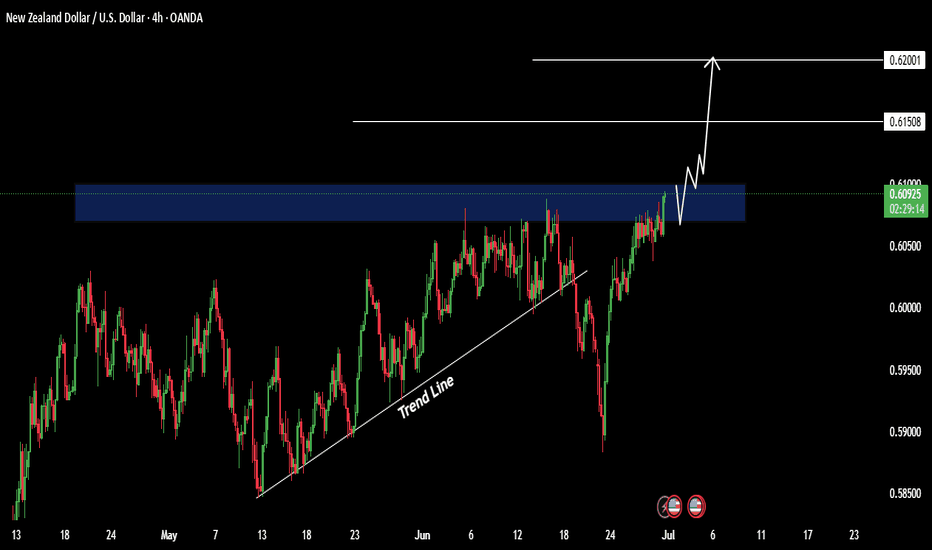

NZDUSD → Pre-breakout consolidation. One step away from a rallyFX:NZDUSD is consolidating, but the chart shows signs of readiness to shift to a distribution phase, which could lead to a rally.

Against the backdrop of a falling dollar, which is continuing its main trend, the NZD may break out of consolidation in a distribution pattern. Since the accumulation is quite large (taking into account the long squeeze), the trend may be strong.

A pre-breakout consolidation is forming relative to 0.6080, followed by the price breaking through the resistance of the global trading range. Consolidation above 0.6080 will confirm the breakdown of the structure, which could trigger distribution

Resistance levels: 0.6080, 0.612

Support levels: 0.6062, 0.604

The price may be supported by a bullish trend and a decline in the dollar. A breakout from the 4-month consolidation may be accompanied by a continuation of the uptrend until the intermediate high of 0.6355 is reached in the medium term.

Best regards, R. Linda!

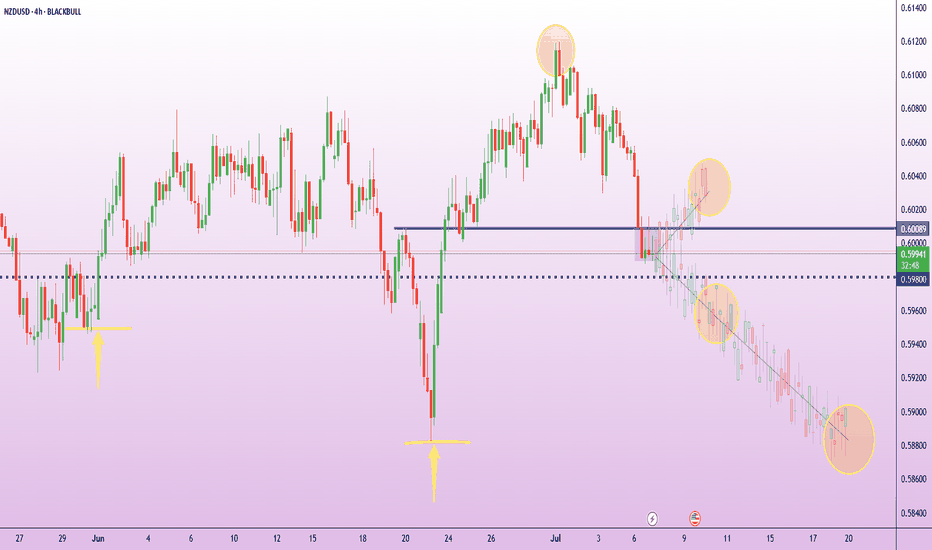

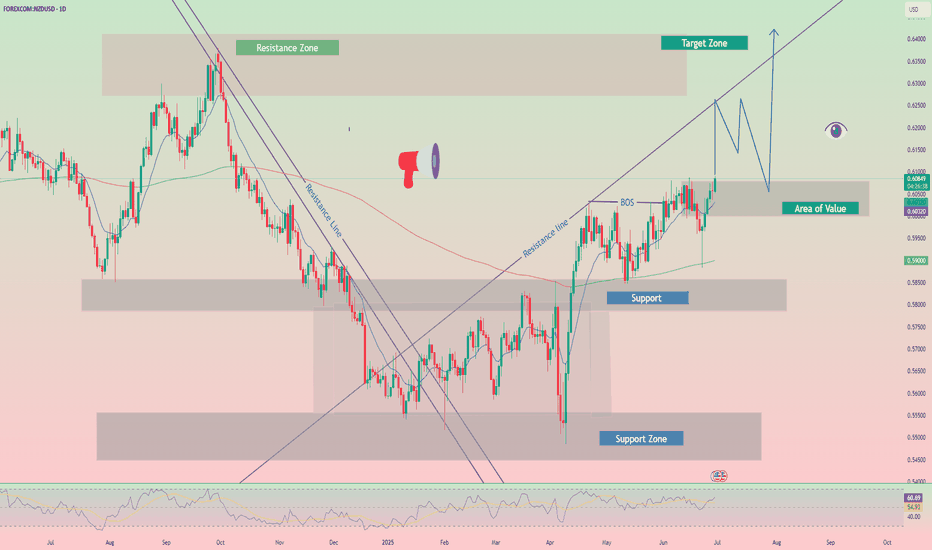

Trading Recommendations for NZD/USDNZD/USD remain in a dominant bullish wave that began in April. Wave extremes from a "horizontal pennant" on the chart. The bearish phase since May 26 remains a part of internal correction. The bullish leg from June 23 has reversal potential.

Weekly Forecast:

The pair is likely to continue its upward movement for a few more days. A sideways trend and reversal conditions are expected near the resistance zone. Downward movement becomes more probable in the second half of week.

Potential Reversal Zones

Resistance: 0.6070 / 0.6120

Support: / 0.5940 / 0.5890

Recommendations:

Selling: Low potential and potentially risky.

Buying: Can be considered if reversal signals appear near the support zone.

Preparing to Short Sell NZDUSD - Large LotsThis pair doesn't really get much attention but the fact is that the US is the strongest country of the majors while New Zealand is actually the weakest. When I pooled together all the economic data, these are the facts.

With that said, this pair is approaching a significant confluence resistance territory and it's highly unlikely to break above. Needless to say, I'm preparing to start scaling shorts with this pair. As I mentioned in the title, since this pair doesn't get much daily pip action, I'll be increasing my lot sizes to make up the difference.

That's it - That's all

Trade Safe

NZDUSD to continue in the upward move?NZDUSD - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.6100 will confirm the bullish momentum.

The measured move target is 0.6130.

We look to Buy at 0.6075 (stop at 0.6050)

Our profit targets will be 0.6125 and 0.6130

Resistance: 0.6100 / 0.6125 / 0.6130

Support: 0.6075 / 0.6060 / 0.6050

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDUSD Breakout Needs to GrowthNZD/USD Technical Outlook

NZD/USD shows early signs of a potential shift from distribution to accumulation, indicating a possible bullish breakout. This setup is forming against the backdrop of a weakened U.S. Dollar, which continues to trend downward, providing fundamental support to NZD strength.

The pair has been consolidating within a distribution pattern, but current chart signals suggest a buildup in bullish pressure. If the pair breaks above the consolidation range, it may trigger a rally supported by dollar weakness and renewed buying interest in risk-sensitive assets like the Kiwi.

Key Levels to Watch:

Resistance: 0.61500 / 0.6260

You may find more details in the chart Ps Support with like and comments for more analysis.