USDNZD trade ideas

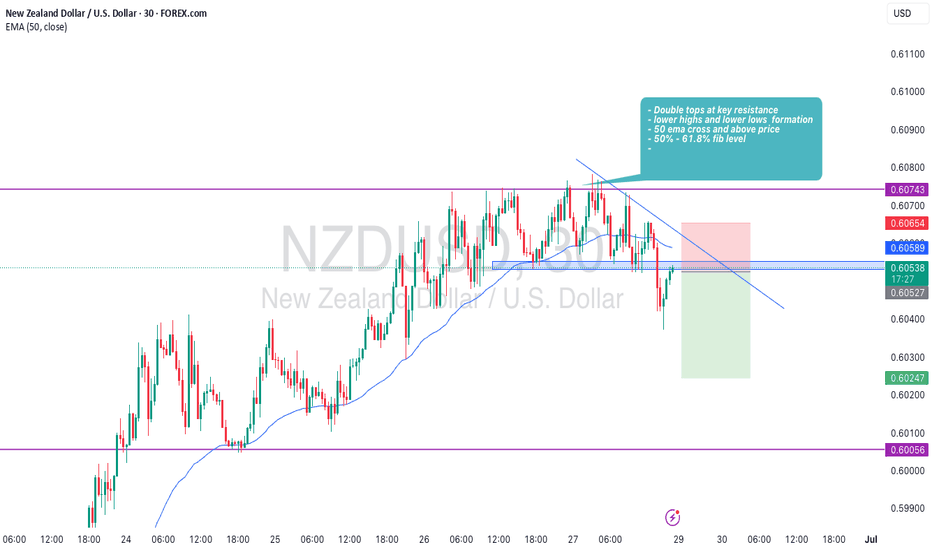

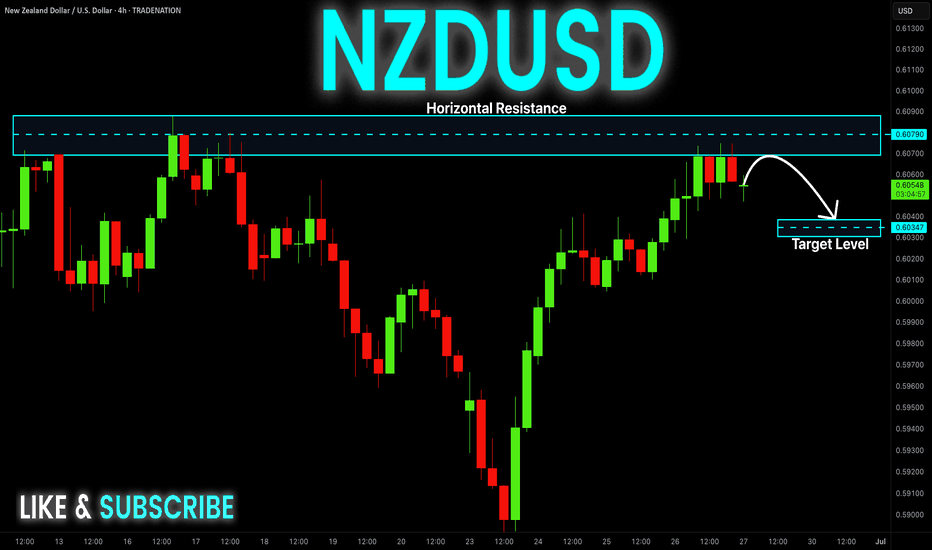

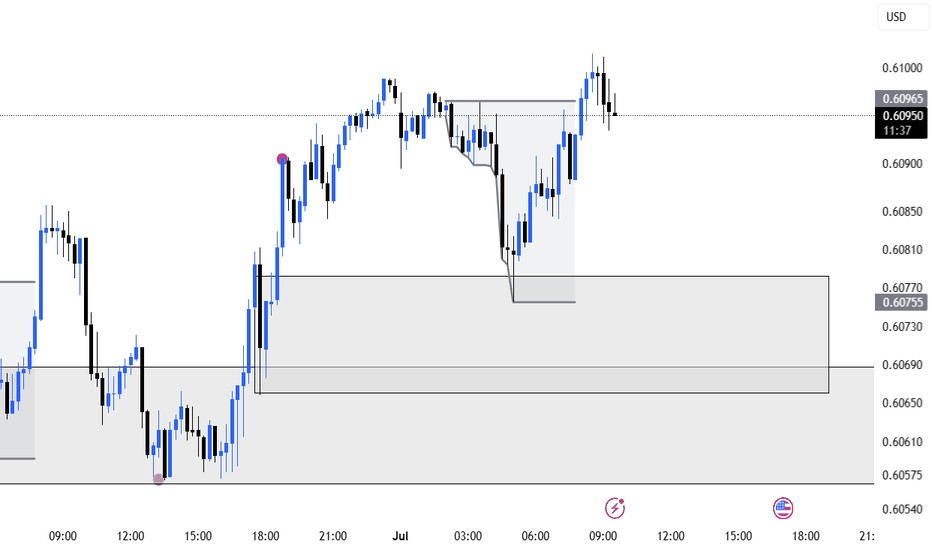

NZD-USD Will Fall! Sell!

Hello,Traders!

NZD-USD made a retest

Of the horizontal resistance

Level of 0.6087 and as it

Is a strong key structure

We will be expecting

A local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

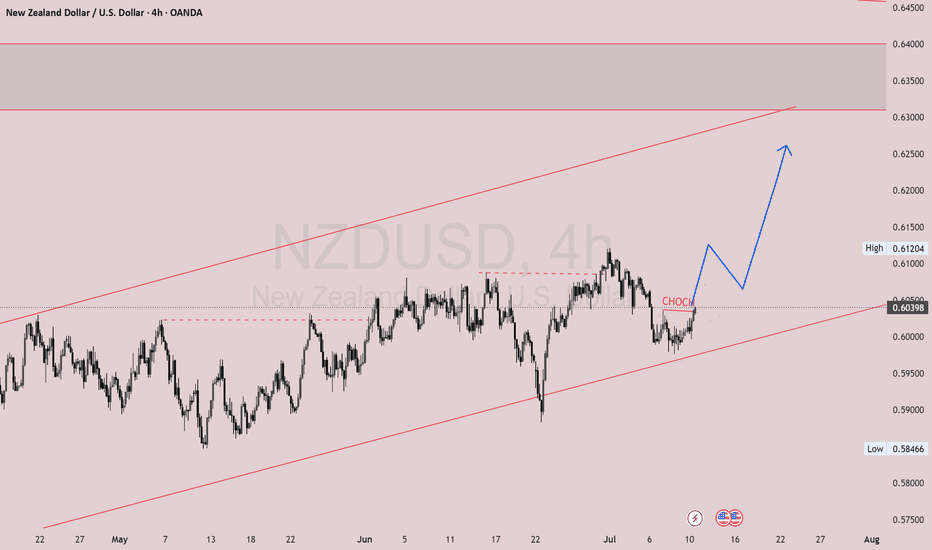

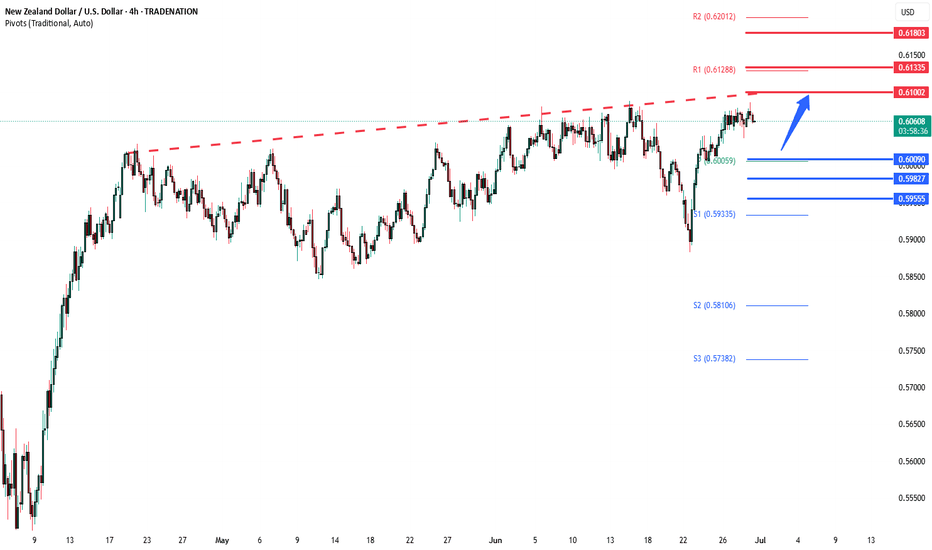

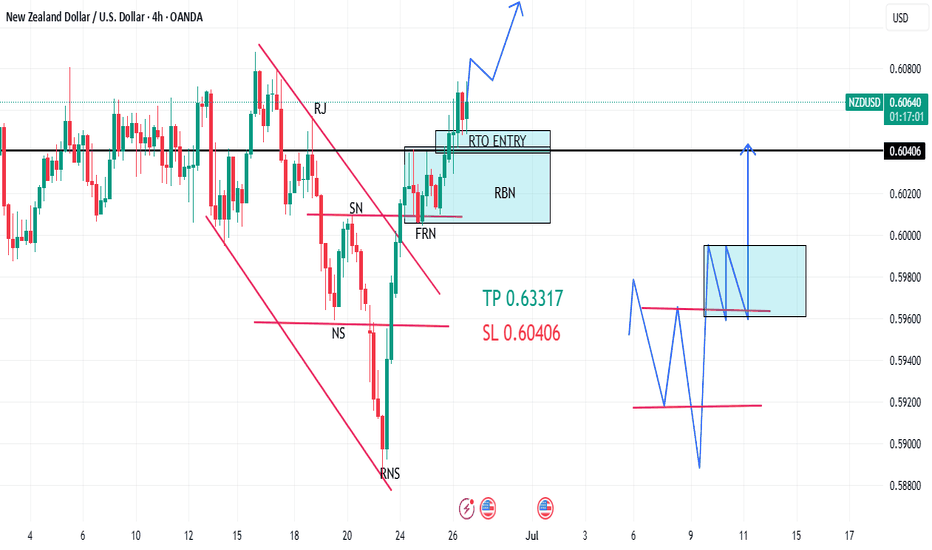

NZD/USD showing a potential bullish setupNZDUSD 4H Trade Breakdown – Bullish Reversal in Play 🔥📈

This setup is a textbook example of a smart money reversal backed by structure, market psychology, and clear technicals.

1. Change of Character (CHoCH):

- The market was previously in a downtrend.

- Price broke above the last lower high, signaling a CHoCH – the first sign that buyers are gaining control.

- This is a key point where many smart traders start paying attention.

2. Trendline & Channel Respect:

- Price tapped perfectly off the ascending trendline, confirming the long-term bullish channel.

- This adds confluence (multiple confirmations) to the bullish bias.

3. Market Structure Shift:

- After the CHoCH, price formed a higher low and started pushing up.

- This shows a shift to bullish structure (higher highs and higher lows).

4. Projected Move:

- The blue arrow shows a likely path: a bullish break, possible pullback to retest the broken structure, then continuation up.

- Targeting above 0.61200, with potential for further highs.

Why this trade stands out:

✅ Structure break (CHoCH)

✅ Strong support off trendline

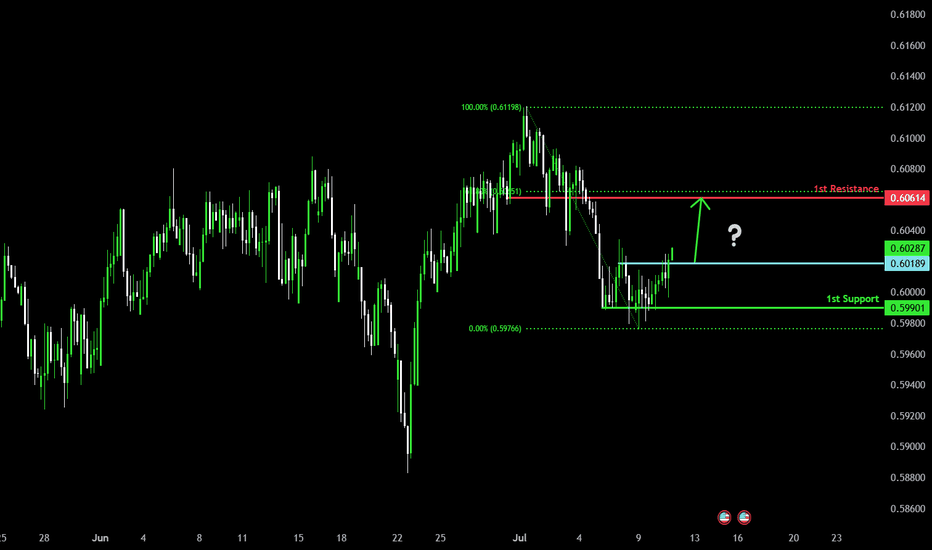

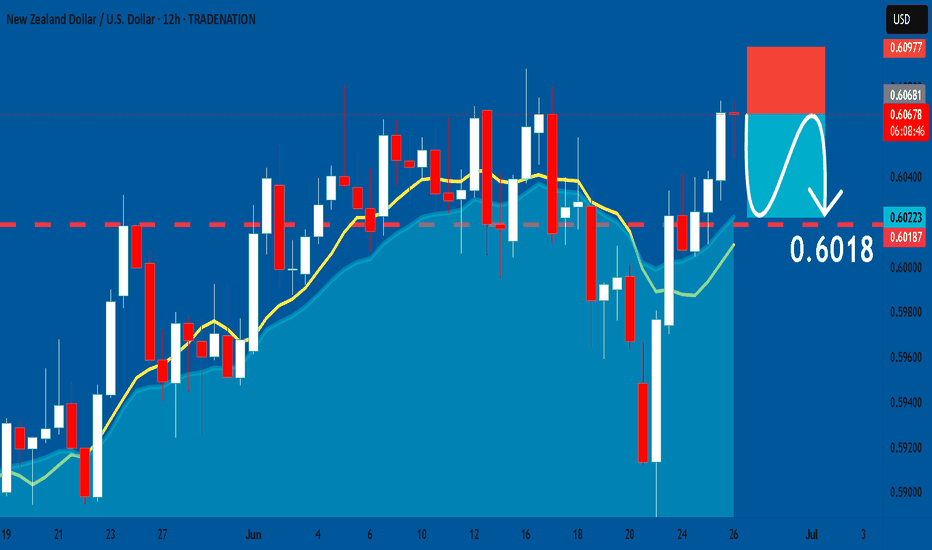

Potential bullish rise?The Kiwi (NZD/USD) is reacting off the pivot and could rise from this level to the 1st resistance.

Pivot: 0.6018

1st Support: 0.5990

1st Resistance: 0.6061

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

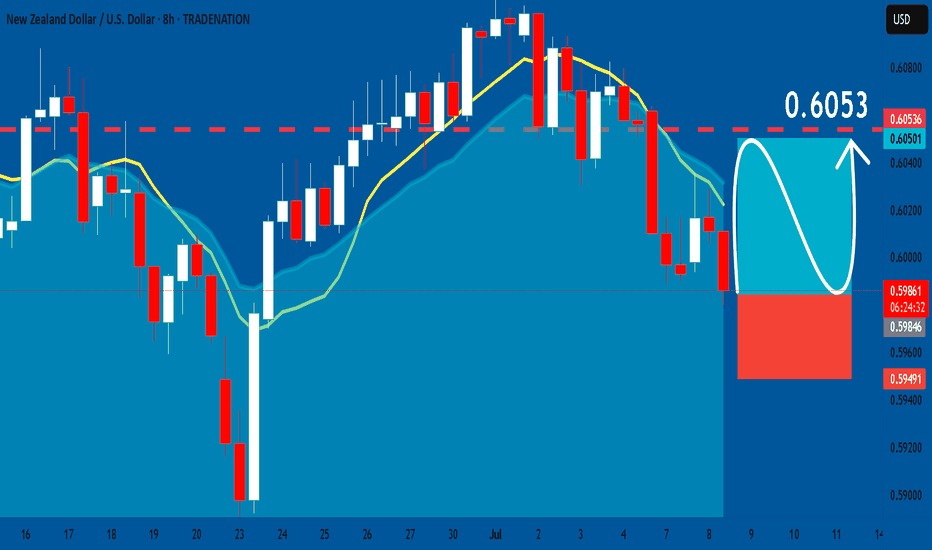

NZDUSD: Bullish Continuation & Long Trade

NZDUSD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy NZDUSD

Entry - 0.5984

Stop - 0.5949

Take - 0.6053

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

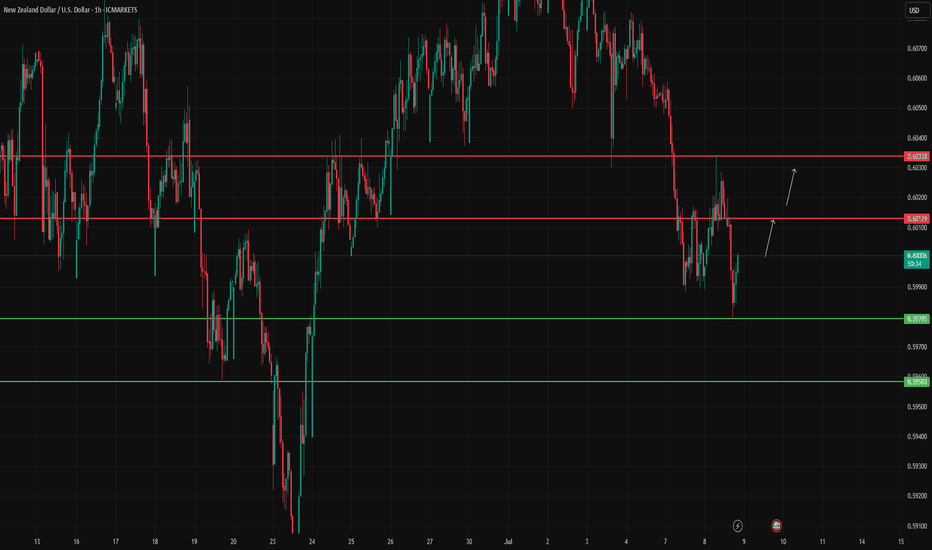

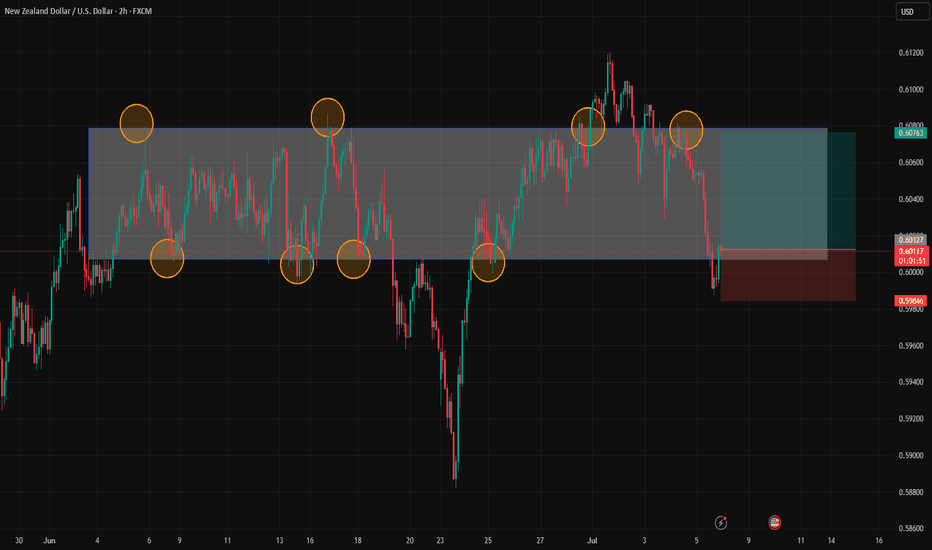

NZDUSD Wave Analysis – 7 July 2025

- NZDUSD reversed from resistance level 0.6100

- Likely to fall to support level 0.5950

NZDUSD currency pair recently reversed down from the key resistance level 0.6100 (which has been steadily reversing the price from October, as can be seen from the daily NZDUSD chart below) – intersecting with the upper daily Bollinger Band and the resistance trendline of the daily up channel from April.

The downward reversal from the resistance level 0.6100 stopped the previous medium-term impulse ABC correction (2) from the start of April.

Given the strength of the resistance level 0.6100, NZDUSD currency pair can be expected to fall to the next support level 0.5950.

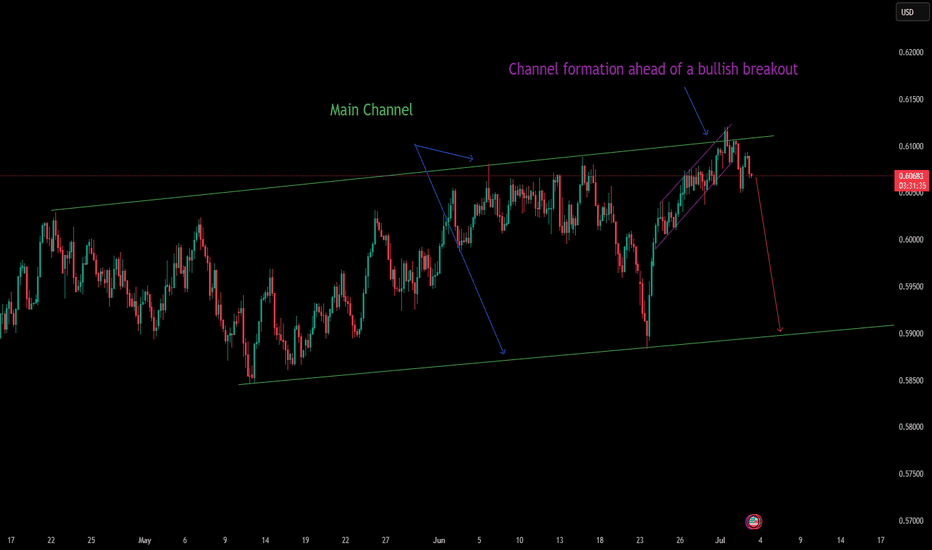

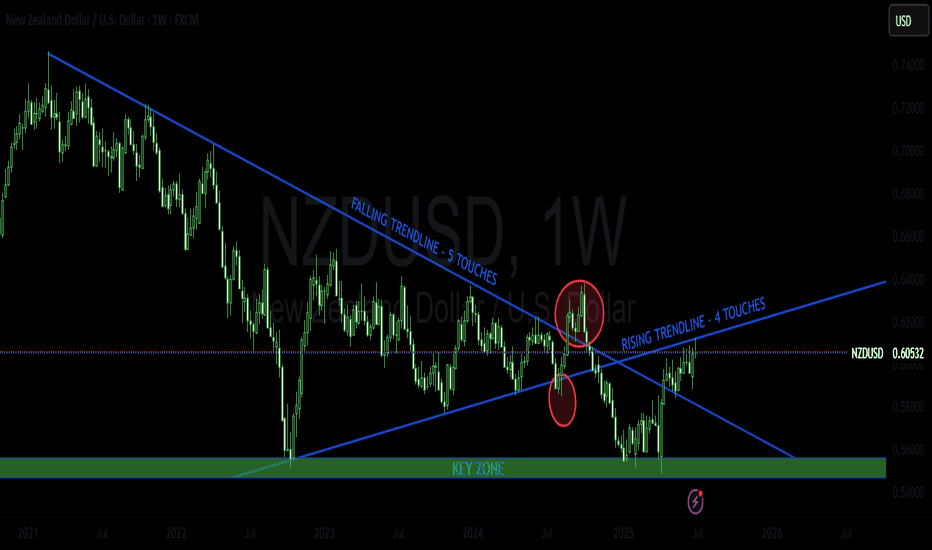

NZDUSD - GLOBAL NEUTRAL VIEWLooking at classic trendline trading, the pair is trading between 2 strong trendline confluence areas. Looking at past movements, the pair completed both bull and bear traps. My view on this is to wait and see what will unfold in the coming weeks.

Please do your own analysis before placing any trades.

Cheers and Happy Trading !!!!

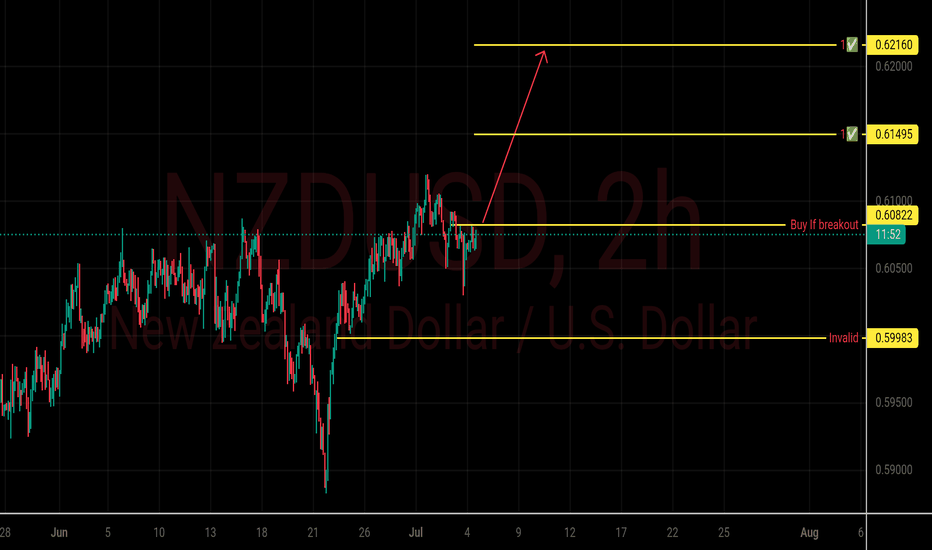

NZDUSD Buy Setup✅ Key Levels:

Buy if Breakout: 0.60822

Invalidation (Stop Loss): 0.59983

Target 1 (TP1): 0.61495

Target 2 (TP2): 0.62160

---

🔍 Analysis Summary:

Breakout Setup: Price is approaching the resistance level at 0.60822. A confirmed breakout above this level signals a potential bullish move.

Trend: Uptrend continuation expected if price holds above the breakout level.

Invalidation Point: If price breaks below 0.59983, the setup becomes invalid, suggesting bearish pressure resumes.

Targets:

First take profit at 0.61495 (safe/partial profit-taking zone)

Second take profit at 0.62160 (full target if momentum sustains)

---

⚠️ Disclaimer:

This is a technical analysis and not financial advice. Always combine with your own research and risk management strategy.

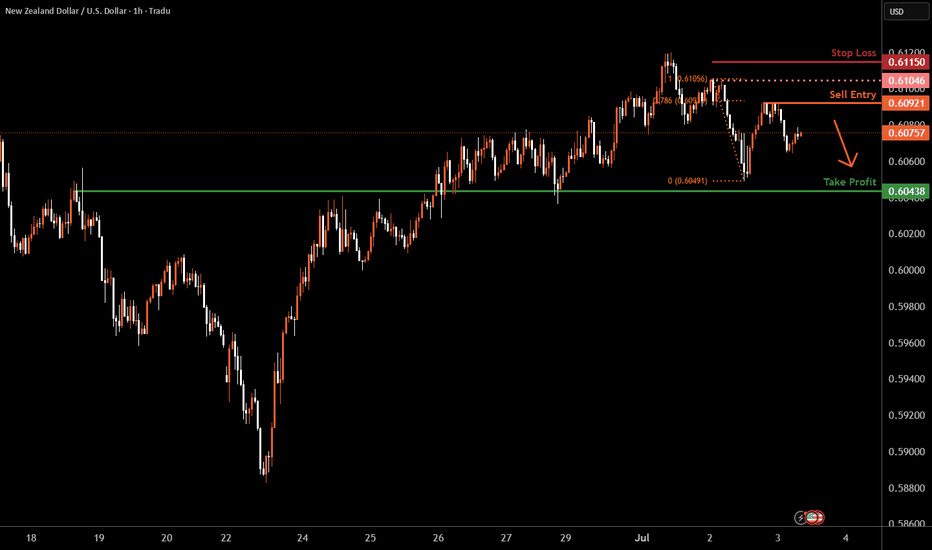

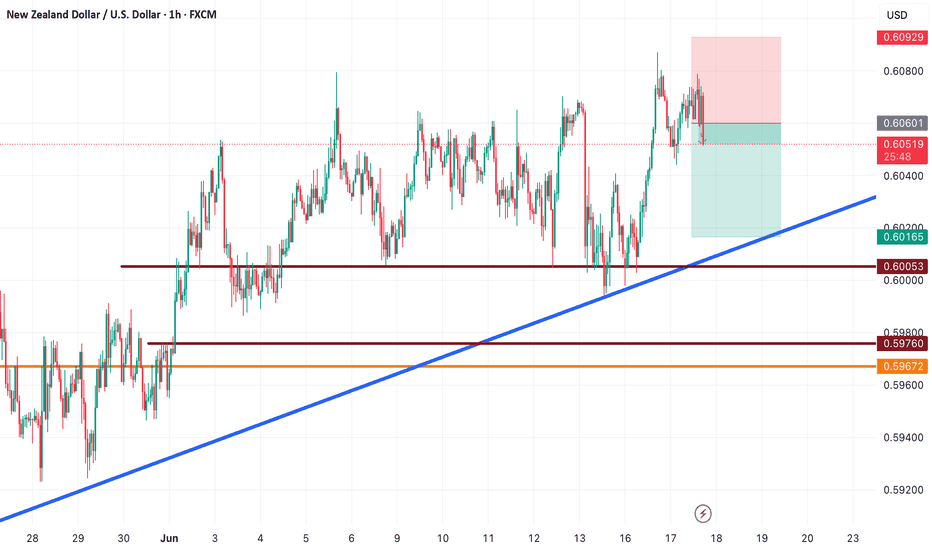

Kiwi H1 | Heading into a swing-high resistanceThe Kiwi (NZD/USD) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 0.6092 which is a swing-high resistance that aligns with the 78.6% Fibonacci retracement.

Stop loss is at 0.6115 which is a level that sits above a swing-high resistance.

Take profit is at 0.6043 which is an overlap support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

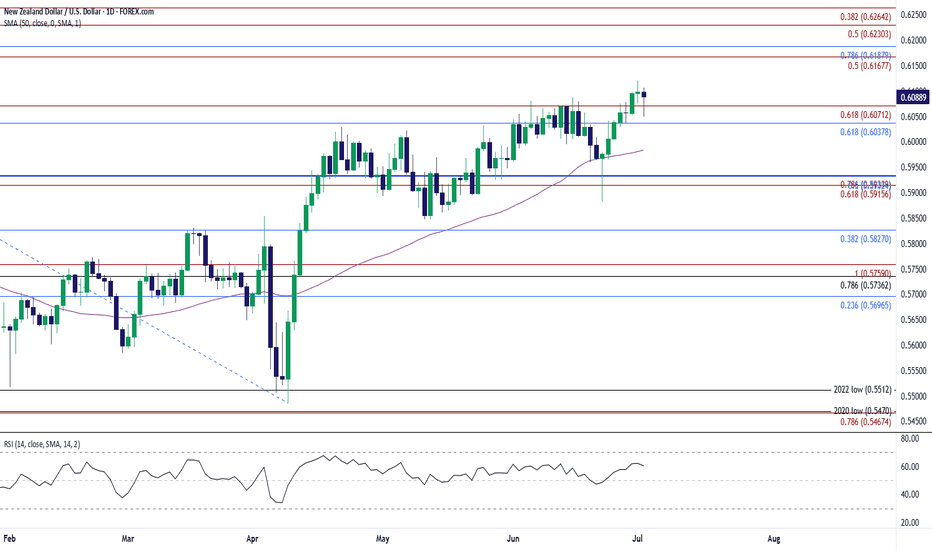

NZD/USD Pulls Back to Snap Bullish Price SeriesNZD/USD snaps the recent series of higher highs and lows as it pulls back from a fresh yearly high (0.6120), and lack of momentum to hold above the 0.6040 (61.8% Fibonacci retracement) to 0.6070 (61.8% Fibonacci extension) zone may push the exchange rate toward the June low (0.5883).

Failure to defend the May low (0.5847) may lead to a test of 0.5830 (38.2% Fibonacci retracement), but NZD/USD may further retrace the decline from last year should it continue to close above the 0.6040 (61.8% Fibonacci retracement) to 0.6070 (61.8% Fibonacci extension) zone.

Need a move/close above the 0.6170 (50% Fibonacci extension) to 0.6190 (78.6% Fibonacci retracement) region brings the 0.6230 (50% Fibonacci extension) to 0.6260 (38.2% Fibonacci extension) zone on the radar, with the next area of interest coming in around the October high (0.6351).

--- Written by David Song, Senior Strategist at FOREX.com

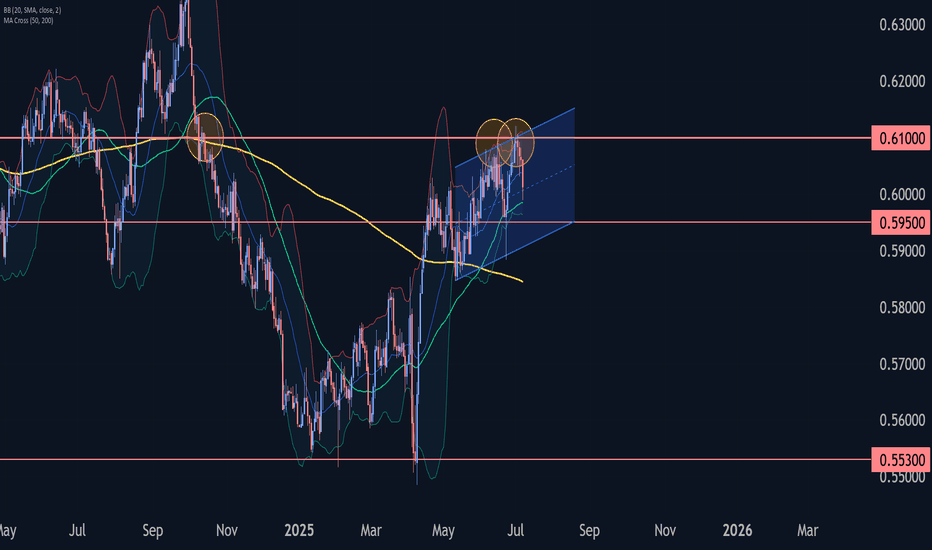

NZDUSD bullish momentum resistance at 0.6100Trend Overview:

The NZDUSD currency price remains in a bullish trend, characterised by higher highs and higher lows. The recent intraday price action is forming a continuation consolidation pattern, suggesting a potential pause before a renewed move higher.

Key Technical Levels:

Support: 0.6000 (primary pivot), followed by 0.5985 and 0.5950

Resistance: 0.6100 (initial), then 0.6140 and 0.6180

Technical Outlook:

A pullback to the 0.6000 level, which aligns with the previous consolidation zone, could act as a platform for renewed buying interest. A confirmed bounce from this support may trigger a continuation toward the next resistance levels at 0.6100, 0.6140, and ultimately 0.6180.

Conversely, a daily close below 0.6000 would suggest weakening bullish momentum. This scenario would shift the bias to bearish in the short term, potentially targeting 0.5985 and 0.5950 as downside levels.

Conclusion:

NZDUSD maintains a bullish structure while trading above the 0.6000 support. A bounce from this level would validate the consolidation as a continuation pattern, with upside potential toward the 0.6100 area. A breakdown below 0.6000, however, would invalidate this view and suggest deeper corrective risk.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

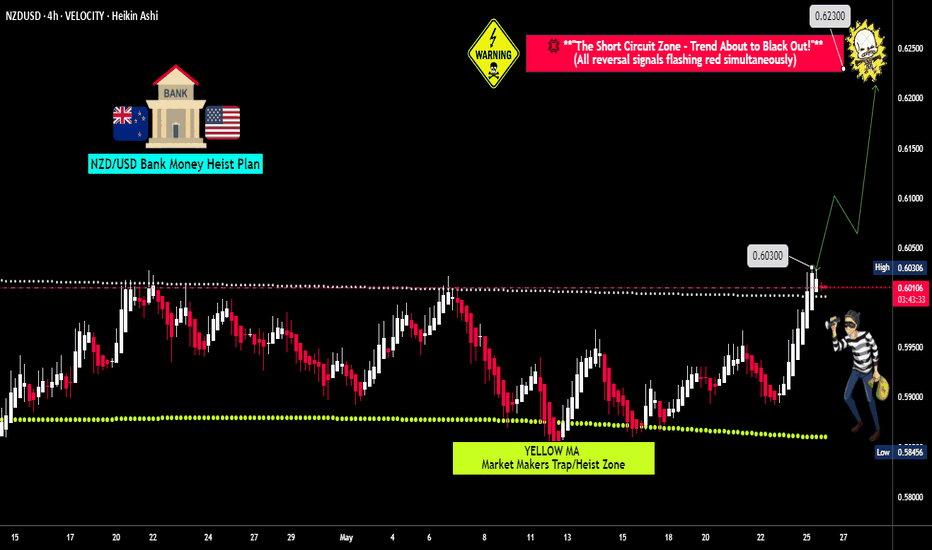

Is This the Next Big Heist? Thief Trader Eyes NZD/USD Long SetupThief Trader’s NZD/USD Heist Plan – Long Setup in Play!

🌍 **Hello Global Wealth Warriors!**

Hello, Bonjour, Ciao, Salut, Guten Tag, Ola!

📢 **Fellow Profit Pirates & Market Mavericks**, it’s time to set sail again! Get ready to loot the forex seas with our latest **Thief Trader Strategy** targeting the **NZD/USD (The Kiwi)** pair.

---

🔎 **Trade Overview**

💥 Setup: Long Entry Plan – Executing our cunning blueprint with Thief Trading's sharp technical & fundamental intel**.

🎯 Target: 0.62300 (or exit just before for safety).

⚠️ Danger Zone: Watch for traps at the RED Zone Level – signs of overbought conditions, consolidation, trend flips & bearish setups.

---

🟢 **Entry Signal** – *The Heist Begins!*

📈 **Primary Entry**:

> Breakout above **MA Line (0.60300)** = Bullish move → *Place a Buy Stop above ATR Line*

📉 **Pullback Option**:

> *Buy Limit* at recent swing low/high on **15 or 30-min TF**.

📌 **Pro Tip**:

Set an **Alert** on your chart to catch the breakout live. Timing is everything!

---

🛑 **Stop Loss – The Getaway Plan**

📍 **SL Recommendation**:

> Recent swing low on the **4H chart (0.59400)** for day/swing trades.

> 🎯 Customize your SL based on risk, lot size, and total orders.

---

🔐 **Scalpers vs. Swingers**

👀 **Scalpers**: Focus ONLY on long-side plays.

💰 Got deep pockets? Dive in.

😎 Otherwise, swing traders – this is your golden moment. Trail your SL to protect profits.

🌐 **Market Pulse** – Momentum Watch

📊 Kiwi is navigating a **MA Resistance Zone**, but bullish bias remains due to:

* **Fundamentals**

* **Macro Insights**

* **COT Reports**

* **Sentiment & Intermarket Trends**

* **Quant Analysis + Overall Score**

📎 Check the linkks for detailed breakdown.

📰 **News Warning!**

⚠️ Major releases ahead?

* Pause entries.

* Protect trades with **trailing SLs**.

---

🚨 **Join the Next Heist with Thief Trading!**

💥 Smash that **Boost** or **Like** to join our profit squad.

With **Thief Trader Style**, we dominate the markets DAILY.

Your support fuels our mission. ❤️💼

---

💸 Stay ready for the next move, money-makers.

🎯 Eyes on the chart – timing is profit.

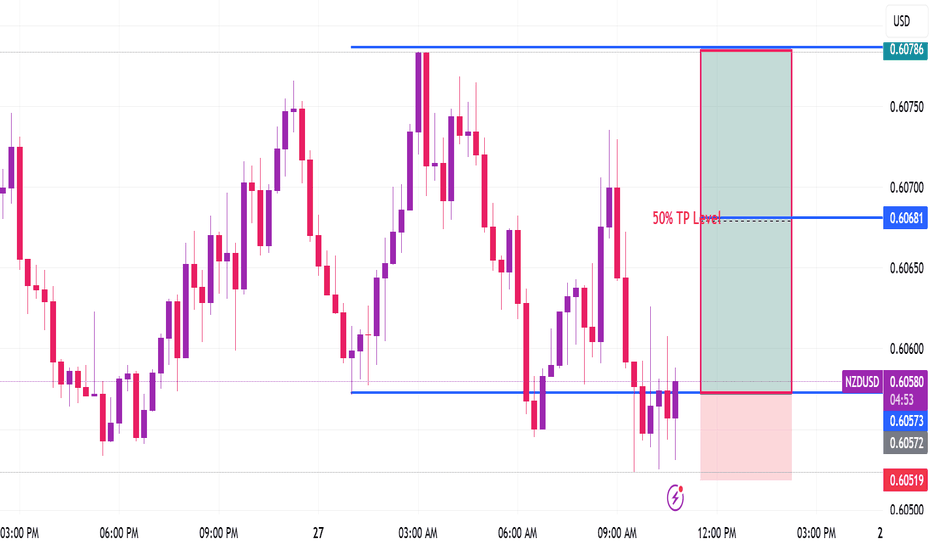

NZD/USD Short Setup – Quick Play Ahead!🔻 NZD/USD Short Setup – Quick Play Ahead!

The Kiwi pair is showing signs of exhaustion near key resistance levels, and bearish momentum is building up.

I'm currently eyeing a short-term sell position with a target at 0.60180.

If price action confirms this setup, we could see a clean move toward that zone.

📉 Watch for rejection signals and manage risk wisely.

👉 Follow for more sharp entries, clean technicals, and daily FX setups!

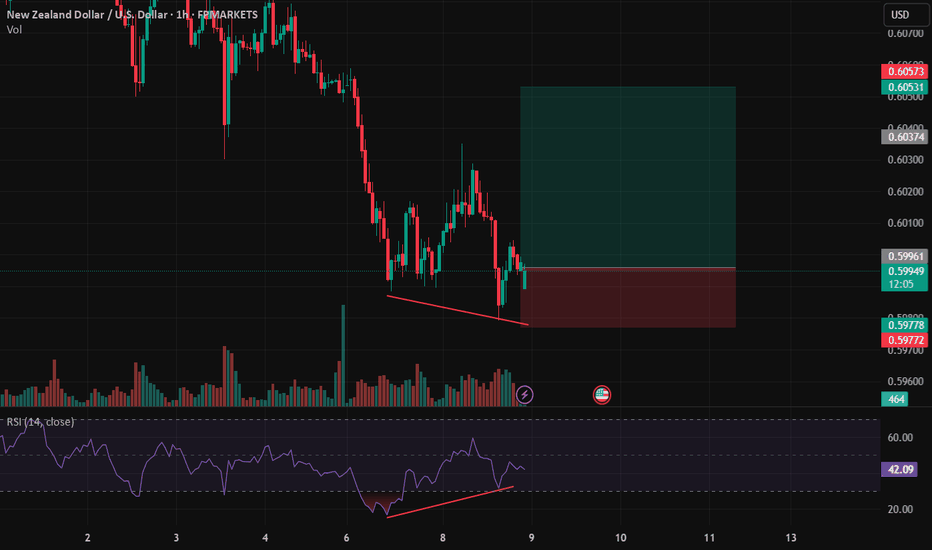

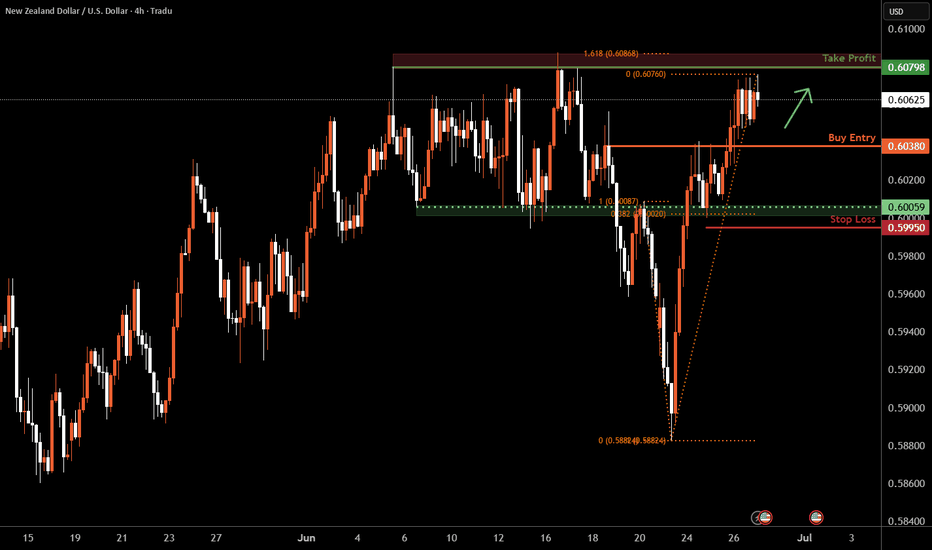

Kiwi H4 | Falling toward a pullback supportThe Kiwi (NZD/USD) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 0.6038 which is a pullback support.

Stop loss is at 0.5995 which is a level that lies underneath an overlap support and the 38.2% Fibonacci retracement.

Take profit is at 0.6079 which is a multi-swing-high resistance that aligns closely with the 161.8% Fibonacci extension.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

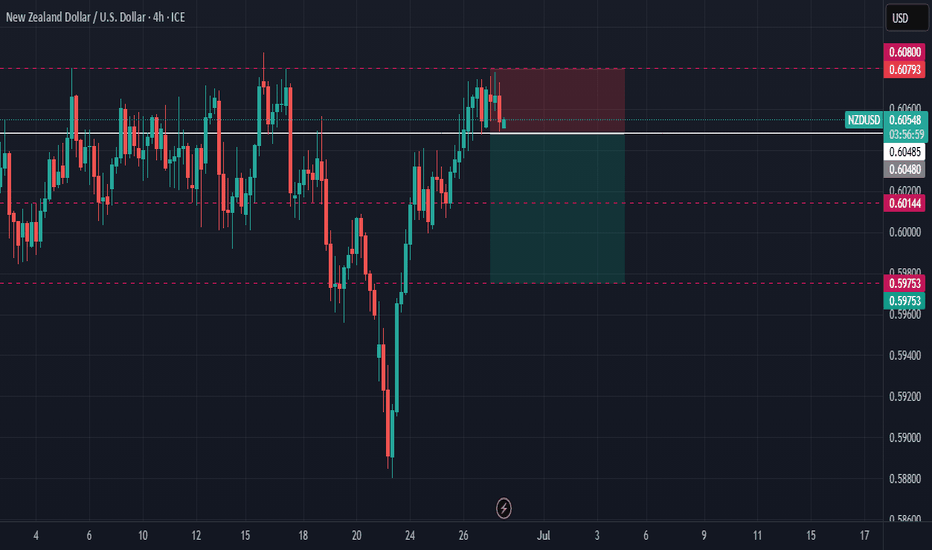

NZDUSD: Short Signal Explained

NZDUSD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short NZDUSD

Entry Point - 0.6067

Stop Loss - 0.6097

Take Profit - 0.6018

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️