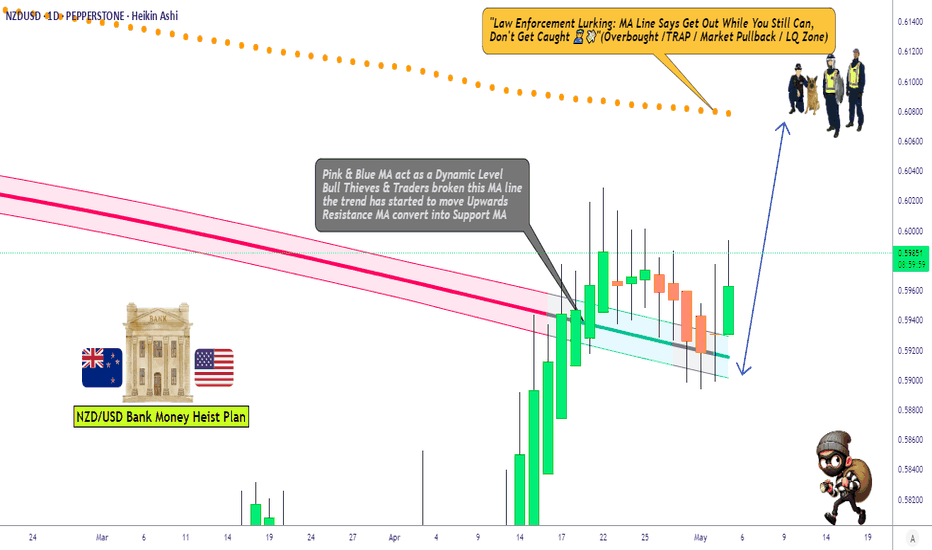

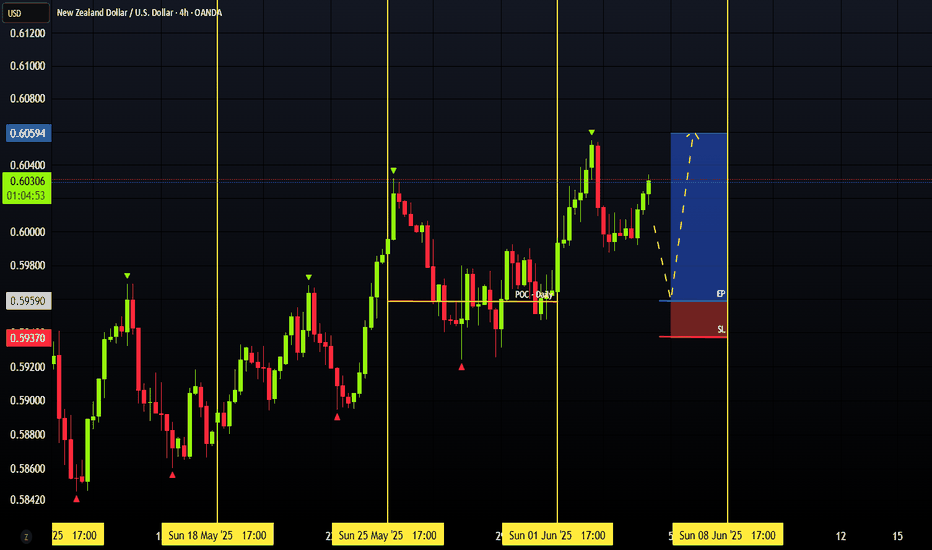

"Vault Breached! NZD/USD Bullish Loot (Live Heist)"🚨 "THE KIWI BANK HEIST" 🏦💰

NZD/USD Bullish Raid – Loot Fast Before the Cops Arrive!

🌟 Greetings, Money Bandits! 🌟 (Hola! Bonjour! Ciao! Konnichiwa!)

🔥 Thief Trading Intel:

The Vault is Open! 🏦➡️📈 – Price is bullish, but overbought.

Red Zone = Police Trap! 🚨 (Resistance/Reversal Risk)

Escape Plan: Take profits near 0.62400 (or bail early if traps trigger).

🔐 ENTRY: "BREAK IN NOW!"

"Buy the dip!" – Use 15M/30M swing lows for stealthy entries.

Set Alerts! ⏰ (Don’t miss the heist!)

🛑 STOP-LOSS: "THIEF’S SAFETY NET"

"Hide at 0.59500 (4H Swing Low)" – Adjust based on your loot size!

🎯 TARGET: "GRAB & VANISH!"

"0.62400 or escape earlier!" – Don’t get greedy; cops (bears) are lurking.

⚡ SCALPERS’ NOTE:

"Only steal LONG!" – Use trailing SL to protect your bag.

"Rich? Charge in! Poor? Wait for swings!"

📡 FUNDAMENTAL BACKUP:

"Kiwi is bullish… but check the news!" 📰 (COT, Macro Data, Sentiment)

⚠️ ALERT: Avoid trading during high-impact news – cops (volatility) love chaos!

💥 BOOST THIS HEIST! (Like & Share = More Loot!)

🚀 "Support the crew! Hit 👍, and let’s rob this market blind!" 💸🤝

Next heist coming soon… Stay tuned, bandits! 🏴☠️🎭

USDNZD trade ideas

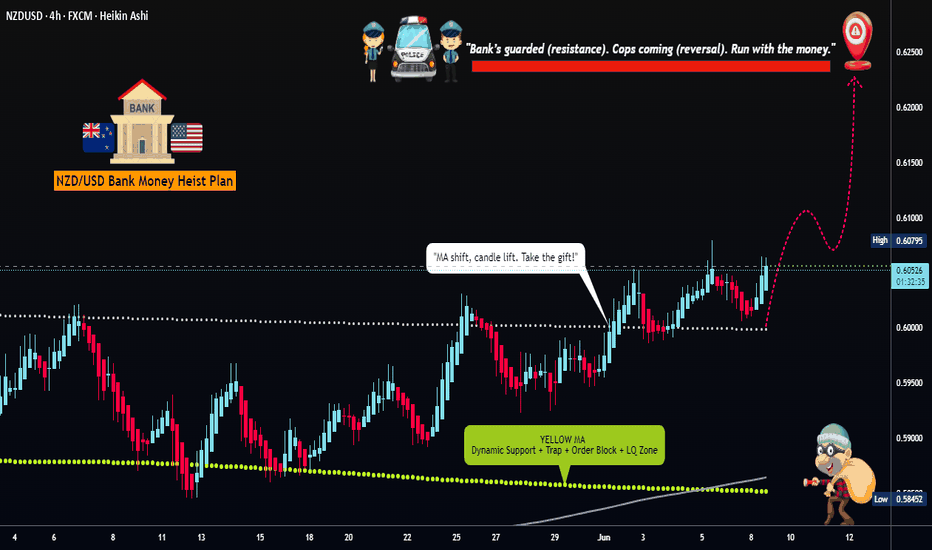

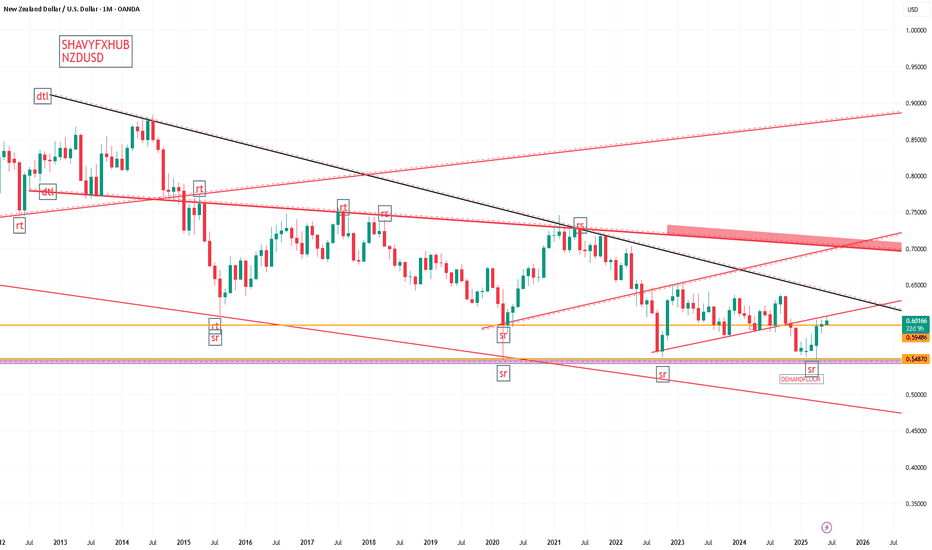

NZD/USD "The Kiwi" Forex Bank Money Heist (Bullish)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Yellow MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 1D timeframe (0.58400) Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.60800

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸NZD/USD "The Kiwi" Forex Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with overall score... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

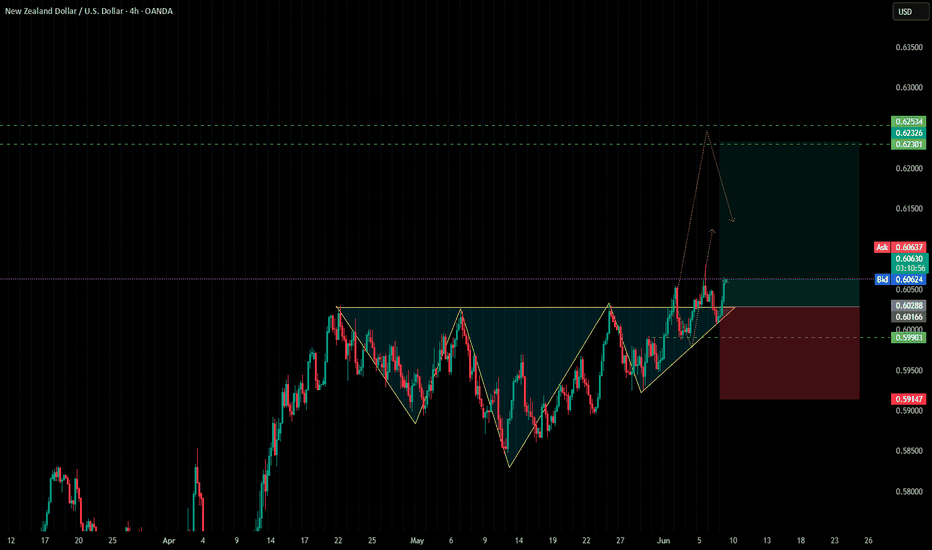

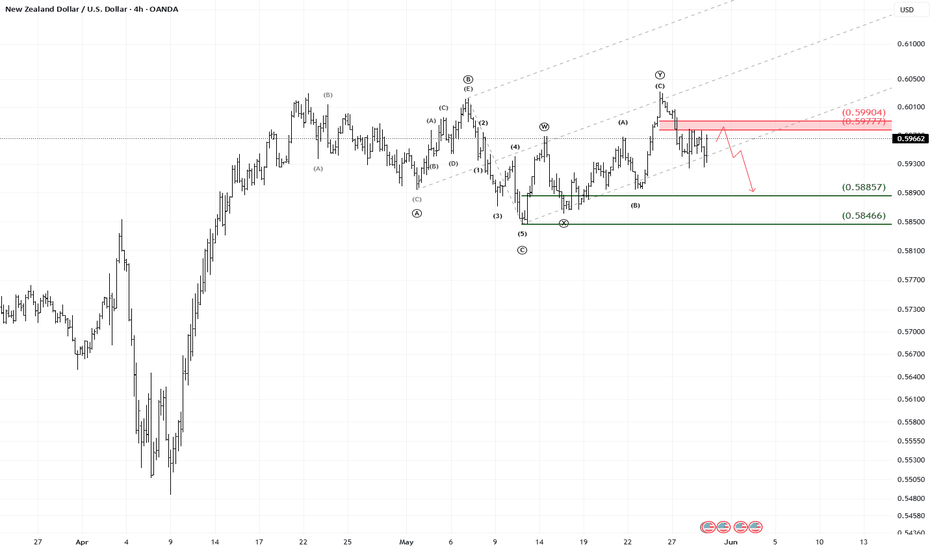

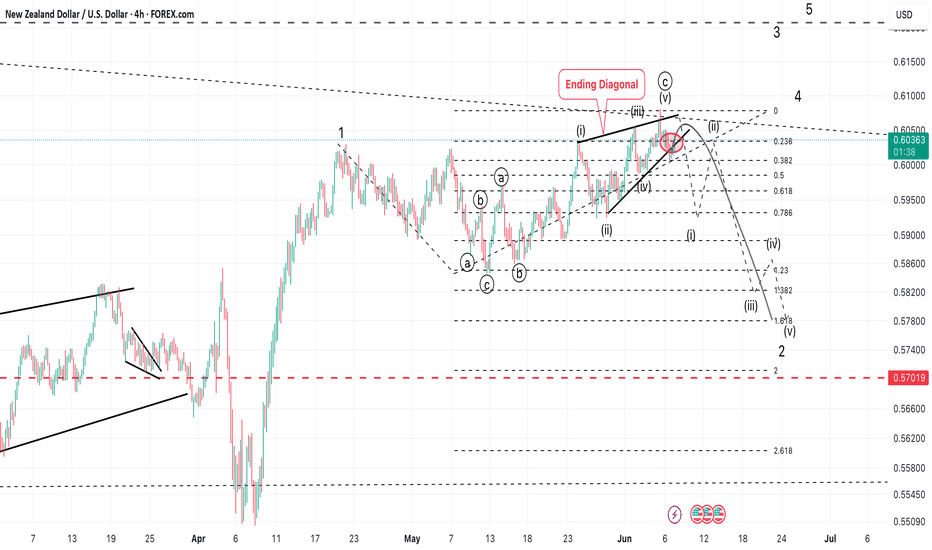

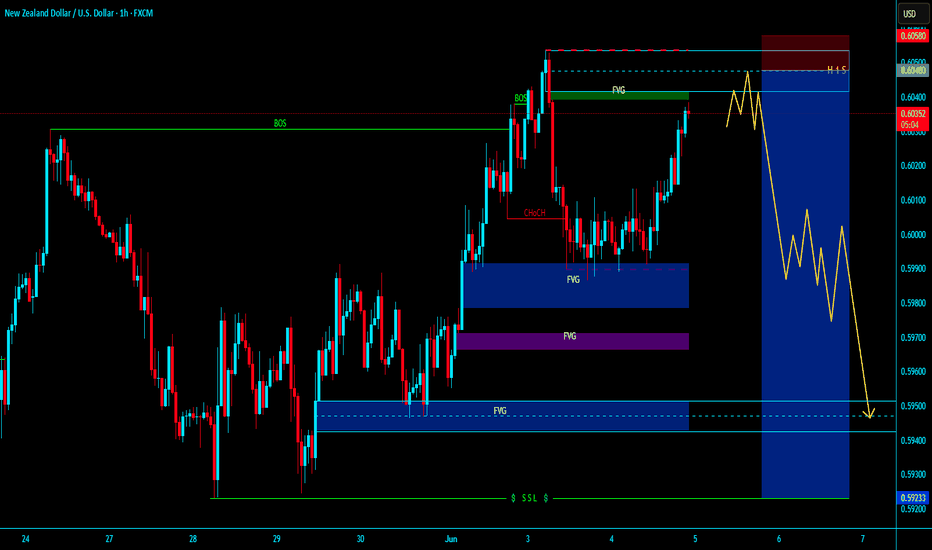

NZD/USD – Bearish Reversal Expected Below 0.5990–0.5977 ResistanThe NZD/USD pair is approaching a key resistance zone at 0.5990–0.5977, which has been tested multiple times and aligns with the upper boundary of a potential corrective structure.

🔹 Elliott Wave Context:

The price action appears to be completing a corrective wave (C) structure, indicating that upside momentum may be limited.

This scenario suggests a potential bearish reversal from the resistance zone.

🔹 Targets & Levels:

Resistance: 0.5990–0.5977

First support target: 0.5885

Next major support: 0.5846

📌 Trading Plan:

Watching for bearish confirmation (rejection candlesticks or reversal pattern) below 0.5990–0.5977

Potential short entries targeting the support levels

A break above 0.5990 would invalidate the bearish setup and suggest continuation to the upside

This chart offers a clear bearish bias while price remains below the resistance zone, supported by Elliott Wave context and previous price action behavior.

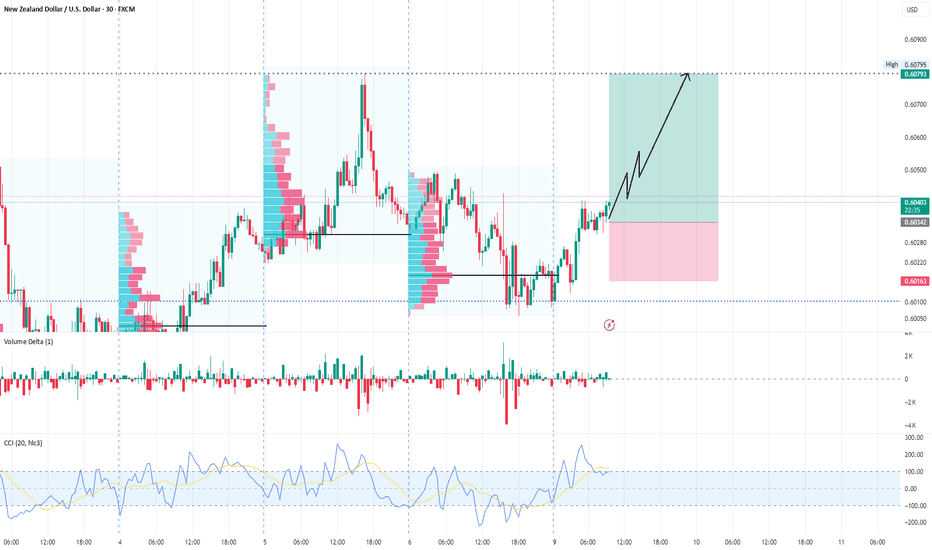

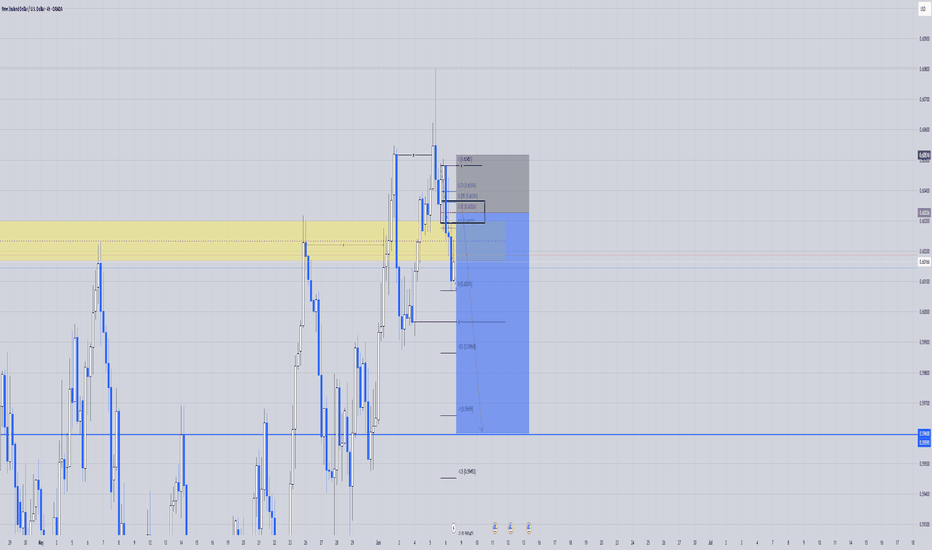

NZDUSD Long📊 Chart Elements Breakdown

✅ Trade Setup

Buy Entry Zone: Around 0.60385

Stop Loss (Red Zone): Below 0.60163

Take Profit (Green Zone): Near 0.60795

Risk/Reward Ratio: Roughly 1:2, showing a favorable setup

📈 Indicators & Tools Used

1. Volume Profile (Visible Range)

Displays where the most trading activity (volume) occurred in each session.

You’ve marked high-volume nodes (HVN) and low-volume areas.

Price is moving away from a high-volume consolidation zone, suggesting a breakout attempt.

2. Volume Delta (Histogram)

Shows the difference between buying and selling volume.

Currently showing increasing green bars → bullish delta, indicating buyers are gaining control.

3. CCI (Commodity Channel Index)

CCI(20) is above +100, signaling overbought conditions but also confirming bullish momentum.

This supports the bullish move continuation theory.

🧠 Trading Logic

Accumulation Zone identified before the breakout (low-volume area marked).

Price retested support and showed strength with a bounce.

The break above recent structure around 0.6035 combined with positive delta and CCI signals is a bullish confluence.

Targeting the previous swing high at 0.60795 aligns with volume-based resistance.

🔍 Summary

You're anticipating:

A bullish continuation after a clean retest of support.

Strong buying pressure confirmed by Volume Delta and CCI.

A breakout from a range, potentially targeting liquidity above 0.6079.

GBPUSD 4 Hour Chart GBP/USD has currently completed the minute degree 5th wave and is now entering a corrective 2nd wave. The 5th wave remains valid as long as the price stays below 1.36168. There is a high probability of a downward move towards the Fibonacci retracement zone between 0.618 and 0.786, corresponding to the price range of 1.26811 to 1.24270, where an ABC correction is expected to complete.

NZDUSD1. New Zealand 10-Year Bond Yield

As of June 6, 2025, the New Zealand 10-year government bond yield is approximately 4.58% to 4.64%, with a recent slight increase to 4.64% on June 6, 2025.

The Reserve Bank of New Zealand (RBNZ) official cash rate stands at 3.25% as of early June 2025, following cuts from 3.50% in May.

Bond yields reflect inflation expectations, economic outlook, and monetary policy stance.

2. United States 10-Year Bond Yield 4.5%

3. Interest Rate Differential

The 10-year bond yield differential (NZ minus US) is roughly:

4.6%(NZ)−4.5%(US)≈+0.1%

This small positive differential indicates New Zealand bonds yield slightly more than US bonds, offering a modest carry advantage for NZD over USD

The current Federal Reserve (Fed) policy interest rate target range is 4.25% to 4.50%, a level that has been maintained since December 18, 2024. The Fed has held rates steady through its meetings so far in 2025, including the most recent one in May.

The next Fed interest rate decision is scheduled for June 18, 2025, with the announcement expected at 6:00 PM UTC (2:00 PM ET), followed by a press conference by Fed Chair Jerome Powell.

The policy rate differential favors the US slightly, with the Fed’s rate around 4.25 TO 4.5%% and RBNZ’s at 3.25%–3.50%, reflecting the recent easing by New Zealand.

4. Carry Trade Advantage

The carry trade incentive for NZD/USD is modest due to the small yield differential.

Investors borrowing in USD to invest in NZD assets gain a slight positive yield spread from the 10-year bond yields but face currency risk and potential volatility.

The carry advantage is limited by RBNZ’s recent rate cuts and the Fed’s relatively higher policy rates.

Conclusion

The NZD/USD 10-year bond yield differential currently offers a small carry advantage to NZD, but this is tempered by the policy rate differential favoring the USD due to recent RBNZ easing. The carry trade appeal for NZD/USD is therefore limited in June 2025, with currency movements likely influenced more by economic data, risk sentiment, and central bank guidance than pure yield spreads.

#NZDUSD

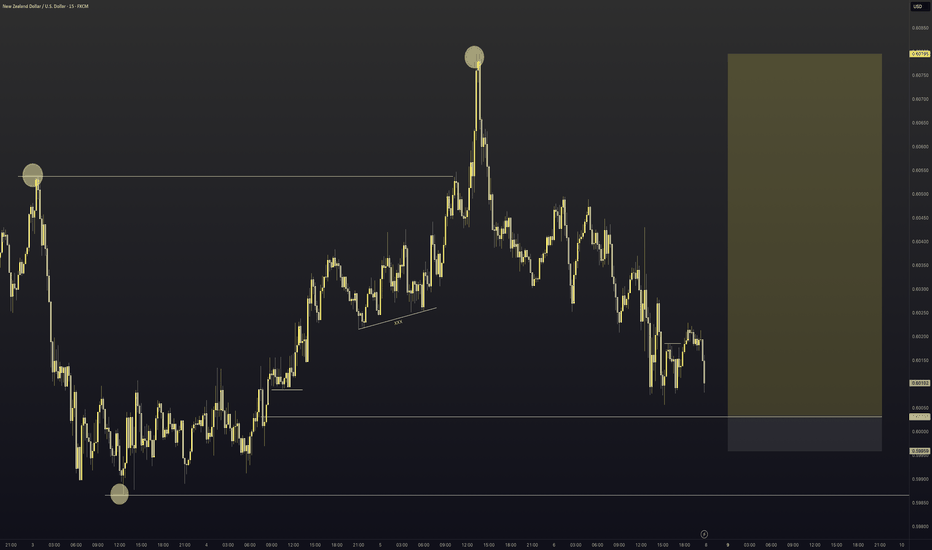

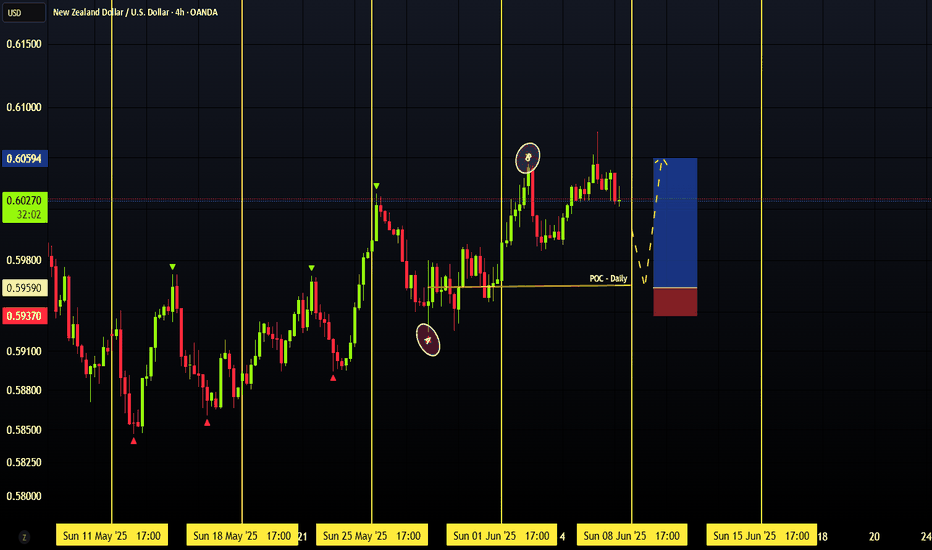

NU Short prespectiveLooking at NU on the 4 hr, we have a nice rejection with the pinbar taking out sell side liquidity. We can also observe that price retraced back into the resistance zone before the further push to the down side. Friday Market closed with bearish sentiment.

As such we have a good amount of Fvg that we can potentially target as an entry. Here we have established the .62% as an entry using the fib retracement to target the previous lows.

Now, this trade will be invalid if price fails to stay below the new LH and would make this short invalid. Currently price is testing a resistance as per historical data would present.

NZDUSD 1. New Zealand 10-Year Bond Yield

As of June 6, 2025, the New Zealand 10-year government bond yield is approximately 4.58% to 4.64%, with a recent slight increase to 4.64% on June 6, 2025.

The Reserve Bank of New Zealand (RBNZ) official cash rate stands at 3.25% as of early June 2025, following cuts from 3.50% in May.

Bond yields reflect inflation expectations, economic outlook, and monetary policy stance.

2. United States 10-Year Bond Yield 4.5%

3. Interest Rate Differential

The 10-year bond yield differential (NZ minus US) is roughly:

4.6%(NZ)−4.5%(US)≈+0.1%

This small positive differential indicates New Zealand bonds yield slightly more than US bonds, offering a modest carry advantage for NZD over USD

The current Federal Reserve (Fed) policy interest rate target range is 4.25% to 4.50%, a level that has been maintained since December 18, 2024. The Fed has held rates steady through its meetings so far in 2025, including the most recent one in May.

The next Fed interest rate decision is scheduled for June 18, 2025, with the announcement expected at 6:00 PM UTC (2:00 PM ET), followed by a press conference by Fed Chair Jerome Powell.

The policy rate differential favors the US slightly, with the Fed’s rate around 4.25 TO 4.5%% and RBNZ’s at 3.25%–3.50%, reflecting the recent easing by New Zealand.

4. Carry Trade Advantage

The carry trade incentive for NZD/USD is modest due to the small yield differential.

Investors borrowing in USD to invest in NZD assets gain a slight positive yield spread from the 10-year bond yields but face currency risk and potential volatility.

The carry advantage is limited by RBNZ’s recent rate cuts and the Fed’s relatively higher policy rates.

Conclusion

The NZD/USD 10-year bond yield differential currently offers a small carry advantage to NZD, but this is tempered by the policy rate differential favoring the USD due to recent RBNZ easing. The carry trade appeal for NZD/USD is therefore limited in June 2025, with currency movements likely influenced more by economic data, risk sentiment, and central bank guidance than pure yield spreads.

#NZDUSD

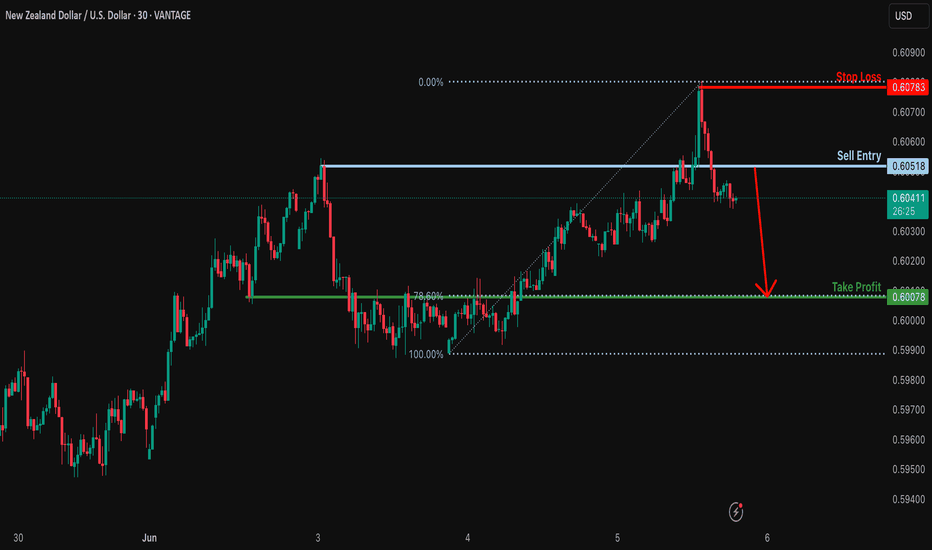

Bearish drop for Kiwi?The price is rising towards the resistance level which is a pullback resistance and could drop from this level to our take profit.

Entry: 0.6051

Why we like it:

There is a pullback resistance level.

Stop loss: 0.6078

Why we like it:

There is a pullback resistance level.

Take profit: 0.6007

Why we lik eit:

There is an overlap support level that aligns with the 78.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

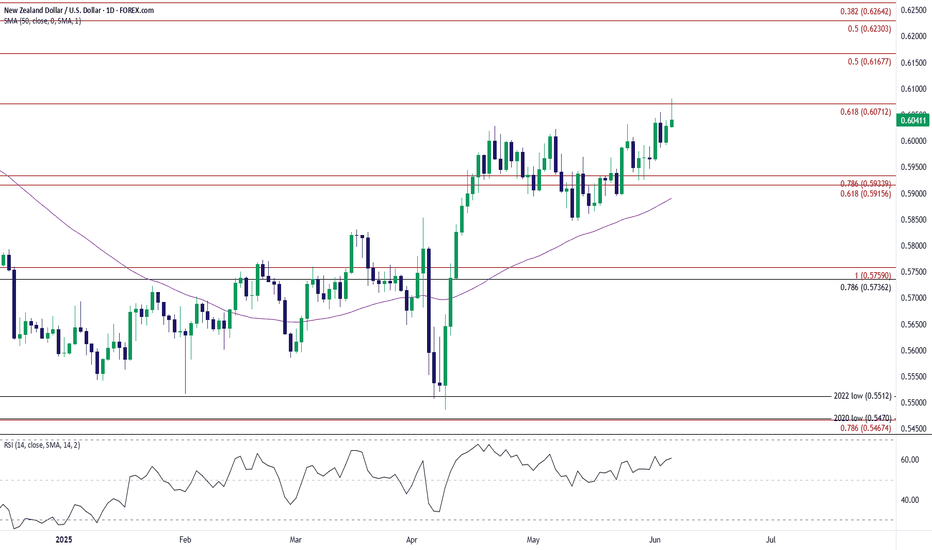

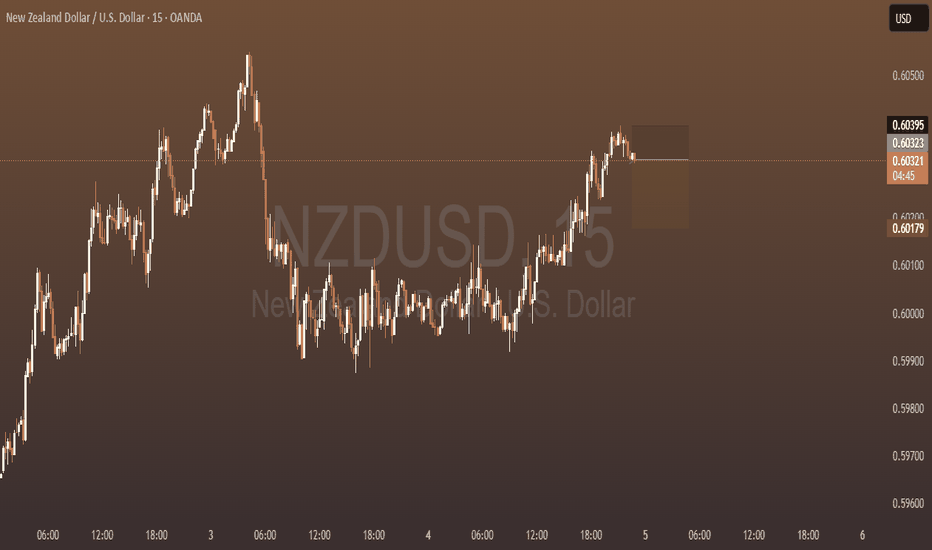

NZD/USD Registers Fresh Yearly HighNZD/USD breaks out of the range bound price action from earlier this week to register a fresh yearly high (0.6080).

Still need a close above 0.6070 (61.8% Fibonacci extension) to open up 0.6170 (50% Fibonacci extension), with the next area of interest coming in around 0.6230 (50% Fibonacci extension) to 0.6260 (38.2% Fibonacci extension).

At the same time, lack of momentum to close above 0.6070 (61.8% Fibonacci extension) may push NZD/USD back toward the weekly low (0.5961), with a break/close below the 0.5920 (61.8% Fibonacci extension) to 0.5930 (78.6% Fibonacci extension) region bringing the May low (0.5847) on the radar.

--- Written by David Song, Senior Strategist at FOREX.com

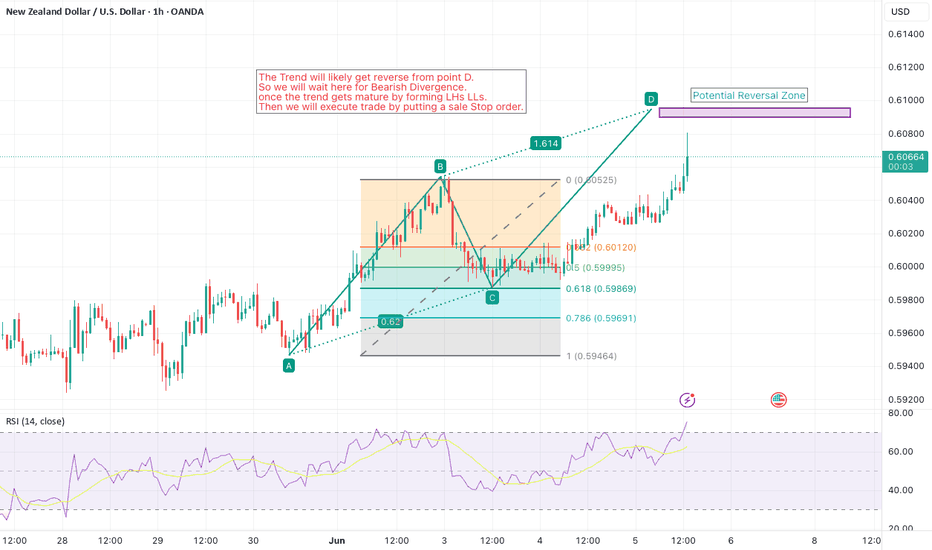

NZD/USD Bearish Reversal Setup | AB=CD -Week 7Hey Traders!

I'm currently watching a possible bearish reversal setup forming on the NZD/USD 1H chart based on:

✅ Confluence Factors:

🔹 AB=CD Harmonic Pattern

Price is approaching the D point near the PRZ (Potential Reversal Zone)

AB=CD ratio aligns closely with 1.618 and 0.618 fibs for BC leg

🔹 Bearish RSI Divergence

RSI is showing a higher high while price action is also making a higher high

Classic sign of momentum weakening at the top

📌 Trading Plan:

Wait for price to reach or slightly exceed point D / PRZ zone

Watch for clear lower highs and lower lows on price structure

Confirm entry with bearish divergence and candle confirmation

Enter via Sell Stop below support or structural break

Target: Previous support zones

Stop Loss: Above PRZ/point D

#NZDUSD #HarmonicPatterns #RSIDivergence #TechnicalAnalysis #TradingSetup #ABCDPattern #Forex #TradingView

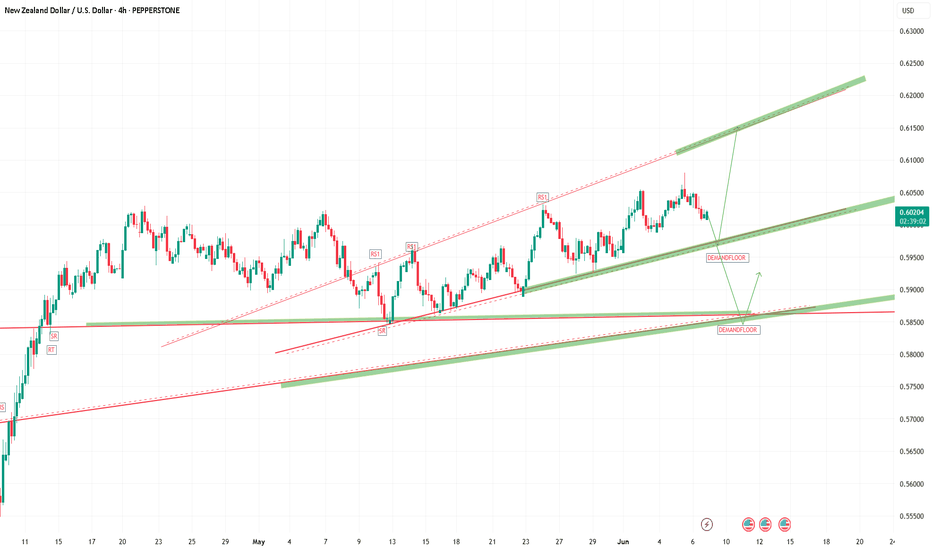

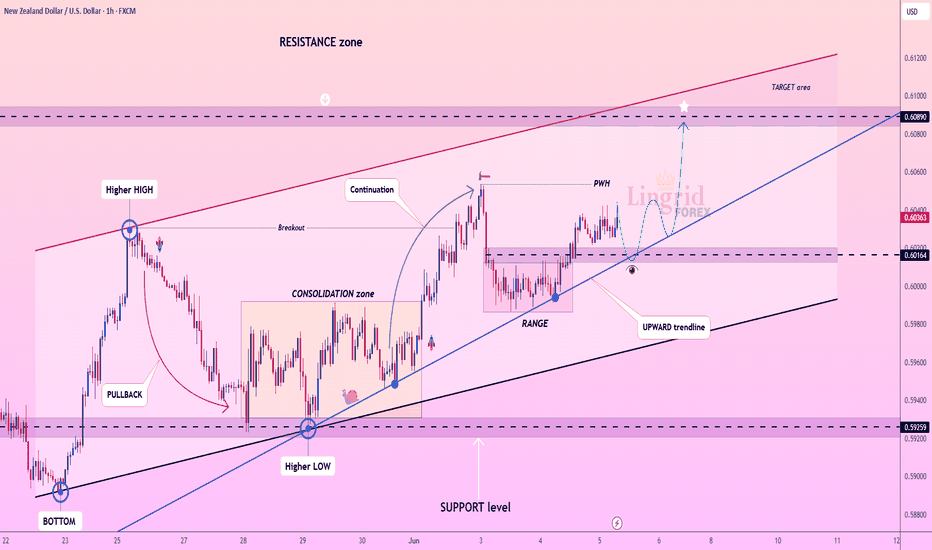

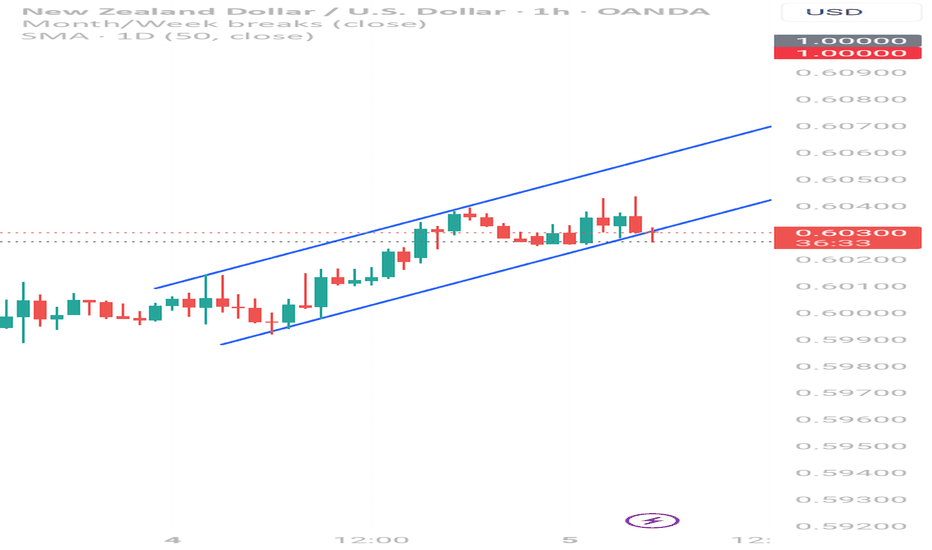

Lingrid | NZDUSD Uptrend Trend Continuation Trade FX:NZDUSD is trending within a clean upward channel, recently bouncing off the trendline near 0.60164. After consolidating in a narrow range, the pair is showing signs of upward continuation toward the 0.60890 resistance zone. A retest of the trendline followed by a bullish reaction could confirm the breakout move.

📈 Key Levels

Buy zone: 0.60160–0.60220

Buy trigger: breakout above 0.60400 with momentum

Target: 0.60890

Sell trigger: breakdown below 0.60100

💡 Risks

False breakout above 0.60400 may trap buyers

Close below trendline invalidates bullish structure

Range-bound price action may delay breakout follow-through

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

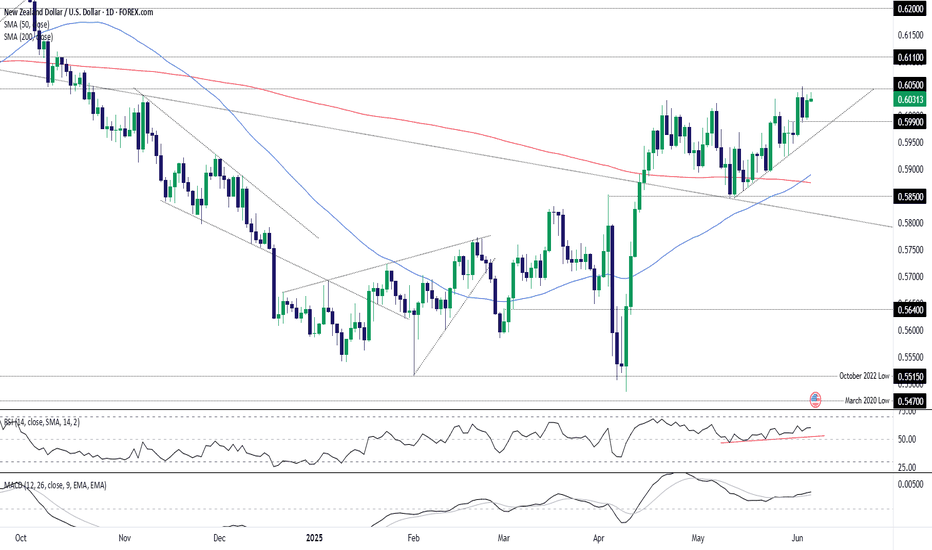

NZD/USD: Bullish signals build ahead of U.S. data gauntletNZD/USD is holding an established uptrend with bullish momentum building, supported by strengthening RSI and MACD signals. The pair is testing key resistance at .6050—a level that’s capped price repeatedly over the years.

A break and close above would confirm a bullish setup, allowing for longs to be established above the level with a stop just beneath. Initial resistance comes in at .6110, with scope for a move towards .6200 if momentum continues.

Good luck!

DS

NZD/USD Buy Opportunity at Channel Support (1H)📈 NZD/USD – Bullish Channel Setup (1H Timeframe)

Price action is currently moving within a clearly defined ascending channel. After a period of consolidation, the pair has been making higher highs and higher lows, respecting the structure of this bullish channel.

🔹 Trend Bias: Bullish (short-term) 🔹 Support Zone: Lower boundary of the channel (around 0.6020) 🔹 Resistance Zone: Upper boundary of the channel (around 0.6060) 🔹 Current Price: 0.60288 – sitting right above the channel’s midline and testing support

🔍 Analysis:

Price is respecting the ascending trendline and forming minor pullbacks along the way.

The current candle is testing the lower boundary of the channel, which could act as a potential bounce zone if bullish pressure continues.

If price holds above this trendline support, we could see another leg toward the channel top near 0.6060.

However, a break and close below the channel support could open the door for a deeper pullback toward 0.6000 or even 0.5980.

📌 Watchlist Setup:

Buy scenario: Look for bullish confirmation around 0.6020 – bullish engulfing or strong rejection wicks.

Sell scenario: Wait for a clear break and retest of the lower channel line for possible short entries.

🧠 Bias Caution: Always align this setup with your higher timeframe analysis (e.g., 4H or Daily) and watch for upcoming news events that could impact USD or NZD.

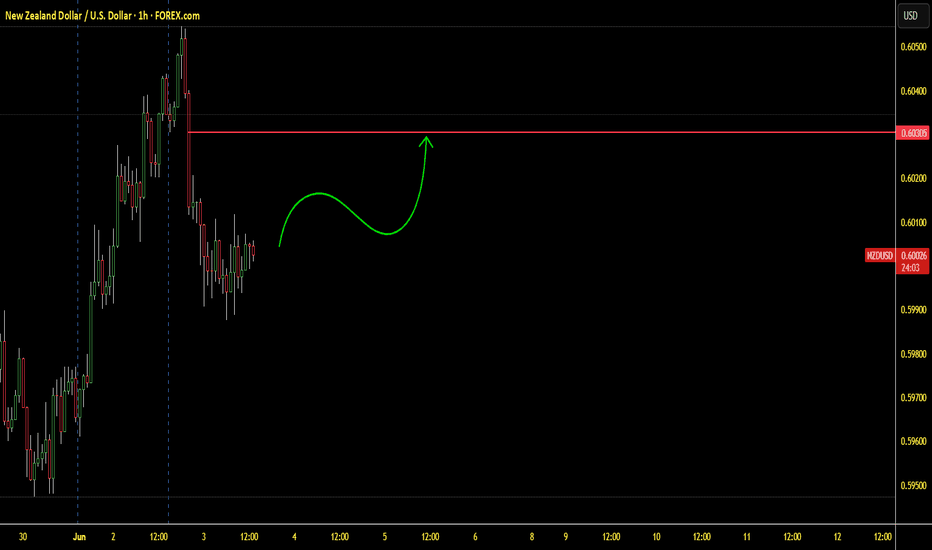

NZDUSD – Long Bias LiveNZDUSD – Long Bias Live

🟢 Entered long at market open

🎯 Target: 0.60305

⏳ Plan to hold ~3-5 days (usually much soon)

Price has been grinding lower into support near 0.5980–0.5990. After basing, I’m playing for a rally up to 0.60305 (red line). I’m already in this long—if you’d like to join, be prepared to hold through the next few sessions.

📝 Not financial advice—trade responsibly!

💡 All setups can be replayed on TradingView for confirmation.

#NZDUSD #Forex #SwingTrade #TradingView #MarketAnalysis

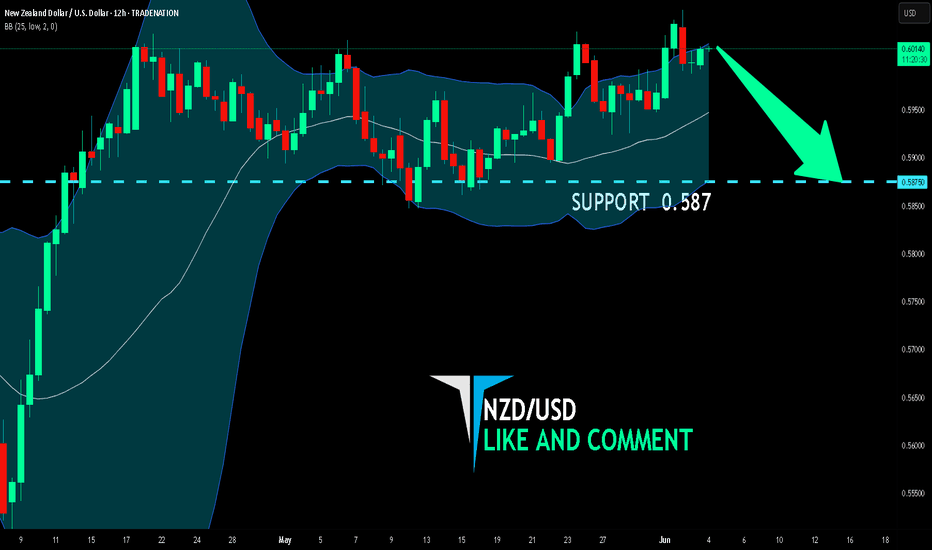

NZD/USD BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

NZD-USD uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 0.587 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the NZD/USD pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

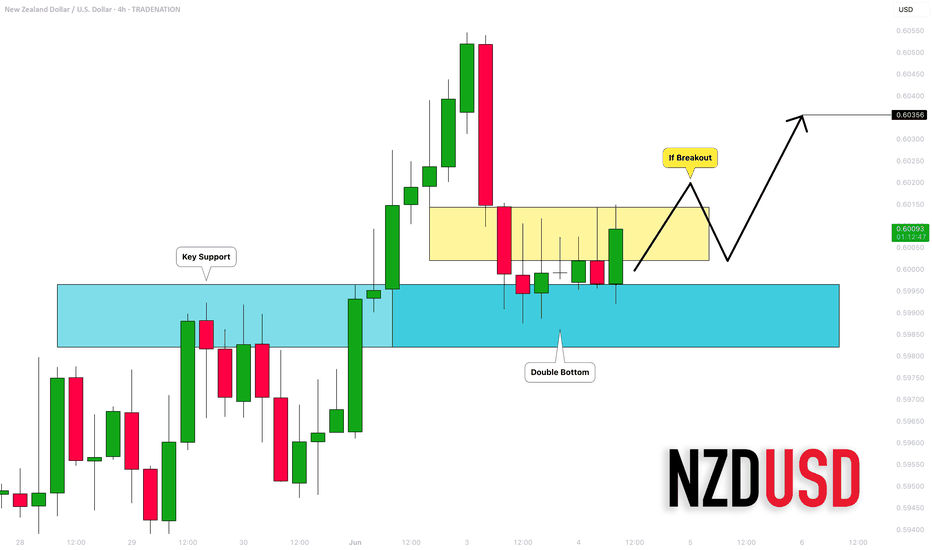

NZDUSD: Your Trading Plan For Today Explained 🇳🇿🇺🇸

NZDUSD is currently consolidating on a strong intraday/daily support.

To buy the pair with a confirmation, I suggest to focus on a double

bottom pattern on a 4H time frame.

Its neckline breakout and a 4H candle close above 0.6015

will provide a reliable bullish confirmation.

Goal will be 0.6035.

Alternatively, if the price sets a new lower low on a 4H,

this setup will become invalid.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.