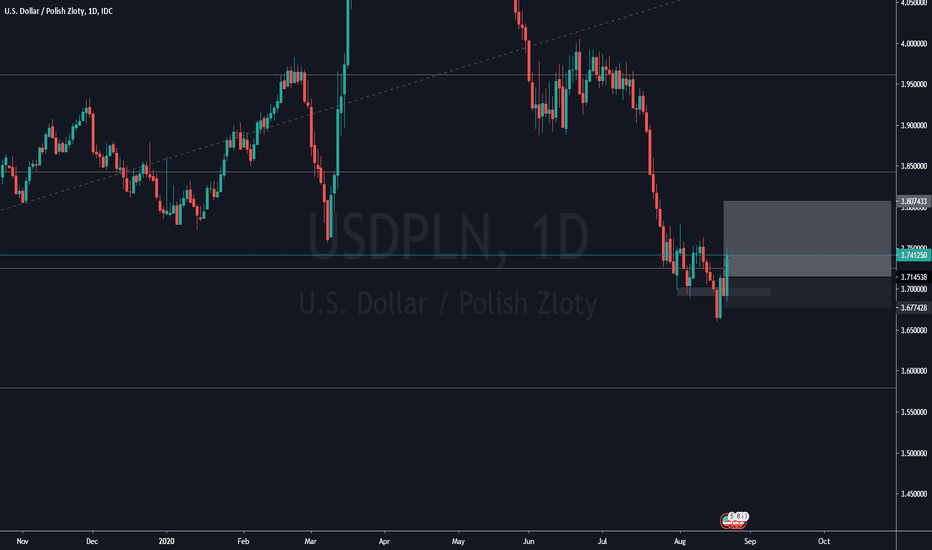

USDPLN first updateI purchased USD on Thursday right after the market closed

Here is what i think

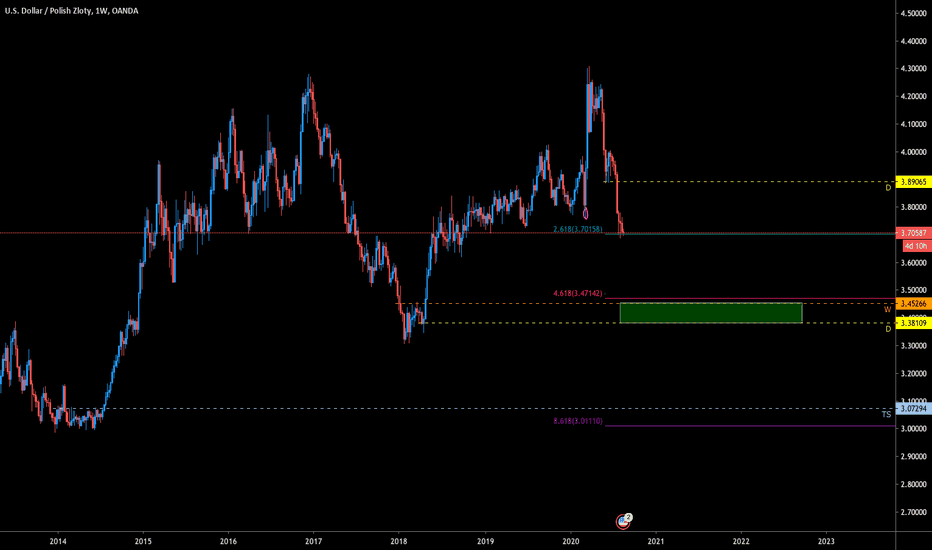

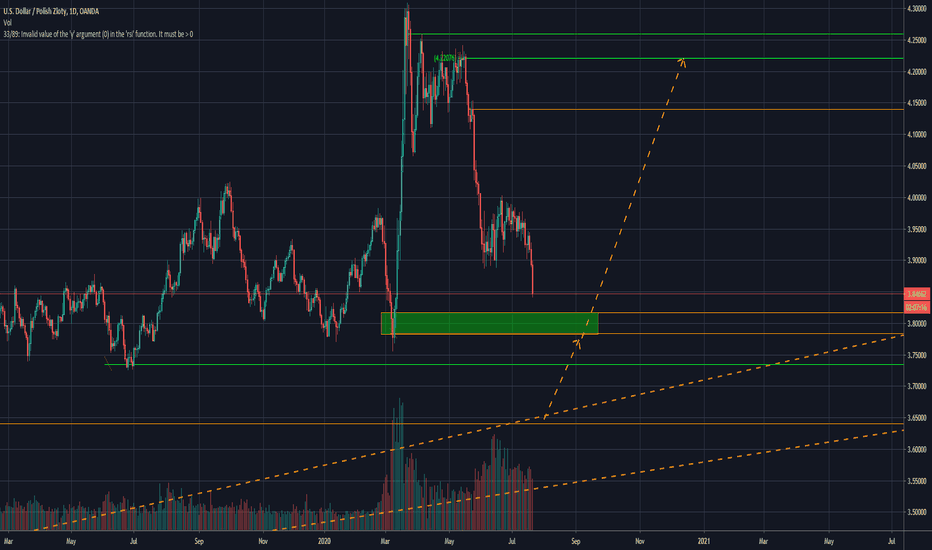

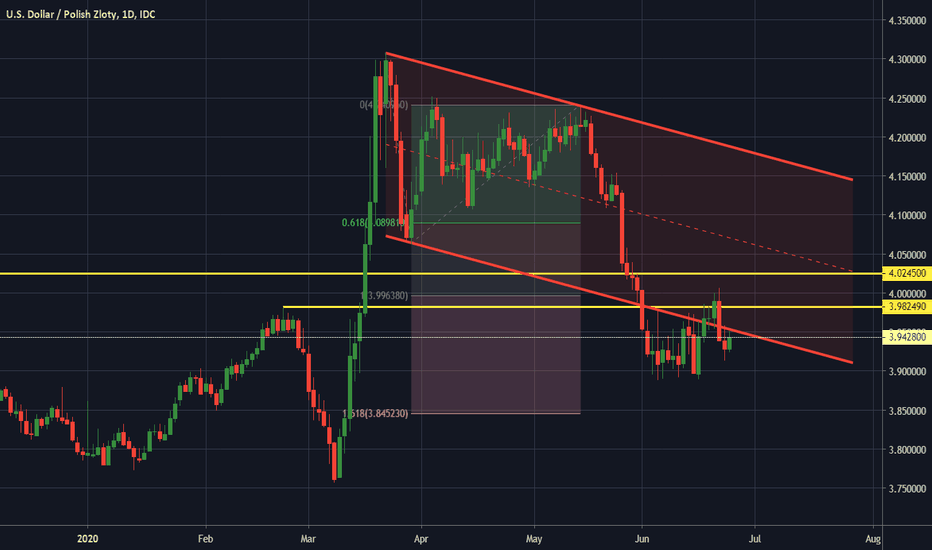

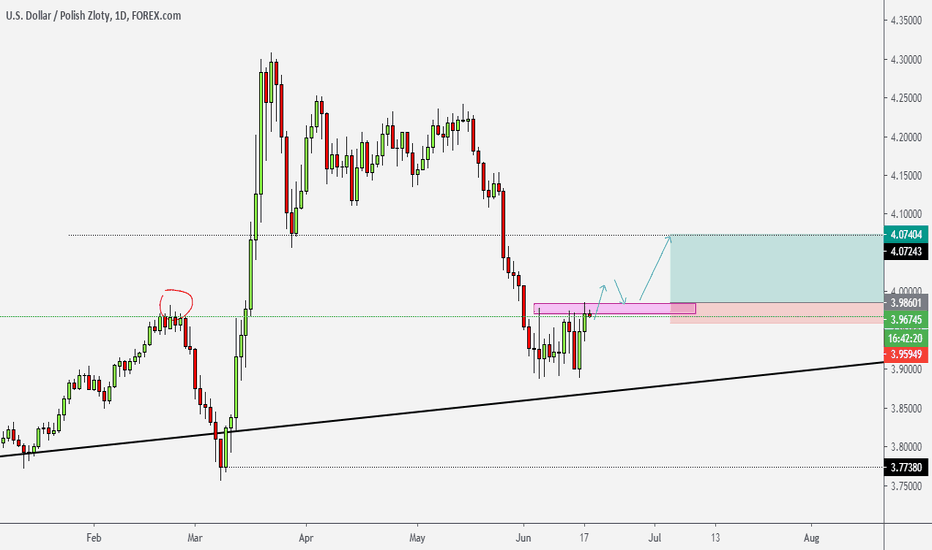

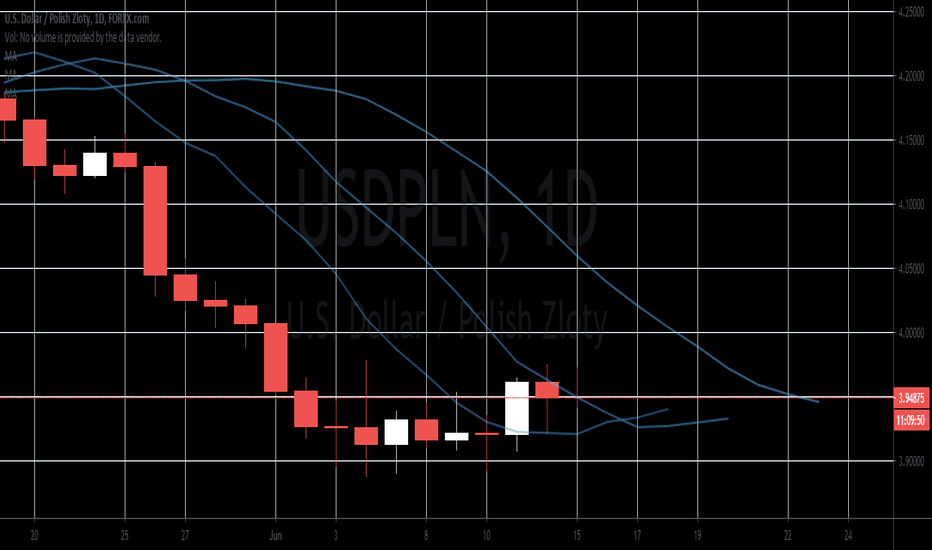

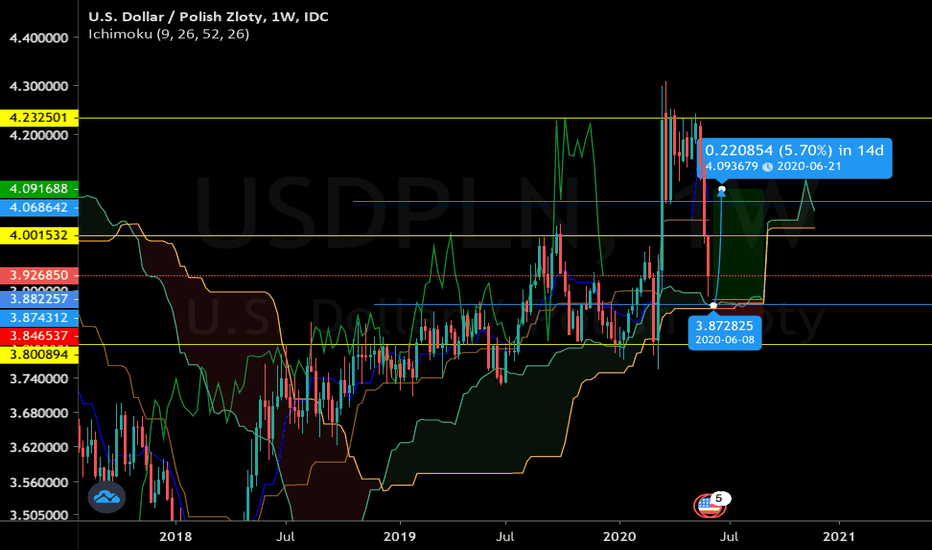

Weekly showed a very strong support using FIB

Daily closed showing a rejection since the there is a very strong resistance

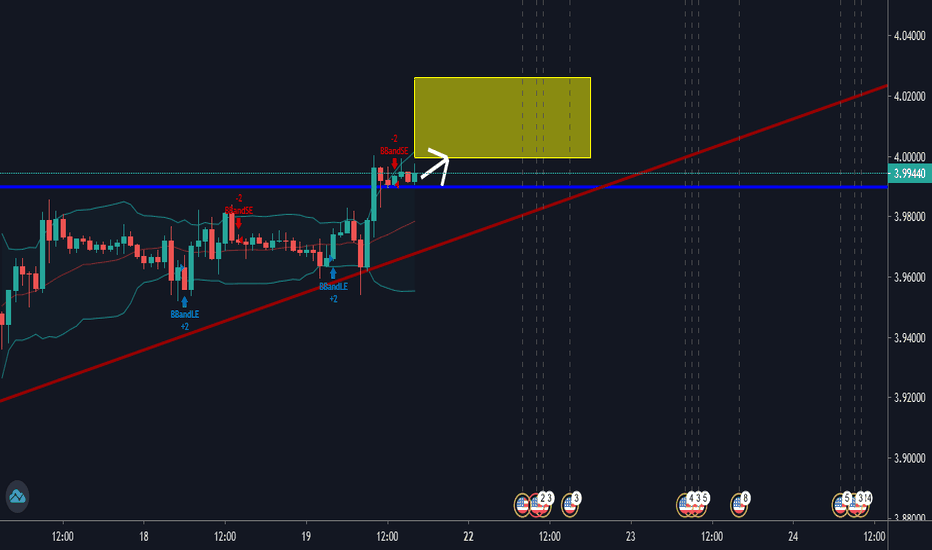

4H confirms a rejection using trend-line

so i would suggest to wait for a break out on a daily chart ;) then from there we look for long positions. i will update once the confirmation has been made

wish you all a great weekend

Planning to update you whenever i plan to make trades...Swing traders KEEP UP! :)

USDPLX trade ideas

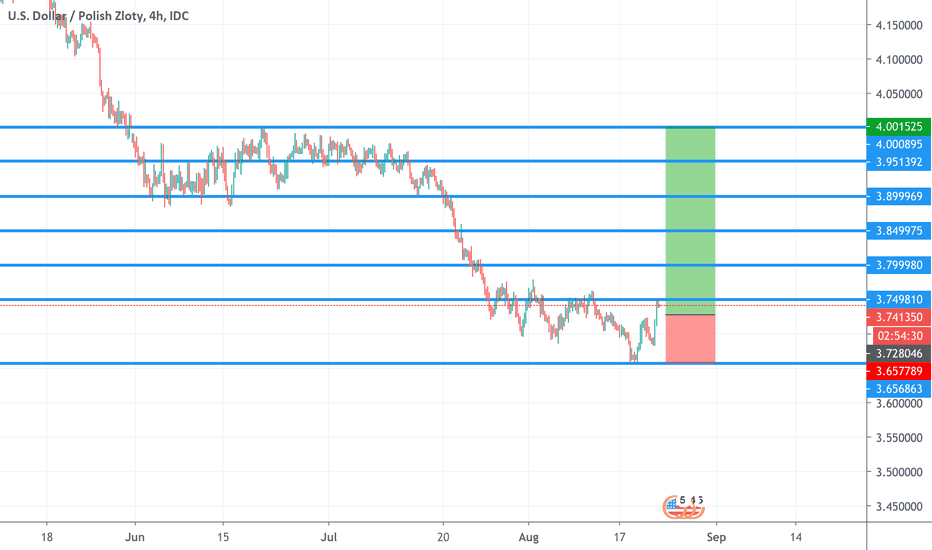

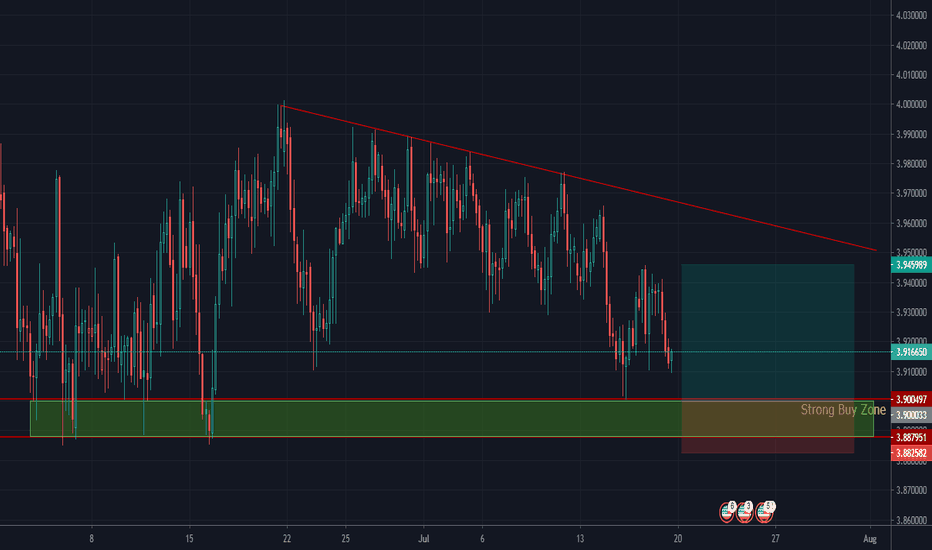

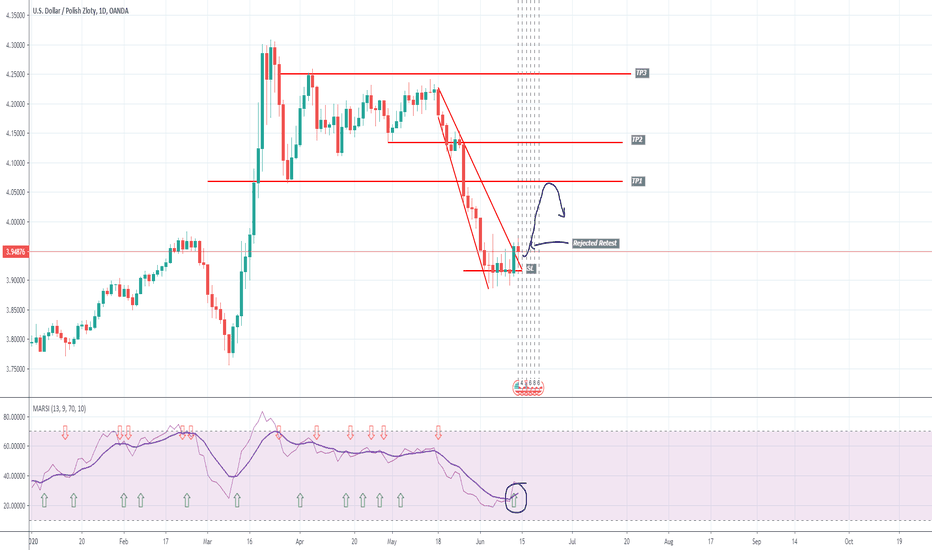

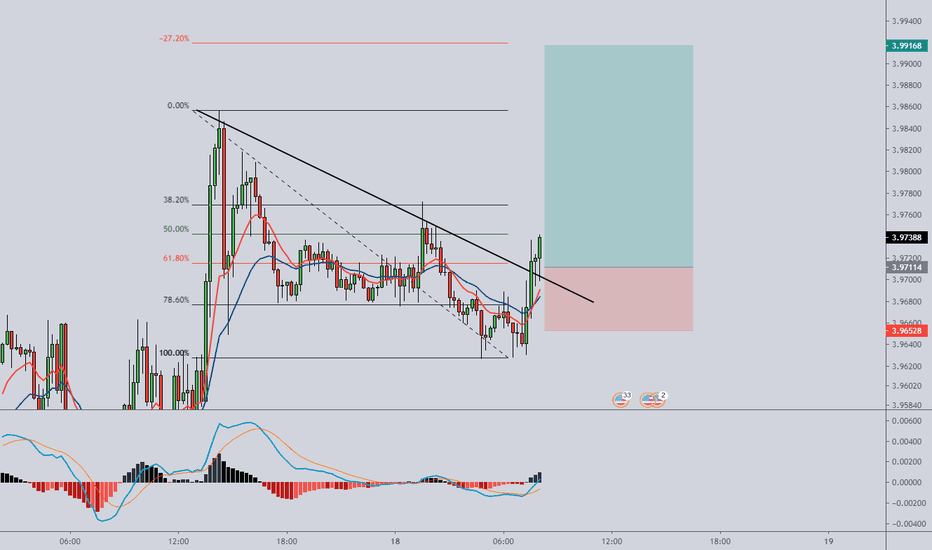

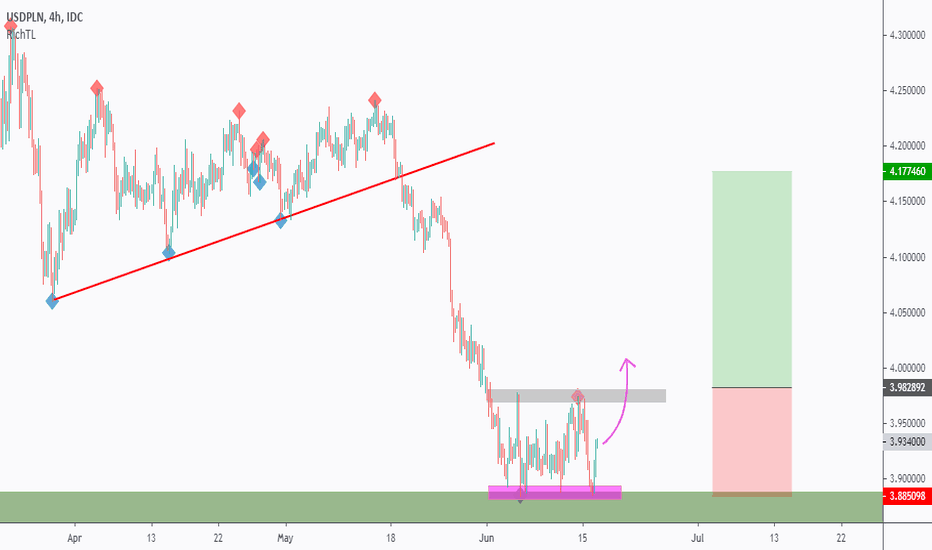

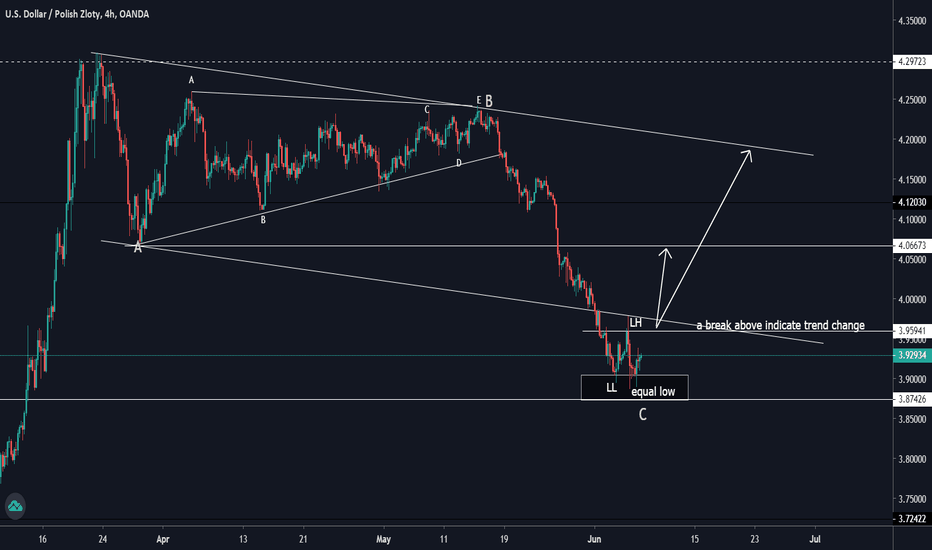

USDPLN waiting for a trigger to buyon DAILY: USDPLN rejected our previous support zone in green so we are still looking for objective buy setups on lower timeframes

on H4: USDPLN formed a new trendline red so we are still waiting for a momentum candle close above our gray zone to buy this one.

meanwhile, this one would be overall bearish and can still test our support one more time before going upward, in this case, we will be looking for new objective buy setups to form.

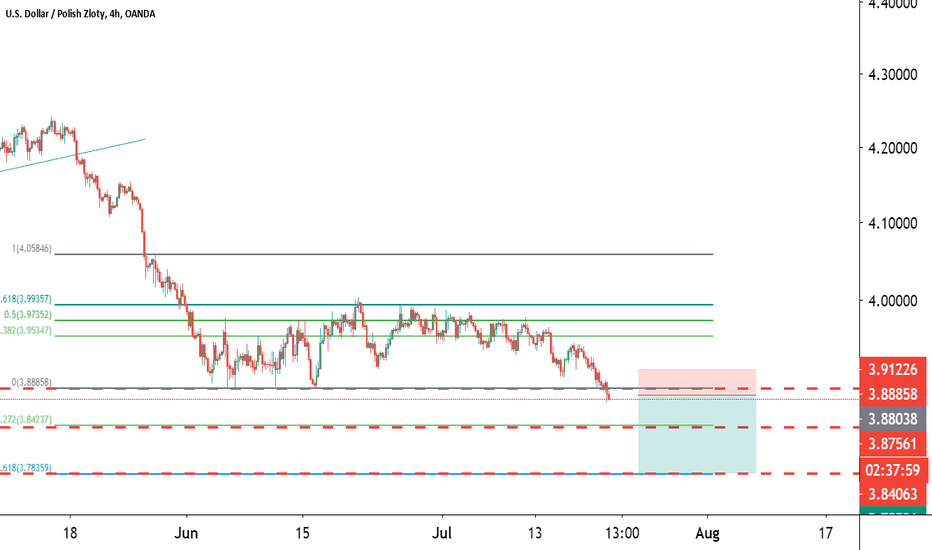

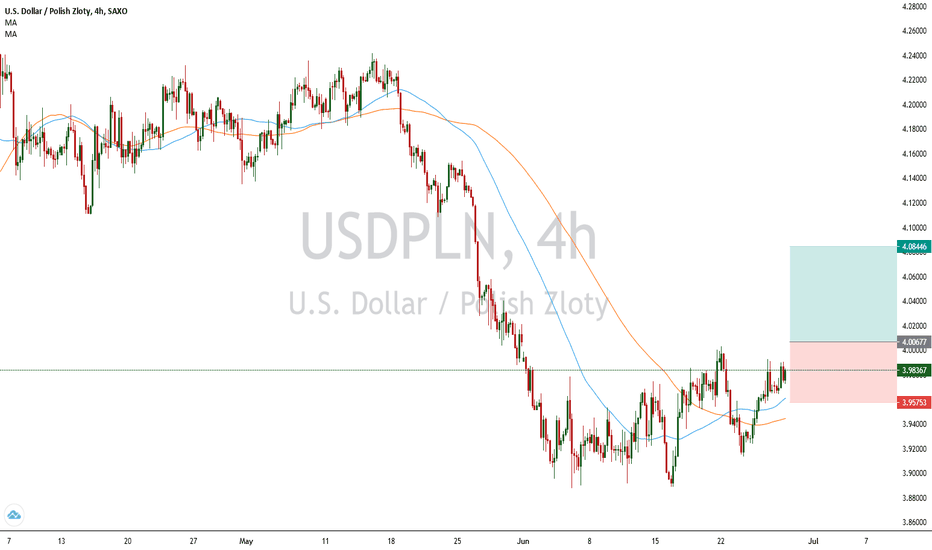

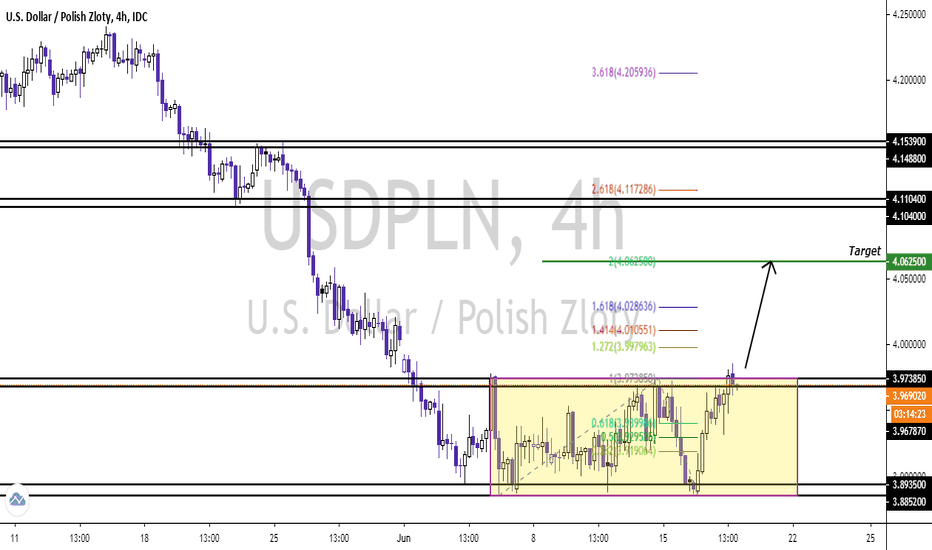

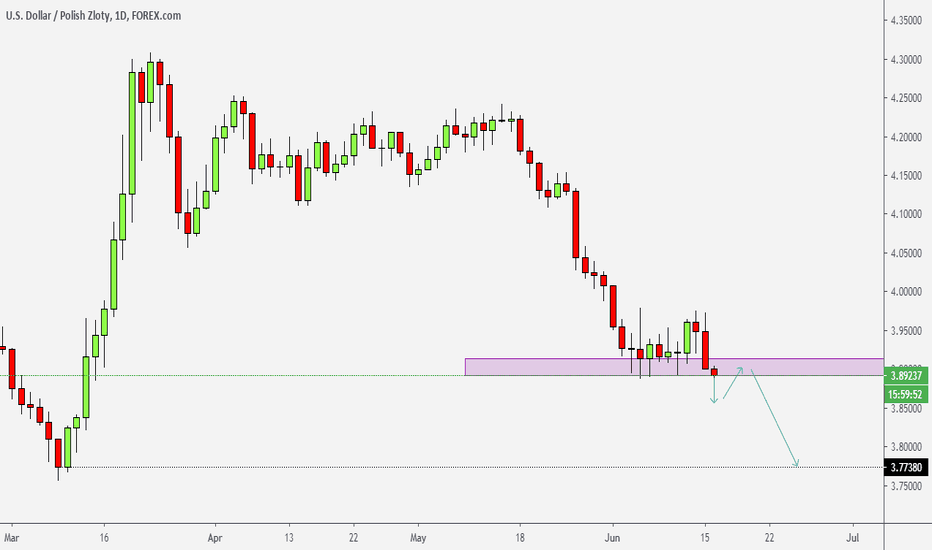

USDPLN, D1 - still below the lower limit of the channelThe USDPLN currency pair has dropped significantly despite the cut in the interest rates in Poland. The market currently is hovering around the lower limit of the key downward channel which could be the important support/resistance area. Also, an important resistance could be located at the previous top at 3,98.

It seems that only a move above could open the way to the higher levels. However, if PLN will be getting stronger the next possible support may be located at 161,8 Fibo expansion near 3,84.

________

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

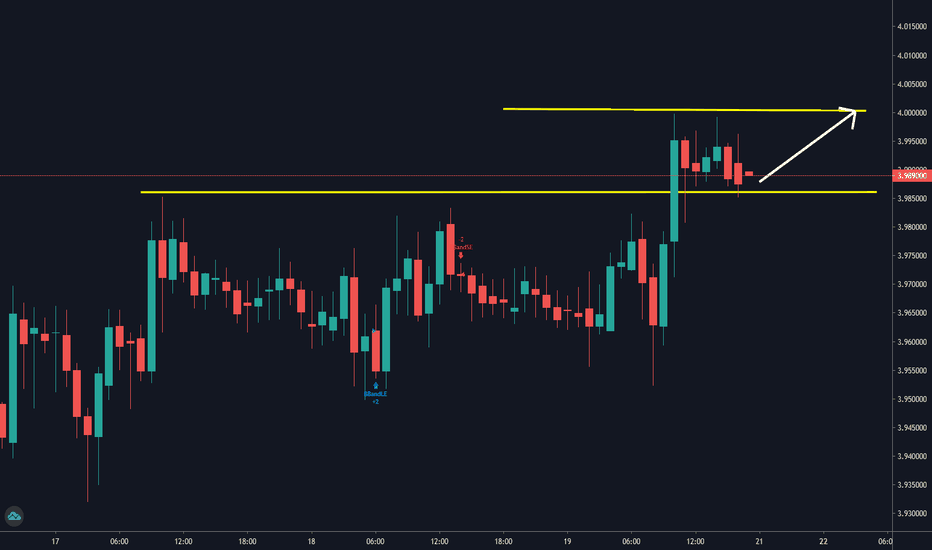

Can it hold on support and breakthrough resistance again?Looking at a high momentum move through previous resistance with a potential to continue higher. The price has found support around its current price, if this support holds another run through resistance should be expected. But if the support doesn't hold we will be reversing to the downside. Either way, set pending orders to catch the momentum. TP at 4.0051 and SL at 3.985

TheHonestTrader

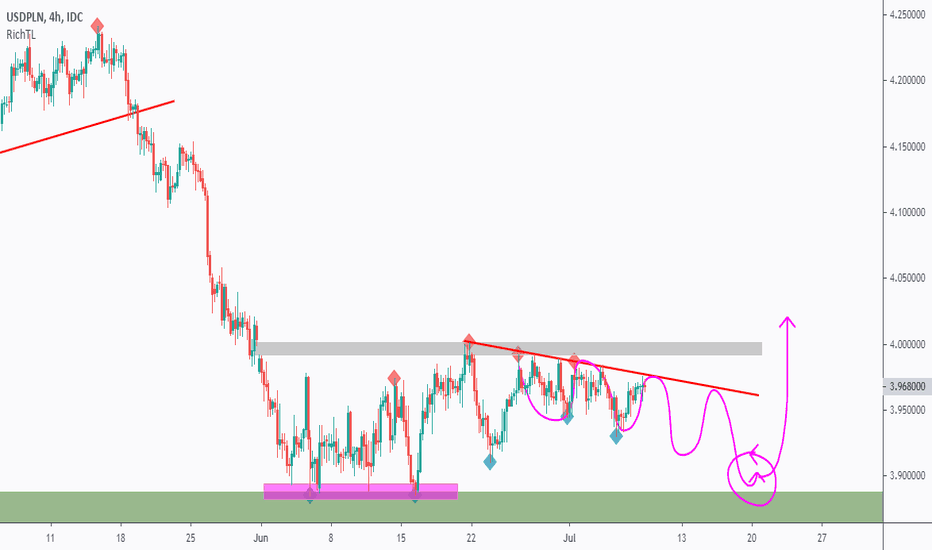

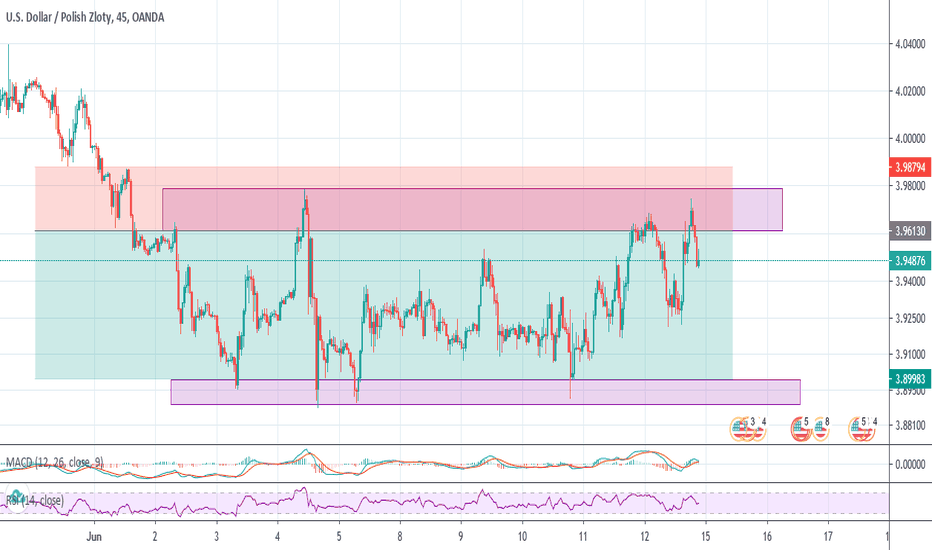

USDPLN waiting for the double bottom pattern to formon DAILY: USDPLN is sitting around a support zone in green so we will be looking for objective buy setups on its retest.

on H4: USDPLN is forming a double bottom pattern (still an idea) so we are waiting for a momentum candle close above its neckline to buy it long-term.

and if price retests our support zone again, then we will be looking for new objective buy setups on lower timeframes.

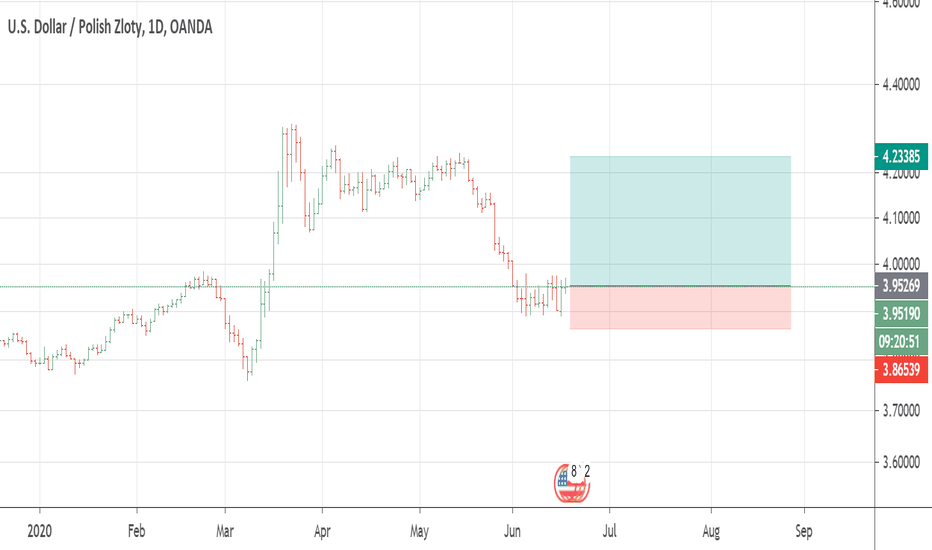

USD/PLN will continue its downward momentumThe pair will continue its downward momentum in the coming days. A report from the OECD is bringing back the confidence in the Polish zloty. According to the international organization, Poland’s first-quarter GDP drop was among the lowest in the group. For years, the country has been on top of the European Union’s fastest-growing economies and analysts are expecting Poland to continue this trend in the coming years. With a robust recovery in hindsight, the eastern European country’s central bank is expected by analysts to increase its rate. Poland is currently sitting at a 0.10% interest rate, down from 1.50% prior to the coronavirus pandemic. On the other hand, the United States is expected to further slowdown. Despite introducing the largest stimulus in history, America will still suffer from the increasing US-China tension in the coming quarters. The two (2) largest economies are currently in dispute with the coronavirus pandemic.