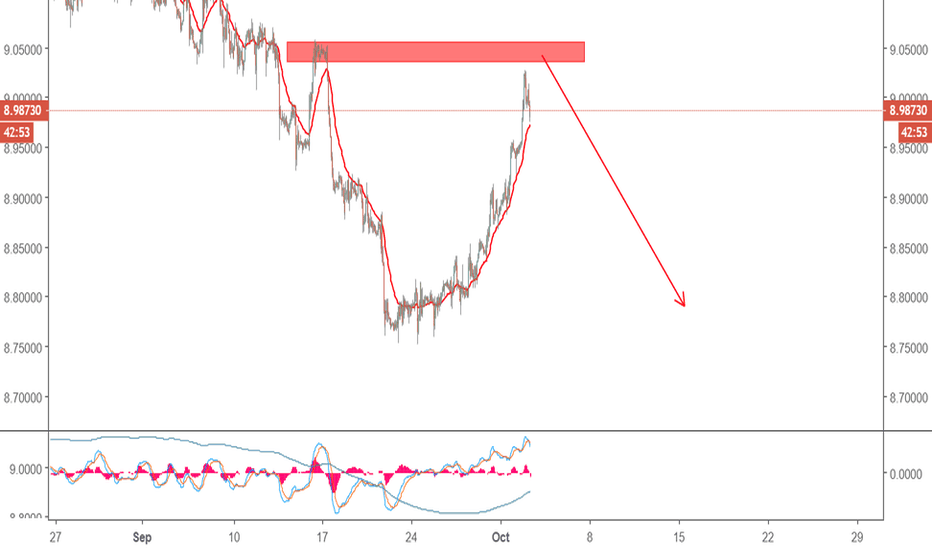

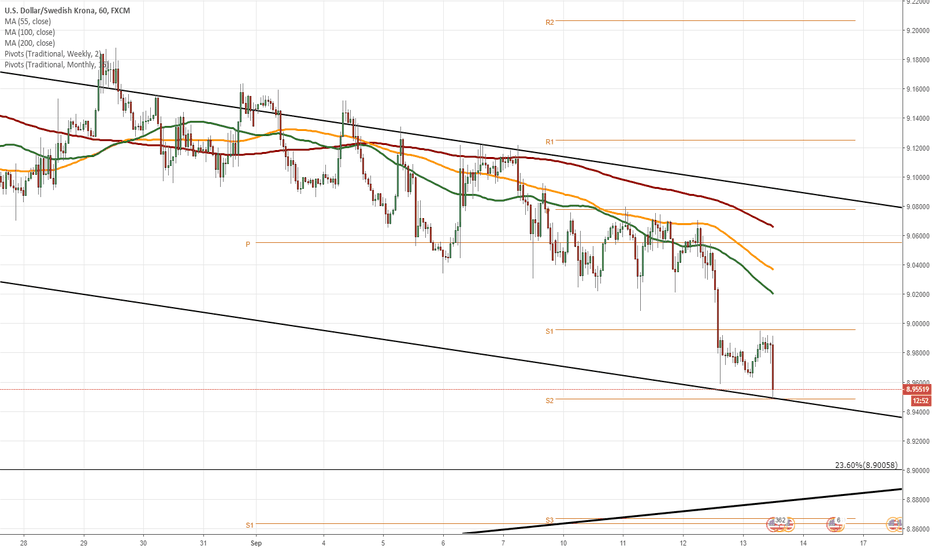

Exotic Lover's! USDSEK Possible Resistance Breakout!I was testing yen strength as the EURJPY and GBPJPY are doing nice with there fall USDSEK could better relly upward too. I am saying this cause USDSEK currently has like -0.80 correlation to the EURJPY and GBPJPY. Seeing a weak pound USD is also pulling down the GBPUSD and talking about this pair it is highly positively correlated to EURJPY and GBPJPY so, if it falls hard that's good for EURJPY and GBPJPY short (sell)! And as I said if EJ and GJ are falling what we end up with? USDSEK upward relly right? Eh! Charts show everything I hope you all do understand.

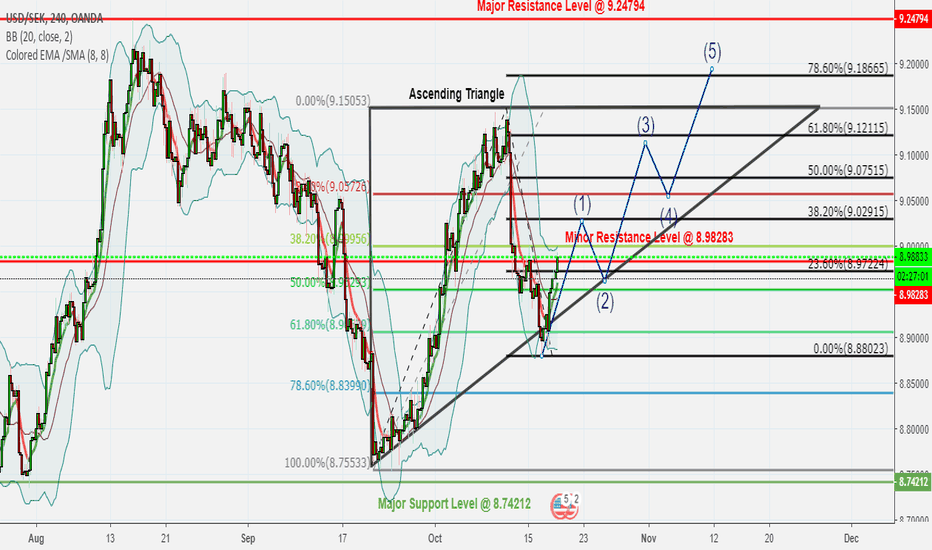

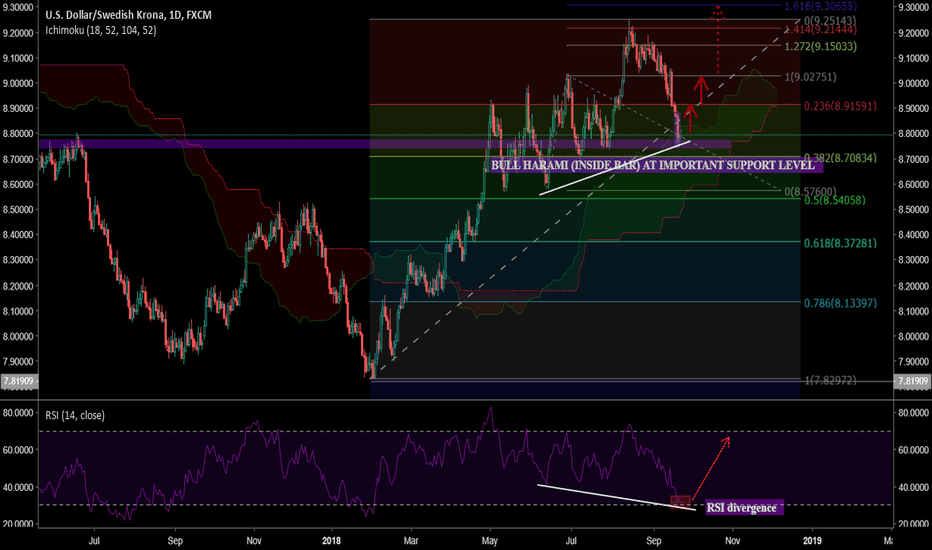

The Key point in Chart.

1) Price trying to breakout the Minor Resistance Level @ 8.98283.

2) Ascending Triangle pattern indicating upward continuation in price.

3) Impulse waves are in uptrend side of the Elliott wave.

4) Fibonacci Extension 38.20% chasing by the price and could possibly chase further higher levels depending on the pair upward strength.

Ok, thank you never mind I don't wanna stretch this post longer. Everything is told by chart itself better just be careful with the news sentiment, concerned +/- correlated pairs activities how they acting in whole and some important levels like those resistance, support etc.

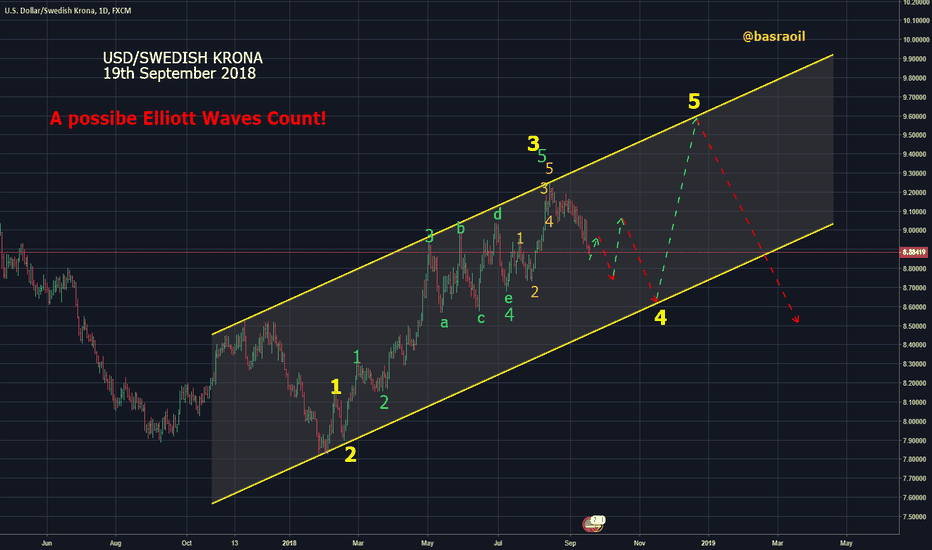

USDSEK trade ideas

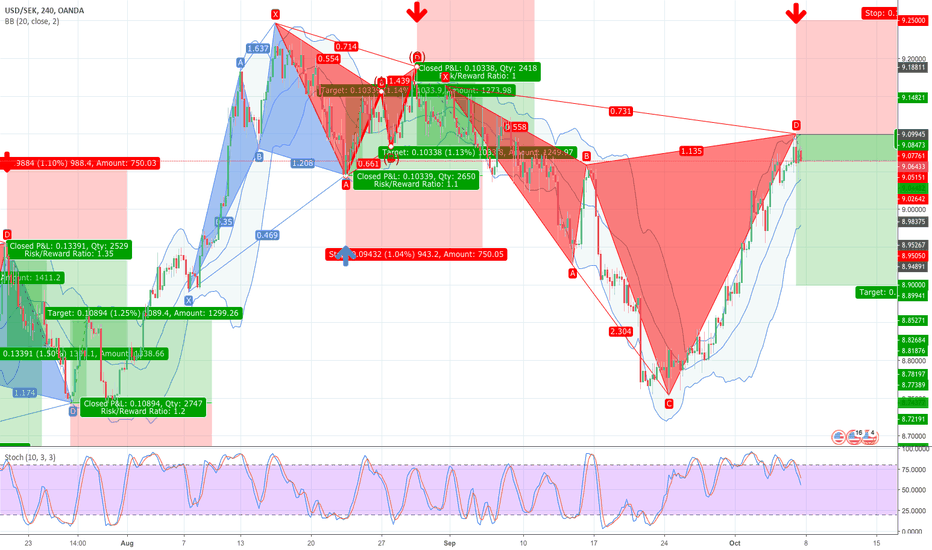

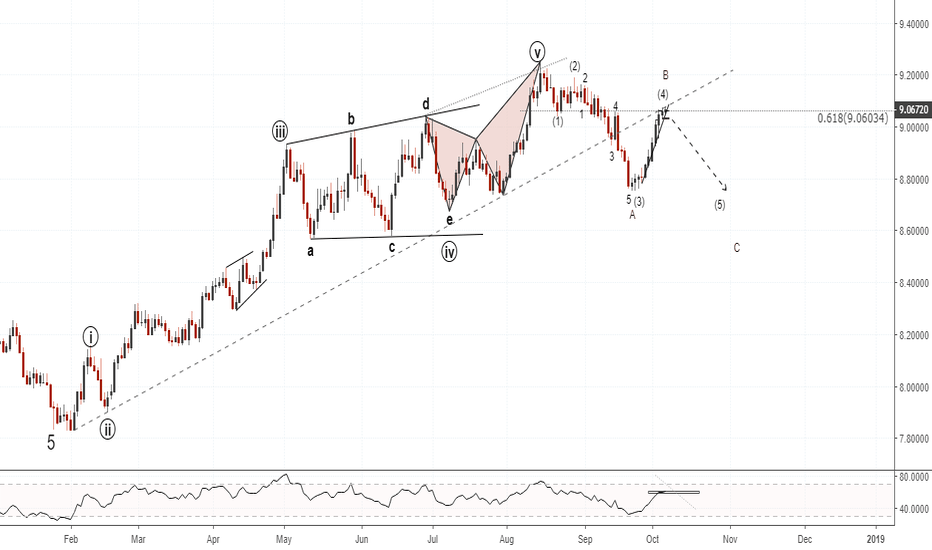

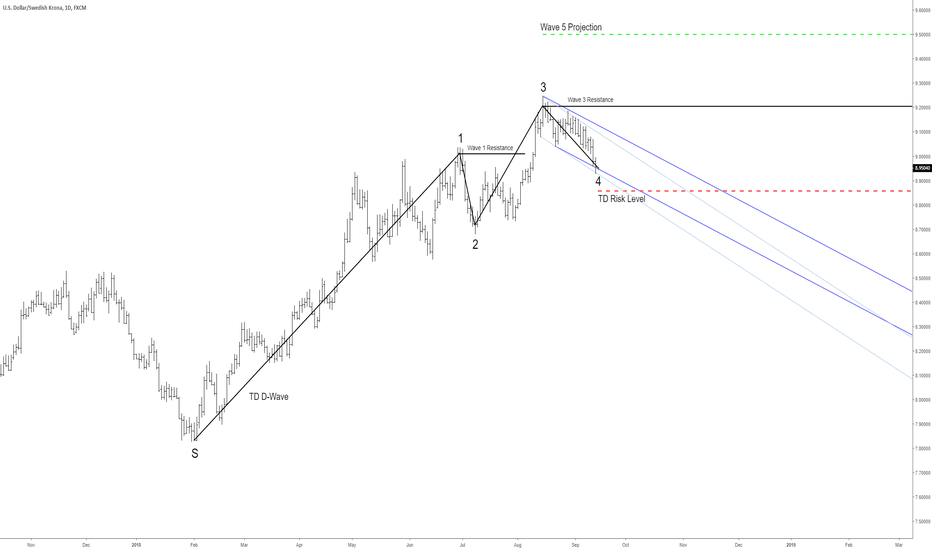

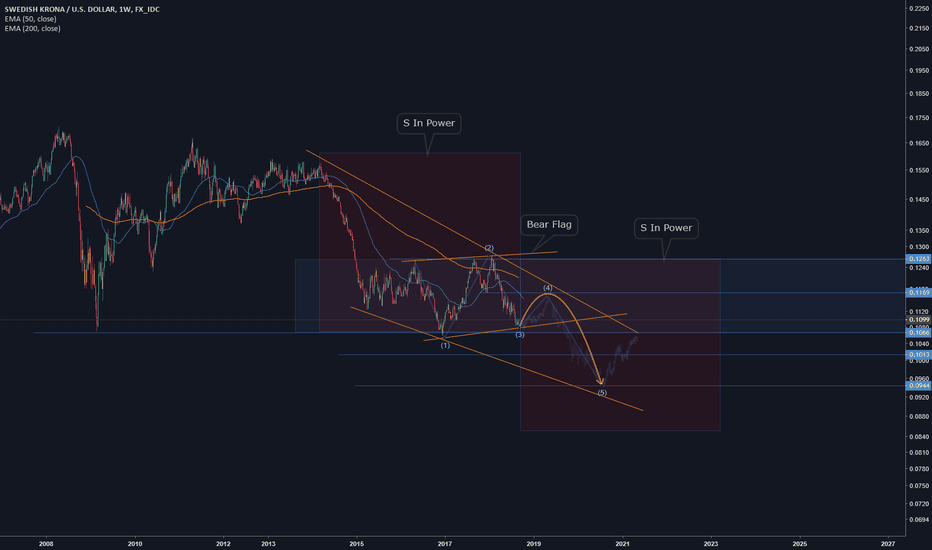

USDSEK | Start of the 5th Wave?Assuming that the 4th wave has just completed and high probability for a 4th wave is between 23.6% and 38.2% of the 3rd wave in an impulsive / motive wave.

Reaction near the 38.2% fib level of the 3rd wave - looks more likely to be a 1 wave of the 5th wave on a higher degree or else a reactionary X wave.

This is purely my opinion.

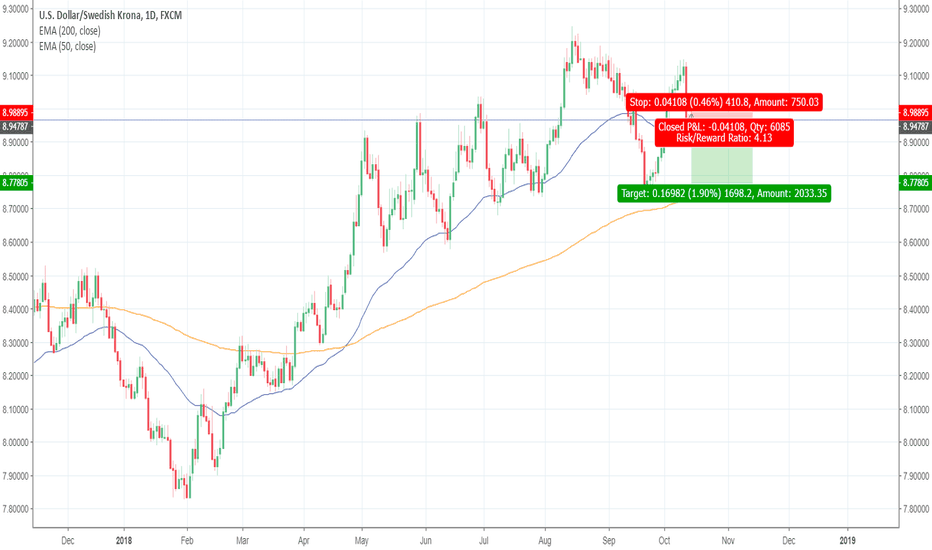

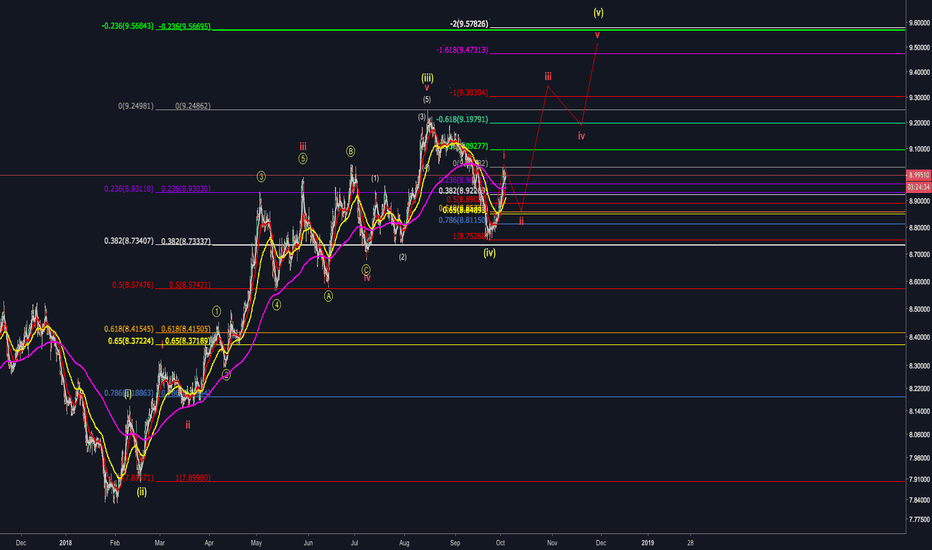

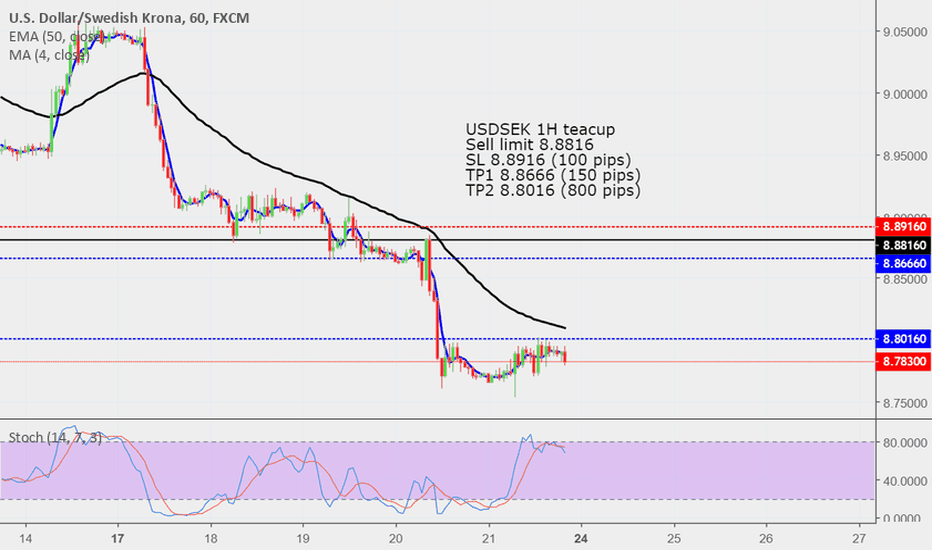

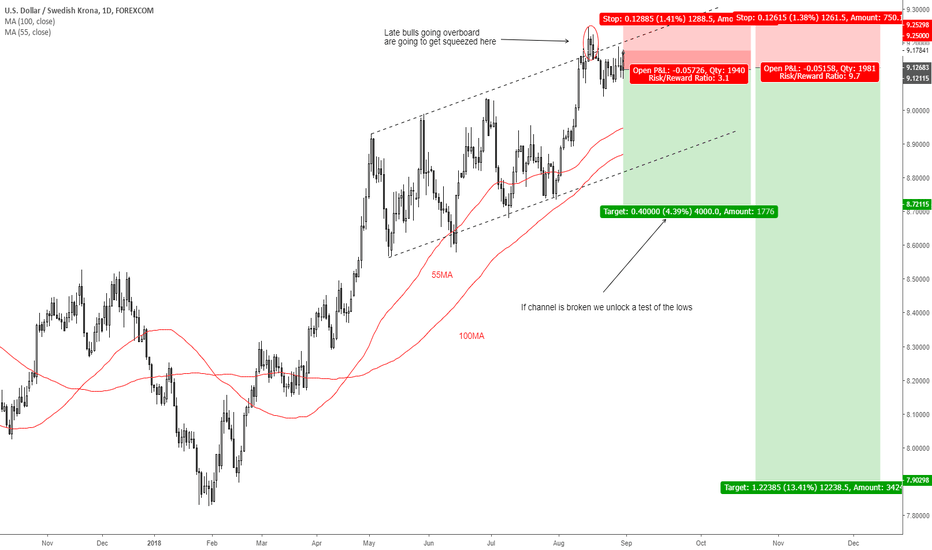

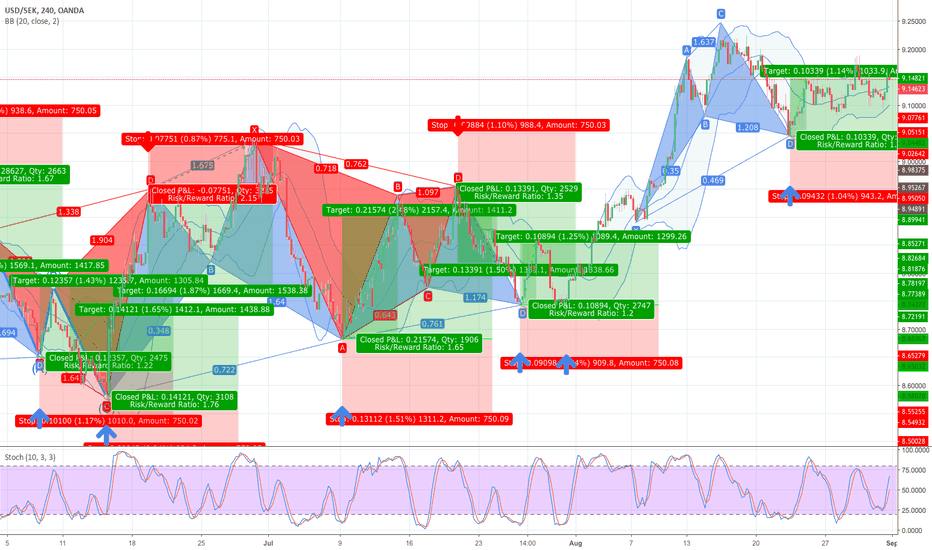

SEK is the cheapest G10 currency=> Here we are shorting the dollar against SEK as we see a fresh leg down in the dollar for September flows.

=> Markets have gone overboard on risk premium and we are looking to get advantage of the Swedish elections coming up in two weeks.

=> Fundamentals are improving in both Sweden and Europe and a rising Euro will help move SEK as collateral here.

=> GL

(Entry at MKT; Stop 9.25; Targets 8.85 and 7.90)

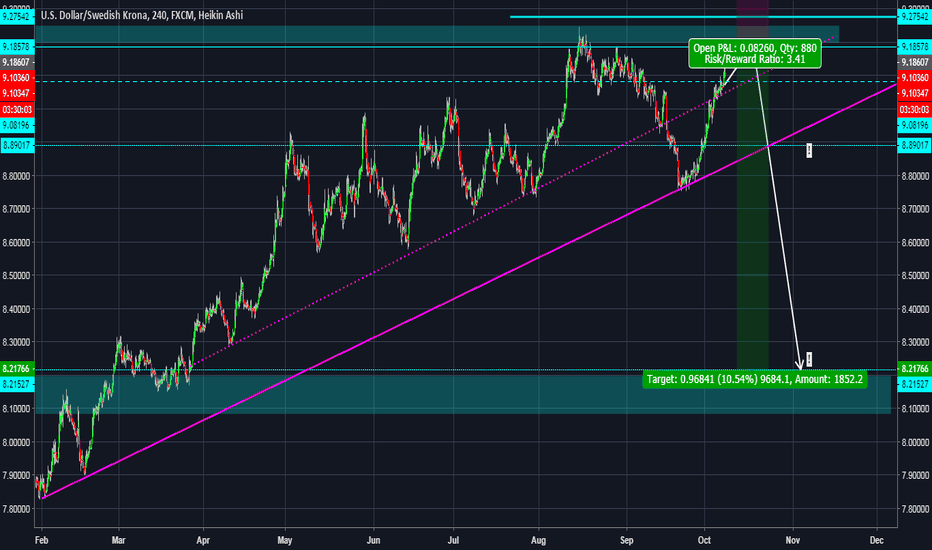

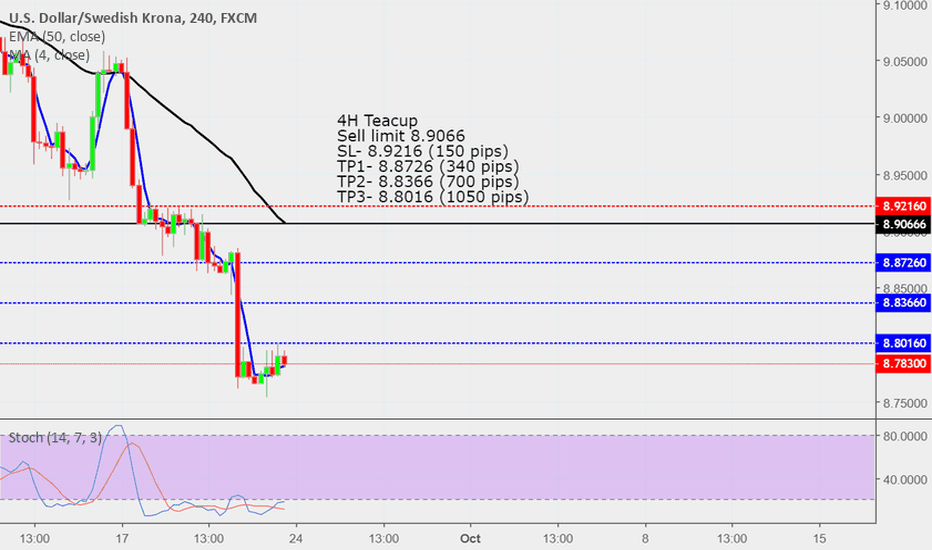

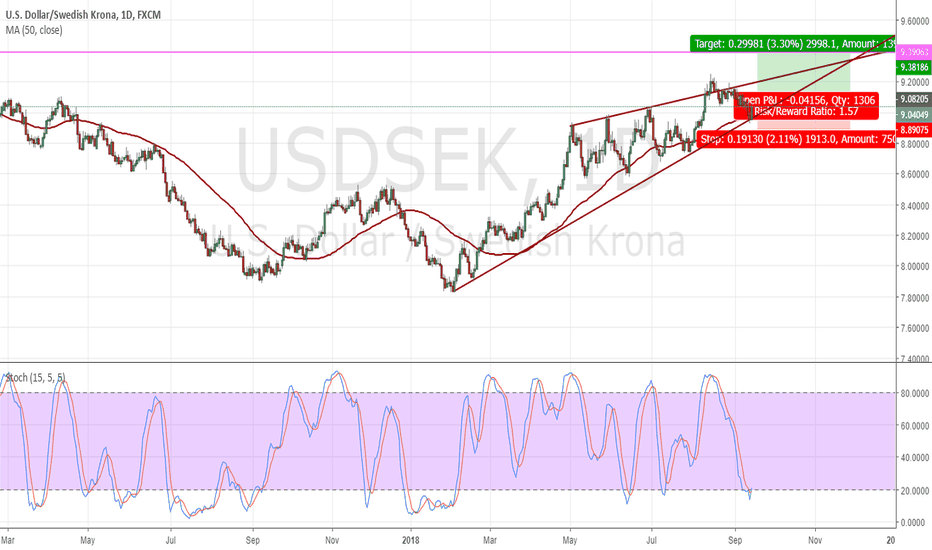

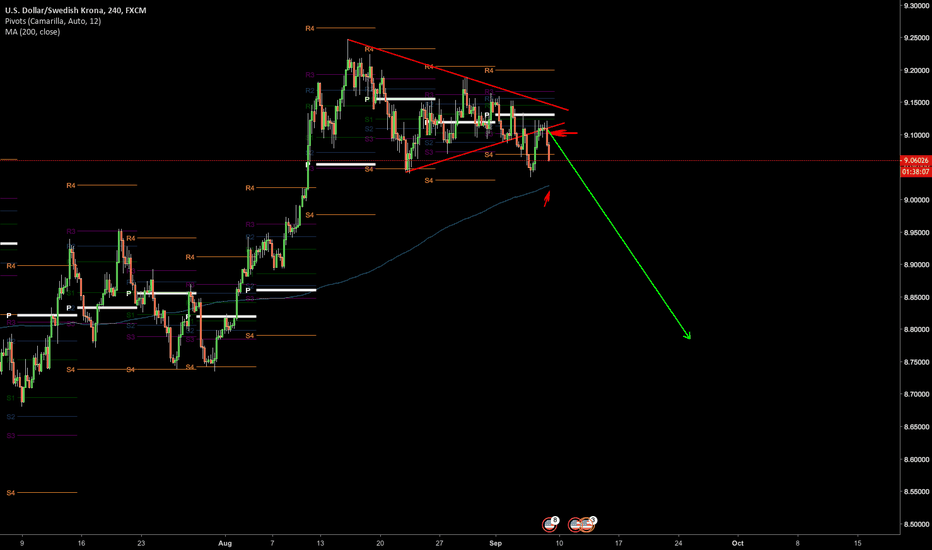

USD/SEK 1H Chart: Short-term increase expectedThe US Dollar has been depreciating against the Swedish Krona in a short-term descending channel since the middle of August. This gradual decrease in price began when the rate reversed from the upper boundary of a medium-term ascending channel at 9.2290.

The pair reversed from the lower boundary of the junior channel during Thursday's morning hours. The common scenario would be a surge towards the upper channel line located circa 9.0800. However, technical indicators suggest that this advance might not be immediate, as the pair is being pressured by the 55-, 100– and 200-hour SMAs.

Important level to look out for is the monthly PP at 9.0637.

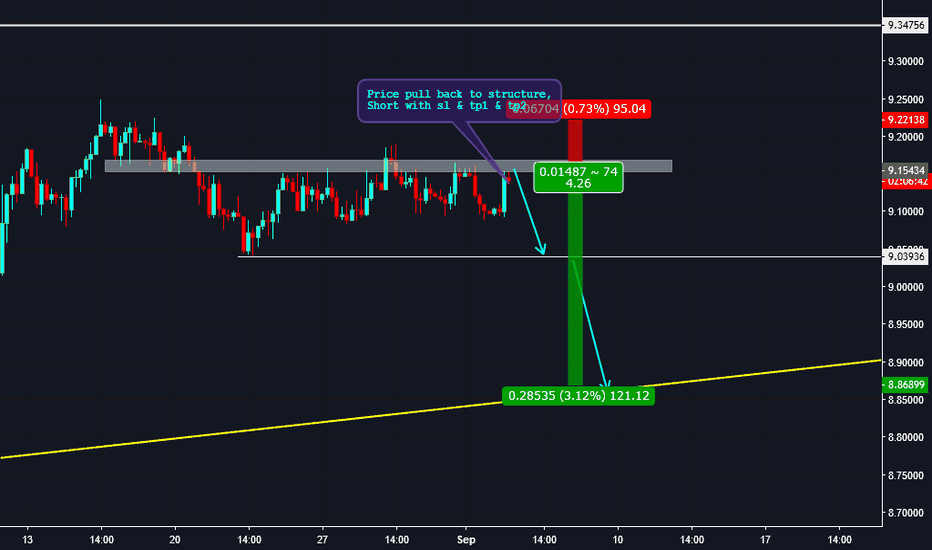

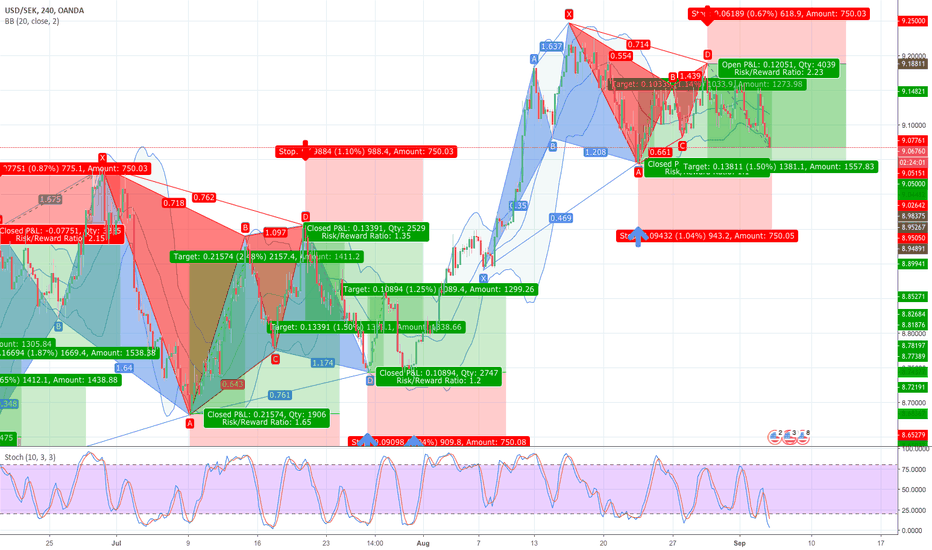

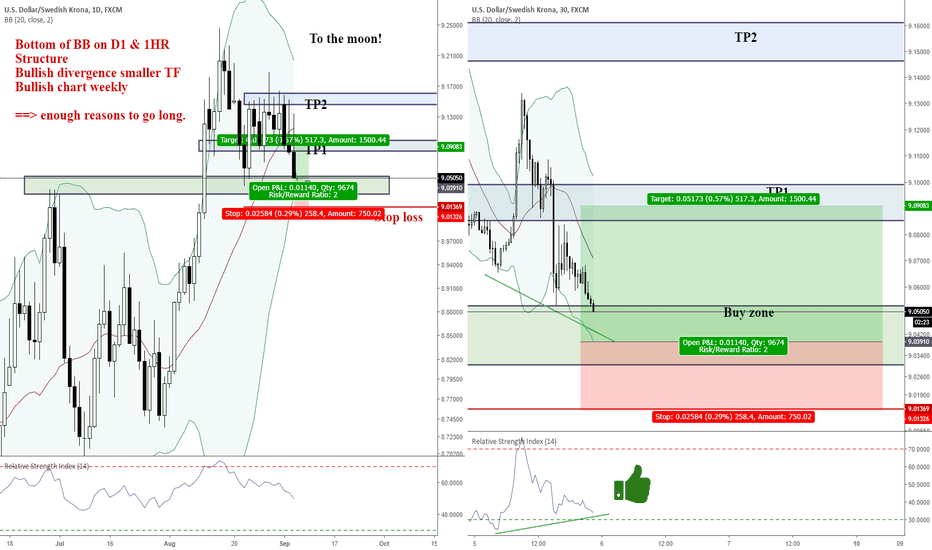

USDSEK bounce imminent: high probability, RR of 2.It is all in the chart :)

From experience & instinct there is a high probability USDSEK is going to bounce now.

Bullish divergence is my condition to enter a trade and it is filled.

I will update this idea as this pair moves.

I do not know what the perfect way to scale in is. I do not own a quantum fund.

My scaling is small large medium (example: 0.2 lot 1 lot 0.5 lot), I do not know if this is the best, but this is how I like it. I do not want to go big too high in case I got stopped, just enough to not miss out if it bounces early, and not too low or I will miss all winners and only get filled big on losers.

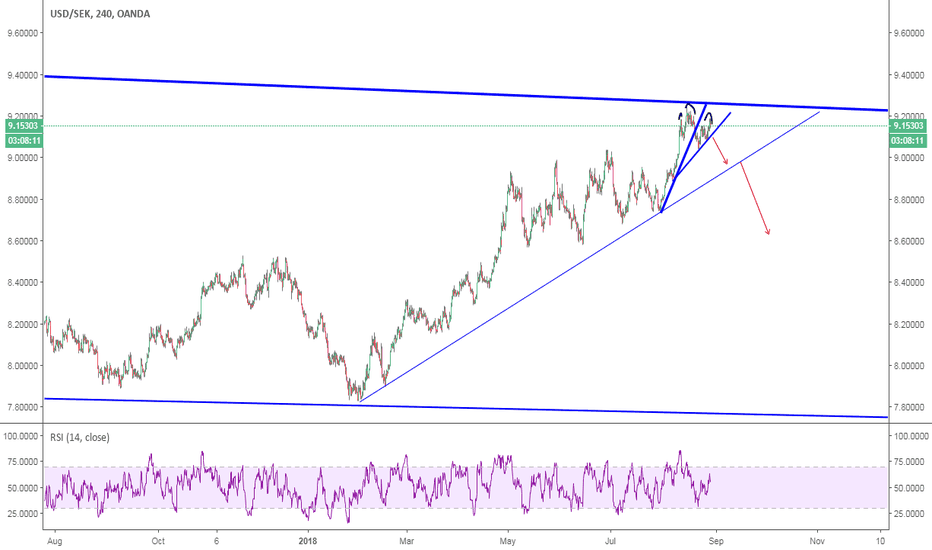

1W Channel Up. Long.USDSEK is trading within a long term 1W Channel Up (RSI = 67.172, MACD = 0.190, Highs/Lows = 0.1401, B/BP = 0.3894), which has just tested the first Support at 9.03686. If it doesn't continue higher from here then the Higher Low will be made at the lower Support on 8.93186. Both are technical long entries with TP = 9.35123.