USDT.D trade ideas

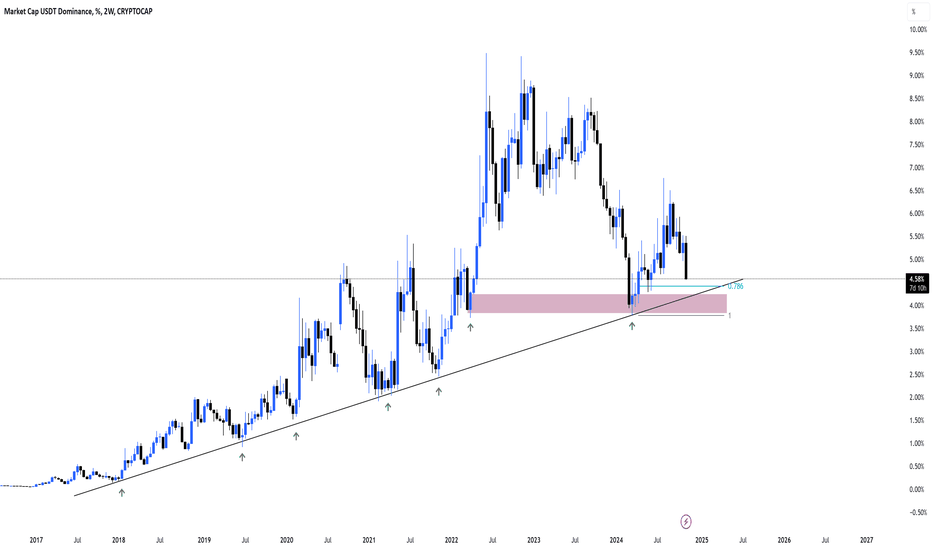

USDT.D 2WUSDT Dominance (2W)

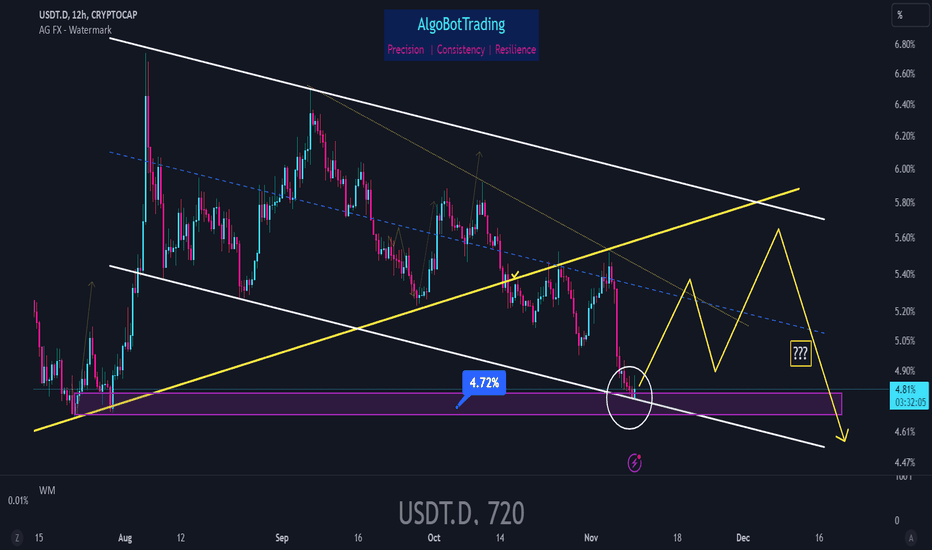

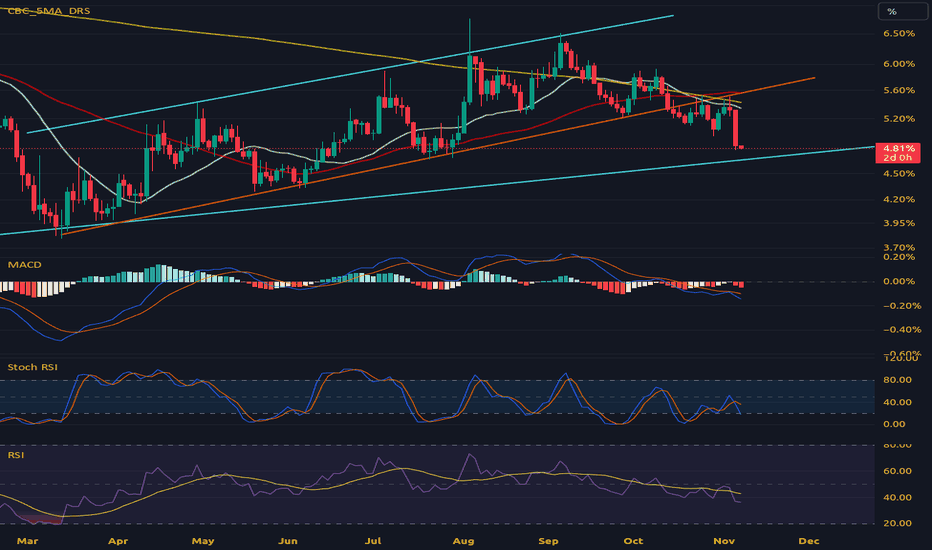

With the price nearing a support level and an ascending trendline, there is a possibility of a price rebound from this area!

The dominance of USDT could be a signal of capital flowing into USDT, which may indicate capital outflow from other cryptocurrencies.

In summary, if you hold cryptocurrencies, be aware that USDT dominance has now reached a support zone.

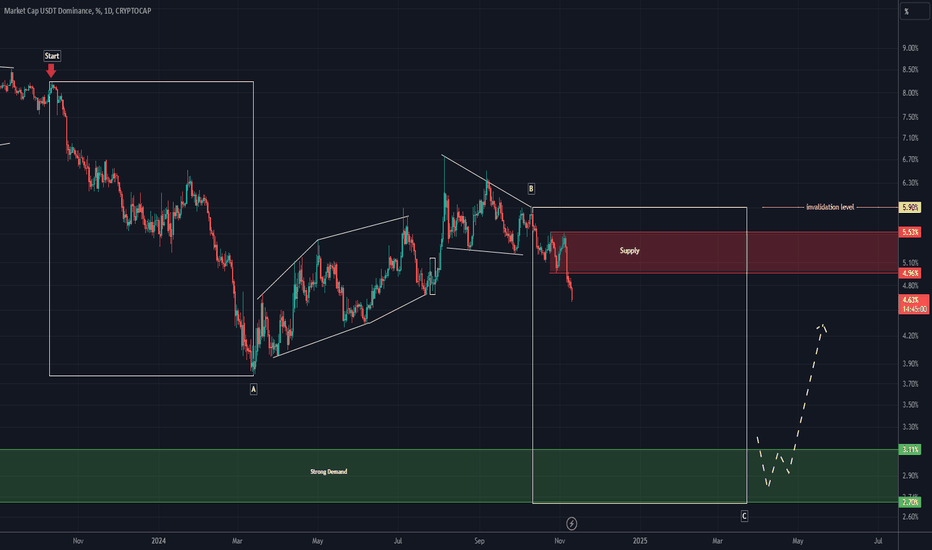

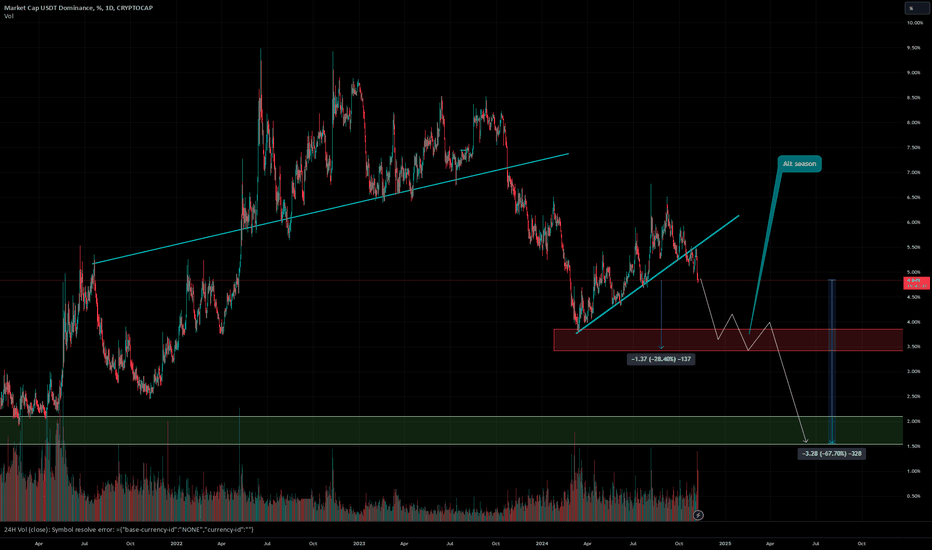

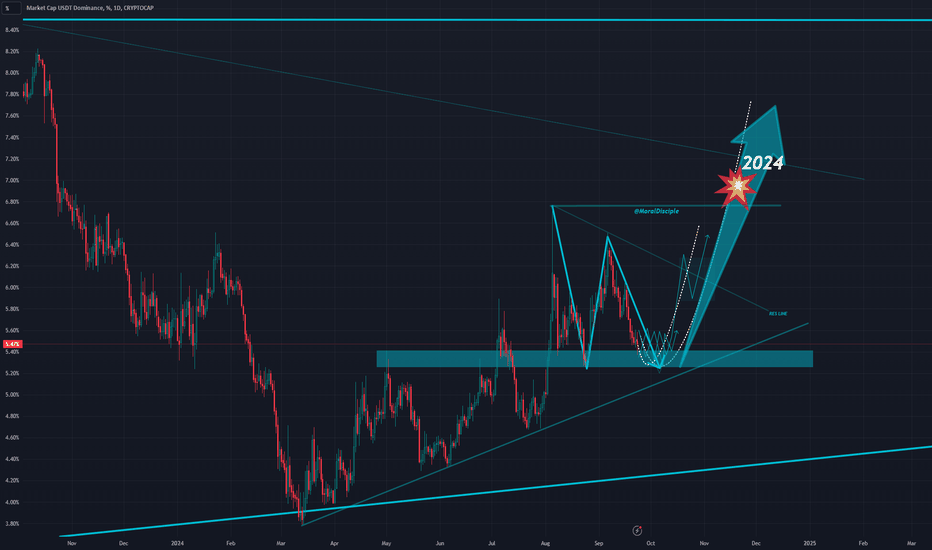

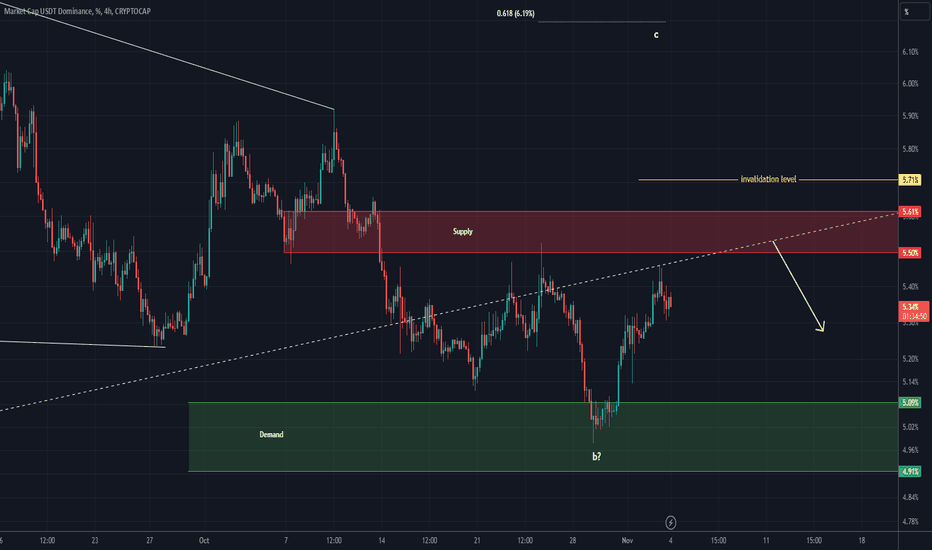

Tether Dominance is very bearish (1D)It seems that Tether Dominance has entered a large C wave.

Any return of Tether Dominance to supply is a buy opportunity in altcoins.

We expect Tether Dominance to be supported from the lower green box.

It is better to forget sell/short positions for a while!

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

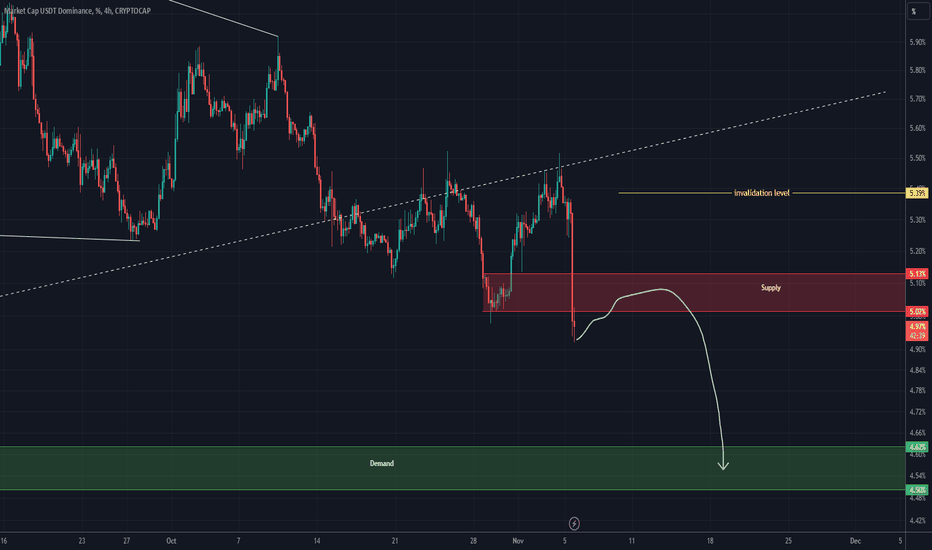

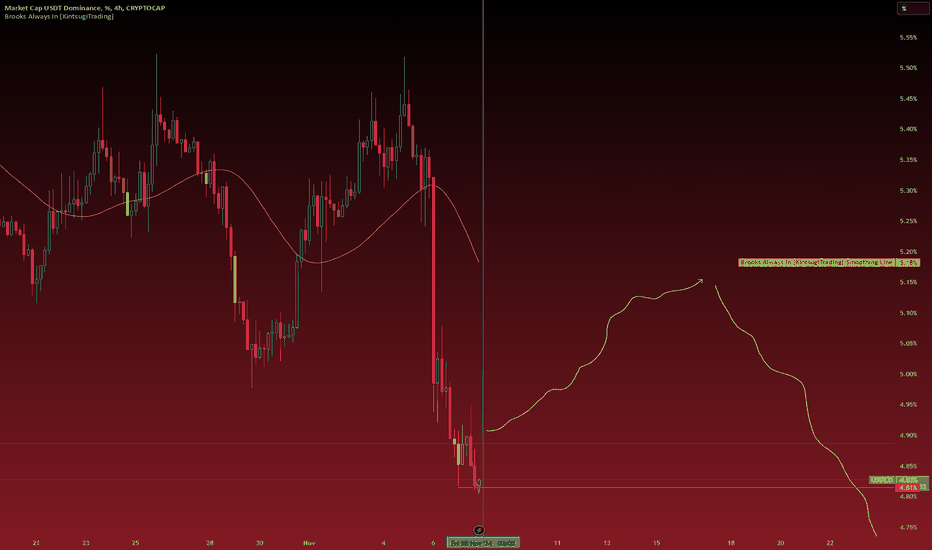

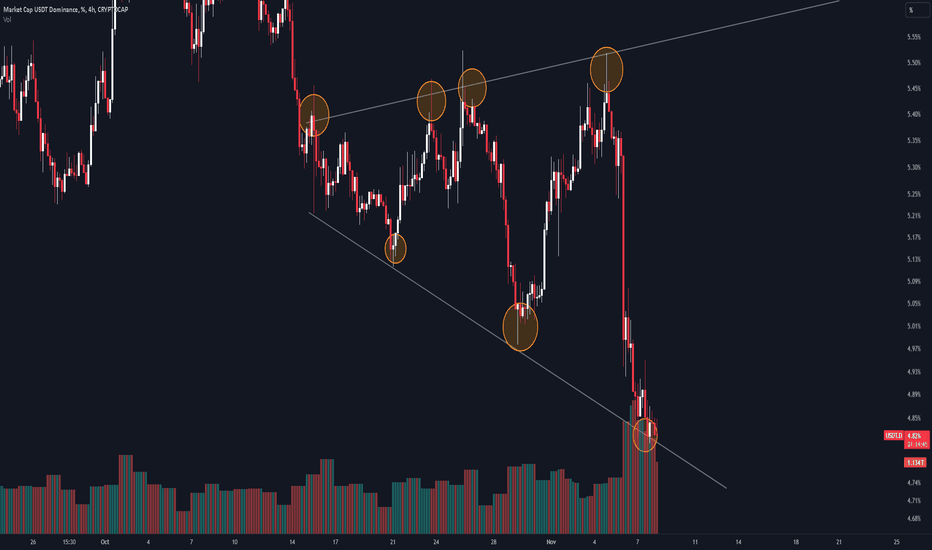

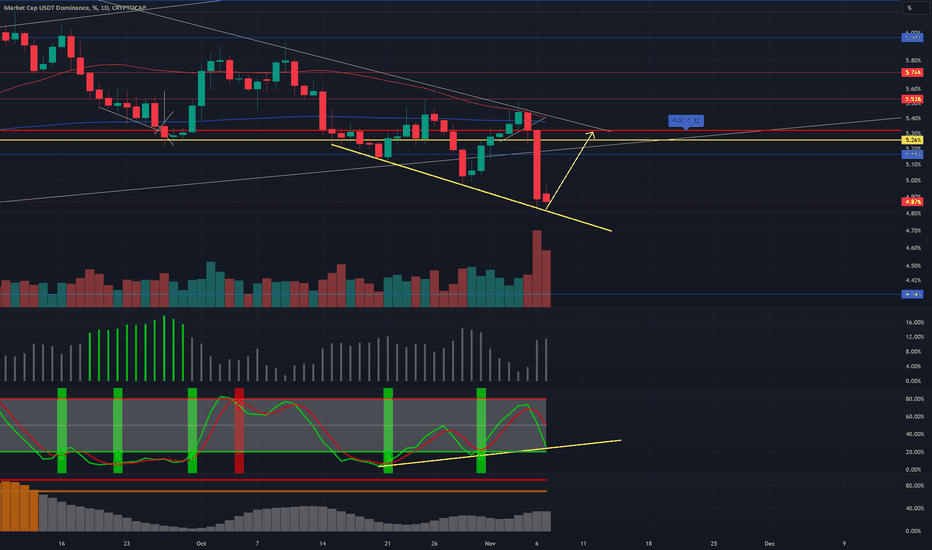

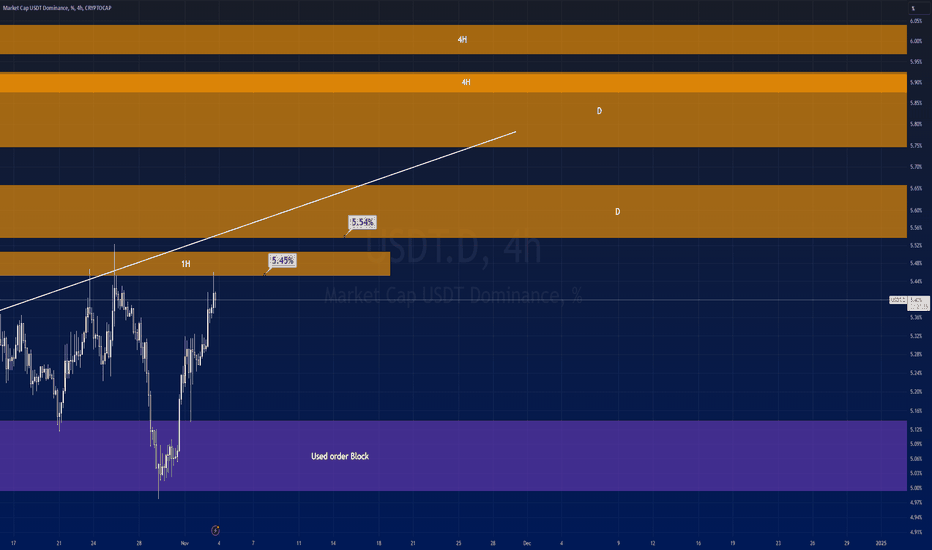

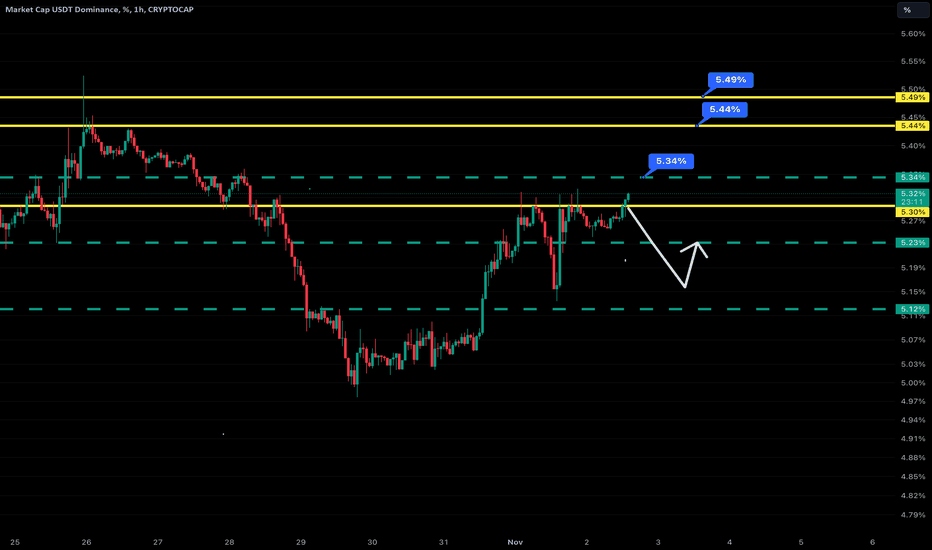

Tether Dominance UPDATE (4H)Due to the US election and the heavy decline and rejection, Tether Dominance is expected to reach the lower support range.

Support and resistance ranges are marked on the chart

Closing a daily candle above the invalidation level will violate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

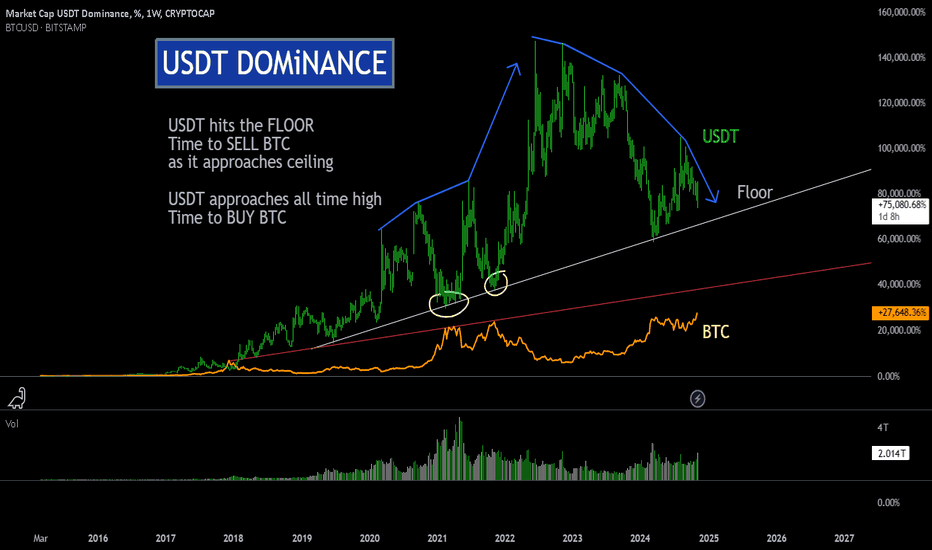

USDT Dominance: When to Buy Sell BTC King Dollar still drives the price of BTC

USDT issued by Tether iFENEX or Coinbase/Circle USDC

transferred to designated co dealers to

drive price of BTC in unison by the Gang of 8 Major dealers

Sell USDT buy BTC

Care of the FED FOMC and other Central Banks cutting rates

When Miners begin to Sell BTC and Funds of Funds mature for settlement

Sell BTC buy Dollar

this is reflected inversely correlated since 2015 close to 10 years which

established a cycle trend and tradition among heavy hitters dealers and Ogs (Veterans)

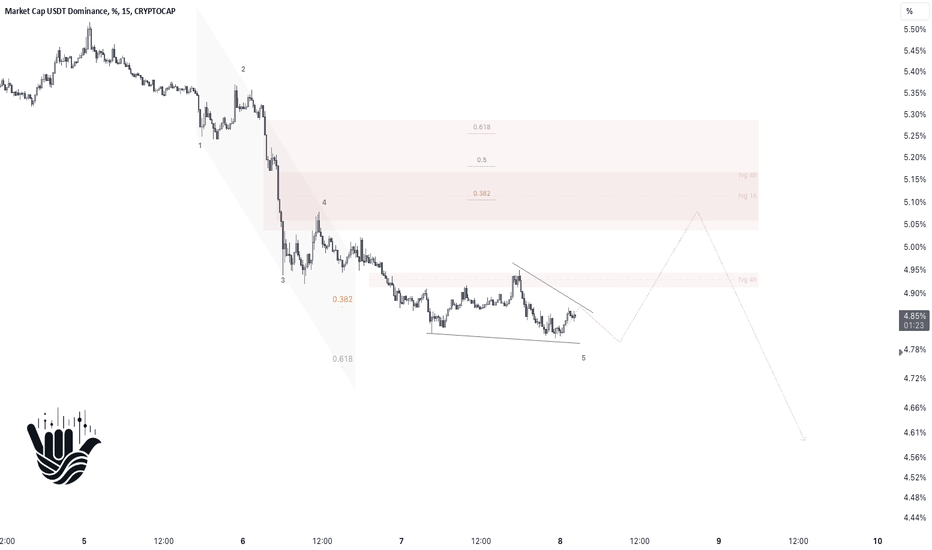

What a beautiful patternExpanding triangle pattern🤔

One of the signs of its existence is the fluctuations of the candles inside it, which when it hits its lines, it moves strongly in the opposite direction.

And the interesting thing is that after getting out of the expanding pattern, we will probably see a lot of fluctuation in the market😎

If you want me to analyze a coin, tell me in the comment🫡

⚠️ Do capital management to survive ⚠️

You are not Long enough !I think this is what going to happen

We pump to 102K as local top

And range between 80K-100K for few months while alt season especially in ETH continues

Then from 90K we get a Pump to 140K ish

But as BTC only season

No gains on most alts

And probably 140K would be the Top For 2025

I think from that date we see BTC acting more like SPX and we will probably see a total of 20K pump per year

While 99% of alts would be dead to most people

USDT chart

The chart shows strong resistance around the

83,624 level, which has historically acted as a barrier.

Stochastic Oscillator, Currently, it is moving upwards but hasn't yet reached the overbought zone, which suggests there might still be room for further upward movement before a reversal.

The RSI is in a bullish position but hasn’t reached extreme overbought levels. This supports a bit more upward movement potential.

The MACD is in a bullish crossover and momentum is positive, indicating continued upward trend strength.

Given these indicators, a reasonable take-profit level could be set around $83,500 - $85,000. This range captures the resistance while allowing some buffer above the $83,624 level, where some profit-taking might occur if momentum continues.

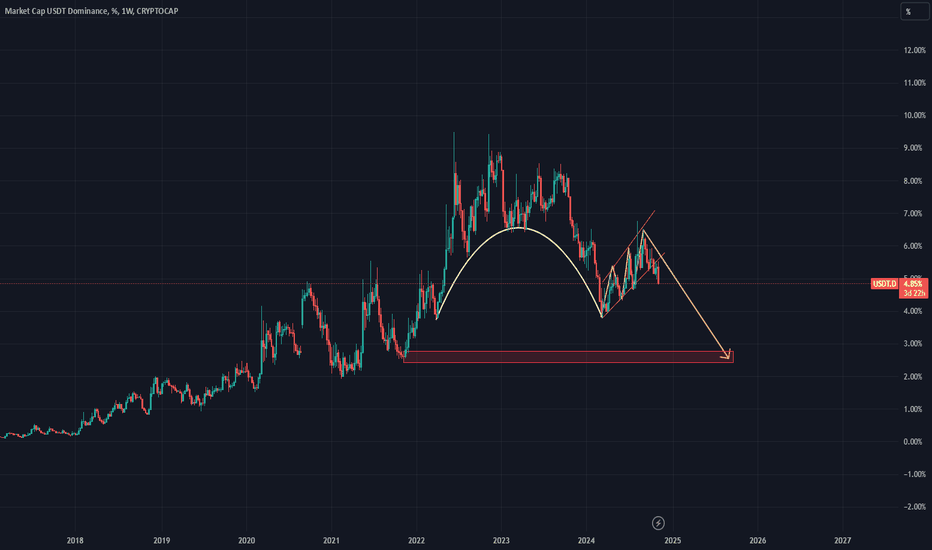

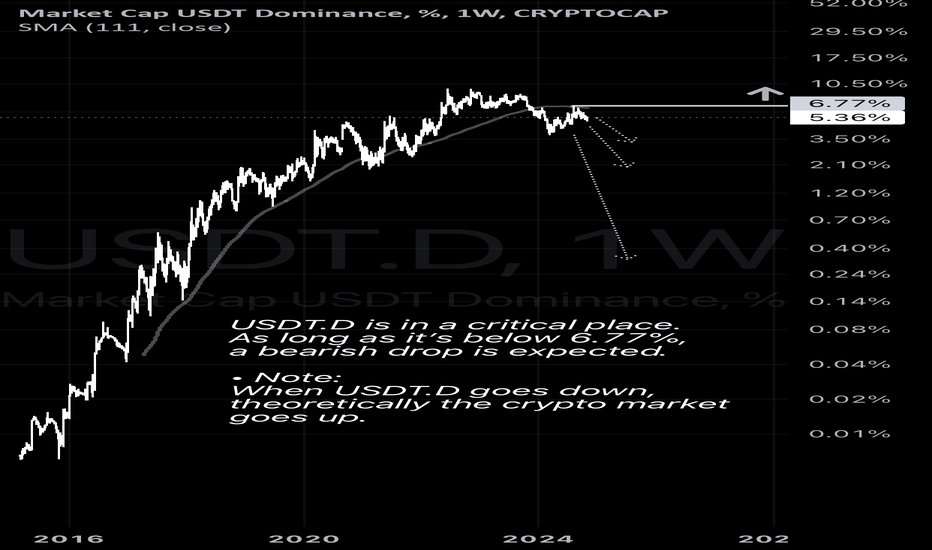

USDT.DThe USDT.D dominance is expected to decline due to the formation of a cup and handle pattern.

The identified level is the weekly order block, which is expected to prompt profit-taking in altcoins if a reversal occurs from this level. In any case, I will start taking profits once USDT.D reaches this level, along with additional confirmations from indicators like USDC.D and BTC.D.

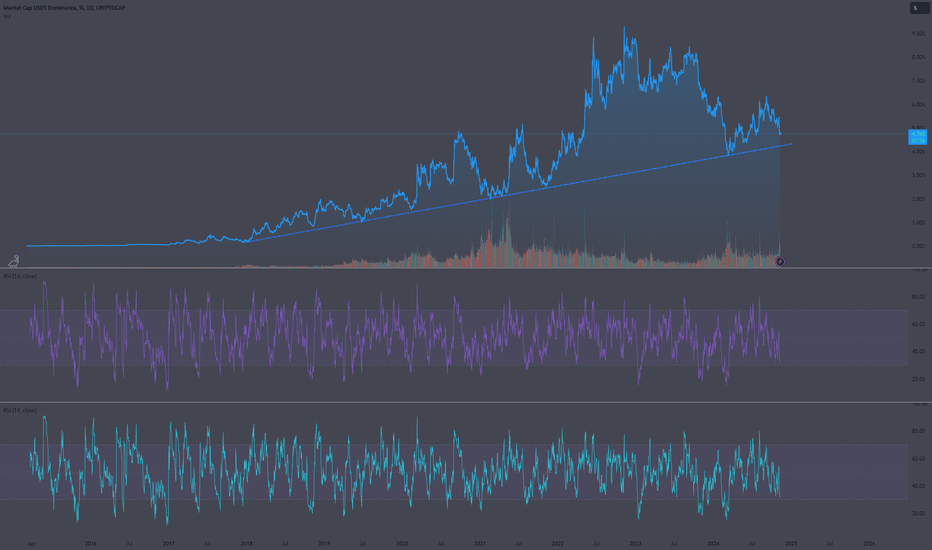

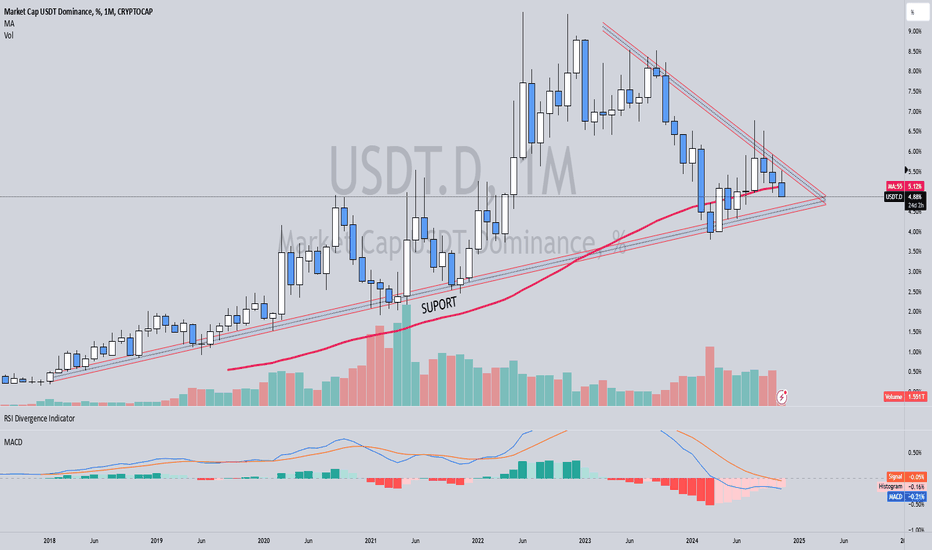

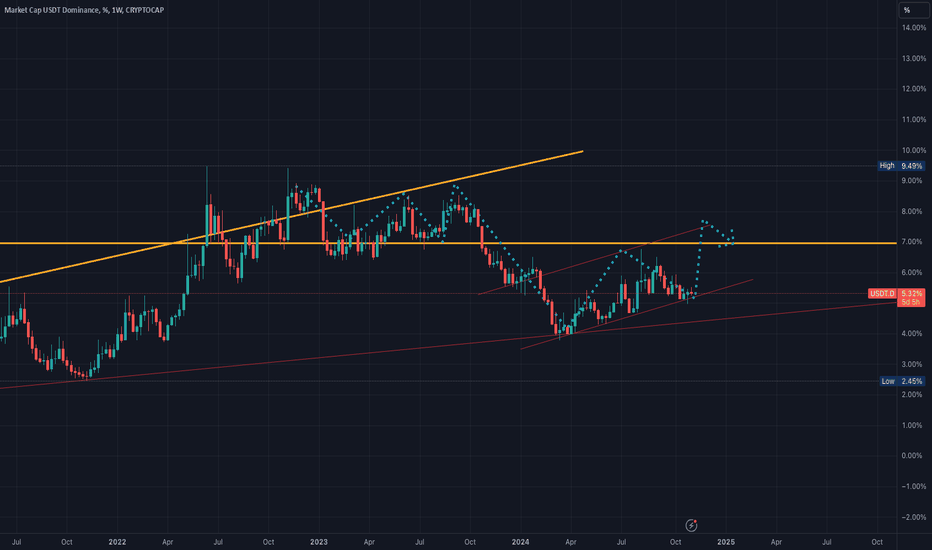

USDT.DCRYPTOCAP:USDT Dominance: It has steadily decreased over the past two years 📉 and is now at the MA55 support level on the monthly chart (1M) 🛡️. In March this year, it reached this support and quickly rebounded 📈. We might see a false breakdown below this support over a period of few months 🔄. Additionally, there is a symmetrical triangle 📐; if the price touches the support, the chances for a quick rebound are high, as it usually does not stay at this level for long ⏳.

A decrease in USDT dominance means that less money remains in stablecoins and is moving toward other cryptocurrencies such as BTC, ETH, and altcoins 🚀. This is often a sign of growth in the crypto market 📈, as investors take on more risk, shifting from stablecoins to more volatile assets.

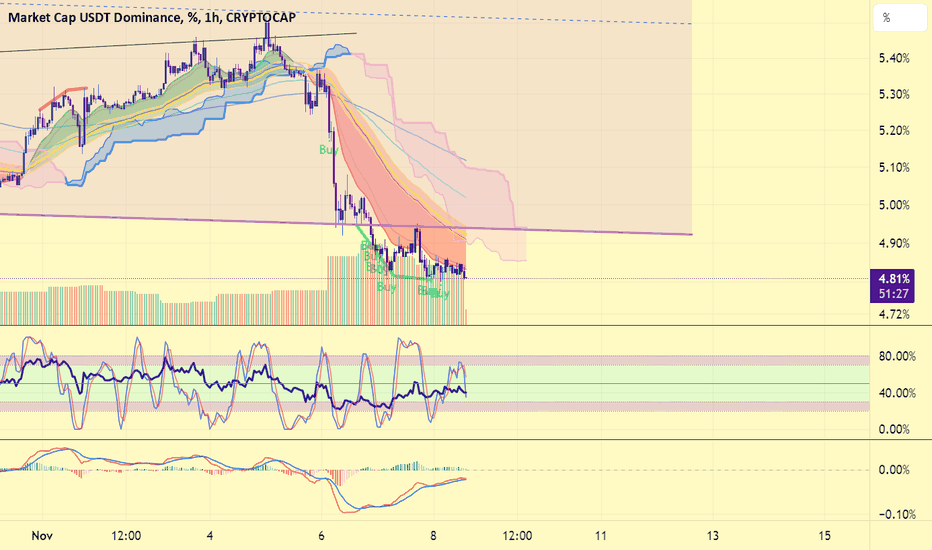

USDT DOMINANCE UPDATE (4H)First of all you should know that "USDT Dominance" is always moving inverse of BTCUSDT .

When the Dominance Tether hits the red box, we expect a reject. This area seems to cause the cryptocurrency market to take a break for the continuation of the drop

Closing a daily candle above the invalidation level will violate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You