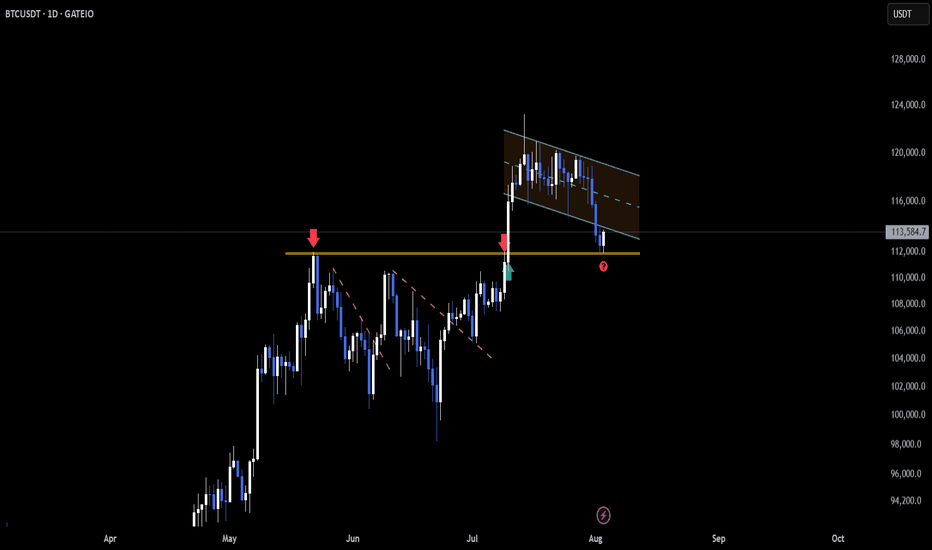

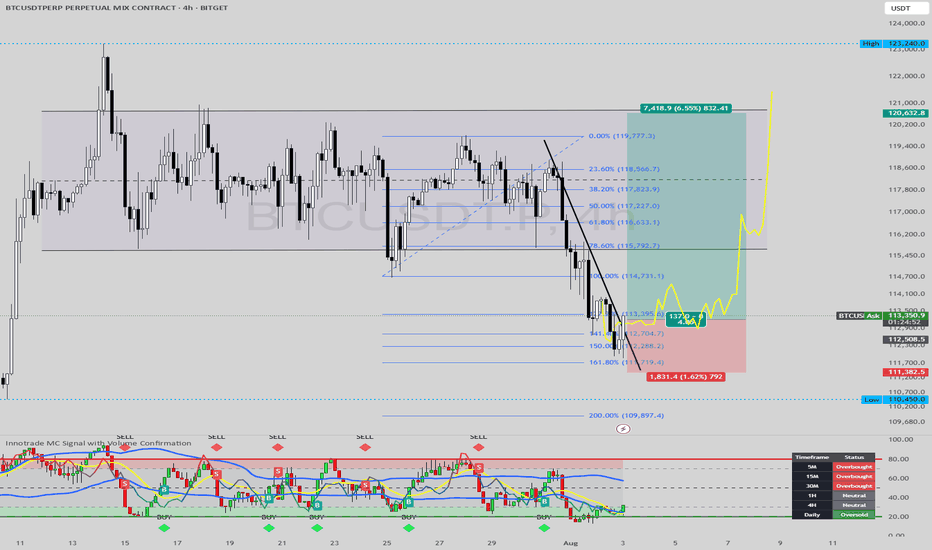

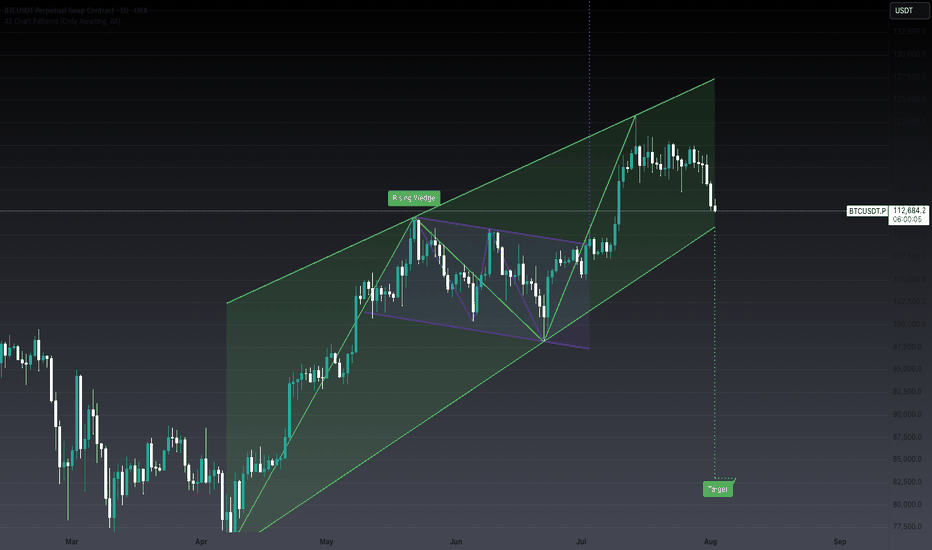

BTC Retests Broken Channel as Daily Support Holds📉 On the 4H chart, CRYPTOCAP:BTC has broken below its descending channel and is now testing the underside — a classic retest zone where bulls and bears collide 👀

📆 Meanwhile, the Daily timeframe shows price still holding above the key 11800 support level 🛡️

This zone remains pivotal — a bounce could reclaim momentum, while a failure might trigger deeper downside.

The next few candles will be critical for directional clarity.

Are we about to reclaim the structure or head lower from here?

Not financial advice.

USDTBTC trade ideas

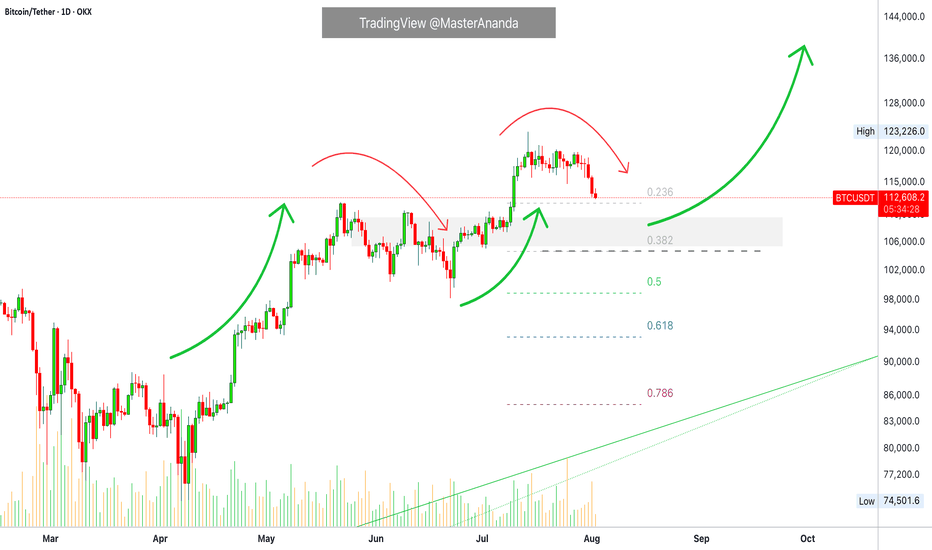

A lose Cycle! Sell The Bottom, Buy The Hype!? Why Do You Buy When Everyone Else Is Terrified?

What drives us to make the exact opposite of a rational decision?

Is a crashing market truly a buying opportunity or just a trap?

Hello✌️

Spend 2 minutes ⏰ reading this educational material.

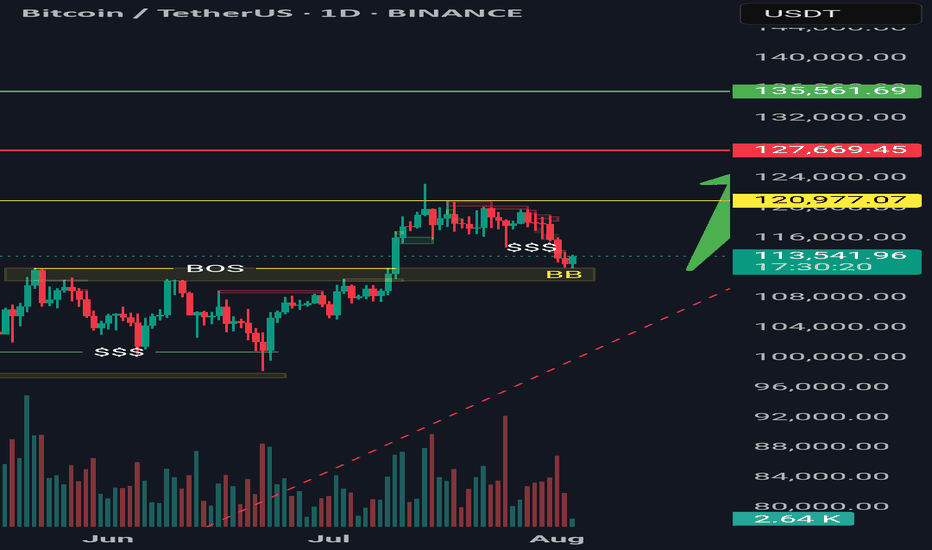

🎯 Analytical Insight on Bitcoin :

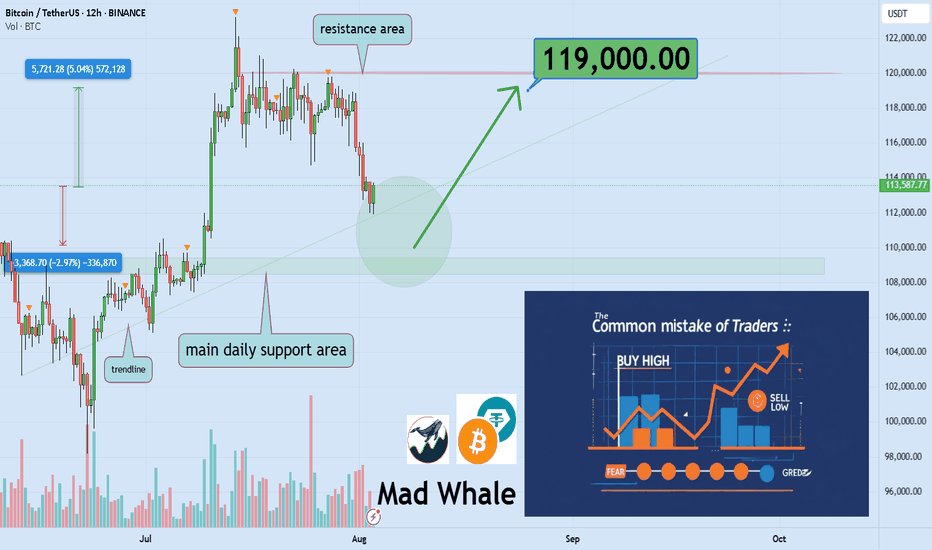

BINANCE:BTCUSDT has created strong liquidity with this recent pullback 📉 and is now testing a key daily support level. I’m looking for a potential bounce of at least 5%, targeting around $119,000, near a significant daily resistance 🚀.

Now , let's dive into the educational section,

🌀 Retail Traders: Victims of Hype, Fear, and Noise

Most casual traders sell during a dip, not because of a plan but because of panic. As soon as they see red candles flooding the chart, they react emotionally, not logically. Then, when prices rally and social media is buzzing, they jump back in, usually at the worst possible time. This cycle of buying tops and selling bottoms isn’t random. It is driven by crowd psychology, and unless you recognize it, you’ll keep falling for the same trap again and again.

🧭 No Strategy or Stop Loss Means You’re Gambling

If you enter a trade without knowing where you'll exit, you’re not trading. You’re guessing. A strategy is not optional. It is your foundation. Proper take-profit and stop-loss levels are what keep emotions out of the equation. Traders without a plan either take profits too early or hold onto losses too long, hoping they’ll bounce back. This isn’t trading. This is gambling with extra steps.

🔍 Technical and Fundamental Analysis Work Best Together

Only reading charts without understanding the asset means you're blind to context. Only studying the fundamentals without watching price action means you’re missing timing. Technical analysis helps you pinpoint when to act. Fundamental analysis tells you why to act. The best traders blend both. You find the "what" through fundamentals, and the "when" and "how" through technicals.

⚠️ Buying the Hype and Selling the Panic Hurts

Markets swing between extremes. When your favorite coin is pumping and influencers are screaming 🚀🚀 it might be too late. That is often when smart money exits and retail rushes in. On the flip side, when everyone is doom-posting and charts are dripping red, that is when opportunity quietly appears. But only if you’ve done your homework. It’s not about being a contrarian. It’s about being informed.

🛠 Useful TradingView Tools to Avoid Getting Tricked

To avoid emotional decisions, there are a few essential tools in TradingView that every trader should get familiar with:

Volume Profile

Shows you where the highest buying and selling activity has occurred. It helps reveal the zones where whales might have entered the market.

Fear & Greed Indicator

Gives you a quick sense of the market’s emotional state. When everyone’s afraid, it might just be the right time to start thinking about buying.

Divergence Scanner

Helps you spot potential price reversals before they happen by detecting divergences between price and momentum.

Alerts

Stop checking the charts 24/7. Set alerts on key resistance and support levels so you only react when it actually matters.

Multi-Timeframe Analysis

Don’t stay locked into the 15-minute chart. Use daily and weekly timeframes to understand the bigger picture and avoid short-term noise.

🎯 Final Thought and Recommendation

In this market, the winners aren’t the fastest. They are the most prepared. Build your strategy, manage risk with stop losses, blend technical with fundamentals, and most importantly, don’t let the crowd think for you.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

The Great Trap: How Billionaires Are Winning, and You're Not!The Great Crypto Trap: How Billionaires Are Winning—And You're Not

The ETFs, Saylor, and all of Trump's billionaire friends are getting richer—thanks to crypto.

Meanwhile, most retail traders are just trying to stay above water. Leverage trades are wiped out, charts feel rigged, and the market makes you feel like you're swimming against a riptide.

Why?

Because these rich guys have a plan: manipulate you and take your money. That’s how they stay rich.

Understanding their strategy is the first step to stop being their exit liquidity.

🧠 The New Battlefield

Crypto is no longer a playground for cypherpunks and tech rebels. It’s fully institutional now. We're not just trading against whales—we're fighting the same entities that own the media, control Wall Street, and write the rules.

So forget the old ways of thinking. The tables have turned.

🗓 The Sunday Rekt Routine

To maximize destruction, they need to avoid friendly fire. So they pump on the weekend when retail is free and optimistic, then dump on Monday to close the CME gap—like clockwork.

The playbook:

Weekend: Pump. Trap your long.

Monday: Dump. “Fill the gap.” Liquidate everyone.

Response:

Don’t fall for weekend FOMO. Exit Sunday afternoon. Wait until Tuesday to re-enter, once Monday’s high and low are set. Trade smart, not emotional.

📈 Top-of-the-Market FOMO

You’ve seen it before. Just before the crash, the media frenzy begins. Influencers say “Don’t miss this pump!” or “99% will miss the next big move!” The ETF gods hint at new inflows. It's a setup.

They're not hyping it for your benefit—they're offloading their bags in your face.

Just look at the charts:

BlackRock bought billions to drive BTC to 121K.

Then, in 72 hours, they dumped billions.

Saylor? Silent. No new buys. That’s not coincidence—it’s coordination.

Response:

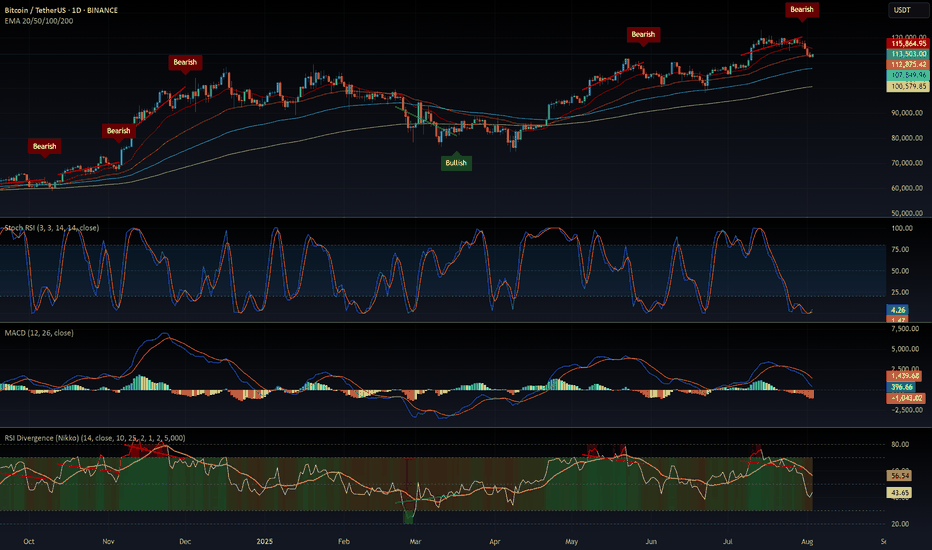

Check the MACD, RSI, and Stochastic RSI on daily or weekly timeframes. If they're maxed out and the influencers are screaming green—it’s probably too late.

When they stop buying, the dump is already planned.

🧰 How to Outsmart Them

Watch the MACD for crossovers and divergence.

Monitor RSI zones—don’t long into extreme overbought conditions.

Use Stoch RSI to anticipate momentum shifts.

Rule: When everything is overheated, and FOMO is peaking—step back. Let them dump into each other. You’ll get your entry later, cleaner and cheaper.

⚔️ This Is War

Make no mistake: this is a war for your money.

They want yours. You want theirs.

Only the smart survive.

To be continued.

DYOR.

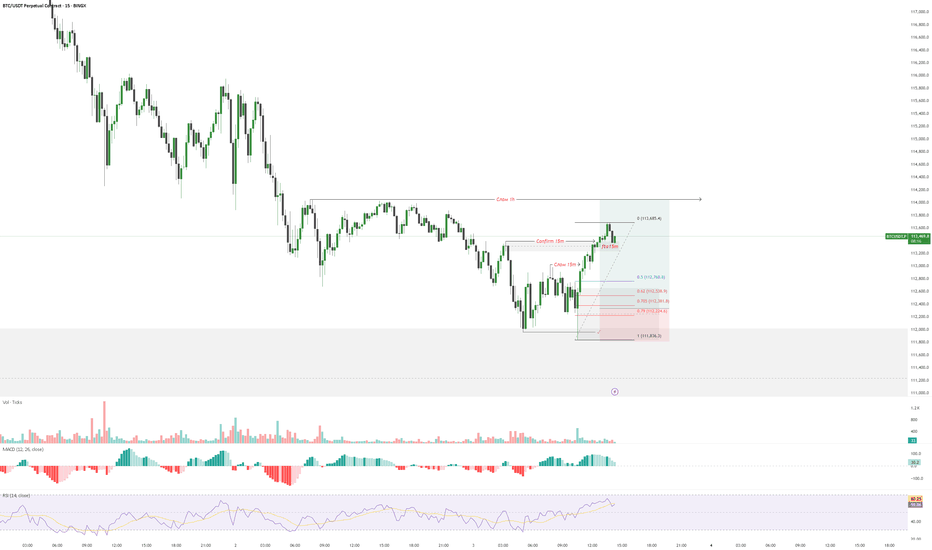

mBos 15mWe came to 4h OB, swiped some liquidity and received a reaction. Expectations for the price to return back to the wick and continue up to take the liquidity there. As there is no break on the HTF, it is a trade with higher risk.

Entry on the test of 15m wick. Stop below wick. Take on the swim of EQH

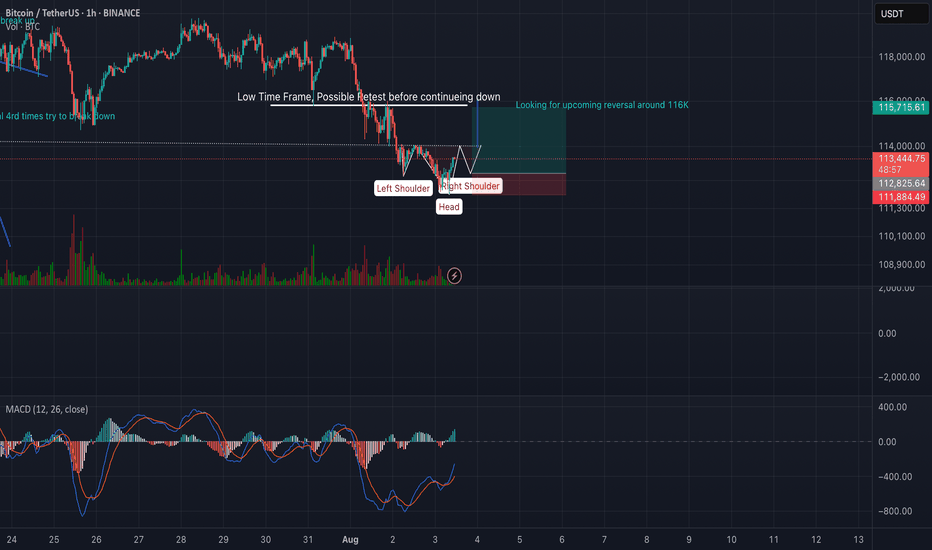

Low Time Frame Possible HnSThis chart illustrates a potential inverse head and shoulders pattern forming on a low time frame, signaling a possible short-term bullish reversal. The pattern is clearly marked with a Left Shoulder, Head, and Right Shoulder, suggesting a setup as shown.

The neckline area is labeled as a possible retest zone, where price may briefly revisit before either confirming the reversal or continuing the downtrend. A clean breakout and hold above this neckline would validate the pattern, with a projected upside target around 116K, as noted on the chart.

Risk management is visualized with a favorable risk-to-reward setup. However, a breakdown below the head would invalidate the pattern and imply further downside to the 110K 109K area.

This setup is ideal for traders watching for a short-term reversal, provided there is volume confirmation and alignment with broader market structure.

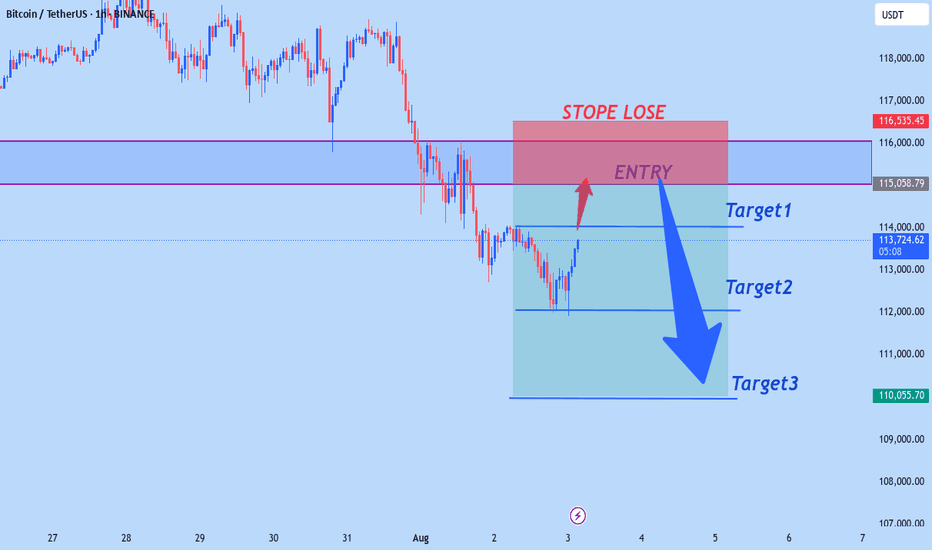

Bitcoin Long Position: Strong Trendline Support! Looking to take a long position on Bitcoin (BTC/USDT) as it bounces off the ascending trendline 🚀. The trendline has historically shown strong support levels, and it’s currently retesting it for a potential reversal.

Key Points:

Current Price: 112,580 USDT 💰

Support Zone: Trendline support is around 112,000 – 111,800 ⬇️

Target: Higher Highs near 116,322 (EMA 20 resistance level) 📈

Stop Loss: Set just below the trendline at 111,500 🔒

Trade Setup:

Entry: At 112,580 USDT

Stop Loss: 111,500 USDT

Target 1: 114,800 – 115,500 USDT

Target 2: 116,322 USDT (potential breakout)

Reasoning:

Trendline Rebound: BTC is testing a major trendline support.

Short-Term Momentum: Expecting a continuation after this test.

Risk Management: Tight stop below the trendline for safety.

🔔 Stay updated: Follow for more setups and updates! Happy trading!

The Only Bitcoin Chart You NeedUnderstanding Price Action is essential for successful trading as it allows traders to interpret market dynamics and make informed decisions based on pure price movements. By focusing solely on price movements, traders can eliminate noise and distractions caused by indicators or external factors, leading to a clearer understanding of market trends and patterns.

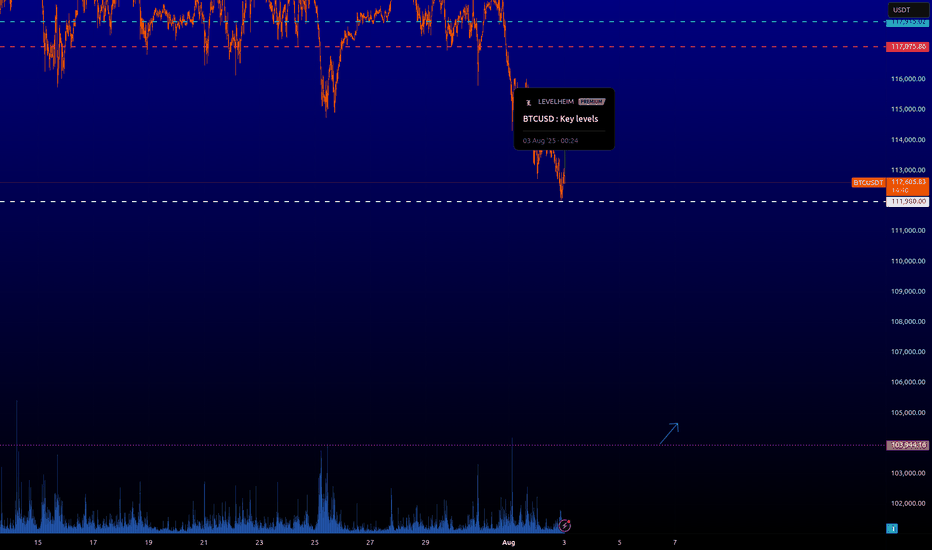

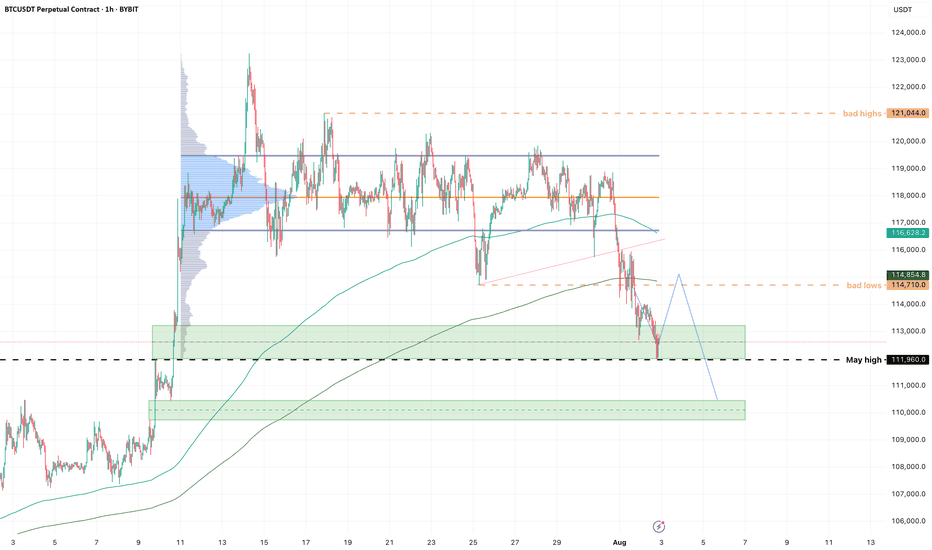

BTC - HOOOLLDDD!!!!Looks like we got our downside first.

Short update, but important level to watch is that 112k high from May this year. I longed on a ltf low hold, looking for a bounce into the highs of this sell-off cluster, then see what's what.

Flow is still very heavy; I expect to get stopped on this but it's one of those setups I just have to take, or I kick myself tomorrow.

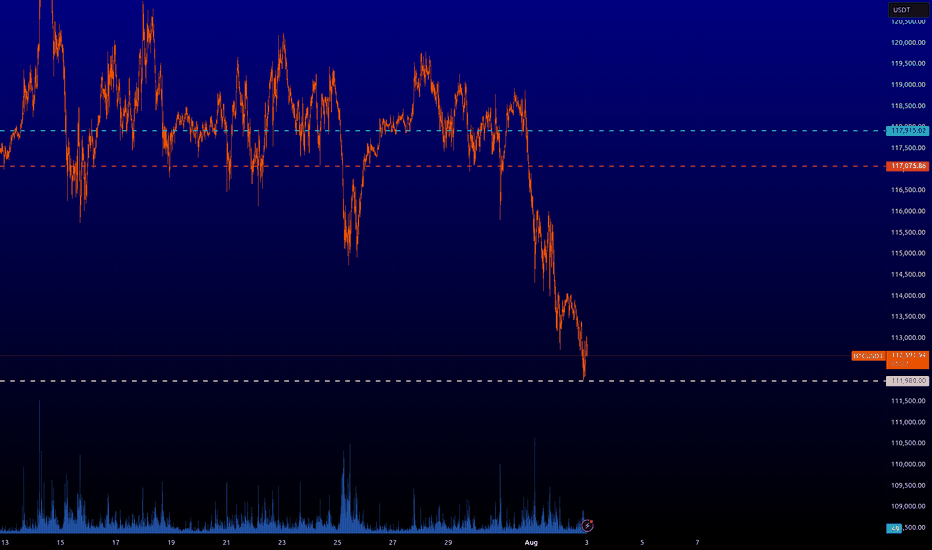

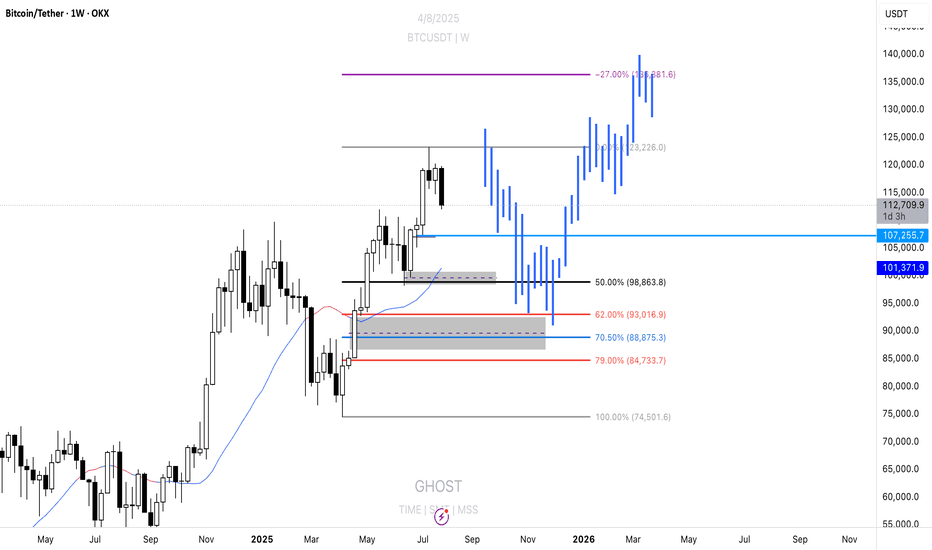

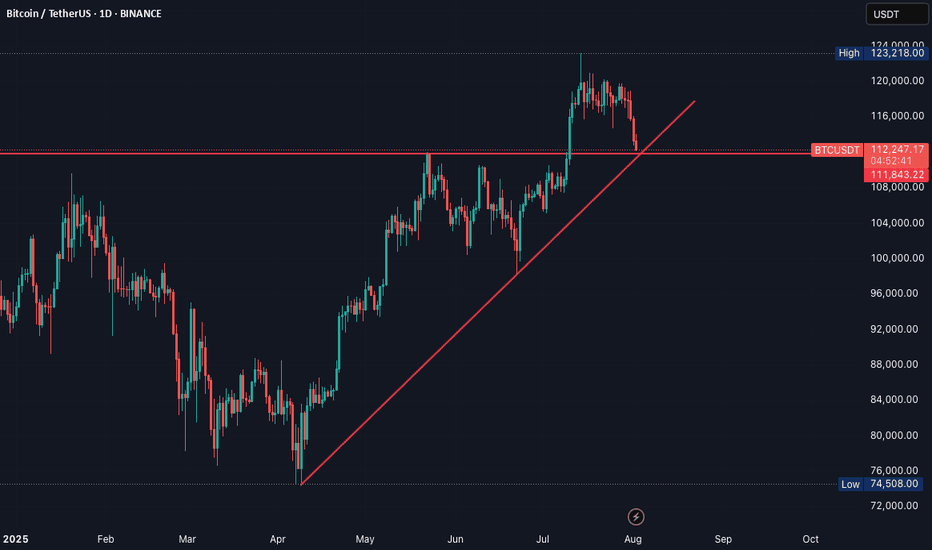

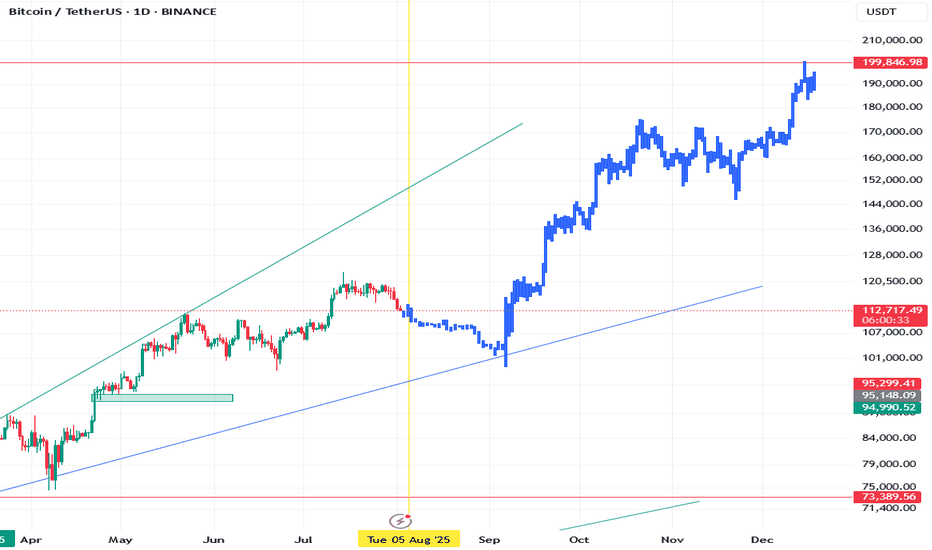

From Euphoria to Exhaustion – BTC's Next Move?BTC Idea – Bearish Divergence + Key Level Watch ⚠️

Summary / Bias:

BTC has tapped 120K and is now showing early signs of weakness. A bearish divergence on the MACD Histogram (weekly) is flashing caution, while price has retraced back to the critical 112K zone. I'm leaning bearish short-term, expecting a move towards 100K, and possibly as low as 93K, if key confirmations unfold.

Technical Context:

Weekly MACD Histogram shows a clear bearish divergence, signaling potential exhaustion.

BTC rejected from 120K and has pulled back to 112K.

Price crossed below the Yearly Camarilla L#, but we need a weekly close below to confirm further downside.

112K remains the key pivot – failure to bounce strongly here could open the door for deeper retracement.

Scenarios to Watch:

🟥 Bearish Continuation (Primary Bias)

Breakdown and close below 112K

Downside targets:

TP1: 100K

TP2: 93K

🟨 Neutralizing Risk

Hold above 112K with strong bounce = neutral bias, reassess

Close back above 115K+ with strength = invalidate bearish lean

Caution & Patience:

Now is not the time for aggressive longs. Signs of exhaustion + major level retest call for defensive positioning and high-quality setups only. Let confirmation guide entries.

NFA. Risk management always.

Will update if structure shifts.

btcThis is not a signal.

Just my outlook on BTC based on data

No fluff

No fancy indicators

And definetly no rectangles

Just watch and see how it plays out, as we are currently in a big indecision zone as well as the weekend I would not enter any positions now but rather wait for monday-wednesday to enter.

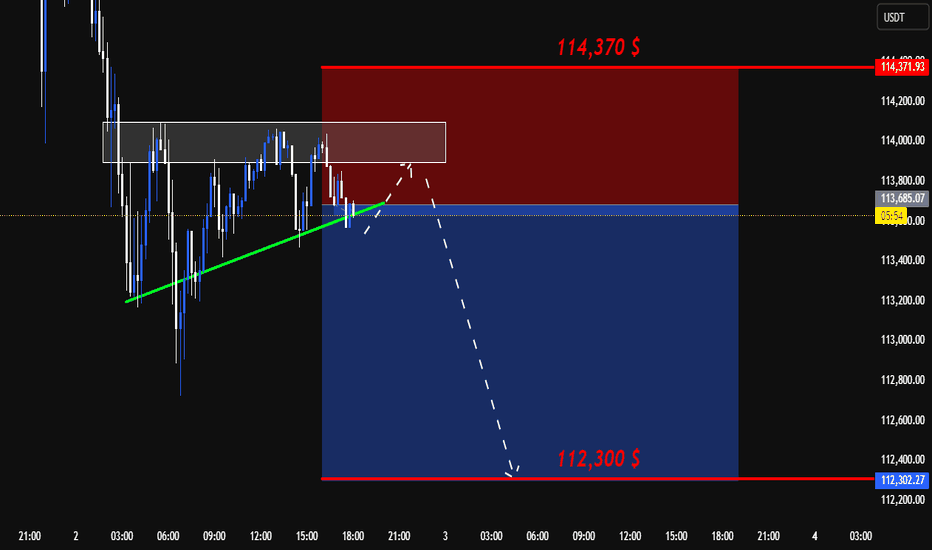

BTC SHORT SETUP INTRADAY ( 02 AUG 2025 )If you have doubt on our trades you can test in demo.

Details:

Entry: 113,680 $ - 113,450 $

Target Price: 112,300 $

Stop loss: 114,370 $

Trade Ideas:

Idea is clearly shown on chart + we have some secret psychologies and tools behind this.

What is required to Join VIP?

- Nothing just you have to share 10% of your profit with us at the end of the month which you earned from our signals. Yeah this is just the requirement, trade where ever you like your favorite broker or else you don't need to pay fees first or create account thru our link.

Trade Signal:

I provide trade signals here so follow my account and you can check my previous analysis regarding BITCOIN. So don't miss trade opportunity so follow must.

BINANCE:BTCUSDT BINANCE:BTCUSDT.P BINANCE:BTCUSD

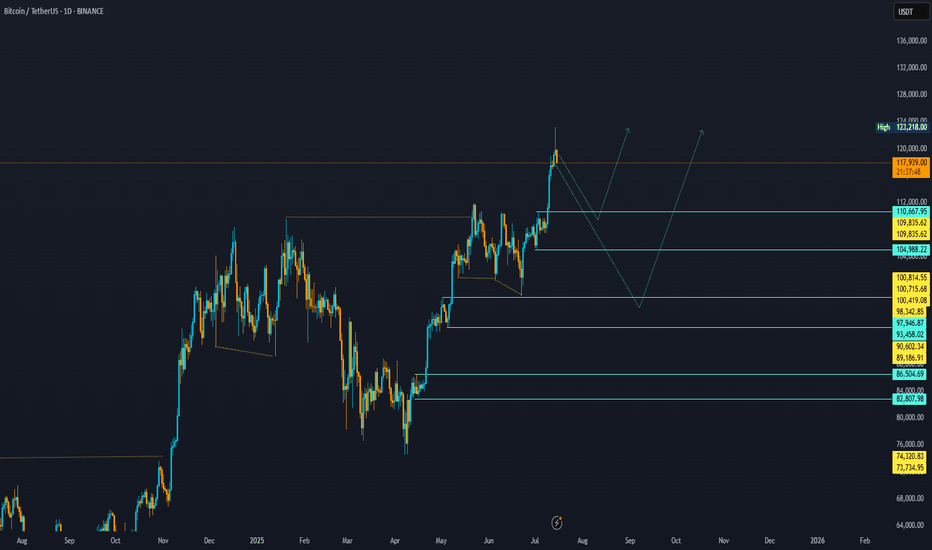

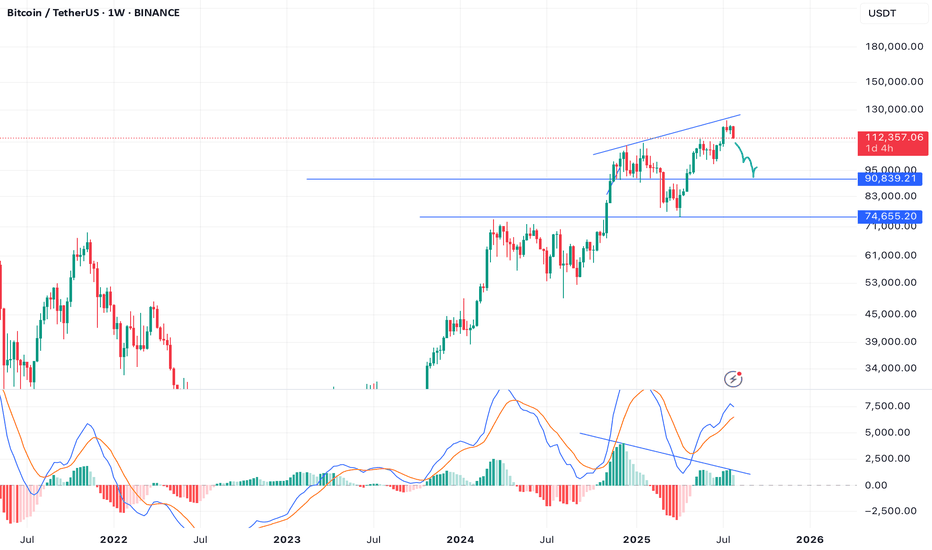

Bitcoin Enters Correction Mode?Bitcoin is already trading at support in the form of the previous all-time high and EMA55. Bitcoin is down more than 8% since its 14-July all-time high. We can see that a correction is already in, a retrace. This retrace we consider part of the normal workings of the market, price fluctuations which invariably always show up. The end result is a higher high, a rising wave, higher prices on the long haul.

Support is strong at current prices but even stronger is the support zone right above $100,000. As long as Bitcoin trades above $100,000, we will continue with a strong bullish outlook. If Bitcoin manages to move and close below $100,000 monthly or weekly, we will consider the short-term, the mid-term and update our map if necessary. For now, the bulls are still in control.

When Bitcoin peaked 22-May it went sideways for an entire month. From a peak of $112,000 it hit a low of $100,000. Now we have a peak around $123,000 and prices can easily swing around in this wide range.

After a few weeks, or several months, exactly as it happened last time, Bitcoin will go up. So you can expect retraces and corrections, but this is only short-term long-term we grow.

Namaste.

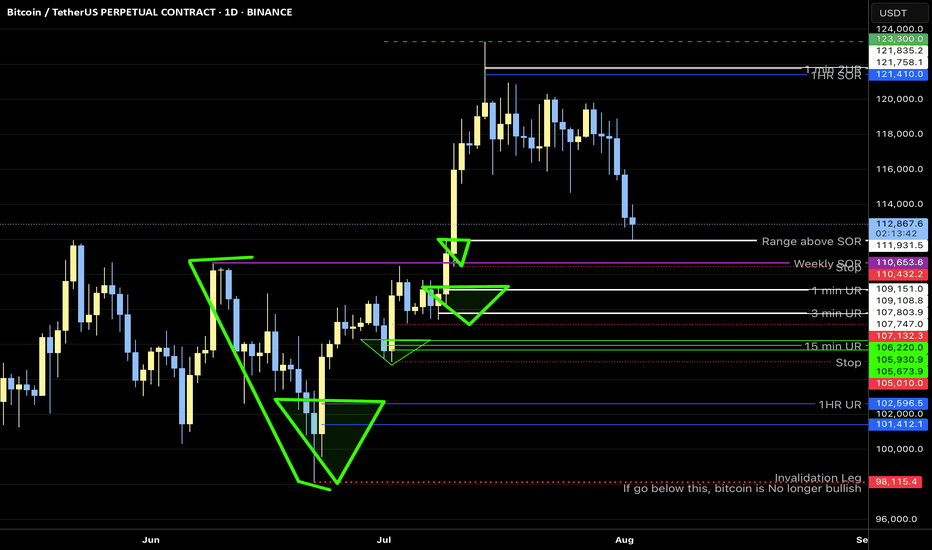

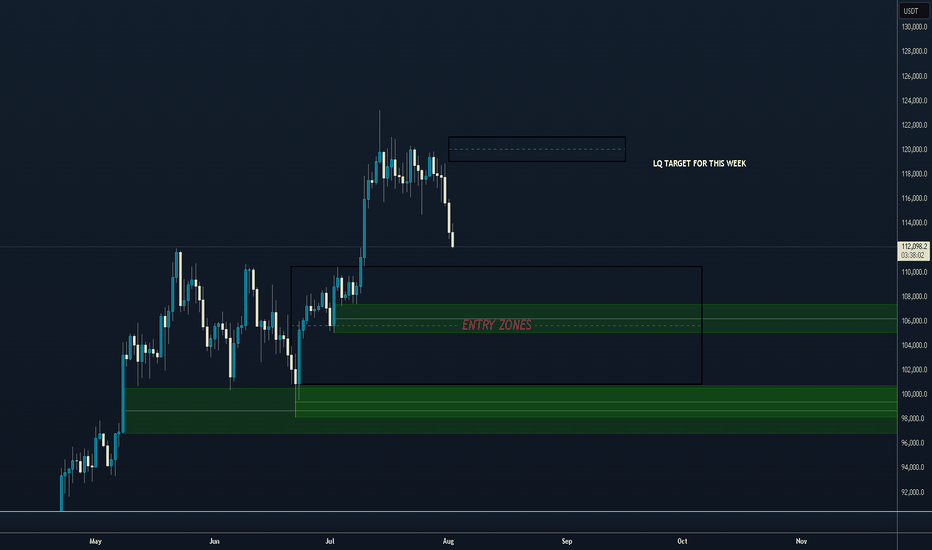

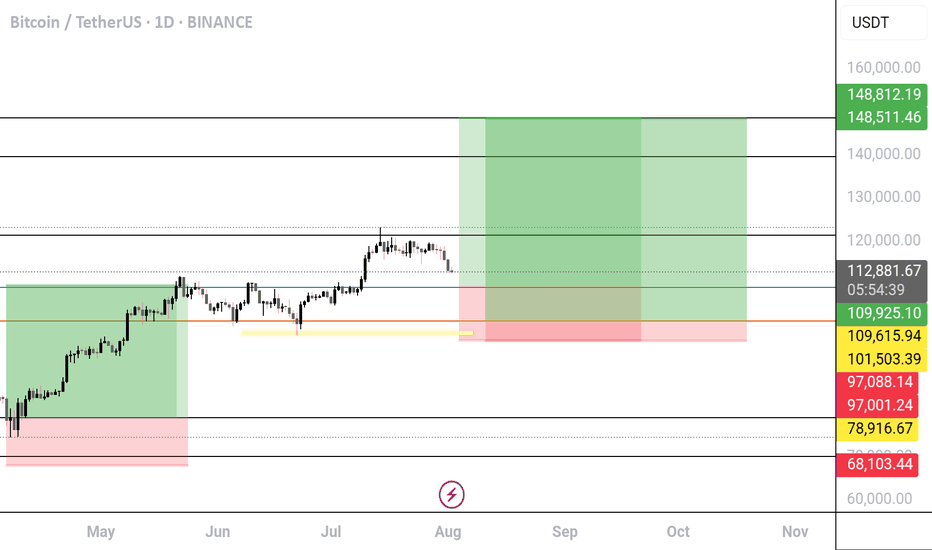

BTC/USDT Long Setup - Dual entry position

🟢 BTC/USDT Long Setup – Dual Entry Position

I’m going to be positioned long on BTC with two entries:

Entry 1: 109K if don't holds

Entry 2: 101k

Stop-loss: 97K

Target: 148.5K

R/R: ~5.4:1

Reasoning:

Market structure remains bullish with clean higher highs and higher lows.

The recent selloff is seen as a healthy pullback into a demand zone — not a trend reversal.

Both entries are placed to catch either a shallow bounce or a deeper liquidity sweep without overexposing risk.

Setup remains valid unless we see a clean daily close below 97K.

Letting price play out — no mid-range noise, no overtrading. Focused on structure, trend, and reward.

---