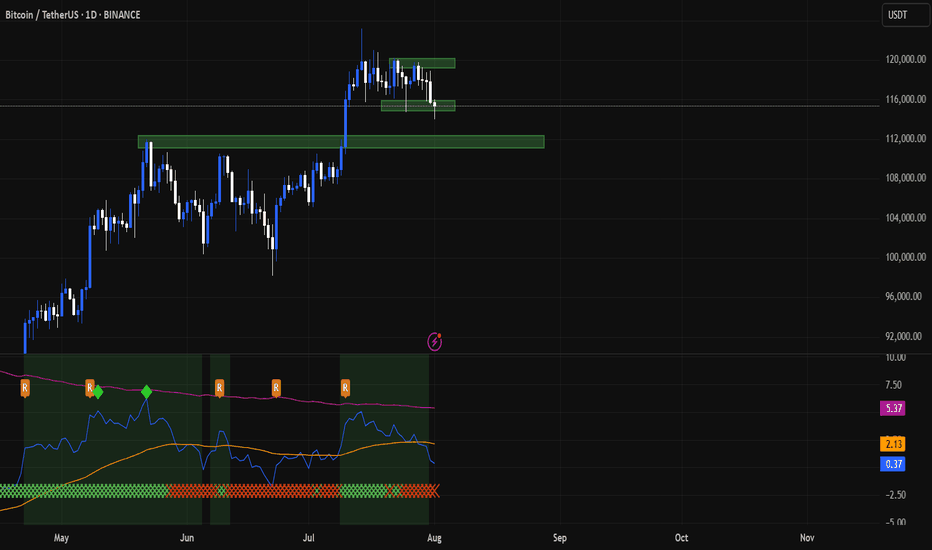

#BTC Update #14 – Aug 02, 2025#BTC Update #14 – Aug 02, 2025

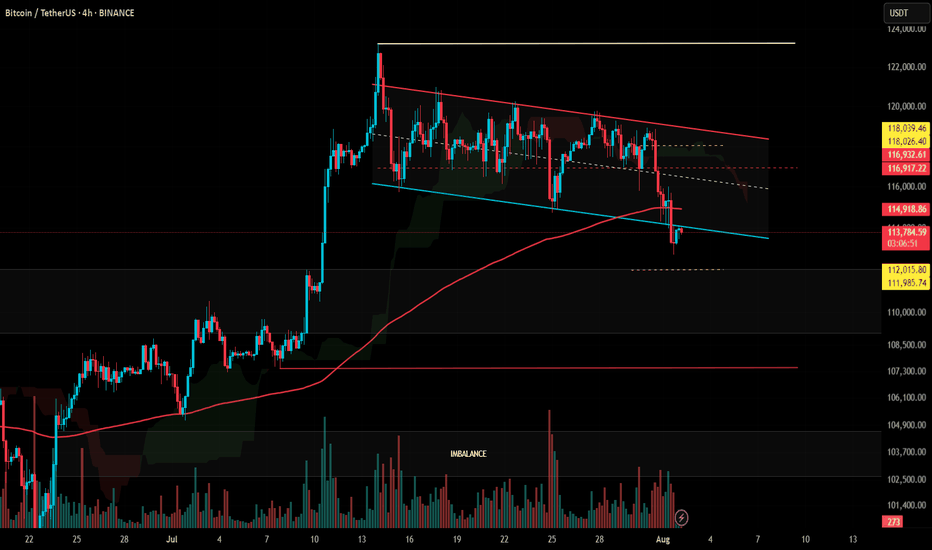

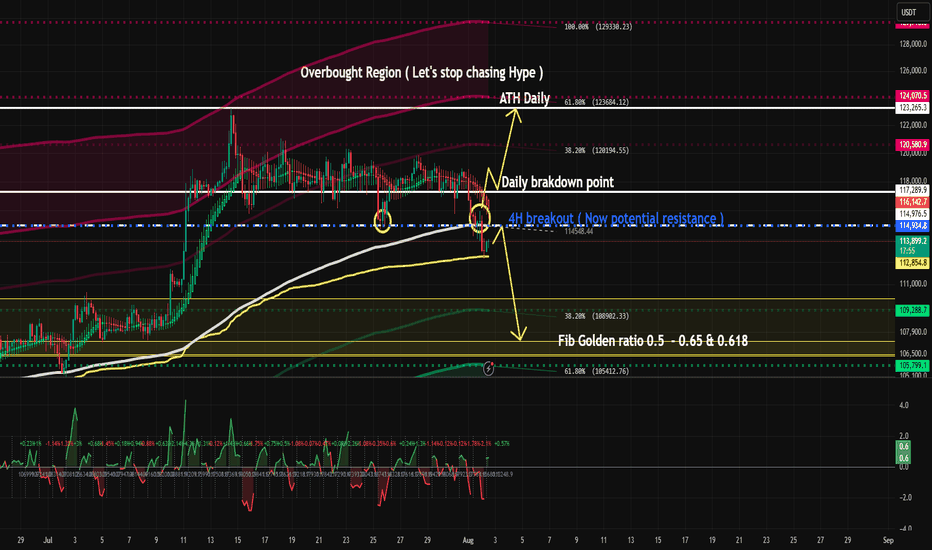

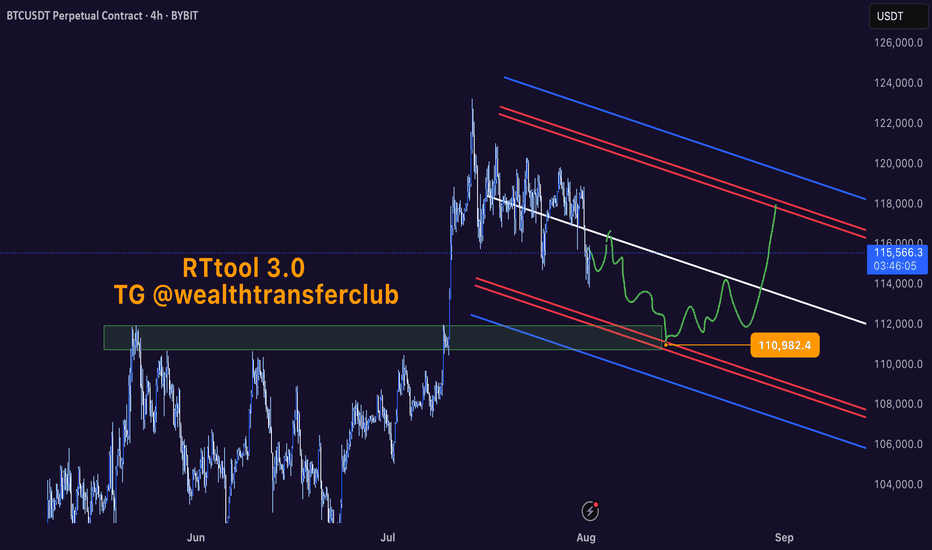

Unfortunately, Bitcoin has closed below its current channel and now appears to be retesting that level. If this retest confirms, I expect a pullback down to the $110,000 zone. However, if Bitcoin manages to re-enter the channel, its first target will be $118,800. Although it’s a descending channel, moving within it suggests a relatively stable market. Closing below it may not end well and could deepen the retracement. That's why I recommend caution with all coins right now.

Even though it seems like a distant possibility at the moment, don’t forget there’s also an imbalance zone around the $103,500 level. A sharp wick or a significant drop could bring Bitcoin back to revisit that area. The probability is currently low, but it can’t be ruled out completely. I don’t recommend rushing into any long or short positions at this stage.

USDTBTC trade ideas

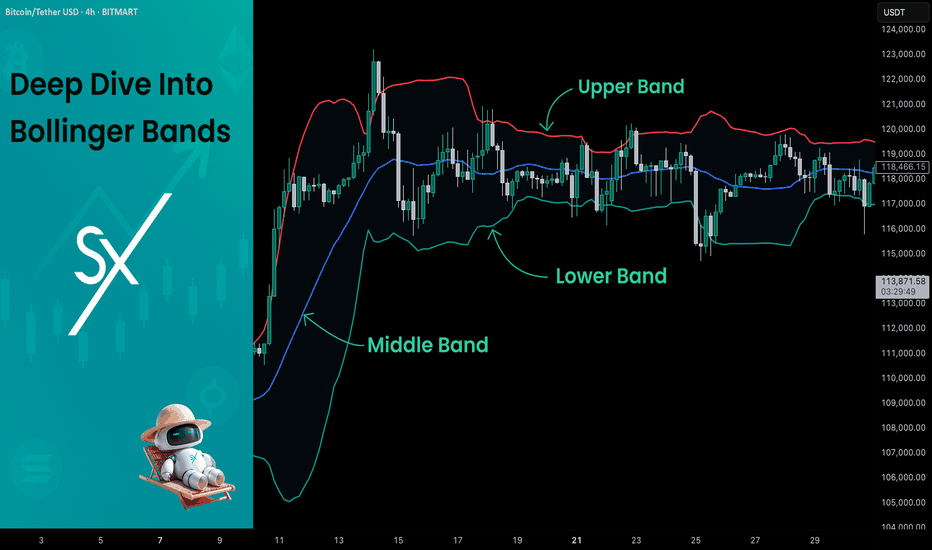

Deep Dive Into Bollinger Bands 🗓This article explores the Bollinger Bands indicator—a powerful volatility tool used by traders worldwide. You'll learn how it works, how to calculate it, and how to use it to detect potential breakouts, trend reversals, and overbought or oversold conditions in the market.

📚 Introduction to Bollinger Bands

In the fast-paced world of trading, understanding market volatility is key to making informed decisions. Bollinger Bands, developed by John Bollinger in the 1980s, offer a visual and statistical method to measure this volatility. Unlike simple moving averages, which only tell you the trend, Bollinger Bands expand and contract based on recent price action, helping traders spot overbought, oversold, or consolidation phases.

These bands dynamically adjust to market conditions, making them one of the most popular indicators for trend-following, mean-reversion, and breakout strategies. Whether you’re trading crypto, stocks, or forex, Bollinger Bands can help you identify high-probability setups by combining trend direction with volatility.

📚 How Bollinger Bands Are Calculated

Bollinger Bands consist of three lines:

Middle Band – This is a simple moving average (SMA) of the price, typically over 20 periods.

Upper Band – The middle band plus two standard deviations.

Lower Band – The middle band minus two standard deviations.

Middle Band = SMA(n)

Upper Band = SMA(n) + (k × σₙ)

Lower Band = SMA(n) - (k × σₙ)

Where σₙ is the standard deviation of the price for n periods and k is the multiplier, typically set to 2, which captures ~95% of price action under normal distribution. The middle band shows the average price over the last 20 candles. The upper and lower bands adjust based on how volatile the price has been — expanding in high volatility and contracting in low volatility.

🤖 For those traders who want to implement Bollinger Bands into algorithmic strategy we provide formula it's calculation in Pine Script:

basis = ta.sma(src, length) // Middle Band (SMA)

dev = mult * ta.stdev(src, length) // Standard Deviation × Multiplier

upper = basis + dev // Upper Band

lower = basis - dev // Lower Band

📚 How to Use MACD in Trading Strategies

⚡️Bollinger Band Squeeze (Volatility Contraction and Expansion)

The idea is pretty simple, а squeeze indicates low volatility and often precedes a breakout. The squeeze is the situation when the Upper Band and Lower Band contract, and BB width is at a local minimum. In this case you shall be prepared for the high volatility after the period of low volatility. This strategy doesn’t predict direction — it prepares you for volatility.

Long setup:

Price is in long-term uptrend, you can use 200 EMA as a major trend approximation - price shall be above it.

Bollinger Bands is narrow in comparison to the previous period. Price usually is in sideways.

Open long trade when candle shows a breakout and closes above the Upper Band.

Set a trailing stop-loss at the Middle Band.

Short setup:

Price is in long-term downtrend, you can use 200 EMA as a major trend approximation - price shall be below it.

Bollinger Bands is narrow in comparison to the previous period. Price usually is in sideways.

Open short trade when candle shows a breakdown and closes below the Lower Band.

Set a trailing stop-loss at the Middle Band

📈Long Trading Strategy Example

1. Price candle shall be closed above 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Bollinger Bands shall be narrow in comparison with the previous periods.

3. Open long trade when candle closes above the Upper Band.

4. Close trade when price touched the Middle Band.

📉Short trading strategy example

1. Price candle shall be closed below 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Bollinger Bands shall be narrow in comparison with the previous periods.

3. Open short trade when candle closes below the Lower Band.

4. Close trade when price touched the Middle Band.

⚡️Mean Reversion (Rebound from the Bands)

This is the most common approach to use Bollinger Bands. The idea is also very simple, we just want to open long if price touches Lower Band and short if price reaches Upper Band. Price tends to revert to the mean (Middle Band), especially in range-bound markets. It's very important to trade in the direction of the major trend to reduce the probability of the large move against you.

Long setup:

Price is in long-term uptrend, you can use 200 EMA as a major trend approximation - price shall be above it.

Open long trade when price touches the Lower Band.

Set the initial stop-loss at the fixed percentage below entry price. Choose this percentage number with your personal risk/money management, you shall be comfortable to lose this amount of money in case of stop-loss hit.

If price reached Middle Band set stop-loss at breakeven.

Close trade when price reached the Upper Band.

Short setup:

Price is in long-term downtrend, you can use 200 EMA as a major trend approximation - price shall be below it.

Open short trade when price touches the Upper Band.

Set the initial stop-loss at the fixed percentage above entry price. Choose this percentage number with your personal risk/money management, you shall be comfortable to lose this amount of money in case of stop-loss hit.

If price reached Middle Band set stop-loss at breakeven.

Close trade when price reached the Lower Band.

🧪 Important: the most common approach to close trades is the Middle Band touch, this is classic mean reversion. We experimented multiple times with different approached and revealed that usually it's better to take profit at the Upper/Lower band for long/short trades and use Middle Band only for setting stop-loss at breakeven. This approach provides better risk to reward ratio.

📈Long Trading Strategy Example

1. Price candle shall be closed above 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Open long trade the Lower Band.

3. Put Initial stop-loss 2% below the entry price.

4. When price reached Middle band place stop-loss at the breakeven.

5. Close long trade at the Upper Band.

📉Short trading strategy example

1. Price candle shall be closed below 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Open short trade the Upper Band.

3. Put Initial stop-loss 2% above the entry price.

4. When price reached Middle band place stop-loss at the breakeven.

5. Close short trade at the Lower Band.

🧪 Important tip: notice that initial stop-loss is needed only to avoid disaster in case of price moves strongly against you. This percentage shall give enough space to avoid its reaching too often. Mean reversion strategy provides fast trades with the small average gain, so you shall maintain the high win rate (perfectly above 70%). You have to choose stop-loss based on particular asset volatility.

⚡️Combined Approach: Mean Reversion + Trend Following

Skyrexio made multiple researches about Bollinger Bands strategies and we found that we can receive better gains in combination of different approaches. Mean reversion gives you great entry with discount but you don't need to exit that early. Use the trading stop and allow to gain profit while market is moving in your direction.

This approach you can find in our advanced strategy Bollinger Bands Enhanced Strategy which we shared in 2024. Click on the link to read about it and understand how you can combine best features of this popular indicator.

📚 Conclusion

Bollinger Bands are more than just a volatility indicator — they provide a flexible framework for understanding price dynamics and market conditions. By visualizing the relationship between price and standard deviation around a moving average, traders can gain valuable insights into whether an asset is consolidating, trending, or preparing for a breakout.

The real strength of Bollinger Bands lies in their versatility. They can adapt to different trading styles — whether you’re a short-term scalper, a swing trader, or a long-term position holder. From identifying squeeze setups to riding strong trends or capturing mean reversion moves, BBs offer a strategic edge when used correctly.

However, Bollinger Bands should never be used in isolation. Like any technical tool, they work best when combined with momentum indicators like RSI or MACD, volume analysis, and price action signals. Context is key: a signal that works well in a ranging market may fail during high momentum trends.

Ultimately, Bollinger Bands help traders make more informed, disciplined decisions by clarifying where price stands relative to recent history. When paired with sound risk management and broader market awareness, they become a powerful ally in navigating market uncertainty.

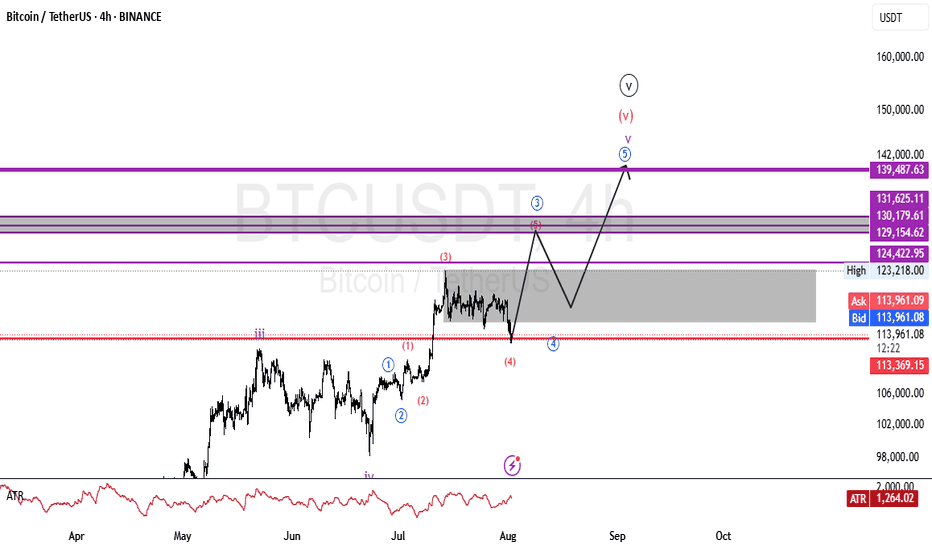

BTCUSDT: Elliot Wave AnalysisAs you can see in the chart, the fourth wave has ended and there is a possibility of an increase in the next stage to the level between 128,000 and 131,000, followed by a correction for a larger fourth wave and finally the last leg of the increase to the fifth wave, which has the possibility of reaching 139,000 to 140,000.

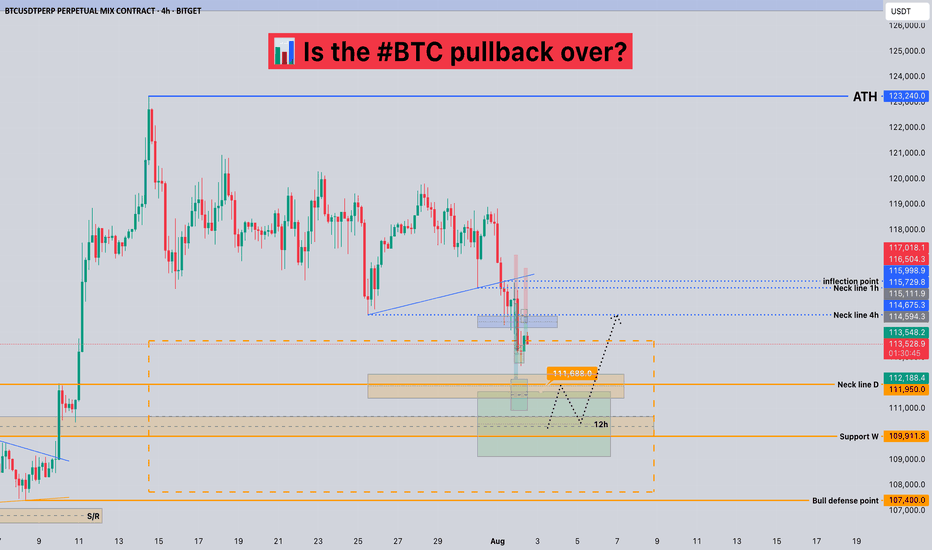

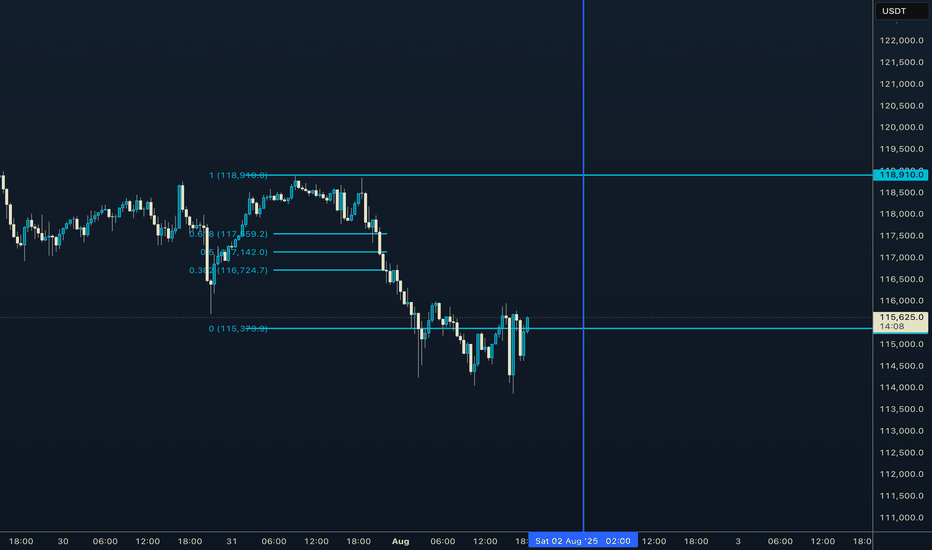

Is the #BTC pullback over?📊 Is the #BTC pullback over?

🧠From a structural perspective, a bearish structure has formed on both the 1-hour and 4-hour charts, so we should be wary of the risk of a further pullback.

➡️Resistance is the area formed by the two necklines (114675-115729).

Support is primarily the overlap between the yellow and green areas (110000-111688). If we can establish a bullish structure on the 1-hour chart here, we still have a chance of continuing the bullish trend.

🤜If you like my analysis, please like 💖 and share 💬 BITGET:BTCUSDT.P

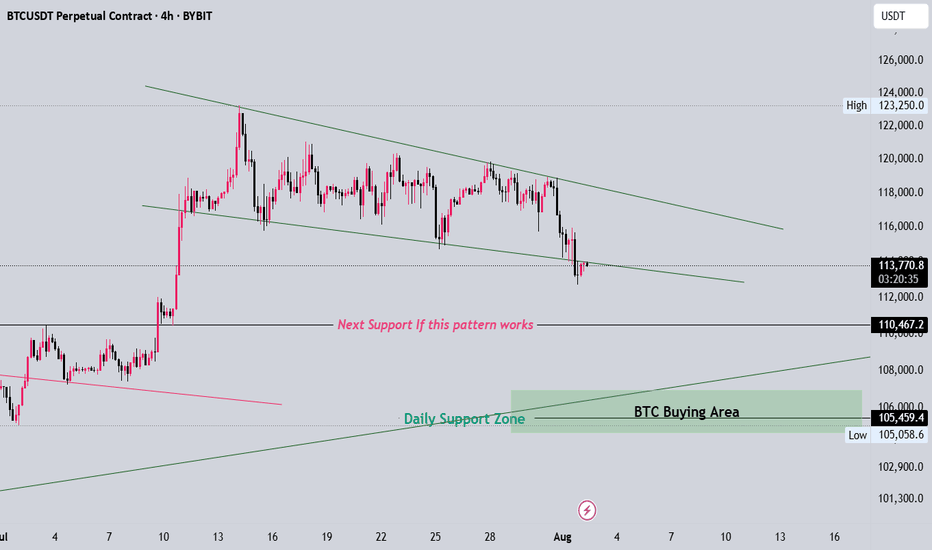

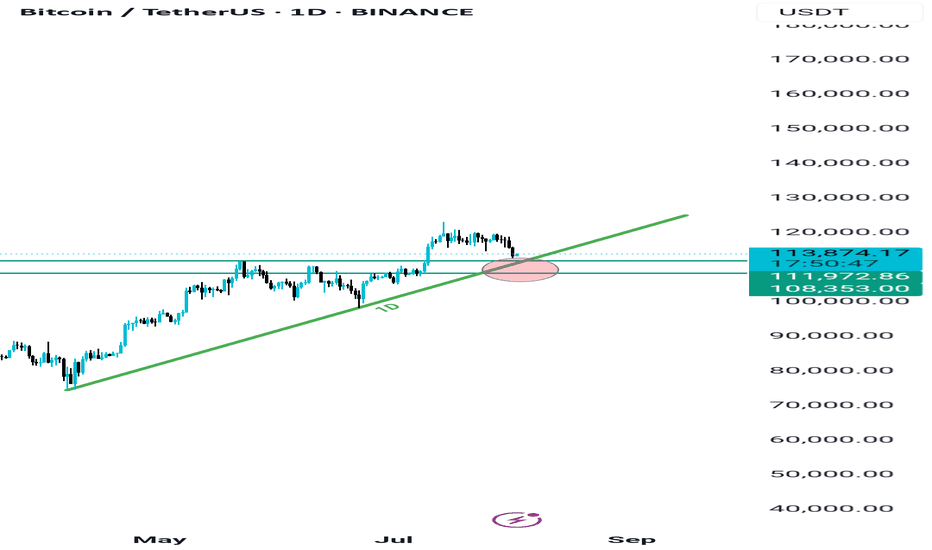

BTC 108K - 112K ZONE Why 108k to 112k zone is important?

Bitcoin recently made a new all-time high and is now undergoing a healthy correction — nothing to worry about.

The $108,000 to $112,000 zone is a key support area due to three major factors:

1. Strong previous support level

2. A daily trendline aligning with this zone

3. 50% Fibonacci retracement of the recent impulse move

If this support holds, there's a strong possibility Bitcoin will form a new ATH around $130,000 to $140,000.

DON'T PANIC wait for confirmation and see the magic 🚀 🚀

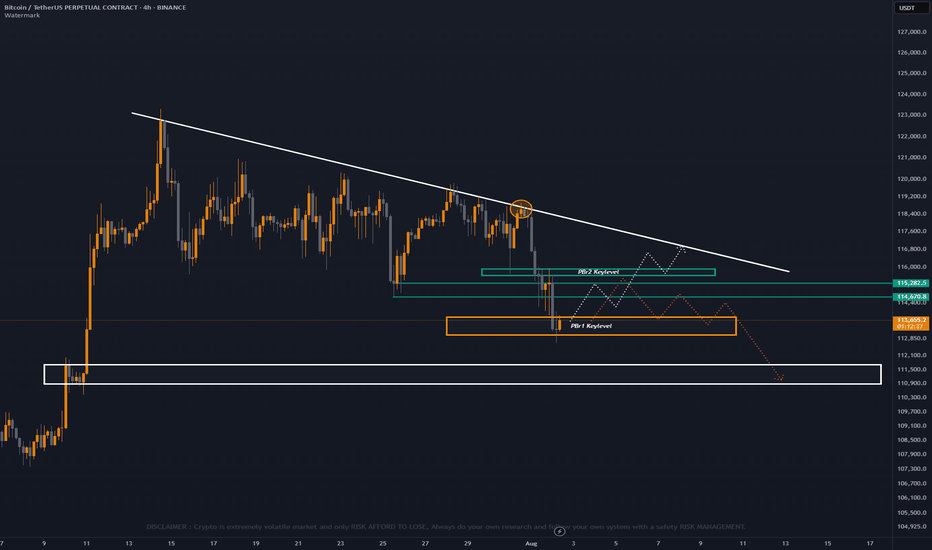

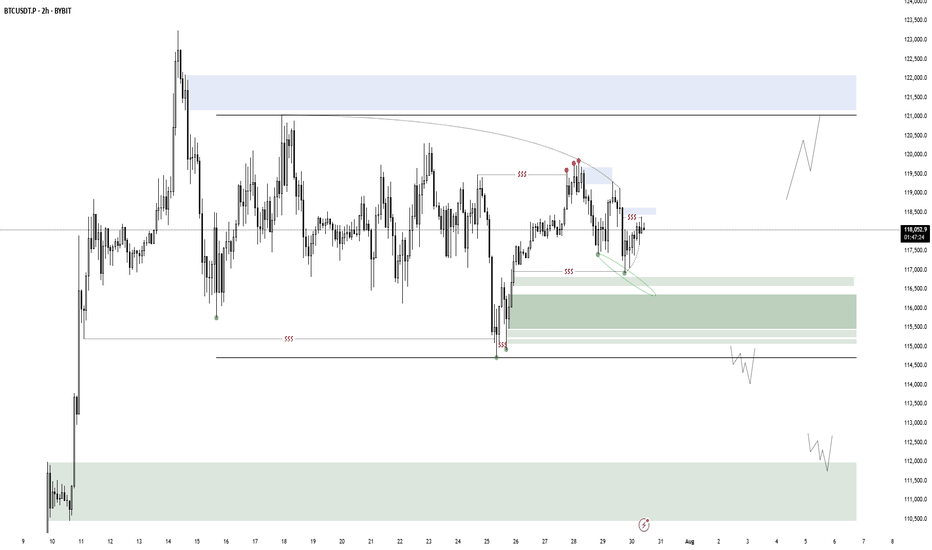

_Bitcoin Update

Bitcoin broke below on our local PBr2 support at 115.7k range keylevel panda fam this is a sign of first mini bearish breakout, But bitcoin price is now sitting at H4 PBr1 support keylevel 113.4k range.

Two case scenario possible for bitcoin:

1.) White broken lines — a bounce back with new swing high confirmation for reclaim back on structure for possible next major trend resistance breakout | BULLISH BIAS 🐂

2. ) Red broken lines — retest at PBr2 as local resistance and possible drop until white box support at 111.2k range area | BEARISH 🐻

In this case while bitcoin is ondecision panda fam we need to consider both case scenario with a short term possibilities but the best thing here is we already know where are the importance keylevel S / R to observe not just a random keylevel. 💯

ℹ️ : @pandanambawan

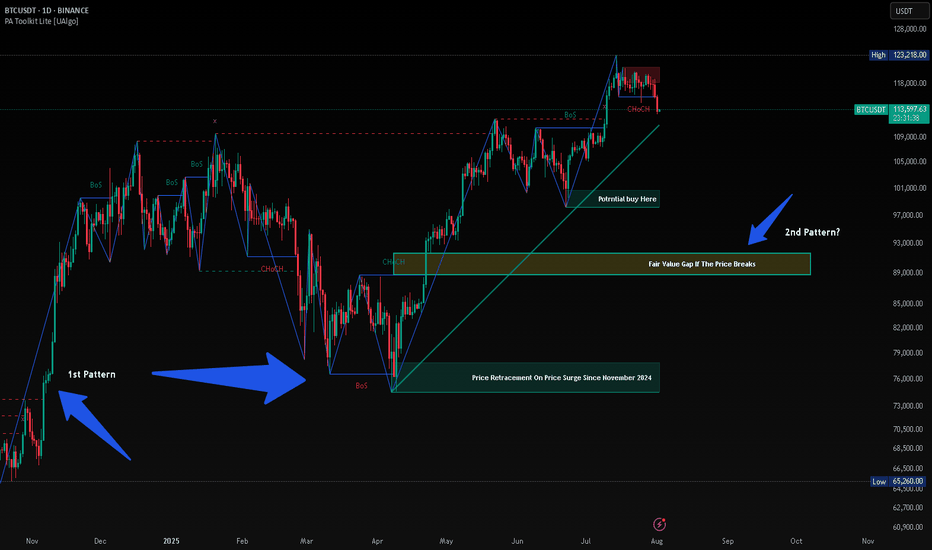

BTC HUNTS LIQUIDITYThis is just my opinion, BTC will hunt liquidity before taking new High. Since November 2024 after President Trump was elected, the price of BTC surge from $74,000 and retrace almost the same price on April 2025 after taking its new High. History will repeat itself and when history failed, there will be a long Bearish at least 90%.

Bitcoin projection for the rest of the year. Bullish.We are in a retracement phase , i think btc will retrace deep enough to convince people that bull run is over . Once that happens it will flip to the upside and leave everyone shocked.

A retrace towards 108k-104k is possible.

Once they get tapped btc will start a new run towards a new all time high where everything will get to an end and a new besr market will start. Until then lets enjoy the rest of the year.

Reversal from Channel Bottom or a Real Breakdown? Identifying th

🎯 BTCUSDT - Analysis

🔹 Analysis Date: 1 August 2025

📉BTCUSDT:

Price is currently moving inside an ascending channel and has touched the bottom of the channel again, offering a potential buy opportunity.

However, for those seeking a low-risk entry, the zone around 118,000 could be ideal—if price returns to the channel and confirms support.

Although it seems the channel’s lower boundary might break, this could be a fake break to mislead traders before a rebound.

The support at 110,000 is a crucial short-term level; if it fails, a deeper correction toward 98,090 or even 94,000 is likely.

Our targets remain at the upper boundary of the channel.

⚠️ Risk Management Tip: Wait for confirmation near 118,000 if unsure, and always size positions based on overall volatility.

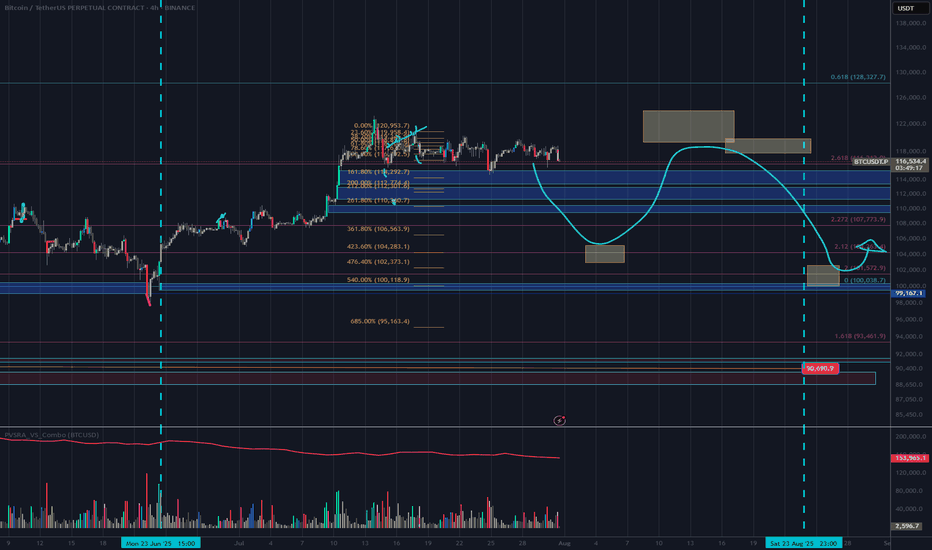

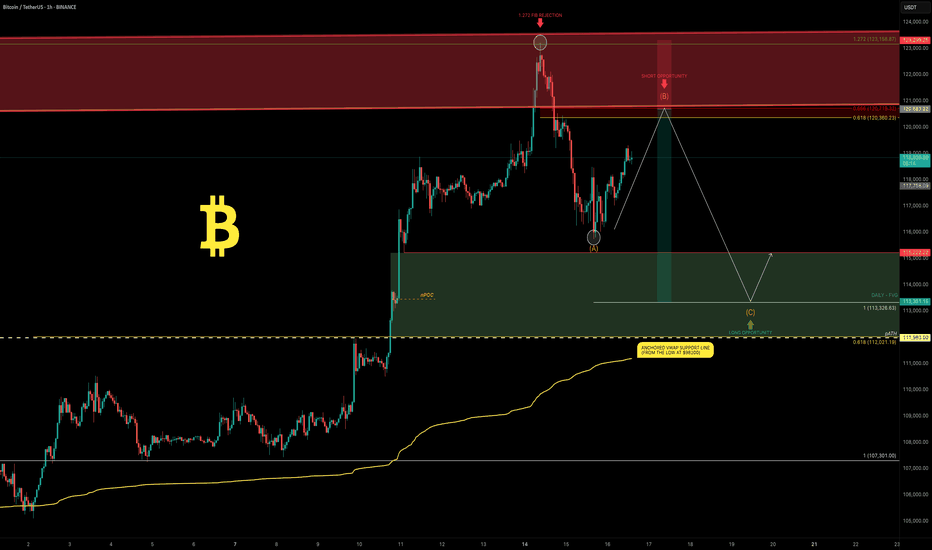

Bitcoin: New All-Time High — What’s Next?Bitcoin had an incredible run, breaking the old all-time high ($111,980) with strong bullish momentum and setting a fresh ATH at $123,218 (Binance). We just witnessed the first major corrective move of ~6% and a decent bounce so far — but the big question is:

What’s next? Will Bitcoin break higher over the summer or form a trading range here?

Let’s dive into the technicals.

🧩 Higher Timeframe Structure

May–June Range:

BTC was stuck between $110K–$100K, forming an ABC corrective pattern. Using trend-based Fib extension (TBFE) from A–B–C:

✅ C wave completed at $98,922 (1.0 TBFE)

✅ Upside target hit at $122,137 (-1 TBFE)

Full Bull Market TBFE:

➡️ 1.0 → $107,301 → previously rejected

➡️ 1.272 → $123,158 → recent rejection zone

Pitchfork (log scale):

➡️ Tapped the upper resistance edge before rejecting.

Previous Bear Market Fib Extension:

➡️ 2.0 extension at $122,524 hit.

2018–2022 Cycle TBFE:

➡️ 1.618 at $122,011 tapped.

Macro Fibonacci Channel:

➡️ Connecting 2018 low ($3,782), 2021 ATH ($69K), 2022 low ($15,476) →

1.618–1.666 resistance band: $121K–$123.5K.

✅ Conclusion: Multiple fib confluences mark the $122K–$123K zone as critical resistance.

Daily Timeframe

➡️ FVG / Imbalance:

Big daily Fair Value Gap between the prior ATH and $115,222 swing low.

BTC broke the prior ATH (pATH) without retest → a pullback to this zone is likely.

Lower Timeframe / Short-Term Outlook

We likely saw a completed 5-wave impulse up → now correcting.

The -6% move was probably wave A, current bounce = wave B, next leg = wave C.

➡ Wave B short zone: $120K–$121K

➡ Wave C target (1.0 TBFE projection): ~$113,326

➡ Confluence at mid-FVG + nPOC

Trade Setups

🔴 Short Setup:

Entry: $120,300–$121,000

Stop: Above current ATH (~$123,300)

Target: $113,500

R:R ≈ 1:2.3

🟢 Long Setup:

Entry: Between Prior ATH and $113,000

Stop: Below anchored VWAP (~$110,500)

Target: Higher, depending on bounce confirmation.

🧠 Educational Insight: Why Fibs Matter at Market Extremes

When markets push into new all-time highs, most classic support/resistance levels disappear — there’s simply no historical price action to lean on. That’s where Fibonacci extensions, channels, and projections become powerful tools.

Here’s why:

➡ Fibonacci extensions (like the 1.272, 1.618, 2.0) help estimate where trend exhaustion or profit-taking zones may appear. They are based on the psychology of crowd behavior, as traders anchor expectations to proportional moves from previous swings.

➡ Trend-Based Fib Extensions (TBFE) project potential reversal or continuation zones using not just price levels, but also the symmetry of prior wave moves.

➡ Fibonacci channels align trend angles across multiple market cycles, giving macro context — like how the 2018 low, 2021 ATH, and 2022 low project the current 1.618–1.666 resistance zone.

In short:

When you don’t have left-hand price history, you lean on right-hand geometry.

That’s why the $122K–123K zone wasn’t just random — it’s a convergence of multiple fib levels, cycle projections, and technical structures across timeframes.

⚡ Final Thoughts

Bitcoin faces major resistance around $122K–$123K backed by multiple fib and structural levels. A retest of the prior ATH zone (~$112K–$113K) looks probable before the next big directional move. Watch lower timeframe structure for signs of completion in this corrective phase.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

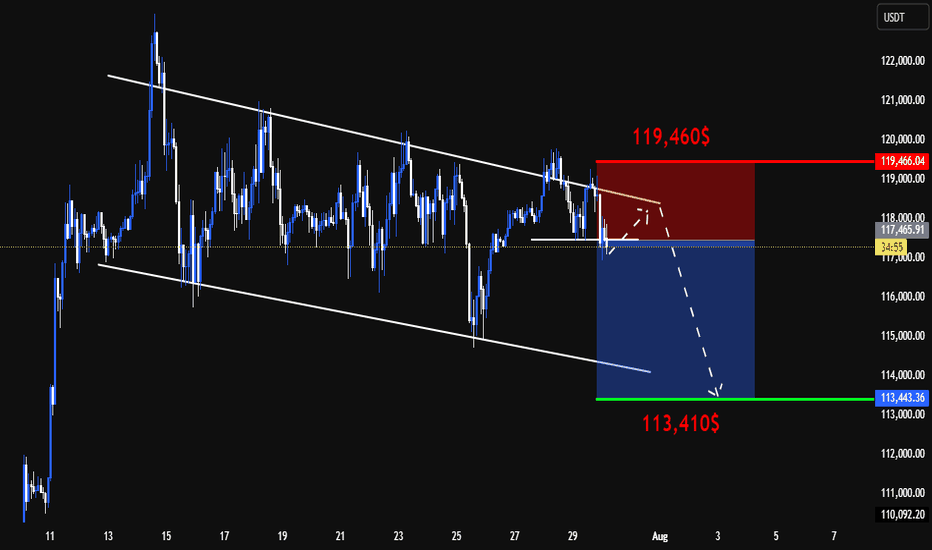

BTC HUGE DROP TO 113,400$ - BIG CRASH !*Sorry for posting to late as I am between a trip in Malaysia.*

Details:

Entry: Now - 117,000 $

Target Price: 113,410 $

Stop loss: 119,460 $

Trade Ideas:

Market creating a flag pattern here. Though its not only the logic we have some secret logics here and indicators which I shared in the VIP.

What is required to Join VIP?

- Nothing just you have to share 10% of your profit with us at the end of the month which you earned from our signals. Yeah this is just the requirement, trade where ever you like your favorite broker or else you don't need to pay fees first or create account thru our link.

Trade Signal:

I provide trade signals here so follow my account and you can check my previous analysis regarding BITCOIN. So don't miss trade opportunity so follow must.

BINANCE:BTCUSDT BINANCE:BTCUSDT.P BINANCE:BTCUSD

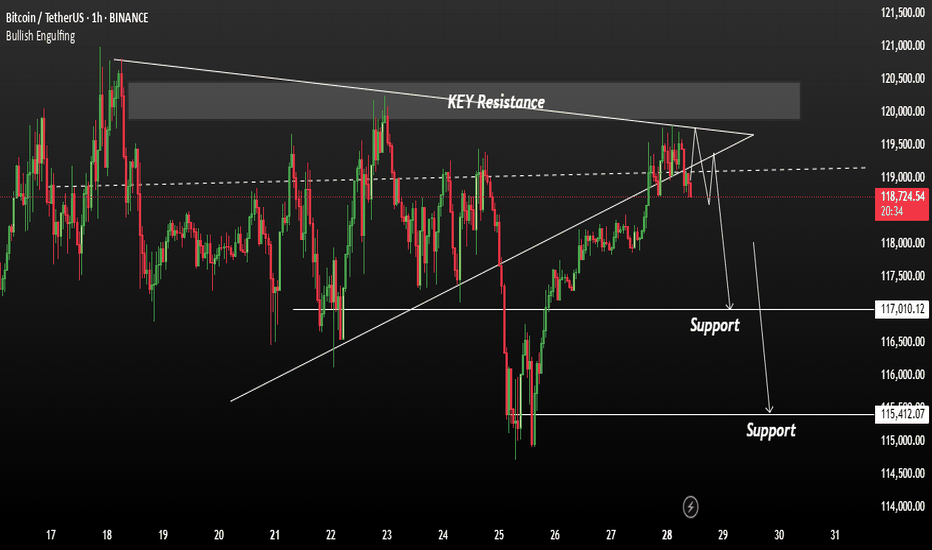

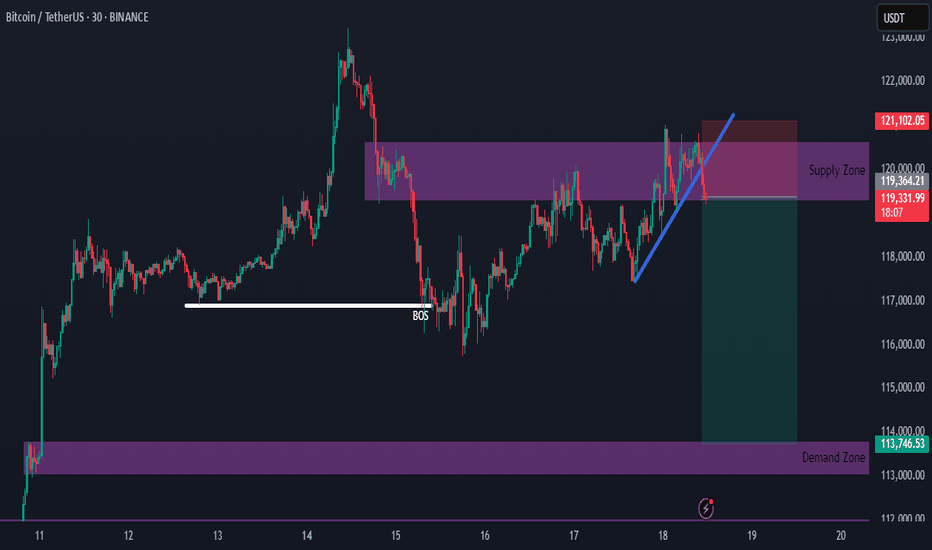

Quick Bitcoin Analysis – 30-Minute TimeframeQuick Hey friends 👋

Bitcoin was recently moving inside a weak upward channel on the 30-minute chart. But now, it has broken below the channel with a strong bearish candle. This suggests we’re entering a short-term correction.

🔹 However, don’t forget — the overall trend is still bullish.

This drop looks more like a healthy pullback, not the start of a full downtrend.

🎯 Possible Targets for This Correction:

✅ Target 1: Around $114,500

(This comes from measuring the width of the broken channel.)

✅ Target 2: Strong support near $113,500

(This level has shown solid buyer interest in the past.)

📊 The RSI is also approaching the oversold zone, which means we might see a small bounce or slowdown in the drop soon.

📌 In short:

This is likely just a dip in a bigger uptrend. Be patient, watch key support zones, and don’t rush into trades.

Always stick to proper risk management! 💼

Bitcoin Analysis – 30-Minute Timeframe

Bitcoin Could Accept bearish TrendBitcoin is currently testing a key resistance zone between 120,000 and 121,000. While price action is attempting to break higher, market conditions suggest the possibility of a false breakout rather than a sustained bullish continuation.

BTC has approached a significant resistance band, and early signs of exhaustion are visible. Unless the price decisively holds above 121,000, any breakout may lack conviction. Given the broader unresolved downtrend, a corrective move remains likely.

If the breakout fails to sustain, we anticipate a pullback toward the 117,000 to 115,000 range. This would align with a retest of previous support zones and continuation of the short-term bearish structure.

Ps: Support with like and comments for better analysis Thanks.

BTC ReaccumulationI'm watching here either for a local model 1 which forms a MTF accumulation model 2 or a model 1 which deviates the range one more time. There is a nice build up of liquidity to the upside but sadly no clear model 2 POI. The technical target if the model gets confirmed will be the range high but i would expect to see a new ATH. Let's see.

BTC CLS RANGEWaiting for the daily candle to close inside of the range as seen on the graph with the horizontal line.

Then I will be immediatly looking for an entry, either a FVG or a OB or an IFVG. (I will update the entry points asap)

Then I will target 50% of the range as seen on the graph market 0 .5 on the fibonacci retracement where I will take 75% of the position.

Then I will set my SL at my entry price and target the opposing range or LQ which is at 119500-120000K

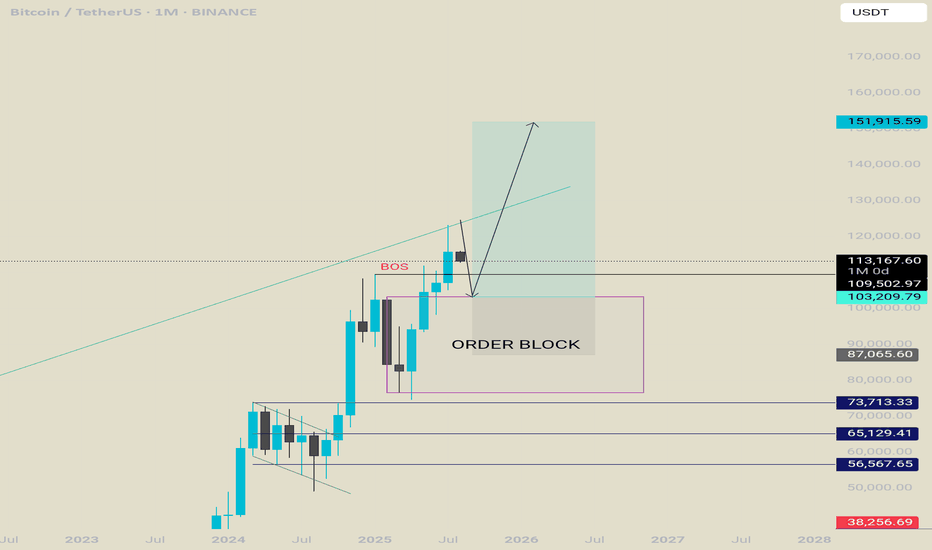

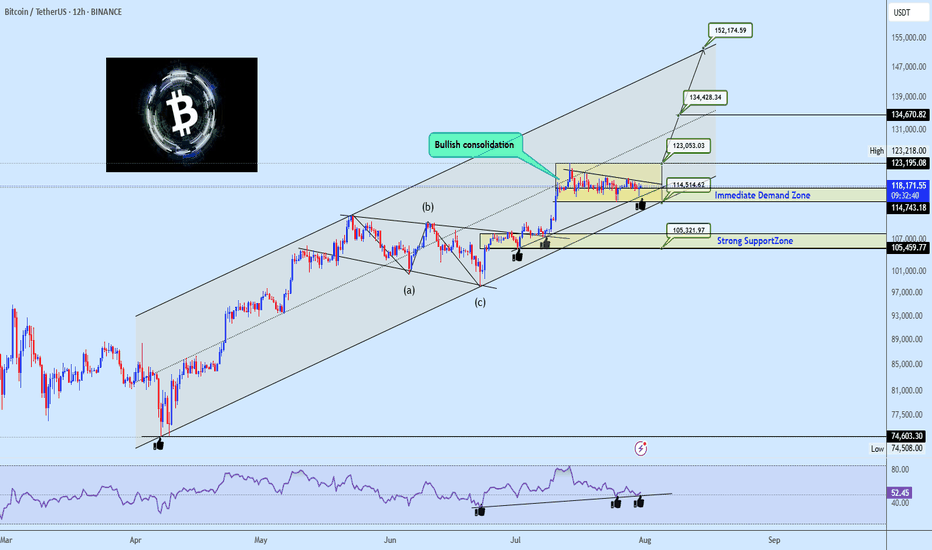

Bullish Channel Intact: BTC Poised for Next Leg Toward 152KBitcoin continues to coil within a bullish consolidation zone above the critical $114.5k–$117.5k Immediate Demand Zone, firmly riding the ascending channel structure that has guided price since the March swing low. The prior wave structure confirms a clean ABC correction, followed by a powerful breakout and a structured range indicative of accumulation, not exhaustion.

The RSI shows persistent bullish divergence, confirming hidden strength, with multiple support bounces confirming demand. The current tight consolidation above former resistance now flipped demand presents a launchpad scenario for a breakout towards major projected upside targets.

Targets to Watch:

🟢 $123,053 – Range breakout threshold, aligns with channel midline and prior local high.

🟢 $134,428 – Measured move from current range and top channel boundary intersection.

🟢 $152,174 – Final leg projection based on macro channel trajectory and bullish wave extension potential.

On the downside, failure to hold $114.5k opens the door to a test of the $105k Strong Support Zone, which aligns with prior structural demand and broader trendline confluence.

💬 Drop your favorite altcoins in the comments for quick analysis , let's catch the next movers before they fly!

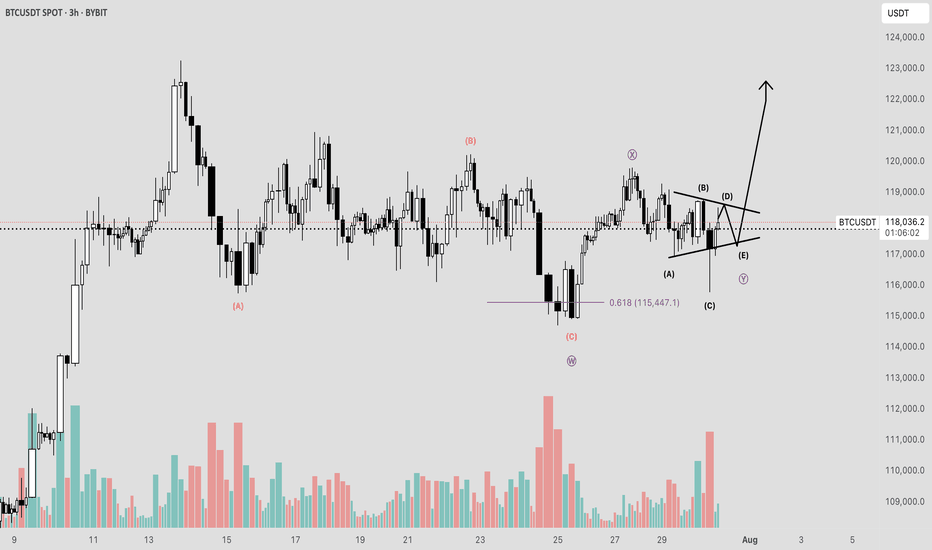

BTC Elliot Wave Double Combo CorrectionToday, I observed that Bitcoin may be unfolding within a complex double corrective wave structure—specifically a WXY pattern—potentially culminating in a contracting triangle.

Such corrective formations represent a temporal pullback, wherein the market undergoes a period of consolidation following an impulsive advance, also referred to as a pullback in time. This phase often serves as a mechanism for establishing structural support within a defined range prior to a continuation move.

A key point of uncertainty lies in whether the integrity of the triangle has been compromised by the recent, pronounced liquidity sweep. From the perspective of both the daily and 4-hour charts, this move resembles a classic deviation or "fake-out" rather than a legitimate breakout.

Nonetheless, the market may remain in a state of indecision for a few more sessions, characterized by erratic or range-bound price action, before committing to a more definitive trend.

A sustained break and successful retest above the 120K level would serve as a strong technical confirmation that Bitcoin intends to pursue higher valuations.