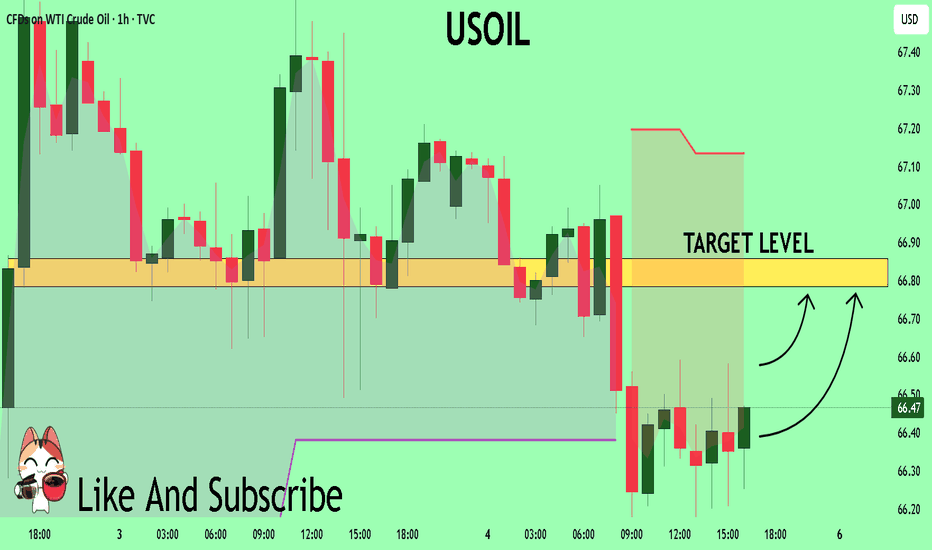

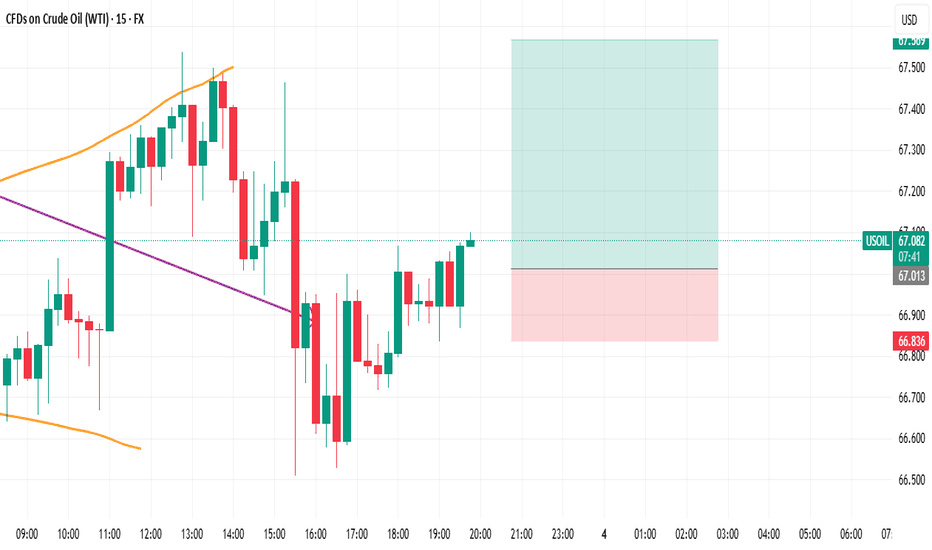

USOIL Set To Grow! BUY!

My dear friends,

USOIL looks like it will make a good move, and here are the details:

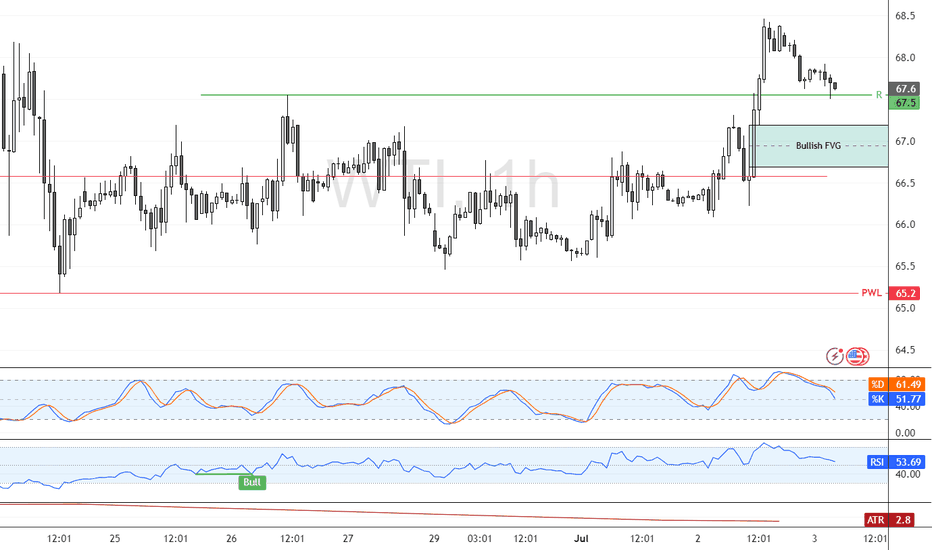

The market is trading on 66.47 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear (short / long) signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 66.79

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USOIL trade ideas

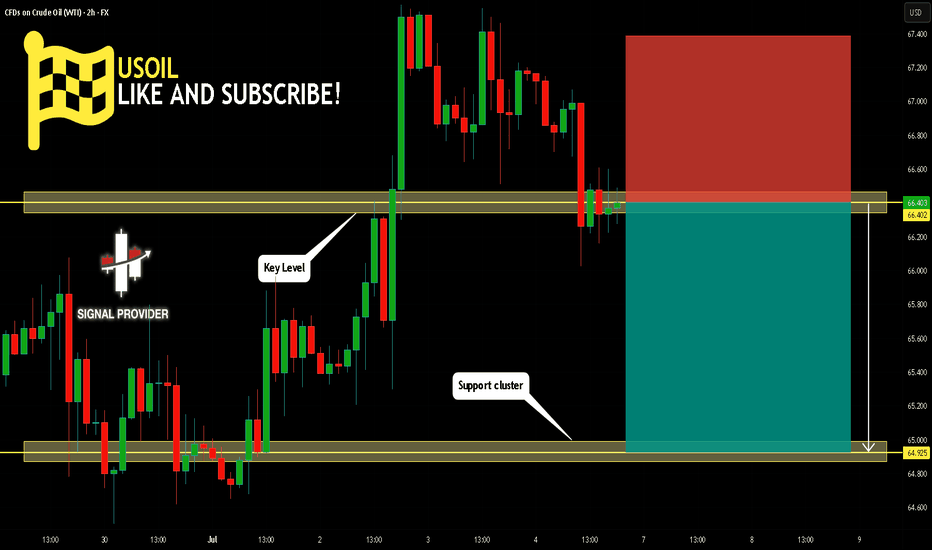

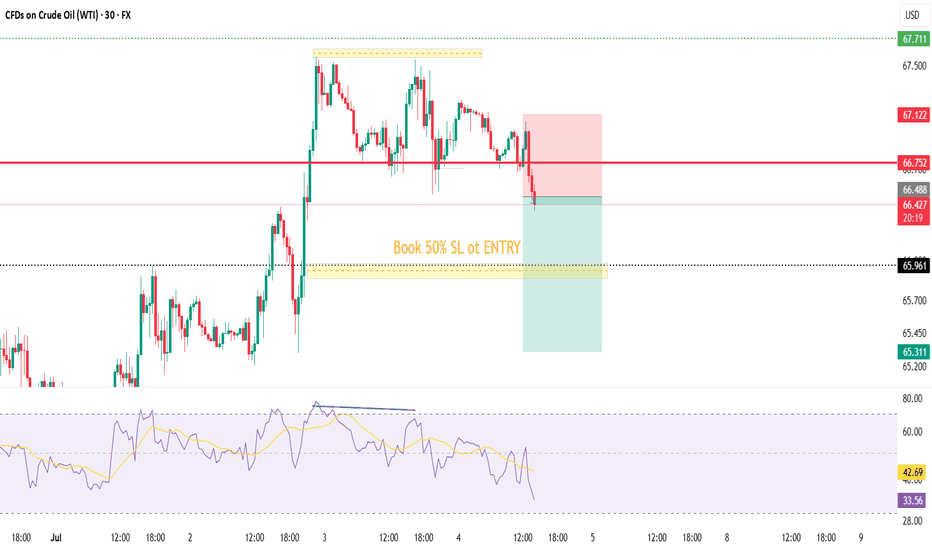

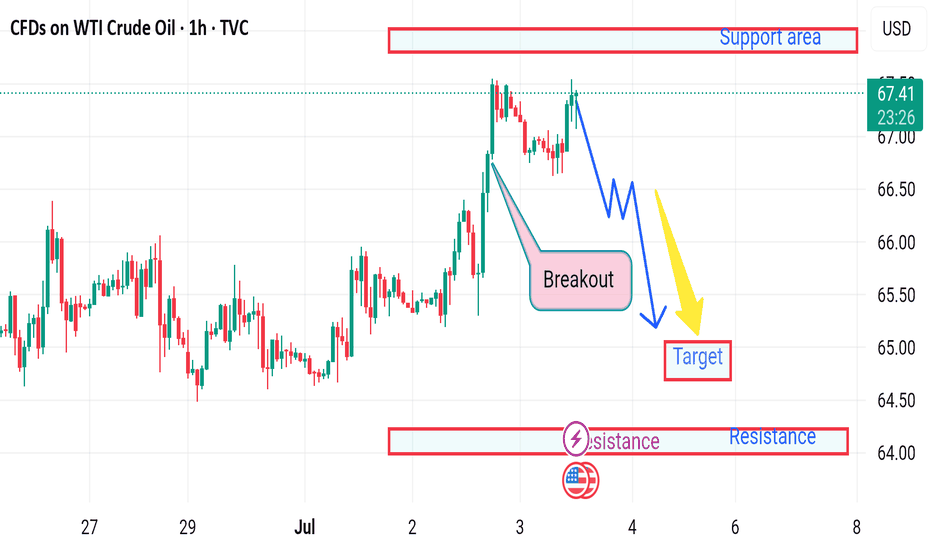

USOIL Is Bearish! Short!

Please, check our technical outlook for USOIL.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 66.402.

Considering the today's price action, probabilities will be high to see a movement to 64.925.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

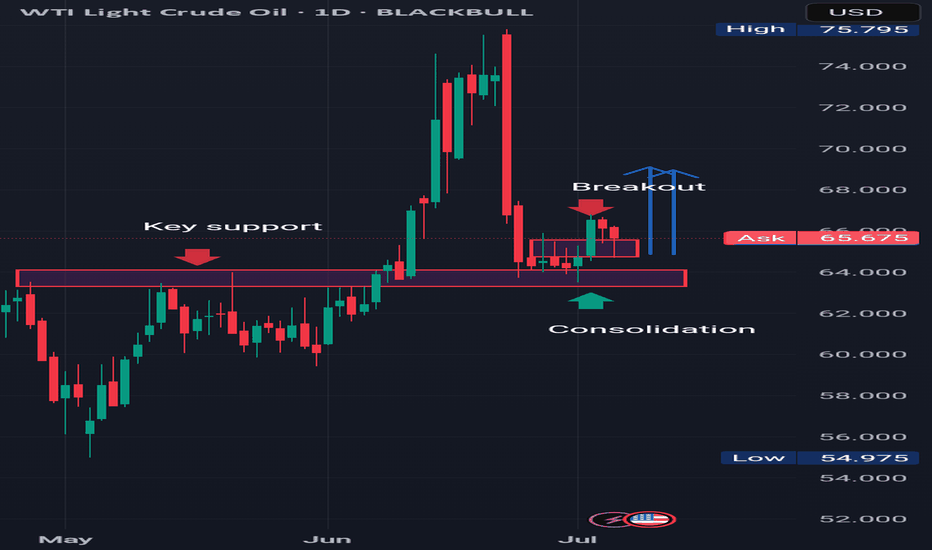

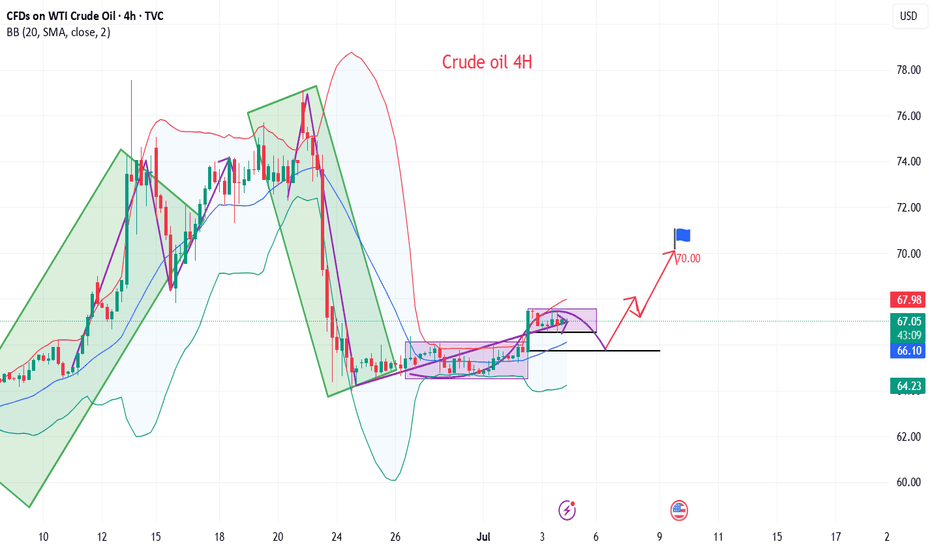

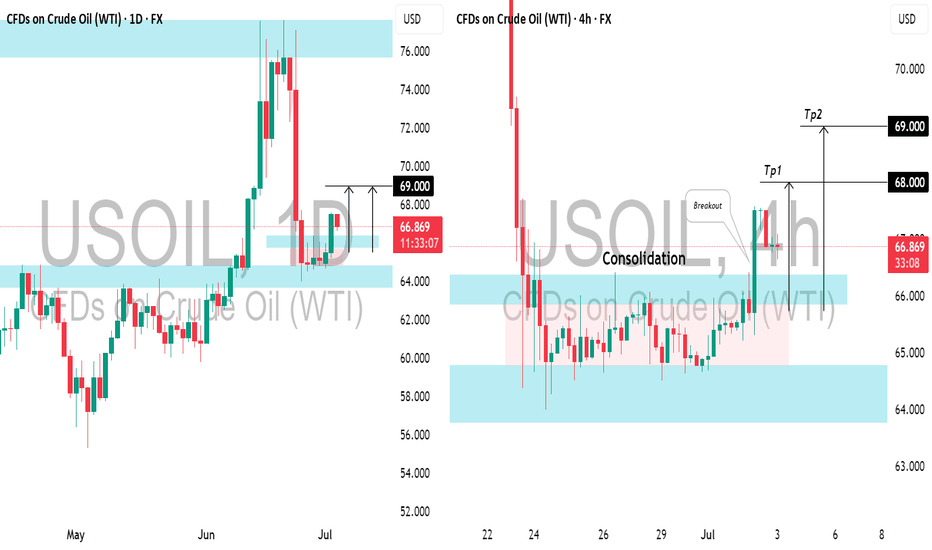

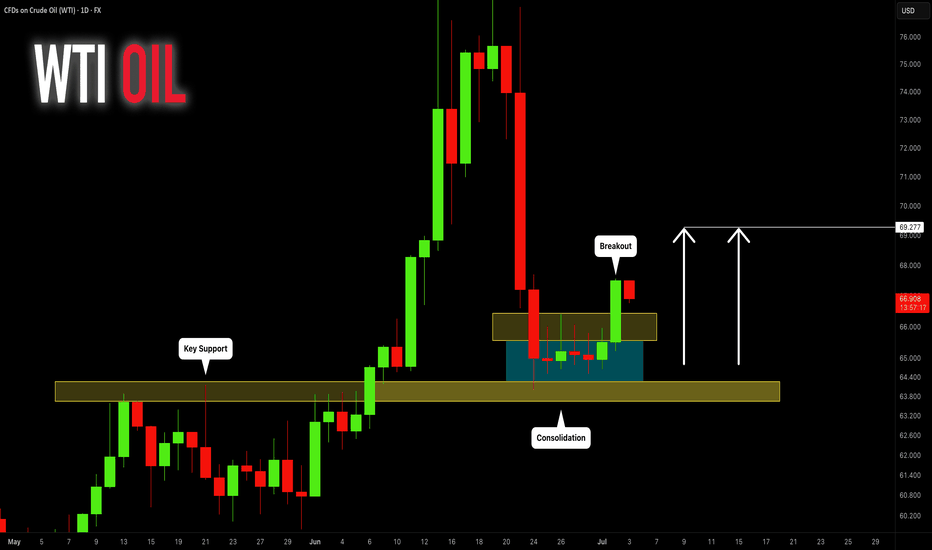

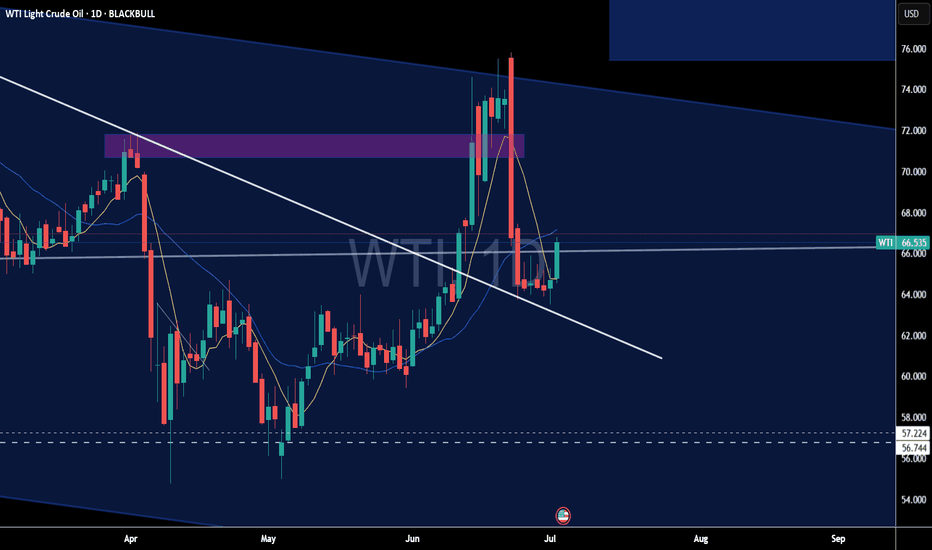

CRUDE OIL (#WTI): Consolidation is Over

📈Crude Oil was consolidating for 6 trading days in a row

after a test of a key daily support.

The yesterday's Crude Oil Inventories data made the market bullish

and the price successfully violated a minor resistance of a sideways movement.

We can expect that the market will grow more.

Next resistance - 69.27

—————————

Daily time frame

—————————

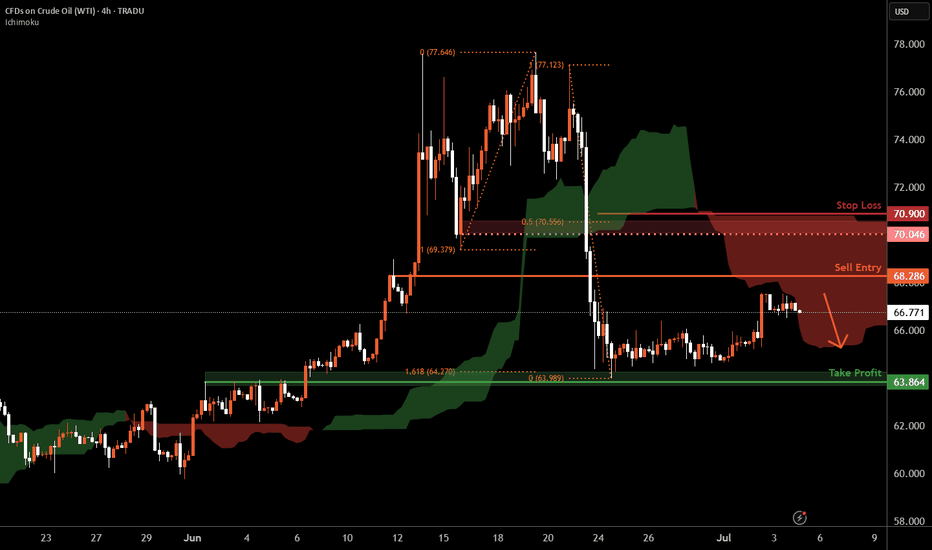

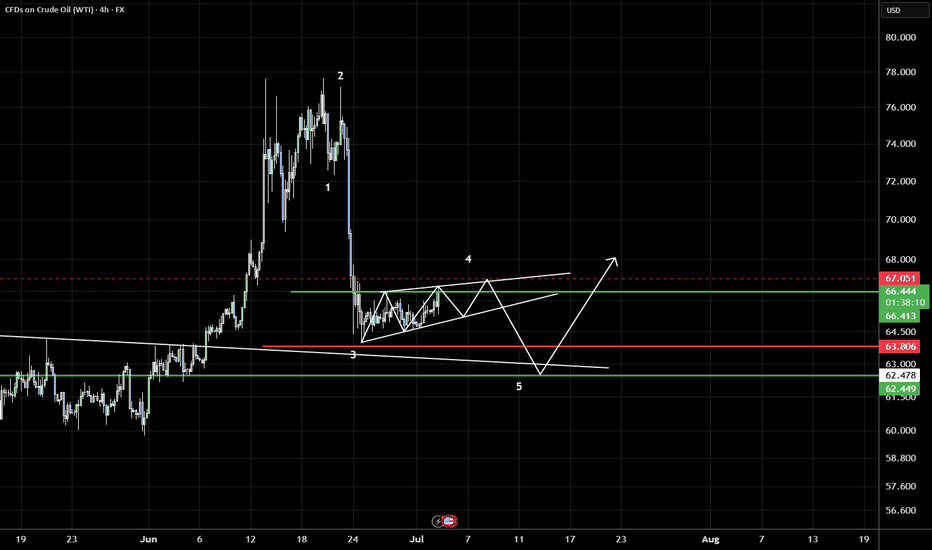

WTI Oil H4 | Potential bearish reversalWTI oil (USOIL) could rise towards a pullback resistance and potentially reverse off this level to drop lower.

Sell entry is at 68.28 which is a pullback resistance.

Stop loss is at 70.90 which is a level that sits above the 50% Fibonacci retracement and a pullback resistance.

Take profit is at 63.86 which is a pullback support that aligns closely with the 161.8% Fibonacci extension.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Crude oil moves up alternately during the day

💡Message Strategy

WTI crude oil prices snapped a three-day winning streak and were trading around $66.00 a barrel in early European trading Thursday. Crude oil prices fell as rising U.S. crude inventories heightened concerns about weak demand in the United States, the world's largest oil consumer.

📊Technical aspects

From the daily chart level, crude oil fluctuates upward in the medium term and tests around 78. The K-line closes with a large real negative line, which has not yet destroyed the moving average system and is still supported. The medium-term objective upward trend remains unchanged.

However, from the perspective of momentum, the MACD indicator crosses downward above the zero axis, indicating that the bullish momentum is weakening. It is expected that the medium-term trend of crude oil will fall into a high-level oscillation pattern.

The short-term trend of crude oil (4H) fluctuated and consolidated for two trading days. The oil price repeatedly crossed the moving average system, and the objective trend direction fluctuated. From the perspective of the primary and secondary rhythms, the current rhythm is a secondary oscillation rhythm. According to the law of primary and secondary alternation, the subjective trend still maintains an upward direction. In terms of momentum, there are signs of weakening upward momentum, and it is expected that the crude oil trend will continue to be mainly upward.

💰Strategy Package

Long Position:65.50-66.00,SL:64.50,Target:69.00-70.00

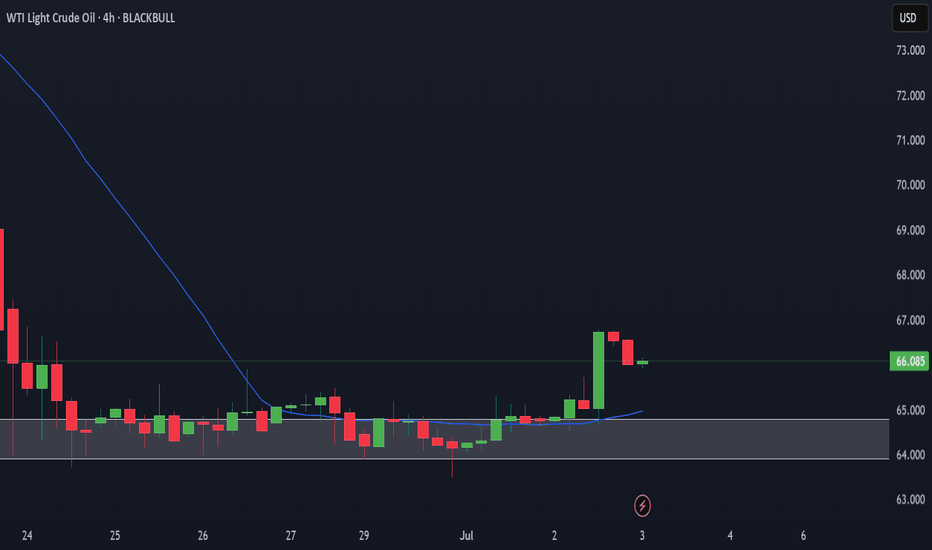

Market next move ❗ Disrupted Market Outlook:

⚠️ False Breakout Risk:

The recent "Breakout" above previous highs may be a bull trap. Although price surged, the follow-up candles are showing lower highs, suggesting weakening bullish momentum.

📉 Bearish Divergence (not shown but likely):

Based on the price action, there's a potential bearish divergence with RSI/MACD (if overlaid), as price makes higher highs while momentum likely weakens.

🔄 Resistance Reversal Zone:

The area labeled as "Support area" at the top (near $67.50) is actually acting as resistance again — the market is failing to hold above this level.

🔁 Retest Failure:

After the breakout, price failed to establish strong support and is consolidating below the highs, hinting at a potential breakdown below $66.

---

🔻 Disruption Path:

1. Drop to $66.00 - immediate pullback from failed breakout.

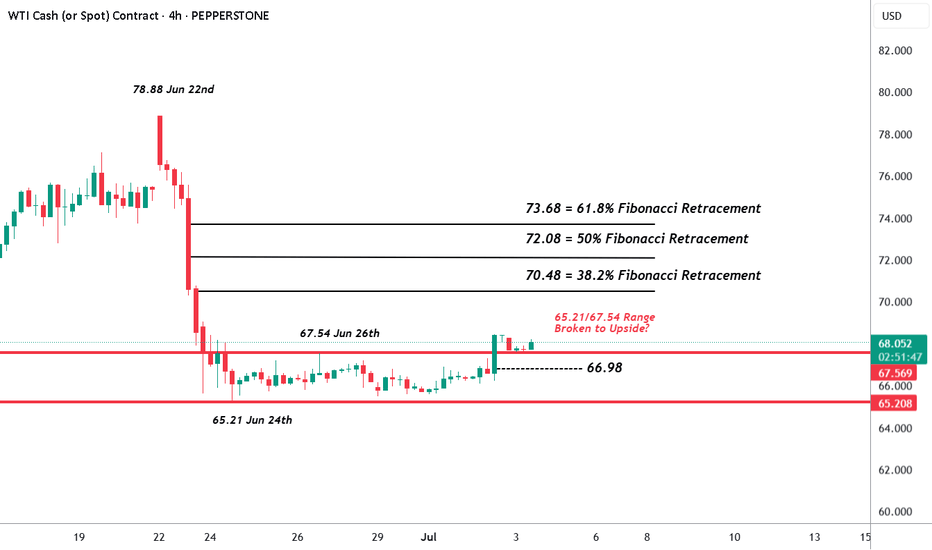

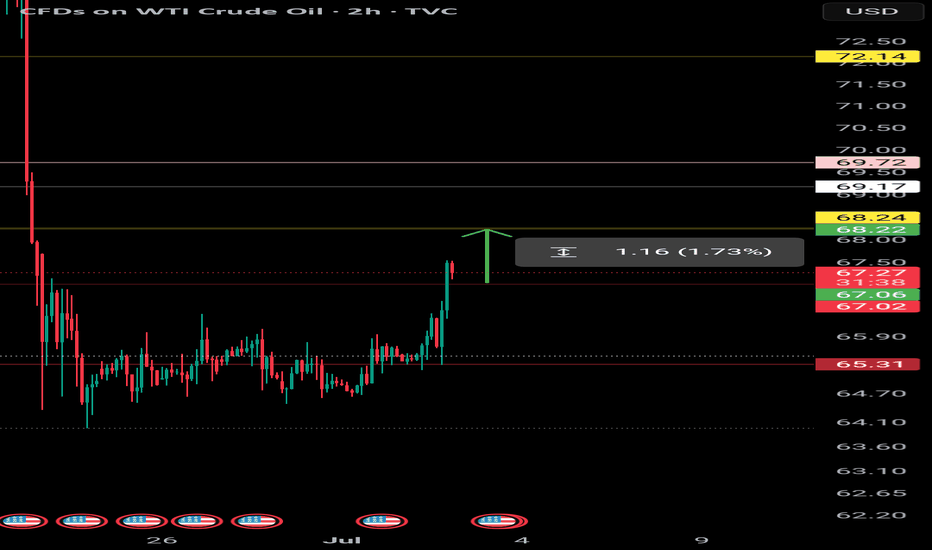

Oil (WTI) – Preparing for Potential Fresh VolatilityThe price of Oil (WTI) fell dramatically last week, from a high of 78.88 on Monday June 23rd to a low of 65.21 on Tuesday June 24th, as a ceasefire was first agreed and then held between Israel and Iran. This shifted the focus for traders back to US trade talks and looming tariffs, the direction of US economic growth and the potential for another OPEC+ production increase. Although, it must be said that nervousness about the sustainability of the ceasefire is still drawing the focus of traders this week and may continue to do so.

In terms of trade, Oil prices jumped higher yesterday as a trade deal between the US and Vietnam was announced, but the question remains, could this rally be short lived?

President Trump stated on Tuesday that he doesn’t expect to delay his July 9th tariff deadline, which could see higher import penalties reimposed on key trading partners, such as Japan and the EU. While it seems that traders may still be unsure whether he really means this, any potential impact on Oil prices could increase the closer we move to the deadline.

Today’s data releases could provide some key insights into the health of the US economy, with Non-farm payrolls released at 1330 BST and the US ISM Services PMI due at 1500 BST. Traders expect jobs growth to continue to moderate, so any bigger downside surprises could increase Oil price volatility, and the direction of service activity (bars, restaurants etc), the main driver of US growth for many months, may also be crucial for sentiment. Traders may be watching for whether there has been any major deterioration in this services PMI reading, back towards, or below 50, which is the dividing line between economic contraction and expansion.

Then, Sunday’s (July 6th) OPEC+ meeting, where the group is expected to agree to an August supply increase for a fourth month in a row, moves into focus. Depending on this OPEC+ decision and any tariff or geo-political developments over the weekend, Oil prices could potentially open up at very different levels on Monday morning.

Technical Update: Breaking Higher From Range?

Following the aggressive sell-off in the price of Oil from the 78.88 June 22nd high into the 65.21 June 24th low, a period of stability materialised as traders assessed the developing geo-political backdrop.

This saw price activity held by support offered by the 65.21 price low and resistance by the 67.54 June 26th high. However, as the 4 hourly chart above shows, the latest activity has now seen prices move out of this range, with a closing break above the previous 67.54 high.

While a break higher from such a sideways range in price is not a guarantee of continued upside, traders may now be viewing this type of activity as reflecting potential for a more extended phase of price strength.

Next Possible Resistance Levels.

If further price strength is to emerge, it might now suggest possibilities to test the 70.48 level, which is equal to the 38.2% Fibonacci retracement of the June 22nd to June 24th decline.

Closing breaks above this resistance may then lead to further attempts at price strength towards 72.08, which is the higher 50% retracement level.

Next Possible Support Levels

While some traders might view a move back into the old sideways price range, which would be represented by closes back under the 67.54 recent high, as marking the possibility of increasing downside pressure again, it might in fact be breaks under the 66.98 level, which is equal to half latest strength, that indicates the potential of further price declines.

Such downside closing breaks may well suggest potential to retest the 65.21 June 24th low trade, possibly further if this in turn gives way.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

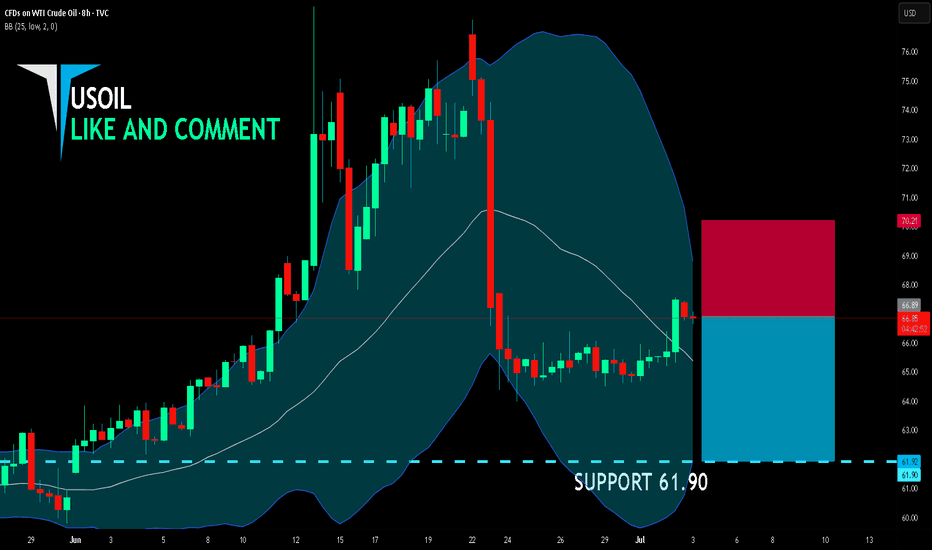

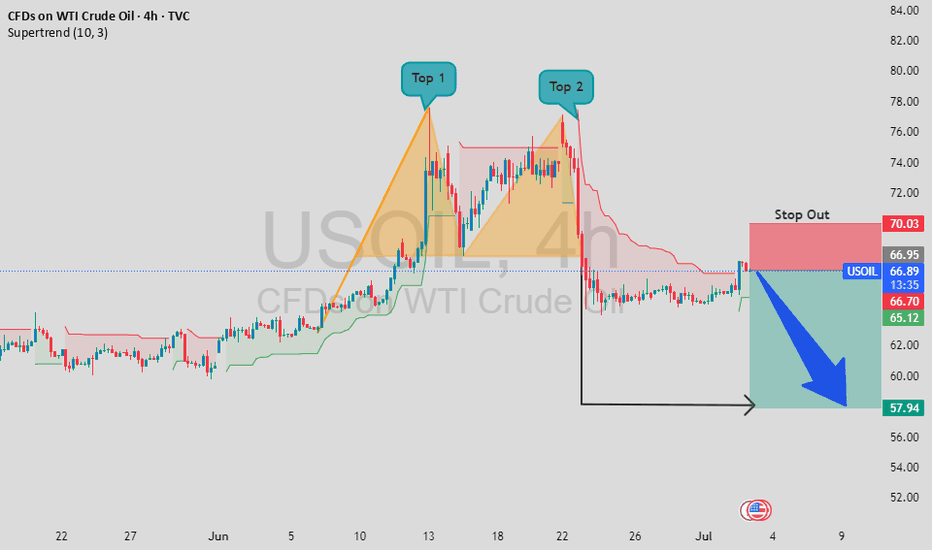

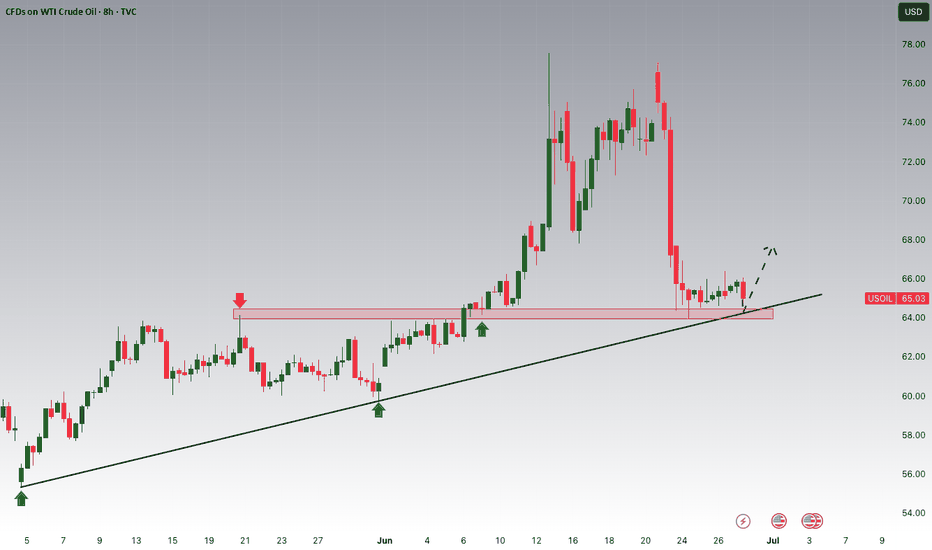

USOIL BEARS ARE GAINING STRENGTH|SHORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 66.89

Target Level: 61.90

Stop Loss: 70.21

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 8h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CRUDE OIL (WTI): Consolidation is Over

Crude Oil was consolidating for 6 trading days in a row

after a test of a key daily support.

The yesterday's Crude Oil Inventories data made the market bullish

and the price successfully violated a minor resistance of a sideways movement.

We can expect that the market will grow more.

Next resistance - 69.27

❤️Please, support my work with like, thank you!❤️

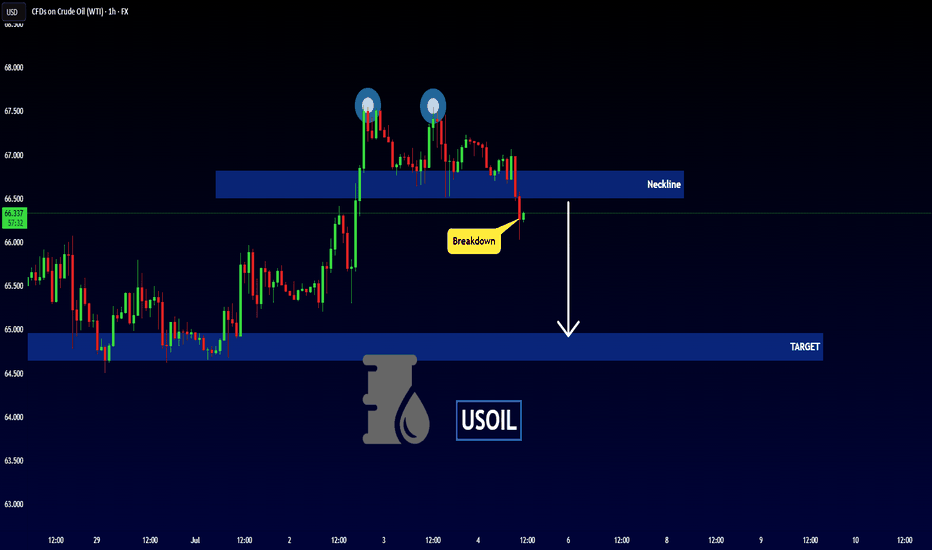

USOIL Double Top Breakdown | Short Setup Alert!USOIL Double Top Breakdown | Short Setup Alert!

Hey traders! A classic Double Top pattern has formed on the 4H USOIL chart (Top 1 & Top 2), signaling a potential trend reversal. After breaking the neckline, price action confirms bearish momentum. The stop-out level is clearly marked at 70.00 , while the target zone is set around 58.00. This setup offers a great risk-reward ratio.

📍 Supertrend also aligns with bearish confirmation.

💬 Drop your thoughts in the comments section – let's discuss the trade!

❤️ If you find this helpful, don’t forget to support with a like and follow!

Stay sharp and trade safe!

DON'T TRADE THE NOISE - Trade what the chart is telling you!All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

tradingview.sweetlogin.com

USOIL is Nearing the Daily TrendHey Traders, in tomorrow's trading session we are monitoring USOIL for a buying opportunity around 64.30 zone, USOIL is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 64.30 support and resistance area.

Trade safe, Joe.

Sudden Oil Spike - what you need to know!Iran suspended cooperation with the U.N. nuclear watchdog, amid a surprise build in US crude inventories.

Iran’s move added a modest risk premium to prices, though analysts noted that no actual supply disruptions have occurred.

$66 is a key level for WTI crude to hold above.

If it can maintain this area, we will likely see higher price. $66 is a multi year trendline of support going back to 2021.

Energy stocks / XLE basket is showing some bullish divergence, perhaps indicating this oil move has legs.

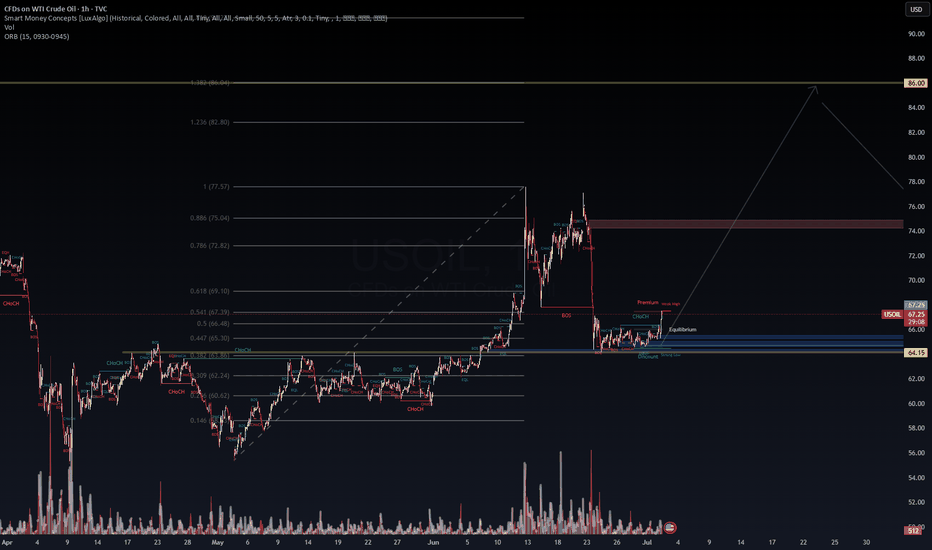

WTI Surge Incoming? $67 Base Could Launch Prices Toward $86Wavervanir_Intl created with TradingView.com, Jul 02, 2025 12:27 UTC‑7

CFDs on WTI Crude Oil · 1h · TVC 67.26 H67.41 L67.26 C67.27 +0.02 (+0.02%)

---

**🎯 Short‑Term Outlook (1 h)**

• Price rebounding from demand zone at $64.15 & equilibrium

• Break of 0.447–0.5 fib (~65.30–66.48) → targeting 70.00 then 72.82

• Entry: 67.30–67.50 | SL: <65.50 | TP1: 70.00 | TP2: 72.80

**📊 Mid‑Term (Daily/Weekly)**

• Weekly Heikin‑Ashi confirms bullish reversal, testing long-term resistance near $74–76

• Breakout clears range → potential extension to $86 (1.382 fib)

• If rejected → expect pullback to 67–70 base zone

**⚠️ Macro Catalysts & Risk**

• Bullish from inventory draws & Middle East tensions

• Upcoming OPEC+ July 6 meeting could shift supply dynamics

**🏁 Summary**

- Play for short‑term lift to fib targets

- Monitor mid‑term breakout above ~$75.60 for extended rally

- Place stops below structured support for controlled risk

Stay agile—conditions remain fluid with macro implications in control.

#Oil #WTI #Fib #Demand #Supply #OPEC #WaverVanir

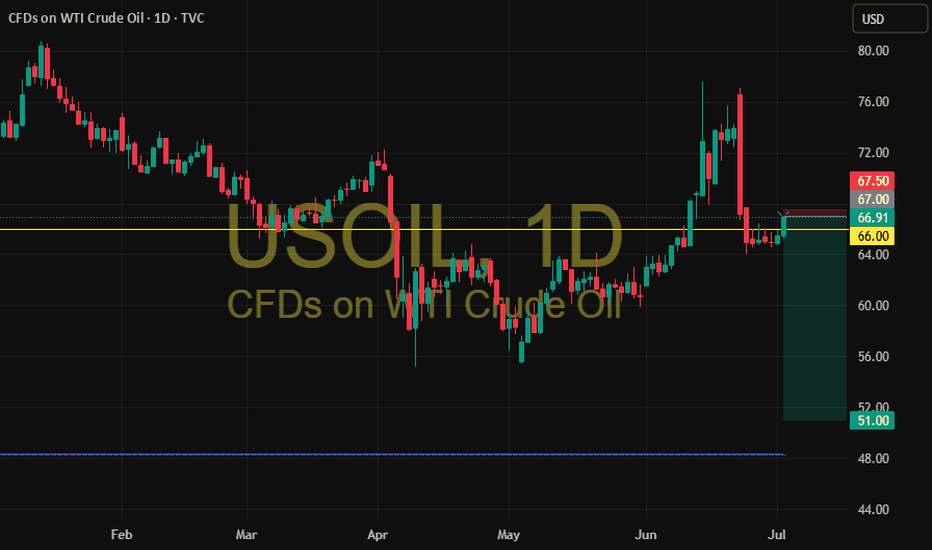

Classic Bear Flag on Oil 🚩 Classic Bear Flag on Oil 🛢

A textbook bear flag has formed on the oil chart:

📏 Flagpole: From $77 down to $64 – a move of 13 points

📉 If price breaks below the lower support of the flag:

🎯 Target = $64 − $13 = $51

⚠️ This sets a bearish target at $51,

assuming momentum continues and there's no invalidation.

usoil 67

sl 67.5

tp1 66

tp2 65.5

tp3 65

tp4 64.5

tp5 open