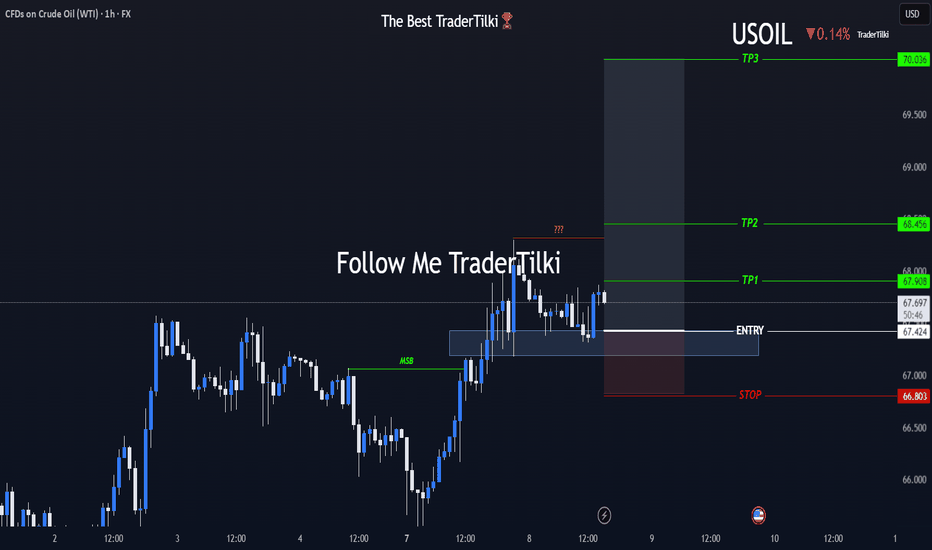

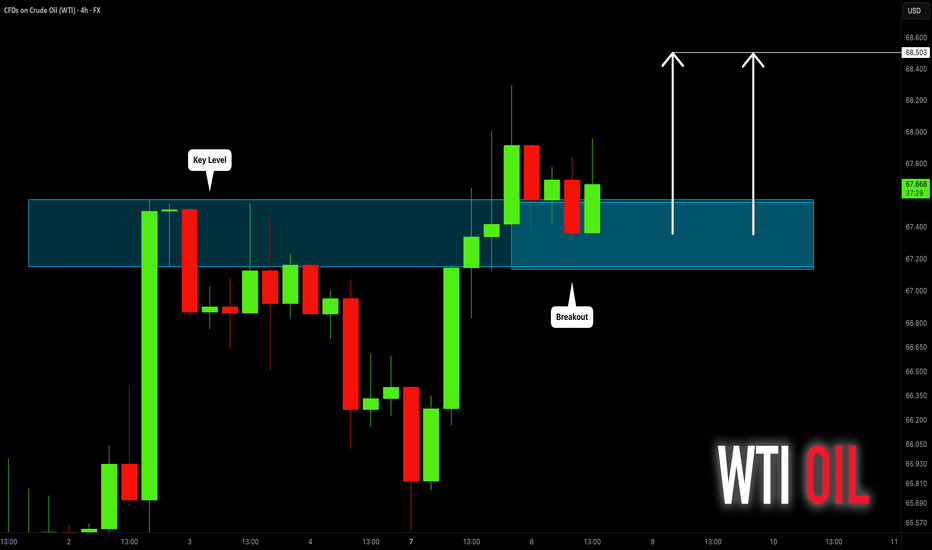

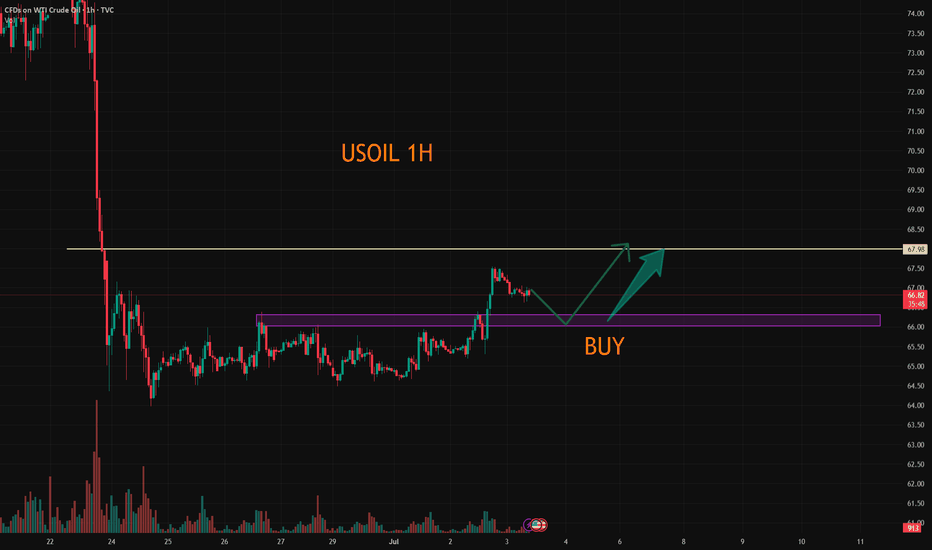

Strong USOIL Setup: Long from Support + 4.34 R/RHey Guys, hope you're all doing well!

I've placed a limit buy order on USOIL from a key support level. Below are the relevant levels for your reference:

- 🔵 Entry Level: 67.424

- 🔴 Stop Loss: 66.803

- 🟢 Target 1 (TP1): 67.908

- 🟢 Target 2 (TP2): 68.456

- 🟢 Target 3 (TP3): 70.036

📊 Risk/Reward Ratio: 4.34

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone who shows love and appreciation! 🙏

USOUSD trade ideas

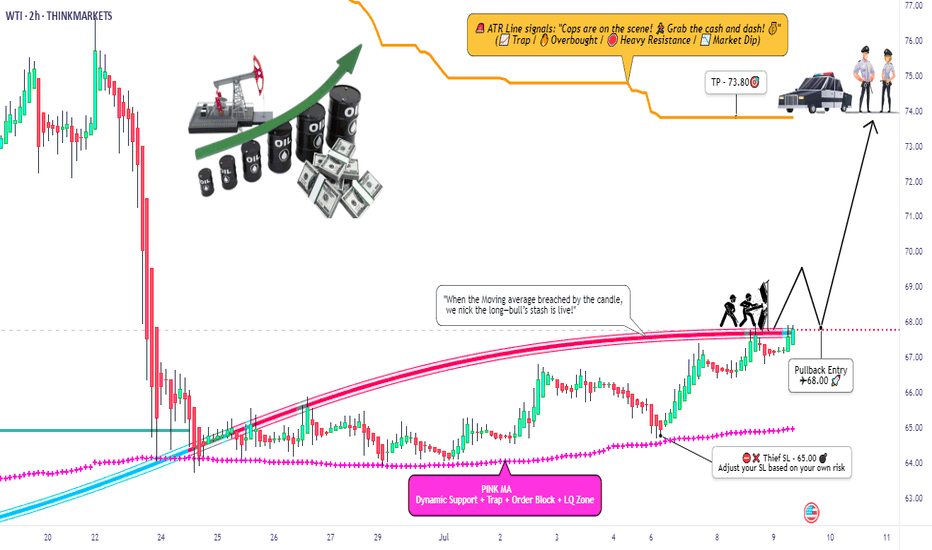

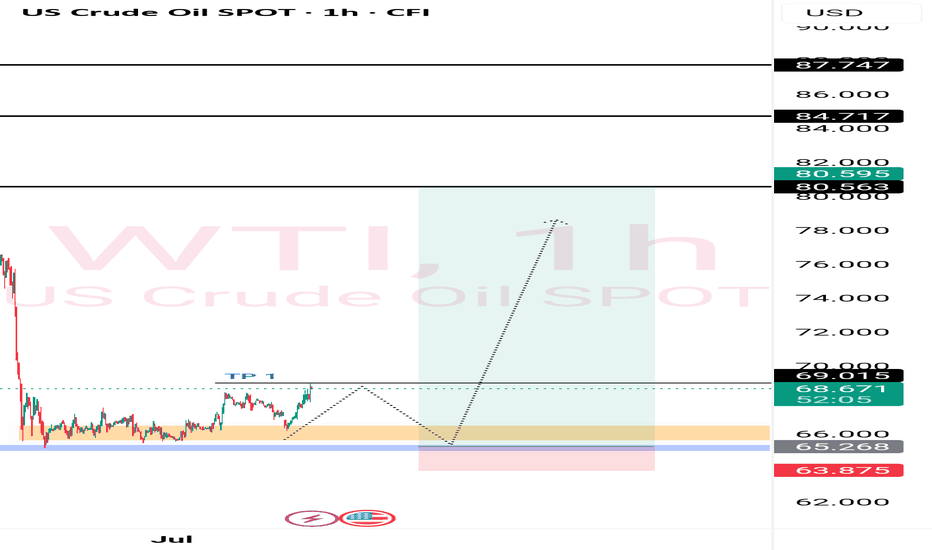

WTI Oil Heist: Bullish Breakout Plan for Big Gains!🚨 Ultimate WTI Oil Heist Plan: Bullish Breakout Strategy for Big Profits! 🚀💰

🌟 Hello, Wealth Chasers & Market Mavericks! 🌟

Hola, Bonjour, Hallo, Marhaba! 🗺️

Get ready to execute the Ultimate WTI / US Oil Spot Heist using our 🔥 Thief Trading Style 🔥, blending sharp technicals with powerful fundamentals! 📈💡 This swing trade plan targets the energy market’s bullish potential, but stay sharp—volatility lurks! 🚨 Follow the chart setup for a long entry, and let’s aim for those juicy profits while dodging the high-risk ATR zone where the market “police” might trap overzealous traders. 🏦⚠️

📊 The Heist Plan: WTI / US Oil Spot (Swing Trade)

Entry 📈:

The breakout is your signal! 🎯 Wait for the Moving Average crossover and a confirmed pullback at $68.00 on the 2H timeframe. Once it triggers, go long and ride the bullish wave! 🐂 Set an alert to catch the breakout in real-time. 🚨

Stop Loss 🛑:

Protect your capital like a pro! 💪 Place your stop loss below the recent swing low at $65.00 (2H timeframe, candle body wick). Adjust based on your risk tolerance, lot size, and number of positions. Rebels, beware—straying too far from this level could burn you! 🔥

Target 🎯:

Aim for $73.80 or exit early if momentum fades. Scalpers, stick to long-side trades and use a trailing stop to lock in gains. 💰 Swing traders, follow the plan and secure profits before the market consolidates or reverses. 🏴☠️

📊 Market Context & Key Drivers

The WTI / US Oil Spot market is currently consolidating with a bullish bias 🐂, driven by:

Fundamentals: Check macroeconomic data, seasonal trends, and intermarket correlations. 📉

COT Report: shows net-long positions increasing, signaling bullish sentiment. 📅

Sentiment & Quantitative Analysis: Market mood leans positive, but overbought risks loom near the ATR zone. ⚠️

Stay informed! 📰 Monitor news releases, as they can spike volatility. Avoid new trades during major announcements and use trailing stops to protect open positions. 🔒

📊 Pro Tips for the Heist

Scalpers: Go long with tight trailing stops to safeguard profits. 💸

Swing Traders: Stick to the plan, adjust stops based on risk, and exit before the high-risk ATR zone ($73.80+). 🚪

Risk Management: Never risk more than you can afford. Tailor your lot size and stop loss to your account size. 🛡️

Stay Updated: Market conditions shift fast—keep an eye on fundamentals and sentiment to stay ahead. 👀

📊 Why Join the Heist?

This Thief Trading Style plan is your ticket to navigating the WTI market with confidence! 💪 Boost this idea to strengthen our trading crew and share the wealth-making vibe. 🚀💥 Like, follow, and stay tuned for more high-octane strategies! 🤑🐱👤

Disclaimer: This is a general market analysis, not personalized investment advice. Always conduct your own research and consider your risk tolerance before trading. Markets are dynamic—stay vigilant and adapt to new developments. 📡

Let’s make this heist legendary! 🌟💰 See you at the next breakout! 🤝🎉

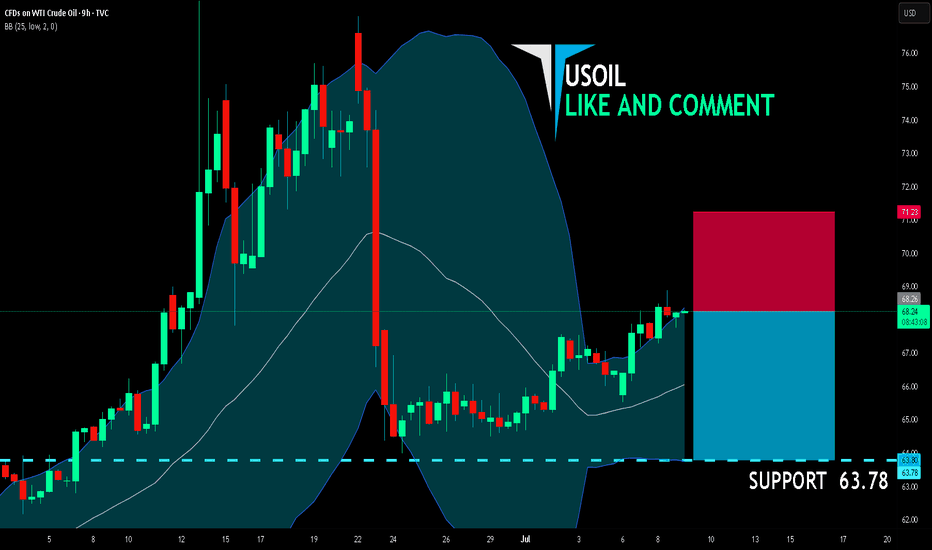

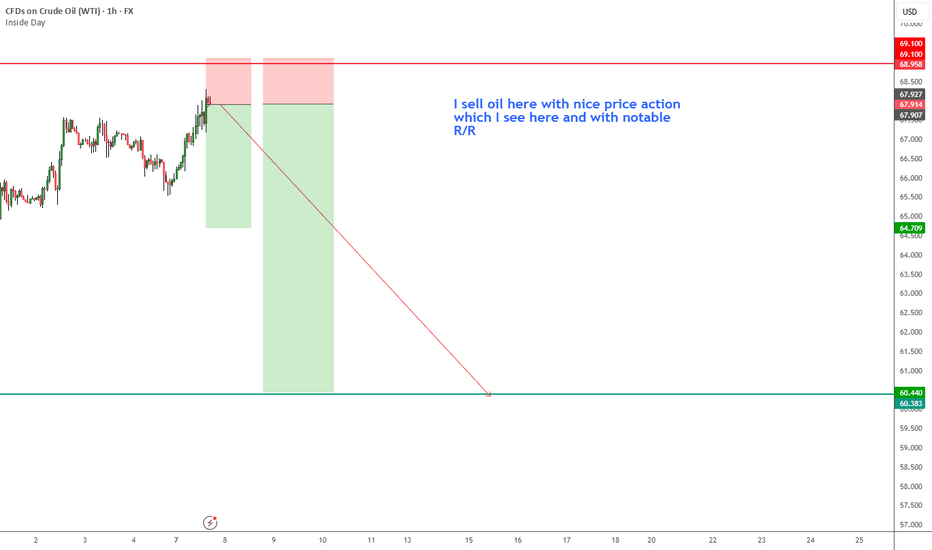

USOIL BEST PLACE TO SELL FROM|SHORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 68.26

Target Level: 63.78

Stop Loss: 71.23

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

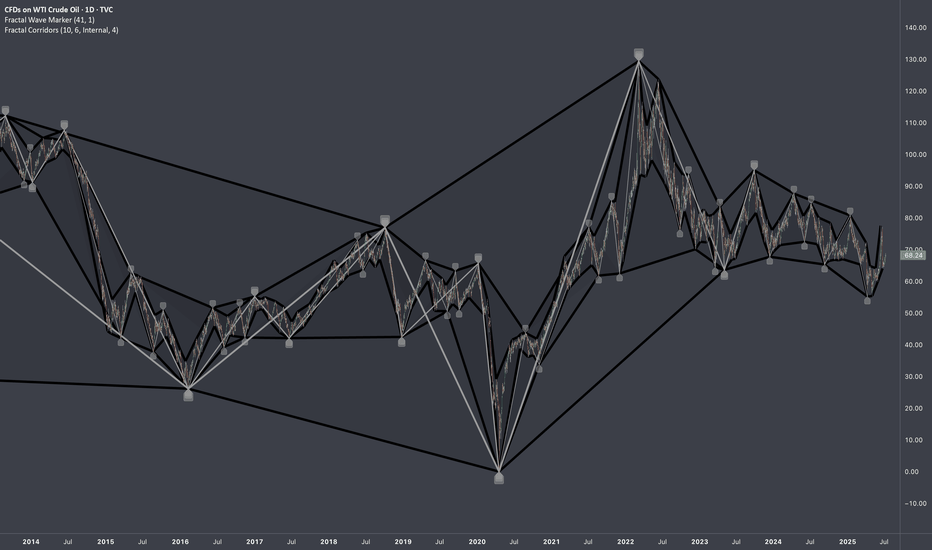

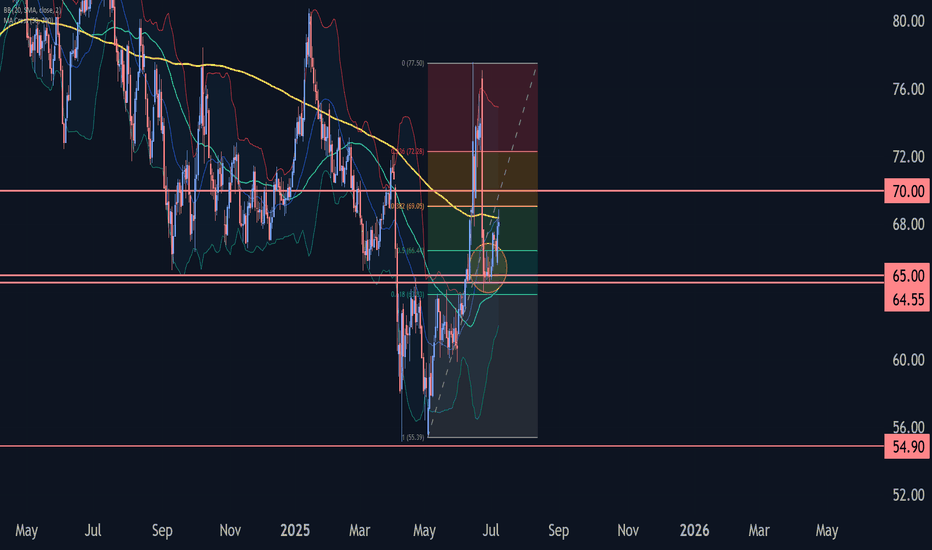

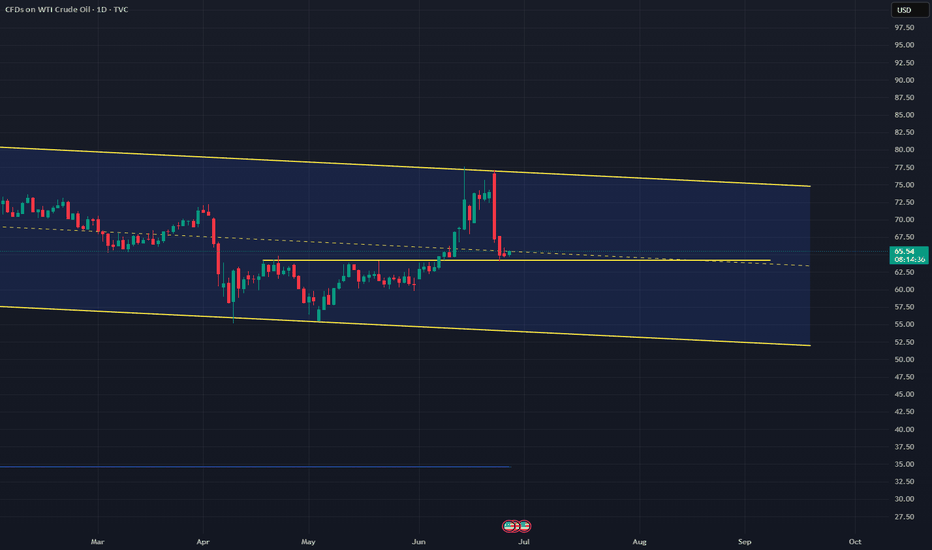

Crude Oil Eyes 3-Year Resistance Once AgainWTI has rebounded cleanly from the neckline of an inverted head-and-shoulders pattern—formed ahead of the June Middle East conflict—establishing a strong support zone above $63.40.

Prices are currently trading above $67. A sustained hold above this level could target $69 and $72, aligning with the upper edge of the 3-year declining channel. A confirmed breakout above $72 may extend gains toward $78, $80, $84, and $88 respectively.

On the downside, a close below $63.80 may trigger renewed selling pressure toward $60, $58, and $56—within the mid-zone of the broader down trending channel.

- Razan Hilal, CMT

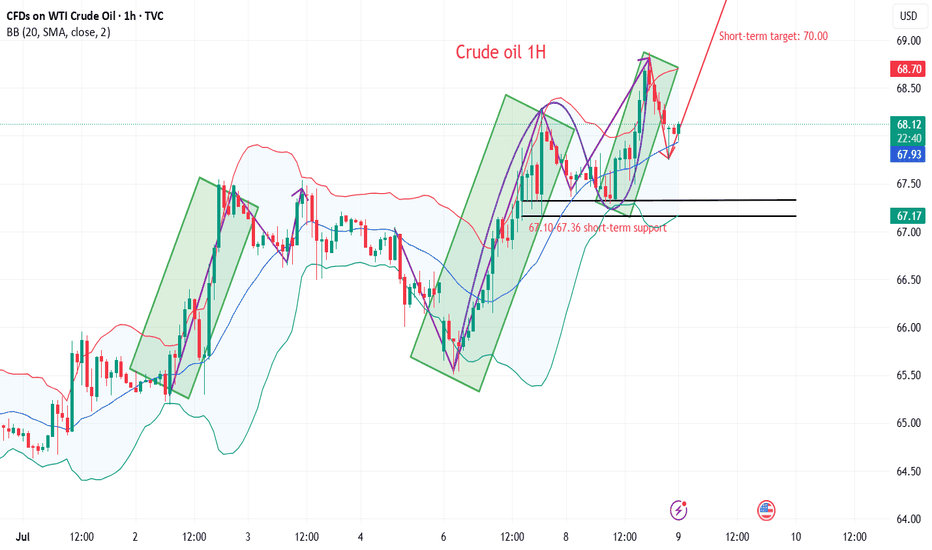

Crude oil shock trend direction

💡Message Strategy

During the European trading session on Monday, the West Texas Intermediate (WTI) crude oil futures on the New York Mercantile Exchange recovered the previous losses and rebounded to around $67.50 per barrel. Although OPEC+ confirmed that the increase in oil production in August will be higher than expected, oil prices still rebounded.

From the daily chart level, the medium-term trend of crude oil fluctuated upward and tested around 78. The K-line closed with a large real negative line, which has not yet destroyed the moving average system and is still supported. The medium-term objective upward trend remains unchanged. However, from the perspective of momentum, the MACD indicator crosses downward above the zero axis, indicating that the bullish momentum is weakening. It is expected that the medium-term trend of crude oil will fall into a high-level oscillating upward pattern.

📊Technical aspects

The short-term (1H) trend of crude oil failed to continue to hit a new low and showed a rebound rhythm. The oil price crossed the moving average system, and the short-term objective trend entered a transition period. From the perspective of momentum, the MACD indicator crossed the zero axis, and the red column indicated that the bullish momentum was sufficient. At present, the price is running in a wide range, with a range of 65.50-67.80. It is expected that the trend of crude oil will repeatedly test the upper edge of the range within the range.

💰Strategy Package

Long Position:67.00-67.50,SL:65.50,Target:70.00

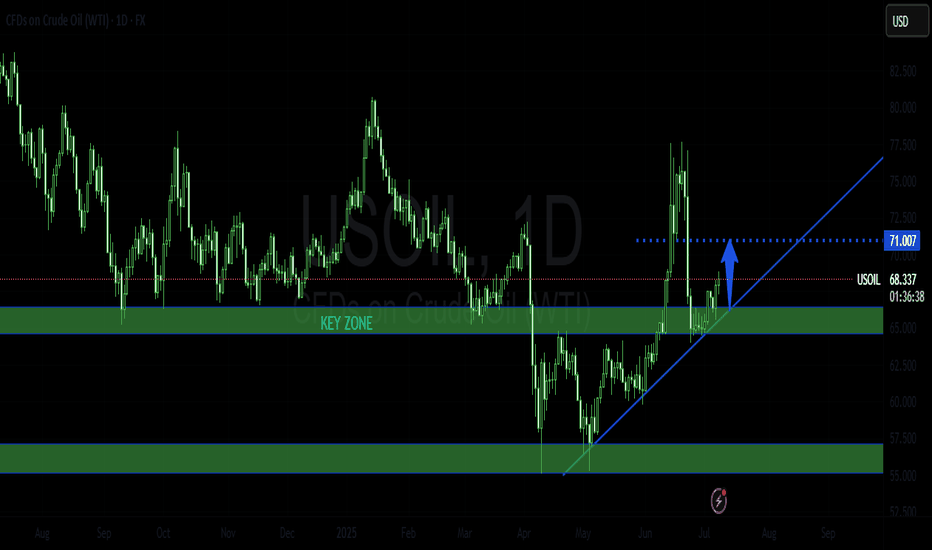

WTI crude oil Wave Analysis – 8 July 2025- WTI crude oil reversed from the support zone

- Likely to rise to resistance level 70.00

WTI crude oil recently reversed up from the support zone located between the key support level 64.55 (former resistance from the end of April), the lower daily Bollinger Band and the 61.8% Fibonacci correction of the upward impulse from May.

The upward reversal from this support zone started the active medium-term ABC correction (2).

WTI crude oil can be expected to rise to the next round resistance level 70.00 (target price for the completion of the active impulse wave i).

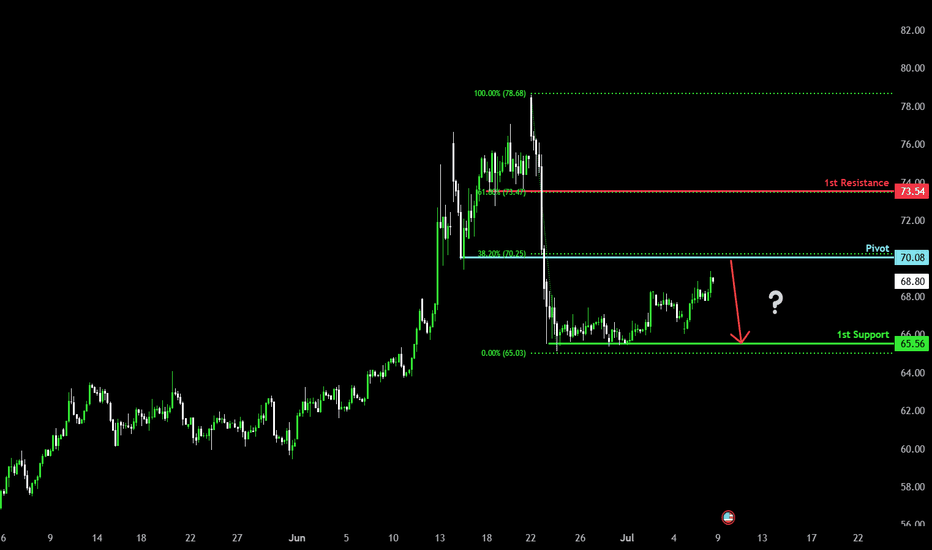

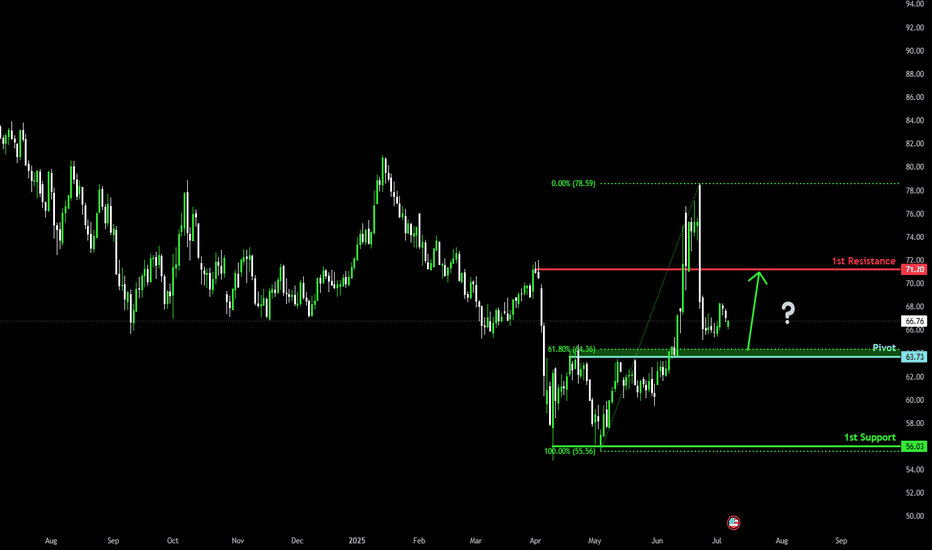

Bearish reversal off 38.2% Fibonacci resistance?WTI Oil (XTI/USD) is rising towards the pivot and could reverse to the 1st support which is a pullback support.

Pivot: 70.08

1st Support: 65.56

1st Resistance: 73.54

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

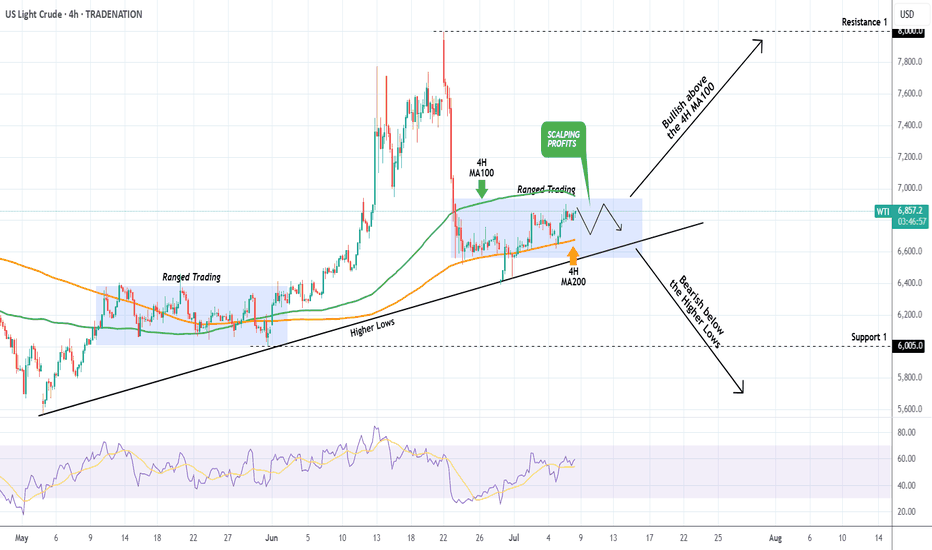

WTI OIL Best scalping opportunity at the moment!WTI Oil (USOIL) has been consolidating inside a ranged trading set-up, with the 4H MA100 (green trend-line) as its Resistance and the 4H MA200 (orange trend-line) as its Support.

We saw this previously from May 13 to June 01 and it presents the best scaling opportunity in the market at the moment. That previous Ranged Trading pattern eventually broke upwards as the Higher Lows trend-line held.

As a result, after you get your scalping profits within this range, look for a clear break-out above the 4H MA100 (candle closing) in order to go long (Resistance 1) or a break-out below the Higher Lows (candle closing) in order to go short (Support 1).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

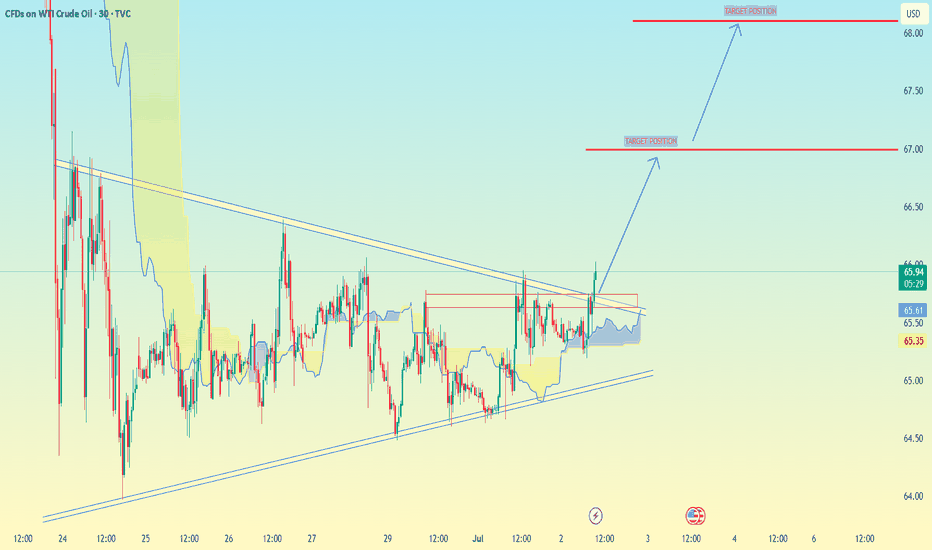

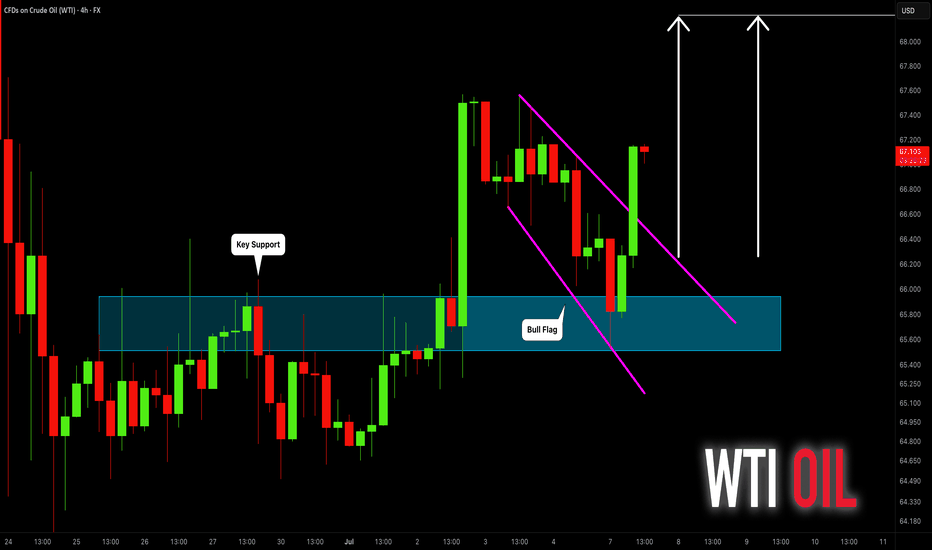

(WTI Crude Oil) on the 30-minute timeframe:(WTI Crude Oil) on the 30-minute timeframe:

You have a clear triangle breakout happening.

The chart shows two bullish target positions marked with blue arrows.

Based on your chart:

Current Price Zone: Around 66.20 - 66.25

Target Levels:

✅ First Target: 67.00

✅ Second Target: 68.00 - 68.10

---

Summary Trading Idea:

Breakout above resistance trendline confirmed.

First resistance and partial target at 67.00

Final target near 68.00 - 68.10, where the next significant resistance lies.

Let me know if you want stop-loss suggestions or a detailed entry strategy.

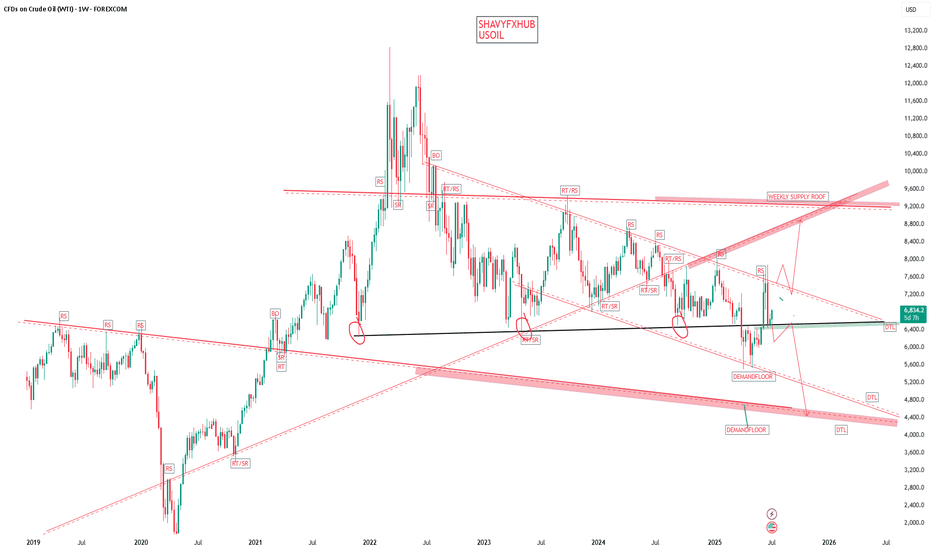

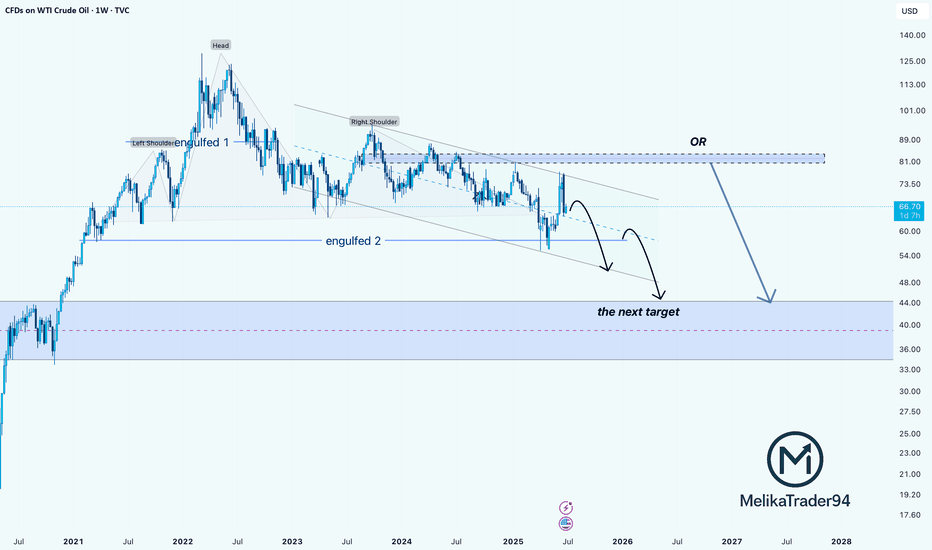

WTI Crude Oil: Double Engulf + H&S Breakdown Points to $40Hello guys! Let's dive into WTI!

The weekly chart of WTI Crude Oil reveals a bearish Head & Shoulders pattern playing out over a long-term descending channel. Price recently got rejected from the upper trendline, showing weakness despite a short-term bounce.

- Engulfed 1 & 2:

Two major engulfing zones failed to hold as support, turning into strong resistance.

- Bearish Scenario in Play:

After the recent upside move into resistance, price is likely to follow one of two paths:

- Continuation Within the Channel:

Rejection from the upper bound of the descending channel leads to a stair-step decline toward the $47–52 zone.

- Final Rejection from Supply Zone ($83–89):

A larger corrective push could test this area before a full collapse toward the long-term demand zone.

Main Target:

The blue shaded region ($36–47) stands out as a strong long-term demand zone, where buyers may finally step in.

____________________

Invalidation point:

Unless crude oil breaks above the $89 zone with strong volume, all signs point to further downside.

The chart structure favors a slow bleed with temporary bounces, ultimately targeting the $40s.

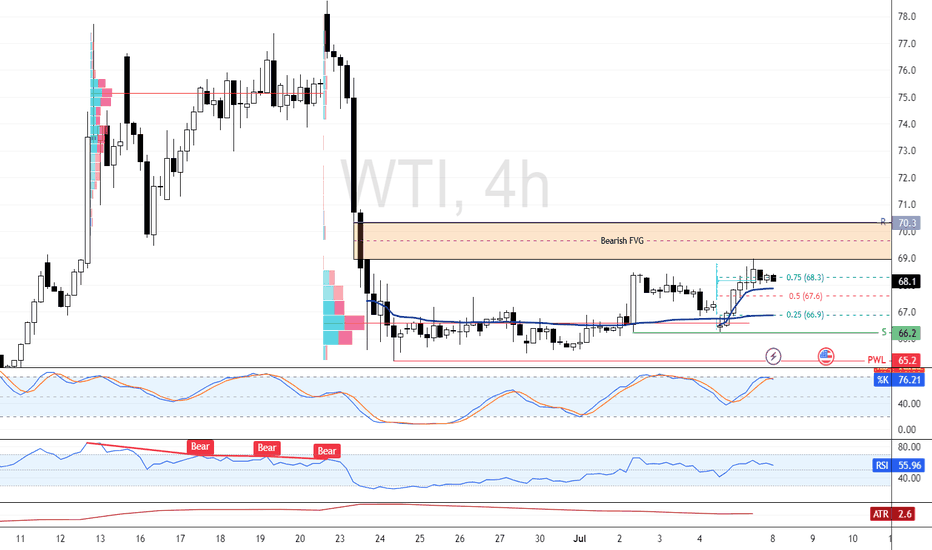

Momentum Cools as Oil Eyes Reentry From $67.6FenzoFx—Crude Oil bounced from $66.2, a support backed by the volume profile point of interest, but lost momentum after hitting the bearish FVG.

Currently trading near $68.2 with Stochastic overbought. A pullback to $67.6 can offer a low-risk reentry. The bullish bias remains intact above $65.2, with $70.3 as the next target.

Crude oil continues to fluctuate upward

💡Message Strategy

OPEC+, led by Asian countries, announced on Saturday that it would increase production by an additional 548,000 barrels per day from next month, more than 30% higher than market expectations of 411,000 barrels per day, accelerating the pace of resumption of production after the production cuts in 2023.

In addition to supply-side factors, demand prospects are also affected by trade concerns. U.S. Commerce Secretary Howard Lutnick said that the country-specific tariffs that the Trump administration intends to implement will officially take effect on August 1, later than the previously scheduled July 9, leaving trading partners with a short breathing space.

Market concerns about the impact of this policy on crude oil consumption have intensified, especially among importing countries, mainly Asian countries.

Confidence in the Asian market remains, and Saudi Arabia raises prices to Asia

Despite the increase in supply, OPEC+ still emphasized in its statement that "the global economic outlook is stable and the market fundamentals are healthy." As a signal of confidence, Saudi Arabia has raised the prices of major crude oil varieties for Asian customers, indicating that it believes that the Asian market has the ability to absorb additional supply.

According to OPEC+ representatives, the alliance will consider whether to increase supply by another 548,000 barrels per day in September at its next meeting on August 3, thereby fully restoring the 2.2 million barrels per day quota cut last year.

📊Technical aspects

From the daily chart level, crude oil fluctuates upward and tests around 75 in the medium term. The K-line closes with a large real negative line, which has not yet destroyed the moving average system and is still supported. The medium-term objective trend remains upward. However, from the perspective of momentum, the MACD indicator crosses downward above the zero axis, indicating that the bullish momentum is weakened. It is expected that the medium-term trend of crude oil will fall into a high-level oscillation pattern.

After the short-term (4H) trend of crude oil fluctuates and consolidates, it turns into an upward rhythm. The moving average system is arranged in short positions, and the short-term objective trend is upward. The MACD indicator fast and slow lines cross the zero axis, and the bullish momentum is full. It is expected that the crude oil trend will continue to rise after a slight rebound during the day.

💰Strategy Package

Long Position:66.00-67.00,SL:65.00,Target:69.00-70.00

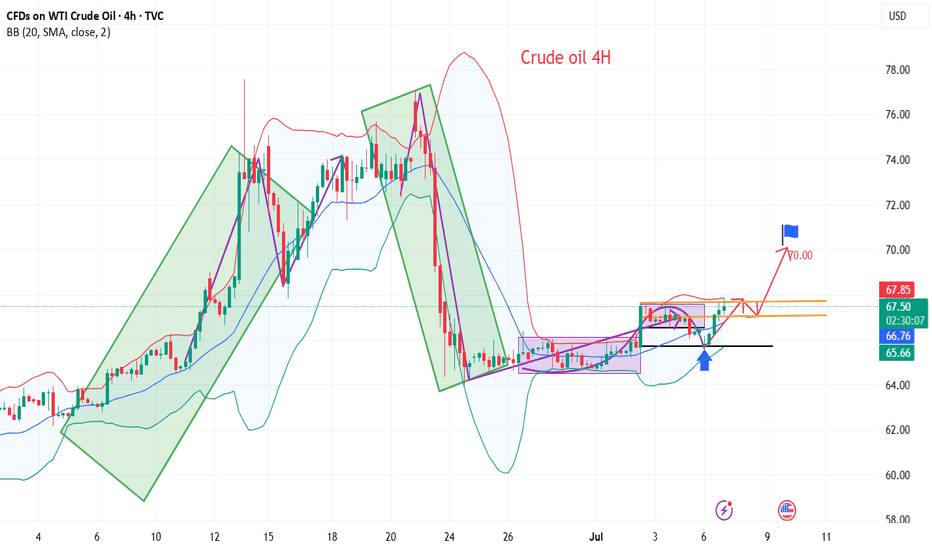

CRUDE OIL (WTI): Move Up Ahead!

Last week, I already shared a bullish setup on WTI Crude Oil

on a daily time frame.

I see a strong intraday bullish confirmation today.

After a test of an underlined blue support area,

the price went up strongly and violated a resistance line

of a bullish flag pattern on a 4H time frame.

The market is going to rise more.

Goal - 68.2

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL:Today's Trading Strategy

Oil prices have signs of upward breakthrough at present, yesterday's trend broke the short - term narrow range of shock range, on the idea of retracting to do more. The more appropriate long point is 66-66.3, if short, the more appropriate point is 67-67.4, but the short position is recommended not to be too heavy, not to do less than the point.

Trading Strategy:

SELL@67-67.4

TP: 66-66.3

BUY@66-66.3

TP: 67.5-68

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

Falling towards pullback support?WTI Oil (XTI/USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 63.73

1st Support: 56.03

1st Resistance: 71.20

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

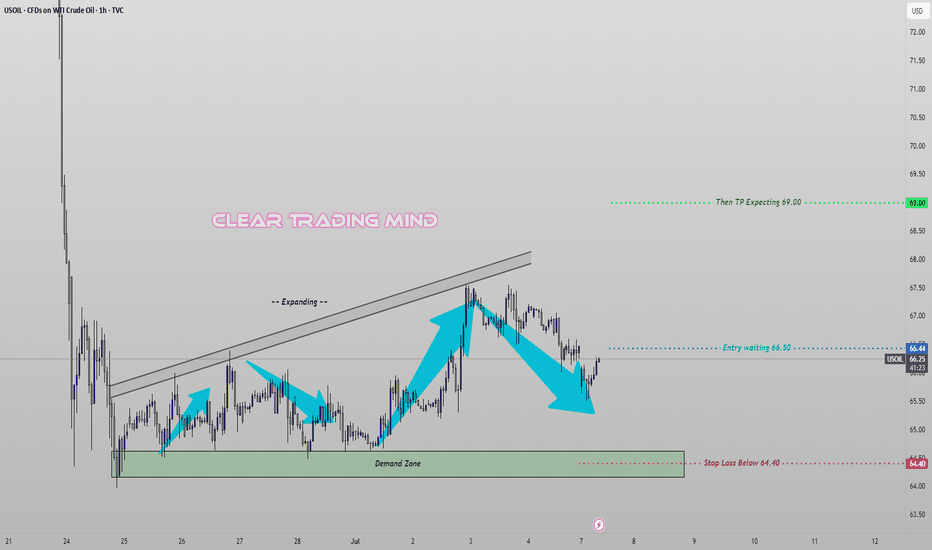

Crude Oil Eyes Bullish Breakout – Demand Zone Holding StrongCrude Oil (USOIL) is forming a potential bullish reversal structure on the 1H timeframe, supported by repeated bounces from a well-respected demand zone. Price currently consolidates below the key resistance level with a visible expanding channel, hinting at possible volatility and breakout.

🔹 Trade Idea:

I’m waiting for a clear break and close above 66.50 for a valid long entry. The setup remains invalid unless price confirms this breakout.

🔹 Technical Highlights:

- Strong demand zone held price multiple times

- Formation of higher impulses with retracements aligning well with Fibonacci levels

- Market structure suggests a continuation toward upper targets if 66.50 is broken with momentum

🔹 Trade Plan:

- Buy Above: 66.50 (breakout confirmation)

- Stop Loss: 64.40 (below demand zone and structure support)

- Target: 69.00 (near 2.272 Fibonacci extension)

⚠️ Note: No entry unless 66.50 is broken convincingly. Setup favors disciplined execution only on confirmation.