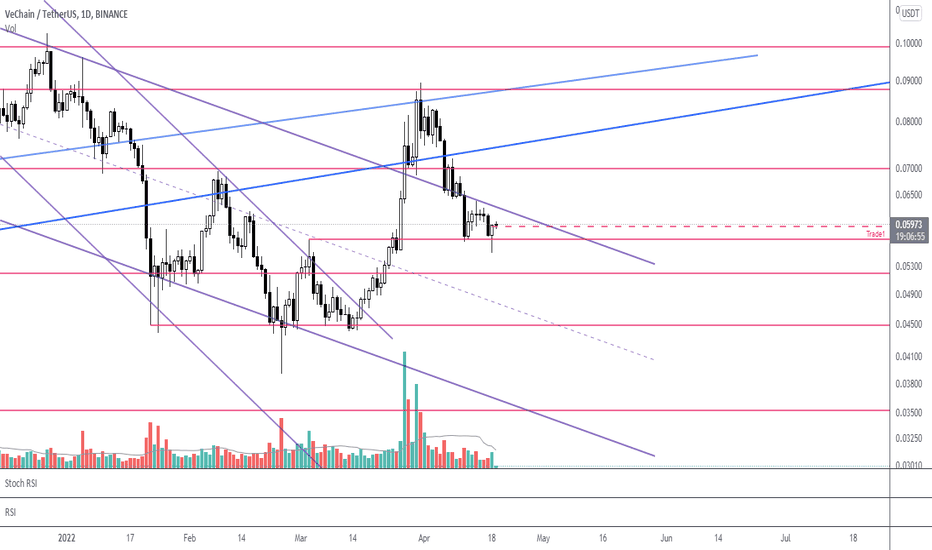

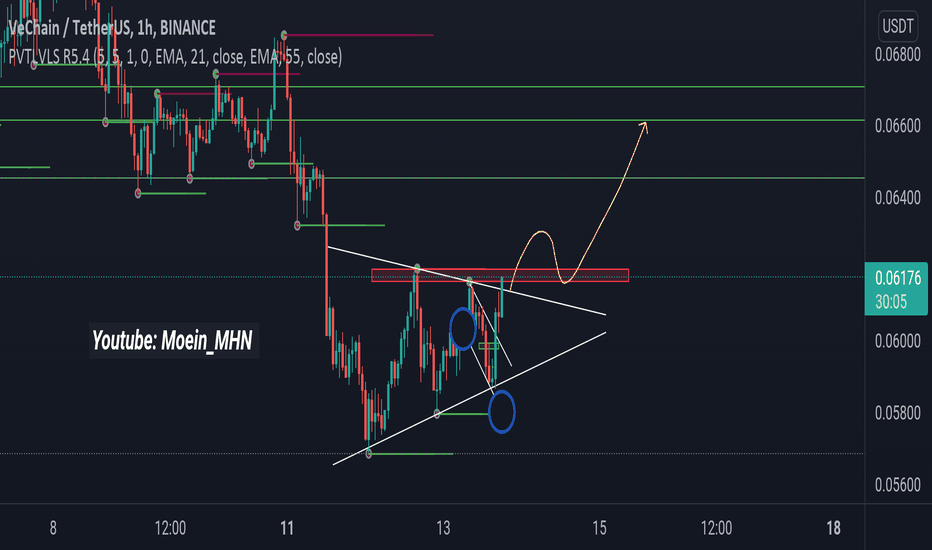

VETUSDT - Scalping short tradeHi,

This is iJustCoin, the one lucky trader who puts his money where his mouth is!

Well, i updated my trading strategy and i am excited to provide a signal.

My indicator gave me the signal to short and it looks like a promising trade!

You may notice that my SL is INCREDIBLY huge and you may think "boy,this trade won't make me a millionare and there is not point to trade that".

Well i'd think that too. But i wanted to make trading more relaxed and comfortable so i could be enjoying my life taking profits instead of getting bamboozled each time price hits my tight SL.

So that kind of SL is a part of my trading strategy upgrade. Hope it will bring you joy as well.

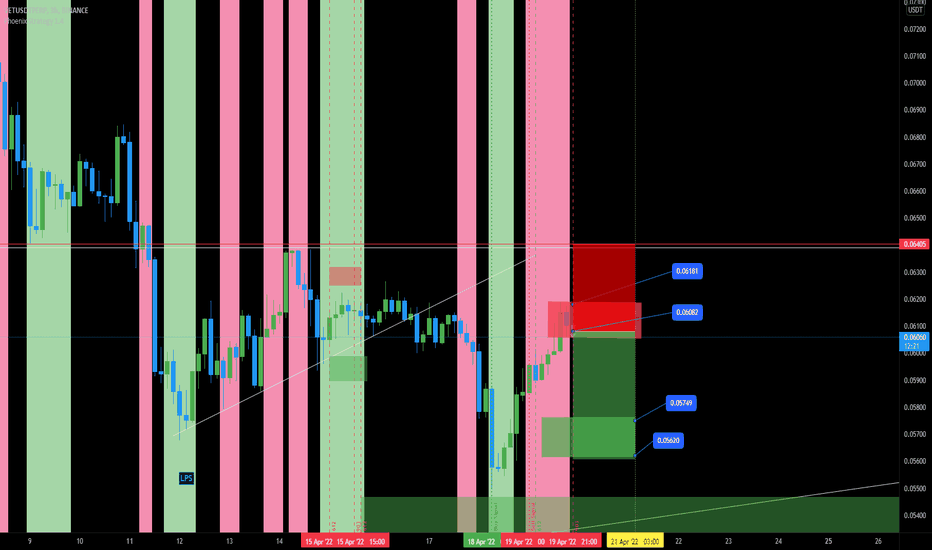

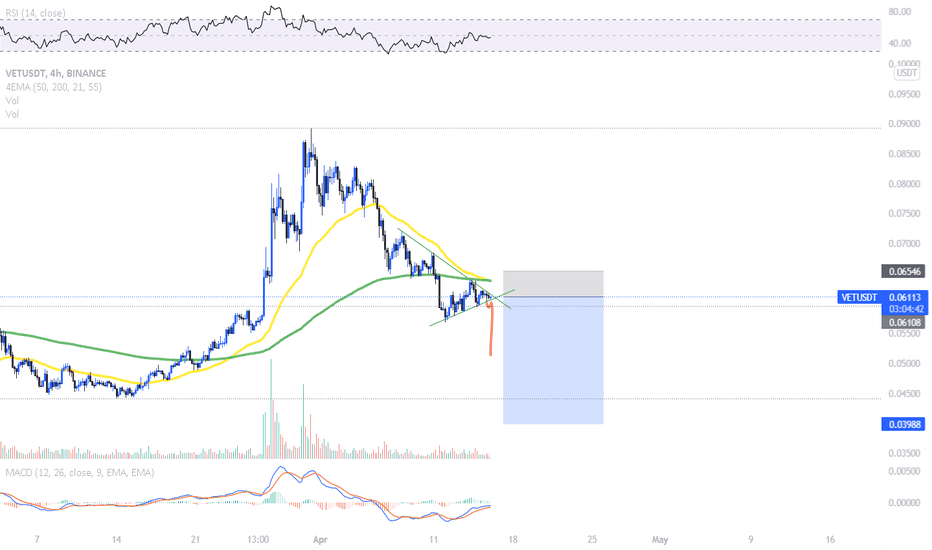

Anyway here is the trade:

SL: $0.06405 / 5.30%

Entry 1: $0.06082

Entry 2: $0.06186

Take Profit 1: $0.05749/ 5%

Take Profit 2: $0.05620 / 7%

Estimate trade duration: 12-30 hours

If you didn't click Like - you should do that right now.

Feel free to ask me any questions related to the idea in the comment section - i'll be glad to reply.

And make sure YOU ARE FOLLOWING ME!

Bye-bye!

Good Luck!

***

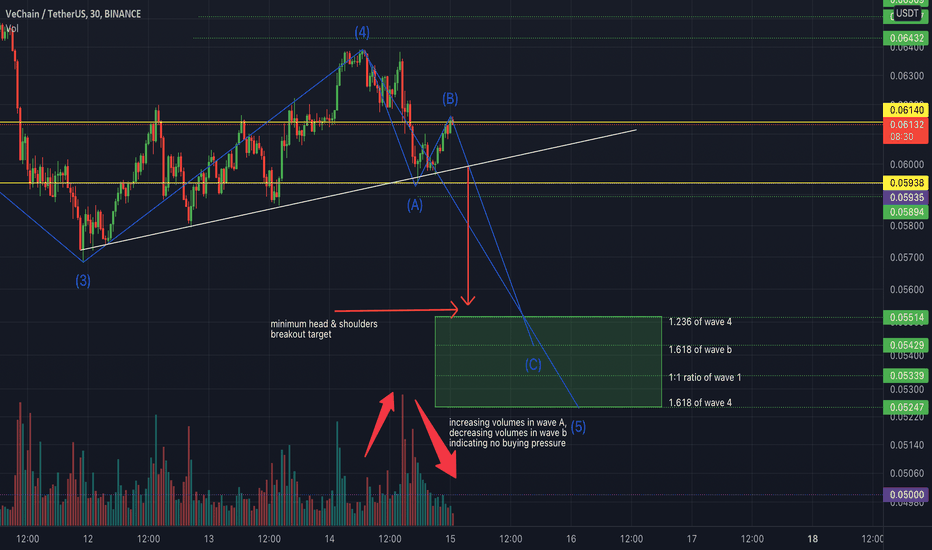

Chart Code:

Pastel Green Vertical Line - iJustCoin Phoenix Reader Strategy Long Signal

Pastel Red Vertical Line - iJustCoin Phoenix Reader Strategy Short Signal

Red Dashed Lines - Downward Reversal Momentum

Green Dashed Lines - Upward Reversal Momentum

Green Rectangle - Buying Area

Red Rectangle - Selling Area

Red Line - Stop Loss

Bold Aqua Dotted Line - Estimate Price Direction

Yellow Dotted Lines - Estimate Timerange of the price target might be getting hit

Orange Dotted Line - Profit taking Point

***

VETUSDT.P trade ideas

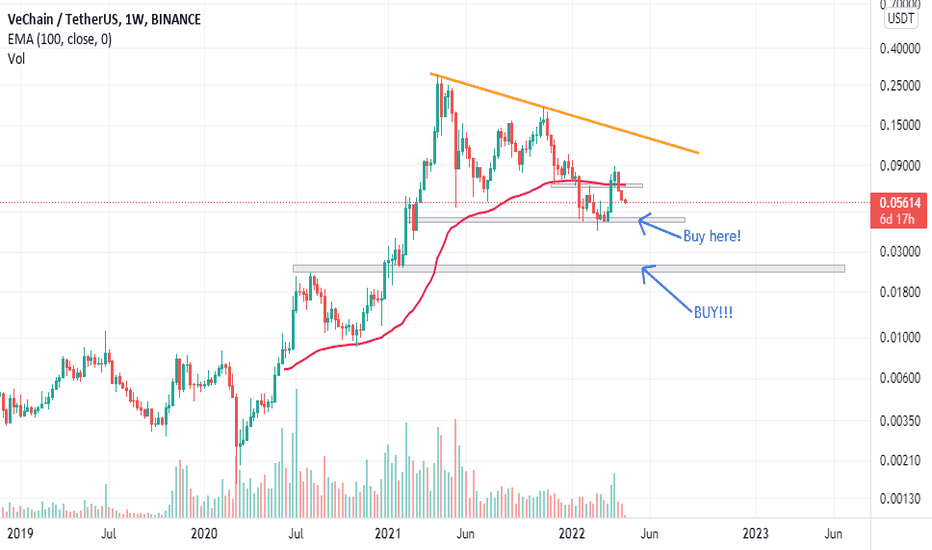

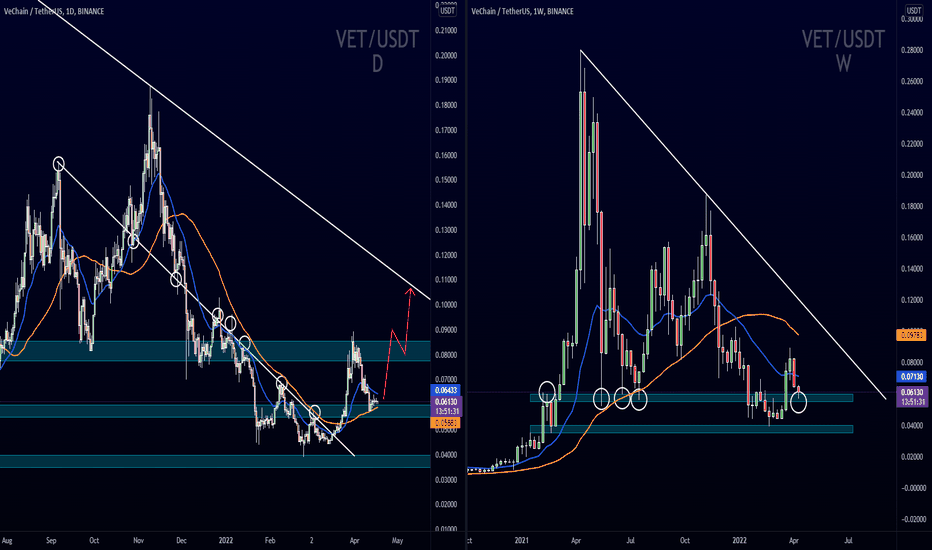

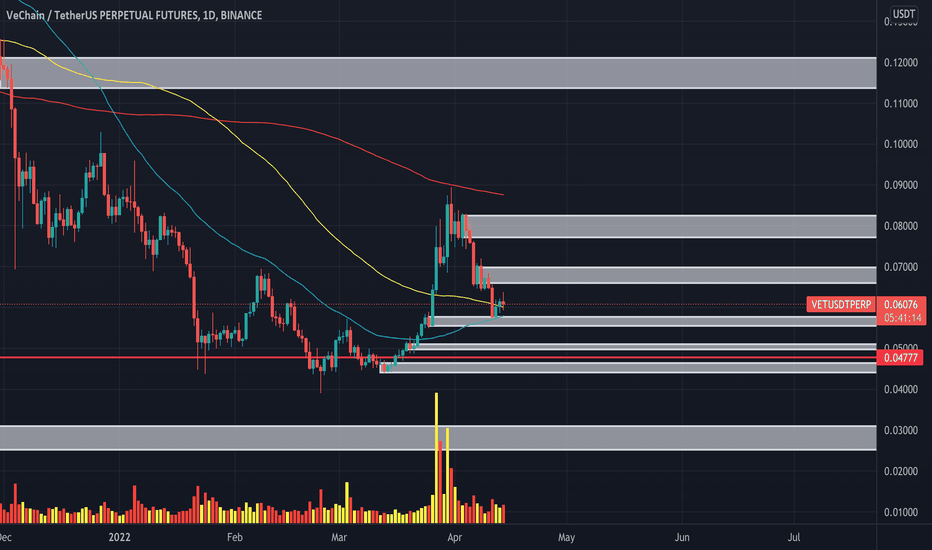

#VET on my ultimate 10 coin of investment list IMO

there are 2 areas to start buying vechain

the 1st one :

the area between

0.057-0.059

the 2nd area:

between

0.032-.039

invalidation of this setup would be weekly violation of

0.030

that's around -40 %

so as usual do your own research and manage your risks

and definitely not a financial advise

the targets will be in green

0.1

0.12

0.18

0.26

0.35

0.45

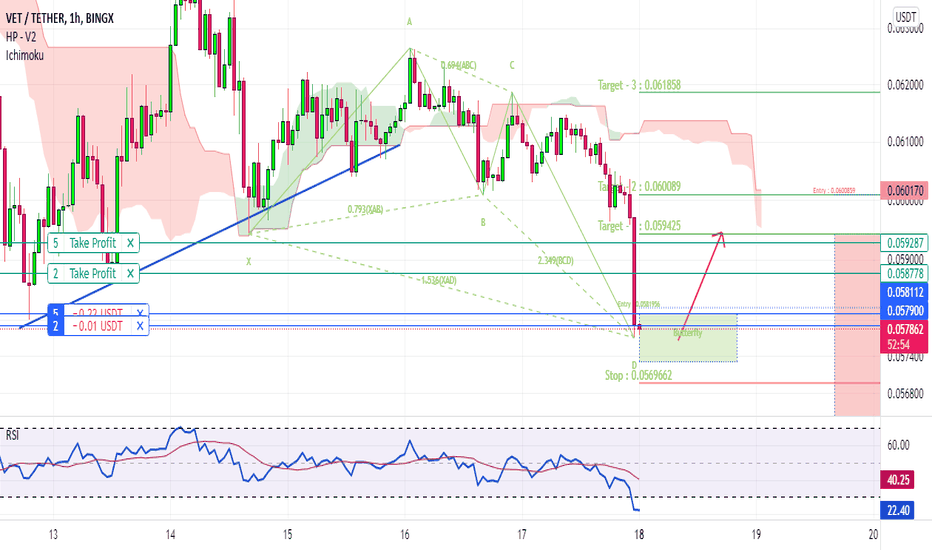

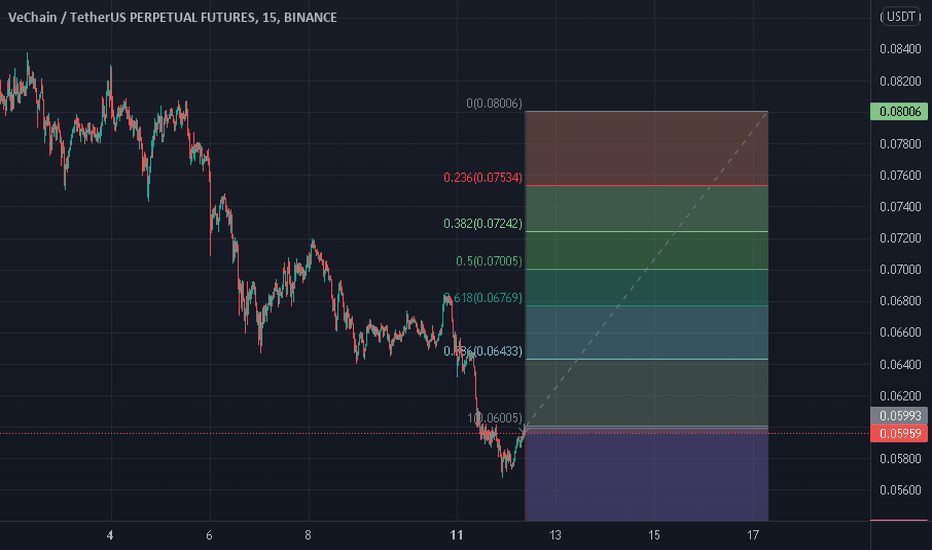

VETSalaam

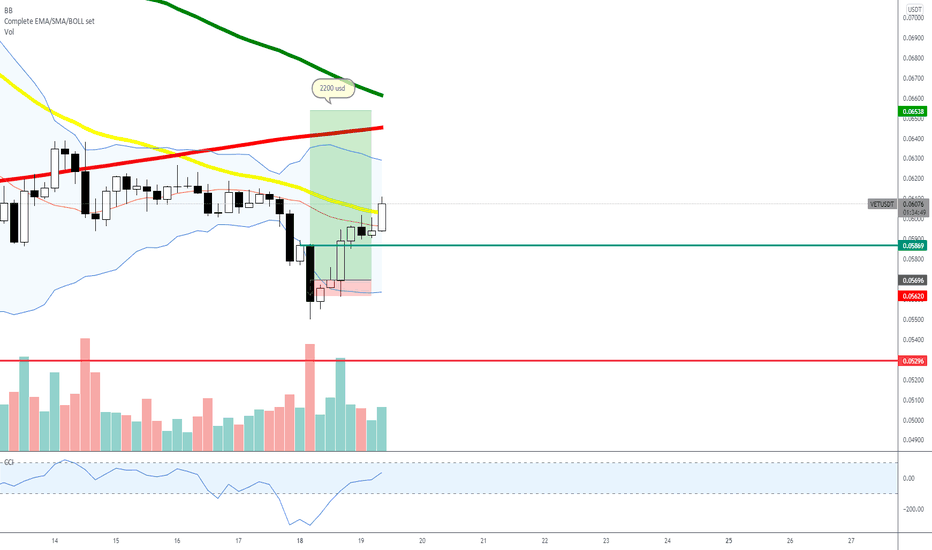

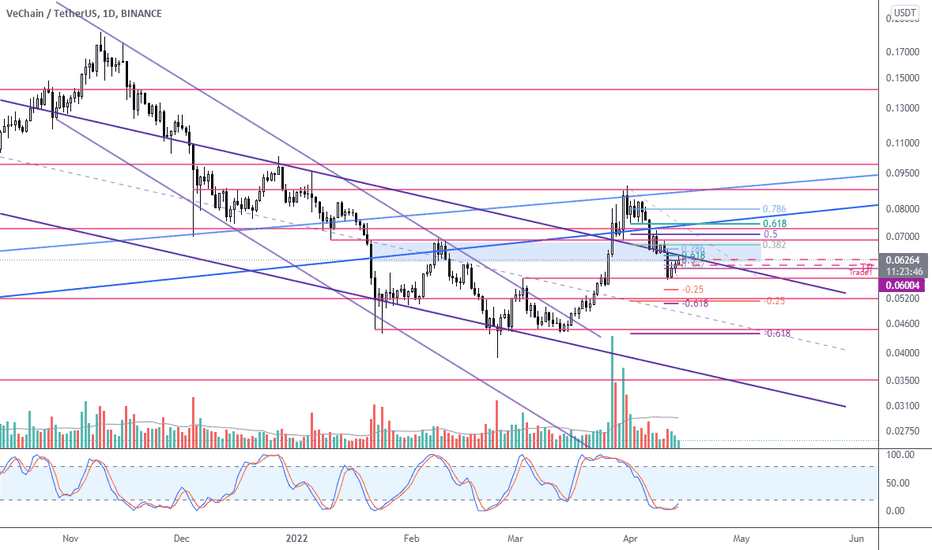

Despite VET return backed to the channel and we saw powerful bearish candle 2 days ago, it stopped at key level 0.057 and yesterday's candle closed as beautiful bullish pinbar that coincide with 61 FIBO of last swing 0.044-0.087.

The key levels are the most important of analysis compared with trend lines and channels because trend lines are subjective and not absolute.

We see same scenario in BTC and ETH.

Let's see if VET could break the channel's resistance at 0.062 and close a daily candle above it or not.

The next resistance is 0.07.

Manage your risk!

Good luck,

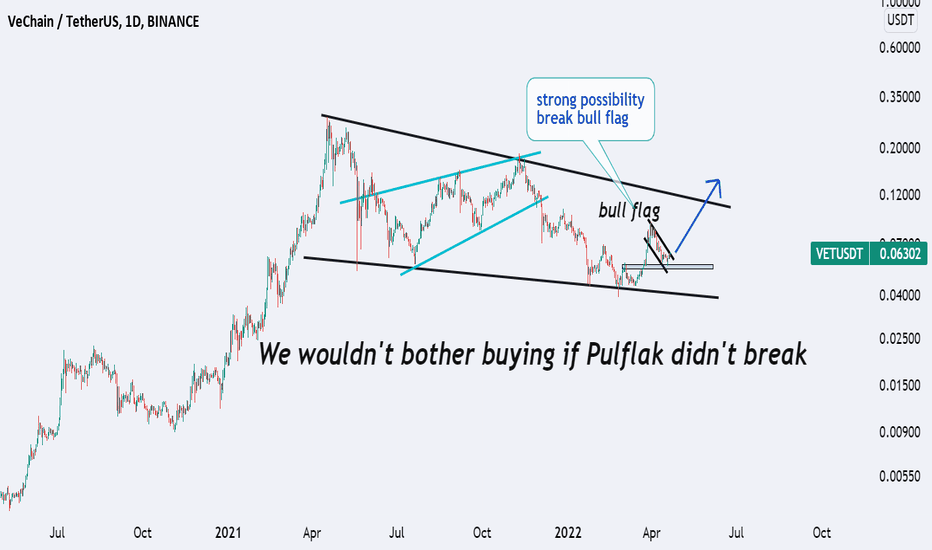

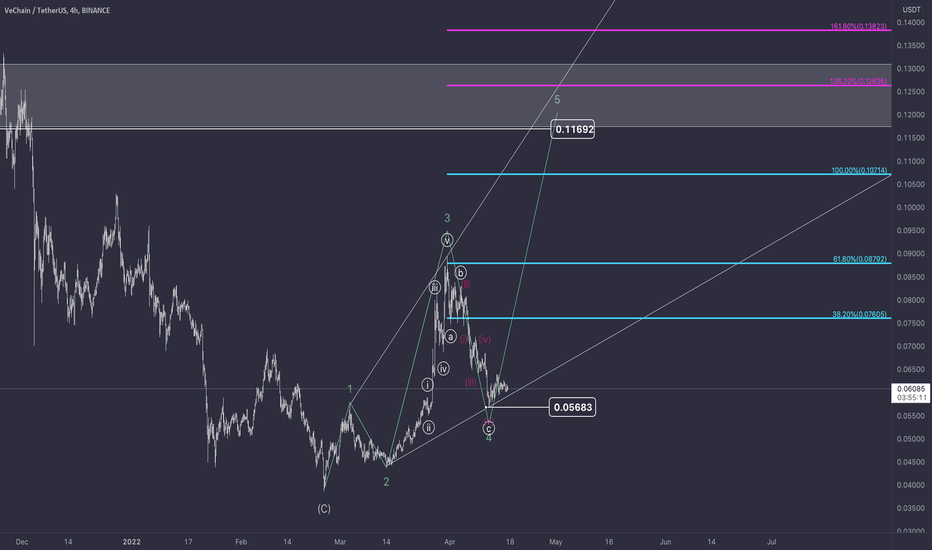

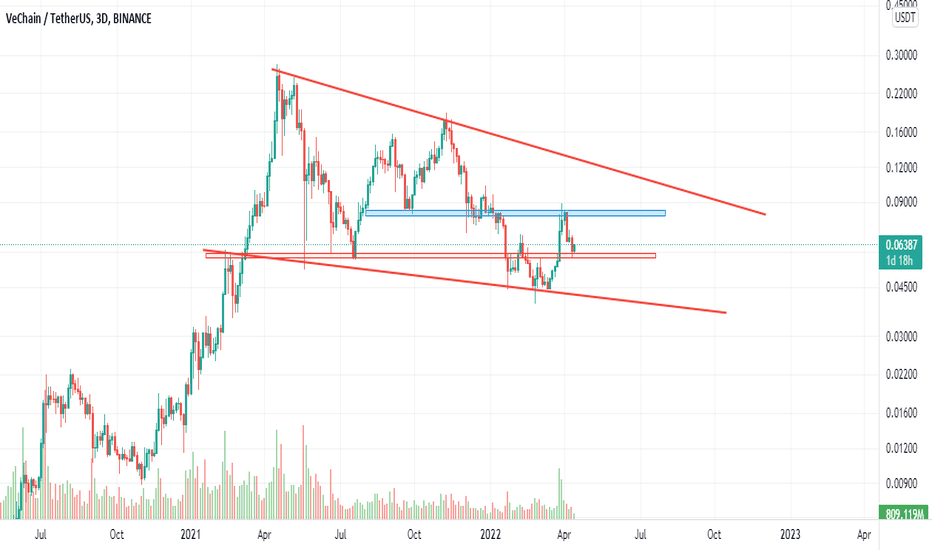

VECHAIN - Breakout Coming 🚨Vechain has completed the higher timeframe ABC correction and now we simply need to look for bullish corrections to enter.

We currently have a really nice bull flag with a solid trendline which we can monitor for a break. It's possible that we may revisit the double bottom before moving up so just bare that in mind and have it marked out on your charts incase we do get that scenario.

Trade Idea:

- Enter on breakout of corrective bullflag (red trendline)

- Stops below the correction

- Targets: 0.17, 0.28, 0.35, 0.45

Let us know your thoughts below.

Goodluck and trade safe!

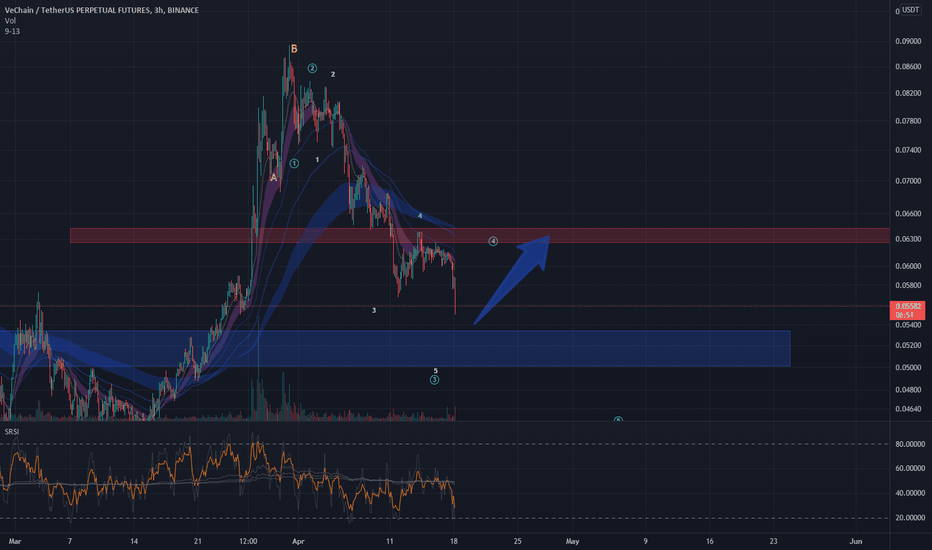

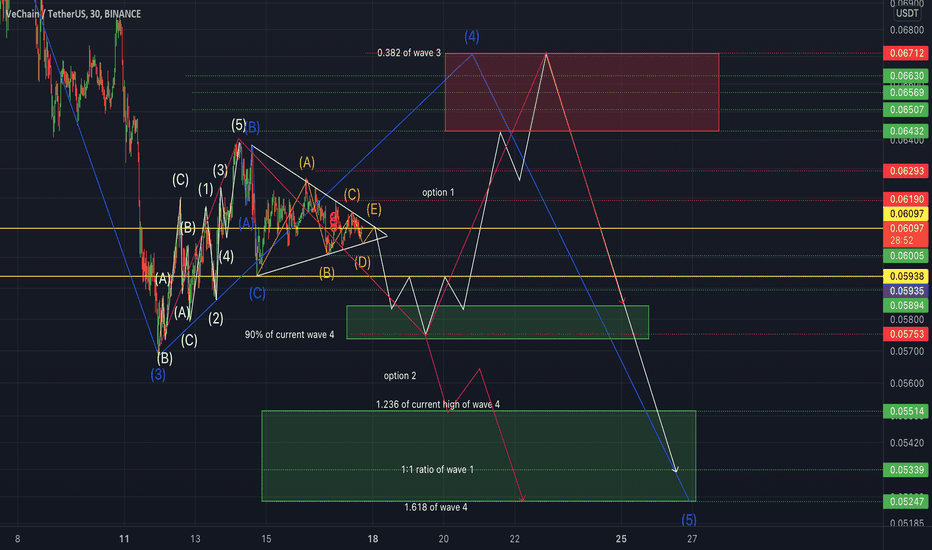

A couple of different options for VET to take next week.I think both these options could easily play out, option 1 would take our 4th wave higher before we move down in our 5th. (if option 1 plays out then we would Need to adjust our lower end targets for wave 5.

Option 2 we go straight down to target levels to complete wave 5 and move on ups from there.

Option 3 would be that we just blast off to the moon and all my counts are wrong.

VETUSDTDISCLAIMER:

This is not financial advice! This is an opinion-based show. I am not a financial adviser. Please only invest what you can afford to lose, and we encourage you to do your own research before investing.

everyone should buy and sell according to their own strategy.

Everything you need to know is outlined in the chart and keep in mind that we are moving forward with probabilities and the analysis may be wrong so take capital management seriously.

VETSalaam

VET return back inside the channel and retest the resistance line

also, go below the support area and retest it.

4h rejected from 61 Fibo that coincide with the resistance trend line (channel line)

But there is also the possibility that the weekly candle close above the channel.

(In this case, VET could continue rising.)

Don't forget to manage your risk.

Good luck

🔥 VET is in the wedge pattern 🔥Hello traders 🐺 .

1_pattern :

In the chart above we can see that VET is inside of the very big wedge pattern also you can call this as a bull flag because this pattern was formed after a bull run , the important fact about this pattern is that the this one formed in the higher time frame and as you might know the higher time frame you analysis the more your accurate become .

let's goes into the daily chart to look for the other patterns :

In the daily chart we can see that price tries to found a support from the weekly support and if price success to reverse from here , the next target is around the 0.618 which is alignment with the daily resistance structure ( blue box ) , but you can also take some profit above it around the 1.0 and after that at the top of the wedge .

2_EMA Ribbon :

after price break above the EMA Ribbon but after touching the daily resistance , price started to retracement and goes below the EMA Ribbon again but as you can see , EMA Ribbon is flipping bullish right now and in my opinion still there is good chance to goes above it again .

3_RSI & TSI :

TSI is still bullish and above the zero line and there is chance to find support from the zero line , but RIS is below the 50 however it's not bearish or bullish .

4_ price targets :

about the price targets I was talked about in the section 1 ( pattern ) .

This is not a Financial advice and always trade based on your trading strategy ; have nice day my dear friends .

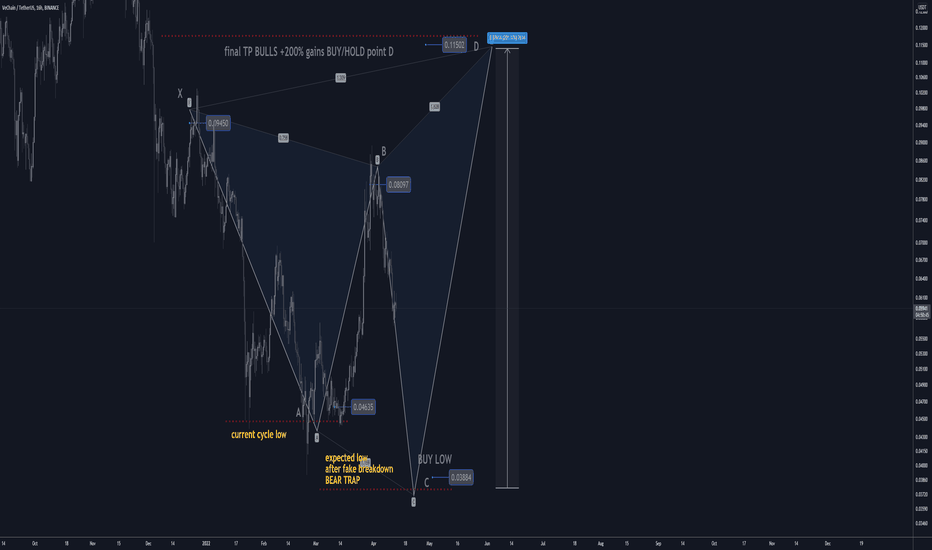

VETUSDT H16: 200% gains XABCD BEST LEVEL TO BUY(SL/TP)(UPDATED)Why get subbed to me on Tradingview?

-TOP author on TradingView

-2000+ ideas published

-15+ years experience in markets

-Professional chart break downs

-Supply/Demand Zones

-TD9 counts / combo review

-Key S/R levels

-No junk on my charts

-Frequent updates

-Covering FX/crypto/US stocks

-before/after analysis

-24/7 uptime so constant updates

🎁Please hit the like button and

🎁Leave a comment to support our team!

VETUSDT H16: 200% gains XABCD BEST LEVEL TO BUY(SL/TP)(UPDATED)

IMPORTANT NOTE: speculative setup. do your own

due dill. use STOP LOSS. don't overleverage.

IMPORTANT NOTE: always do your own due dill.

not financial advice.

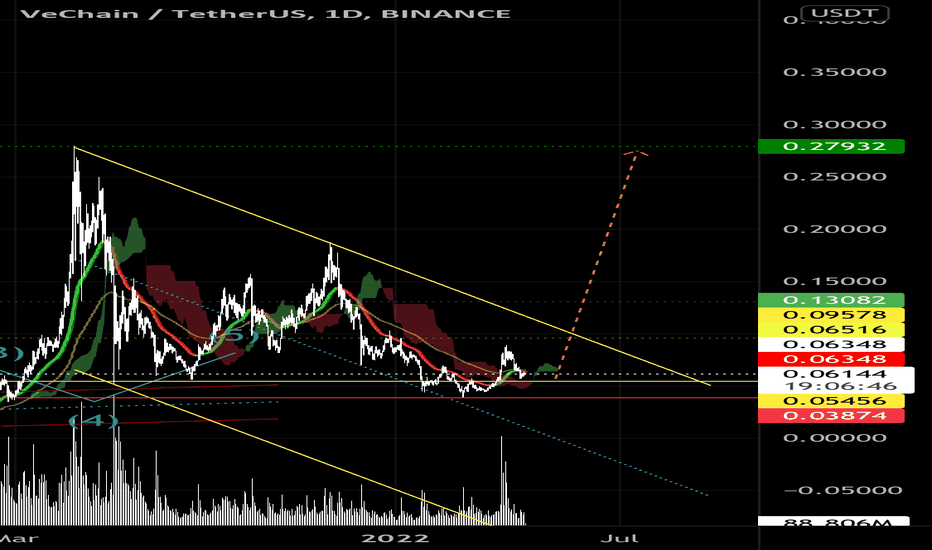

🔸 Summary and potential trade setup

::: VETUSDT 16hour/candle chart review

::: new setup based on XABCD patter

::: still great setup for 200% gains

::: updated / revised / more realistic scenario

::: break below current cycle low at 0.046

::: expect actual low point C at 0.0388

::: at point C / so it's cycle low soon

::: speculative XABCD setup in progress

::: BULLS BUY DIPS / market BUY at 0.0388

::: from my level TP +200% gains

::: this is BUY/HOLD setup

::: patient traders only

::: not for gamblers

::: SPECULATIVE SETUP

::: do your own due dill

::: and use proper risk management

::: TP bulls is +200% gains USD

::: details: see chart

::: FINAL TP +200% gains point D

::: recommended strategy: BUY/HOLD

::: SWING TRADE: BUY/HOLD IT 0.05

::: final TP BULLS is 0.115 cents

::: bull run not over yet

::: good luck traders!

::: BUY/HOLD and get paid. period.

🔸 Supply/Demand Zones

::: N/A

::: N/A

🔸 Other noteworthy technicals/fundies

::: TD9 /Combo update: N/A

::: Sentiment mid-term: BULLS/PUMP/point D

::: Sentiment short-term: BEARS/PULLBACK/point C

RISK DISCLAIMER:

Trading Crypto, Futures , Forex, CFDs and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use tight stop loss.

Vetusdt / harmonic pattern / Elliotte 1-VETUSDT is in a long-term downtrend. We have identified the major points and it includes two downward waves and one upward correction wave, and it seems that the upward correction wave is similar to what has happened in the past. We think this wave should be ABC. To confirm this speculation, a harmonic pattern has also been identified.

2-We expect vetusdt to be able to touch the channel ceiling