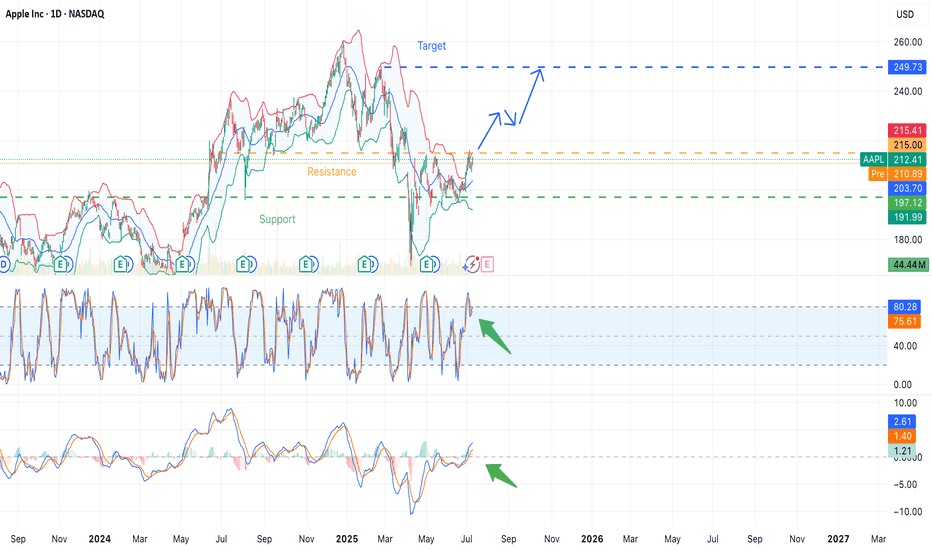

AAPL: Update - Key Levels to Watch for Price DevelopmentAAPL: Update - Key Levels to Watch for Price Development

Overall nothing changed and AAPL remains a valuable and strong structure

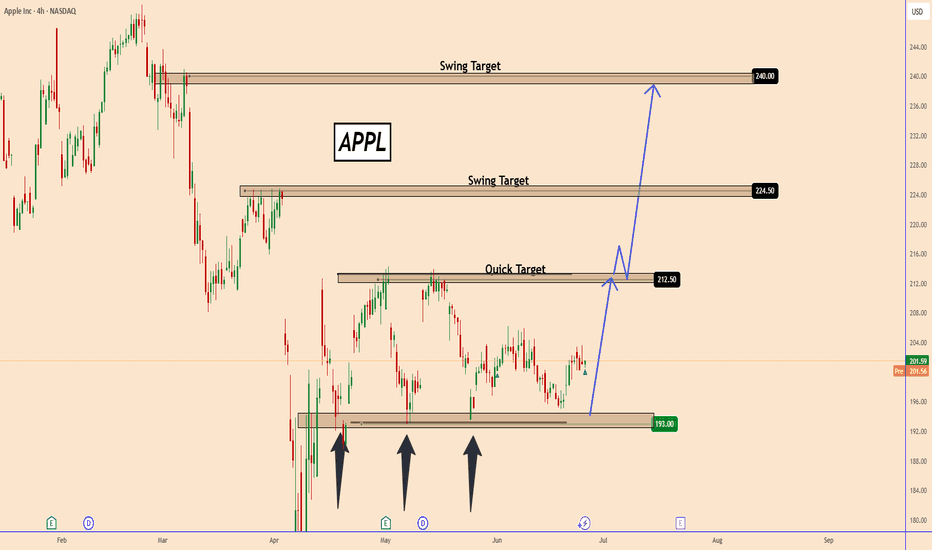

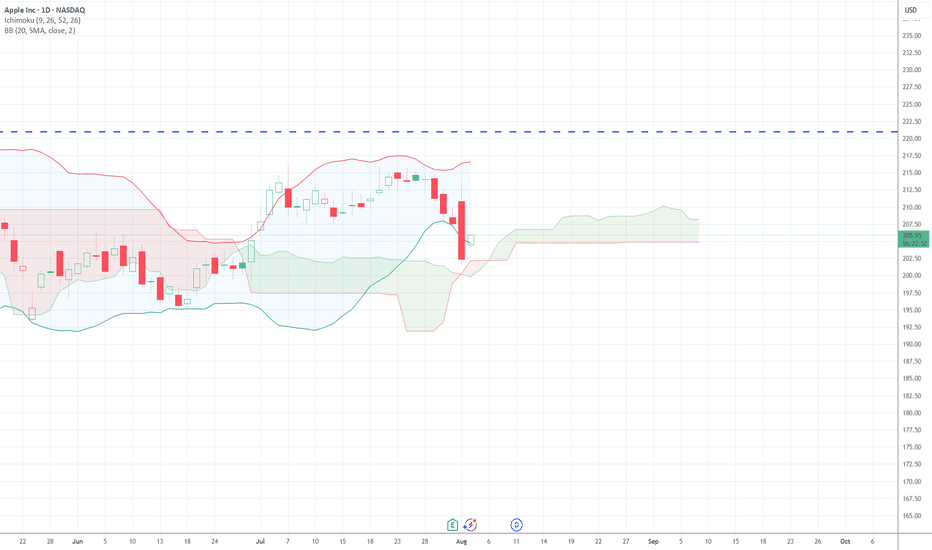

Apple's stock (AAPL) has been range-bound between $193 and $212.50 for the past two months, repeatedly testing support near $193 on three occasions.

Each time, the price has rebounded strongly, pushing back toward $212.50—the upper boundary of this trading range.

Given this pattern, the likelihood of another move toward $212.50 remains high.

If AAPL successfully breaches $212.50, it could signal a larger bullish breakout, with upside targets at $224.50 and $240, as highlighted in the chart.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

AAPL trade ideas

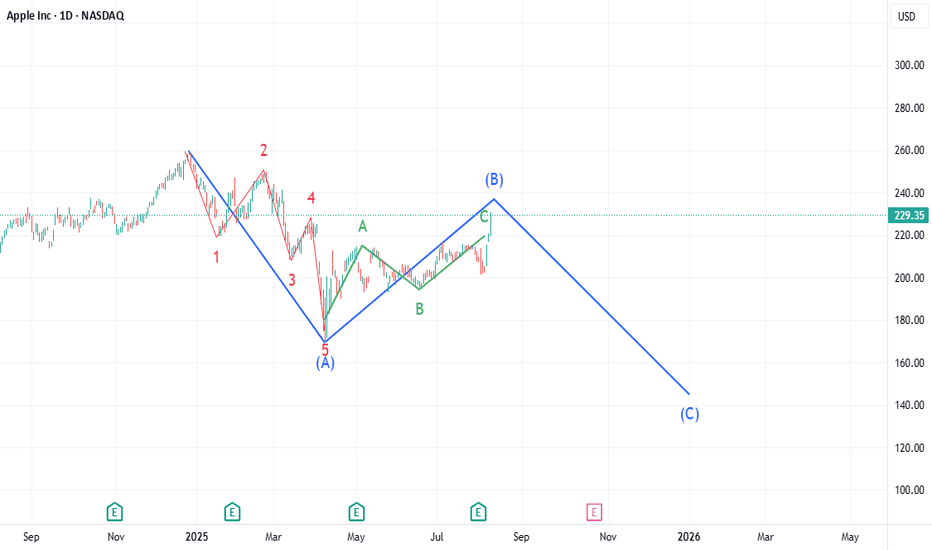

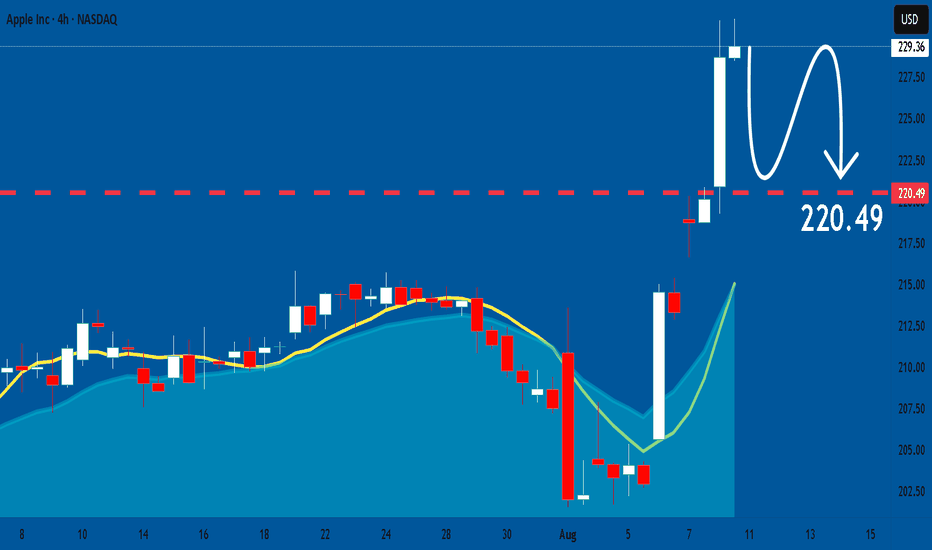

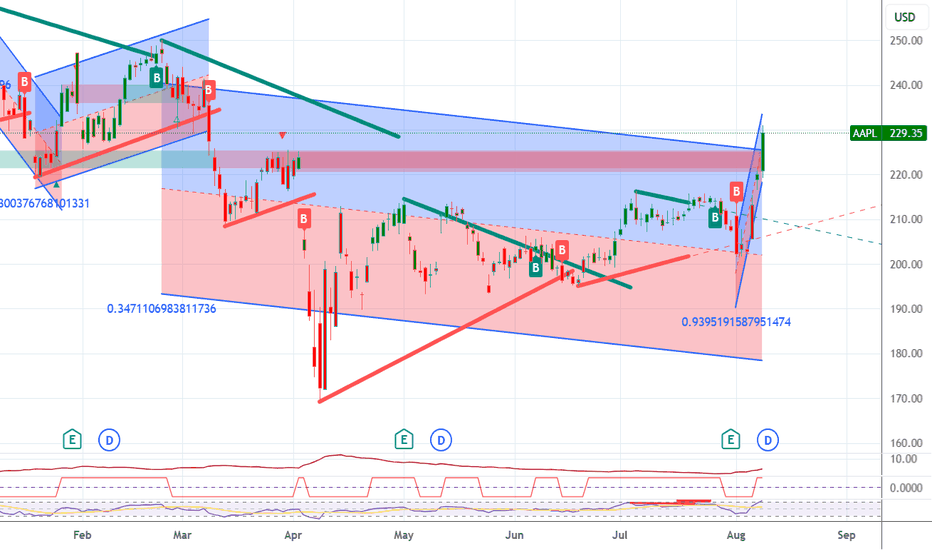

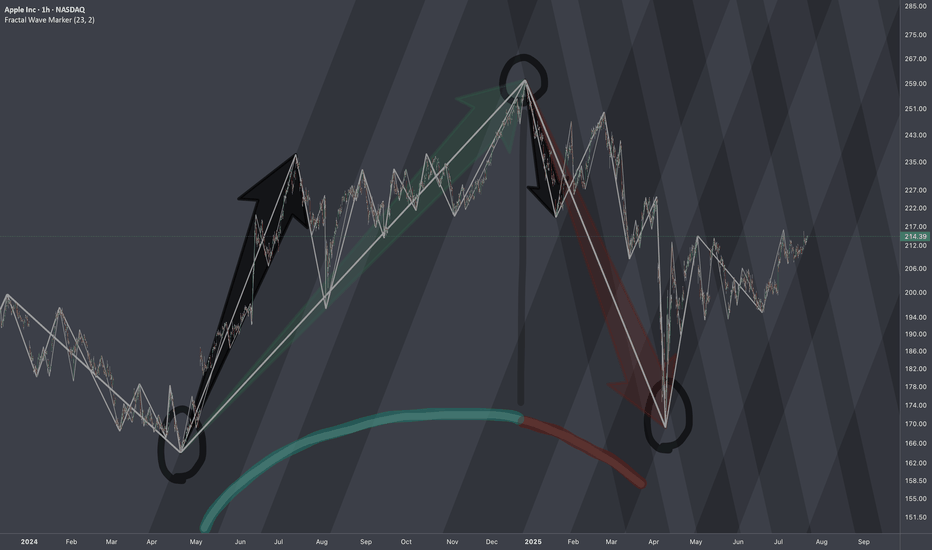

AAPL: End of B Wave in ABC CorrectionApple blasted upwards Wednesday through Friday for what likely is a blowoff of wave C ov Wave B. AAPL could potentially reach 232, but that is as high as I am anticipating. The next wave down will likely be more violent than Wave A and could bring AAPL down to as low as $143 over the next 3 - 5 months.

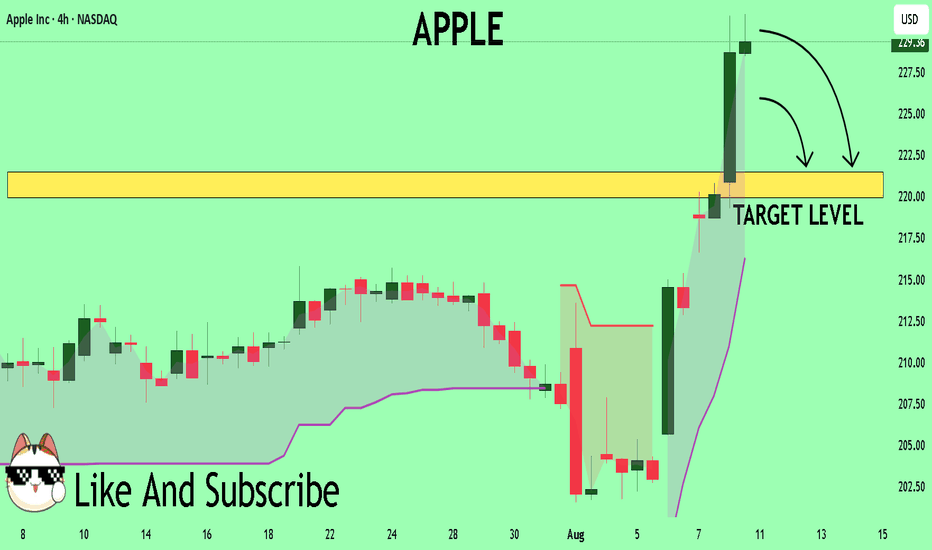

APPLE My Opinion! SELL!

My dear friends,

Please, find my technical outlook for APPLE below:

The price is coiling around a solid key level - 229.36

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 221.47

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

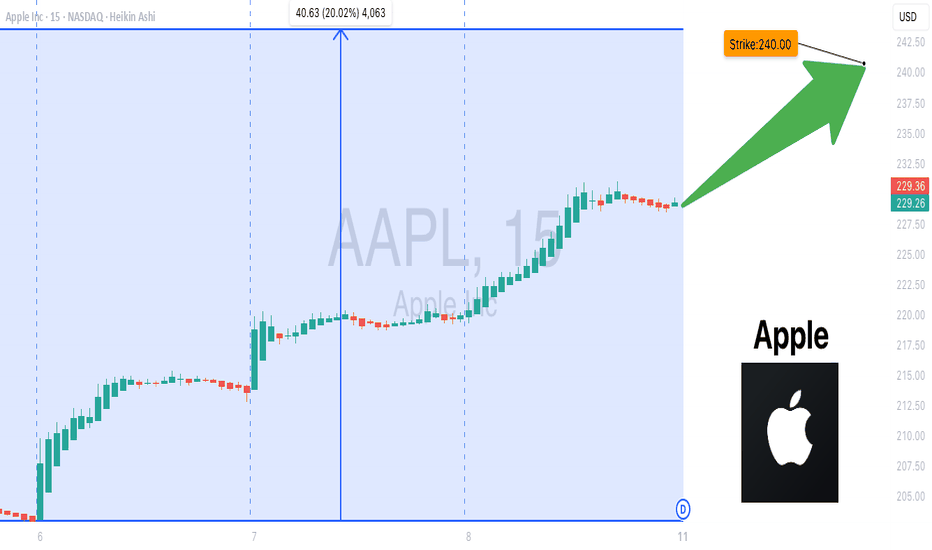

AAPL Eyeing \$240 Breakout — Don’t Miss This Move

🚀 **AAPL Eyeing \$240 Breakout — Calls Lined Up for 100%+ Move** 📈

💎 Weekly sentiment: **STRONG BULLISH** (Call/Put = 1.86)

📊 RSI: Daily 77.7 | Weekly 59.8 | Volume 1.3x ↑ (Institutional Buying Confirmed)

🔥 VIX: 15.15 (Low Volatility = Green Light)

🎯 **Trade Setup**

* Type: **Call** (Long)

* Strike: **\$240.00**

* Expiry: **2025-08-15**

* Entry: \$0.65 | PT: \$1.30 | SL: \$0.32

* Confidence: **85%** | Timing: Open

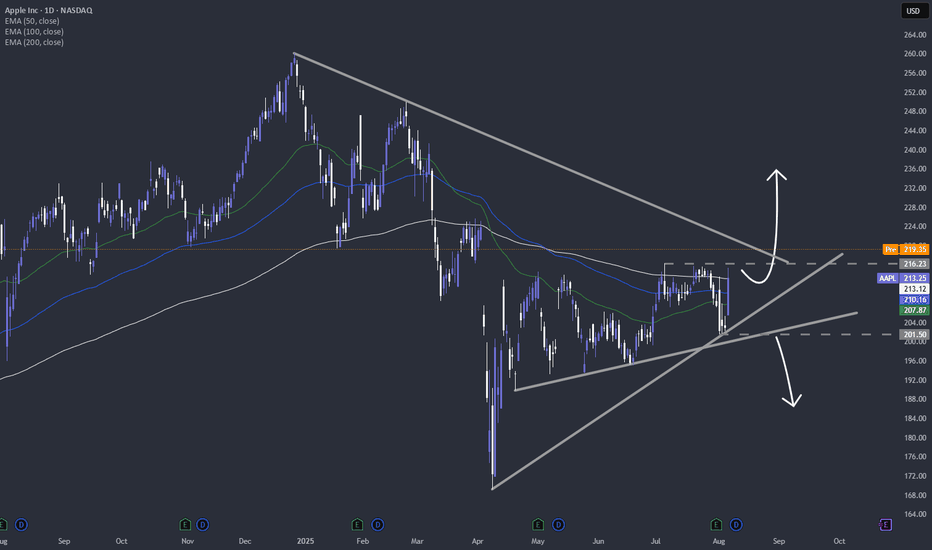

AAPL: The Rally Might Not Be OverWhile many tech giants have already reached new all-time highs, Apple is still lagging behind — NASDAQ:AAPL hasn’t yet broken out. This may represent both a risk and an opportunity for latecomers.

Investor caution remains due to potential tariffs on Apple products from China, with the decision now postponed until August.

This uncertainty may be holding the price back, but could also lead to a strong accumulation phase if no negative headlines emerge in the near term.

Technicals:

• A breakout above $215 could open the way toward $249 (previous high).

• Support at $197 remains strong.

• Stochastic is in overbought, but MACD confirms bullish momentum.

NASDAQ:AAPL may start catching up with the broader market — especially if tariff fears subside. Watch closely for a confirmed breakout above $215.

APPLE: Forecast & Trading Plan

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the APPLE pair which is likely to be pushed down by the bears so we will sell!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AAPL LONGApple is breaking out, supported by bullish accumulation volume patterns indicating strong buying pressure. Key bullish points:

$100B U.S. investment strengthens domestic operations and tariff protection.

Strategic supply chain shifts to U.S. and India reduce geopolitical risks.

Leading tech sector rally amid AI growth potential.

With momentum building, $275 is the next target.

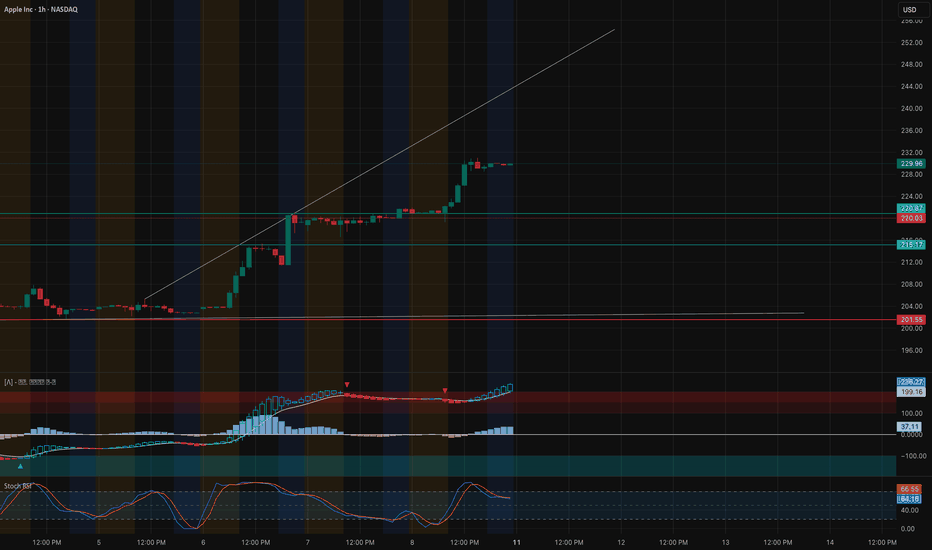

AAPL Technical Analysis & Options GEX Outlook. Aug. 11Technical Analysis (1H Chart)

Apple (AAPL) has maintained a strong bullish structure with consecutive Break of Structure (BOS) levels forming since the early August rally. The recent CHoCH on August 8th was quickly reclaimed with another BOS, confirming bullish continuation. Price is currently consolidating just under the $231.00 mark, aligning with a diagonal trendline resistance.

Momentum indicators remain supportive:

* MACD is in bullish expansion after a brief pullback.

* Stoch RSI is in mid-to-high range, leaving room for another upside push.

Key intraday support sits around $228.00–$228.20 (prior demand zone). A breakdown here could retest the $222.50–$223.00 range, which aligns with previous structure support. Immediate bullish continuation above $231.00 would target the mid-$230s, potentially $235.00 in extension.

Options GEX Analysis

* Major Gamma Wall: $231.00 – heavy CALL positioning acting as resistance.

* Other Key Levels:

* $227.50 (GEX8 + CALL zone) – strong support if retested.

* $222.50 (2nd CALL wall + GEX10) – deeper support before trend reversal risk.

* Downside Risk Zones:

* $210.00 – HVL support & psychological zone.

* $205.00–$200.00 – large PUT walls; breach here could accelerate downside.

IV & Flow:

* IVR: 18.2 (low) → Options relatively cheap.

* IVx: 28.8 (slightly down -3.26%).

* Calls lead at 4.1% over puts, reinforcing a bullish tilt.

Trade Outlook:

* Bullish Scenario: Break & close above $231.00 opens path to $235.00 and possibly $240.00. Best suited for CALL spreads or debit calls targeting the $235 strike, expiration 1–2 weeks out.

* Bearish Scenario: Rejection at $231.00 with breakdown below $228.00 invites PUT entries toward $223.00, stop above $231.20.

* Neutral/Range Play: If price stalls between $228.00–$231.00, short-term iron condors or straddles could work.

Disclaimer: This analysis is for educational purposes only and is not financial advice. Trade at your own risk.

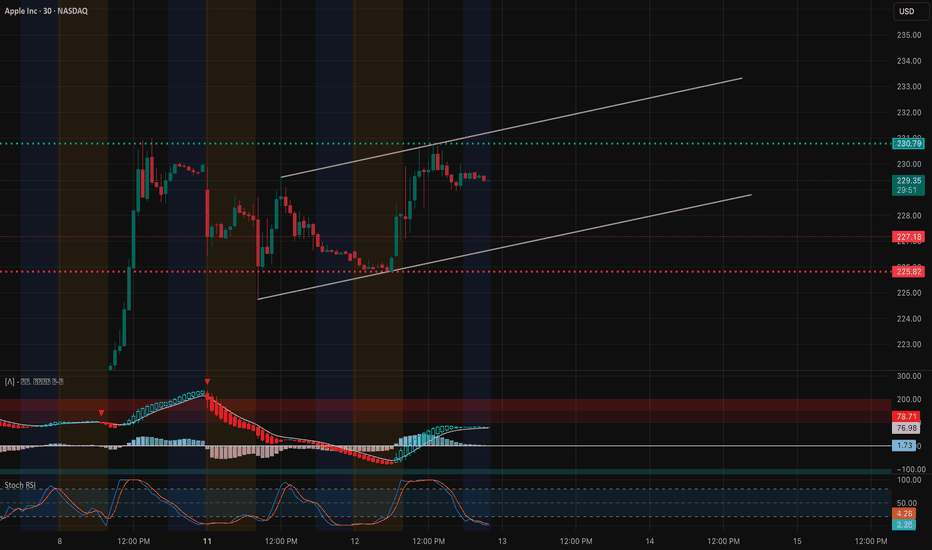

AAPL – TA + GEX Confluence for August 13, 202530-Minute Price Action

AAPL is trading inside a rising channel, showing steady higher lows but stalling under $230.79.

* Resistance: $230.79 – tested multiple times, acting as a lid.

* Support: $227.18 – intraday floor; $225.82 – lower channel & previous demand.

* Indicators:

* MACD momentum is still positive but flattening, signaling reduced buying pressure.

* Stoch RSI is near oversold levels, giving room for a potential bounce if support holds.

1-Hour GEX Insights

* Highest Positive NET GEX / Gamma Wall: $230.79 – aligns perfectly with 30m resistance, explaining repeated stalls.

* Next Call Walls Above: $233.5 & $237.5 – strong upside targets if $230.79 is broken.

* Put Support: $217.5 (1st defense), $210 (major downside GEX floor).

* IVR: 16.9 – relatively low implied volatility, making long options cheaper than usual.

TA + GEX Combined Read

The $230.79 level is critical — it’s both technical resistance on the 30m and the largest gamma wall on the 1h GEX chart.

* If AAPL breaks and holds above $230.79, gamma positioning could fuel a quick push to $233.5 and possibly $237.5.

* If rejected again, expect a pullback toward $227.18 and possibly $225.82, where technical support and the lower channel converge.

Trading Scenarios for August 13

* Bullish Breakout: Long calls or call spreads above $230.79 targeting $233.5 / $237.5.

* Bearish Rejection: Short-term puts or put spreads if $230.79 rejects and $227.18 breaks, targeting $225.82.

* Range Play: If stuck between $227–$231, credit spreads could work given low IVR.

Reasoning

The 30m chart shows the rising channel structure, and the 1h GEX confirms why $230.79 is the decision point. A breakout can trigger hedging pressure to the upside; failure there points to a controlled drift back to lower channel support.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk appropriately before trading.

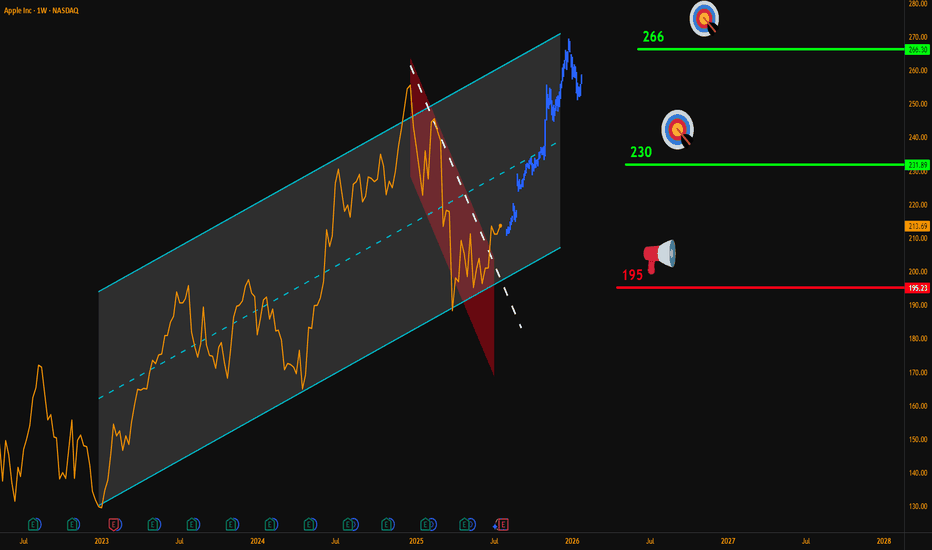

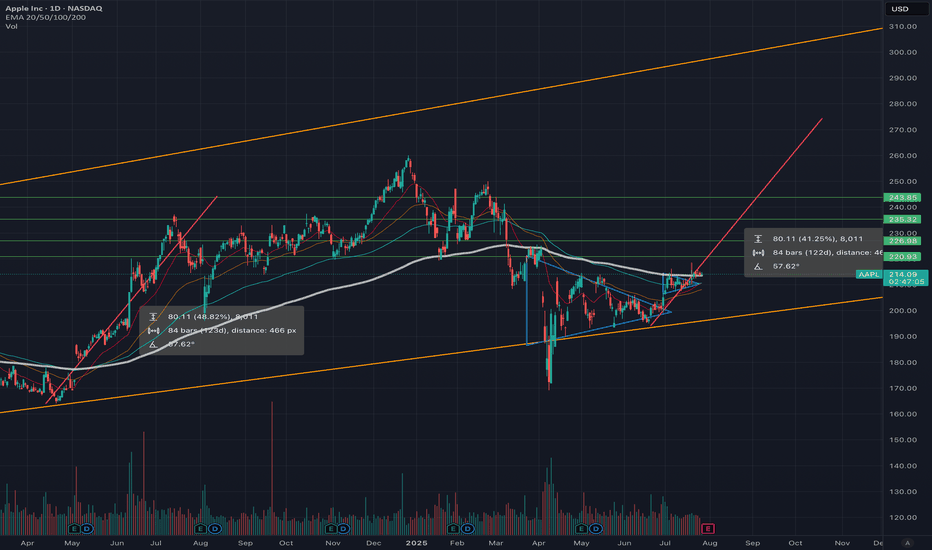

AAPL Weekly Breakout – Targeting $266Hello Traders,

Here’s my latest analysis on Apple (AAPL) based on the weekly chart.

🔍 Chart Breakdown:

Main Uptrend Channel (Blue): Price has respected this channel since 2023.

Red Downtrend Sub-Channel: Recent corrective phase is now broken.

Breakout Signal: Last week, AAPL closed above the sub-channel’s upper line, confirming bullish momentum.

📌 Updated Trade Setup Section:

Entry Zone: Around $215 (current price)

Stop-Loss: Weekly close below $195 (Risk = $20)

Targets:

✅ $230 (Reward = $15 → R:R = 0.75:1)

✅ $266 (Reward = $51 → R:R = 2.55:1)

Always confirm with your own strategy before entering a trade. Position sizing and risk control are key.

💬 Do you think AAPL can reach $266 before Q4 2025? Share your thoughts below!

NASDAQ:AAPL

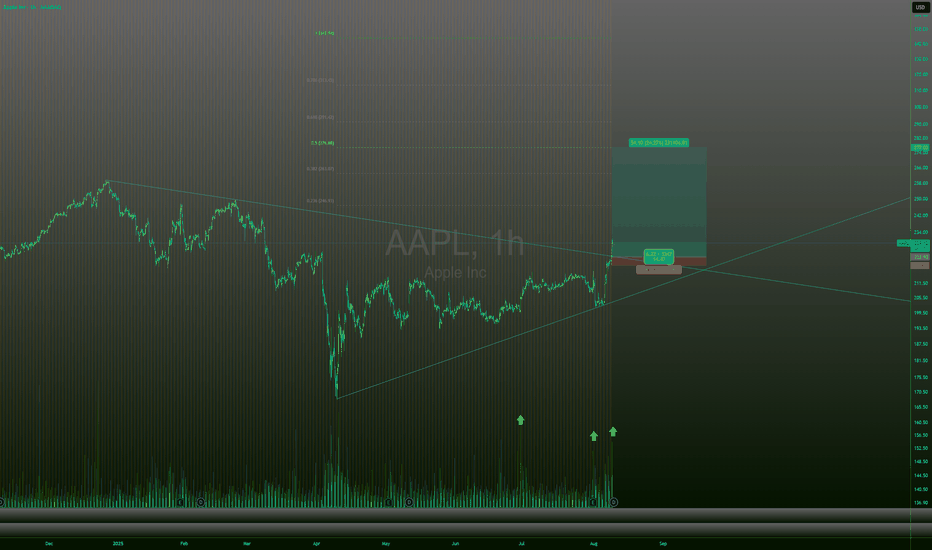

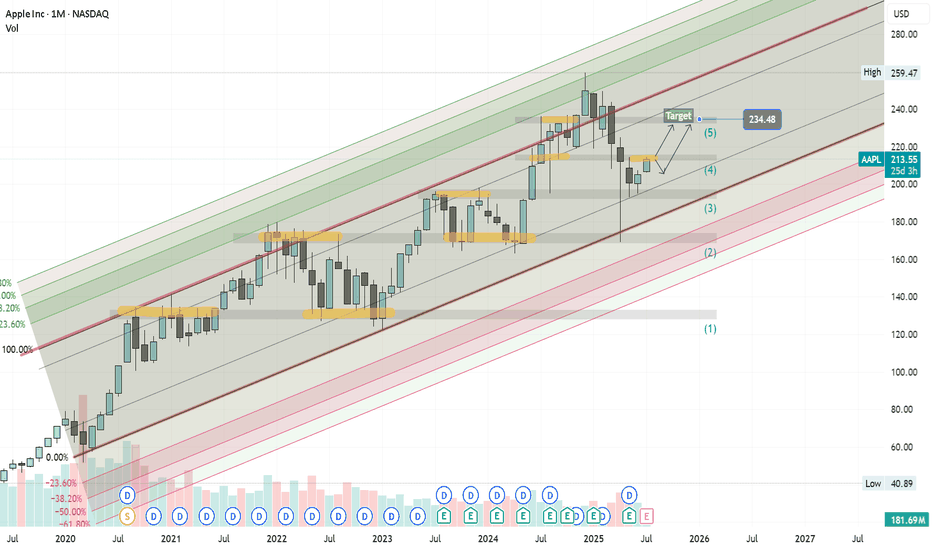

Apple Is Climbing the Fibonacci Channel Ladder – Step 5 Ahead?On the monthly chart, Apple (AAPL) is steadily moving within a well-defined ascending Fibonacci channel, like climbing a ladder — step by step.

The price is currently testing Step 4 , a zone that has acted as a strong resistance barrier.

Despite the pressure here, the structure still appears bullish, and even a minor pullback might simply be a pause before the next move.

If momentum picks up, we could soon see a breakout toward the next step — targeting 234 at Step 5.

The trend remains technically intact unless the channel is broken, and the overall formation still leans toward continuation.

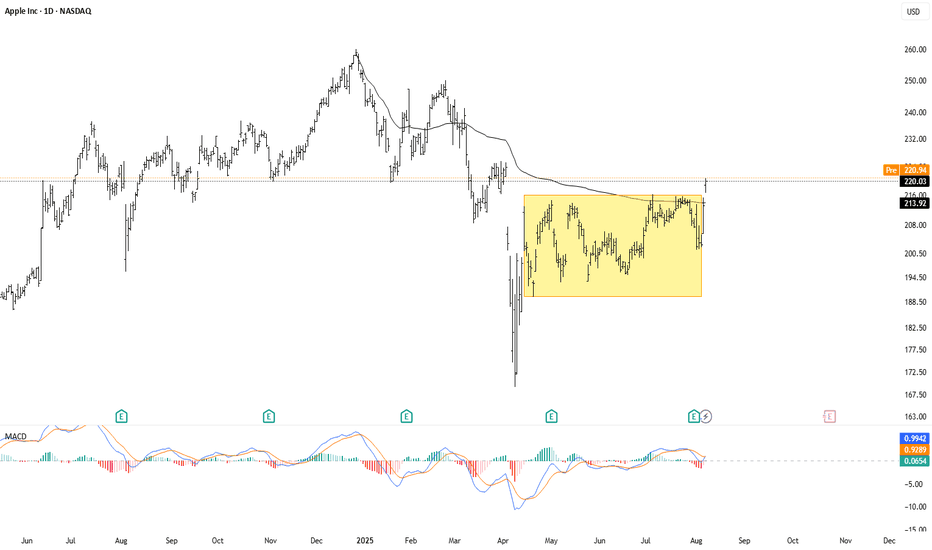

Apple (AAPL) Shares Surge to Four-Month HighApple (AAPL) Shares Surge to Four-Month High

According to the AAPL price chart, the stock rose to the $220 level yesterday – marking its highest point since early April.

The rally was fuelled by several bullish factors:

→ Trade developments: President Trump announced an additional 25% tariff on goods from India, but notably excluded smartphones – a key point, as a significant portion of iPhones are manufactured there.

→ Seasonal momentum: Apple is approaching its historically strong period. A new iPhone model is traditionally unveiled in September, followed by the start of the holiday shopping season and strong retail demand.

Technical Analysis of Apple (AAPL) Shares

In our previous analysis, we identified an ascending channel (marked in blue) formed by price fluctuations following the April 2025 correction. A bullish reversal (highlighted with an arrow) has provided a basis to update the channel’s slope. In this configuration, the price is now in the upper half of the channel, moving towards its upper boundary.

From a price action standpoint, AAPL's rally is characterised by aggressive upward movement, accompanied by bullish gaps. This is a notable observation, suggesting that while sellers attempted to regain control during a consolidation phase in late July, they lacked conviction – with momentum now favouring the bulls.

This resembles a failed Rounding Top bearish pattern – bulls were able to push the price higher, signalling strong demand.

Potential resistance levels:

→ Near-term: The upper boundary of the channel, reinforced by the $225 level – a price point that has previously acted as a reversal zone.

→ Longer-term: A descending trendline (marked in red), drawn across key highs from recent months.

Bulls might find support at the channel median, which is further reinforced by the former resistance level of $214.

Having risen more than 8% since the start of the week, AAPL now appears overbought in the short term. However, given the strong fundamental backdrop, any potential pullbacks might prove to be shallow.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

AAPL - Breakout in Apple After ConsolidationApple's stock appears to be breaking out of its three months trading range between 216 and 190, potentially opening the way for more upside from here. Not only did the pair break above the previous highs, it has also broken above the VWAP line from last year's highs.

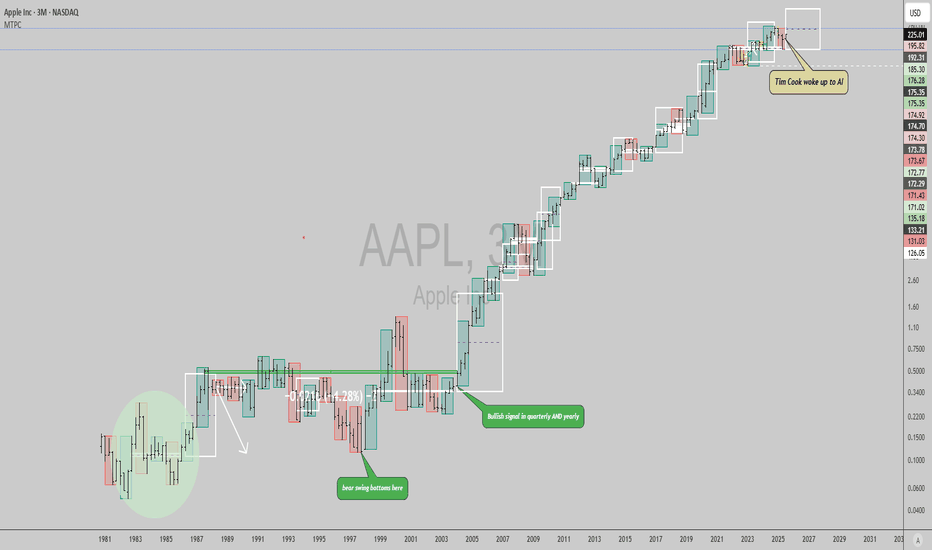

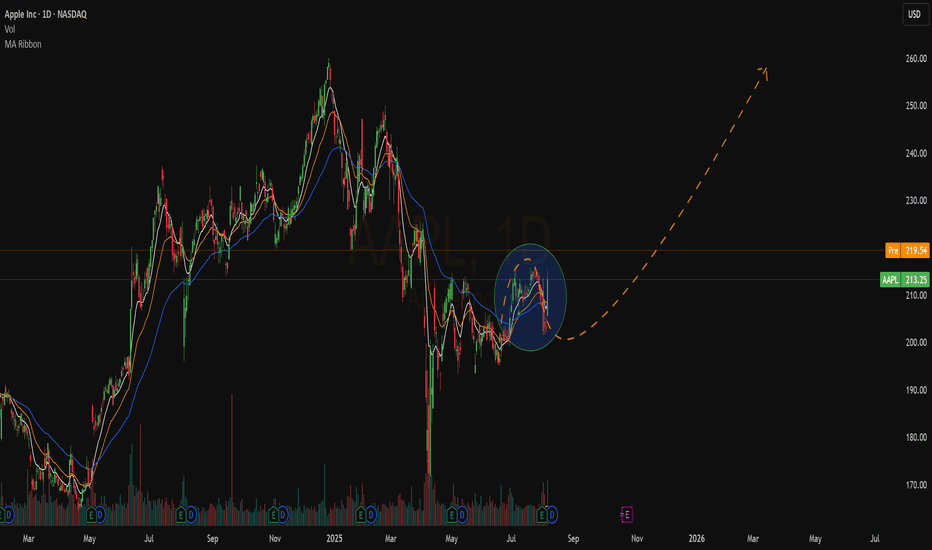

$AAPL: +57% in 2 years or lessLong term trend will confirm this quarter, nice catalyst with the events that took place a week ago after the latest earnings report: Tim Cook held a rare all hands meeting telling employees the following: The AI revolution is “as big or bigger” than the internet, smartphones, cloud computing and apps. “Apple must do this. Apple will do this. This is sort of ours to grab”.

Check out the historical track record of quarterly trend signals in the chart, every single damn one of them worked.

Best of luck!

Cheers,

Ivan Labrie.

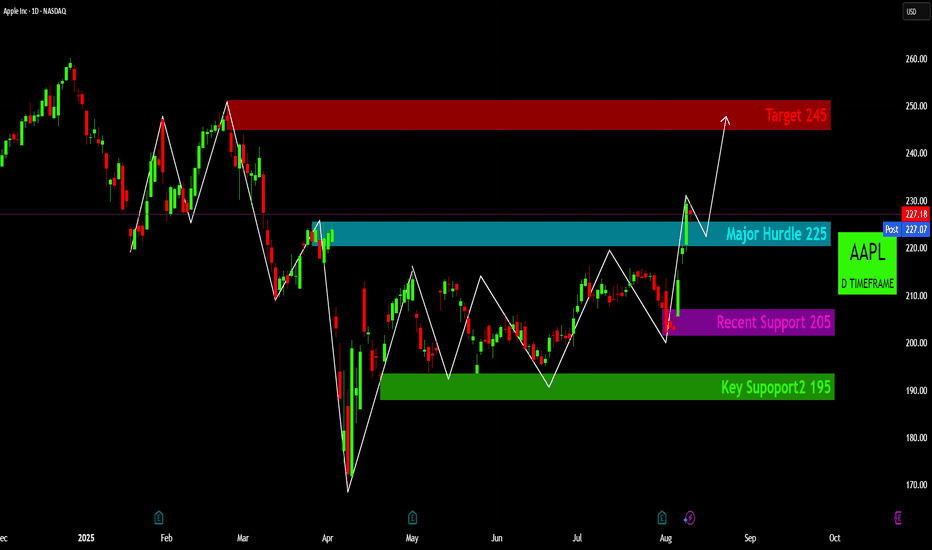

Apple's Ascent: Breaking Barriers, Targeting $245!AAPL: Preparing for Potential New Highs

Apple Inc. (AAPL) demonstrates a constructive bullish outlook on the daily timeframe, marked by a clear reversal pattern and a decisive breakout above a key resistance level. Recent price action indicates a notable shift in market sentiment, suggesting considerable upward potential.

Technical Foundation: Over recent months, AAPL has developed a solid bottoming formation originating from its April lows, anchored by consistent demand near $195 (Key Support) and further supported by a rebound from $205 (Recent Support). These levels highlight growing confidence among buyers, as well as effective accumulation at lower prices. 🛡️

Breakout Confirmation: A significant technical event occurred when price broke convincingly through the $225 (Major Hurdle) zone, which previously served as a substantial resistance area. This successful breakout provides confirmation of renewed bullish momentum and points to evolving market dynamics. 💥

Consolidation Phase: At present, AAPL is consolidating above the newly established support at $225. This consolidation is integral for digesting recent gains and validating the breakout level. Should $225 hold as support, it will reinforce the foundation for continued advancement. ✨

Upside Outlook: With the $225 barrier now surpassed and ongoing buying interest, the primary upside target is identified near the $245 level. This resistance aligns with prior highs and represents a logical short-term objective for price appreciation. 🎯

Risk Management Considerations: Despite the positive outlook, disciplined risk management requires close attention to key support areas. The $225 level (now support) is immediately relevant, followed by $205 and the critical $195 zone. Any breach of these supports should prompt a re-assessment of the prevailing bullish view. ✅

tradingview.sweetlogin.com

tradingview.sweetlogin.com

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

#AAPL 4 Touches on suppt then! Altve Trend line-day early break SOME INTERESTING CHART FEATURES

1. This often works...notice four price touches onto the the blue horizontal support line at $194 and then when it doesn't touch (see smiley) it often triggers a move, as in this case!

2. There's above average volume, verifying the move.

3. In recent years it's noticeable that multiple parallel trendlines coexist due to the trading computer algorithms. In this case there's a CLEAR parallel 'internal' trendline which was broken 1 day earlier than the higher trendline which was broken out off today.

To discover the 'internal' trendline resistances and supports, be prepared to draw through 'aberrations' of price movement. In this case there was a confluence between the downward-sloping black trendline, the closing price and the long-term rising black support.

4. The thick blue horizontal level at $214 produces a confluence in conjunction with the closing price line and the thick red downward-sloping resistance.

5. Another thing you often see, as with NASDAQ:AAPL is the price initially going DOWN after decent results (Puzzled me for nearly 30yrs!) and then shooting upwards.

PS: Yellow circles denote centres of confluence.

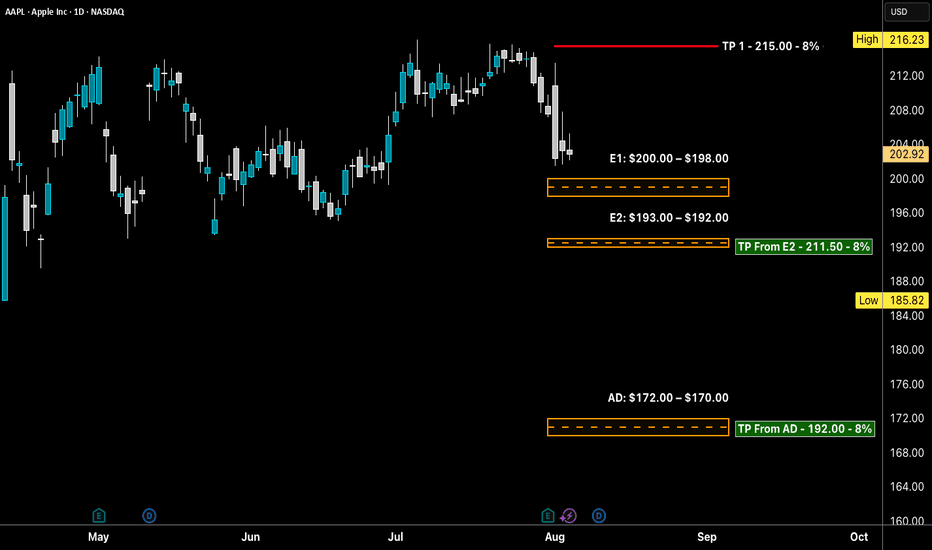

AAPL LONG Swing Entry PlanNASDAQ:AAPL LONG Swing Entry Plan

E1: $200.00 – $198.00

→ Open initial position targeting +8% from entry level.

E2: $193.00 – $192.00

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

AD: $172.00 – $170.00

→ If reached, enter with double the initial size to lower the overall cost basis.

→ Profit target remains +8% from the new average across all three entries.

Risk Management:

Stop Loss:

Risk is capped at 12% below the average entry price (calculated across all executed positions including the Edit Zone).

Position Sizing Approach:

Entry 1: 1x

Entry 2: 1x

AD Zone: 2x

→ Total exposure: 4x

→ Weighted average determines final TP and SL calculations.

______________________________________

Legal Disclaimer

The information provided in this content is intended for educational and informational purposes only and does not constitute financial, investment, or legal advice or recommendations of any kind. The provider of this content assumes no legal or financial responsibility for any investment decisions made based on this information. Users are strongly advised to conduct their own due diligence and consult with licensed financial advisors before making any financial or investment decisions.

Sharia Compliance Disclaimer: The provider makes no guarantees that the stocks or financial instruments mentioned herein comply with Islamic (Sharia) principles. It is the user’s responsibility to verify Sharia compliance, and consultation with a qualified Sharia advisor is strongly recommended before making any investment decisions

Time to buy? Too much negative press. Buy in Fear- Updated 28/7Apple has been making steady gains since April 8th. Trading volume has been consistently strong, increasing intermittently, with sell pressure exhausted at the 200 USD mark. The price point is now sitting above the 200 daily EMA support, which indicates strong potential for continued upward movement. Apple's earnings are in focus this week, with predictions that they will exceed expectations, but the extent of that exceedance is the question.

Regardless of the competition from Chinese-made phones or Samsung, once you are in the Apple ecosystem, it is rare to leave. Even if buying cycles slow down, Apple often provides innovative solutions to problems that no other provider can. The focus on Apple regarding AI appears slightly biased and carries some elements of fear, uncertainty, and doubt (FUD). It would be foolish to bet against Apple in the long term, even if the necessary technology is obtained through acquisition. With a strong cash position, this should not be an obstacle.

So far, the charts have shown us two positive moves after flag patterns, with resistance just below and around the EMA 200 level, which is now acting as support. The RSI is in the upper regions but is far from overbought, indicating we have a good level of momentum. The accumulation distribution chart also suggests strong support for Apple from institutions. No clear pattern is yet forming on the charts, except for a possible ascending triangle on the weekly, which would be very bullish.

The 50-day EMA is likely to cross the 200 EMA in mid-August, drawing a lot of attention as this would create a Golden Cross. This event would occur just prior to the Apple launch in September, which is rumored to introduce significant updates and advancements. Considering all these factors, I anticipate that Apple will continue its upward momentum for the next six weeks, with some substantial moves followed by pullbacks to support levels. The launch events will likely propel Apple to reach an all-time high (ATH). NFA

Target price is >260

AAPL US production lines. Politics or honest long-term strategy?NASDAQ:AAPL is investing into the US. Is it a short-term political move, or an actual genuine intention to "make America great again"?

Let's take a look.

NASDAQ:AAPL

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

$AAPL: Structure SurgeryResearch Notes

Original Structure:

Altering structure for experimental purposes

Angle of fib channels that rises from cycle low, has been pushed into the past to the top of first major reaction. blue area resembles the change

Reason

The the angle of Fibonacci channels which cover the general decline (from perspective of ATH to end of cycle), are adjusted to the angle of the first bear wave of smaller scale.

Therefore, when it comes to measurements of opposing forces for working out interference pattern, having this symmetric approach of mapping interconnections is fair.