Airbnb: Packs Its Bags with Tourism and Goes on VacationIon Jauregui – Analyst at ActivTrades

Airbnb Inc. (NASDAQ: ABNB) recently released its quarterly results, significantly exceeding market expectations and reaffirming its position as a leader in the tourism sector, which continues to recover following the impacts of the pandemic.

Fundamental Anal

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.56 EUR

2.56 B EUR

10.72 B EUR

412.89 M

About Airbnb, Inc.

Sector

Industry

CEO

Brian Chesky

Website

Headquarters

San Francisco

Founded

2007

FIGI

BBG00YJQCQY9

Airbnb, Inc. engages in the management and operation of an online marketplace. Its marketplace model connects hosts and guests online or through mobile devices to book spaces. The company was founded by Brian Chesky, Nathan Blecharczyk and Joseph Gebbia in 2007 and is headquartered in San Francisco, CA.

Related stocks

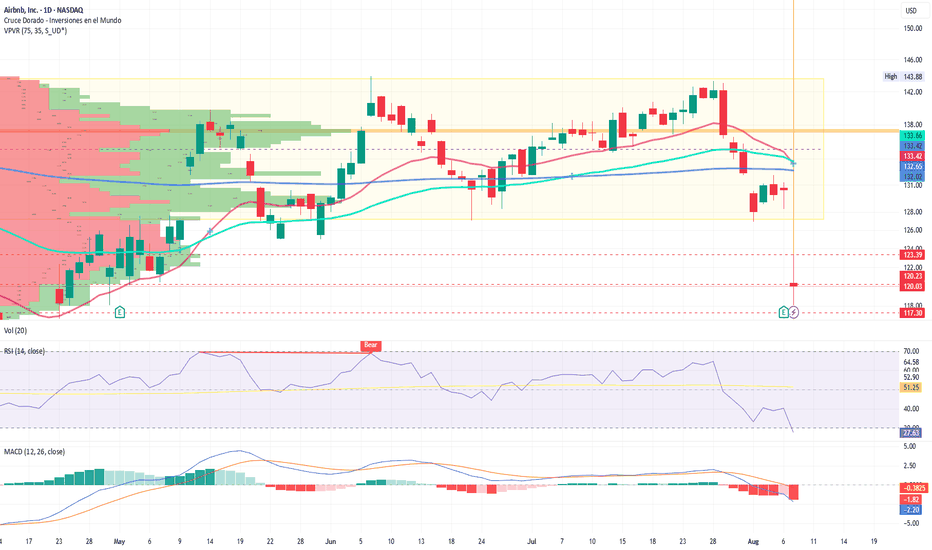

August is a key turning point

Hello, fellow traders!

Follow us to get the latest information quickly.

Have a great day!

-------------------------------------

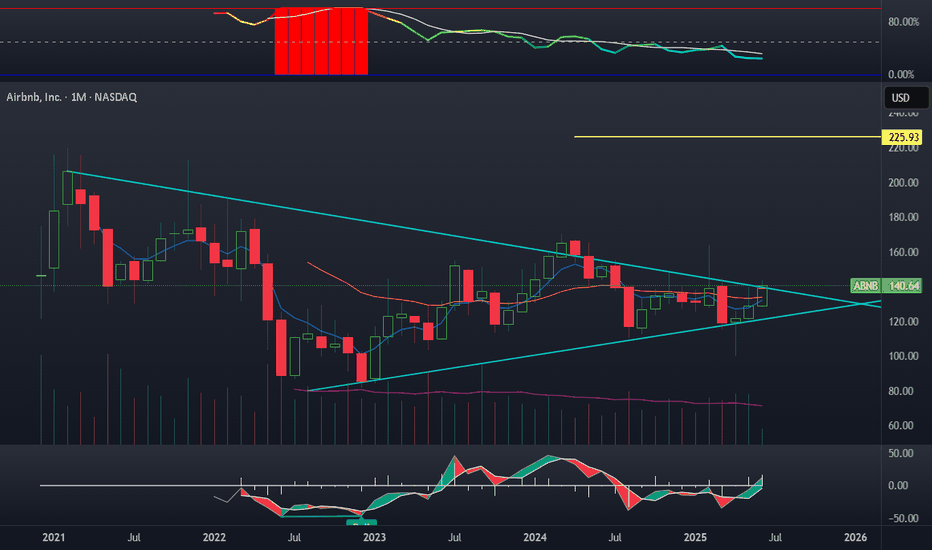

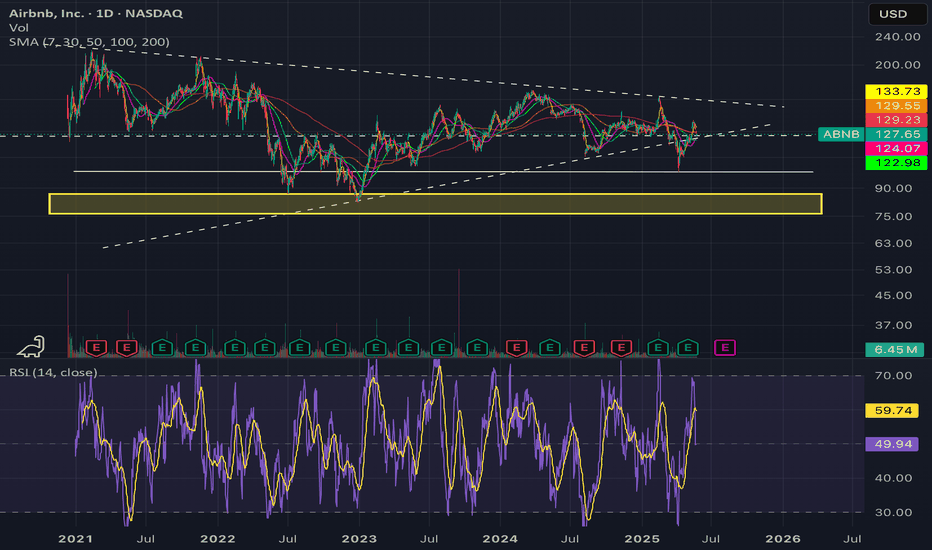

(ABNB 1M chart)

ABNB is at a key turning point.

The key question is whether it can find support near 126.34 and rise.

-

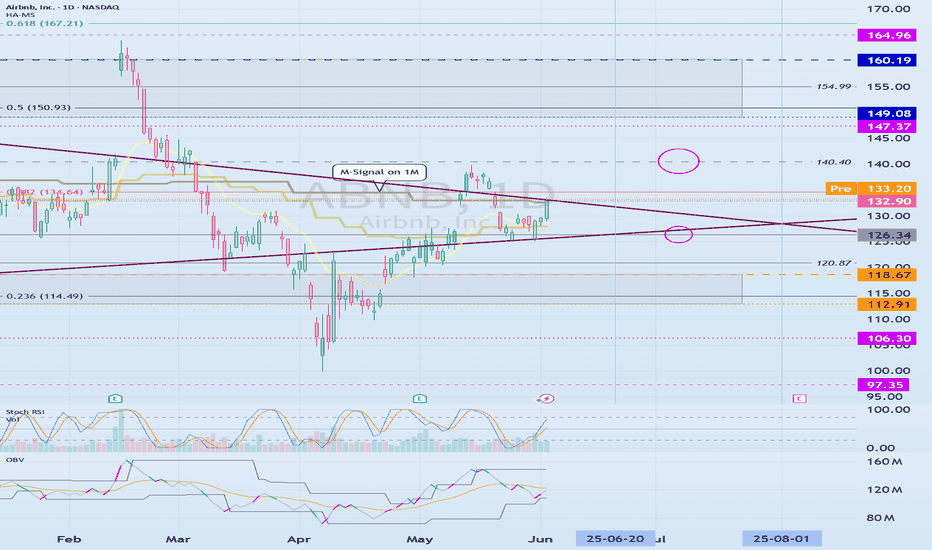

(1D chart)

The key is whether the price can

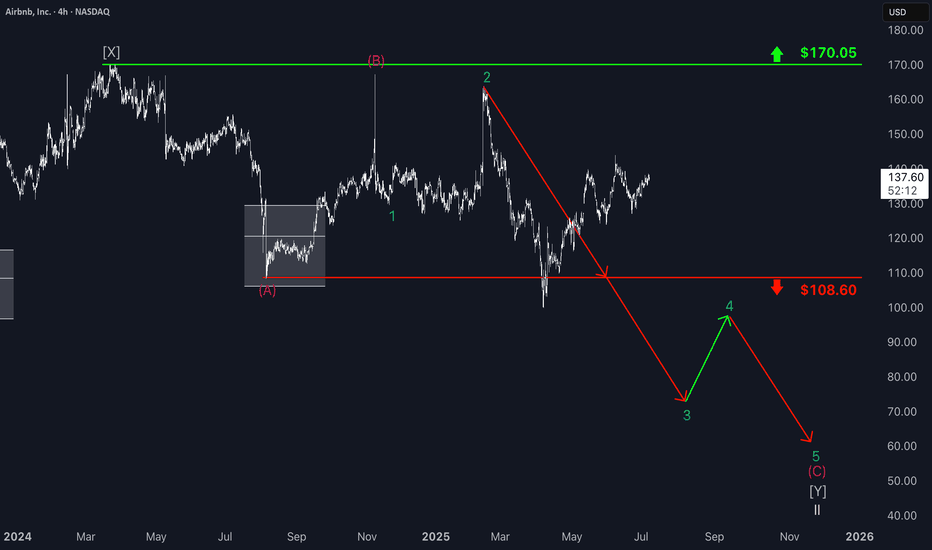

Airbnb: Downtrend Set to Resume SoonSince our last update, Airbnb has experienced a rebound, which diverted the stock from the anticipated sell-off. However, the price is expected to soon resume its downward trajectory and, as the next key step, break through support at $108.60. This move should complete turquoise wave 3, with all sub

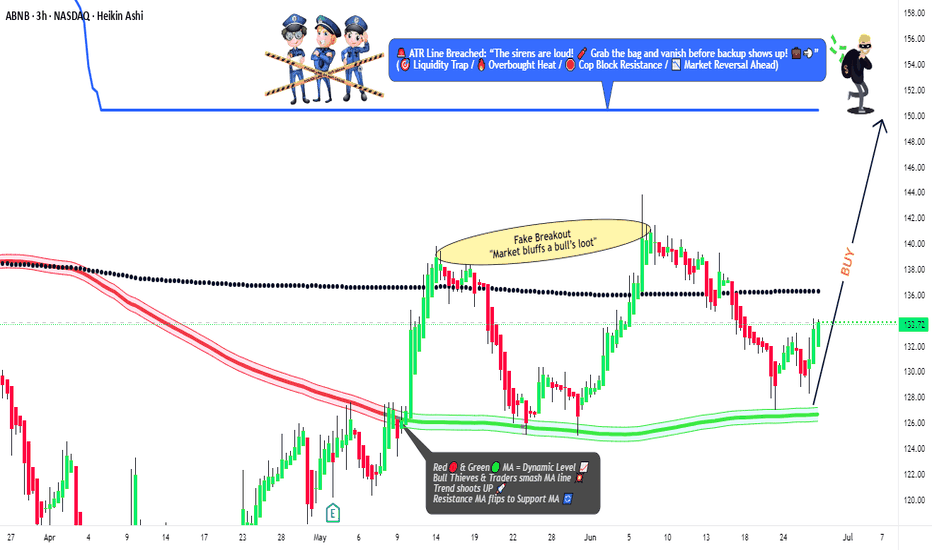

"AIRBNB: The Market’s Next BIG Move – Are You In or Out?"🚨 AIRBNB HEIST ALERT: Bullish Loot Grab Before the Escape! (Swing/Day Trade Plan) 🚨

🌟 Attention Market Pirates & Profit Raiders! 🌟

🔥 THIEF TRADING STYLE STRATEGY – AIRBNB (ABNB) LOOTING ZONE! 🔥

📌 THE HEIST PLAN:

Based on high-risk, high-reward technical & fundamental analysis, we’re eyeing a bulli

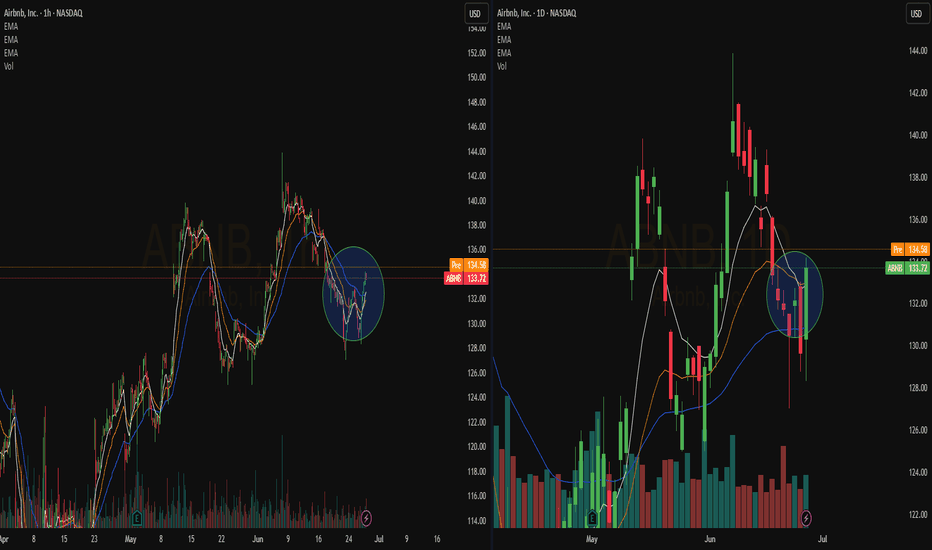

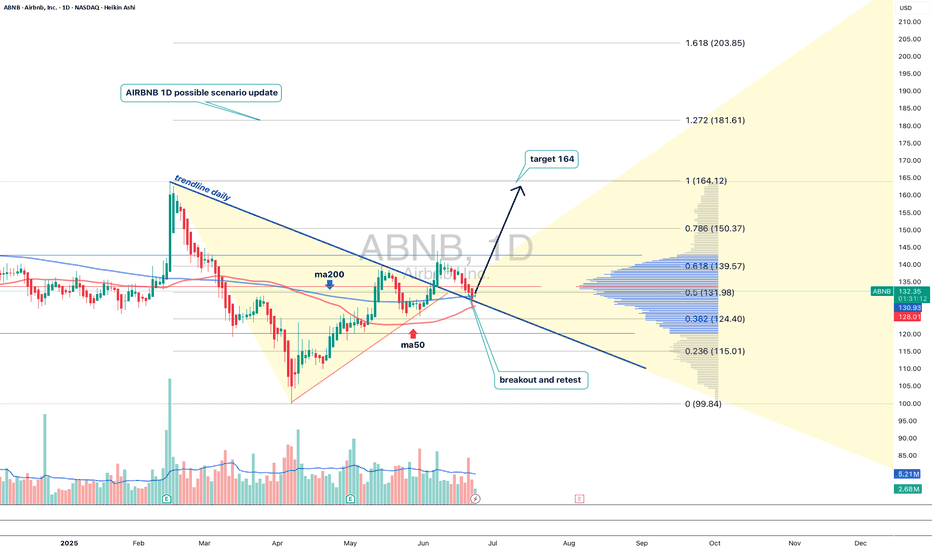

Airbnb: Proof that even stocks love to traveThe analysis of Airbnb (ABNB) stock reveals an intriguing setup following the breakout and retest of a key resistance level, which previously acted as a trendline on the daily chart. After successfully breaking above this line and confirming it with a retest, the price is now showing potential for f

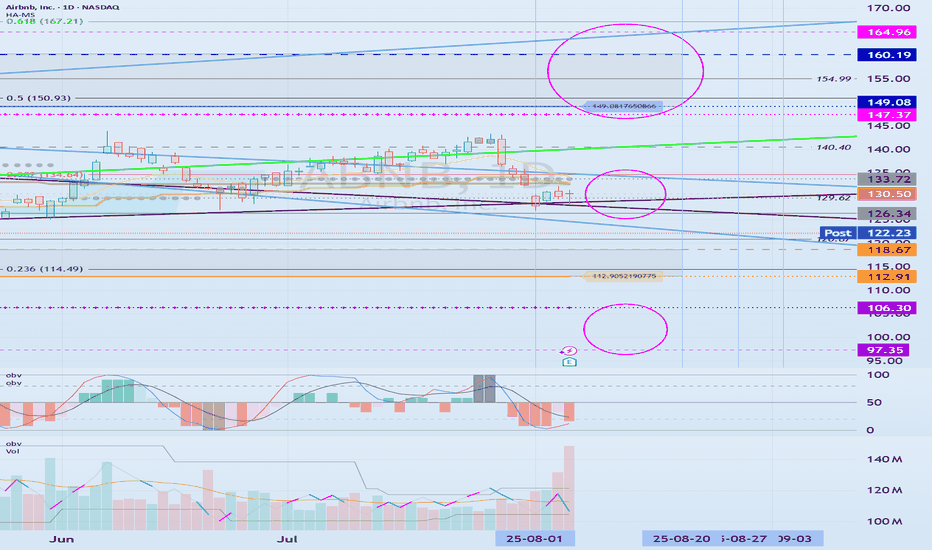

The key is whether it can hold the price by rising above 134.64

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ABNB 1D chart)

The key is whether it can hold the price by rising above the M-Signal indicator on the 1M chart.

If the price breaks through the tria

Mid life crisis @ $ABNB ; PT < $80- Valuation doesn't make sense on $ABNB.

- Market is too generous on $ABNB.

- NASDAQ:BKNG is defacto king when it comes to travel and booking. Market also reflects that by awarding NASDAQ:BKNG a whooping 180 billion market cap.

- NASDAQ:EXPE valuation is too cheap to ignore and revenue numbe

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where ABNB is featured.

Frequently Asked Questions

The current price of ABNB is 106.92 EUR — it has increased by 0.95% in the past 24 hours. Watch AIRBNB INC-CLASS A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange AIRBNB INC-CLASS A stocks are traded under the ticker ABNB.

ABNB stock has risen by 1.95% compared to the previous week, the month change is a −10.51% fall, over the last year AIRBNB INC-CLASS A has showed a 0.36% increase.

We've gathered analysts' opinions on AIRBNB INC-CLASS A future price: according to them, ABNB price has a max estimate of 154.21 EUR and a min estimate of 83.96 EUR. Watch ABNB chart and read a more detailed AIRBNB INC-CLASS A stock forecast: see what analysts think of AIRBNB INC-CLASS A and suggest that you do with its stocks.

ABNB reached its all-time high on Nov 16, 2021 with the price of 184.90 EUR, and its all-time low was 77.52 EUR and was reached on Dec 28, 2022. View more price dynamics on ABNB chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ABNB stock is 0.92% volatile and has beta coefficient of 1.29. Track AIRBNB INC-CLASS A stock price on the chart and check out the list of the most volatile stocks — is AIRBNB INC-CLASS A there?

Today AIRBNB INC-CLASS A has the market capitalization of 65.51 B, it has decreased by −7.27% over the last week.

Yes, you can track AIRBNB INC-CLASS A financials in yearly and quarterly reports right on TradingView.

AIRBNB INC-CLASS A is going to release the next earnings report on Oct 29, 2025. Keep track of upcoming events with our Earnings Calendar.

ABNB earnings for the last quarter are 0.87 EUR per share, whereas the estimation was 0.80 EUR resulting in a 9.90% surprise. The estimated earnings for the next quarter are 1.98 EUR per share. See more details about AIRBNB INC-CLASS A earnings.

AIRBNB INC-CLASS A revenue for the last quarter amounts to 2.63 B EUR, despite the estimated figure of 2.57 B EUR. In the next quarter, revenue is expected to reach 3.50 B EUR.

ABNB net income for the last quarter is 545.00 M EUR, while the quarter before that showed 142.35 M EUR of net income which accounts for 282.86% change. Track more AIRBNB INC-CLASS A financial stats to get the full picture.

No, ABNB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 15, 2025, the company has 7.3 K employees. See our rating of the largest employees — is AIRBNB INC-CLASS A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AIRBNB INC-CLASS A EBITDA is 2.28 B EUR, and current EBITDA margin is 23.58%. See more stats in AIRBNB INC-CLASS A financial statements.

Like other stocks, ABNB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AIRBNB INC-CLASS A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AIRBNB INC-CLASS A technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AIRBNB INC-CLASS A stock shows the strong sell signal. See more of AIRBNB INC-CLASS A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.