ABNB trade ideas

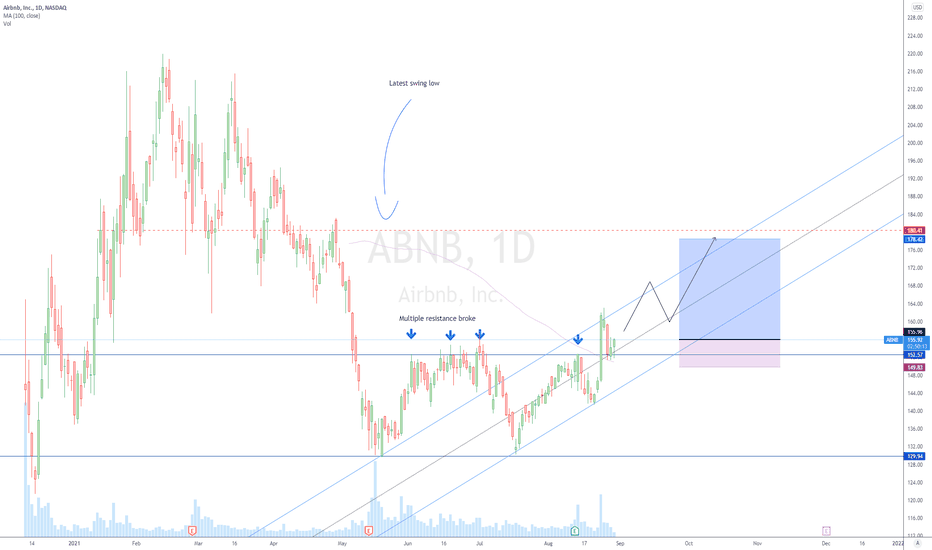

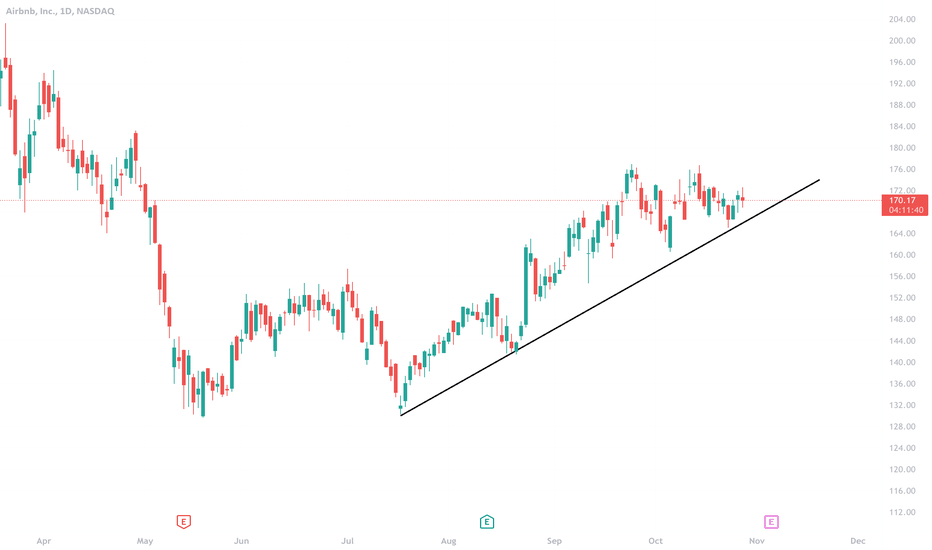

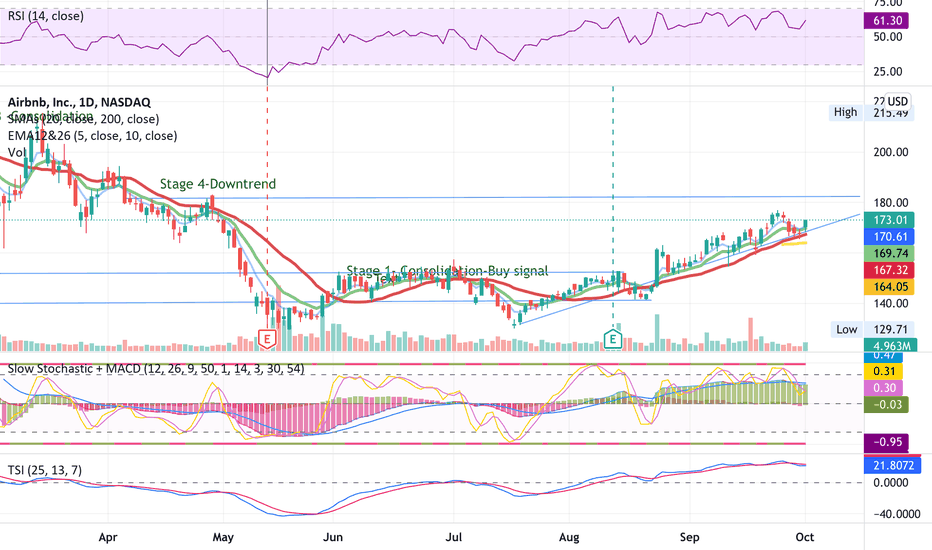

ABNB 30-08-2021 LongAsset and Time frame -ABNB, Daily

Entry Price -155.97

Exit(Stop Loss) -149.83

Exit(Take Profit) -178.42

Technical Analysis -Price has been going sideways on the daily chart with multiple attempts of breaking the 152.x level, price action started going in an up-trending channel since July and now broke the 152.x level for the first time with a big volume spike and a retest, now price is retesting the 152.x level + the daily 100 MA as secondary support and confluence.

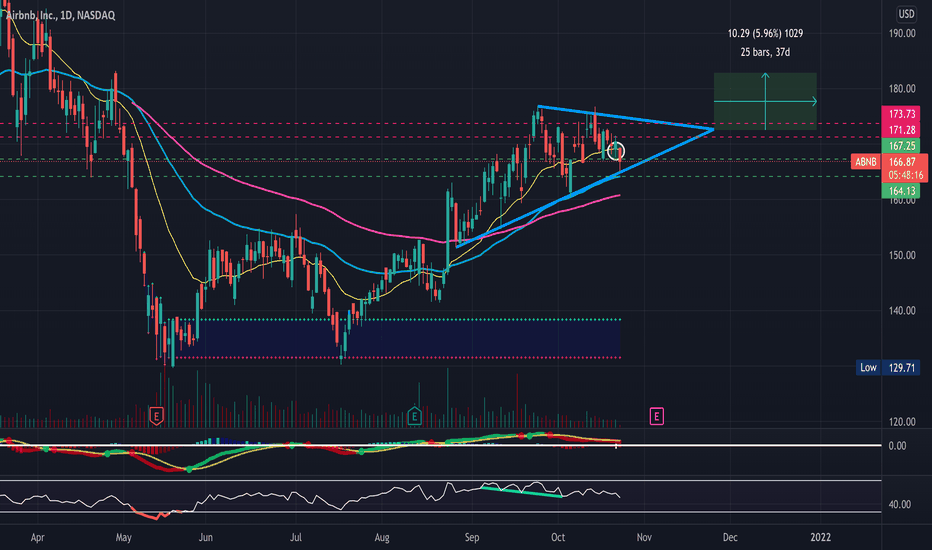

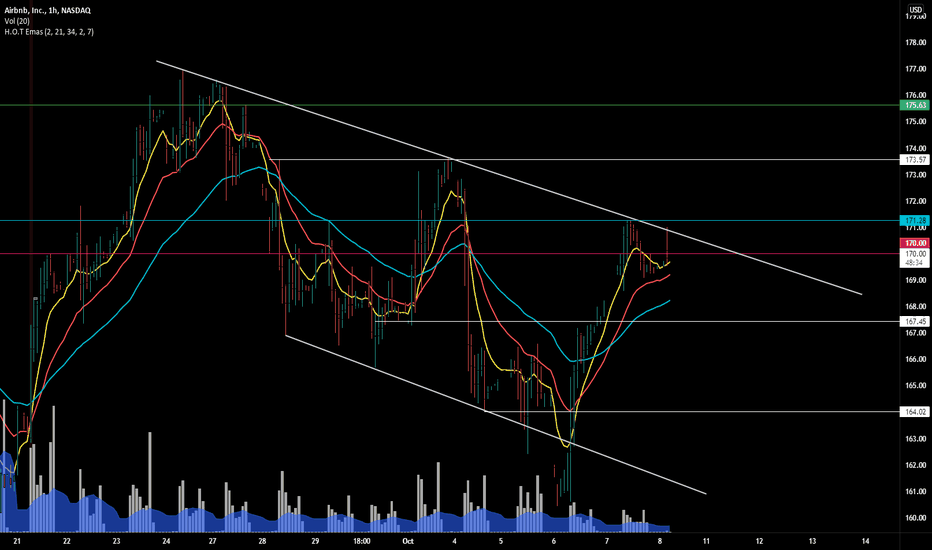

Ascending Triangle Forming- BullishABNB really catching my eye here- Big ascending triangle forming on the 2-hour timeframe along with a big falling wedge on the hourly timeframe (See Attached Chart Below). Will be looking for a breakout from this triangle (Broader Markets Permitting) - Just some support and resistance levels to keep an eye on along with some RSI-based supply and demand zones - Bullish

- Bollinger Bands Squeezing (Not Pictured)

- Falling wedge on the hourly timeframe

- MACD cross

- Slight bullish hidden divergence on the RSI

- Sitting right on its 100-day EMA

PT1- $171.21

PT2- $172.46

PT3- $175.67 + Breakout

Hourly Timeframe-

Previously Charted-

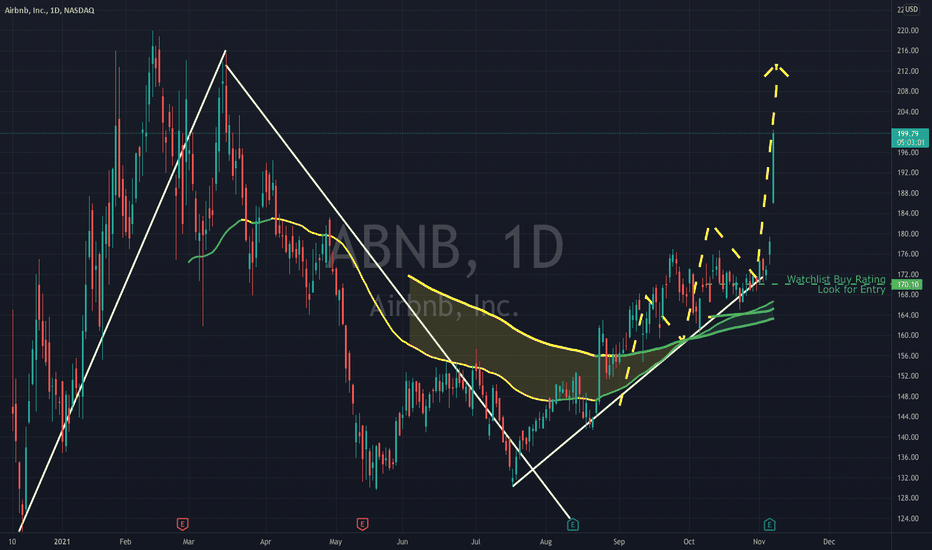

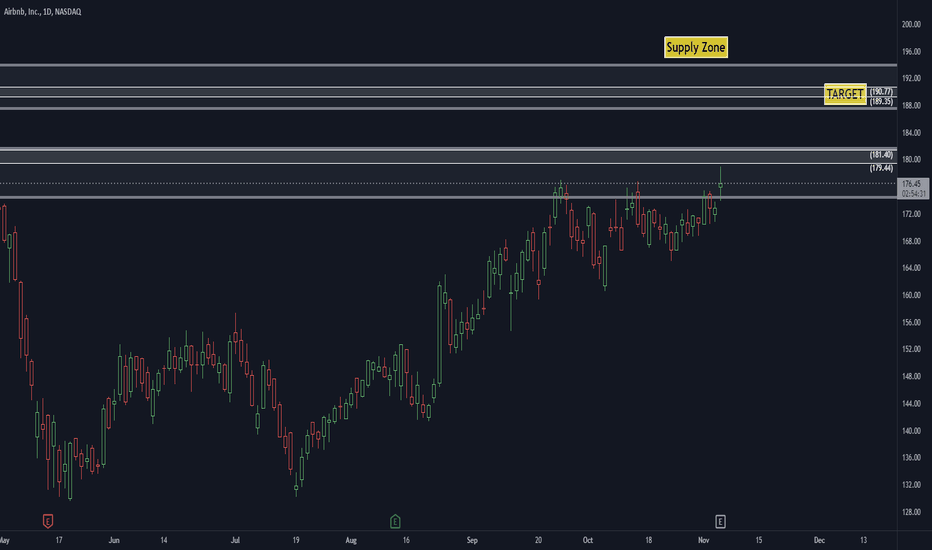

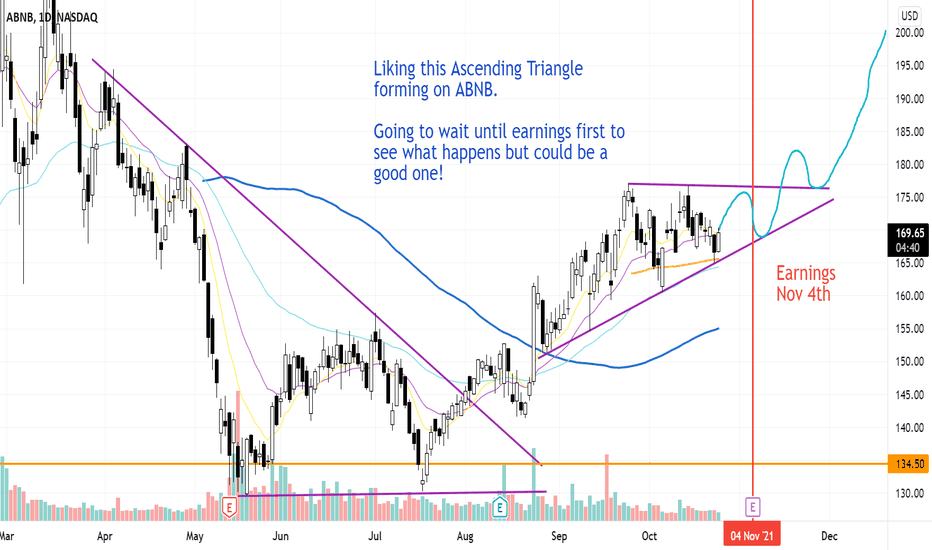

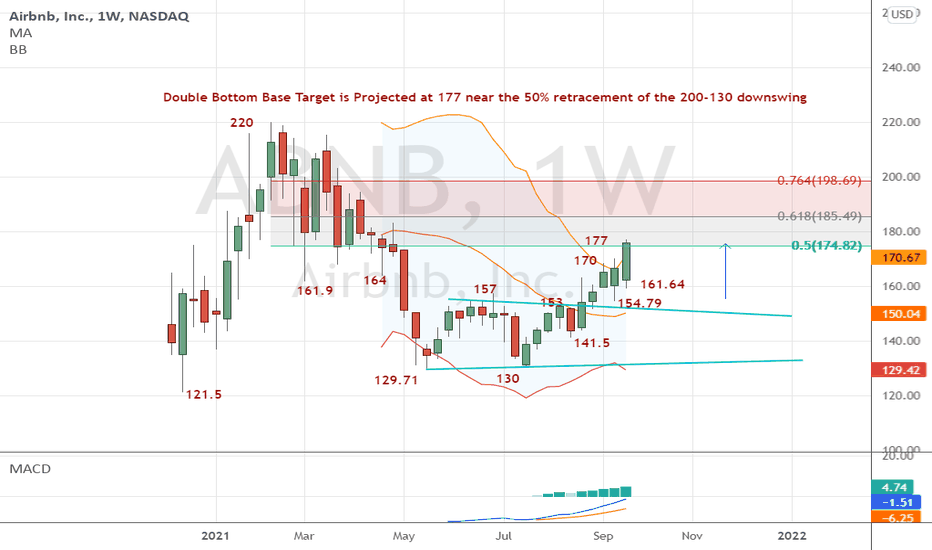

$ABNB Triangle Breakout, Earnings Beat$ABNB Airbnb reported earnings after hours today, beating EPS and revenue estimates. Stock is currently flat in AH trading but did run up 3% today.

I'll be keeping a close eye on this at the open tomorrow...after crushing the earnings options IV this could start to run toward $200 throughout the day tomorrow assuming the overall market sentiment remains bullish or neutral. I will be looking at near the money calls if it breaks above $180.

Besides the earnings move...chart looking solid today with a breakout and close above ~$176 resistance. It is possible it retests ~$176 as support in the AM if the overall market is down...for me that would be an ideal entry point into a bullish options trade.

Near term target: $200-$210 range by early December

Note: This is NOT investment advice. Educational only.

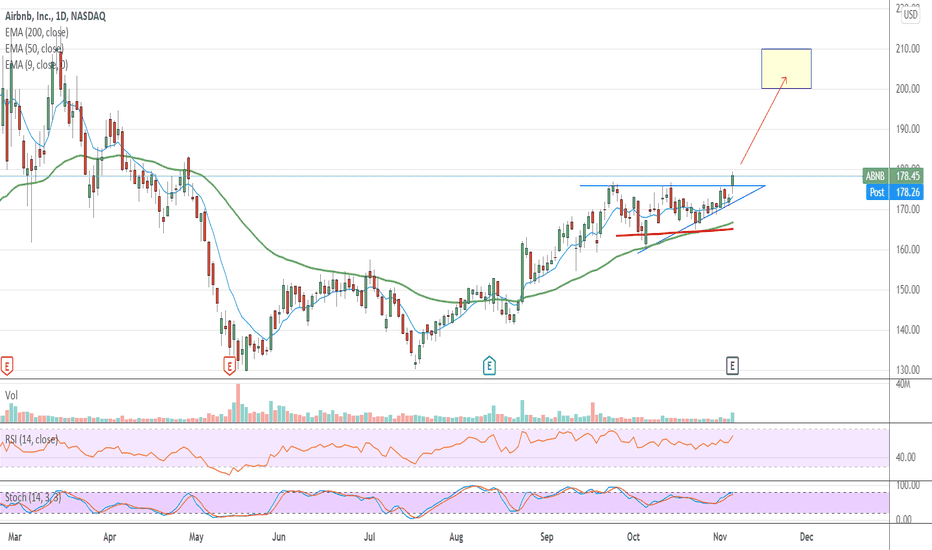

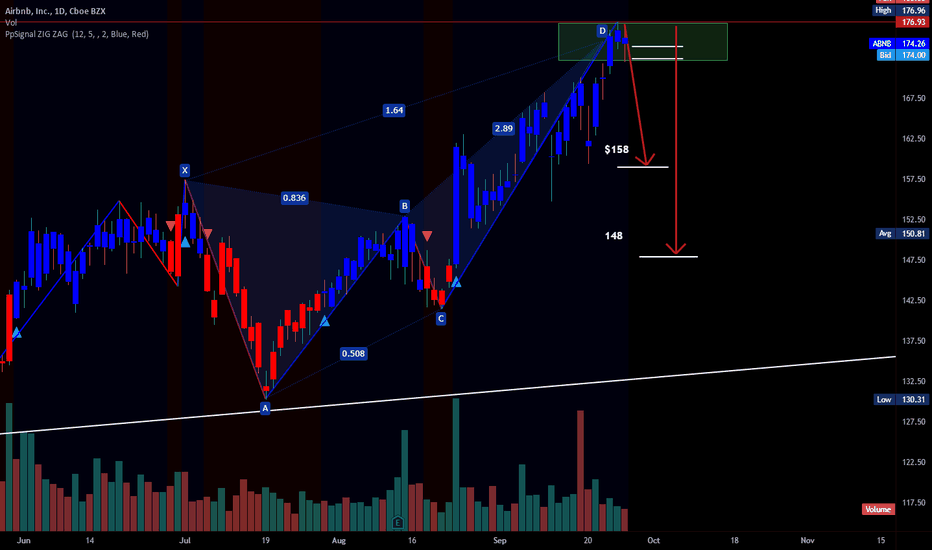

ABNB: Bullish OutlookTechnically I like the price action for ABNB, despite it sitting in a supply zone. Difference between now and in the past is the momentum is confirming the move. Some may look at Zillow and base that decline and sentiment as an overlay onto the rental property business - but I think they're not as correlated as many speculate.

Bullish outlook on ABNB with targets identified into the upper supply zone.

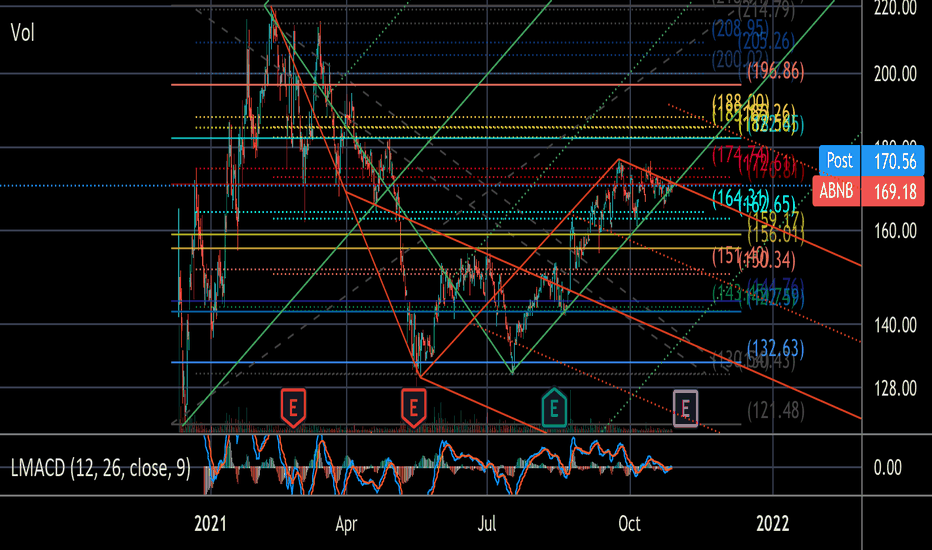

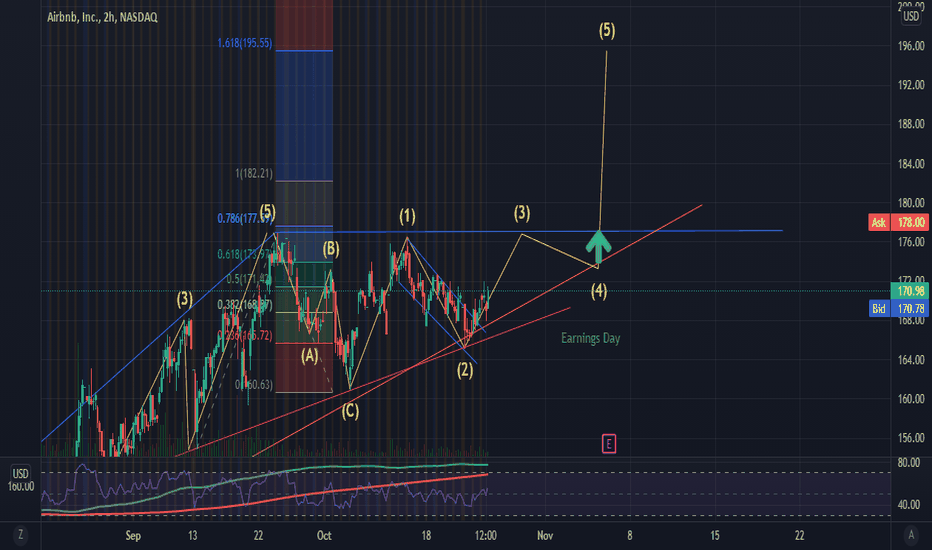

Airbnb will experience higher volatility soon..!In 1 week there will be the earnings, ABNB is at the lower border of an upward regression channel and also has built a contracting triangle (consolidation pattern) its earning will push Airbnb outside the consolidation!

the question is which side is more probable?

Because of the Delta variant surge, I do not think tourism-related stocks could beat the expectation..!

But as I always said, trading before earnings= gambling!

and I prefer to stay out of it!

Best,

Moshkelgosha

DISCLAIMER

I’m not a certified financial planner/advisor nor a certified financial analyst nor an economist nor a CPA nor an accountant nor a lawyer. I’m not a finance professional through formal education. The contents on this site are for informational purposes only and do not constitute financial, accounting, or legal advice. I can’t promise that the information shared on my posts is appropriate for you or anyone else. By using this site, you agree to hold me harmless from any ramifications, financial or otherwise, that occur to you as a result of acting on information found on this site.

$ABNB will be $181.00 by Dec 2nd -Fib flag formation So I did two fib growth pitchforks..

—one mod schiff Bearish and one original recipe bullish, and that’s an obvious flag formation, double major resistance at $180 to $182

If I was a betting man I would bet a debit call spread with the short call 60+ days out 12/15/21 on the top end w a $190 strike..

-and a slightly out of the money call January 2022 at $175 strike.. Cha Ching!

$ABNBAn essential aspect of Airbnb's business is that the company does not own or operate any rental properties. Similar to eBay, it creates the platform and manages the interactions between hosts and guests. The asset-light business model has the potential for excellent profit margins because there is no need to pay for building or maintaining expensive structures like hotels or resorts. Moreover, Airbnb can hire customer service staff in low-cost parts of the world to support guests staying at properties in high-cost areas like Los Angeles.

The coronavirus pandemic caused Airbnb's revenue to fall by 29.7% in fiscal 2020. Before the outbreak, Airbnb increased revenue by 42.6% and 31.6% in 2018 and 2019, respectively. Overall revenue was highest in 2019, where it totaled $4.8 billion. Still, management feels that's just the tip of the iceberg. It estimates Airbnb's total addressable market at around $3.4 trillion.

To put that figure into context, Statista estimates the worldwide hotel and resort market peaked at $1.47 trillion in 2019. It seems management's estimate of its total addressable market may be on the optimistic side.

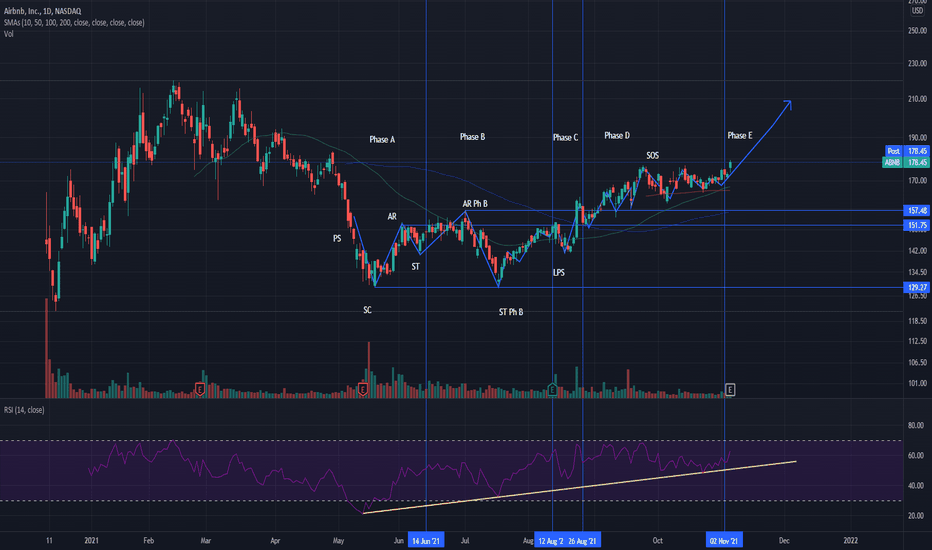

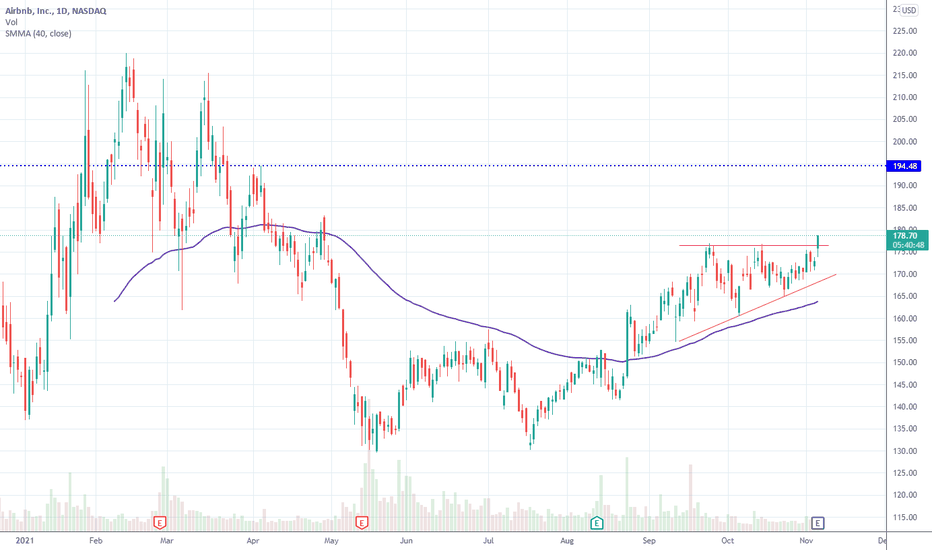

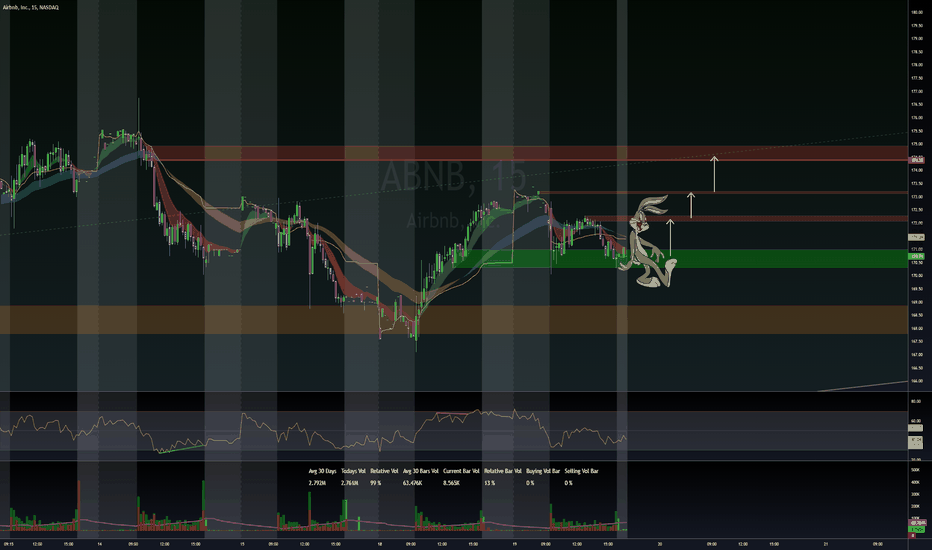

Airbnb I’ve been very bullish on before it even went public.

It has a slight rough start to the year but it seems to have found its step.

It had a clear double bottom on the daily and now is following a nice upwards trend and is now currently sitting at support

Implying, if Airbnb is able to hold these prices we could see this continue it’s way up and with earnings around the corner it would be very interesting to see what happens from here.

MACD flat.

RSI below 50.

Watchlist this.

Factor Four

Symmetrical Triangle - Watching closelyABNB forming a big symmetrical triangle but frankly looking quite bullish, will be looking for a breakout from this triangle (Broader Markets Permitting) - Just some support and resistance levels to keep an eye on along with some RSI-based supply and demand zones

- Sitting right on its 20-day EMA

- Bollinger Bands Squeezing (Not Pictured)

- Slight bullish hidden divergence on the RSI

- MACD cross on the hourly timeframe (See Chart Below)

PT1- $171.21

PT2- $172.46

PT3- $175.67 + Breakout

AIRBNB (ABNB) Trade UpdatesUpdate on AIRBNB investment made in August.

After my entry (at 144,71 see the previous post), a rather solid uptrend started.

We are now on a very important volumetric level; a small double bottom has also been created, so a slight pull-back in the short term could be physiological. It is important to see if the 200 moving average will hold, given that the company's listing is a recent thing, the second support to keep in mind is the trendline I have drawn.

The most important thing to point out is the relative strength of the company; in a difficult period for the general markets, ABNB only rose in the months of September and October. This is an important signal of strength, as is the awareness that the world is slowly starting up again and so is Airbnb, closely linked to tourism.

Let's remember that from March 2021 to May 2021 the stock had lost 40%! An enormity, clearly due to external events (COVID and tourism paralysis) rather than to company problems, which, on the contrary, has solid foundations.

I remind you that mine is a long-term investment perspective with gradual accumulation with each pullback, for those interested in pure trading, the targets for a take profit in my opinion are:

- $ 180

- $ 190 important volumetric level where the institutions have started to push the price down

- $ 215 very close to an all-time high, an area where I will take home part of the profits.

Pay attention to the earnings at the beginning of December.

Happy trading

Lazy Bull

DISCLAIMER: I am not a financial advisor nor a CPA. These posts, videos, and any other contents are for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments.