ABNB trade ideas

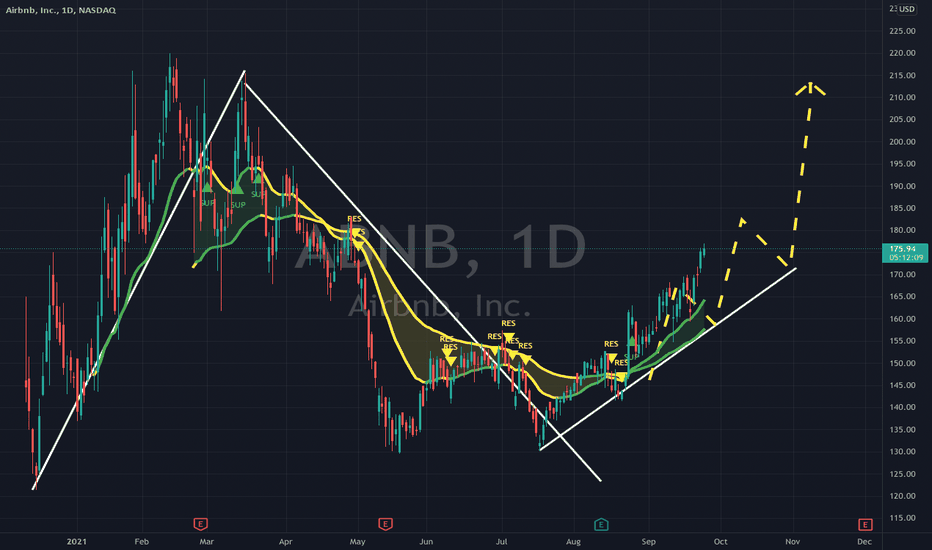

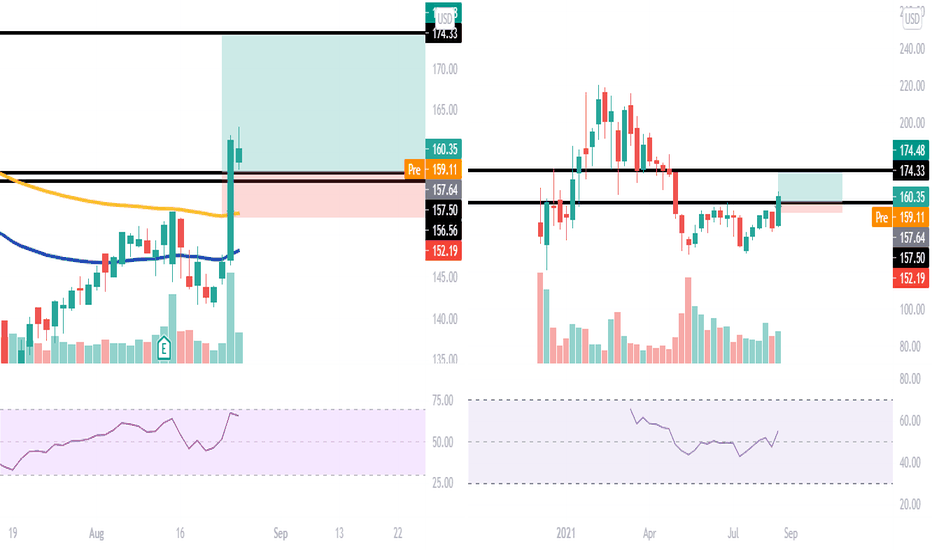

ABNB: RECOVERY PLAY, ICHIMOKU ANALYSISABNB :

Another reopening play, people looking to travel again.

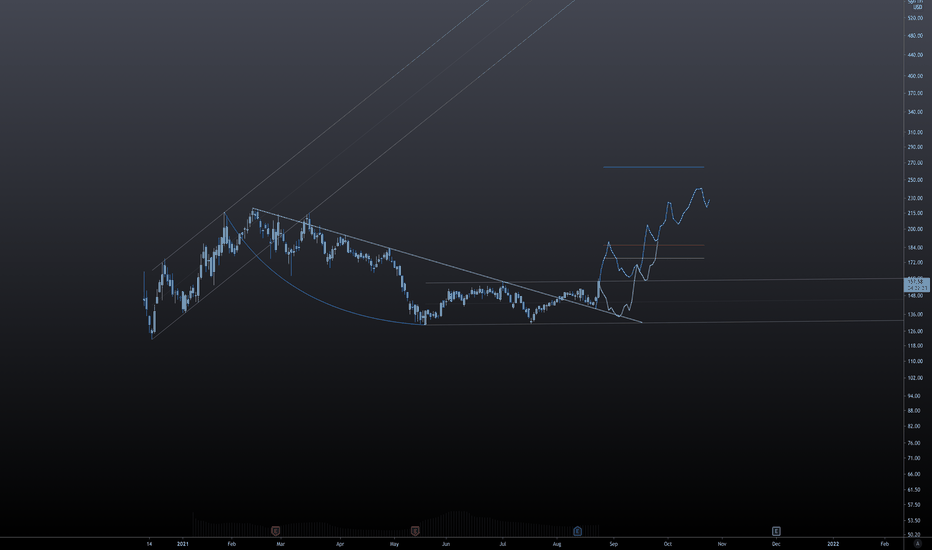

Ichimoku analysis on daily:

The price is currently blocked by the cloud. Pressure is building to reintegrate the cloud.

The lagging span (green line) has broken the Tenkan (blue line) and is heading for a test of the Kinjun (dark red line), the flat zone of the Kinjun is our 1st target/resistance at 156 (providing the price can reintegrate the cloud).

This is what I'm playing now with a long trade.

The next step will be for the price to reach the top of the clouds (and maybe break out of it) and the lagging span to break the Kinjun, confirming the change of trend.

Note how Ichimoku is precise, all flat zones (of clouds and Laggin span) represent former supports and resistances (the 4 targets on the chart).

On a separate note you can see a sort of ascending triangle on the daily chart.

Trade safe!

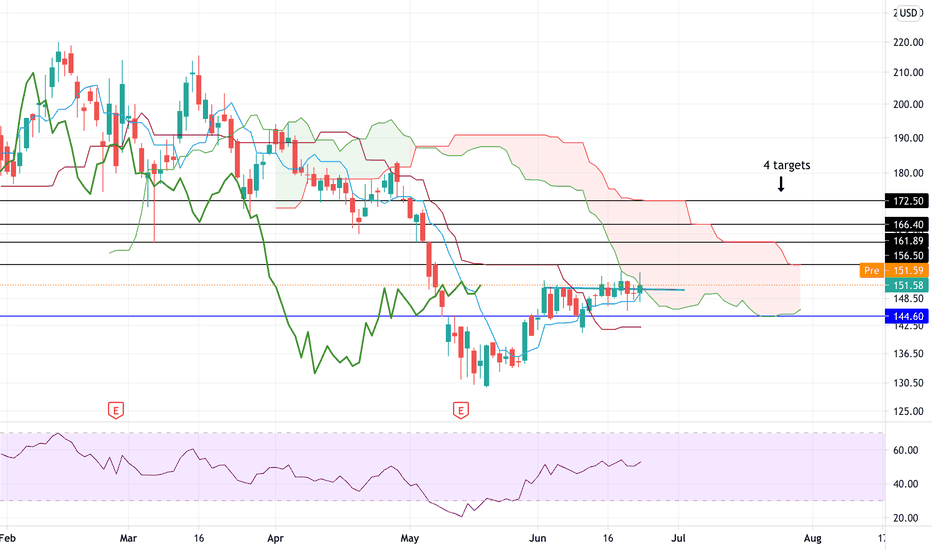

More on Ichimoku (by Investopedia):

The Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction. It does this by taking multiple averages and plotting them on a chart. It also uses these figures to compute a “cloud” that attempts to forecast where the price may find support or resistance in the future.

Key takeaways:

The Ichimoku Cloud is composed of five lines or calculations, two of which comprise a cloud where the difference between the two lines is shaded in.

The lines include a nine-period average, a 26-period average, an average of those two averages, a 52-period average, and a lagging closing price line.

The cloud is a key part of the indicator. When the price is below the cloud, the trend is down. When the price is above the cloud, the trend is up.

The above trend signals are strengthened if the cloud is moving in the same direction as the price. For example, during an uptrend, the top of the cloud is moving up, or during a downtrend, the bottom of the cloud is moving down.

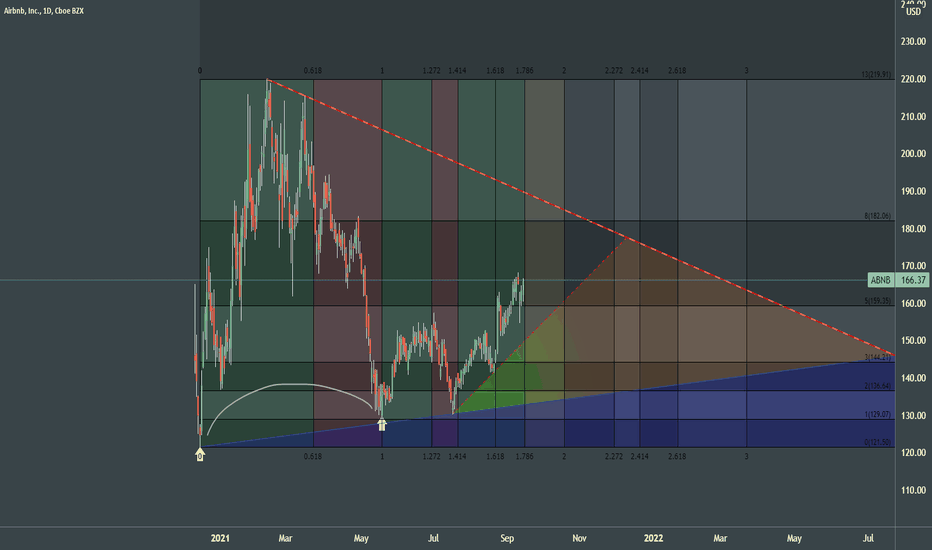

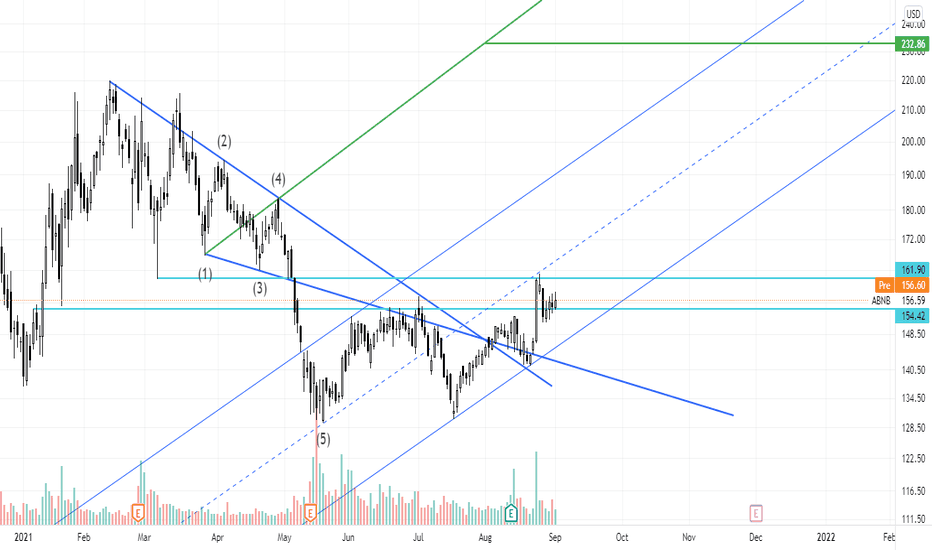

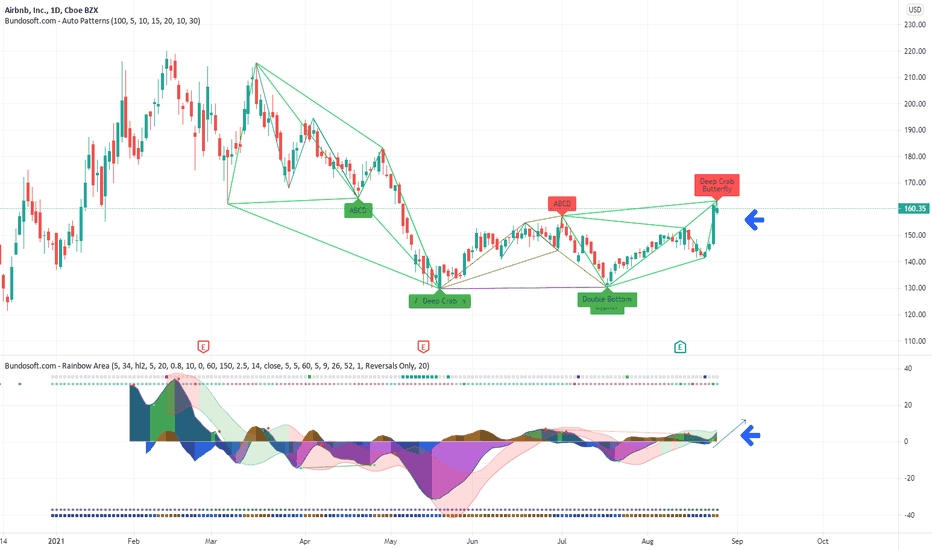

AIRBNB INC Scheme IAirbnb looks like it's in a strong uptrend condition. However, I wouldn't necessarily buy $ABNB right now. Seeking the next best prices for accumulation. Just waiting for the price reaction at dashed lines. Needed more candle market data to form of specific signaling patterns at the critical levels to clear up its actual path.

Time Fib based on big cycle (0; 1)

For support and resistance look for fib sequence levels.

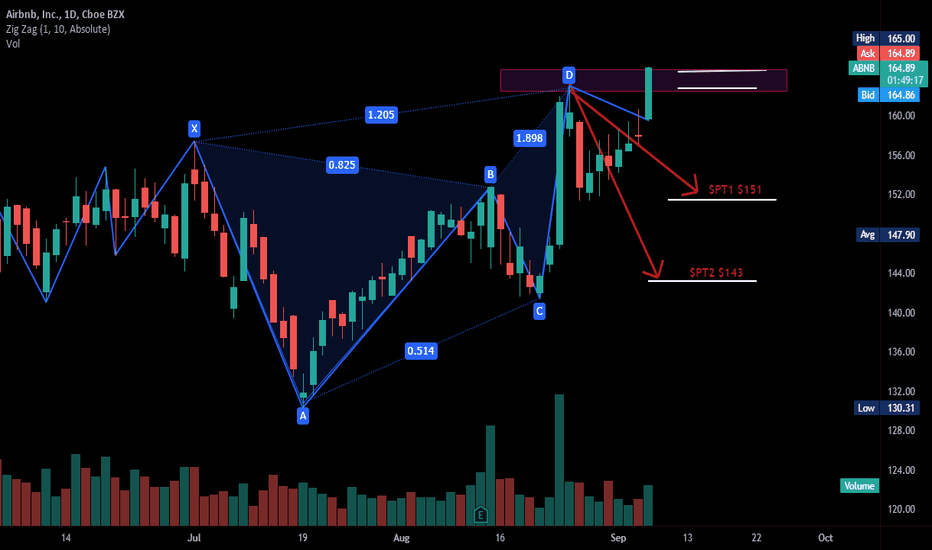

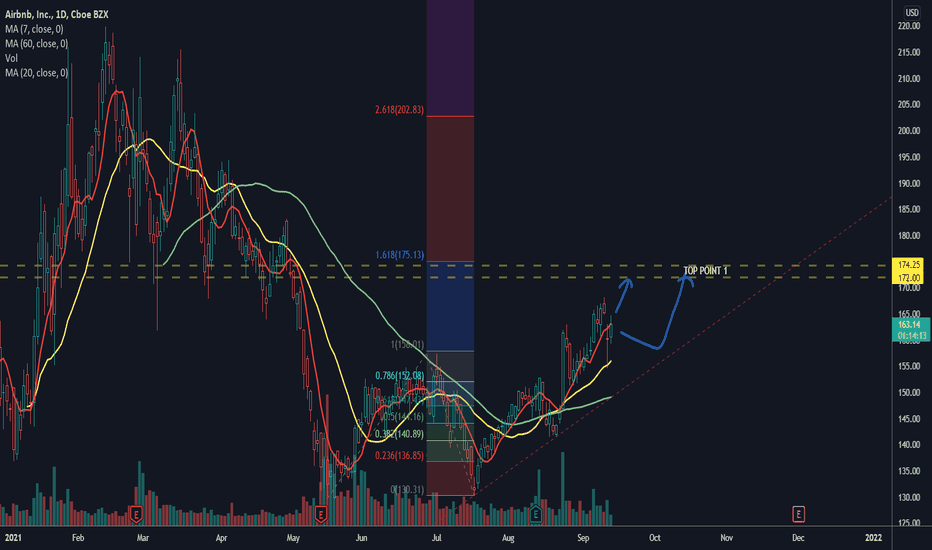

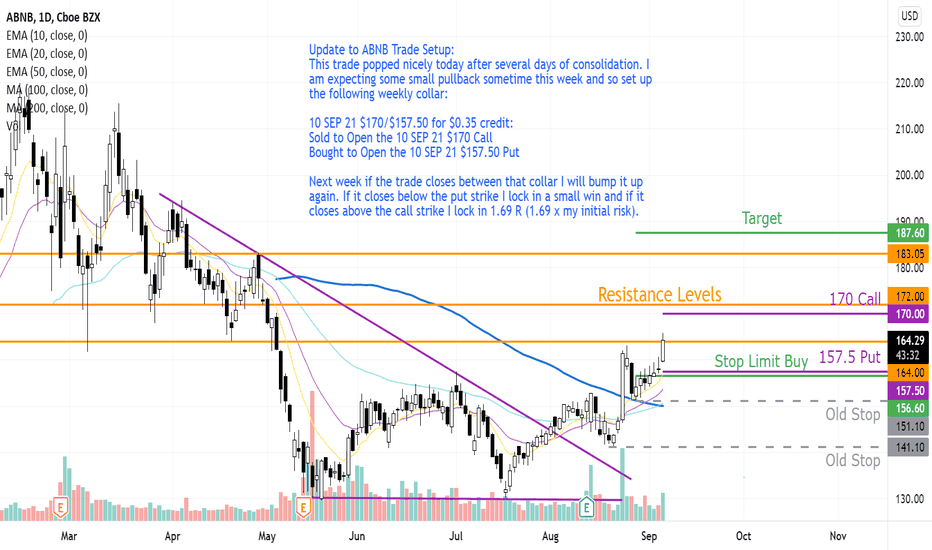

Update to ABNB Trade Setup: Weekly CollarUpdate to ABNB Trade Setup:

This trade popped nicely today after several days of consolidation. I am expecting a small pullback sometime this week and so set up the following weekly collar:

10 SEP 21 $170/$157.50 for $0.35 credit:

Sold to Open the 10 SEP 21 $170 Call

Bought to Open the 10 SEP 21 $157.50 Put

Next week if the trade closes between that collar I will bump it up again. If it closes below the put strike I lock in a small win and if it closes above the call strike I lock in 1.69 R (1.69 x my initial risk).

For details on the original trade setup:

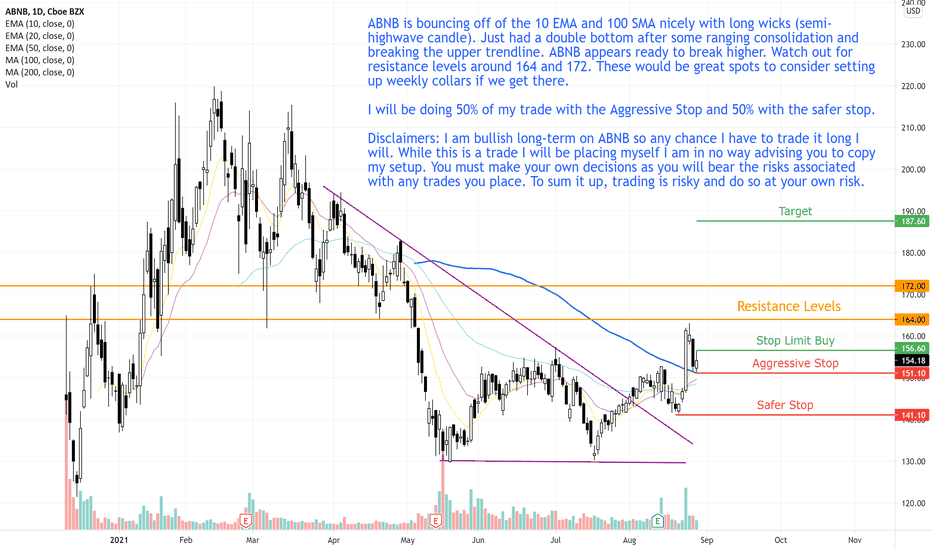

ABNB Trade SetupABNB is bouncing off of the 10 EMA and 100 SMA nicely with long wicks (semi-highwave candle). Just had a double bottom after some ranging consolidation and breaking the upper trendline. ABNB appears ready to break higher. Watch out for resistance levels around 164 and 172. These would be great spots to consider setting up weekly collars if we get there.

I will be doing 50% of my trade with the Aggressive Stop and 50% with the safer stop.

Disclaimers: I am bullish long-term on ABNB so any chance I have to trade it long I will. While this is a trade I will be placing myself I am in no way advising you to copy my setup. You must make your own decisions as you will bear the risks associated with any trades you place. To sum it up, trading is risky and do so at your own risk.

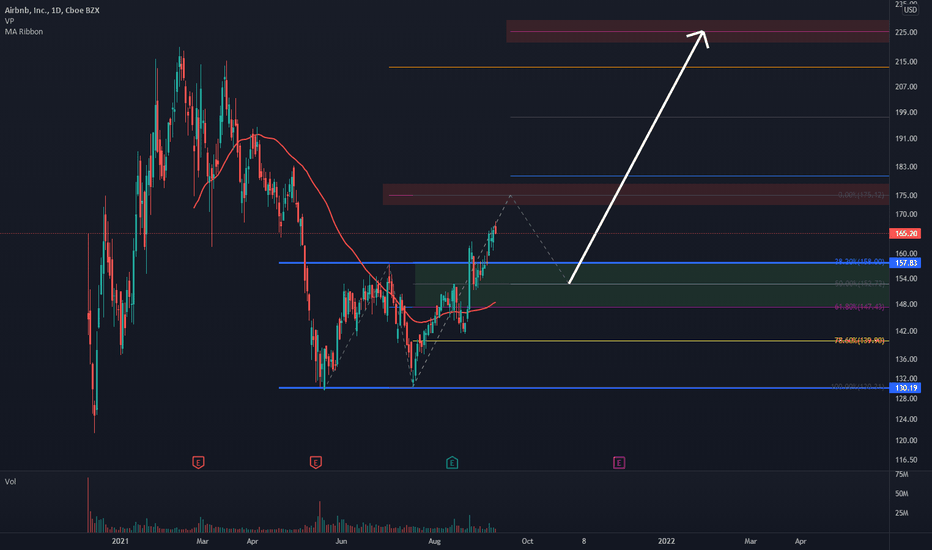

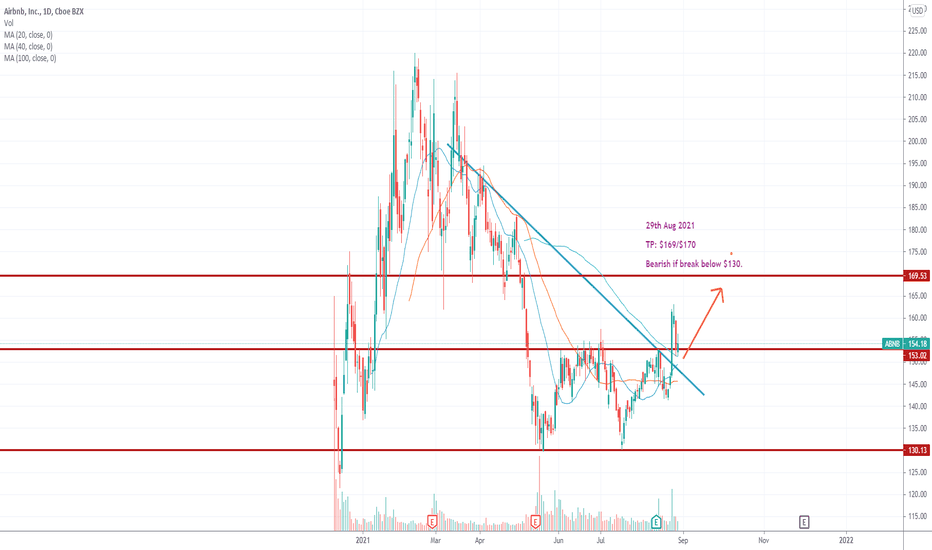

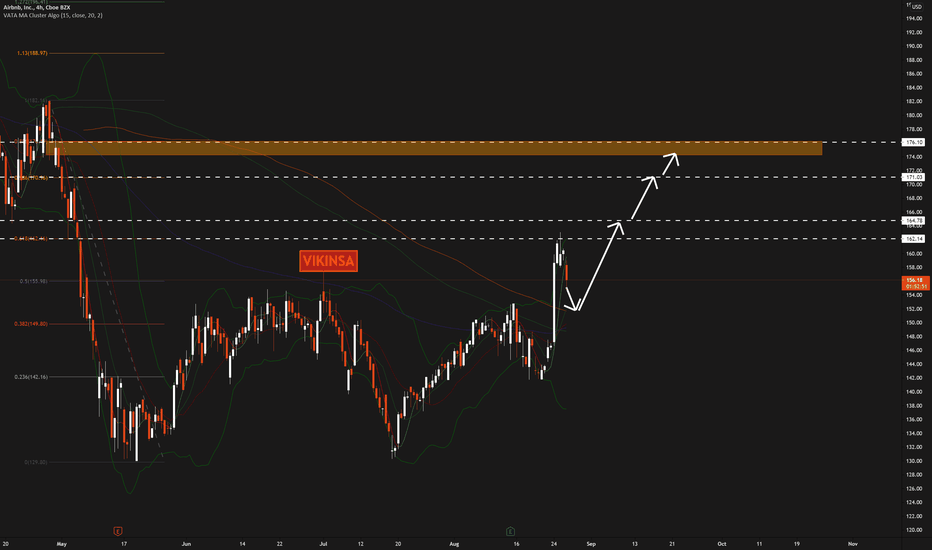

AIRBNB Can Go HigherTraders, AIRBNB stock broke out and can now form a complex FCP W pattern which can take the price higher. But after such a violent move, there can be some profit taking so it can first fall down a bit to test 200 sma and then if we get a confirmation to the upside, this will become a good BUY stock. Watch it closely.

Rules:

1. Never trade too much

2. Never trade without a confirmation

3. Never rely on signals, do your own analysis and research too

✅ If you found this idea useful, hit the like button, subscribe and share it in other trading forums.

✅ Follow me for future ideas, trade set ups and the updates of this analysis

✅ Don't hesitate to share your ideas, comments, opinions and questions.

Take care and trade well

-Vik

____________________________________________________

📌 DISCLAIMER

The content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of education only.

Not a financial advice or signal. Please make your own independent investment decisions.

____________________________________________________

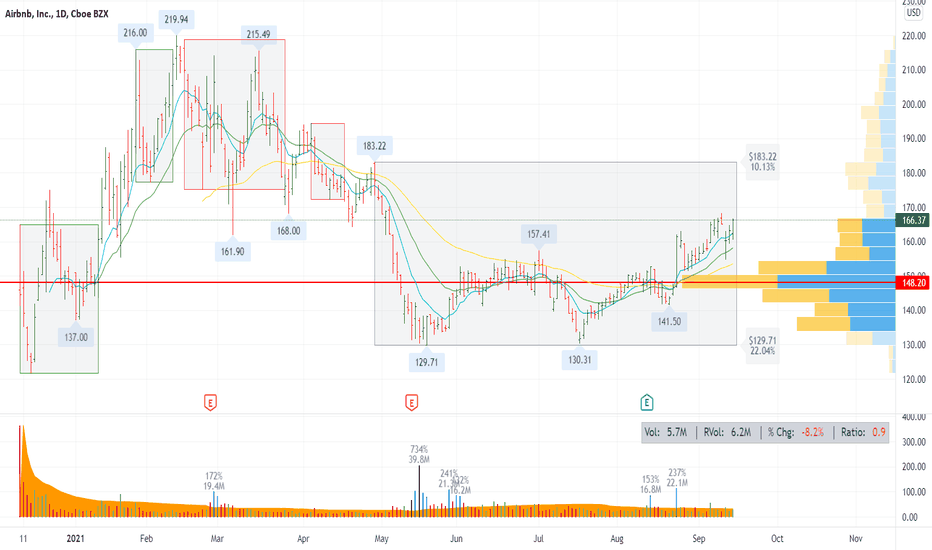

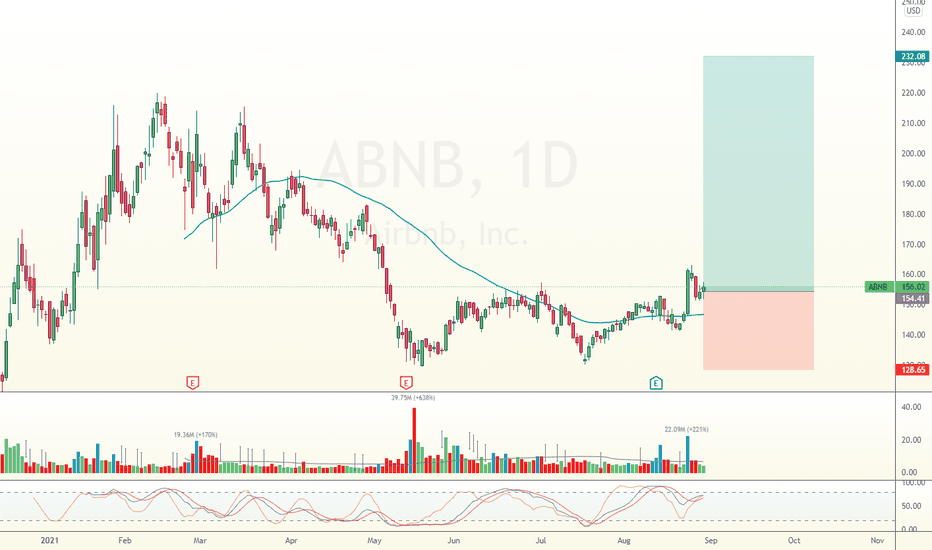

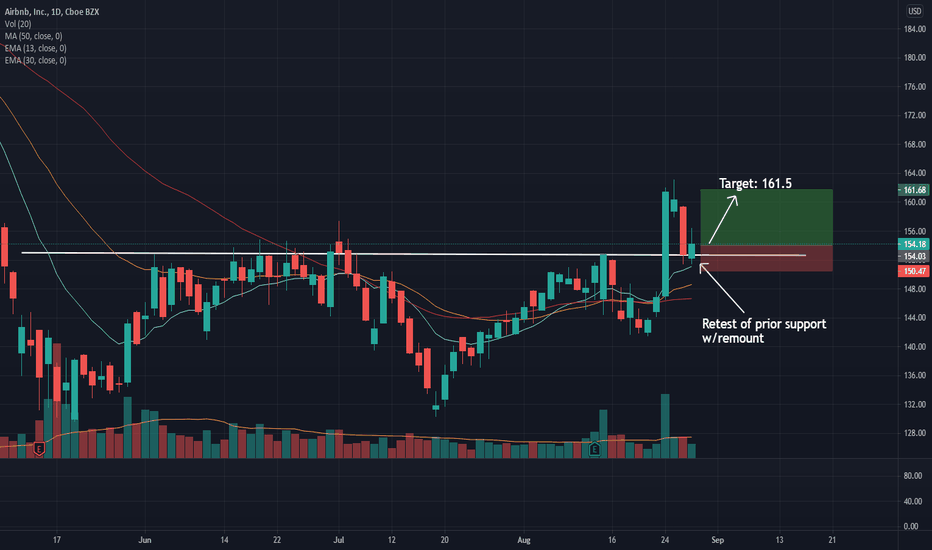

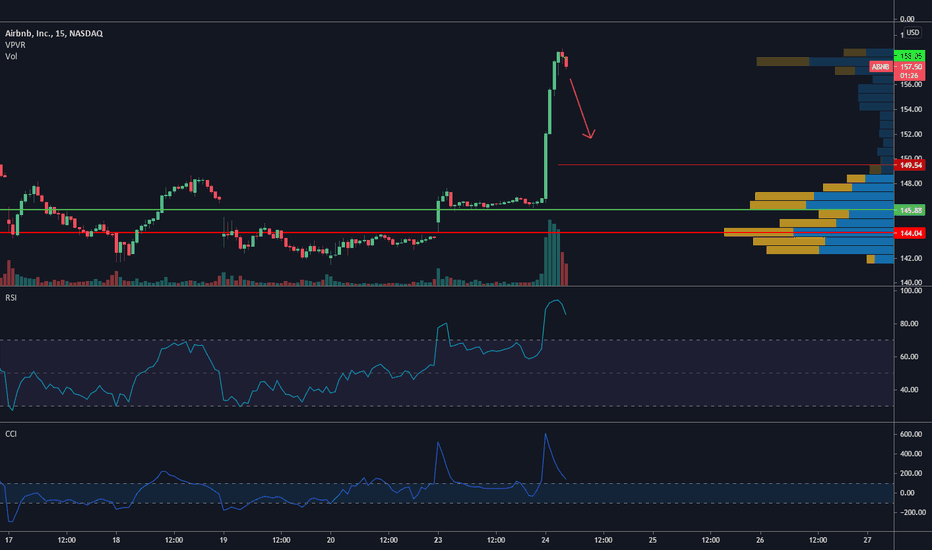

Possible ABNB Upside Reversal ABNB broke above a major resistance level of 156 and is currently holding above at 159

Once price action had broke key resistance, price held above the 50 & 100 day EMA acting as support on the daily & weekly..

The past 5 days has been followed with an increase in bull volume on the daily chart as well as a run to over bought levels on the daily rsi

(If bull momentum is strong enough RSI could push to 80-90 before having a pullback, The weekly RSU is turned up around the 50 level showing there is room for more upside)

On the weekly chart we had 4 weeks of strong bull volume showing enough interest to break above that 156 key resistance.

I believe we could see this pullback to test 156 before continuing the run to next resistance of 175.

I would like to see a small pullback with light volume for an entry or a break above previous days high of 162 with high bull volume

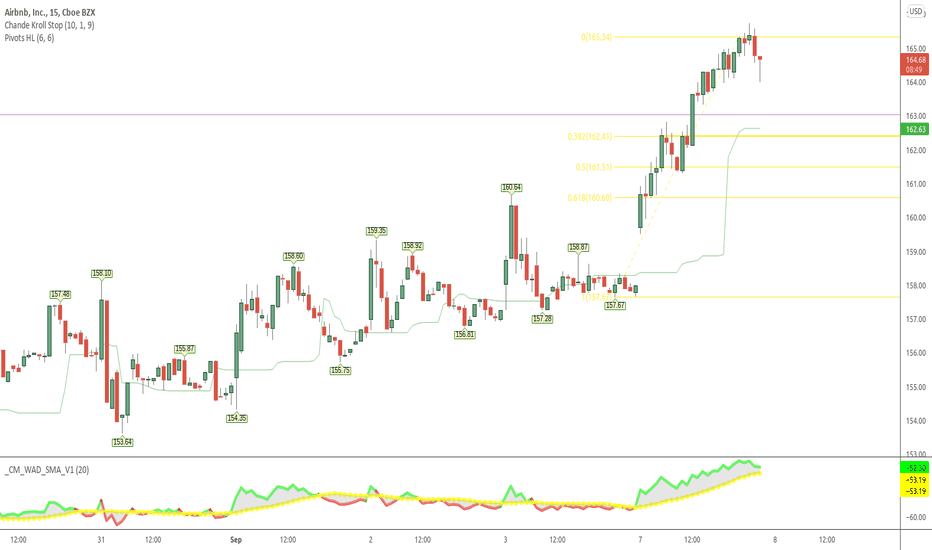

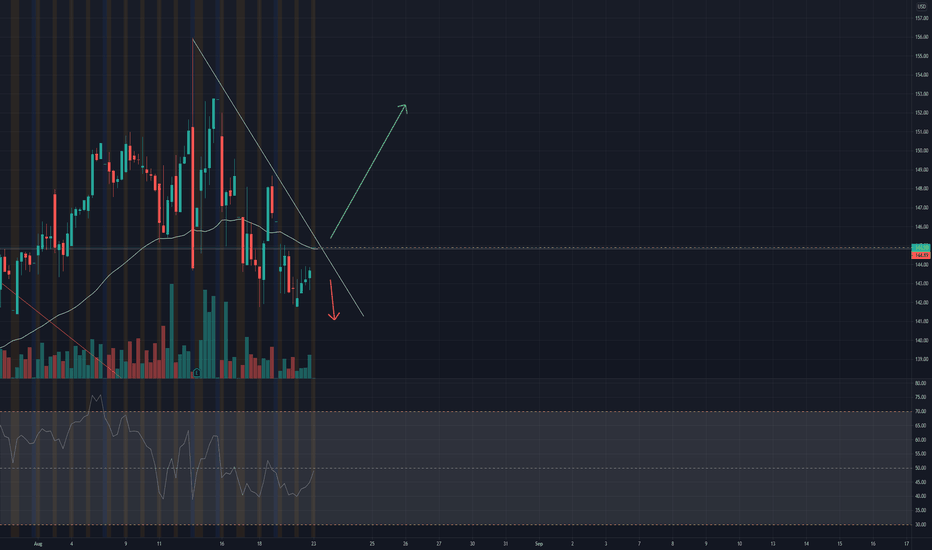

AIRBNB (ABNB) | Short-term Breakout, Wait For a RetestHi,

AIRBNB made quite a solid breakout after Reuters reported that the company has offered to provide free, temporary housing to 20,000 Afghan refugees worldwide. Do your own analysis and if this matches with my TA then you are ready to go. Wait for a retest of the breakout area!

Regards,

Vaido

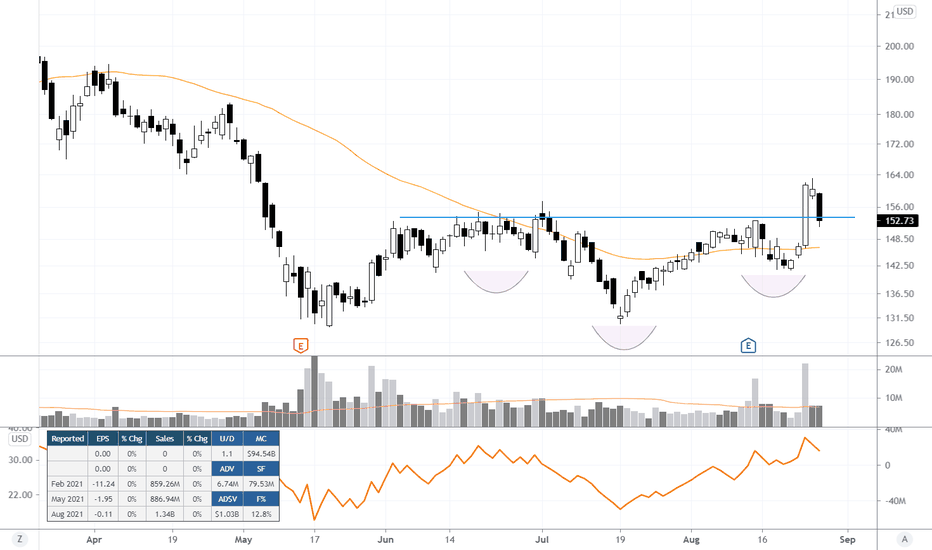

Airbnb stock, is it a buy?Who doesn't know AirBnB? Airbnb, Inc., operates a platform for stays and experiences to guests worldwide. The company's marketplace model connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms and luxury villas. The company was formerly known as AirBed & Breakfast, Inc. and changed its name to Airbnb, Inc. in November 2010.

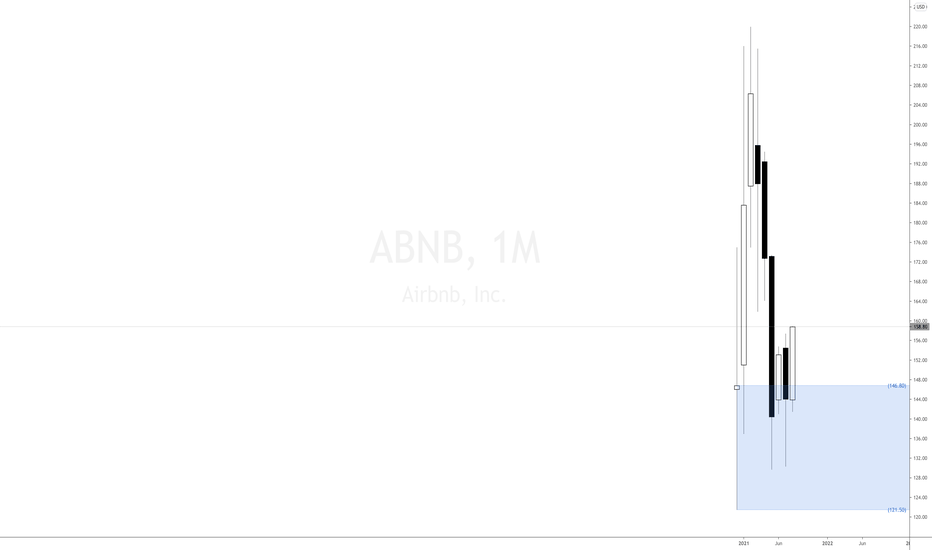

On March 11 2020, the World Health Organization (WHO) declared the outbreak of coronavirus, known as COVID-19, to be a global pandemic. Since then, the outbreak has evolved rapidly, with governments worldwide taking swift action to slow the spread of COVID-19. Airbnb was affected by this declaration because that meant that his business model would suffer tremendously as travelling around the world would come to a halt. No tourists = no income. At the time, Airbnb was not traded publicly. It was not until last December 2020 when Airbnb IPO happened and created the only imbalance available on the monthly timeframe, around 146 dollars per share.

The meteoric rise of Airbnb across cities since its introduction in 2008 has disrupted the housing markets of major cities worldwide. Some studies demonstrate the increasing trend in rental and property prices that parallels increasing Airbnb activity.

The COVID-19 pandemic presents a unique case study of this stock. Amid growing concern over how the delta variant of Covid-19 could affect people's travel plans, Airbnb (ABNB) endured another month with monthly demand in control. Why? Because the revenue model of Airbnb is founded on is under significant pressure with the halting of global travel. Regardless of any negative impact that COVID-19 may have had on Airbnb, imbalances are created and usually created when there is a trending market unless there is over-extension. Airbnb shares may have dropped after investor worries about the impact of Delta variant on travel overshadowed the online rental company's second-quarter results. Yet, that report didn't do much with the monthly imbalance taking control around $146.

I hold shares of this monster business that will probably become the Amazon of online accommodation reservations.