ABNB trade ideas

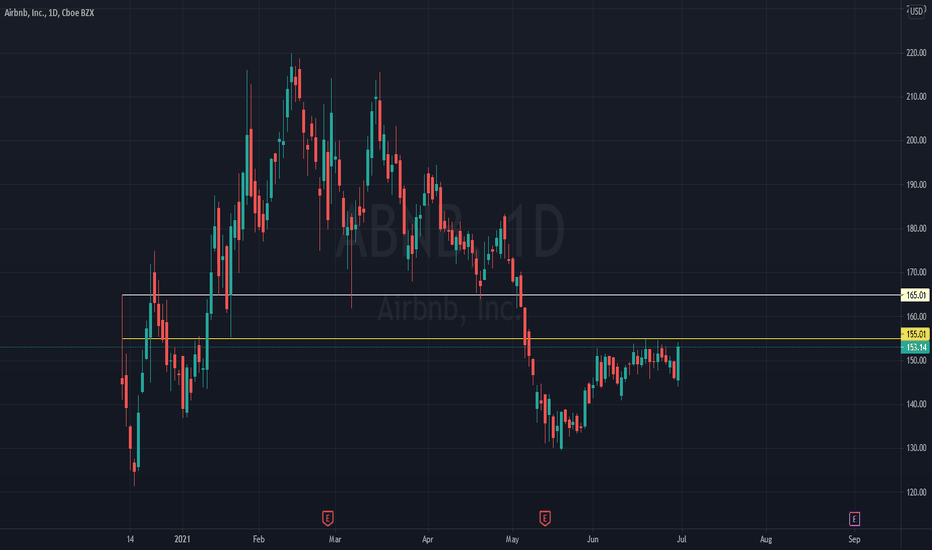

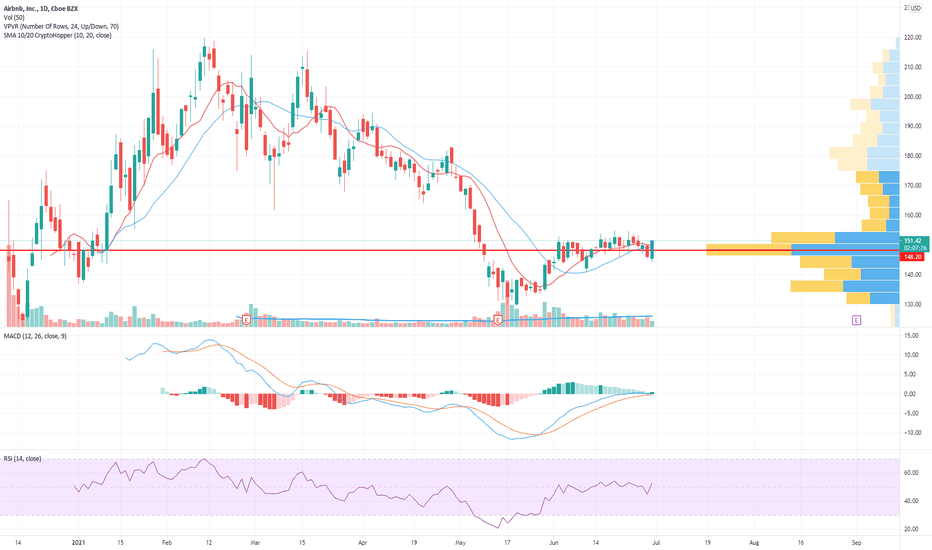

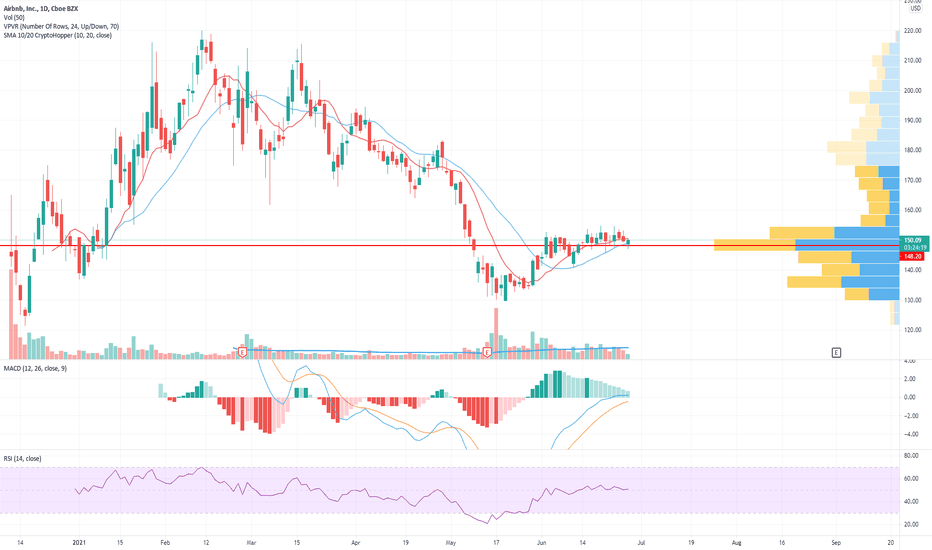

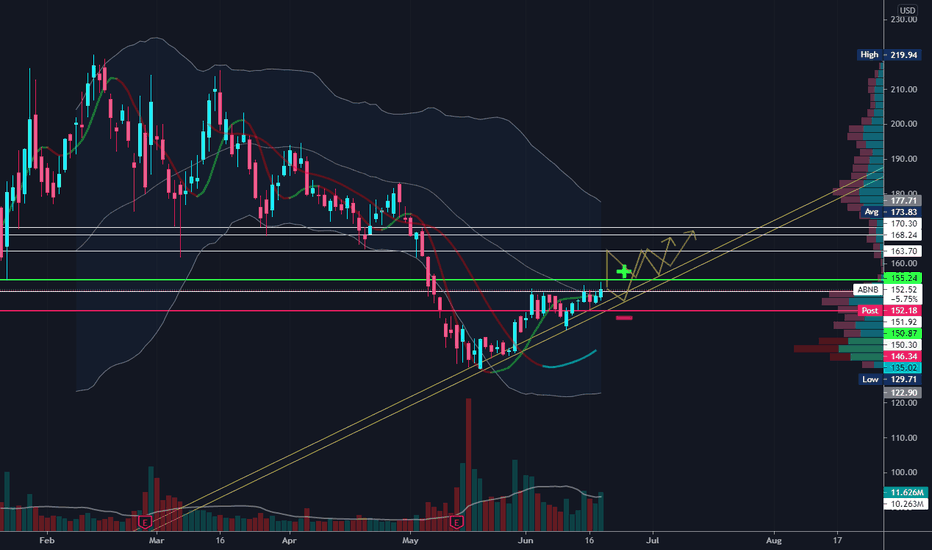

ABNB - long from 136 area KEY NOTE - SPECULATIVE SETUP - not a financial advise - do your own analysis

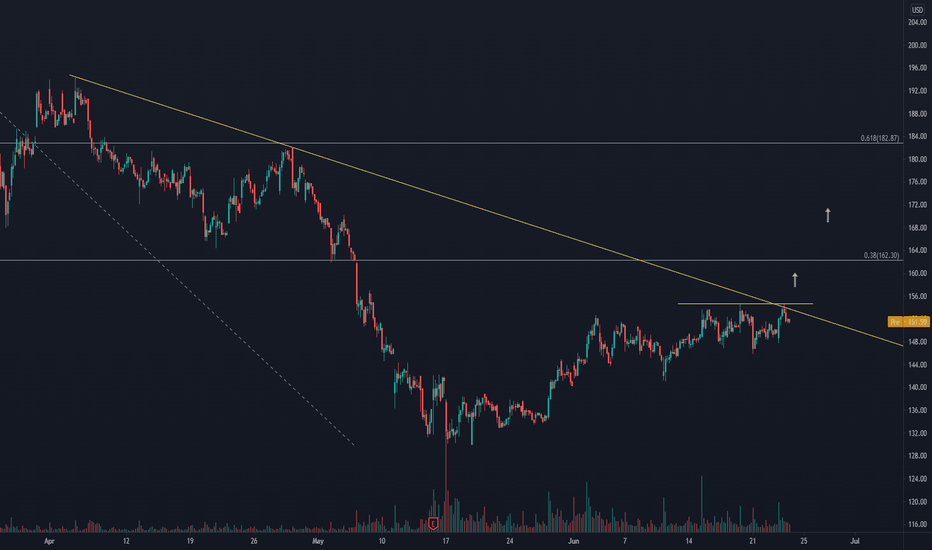

⏳ Analysis TF - 15 minutes

A correction is possible with a little room to move lowed without impacting the trend higher

Looking to buy at dips around 133 to 136

Retracement to support area

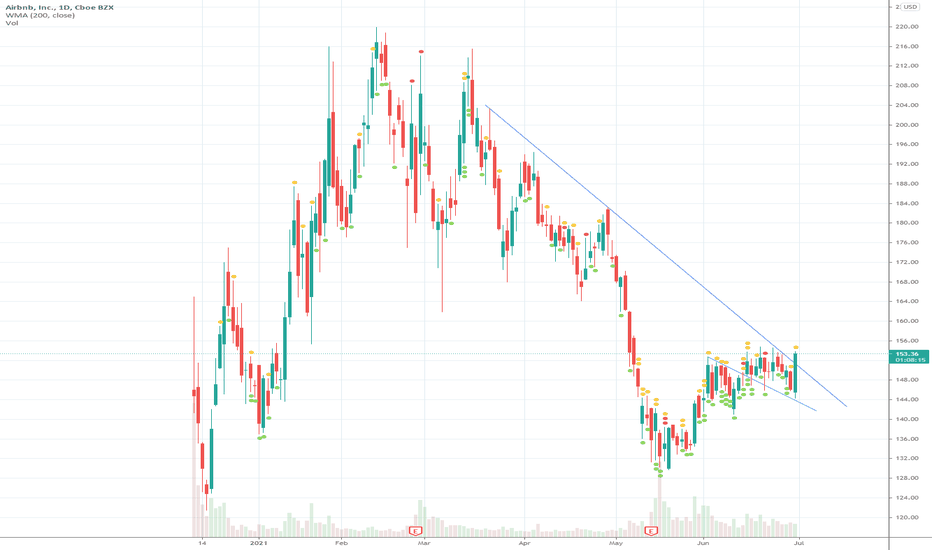

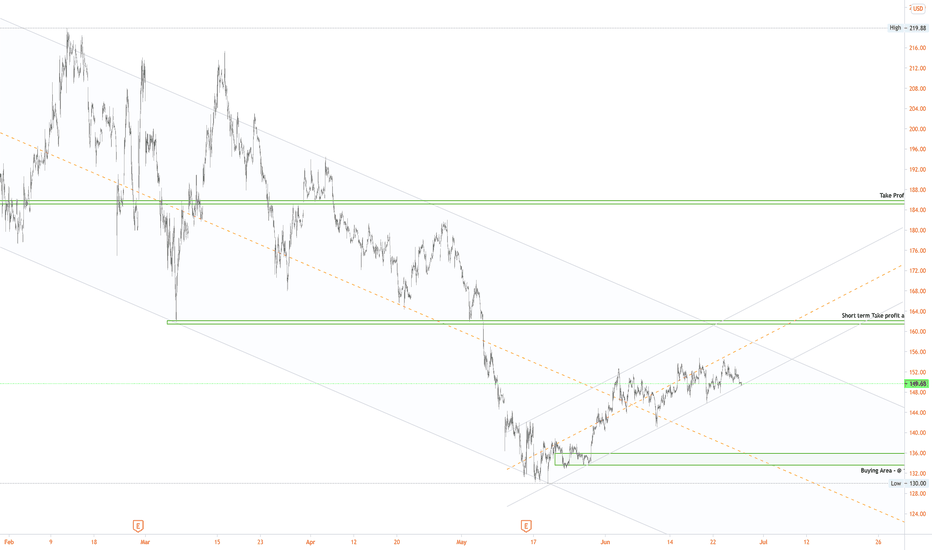

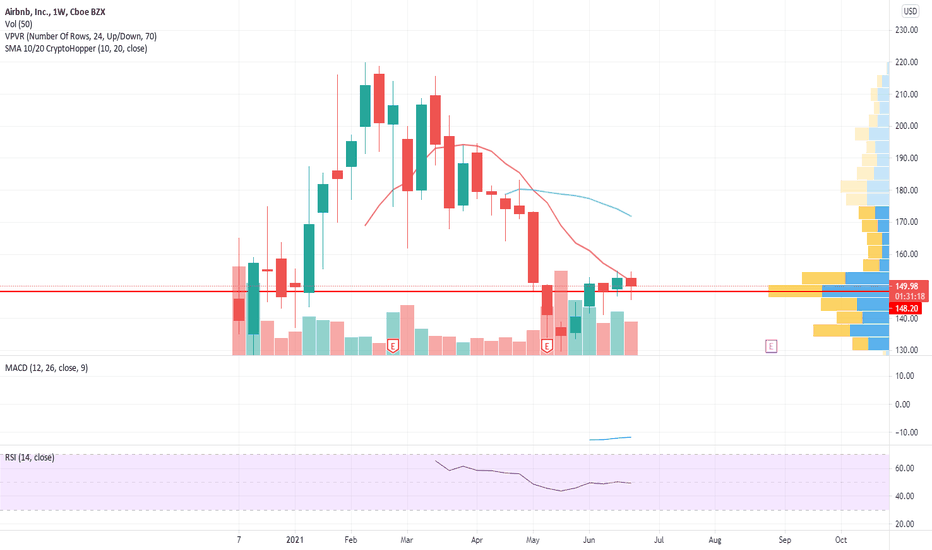

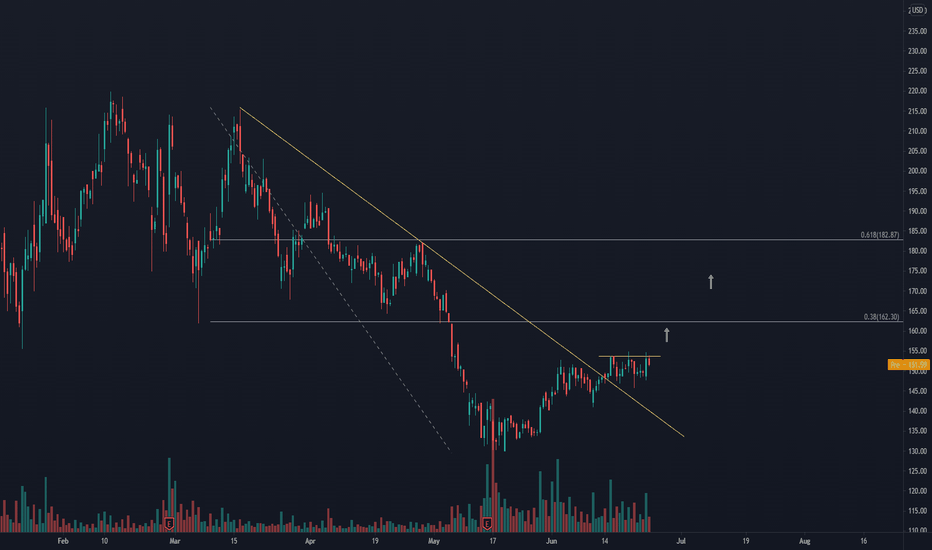

Analysis / Trade Setup / Long and then short

± Short-term Bearish # Long term-Bullish

± Support and Resistance in play

± Major Falling broken

± Bullish trend reversal

± Go long for more $$$

± HAPPY TRADING

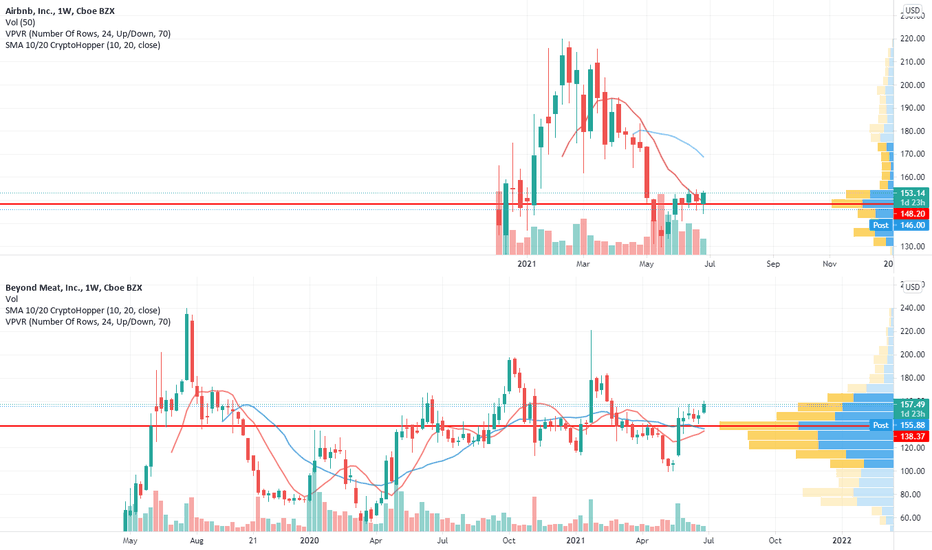

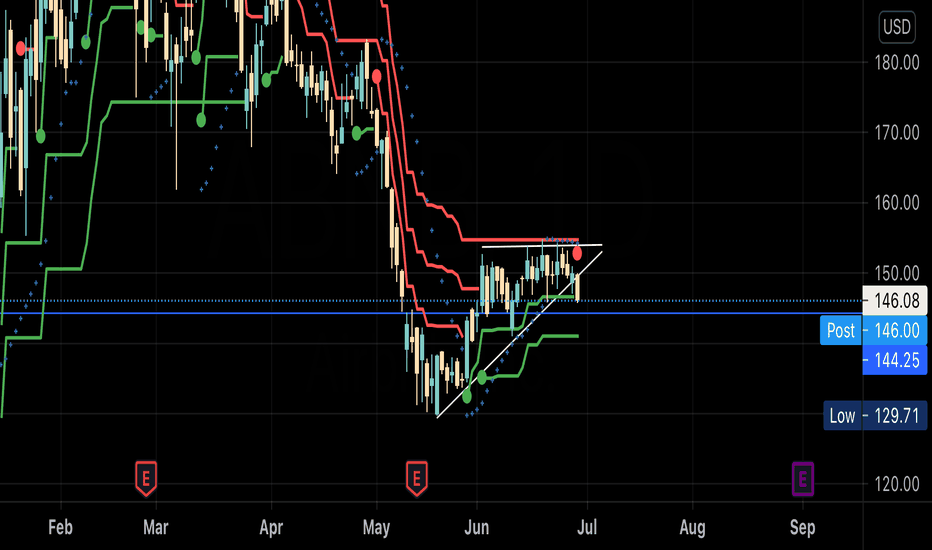

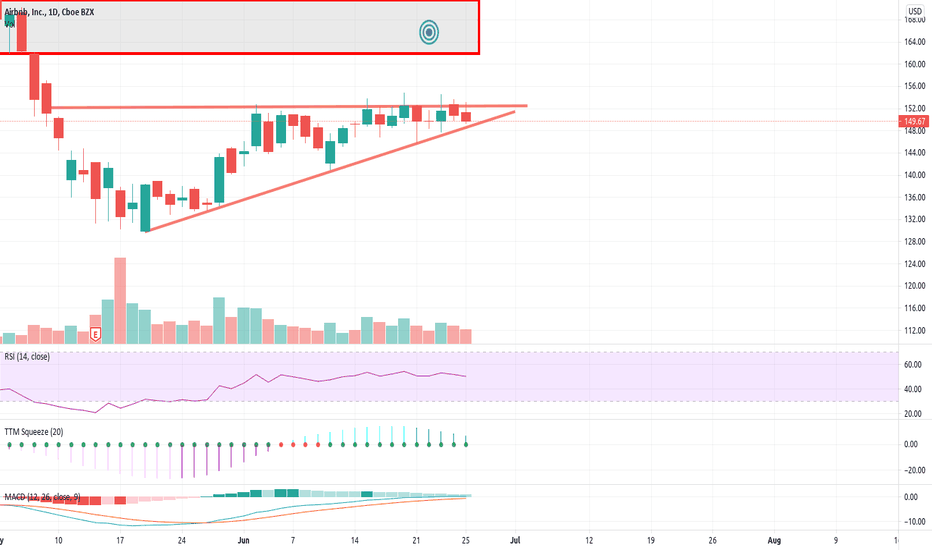

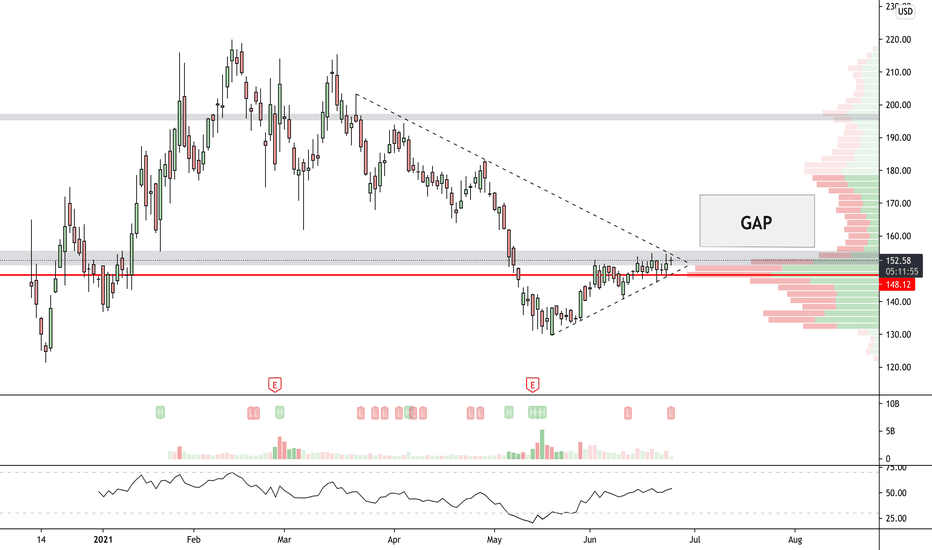

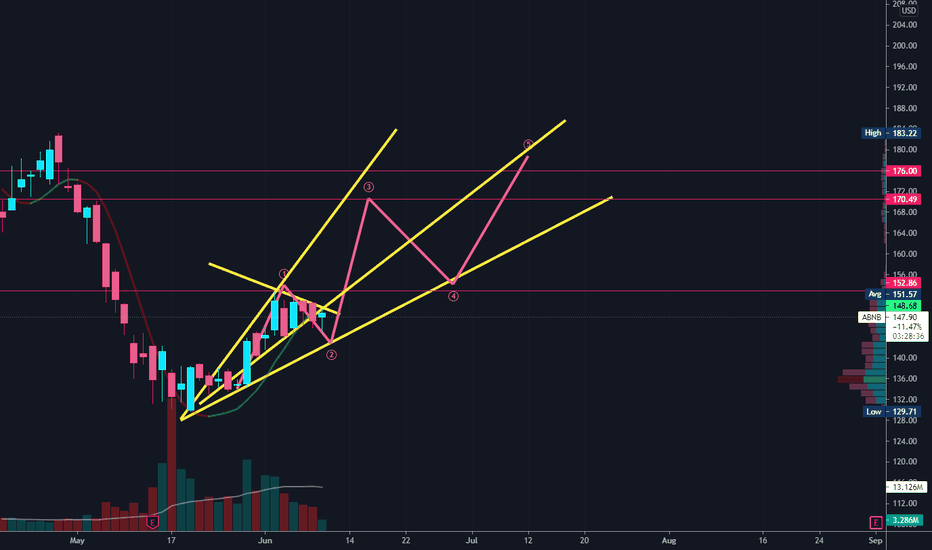

ABNB - WHERE THE HATERS AT? LOOKING FOR 160PT - ASCEND TRIANGLE

All,

ABNB looks good as I previously compared was indentical to BMBL on wave 2 big buy would have big returns and it did. Only question does it break out the top of this ascend triangle here or bounce down one more wave in pattern off trend then break. Need to see next week.

Outside factors:

-Obviously DJ/SPY tanking is never good for companies overall.

-Breaking below 2nd yellow uptrend (in pink would be a small put position for $10 150 to 150) Do not think this is likely at all though

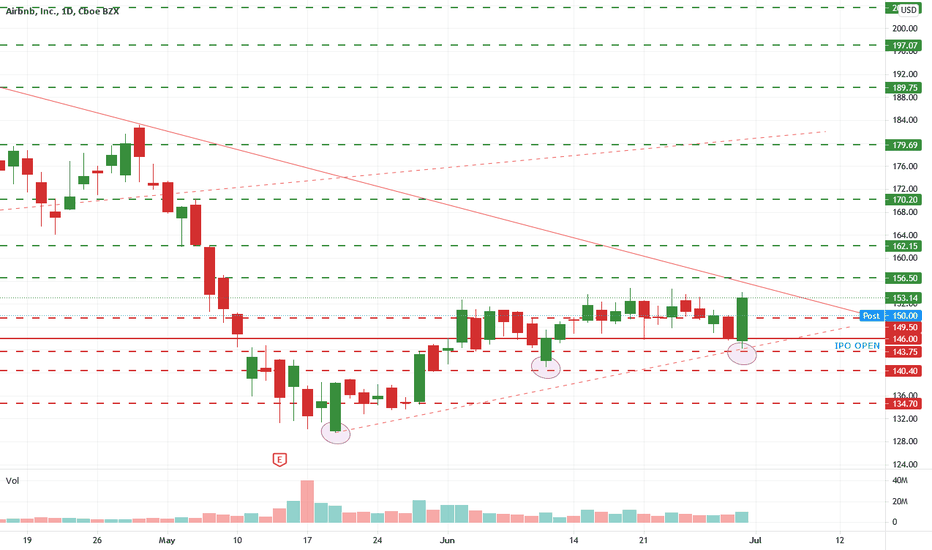

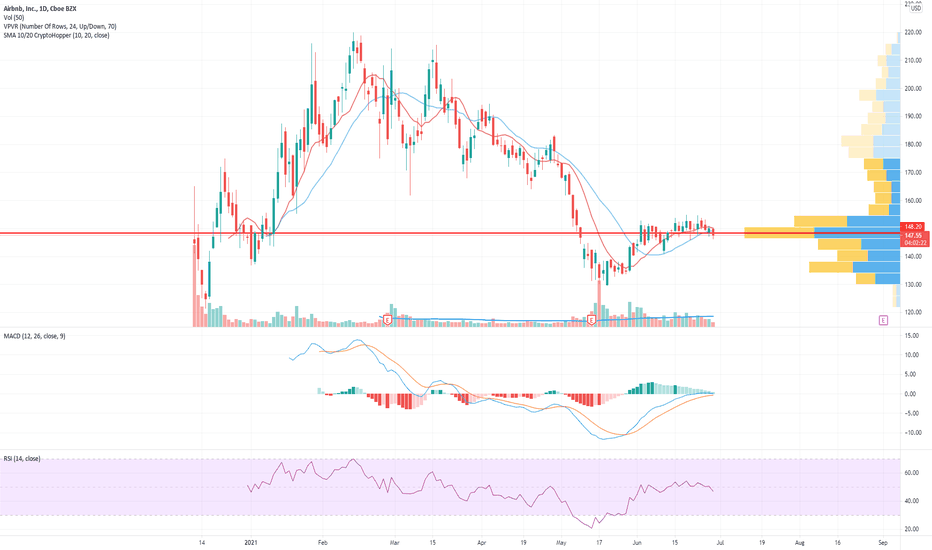

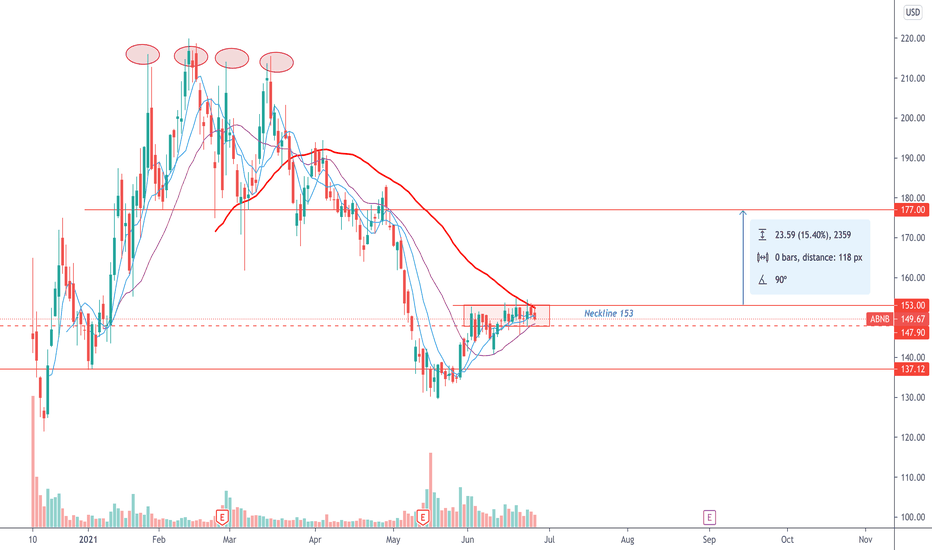

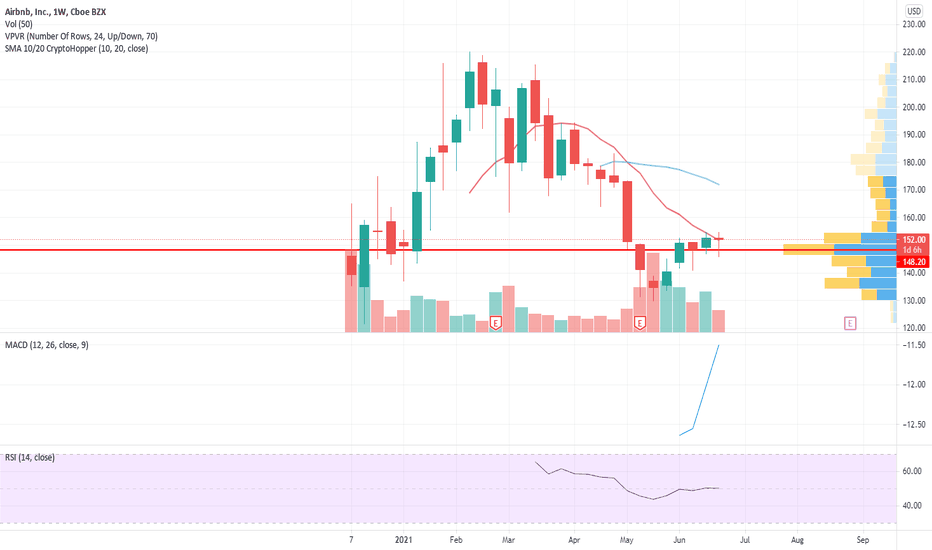

ABNB BREAKOUTLooks like trend will break to new highs right after the July 4th-5th vacation. Moreover, positive EURO 2020 data which proves that the service is also essential for new kind of travel in Euro Zone, not only in US.

Therefore, both technically and fundamentally important milestones are to be reached soon which makes the outlook remarkably positive.

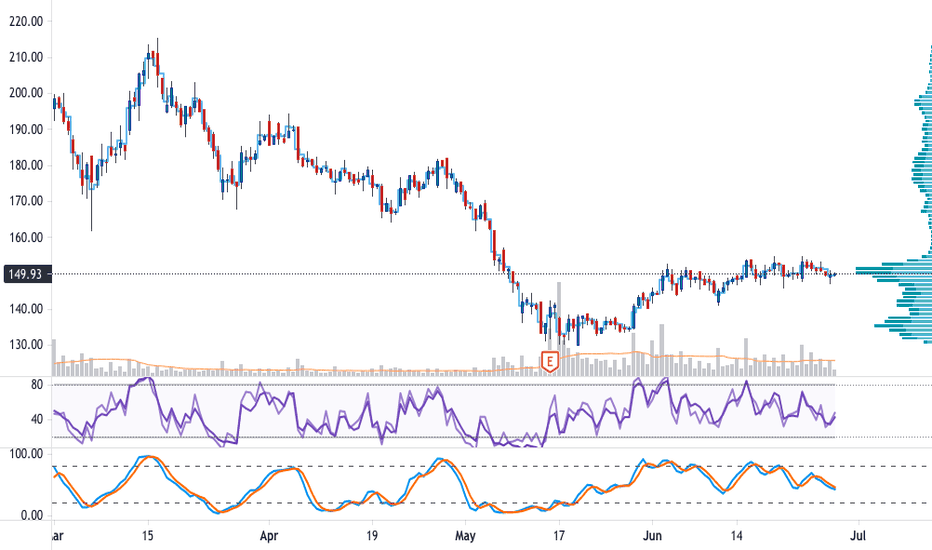

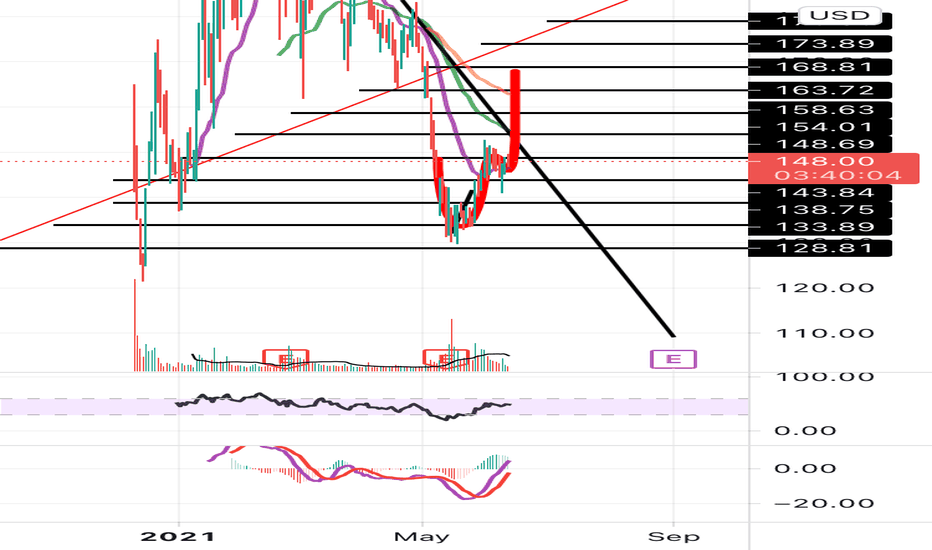

AirBnb - expect downside Airbnb's IPO price was $68, and it listed at $146, a massive premium. Naturally there is a fair amount of selling pressure, and it may struggle to maintain its price above its listing price.

On the expectation of broader market downside, expecting price to drift down to $80-90 range.

Trade review How i Traded $SQ, $ABNB, $ROKU, $NVDA, & $SNAP!In this video I will reviewing trades i took 6/18/2021 which were $SQ, $NVDA, $ABNB , $ROKU showing you guys my favorite pattern "Flags" to make some insane returns! Traded these tickers using my knowledge of technical Analysis , sharing my levels: Support & Resistance , my trendlines , Fibs, Waves, Price Action, Channels , Emas, and prior experienced , while providing both bullish & bearish scenarios for you to be able to understand my analysis and wait for confirmation as always!