ABNB trade ideas

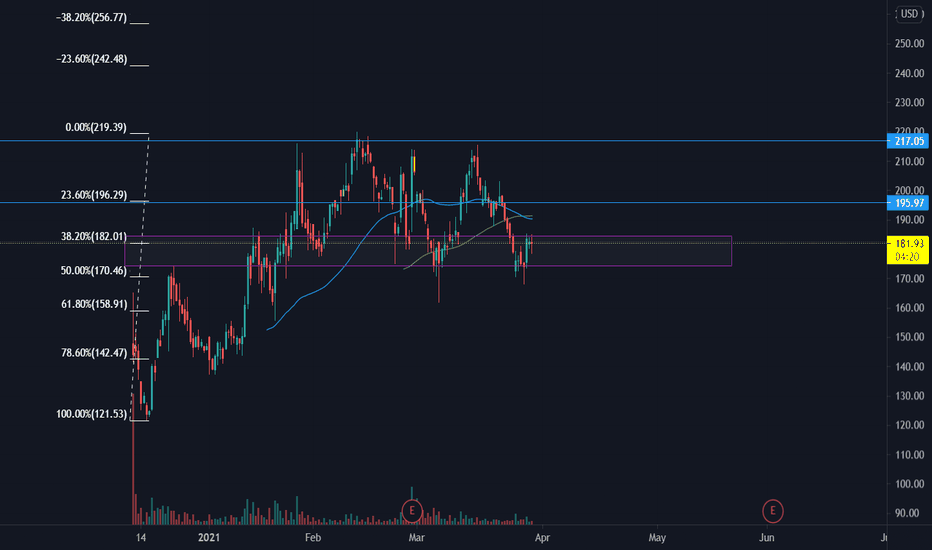

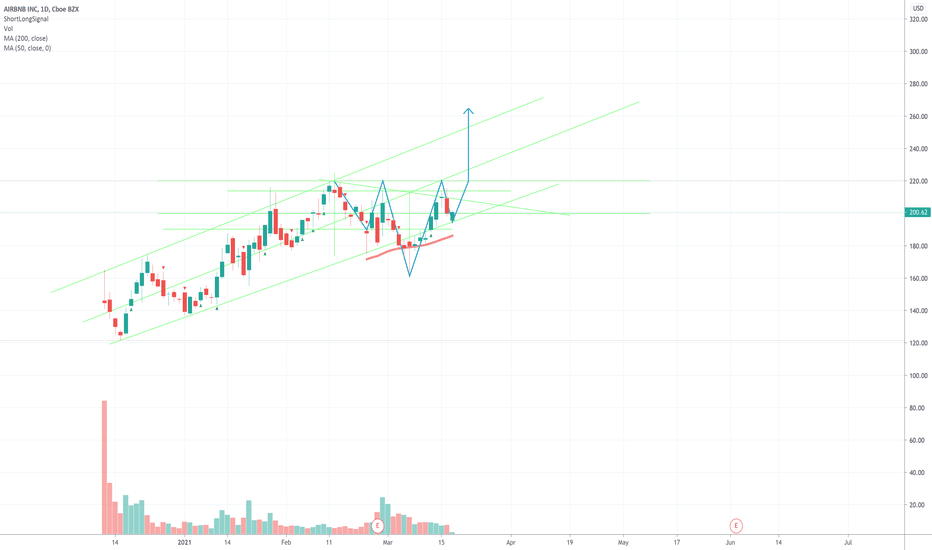

ABNB IdeaG'day Guys. Hows going?

Today let's start with ABNB. This pair kinda effected a lot during pandemic. Let's hope their stocks build up once again.

From my perspective, this pair on the recovery structure. I don't read much about them but i analyst based on experience and human behavior

which is considering human behavior internally (Company itself) and externally (Consumer)

Let's what happen next on this pair. Cheers

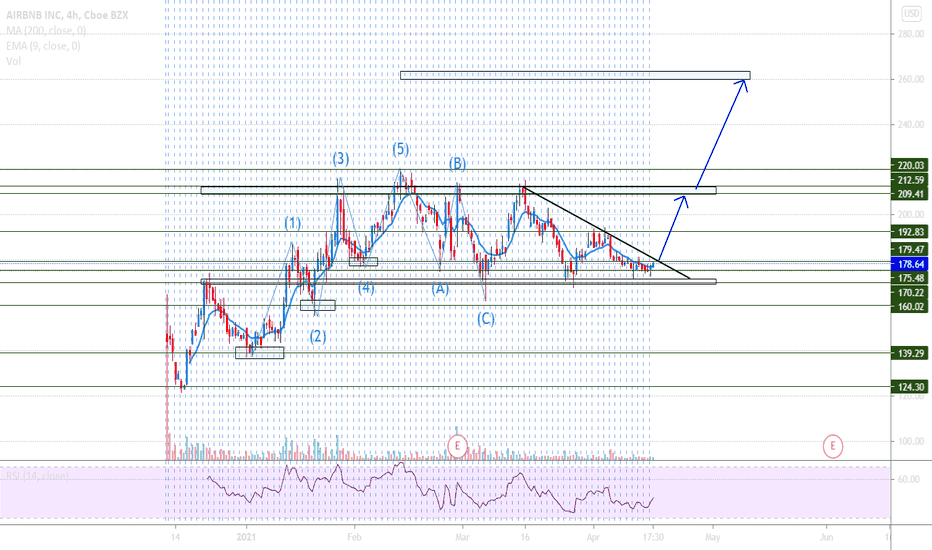

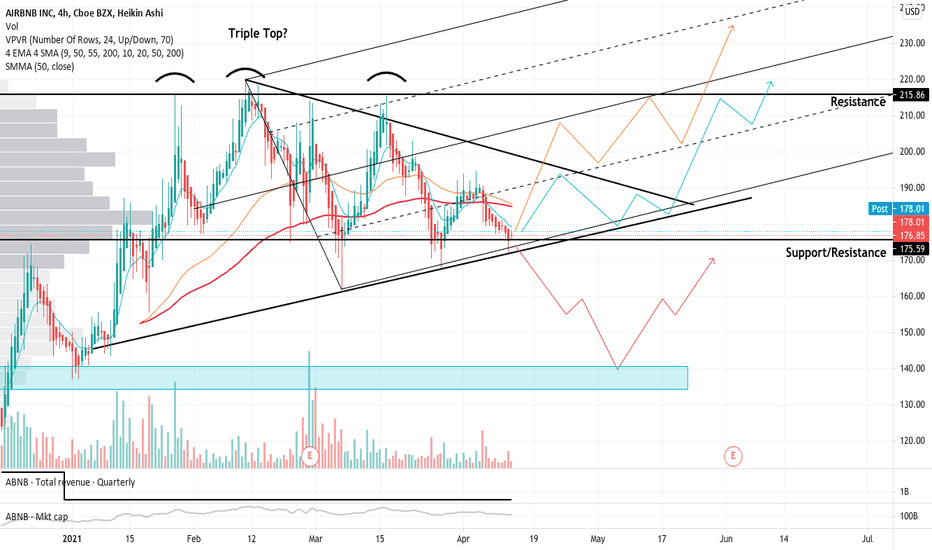

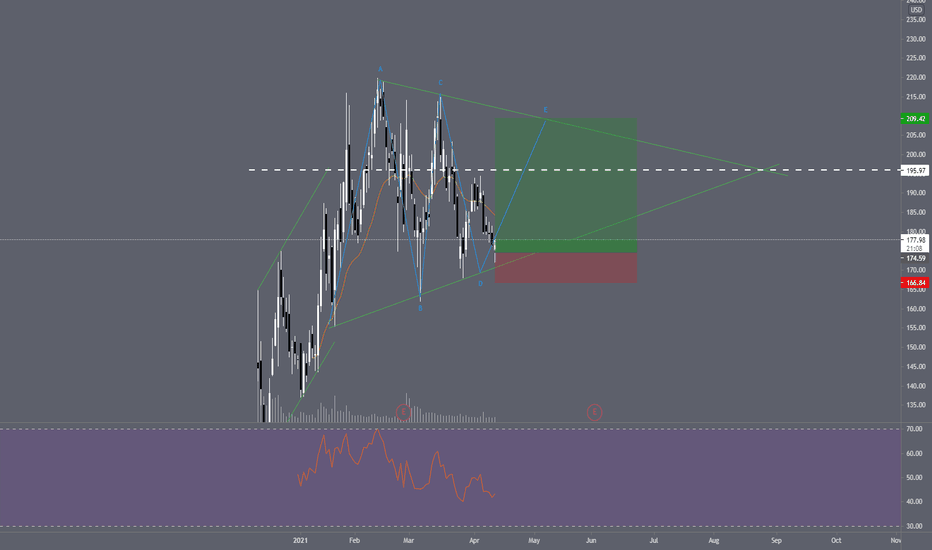

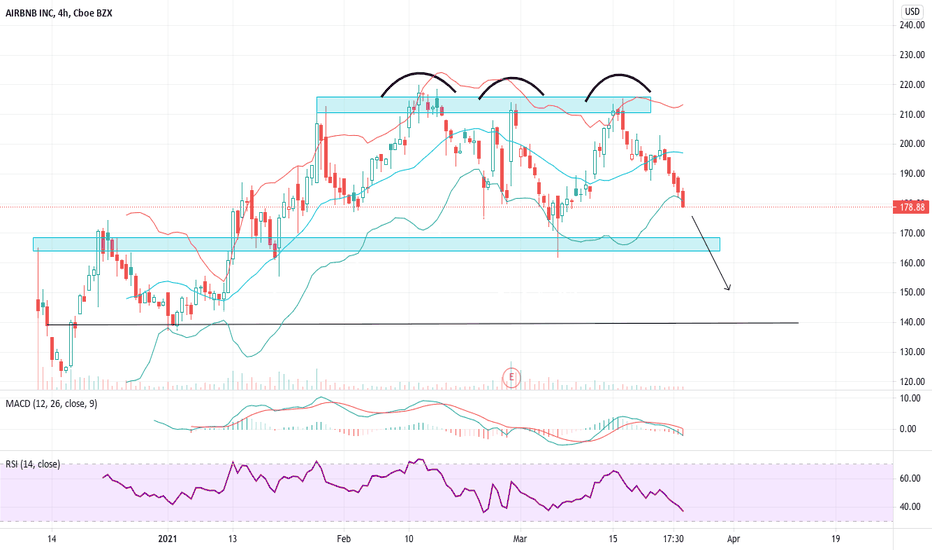

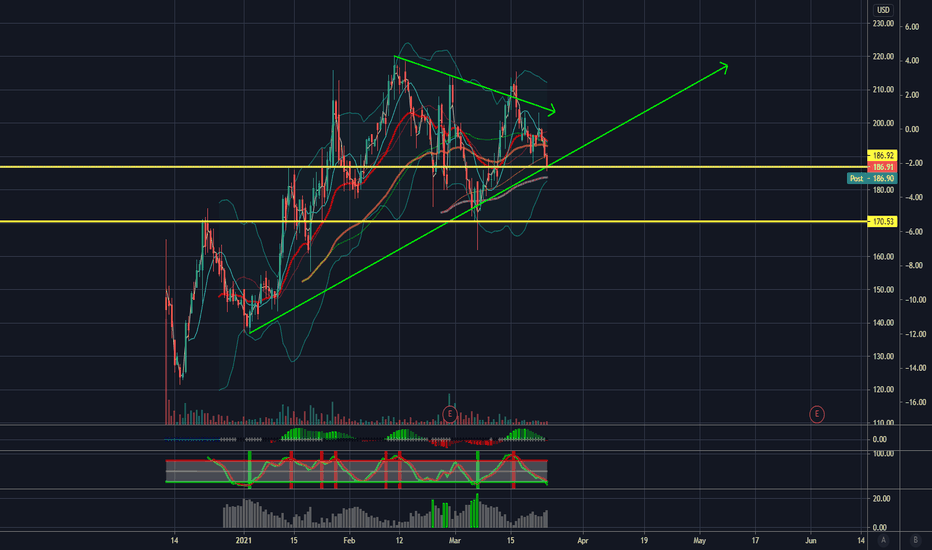

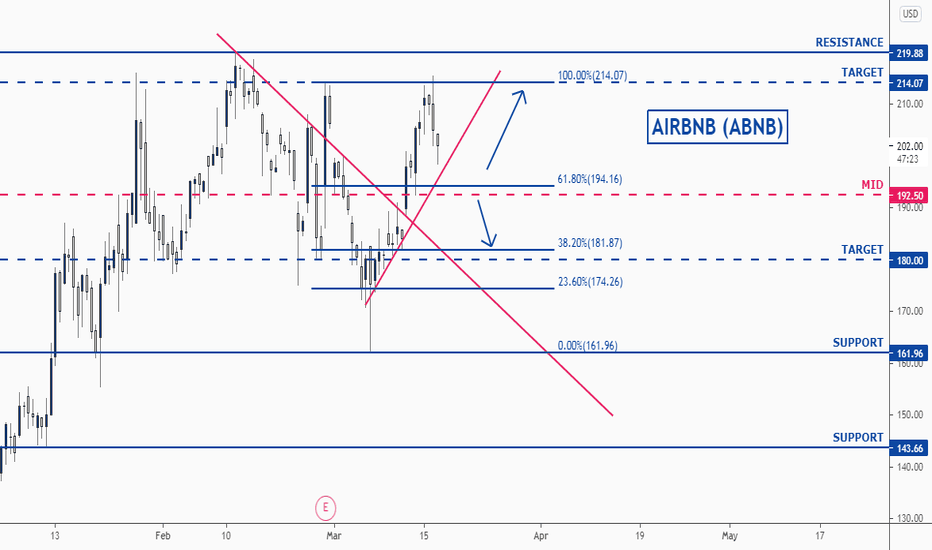

$ABNB- Time to Sell or Time to Buy More?Option 1 (Orange):

$ABNB is forming a wedge formation and is likely to breakout soon, possibly past that $216 resistance level.

Option 2 (Red):

$ABNB has formed the bearish triple top pattern and is likely to fall further, possibly to that $140 zone, before turning to the upside.

Option 3 (Blue):

$ABNB is forming a new uptrend after seeing growth too steep to hold in the weeks following the IPO.

My Outlook:

I think that Airbnb has enormous potential as a company, especially as we climb back from this pandemic. The vaccines are out, and a huge number of Airbnbs and Vrbos have been booked for this summer. Personally, I would say option one is the most likely outcome, but I am also wary of that triple top formation. If it breaks that bottom support trendline this could potentially fall all the way to $140.

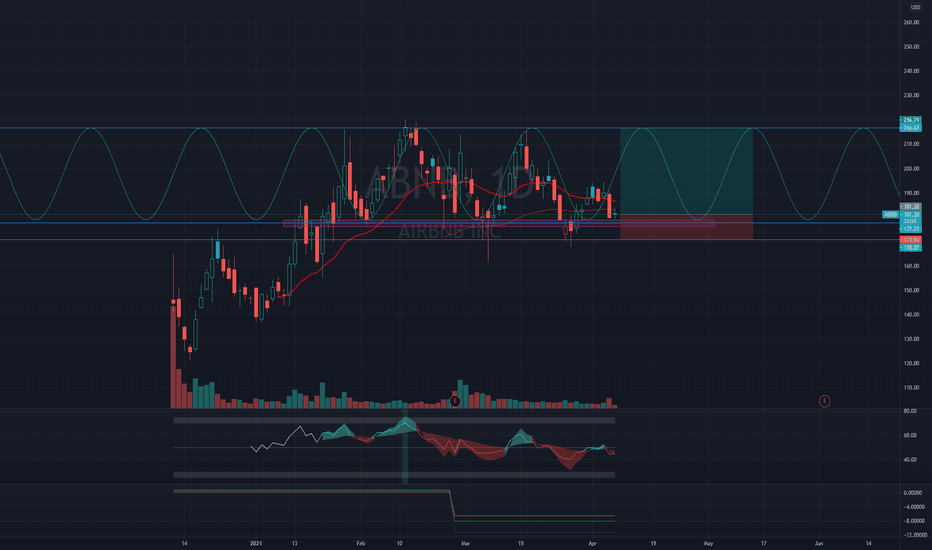

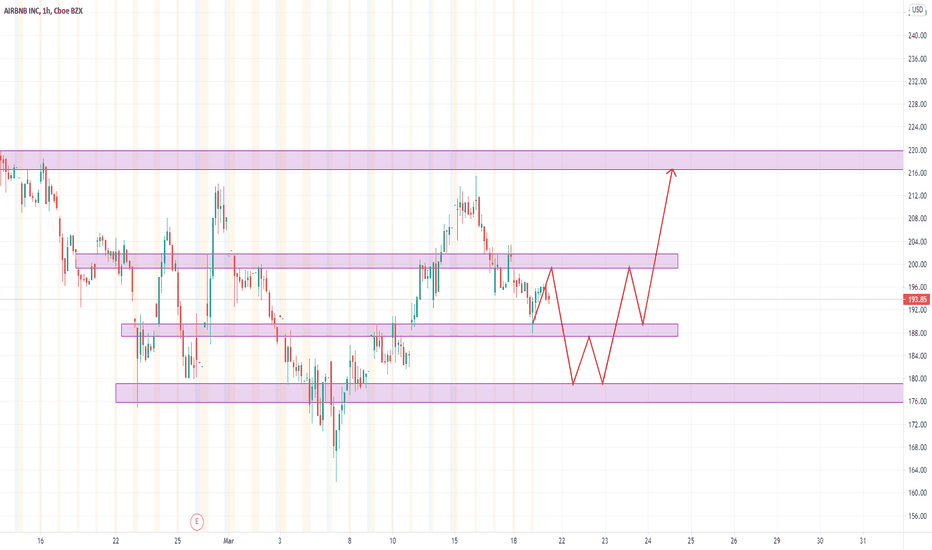

some ABNB upside left before pullback?making a higher low on the daily here on the last dip/bottom trendline dip entry. not looking for any crazy movement here but we can long 188 stop 175 and target 210-215 before a pullback back to trendline. remember what i always say though, recent IPOs are always higher risk because theres no chart history for traders to trade off of. goodluck!

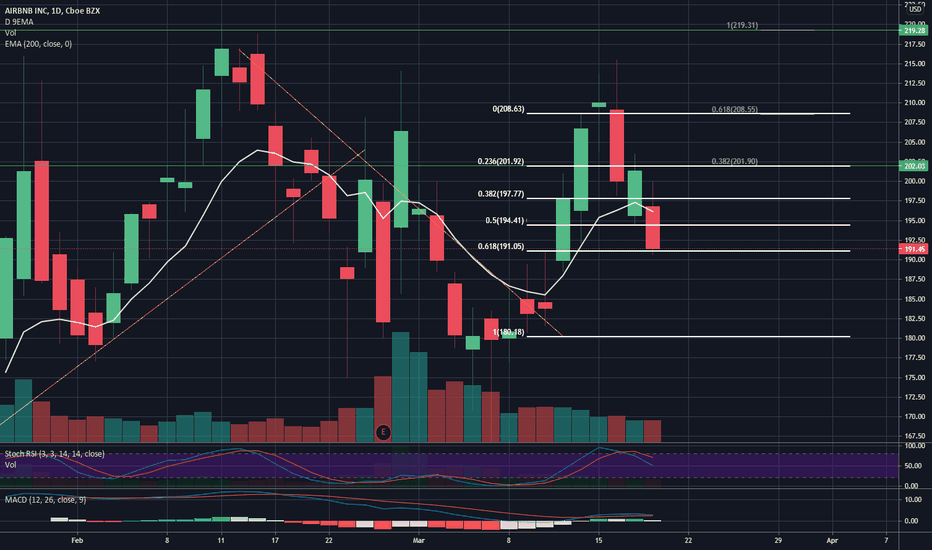

$ABNB Inverse Head and Shoulders Pattern?I've been watching $ABNB and thought we might have had a Double Bottom pattern last week. However, it now looks like it's morphed into a "possible" Head and Shoulders pattern. All TBD. I will look for this to hold above to 50 day and if so, near the end of day I'll likely take about 1/4 position as it would not have confirmed a H&S pattern yet but I like early entries with defined risk which would be back below the 50 SMA... Idea, not investing / trading advice.

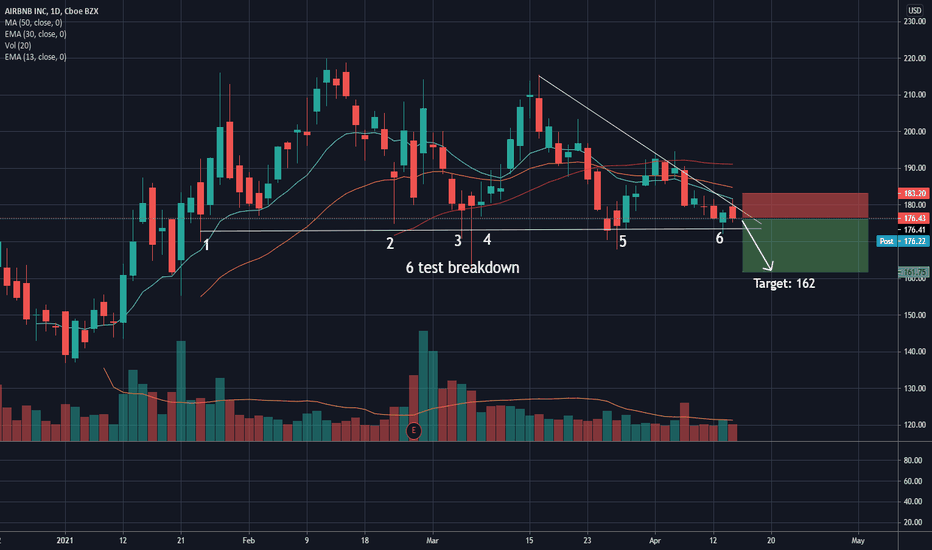

AIRBNB—-> experience bull waveAirbnb has shown triple bottom and currently sitting on support level. usually triple bottom are very strong and I believe Airbnb is ready to test its resistance which is around 210 level. I think that in coming days momentum will build up.

The best strategy here will be a put credit spread.

Idea for entertainment, not a trading advice

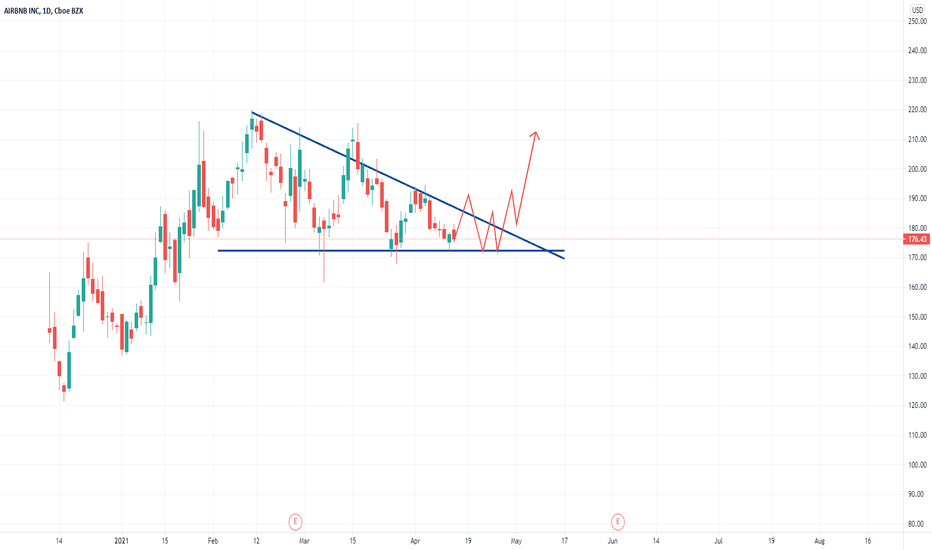

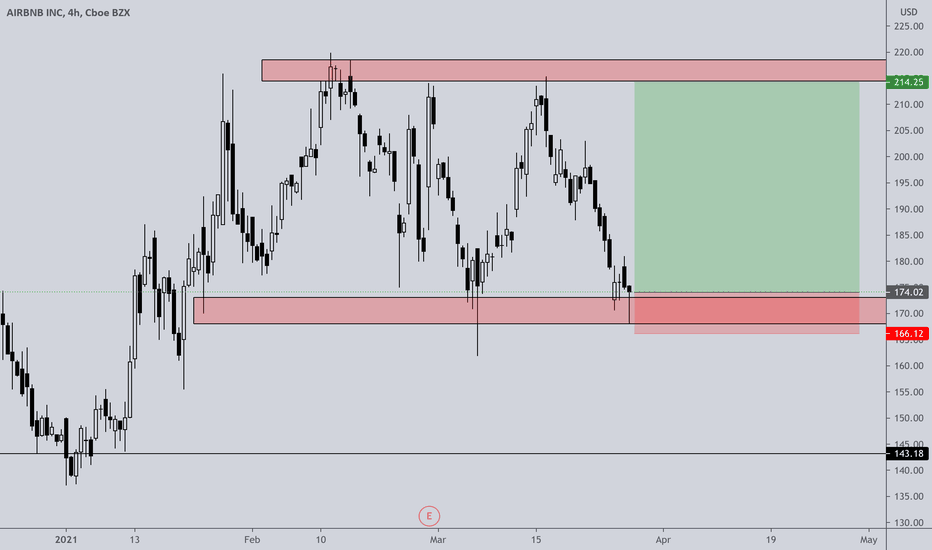

$ABNB could go either way,but leaning to the bull sideNASDAQ:ABNB I has been consolidating in a large range from around 174-214. It tapped the 173.50 support a couple of times last week and may be looking to reverse and head back up to to the upper end of the channel. The confirmation would be the hold of the support while also breaking through the trend line(green), this would also serve as your safe entry. First price target around 186.50, second 198 and ultimate around 210. If looking at options, if the break happens this week, you could play the 190C weekly if you are risky. Or the safer bet is the 190C or 200C for 4/16.

A bear case would have the price failing to hold support at 173.50 and continue to fall and hold trend, with targets to the down side of 162.40 and 145.50

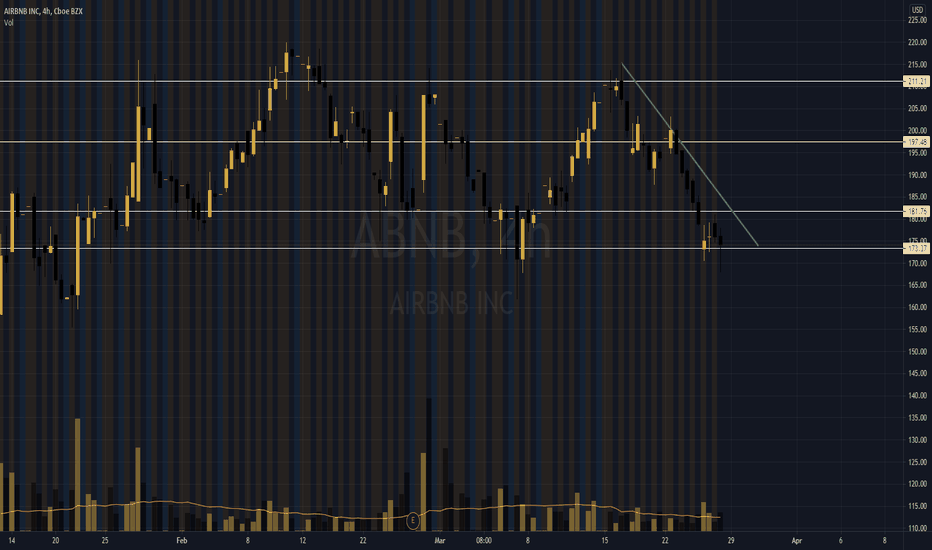

Next few days are crucial for AIRBNB!We are going to be testing the upper resistance line of the falling wedge soon.

If we break the upper resistance line and stay above the 50d MA then it's bullish.

If we get rejected at the upper resistance line, and cross below the 50d MA, then we are probably going to stay within the falling wedge for a bit longer

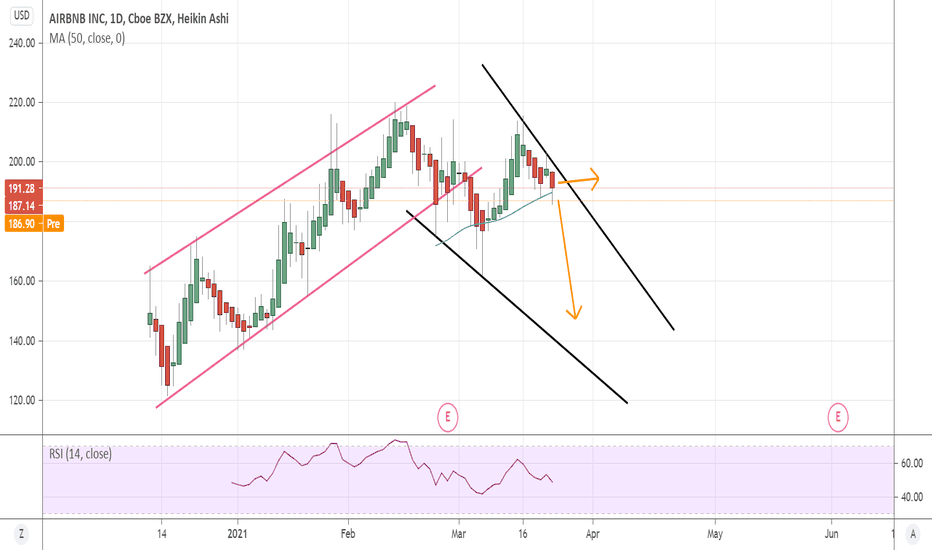

AIRBNB IdeaG'day guys

Here some AIRBNB price movement projection. For those commenting either positive / negative i really appreciate you guys comment. This projection based on technical analysis and reading of current economic situations.

AIRBNB might another sector that huge effected during pandemic, that the reason the market share drop up. Yeah let's see what happen next with this pair.

Hopefully, everyone effected recovering soon.

Cheers.

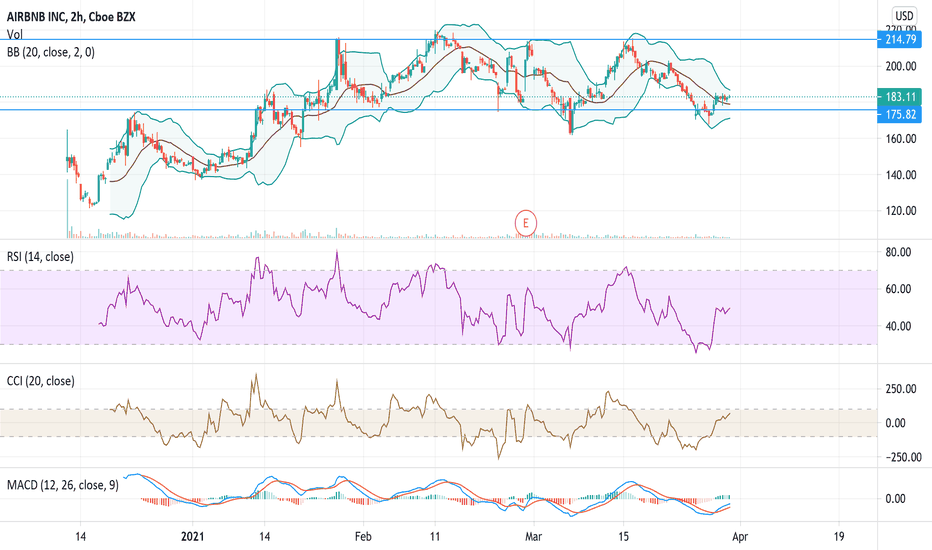

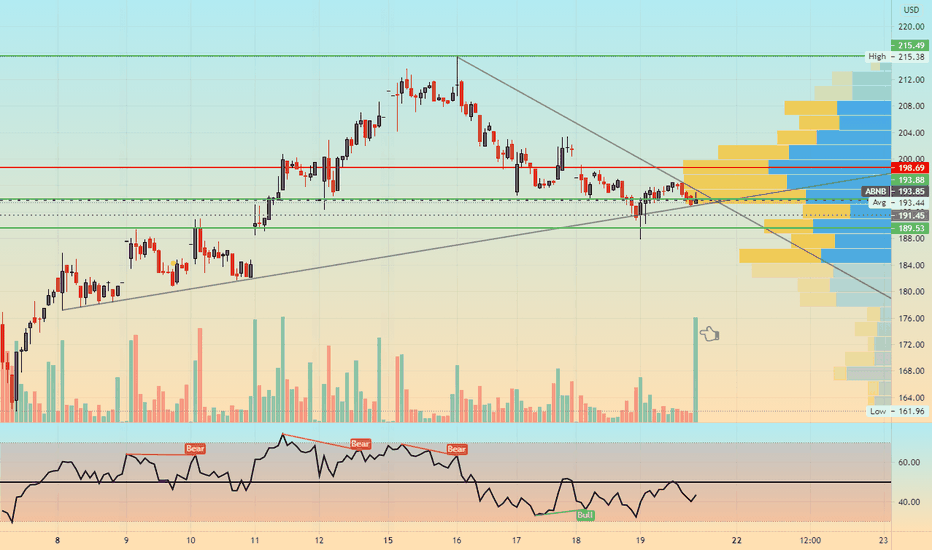

ABNB Stock 16/03/21 Analysis 4H ChartNASDAQ:ABNB

- Trend Analysis -

📑Value: 6/20

📈Growth: 16/20

💰Profitability: 16/20

🚀Momentum: 14/20

💸Earnings: 8/20

🖇️Total Score: 60/100

Data:

Volume 3.94M

Average Volume (3 months) 7.24M

Previous Close $209.99

Open $209.76

Shares Outstanding 120.78M

Technicals:

( Simple Moving Average )

10D SMA $189.26 (+6.09%)

50D SMA $183.93 (+9.17%)

200D SMA $56.66 (+254.39%)

Market Cap $123.89B

Total Debt $2.33B

Cash $6.39B

Enterprise Value $119.82B

Revenue $3.38B

Gross Profit $2.50B

Net Income -

EPS Diluted -$16.12

Free Cash Flow / Share -$2.35