ABNB trade ideas

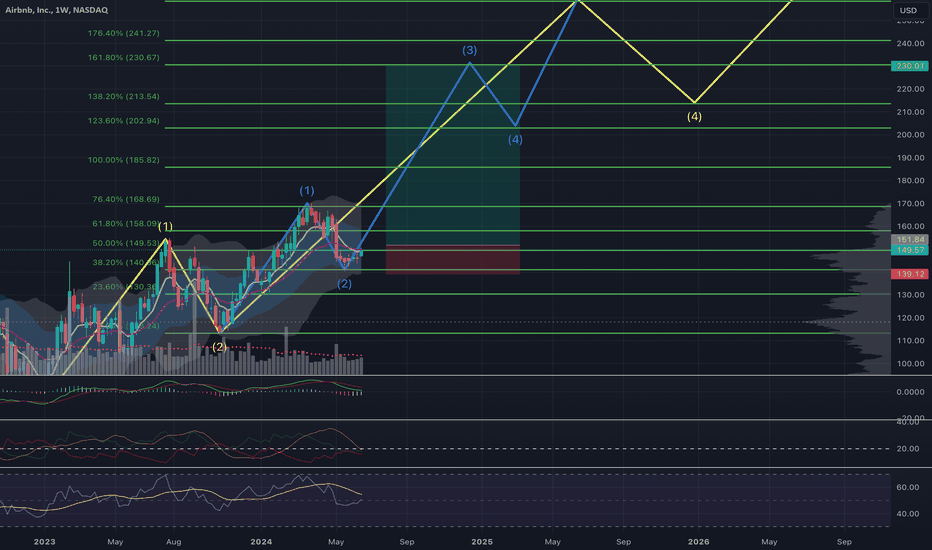

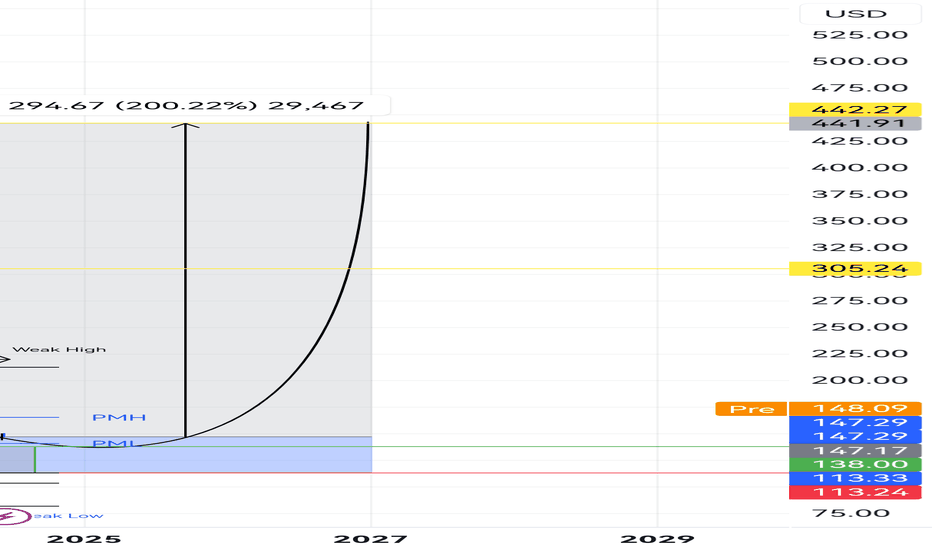

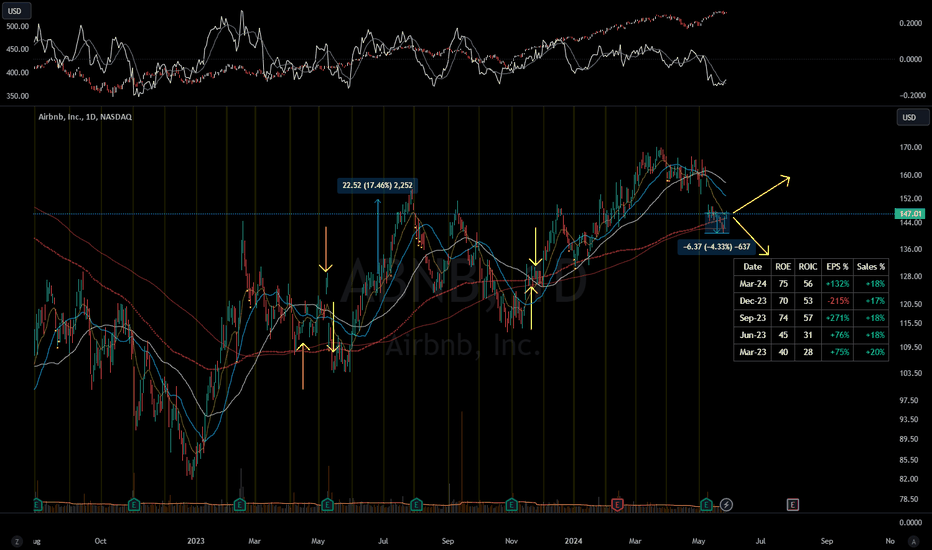

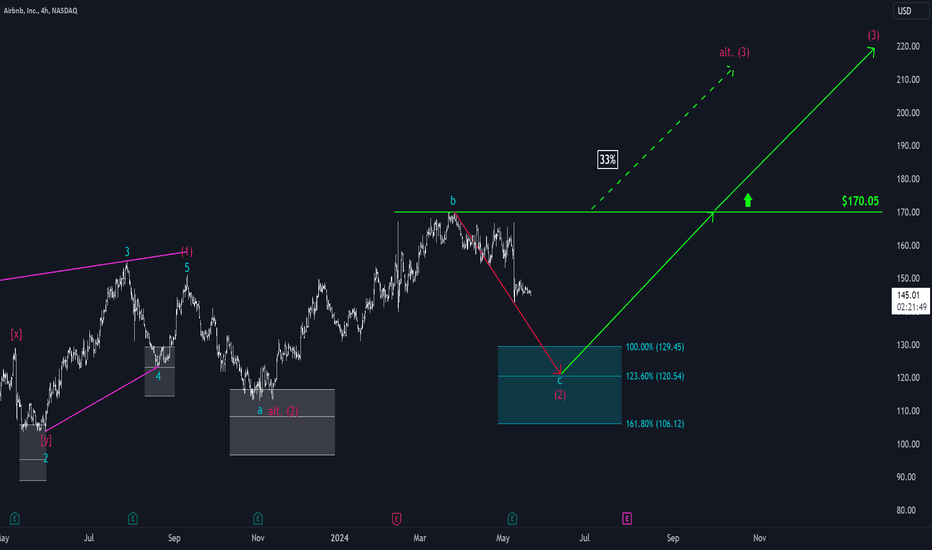

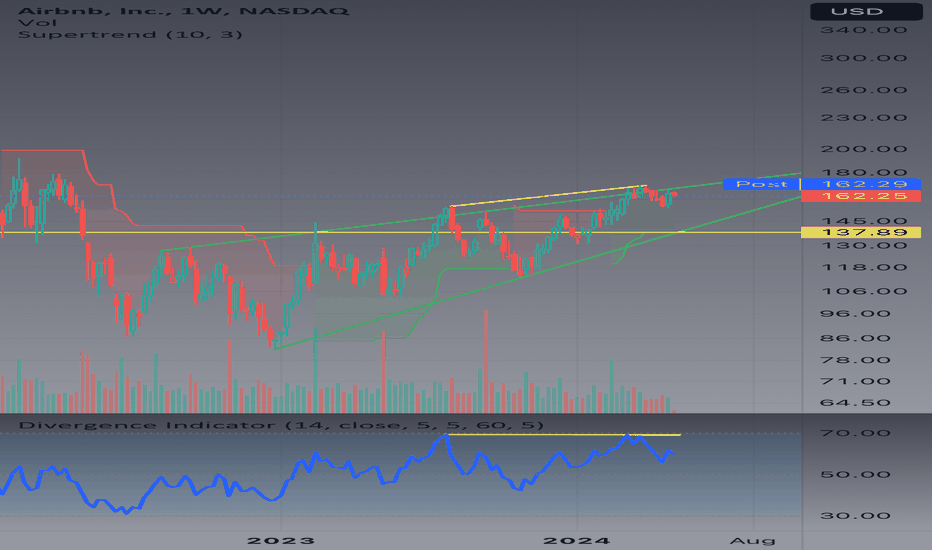

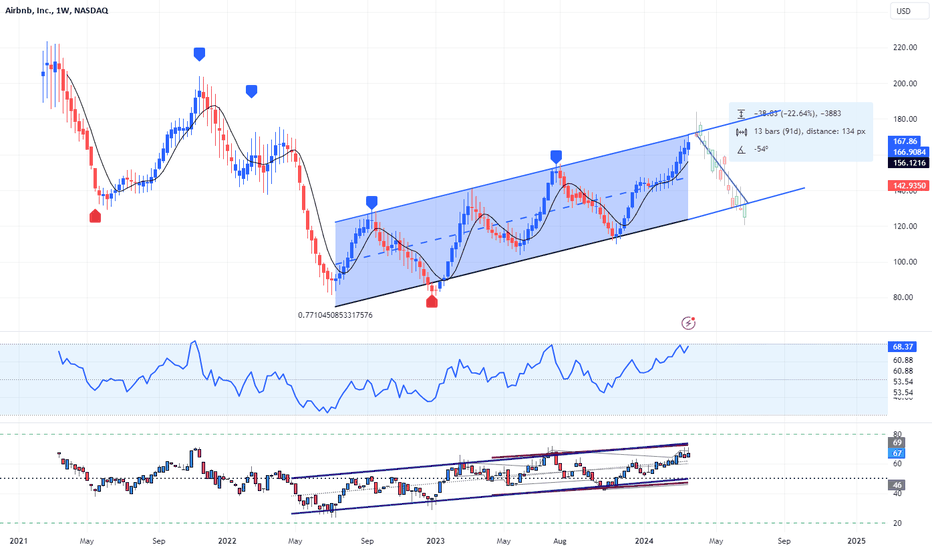

ABNB TRADE IDEAWhen considering the forecast and the evidence that supports it, it is likely in wave three to a higher degree, which is the bread and butter of swing trading. That said, the safest wave three entry is often the break above wave one of three, but in this case, the 8 and 21 EMA gave a buy signal, weekly volume is ticking up, and the weekly RSI is holding above 40. Therefore, a break above the weekly 8EMA may be the buy signal we are looking for. For any trade, you need a reason to enter, which is listed, a valid stop, which would be the wave 2 of 3 low in this case, and a target, which will be at least the 161.8% extension, based on typical Elliot wave theory and the overall forecast.

PRIMARY FORECAST FOR ABNBWhile there is an alternate count that treats wave two as a flat correction, there is more evidence to support the listed forecast. Based on the high extension of wave one of three, it is likely that wave three will be extended and target the 260 zone. Currently, the weekly volume steadily increasing over the past few weeks supports that this could get moving to the upside soon. We will want to see the RSI hold above about 40 to confirm the count is correct and in fact in wave three on a higher degree.

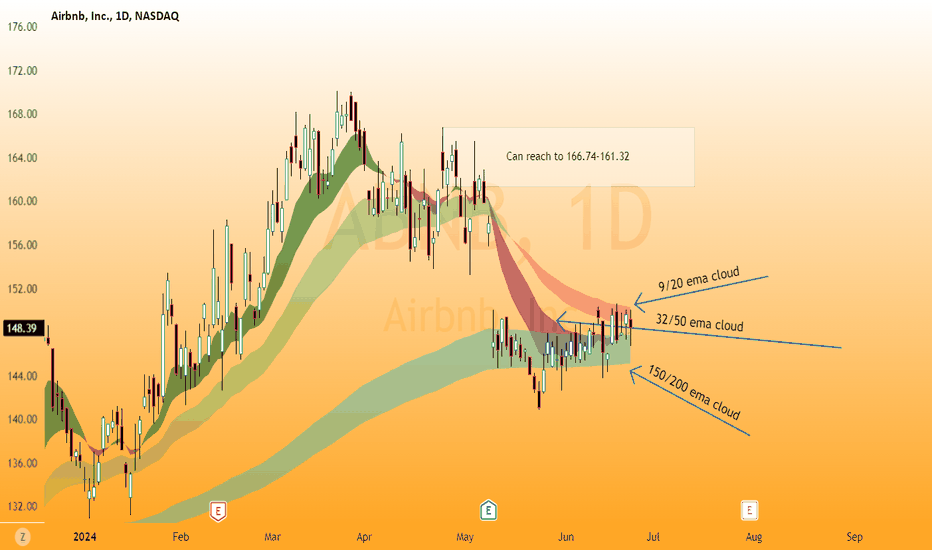

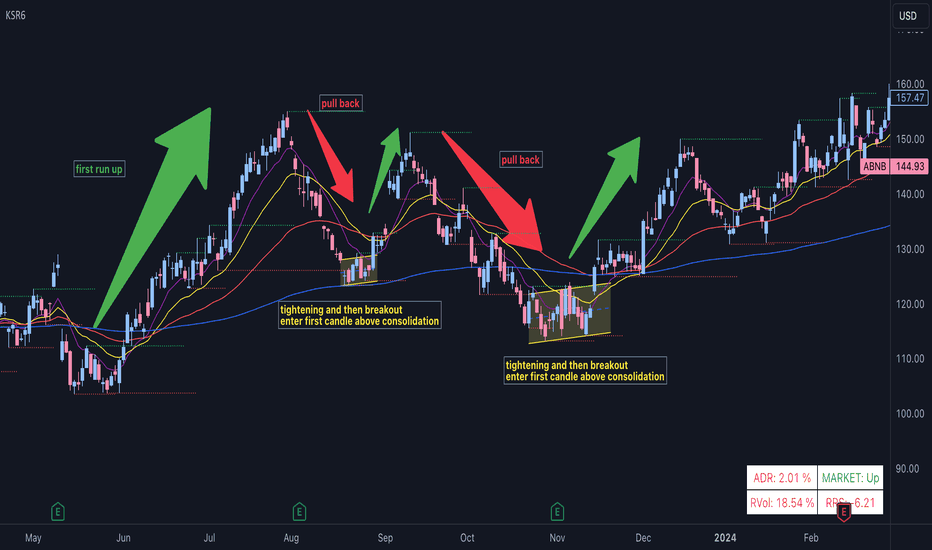

$ABNB ALMOST READY?WHAT CAN I SAY ABOUT NASDAQ:ABNB ?

NASDAQ:ABNB

well,

there is a lot to like here, lets dive in

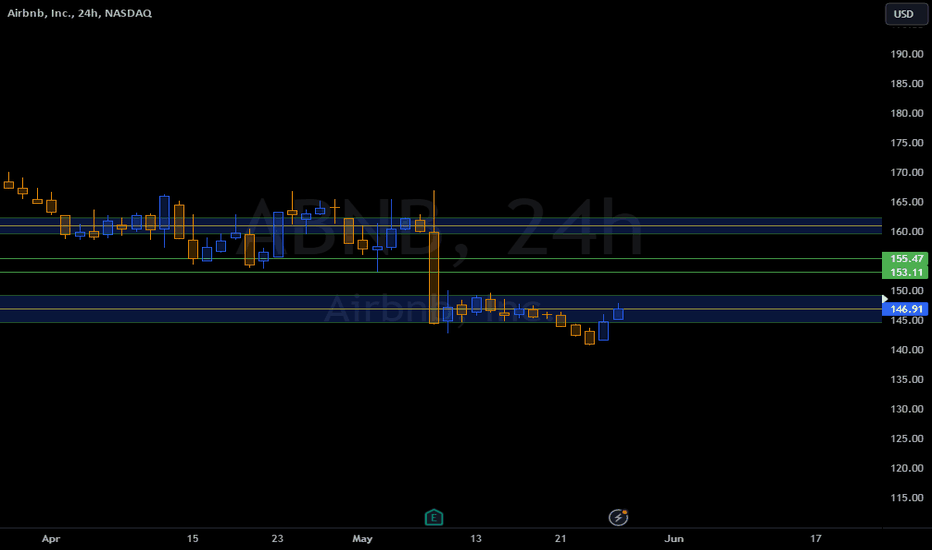

I'm waiting for a daily close above the 34 ema, $150 area, i want the saty phase ema to be above the 23.60 level in blue, i would also like the ema to turn green above this level but not a big deal for me on this trade. then go long for the gap fill till $155 - $156 area

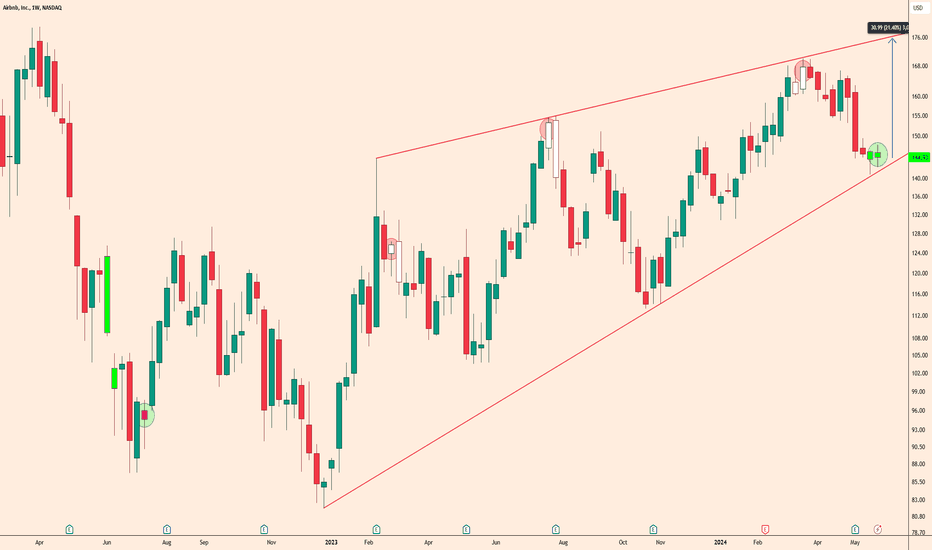

Airbnb Rising Wedge OpportunityAirbnb carries a potential profit of more than 21% unless it closes below $140 per week. Since my usual bottom finder indicator is currently giving a buy signal, I can open a long targeting $176 with a stop at $140. But in the long term a rising wedge pattern is forming.

ABNB - - A potential setup for a swing tradeRemain vigilant for daily reversal candles occurring near the support area. In the event of a daily closing breach of the support levels (red lines), there is a possibility of further downward movement, emphasizing the importance of implementing risk management strategies.

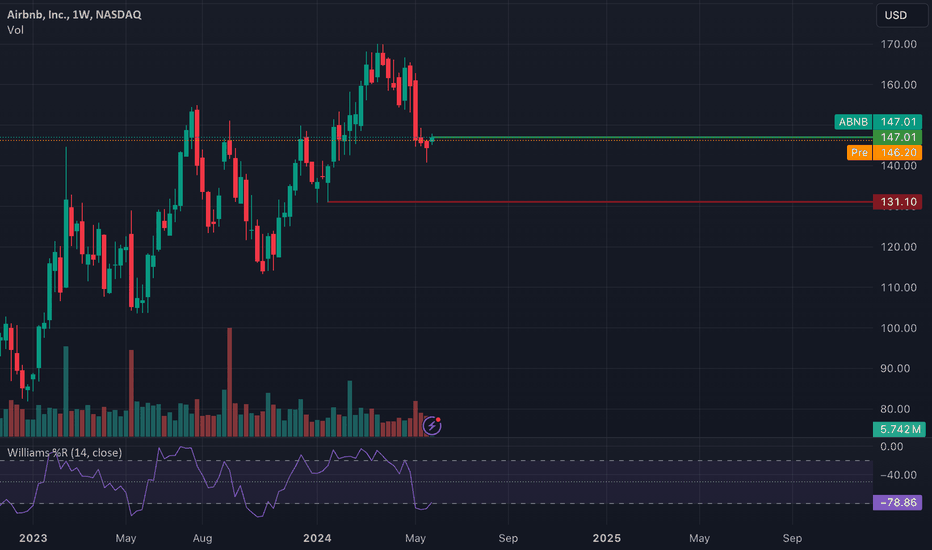

2024-05-28 ABNB Bottom fishing position with tight stoplossABNB has really good fundamental, stock went down due to weak guidance. However, looks like a bottom fishing position can be place with a tight stop at this point. If stock reverse and goes further down more than 5%, just cut loss, no second guess (not a financial advise).

Airbnb: Downhill 🏂Airbnb shares should approach our turquoise Target Zone between $129.45 and $106.12 before placing the low of the magenta wave (2) there. Subsequently, it should turn around and rise above the resistance at $170.05. Should the price exceed this resistance now (33% likely), we will already see it in the magenta-colored wave alt. (3).

Airbnb beats analysts' estimatesAirbnb delivered its quarterly results for the first quarter of 2024, surpassing analysts' estimates on the top and bottom lines. The company reported revenue growth of 18% YoY, bringing the figure to $2.1 billion. The net income was $264 million, up 126% YoY, and operating income amounted to $1.9 billion, recording an increase of 18% YoY. Per the investor letter, the company conducted share buybacks worth $750 million in the first quarter of the current year and registered 132.6 million bookings, marking an increase of 9.5% YoY.

Net revenue = $2.1 billion (18% YoY) vs. $1.8 billion in 1Q23

Net income = $264 million (126% YoY) vs. $117 million in 1Q23

Operating income = $1.9 billion (18% YoY) vs. $1.6 billion in 1Q23

Earnings per share = $0.41 (127% YoY) vs. $0.18 in 1Q23

Additional information

Active listings rose by 15% in the first quarter of 2024.

Long-term stays of 28 days or more accounted for 17% of gross nights booked, down about 1% compared to the first quarter of 2023.

Gross nights booked in non-urban areas grew by 10% YoY.

Forward guidance

Airbnb expects its revenue to increase by approximately 10% in the second quarter of 2024, bringing it to $2.68 billion. Further, the company anticipates stable growth in bookings and adjusted EBITDA to be flat to up on a nominal basis but down on an adjusted EBITDA margin basis when compared to the second quarter of 2023. In addition to that, Airbnb expects its full-year 2024 stock-based compensation expense to be approximately 20% higher than in the full year 2023.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor or any other entity. Therefore, your own due diligence is highly advised before entering a trade.

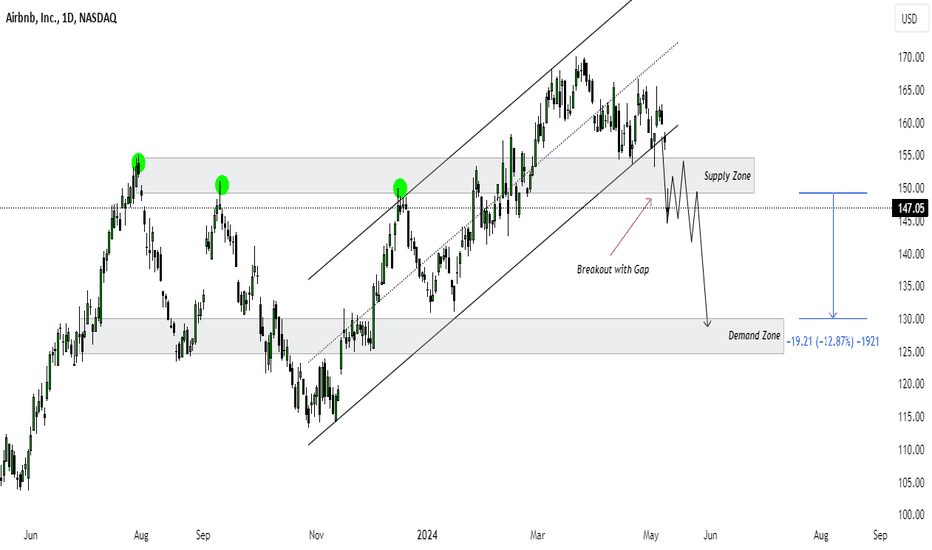

ABNB POTENTIAL DOWNSIDE MOMENTUM AHEAD WITH THIS BREAKOUTABNB has undergone a notable shift in its recent trajectory. A significant breakout accompanied by a gap suggests the possibility of a downward momentum, potentially returning towards the lower support levels. Furthermore, the failure of bullish momentum above the resistance confirms a significant sell zone. Anticipating a further decline of approximately 10% to 12% from the $150 region.

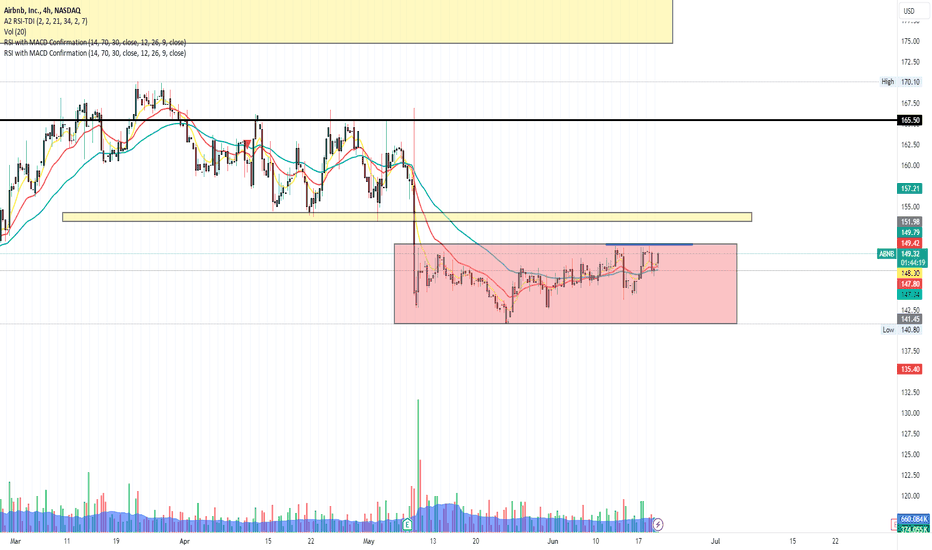

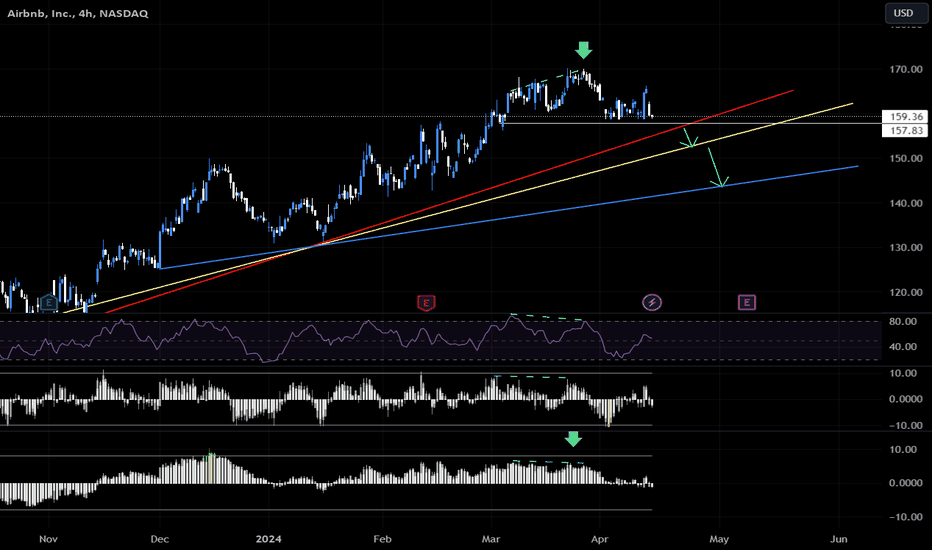

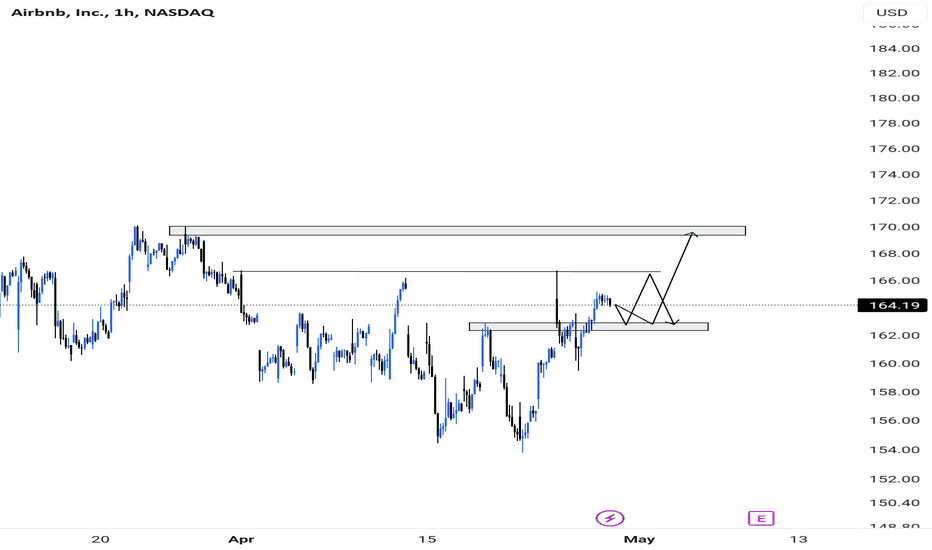

ABNB Potential Bearish Continuation SetupAfter the first "confirmed " reversal signal of Extreme Reversal Sniper on the H4 Chart Time Frame; we look for bearish breakout confirmation as decribed on the chart.

Holding Period : 5- 7 days

Major Trend : Bullish

Chart Time Frame: H4

Trade Type: Correction

Price Target: Targets are the trendlines on the chart.

Status : Not confirmed yet.

Important Note: Reversal/Correction is not confirmed. You need to wait for the confirmation signal.

Airbnb Shares Tumbles 8% After Weak ForecastsAirbnb shares ( NASDAQ:ABNB ) fell more than 8% in extended trading on Wednesday after the company issued a weaker-than-expected current-quarter outlook, overshadowing its strong Q1 results that topped Wall Street expectations. The company said its current-quarter results face "a significant sequential headwind" from the timing of Easter, an added leap-year day in the prior quarter, and the impact of foreign exchange fluctuations. However, the rentals platform sees accelerating sequential revenue growth between the second and third quarters, driven by a summer travel backlog spearheaded by the Paris Olympics in July and August.

For the three months ending March 31, the company posted adjusted earnings of 41 cents per share, well above the 24-cents-a-share figure modeled by analysts. Revenue in the period of $2.14 billion grew 18% from the last year's first quarter and topped the $2.06 billion consensus view. Gross bookings registered $22.9 billion, up 12% year-over-year (YOY), while nights and experiences booked on the platform improved 9.5% from a year earlier to 132.6 million, edging past expectations of 132.1 million.

Airbnb ( NASDAQ:ABNB ) noted that one-off events, such as the solar eclipse in North America, helped drive user engagement to the platform in the quarter, adding that 500,000 guests booked stays during the eclipse. Since topping out in late March, the Airbnb ( NASDAQ:ABNB ) share price has consolidated within a narrow range around the 50-day moving average, indicating a lack of conviction from both buyers and sellers.

Airbnb ( NASDAQ:ABNB ) shares fell 8.4% to $144.58 in after-hours trading. Through the close of trading Wednesday, the stock had gained about 25% over the past 12 months.

The Easter holiday occurring in the first quarter rather than the second and currency-exchange impacts were partly to blame for Airbnb ( NASDAQ:ABNB ) projecting current-quarter revenue below lofty Wall Street estimates.

Technical Outlook

Airbnb ( NASDAQ:ABNB ) shares is down 6.34% on Thursday's early Market Trading with a weak Relative Strength Index (RSI) of 34.38 indicating a slight oversold condition for the stock.

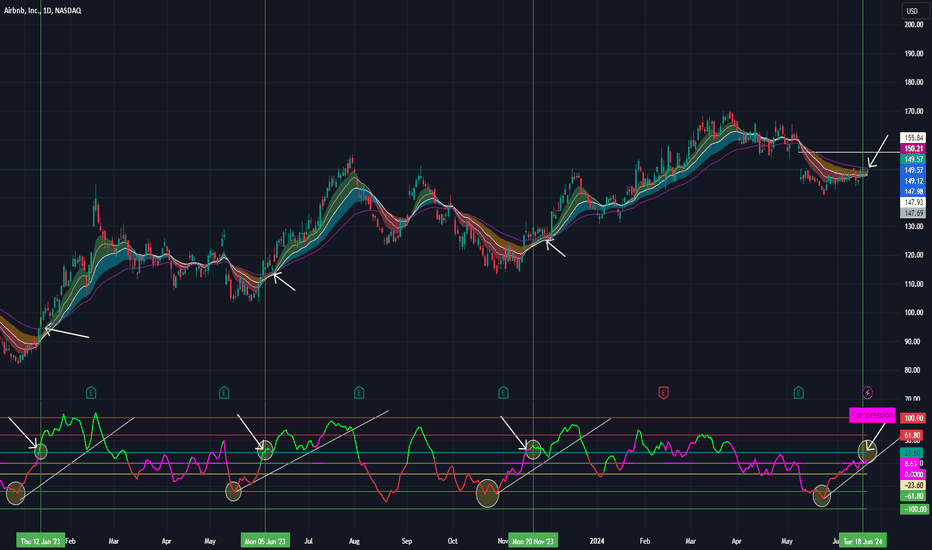

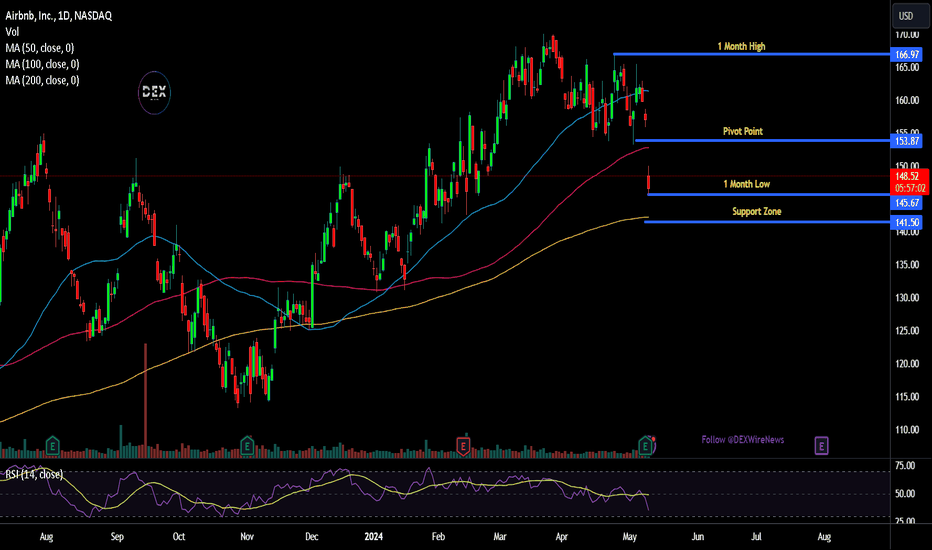

Ichimoku Watch: Airbnb (ABNB) Testing Support Upcoming Earnings Release:

Airbnb, Inc. (ticker ABNB) is scheduled to report earnings today after the market closes. The consensus EPS estimate for the fiscal quarter ending March 2024 is $0.23, while the reported EPS for the same quarter a year prior was $0.18.

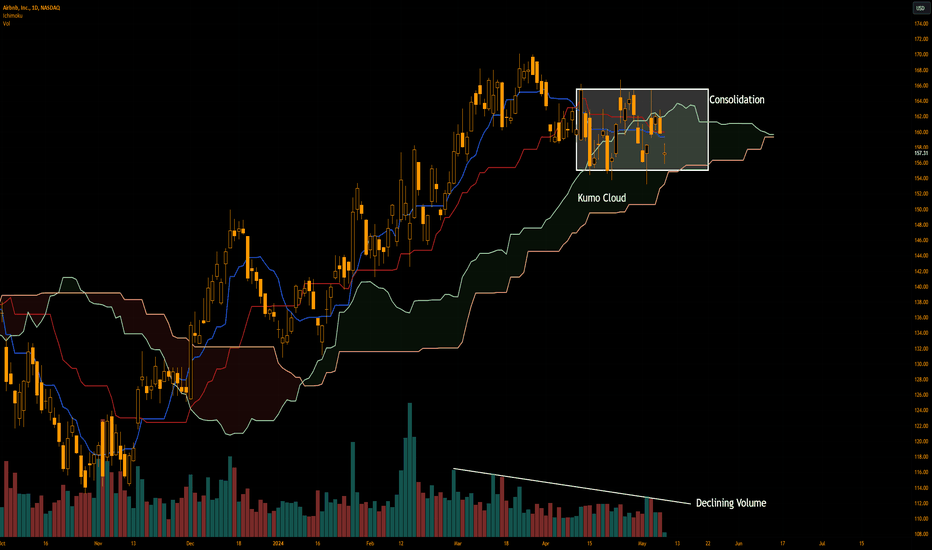

Buyers Preparing to Show?

Airbnb is quite an interesting stock to monitor at the moment.

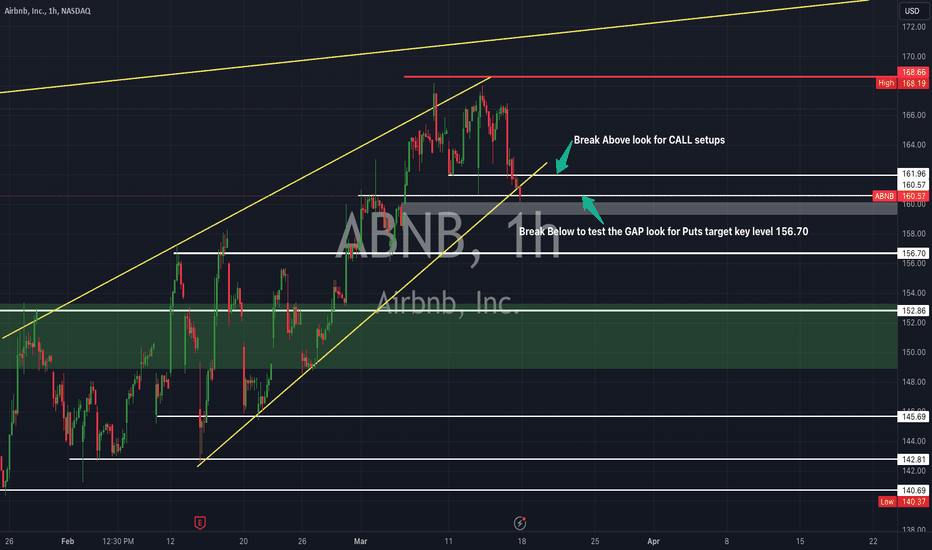

Most traders can clearly see that the trend in this market is higher in the long term and that the stock has been consolidating between $155.09 and $165.54 since 11 April, with volume steadily declining as the range progresses.

It is also clear that the stock is testing the Ichimoku Cloud (difference between Leading Span A and Leading Span B) to perhaps form support (although the Leading Span A has drastically closed in on the Leading Span B and may cross lower, the fact is that the Cloud may still offer support). If you couple this with the range support edge nearby at $155.09, this could be where buyers come into the market.

Price Direction?

The range support at $155.09 and the Kumo Cloud could be enough to buttress buying in this market. To find confirmation before entering a long trade, some traders may wait and see if a conversion-base line crossover forms. You can see that the conversion line (blue) has just crossed under the baseline (red); a crossover back above the conversion line will be recognised as a bullish signal and is a common way of entering into an established uptrend.

AIRBNB MARCH 18 '24The overall trend is bullish on the bigger time frame, but we can see a clear rising wedge with the strong break. The technicals align with the current news as well the company hasn't been doing well overall with AIRBNB productivity and new rules and regs have scared customers. Lets see how this plays.

Airbnb (ABNB) take profit and risk freeAirbnb, rebalancing and stop at 0

Stock picking is one of the most complicated things, especially in the long term.

Airbnb (ABNB) is the result of a study I carried out years ago shortly after its listing, the market cap, is higher than historic tourism giants, and the business model and growth possibilities remain important.

Its main competitor (Booking) has done better , incorporating the tourist rental business into the enormous hotel database, increasingly becoming the point of reference in the sector.

A sector in which I continue to believe but ...

How sustainable can it be?

Short-term rentals are out of control now, heavily influencing the cost or even the very EXISTENCE of long-term or "canonical" rentals. Here ethical and political aspects come into play.

It is becoming a problem in some areas even outside the big cities, for those who cannot afford rent which very often equals their salary, when it goes well.

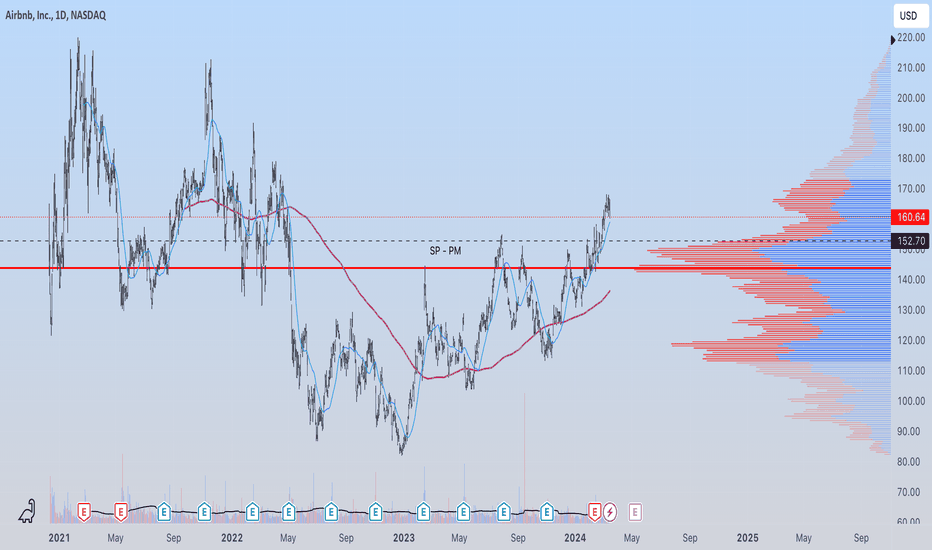

From a graphic point of view, the stock is in an uptrend, and the macroeconomic data have always been positive apart from the last earnings, -183%, an alarm bell which, added to my reasoning, leads me to diversify, while continuing to believe in the tourism sector.

I take home all the profit generated and set the stop at 0.

I am doing a study on the best sector ETF, to include the capital allocated to ABNB, which I hope will continue to grow.

Possible scenarios:

at 152.70: I completely exit the remaining position and reinvest the amount in an ETF (which will be communicated once done)

Rebalancing target: historical high in the $220 area

I'll keep you up-to-date

Happy trading

Lazy Bull