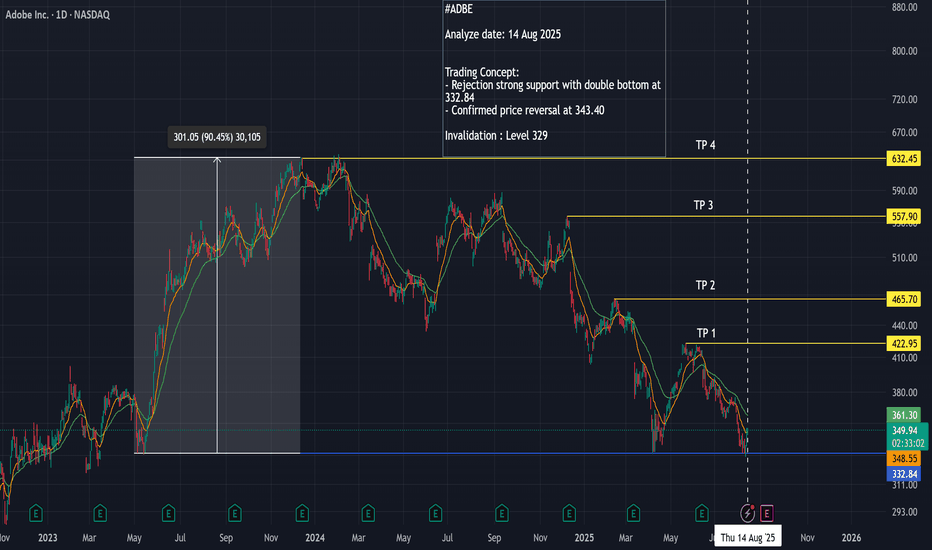

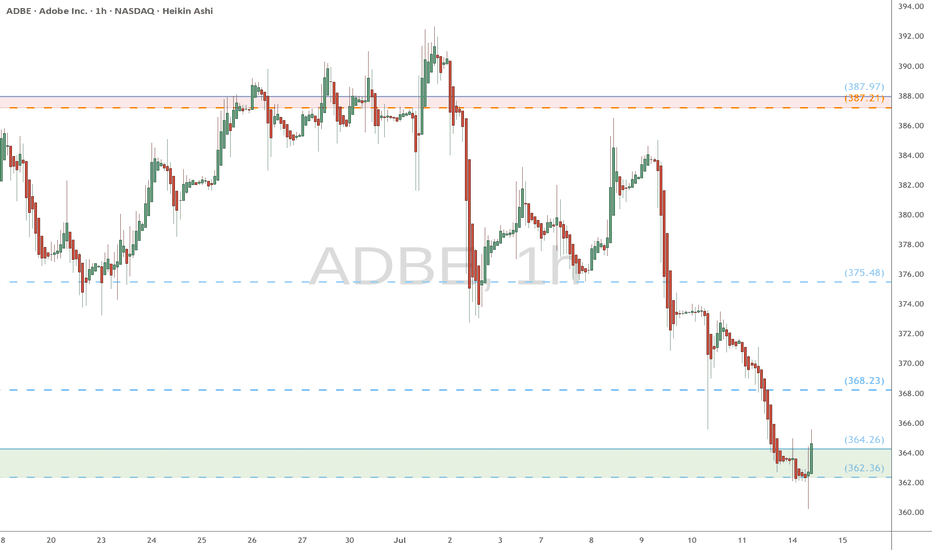

Thanks me later - ADBE Rejection Strong Support!

NASDAQ:ADBE

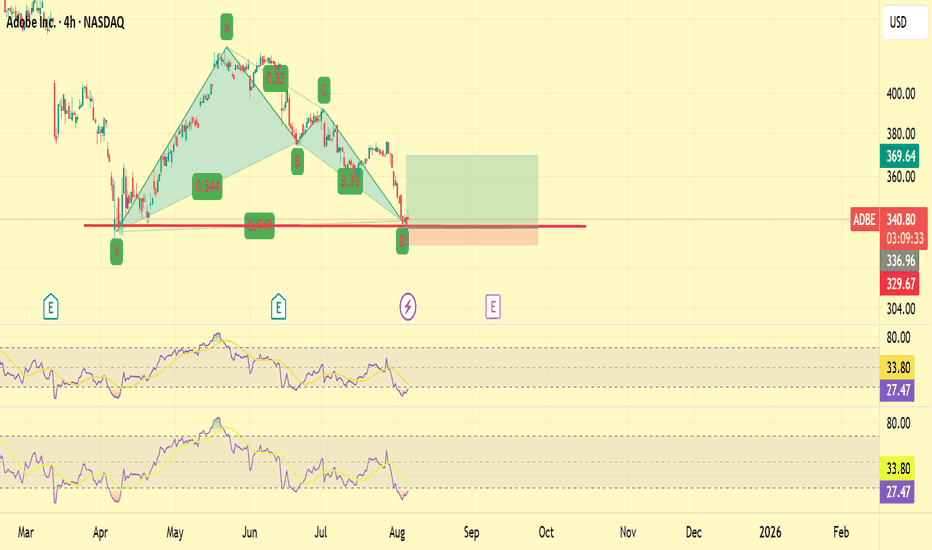

ADBE has been confirmed of rejection strong support at 332.84 through price reversal at 343.30.

ADBE must break level 376.0 to create higher high as a confirmation of bullish trend reversal.

Set up invalidation at 329.0 for the longterm target at 632.45.

Key facts today

Adobe (ADBE) was downgraded by Melius Research, contributing to a decline in European software stocks due to concerns over the impact of new AI models on the sector.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

13.85 EUR

5.26 B EUR

20.35 B EUR

422.72 M

About Adobe Inc.

Sector

Industry

CEO

Shantanu Narayen

Website

Headquarters

San Jose

Founded

1982

FIGI

BBG00GQ6RYG1

Adobe, Inc. is a global technology company, which engages in the provision of digital marketing and media solutions. It operates through the following segments: Digital Media, Digital Experience, and Publishing and Advertising. The Digital Media segment offers products and services that enable individuals, teams, businesses, and enterprises to create, publish, and promote content anywhere and accelerate productivity by transforming view, share, engage with and collaborate on documents and creative content. The Digital Experience segment focuses on integrated platform and set of products, services, and solutions that enable businesses to create, manage, execute, measure, monetize, and optimize customer experiences that span from analytics to commerce. The Publishing and Advertising segment includes legacy products and services that address diverse market opportunities, including eLearning solutions, technical document publishing, web conferencing, document and forms platform, web app development, high-end printing, and Adobe Advertising offerings. The company was founded by Charles M. Geschke and John E. Warnock in December 1982 and is headquartered in San Jose, CA.

Related stocks

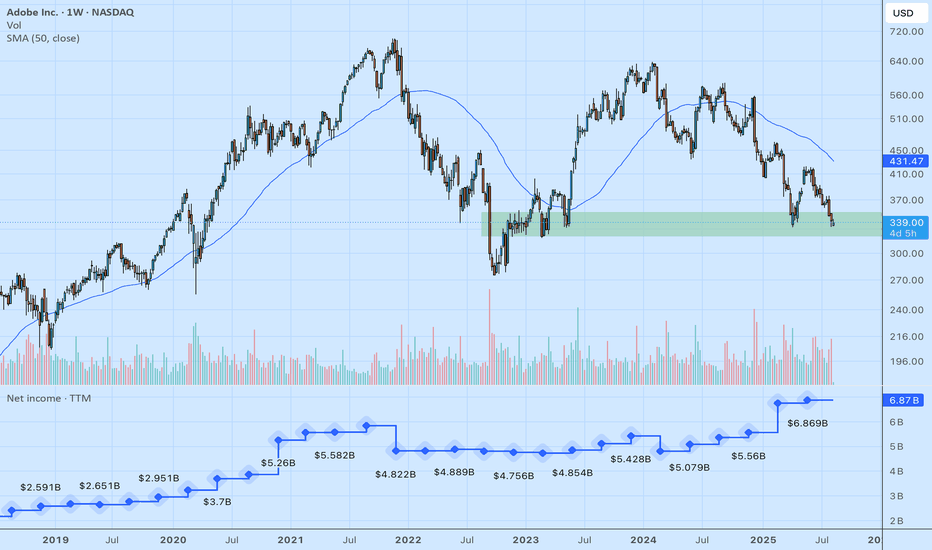

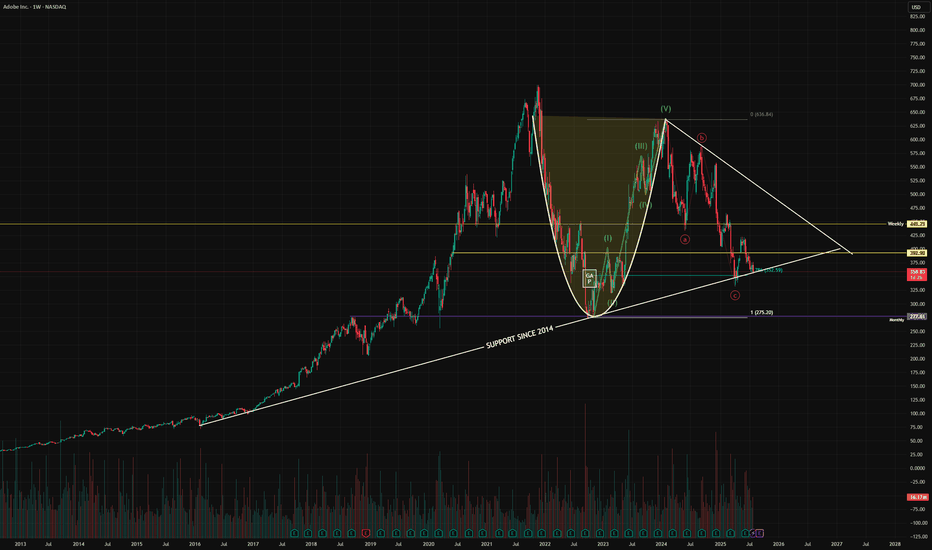

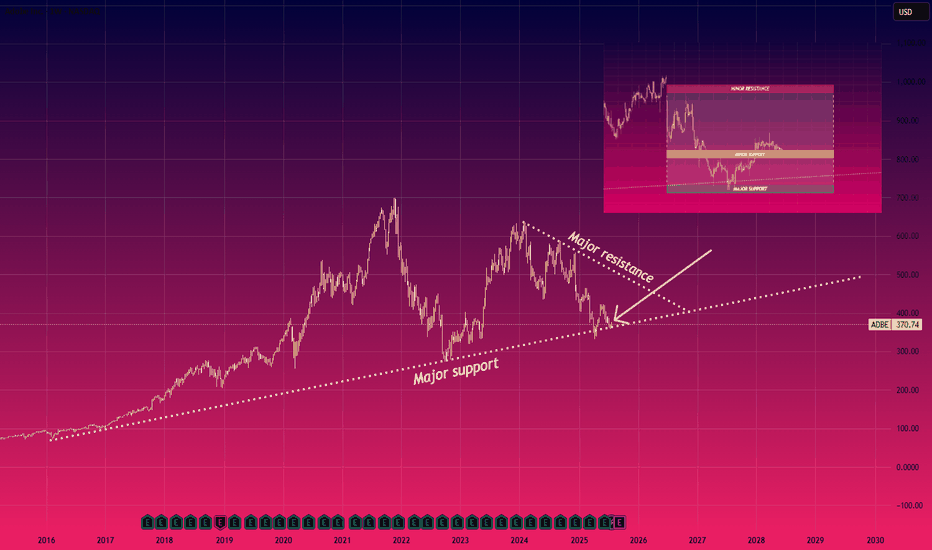

$ADBE is an IA sleeping giantHi there, I bring you Adobe today.

Between 2020 and 2024, Adobe delivered sustained growth, moving from $12.87 B in 2020 to $21.51 B in 2024, an impressive 67% cumulative increase. Operating income grew from $4.24 B to $6.74 B over the same period. Net income peaked at $5.26 B in 2020, dropped in 2

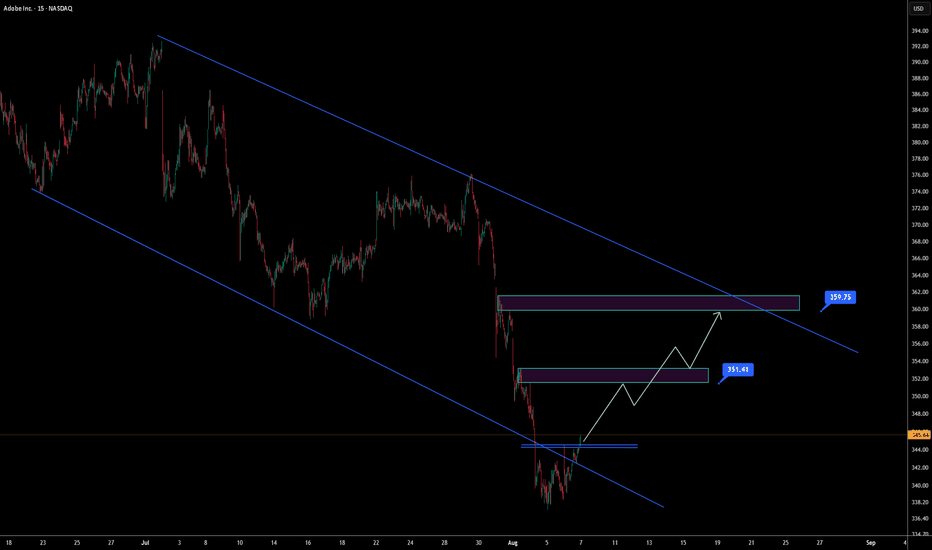

ADBE - Bullish Breakout from Channel Support | Targeting 359.75Price recently bounced from the lower boundary of a well-defined descending channel, finding support at a key demand area.

The breakout above local resistance suggests bullish momentum building up, with two target zones mapped at 351.41 and 359.75.

Watching for a potential continuation towards the

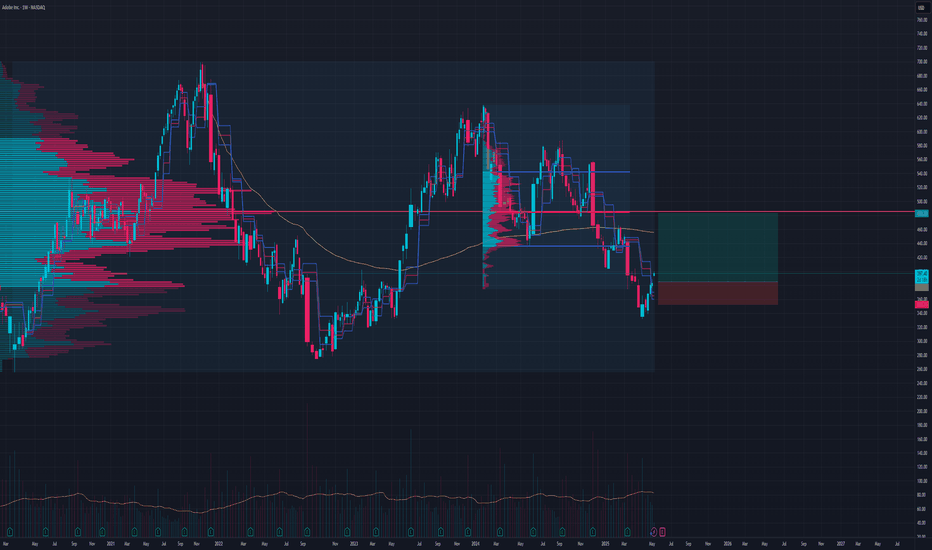

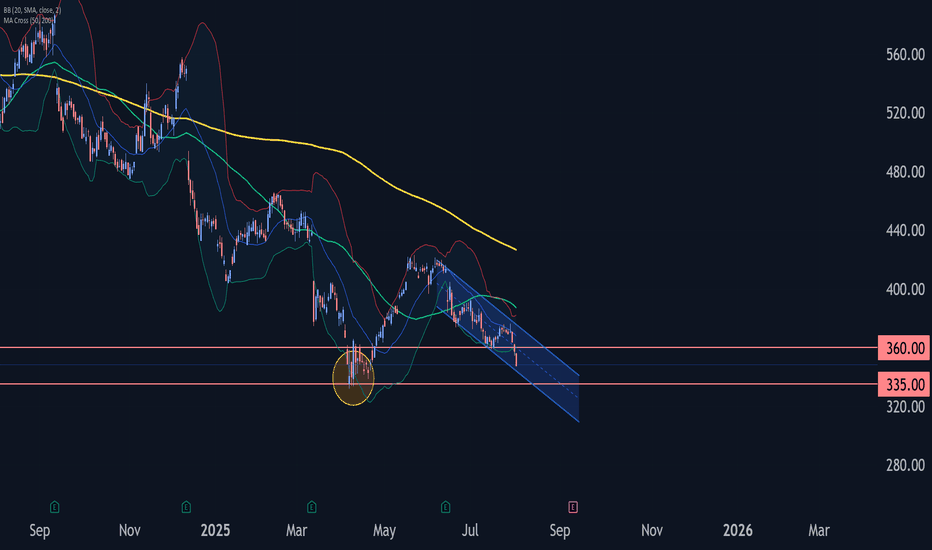

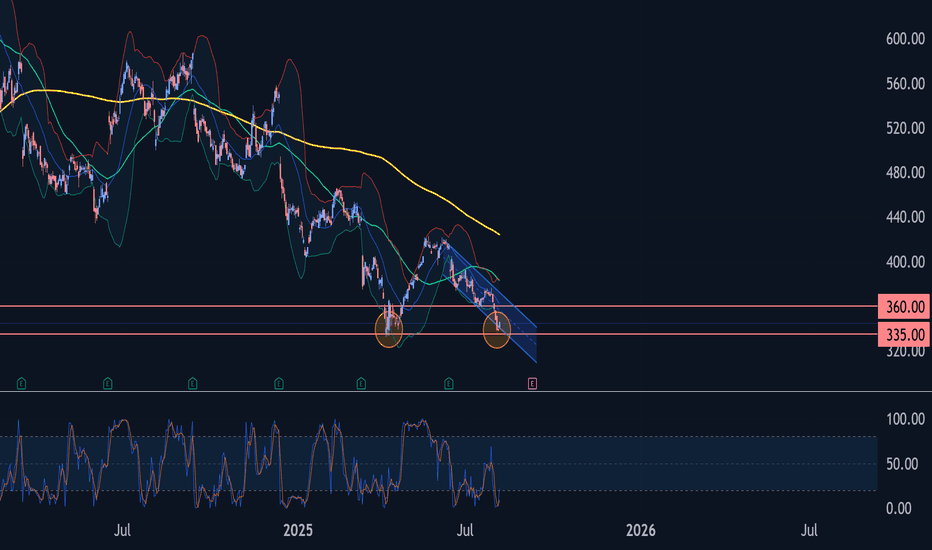

Adobe Wave Analysis – 1 August 2025- Adobe broke the key support level 360.00

- Likely to fall to support level 335.00

Adobe recently broke below the key support level 360.00 (which stopped the previous minor impulse wave i at the start of July).

The breakout of the support level 360.00 accelerated the active impulse wave C of the

Adobe Wave Analysis – 6 August 2025- Adobe reversed from strong support level of 335.00

- Likely to rise to resistance level 360.00

Adobe recently reversed up from the support zone between the strong support level of 335.00 (which stopped the sharp daily downtrend in April) and the lower daily Bollinger Band.

This support zone was

Bottom Feeding - Opportunity?Adobe is sitting on two areas of support - an 11 year old trendline and the 0.786 Fibonacci. It looks like it's coiling up in a giant triangle. This is a steadily growing business with a very sticky product suite. Whilst everyone is falling over themselves to buy Figma at $110, I think it's time to

L: Quick Analysis on $NASDAQ:ADBE Support and ResistanceQuick Analysis on NASDAQ:ADBE Support and Resistance

The chart shows NASDAQ:ADBE nearing a major support level around $370, Which has held since 2016, the downward resistance line suggests continued pressure, but a breakout above $400 levels could signal a bullish reversal

Please note this

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ADBE5784629

Adobe Inc. 4.95% 04-APR-2034Yield to maturity

4.61%

Maturity date

Apr 4, 2034

ADBE5981558

Adobe Inc. 5.3% 17-JAN-2035Yield to maturity

4.60%

Maturity date

Jan 17, 2035

US724PAD1

ADOBE 20/30Yield to maturity

4.30%

Maturity date

Feb 1, 2030

ADBE5981252

Adobe Inc. 4.95% 17-JAN-2030Yield to maturity

4.06%

Maturity date

Jan 17, 2030

US724PAC3

ADOBE 20/27Yield to maturity

3.99%

Maturity date

Feb 1, 2027

ADBE5784440

Adobe Inc. 4.8% 04-APR-2029Yield to maturity

3.97%

Maturity date

Apr 4, 2029

ADBE5981557

Adobe Inc. 4.75% 17-JAN-2028Yield to maturity

3.91%

Maturity date

Jan 17, 2028

ADBE5784439

Adobe Inc. 4.85% 04-APR-2027Yield to maturity

3.81%

Maturity date

Apr 4, 2027

See all ADBE bonds

Curated watchlists where ADBE is featured.

Frequently Asked Questions

The current price of ADBE is 299.60 EUR — it has decreased by −0.60% in the past 24 hours. Watch ADOBE SYSTEMS INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange ADOBE SYSTEMS INC stocks are traded under the ticker ADBE.

ADBE stock has risen by 2.68% compared to the previous week, the month change is a −4.82% fall, over the last year ADOBE SYSTEMS INC has showed a −38.89% decrease.

We've gathered analysts' opinions on ADOBE SYSTEMS INC future price: according to them, ADBE price has a max estimate of 519.83 EUR and a min estimate of 240.58 EUR. Watch ADBE chart and read a more detailed ADOBE SYSTEMS INC stock forecast: see what analysts think of ADOBE SYSTEMS INC and suggest that you do with its stocks.

ADBE reached its all-time high on Nov 22, 2021 with the price of 617.00 EUR, and its all-time low was 121.85 EUR and was reached on Jun 12, 2017. View more price dynamics on ADBE chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ADBE stock is 0.23% volatile and has beta coefficient of 0.95. Track ADOBE SYSTEMS INC stock price on the chart and check out the list of the most volatile stocks — is ADOBE SYSTEMS INC there?

Today ADOBE SYSTEMS INC has the market capitalization of 126.94 B, it has decreased by −3.42% over the last week.

Yes, you can track ADOBE SYSTEMS INC financials in yearly and quarterly reports right on TradingView.

ADOBE SYSTEMS INC is going to release the next earnings report on Sep 10, 2025. Keep track of upcoming events with our Earnings Calendar.

ADBE earnings for the last quarter are 4.46 EUR per share, whereas the estimation was 4.38 EUR resulting in a 1.75% surprise. The estimated earnings for the next quarter are 4.45 EUR per share. See more details about ADOBE SYSTEMS INC earnings.

ADOBE SYSTEMS INC revenue for the last quarter amounts to 5.18 B EUR, despite the estimated figure of 5.11 B EUR. In the next quarter, revenue is expected to reach 5.08 B EUR.

ADBE net income for the last quarter is 1.49 B EUR, while the quarter before that showed 1.75 B EUR of net income which accounts for −14.62% change. Track more ADOBE SYSTEMS INC financial stats to get the full picture.

No, ADBE doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 15, 2025, the company has 30.71 K employees. See our rating of the largest employees — is ADOBE SYSTEMS INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ADOBE SYSTEMS INC EBITDA is 8.11 B EUR, and current EBITDA margin is 40.74%. See more stats in ADOBE SYSTEMS INC financial statements.

Like other stocks, ADBE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ADOBE SYSTEMS INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ADOBE SYSTEMS INC technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ADOBE SYSTEMS INC stock shows the sell signal. See more of ADOBE SYSTEMS INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.