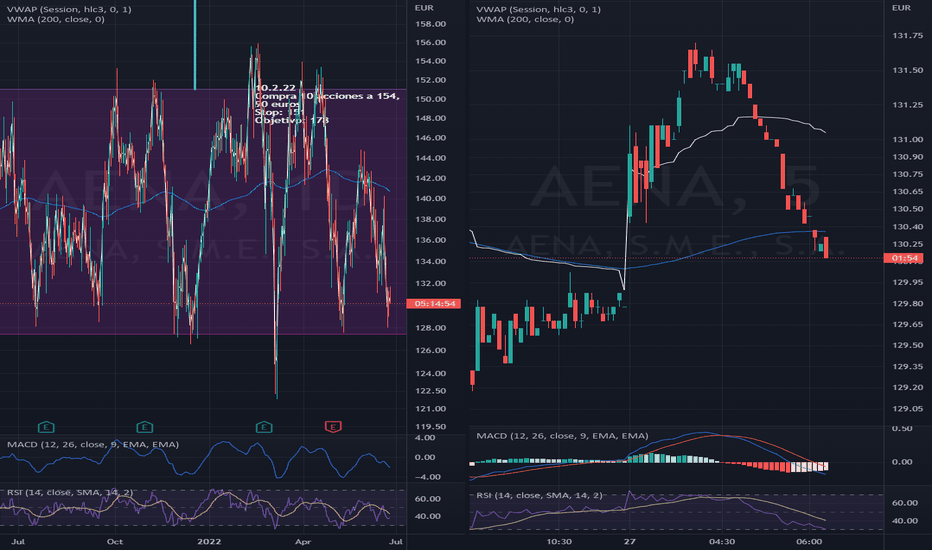

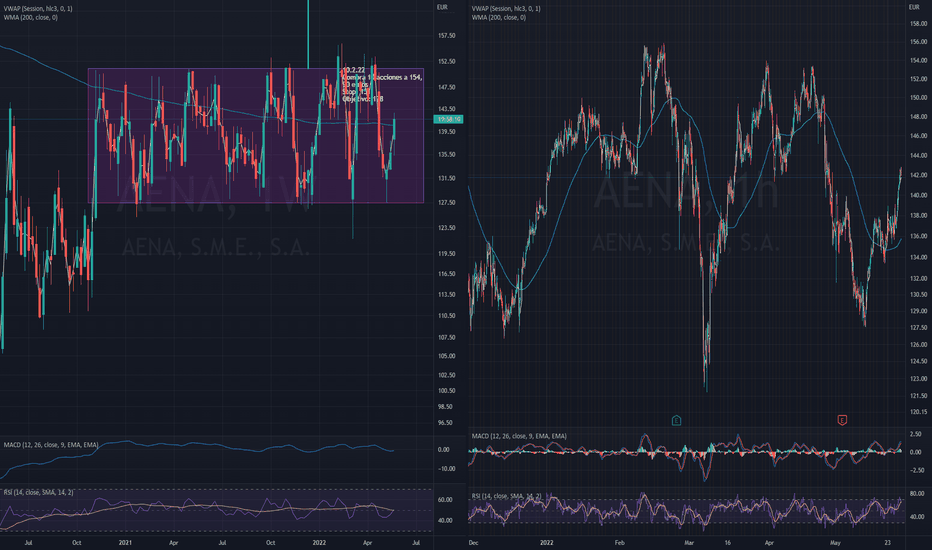

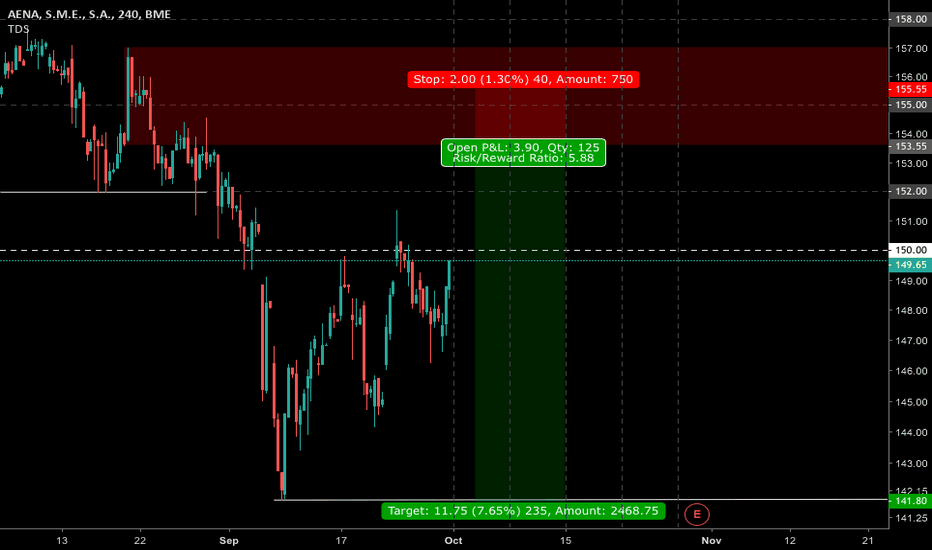

AENA + Double Button + UP06/27/2022 (mm-dd-yy)

TARGET 150

TRIGGER 131

STOP 1 = 129

STOP 2 = 127

Historic:

06/27/2022 (mm-dd-yy)

Fear & Greed Index: 28

Mid-term forecast (1-2 weeks):

If price breaks the 131 resistance, a resumption of a strong uptrend is expected.

Aiming at 150 (1-2 weeks) and (2-4 weeks)

If the support a

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.35 EUR

1.93 B EUR

5.76 B EUR

690.84 M

About AENA, S.M.E., S.A.

Sector

Industry

CEO

Maurici Lucena Betriu

Website

Headquarters

Madrid

Founded

1991

ISIN

ES0105046017

FIGI

BBG00HVY2279

Aena S.M.E. SA engages in the management and operation of airport terminals. It operates through the following business segments: Airports, Real Estate Services, and International. The Airports segment provides airport services such as cargo handling, air transportation and passenger security. The Real Estate Services segment includes industrial and real estate assets that are not included in terminals. The International segment deals with the international development business. The company was founded on June 19, 1991, and is headquartered in Madrid, Spain.

Related stocks

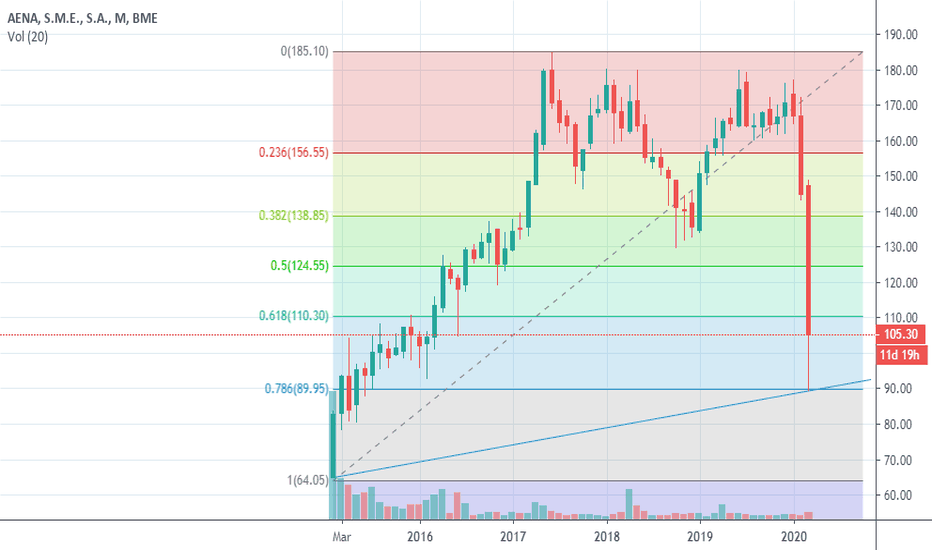

AENA + CHANEL UP 05/26/2022 (mm-dd-yy)

TARGET 176

TRIGGER 151

STOP 1 = 148

STOP 2 = 127

Historic:

05/26/2022 (mm-dd-yy)

Fear & Greed Index: 28

Mid-term forecast (1-2 weeks):

If price breaks the 151 resistance, a resumption of a strong uptrend is expected.

Aiming at 176 (1-2 weeks) and 180 (2-4 weeks)

If the suppo

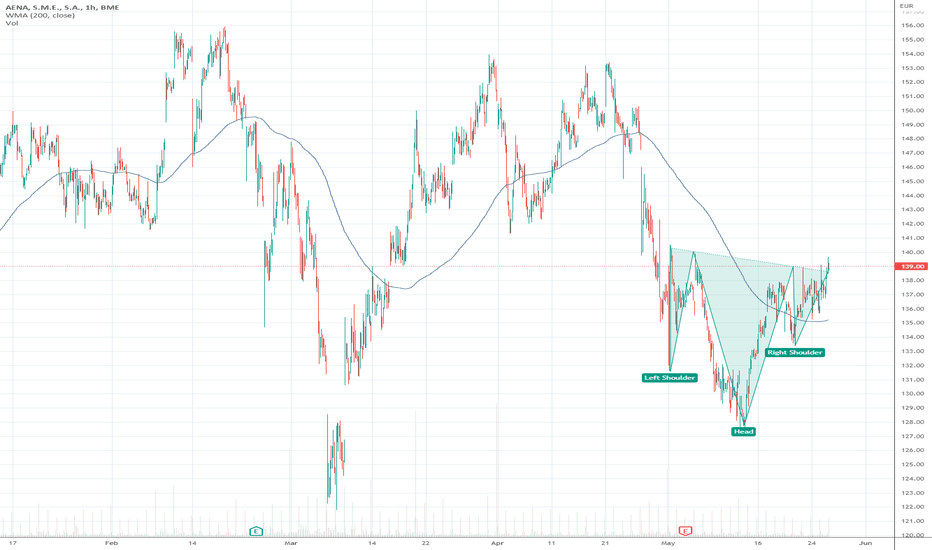

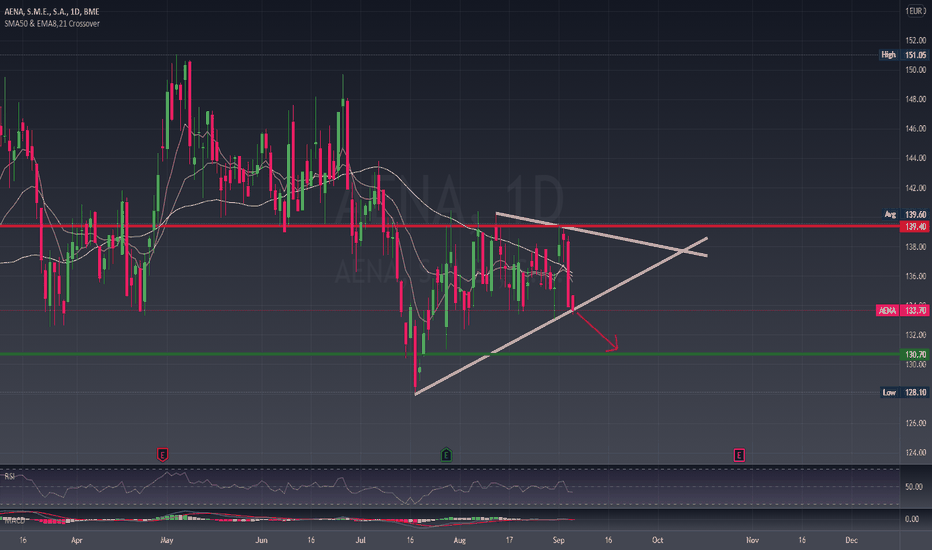

Aena S.M.E., S.A. (AENA.mc):We can found a technical figure Triangle in Spanish company Aena, SME S. A. (AENA.mc) on a daily chart. Aena, SME S. A.is a Spanish public company incorporated as a public limited company that manages general interest airports in Spain. The company, which is 51% owned by the public business entity E

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Frequently Asked Questions

The current price of AEN2 is 25.67 EUR — it has increased by 1.58% in the past 24 hours. Watch AENA SA stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange AENA SA stocks are traded under the ticker AEN2.

AEN2 stock has risen by 4.52% compared to the previous week, the month change is a 9.42% rise, over the last year AENA SA has showed a 13.28% increase.

We've gathered analysts' opinions on AENA SA future price: according to them, AEN2 price has a max estimate of 39.00 EUR and a min estimate of 17.50 EUR. Watch AEN2 chart and read a more detailed AENA SA stock forecast: see what analysts think of AENA SA and suggest that you do with its stocks.

AEN2 reached its all-time high on Aug 8, 2025 with the price of 24.56 EUR, and its all-time low was 22.46 EUR and was reached on Jun 27, 2025. View more price dynamics on AEN2 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AEN2 stock is 1.57% volatile and has beta coefficient of 0.64. Track AENA SA stock price on the chart and check out the list of the most volatile stocks — is AENA SA there?

Today AENA SA has the market capitalization of 38.12 B, it has increased by 4.34% over the last week.

Yes, you can track AENA SA financials in yearly and quarterly reports right on TradingView.

AENA SA is going to release the next earnings report on Oct 29, 2025. Keep track of upcoming events with our Earnings Calendar.

AEN2 earnings for the last quarter are 0.39 EUR per share, whereas the estimation was 0.41 EUR resulting in a −3.34% surprise. The estimated earnings for the next quarter are 0.43 EUR per share. See more details about AENA SA earnings.

AENA SA revenue for the last quarter amounts to 1.67 B EUR, despite the estimated figure of 1.62 B EUR. In the next quarter, revenue is expected to reach 1.73 B EUR.

AEN2 net income for the last quarter is 592.44 M EUR, while the quarter before that showed 301.31 M EUR of net income which accounts for 96.62% change. Track more AENA SA financial stats to get the full picture.

Yes, AEN2 dividends are paid annually. The last dividend per share was 7.91 EUR. As of today, Dividend Yield (TTM)% is 3.11%. Tracking AENA SA dividends might help you take more informed decisions.

AENA SA dividend yield was 4.00% in 2024, and payout ratio reached 61.31%. The year before the numbers were 3.78% and 57.07% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 15, 2025, the company has 10.51 K employees. See our rating of the largest employees — is AENA SA on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AENA SA EBITDA is 3.57 B EUR, and current EBITDA margin is 59.70%. See more stats in AENA SA financial statements.

Like other stocks, AEN2 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AENA SA stock right from TradingView charts — choose your broker and connect to your account.