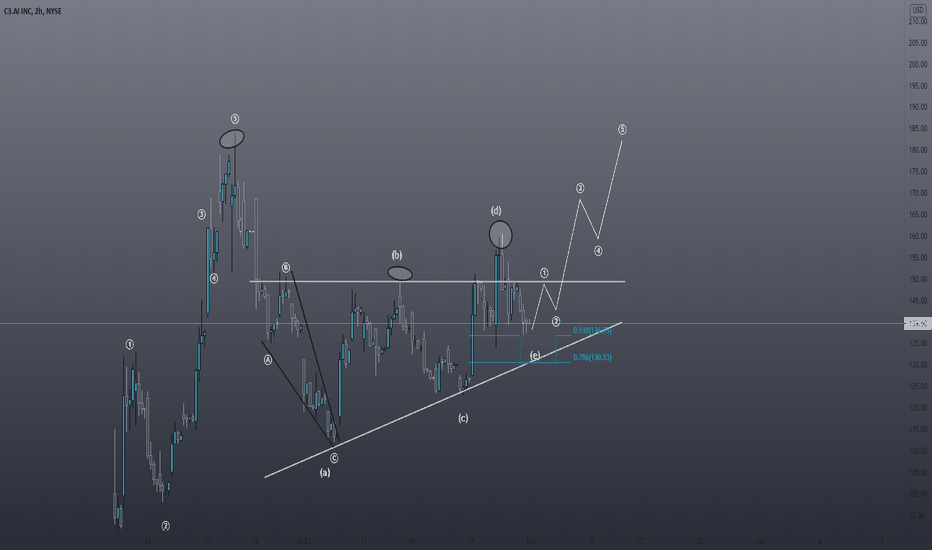

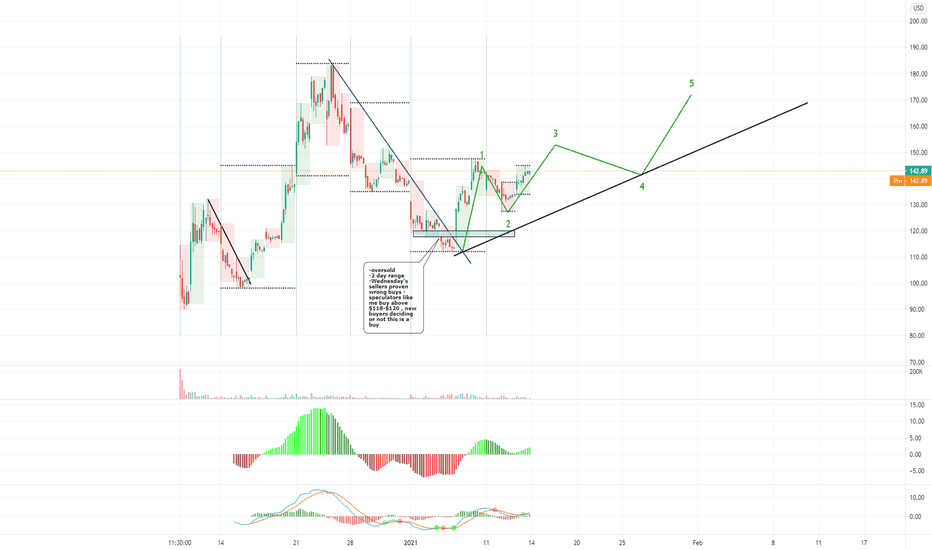

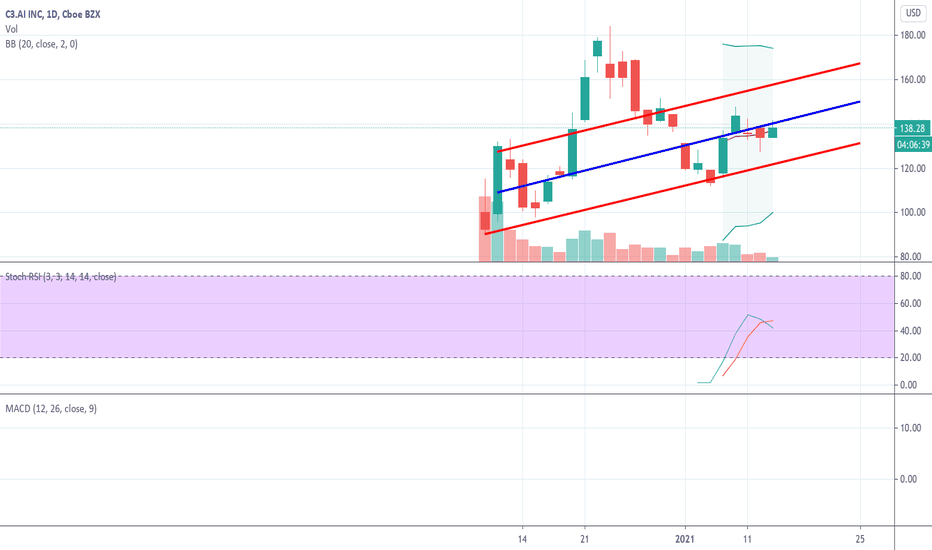

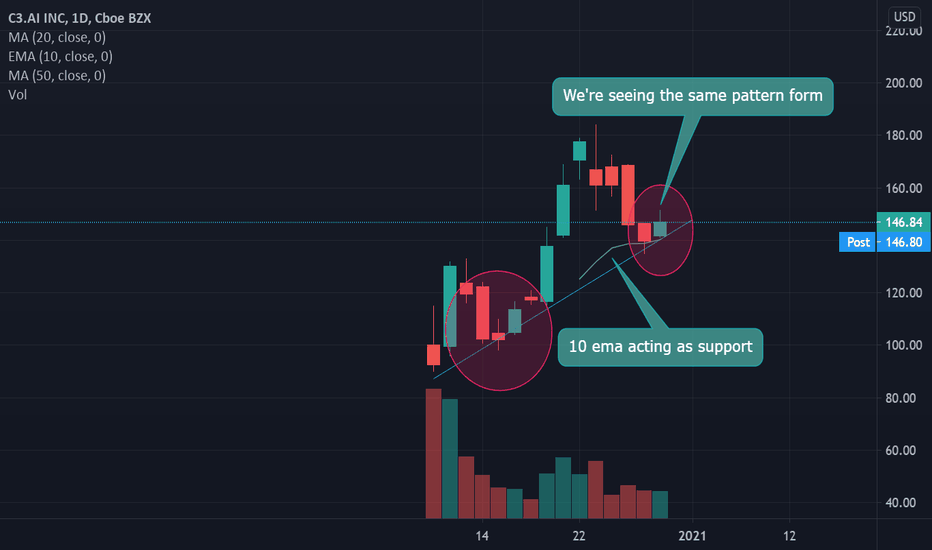

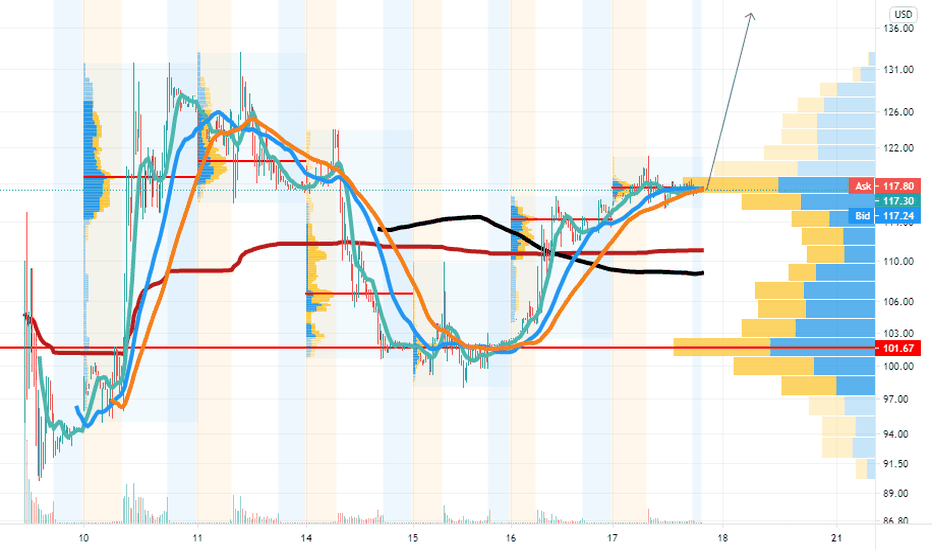

#AI Acending Triangle?- AI looks like an acending triangle with a possible abcde traingle forming although this can also be a 1,2 count.

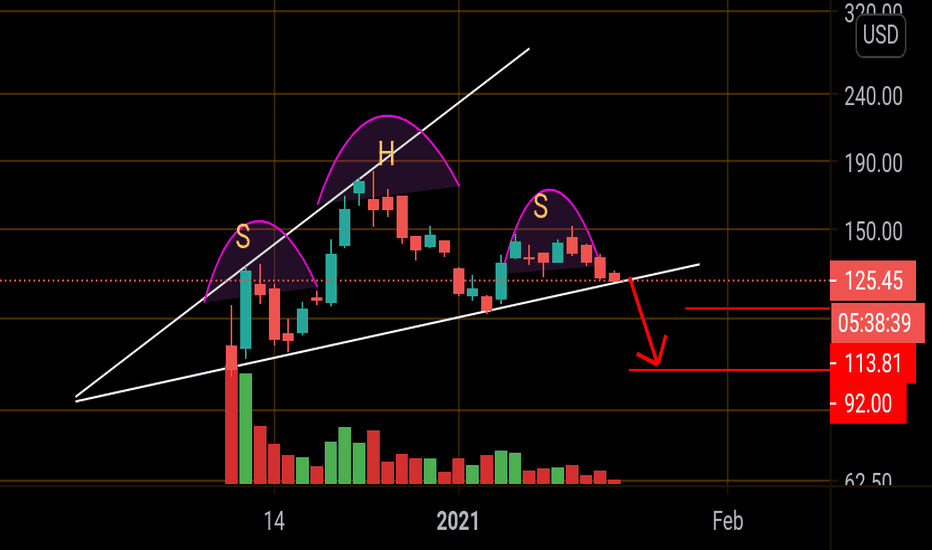

- Depending how the market open on Monday this count can go for e making it a nice head and shoulders also playing out going down to where the .786 fib is at with with a really strong trendline as well, the cloud is also there with a strong area of support.

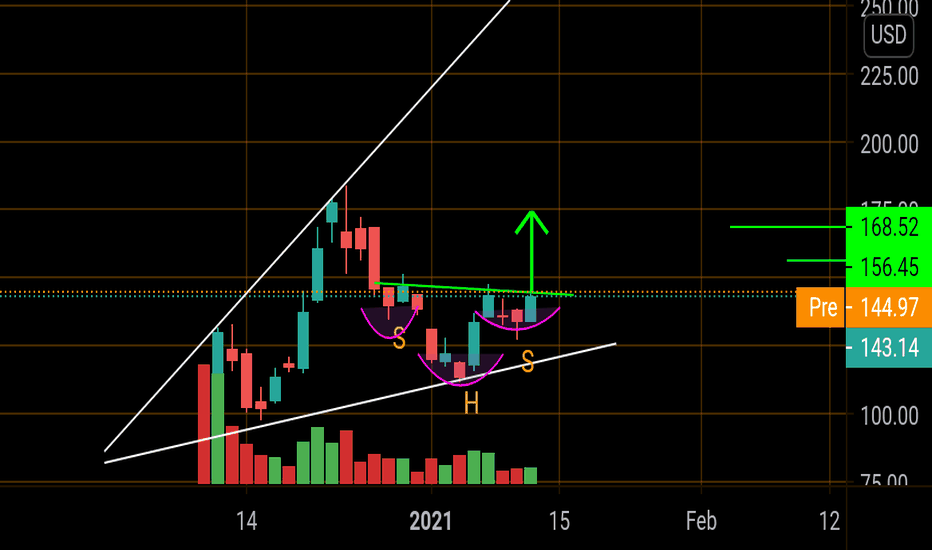

- This can also be a 1,2 going for a strong wave 3 all depends on your risk to reward ration but keep this one on watch for a move to the upside.

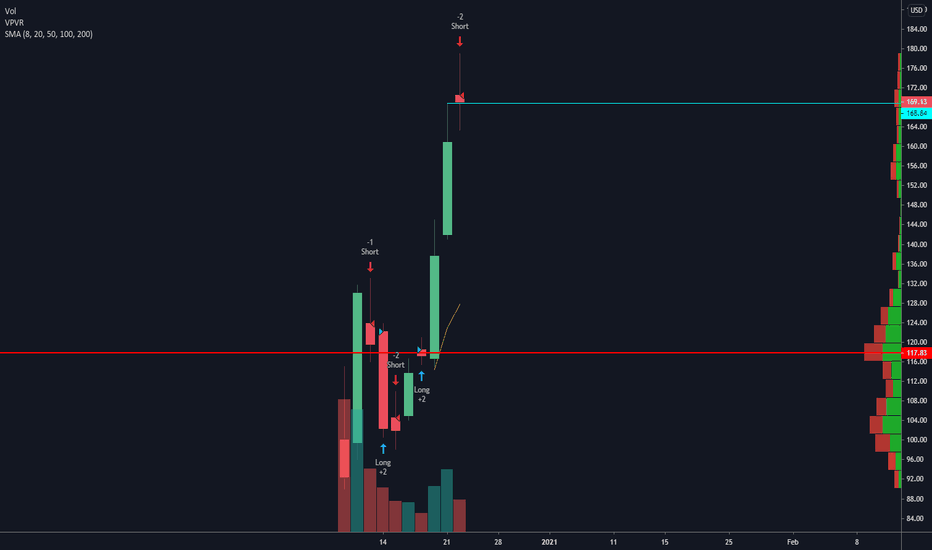

AINC trade ideas

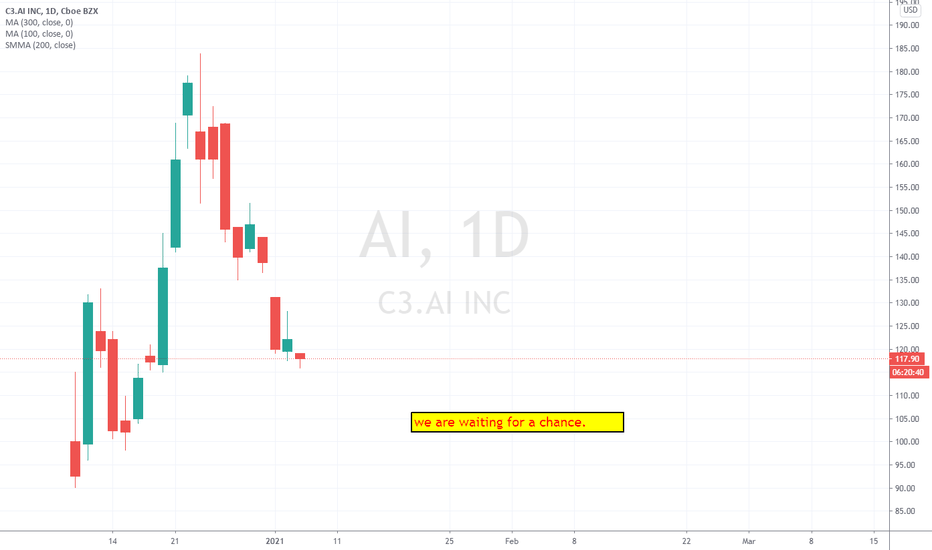

Keep it in your watchlistPotential gain:+75%

Reward/risk:>4.5

Timeframe: 4-6 wks

I always try to present the charts in a simple comprehensive format to prevent any confusion.

This is just my technical view, neither a fundamental comment,nor a recommendation to trade..!

Please review my track record and calculate the odds for yourself..!

Don't forget to like, comment, and Follow to encourage me to continue this.

I would appreciate if you share my analysis on your own social media.

You can send TradingView coins to support me publishing high quality ideas..!

Stay tuned great live stream and quality content videos coming soon..!

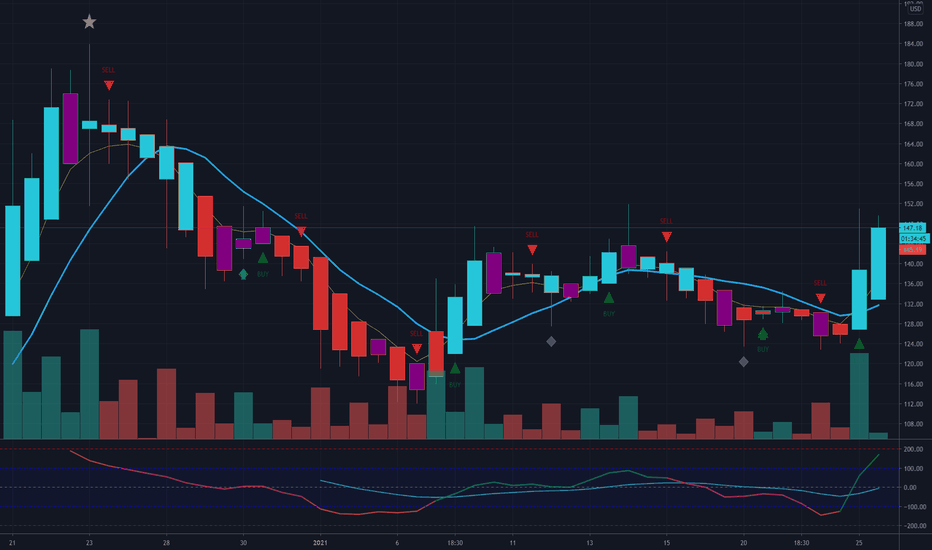

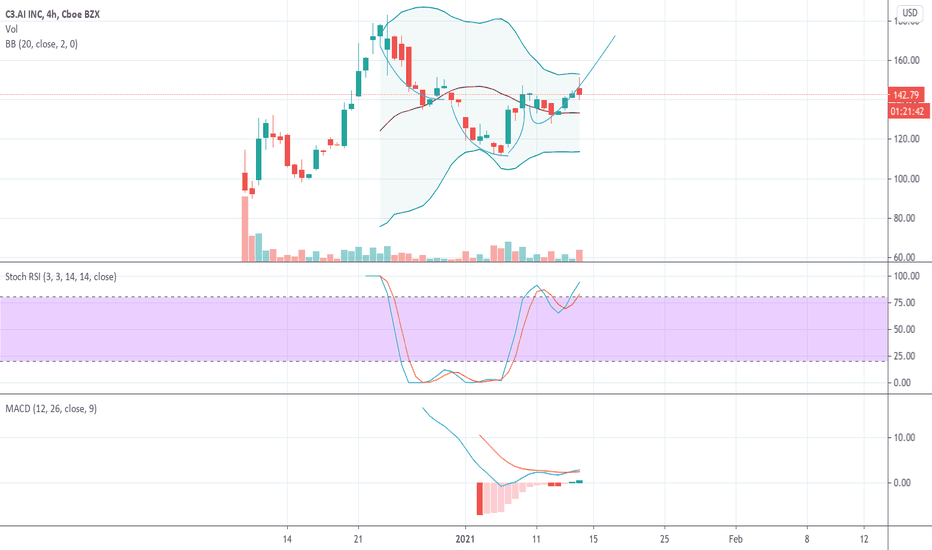

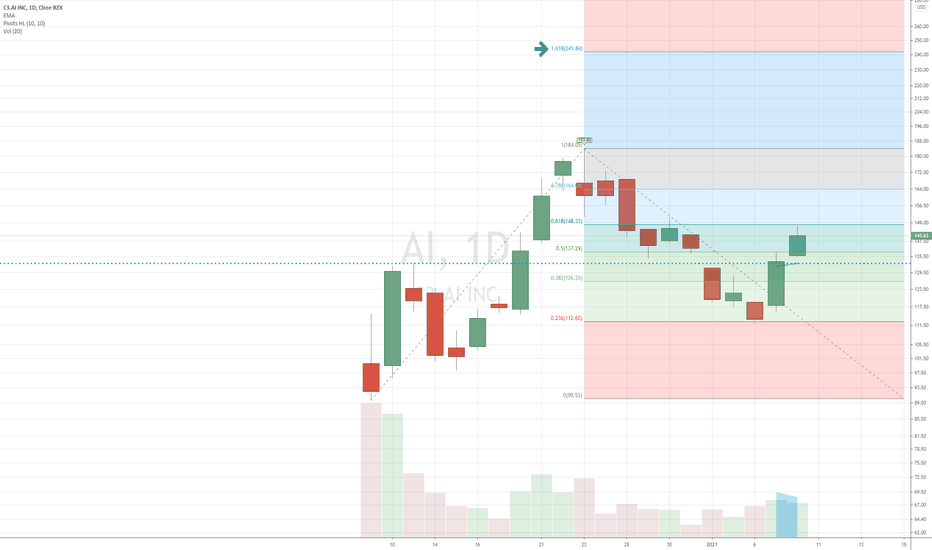

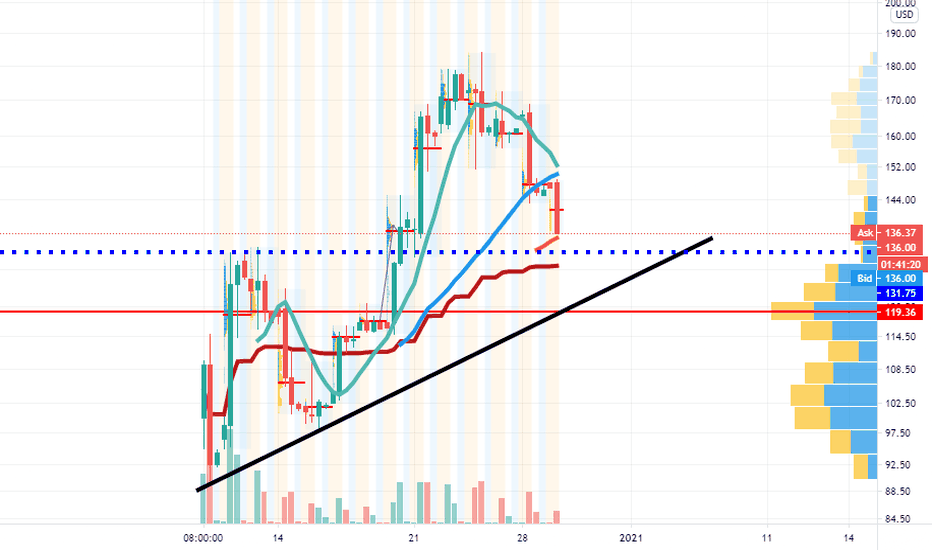

AI over 138.30C3.ai is a leading enterprise AI software provider for building enterprise-scale AI applications and accelerating digital transformation. Friday's candle on increased relative volume may be a reversal doji, bouncing off VPOC as support. Entry at 138.30, still waiting for it to confirm reversal, break out of the triangle, and break above recent closes to enter.

Another clean set up to watch Follow me for clean charts and trade ideas but we will be looking for this to make a move if we can get above this wedge no trades yet but we will watch LET THIS ONE COOK

How to trade this and my trade idea around this will be covered in tonight's free trade idea webinar hit the link to sign up us02web.zoom.us

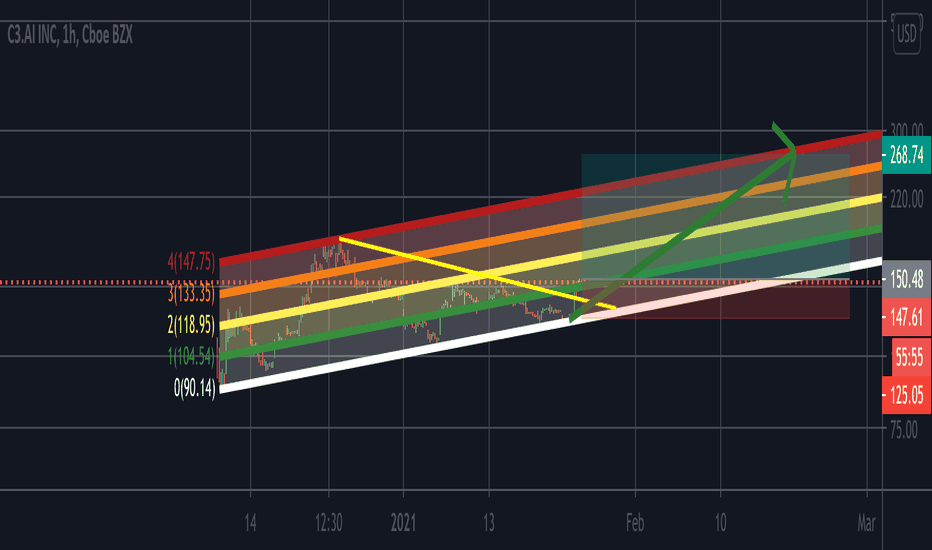

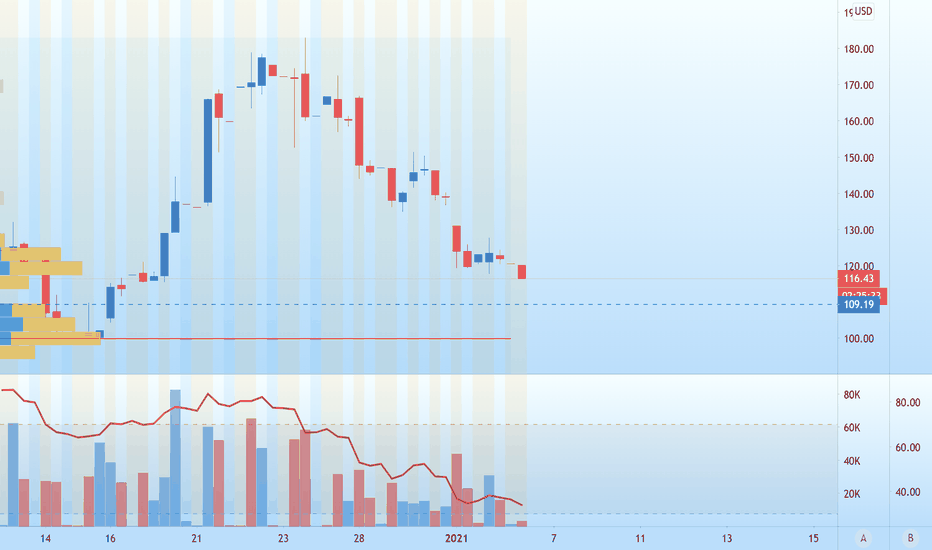

AI channel trade ideaDon't have much to work with since this IPO just listed. I caught the initial rally let's see if there's a round 2. Yellow line was the downtrend that was broken. Green line is double bottom conformation.

Fib targets are

1.139

2.148

3.156

OBV is on the verge of a bullish crossover

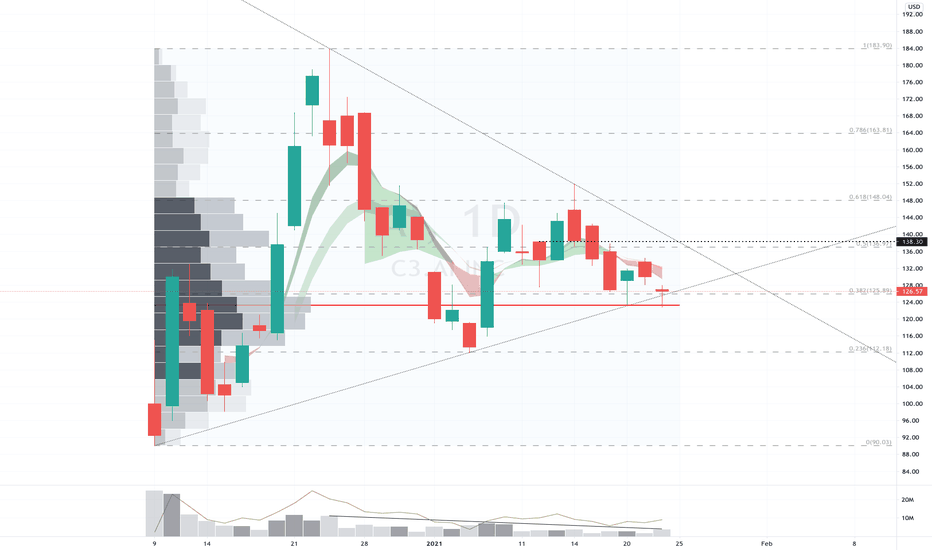

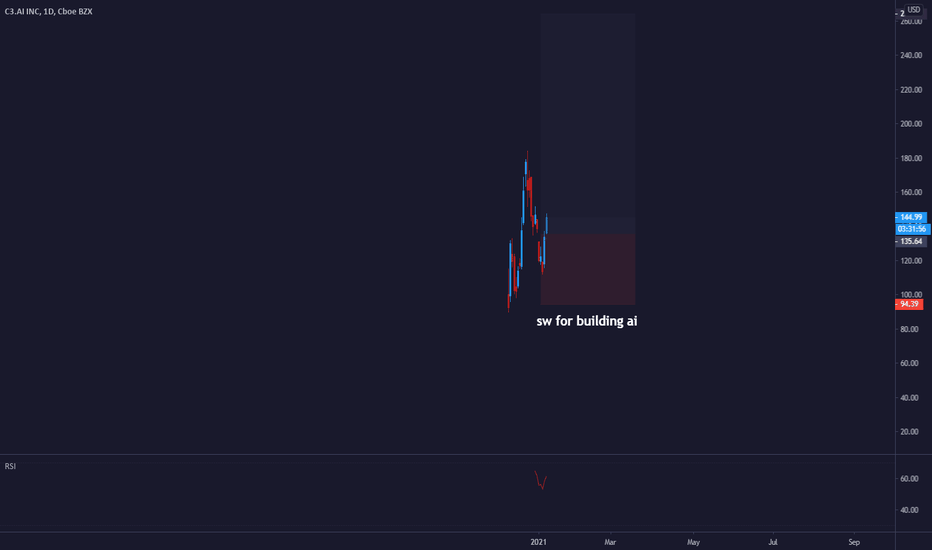

IPOsI find these very difficult to trade..lol

It is wonderful while they are going up..but when it is time to come down, there is no support and you are like..Holy Cow! Free fall!!

I look at the chart and there is nothing to catch price except possible the bottom, which does not always hold.

There is no base established. I have decided I will not touch another IPO until there is a trading base established. My new rule. Unless I want to do a momentum short term trade and sell super quick..I am out. I do not care how good it looks..lol

This has been added to my set of trading rules, or my plan.

Comments encouraged

what is your experience with trading these?