ALBE trade ideas

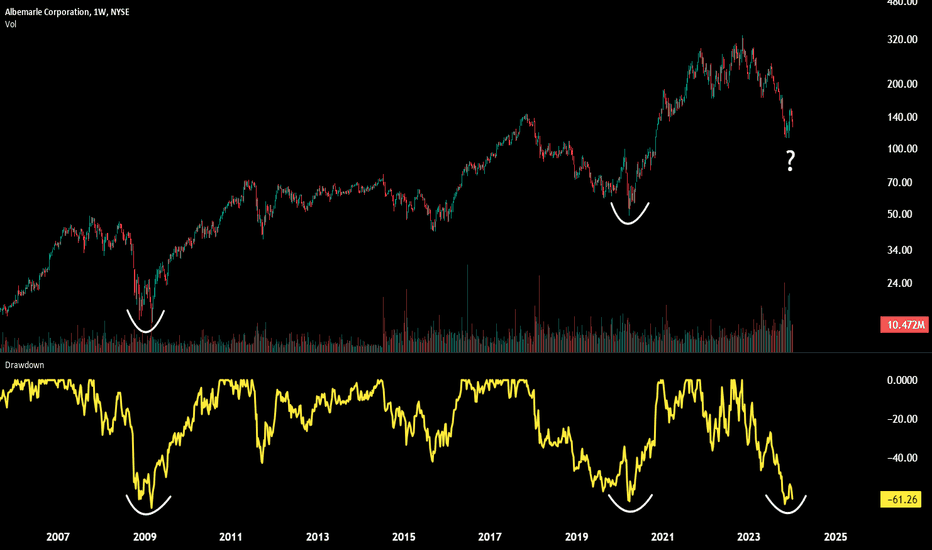

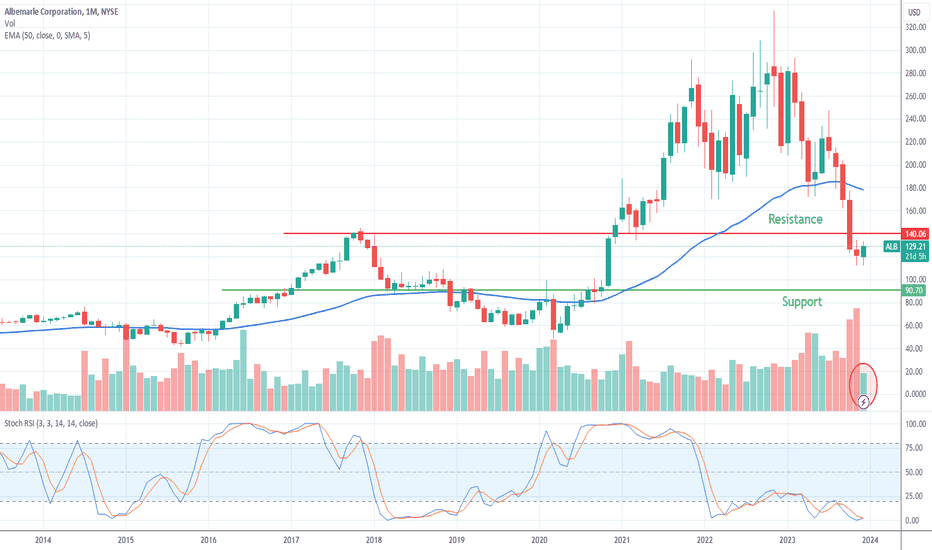

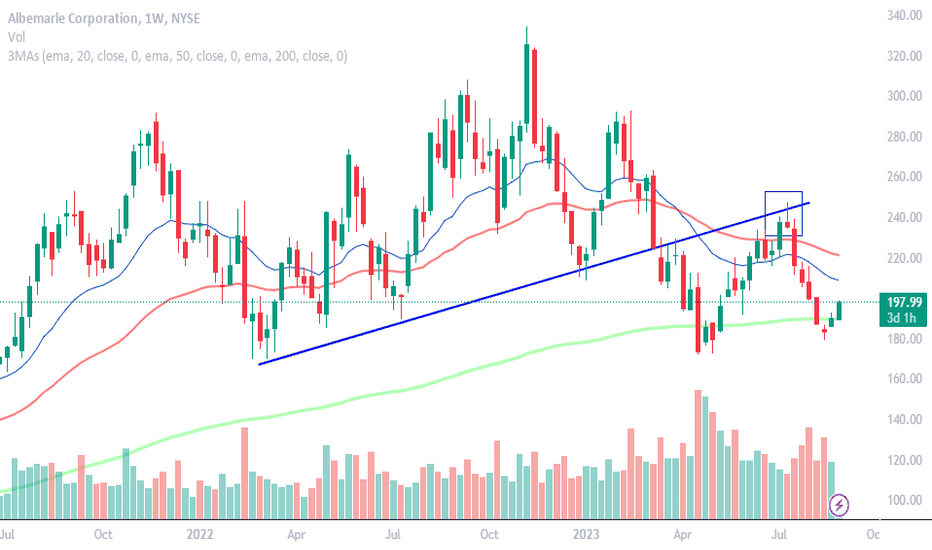

One of Albemarle's Biggest Drawdowns in HistoryAlbemarle is in the midst of one of its biggest retracements in history. It has only fallen this far from its all time high three times in the last thirty years and has had a massive recovery after each of these dips.

Still fundamentally sound, profitable, and trading at some of its lowest multiples ever, it doesn't get much better than this.

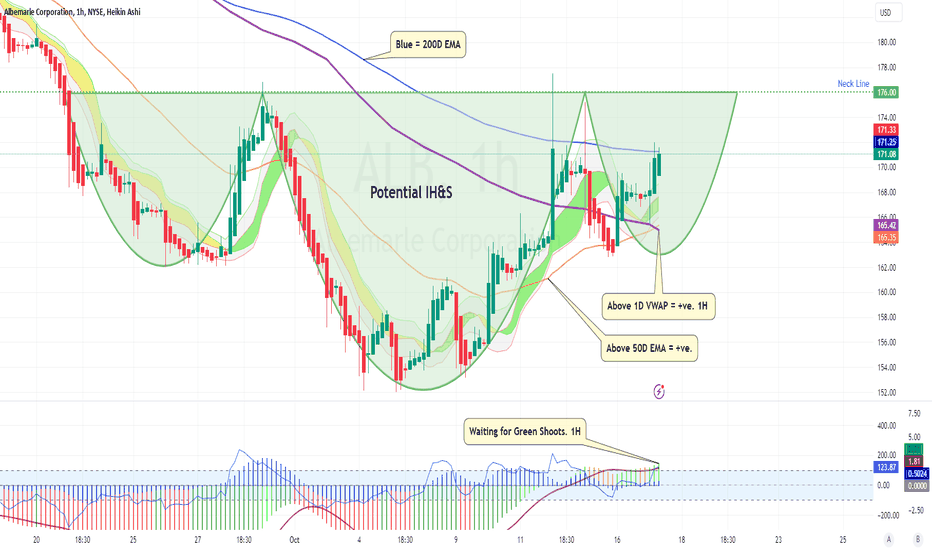

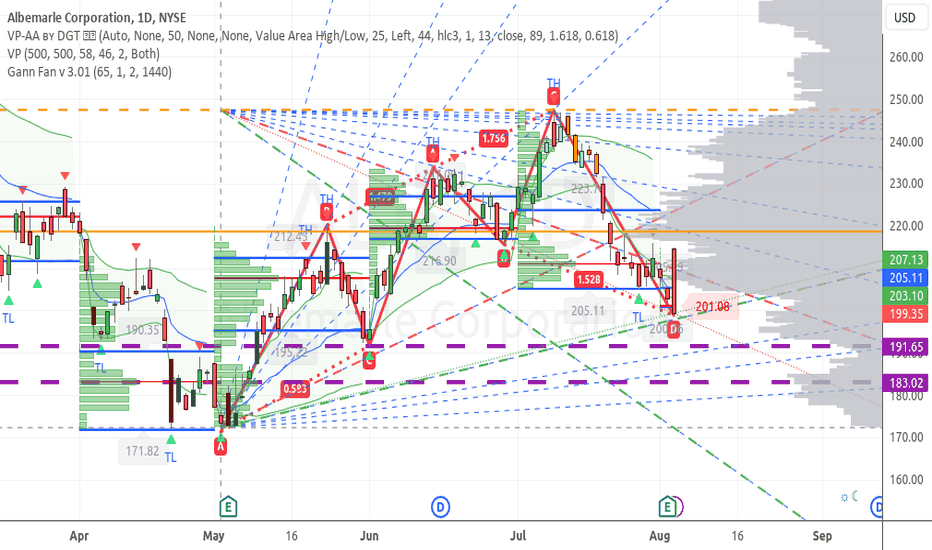

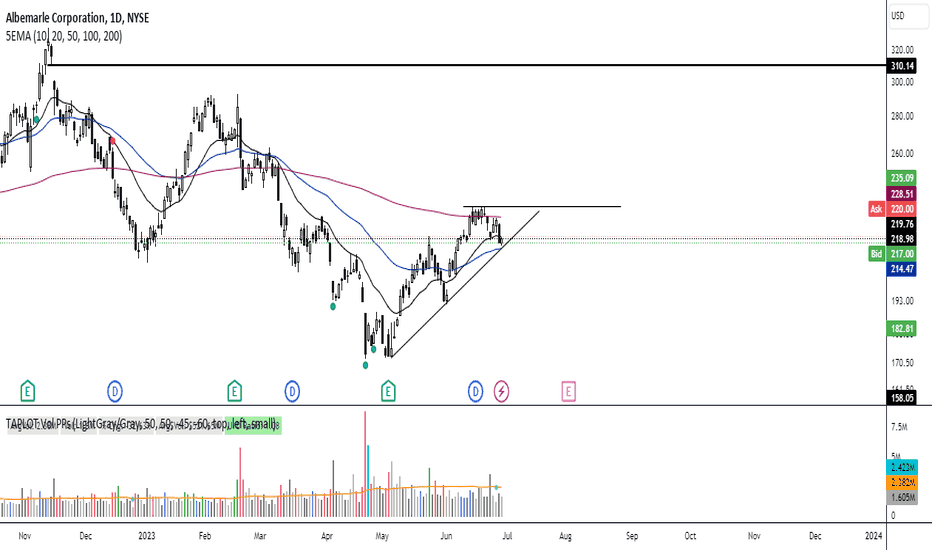

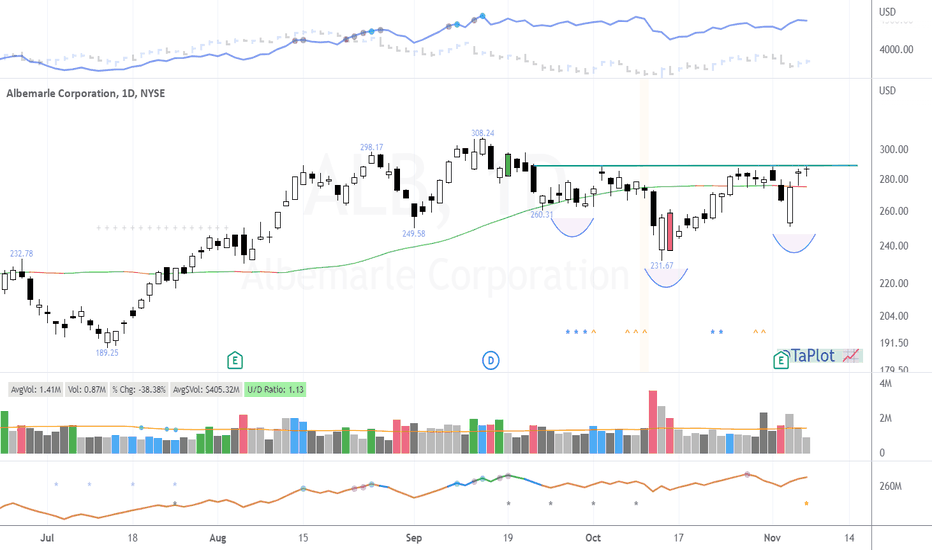

ALB.NYSE Albemarle Corp IH&SAlbemarle could be printing an Inverse Head & Shoulder pattern as seen on the Chart.

While this is early, positive trend signals that it might complete this formation.

As we know, this pattern is a Bullish signal for more possible Upside to come.

Smash the Rocket Boost Button should you appreciate my Chart Study.

Regards Graham.

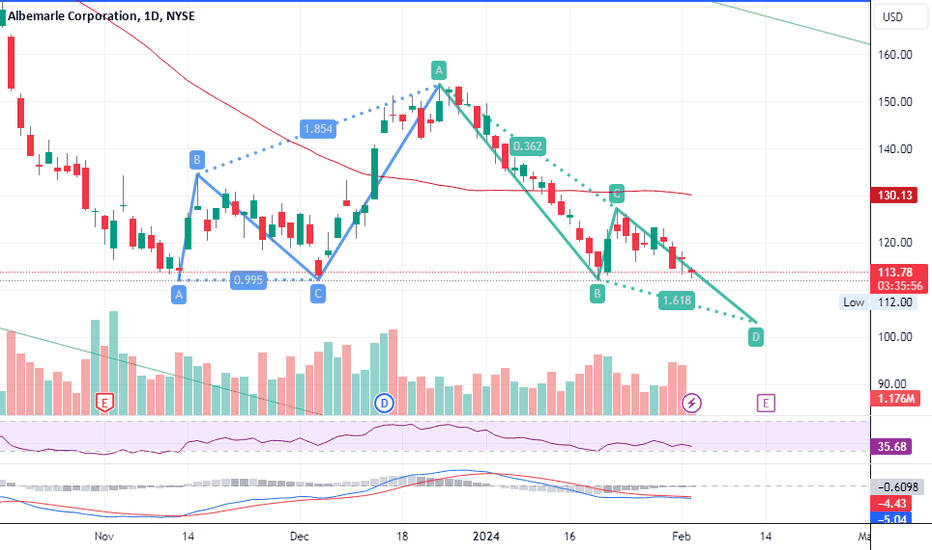

LithiumLithium stocks have experienced a massive sell-off in the past year because of a slow-down in EV adoption and an increasing supply outweighing the demand for lithium. As a result, the rout in lithium has provided investors with a good opportunity to get into some of the major lithium stocks at a discount.

Albemarle Corporation (ALB) is one of the largest players in the Lithium space and the stock price has seen a massive influx of investors in the past 4 weeks. This shows that the first bottom is at play and the stocks will push higher from their November lows.

However, due to the anticipated economic slowdown, EV sales are not looking promising and the stock is expected to report weaker Q4 earnings.

This is a stock we are looking into adding to our portfolio.

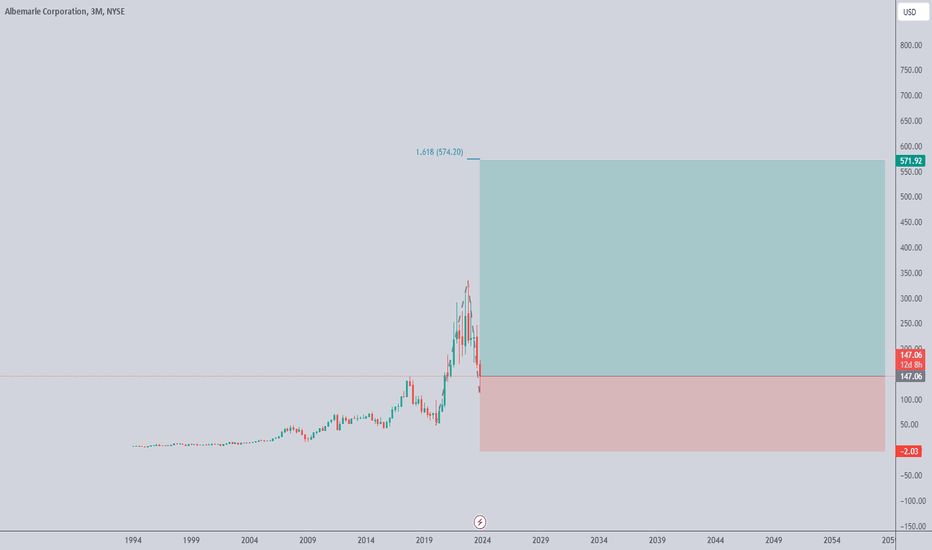

COMPRAR ALBAlbemarle is the world's largest lithium producer. Our outlook for robust lithium demand is predicated upon increased demand for electric vehicle batteries. Albemarle produces lithium from its salt brine deposits in Chile and the U.S. and its hard rock joint venture mines in Australia.

-World's largest lithium producer.

-Minimal financial stress.

-USD 10 billion in annual revenues.

-Generates 35% of net profits.

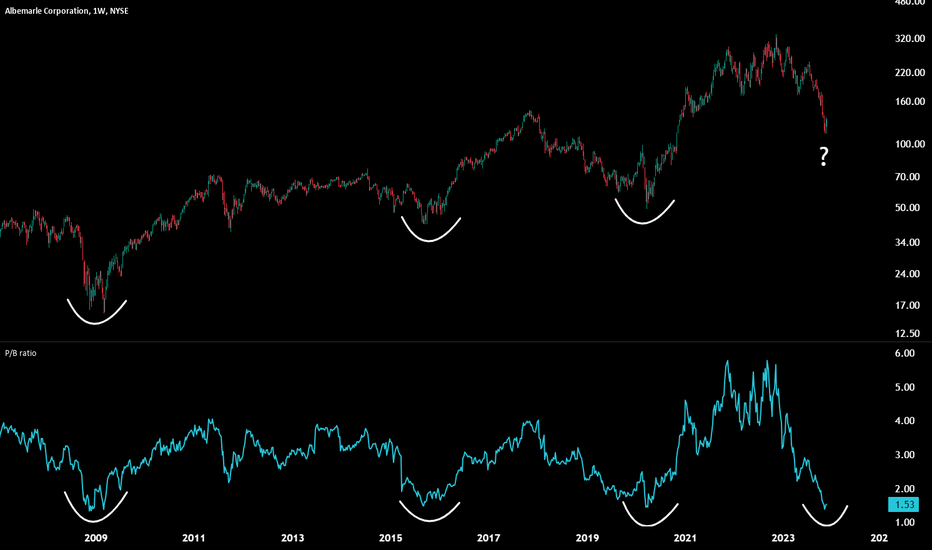

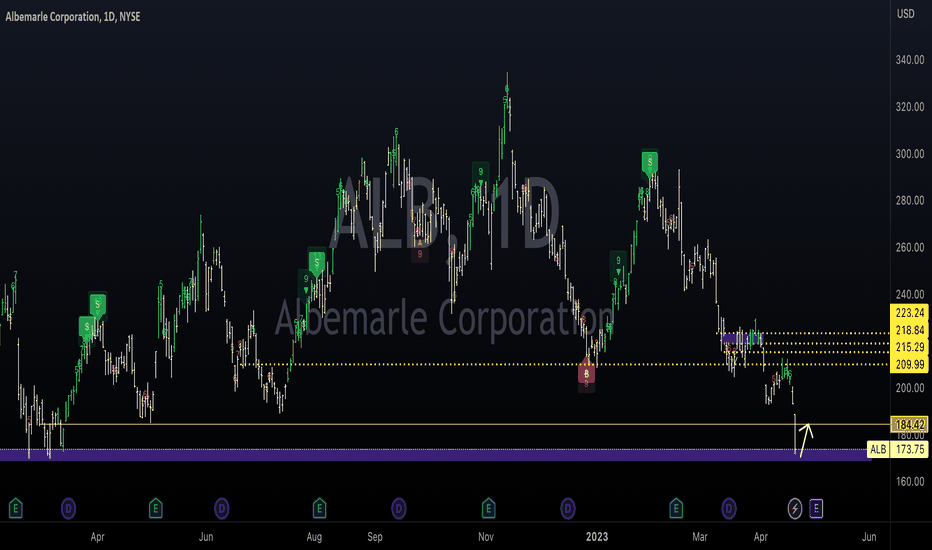

P/B Ratio of Lithium Producer, ALB, Nearing Historical LowAlbemarle has been beaten up throughout most of 2023, sliding over 60% from its historical high. After such a major decline, the Lithium monster's Price-to-book ratio is nearing a level comparable to its major lows in 2008, 2015, and 2020.

For a company that also has a trailing twelve month earnings yield that is at historical highs, such a selloff seems overblown and could be a time for the long-term investors to load up on a company with an otherwise solid outlook.

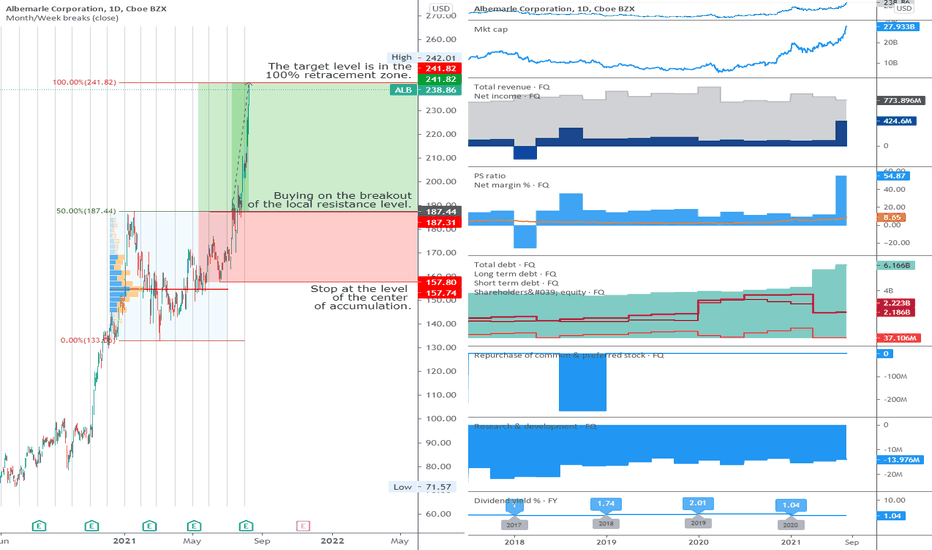

Tutorial: Range.Buy when the resistance level of the range is broken upwards. The stop is placed below the support level of the range or below the local support level within the range if the support level is near the accumulation level. The minimum target is the size of the range, postponed upward from the point of breaking through the resistance level. This corresponds to retracement levels of 0-50-100%.

Other tutorials:

Consolidation.

Model 3W.

Model "Head and Shoulders".

ALB - basic idea.

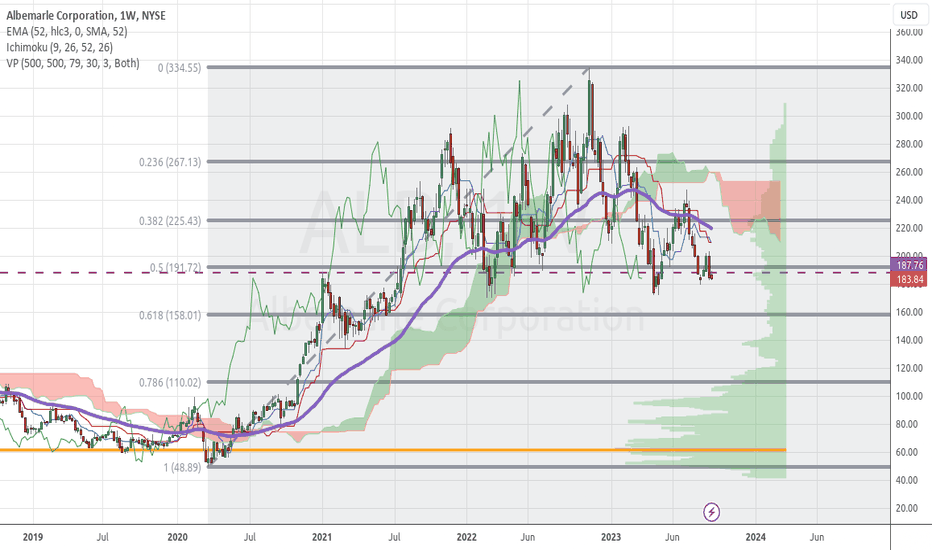

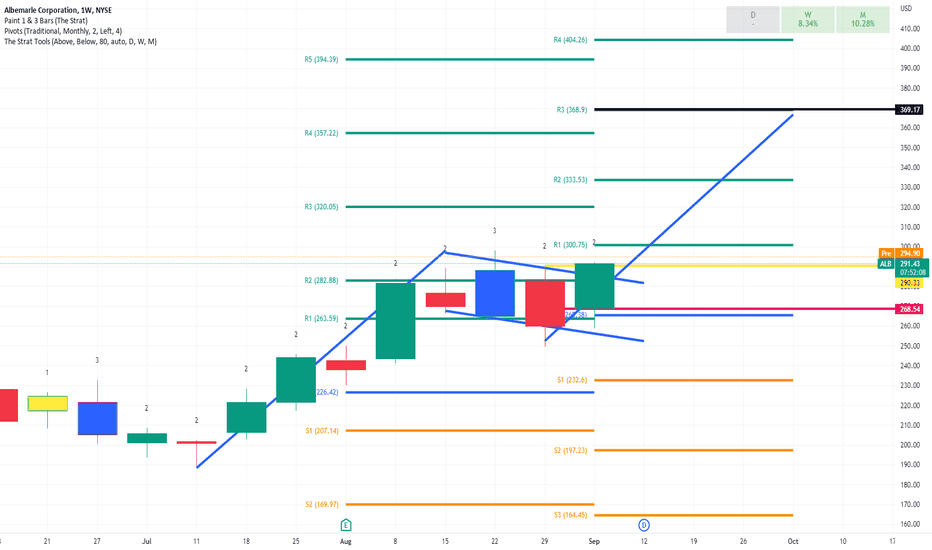

ALB WeeklyALB

“Albemarle said Tuesday it has secured a $90 million grant from the US Department of Defense to support the reopening of its lithium mine in Kings Mountain, North Carolina.” (9/12/23)

48.4% upside (finbox models)

4.5% Free cash flow yield (prefer greater than 7%)

Piotroski Score 7 (excellent)

24.1 % return on invested capital (excellent)

consistent earnings beats

PEG ratio .4 (exceptional)

49.38% ROE

Debt to Equity 36.32%

Strategy;

You have a triple bottom at a key pivot area, right on the 50% fib retrace. Gartley, Gann, Wyckoff, and everyone else would tell you this is a good entry area.

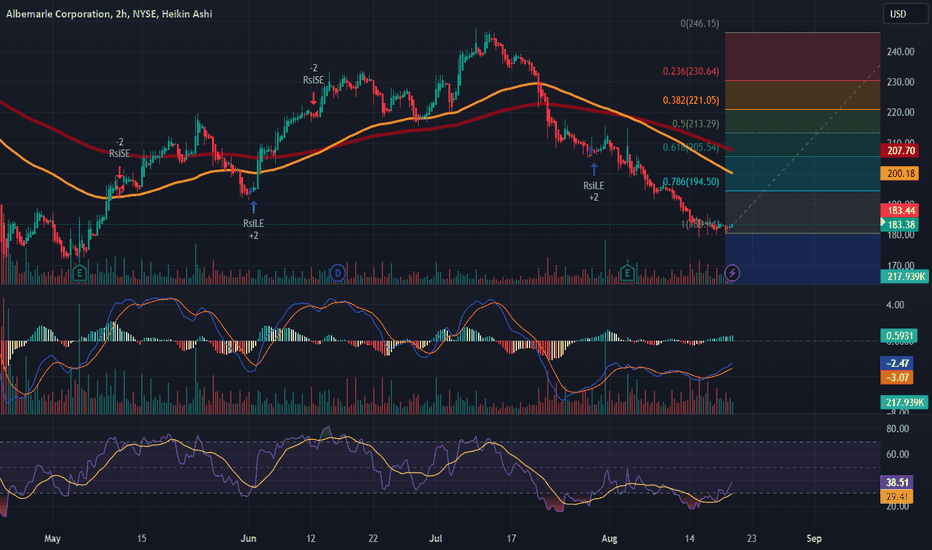

Time for a reversal on a 2 hour chartokay so observing this chart on a 1 hour or two hour time frame if price action can continue to consolidate with the market its due for a reversal and it looks like its to the upside. Im looking for a price target of 220 and a stop loss of 10%. longterm this stock is a good hold profitable makes money and will be necessary for its lithium segment (ev).

this happened before and the price went back up rather quickly so depending on the news coming out the feds keep a close eye on this one for sure

Yields high return on invested capital

Strong earnings should allow management to continue dividend payments

Analysts anticipate sales growth in the current year

RSI suggests the stock is in oversold territory

Low earnings quality, with free cash flow trailing net income

Stock price movements are quite volatile

Cash flows can sufficiently cover interest payment

ALB Daily Lithium...

I almost was tempted to buy this on the selloff today, beat on earnings but short on revenue. Glad I held off.

Huge bearish engulfing, and already extended over 150% off the high. WSJ announced after market today that ALB will be paying 218.5 million in a foreign bribery scheme.

I don't see much support below (between the two purple horizontal lines) if it fails to bounce off the prior pivot....

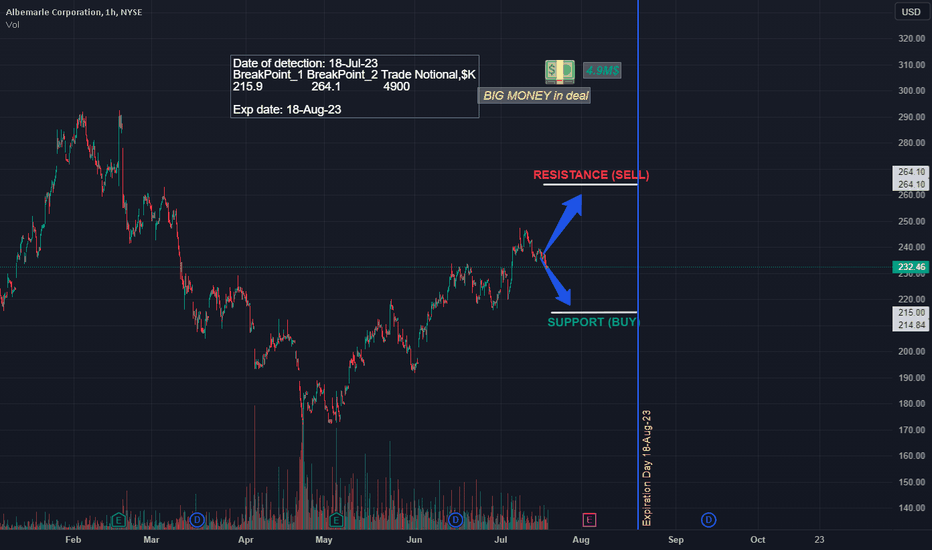

#ALB big money in deal, keep an eye on resistance/support levelsBased on our team's research of the options market, we expect buy activity at the support level or sell activity at the resistance.

We primarily consider levels to be activity zones, but not to be a super-fine level for establishing a limit order. Please, use them in combination with our own strategy, not in alone.

We do the best research as we can to find new opportunities in the massive amount of information every day to help you make data-driven trading decision.

Please feel free to leave any comments you have and like this idea if you agree with us. Any feedback or comments will be read. We appreciate it all!

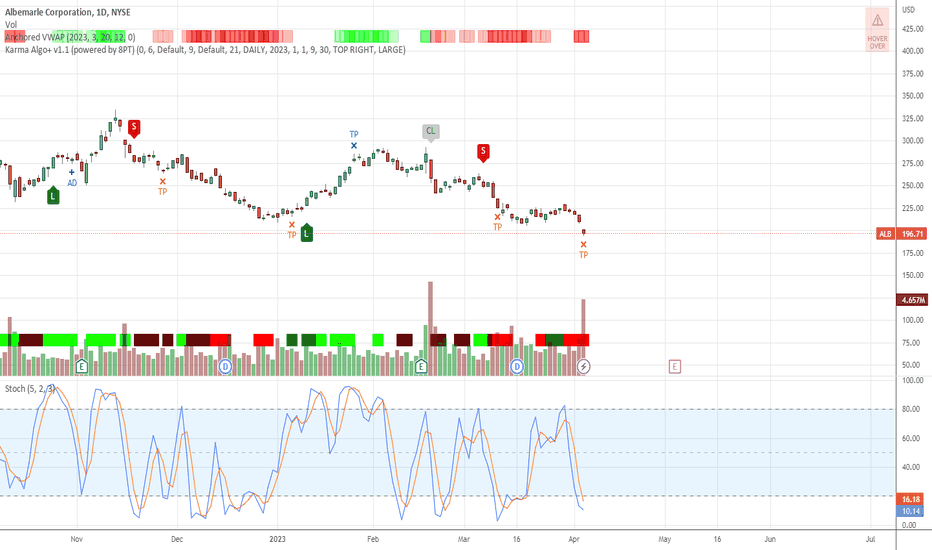

Albermarle Corp (ALB) - Accelerated EPS and SalesAlbemarle Corp (ALB) is currently trading at $218.97. 388% Earnings Qtr to Qtr (YoY) Growth

128% Revenue Qtr to Qtr (YoY) Growth.

ROIC 28% Qtr to Qtr (YoY)

Currently trading above the 20EMA, making a pullback currently. I will buy this stock when theres a pocket pivot or daily missed pivot or breakout of most recent high structure.

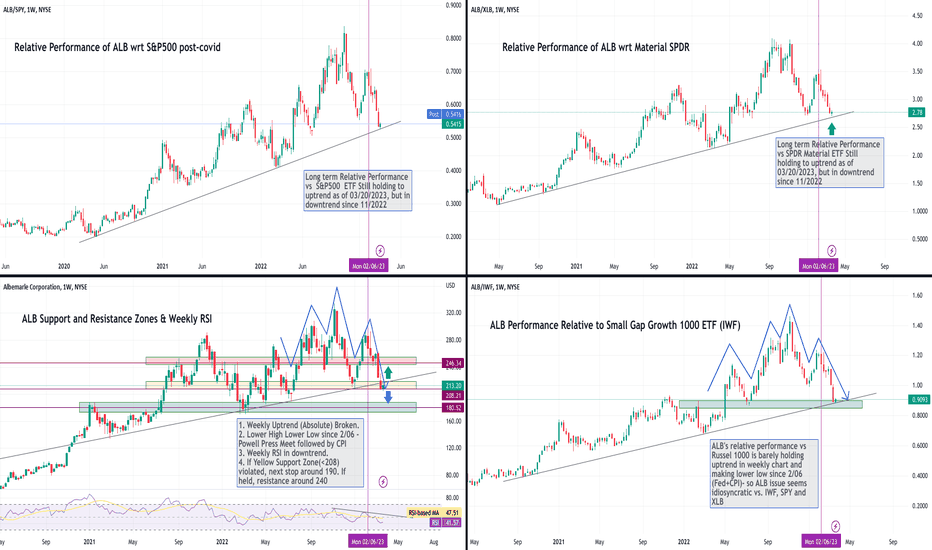

ALB Relative Performance at the Juncture of Breaking down/out$ALB cheap @ 9x FPE but technical is poor relative to #SPY, #IWF #XLB. This week is critical could break relative uptrend to all 3 ETFs. Though daily RSI could bounce weekly still in downtrend, bounce will be retested. Next Support @ 186. MS' PT 155 siting oversupply of Lithium.

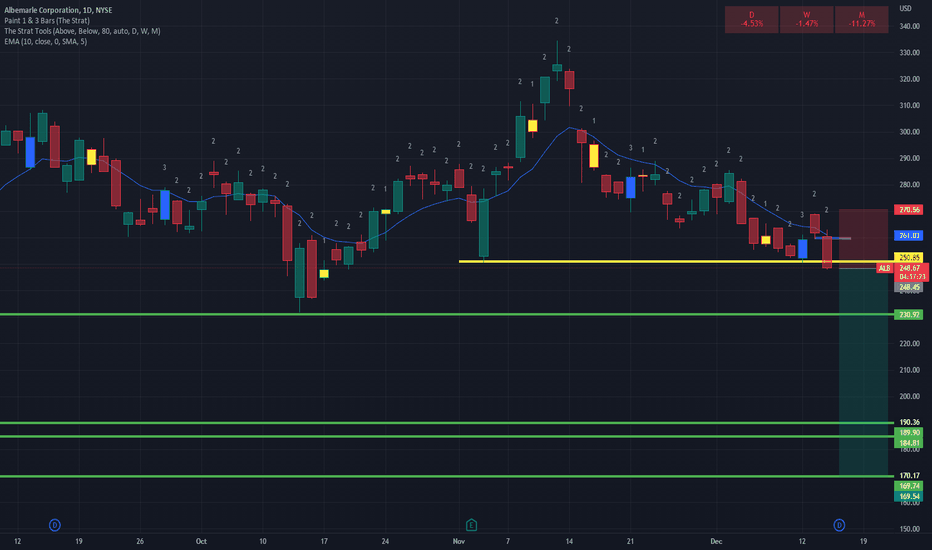

#ALB to 170$?Hello dear Traders,

Here is my idea for #ALB

Price closed below yellow line (previous month low)

Price closed in 15 Minute chart below purple trigger line -> Enter Trade.

Targets marked in the chart (green lines)

Invalidation level marked with red line

Good luck!

❤️Please feel free to ask any question in comments. I will try to answer all! Thank you.

Please, support my work with like, thank you!❤️

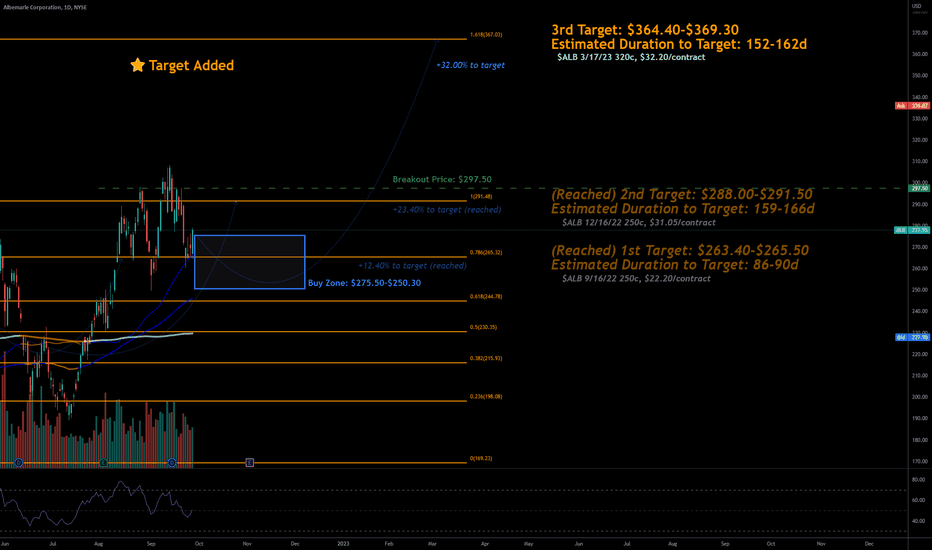

9/28/22 ALBAlbemarle Corporation ( NYSE:ALB )

Sector: Process Industries (Chemicals: Specialty)

Market Capitalization: $31.587B

Current Price: $277.95

Breakout price: $297.50

Buy Zone (Top/Bottom Range): $275.50-$250.30

Price Target: $364.40-$369.30 (3rd)

Estimated Duration to Target: 152-162d (3rd)

Contract of Interest: $ALB 3/17/23 320c

Trade price as of publish date: $32.20/contract

$ALB long ideaHello dear Traders,

Here is my idea for #ALB

Daily close above the yellow trigger line (previous month high) to enter trade.

We try to anticipate a 3-2-2 bullish reversal in the weekly chart - price found support at monthly pivot Line

Momentum: Weekly UP, Monthly UP

LIT ETF with IV30% Rank = 9%

Targets marked in the chart (black lines)

Invalidation level marked with red line

Please feel free to ask any question in comments. I will try to answer all! Thank you