$AMC Blockbuster Short Squeeze BrewingDue to a constant stream of flops, movie theaters have experienced a significant hit. With this in mind, it comes as no surprise that AMC Entertainment Holdings, Inc. (NYSE: AMC) fell more than 50% since March. However, there could be a glimmer of hope with the much anticipated releases of Oppenheimer and Barbie approaching this month. With AMC stock highly shorted at the moment, the possibility of a short squeeze occurring this month is relatively high if both movies are blockbusters as expected.

AMC Fundamentals

As things stand, AMC is the world’s largest theater brand and as such it has the potential to generate a significant quantity of revenue from a single blockbuster. For example, AMC made more than %70 of the box office gross from Avatar: The Way Of Water, and since it made $2.32 billion AMC made more than $1.62 billion. Keeping that in mind, two highly anticipated potential blockbusters are on the horizon.

Pink Nuke

On July 21st both Oppenheimer and Barbie are coming out in theaters which is significant since these movies mark a shift away from repetitive storytelling in Hollywood. Over the course of the past few years, Hollywood has developed superhero fatigue, and repetitive storytelling and unnecessary sequels have been flooding the market. Thankfully, these issues do not apply to Barbie and Oppenheimer.

These two movies are vastly different, however, it is that difference that makes each story appealing. When it comes to Barbie, Its existential narrative is drastically different from Hollywood’s classical narrative and its hyperbolic comedic tone in regards to gender commentary also sets it apart.

On the other hand, Oppenheimer’s story is in many ways an inversion of Hollywood’s classical narrative where the main protagonist is viewed as an infallible character or morally justified. In short, both of these movies are unique stories and modern day cinemagoers are in search of genuinely unique stories that are not carbon copies of a cliche narrative. It is for this reason that these movies could shake the box office.

Additionally, Oppenheimer is directed by none other than Christopher Nolan, who is considered one of the best directors today. His involvement in Oppenheimer is a source of comfort for many moviegoers which is part of the reason why the movie is currently highly anticipated.

Both of these movies are about to be released while AMC stock is experiencing mounting short selling pressure. If these movies become box office giants, AMC’s revenues are likely to receive a much needed boost which would result in the stock running.

Short Data

In the meantime, AMC stock has a high short interest of 22.5% and 34.7% of its float on loan. At the same time, cost to borrow is extremely high at 206% and utilization is at 91%. In light of the stock’s short data, a major short squeeze could occur in AMC stock if Oppenheimer and Barbie prove to be the major hits they are expected to be.

Risks

Despite AMC’s short squeeze potential, the stock remains very risky due to the company’s financial situation. Currently, AMC is in dire need to raise capital and is incapable of doing so due to a lawsuit against the company’s planned 1 for 10 reverse split. Through this reverse split, AMC will have room to offer its shares to the public as the company’s outstanding shares are nearly maxed out. Based on this, the risk of bankruptcy could be extremely viable if AMC is unable to raise the cash it needs.

Another risk that could be facing AMC is Oppenheimer and Barbie not performing well at the box office due to the decline in moviegoers since the pandemic. If that is the case, AMC’s prospects could be bleak since both movies are arguably the most anticipated movie releases this year.

AMC Financials

According to its Q1 2023 report, AMC’s assets decreased QoQ from $9.1 billion to $8.8 billion and its cash balance also fell from $631.5 million to $495.6 million. On the other hand, total liabilities slightly decreased from $11.76 billion to $11.43 billion, however, current liabilities increased from $1.6 billion to $1.7 billion. Having said that, the most alarming thing in AMC’s balance sheet is the disparity that exists between its cash balance and its current liabilities. If not remedied, this issue could lead to bankruptcy.

AMC’s revenues have done surprisingly well in Q1 as they increased YoY from $785.7 million to $954.4 million. Meanwhile, operating expenses also increased YoY from $952 million to $1 billion. Despite the increase in expenses, AMC’s net loss decreased due to increased revenue resulting in a YoY decrease from $337.4 million to $235.5 million.

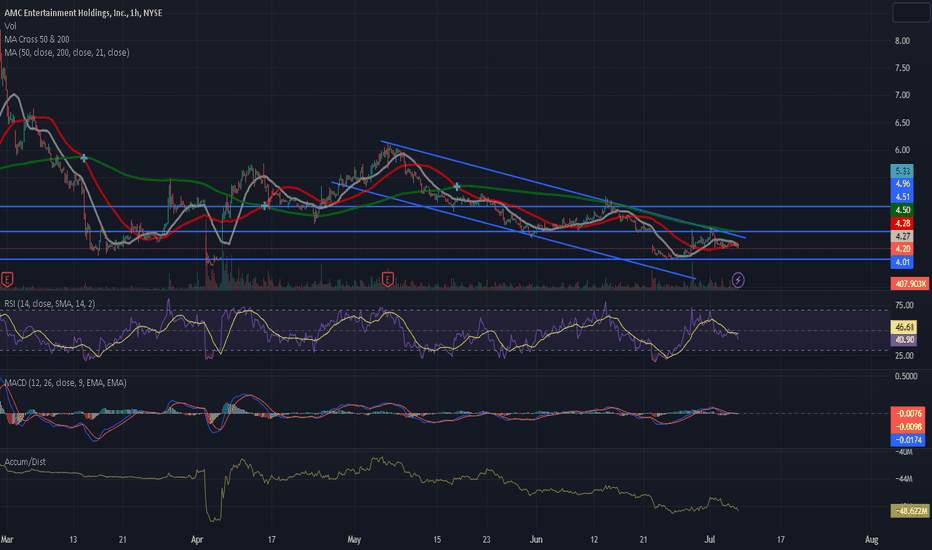

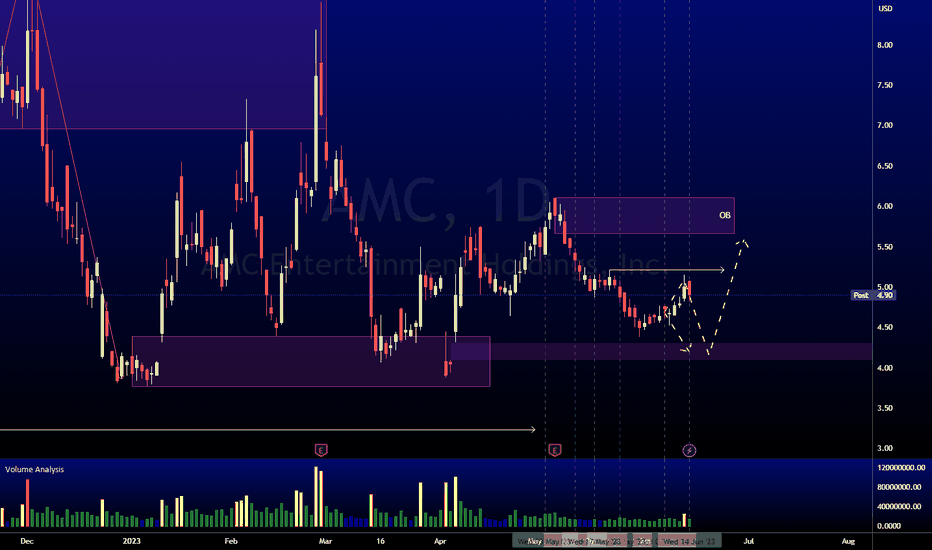

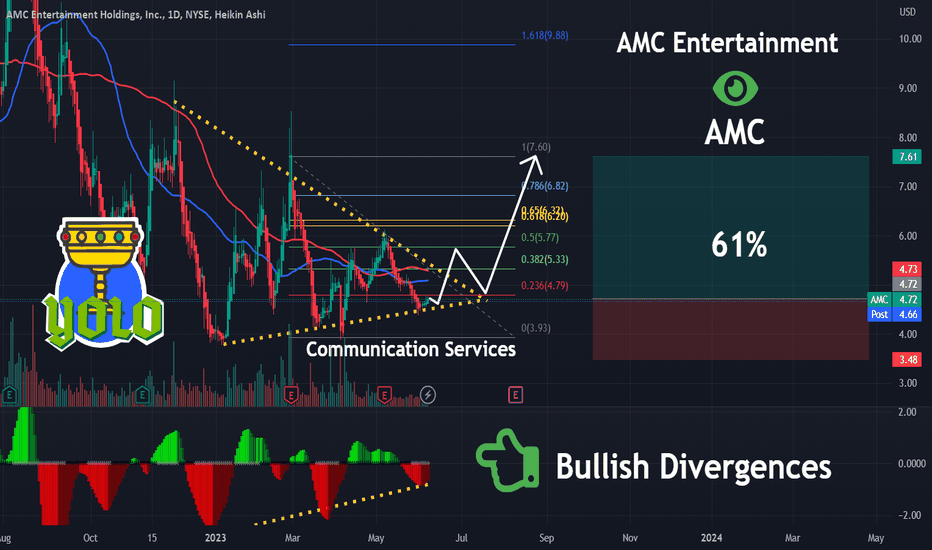

Technical Analysis

AMC stock is in a bearish trend with the stock trading in a downward channel. Looking at the indicators, AMC is trading below the 200, 50, and 21 MAs which are bearish signals. Meanwhile, the RSI is neutral at 40 and the MACD is neutral as well.

As for the fundamentals, AMC stock could witness a short squeeze this month due to the much anticipated release of Oppenheimer and Barbie. If both movies perform well at the box office, AMC would be able to realize more revenues in Q3 which would be a sigh of relief for the struggling movie theater. Moreover, developments regarding the lawsuit against AMC’s planned reverse split will be future catalysts as the company could file for bankruptcy if it is unable to raise the cash it needs to continue operating.

AMC Forecast

A short squeeze might be on the horizon for AMC stock with Oppenheimer and Barbie set to be released on June 21. Given that both movies are highly anticipated, a short squeeze may occur if they perform as well as expected at the box office. However, AMC stock remains very risky as the company has to raise capital to maintain its operations which cannot be done at the moment due to the lawsuit against its planned reverse split.

AMC2 trade ideas

AMC Entertainment (AMC:NYSE) Gets Sell RatingAMC Entertainment (AMC:NYSE) has recently garnered attention from analysts due to its volatile stock performance and ongoing market dynamics. In this post, we explore the sell rating assigned to AMC by analysts, highlighting the key concerns driving their assessments.

Analysts' Sell Rating on AMC Entertainment

Volatility and Overvaluation:

Analysts have expressed concerns about the extreme volatility and potential overvaluation of AMC's stock. The company experienced a significant surge during the meme stock craze, driven by retail investor enthusiasm, which resulted in an inflated stock price. Analysts believe that the current valuation may not align with the company's underlying fundamentals and future growth prospects, leading them to assign a sell rating.

Financial Health and Debt Burden:

AMC's financial health and high debt burden are also significant factors contributing to the sell rating. Despite efforts to navigate the challenging landscape brought on by the COVID-19 pandemic, the company continues to face substantial cash burn and carries a significant amount of debt. Analysts express concerns about AMC's ability to manage its financial obligations and maintain stability in the long term.

Uncertain Recovery in the Entertainment Industry:

The entertainment industry has been significantly impacted by the pandemic, with ongoing uncertainty surrounding the pace of recovery. Analysts highlight the potential challenges AMC may face in attracting audiences back to theatres and generating sustainable revenue growth in a post-pandemic environment. These uncertainties further contribute to the sell rating assessment.

Analyst Recommendations and Investor Considerations

Risk Factors:

Investors should carefully consider the risks associated with holding AMC stock, given the concerns raised by analysts. These risks include potential stock price volatility, the company's financial health, debt obligations, and the uncertain recovery of the entertainment industry.

Diversification and Research:

Maintaining a diversified investment portfolio and conducting thorough research are essential for investors. It is crucial to consider various factors, including analyst ratings, financial indicators, and industry trends, when making investment decisions.

Conclusion:

Analysts have assigned a sell rating to AMC Entertainment due to concerns over stock valuation, the company's financial health, and the uncertain recovery of the entertainment industry. Investors should carefully assess these factors and conduct comprehensive research before making investment decisions related to AMC stock.

This content is provided for general information purposes only and is not to be taken as investment advice nor as a recommendation for any security, investment strategy or investment account.

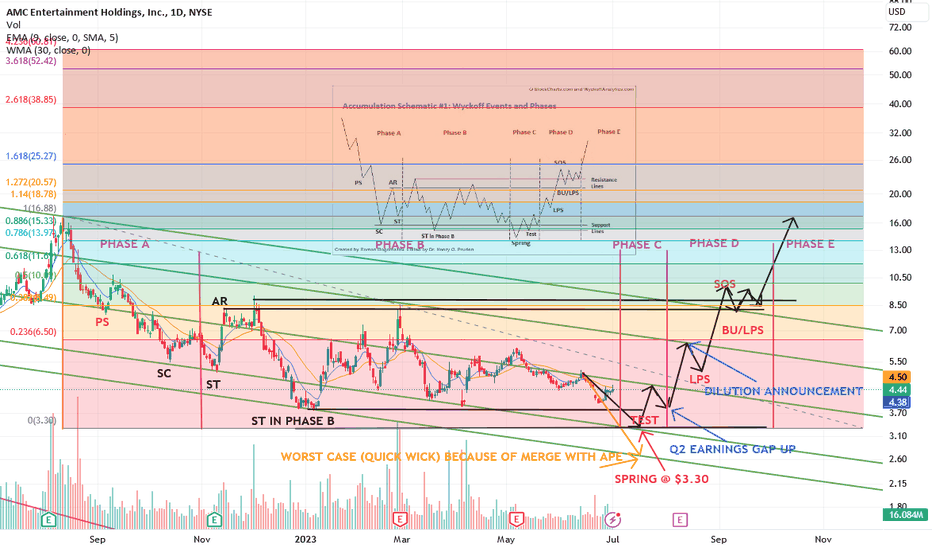

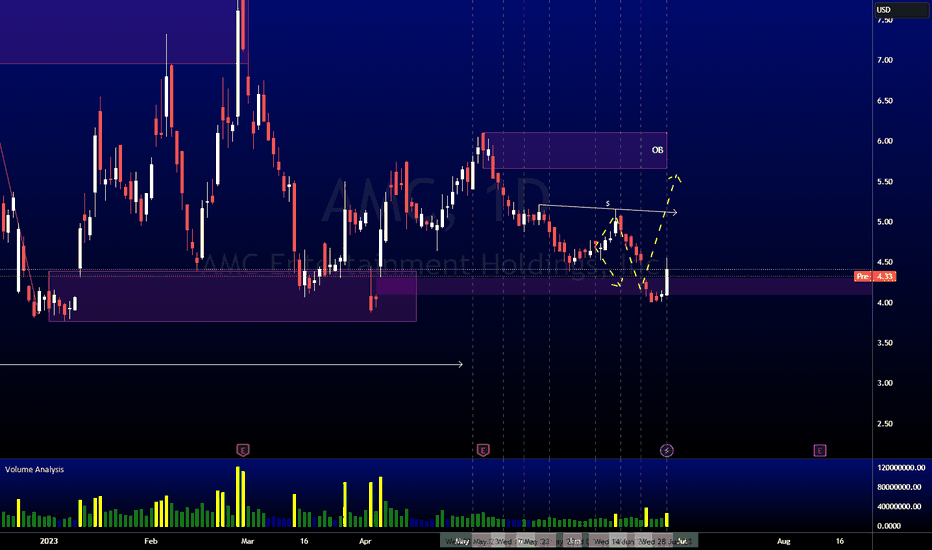

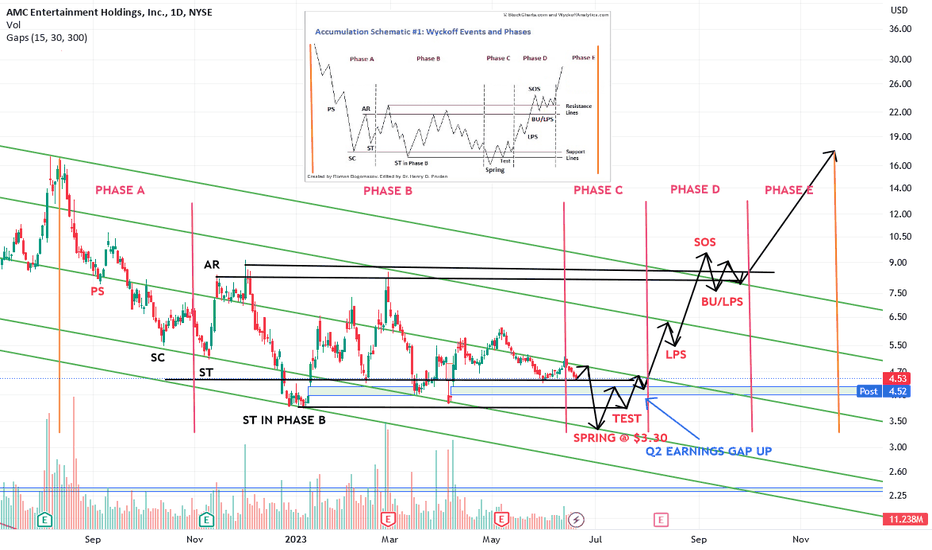

Updated thoughts on AMC Wyckoff accumulation schematicWaiting for the judge's approval on the conversion to reach our spring low. Thinking mid July but no one but the judge knows this.

CTB fees and FTD's at crazy levels on AMC common currently, which in my opinion could cause the Phase C and D to happen extremely quickly by mid August assuming conversion in mid-July.

APE waiting for the trigger up as well.

AMC | InformativeNYSE:AMC

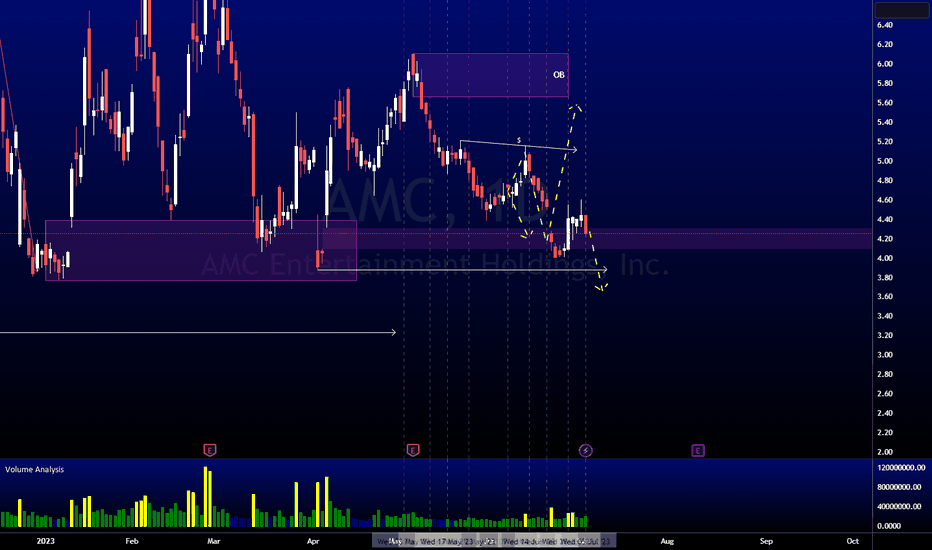

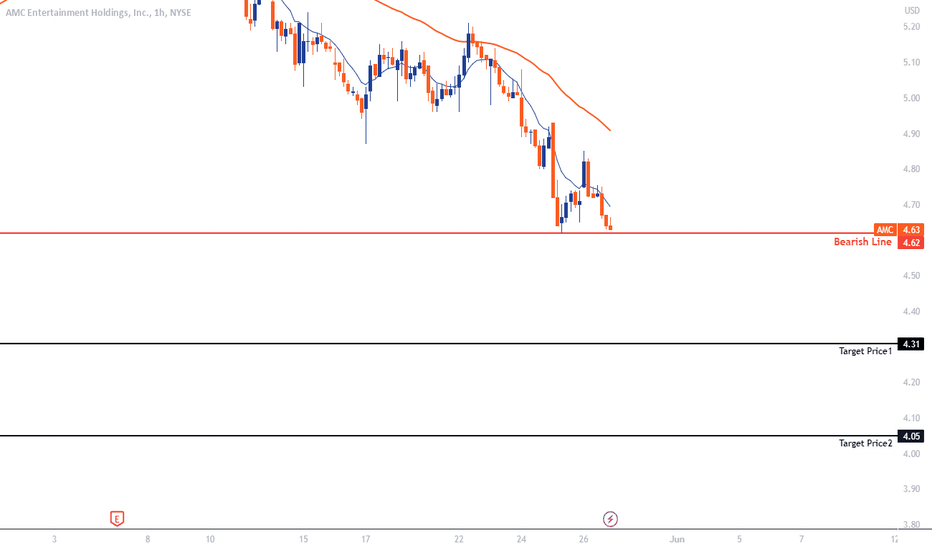

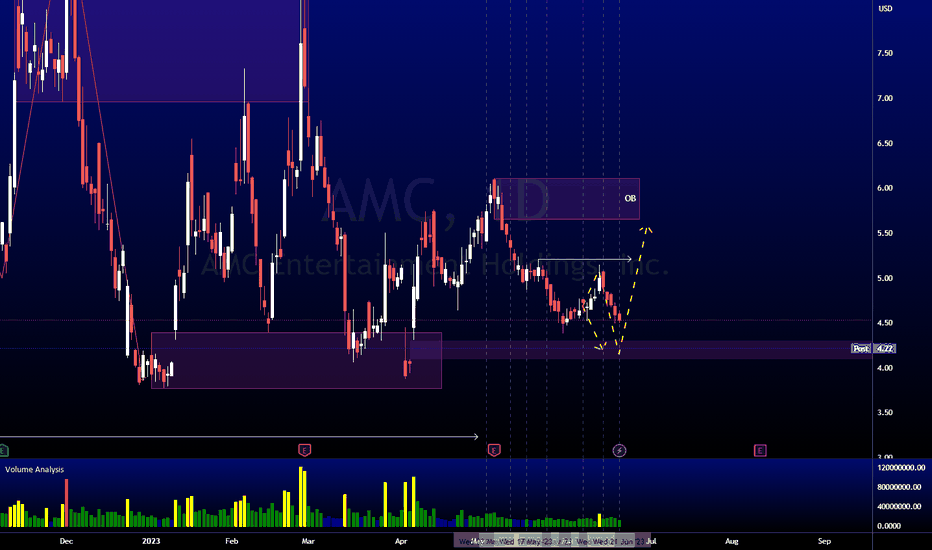

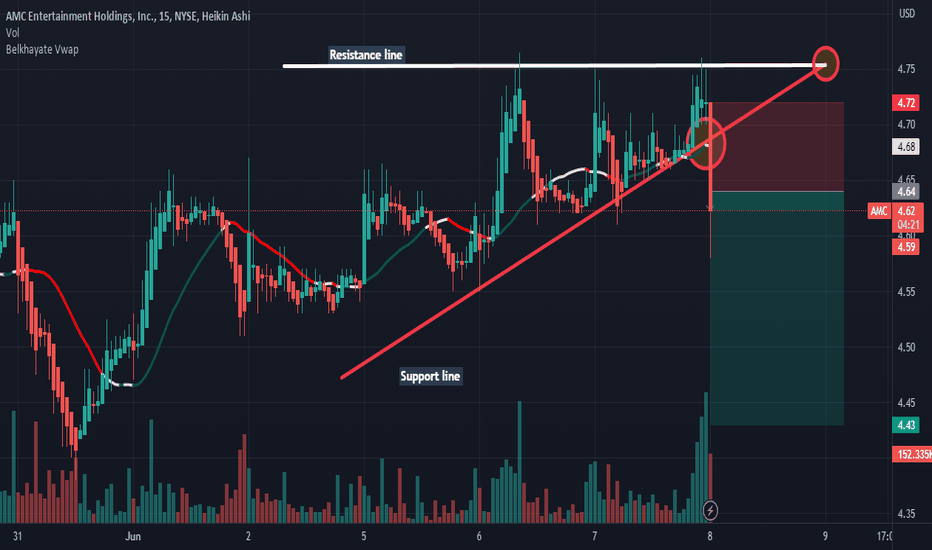

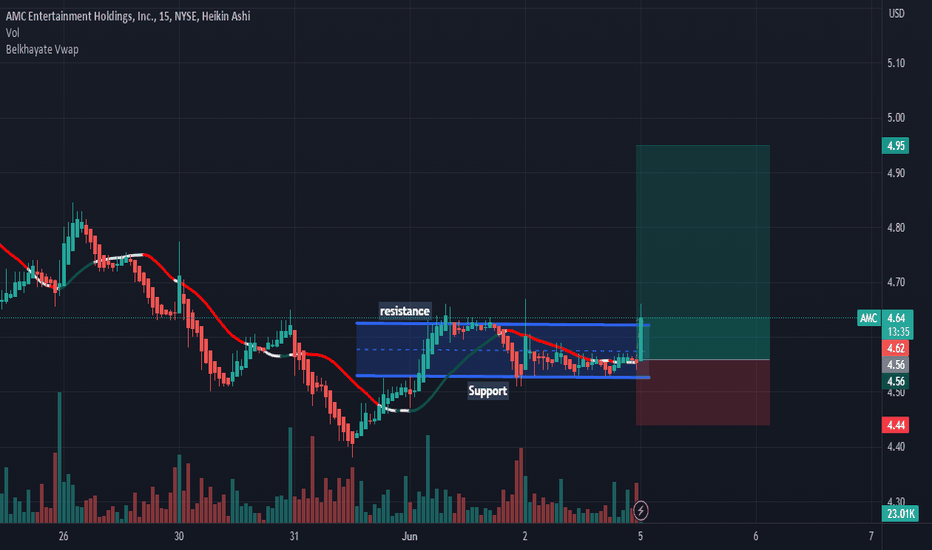

If the price breaks below $4.60, the next target could be $4.30, followed by another potential target at $3.70. If it continues to lose the $3.70 area, there is a possibility of it reaching $1.50.

On the bullish side, there is a potential for a counter-pullback due to the formation of a double bottom and oversold conditions. However, it is important to note that this bullish scenario may be temporary in nature.

AMC Shareholders approved combining AMC shares & APE units !Even though I was one of the first to signal you about the AMC potential to become the next GME Gamestop:

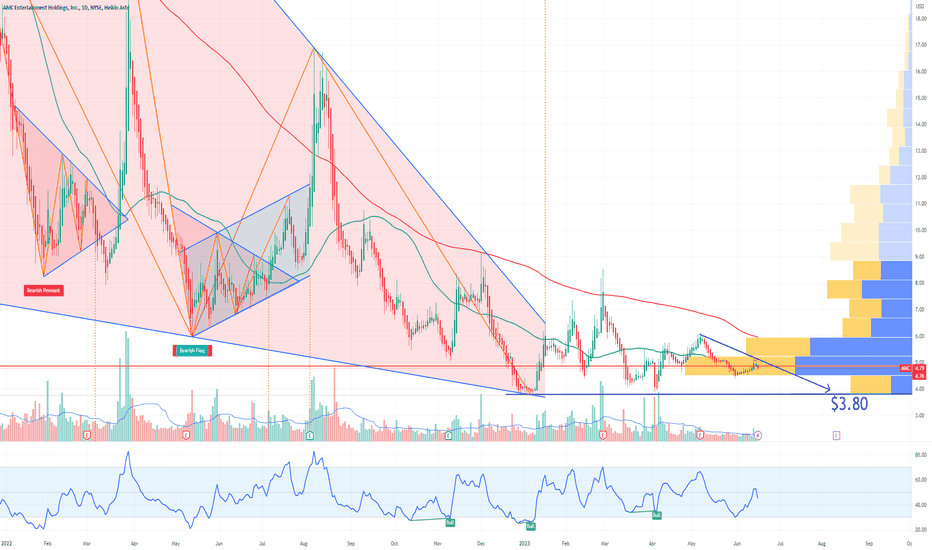

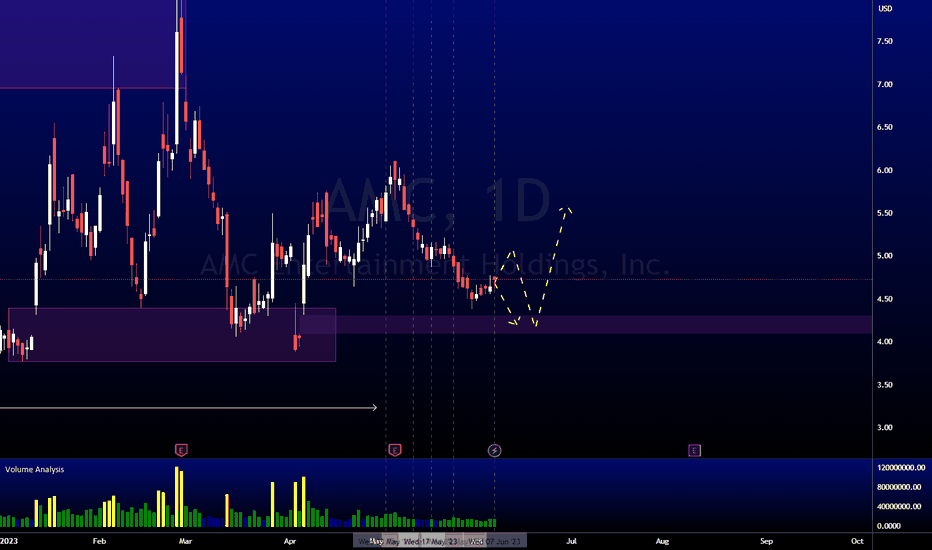

Today I want to share with you my Bearish Thesis:

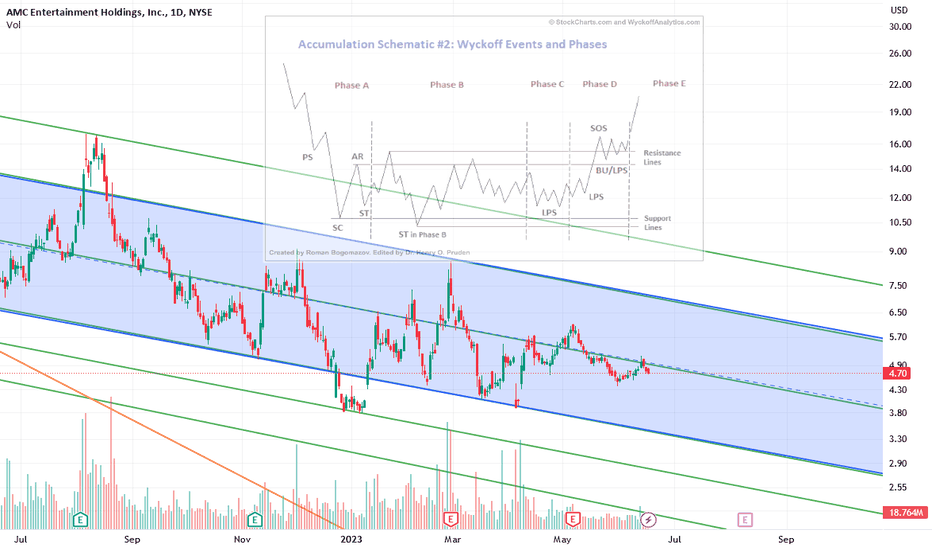

In my opinion, there are factors that suggest AMC Entertainment Holdings (AMC) may experience a decline in share price following the APE (Additional Paid-in Capital) conversion. The approval of combining AMC common shares and APE units by an overwhelming majority of shareholders (87% in favor) indicates a significant increase in the capacity to issue additional common shares (88% in favor).

The increased capacity to issue common shares can potentially lead to dilution of existing shareholders' ownership. As more shares are issued, the existing shares represent a smaller portion of the overall ownership in the company. This dilution, coupled with the potential influx of additional shares in the market, can put downward pressure on the share price.

Furthermore, the approved combination of AMC common shares and APE units may result in increased selling pressure as some shareholders may choose to liquidate their positions. This increased supply of shares in the market can further contribute to downward price movement.

Considering these factors, my price target of $3.80 by fall reflects a bearish sentiment for AMC's stock. It is important to note that the price may even go lower due to the potential dilution and increased selling pressure resulting from the shareholder-approved measures.

Looking forward to read your opinion about it.

WYCKOFF SCHEMATIC 1 IDEAIf conversion approved by court I see something along these lines. If conversion somehow denied then I imagine schematic 2 would be more accurare before ultimately the company going bankrupt because of inability to raise cash. 99% certain conversion is imminent and ultimately will provide AMC the liquidity to thrive.

Showing October as the big move because I think October will be the month that liquidity becomes an issue and shorts will have to cover. The 50 would also be crossing the 200 around then which could lead to more institutional money pouring in.

Not financial advice, just my thoughts.

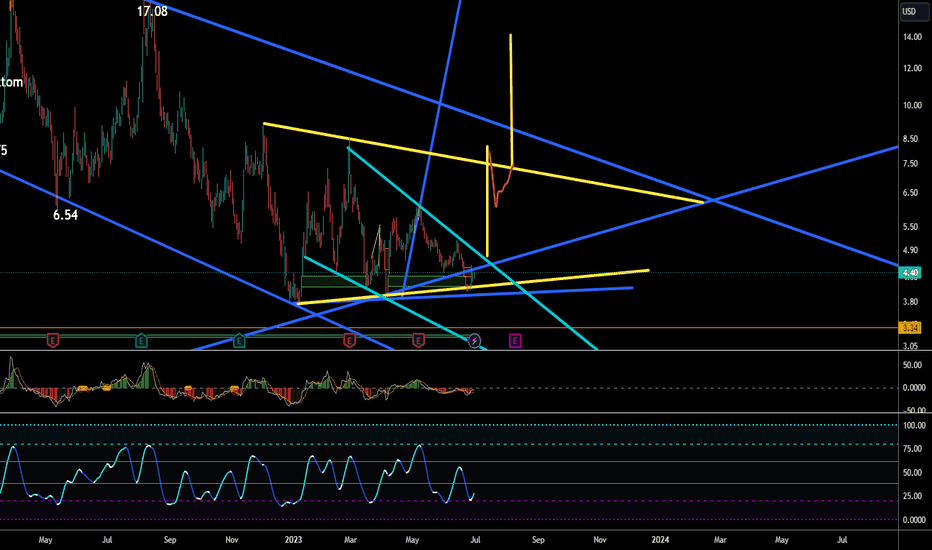

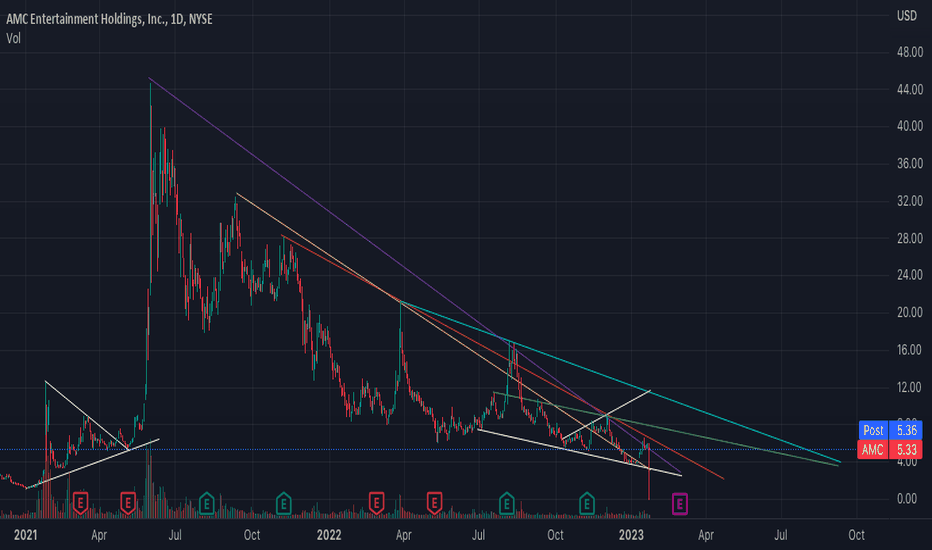

Here are my lines on the AMC chartSo there are a few trend lines that I've been tracking that date as far back as the June 2021 run up (Purple).

We are currently surfing along the top of this Purple trend line and, with the help of some kind of catalyst (earnings is right at the closing point of the trend line) and some high volume, I think we are ready to fly.

The Orange and Green trend lines will likely be resistances on the way up, not sure exactly how strong as AMC is known for busting through resistances on the 4th touch.

The Blue trend line hasn't been tested as often so I can see somewhat of a pullback once it touches it, but ultimately I think AMC is at least a 10$ stock, so earnings should help it get at or above that level.

This has been your BroStock Science of the day. Time will tell.

AMC | It's Coming!!! | LONGAMC Entertainment Holdings, Inc., through its subsidiaries, engages in the theatrical exhibition business. The company owns, operates, or has interests in theatres in the United States and Europe. AMC Entertainment Holdings, Inc. was founded in 1920 and is headquartered in Leawood, Kansas.

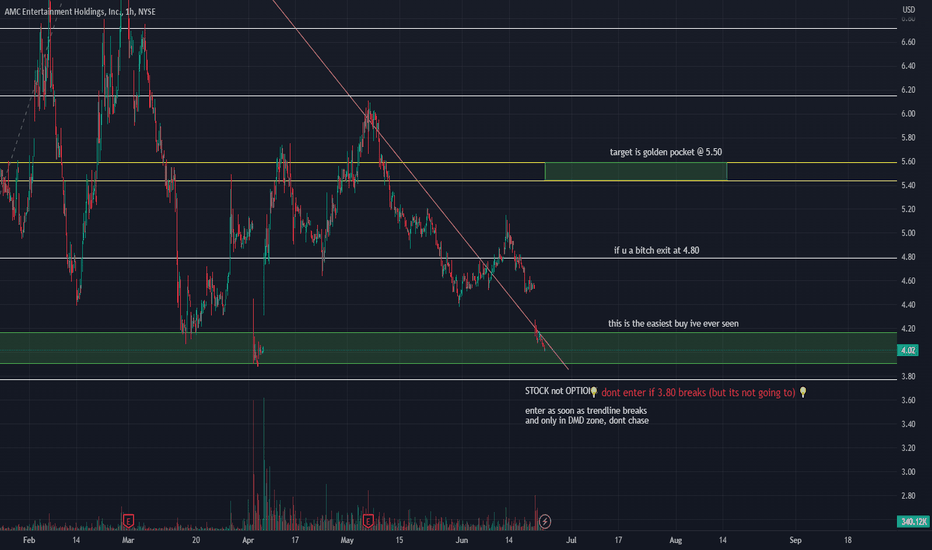

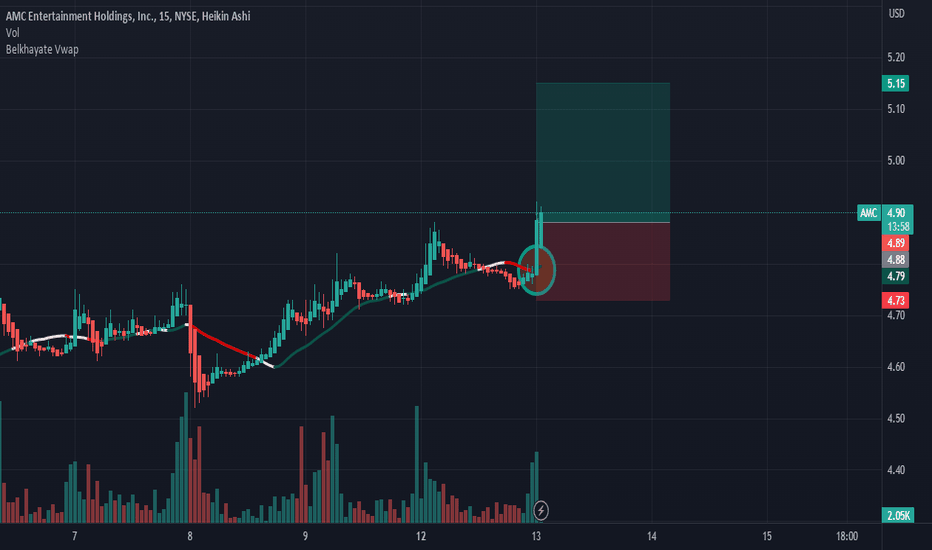

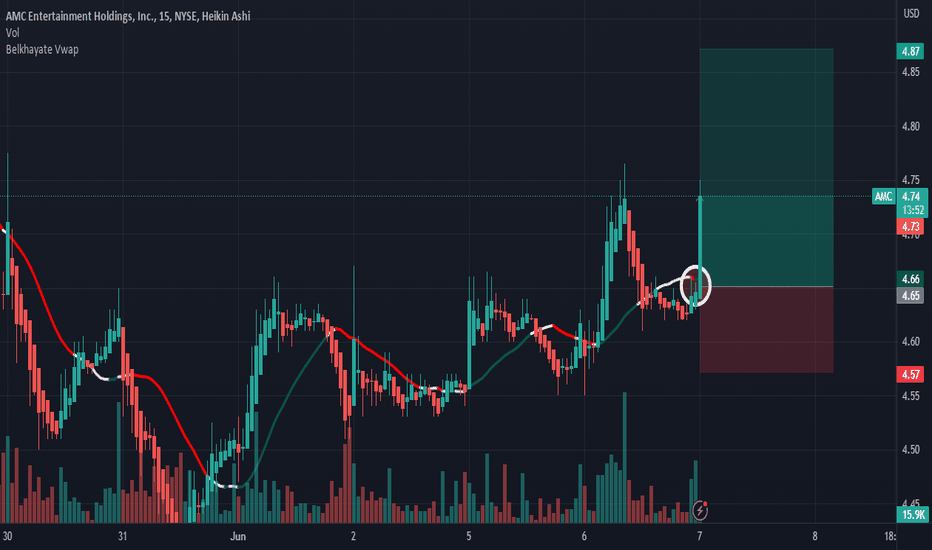

AMC Bullish Long June 23rd AMC Long Options Call for Earnings on June 23rd

I have purchased AMC long options calls with an expiration date of June 23rd and July 7th. The strike price for both contracts is $4.50. I believe that AMC is undervalued and that the stock price will increase after earnings are released on June 23rd.

AMC is a leading movie theater chain with a strong brand and a loyal customer base. The company has been struggling in recent years due to the COVID-19 pandemic, but it is beginning to recover. In the first quarter of 2023, AMC's revenue increased by 83% year-over-year. The company also generated positive earnings for the first time since 2019.

I believe that AMC's earnings report on June 23rd will be positive. I expect the company to report revenue of $1.2 billion and earnings per share of $0.15. If these numbers are met or exceeded, I believe that the stock price will increase significantly.

I am bullish on AMC and I believe that the stock price could reach $6.00 by the end of July. If the stock price does reach this level, I will sell my options contracts for a profit.

Risks

There are a few risks associated with this trade. First, AMC's earnings report could disappoint. If the company reports revenue or earnings below expectations, the stock price could decline. Second, the overall market could decline, which could also impact the price of AMC stock. Third, the options contracts could expire worthless if the stock price does not reach $4.50 by the expiration date.

Conclusion

I believe that the risks associated with this trade are outweighed by the potential rewards. I am bullish on AMC and I believe that the stock price could reach $6.00 by the end of July. If this happens, I will sell my options contracts for a profit.