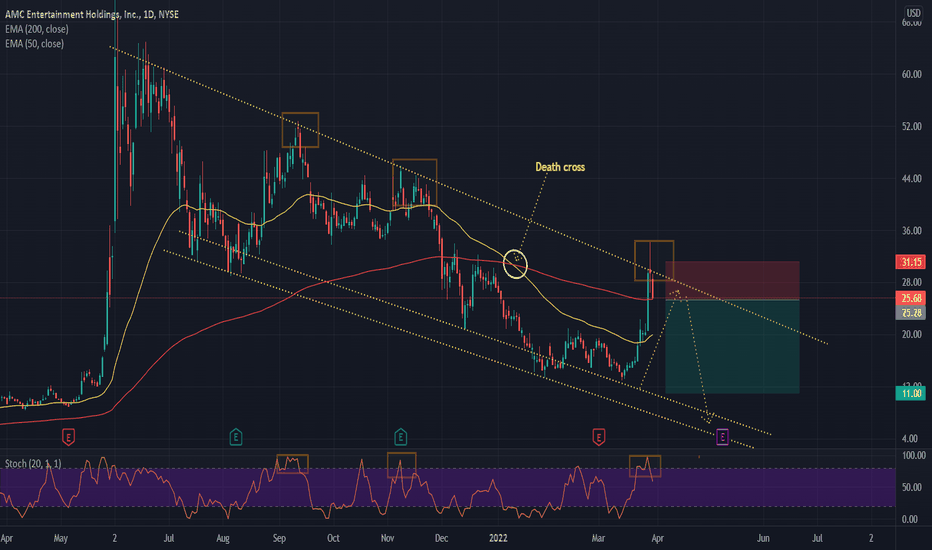

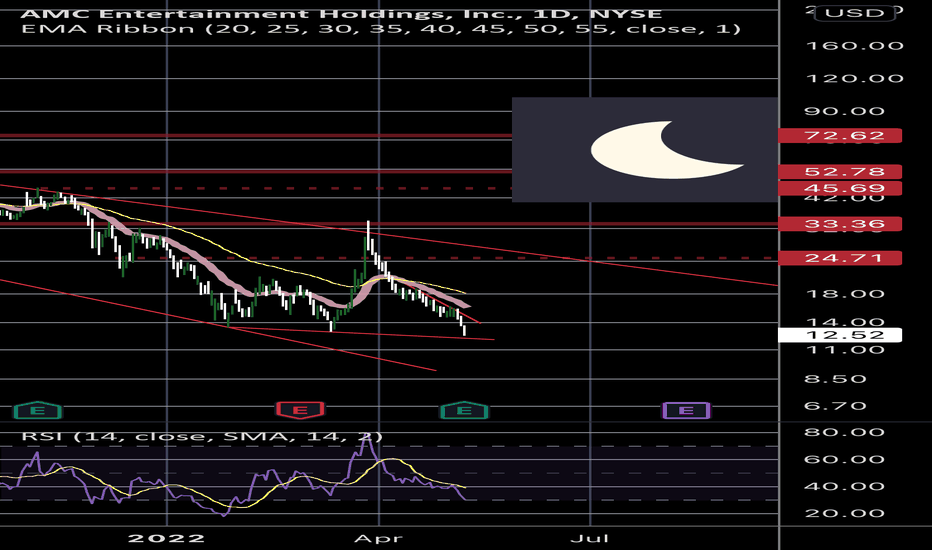

AMC 3/30/2022AMC

Ticket to nowhere

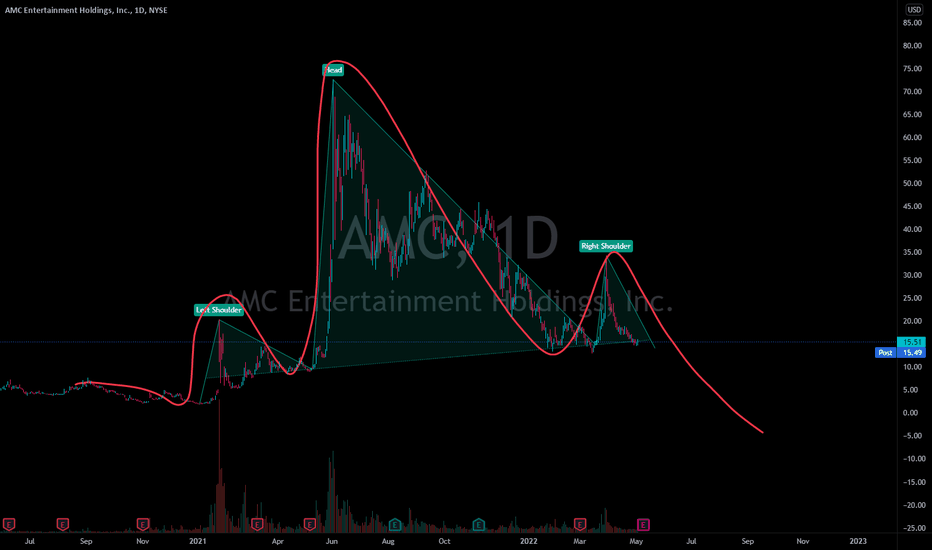

That 7-day AMC pump to end May 2021 sure left behind a lot of blood.

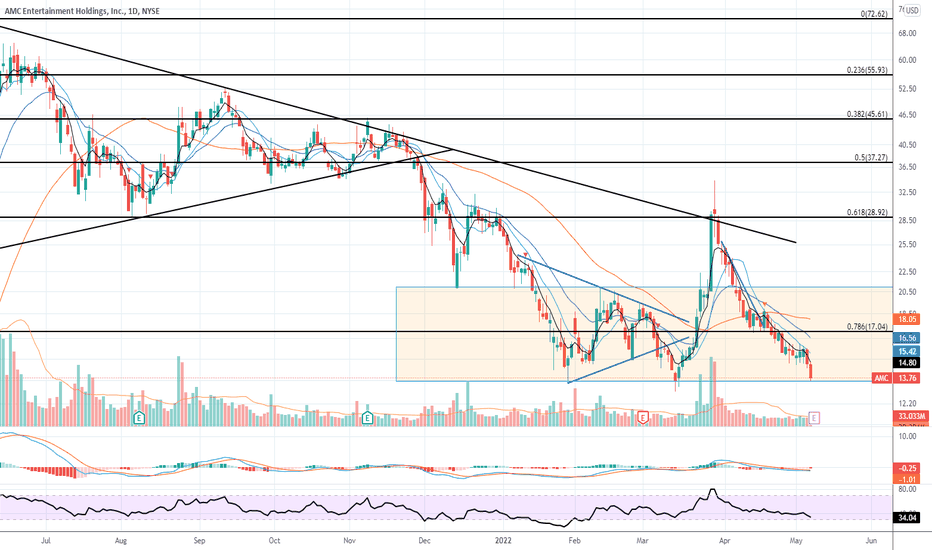

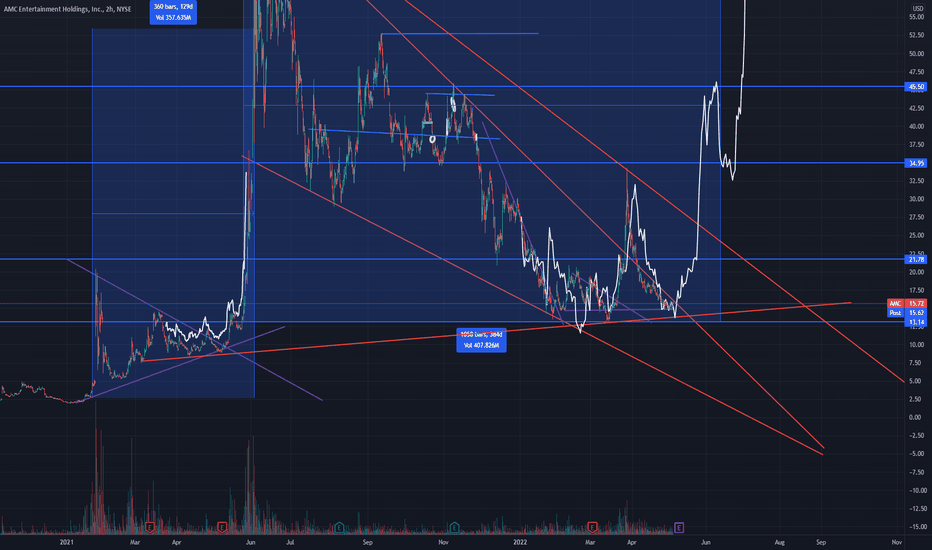

The last 300 days since that 7-day pump, price has been moving downwards in a large price channel.

We have a death cross of 200 and 50 ema signaling the bearish conditions.

Price is currently at resistance level of price channel

Stochastic is overbought.

The last two times price has found itself at resistance area of price channel and stochastic was over-bought, price has made a move back down to support.

This time will be no different.

Yesterday’s candlestick closed a shooting star and resistance and todays closed below that. This is my cue to enter trade.

Entering trade short

Entry: 25.28

Stop loss: 31.15

Target: 11.00, +56.48%, 2.43 RR ratio

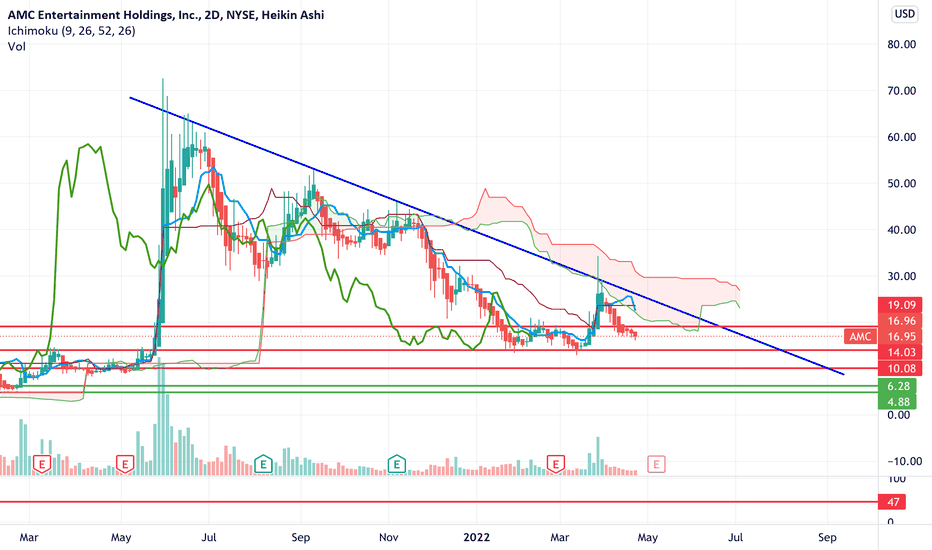

AMC2 trade ideas

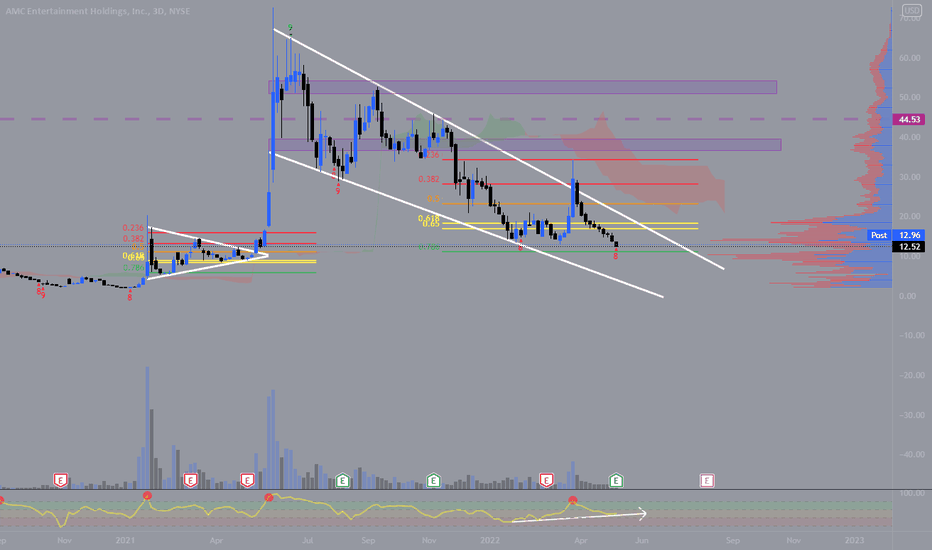

AMC Bullish! Alternate view in play from last weeks analysis...

We are still bullish on AMC, but however a slight change occurred when price broke below 12,72 meaning that the price is now completing a 11 swing sequence (WXYXZ) to the bottom of the channel and expecting to bounce from around the bluebox area of 8,30 and (not expected to go below the bluebox(5.23) from which we will invalidate our analysis).

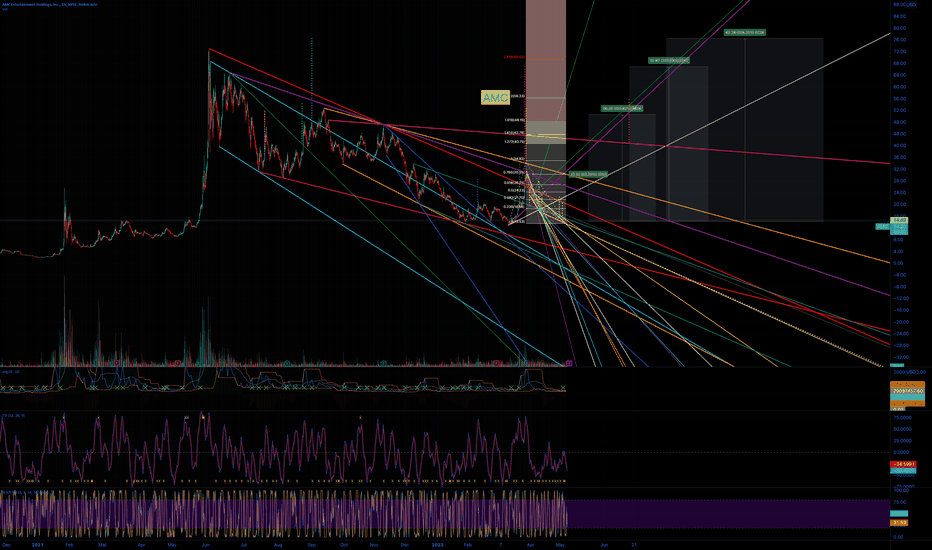

AMC likely to fully crash before end of year As the AMC crash continues after looking at their recent quarter financials I believe we could see $1-2 or lower before year end. AMC is highly unprofitable and burning hundreds of millions every quarter with no sight of profitability in the near future. Their current cash is $1.165 billion from $1.592 the previous quarter, a reduction of $427 million. On top of that their share count increased from 400 million to 515 million. Even with some cash in hand the dilution spiral seems to have already begun and will accelerate as their cash reserve deplete.

At most this company is worth $1-2. Their previous best earning were around $1 a share with current revenue far below their previous peak. Even if they get back to peak earnings they have a incredibly larger interest expense. With the already heavy dilution that’s previous peak of $1 EPS is only 20 cents now. 20 cents EPS at a 10 PE is $2.

AMC USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

AMC USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Will AMC move up due to earning?We can clearly see some support in these areas. Earning report was positive and future upside is expected! If trendline is broken, we can expect a little more downside but should move up to at least 24-26$ soon, before potentially heading up to the 40-50$ levels. I don‘t recommend options. Nevertheless I scooped up some more shares yesterday. Let‘s see how Amy will behave, once the market bottoms out!

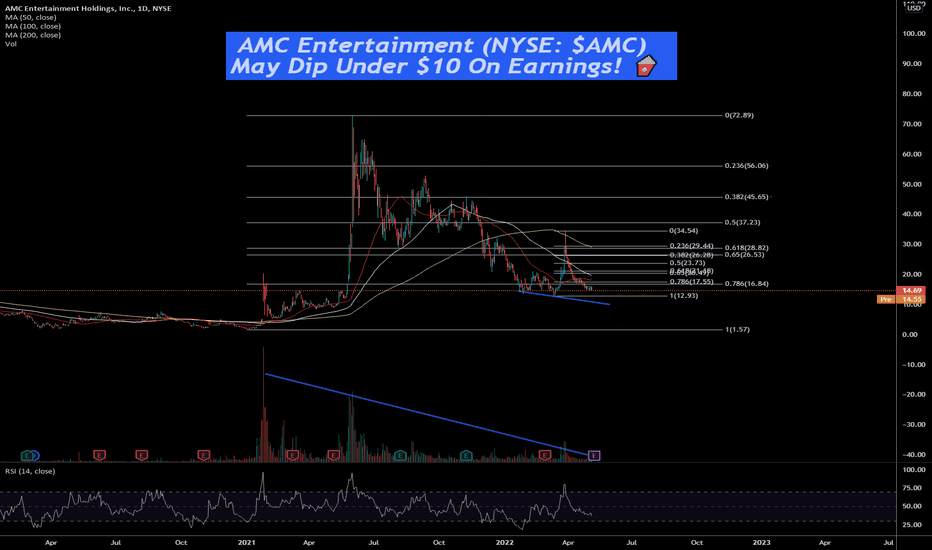

$AMC: Spike Incoming?⚡Possible retest of the 7.86 Fib (11$) Strong VPVR support, this would also test the previous 0.5 Fib which acted as strong resistance, confirming this support is a sign of reversal

⚡Golden pocket reistance 16.9-18.8$ Confirmed by VPVR

⚡23$ resistance confirmed by 0.5 Fib + Ichimoku Cloud resistance

⚡28$ Resistance 0.382 Fib confirmed by volatile candles

⚡34$ 0.236 Fib resistance + doubble bottom resistance, last time the 0.236 Fib controlled the upswing

⚡Strong Bullish Divergence on the MFI, could signify bullish price action

⚡TD-Sequential red 8 on downtrend, signal of reversal

⚡The Options Chain hints for a reclaim of the 14$ level

⚡Lower targets are unlikely according to the Options Chain

*WARNING* This thread is not financial advice. I am not a financial advisor.

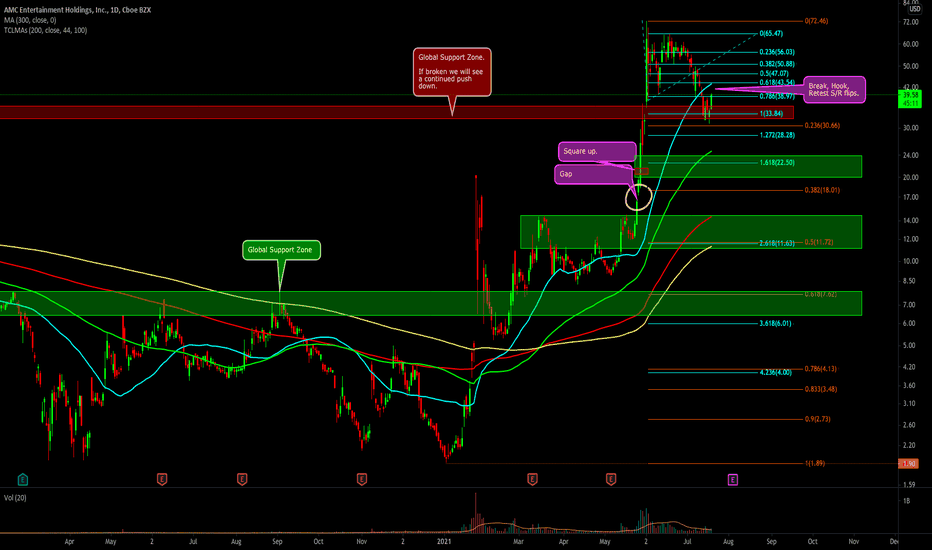

AMC appears to be setting up for another push downBefore you start hating, I am simply making a technical analysis and do not care how strong your hands are. I have zero positions in this nor am I taking one.

We are at a critical level of global support. If it breaks, we could see a push down to either of these green boxes.

We have broken the 44ppma (blue moving average) and currently hooking back to retest it. This is a bearish sign on over extended securities. Watch out for an exhaustion push back out above it to suck in more retail longs.

The next real level of important global support is down around the .618 retracement of this entire leg of money.

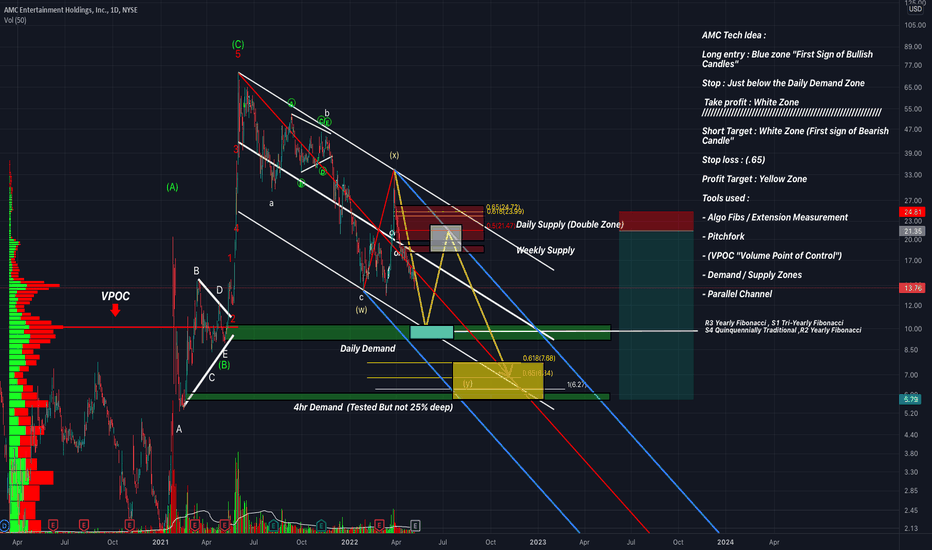

AMC UPDATEAMC Tech Idea :

Long entry : Blue zone "First Sign of Bullish

Candles"

Stop : Just below the Daily Demand Zone

Take profit : White Zone

/////////////////////////////////////////////////////////////

Short Target : White Zone (First sign of Bearish

Candle"

Stop loss : (.65)

Profit Target : Yellow Zone

Tools used :

- Algo Fibs / Extension Measurement

- Pitchfork

- (VPOC "Volume Point of Control")

- Demand / Supply Zones

- Parallel Channel

$AMC to the moon?Basically yes, you can see $AMC reaching the $60 level without any problem, i want to put some fact in the table, punished stocks after earnings are those which have problems with the supply chain and distribution costs increased by the prices of oil and nat gas, in the case of $AMC, they don't produce nothing, they are yous waiting for you to seat in a dark room to watch the most incredible movies and events, so, i think this is a derisked stock.

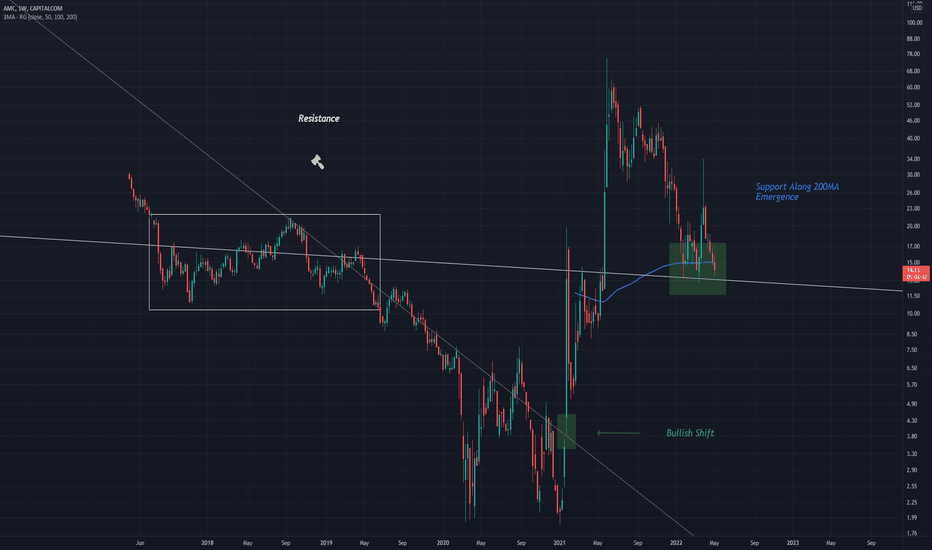

AMC May Have Found SupportA trendline can be drawn showing a resistance area, which now could be considered a support area

This is a resistance / support analysis

The shift from bear to bull market is in green

Emergence of the 200MA allows an assumption of a support as it aligns above the down trend line

AMC Entertainment (NYSE: $AMC) May Dip Under $10 On Earnings! 🍿AMC Entertainment Holdings, Inc., through its subsidiaries, engages in the theatrical exhibition business. The company owns, operates, or has interests in theatres in the United States and Europe. As of March 1, 2022, it operated approximately 950 theatres and 10,600 screens. The company was founded in 1920 and is headquartered in Leawood, Kansas.

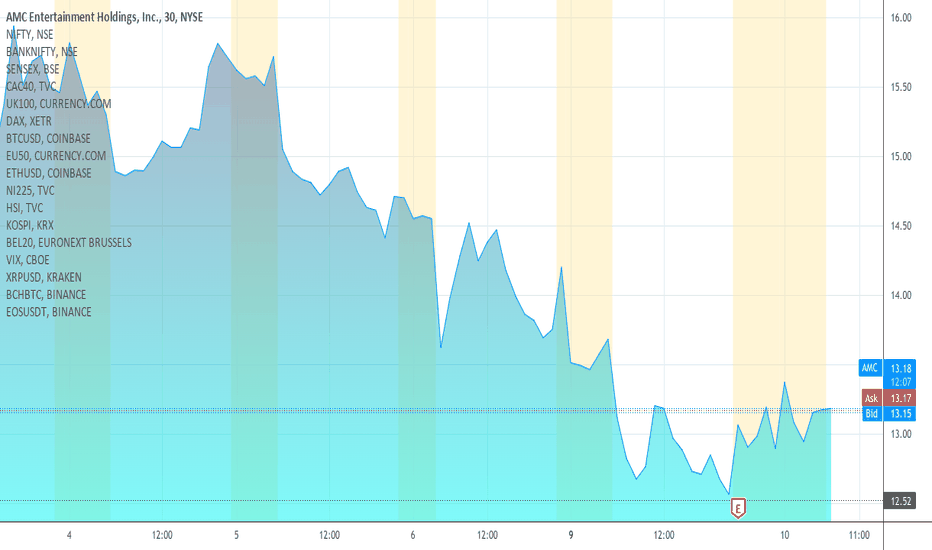

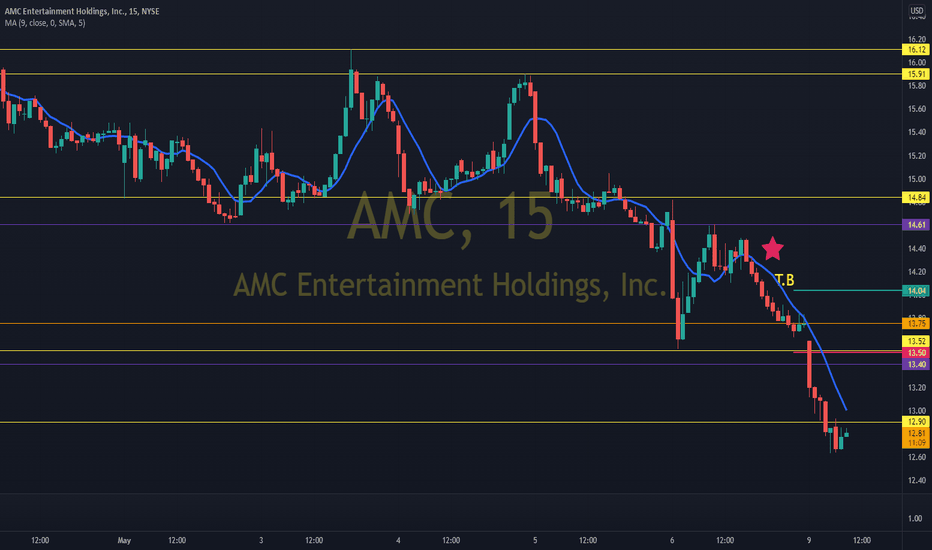

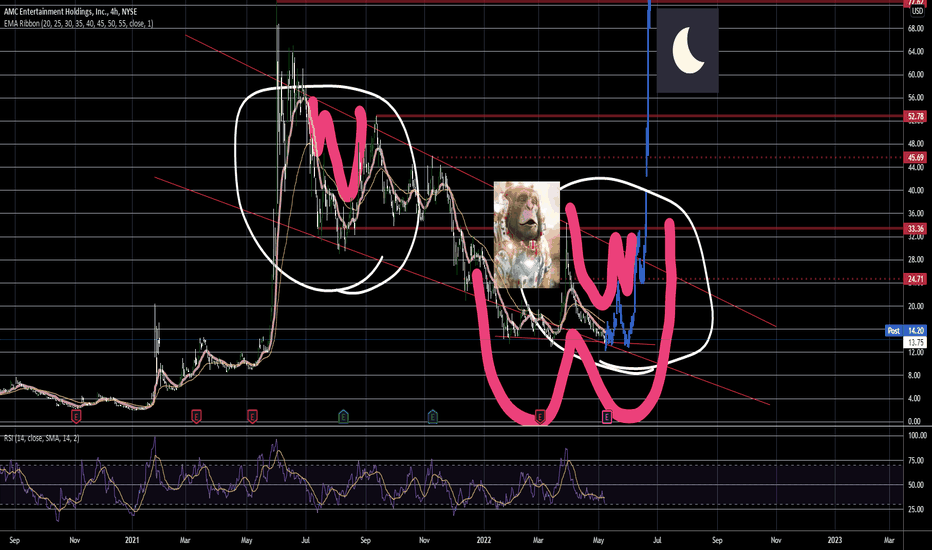

Move up around earnings?I was messing around with the bar pattern tool and found a strong similarity in the movements from May to June compared to where the stock is now. Not only that but there is upward momentum that starts around earnings "5/9/22" which is a beneficial catalyst. Also with this rate hike causing the cost to borrow to go up, I'm feeling pretty BULLISH about what is to come in these upcoming weeks.

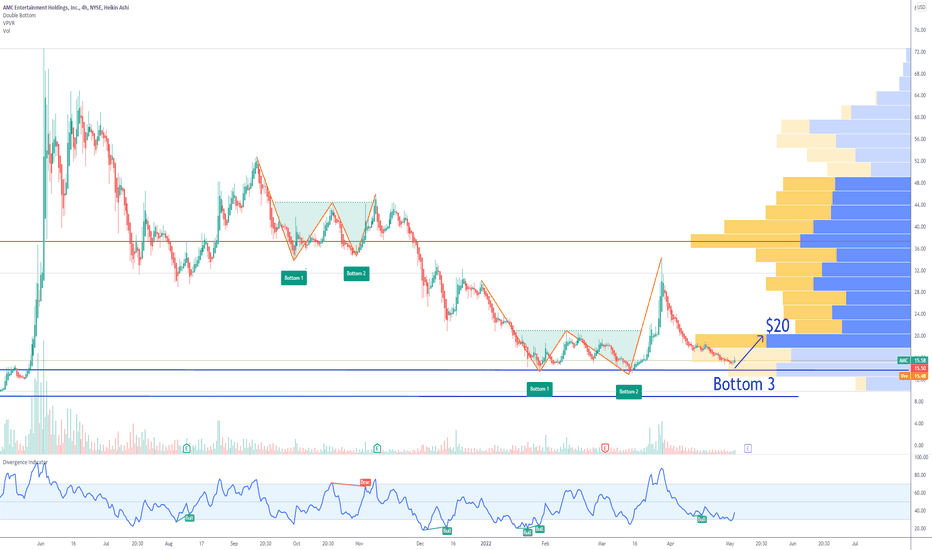

AMC close to a Triple BottomIf we look at the chart, we can see AMC close to complete a triple bottom, which is one of the most bullish chart patterns out there.

It has just touched the oversold area from which it bounced.

My new price target is the $20 resistance.

Looking forward to read your opinion about it.

AMC is dead First off, I am sorry for all those that wasted time and money investing in this company. We all have been scammed....by the internet, by the media, by Adam Aaron and the rest of the Executive Board.

This stock is nothing but a giant blow off top. Shorts are in this play because they are more certain than anyone else is that this company will go bankrupt....and they are ALWAYS right. If people are buying and holding, they are selling and the shares are flying off the shelves. AMC has not paid off any debt, only accumulated more debt. Ask yourself why that is the case? They are spending your hard earned money on things like gold mines and NFT's.

I think its time for all to wake up. This ship has sailed a long time ago.

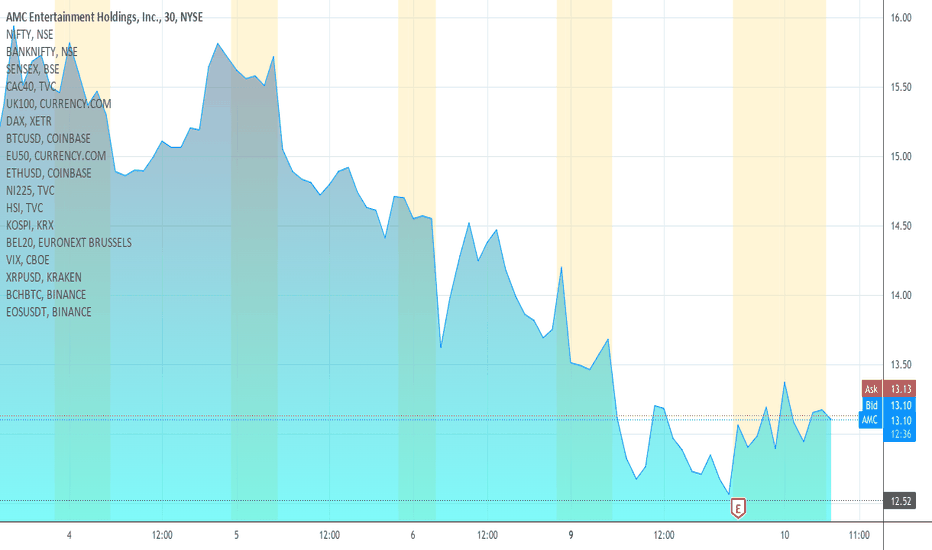

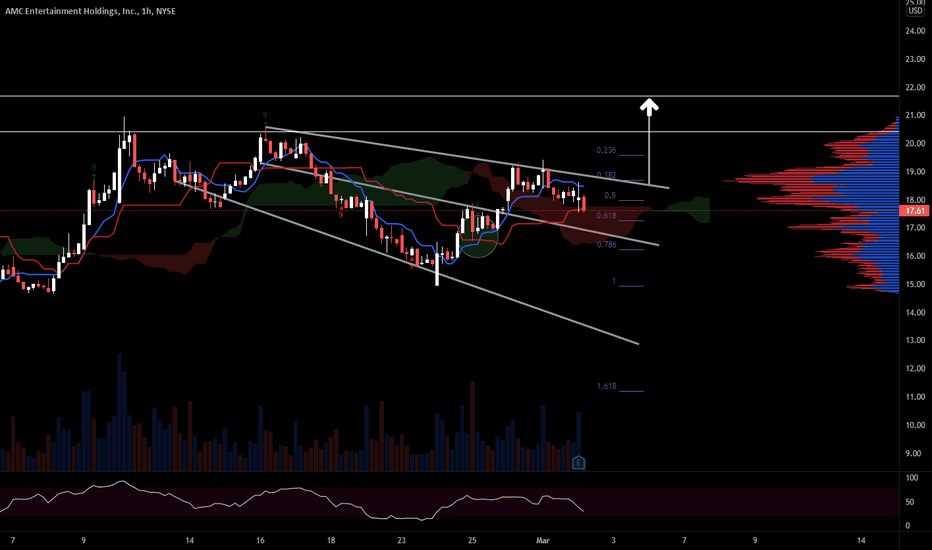

$AMC: Breakout to 21$ AMC has for the last couple of days been trading under a descending channel. This pattern has started from the resistance of 20$. As of now we are seeing a slight retracement because of the earnings. MFI is heading down which indicates that money is flowing out of AMC on the 1H chart. Earlier today we had a retracement to 17.55$. This level succesfully bounced the price. The 17.55$ level was slightly above the 6.18 Fib. It is possible that Fib level 6.18 gets retested (17.26$) to bounce the price.

We could also see a retest of 16.5$ which is the bottom of the Ichimoku Cloud. That scenario is unlikely at the current state. We are still bullish on the Ichimoku Cloud due to the fact that we are still under a Bullish TK-Cross which indicates that the price will remain under an uptrend.

As of now i am waiting for Bullish Divergence on the MFI backed up with volume and a red 9 on the TD-Sequential to ensure that AMC retests 21$. The 19$ level needs to hold. This level is a large level of resistance confirmed by the large VPVR node. Strong levels of support are located at 17-16$ confirmed by large VPVR nodes. We need to see a daily close above 19$ to remain bullish.