Caterpillar Breaks Long-Term DowntrendIndustrial stocks remain underperformers thanks to the coronavirus recession. However, a few companies struggling before the crisis have started breaking out.

One of them was Deere . The animal spirits have also been at work in Caterpillar.

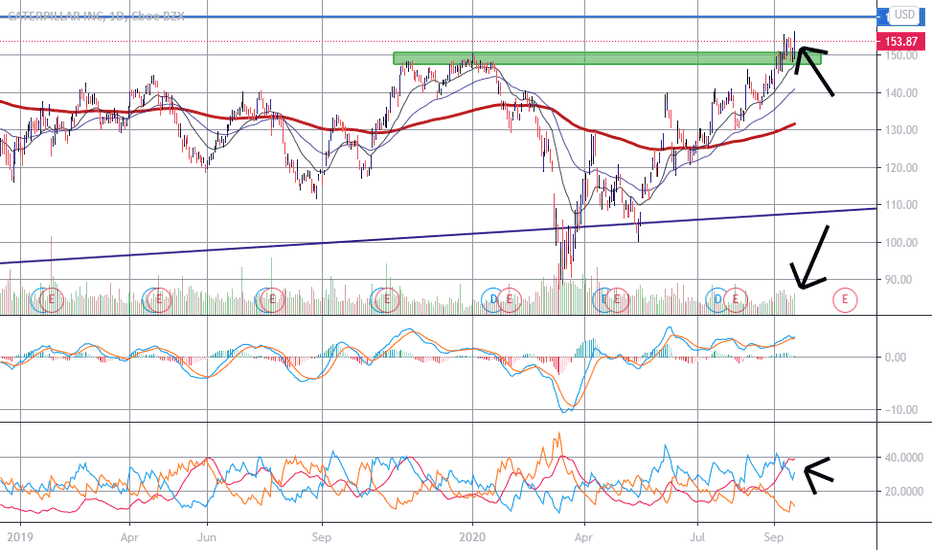

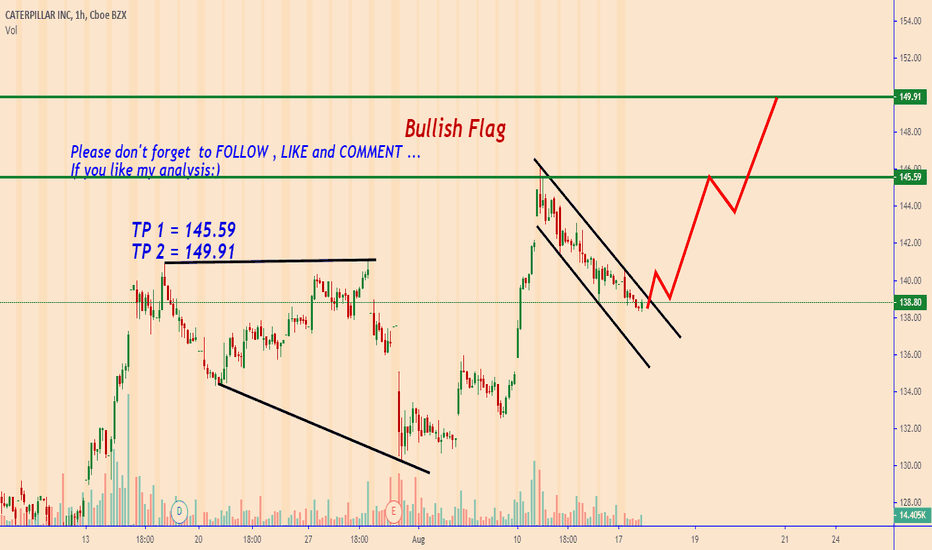

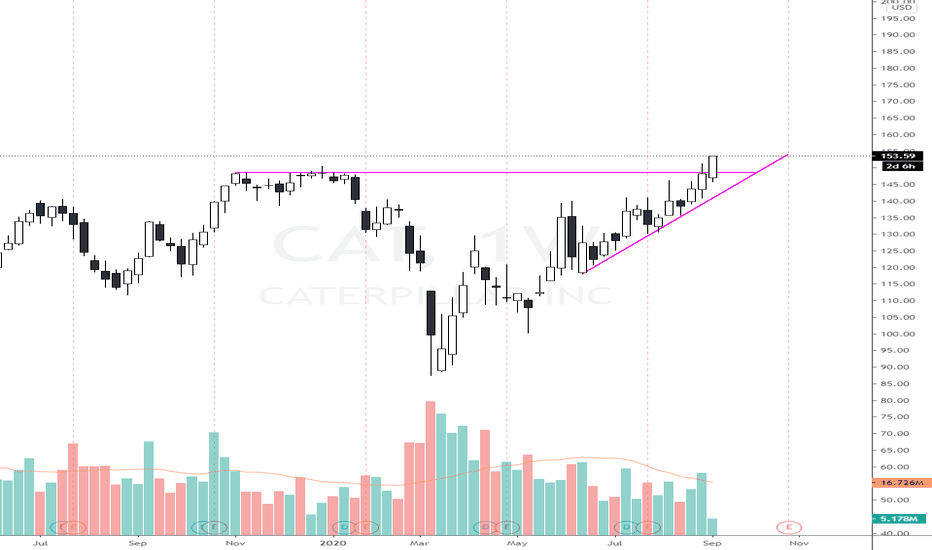

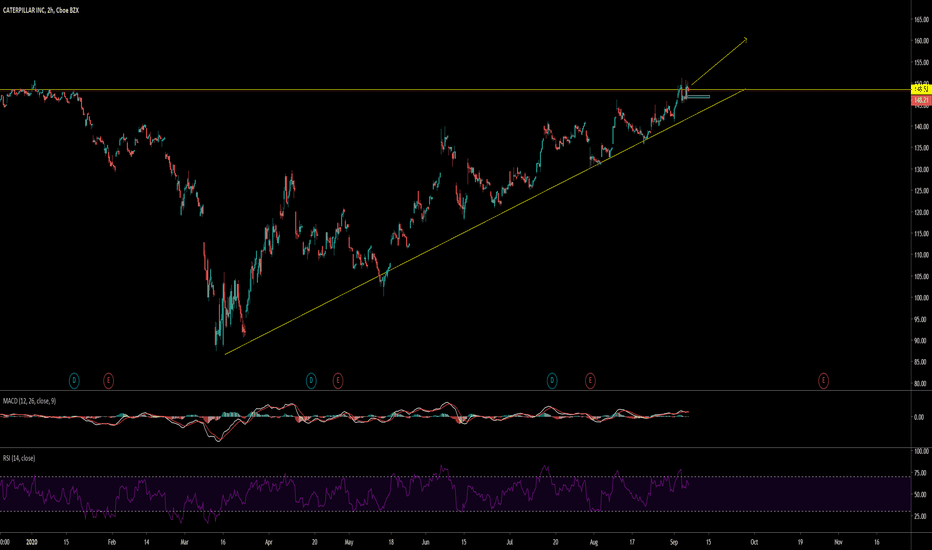

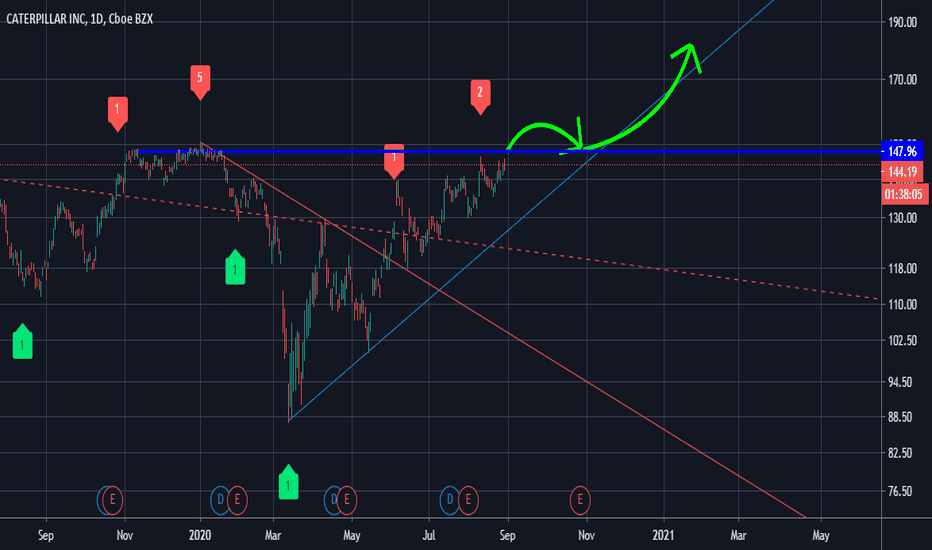

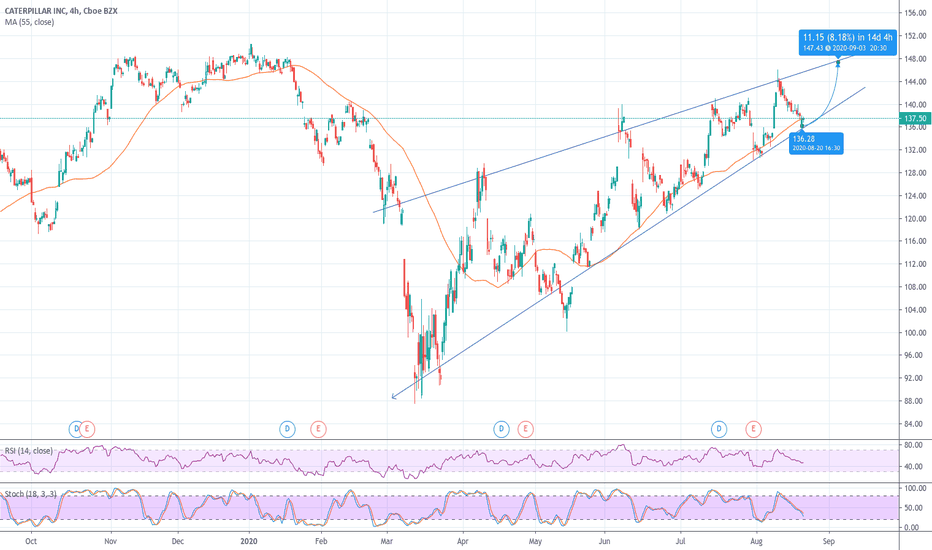

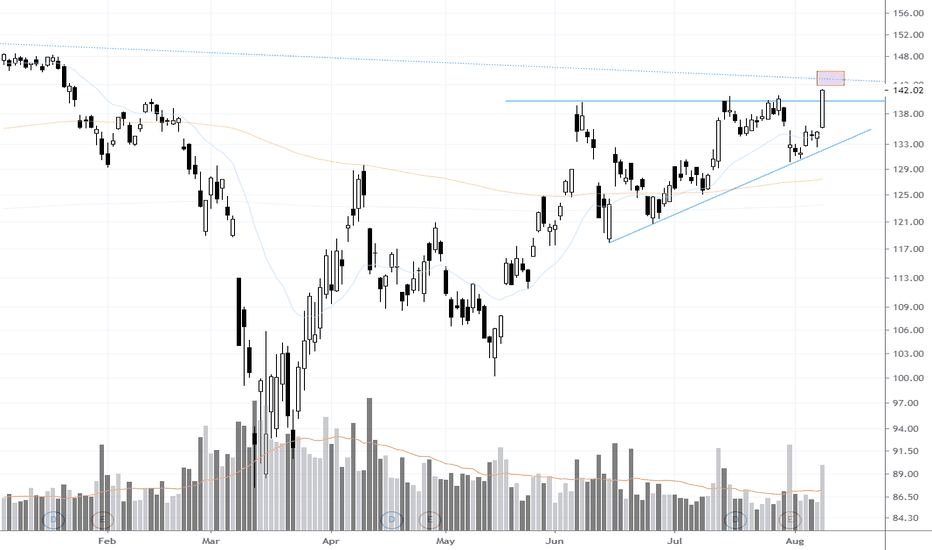

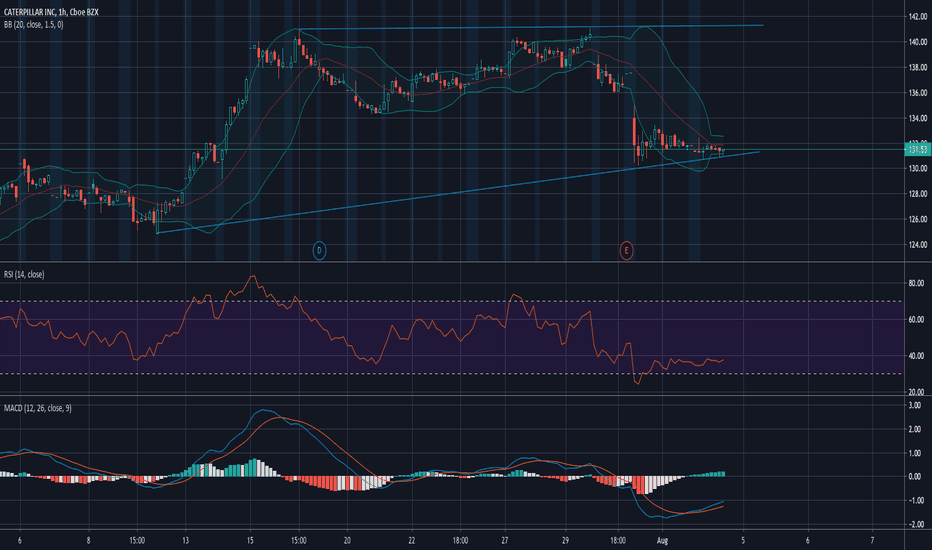

The first chart feature for CAT is a weekly downtrend in place since early 2018. This ran along the pre-covid high and into the August consolidation area of $135-140.

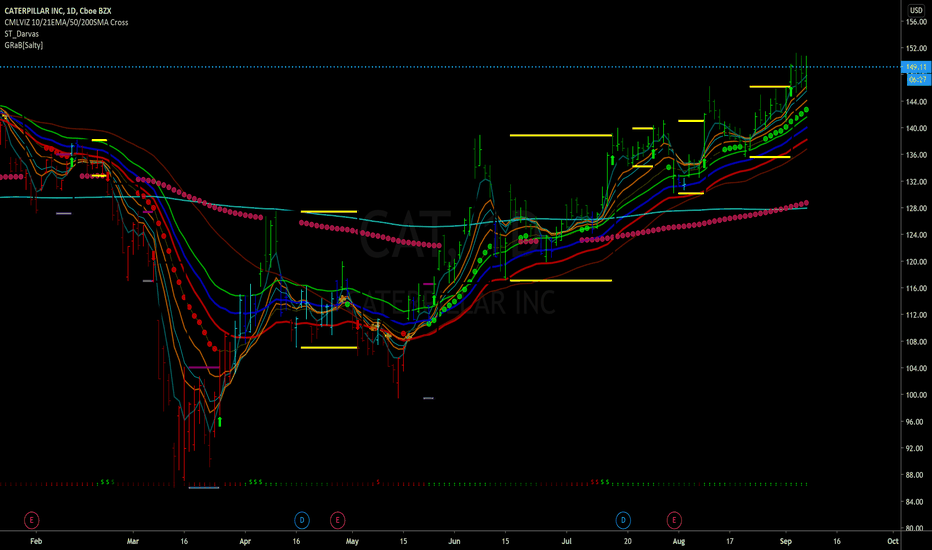

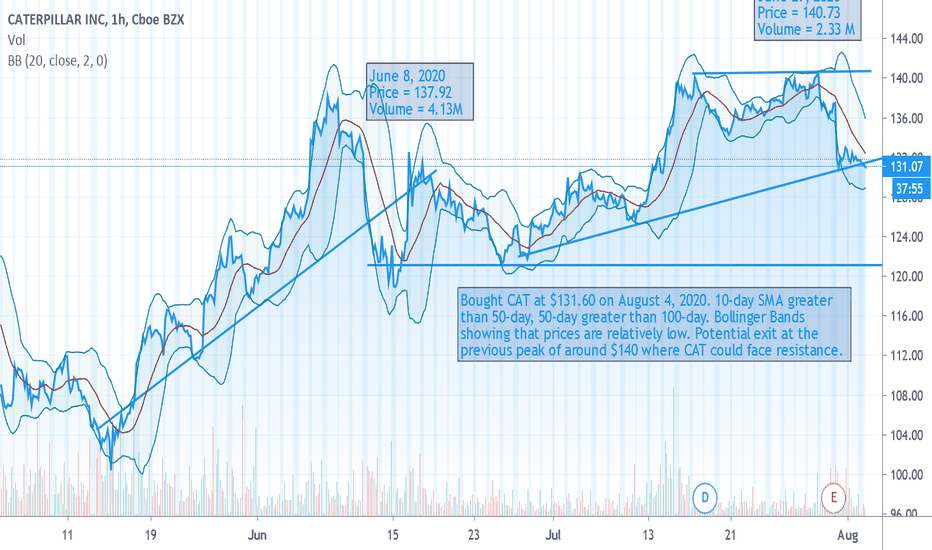

Next, the equipment maker’s recent low of $142.73 was just half a percent above its 50-day simple moving average (SMA). Speaking of the 50-day SMA, it rose above the 200-day SMA in early August – a “golden cross.”

Finally, CAT’s advanced despite poor monthly sales reports and warnings about the weak economy. But recent economic data, especially from China, have fueled some optimism.

Given the fact that stocks have started the week by jumping higher (“market order Monday?”), some traders may want to see CAT retest closer to $140. However, the daily and weekly charts could be signaling a longer-term breakout.

TradeStation is a pioneer in the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

CAT trade ideas

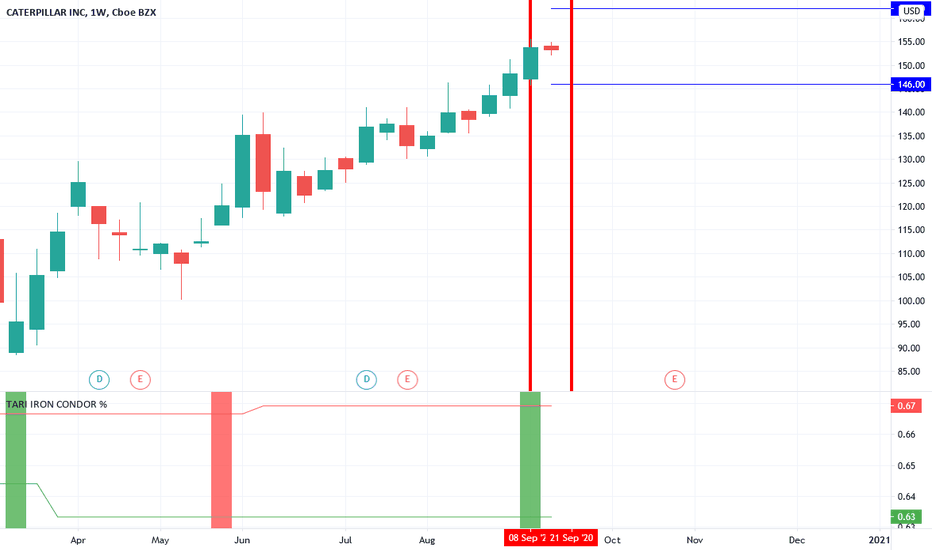

Iron TariHi guys,

this is another iron condor from the strategy W1 5% strike.

Probability 63% gives a Rew/Risk = 100-63/63=0.58

Today the market does'nt pay enough, RR is 0.60, not that much we'd like to trade, but we can leave a pending order to get something more.

In this case I prefer to widen the spreads of the 2 vertical, always having a RR not lower than 0.58. This is because the wider the spreads are, the higher our prability of success are. In this case the breakeven moves a bit giving us an higher range to be protibable, plus the max loss moves on each side of 4$. 8$ more for the iron condor is a good extra room for the price.

So in this case we enlarge our probability of success, without touching the RR ratio.

Enjoy your Wallet!

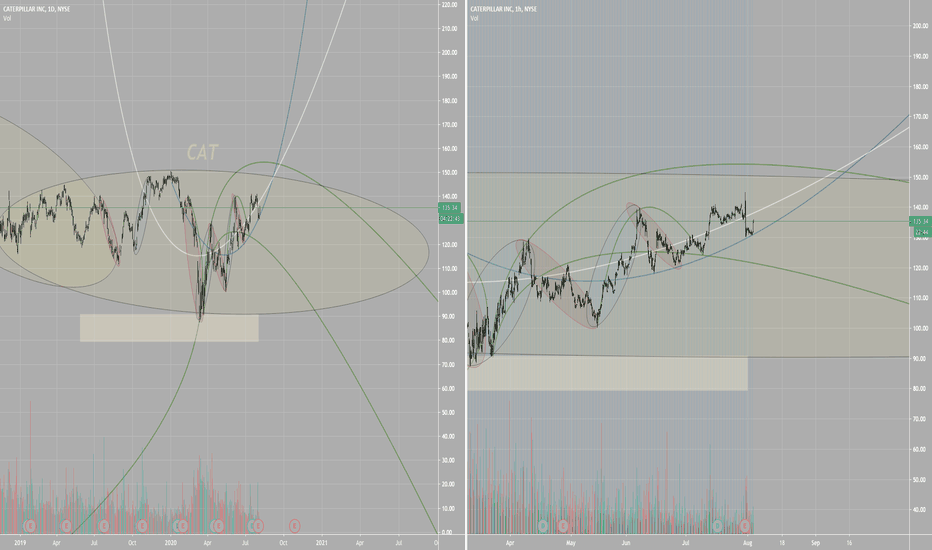

Tari.

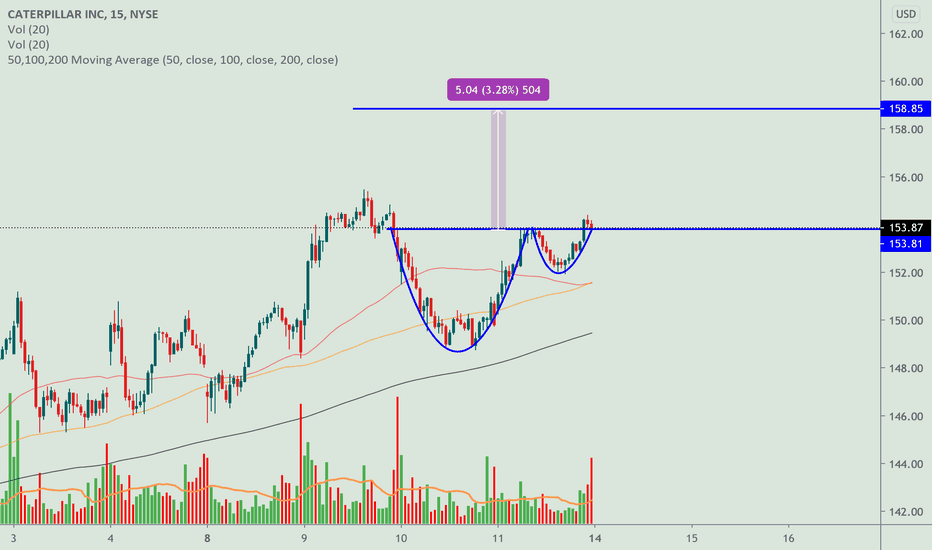

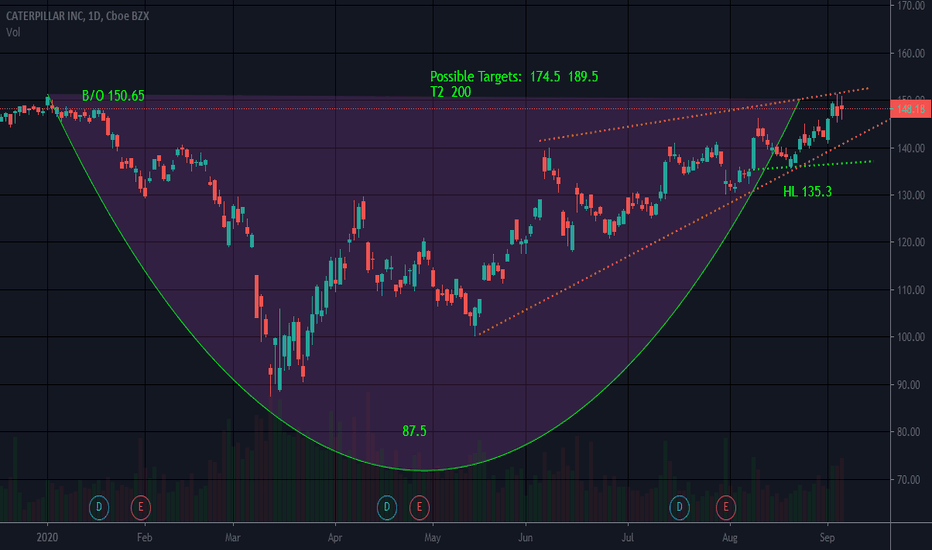

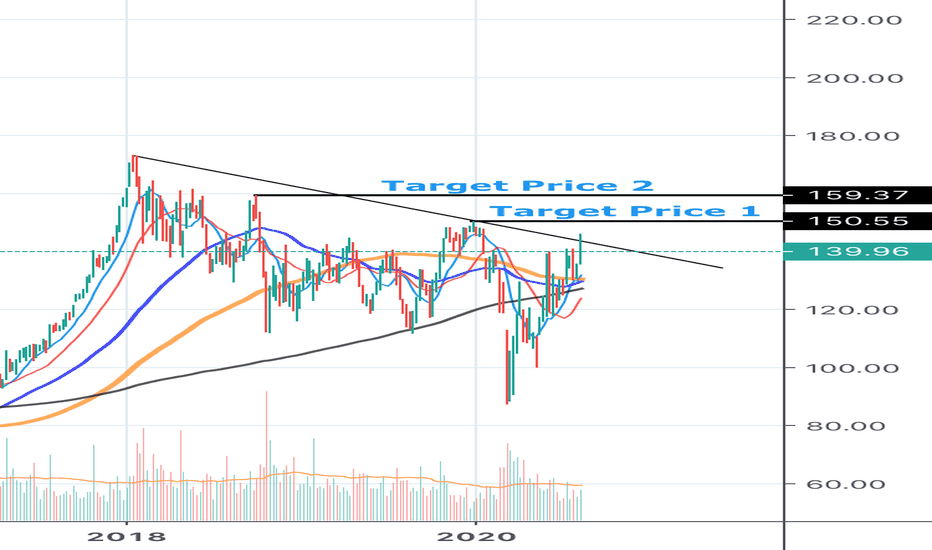

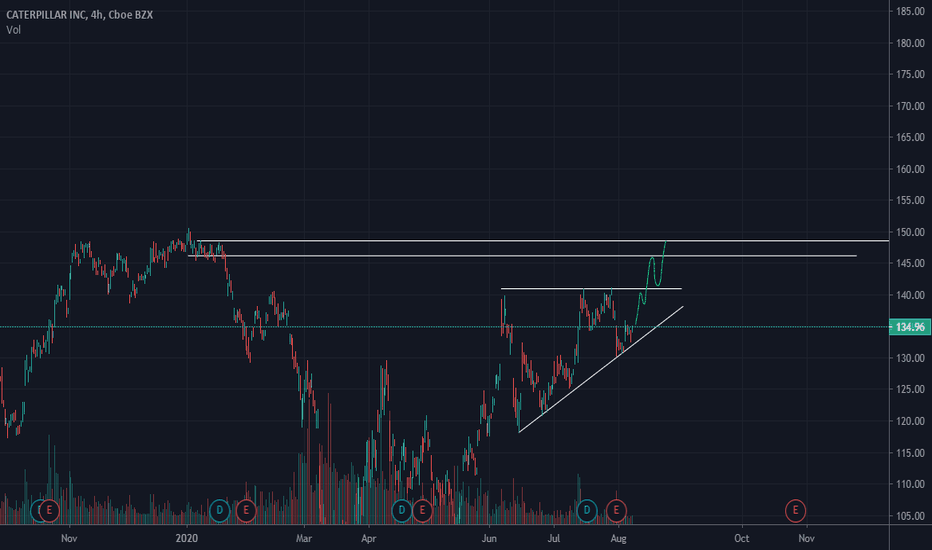

CAT-LongCAT is breaking out of a long term pattern. Breakout is with a strong volume. Some money surely preparing for a worldwide recovery from covid-19. Recently lots of analyst recommended the stock based on its fundamentals. price to sales ratio is very attractive. Dividend paying stock projected to have 39% higher EPS next year. So boys from Wall street are now adding. This is just an opinion. Do not buy or sell any financial assets reading this post. This is just for educational purposes. Do your own homework before putting your hard earned money based anyone's post.

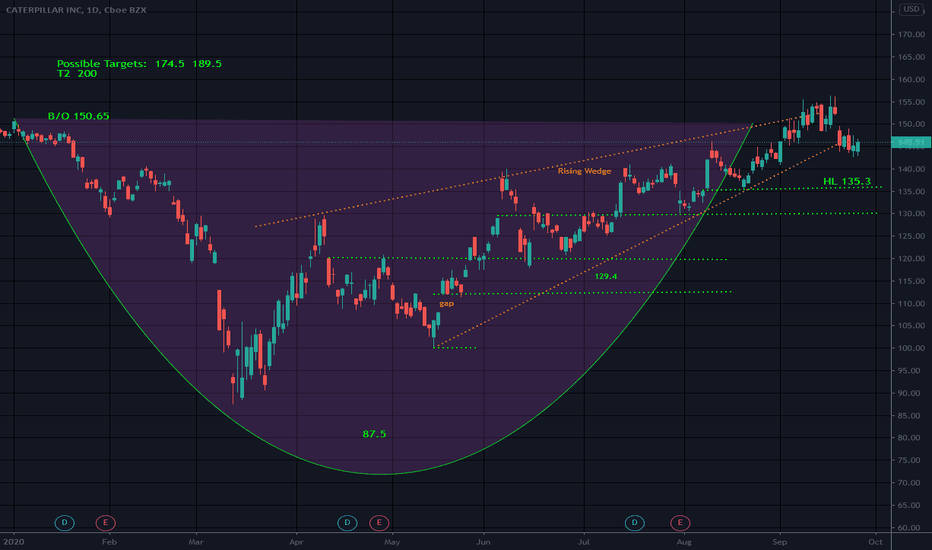

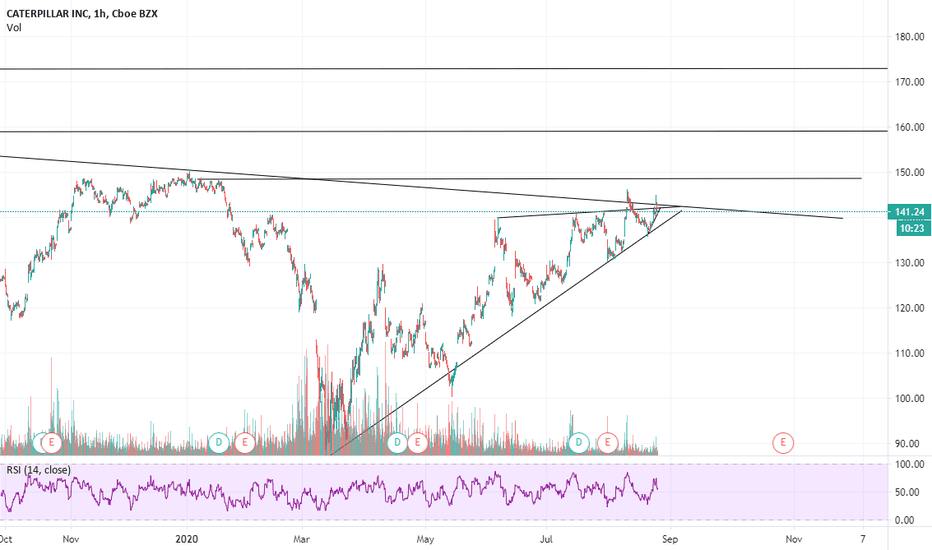

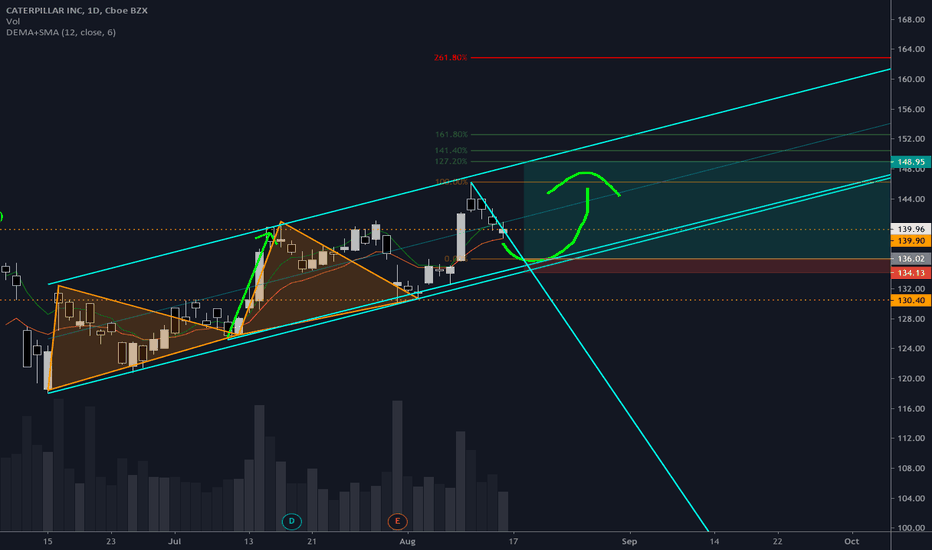

Cup and HandleFell under b/o for now HL= handle low

Do not like the narrowing channel?? Or is it a rising wedge? Dunno Long with a stop.not gonna say where/depends on how long you want to hang etc

Strong S at 140ish and 136ish

Short interest is low

It broke out and hit 151.2 but did not hold on. Market has been tough though.

Old high of 173.24 where R may occur.

Feels like a pull back is coming..but who knows? LOL

Not a recommendation

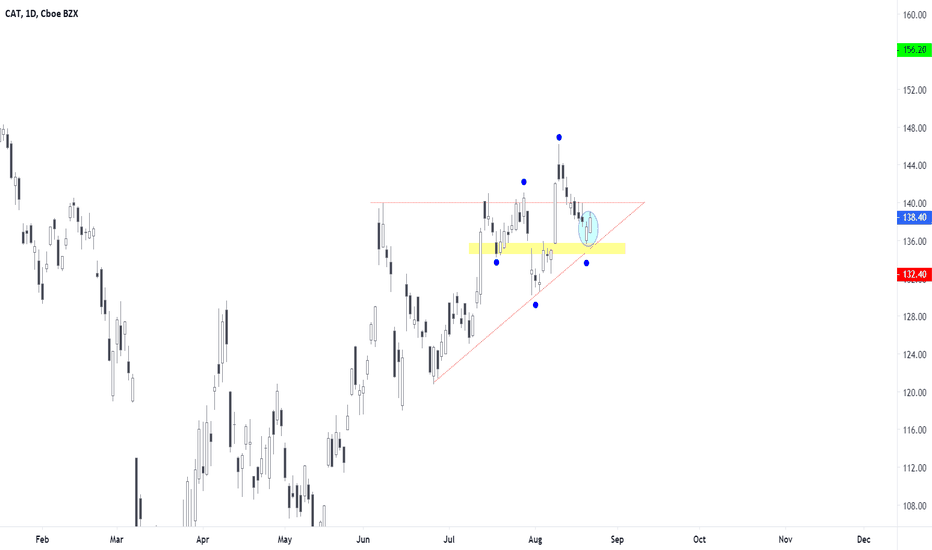

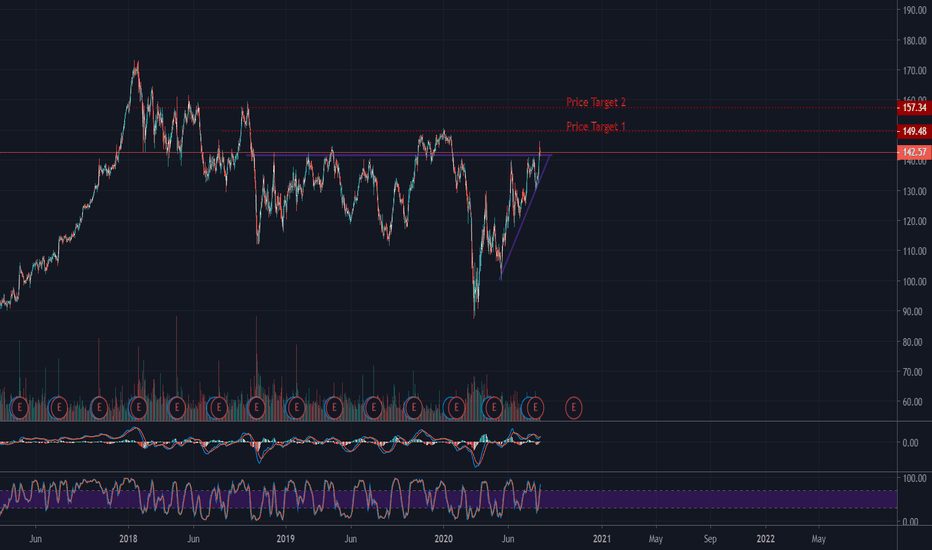

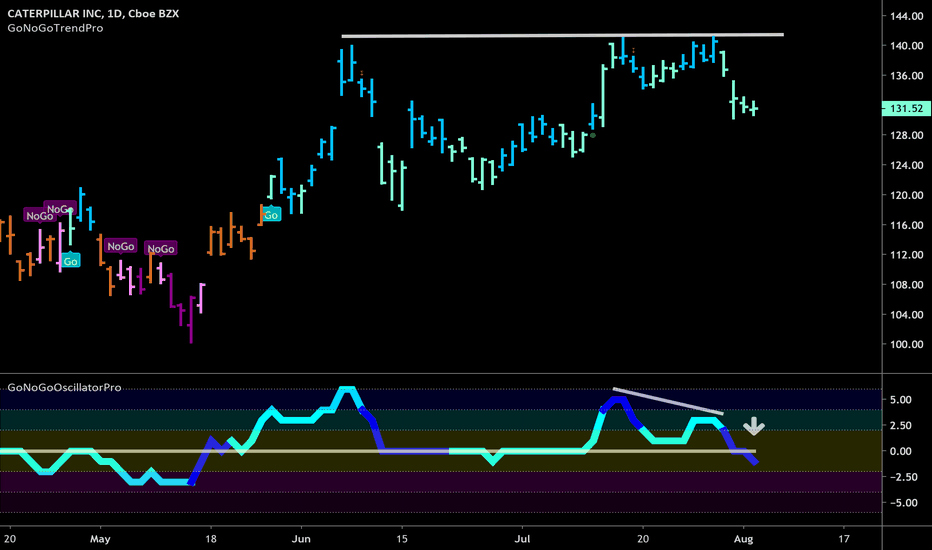

Troubled waters ahead for Caterpillar?The GoNoGo Chart of Caterpillar Inc, is an interesting one. The trend is a “Go”, but is experiencing some signs of weakness.

Having failed at resistance around $140, the GoNoGo Trend is painting the paler bars of a slightly less *bullish environment.

In the GoNoGo Oscillator panel, we see that there has been *bearish divergence and that now the oscillator is breaking below zero accompanied by heavy volume.

We’ll be keeping an eye on CAT to see if it can maintain its “Go” trend.

What are the GoNoGo Indicators?

The GoNoGo Trend indicator blends traditional trend concepts to color price action according to the strength of its trend. The colors range from *bright blue (strongly *bullish) to dark *purple (strongly *bearish)

The GoNoGo Oscillator blends traditional *momentum concepts to demonstrate the velocity of price action. The oscillator ranges from -6 (extremely *oversold) to +6 (extremely *overbought)