CAT trade ideas

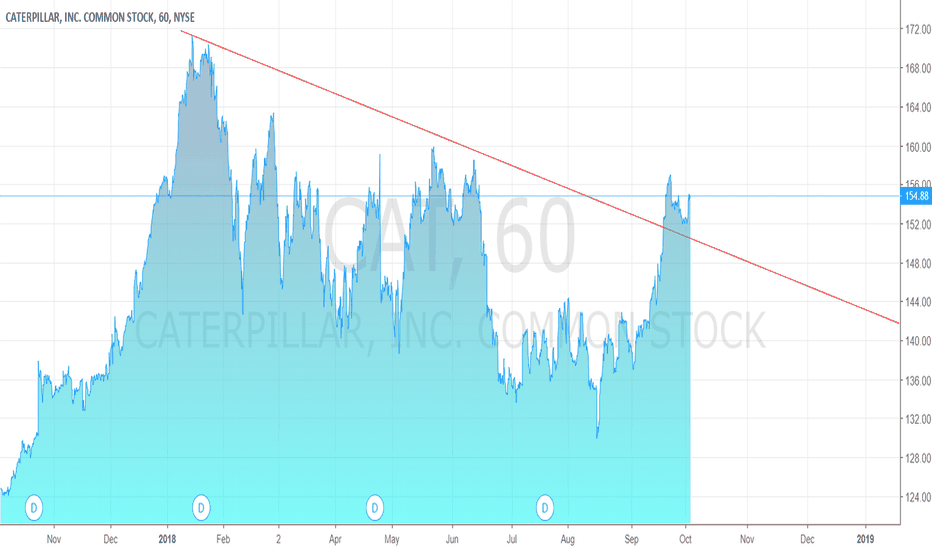

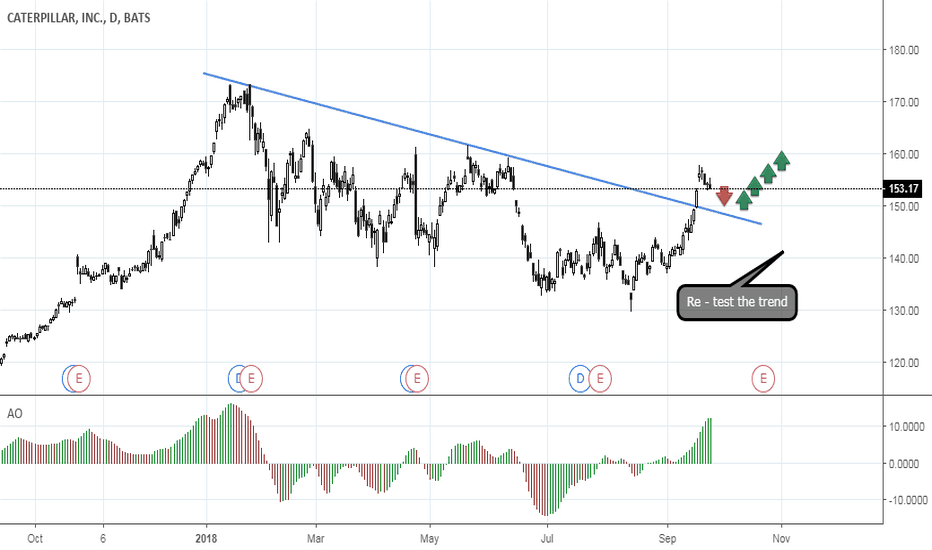

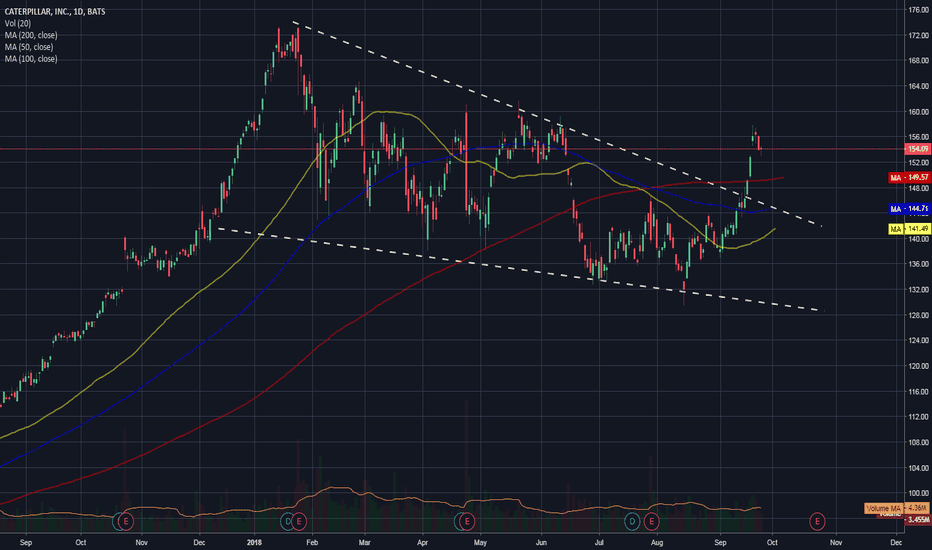

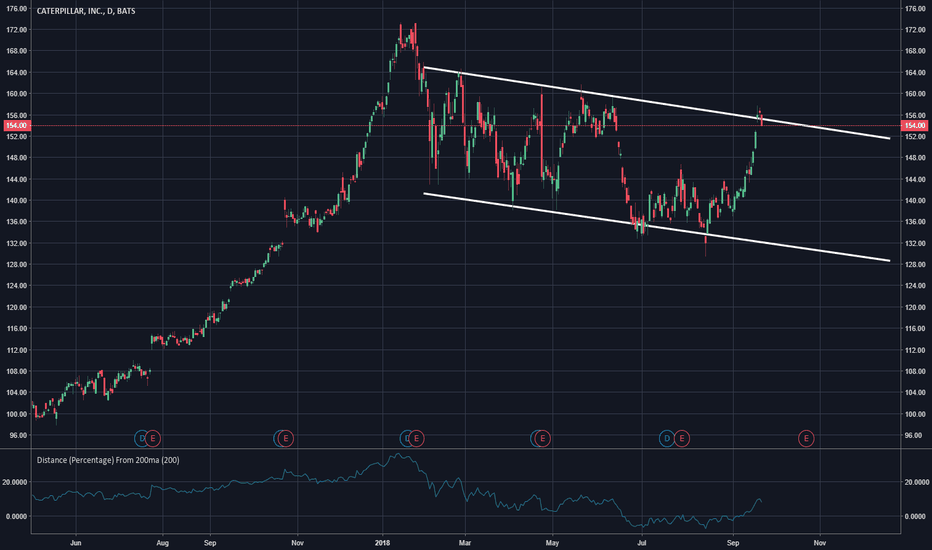

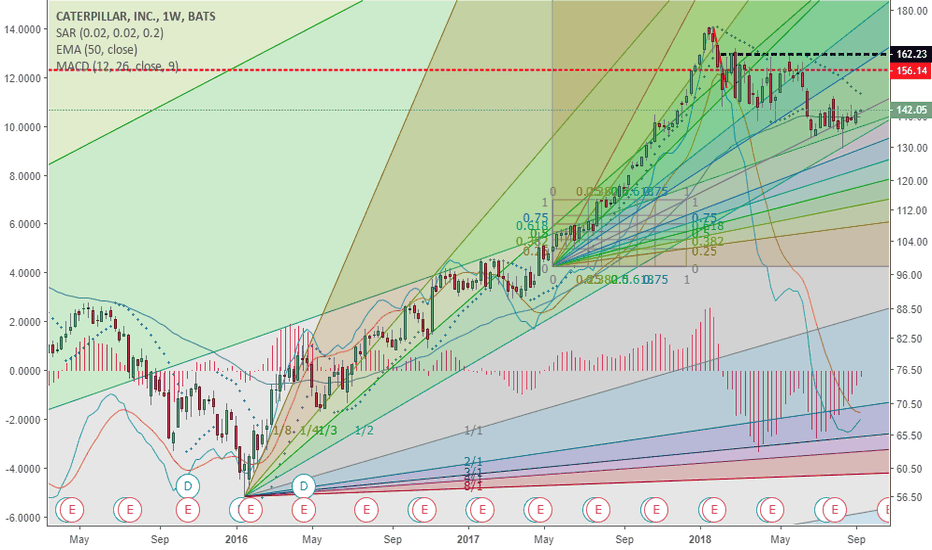

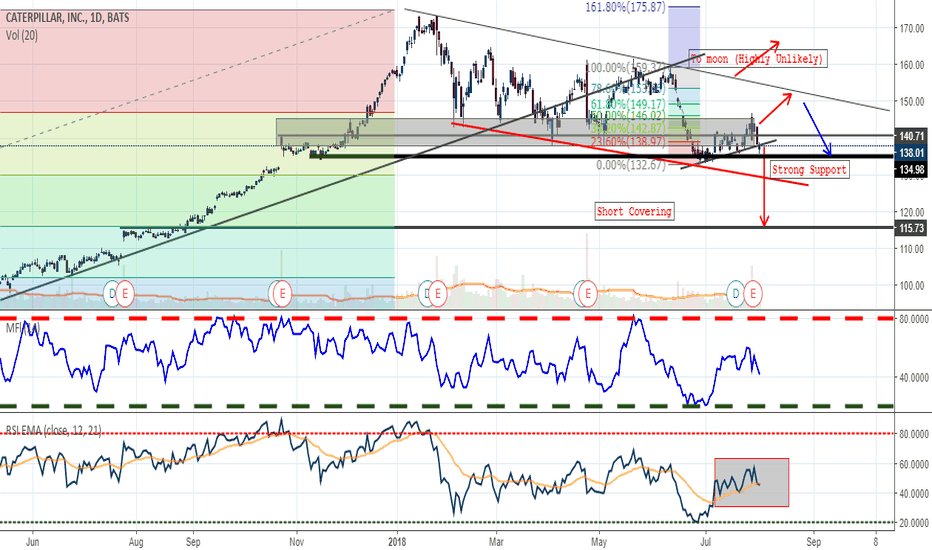

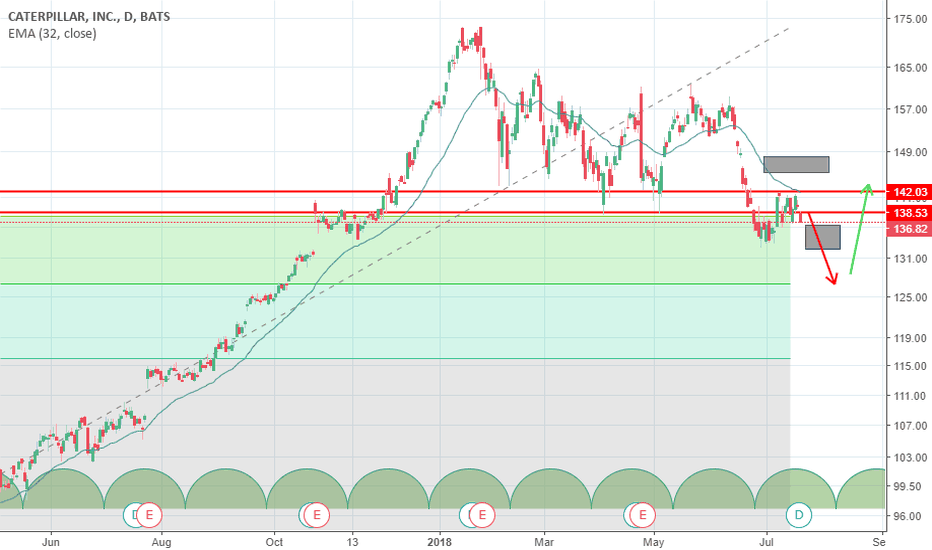

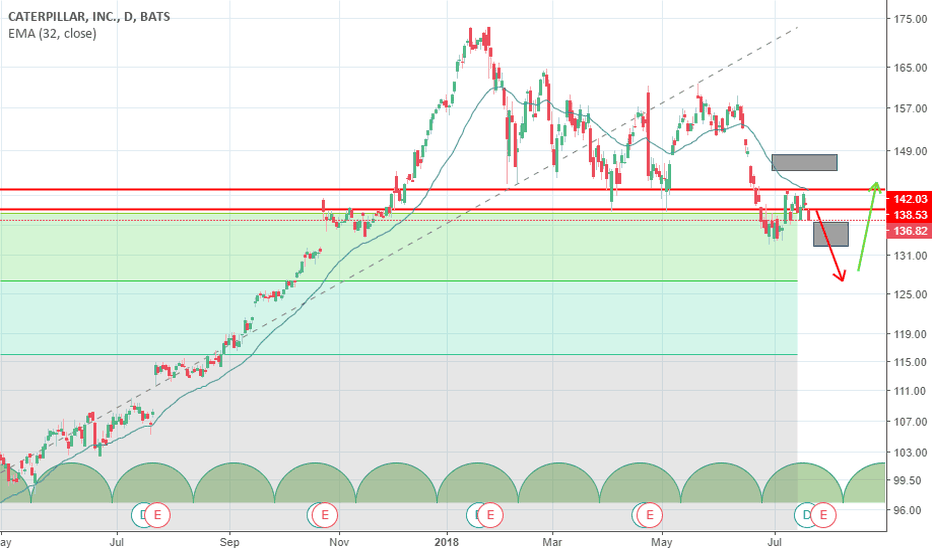

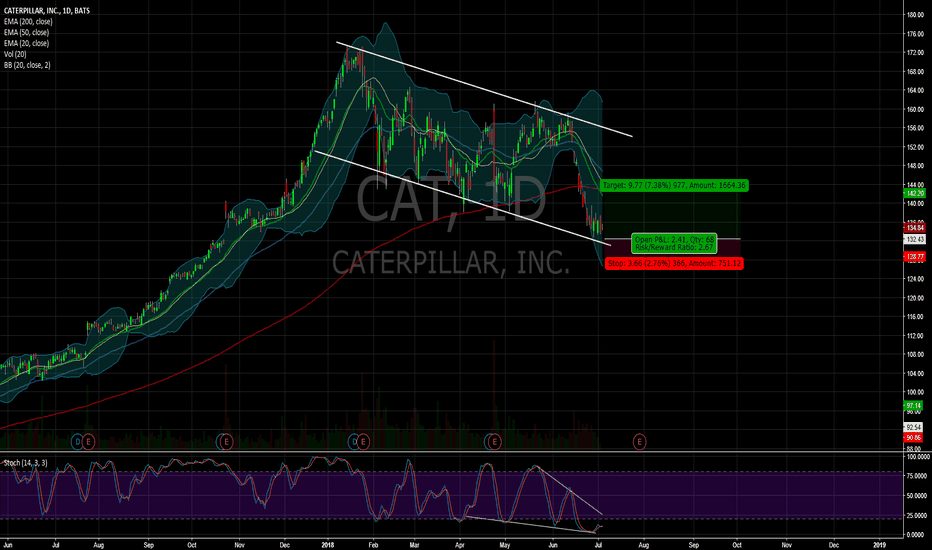

CAT at upper resistance - flag breakout or drop?CAT is testing the upper resistance of it's flag-like pattern.

Potential next moves - continuation of the bullish rise from earlier in the year as the flag pattern ends..... or a fall back into the channel.

With trade fears and steel tariffs, the latter is more likely at this time

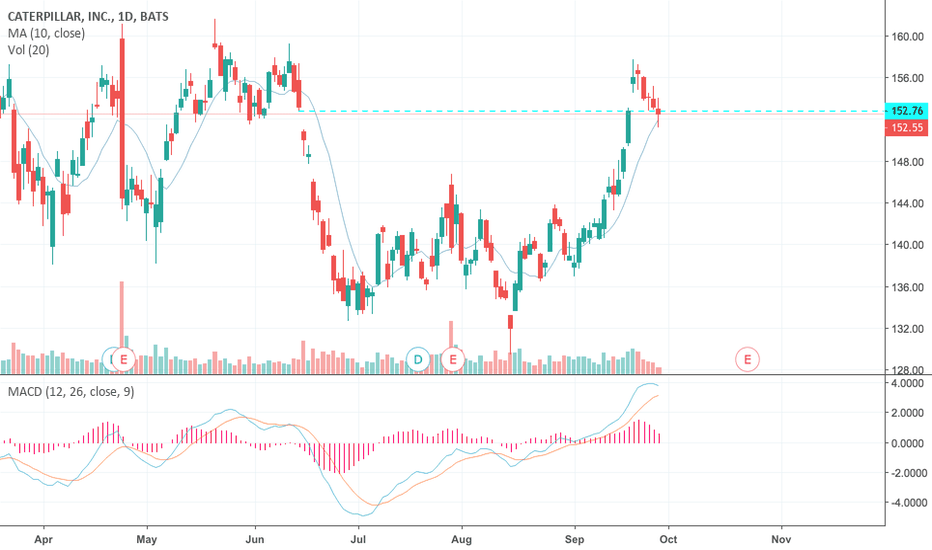

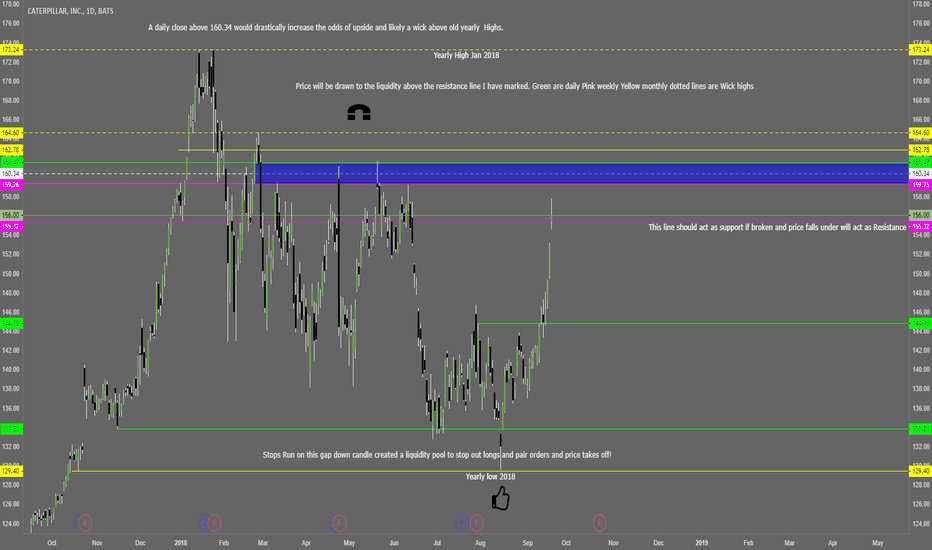

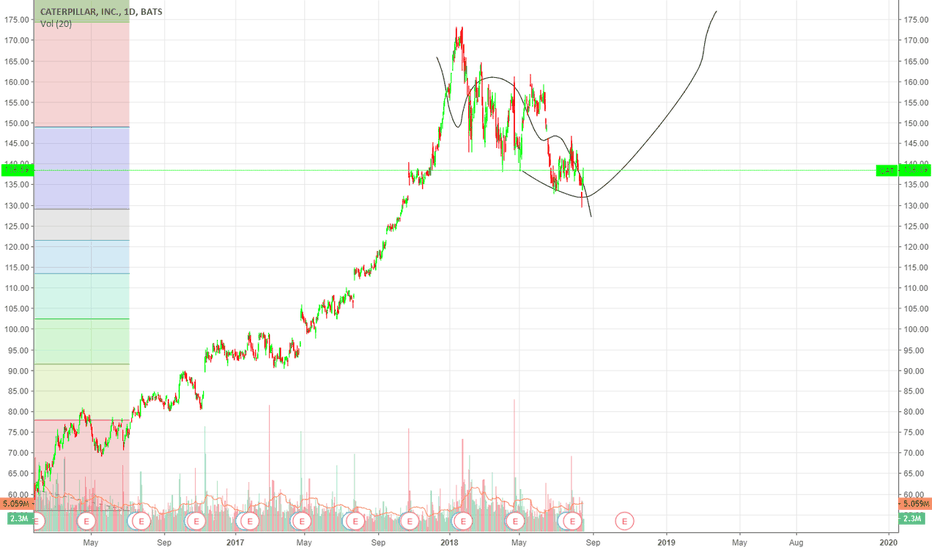

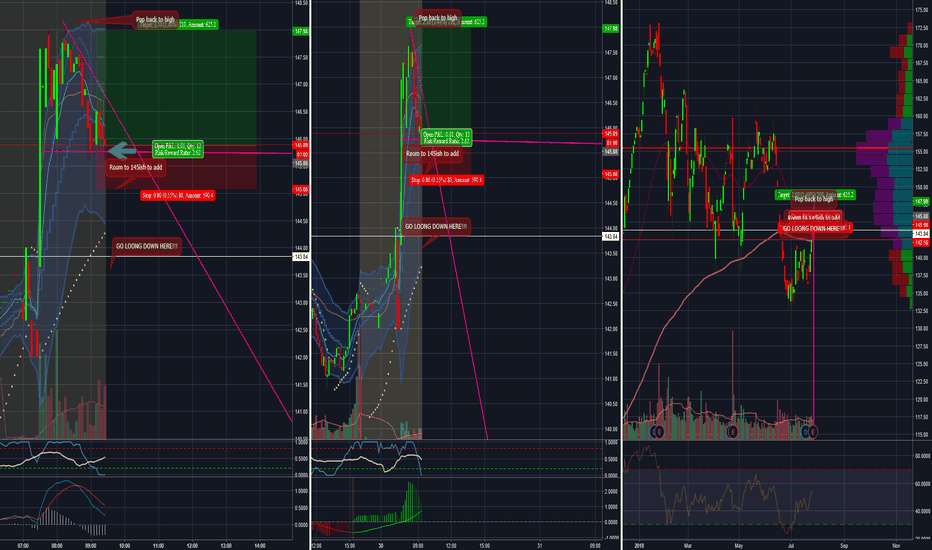

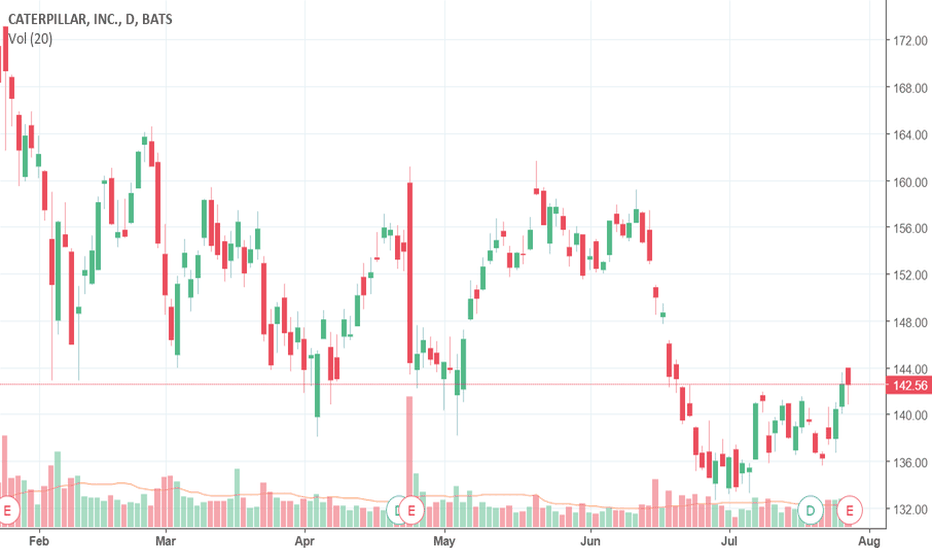

$CAT Earnings Beat $CAT has earnings beat stock gapping up this morning. Would go long a few for a pop at open short squeeze give it room to 145ish to add and look for a push back towards highs. I think this will pop and then gap fill back down possibly to 144 or under. I would pick some up and look for a slow move back to highs in this area. CAT

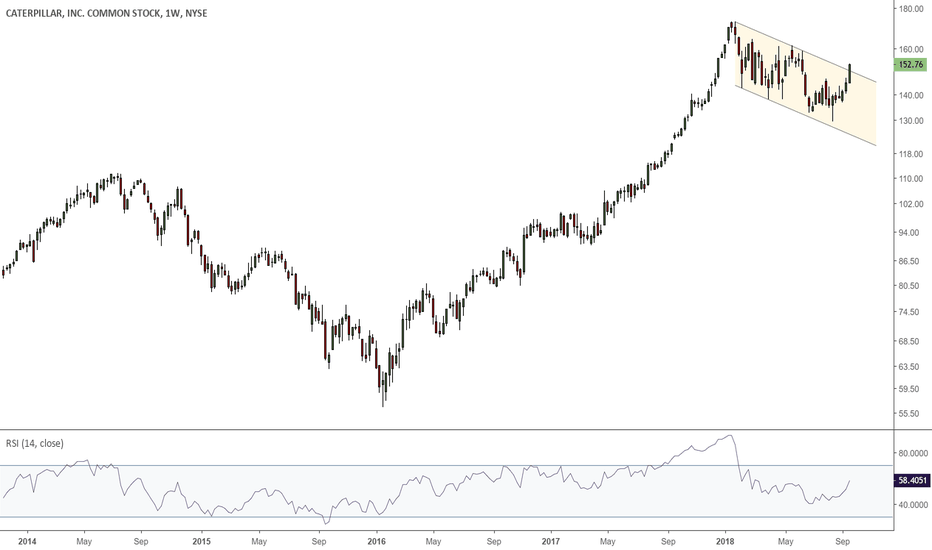

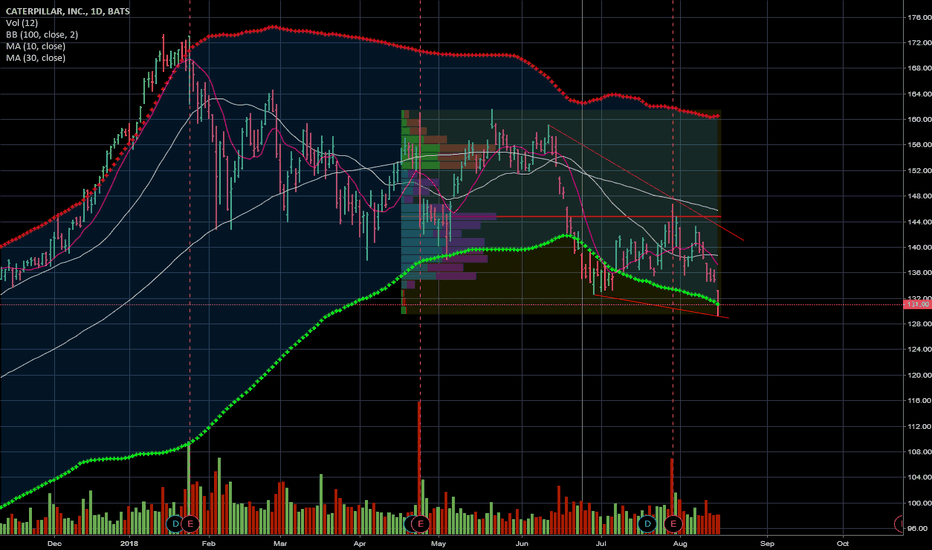

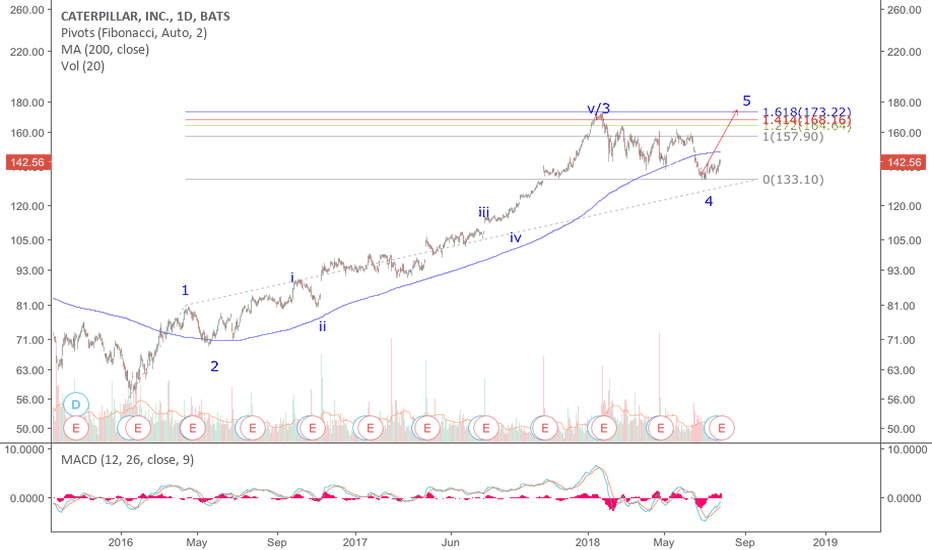

Caterpillar (CAT) earnings preview: strong double-digit growthCaterpillar has carefully assembled its brand and product portfolio over the past 100 years to create the largest construction and mining equipment manufacturer in the world. In a push to realize research and development and production efficiencies, Caterpillar has become the largest or second-largest manufacturer of virtually every product it makes while generating a double-digit return on invested capital.

While the company has entered new geographies organically, acquisitions have helped it create a robust product line. Typically, larger and higher-priced equipment is completely designed and manufactured in-house at Caterpillar, while smaller and lower-priced equipment is largely assembled from premanufactured components from various suppliers. Over the past decade, Caterpillar has increased its adoption of lean manufacturing principles, particularly with new hires from the automotive industry.

Caterpillar increased manufacturing segment revenue 33% to $12.2 billion compared with the prior year’s quarter. The industry has been in growth mode thanks to a combination of U.S. tax reform, strong economic activity, and positive commodity price trends. Caterpillar’s resource industries and energy and transportation segments clearly demonstrate this point, as both segments increased revenue 32% to $2.2 billion, and 27% to $4.3 billion, respectively.

www.finstead.com

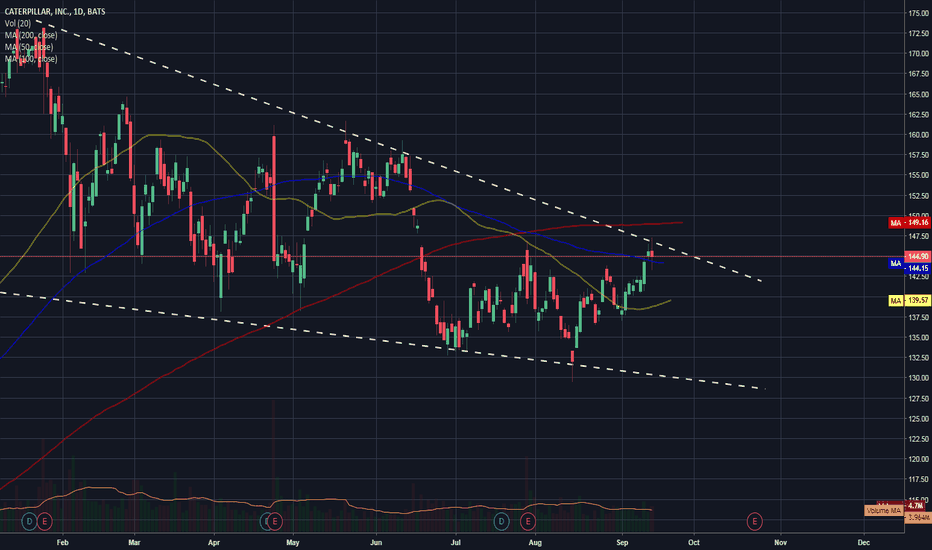

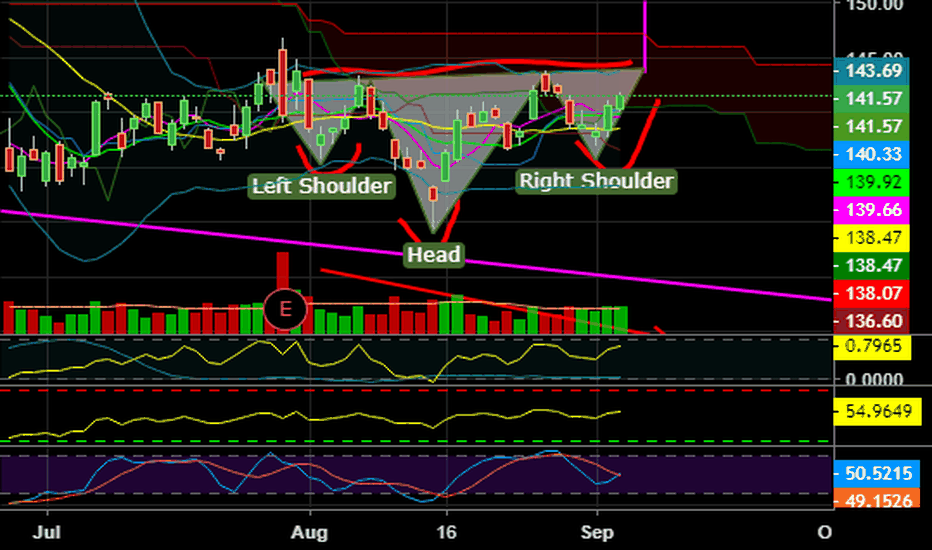

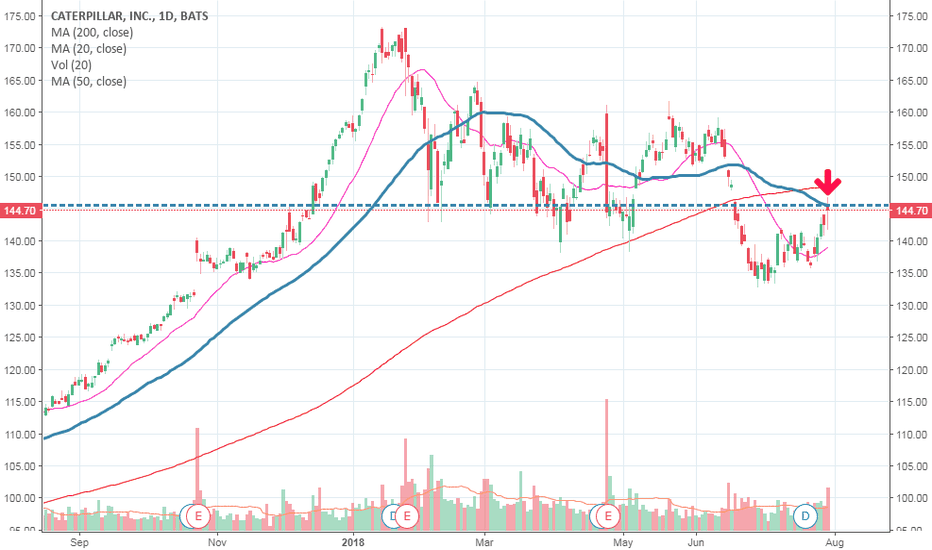

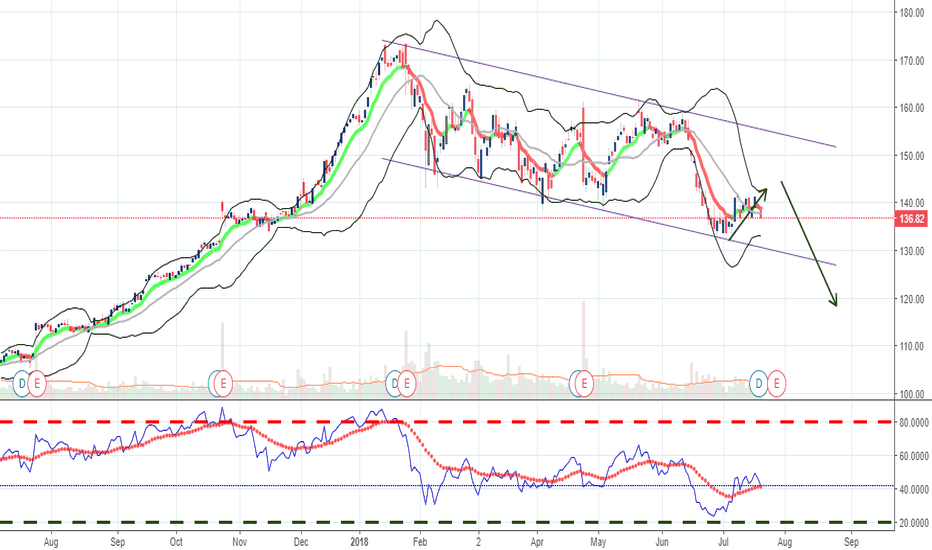

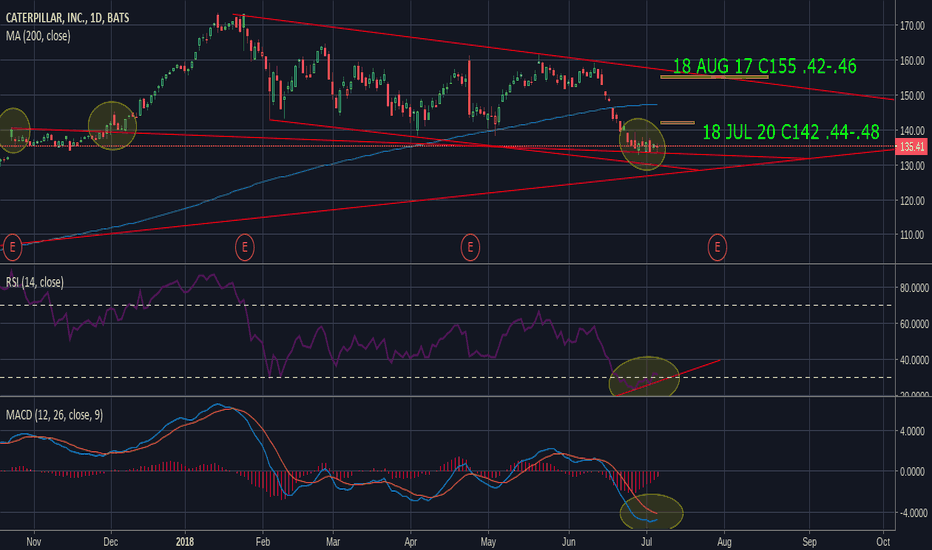

CAT looks ready to make a move into ERTwo different options for trading on chart. RSI in bullish diversion, MACD curling upward, base building at an area of support. Could head back up toward 200MA at 147 area and toward filling two gaps left above. Run could come into ER on July 31, options on chart depend on risk taste, whether or not you want to play the ER. Good luck to all.