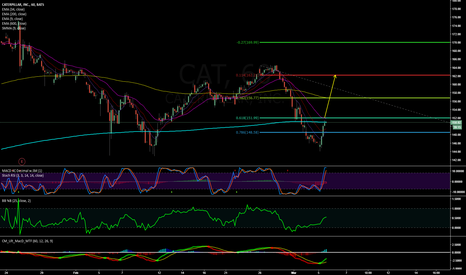

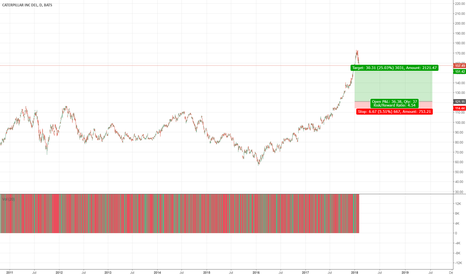

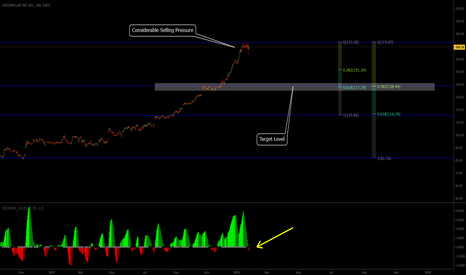

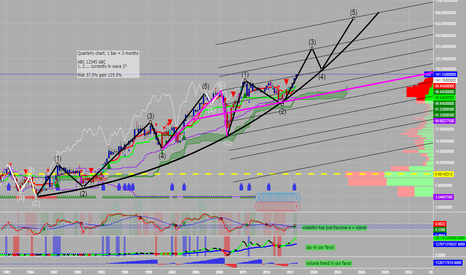

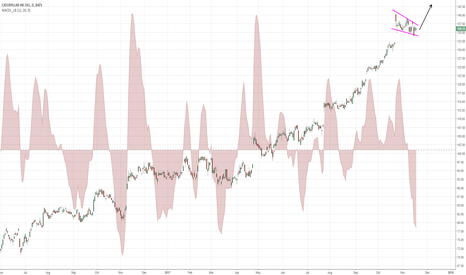

LONG TERM SHORT ON CATShort from 155 will continue to sell up to 175. Will cut at 180.

- Z score 2.33 that shows the company is in some distress.

- In the construction industry growth with slow- down in the back half of 2018 due to in the impact of seasonal sales in China. 2018 material costs inflation will affect their margin.

- Period costs with increase due to labour inflation and targeted investments in growth initiatives including expanded services and offerings.

- CAT is currently facing investigation by US government that has included search warrant activity at three locations. Potential fines and penalties have not been announced by the government. If it is found guilty, it will be a blow to its reputation and share price.

- During 2016, the company had $1.09bn of restructuring costs. In 2017, the restructuring costs were $1.256bn. Forecasts predict a $400mn restructuring costs for 2018.

- Caterpillar has benefited from natural disasters this year, but as housing starts to eventually slow down and commercial construction may slow down, it will play a significant role in caterpillars results. If these activities were to decrease, demand for CATs products, may be significantly impacted.

- The company is experiencing problems in regard to the supply chain to ramp production.

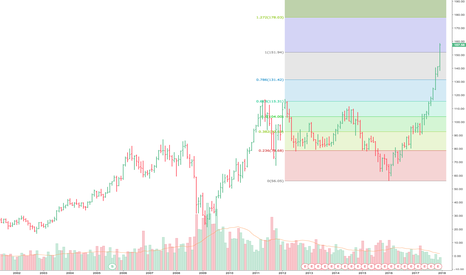

- $1.5bn Short interest

NeroTree Capital gives CAT a rating of sell with a price target of 120 over the next 52w.

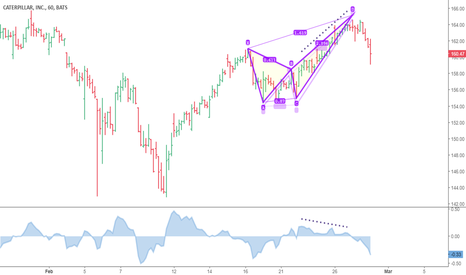

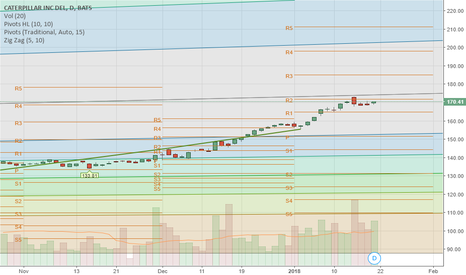

CAT trade ideas

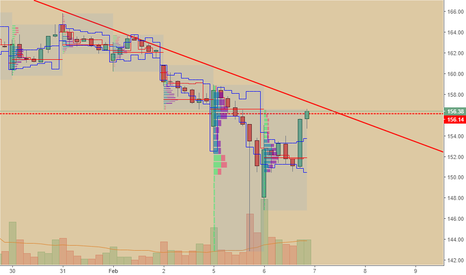

Post-Earnings FadeCAT jammed higher into earnings. And the results released were pretty darn good. Massive beats. Yet this is one of those times where the pre-earnings run priced in good numbers. Given the rejection after the earnings event, the stock is seeing some pretty good weakness short term. Look for retracements and start selling put spreads into them.

CAT is a little loftyI believe this needs more time to digest the move. AA earnings this week tells us one thing for sure. There is a disconnect from actual demand versus expectations. BA took it on the chin for that reason. Now expectations are huge for CAT. I for one have watched the heavy equipment for sale on craigslist and others. I've never seen so much used equipment for sale. Does that mean everyone is going new? I don't know. RSI is above 80 on this hot stock. I'd be careful to the long side for the near term.