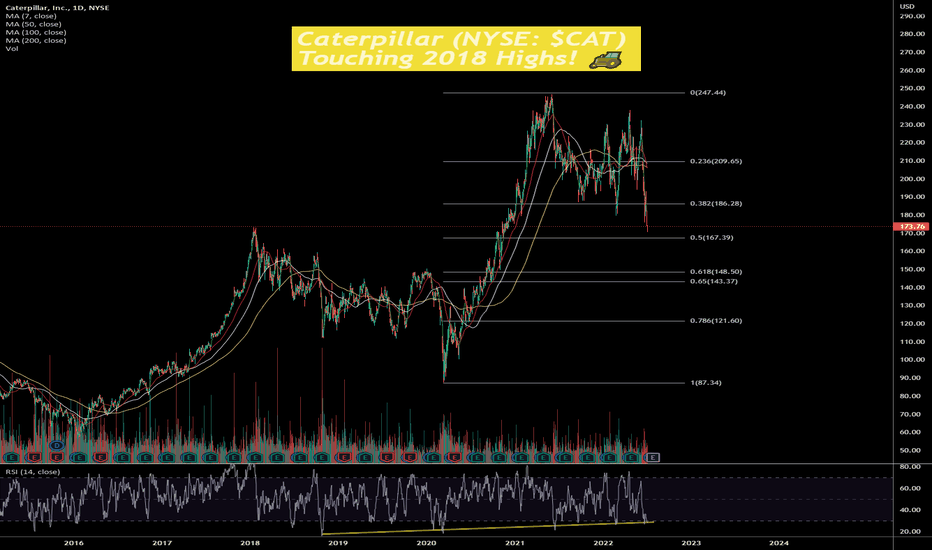

Caterpillar (NYSE: $CAT) Touching 2018 Highs! 🚜Caterpillar Inc. manufactures and sells construction and mining equipment, diesel and natural gas engines, and industrial gas turbines worldwide. Its Construction Industries segment offers asphalt pavers, backhoe loaders, compactors, cold planers, compact track and multi-terrain loaders, excavators, motorgraders, pipelayers, road reclaimers, site prep tractors, skid steer loaders, telehandlers, and utility vehicles; mini, small, medium, and large excavators; compact, small, and medium wheel loaders; track-type tractors and loaders; and wheel excavators. The Resource Industries segment provides electric rope shovels, draglines, hydraulic shovels, rotary drills, hard rock vehicles, track-type tractors, mining trucks, longwall miners, wheel loaders, off-highway trucks, articulated trucks, wheel tractor scrapers, wheel dozers, fleet management, landfill compactors, soil compactors, machinery components, autonomous ready vehicles and solutions, select work tools, and safety services and mining performance solutions. The Energy & Transportation segment offers reciprocating engines, generator sets, integrated systems and solutions, turbines and turbine-related services, remanufactured reciprocating engines and components, centrifugal gas compressors, diesel-electric locomotives and components, and other rail-related products and services for marine, oil and gas, industrial, and electric power generation sectors. The company's Financial Products segment provides operating and finance leases, installment sale contracts, working capital loans, and wholesale financing plans; and insurance and risk management products for vehicles, power generation facilities, and marine vessels. The All Other operating segment manufactures filters and fluids, undercarriage, ground engaging tools, etc. The company was formerly known as Caterpillar Tractor Co. and changed its name to Caterpillar Inc. in 1986. The company was founded in 1925 and is headquartered in Deerfield, Illinois.

CAT trade ideas

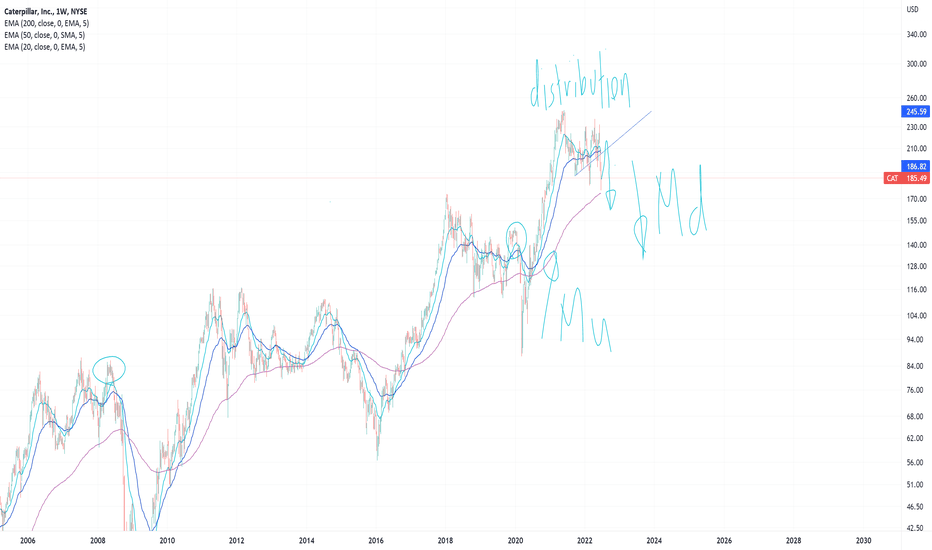

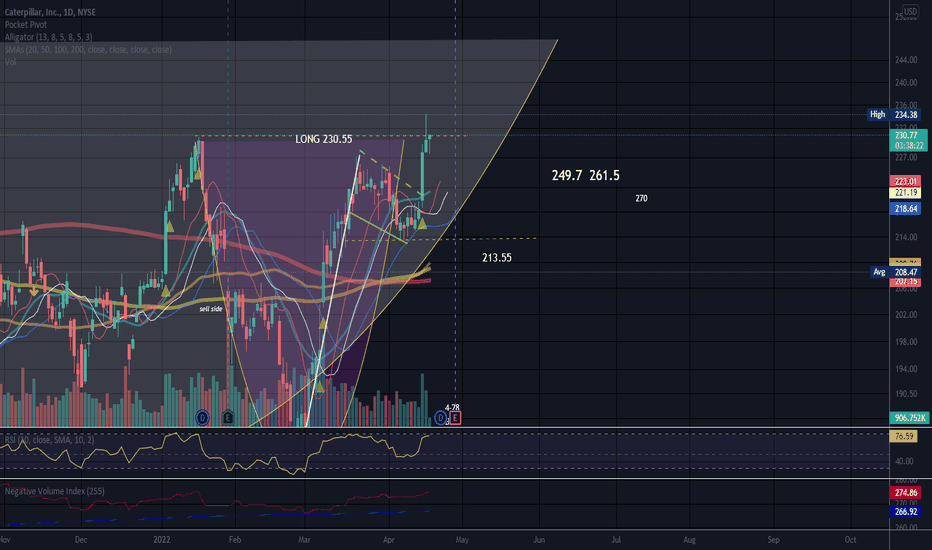

DEAT CAT BOUNCEHey guys,

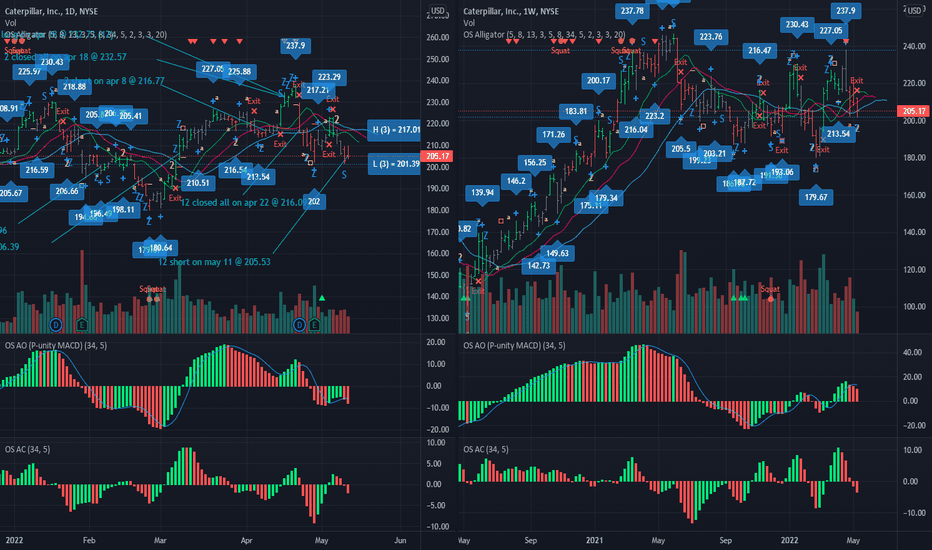

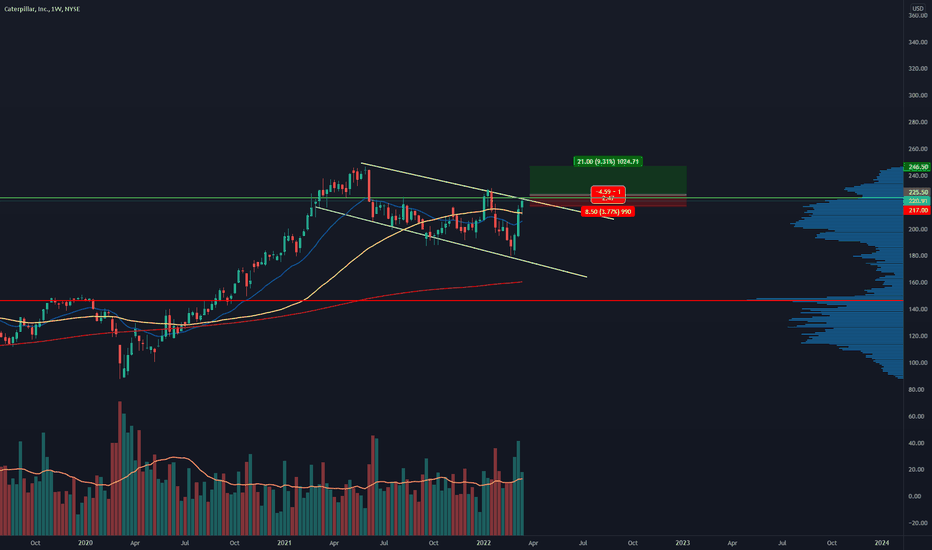

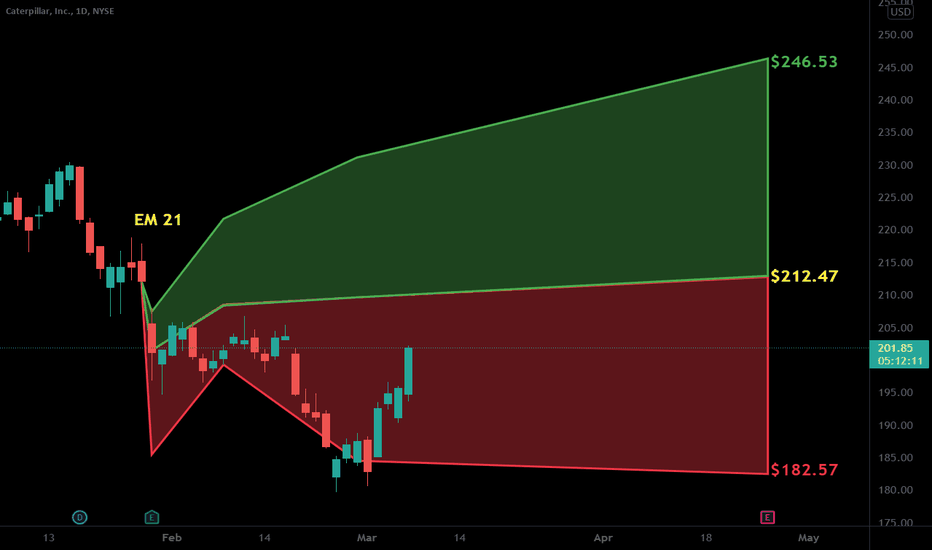

I went back in the chart and circled what I considered to be similar situations to where we're at right now. I think over the next month, there is an extremely high chance CAT has a fakeout rally that could very well reach $225/share. That being said, I don't expect it to breach ATH's, and I expect the rally to be an incredible shorting opportunity before a potentially violent markdown phase. The agriculture sector is still relatively high up, and when you look into it, it is fresh off of distribution and primed for a markdown(made obvious in names like DE, CF, and MOO). I am currently waiting on CAT to rally, hopefully up to $220-230/share before selling my position and flipping entirely short on the stock. I expect this stock to see the low $100's well before year-end.

Disclaimer: I was previously short CAT, and am currently long CAT at $180/share in anticipation of a dead CAT bounce(ha)

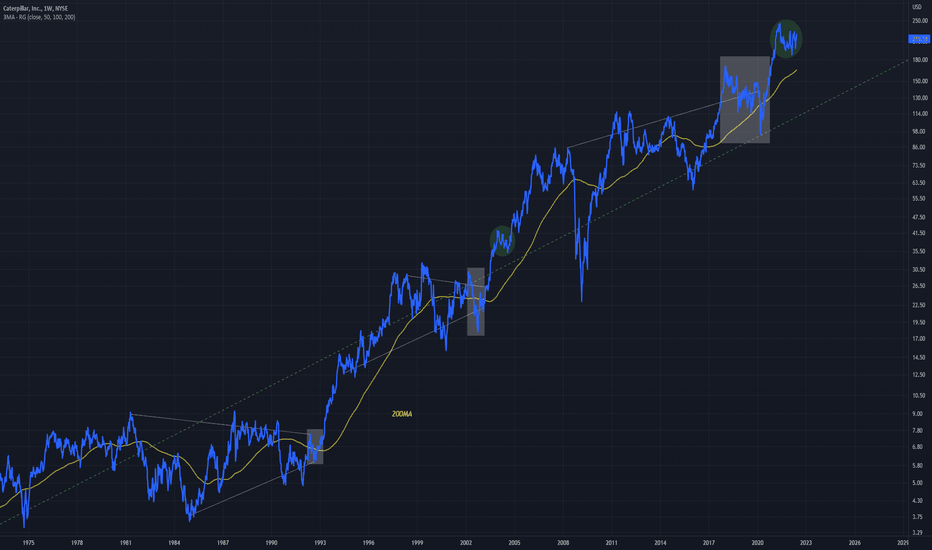

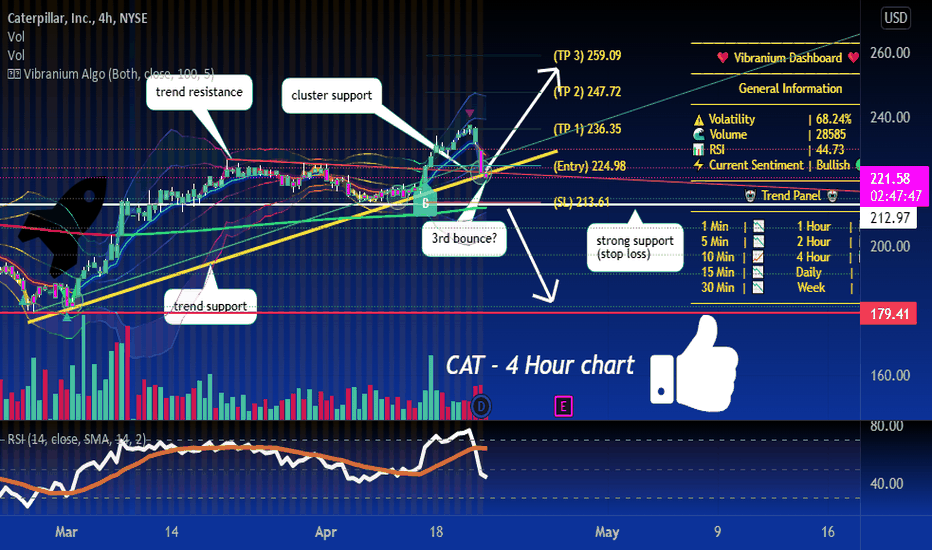

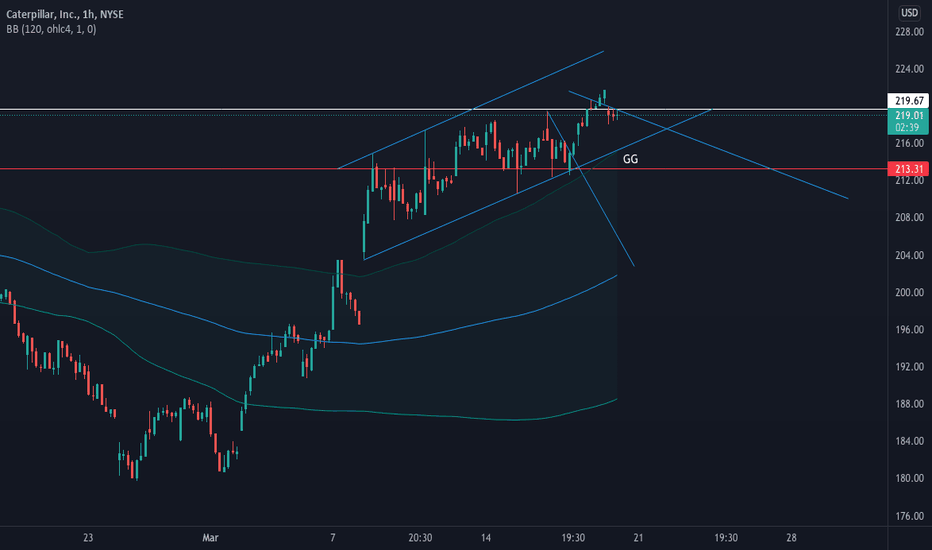

CAT - Bullish Above Major Trend Line Similar chart formations can be seen along this uptrend that has formed on CAT

The similarities become closer when you look at the white rectangles highlighted

This is the period before growth begins

The green circle furthers this, pinpointing where we are in a comparable price movement

CAT To Rise In Value?Good Day To The Investing World

Pretty much the only reason that CAT will rise in price is because of the unpredicted volatility. Since the value went sharp down, there will obviously be corrections on the stock. Meanwhile, if the price drops sharp, this may always be a big buy opportunity as it will correct itself straight after, giving you quick money. Also, we can see the Zachs Rating is giving us a #1 (Strong Buy).

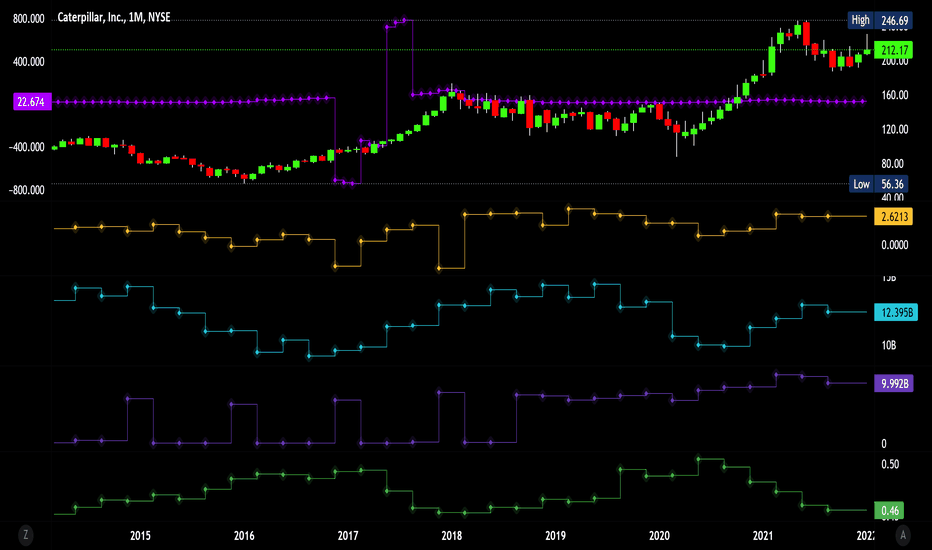

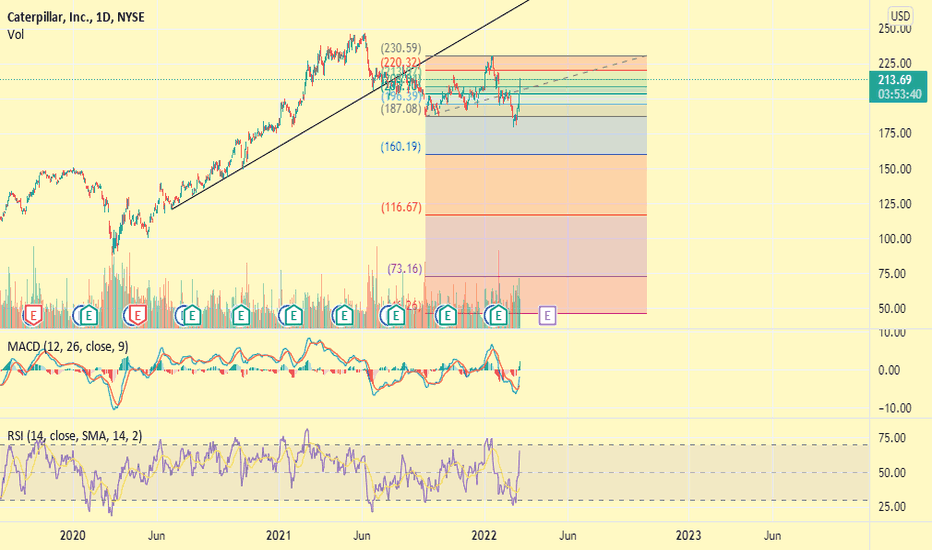

Fundamentals - Caterpillar earnings 1/28Caterpillar (CAT) earnings are tomorrow on 1/28 at 6:30am. Caterpillar (CAT) reported Q3 September 2021 earnings of $2.66 per share on revenue of $12.4 billion. The consensus earnings estimate was $2.26 per share on revenue of $12.6 billion. Revenue grew 25.5% on a year-over-year basis. As you can see from this Fundamental analysis, Caterpillar is at a fair price right now with its P/E around average, based on the past 7 years.

Q4 December 2021 Consensus:

EPS = $2.22

Revenue = $13.21B

Fundamentals:

P/E = 22.67

EPS = $2.62

Revenue = $12.39B

Cash = $9.99B

D/A = .46

Div/Yld = 1.997

52 week high = $246.69

52 week low = $179.34

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

tradingview.sweetlogin.com

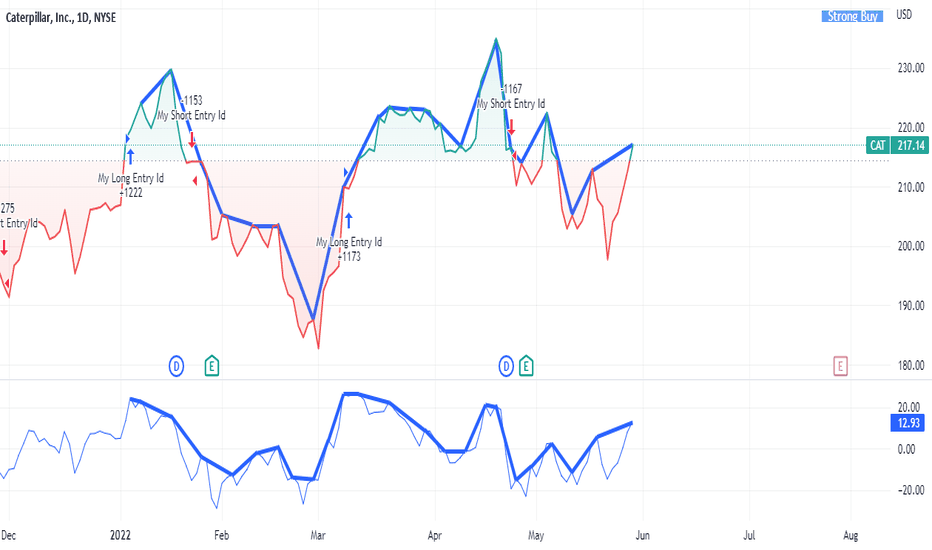

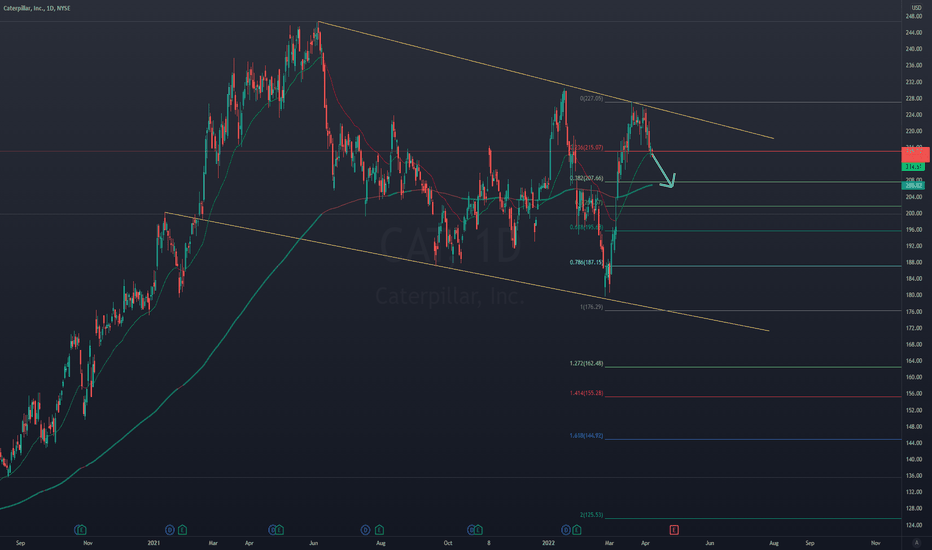

Short CAT @ 205.53 Fractal BreakoutCAT crossed downward the last daily fractal of 202 on may 10. One day after, there is still a red zone bar, bearish divergent that provides an improved opportunity to enter.

Williams theory dictates that a Blue Light special would be entered after crossing the las lowest low, this would mean tomorrow (may 12) crossing below 203. 59 (todays low).

Im shorting today however, at 205.53. First confirmation would be crossing below 203.59 and then below 202 again.

Stop loss is price closing above the Balance Line (red). Target is whenever the trend ends, which is also signaled by price closing above the Balance Line.

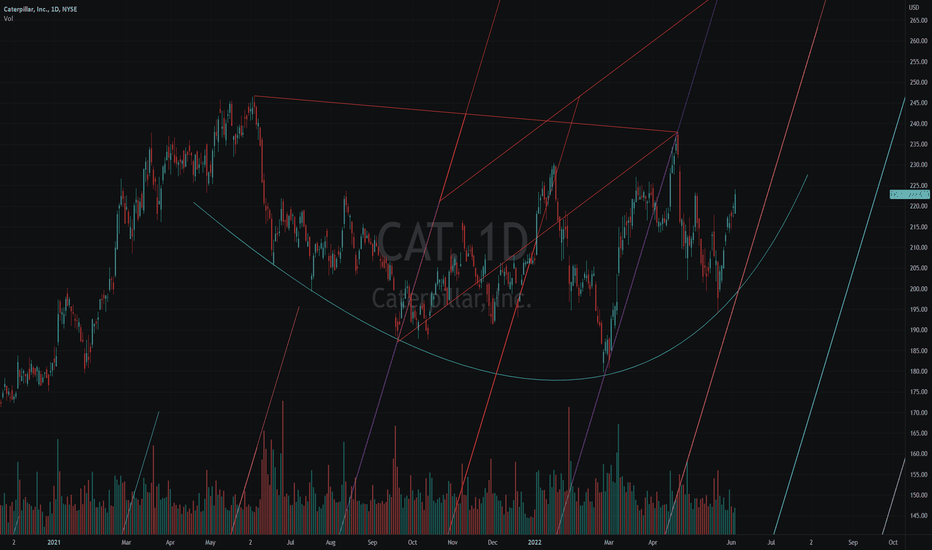

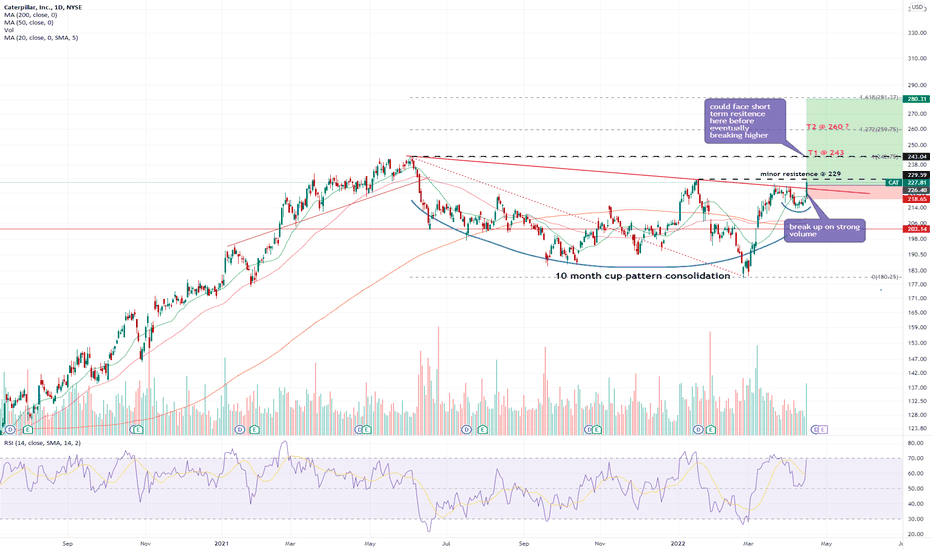

Cup and Handle/ Earnings 4-28 BMOAlso see a bull flag and price has broken upper trendline.

Resistance noted at buy side of cup. The other side, the sell side, is a high so it is not unusual to encounter resistance there.

There is a larger cup and handle with a break of 246.79 which is a bit above the high of this cup.

CAT has 8 earnings misses out of the last 19 reports. Some of the misses are on EPS, but majority are a miss on revenue. Guidance was not on this report I read, and can be crucial at earnings.

There has been significant insider selling in the last 3 months. Just FYI. Negative volume is high so large money is buying on down days. Cat does make agriculture equipment as part of it's business which has been a hot item since the supply lines were interrupted. Folks have to eat (o:

I plan to watch as sometimes things can get sticky in the days leading up to earnings. Long with a clear break of long entry level or possibly a fall to a strong level of support.

No recommendation

CAT - more upsideCAT consolidated for 10 months forming a cup like pattern. There was a minor handle before we see a strong break up last Thurs on strong volume.

The odds are good that it has some room to go , though we are likely to face resistence and some consolidation @ 243. If it can clear this level, then the next targt is 260.

Disclaimer: Just my 2 cents and not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance and don't forget that money management is important! Cheers.

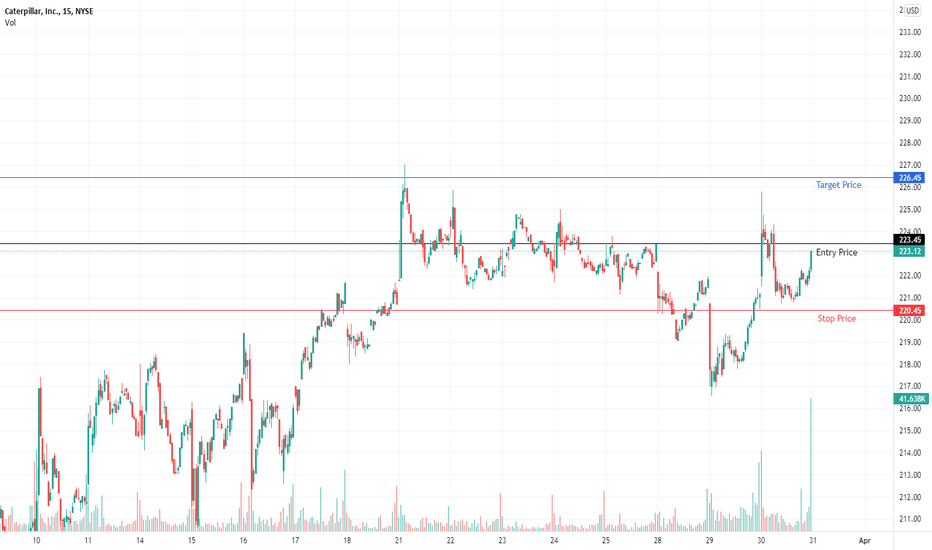

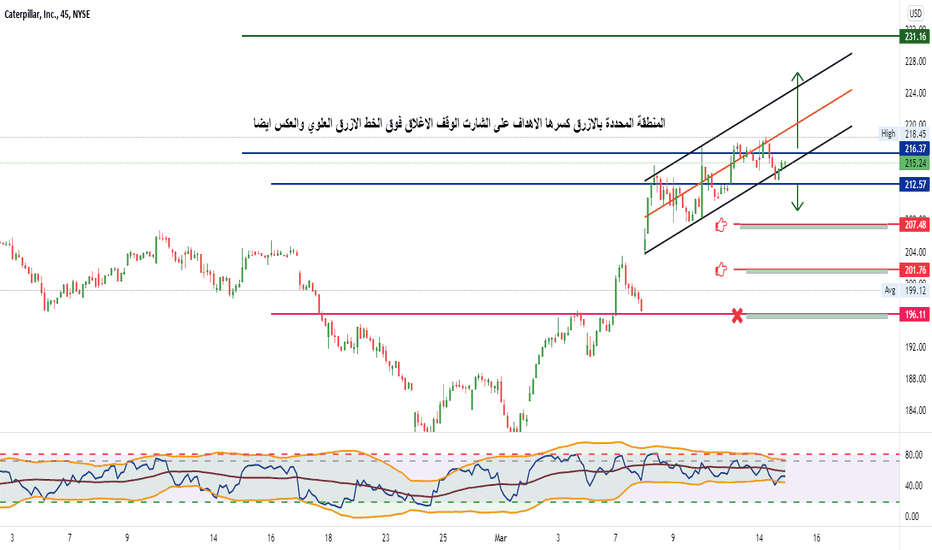

Cat ShortCondition: Ranging/trending. Overly ambitious sentiment that CAT will rebuild Ukraine.

Entry: Wait until after earnings. Test of trend, potentially an overbought daily stoch.

Stop: 0.5% above swing high from 18th Jan.

Target: 2:1 R minimum/ Early Feb consolidation/historic midline.

Downtrend noted since May 21

Current (general) preferred entry ticker conditions and entry signals are either.

a) Reversion to mean from overextension, providing there has been evident support from historical price action and/or a bullish/bearish pintail or rejection evident by an engulfing candle immediately after the supposed support/rejection.

b) Oscillators (Daily/Weekly Stoch as well as the Average Sentiment Oscillator) all providing confluence with a trend line/support level.

Maintain 2:1 RR, use retracements as much as possible. If over extended and sufficient confluence and I'm at my computer, consider a market order.

Establish confluence of support/resistance, trend, oscillators, congruent candles (pintail or engulfing reversal).

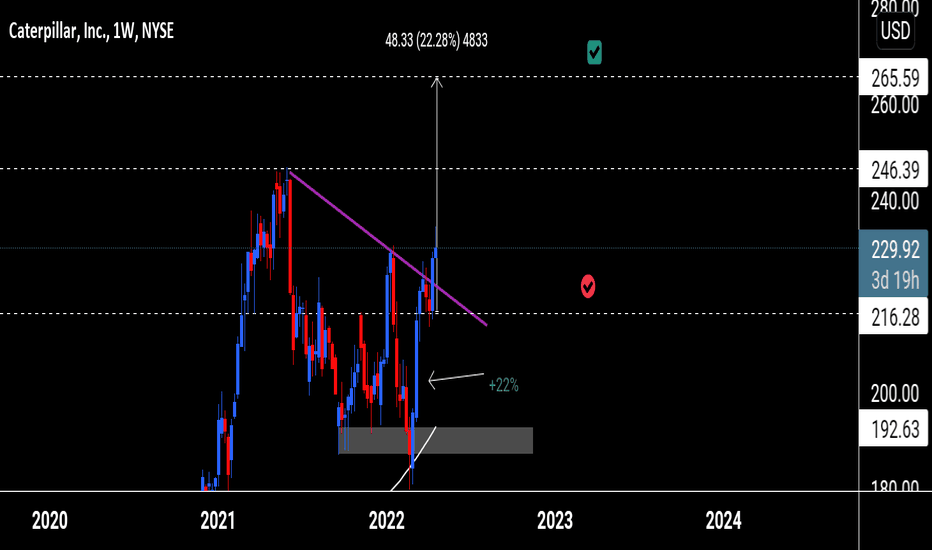

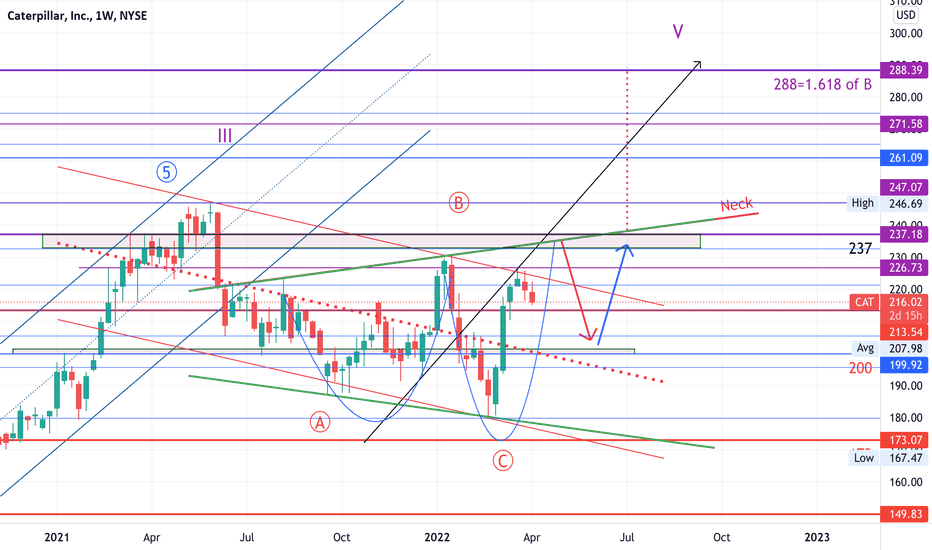

CAT ,a gauge of economy, may retrace to 200 for a RS; TP=288CAT may be finishing the head of a head & shoulder pattern up to the 237 Resistance zone( also upper side of the green Megaphone). Then it may go down to 200 to make the RS this coming May. Measured target of this H&S will be 288 which is also 1.618 Fibo of the whole wave IV.

179.67 may already be the low of wave IV Megaphone pattern. The final wave V might be in 2023 where a BIG ABC correction may come to reset the market. (Recent yield curve inversion signals a recession within 1 or 2 years)

Not trading advice

CAT and DE: SHORT OF THE DAYCAT and DE are two of those companies that have been trading like TECH companies over the last year and they have significant moves to the downside coming over the next two weeks. Systematically, you can see the significant to then the consolidation phase. Look for a lot of selling over the next few weeks from these two stocks. I have a PT of 160 for CAT and 322 for DE.

Also, there has been insider selling from both of these companies. Most notably - Rajesh Kalathur, President, JD Financial & CIO, on March 07, 2022, sold 32,391 shares in Deere (DE) for $12,956,400.

Not financial advice