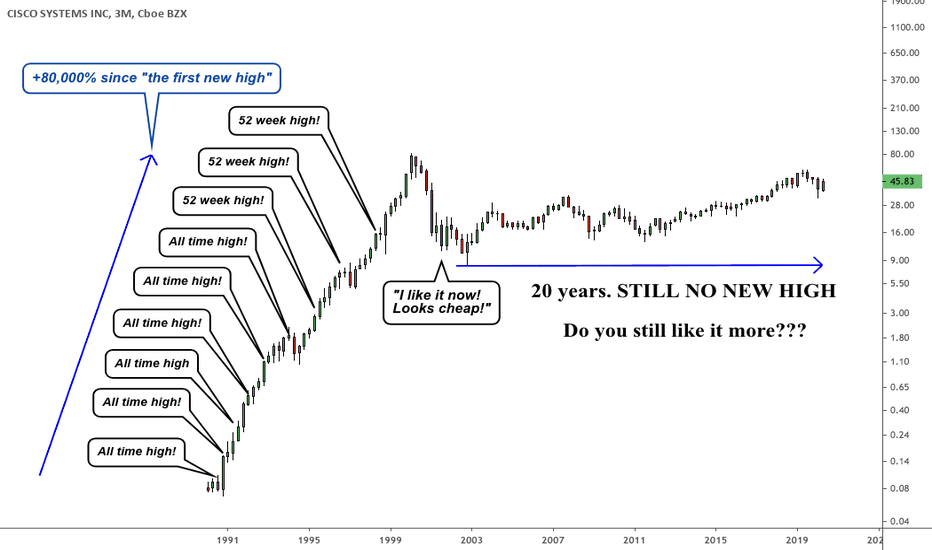

When friends ask what stock to buy, "but it's an all time high!"A lot of my friends ask me what they should buy. I usually say something like, I like XYZ right now. They don't ask why. They don't try to understand the context or the time frame. They simply respond with, but it's at an all time high. Then I shake my head at how everyone wants a discount + outsized returns.

Quality is at a premium for a reason.

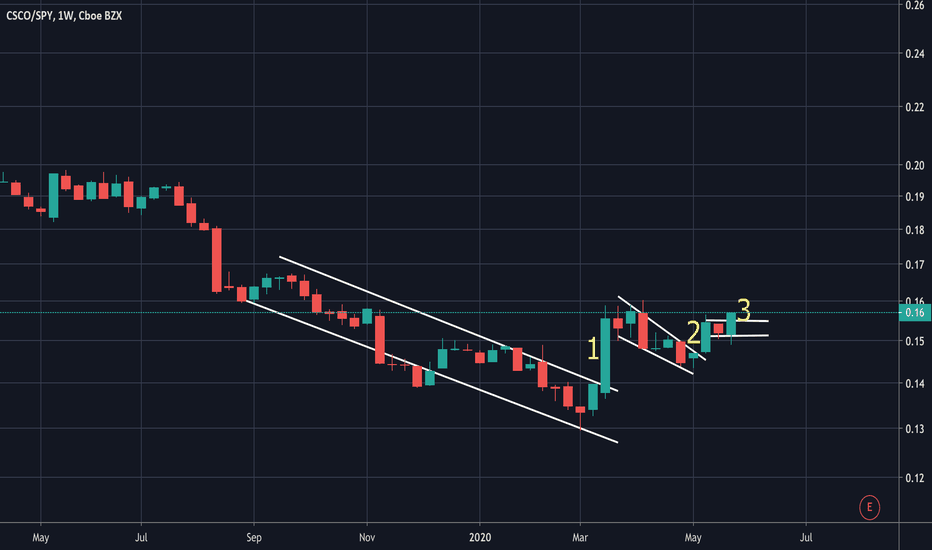

Not all of my preferred stocks are always at all time highs, but they are almost always proving to be market leaders in their sector OR they are positioned to be a major turnaround story.

I used to bottom fish a lot. Buying historical low points in stocks, like energy stocks in 2016 (when everyone thought oil bottomed) or even recently in March (it worked, but so did ALL bottom fishing opportunities, including the bankrupt stocks).

Buying stocks at a discount often comes with a lot of headache. I am not saying it does not work. You need the right market conditions for it. Simple as that. Valuation as a fundamental strategy has not worked very well in the last decade for a reason, FED cough cough.. FED.

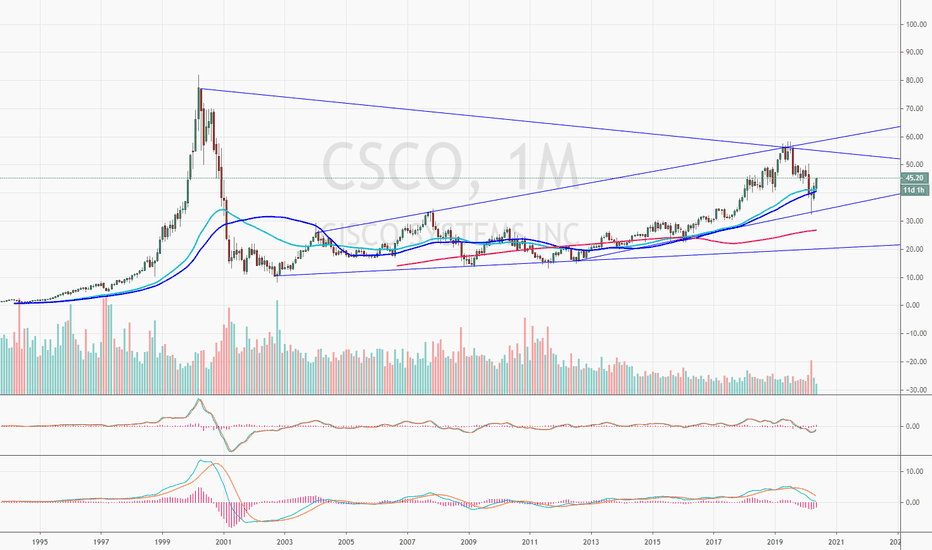

Typically , the best bottom fishing opportunities are stocks that consolidate for a long time (trade in a tight range) and end up breaking a new 52 week high before making a huge run.

Strength > weakness when it comes to trend following and seeing faster returns.

Know your time frame .

Buying strong names on weakness is great, but I've spoken with legendary traders that ALL say the same thing. The best trades always happen right away , without turning back .

So let that sink in.

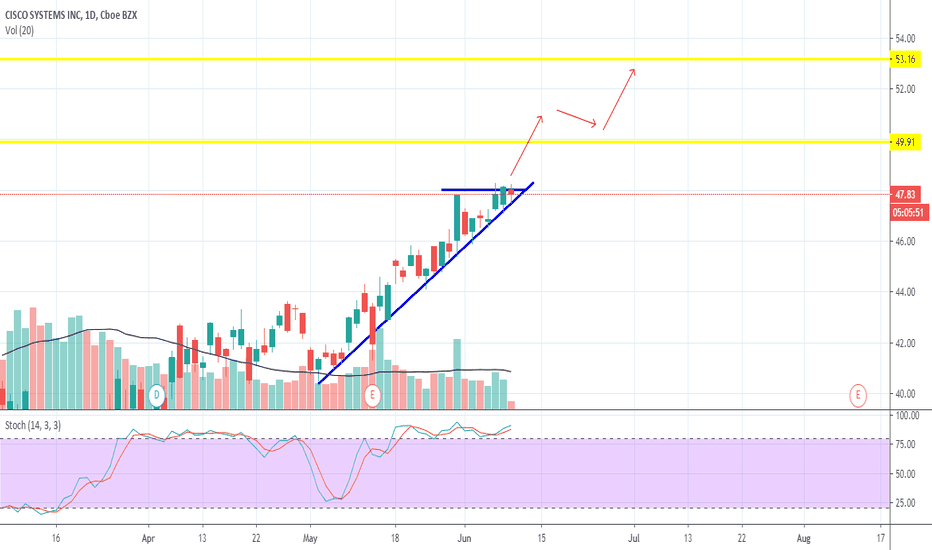

CSCO trade ideas

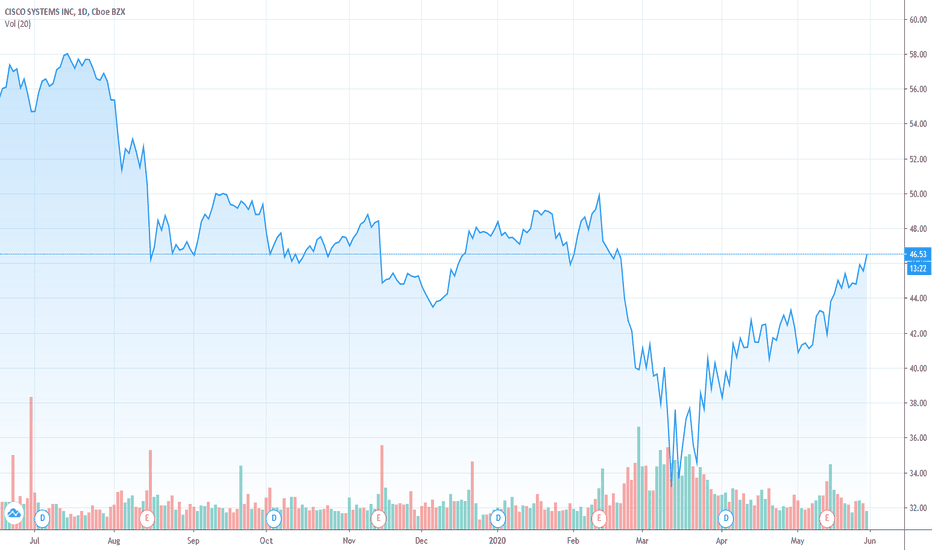

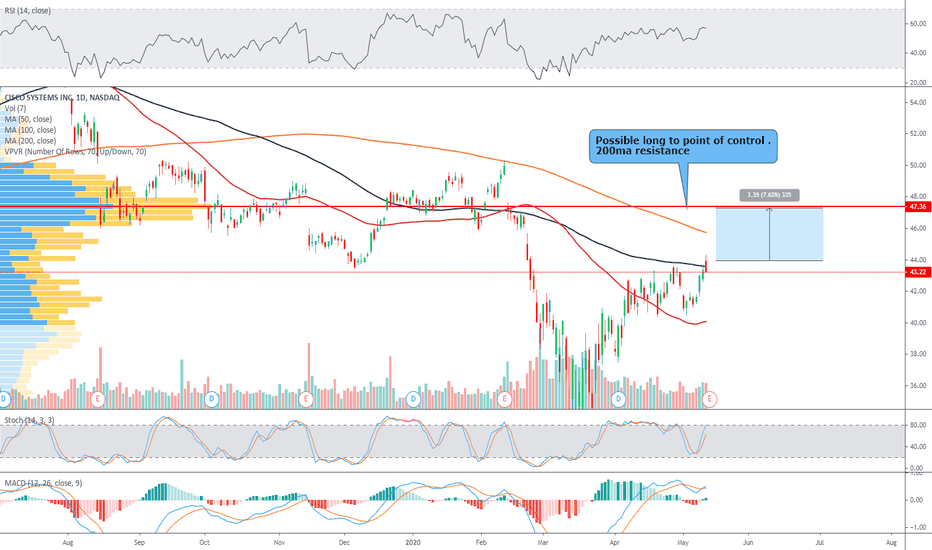

CSCO Play overview Took a call debit spread today in CSCO. Showed up one one of my TOS scanners this morning. This is what I saw:

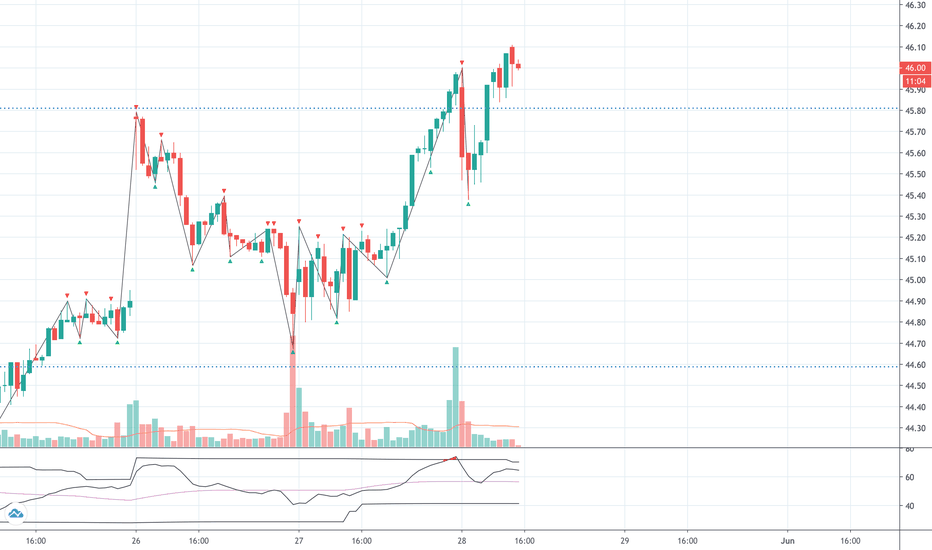

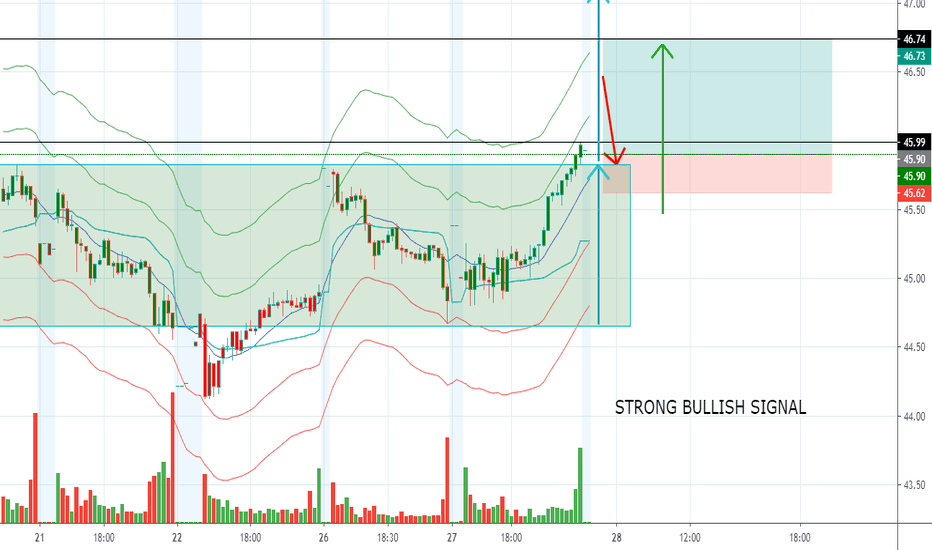

Daily: Has been trending up, higher highs, lower lows. I also noticed the fractal formed on the 20th. My entry was below it but was looking for that cross.

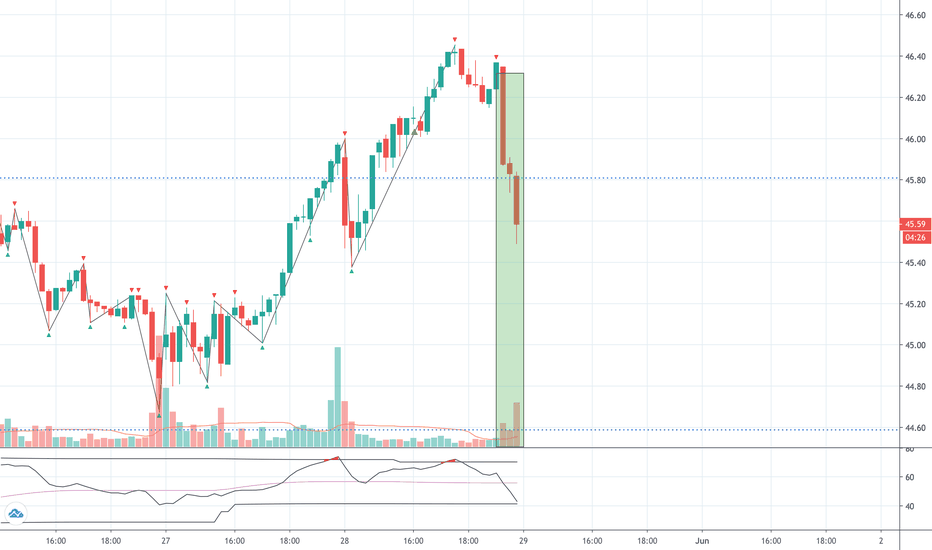

1HR: More fractals formed along the $45.80 area. Also on the 26th and 27th there was a nice bottom with several pin bars and big bars moving up into today.

15 min: Today it opened with a move down. Felt this wasn't warranted and saw it as a buying opportunity.

Other thoughts:

-Maybe got in a little early; could have looked for the retest to enter.

-Moving forward Im looking out for big volume spikes to the upside. This demonstrates to me that Market Makers want to take it higher. Don't want to trade against them.

-Looking over my past trades my risk/reward ratio isn't great. Have been losing more than I make, so Imma let this one ride a little longer than I usually would.

-Watched a Bill Williams video recently talking fractals and not caring about daily P/L if your trading with the trend. Going to try to practice this.

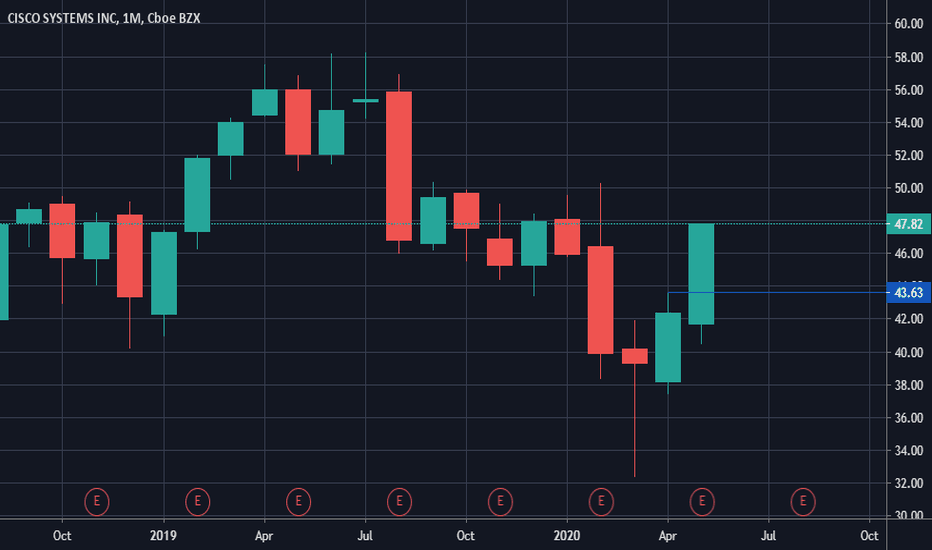

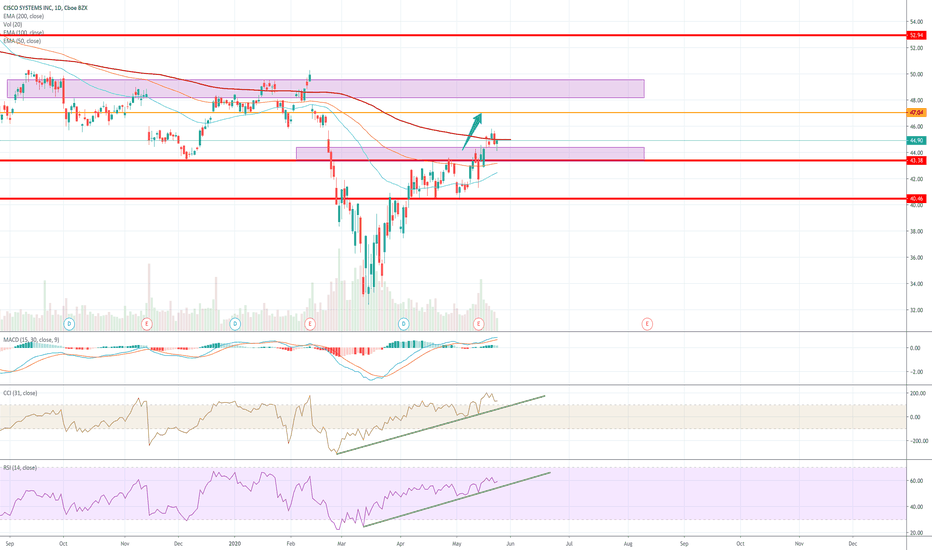

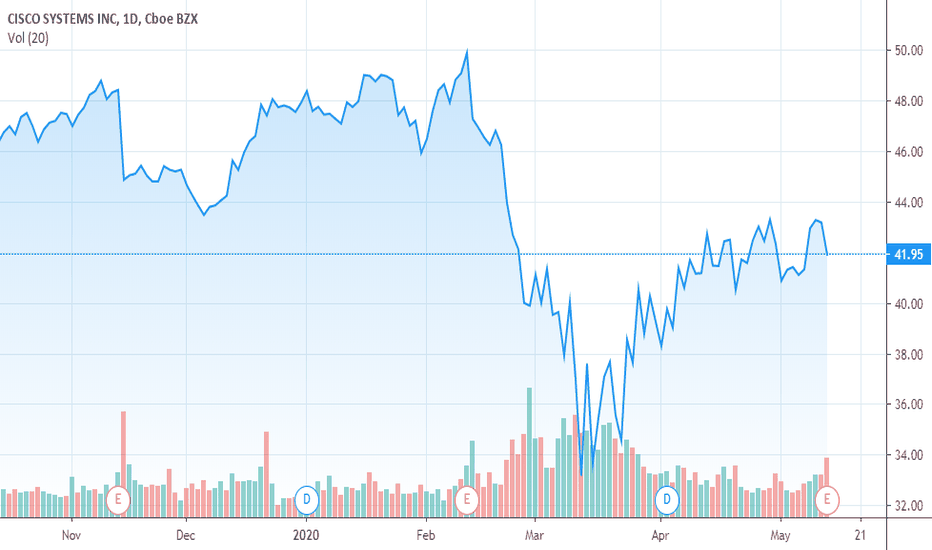

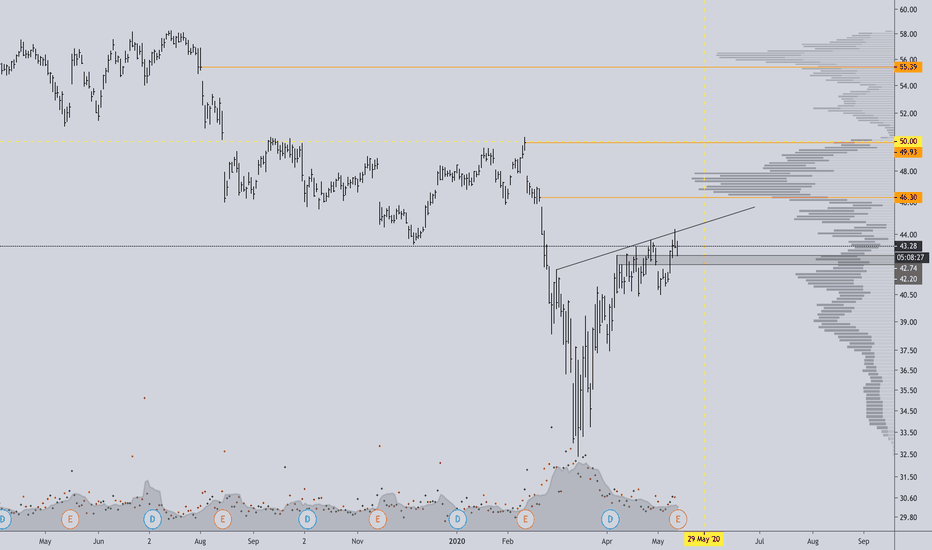

Bullish Weekly Chart - LongWeekly chart looks great!

Volume is Bullish

PMO is Bullish

MACD is Bullish

Stochastic is Bullish

Long!

DISCLAIMER

The Content herein is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

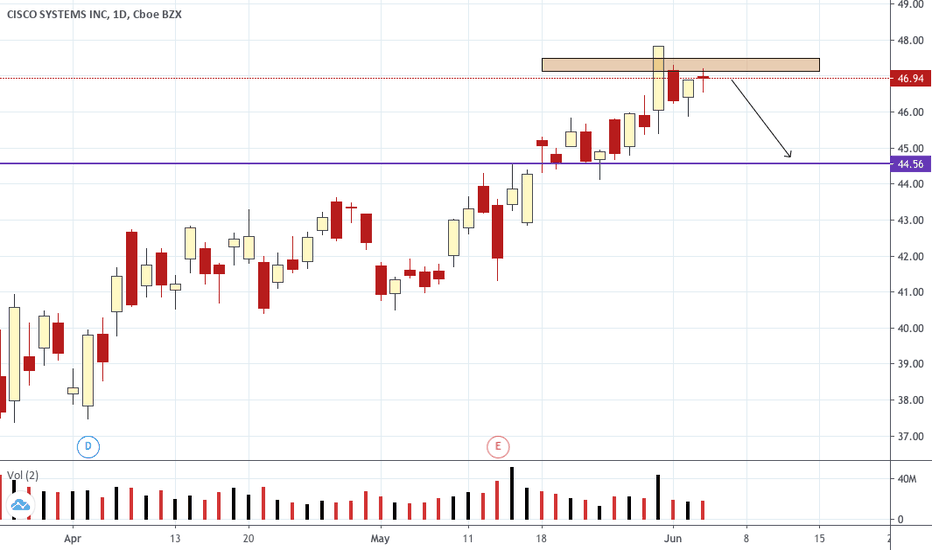

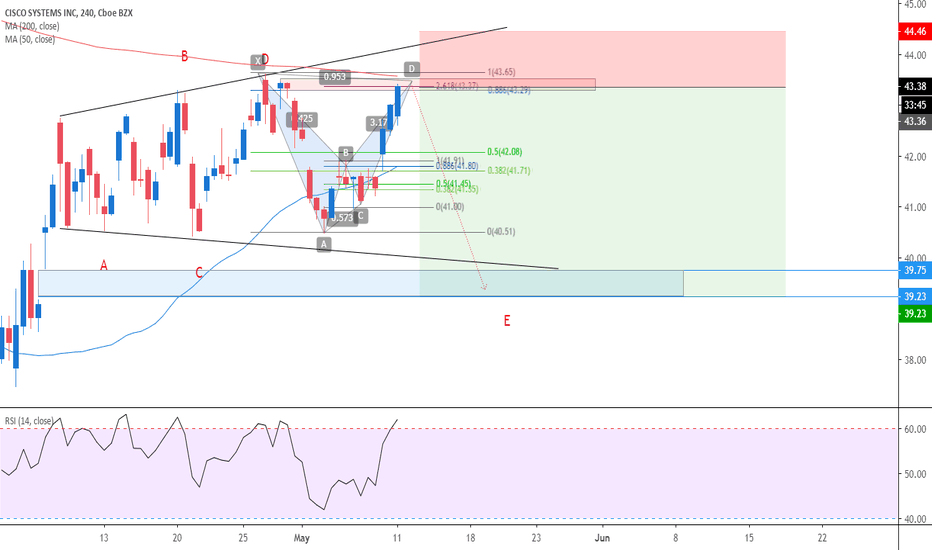

CISCO SYSTEMS now is in BUY situationHey traders, **DISCLAIMER** content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. CISCO SYSTEMS is interesting, it can pull back to finally soar.

Please LIKE & FOLLOW, thank you!

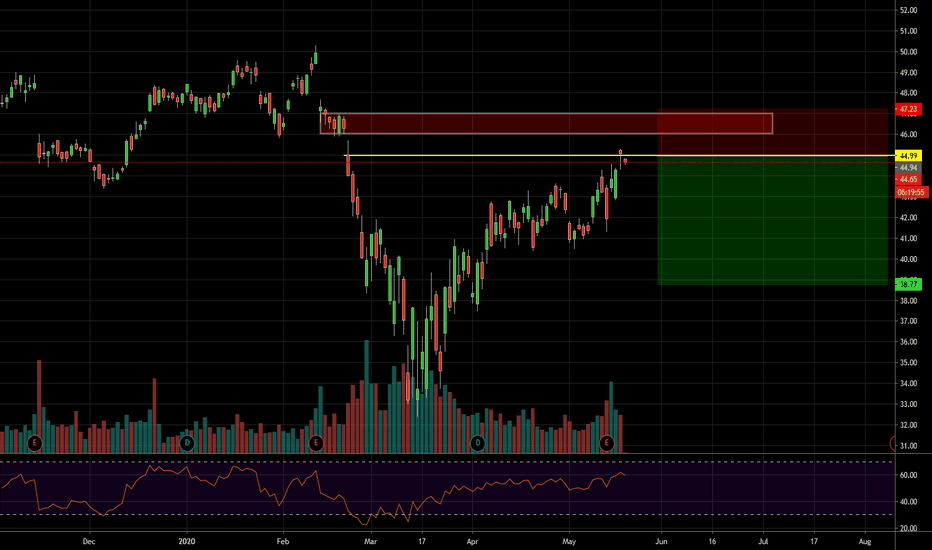

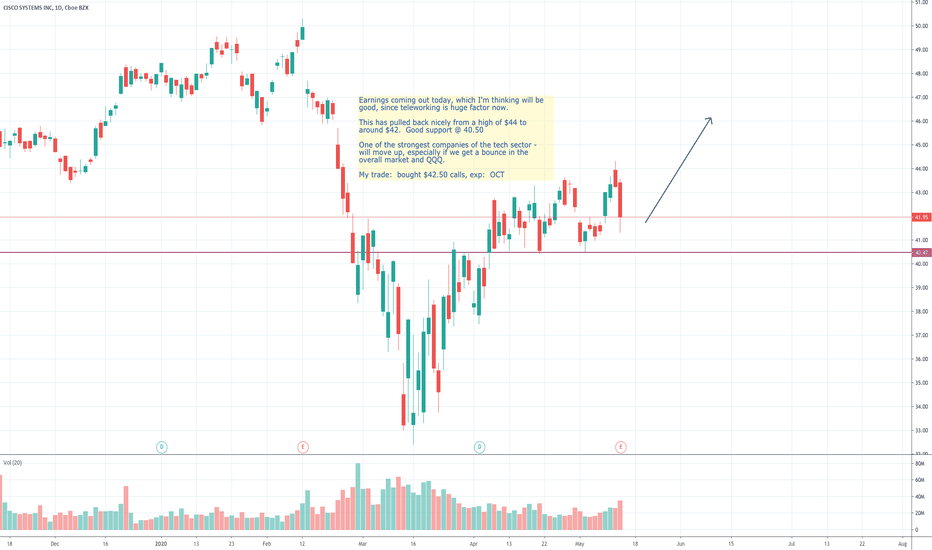

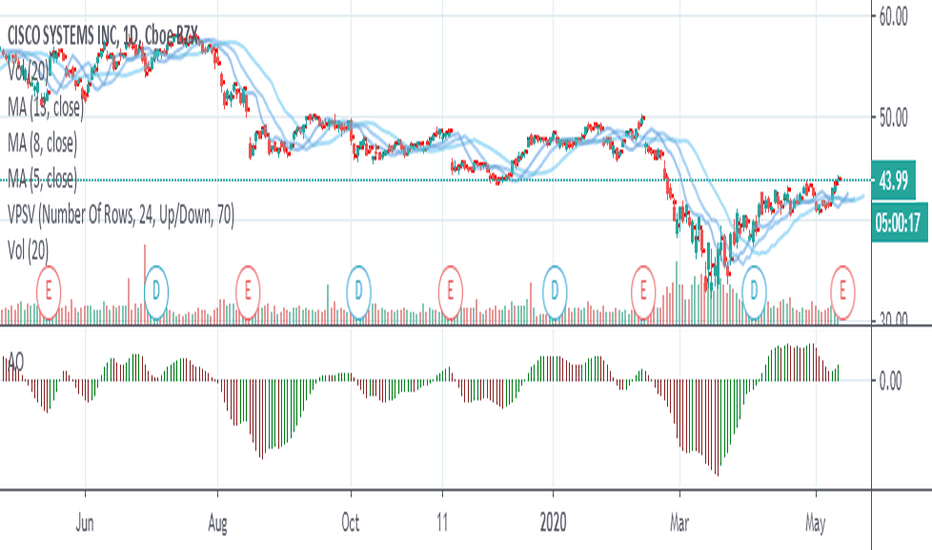

CSCO EARNINGS DUE TOMORROW DO A CALL TRADE READ MOREInvestors are always looking for stocks that are poised to beat at earnings season and Cisco Systems, Inc. CSCO may be one such company. The firm has earnings coming up pretty soon, and events are shaping up quite nicely for their report.

That is because Cisco is seeing favorable earnings estimate revision activity as of late, which is generally a precursor to an earnings beat. After all, analysts raising estimates right before earnings — with the most up-to-date information possible — is a pretty good indicator of some favorable trends underneath the surface for CSCO in this report.

In fact, the Most Accurate Estimate for the current quarter is currently at 76 cents per share for CSCO, compared to a broader Zacks Consensus Estimate of 72 cents per share. This suggests that analysts have very recently bumped up their estimates for CSCO, giving the stock a Zacks Earnings ESP of +6.29% heading into earnings season.

I BOT THE 43.5 CALL, IF YOU DON'T TRADE OPTIONS BY A FEW SHARES OF THE STOCK

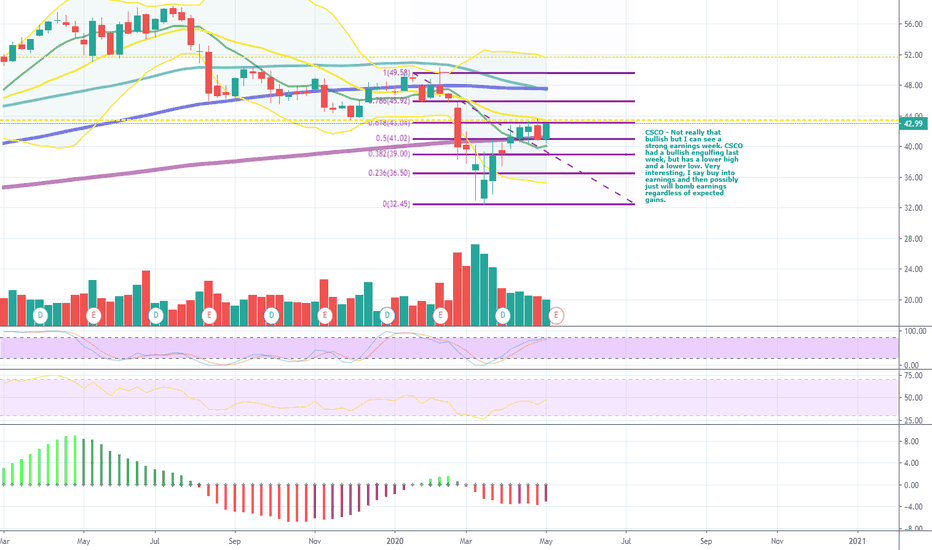

CSCO pre earningsCSCO - Not really that bullish but I can see a strong earnings week. CSCO had a bullish engulfing last week, but has a lower high and a lower low. Very interesting, I say buy into earnings and then possibly just will bomb earnings regardless of expected gains. Volume is barely gaining and although it can smash, I don't see big earnings bumps unless pre earnings is quite quiet. Lows were bought up but current level is a big hover.

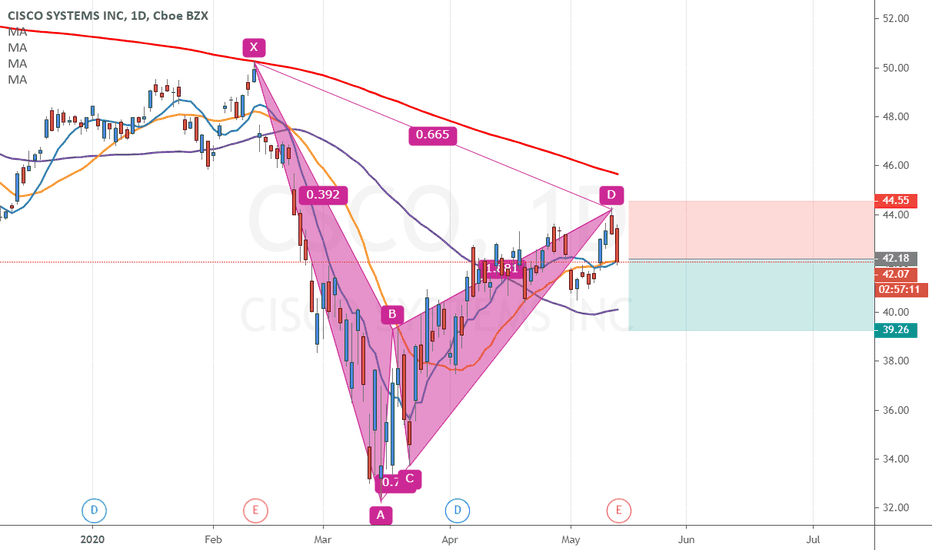

CSCO - Bearish Outlook near termCSCO rejected resistance line multiple times and is beginning to show weakness and break bullish wedge trend with higher lows and higher highs. Rising wedges also typically have a breakout to the downside as buyers exhaust and that is my expectation with CSCO as well.