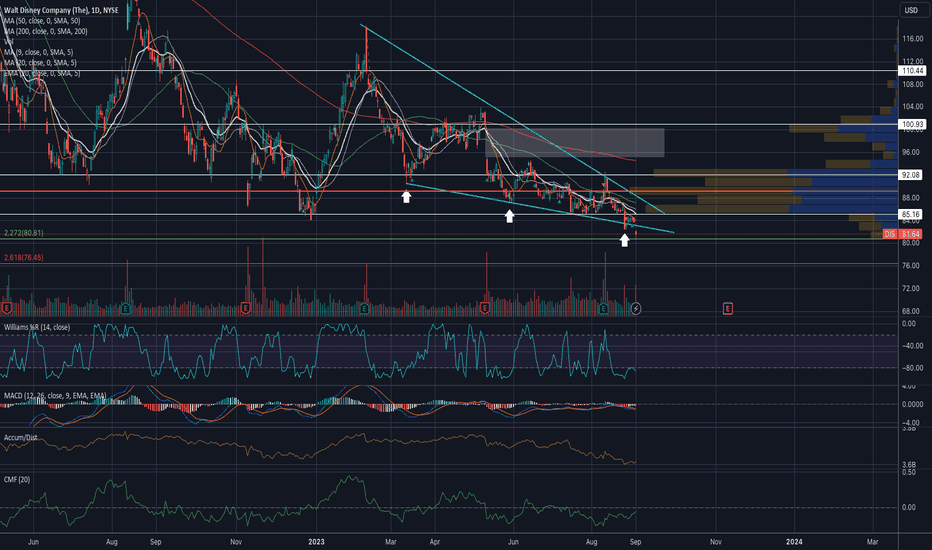

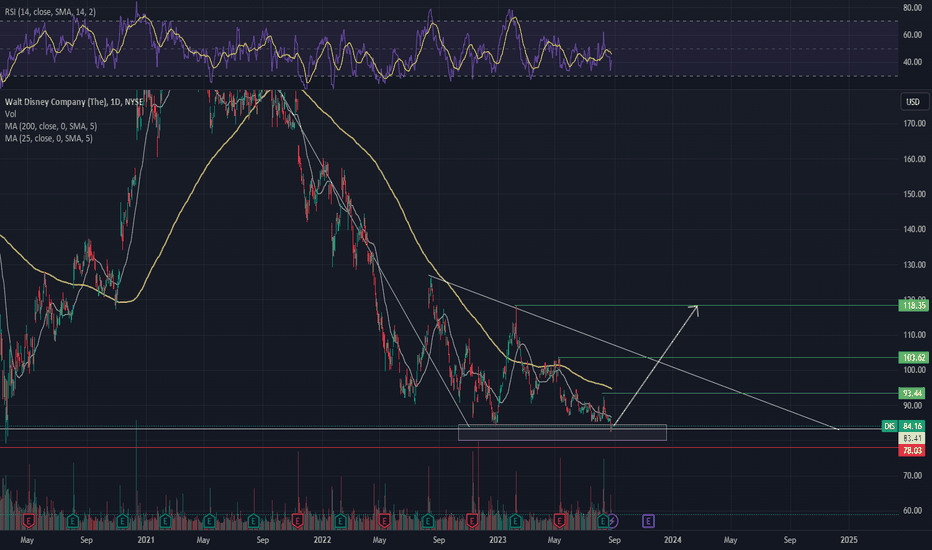

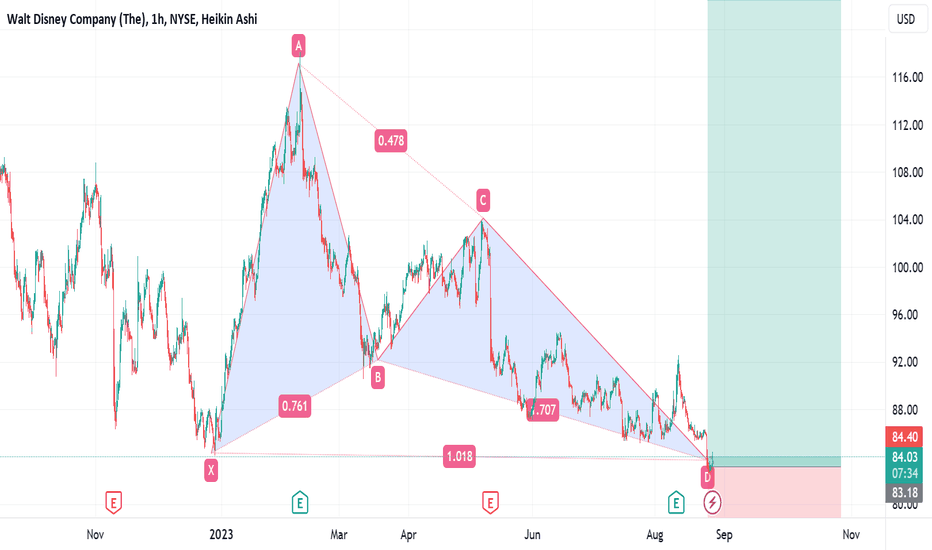

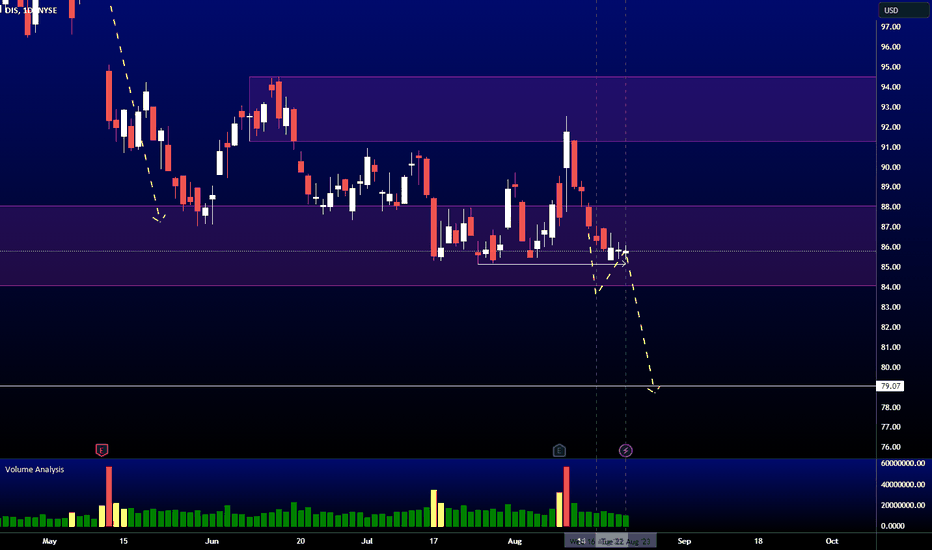

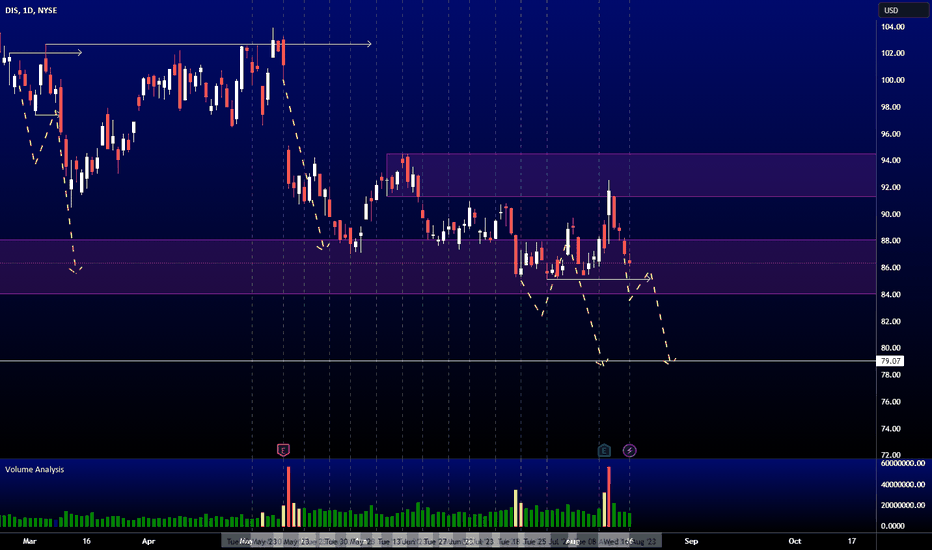

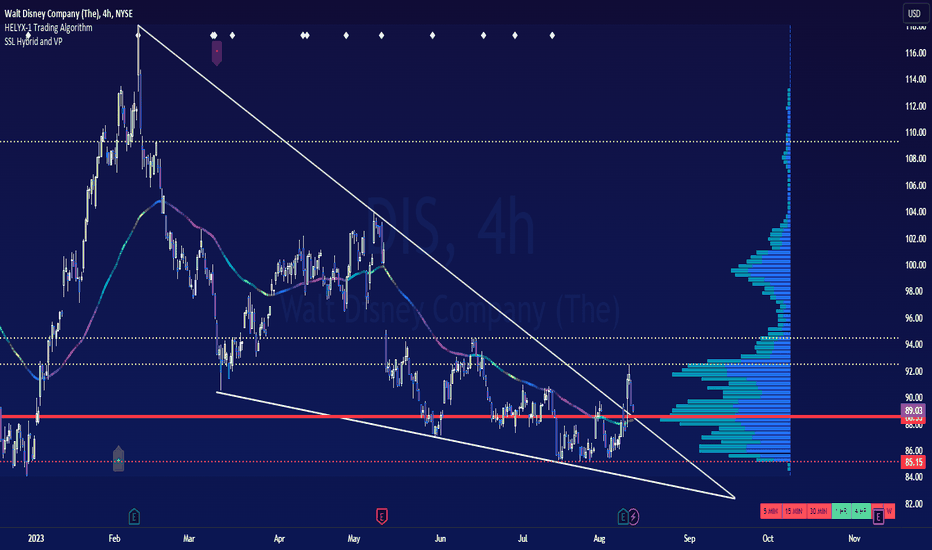

$DIS - broke down what's next?NYSE:DIS Just when you thought things were turning up and bad news might be drying up, Spectrum news came out on Friday, causing the price to gap down to near the $80 area.

The bulls need to reclaim $85, as I stated in my earlier post.

If $80 breaks, there is a real danger that the stock could go down to $76.45 area.

$80 is the key critical support level to prevent further breakdown.

$85 is the key resistance area to reverse the trend.

I could be wrong but I think we see a bounce next week.

Place your bets!

Like and follow me for more charts and trade ideas.

DIS trade ideas

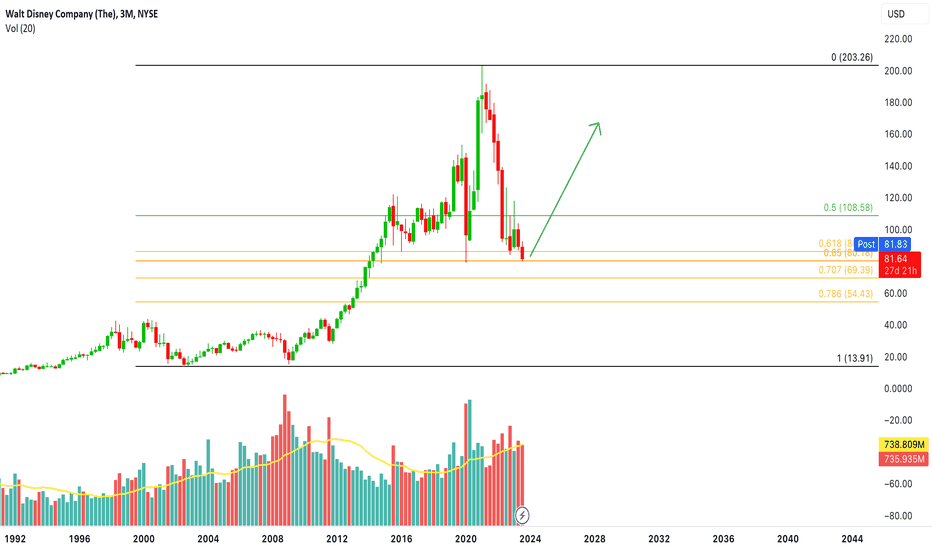

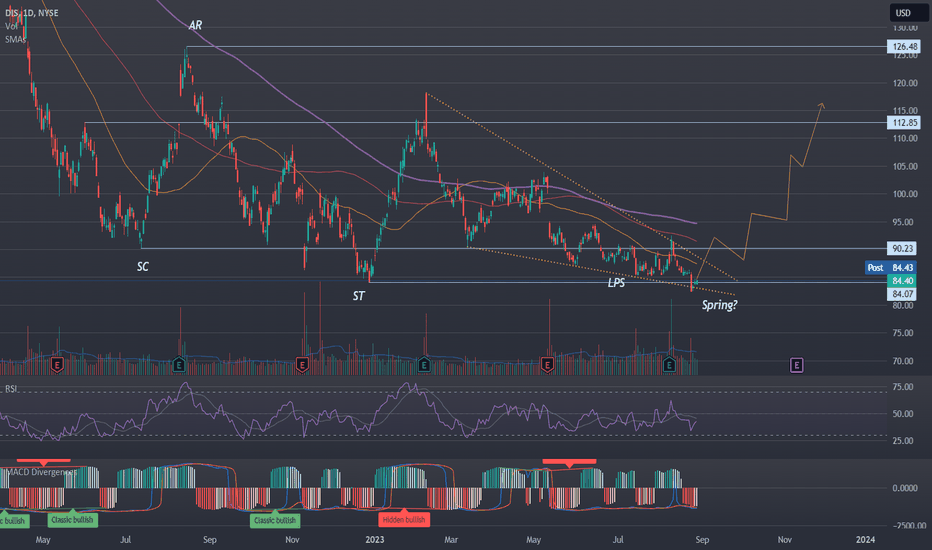

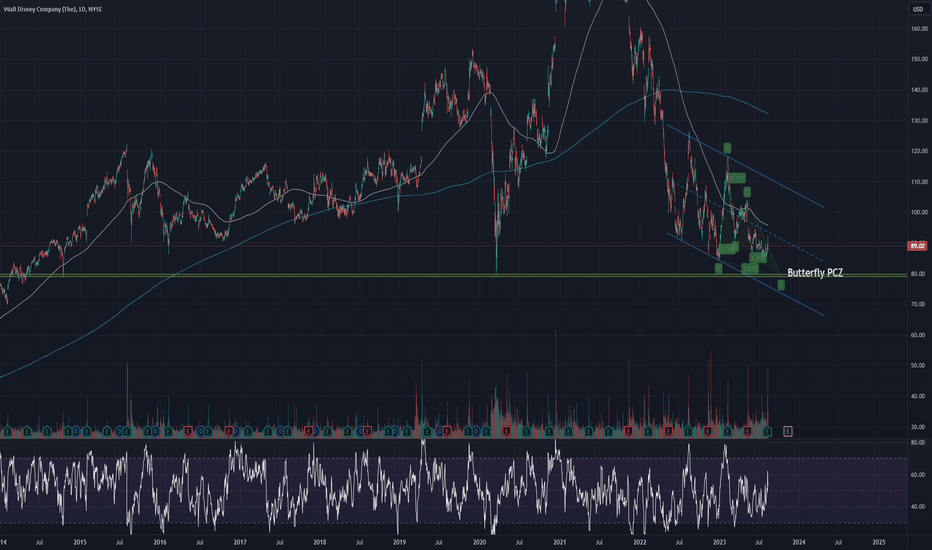

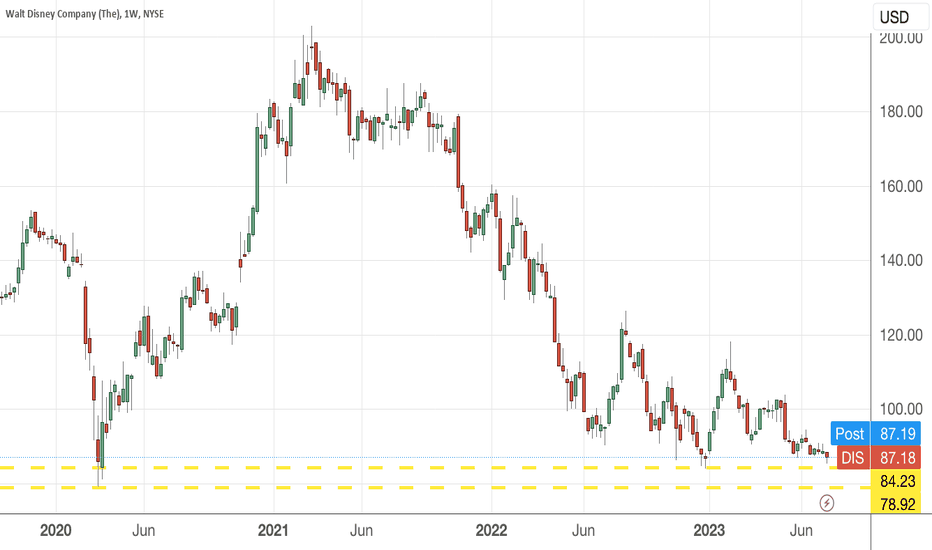

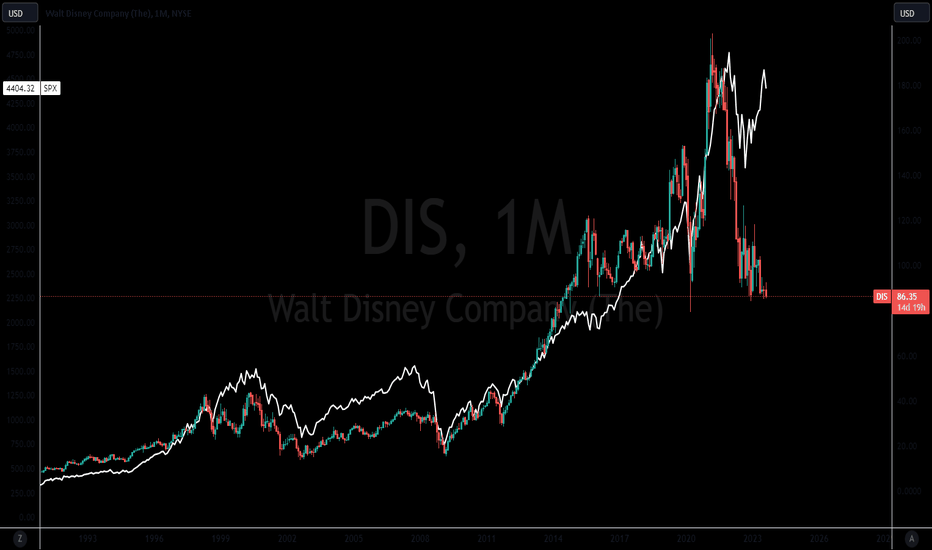

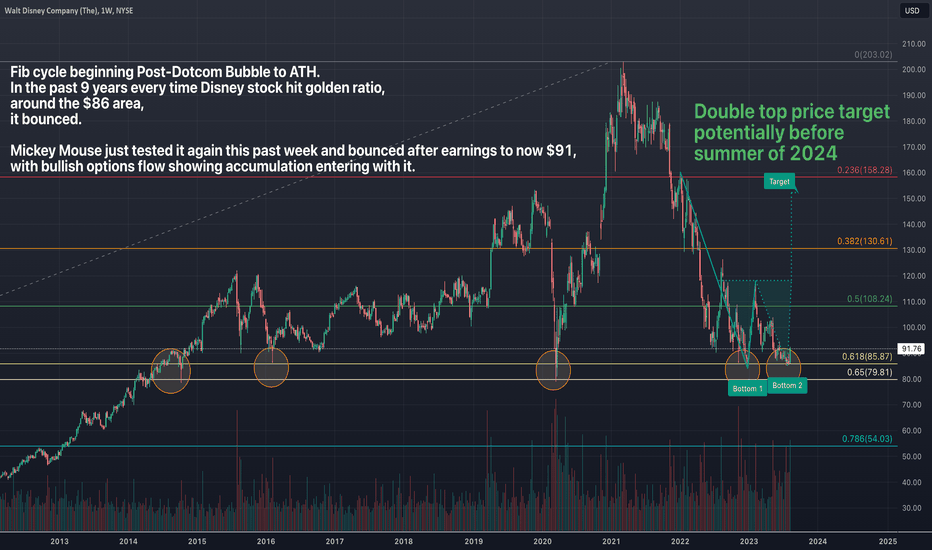

79-80 sends us LONGHi everyone, when zooming out and looking at the bigger picture for Disney, the area of 79-80 puts us right at the golden pocket dating all the way back to the year 2000. I think the risk is minimal at this level and the reward can be very nice.

Keep in mind, this is A 3 MONTH VIEW CHART. What I'm trying to say is don't expect to get rich over night.

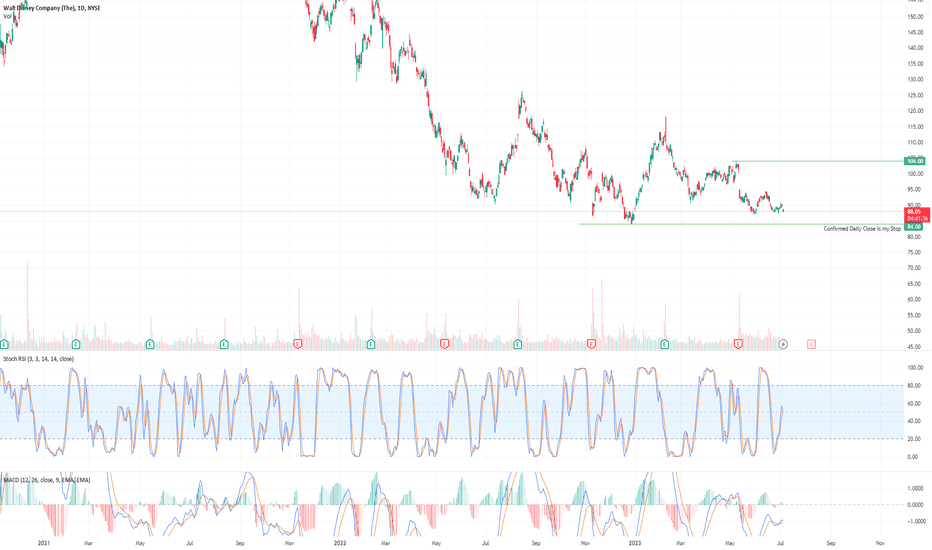

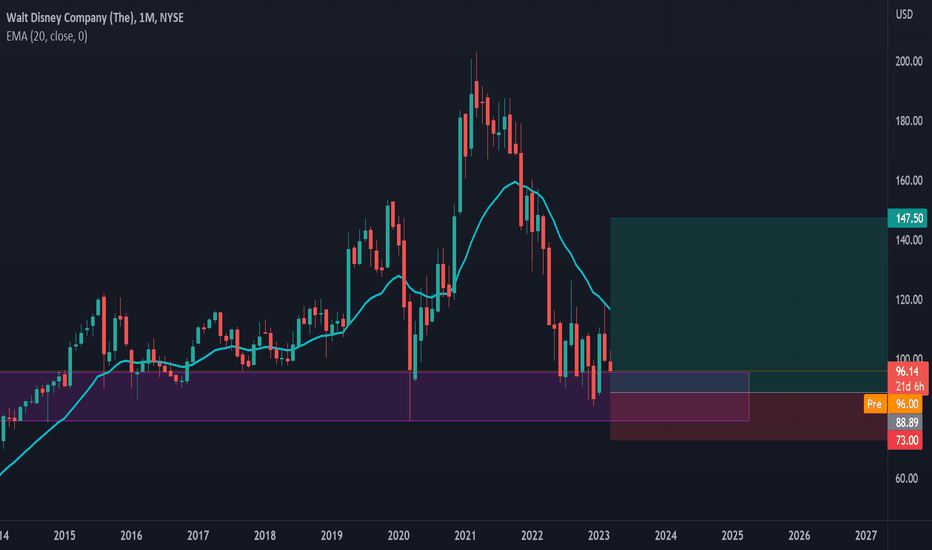

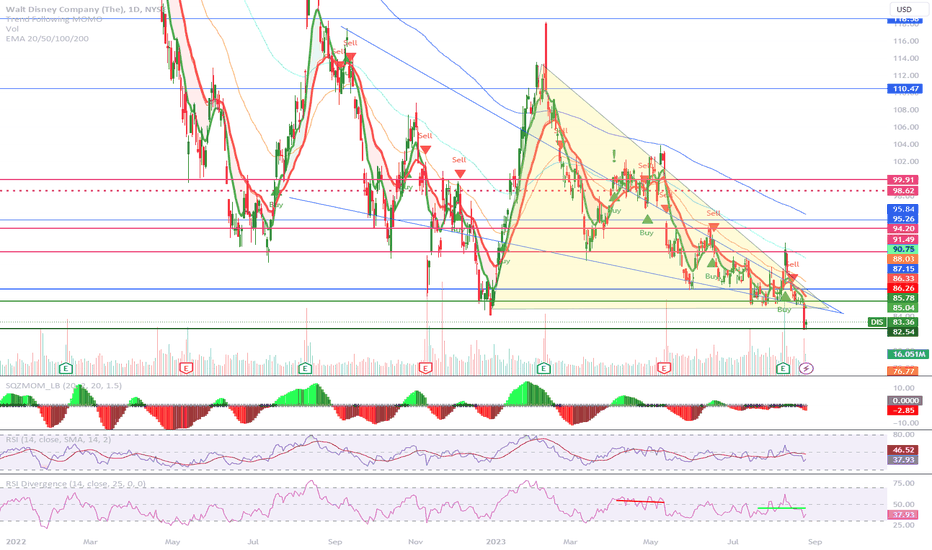

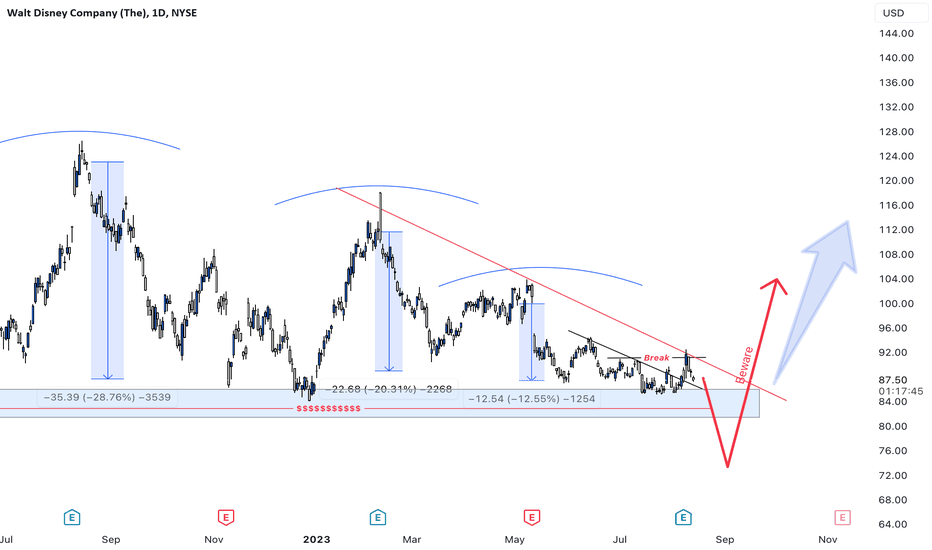

Fair price Range for Walt Disney $DISAs shown on the chart I think NYSE:DIS is in a good price ranges that will not be found again in the future

My Entry Price is 88 USD

Stop Loss is Daily Close Below 84 USD

My Target is 104 USD in Mid-Term time and 145 USD in the future

Make Sure that You Can Afford the Loss Before Opening Positions

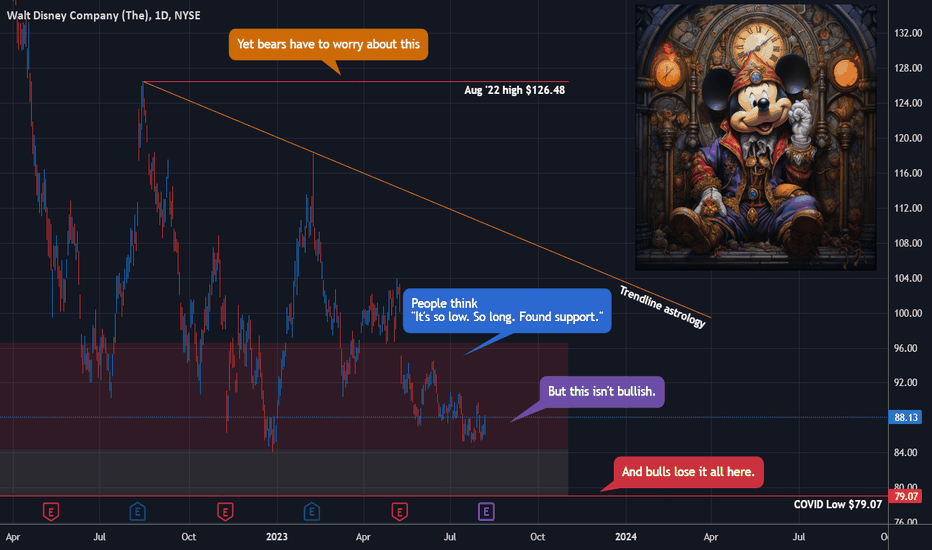

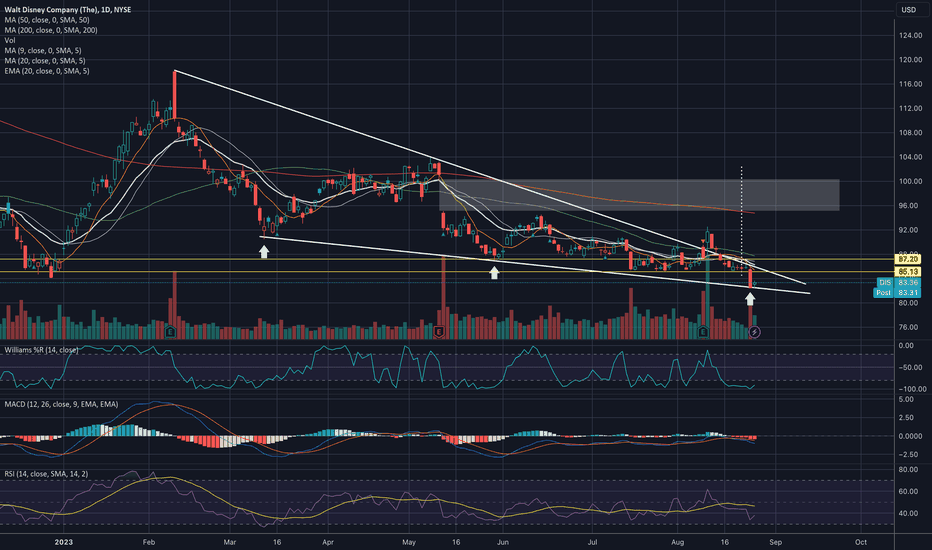

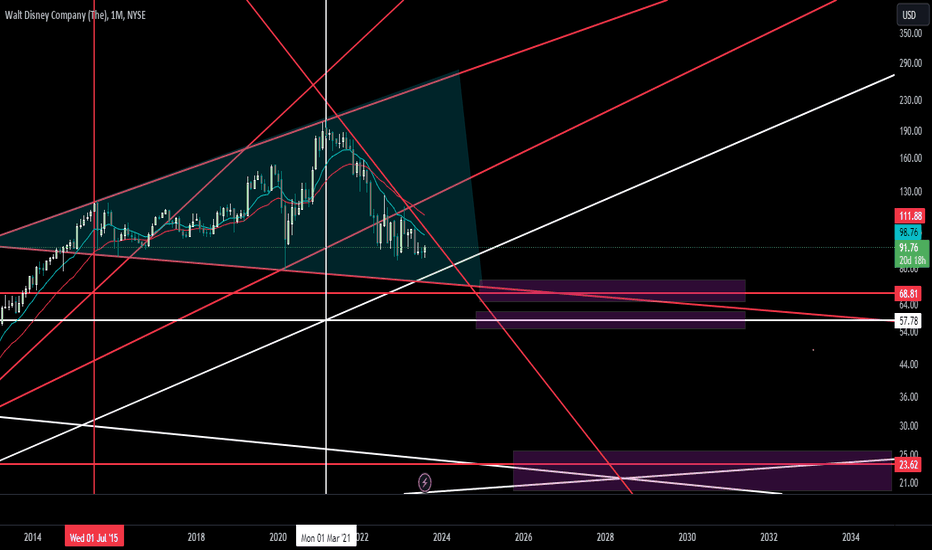

Disney - Is Your Compass Upside Down?On trading social media, Disney has been the target of moonboys for quite a while.

For some reason, whenever a stock is in a landslide and doesn't go up, everyone gets it in their head that they're going to BUY THE CALLS and catch the next MOTHER OF ALL SHORT SQUEEZES.

And this is because you want to gamble on a single day candle, which results in you blowing your account, and then you stop using TradingView and can't have fun anymore.

Disney, fundamentally, is a company that may not have any future whatsoever in a society that returns to mankind's traditions.

For so many years, it has been pushing a warped and depraved culture at both its parks and via its broadcasting networks. It was even an entertainment industry leader in onboarding the Chinese Communist Party's Zero-COVID social credit edicts.

And this is a problem if you want to get long.

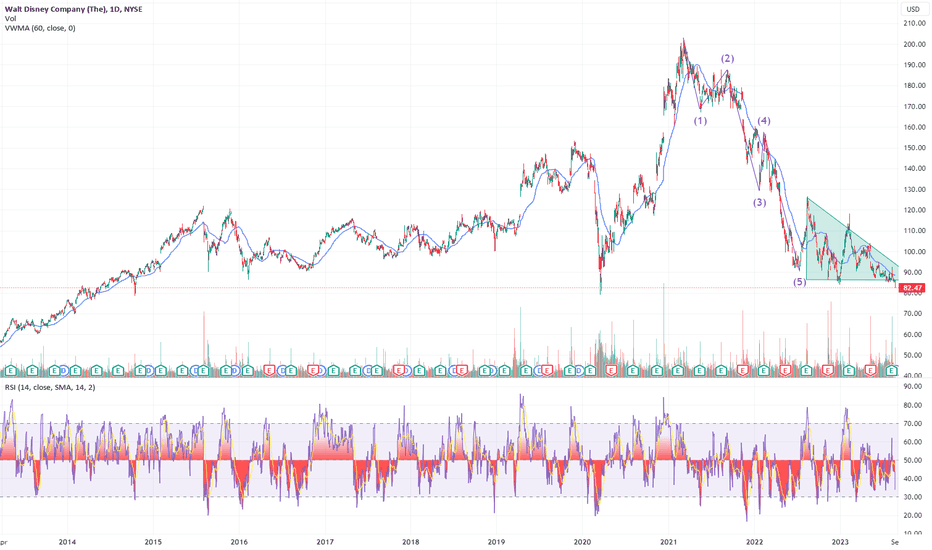

They always say "zoom out," and so let's look at yearly candles:

8 months of price action for 2023 so far indicates that we've probably just been painting the wick portion of a year that will break the 2020 COVID low.

And the first place you find support below the COVID low is at $40.

"Sure, sure. But it's Disney. It's the stock market. EVERYONE KNOWS it's going up. Bears always get #rekt LOL."

"Bear flags" and "bull flags" are astrology and don't exist. But what does exist is when an equity spends more than a year in an area it should have bounced from and simply doesn't go up, which is what we see on the monthly.

But the contrary, on the Weekly, there is a problem for bears, which is the August of '22 high at $126.

And so there is a potential that tomorrow's earnings call actually results in a raid to $80 that actually produces a bullish buying opportunity with a target of $126.

The problem is, the "JPM Collar" has the world's most significant bank long on SPX 4,200 puts that expire September 29 that have literally been under water every second of every day since they were bought at the end of Q2.

SPX/ES - An Analysis Of The 'JPM Collar'

However, I note in my recent SPX call:

SPX - The Sound of a Shattering Iceberg

And a recent Nasdaq call

Nasdaq NQ - Is It Time To Sell The Rip?

With CPI pending on Thursday morning, what happens tomorrow is really significant.

That although I suspect our index tops to get raided, the problem is, are you going to see $40+ on Disney in a time frame of less than 3 weeks?

September is likely to be something of a "chilly autumn" for equities markets with the way everything is set up, including the SOXS bear semiconductor ETF and the VIX.

If there's to be anymore rally, that rally may only come in Q4.

And thus, that would mean for Disney that a likely scenario would be a raid on the lows from earnings and even more bearish consolidation, with the $126 target being left for the beginning of Q4.

This stock is a lot like Verizon and T-Mobile. It's better left not bothered with until it starts to show you signs that a bank or a fund really wants to rip it bigly in one direction or the other.

There's lower hanging fruit and greener pastures out there to trade.

$DIS - could see upsideNYSE:DIS is looking like it could make a move to the upside. If it can close above $85, it could see further upside. Bad news may already be priced in.

Here are target areas:

- $85

- $92

- $94

- $100

- $92 is a key resistance area.

What could be the catalyst?

Cancel Snow White?

Fire diversity hire manager?

Like and follow me for more charts.

Are you afraid of Success ?If you think logically, this may not seems to make much sense. Who in this world would not want more success in their lives , be it career, family, relationship? However , on a deeper note, it is true that some are truly fearful of gaining success. WHY?

One of the factors is they are too complacent, too comfortable with what they have currently. Example, someone holding a not too bad job that pays $XXX a month and he knows how to get his job done (since he has been doing it for years). A promotion would means more responsibility and not necessarily a higher pay that commensurates with it. So, weighing the pros and cons, this guy could simply stay put in his position.

In the world of bodybuilding, there is a saying that you need to shock the muscles in order for it to grow. That means, you cannot stick to the same regime week in week out. A barbell bicep curl and an alternate dumbell curl will yield different results even though they are both working on your biceps. The same for using dumbells versus a cable pull machine.

So, in the world of investment, we too need to take a different approach. Our starting point is where you are right now, never mind your age, income or financial standing. You got to have the hunger, the urge to want to change, change for the better, expect better things to come in the future. We call that having a vision. www.biblegateway.com)

Many great companies are where they are today because decades ago, the founders had a dream , a vivid imagination of what the company will be. They work towards their dreams. Nobody said it will be a straight path to success (perhaps that pullback, failure to some is what scares people to pursue) but one that has its usual ups and downs.

Your portfolio may not be green and profitable all year round but that is OK if you know what you are doing. You spend more time review them, scrutinise your investment objectives, weed out those companies that are not structurally aligned with your vision and continue to invest in great profitable companies. Stay on the course, that is easier said than done.

Others fear success because they may have a limiting beliefs about being rich. They may have seen someone in their lives that were rich and perhaps were disgusted with their arrogance, behaviour, etc. So they think if they become rich, they will be like them. These thoughts become so repelling that it becomes an obstacle to their impending success.

If you did not inherit your wealth, then you must know that many become successful because they put in lots of hard work. The latter may not guarantee success but it is an important ingredient. Work hard towards your vision/goals. The clearer you know what you want in life, they more self disciplined, committed you become. Your goals drive you , no external motivation of sort is needed.

You defer your spending because you have a better purpose to using that money. You choose to buy a cheaper product because it serves the same function and you save on the remaining sum for a better purpose. It becomes part of your daily routine, your daily habits. It no longer becomes a chore.

One benefit of becoming financially free or successful is it offers you CHOICES. For now, you may have to take on more than one job to save more money towards your goals. And that is fine. When you arrived, you discovered that you work not because you have to but you want to. The pressure is off, the mood is totally different and you look at things differently.

Just like how others have impacted on you, you too, when successful will become a role model to some. Others want to be like you, hard working, humble and yet generous to those in need, sharing your knowledge and making a difference in other lives. You do not need to be a philanthropist like Bill Gates or Warren Buffett to do what they are doing. Choose your own path and contribute in other meaningful ways as well.

Choose Success !

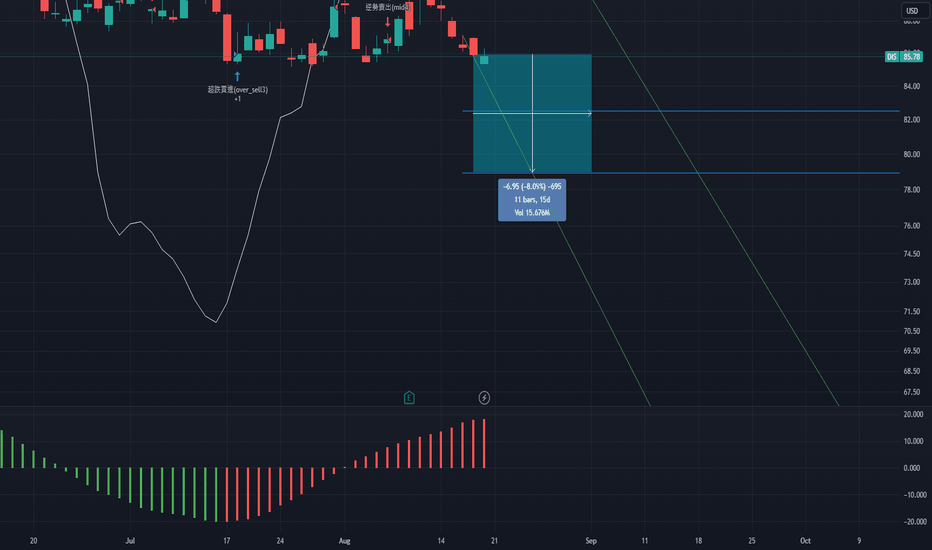

DIS, 10d+/-8.09%falling cycle -8.09% more than 10 days.

==================================================================================

This data is analyzed by robots. Analyze historical trends based on The Adam Theory of Markets (20 moving averages/60 moving averages/120 moving averages/240 moving averages) and estimate the trend in the next 10 days. The white line is the robot's expected price, and the upper and lower horizontal line stop loss and stop profit prices have no financial basis. The results are for reference only.

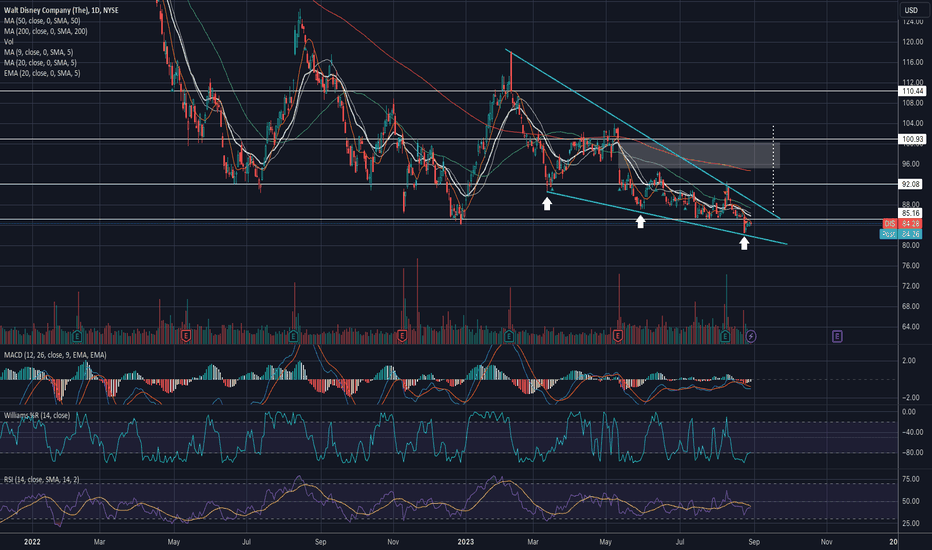

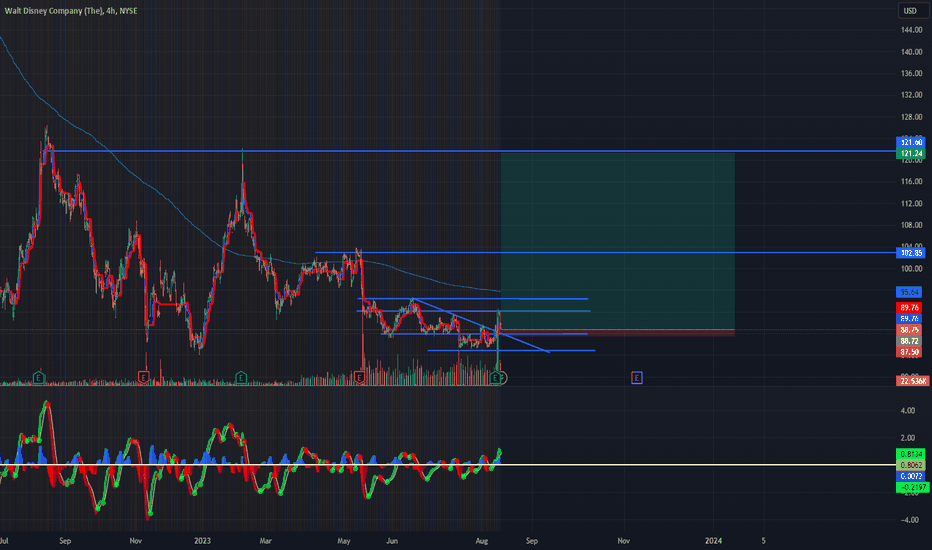

DIS AnalysisPrice did not play out to my last analysis. Price rallied higher into the bearish OB at 94.52 after earnings, but is unable to sustain the bullish momentum. Price is currently on a bearish retracement. If we break the lows at 85.16, we should see price heading down to 79.07, following my original expectation.

Falling Wedge (Breakout & Retrace) (Continued)As in my last publication, the falling wedge played out beautifully as DIS rallied with amazing strength, amassing +4.8% yesterday. The option contract I recommended and alerted was up big time. However, today had a major sell-off (coupled with PPI data release) that looks like a retrace to test the upper trendline. A good bounce near the upper trendline of the falling wedge would allow for a continuation of this breakout.

The mid-88 price (thick red line) appears to be a where it wants to head before bouncing, which coincides with where the upper trendline would be. Using the volume profile, we can also see that the thick redline coincides with a level with strong liquidity. A bounce is highly probable there! I would wait to re-enter a call if it gets near there, perhaps a 90C or 95C November contract.

I no longer hold any positions in DIS after booking the profits from the breakout.

Good luck!

Follow for more!

DIS bullish thesis based on technical analysis and options flowDIS on the weekly chart is testing the golden pocket again, for the 5th time in the past 9 years.

Every time it bounced above golden ratio, upside price action was seen.

Currently above it, with golden ratio being around $86, potential double bottom and a lot of shorts betting against the company with the loss of subscribers, weakness in parks, and their political unpopular views.

Key here will be looking for options activity from big players to see if shorts get squeezed and Mickey Mouse can rise again.