DIS trade ideas

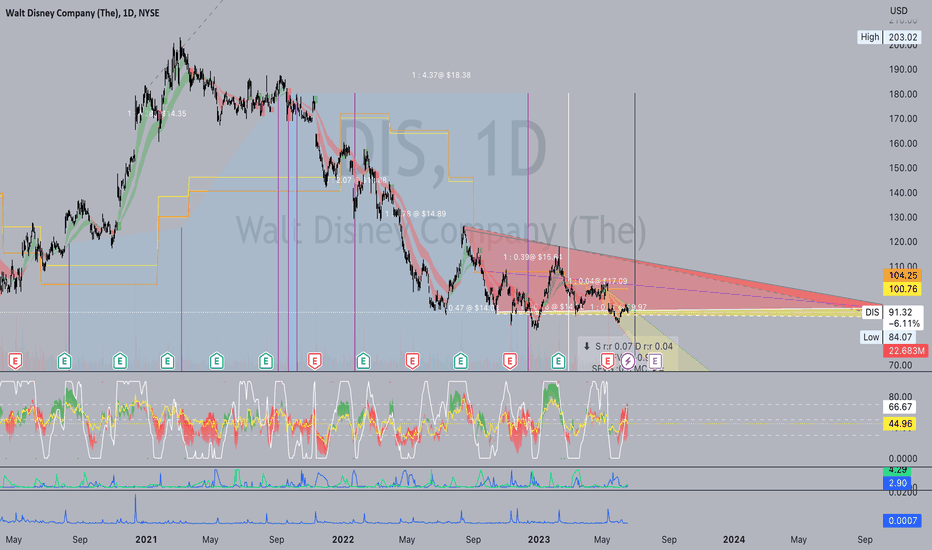

I might want to own DisneyI might want to own Disney as my first stock. Now this is why!

Are you aware that Netflix stopped allowing users of different IPs to log in and watch the show, even when you had a premium subscription?

That means, even if you are from the same household, but one of you has an extended overseas trip, he could be booted out after he has "used up" the overseas button.

In some countries, the subscription fee of Disney is 3 times cheaper than Netflix. I'm unsure if that's what Disney offers for the first-time sign-up client, but it is worth noticing.

Disney owns some of the biggest brands, such as Marvel, Starwars, 20th Fox Century Studio, and more.

Although I'm not optimistic about some of the new Marvel series, there is so much more potential with Disney.

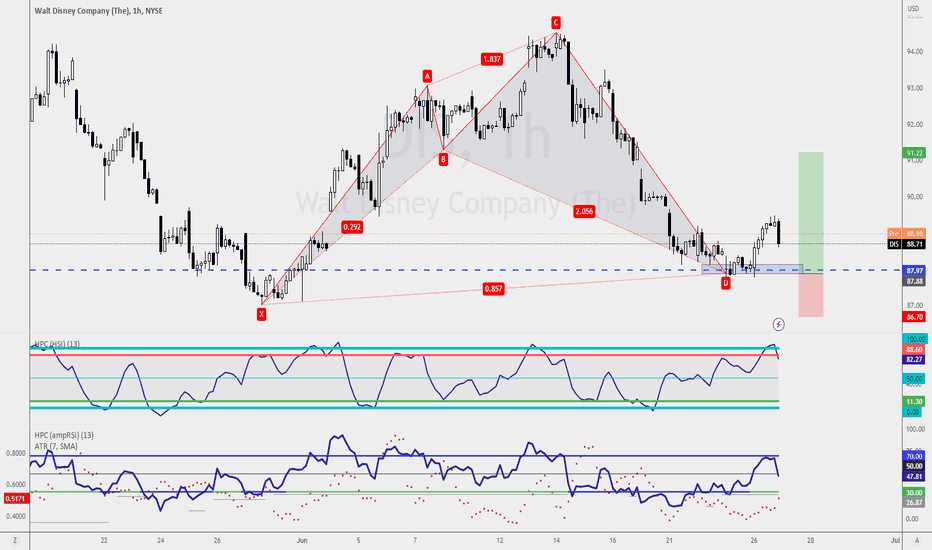

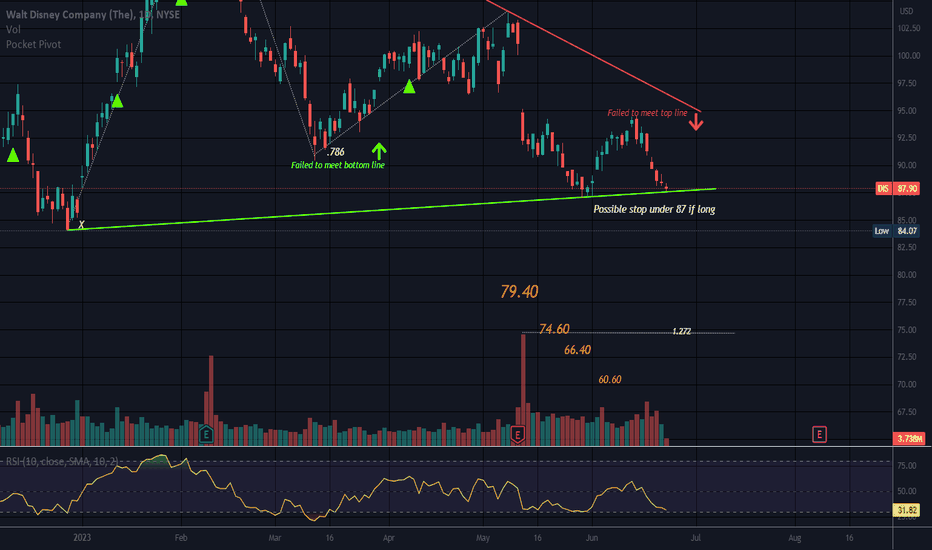

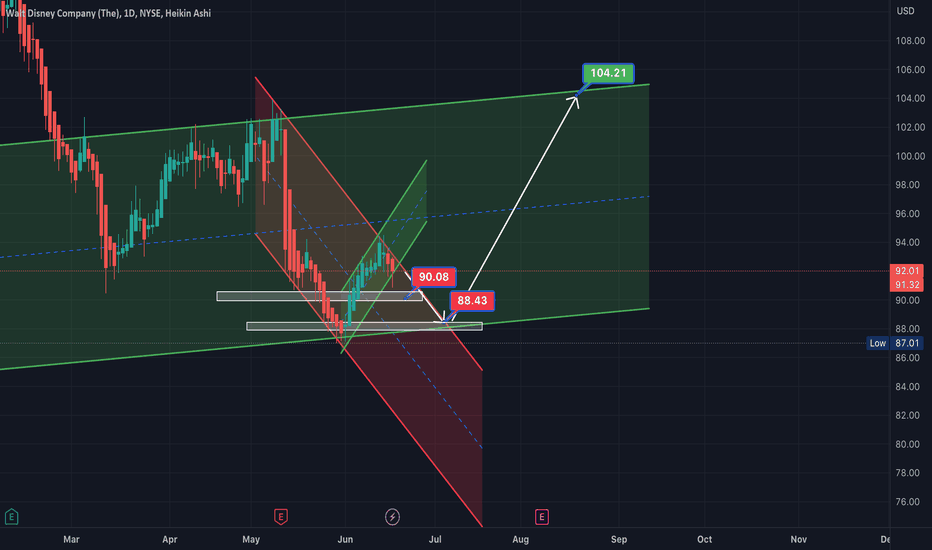

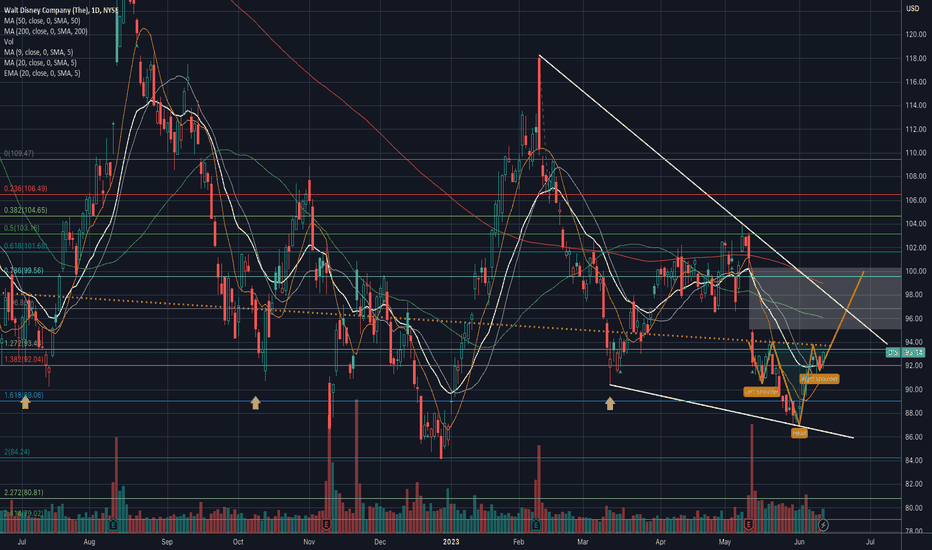

So when the Bullish Shark Pattern has confirmed at $87.90, it is great news for me to own my first stock and it might be Disney.

What's your take on this?

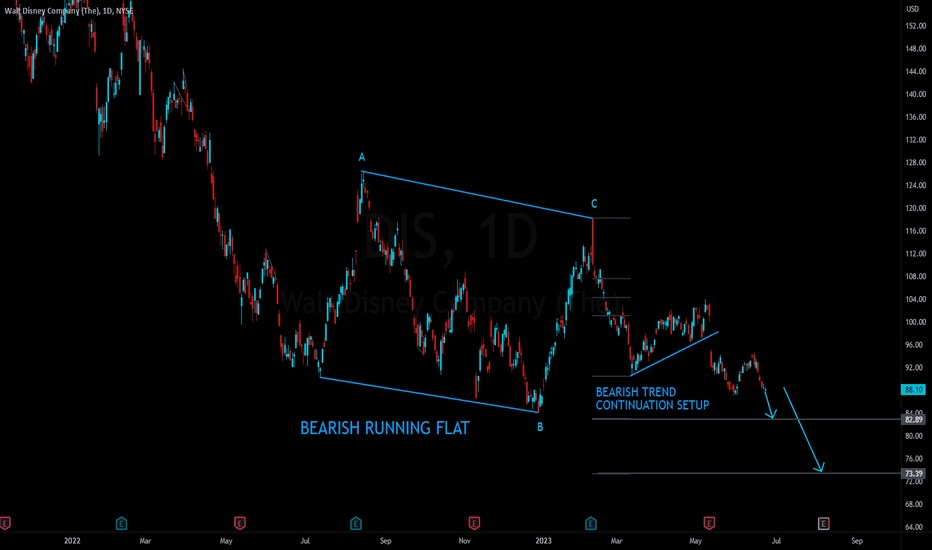

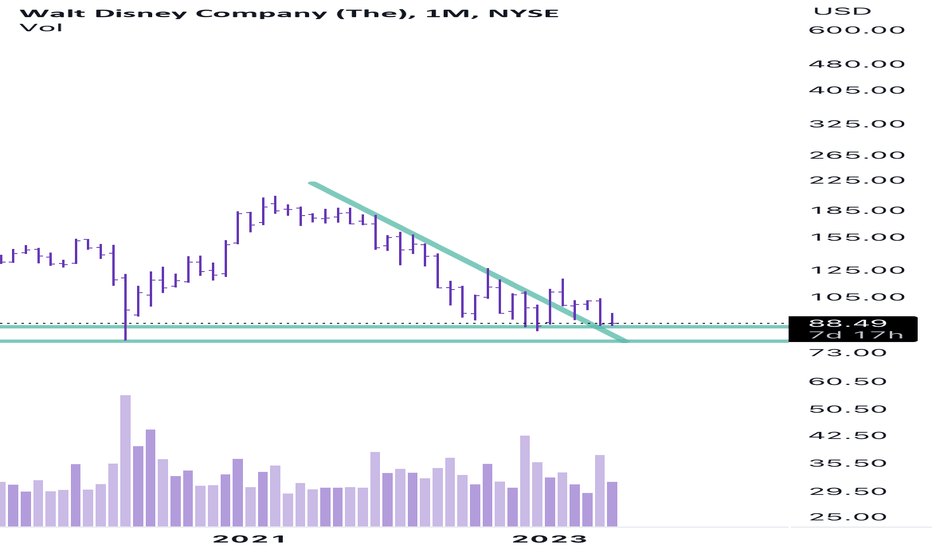

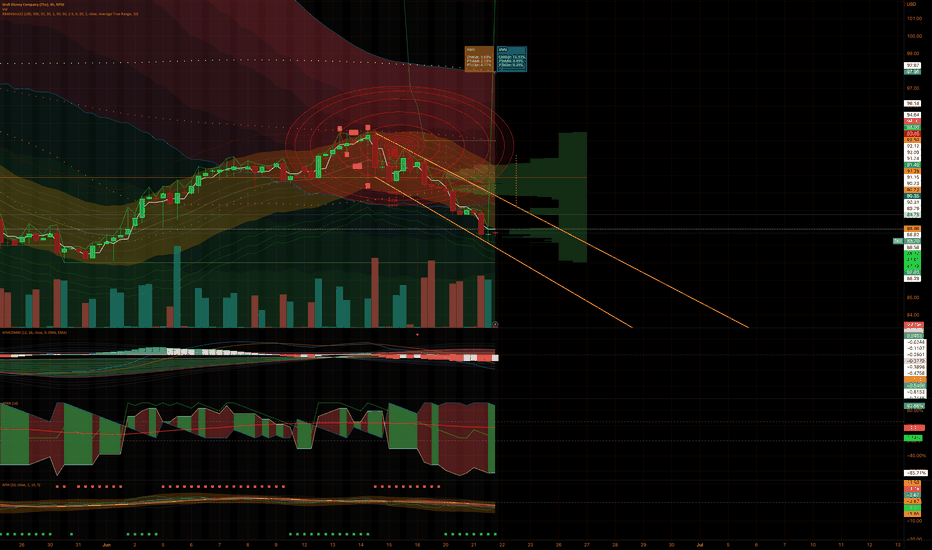

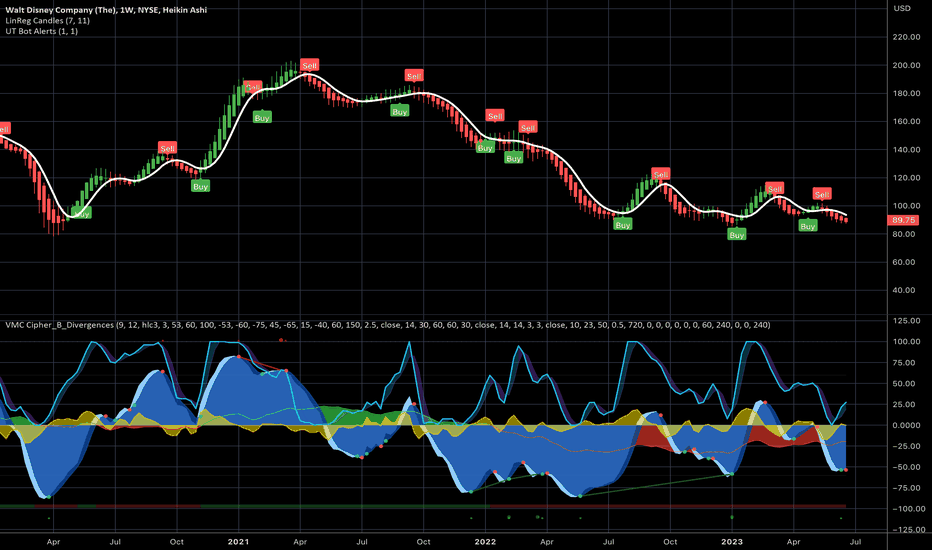

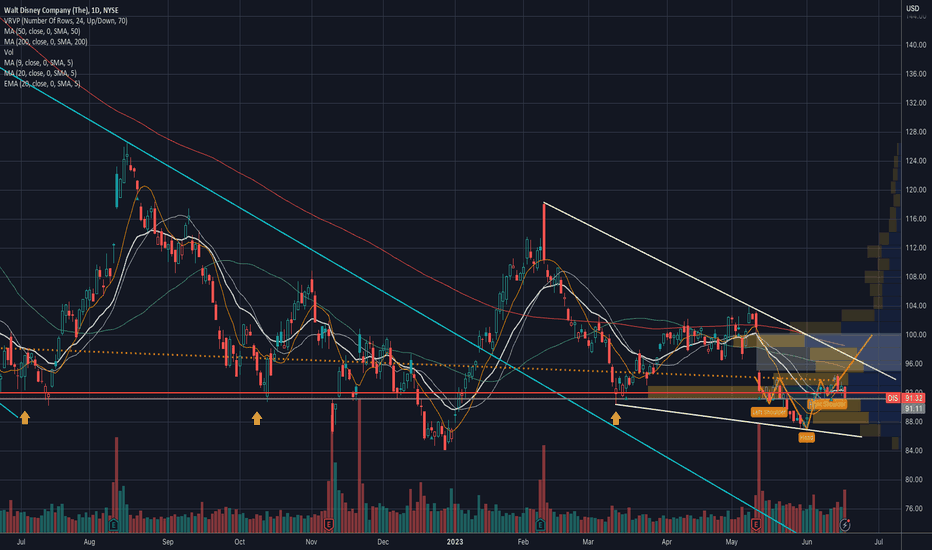

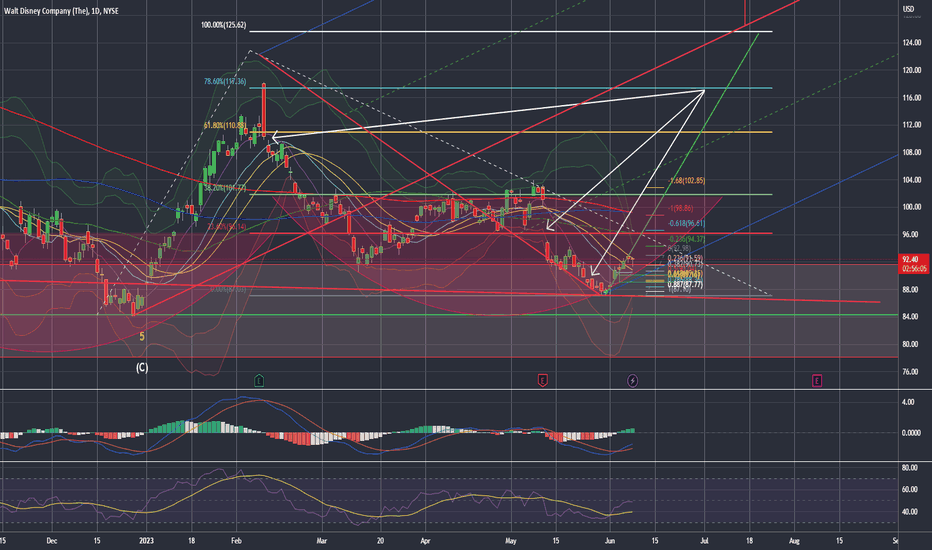

🐭 BEARISH CONTINUATION DISNEY 📉It appears Disney has created a bearish running flat on the Weekly time frame.

It has also then proceeded to create a bearish flag on the Daily time frame.

This indicates that the trend will continue to the down side.

The bearish running flat is a three-wave corrective pattern within a downtrend. It consists of:

Wave A: Sharp downward impulse.

Wave B: Upward correction, falling short of the previous high.

Wave C: Strong downward impulse, confirming the downtrend's continuation.

It is great to find larger time frame setups that indicate the direction of the trend then taking trend continuation setups on the lower time frame in that direction!

This adds greater probability when taking trend continuation setups.

As the greats always say "The trend is your friend!"

Also to add to the probability, the bearish daily flag has a healthy correction into the 50% retracement zone of the impulse then reversed. Indicating that it is more than likely a progressive impulse rather than a corrective one.

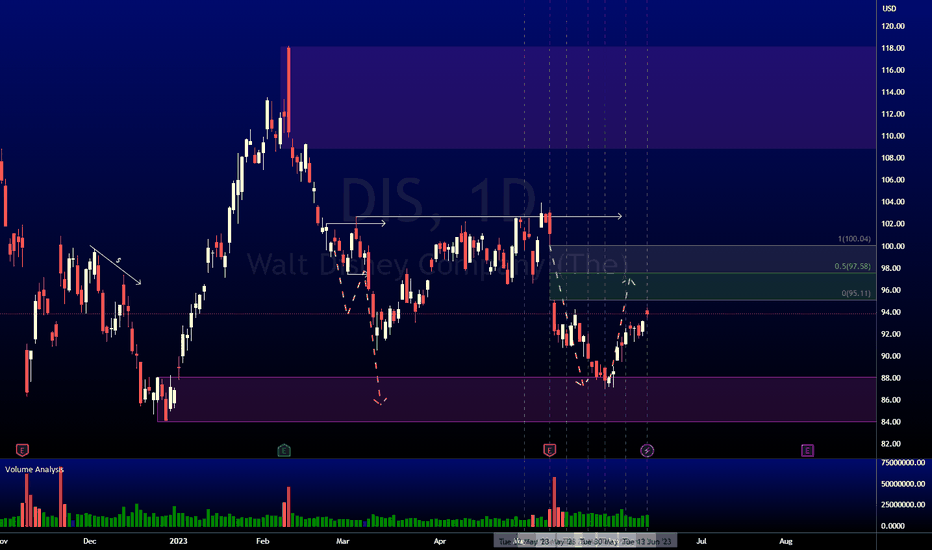

Symmetrical TrianglePrice is at the support line of a large triangle.

The last leg failed to meet the top line which can be a negative indicator if one relies more on price action than indicators.

All triangles are neutral until broken with a trend in that direction. Some would say 2 closes below the line. But the market can do somersaults and make you feel like you need to go back to the drawing board )o:

Spinning top/Doji representing indecision at a support level. Time will tell.

This market as of late makes me question myself on a regular basis but all we can do is make an educated guess,

No recommendation. Possible M pattern with the 2nd leg reaching the .786 of the 1st leg up.

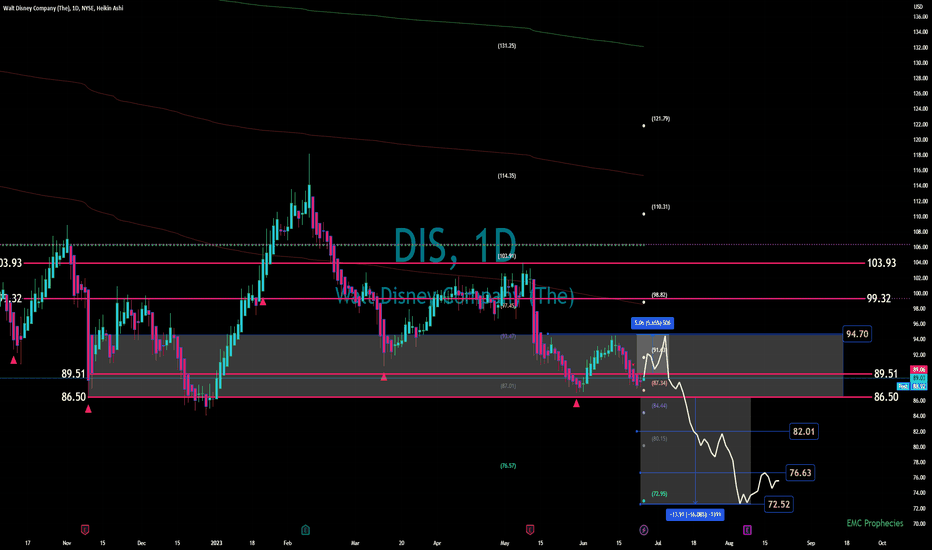

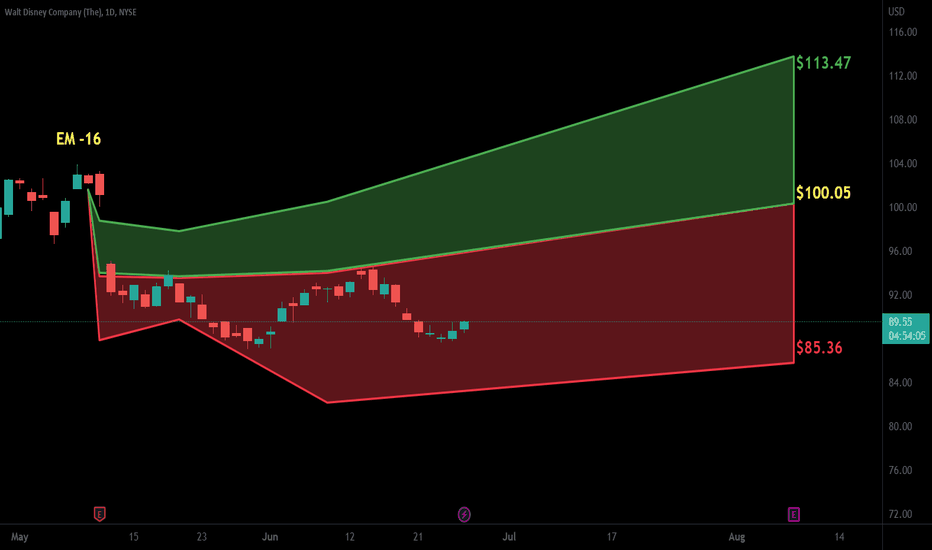

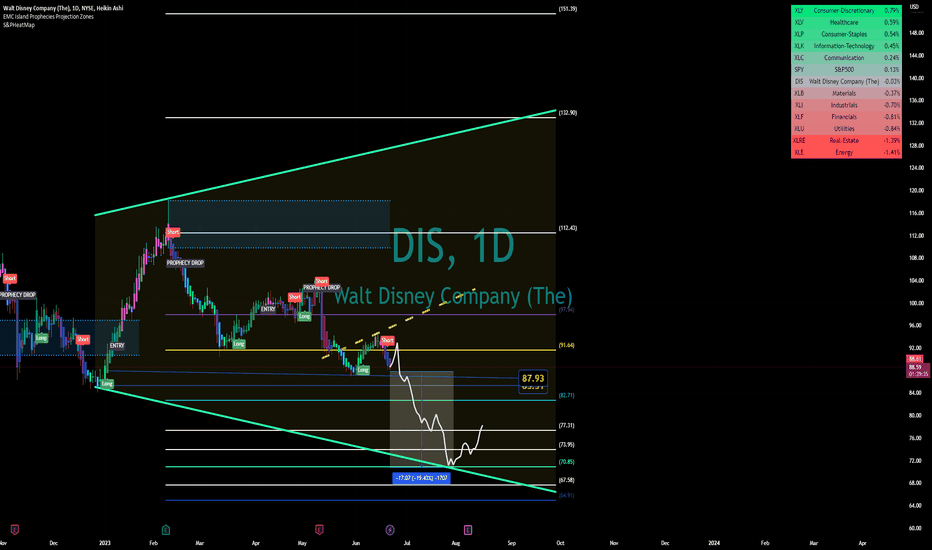

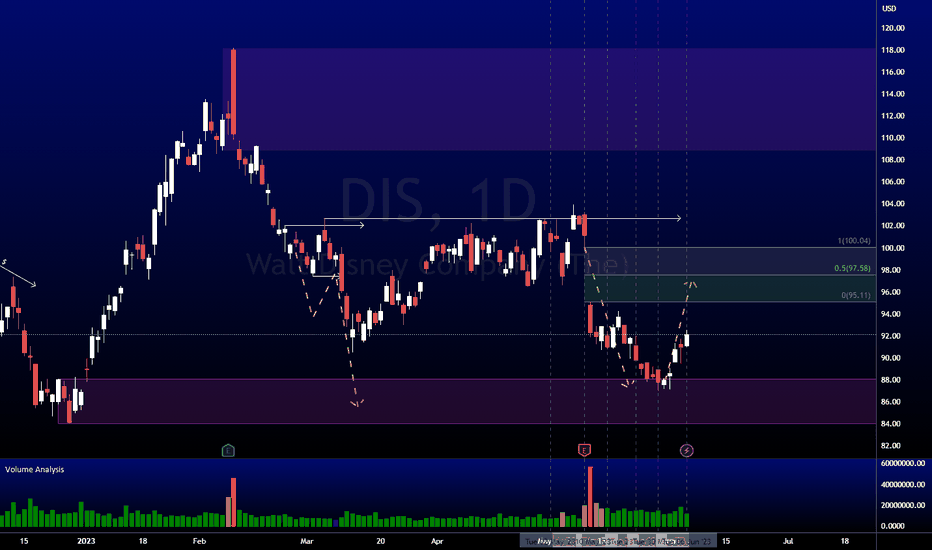

DIS FunnelI set a funnel for DIsney and layered it w Fib LEvels for ranges of focus in the trade. Watching this next pop lower high range from 91-97. I we reject will watch it clear 85-88 for a drop potential down 67-77 range on the drop. THere is hidden reversals at 77 and 82 for bounce to watch for on this down trend. But im watching this Head and Shoulders Inverse Cup Drop pattern to retest the base line of this funnel support. Just a thought theory not financial advice.

Dont forget to Boost and COmment and vibe.

#1LoV3

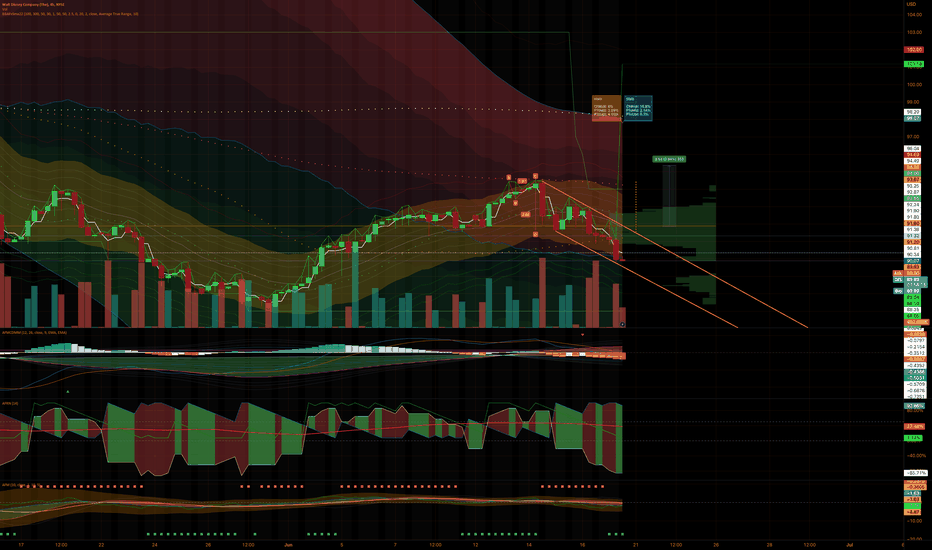

DIS AnalysisPrice did not play out as analyzed last week. I was expecting price to continue higher into the fair value gap at 97.58, but price is currently making a bearish retracement back into the bullish POI at 89.56. From here, we would want to see a confirmation on the lower timeframe for price to continue higher.

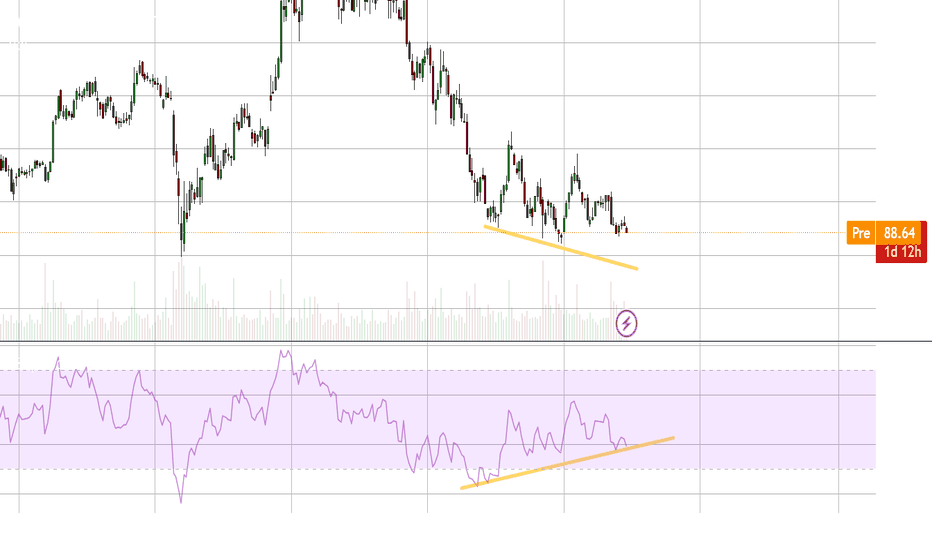

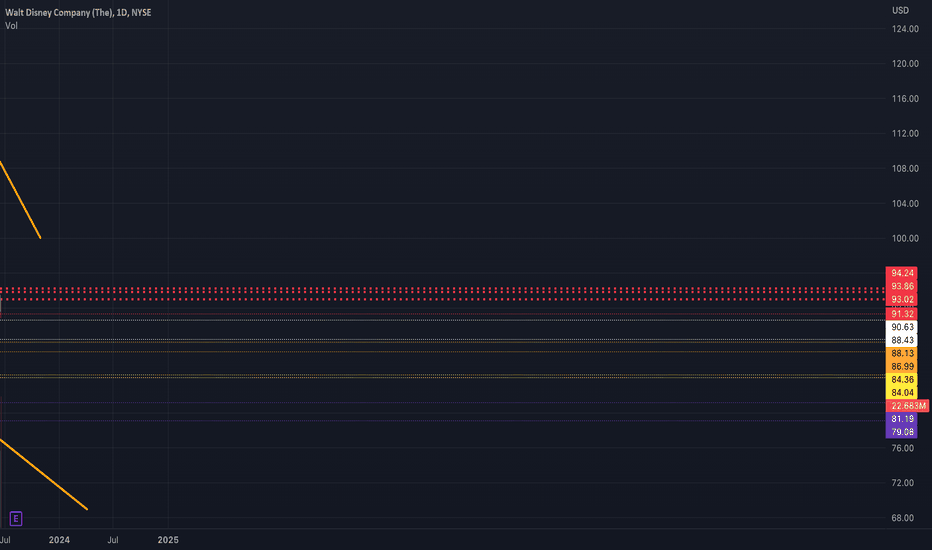

Walt Disney Call Option TradeGood morning to everyone.Im here to learn by receiving and sharing whats posted and sharing what i see in the market. This is a trade im currently watching on Disney. im waiting for a brake around 90.60. My levels and interest to purchase are at 1st 87.48 - 87.00 2nd 84.36 - 84.07 These two levels i see as nice bounces for a Call Option and my last level of intrest is 81.19 - 79.08 this level i would be intrested in purchasing shares and Call Option with a nice experation date. Each trade will need the confirmation of support follwed by a power candle before entry. I also charted down from the Daily to the 15 Minute time frame. please share perspectives.

$DIS - Whats next?NYSE:DIS - Friday CFO departure news came at a time when the stock was trying to break out of the resistance neckline. But IHS still intact. Its still above long term support. Current area is volume profile's point of control area (peak) so its having a hard time moving away from here. Breaking above $95 would be 🚀. Next week is important. 👀💥🚀

Targets - $96.86, $100, $106. Downside risk $89-$85.

DIS - Let's Ride - 2.0DIS has responded as suggested since the last post that identified the gap and go along with the bottoming candle formations made to date. Now it appears DIS will take a small breather, and potentially fill in the gap before heading much higher. 93.54 is the upside target before retracing, but there are enough Elliott Wave counts for a motive wave off the lows so this higher high is not needed to remain bullish. Area of interest is highlighted lower. For regular updates try the affiliate link in the bio. GLTA!